UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-23758

Eagle Point Institutional Income Fund

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 202

Greenwich, CT 06830

(Address of principal executive offices) (Zip code)

Thomas P. Majewski

c/o Eagle Point Institutional Income Fund

600 Steamboat Road, Suite 202

Greenwich, CT 06830

(Name and address of agent for service)

Copies to

Thomas J. Friedmann

Philip Hinkle

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, MA 02110

(617) 728-7120

Registrant’s telephone number, including area code: (203) 340-8500

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Report to Stockholders |

The Company’s Semiannual Report to stockholders for the six months ending June 30, 2022 is filed herewith.

Eagle Point Institutional Income Fund

Semiannual Report – June 30, 2022

Table of Contents

Letter to shareholders and Management Discussion of Fund Performance

Dear Shareholders:

We are pleased to provide you with the enclosed report of Eagle Point Institutional Income Fund (“we,” “us,” “our” or the “Fund”) for the period from June 1, 2022 (the date the Fund commenced operations) to June 30, 2022.

The Fund is a non-diversified closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”) and is advised by Eagle Point Credit Management LLC (the “Adviser”). The Fund is organized as a Delaware statutory trust. The Fund offers its shares of beneficial interest (“Shares”) to investors on a continuous basis at their net asset value per share plus any applicable sales load. The Fund’s primary investment objective is to generate high current income, with a secondary objective to generate capital appreciation. We seek to achieve these objectives by investing primarily in equity and junior debt tranches of collateralized loan obligations (“CLOs”) and may also invest in other securities or instruments that are related investments or that are consistent with our investment objectives.

The Adviser has significant expertise in CLO investing, including 55 years of combined CLO industry experience among the senior investment team and differentiated origination, due diligence, structuring and portfolio management techniques. The Adviser managed a total of 74 funds and separate accounts (including non-CLO strategies) with an aggregate of approximately $7.2 billion of assets under management (including undrawn capital commitments) as of June 30, 2022. The Fund was formed in order to provide access to institutional credit investment strategies to investors in a continuously offered, SEC-registered and non-traded format.

In the first six months of 2022 global markets continued to price in increased risk of recession, persistent inflation, geopolitical instability and the impact of supply chain challenges. For risk assets, it was one of the worst half-year performances on record. We witnessed the largest first-half decline in the S&P 500 in over 60 years, with the index falling 21%. High yield bonds declined over 14%, the second-largest six month loss on record (trailing only the second half of 2008). Investment grade bonds also declined over 14%, the largest six month loss in almost 14 years.

Loans meaningfully outperformed many other asset classes in the first half of 2022. The senior secured nature of the asset class, along with their floating rate structure, allowed loans to remain more resilient through the first half.

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 8 for endnotes.

Despite few corporate defaults, the value of CLO equity securities generally fell as the yields demanded in the secondary market widened meaningfully. While nearly all CLO securities faced mark-to-market drawdowns during the first half of 2022, it is in environments of loan price volatility where we believe CLO structures – and CLO equity in particular – are set up to outperform over the medium-term. Historically, it has been a good time to invest in CLO equity when loan prices are low. This is largely driven by CLOs’ high front-loaded cash flows and an ability to reinvest loan principal repayments (which are at par) into discounted loans in the secondary market. CLOs can do this with confidence due to their long-term non-mark-to-market financing structure.

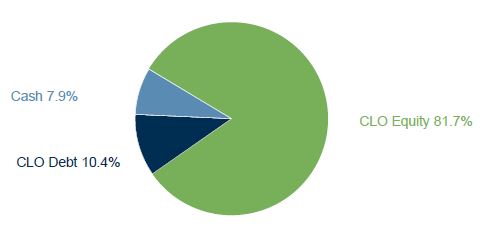

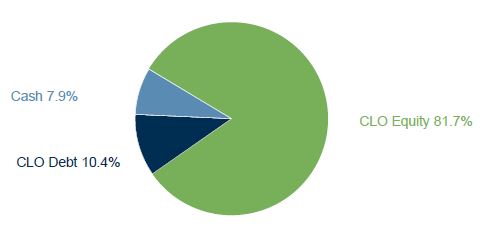

The Fund commenced operations on June 1, 2022 with $10 million of seed capital from the Adviser and its affiliates. The Fund deployed capital prudently during the month of June and we are pleased with the Fund’s current investment portfolio composition. As of June 30, 2022, the Fund’s holdings consisted of nine CLO equity investments and three CLO debt investments, which represents exposure to 11 different CLO collateral managers. The weighted average effective yield of our CLO equity portfolio and CLO debt portfolio, based on current amortized cost, was 18.80%, as of June 30, 2022.

During the reporting period, the Fund acquired new issue investments in the primary market, while also selectively taking advantage of attractive buying opportunities in the secondary market. Seven of the Fund’s CLO equity investments were also investments made across other funds and accounts managed by the Adviser. As a result, the Fund (and such other funds and accounts) benefit from owning a majority position in the equity tranche, enabling our Adviser to exercise certain protective rights over the vehicle (such as the ability to call the CLO after the non-call period, to refinance/reprice certain CLO debt tranches after a period of time and to influence potential amendments to the governing documents of the CLO) that may reduce our risk in these investments and/or enhance the investment’s potential return.

In a rising rate environment, loans and CLOs, which pay a floating rate of interest, are expected to outperform fixed rate credit investments, such as high yield bonds and certain other corporate debt instruments. Generally, increases in interest rates are also expected to be beneficial to CLO equity and CLO debt cash flows over the medium-term. Accordingly, to the extent that LIBOR and SOFR continue to increase over the near-term, we anticipate the Fund’s cash flows will benefit.

For the period ended June 30, 2022, the Fund generated a -2.20% GAAP return on shareholders’ equity1, comprised of $29.8 thousand of net investment income offset by an unrealized loss on portfolio investments of $254.0 thousand. Net asset value per share as of June 30, 2022 was $9.78. Despite mark-to-market volatility amidst a challenging macroeconomic backdrop, we are pleased with the positive net investment income that the Fund generated with core, recurring

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 8 for endnotes.

income in its first month of operations. Further, the Adviser’s proactive approach to managing the Fund is expected to continue to position the portfolio to create long-term shareholder value.

We want to highlight the Fund’s dividend reinvestment plan for shareholders. This plan allows shareholders to have their distributions automatically reinvested into new shares at the net asset value per share. We encourage all shareholders to carefully review the terms of the plan. See “Dividend Reinvestment Plan” in the enclosed report.

While the CLO market continues to command attention from investors worldwide, we believe the CLO market, and CLO equity in particular, remains inefficient and attractive. In less efficient markets, specialization matters and the Fund benefits from the investment experience of our Adviser, which applies a proprietary, private equity style investment approach to the fixed income market. This approach seeks to maximize returns while mitigating potential risks. We believe the scale and experience of our Adviser in CLO investing provides the Fund with meaningful advantages.

Market Overview2

Loan Market

Senior secured loans to larger US companies comprise the vast majority of our CLOs’ underlying portfolios. The Credit Suisse Leverage Loan Index3 (“CSLLI”), which is a broad index followed by many tracking the corporate loan market, generated a total return of -4.45% in the first half of 2022. Despite the negative return, U.S. leveraged loans have continued to outperform most other risk assets.

While nearly all loans fell in price during the first half, the dispersion between riskier and higher-quality issuers increased, as lower-rated borrowers were more significantly discounted in the secondary market. Importantly, loan downgrades remain limited with CCC-rated loans accounting for approximately 4% of the market at quarter end.

The percentage of loans trading below 80 increased just modestly quarter-over-quarter and they represented less than 3% of the market at June 30. The majority of loans were priced in the low 90s. We expect CLOs that are within their reinvestment periods that are able to reinvest par repayments from existing loans into discounted loans in the secondary market will be net beneficiaries over the medium term. For existing CLOs, an environment of loan price volatility, continued par prepayments on loans and limited defaults allows for greater relative value trading opportunities. Indeed, during the second quarter, the annualized prepayment rate for loans was over 14%. In these markets, for newly issued CLOs, it is an attractive environment to ramp portfolios with new, high-quality loans at handsome discounts to par. For secondary CLO equity purchases, we are able to capitalize on materially discounted prices for CLO equity securities.

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 8 for endnotes.

As recessionary fears continue to weigh on the market, concerns over the impact of increasing inflation, rising interest rates and supply chain issues remained amongst the prevailing risks identified by investors. The retail investor base took to a defensive risk-off position, reversing flows into loan mutual funds. For the first half of 2022, mutual funds and ETFs investing in U.S. leveraged loans experienced net inflows of $16.5 billion, compared to $27.7 billion of inflows for the same period in 2021.4

In concert with spread widening, U.S. leveraged loan issuance slowed significantly and refinancing activity remained quiet. Institutional loan issuance finished the first half of 2022 at $171.8 billion, compared to $330.7 billion for the first half of 2021. Total institutional loans outstanding stood at $1.4 trillion as of June 30, 2022.

Despite the market fears, the loan market recorded just two defaults in the first half of 2022. While defaults are expected to increase, the par-weighted trailing twelve month default rate for U.S. leveraged loans finished June at 0.28%, near all-time record lows. This compares to 1.25% at the end of June 2021 and the long-term default rate of 2.8%.5

We remain aware of greater leverage used by many borrowers in the loan market (and in our underlying portfolios). Many corporate borrowers took advantage of the strong demand for loans to refinance their existing debt, and in return, were able to extend the maturity dates of their debt outstanding. As such, the vast majority of the loan market matures beyond 2025.

CLO Market

The CLO market maintained steady momentum of new CLO creation into the second quarter, one of few areas of issuance across risk assets. While CLO liability spreads widened in parallel with the loan market, the underlying fundamentals for pricing a new CLO remained attractive. Total volumes for U.S. CLO new issuance were lower year-over-year, but still recorded a healthy figure of $71 billion for the first half of 2022.

In the primary market, average CLO AAA spreads reached 200 basis points over SOFR at June 30, a 54 basis point increase quarter-over-quarter, and nearly 86 basis points higher from the start of the year. Amidst the challenging macro and technical environment, a handful of U.S. banks – historically some of the lead buyers of CLO AAAs – paused on new commitments, putting further pressure on pricing. Through July, liability costs have continued to push wider, breaking the 200-point threshold for the first time since December 2020.

While the new issue market remained open in the second quarter, many new CLOs were priced with what we consider to be less than optimal structures. In June specifically, the market saw an increasing number of shorter-dated and static CLOs. As equity investors, we are acutely aware of the relationship between a demonstrable track record of consistent and strong CLO performance, and a CLO collateral manager’s ability to secure attractive financing costs in periods like the present. For

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 8 for endnotes.

opportunistic equity investors able to secure CLO debt financing, a number of new “print-and-sprint” CLOs also priced during the final month of the second quarter.

CLO refinancing and reset activity was muted for most of the first half of 2022. We expect near-term opportunities to refinance to remain few in the wake of widening liability costs. In total, $5 billion in refinancings and $20 billion in resets were completed in the first half of 2022.

While we have started to see distressed ratios within the loan market increase, concentrations of CCC-rated loans within CLOs remain low at 4% and overcollateralization cushions are healthy. Risk of a near-term disruption in equity cash flows remains minimal, in our view.

As we look into the second half of the year, we remain constructive on the overall composition of our portfolio, but we acknowledge the uncertainties ahead. The largest risk for the CLO equity asset class, in our opinion, continues to be mark-to-market volatility, not ultimate loss of capital. It is this ability of CLOs to buy loans at large discounts to par (without any risk to its financing structure) in a stressed market environment that have enabled CLOs to exhibit strong performance through multiple market cycles. While past performance is not necessarily indicative of future results, the proven playbook of CLOs, with locked-in financing longer than its assets, remains unchanged.

Additional Information

In addition to the Fund’s regulatory requirement to file certain quarterly and annual portfolio information as described further in the enclosed report, the Fund makes certain additional financial information available to investors via our website (www.EaglePointInstitutionalIncome.com).

Subsequent Developments

As of July 31, 2022, the Fund’s net asset value per share was $9.73. This represents a decrease of 0.5% compared to the net asset value per share as of June 30, 2022 and it is inclusive of the Fund’s first monthly distribution of $0.074 per share payable to shareholders of record on July 28, 2022.6

Pursuant to the continuous offering, in the period from July 1, 2022 through August 1, 2022, the Fund issued shares for total net proceeds to the Fund of $2.6 million.

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 8 for endnotes.

* * * * *

Management remains keenly focused on continuing to create value for our shareholders. We appreciate the trust and confidence our fellow shareholders have placed in the Fund.

Thomas Majewski

Chief Executive Officer

This letter is intended to assist shareholders in understanding the Fund’s performance during the period from June 1, 2022 to June 30, 2022. The views and opinions in this letter were current as of August 1, 2022. Statements other than those of historical facts included herein may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors. The Fund undertakes no duty to update any forward-looking statement made herein. Information contained on our website is not incorporated by reference into this shareholder letter and you should not consider information contained on our website to be part of this shareholder letter or any other report we file with the Securities and Exchange Commission.

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 8 for endnotes.

ABOUT OUR ADVISER

Eagle Point Credit Management LLC is a specialist asset manager focused on investing in CLO securities and other income-oriented credit investments. As of June 30, 2022, our Adviser had approximately $7.2 billion of assets under management (inclusive of undrawn capital commitments).7

Notes

| 1 | Return on our equity reflects the Fund’s cumulative monthly performance net of applicable expenses and fees measured against beginning capital adjusted for any equity issued during the period. |

| 2 | JPMorgan Chase & Co.; S&P Capital IQ; S&P LCD; Credit Suisse. |

| 3 | The CSLLI tracks the investable universe of the US dollar-denominated leveraged loan market. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. |

| 4 | JPMorgan Chase & Co. North American Credit Research – JPM High Yield and Leveraged Loan Research (cumulative 2022 reports). |

| 5 | “Par-weighted default rate” represents the rate of obligors who fail to remain current on their loans based on the par amount. |

| 6 | A portion of distributions may be estimated to be a return of capital. The actual components of the Fund's distributions for U.S. tax reporting purposes can only be finally determined as of the end of each fiscal year of the Fund and are thereafter reported on Form 1099-DIV. A distribution comprised in whole or in part by a return of capital does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income”. Future distributions may consist of a return of capital. Not a guarantee of future distributions or yield. |

| 7 | Calculated in the aggregate with its affiliate Eagle Point Income Management LLC. |

Page Intentionally Left Blank

Important Information about this Report and Eagle Point Institutional Income Fund

This report is transmitted to the shareholders of Eagle Point Institutional Income Fund (“we”, “us”, “our” or the “Fund”) and is furnished pursuant to certain regulatory requirements. This report and the information and views herein do not constitute investment advice, or a recommendation or an offer to enter into any transaction with the Fund or any of its affiliates. This report is provided for informational purposes only, does not constitute an offer to sell securities of the Fund and is not a prospectus. Such offering is only made by the Fund’s prospectus, which includes details as to the Fund’s offering and other material information.

Investors should read the Fund’s prospectus, statement of additional information and other SEC filings (which are publicly available on the EDGAR Database on the SEC website at http://www.sec.gov) carefully and consider their investment goals, time horizons and risk tolerance before investing in the Fund. Investors should consider the Fund’s investment objectives, risks, charges and expenses carefully before investing in securities of the Fund. There is no guarantee that any of the goals, targets or objectives described in this report will be achieved.

An investment in the Fund is not appropriate for all investors. The investment program of the Fund is speculative, entails substantial risk and includes investment techniques not employed by traditional mutual funds. An investment in the Fund is not intended to be a complete investment program. Past performance is not indicative of, or a guarantee of, future performance. The performance and certain other portfolio information quoted herein represents information as of June 30, 2022. Nothing herein should be relied upon as a representation as to the future performance or portfolio holdings of the Fund. Investment return and principal value of an investment will fluctuate, and Shares, when sold, may be worth more or less than their original cost. The Fund’s performance is subject to change since the end of the period noted in this report and may be lower or higher than the performance data shown herein.

Liquidity will be provided by the Fund only through limited repurchase offers described below (if at all). An investment in the Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Shares and should be viewed as a long-term investment. The Fund’s Shares will not be publicly traded and an investor should not expect to be able to sell Shares regardless of how the Fund performs.

Neither the Adviser nor the Fund provide legal, accounting or tax advice. Any statement regarding such matters is explanatory and may not be relied upon as definitive advice. Investors should consult with their legal, accounting and tax advisors regarding any potential investment. The information presented herein is as of the dates noted herein and is derived from financial and other information of the Fund, and, in certain cases, from third party sources and reports (including reports of third party custodians, CLO managers and trustees) that have not been independently verified by the Fund. As noted herein, certain of this information is estimated and unaudited, and therefore subject to change. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

Forward-Looking Statements

This report may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this report may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described in the Fund’s filings with the SEC. The Fund undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this report.

Summary of Certain Unaudited Portfolio Characteristics

The information presented below is as of June 30, 2022 and derived from the Fund’s unaudited financial statements for the period from June 1, 2022 (commencement of operations) to June 30, 2022.

| Summary of Portfolio Investments1 |

| Cash: $0.8 million1 | | | | |

| | | | | |

| | | | | |

| Number of CLO Securities | | | 12 | |

| Number of Collateral Managers | | | 11 | |

| Fair Value of CLO Equity Securities | | $ | 7,956,757 | |

| Fair Value of CLO Debt Securities | | $ | 1,016,423 | |

1 The summary of portfolio investments shown is based on the estimated fair value of the underlying positions and cash net of pending settlements as of June 30, 2022.

Consolidated Financial Statements for the Period From June 1, 2022

(Commencement of Operations) to June 30, 2022 (Unaudited)

Eagle Point Institutional Income Fund & Subsidiaries

Consolidated Statement of Assets and Liabilities

As of June 30, 2022

(expressed in U.S. dollars)

(Unaudited)

| ASSETS | | | |

| Investments, at fair value (cost $9,227,170) | | $ | 8,973,180 | |

| Cash and cash equivalents | | | 1,451,451 | |

| Interest receivable | | | 97,058 | |

| Expense limitation payments due from Adviser (Note 4) (1) | | | 14,094 | |

| Total Assets | | | 10,535,783 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for securities purchased | | | 680,979 | |

| Professional fees payable | | | 37,970 | |

| Management fee payable | | | 14,094 | |

| Trustee fees payable | | | 8,753 | |

| Administration fees payable | | | 8,716 | |

| Other expenses payable | | | 959 | |

| Total Liabilities | | | 751,471 | |

| | | | | |

| COMMITMENTS AND CONTINGENCIES (Note 7) | | | | |

| | | | | |

| NET ASSETS applicable to 1,000,853 shares of beneficial interest outstanding | | $ | 9,784,312 | |

| | | | | |

| NET ASSETS consist of: | | | | |

| Paid-in capital (Note 5) | | $ | 10,008,530 | |

| Aggregate distributable earnings (losses) | | | (224,218 | ) |

| Total Net Assets | | $ | 9,784,312 | |

| | | | | |

| Shares of beneficial interest outstanding | | | 1,000,853 | |

| | | | | |

| Net asset value per share | | $ | 9.78 | |

(1) The Fund and Adviser entered into an expense limitation and reimbursement agreement ("ELA"). Pursuant to the ELA the Adviser may pay directly or indirectly, the Fund's operating expenses or waive fees to the extent deems it appropriate in the effort to limit expenses borne by the Fund. For the period from June 1, 2022 (Commencement of Operations) through June 30, 2022, the Adviser provided expense limitation to the fund of $14,094, all of which was payable to the Fund by the Adviser at June 30, 2022. The Adviser may seek reimbursement of such expense limitation for a period of three years. See Note 4 "Related Party Transactions" for further discussion.

See accompanying notes to the consolidated financial statements

Eagle Point Institutional Income Fund & Subsidiaries

Consolidated Schedule of Investments

As of June 30, 2022

(expressed in U.S. dollars)

(Unaudited)

| Issuer (1) | | Investment (2) | | Maturity

Date | | Reference

Rate and Spread | | Interest Rate/ Effective Yield | | Acquisition Date (3) | | Principal Amount | | | Cost | | | Fair Value (4) | | | % of Net Assets | |

| Investments at Fair Value | | | | | | | | | | | | | | | | | | | | | | | | | |

| CLO Debt (5) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Structured Finance | | | | | | | | | | | | | | | | | | | | | | | | | |

| Apidos CLO XXXI | | Secured Note - Class E-R | | 04/15/31 | | 3M L+6.60% | | 7.64% | | 06/07/22 | | $ | 525,000 | | | $ | 486,401 | | | $ | 471,923 | | | 4.82 | % |

| Barings CLO Ltd. 2022-II | | Secured Note - Class E | | 07/15/35 | | 3M S+7.84% | | 9.96% | | 06/21/22 | | | 100,000 | | | | 99,000 | | | | 99,000 | | | 1.01 | % |

| Tralee CLO VII, Ltd. | | Secured Note - Class E | | 04/25/34 | | 3M L+7.39% | | 8.57% | | 06/02/22 | | | 550,000 | | | | 485,813 | | | | 445,500 | | | 4.55 | % |

| | | | | | | | | | | | | | | | | | 1,071,214 | | | | 1,016,423 | | | 10.38 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| CLO Equity (6)(7) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Structured Finance | | | | | | | | | | | | | | | | | | | | | | | | | |

| Barings CLO Ltd. 2022-II | | Income Note (8) | | 07/15/72 | | N/A | | 29.50% | | 06/21/22 | | | 1,000,000 | | | | 381,166 | | | | 381,166 | | | 3.90 | % |

| Battalion CLO XXIII Ltd. | | Income Note (8) | | 07/15/36 | | N/A | | 20.04% | | 05/19/22 | | | 600,000 | | | | 479,072 | | | | 480,943 | | | 4.92 | % |

| BlueMountain CLO XXIV Ltd. | | Subordinated Note | | 04/20/34 | | N/A | | 20.47% | | 05/31/22 | | | 750,000 | | | | 498,750 | | | | 457,823 | | | 4.68 | % |

| Dryden 94 CLO, Ltd. | | Income Note (8) | | 07/15/37 | | N/A | | 19.19% | | 04/28/22 | | | 3,000,000 | | | | 2,450,338 | | | | 2,440,964 | | | 24.95 | % |

| Generate CLO 9 Ltd. | | Subordinated Note | | 10/20/34 | | N/A | | 19.54% | | 05/31/22 | | | 600,000 | | | | 486,000 | | | | 461,300 | | | 4.71 | % |

| Octagon 58, Ltd. | | Income Note (8) | | 07/15/37 | | N/A | | 18.25% | | 04/21/22 | | | 3,000,000 | | | | 2,413,608 | | | | 2,384,830 | | | 24.37 | % |

| Regatta XXI Funding Ltd. | | Subordinated Note | | 10/20/34 | | N/A | | 17.65% | | 06/10/22 | | | 650,000 | | | | 487,260 | | | | 432,016 | | | 4.42 | % |

| RR 15 Ltd. | | Subordinated Note | | 04/15/36 | | N/A | | 18.43% | | 06/08/22 | | | 575,000 | | | | 491,625 | | | | 443,923 | | | 4.54 | % |

| Wind River 2022-2 CLO Ltd. | | Income Note (8) | | 07/20/35 | | N/A | | 22.53% | | 06/03/22 | | | 600,000 | | | | 468,137 | | | | 473,792 | | | 4.84 | % |

| | | | | | | | | | | | | | | | | | 8,155,956 | | | | 7,956,757 | | | 81.33 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total investments at fair value as of June 30, 2022 | | | | | | | | | | | | | | | | $ | 9,227,170 | | | $ | 8,973,180 | | | 91.71 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets above (below) fair value of investments | | | | | | | | | | | | | | | | | | | | | 811,132 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Assets as of June 30, 2022 | | | | | | | | | | | | | | | | | | | | $ | 9,784,312 | | | | |

(1) The Fund is not affiliated with, nor does it "control" (as such term is defined in the Investment Fund Act of 1940 (the "1940 Act")), any of the issuers listed. In general, under the 1940 Act, the Fund would be presumed to "control" an issuer if it owned 25% or more of its voting securities.

(2) Securities exempt from registration under the Securities Act of 1933, and are deemed to be “restricted securities”. As of June 30, 2022, the aggregate fair value of these securities is $8,973,180, or 91.71% of the Fund's net assets.

(3) Acquisition date represents the initial date of purchase.

(4) Fair value is determined in good faith in accordance with the Fund's valuation policy and is approved by the Fund's Board of Trustees.

(5) CLO debt positions reflect the interest rate as of the reporting date.

(6) The fair value of CLO equity investments are classified as Level III investments. See Note 3 "Investments" for further discussion.

(7) CLO subordinated notes and income notes are considered CLO equity positions. CLO equity positions are entitled to recurring distributions which are generally equal to the remaining cash flow of payments made by underlying assets less contractual payments to debt holders and fund expenses. The effective yield is estimated based upon the current projection of the amount and timing of these recurring distributions in addition to the estimated amount of terminal principal payment. It is the Fund's policy to update the effective yield for each CLO equity position held within the Fund’s portfolio at the initiation of each investment and each subsequent quarter thereafter. The effective yield and investment cost may ultimately not be realized. As of June 30, 2022, the Fund's weighted average effective yield on its aggregate CLO equity positions, based on current amortized cost, was 19.60%.

(8) Fair value includes the Fund's interest in fee rebates on CLO subordinated and income notes.

See accompanying notes to the consolidated financial statements

Eagle Point Institutional Income Fund & Subsidiaries

Consolidated Statement of Operations

For the period from June 1, 2022 (Commencement of Operations) through June 30, 2022

(expressed in U.S. dollars)

(Unaudited)

| INVESTMENT INCOME | | | | |

| Interest income | | $ | 82,659 | |

| Other income | | | 3,510 | |

| Total Investment Income | | | 86,169 | |

| EXPENSES | | | | |

| Professional fees | | | 37,970 | |

| Management fee (Note 4) | | | 14,094 | |

| Trustee fees | | | 8,753 | |

| Administration fees | | | 8,716 | |

| Other expenses | | | 958 | |

| Total Expenses | | | 70,491 | |

| | | | | |

| Expense limitation provided by Adviser (Note 4) (1) | | | (14,094 | ) |

| | | | | |

| Net Expenses | | | 56,397 | |

| | | | | |

| NET INVESTMENT INCOME | | | 29,772 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) | | | | |

| Net change in unrealized appreciation (depreciation) on investments | | | (253,990 | ) |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | (253,990 | ) |

| | | | | |

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (224,218 | ) |

(1) See note 1 on the Consolidated Statement of Assets and Liabilities.

See accompanying notes to the consolidated financial statements

Eagle Point Institutional Income Fund & Subsidiaries

Consolidated Statement of Changes in Net Assets

(expressed in U.S. dollars, except share amounts)

(Unaudited)

| | | Period from | |

| | | June 1, 2022 | |

| | | (Commencement of | |

| | | Operations) through | |

| | | June 30, 2022 | |

| Net Increase (decrease) in net assets resulting from operations: | | | | |

| Net investment income | | $ | 29,772 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (253,990 | ) |

| Total net increase (decrease) in net assets resulting from operations | | | (224,218 | ) |

| | | | | |

| Capital share transactions: | | | | |

| Proceeds from shares of beneficial interest sold | | | 9,908,530 | |

| Total capital share transactions: | | | 9,908,530 | |

| | | | | |

| Total increase (decrease) in net assets | | | 9,684,312 | |

| Net assets at beginning of period | | | 100,000 | |

| Net assets at end of period | | $ | 9,784,312 | |

| | | | | |

| Capital share activity: | | | | |

| Shares of beneficial interest sold | | | 990,853 | |

| Total increase (decrease) in capital share activity | | | 990,853 | |

See accompanying notes to the consolidated financial statements

Eagle Point Institutional Income Fund & Subsidiaries

Consolidated Statement of Cash Flows

For the period from June 1, 2022 (Commencement of Operations) through June 30, 2022

(expressed in U.S. dollars)

(Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net decrease in net assets from operations | | $ | (224,218 | ) |

| Adjustments to reconcile net increase (decrease) in net assets from operations to net cash provided by (used in) operating activities: | | | | |

| Purchase of investments | | | (8,546,191 | ) |

| Net change in unrealized (appreciation) depreciation on investments | | | 253,990 | |

| Change in assets and liabilities: | | | | |

| Interest receivable | | | (97,058 | ) |

| Expense limitation due from Adviser | | | (14,094 | ) |

| Professional fees payable | | | 37,970 | |

| Management fee payable | | | 14,094 | |

| Trustee fees payable | | | 8,753 | |

| Administration fees payable | | | 8,716 | |

| Other expenses payable | | | 959 | |

| Net cash provided by (used in) operating activities | | | (8,557,079 | ) |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from shares of beneficial interest sold | | | 9,908,530 | |

| Net cash provided by (used in) financing activities | | | 9,908,530 | |

| | | | | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | 1,351,451 | |

| | | | | |

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD | | | 100,000 | |

| | | | | |

| CASH AND CASH EQUIVALENTS, END OF PERIOD | | $ | 1,451,451 | |

See accompanying notes to the consolidated financial statements

Eagle Point Institutional Income Fund & Subsidiaries

Notes to Consolidated Financial Statements

June 30, 2022

(Unaudited)

Eagle Point Institutional Income Fund (the “Fund”) was formed as a Delaware Statutory Trust on October 22, 2021, and is an externally managed, non-diversified closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s primary investment objective is to generate high current income, with a secondary objective to generate capital appreciation. The Fund seeks to achieve its investment objectives by investing primarily in equity and junior debt tranches of collateralized loan obligations (“CLOs”) that are collateralized by a portfolio consisting primarily of below investment grade U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. The Fund may also invest in other related securities and instruments or other securities and instruments that Eagle Point Credit Management LLC (the “Adviser”) believes are consistent with the Fund’s investment objectives, including senior debt tranches of CLOs, loan accumulation facilities and securities and instruments of corporate issuers. The CLO securities in which the Fund primarily seeks to invest are unrated or rated below investment grade and are considered speculative with respect to timely payment of interest and repayment of principal.

As of June 30, 2022, the Fund had two wholly-owned subsidiaries: EPIIF Sub (Cayman) Ltd. (“Sub I”), a Cayman Islands exempted company, and EPIIF Sub II (Cayman) Ltd. (“Sub II”), a Cayman Islands exempted company. As of June 30, 2022, Sub I and Sub II represent 0.0% and 4.4% of the Fund’s net assets, respectively.

The Fund commenced operations on June 1, 2022 and is offering its shares of beneficial interest (“Shares”) on a continuous basis at the applicable period end net asset value per share plus any applicable sales loads.

The Fund intends to operate so as to qualify to be taxed as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), for federal income tax purposes.

The Adviser is the investment adviser of the Fund and manages the investments of the Fund subject to the supervision of the Fund’s Board of Trustees (the “Board”). The Adviser is registered as an investment adviser with the U.S. Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended. Eagle Point Administration LLC, an affiliate of the Adviser, is the administrator of the Fund (the “Administrator”).

UMB Bank n.a. serves at the Fund’s custodian.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Accounting

The consolidated financial statements include the accounts of the Fund and its wholly-owned subsidiaries. All intercompany accounts have been eliminated upon consolidation. The Fund is considered an investment company under accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Fund follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 Financial Services – Investment Companies. Items included in the consolidated financial statements are measured and presented in United States dollars.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP may require management to make estimates and assumptions which affect the reported amounts included in the consolidated financial statements and accompanying notes as of the reporting date. Actual results may differ from those estimates.

Eagle Point Institutional Income Fund & Subsidiaries

Notes to Consolidated Financial Statements

June 30, 2022

(Unaudited)

Valuation of Investments

The most significant estimate inherent in the preparation of the consolidated financial statements is the valuation of investments. In the absence of readily determinable fair values, fair value of the Fund’s investments is determined in accordance with the Fund’s valuation policy. Due to the uncertainty of valuation, this estimate may differ significantly from the value that would have been used had a ready market for the investments existed, and the differences could be material.

There is no single method for determining fair value in good faith. As a result, determining fair value requires judgment be applied to the specific facts and circumstances of each portfolio investment while employing a consistently applied valuation process for the types of investments held by the Fund.

The Fund accounts for its investments in accordance with U.S. GAAP, and fair values its investment portfolio in accordance with the provisions of the FASB ASC Topic 820, Fair Value Measurements and Disclosures, which defines fair value, establishes a framework for measuring fair value and requires enhanced disclosures about fair value measurements. Investments are reflected in the consolidated financial statements at fair value. Fair value is the estimated amount that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date (i.e., the exit price). The Fund’s fair valuation process is reviewed and approved by the Board.

The fair value hierarchy prioritizes and ranks the level of market price observability used in measuring investments at fair value. Market price observability is impacted by a number of factors, including the type of investment, the characteristics specific to the investment and the state of the marketplace (including the existence and transparency of transactions between market participants). Investments with readily available actively quoted prices, or for which fair value can be measured from actively quoted prices in an orderly market, will generally have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Investments measured and reported at fair value are classified and disclosed in one of the following categories based on inputs:

Level I – Observable, quoted prices for identical investments in active markets as of the reporting date.

Level II – Quoted prices for similar investments in active markets or quoted prices for identical investments in markets that are not active as of the reporting date.

Level III – Pricing inputs are unobservable for the investment and little, if any, active market exists as of the reporting date. Fair value inputs require significant judgment or estimation from the Adviser.

In certain cases, inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the determination of which category within the fair value hierarchy is appropriate for any given investment is based on the lowest level of input significant to that fair value measurement. The assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and consideration of factors specific to the investment.

Investments for which observable, quoted prices in active markets do not exist are reported at fair value based on Level III inputs. The amount determined to be fair value may incorporate the Adviser’s own assumptions (including assumptions the Adviser believes market participants would use in valuing investments and assumptions relating to appropriate risk adjustments for nonperformance and lack of marketability), as provided for in the Fund’s valuation policy and accepted by the Board.

An estimate of fair value is made for each investment at least monthly taking into account information available as of the reporting date. For financial reporting purposes, valuations are determined by the Board on a quarterly basis.

Eagle Point Institutional Income Fund & Subsidiaries

Notes to Consolidated Financial Statements

June 30, 2022

(Unaudited)

See Note 3 “Investments” for further discussion relating to the Fund’s investments.

In valuing the Fund’s investments in CLO debt and CLO equity, the Adviser considers a variety of relevant factors, including, as applicable, price indications from a third-party pricing service, recent trading prices for specific investments, recent purchases and sales known to the Adviser in similar securities and output from a third-party financial model. The third-party financial model contains detailed information on the characteristics of CLOs, including recent information about assets and liabilities, and is used to project future cash flows. Key inputs to the model, including, but not limited to assumptions for future loan default rates, recovery rates, prepayment rates, reinvestment rates and discount rates are determined by considering both observable and third-party market data and prevailing general market assumptions and conventions as well as those of the Adviser.

The Fund engages a third-party independent valuation firm as an input to the Fund’s valuation of the fair value of its investments in CLO equity. The valuation firm’s advice is only one factor considered in the valuation of such investments, and the Board does not solely rely on such advice in determining the fair value of the Fund’s investments in accordance with the 1940 Act.

Investment Income Recognition

Interest income from investments in CLO debt is recorded using the accrual basis of accounting to the extent such amounts are expected to be collected. Interest income on investments in CLO debt is generally expected to be received in cash. Amortization of premium or accretion of discount is recognized using the effective interest method. The Fund applies the provisions of Accounting Standards Update No. 2017-08 Premium Amortization on Purchased Callable Debt Securities (“ASU 2017-08”) in calculating amortization of premium for purchased CLO debt securities.

In certain circumstances, interest income may be paid in the form of additional investment principal, often referred to as payment-in-kind (“PIK”) interest. PIK interest is included in interest income and interest receivable through the payment date. The PIK interest rate for CLO debt securities represents the coupon rate at payment date when PIK interest is received. On the payment date, interest receivable is capitalized as additional investment principal in the CLO debt security. To the extent the Fund does not believe it will be able to collect PIK interest, the CLO debt security will be placed on non-accrual status, and previously recorded PIK interest income will be reversed.

CLO equity investments and fee rebates recognize investment income for U.S. GAAP purposes on the accrual basis utilizing an effective interest methodology based upon an effective yield to maturity utilizing projected cash flows. ASC Topic 325-40, Beneficial Interests in Securitized Financial Assets, requires investment income from CLO equity investments and fee rebates to be recognized under the effective interest method, with any difference between cash distributed and the amount calculated pursuant to the effective interest method being recorded as an adjustment to the cost basis of the investment. It is the Fund’s policy to update the effective yield for each CLO equity position held within the Fund’s portfolio at the initiation of each investment and each subsequent quarter thereafter.

Other Income

Other income includes the Fund’s share of income under the terms of fee rebate agreements.

Securities Transactions

The Fund records the purchases and sales of securities on trade date. Realized gains and losses on investments sold are recorded on the basis of the specific identification method.

Cash and Cash Equivalents

The Fund has defined cash and cash equivalents as cash and short-term, highly liquid investments with original maturities of three months or less from the date of purchase. The Fund maintains its cash in bank accounts,

Eagle Point Institutional Income Fund & Subsidiaries

Notes to Consolidated Financial Statements

June 30, 2022

(Unaudited)

which, at times, may exceed federal insured limits. The Adviser monitors the performance of the financial institution where the accounts are held in order to manage any risk associated with such accounts. No cash equivalent balances were held as of June 30, 2022.

Expense Recognition

Expenses are recorded on the accrual basis of accounting.

Offering Costs

Offering costs of the Fund are capitalized and amortized to expense over the twelve month period following such capitalization on a straight line basis. For the period from June 1, 2022 to June 30, 2022, offering costs incurred by the Fund have been paid for by the Adviser, for which it has not yet sought reimbursement. See Note 4 “Related Party Transactions” for further discussion of the Fund’s offering costs.

Organization Costs

Organizational costs of the Fund are expensed as incurred. For the period from June 1, 2022 to June 30, 2022, organizational costs incurred by the Fund have been paid for the by the Adviser, for which it has not yet sought reimbursement. See Note 4 “Related Party Transactions” for further discussion of the Fund’s organizational costs.

Federal and Other Taxes

The Fund intends to operate so as to qualify to be taxed as a RIC under subchapter M of the Code and, as such, to not be subject to federal income tax on the portion of its taxable income and gains distributed to shareholders. To qualify for RIC tax treatment, among other requirements, the Fund is required to distribute at least 90% of its investment company taxable income, as defined by the Code. The Fund has adopted November 30th as its fiscal tax year end.

Because U.S. federal income tax regulations differ from U.S. GAAP, distributions in accordance with tax regulations may differ from net investment income and realized gains recognized for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the consolidated financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain or loss are recognized at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for federal income tax purposes. The tax basis components of distributable earnings differ from the amounts reflected in the Consolidated Statement of Assets and Liabilities due to temporary book/tax differences arising primarily from partnerships and passive foreign investment company investments.

As of June 30, 2022, the federal income tax cost and net unrealized depreciation on securities were as follows:

| Cost for federal income tax purposes | | $ | 9,227,170 | |

| | | | | |

| Gross unrealized appreciation | | $ | 7,526 | |

| Gross unrealized depreciation | | | (261,516 | ) |

| Net unrealized depreciation | | $ | (253,990 | ) |

Eagle Point Institutional Income Fund & Subsidiaries

Notes to Consolidated Financial Statements

June 30, 2022

(Unaudited)

Distributions

The Fund intends to make regular monthly distributions from net investment income. Distributions from net realized capital gains, if any, are declared and paid annually. The Fund also intends to make at least annual distributions of all or a portion of the Fund's net realized capital gains. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

Fair Value Measurement

The following tables summarize the valuation of the Fund’s investments measured and reported at fair value under the fair value hierarchy levels described in Note 2 “Summary of Significant Accounting Policies” as of June 30, 2022:

| Assets | | Level I | | | Level II | | | Level III | | | Total | |

| CLO Debt | | $ | - | | | $ | 1,016,423 | | | $ | - | | | $ | 1,016,423 | |

| CLO Equity | | | - | | | | - | | | | 7,956,757 | | | | 7,956,757 | |

| Total Assets at Fair Value | | $ | - | | | $ | 1,016,423 | | | $ | 7,956,757 | | | $ | 8,973,180 | |

Change in Investments Classified as Level III

The changes in investments classified as Level III are as follows for the period from June 1, 2022 to June 30,2022:

| | | CLO Equity | |

| Beginning Balance at June 1, 2022 | | $ | - | |

| Purchases of investments | | | 8,155,956 | |

| Proceeds from sales or maturity of investments | | | - | |

| | | | | |

| Net realized gains (losses) and net change in unrealized appreciation (depreciation) | | | (199,199 | ) |

| Balance as of June 30, 2022 (1) | | $ | 7,956,757 | |

| | | | | |

| Change in unrealized appreciation (depreciation) on investments still held as of June 30, 2022 | | $ | (199,199 | ) |

(1) There were no transfers into or out of Level III investments during the period.

The net realized gains (losses) recorded for Level III investments are reported in the net realized gain (loss) on investments, foreign currency and cash equivalents balance in the Consolidated Statement of Operations, if applicable. Net changes in unrealized appreciation (depreciation) are reported in the net change in unrealized appreciation (depreciation) on investments, foreign currency and cash equivalents balance in the Consolidated Statement of Operations.

Valuation of CLO Equity

The Adviser utilizes the output of a third-party financial model to estimate the fair value of CLO equity investments. The model contains detailed information on the characteristics of each CLO, including recent

Eagle Point Institutional Income Fund & Subsidiaries

Notes to Consolidated Financial Statements

June 30, 2022

(Unaudited)

information about assets and liabilities from data sources such as trustee reports, and is used to project future cash flows to the CLO note tranches, as well as management fees.

The following table summarizes the quantitative inputs and assumptions used for investments categorized as Level III of the fair value hierarchy as of June 30, 2022. In addition to the techniques and inputs noted in the table below, the Adviser may use other valuation techniques and methodologies when determining the Fund’s fair value measurements as provided for in the valuation policy approved by the Board. The table below is not intended to be all-inclusive, but rather provides information on the significant Level III inputs as they relate to the Fund’s fair value measurements as of June 30, 2022. Unobservable inputs and assumptions are periodically reviewed and updated as necessary to reflect current market conditions.

| | | Quantitative Information about Level III Fair Value Measurements |

| Assets | | Fair Value as of

June 30, 2022 | | | Valuation

Techniques/

Methodologies | | Unobservable

Inputs | | Range / Weighted Average(1) |

| CLO Equity | | $ | 7,575,591 | | | Discounted Cash Flows | | Annual Default Rate (2) | | 0.00% - 3.09% |

| | | | | | | | | Annual Prepayment Rate (3) | | 25.00% |

| | | | | | | | | Reinvestment Spread | | 3.35% - 3.75% / 3.57% |

| | | | | | | | | Reinvestment Price | | 99.50% |

| | | | | | | | | Recovery Rate | | 69.52% - 70.00% / 69.94% |

| | | | | | | | | Expected Yield | | 18.64% - 23.84% / 20.03% |

(1) Weighted average calculations are based on the fair value of investments.

(2) A weighted average is not presented as the input in the discounted cash flow model varies over the life of an investment.

(3) 0% is assumed for defaulted and non-performing assets.

Increases (decreases) in the annual default rate, reinvestment price and expected yield in isolation would result in a lower (higher) fair value measurement. Increases (decreases) in the reinvestment spread and recovery rate in isolation would result in a higher (lower) fair value measurement. Changes in the annual prepayment rate may result in a higher (lower) fair value, depending on the circumstances. Generally, a change in the assumption used for the annual default rate may be accompanied by a directionally opposite change in the assumption used for the annual prepayment rate and recovery rate.

The Adviser categorizes CLO equity as Level III investments. Certain pricing inputs may be unobservable. An active market may exist, but not necessarily for CLO equity investments the Fund holds as of the reporting date.

Certain of the Fund’s Level III investments have been valued using unadjusted inputs that have not been internally developed by the Adviser, including third-party transactions and data reported by trustees. Fair value of $381,166 has been excluded from the table due to being valued at transaction cost.

Valuation of CLO Debt

The Fund’s investments in CLO debt have been valued using an independent pricing service. The valuation methodology of the independent pricing service includes incorporating data comprised of observable market transactions, executable bids, broker quotes from dealers with two sided markets, as well as transaction activity from comparable securities to those being valued. As the independent pricing service contemplates real time market data and no unobservable inputs or significant judgment has been used by the Adviser in the valuation of the Fund’s investment in CLO debt, such positions are considered Level II assets.

Eagle Point Institutional Income Fund & Subsidiaries

Notes to Consolidated Financial Statements

June 30, 2022

(Unaudited)

Investment Risk Factors and Concentration of Investments

The following list is not intended to be a comprehensive list of all of the potential risks associated with the Fund. The Fund’s prospectus provides a detailed discussion of the Fund’s risks and considerations. The risks described in the prospectus are not the only risks the Fund faces. Additional risks and uncertainties not currently known to the Fund or that are currently deemed to be immaterial also may materially and adversely affect its business, financial condition and/or operating results.

Global Economic Risks

Terrorist acts, acts of war, natural disasters, outbreaks or pandemics may disrupt the Fund’s operations, as well as the operations of the businesses in which it invests. Such acts have created, and continue to create, economic and political uncertainties and have contributed to global economic instability. For example, many countries have experienced outbreaks of infectious illnesses in recent decades, including swine flu, avian influenza, SARS and COVID-19. Since December 2019, the spread of COVID-19 has caused social unrest and commercial disruption on a global scale.

Global economies and financial markets are highly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. The COVID-19 pandemic has magnified these risks and has had, and may continue to have, a material adverse impact on local economies in the affected jurisdictions and also on the global economy, as cross border commercial activity and market sentiment have been impacted by the outbreak and government and other measures seeking to contain its spread. The effects of the COVID-19 pandemic contributed to increased volatility in global financial markets and have affected countries, regions, companies, industries and market sectors more dramatically than others. The COVID-19 pandemic has had, and any other outbreak of an infectious disease or serious environmental or public health concern could have, a significant negative impact on economic and market conditions, could exacerbate pre-existing political, social and economic risks in certain countries or regions and could trigger a prolonged period of global economic slowdown, which may impact the Fund and its underlying investments.

Following the onset of the pandemic, certain CLOs held by the Fund experienced increased defaults by underlying borrowers. Obligor defaults and rating agency downgrades caused, and may in the future cause, payments that would have otherwise been made to the CLO equity or CLO debt securities that the Fund held to instead be diverted to buy additional loans within a given CLO or paid to senior CLO debt holders as an early amortization payment. In addition, defaults and downgrades of underlying obligors caused, and may in the future cause, a decline in the value of CLO securities generally. If CLO cash flows or income decrease as a result of the pandemic, the portion of the Fund’s distribution comprised of a return of capital could increase or distributions could be reduced.

Concentration Risk

The Fund is classified as “non-diversified” under the 1940 Act. As a result, the Fund can invest a greater portion of its assets in obligations of a single issuer than a “diversified” fund. The Fund may therefore be more susceptible than a diversified fund to being adversely affected by any single corporate, economic, political or regulatory occurrence.

Liquidity Risk

The securities issued by CLOs generally offer less liquidity than below investment grade or high-yield corporate debt, and are subject to certain transfer restrictions imposed on certain financial instruments and other eligibility requirements on prospective transferees. Other investments the Fund may purchase through privately negotiated transactions may also be illiquid or subject to legal restrictions on their transfer. As a result of this illiquidity, the Fund’s ability to sell certain investments quickly, or at all, in response to changes in economic and other conditions and to receive a fair price when selling such investments may be limited, which could prevent the Fund from making sales to mitigate losses on such investments.

Eagle Point Institutional Income Fund & Subsidiaries

Notes to Consolidated Financial Statements

June 30, 2022

(Unaudited)

Risks of Investing in CLOs

The Fund’s investments consist primarily of CLO securities and the Fund may invest in other related structured finance securities. CLOs and structured finance securities are generally backed by an asset or a pool of assets (typically senior secured loans and other credit-related assets in the case of a CLO) which serve as collateral. The Fund and other investors in CLOs and related structured finance securities ultimately bear the credit risk of the underlying collateral. If there are defaults or the relevant collateral otherwise underperforms, scheduled payments to senior tranches of such securities take precedence over those of junior tranches, and scheduled payments to junior tranches have a priority in the right of payment to subordinated/equity tranches. Therefore, CLO and other structured finance securities may present risks similar to those of the other types of debt obligations and, in fact, such risks may be of greater significance in the case of CLO and other structured finance securities. In addition to the general risks associated with investing in debt securities, CLO securities carry additional risks, including, but not limited to: (1) the possibility that distributions from collateral assets will not be adequate to make interest or other payments; (2) the quality of the collateral may decline in value or default; (3) the fact that investments in CLO equity and junior debt tranches will likely be subordinate in the right of payment to other senior classes of CLO debt; and (4) the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results.

Interest Rate Risk

The fair value of certain investments held by the Fund may be significantly affected by changes in interest rates. In general, rising interest rates will negatively affect the price of a fixed rate debt instrument and falling interest rates will have a positive effect on the price of a fixed rate instrument. Although senior secured loans are generally floating rate instruments, the Fund’s investments in senior secured loans through equity and junior debt tranches of CLOs are sensitive to interest rate levels and volatility. Although CLOs are generally structured to mitigate the risk of interest rate mismatch, there may be some difference between the timing of interest rate resets on the assets and liabilities of a CLO. Such a mismatch could have a negative effect on the amount of funds distributed to CLO equity investors. In addition, in the event of a significant rising interest rate environment and/or economic downturn, loan defaults may increase and result in credit losses which may adversely affect the Fund’s cash flow, fair value of its assets and operating results. In the event that the Fund’s interest expense were to increase relative to income, or sufficient financing became unavailable, return on investments and cash available for distribution to shareholders or to make other payments on the Fund’s securities would be reduced.

LIBOR Risk

The CLO equity and debt securities in which the Fund invests earn interest at, and CLOs in which it invests typically obtain financing at, a floating rate based on LIBOR.

On July 27, 2017, the Chief Executive of the Financial Conduct Authority (“FCA”), the United Kingdom's financial regulatory body and regulator of LIBOR, announced that after 2021 it will cease its active encouragement of banks to provide the quotations needed to sustain LIBOR due to the absence of an active market for interbank unsecured lending and other reasons. On March 5, 2021, the FCA announced that all LIBOR settings will either cease to be provided by any administrator, or no longer be representative (i) immediately after December 31, 2021 for all GBP, EUR, CHF and JPY LIBOR settings and one-week and two-month US dollar LIBOR settings, and (ii) immediately after June 30, 2023 for the remaining US dollar LIBOR settings, including three-month US dollar LIBOR.

Replacement rates that have been identified include the Secured Overnight Financing Rate (SOFR, which is intended to replace U.S. dollar LIBOR and measures the cost of overnight borrowings through repurchase agreement transactions collateralized with U.S. Treasury securities) and the Sterling Overnight Index Average Rate (SONIA, which is intended to replace GBP LIBOR and measures the overnight interest rate paid by banks for unsecured transactions in the sterling market), although other replacement rates could be adopted by market participants. On July 29, 2021, the Alternative Reference Rates Committee (“ARRC”) announced that it recommended Term SOFR, a similar forward-looking term rate which will be based on SOFR, for business loans.

As of the date of the consolidated financial statements, certain senior secured loans had already transitioned to utilizing SOFR based interest rates and newly issued CLO debt securities had begun to transition to such replacement rate. Nevertheless, there can be no assurance that Term SOFR will ultimately be broadly adopted as

Eagle Point Institutional Income Fund & Subsidiaries

Notes to Consolidated Financial Statements

June 30, 2022

(Unaudited)

a replacement to LIBOR.

Loans held by CLO issuers and other issuers in which the Fund may invest may reference LIBOR, and the termination of LIBOR presents risks to such issuers and, indirectly, the Fund. As LIBOR is currently being reformed, investors should be aware that: (a) any changes to LIBOR could affect the level of the published rate, including to cause it to be lower and/or more volatile than it would otherwise be; (b) if the applicable rate of interest on any CLO security is calculated with reference to a tenor which is discontinued, such rate of interest will then be determined by the provisions of the affected CLO security, which may include determination by the relevant calculation agent in its discretion; (c) the administrator of LIBOR will not have any involvement in the CLOs or loans and may take any actions in respect of LIBOR without regard to the effect of such actions on the CLOs or loans; and (d) any uncertainty in the value of LIBOR or, the development of a widespread market view that LIBOR has been manipulated or any uncertainty in the prominence of LIBOR as a benchmark interest rate due to the recent regulatory reform may adversely affect the liquidity of the securities in the secondary market and their market value. Any of the above or any other significant change to the setting of LIBOR could have a material adverse effect on the value of, and the amount payable under, (i) any underlying assets of a CLO which pay interest linked to a LIBOR rate and (ii) the CLO securities in which the Fund invests.

If LIBOR is eliminated as a benchmark rate, market participants (including the Fund) may be subject to the risk that an acceptable transition mechanism may not be found or may not be suitable for a particular issuer. In addition, any alternative reference rate and any pricing adjustments required in connection with the transition from LIBOR may impose costs on issuers or may not be suitable to close out positions and enter into replacement trades. Any such consequence could have a material adverse effect on an issuer in whose securities the Fund may invest and their ability to make distributions or service outstanding debt. If no replacement conventions develop, it is uncertain what effect broadly divergent interest rate calculation methodologies in the markets will have on the price and liquidity of CLO securities and the ability of the collateral manager to effectively mitigate interest rate risks. While the issuers and the trustee of a CLO may enter into a reference rate amendment or the collateral manager may designate a designated reference rate, in each case, subject to the conditions described in a CLO indenture, there can be no assurance that a change to any alternative benchmark rate (a) will be adopted, (b) will effectively mitigate interest rate risks or result in an equivalent methodology for determining the interest rates on the floating rate instrument, (c) will be adopted prior to any date on which the issuer suffers adverse consequences from the elimination or modification or potential elimination or modification of LIBOR or (d) will not have a material adverse effect on the holders of the CLO securities.

In addition, the effect of a phase out of LIBOR on U.S. senior secured loans, the underlying assets of CLOs, is currently unclear. To the extent that any replacement rate utilized for senior secured loans differs from that utilized for a CLO that holds those loans, the CLO would experience an interest rate mismatch between its assets and liabilities, which could have an adverse impact on the Fund’s net investment income and portfolio returns.

Rising Interest Rate Environment

As of the date of the consolidated financial statements, the U.S. Federal Reserve has increased certain interest rates as part of its efforts to combat rising inflation. The prospect of further rate increases magnifies the risks associated with rising interest rates described under “Interest Rate Risk,” above. The senior secured loans underlying the CLOs in which the Fund invests typically have floating interest rates. A rising interest rate environment may increase loan defaults, resulting in losses for the CLOs in which the Fund invests. In addition, increasing interest rates may lead to higher prepayment rates, as corporate borrowers look to avoid escalating interest payments or refinance floating rate loans. Further, a general rise in interest rates will increase the financing costs of the CLOs. However, since many of the senior secured loans within these CLOs have LIBOR floors, if LIBOR is below the applicable LIBOR floor (which can typically range from 0.00% to 1.00% depending on the loan), there may not be corresponding increases in investment income, which could result in the CLO not having adequate cash to make interest or other payments on the securities which the Fund holds.

Leverage Risk

The Fund may incur leverage, including indebtedness for borrowed money, the issuance of debt securities or preferred stock, and leverage in the form of derivative transactions, repurchase agreement transactions, short sale

Eagle Point Institutional Income Fund & Subsidiaries

Notes to Consolidated Financial Statements

June 30, 2022

(Unaudited)

transactions, and other structures and instruments, in significant amounts and on terms the Adviser and the Board deem appropriate, subject to applicable limitations under the 1940 Act. Such leverage may be used for the acquisition and financing of the Fund’s investments, to pay fees and expenses and for other purposes. Any such leverage does not include embedded or inherent leverage in CLO structures in which the Fund invests or in derivative instruments in which the Fund may invest. Accordingly, there is effectively a layering of leverage in the Fund’s overall structure. The more leverage is employed, the more likely a substantial change will occur in the Fund’s net asset value (“NAV”). For instance, any decrease in the Fund’s income would cause net income to decline more sharply than it would have had the Fund not borrowed. In addition, any event adversely affecting the value of an investment would be magnified to the extent leverage is utilized.

Highly Subordinated and Leveraged Securities Risk

The Fund’s portfolio includes equity and junior debt investments in CLOs, which involve a number of significant risks. CLO equity and junior debt securities are typically very highly leveraged (with CLO equity securities typically being leveraged nine to thirteen times), and therefore the junior debt and equity tranches in which the Fund invests are subject to a higher degree of risk of total loss. In particular, investors in CLO securities indirectly bear risks of the collateral held by such CLOs. The Fund generally has the right to receive payments only from the CLOs, and generally does not have direct rights against the underlying borrowers or the entity that sponsored the CLO.

Credit Risk

If a CLO in which the Fund invests, an underlying asset of any such CLO or any other type of credit investment in the Fund’s portfolio declines in price or fails to pay interest or principal when due because the issuer or debtor, as the case may be, experiences a decline in its financial status either or both the Fund’s income and NAV may be adversely impacted. Non-payment would result in a reduction of the Fund’s income, a reduction in the value of the applicable CLO security or other credit investment experiencing non-payment and, potentially, a decrease in the Fund’s NAV. To the extent the credit rating assigned to a security in the Fund’s portfolio is downgraded, the market price and liquidity of such security may be adversely affected. In addition, if a CLO in which the Fund invests triggers an event of default as a result of failing to make payments when due or for other reasons, the CLO would be subject to the possibility of liquidation, which could result in full loss of value to the CLO equity and junior debt investors. CLO equity tranches are the most likely tranche to suffer a loss of all of their value in these circumstances. Heightened inflationary pressures could increase the risk of default by our underlying obligors.

Low Or Unrated Securities Risks

The Fund invests primarily in securities that are rated below investment grade or, in the case of CLO equity securities, are not rated by a national securities rating service. The primary assets underlying the CLO security investments are senior secured loans, although these transactions may allow for limited exposure to other asset classes including unsecured loans, high-yield bonds, emerging market loans or bonds and structured finance securities with underlying exposure to collateralized loan obligation and other collateralized debt obligation tranches, residential mortgage backed securities, commercial mortgage backed securities, trust preferred securities and other types of securitizations. CLOs generally invest in lower-rated debt securities that are typically rated below Baa/BBB by Moody’s, S&P or Fitch. In addition, the Fund may obtain direct exposure to such financial assets/instruments. Securities that are not rated or are rated lower than Baa by Moody’s or lower than BBB by S&P or Fitch are sometimes referred to as “high-yield” or “junk.” High-yield debt securities have greater credit and liquidity risk than investment grade obligations. High-yield debt securities are generally unsecured and may be subordinated to certain other obligations of the issuer thereof. The lower rating of high-yield debt securities and below investment grade loans reflects a greater possibility that adverse changes in the financial condition of an issuer or in general economic conditions or both may impair the ability of the issuer thereof to make payments of principal or interest.

Risks Related to Russia’s Invasion of Ukraine

Russia’s military incursion into Ukraine, the response of the United States and other countries, and the potential for wider conflict, has increased volatility and uncertainty in the financial markets and may adversely affect the Fund. Immediately following Russia’s invasion, the United States and other countries imposed wide-ranging economic sanctions on Russia, individual Russian citizens, and Russian banking entities and other businesses,