- FEAM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

5E Advanced Materials (FEAM) PRE 14APreliminary proxy

Filed: 17 Mar 23, 4:28pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

5E ADVANCED MATERIALS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on April 27, 2023

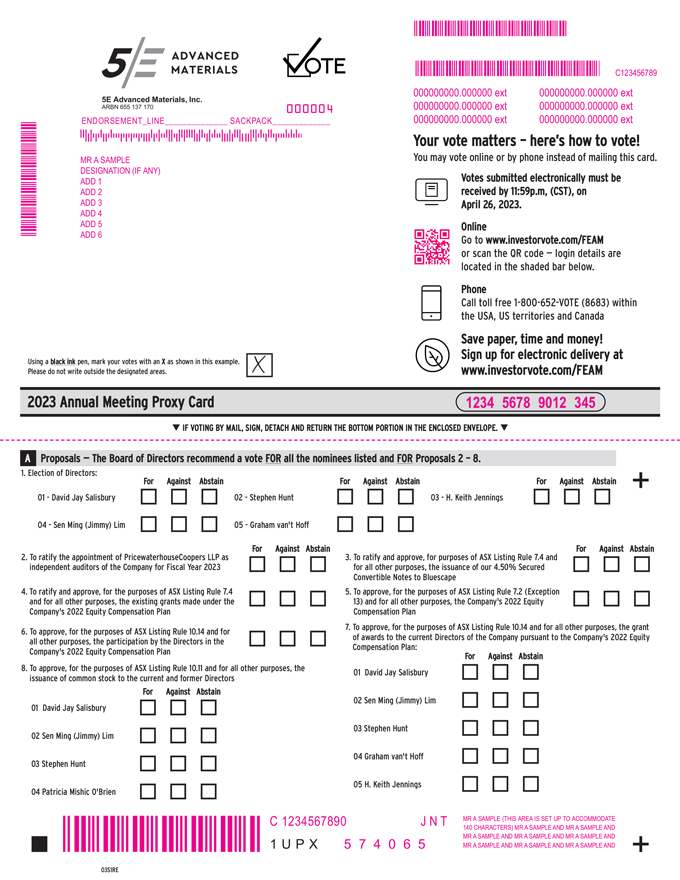

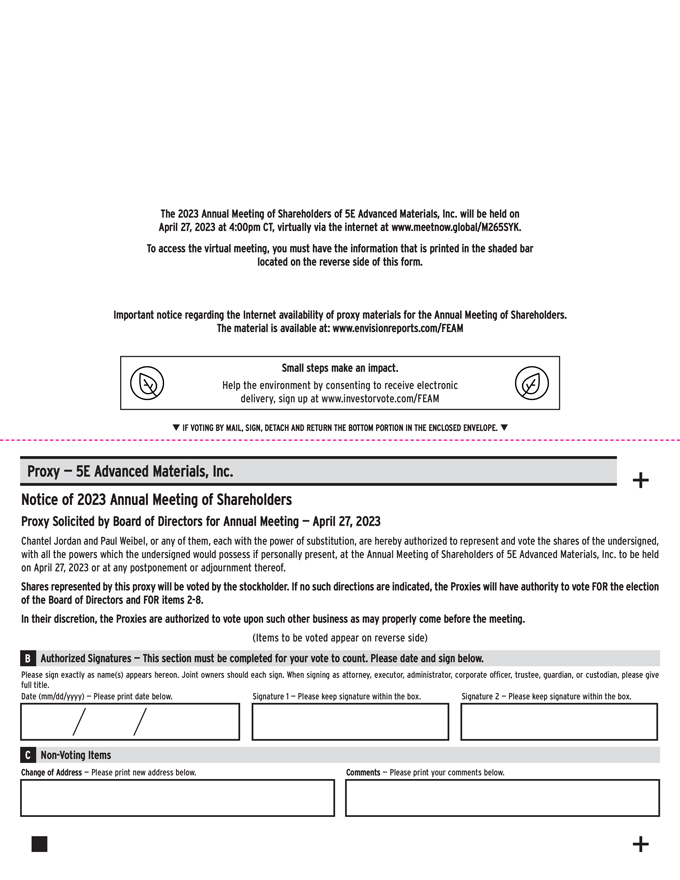

NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of 5E Advanced Materials, Inc., a Delaware corporation (the “Company”), will be held on Thursday, April 27, 2023, at 4:00 p.m. Central time (being 7:00 am AEST on Friday, April 28, 2023). To increase access for all of our stockholders, the Annual Meeting will be online and a completely virtual meeting of stockholders. You may attend, vote, and submit questions during the Annual Meeting via the live webcast on the Internet at www.meetnow.global/M265SYK. You will not be able to attend the Annual Meeting in person, nor will there be any physical location.

Only stockholders of record at the close of business on March 15, 2023, are entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof. Holders of CDIs of the Company at that time will be entitled to receive notice of, and to attend as guests (but not vote at) the Annual Meeting. We are committed to ensuring our stockholders have the same rights and opportunities to participate in the Annual Meeting as if it had been held in a physical location. As further described in the proxy materials for the Annual Meeting, you are entitled to attend the Annual Meeting via the live webcast on the Internet at www.meetnow.global/M265SYK. You may vote by telephone, Internet, or mail prior to the Annual Meeting. While we encourage you to vote in advance of the Annual Meeting, you may also vote and submit questions relating to meeting matters during the Annual Meeting (subject to time restrictions).

To be admitted to the Annual Meeting at www.meetnow.global/M265SYK, you must enter the 15-digit control number found on your proxy card. Holders of CDIs wishing to attend the Annual Meeting will need to do so as guests.

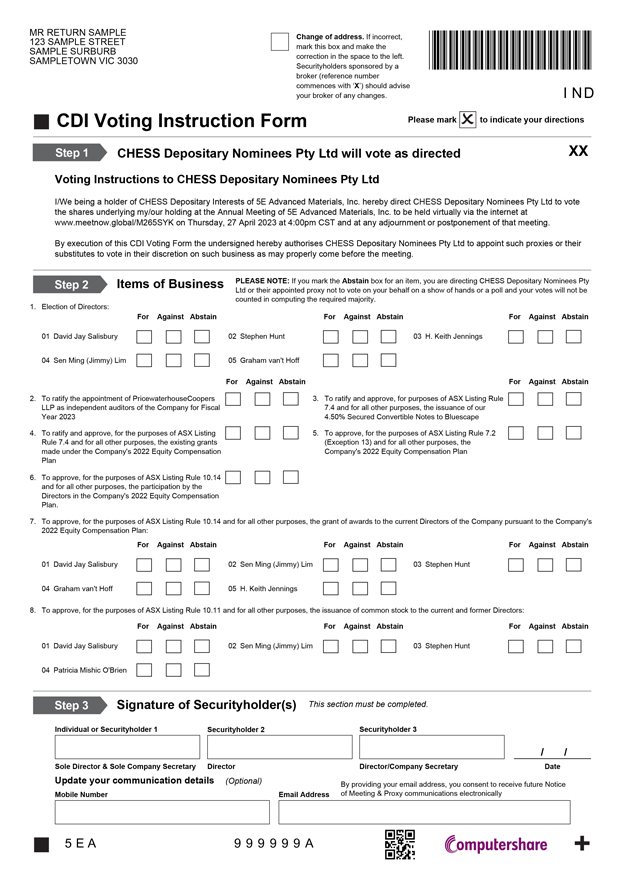

The Annual Meeting will be held for the following purposes:

| 1. | to elect the five directors named in this Proxy Statement, being each of: |

| (1) | David Jay Salisbury; |

| (2) | Stephen Hunt; |

| (3) | H. Keith Jennings; |

| (4) | Sen Ming (Jimmy) Lim; and |

| (5) | Graham van’t Hoff, |

to serve until the 2023 annual meeting of stockholders (the “2023 Annual Meeting”) and until their respective successors are duly elected and qualified or until such director’s earlier death, resignation, or removal;

| 2. | to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the 2023 fiscal year; |

| 3. | to ratify and approve, for purposes of ASX Listing Rule 7.4 and for all other purposes, the issuance of our 4.50% Secured Convertible Notes to Bluescape; |

| 4. | to ratify and approve, for purposes of ASX Listing Rule 7.4 and for all other purposes, the existing grants made under the Company’s 2022 Equity Compensation Plan; |

1

| 5. | to approve, for the purpose of ASX Listing Rule 7.2 (Exception 13) and for all other purposes, the Company’s 2022 Equity Compensation Plan; |

| 6. | to approve, for the purposes of ASX Listing Rule 10.14 and for all other purposes, the participation by the Directors in the Company’s 2022 Equity Compensation Plan; |

| 7. | to approve, for purposes of ASX Listing Rule 10.14 and for all other purposes, the grant of awards to the current Directors of the Company pursuant to the Company’s 2022 Equity Compensation Plan as follows: |

| (1) | To Mr David Salisbury: |

| (a) | 3,701 Director Share Units with an effective date of June 29, 2022 and a vesting date at the Company’s 2023 Annual Meeting; |

| (b) | 1,981 Director Share Units with an effective date of July 1, 2022 and a vesting date of July 1, 2023; |

| (c) | 2,240 Director Share Units with an effective date of October 1, 2022 and a vesting date of July 1, 2023 |

| (d) | 4,061 Director Share Units with an effective date of January, 1, 2023 and a vesting date of July 1, 2023. |

| (2) | To Mr Sen Ming (Jimmy) Lim: |

| (a) | 3,701 Director Share Units with an effective date of June 29, 2022 and a vesting date at the Company’s 2023 Annual Meeting; |

| (b) | 1,300 Director Share Units with an effective date of July 1, 2022 and a vesting date of July 1, 2023; |

| (c) | 1,470 Director Share Units with an effective date of October 1, 2022 and a vesting date of July 1, 2023; and |

| (d) | 1,587 Director Share Units with an effective date of January 1, 2023 and a vesting date of July 1, 2023. |

| (3) | To Mr Stephen Hunt: |

| (a) | 3,701 Director Share Units with an effective date of June 29, 2022 and a vesting date at the Company’s 2023 Annual Meeting; |

| (b) | 1,300 Director Share Units with an effective date of July 1, 2022 and a vesting date of July 1, 2023; and |

| (c) | 1,470 Director Share Units with an effective date of October 1, 2022 and a vesting date of July 1, 2023; and |

| (d) | 2,031 Director Share Units with an effective date of January 1, 2023 and a vesting date of July 1, 2023. |

2

| (4) | To Mr Graham van’t Hoff:, |

| (a) | 1,087 Director Share Units with an effective date of the date of his appointment as a Non-Executive Director and a vesting date of July 1, 2023; and |

| (b) | 2,665 Director Share Units with an effective date of January 1, 2023 and a vesting date of July 1, 2023. |

| (5) | To Mr H. Keith Jennings: |

| (a) | 1,213 Director Share Units with an effective date of the date of his appointment as a Non-Executive Director and a vesting date of July 1, 2023; and |

| (b) | 2,983 Director Share Units with an effective date of January 1, 2023 and a vesting date of July 1, 2023. |

| 8. | to approve, for the purposes of ASX Listing Rule 10.11 and for all other purposes, the issuance of common stock to the current and former Directors of the Company as follows: |

| (1) | To Mr David Salisbury: 3,701 shares of common stock. |

| (2) | To Mr Sen Ming (Jimmy) Lim: 3,701 shares of common stock. |

| (3) | To Mr Stephen Hunt: 3,701 shares of common stock. |

| (4) | To Ms Patricia Mishic O’Brien: 1,947 shares of common stock; and |

| 9. | to consider and transact such other business as may properly come before the Annual Meeting. |

On or about March 22, 2023, we began mailing to certain stockholders this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended June 30, 2022 (the “Annual Report”), and instructions on how to vote online. The Proxy Statement and Annual Report are available at www.envisionreports.com/FEAM.

| By order of the Board of Directors, | ||

| Houston, Texas | ||

| March 22, 2023 | Chantel Jordan, Esq. SVP, General Counsel, Corporate Secretary and Chief People Officer | |

Your vote is very important. You may vote at the virtual meeting or by proxy. Whether or not you plan to virtually attend the Annual Meeting, we encourage you to review the proxy materials and submit your proxy or voting instructions as soon as possible. You may vote your proxy by telephone or Internet (instructions are on your proxy card, and voter instruction form, as applicable) or by completing, signing, and mailing the enclosed proxy card in the enclosed envelope.

Holders of CDIs can direct the Depositary Nominee to vote the common stock underlying their CDIs at the Annual Meeting by completing the CDI Voting Instruction Form. |

3

| 1 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 7 | ||||

| 8 | ||||

| 20 | ||||

| 24 | ||||

| 29 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 30 | |||

| 32 | ||||

| 33 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

| 48 | ||||

| 50 | ||||

| 55 | ||||

This Proxy Statement contains various forward-looking statements that are not historical facts. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “estimate,” “plan,” “guidance,” “outlook,” “intend,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect the Company’s beliefs and expectations based on current estimates and projections. While the Company believes these expectations, and the estimates and projections on which they are based, are reasonable and were made in good faith, these statements are subject to numerous risks and uncertainties, any of which could cause the Company’s actual results, performance, or achievements, or industry results, to differ materially from any future results, performance, or achievements expressed or implied by such forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties, which include, but are not limited to, the risks described in the Company’s Annual Report on Form 10-K for the year ended June 30, 2022, under the heading “Risk Factors” and in other documents filed by the Company with the Securities and Exchange Commission.

These forward-looking statements speak only as of the date hereof, and except as required by law, the Company undertakes no obligation to correct, update, or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. You are advised, however, to consult any additional disclosures we make in our reports to the SEC. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in such disclosures and in our reports to the SEC.

4

This summary contains highlights about our Company and the upcoming 2022 Annual Meeting of Stockholders. This summary does not contain all of the information that you may wish to consider in advance of the meeting, and we encourage you to read the entire Proxy Statement before voting.

2022 Annual Meeting of Stockholders

| Date and Time: | Thursday, April 27, 2023, at 4:00 p.m. Central time (being 7:00 am AEST on Friday, April 28, 2023) | |

| Location: | Live webcast on the Internet at www.meetnow.global/M265SYK | |

| Record Date: | March 15, 2023 | |

| * | Our Annual Meeting will be conducted via live webcast. You may attend, ask questions relating to meeting matters, and vote during the Annual Meeting via the live webcast on the Internet at the link above (subject to time restrictions). You will not be able to attend the Annual Meeting in person. There will be no physical location for stockholders to attend. |

Voting Matters and Board Recommendations

| Proposal | Matter | Board Recommendation | ||

| 1 | (1) Election of David Jay Salisbury as a Director (2) Election of Stephen Hunt as a Director (3) Election of H. Keith Jennings as a Director (4) Election of Sen Ming (Jimmy) Lim as a Director (5) Election of Graham van’t Hoff as a Director | FOR each Nominee | ||

| 2 | Ratification of the Appointment of PricewaterhouseCoopers LLP as Our Independent Registered Public Accounting Firm for the Fiscal Year Ending June 30, 2023 | FOR | ||

| 3 | Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the issuance of our 4.50% Secured Convertible Notes to Bluescape | FOR | ||

| 4 | Ratification and approval, for the purposes of ASX Listing Rule 7.4 and for all other purposes, of the existing grants made under the Company’s 2022 Equity Compensation Plan | FOR | ||

| 5 | Approval, for purposes of ASX Listing Rule 7.2 (Exception 13) and for all other purposes, of the Company’s 2022 Equity Compensation Plan | FOR | ||

| 6 | Approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the participation by the Directors in the Company’s 2022 Equity Compensation Plan | FOR | ||

5

| 7 | Approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the grant of awards to the current Directors of the Company pursuant to the Company’s 2022 Equity Compensation Plan as follows:

(1) 11,983 Director Share Units to Mr David Salisbury; (2) 8,058 Director Share Units to Mr Sen Ming (Jimmy) Lim; (3) 8,502 Director Share Units to Mr Stephen Hunt; (4) 3,752 Director Share Units to Mr Graham van’t Hoff; and (5) 4,196 Director Share Units to Mr H. Keith Jennings,

as further detailed in this Proxy Statement. | FOR each grant | ||

| 8 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issuance of common stock to the current and former Directors of the Company as follows:

(1) 3,701 shares of common stock to Mr David Salisbury; (2) 3,701 shares of common stock to Mr Sen Ming (Jimmy) Lim; (3) 3,701 shares of common stock to Mr Stephen Hunt; and (4) 1,947 shares of common stock to Ms Patricia Mishic O’Brien,

as further detailed in this Proxy Statement. | FOR | ||

6

19500 State Highway 249, Suite 125

Houston, Texas 77070

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

April 27, 2023

This Proxy Statement is being furnished to the stockholders of 5E Advanced Materials, Inc. (the “Company” or “5E Materials”) in connection with the solicitation of proxies for the Company’s 2022 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, April 27, 2023, at 4:00 p.m. Central time (being 7:00 am AEST on Friday, April 28, 2023), or at any adjournment or postponement thereof, for the purposes set forth herein. The Annual Meeting will be held via live webcast on the Internet at www.meetnow.global/M265SYK. This solicitation is being made by the board of directors of the Company (the “Board of Directors” or the “Board”). You will be able to vote and submit questions online through the virtual-meeting platform during the Annual Meeting. Holders of CDIs of the Company will be entitled to receive notice of, and to attend as guests (but not vote at) the Annual Meeting

7

THE INFORMATION PROVIDED IN THE “QUESTIONS AND ANSWERS” FORMAT BELOW IS FOR YOUR CONVENIENCE AND INCLUDES ONLY A SUMMARY OF CERTAIN INFORMATION CONTAINED IN THIS PROXY STATEMENT. YOU SHOULD READ THIS ENTIRE PROXY STATEMENT CAREFULLY.

QUESTIONS AND ANSWERS

Why am I receiving these materials?

We are distributing our proxy materials because our Board is soliciting your proxy to vote at the Annual Meeting. This Proxy Statement summarizes the information you need to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares.

How can I attend the Annual Meeting?

Stockholders as of the Record Date (or their duly appointed proxy holder) may attend, vote, and submit questions virtually during the Annual Meeting by logging in at www.meetnow.global/M265SYK. To log in, stockholders (or their authorized representatives) will need the control number provided on their proxy card. If you are not a stockholder or do not have a control number (including Holders of CDIs), you may still access the meeting as a guest, but you will not be able to submit questions or vote at the meeting. The meeting will begin promptly at 4:00 p.m. Central time on Thursday, April 27, 2023 ((being 7:00 am AEST on Friday, April 28, 2023). We encourage you to access the meeting prior to the start time. Online access will open at 3:45 p.m. Central time, (being 6:45 am AEST) and you should allow ample time to log in to the meeting webcast and test your computer audio system. We recommend that you carefully review the procedures needed to gain admission in advance. A recording of the meeting will be available at www.meetnow.global/M265SYK for 90 days after the meeting.

Holders of CDIs will be entitled to receive notice of, and to attend as guests (but not vote at) the Annual Meeting.

Can I ask questions at the virtual Annual Meeting?

Stockholders and Holders of CDIs as of the Record Date who attend and participate in our virtual Annual Meeting will have an opportunity to submit questions live via the Internet during a designated portion of the meeting. We also encourage you to submit questions in advance of the meeting until 11:59 p.m. Eastern time the day before the Annual Meeting by going to www.meetnow.global/M265SYK and logging in with your control number. During the meeting, we will spend up to 15 minutes answering stockholder questions that comply with the meeting rules of procedure. The rules of procedure, including the types of questions that will be accepted, will be posted on the Annual Meeting website. To ensure the orderly conduct of the Annual Meeting, we encourage you to submit questions in advance. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition. Stockholders must have available their control number provided on their proxy card to ask questions during the meeting.

What if I have technical difficulties or trouble accessing the virtual Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or during the meeting, please call the technical support number that will be posted on the virtual stockholder meeting login page: www.meetnow.global/M265SYK.

8

What proposals will be voted on at the Annual Meeting?

Stockholders will vote on eight proposals at the Annual Meeting:

| 1. | the election of the five directors named in this Proxy Statement, being each of: |

| (1) | David Jay Salisbury; |

| (2) | Stephen Hunt; |

| (3) | H. Keith Jennings; |

| (4) | Sen Ming (Jimmy) Lim; and |

| (5) | Graham van’t Hoff, |

to serve until the 2023 Annual Meeting and until their respective successors are duly elected and qualified or until such director’s earlier death, resignation, or removal;

| 2. | the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the 2023 fiscal year; |

| 3. | the ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, the issuance of our 4.50% Secured Convertible Notes to Bluescape; |

| 4. | the ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the existing grants made under the Company’s 2022 Equity Compensation Plan; |

| 5. | the approval, for the purposes of ASX Listing Rule 7.2 (Exception 13) and for all other purposes, of the Company’s 2022 Equity Compensation Plan; |

��

| 6. | the approval, for purposes of ASX Listing Rule 10.14 and for all other purposes, of the participation by the Directors in the Company’s 2022 Equity Compensation Plan; |

| 7. | the approval, for purposes of ASX Listing Rule 10.14 and for all other purposes, of the grant of awards to the current Directors of the Company pursuant to the Company’s 2022 Equity Compensation Plan as follows: |

| (1) | 11,983 Director Share Units to Mr David Salisbury; |

| (2) | 8,058 Director Share Units to Mr Sen Ming (Jimmy) Lim; |

| (3) | 8,502 Director Share Units to Mr Stephen Hunt; |

| (4) | 3,752 Director Share Units to Mr Graham van’t Hoff; and |

| (5) | 4,196 Director Share Units to Mr H. Keith Jennings, |

as further detailed in this Proxy Statement; and

9

| 8. | the approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issuance of common stock to the current and former Directors of the Company as follows: |

| (1) | 3,701 shares of common stock to Mr David Salisbury; |

| (2) | 3,701 shares of common stock to Mr Sen Ming (Jimmy) Lim; |

| (3) | 3,701 shares of common stock to Mr Stephen Hunt; and |

| (4) | 1,974 shares of common stock to Ms Patricia Mishic O’Brien, |

as further detailed in this Proxy Statement; and

We will also consider other business, if any, that properly comes before the Annual Meeting.

What happens if other business not discussed in this Proxy Statement comes before the meeting?

The Company does not know of any business to be presented at the Annual Meeting other than the proposals discussed in this Proxy Statement. If other business properly comes before the meeting under our Certificate of Incorporation (the “Charter”), Amended and Restated Bylaws (the “Bylaws”), and rules established by the SEC, the proxies will use their discretion in casting all the votes that they are entitled to cast.

How does the Board recommend that stockholders vote on the proposals?

Our Board recommends that stockholders vote “FOR” the election of each director nominees named in this Proxy Statement, “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2023, “FOR” the ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, the issuance of our 4.50% Secured Convertible Notes to Bluescape, “FOR” the ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the existing grants made under the Company’s 2022 Equity Compensation Plan, “FOR” the approval, for purposes of ASX Listing Rule 7.2 (Exception 13) and for all other purposes, of the Company’s 2022 Equity Compensation Plan; “FOR” the approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the participation by the Directors in the Company’s 2022 Equity Compensation Plan, “FOR” the approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the grant of awards to each of the current Directors of the Company pursuant to the Company’s 2022 Equity Compensation Plan, and “FOR” the approval, for the purposes of ASX Listing Rule 10.11 and for all other purposes, of the issuance of common stock to each of the current and former Directors of the Company.

Who is entitled to vote?

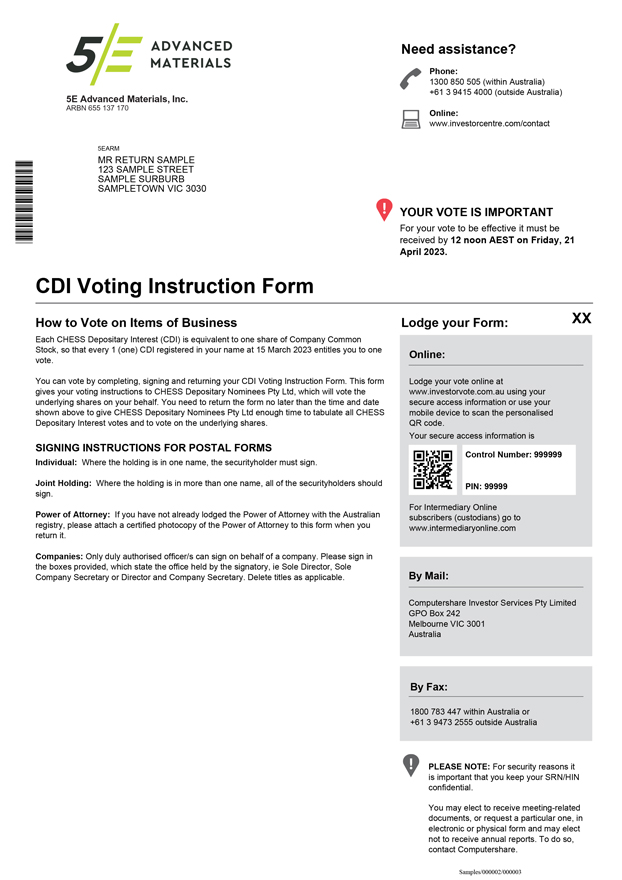

As of the Record Date, 44,149,172 shares of common stock, par value $0.01 per share, were outstanding. Only holders of record of our common stock as of the Record Date will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Each stockholder is entitled to one vote for each share of our common stock held by such stockholder on the Record Date. No cumulative voting rights are authorized. Each CDI holder is entitled to direct CHESS Depositary Nominees Pty Ltd, as depositary nominee (the “Depositary Nominee”) to vote one vote for every 10 CDIs held by such holder on the Record Date.

What does it mean to be a holder of CDIs?

CDIs are issued by the Company through the Depositary Nominee and traded on the Australian Securities Exchange. If you own CDIs, then you are the beneficial owner of one share of common stock for every 10 CDIs that you own. The Depositary Nominee, or its custodian, is considered the stockholder of record for the purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct the Depositary Nominee, or its custodian, as to

10

how to vote the shares of common stock underlying your CDIs. As a beneficial owner, you are invited to attend the Annual Meeting. However, because you are not a stockholder, if you personally want to vote the shares of common stock underlying your CDIs at the Annual Meeting, you must inform the Depositary Nominee via the CDI Voting Instruction Form that you wish to nominate yourself (or another person) to be appointed as the Depositary Nominee’s proxy for the purposes of virtually attending and voting at the Annual Meeting.

Under the rules governing CDIs, the Depositary Nominee is not permitted to vote on your behalf on any matter to be considered at the Annual Meeting unless you specifically instruct the Depositary Nominee how to vote. We encourage you to communicate your voting instructions to the Depositary Nominee in advance of the Annual Meeting to ensure that your vote will be counted by completing the CDI Voting Instruction Form and returning it in accordance with the instructions specified on that form.

How do I vote in advance of the Annual Meeting?

If you are a holder of record of shares of common stock of the Company, you may direct your vote without attending the Annual Meeting by following the instructions on the proxy card to vote by Internet or by telephone, or by signing, dating, and mailing a proxy card.

If you hold your shares in street name via a broker, bank, or other nominee, you may direct your vote without attending the Annual Meeting by signing, dating, and mailing your voting instruction card. Internet or telephonic voting may also be available. Please see your voting instruction card provided by your broker, bank, or other nominee for further details.

How do I vote during the Annual Meeting?

Shares held directly in your name as the stockholder of record may be voted if you are attending the Annual Meeting by entering the 15-digit control number found on your proxy card when you log in to the meeting at www.meetnow.global/M265SYK.

Shares held in street name through a brokerage account or by a broker, bank, or other nominee may only be voted at the Annual Meeting by submitting voting instructions to your bank, broker or other nominee or by presenting a legal proxy, issued in your name from the record holder (your bank, broker or other nominee).

Even if you plan to attend the Annual Meeting, we recommend that you vote in advance, as described above under “How do I vote in advance of the Annual Meeting?” so that your vote will be counted if you are unable to attend the Annual Meeting.

How do I vote if I hold CDIs?

Each CDI holder is entitled to direct the Depositary Nominee to vote one vote for every 10 CDIs held by such holder on the Record Date. Persons holding CDIs are entitled to receive notice of and to attend the Annual Meeting as guests. Holders of CDIs may direct the Depositary Nominee to vote their underlying shares of common stock at the Annual Meeting by completing and returning the CDI Voting Instruction Form to Computershare Australia, the agent the Company has designated for the collection and processing of voting instructions from the Company’s CDI holders. Votes must be received by Computershare Australia by no later than 9:00 p.m. Central time on Thursday, April 20, 2023 (being 12 noon AEST on Friday, April 21, 2023) (two business days prior to the date of the Annual Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

Alternatively, CDI holders can inform the Depositary Nominee via the CDI Voting Instruction Form that they wish to nominate themselves (or another person) to be appointed as the Depositary Nominee’s proxy for the purposes of virtually attending and voting at the Annual Meeting.

11

Can I change my vote or revoke my proxy or CDI Voting Instruction Form?

You may change your vote or revoke your proxy at any time before it is voted at the Annual Meeting. If you are a stockholder of record, you may change your vote or revoke your proxy by:

| • | delivering to the attention of the Secretary at the address on the first page of this Proxy Statement a written notice of revocation of your proxy; |

| • | delivering to us an authorized proxy bearing a later date (including a proxy over the Internet or by telephone); or |

| • | attending the Annual Meeting and voting electronically, as indicated above under “How do I vote during the Annual Meeting?”, but note that attendance at the Annual Meeting will not, by itself, revoke a proxy. |

If your shares are held in the name of a bank, broker, or other nominee, you may change your vote by submitting new voting instructions to your bank, broker, or other nominee. Please note that if your shares are held of record by a bank, broker, or other nominee and you decide to attend and vote at the Annual Meeting, your vote at the Annual Meeting will not be effective unless you present a legal proxy, issued in your name from the record holder (your bank, broker, or other nominee).

If you are a holder of CDIs and you direct the Depositary Nominee to vote by completing the CDI Voting Instruction Form, you may revoke those instructions by delivering to Computershare Australia a written notice of revocation bearing a later date than the CDI Voting Instruction Form previously sent, which notice must be received by no later than 9:00 p.m. Central time on Thursday, April 20, 2023 (being 12 noon AEST on Friday, April 21, 2023).

What is a broker nonvote?

Brokers, banks, or other nominees holding shares on behalf of a beneficial owner (other than the Depositary Nominee) may vote those shares in their discretion on certain “routine” matters even if they do not receive timely voting instructions from the beneficial owner. With respect to “nonroutine” matters, the broker, bank, or other nominee is not permitted to vote shares for a beneficial owner without timely received voting instructions. The only routine matter to be presented at the Annual Meeting is the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2023 (Proposal Two). Each of the other Proposals are nonroutine matters.

A broker nonvote occurs when a broker, bank, or other nominee does not vote on a nonroutine matter because the beneficial owner of such shares has not provided voting instructions with regard to such matter. A broker, bank, or other nominee may exercise its discretionary voting authority on Proposal Two because Proposal Two is a routine matter, and as such, there will be no broker nonvotes on Proposal Two. Broker nonvotes may occur as to the other Proposals or any other nonroutine matters that are properly presented at the Annual Meeting. The effect of broker nonvotes on each of the other Proposals is described below.

What constitutes a quorum?

The presence at the Annual Meeting, either in person or by proxy, of holders of a majority in voting power of the shares of the Company entitled to vote at the Annual Meeting shall constitute a quorum for the transaction of business. Abstentions and broker nonvotes will be counted as present for the purpose of determining whether there is a quorum at the Annual Meeting. Your shares are counted as being present if you participate virtually at the Annual Meeting and cast your vote online during the meeting prior to the closing of the polls by visiting www.meetnow.global/M265SYK, or if you vote by proxy via the Internet, by telephone, or by returning a properly executed and dated proxy card or voting instruction form by mail.

12

What vote is required to approve each matter to be considered at the Annual Meeting?

| Proposal | Matter | Vote Required | Broker Discretionary Voting Allowed | Effect of Broker Nonvotes | Effect of Abstentions | |||||

| 1 | Election of each of the Five Directors Named in this Proxy Statement ((1) David Jay Salisbury, (2) Stephen Hunt, (3) H. Keith Jennings, (4) Sen Ming (Jimmy) Lim, and (5) Graham van’t Hoff) (each as a separate resolution) | Majority of Votes Cast | No | No Effect | No Effect | |||||

| 2 | Ratification of the Appointment of PricewaterhouseCoopers LLP as Our Independent Registered Public Accounting Firm for the Fiscal Year Ending June 30, 2023 | Majority of Shares Present in Person or Represented by Proxy at the Meeting and Entitled to Vote Thereon | Yes | N/A | Same as Vote Against | |||||

| 3 | Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, the issuance of our 4.50% Secured Convertible Notes to Bluescape | Majority of Votes Cast | No | No Effect | No Effect | |||||

| 4 | Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the existing grants made under the Company’s 2022 Equity Compensation Plan | Majority of Votes Cast | No | No Effect | No Effect | |||||

| 5 | Approval, for purposes of ASX Listing Rule 7.2 (Exception 13) and for all other purposes, of the Company’s 2022 Equity Compensation Plan | Majority of Votes Cast | No | No Effect | No Effect | |||||

| 6 | Approval, for purposes of ASX Listing Rule 10.14 and for all other purposes, of the participation by the Directors in the Company’s 2022 Equity Compensation Plan | Majority of Votes Cast | No | No Effect | No Effect | |||||

13

| Proposal | Matter | Vote Required | Broker Discretionary Voting Allowed | Effect of Broker Nonvotes | Effect of Abstentions | |||||

| 7 | Approval, for purposes of ASX Listing Rule 10.14 and for all other purposes, of the grant of awards to the current Directors of the Company pursuant to the Company’s 2022 Equity Compensation Plan, being to each of (1) Mr David Salisbury, (2) Mr Sen Ming (Jimmy) Lim, (3) Mr Stephen Hunt, (4) Mr Graham van’t Hoff, and (5) Mr H. Keith Jennings (each as a separate resolution) | Majority of Votes Cast | No | No Effect | No Effect | |||||

| 8 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issuance of common stock to the current and former Directors of the Company, being each of (1) Mr David Salisbury, (2) Mr Sen Ming (Jimmy) Lim, (3) Mr Stephen Hunt, and (4) Ms Patricia Mishic O’Brien (each as a separate resolution) | Majority of Votes Cast | No | No Effect | No Effect | |||||

Proposal One: Election of Five Directors Named in This Proxy Statement.

Our Bylaws provide that the election of directors shall be determined by a majority of the votes cast at the meeting by the holders of stock entitled to vote thereon. Abstentions and broker nonvotes will have no effect on Proposal One.

Under our Bylaws, a majority of the votes cast means that the number of shares voted “for” a nominee must exceed the votes cast “against” such nominee. The Nominating and Corporate Governance Committee has established procedures under which a director standing for reelection in an uncontested election must tender a resignation conditioned on the incumbent director’s failure to receive a majority of the votes cast. If an incumbent director who is standing for re-election does not receive a majority of the votes cast, the Nominating and Corporate Governance Committee shall make a recommendation to the Board of Directors on whether to accept or reject the resignation, or whether other action should be taken. The Board of Directors shall act on the committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results.

Proposal Two: Ratification of the Appointment of PricewaterhouseCoopers LLP as Our Independent Registered Public Accounting Firm for the Fiscal Year Ending June 30, 2022.

The proposal to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the 2023 fiscal year requires approval by the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote thereon. An abstention on Proposal Two will have the same effect as a vote against. Brokers will have discretionary authority to vote on this proposal. Accordingly, there will not be any broker nonvotes on Proposal Two.

14

Proposal Three: Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, the issuance of our 4.50% Secured Convertible Notes to Bluescape.

This proposal shall be determined by a majority of the votes cast at the meeting by the holders of stock entitled to vote thereon. Abstentions and broker nonvotes will have no effect on Proposal Three. A voting exclusion applies in respect of the proposal as noted below.

Proposal Four: Ratification and approval, for the purposes of ASX Listing Rule 7.4 and for all other purposes, of the existing grants made under the Company’s 2022 Equity Compensation Plan

This proposal shall be determined by a majority of the votes cast at the meeting by the holders of stock entitled to vote thereon. Abstentions and broker nonvotes will have no effect on Proposal Four. A voting exclusion applies in respect of the proposal as noted below.

Proposal Five: Approval, for purposes of ASX Listing Rule 7.2 (Exception 13) and for all other purposes, of the Company’s 2022 Equity Compensation Plan

This proposal shall be determined by a majority of the votes cast at the meeting by the holders of stock entitled to vote thereon. Abstentions and broker nonvotes will have no effect on Proposal Five. A voting exclusion applies in respect of the proposal as noted below.

Proposal Six: Approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the participation by the Directors in the Company’s 2022 Equity Compensation Plan

This proposal shall be determined by a majority of the votes cast at the meeting by the holders of stock entitled to vote thereon. Abstentions and broker nonvotes will have no effect on Proposal Six. A voting exclusion applies in respect of the proposal as noted below.

Proposal Seven: Approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the grant of awards to the current Directors of the Company pursuant to the Company’s 2022 Equity Compensation Plan

This proposal shall be determined by a majority of the votes cast at the meeting by the holders of stock entitled to vote thereon. Abstentions and broker nonvotes will have no effect on Proposal Seven. A voting exclusion applies in respect of the proposal as noted below.

Proposal Eight: Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issuance of common stock to the current and former Directors of the Company

This proposal shall be determined by a majority of the votes cast at the meeting by the holders of stock entitled to vote thereon. Abstentions and broker nonvotes will have no effect on Proposal Eight. A voting exclusion applies in respect of the proposal as noted below.

Voting exclusion statement

The Company will disregard any votes cast in favor of:

| • | Proposal Three by or on behalf of a person who participated in the issue of Convertible Notes (namely, Bluescape) or any of their associates; |

| • | Proposal Four by or on behalf of any person who has participated in the Company’s 2022 Equity Compensation Plan or any of their associates; |

15

| • | Proposal Five, by or on behalf of any person who is entitled to participate in the Company’s 2022 Equity Compensation Plan or any of their associates; |

| • | Proposal Six, by or on behalf of any of the Directors who are entitled to participate in the Company’s 2022 Equity Compensation Plan or any of their associates; |

| • | Proposal Seven, by or on behalf of the current Directors to whom awards are to be granted and any other person who will obtain a material benefit as a result of the grant of the awards (except a benefit solely by reason of being a holder of ordinary securities in the Company) or any of their associates; and |

| • | Proposal Eight, by or on behalf of the current and former Directors to whom common stock are to be issued and any other person who will obtain a material benefit as a result of the issue of common stock awards (except a benefit solely by reason of being a holder of ordinary securities in the Company) or any of their associates. |

However, the Company need not disregard a vote cast in favor of any of the above Proposals by:

| • | a person as proxy or attorney for a person who is entitled to vote on the relevant Proposal, in accordance with directions given to the proxy or attorney to vote on the relevant Proposal in that way; |

| • | the chair of the Annual Meeting as proxy or attorney for a person who is entitled to vote on the relevant Proposal, in accordance with a direction given to the chair to vote on the relevant Proposal as the chair decides; or |

| • | a holder acting solely in a nominee, trustee or custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: |

| • | the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on the relevant Proposal; and |

| • | the holder votes on the relevant Proposal in accordance with directions given by the beneficiary to the holder to vote in that way. |

What is the deadline for submitting a proxy or CDI Voting Instruction Form?

To ensure that proxies are received in time to be counted prior to the Annual Meeting, proxies submitted by Internet or by telephone should be received by 11:59 p.m. Eastern time on Wednesday, April 26, 2023, and proxies submitted by mail should be received by the close of business on Wednesday, April 26, 2023 (the day prior to the date of the Annual Meeting).

CDI Voting Instruction Forms must be received by Computershare Australia by no later than 9:00 p.m. Central time on Thursday, April 20, 2023 (being 12 noon AEST on Friday, April 21, 2023) (two business days prior to the date of the Annual Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

What does it mean if I receive more than one proxy card or CDI Voting Instruction Form?

If you hold your shares or CDIs in more than one account, you will receive one proxy card or CDI Voting Instruction Form for each account (as applicable). To ensure that all of your shares or CDIs are voted, please complete, sign, date, and return one proxy card or CDI Voting Instruction Form for each account or use the proxy card for each account to vote by Internet or by telephone.

16

How will my shares be voted if I return a blank proxy card or a blank CDI Voting Instruction Form?

If you are a holder of record of our common stock and you sign and return a proxy card or CDI Voting Instruction Form or otherwise submit a proxy without giving specific voting instructions, your shares will be voted:

| • | “FOR” the election of each of the directors named in this Proxy Statement; |

| • | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2023; |

| • | “FOR” the ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the issuance of our 4.50% Secured Convertible Notes to Bluescape; |

| • | “FOR” the ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the existing grants made under the Company’s 2022 Equity Compensation Plan; |

| • | “FOR” the approval, for the purposes of ASX Listing Rule 7.2 (Exception 13) and for all other purposes, of the Company’s 2022 Equity Compensation Plan; |

| • | “FOR” the approval, for the purposes of ASX Listing Rule 10.14 and for all other purposes, of the participation by the Directors in the Company’s 2022 Equity Compensation Plan; |

| • | “FOR” the approval, for purposes of ASX Listing Rule 10.14 and for all other purposes, of the grant of awards to each of the current Directors of the Company; and |

| • | “FOR” the approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issuance of common stock to the current and former Directors of the Company. |

If you hold your shares in street name via a broker, bank, or other nominee and do not provide the broker, bank, or other nominee with voting instructions (including by signing and returning a blank voting instruction card), your shares:

| • | will be counted as present for purposes of establishing a quorum; |

| • | will be voted in accordance with the broker’s, bank’s, or other nominee’s discretion on “routine” matters, which includes the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2023 (Proposal Two); and |

| • | will not be counted in connection with the other Proposals or any other nonroutine matters that are properly presented at the Annual Meeting. For each of these proposals, your shares will be treated as “broker nonvotes.” |

Our Board knows of no matter to be presented at the Annual Meeting other than Proposals identified in this Proxy Statement. If any other matters properly come before the Annual Meeting upon which a vote properly may be taken, shares represented by all proxies received by us will be voted with respect thereto as permitted and in accordance with the judgment of the proxy holders.

Who is making this solicitation and who will pay the expenses?

This proxy solicitation is being made on behalf of our Board. The Company will pay the cost of soliciting proxies for the Annual Meeting. In addition to solicitation by mail, our employees may solicit proxies personally or by telephone or facsimile, but they will not receive additional compensation for these services. Arrangements may be made with brokerage houses, custodians, nominees, and fiduciaries to send proxy materials to their principals, and we may reimburse them for their expenses.

17

Will a stockholder list be available for inspection?

A list of stockholders entitled to vote at the Annual Meeting will be available for inspection by stockholders for any purpose germane to the meeting for 10 business days prior to the Annual Meeting, at 5E Advanced Materials, Inc., 19500 State Highway 249, Suite 125, Houston, Texas, 77070 between the hours of 9:00 a.m. and 5:00 p.m. Central time. The stockholder list will also be available to stockholders of record for examination during the Annual Meeting at www.meetnow.global/M265SYK. You will need the control number included on your proxy card, or voting instruction form, or otherwise provided by your bank, broker, or other nominee.

What is “householding” and how does it affect me?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, we send only one Proxy Statement and one Annual Report to eligible stockholders who share a single address, unless we have received instructions to the contrary from any stockholder at that address. This practice is designed to eliminate duplicate mailings, conserve natural resources, and reduce our printing and mailing costs. Stockholders who participate in householding will continue to receive separate proxy cards.

If you share an address with another stockholder and receive only one set of proxy materials but would like to request a separate copy of these materials, please contact our mailing agent, Broadridge, by calling (866) 540-7095 or writing to Broadridge Householding Department, 51 Mercedes Way, Edgewood, New York 11717, and an additional copy of proxy materials will be promptly delivered to you. Similarly, if you receive multiple copies of the proxy materials and would prefer to receive a single copy in the future, you may also contact Broadridge at the above telephone number or address. If you own shares through a bank, broker, or other nominee, you should contact the nominee concerning householding procedures.

How can I find out the results of the voting at the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

When are stockholder proposals due for the 2023 Annual Meeting of the stockholders?

We intend to hold our next annual meeting in late 2023. Our stockholders are entitled to present proposals for action at a forthcoming meeting if they comply with the requirements of our Charter, our Bylaws, and the rules established by the SEC.

As we expect to hold our next annual meeting in late 2023 (which will be a date changed by more than 30 days from the date of the 2022 Annual Meeting), under Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”), if you want us to include a proposal in the proxy materials for our 2023 Annual Meeting of stockholders, we must receive the proposal at our executive offices at 19500 State Highway 249, Suite 125, Houston, Texas 77070, no later than a reasonable time before we begin to print and send our proxy materials.

As we expect to hold our next annual meeting in late 2023 (which will be a date more than 30 days in advance of the anniversary of the 2022 Annual Meeting), pursuant to our Bylaws, a stockholder proposal of business submitted outside of the process established in Rule 14a-8 and nominations of directors must be received no earlier than the close of business on the 120th day prior to the 2023 Annual Meeting , and not later than the later of close of business on the 90th day prior to the 2023 Annual Meeting and the close of business on the tenth (10th) day following the first date of public disclosure of the date of the 2023 Annual Meeting. All proposals submitted outside of the process established in Rule 14a-8 and nominations of directors must comply with the requirements set forth in our Bylaws. Any proposal or nomination should be addressed to the attention of our Secretary, and we suggest that it be sent by certified mail, return receipt requested.

18

In addition, as we expect to hold our next annual meeting in late 2023 (which will be a date changed by more than 30 calendar days from the date of the 2022 Annual Meeting), to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than the later of 60 days prior to the date of the 2023 Annual Meeting or the tenth (10th) day following the date of public announcement of the date of the 2023 Annual Meeting.

Whom can I contact for further information?

You may request additional copies, without charge, of this Proxy Statement and other proxy materials or ask questions about the Annual Meeting, the proposals, or the procedures for voting your shares by writing to our Corporate Secretary at 19500 State Highway 249, Suite 125, Houston, Texas 77070.

19

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL ONE (1) TO (5)

ELECTION OF DIRECTORS

General

At the Annual Meeting, our stockholders will vote on five directors for a one-year term and until the election and qualification of their respective successors in office, or until such director’s earlier death, resignation, or removal. ASX Listing Rule 14.5 requires that an entity which has directors must hold an election of directors at each Annual Meeting. Further, in accordance with ASX Listing Rule 14.4, a director must not hold office (without re-election) past the third Annual Meeting following their appointment of 3 years, whichever is longer.

The directors named herein have agreed to serve, if elected, until the next annual meeting of stockholders and until their successors have been duly elected and qualified or until their earlier death, resignation, or removal. There are no family relationships between or among any of our executive officers, nominees, or continuing directors.

The election of each director will be voted on separately.

If a proposal to elect a director is approved, the director will be appointed for a one-year term as outlined above. If a proposal to elect a director is not approved, the director will not be appointed and will cease to be a director, and the board may be required to take steps to fill that vacancy.

Director Nominees

The following table sets forth information with respect to our director nominees for election at the Annual Meeting:

| Name | Independent | Age | ||

| (1) David Jay Salisbury | Yes | 71 | ||

| (2) Stephen Hunt | Yes | 60 | ||

| (3) H. Keith Jennings | Yes | 53 | ||

| (4) Sen Ming (Jimmy) Lim | No | 49 | ||

| (5) Graham van’t Hoff | Yes | 61 |

20

Board Skills Matrix

| (1) David Jay Salisbury | (2) Stephen Hunt | (3) H. Keith Jennings | (4) Sen Ming (Jimmy) Lim | (5) Graham van’t Hoff | Total | |||||||||

Executive Leadership | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | ||||||||

Mining/Rare Earth Minerals/Specialty Chemicals Industry Experience | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | ||||||||

Business Operations | ✓ | ✓ | ✓ | 3 | ||||||||||

Strategic Development/Planning | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | ||||||||

Corporate Governance | ✓ | ✓ | ✓ | 3 | ||||||||||

Financial Expert | ✓ | 1 | ||||||||||||

Business to Business Sales and Marketing | ✓ | ✓ | 2 | |||||||||||

Capital Markets | ✓ | ✓ | ✓ | 3 | ||||||||||

ESG Leadership | ✓ | ✓ | ✓ | 3 | ||||||||||

M&A Experience | ✓ | ✓ | ✓ | 3 | ||||||||||

International Experience | ✓ | ✓ | ✓ | ✓ | ✓ | 5 | ||||||||

Board Diversity Matrix (as of March 22, 2023)

Total Number of Director Nominees: 5

Part I: Gender Identity | Female | Male | Nonbinary | Did Not Disclose Gender Identity | ||||||||||||

Directors | — | 5 | — | — | ||||||||||||

Part II: Demographic Background |

| |||||||||||||||

African American or Black | — | 1 | — | — | ||||||||||||

Alaskan Native or Native American | — | — | — | — | ||||||||||||

Asian | — | 1 | — | — | ||||||||||||

Hispanic or Latinx | — | — | — | — | ||||||||||||

Native Hawaiian or Pacific Islander | — | — | — | — | ||||||||||||

White | — | 3 | — | — | ||||||||||||

Two or More Races or Ethnicities | — | — | — | — | ||||||||||||

LGBTQ+ | — | — | — | — | ||||||||||||

Did Not Disclose Demographic Background | — | — | — | — | ||||||||||||

More detailed biographical descriptions of the nominees are set forth in the text below. These descriptions include the experience, qualifications, qualities, and skills that led to the conclusion that each director should serve as a member of our Board at this time.

21

| (1) David J. Salisbury was appointed as Chairman of the Board in January 2022. Mr. Salisbury has served as Chairman of ABR since August 1, 2020, and served as Executive Chairman of ABR from May 2021 to August 2021. Mr. Salisbury has also served as Chairman of Fort Cady (California) Corporation, a subsidiary of ABR, since August 2020 and served as the President and CEO of Fort Cady (California) Corporation from May 2021 to August 2021. Mr. Salisbury’s business experience spans a period of over 40 years with significant involvement in underground and surface coal, open-pit gold, uranium mining, and copper mine development. Over that period, he has held senior executive positions at The Coteau Properties Company, Energy Resources Company, Al Hamilton Contracting Company, Cordero Mining Company, Kennecott Ridgeway Mining Company Inc., Rössing Uranium Limited, Kennecott Minerals Company, Resolution Copper Mining, LLC (Rio Tinto), and PetroDome Energy LLC. While working for Rio Tinto, Mr. Salisbury was President and CEO of Resolution Copper Company LLC, President and CEO of Kennecott Minerals Company, and Managing Director and CEO of Rössing Uranium Limited. In addition, he was a Leader for Rio Tinto’s global improvement program, Improving Performance Together, focused on the development of common improvement processes related to ore and mineral processing across global operations. Over his career, Mr. Salisbury has been responsible for operating and capital-budget development, operating-cost control, product quality, profit/loss, engineering, safety, field operations and maintenance, strategic planning, environmental compliance, market development, merger and acquisition analysis, employee relations, community, public relations, and government relations at both the state and federal levels. He was also directly responsible for the development, construction, and operations of four mines. Mr. Salisbury holds a Bachelor of Science, Electrical Engineering, from Utah State University and an MBA from the University of South Carolina. | |

| (2) Stephen Hunt was appointed as a Director in January 2022. Mr. Hunt has also served as a Director of ABR since May 2017. Mr. Hunt is currently Executive Chairman of Sparc Technologies Ltd. (ASX: SPN), which is developing and commercializing graphene applications as well as photocatalytic hydrogen production. Mr. Hunt’s experience includes over 20 years of serving as a Director of multiple ASX-listed companies. Previous Directorships include Executive Chairman and Non-Executive Director of Volt Resources Ltd. (ASX: VRC), Non-Executive Director of Magnis Energy Technologies Ltd. (ASX: MNS), Non-Executive Director of IMX Resources Ltd. and Australian Zircon Ltd. | |

| (3) H. Keith Jennings was appointed as a Director in October 2022. Mr. Jennings has over 30 years’ experience as a global business leader with a focus on finance across the pharmaceuticals, genomics, chemicals, fuels and energy sectors. Mr. Jennings most recently acted as Executive Vice President and Chief Financial Officer of Weatherford International (NASDAQ: WFRD). Prior to this, Executive Vice President and Chief Financial Officer of Calumet Specialty Products Partners (NASDAQ: CLMT), the Vice President, Finance and Vice President & Treasurer of Eastman Chemical Company (NYSE: EMN). He has also served as the Vice President & Treasurer of Cameron International (NYSE:CAM). Mr. Jennings holds a Bachelor of Commerce from the University of Toronto and an MBA from Columbia University and is a Chartered Professional Accountant. | |

22

| (4) Sen Ming (Jimmy) Lim was appointed as a Director in January 2022. Mr. Lim has also served as a Director of ABR since February 2021. Mr. Lim has served as the Managing Director and Founder of Virtova Capital Management Limited, a natural resources industry advisory firm providing corporate advisory services encompassing M&A and structured financings in relation to assets in the sector since 2018. In this role, he advises several ASX-listed mining companies with respect to mergers, acquisitions, and structured finance. Mr. Lim has worked for global investment banks in Australia (JPMorgan) and Hong Kong (Morgan Stanley and Goldman Sachs). Mr. Lim has served as a Non-Executive Director of Stanmore Resources Limited since October 2019. | |

| (5) Graham van’t Hoff was appointed as Director in October 2022. Mr. van’t Hoff is a global business executive with a 35-year career focused on business restructuring and growth with a track record of scaling business and driving growth through business disruption, restructures, technology integration and tight project management disciplines. Mr. van’t Hoff finished his 35-year career with Royal Dutch Shell PLC (NYSE: SHEL) as the Executive Vice President of Global Chemicals where he was responsible for the company’s $25bn global chemicals business over a seven year period of record profitability. Prior to this role, he held the positions of Chairman, Shell UK, Executive Vice President, Alternative Energies and CO2 and Vice President, Base Chemicals. Mr. van’t Hoff holds a Bachelor of Arts and Master of Arts in Chemistry from Oxford University, UK and a Master of Business Management with distinction from Alliance Manchester Business School, UK. | |

Our directors bring a range of skills and experience in relevant areas, including finance, exploration and production, environment, international business and leadership, as well as specialty chemicals. We believe this cross-section of capabilities enables our Board of Directors to help guide our objectives and leading corporate governance practices.

Recommendation of Our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH NOMINEE NAMED ABOVE.

23

Our Board believes sound corporate-governance processes and practices, as well as high ethical standards, are critical to handling challenges and to achieving business success. We embrace leading governance practices and conduct ongoing reviews of our governance structure and processes to reflect changing circumstances. Below are highlights of our corporate-governance practices and principles.

Director Independence

Our common stock is listed on the Nasdaq Stock Market (the “Nasdaq”). Under the rules of the Nasdaq, independent directors must comprise a majority of a listed company’s board of directors within one year of listing on the Nasdaq. In addition, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees must be independent. Under the rules of the Nasdaq, a director will only qualify as an “independent director” if the director has no relationship which, in the opinion of the Company’s board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee, (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or (2) be an affiliated person of the listed company or any of its subsidiaries.

At least annually, our Board evaluates all relationships between us and each director in light of relevant facts and circumstances for the purposes of determining whether a relationship exists that might interfere with such director’s ability to satisfy his or her responsibilities as an independent director. Based on this evaluation, our Board will make an annual determination of whether each director is independent within the meaning of the independence standards of Nasdaq and the SEC.

Our Board has determined that each of Messrs. Salisbury, Hunt, Jennings, and van’t Hoff qualifies as an “independent director” as defined under the rules of the Nasdaq. Mr. Lim is not independent. Our Board also has determined that Messrs. Jennings, Hunt, and Salisbury, who comprise our Audit Committee, Messrs. van’t Hoff and Jennings, who comprise our Compensation Committee, and Messrs. van’t Hoff and Salisbury, who comprise our Nominating and Corporate Governance Committee, satisfy the independence standards for such committees established by the SEC and the rules of the Nasdaq, as applicable. In making such determinations, our Board considered the relationships that each such non-employee director has with our Company and all other facts and circumstances our Board deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director and any institutional stockholder with which he or she is affiliated.

Board Leadership Structure

Our Corporate Governance Guidelines provide the Board will determine the Board leadership structure in a manner that it determines to be in the best interests of the Company and its stockholders. The Chairman of the Board and CEO positions may, but need not be, filled by the same individual. At this time, the offices of the Chairman of the Board and the CEO are not combined. If the offices were combined, the Board would appoint a lead independent director to coordinate the activities of the other independent directors and to perform such other duties and responsibilities as the Board may determine.

Role of the Board in Risk Oversight

The Board is responsible for the oversight of risk, while management is responsible for the day-to-day management of risk. The Board, directly and through its committees, carries out its oversight role by regularly reviewing and discussing with management the risks inherent in the operation of our business and applicable risk mitigation efforts. Management meets regularly to discuss the Company’s business strategies, challenges, risks and opportunities and reviews those items with the Board at regularly scheduled meetings. The Compensation Committee is responsible for

24

overseeing the management of risks relating to our compensation plans and arrangements, including whether the Company’s incentive compensation plans encourage excessive or inappropriate risk taking. The Audit Committee is responsible for overseeing our risk assessment and management processes related to, among other things, our financial reports and record-keeping, major litigation and financial risk exposures and the steps management has taken to monitor and control such exposures. The Nominating and Corporate Governance Committee is responsible for risk oversight associated with corporate governance practices and the composition of our Board and its committees.

Evaluations of the Board of Directors

The Board evaluates its performance and the performance of its committees and individual directors on an annual basis through an evaluation process administered by our Nominating and Corporate Governance Committee. The Board discusses each evaluation to determine what, if any, actions should be taken to improve the effectiveness of the Board or any committee thereof or of the directors.

Board and Committee Meetings and Attendance

Directors are expected to make every effort to attend all meetings of the Board and all meetings of the committees on which they serve. During fiscal year 2022, our Board had 13 Board meetings. During fiscal year 2022, each member of our Board attended at least 75% of all Board and relevant Committee meetings held during the period in which such director served. Our independent directors hold regularly scheduled executive sessions without our management present. These executive sessions of independent directors are chaired by our Chairman of the Board.

Board Attendance at Annual Stockholders’ Meeting

Each director is encouraged and generally expected to attend the Company’s annual meeting of stockholders.

Board Committees

Our Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The composition and responsibilities of each of the committees of our Board are described below. Copies of the charters of the committees are available on the investor relations page of our website at https://5eadvancedmaterials.com/investors/corporate-governance/. The information in or accessible through our website is not incorporated into, and is not considered part of, this Proxy Statement. Members serve on these committees until their resignation or until otherwise determined by our Board. Our Board may establish other committees as it deems necessary or appropriate from time to time.

The following table provides current membership and meeting information for 2022 for each of these committees of our Board with directors marked with an asterisk (*) identified as committee chair:

| Name | Audit | Nominating and Corporate Governance | Compensation | |||

David Jay Salisbury | ✓ | ✓ | ||||

Stephen Hunt | ✓ | |||||

H. Keith Jennings | ✓* | ✓ | ||||

Sen Ming (Jimmy) Lim | ||||||

Graham van’t Hoff | ✓* | ✓* | ||||

Total meetings held in 2022 | 6 | 8 | 3 |

25

Audit Committee

Messrs. Jennings, Hunt and Salisbury are the members of the Audit Committee. Mr. Jennings is the Chairman of the Audit Committee. Each proposed member of the Audit Committee qualifies as an independent director under the NYSE corporate governance standards and the independence requirements of Rule 10A-3 of the Exchange Act. Our Board has determined that Mr. Jennings qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K, and that each of the members is able to read and understand fundamental financial statements, as defined under the rules of the Nasdaq.

Under its charter, the functions of the Audit Committee include, among other things:

| • | the Company’s accounting and financial reporting processes and the integrity of its financial statements; |

| • | the audits of the Company’s financial statements and the appointment, compensation, qualifications, independence and performance of the Company’s independent auditors; |

| • | the Company’s compliance with legal and regulatory requirements; and |

| • | the performance of the Company’s internal accounting controls, disclosure controls and procedures and internal control over financial reporting. |

Compensation Committee

Messrs. van’t Hoff and Jennings are the members of the Compensation Committee. Mr. van’t Hoff is the Chairman of the Compensation Committee. All of the members of the Compensation Committee are independent directors and are considered to be a “non-employee director” under Rule 16b-3 of the Exchange Act.

Under its charter, the functions of the Compensation Committee include, among other things:

| • | determine, or recommend to the Board for determination, the compensation of the Chief Executive Officer (the “CEO”) and all other executive officers (as defined herein) of the Company; |

| • | make recommendations to the Board with respect to (to the extent set forth in this charter or otherwise directed by the Board) compensation of the non-employee directors; |

| • | make recommendations to the Board with respect to incentive compensation plans and equity-based plans that are subject to Board approval; |

| • | exercise oversight with respect to the Company’s compensation philosophy, incentive compensation plans and equity-based plans covering executive officers and senior management; |

| • | review and discuss with management the Company’s Compensation Discussion & Analysis required by SEC rules to be included in the Company’s proxy statement and annual report on Form 10-K; and |

| • | produce the annual compensation committee report for inclusion in the Company’s proxy statement and annual report on Form 10-K. |

The Compensation Committee charter also provides that the Compensation Committee shall have the sole authority to retain or obtain the advice of a compensation consultant, legal counsel or other adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the Compensation Committee will consider the independence of each such adviser.

26

Nominating and Corporate Governance Committee

Messrs. Salisbury and van’t Hoff are members of the Nominating and Governance Committee. Mr. van’t Hoff is the Chairperson of the Nominating and Corporate Governance Committee. All of the members of the Nominating and Governance Committee are independent directors.

Under its charter, the functions of the Nominating and Corporate Governance Committee include, among other things:

| • | identify and recommend to the Board for selection the individuals qualified to serve on the Company’s Board (consistent with criteria that the Board has approved) either for election by stockholders at each meeting of stockholders at which directors are to be elected or for appointment to fill vacancies on the Board; |

| • | develop, recommend to the Board and assess corporate governance policies for the Company; and |

| • | oversee the evaluation of the Board. |

The Nominating and Corporate Governance Committee has the sole authority to retain and terminate any search firm to be used to identify director candidates and shall have sole authority to approve the search firm’s fees and other retention terms. The Nominating and Corporate Governance Committee is leading the current CEO search.

The Nominating and Corporate Governance Committee meets periodically, and no less frequently than annually, to assess, develop and communicate with the full Board concerning the appropriate criteria for nominating and appointing directors, including the Board’s size and composition, corporate governance policies, applicable listing standards and laws, individual director performance, expertise, experience, qualifications, attributes, skills, tenure and willingness to serve actively, the number of other public and private Company Boards on which a director candidate serves, consideration of director nominees proposed or recommended by stockholders and related policies and procedures, and other appropriate factors. Whenever a new seat or a vacated seat on the Board is being filled, candidates that appear to best fit the needs of the Board and the Company will be identified, interviewed and evaluated by the Nominating and Corporate Governance Committee. Potential director candidates recommended by the Company’s management and stockholders are evaluated in the same manner as nominees identified by the Nominating and Corporate Governance Committee. Candidates selected by the Nominating and Corporate Governance Committee will then be recommended to the full Board.

Director Nominations by Stockholders

Nominations of persons for election to the Board may be made by any stockholder of the Company who is a stockholder of record and complies with the notice procedures set forth in the Bylaws, and such nominations must be accompanied by a written consent from the proposed nominee to be named as a nominee and to serve as a director if elected. All candidates, regardless of the source of their recommendation, are evaluated in the same manner as nominees identified by the Nominating and Corporate Governance Committee.

Election of Directors

We have voluntarily adopted a majority-voting standard for uncontested elections of directors. Our Bylaws provide that, unless otherwise required by law or our Certificate of Incorporation or Bylaws, the election of our directors will be decided by a majority of the votes cast at a meeting of the stockholders by the holders of stock entitled to vote in the election, unless our Secretary determines that the number of nominees for director exceeds the number of directors to be elected, in which case directors will be elected by a plurality of the votes of the shares represented in person or by proxy at any meeting of stockholders held to elect directors and entitled to vote on such election of directors.

27

If a nominee for director who is not an incumbent director does not receive a majority of the votes cast, the nominee will not be elected. Our Nominating and Corporate Governance Committee has established procedures under which a director standing for reelection in an uncontested election must tender a resignation conditioned on the incumbent director’s failure to receive a majority of the votes cast. If an incumbent director who is standing for reelection does not receive a majority of the votes cast, the Nominating and Corporate Governance Committee will make a recommendation to the Board of Directors on whether to accept or reject the resignation, or whether other action should be taken. The Board of Directors must act on the committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results. The director who fails to receive a majority vote is not permitted to participate in the committee’s recommendation or the Board of Directors’ decision.

Corporate Governance Guidelines and Code of Business Conduct

We have adopted Corporate Governance Guidelines and a written Code of Business Conduct, which are available on our website at https://5eadvancedmaterials.com/investors/corporate-governance/. The information in or accessible through our website is not incorporated into, and is not considered part of, this Proxy Statement.

Our Corporate Governance Guidelines provide the framework for our corporate governance along with our Charter, Bylaws, committee charters and other key governance practices and policies. Our Corporate Governance Guidelines cover a wide range of subjects, including the conduct of Board meetings, independence and selection of directors, Board membership criteria, and Board committee composition. Our guidelines currently provide for our directors to retire upon reaching age 70. Due to Mr. Salisbury’s institutional knowledge and recent transitions on the Board, the Board believes that it would be in the best interests of the Company and its shareholders for Mr. Salisbury to stand for reelection to the Board.

Our Code of Business Conduct and Ethics is applicable to our directors, executive officers and employees. The Code of Business Conduct and Ethics codifies the business and ethical principles that govern all aspects of the Company’s business. Any waiver of this Code of conduct for any individual director or officer of our Company must be approved, if at all, by our board of directors. Any such waivers granted, as well as substantive amendments to this Code, will be publicly disclosed by appropriate means in compliance with applicable listing standards and SEC rules.