Filed by Alpha Capital Holdco Company

Pursuant to Rule 425 of the Securities Act of 1933

Subject Company: Alpha Capital Holdco Company

(Commission File No.: 333-262552)

1 Analyst Presentation The truly unified data platform April 2022

2 These materials and the related presentation (together with oral statements made in connection herewith, this “Presentation”) are for informational purposes only to assist interested parties in making their own evaluation with respect to a potential business combination and related transactions (the “Business Combination”) between Alpha Capital Acquisition Company (“Alpha Capital”) and Semantix Tecnologia em Sistema de Informação S . A . together with its subsidiaries, (“Semantix”) and the potential financing of a portion of the potential Business Combination through a private placement of securities, and for no other purpose . The information contained herein does not purport to be all inclusive or to contain all of the information that may be required to make a full analysis of Semantix or the Business Combination, and none of Alpha Capital, Semantix or any of their respective a ffi liates or control persons, o ffi cers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation . Each of Alpha Capital and Semantix and their respective a ffi liates and control persons, o ffi cers, directors, employees and representatives expressly disclaim any and all representations or warranties, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation . Nothing herein should be construed as legal, financial, tax or other advice . You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein . You are also reminded that the United States securities laws restrict persons with material non - public information about a company obtained directly or indirectly from the company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information . The reader shall not rely upon any statement, representation or warranty made by any other person, firm or corporation in making its investment decision . None of Alpha Capital, Semantix or any of their respective a ffi liates or control persons, o ffi cers, directors, employees or representatives, shall be liable to the reader for any information set forth herein or any action taken or not taken by any reader, including any investment in shares of any Alpha Capital or Semantix . Certain information contained in this Presentation relates to or is based on studies, publications, surveys and Semantix’s or Alpha Capital’s own internal estimates and research . In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions . Finally, while Semantix and Alpha Capital believe their internal research is reliable, such research has not been verified by any independent source and Semantix and Alpha Capital cannot guarantee and make no representation or warranty, express or implied, as to its accuracy and completeness . This Presentation contains preliminary information only, is subject to change at any time and, is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with Semantix and Alpha Capital . This meeting and any information communicated at this meeting are strictly confidential and should not be distributed, disclosed or used for any purpose other than for the purpose of your firm’s participation in the potential private placement of securities, that you will not distribute, disclose or use such information in any way detrimental to Semantix or Alpha Capital, and that you will return to Semantix and Alpha Capital, delete or destroy this Presentation upon request . Neither Semantix nor Alpha Capital undertakes any obligation to update this Presentation unless otherwise required by law . Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information . Certain statements in this Presentation may be considered forward - looking statements and forward - looking information within the meaning of applicable United States securities legislation (collectively herein referred to as “forward - looking statements”) . Forward - looking statements generally relate to future events or future financial or operating performance of Semantix or Alpha Capital . For example, statements concerning the following include forward - looking statements : the growth of Semantix’s business and its ability to realize expected results, including with respect to its net revenue, EBITDA and EBITDA margin ; the viability of its growth strategy, including with respect to its ability to grow market share in Brazil and internationally, grow revenue from existing customers, and consummate acquisitions ; opportunities, trends and developments in the data industry, including with respect to future financial performance in the industry ; the size of Semantix’s total addressable market ; the expected benefits of the proposed Business Combination ; any indications of interest in the proposed PIPE financing ; the satisfaction of closing conditions to the potential Business Combination and any related financing, the amount of redemption requests made by Alpha Capital’s public stockholders and the completion of the potential Business Combination, including the anticipated structure and closing date of the proposed Business Combination and the use of the cash proceeds therefrom ; anticipated management and directors of the resulting issuer ; any anticipated shareholder approvals ; and the pro forma ownership of the resulting issuer . In some cases, you can identify forward looking statements by terminology such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “could,” “plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target,” “trend” or other similar expressions (or the negative versions of such words or expressions) . Such forward - looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward - looking statements and could adversely affect the outcome and financial effects of the plans and events described herein . In addition, even if the outcome and financial effects of the plans and events described herein are consistent with the forward - looking statements contained in this Presentation, those results or developments may not be indicative of results or developments in subsequent periods . Although Semantix and Alpha Capital have attempted to identify important risks and factors that could cause actual actions, events or results to differ materially from those described in forward - looking statements, there may be other factors and risks that cause actions, events or results not to be as anticipated, estimated or intended . Forward - looking information contained in this Presentation are based on current estimates, assumptions, expectations and projections, including with respect to the management’s expectations regarding Semantix’s growth based on historical financial results and anticipated commercial developments, the anticipated success of current strategies for market penetration and capture in Brazil and globally in light of competition from existing market participants and the emergence of competitors in the future, management’s expectations with respect to the development of technology and other proprietary intellectual property by Semantix based on existing technological realities and strategies with respect to intellectual property development, management’s expectations regarding the likelihood Semantix will be able to enter into commercial arrangements with relevant third - parties and customers, Semantix’s ability to maintain adequate margins based on financial metrics available to management, the ability of Semantix and Alpha Capital to complete the transactions described in this Presentation, the ability of Semantix to finance its ongoing capital needs, the continued involvement of Semantix’s management in Semantix’s operations and the ability of Semantix to attract and retain talent in the future, which are based on the information available as of the date of this document, and, while considered reasonable by Semantix or Alpha Capital, as applicable, are inherently uncertain . Historical statements contained in this document regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future . In this regard, certain financial information contained herein has been extracted from, or based upon, information available in the public domain and/or provided by Semantix . In particular, historical results should not be taken as a representation that such trends will be replicated in the future . No statement in this document is intended to be nor may be construed as a profit forecast . Factors that may cause actual results to differ materially from current expectations include, but are not limited to, factors beyond the control of Semantix and Alpha Capital including : general economic conditions ; factors associated with companies, such as Semantix, that are engaged in the data industry, including the impact of the COVID - 19 pandemic and a wide variety of other significant business, economic and competitive risks and uncertainties ; the ability to obtain approval of the stockholders of Alpha Capital ; legal or regulatory developments (such as any SEC statements or enforcement or other actions relating to SPACs) ; the ability to maintain the listing of the combined company’s securities on a U . S . exchange ; the inability to complete the proposed PIPE financing ; the risk that the proposed business combination disrupts current plans and operations of Alpha Capital or Semantix as a result of the announcement and consummation of the transaction described herein ; the risk that any of the conditions to closing the Business Combination are not satisfied in the anticipated manner or on the anticipated timeline ; the failure to realize the anticipated benefits of the proposed Business Combination ; risks relating to the uncertainty of the projected financial information with respect to Semantix and costs related to the proposed business combination ; the outcome of any legal proceedings or regulatory action that may be instituted against Alpha Capital or Semantix, or any of their respective directors or o ffi cers, following the announcement of the potential transaction ; the amount of redemption requests made by Alpha Capital’s public stockholders ; and those factors discussed in this Presentation, Alpha Capital’s final prospectus dated February 18 , 2021 and any Annual Report on Form 10 - K or Quarterly Report on Form 10 - Q, in each case, under the heading “Risk Factors,” and other documents of Alpha Capital filed, or to be filed, with the SEC . If any of these risks materialize or Alpha Capital or Semantix’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . . D i sclai m er

3 Nothing in this Presentation should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved . You should not place undue reliance on forward - looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein . This Presentation also contains certain financial forecast information of Semantix . Such financial forecast information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties . Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved . Use of Non - IFRS Financial Measures and Industry Metrics . This Presentation, includes certain non - IFRS financial measures (including on a forward - looking basis) and industry metrics such as EBITDA, EBITDA margin and net revenue retention . These measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with IFRS or Brazilian accounting standards for private enterprises and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with IFRS or Brazilian accounting standards for private enterprises . Semantix believes that these measures (including on a forward - looking basis) provide useful supplemental information to investors about Semantix . Semantix’s management does not consider these non - IFRS measures in isolation or as an alternative to financial measures determined in accordance with IFRS or Brazilian accounting standards for private enterprises . Semantix’s management uses forward - looking non - IFRS measures to evaluate Semantix’s projected financials and operating performance . However, there are a number of limitations related to the use of these measures, including that they exclude significant expenses that are required by IFRS to be recorded in Semantix’s financial measures . In addition, other companies may calculate non - IFRS measures or industry metrics differently, or may use other measures to calculate their financial performance, and therefore, Semantix’s non - IFRS measures and industry metrics may not be directly comparable to similarly titled measures of other companies . Additionally, to the extent that forward - looking non - IFRS financial measures are provided, they are presented on a non - IFRS basis without reconciliations of such forward - looking non - IFRS measures due to the inherent di ffi culty in forecasting and quantifying certain amounts that are necessary for such reconciliations . Additional Information . In connection with the proposed Business Combination, Alpha Capital has filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form F - 4 , containing a preliminary proxy statement/prospectus of Alpha Capital, and after the registration statement is declared effective, Semantix expects that Alpha Capital will mail a definitive proxy statement/prospectus relating to the proposed Business Combination to its shareholders . This Presentation does not contain all the information that should be considered concerning the potential Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination . Shareholders of Alpha Capital and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed by Alpha Capital or Semantix in connection with the proposed Business Combination, as these materials will contain important information about Semantix, Alpha Capital and the potential Business Combination . When available, the definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to shareholders of Alpha Capital as of a record date to be established for voting on the proposed Business Combination . Shareholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed by Alpha Capital with the SEC, without charge, once available, at the SEC’s website at www . sec . gov . No Offer or Solicitation . This Presentation shall not constitute a “solicitation” as defined in Section 14 of the Securities Exchange Act of 1934 , as amended . This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . Any offering of securities (the “Securities”) will not be registered under the Securities Act of 1933 , as amended (the “Securities Act”), and will be offered as a private placement to a limited number of institutional “accredited investors” as defined in Rule 501 (a)( 1 ), ( 2 ), ( 3 ) or ( 7 ) under the Act and “Institutional Accounts” as defined in FINRA Rule 4512 (c) . Accordingly, the Securities must continue to be held unless a subsequent disposition is exempt from the registration requirements of the Securities Act . Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Securities Act . The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to be issued . Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time . NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE . Alpha Capital, Semantix and their respective directors and executive o ffi cers may be deemed participants in the solicitation of proxies from Alpha Capital’s stockholders with respect to the potential Business Combination . A list of the names of Alpha Capital’s directors and executive o ffi cers and a description of their interests in Alpha Capital is contained in Alpha Capital’s final prospectus relating to its initial public offering, which was filed with the SEC on February 18 , 2021 and is available free of charge at the SEC’s web site at www sec gov, or by directing a request to Alpha Capital . Additional information regarding the interests of the participants in the solicitation of proxies from the shareholders of Alpha Capital with respect to the proposed Business Combination will be contained in the proxy statement/prospectus for the proposed Business Combination filed by Alpha Capital when available . Trademarks . This Presentation contains trademarks, service marks, trade names and copyrights of Semantix, Alpha Capital and other companies, which are the property of their respective owners . The use or display of third parties’ trademarks, service marks, trade name or products in this Presentation is not intended to, and does not imply, a relationship with Alpha Capital or Semantix, or an endorsement of sponsorship by or of Alpha Capital or Semantix . Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Alpha Capital or Semantix will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names . Disclaimer (cont’d)

4 Semantix and Alpha Capital to combine creating LatAm’s fully integrated data platform Alec Oxenford Founder & Sponsor CEO and Chairman Rafael Steinhauser Founder & Sponsor President and Director Leonardo Santos Found e r CEO Adriano Alcalde CFO André Frederico General Manager LatAm

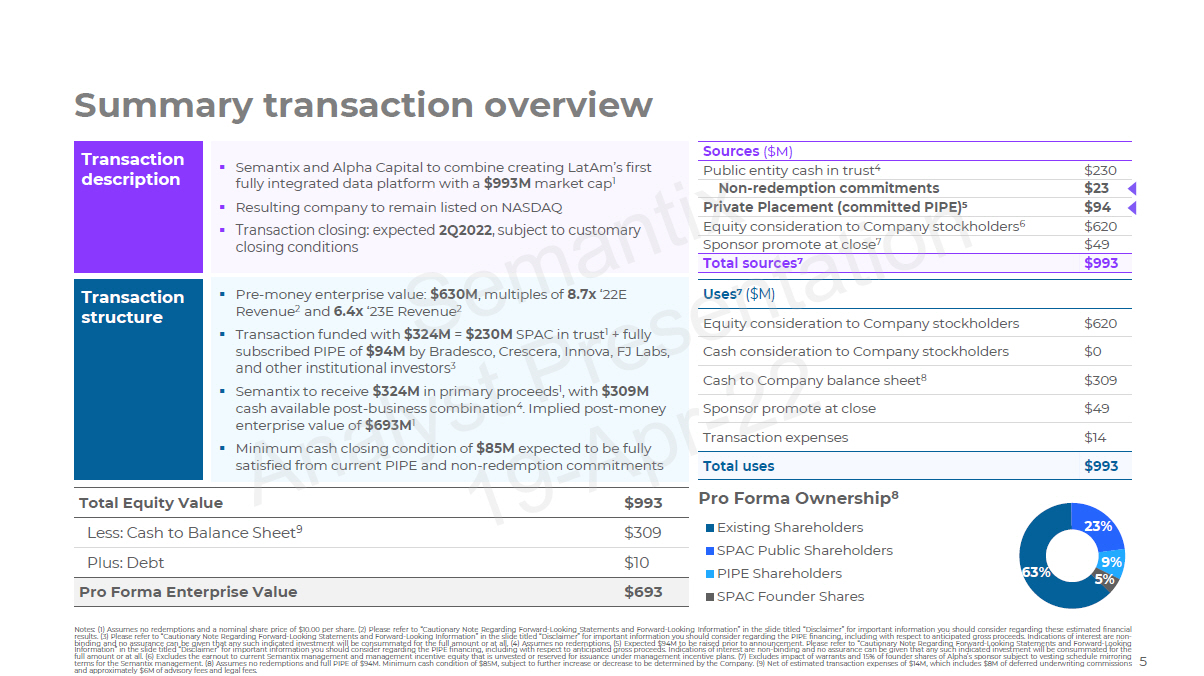

Notes : ( 1 ) Assumes no redemptions and a nominal share price of $ 10 . 00 per share . ( 2 ) Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results . ( 3 ) Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding the PIPE financing, including with respect to anticipated gross proceeds . Indications of interest are non - binding and no assurance can be given that any such indicated investment will be consummated for the full amount or at all . ( 4 ) Assumes no redemptions . ( 5 ) Expected $ 94 M to be raised prior to announcement . Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding the PIPE financing, including with respect to anticipated gross proceeds . Indications of interest are non - binding and no assurance can be given that any such indicated investment will be consummated for the full amount or at all. (6) Excludes the earnout to current Semantix management and management incentive equity that is unvested or reserved for issuance under management incentive plans. (7) Excludes impact of warrants and 15% of founder shares of Alpha’s sponsor subject to vesting schedule mirroring terms for the Semantix management. (8) Assumes no redemptions and full PIPE of $94M. Minimum cash condition of $85M, subject to further increase or decrease to be determined by the Company. (9) Net of estimated transaction expenses of $14M, which includes $8M of deferred underwriting commissions 5 and approximately $6M of advisory fees and legal fees. Summary transaction overview ▪ Semantix and Alpha Capital to combine creating LatAm’s first fully integrated data platform with a $993M market cap 1 ▪ Resulting company to remain listed on NASDAQ ▪ Transaction closing: expected 2Q2022 , subject to customary closing conditions ▪ Pre - money enterprise value: $630M , multiples of 8.7x ‘22E Revenue 2 and 6.4x ‘23E Revenue 2 ▪ Transaction funded with $324M = $230M SPAC in trust 1 + fully subscribed PIPE of $94M by Bradesco, Crescera, Innova, FJ Labs, and other institutional investors 3 ▪ Semantix to receive $324M in primary proceeds 1 , with $309M cash available post - business combination 4 . Implied post - money enterprise value of $693M 1 ▪ Minimum cash closing condition of $85M expected to be fully satisfied from current PIPE and non - redemption commitments Total Equity Value $993 Less: Cash to Balance Sheet 9 $309 Plus: Debt $10 Pro Forma Enterprise Value $693 Sources ($M) Public entity cash in trust 4 $230 Non - redemption commitments $23 Private Placement (committed PIPE) 5 $94 Equity consideration to Company stockholders 6 $620 Sponsor promote at close 7 $49 Total sources 7 $993 Uses 7 ($M) Equity consideration to Company stockholders $620 Cash consideration to Company stockholders $0 Cash to Company balance sheet 8 $309 Sponsor promote at close $49 Transaction expenses $14 Total uses $993 63% 23% 9% 5% Pro Forma Ownership 8 Existing Shareholders SPAC Public Shareholders PIPE Shareholders SPAC Founder Shares Transaction structure T ra n s a cti o n description

6 End - to - end SaaS platform that enables a complete data analytics and AI journey Low code, low touch and cost - effective solution Leadership position in LatAm going global through Nasdaq listing

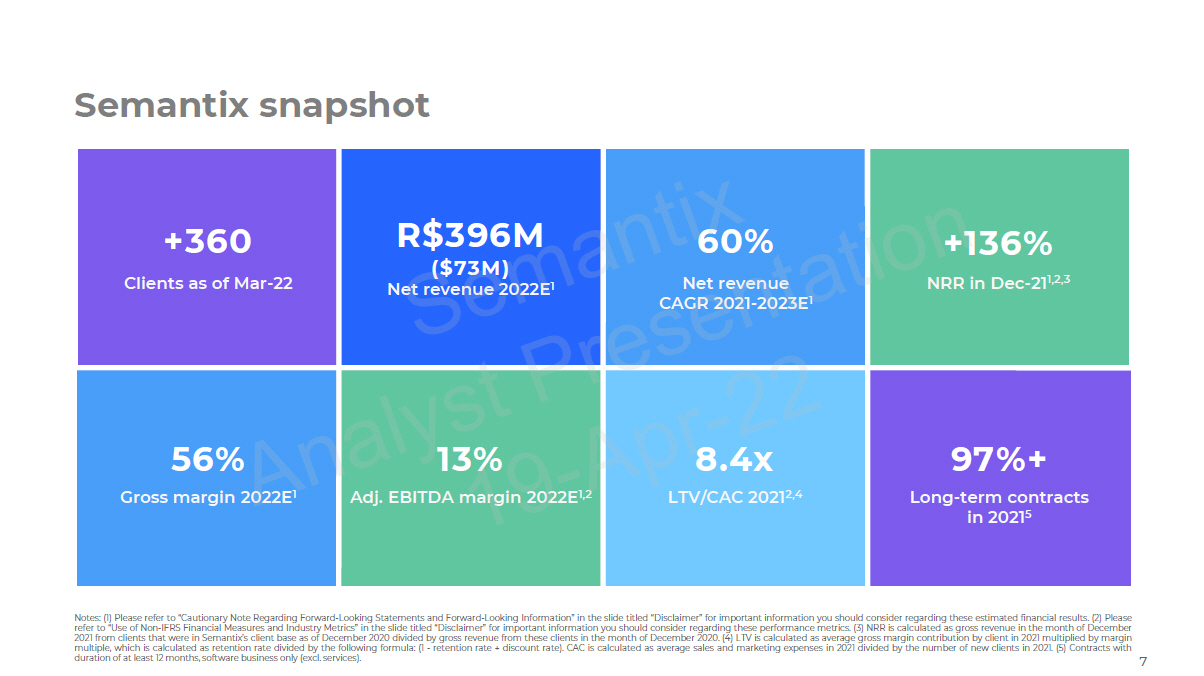

7 Notes : ( 1 ) Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results . ( 2 ) Please refer to “Use of Non - IFRS Financial Measures and Industry Metrics” in the slide titled “Disclaimer” for important information you should consider regarding these performance metrics . ( 3 ) NRR is calculated as gross revenue in the month of December 2021 from clients that were in Semantix’s client base as of December 2020 divided by gross revenue from these clients in the month of December 2020 . ( 4 ) LTV is calculated as average gross margin contribution by client in 2021 multiplied by margin multiple, which is calculated as retention rate divided by the following formula : ( 1 - retention rate + discount rate) . CAC is calculated as average sales and marketing expenses in 2021 divided by the number of new clients in 2021 . ( 5 ) Contracts with duration of at least 12 months, software business only (excl . services) . Semantix snapshot +360 Clients as of Mar - 22 R$396M ($73M) Net revenue 2022E 1 60% Net revenue CAGR 2021 - 2023E 1 +136% NRR in Dec - 21 1,2,3 56% Gross margin 2022E 1 13% Adj. EBITDA margin 2022E 1,2 8.4x LTV/CAC 2021 2,4 97%+ Long - term contracts in 2021 5

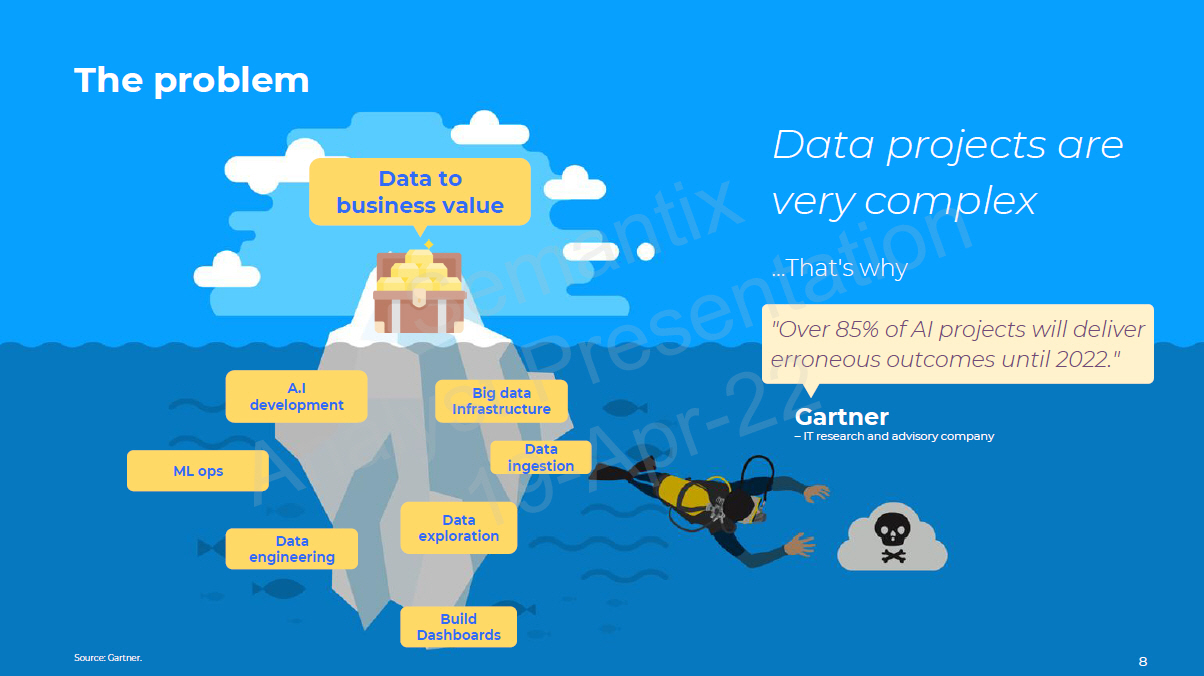

8 Source: Gartner. The problem "Over 85% of AI projects will deliver erroneous outcomes until 2022." Data to business value ML ops Data i n g e st i on Data e xp l or a t i on Data en gi nee ri n g Build Da s hb o a r d s Big data I n frastructure Gartner – IT research and advisory company A.I development Data projects are very complex ...That's why 8

9 All - in - one Stack agnostic Data governance Scalable and safe Premium 24x7 support Intuitive interface Extensible via APIs Plug - and - play algorithms Multi - cloud Infrastructure automation Data integration Data engineering Data visualization AI lifecycle Rebuilding data journey in a frictionless way Simple & Agile Enterprise Ready

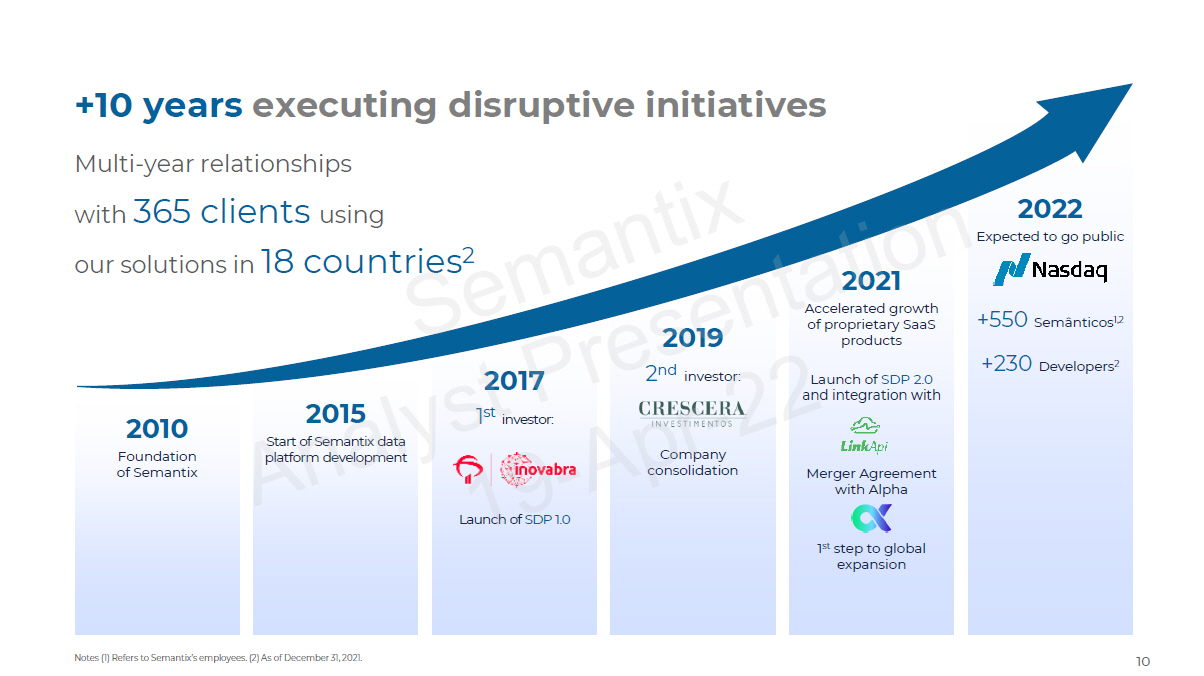

10 Notes (1) Refers to Semantix’s employees. (2) As of December 31, 2021. +10 years executing disruptive initiatives Multi - year relationships with 365 clients using our solutions in 18 countries 2 2010 F ou n d a t ion of Semantix 2015 Start of Semantix data platform development 2017 1 st investor: Launch of SDP 1.0 2019 2 nd investor: Company co n soli d a t i on 2021 Accelerated growth of proprietary SaaS products Launch of SDP 2.0 and integration with Merger Agreement with Alpha 1 st step to global expansion 2022 Expected to go public +550 Semânticos 1,2 +230 Developers 2

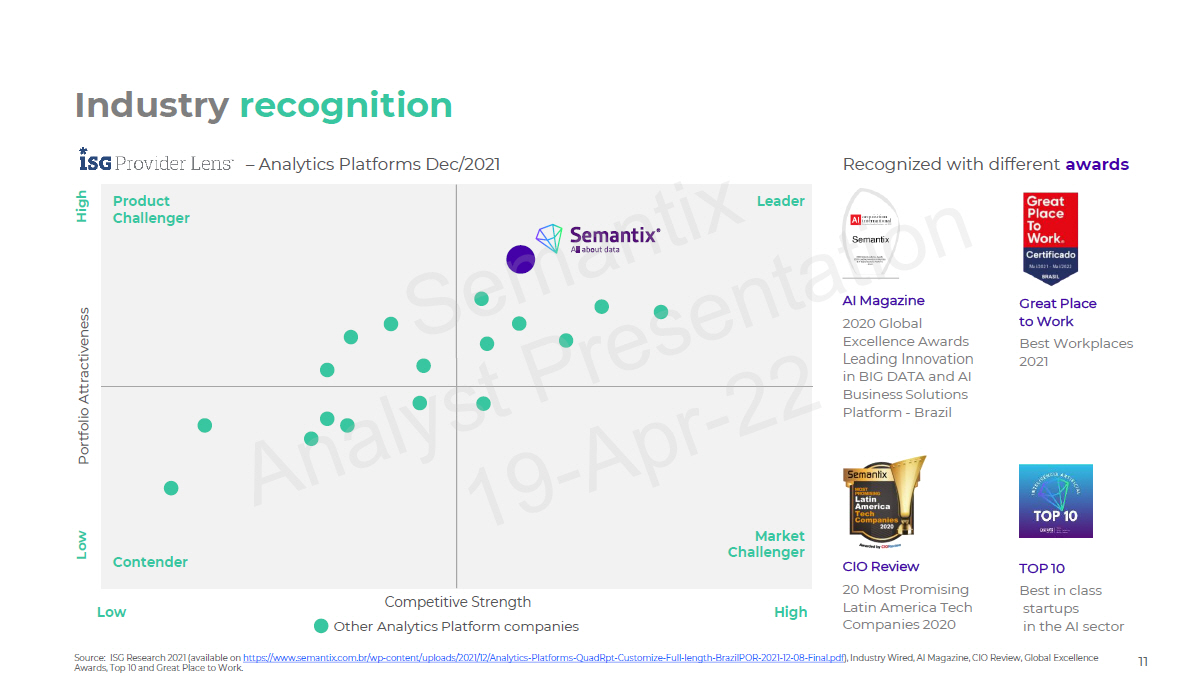

11 Source: ISG Research 2021 (available on https://www.semantix.com.br/wp - content/uploads/2021/12/Analytics - Platforms - QuadRpt - Customize - Full - length - BrazilPOR - 2021 - 12 - 08 - Fi nal.pd f ), Industry Wired, AI Magazine, CIO Review, Global Excellence Awards, Top 10 and Great Place to Work. Industry recognition – Analytics Platforms Dec/2021 Product C ha l len ger L eade r Contender M a rk e t C ha l len ger Portfolio Attractiveness H i gh L ow H i gh L ow Competitive Strength Other Analytics Platform companies AI Magazine 2020 Global Excellence Awards Leading Innovation in BIG DATA and AI Business Solutions Platform - Brazil TOP 10 Best in class startups in the AI sector Great Place to Work Best Workplaces 2021 CIO Review 20 Most Promising Latin America Tech Companies 2020 Recognized with different awards

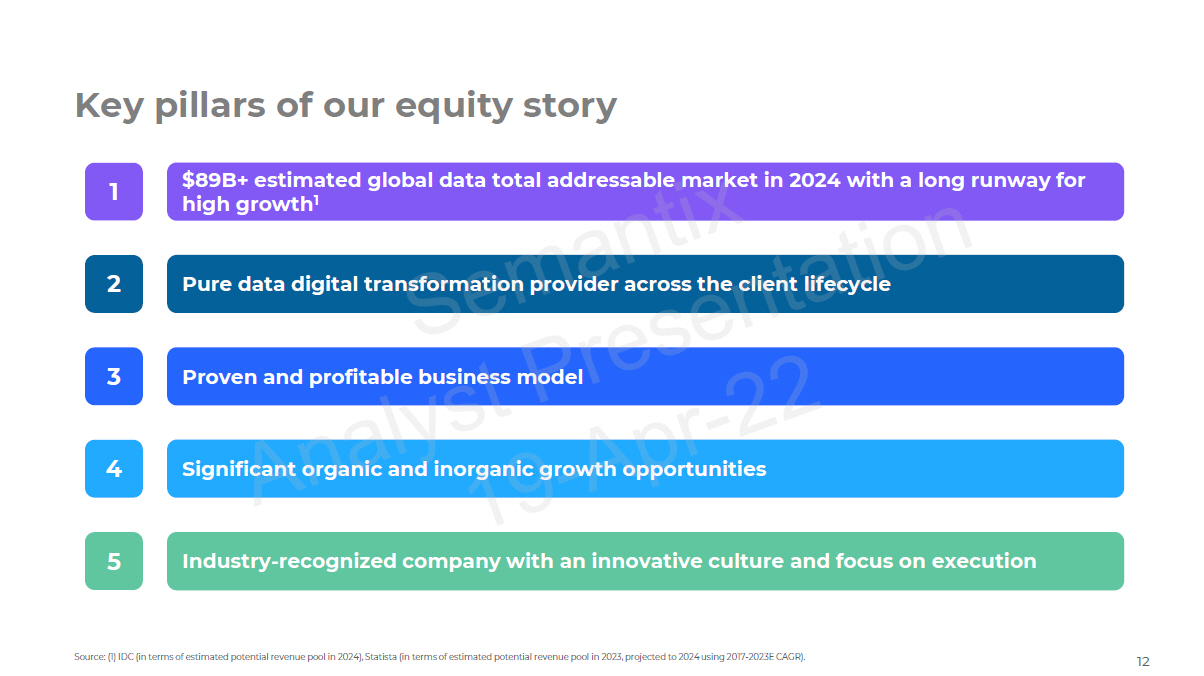

12 Key pillars of our equity story $89B+ estimated global data total addressable market in 2024 with a long runway for high growth 1 Pure data digital transformation provider across the client lifecycle Significant organic and inorganic growth opportunities Industry - recognized company with an innovative culture and focus on execution Proven and profitable business model 1 2 3 4 5 Source: (1) IDC (in terms of estimated potential revenue pool in 2024), Statista (in terms of estimated potential revenue pool in 2023, projected to 2024 using 2017 - 2023E CAGR).

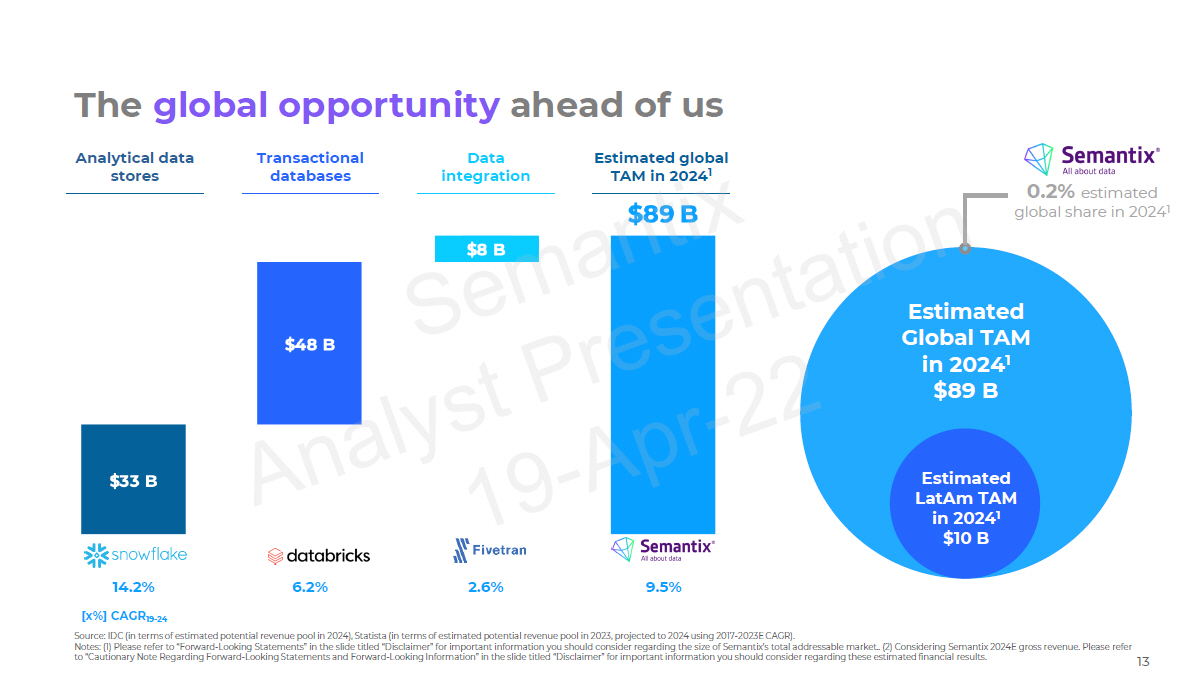

13 Estimated Global TAM in 2024 1 $89 B 0.2% estimated global share in 2024 1 Source: IDC (in terms of estimated potential revenue pool in 2024), Statista (in terms of estimated potential revenue pool in 2023, projected to 2024 using 2017 - 2023E CAGR). Notes: (1) Please refer to “Forward - Looking Statements” in the slide titled “Disclaimer” for important information you should consider regarding the size of Semantix’s total addressable market.. (2) Considering Semantix 2024E gross revenue. Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. The global opportunity ahead of us Estimated LatAm TAM in 2024 1 $10 B Analytical data stores Tra ns ac tion a l databases Data in t e g ra tion Estimated global TAM in 2024 1 6 . 2 % 2 .6% 9 . 5% 14.2% [x%] CAGR 19 - 24

Snapshot of our solutions AI & Data Analytics Services Technical and advisory services, including data analytics consulting, cloud monitoring, data integration and data engineering services Building data - driven solutions and placing clients one step ahead with frontier technology 14 Third - party Software Marketplace and managed services of 3rd party components focused on data lake creation, data search and visualization Proprietary SaaS Data preparation Data ingestion & integration Data lab Data lake automation Data visualization Access Management

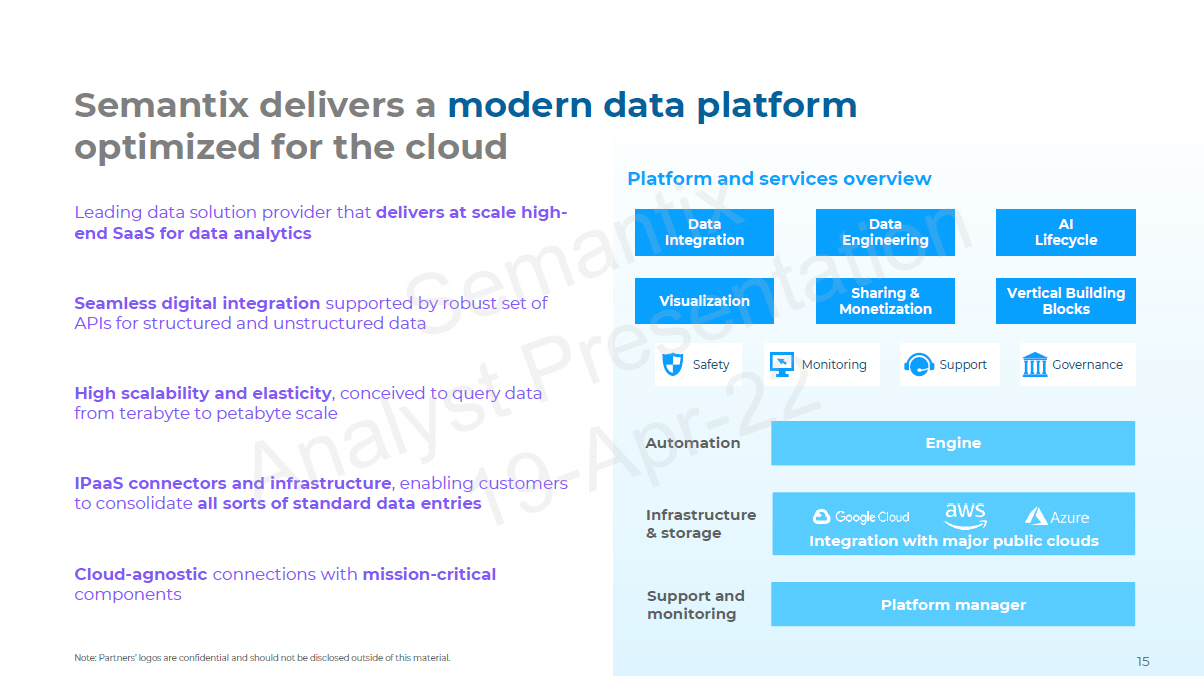

15 Note: Partners’ logos are confidential and should not be disclosed outside of this material. Semantix delivers a modern data platform Platform and services overview optimized for the cloud Leading data solution provider that delivers at scale high - end SaaS for data analytics Cloud - agnostic connections with mission - critical components IPaaS connectors and infrastructure , enabling customers to consolidate all sorts of standard data entries Automation Engine Support and monitoring Platform manager S a fety Monitoring Support Governance Integration with major public clouds Infr a s t r u c tu r e & storage Data I n t e gr a t i on Data Engi nee ring AI Lifecycle Visualization Sharing & Monetization Vertical Building Blocks High scalability and elasticity , conceived to query data from terabyte to petabyte scale Seamless digital integration supported by robust set of APIs for structured and unstructured data

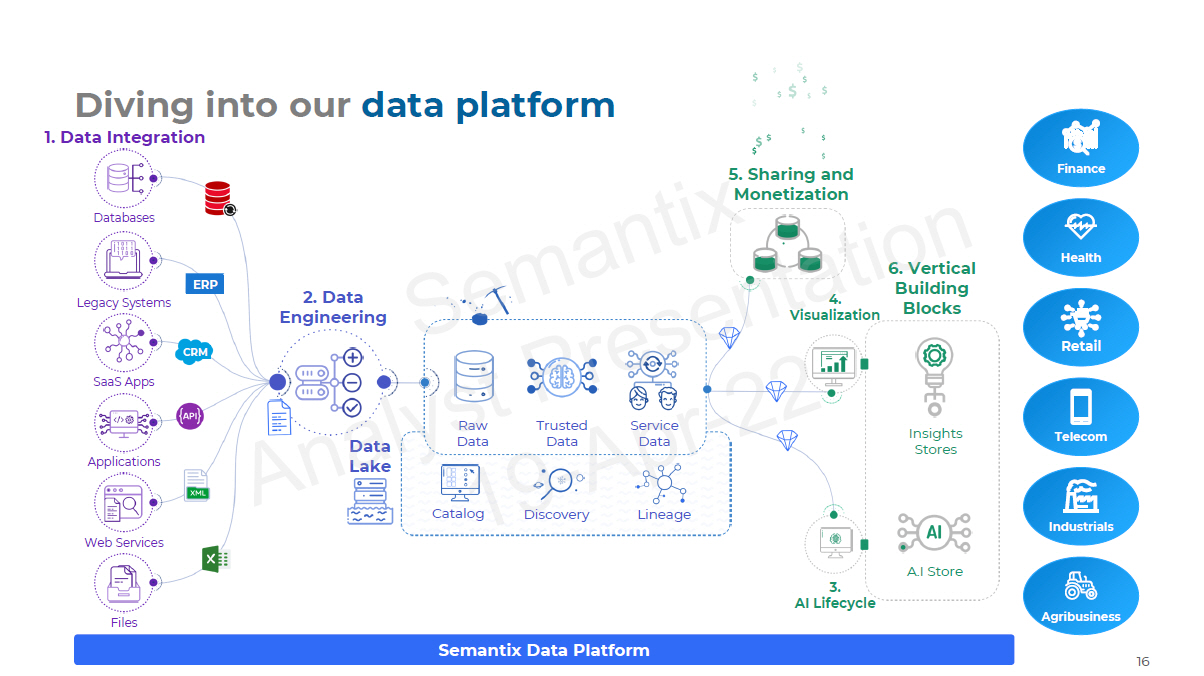

16 Diving into our data platform Files 2. Data E n gi nee ring 1. Data Integration 6. Vertical Building Blocks In sig ht s Stores 4. Visu a l iza t i on Da t a L a ke R aw D a t a Dat abas es Legacy Systems SaaS Apps A pp lic a ti on s Web Services Ca t alog Discovery Lineage Trusted D a t a Service D a t a ERP CRM 5. Sharing and Monetization A.I Store 3. AI Lifecycle Semantix Data Platform A gr i bus i ness T e l e c om Re t a il In d us t r i a l s Hea l t h F i nan c e

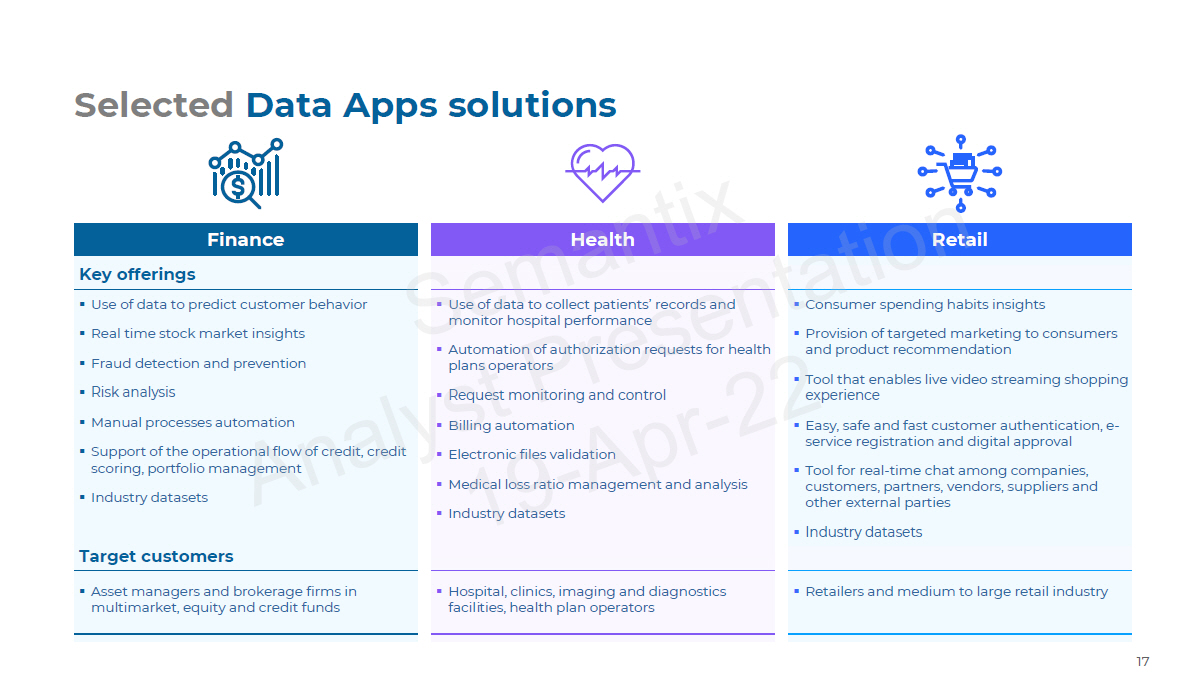

17 Selected Data Apps solutions Finance Health Retail Key offerings ▪ Use of data to predict customer behavior ▪ Real time stock market insights ▪ Fraud detection and prevention ▪ Risk analysis ▪ Manual processes automation ▪ Support of the operational flow of credit, credit scoring, portfolio management ▪ Industry datasets ▪ Use of data to collect patients’ records and monitor hospital performance ▪ Automation of authorization requests for health plans operators ▪ Request monitoring and control ▪ Billing automation ▪ Electronic files validation ▪ Medical loss ratio management and analysis ▪ Industry datasets ▪ Consumer spending habits insights ▪ Provision of targeted marketing to consumers and product recommendation ▪ Tool that enables live video streaming shopping experience ▪ Easy, safe and fast customer authentication, e - service registration and digital approval ▪ Tool for real - time chat among companies, customers, partners, vendors, suppliers and other external parties ▪ Industry datasets Target customers ▪ Asset managers and brokerage firms in multimarket, equity and credit funds ▪ Hospital, clinics, imaging and diagnostics facilities, health plan operators ▪ Retailers and medium to large retail industry

18 What problems are we solving? C ost Reduced costs of data infrastructure management Time to value Modern, and ready big data environment accelerating value creation F l e xibility Agnostic platform with more flexibility, portability, and free of lock - ins Governance Superior management and governance of data projects throughout the organization Friction Centralized data infrastructure allowing faster and more simple deployment

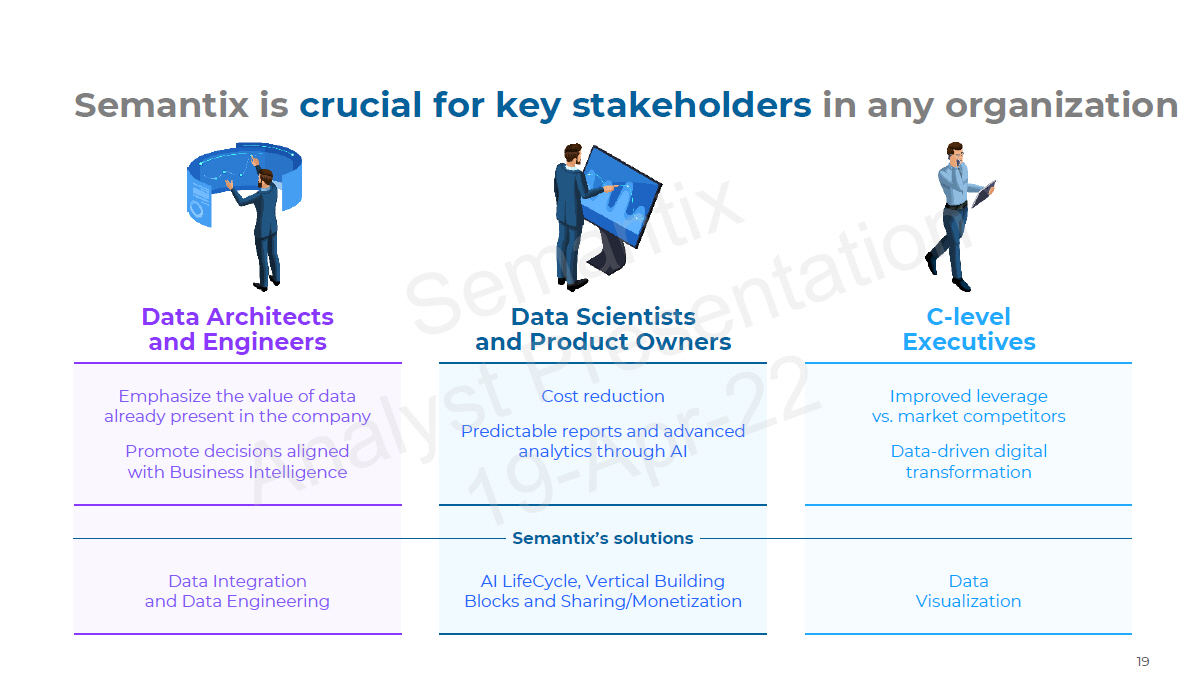

19 Semantix is crucial for key stakeholders in any organization Emphasize the value of data already present in the company Promote decisions aligned with Business Intelligence Cost reduction Predictable reports and advanced analytics through AI Improved leverage vs. market competitors Data - driven digital transformation Semantix’s solutions Data Integration and Data Engineering AI LifeCycle, Vertical Building Blocks and Sharing/Monetization Data Visualization Data Architects and Engineers Data Scientists and Product Owners C - level Exec u tives

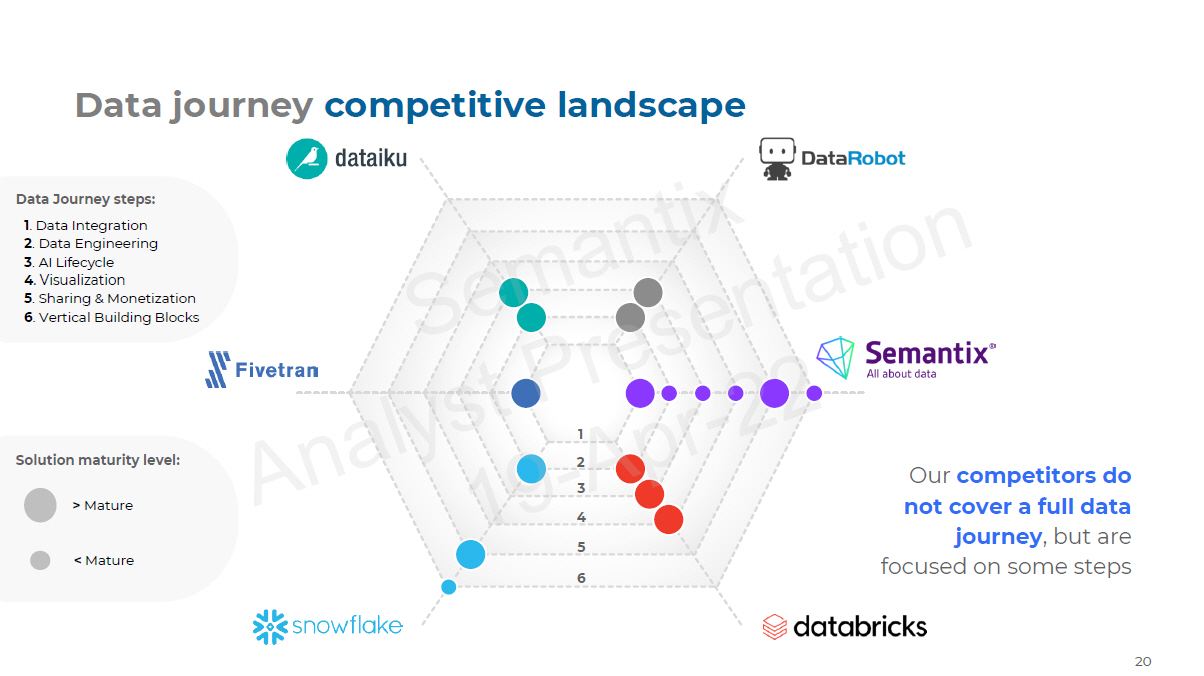

20 Data journey competitive landscape Our competitors do not cover a full data journey , but are focused on some steps 1 2 3 4 5 6 Data Journey steps: 1. Data Integration 2. Data Engineering 3. AI Lifecycle 4. Visualization 5. Sharing & Monetization 6. Vertical Building Blocks Solution maturity level: > Mature < Mature

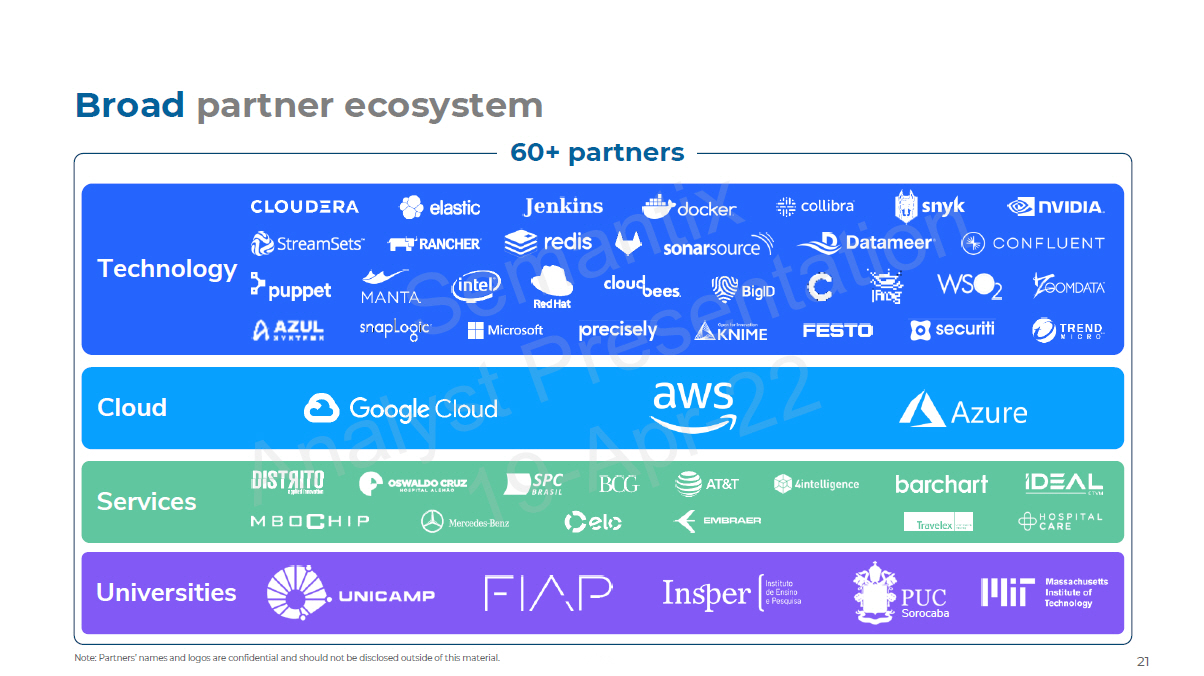

21 Broad partner ecosystem 60+ partners Note: Partners’ names and logos are confidential and should not be disclosed outside of this material. Technolog y Cloud Services Uni versities S oroc a b a

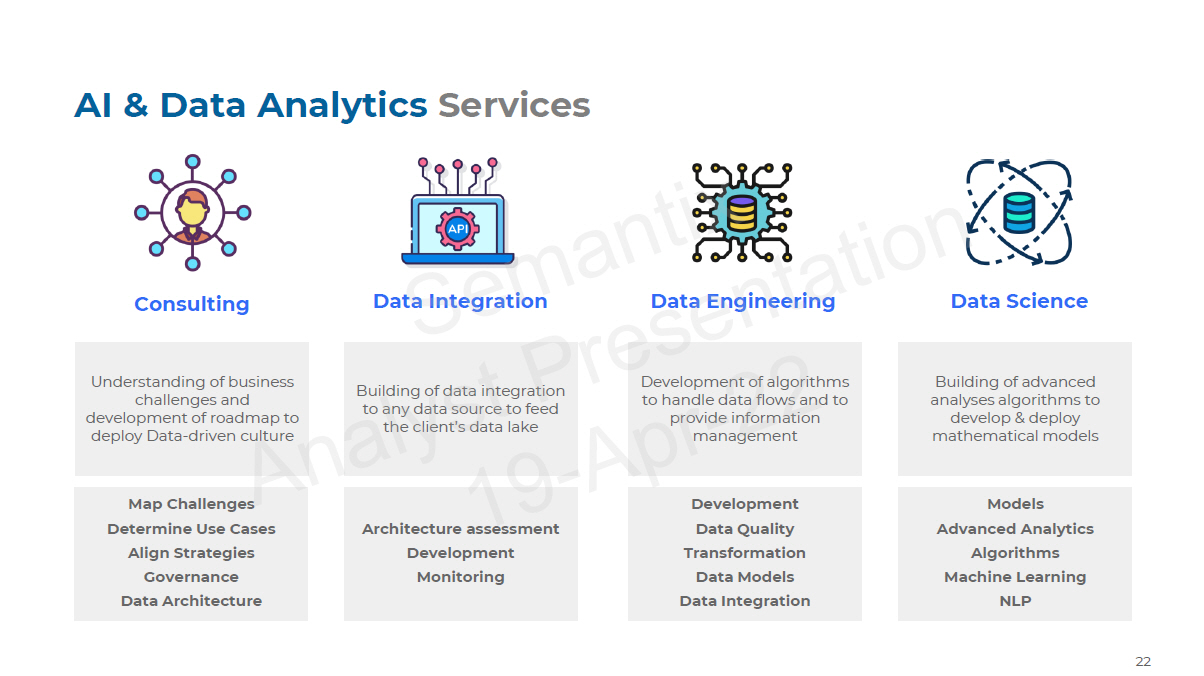

22 AI & Data Analytics Services Consulting Data Engineering Data Science Data Integration Understanding of business challenges and development of roadmap to deploy Data - driven culture Map Challenges Determine Use Cases Align Strategies Governance Data Architecture Development Data Quality Transformation Data Models Data Integration Models Advanced Analytics Algorithms Machine Learning NLP Architecture assessment Development Monitoring Building of data integration to any data source to feed the client’s data lake Development of algorithms to handle data flows and to provide information management Building of advanced analyses algorithms to develop & deploy mathematical models

23 The Challenge How can we use data to reduce disruption in the Mercedes’ truck production line and improve inspection processes to reduce insurance claims? Delivering with speed Apriori Algorithm ML to track production line Relative Risk using WOE Algorithm to map risks prior to the production ML Analysis of truck’s production line Neural Network algorithms to treat on - road truck data Information theory + Logistic Regression algorithms Outcomes and metrics Reduce failures before the truck start the production Indentify probability of high risk failures Improved Identifation process for Hidden failures in Production Line Industry AI models to monitor production disruption and identify the problem source Semantix solutions: Software AI & Data Analytics Services “The SDP Semantix Data Platform enabled us to improve manufacturing efficiency, resulting in a 6 % productivity increase over the last 2 years” Client A CIO of a leading Global Automobile company How we impact our clients

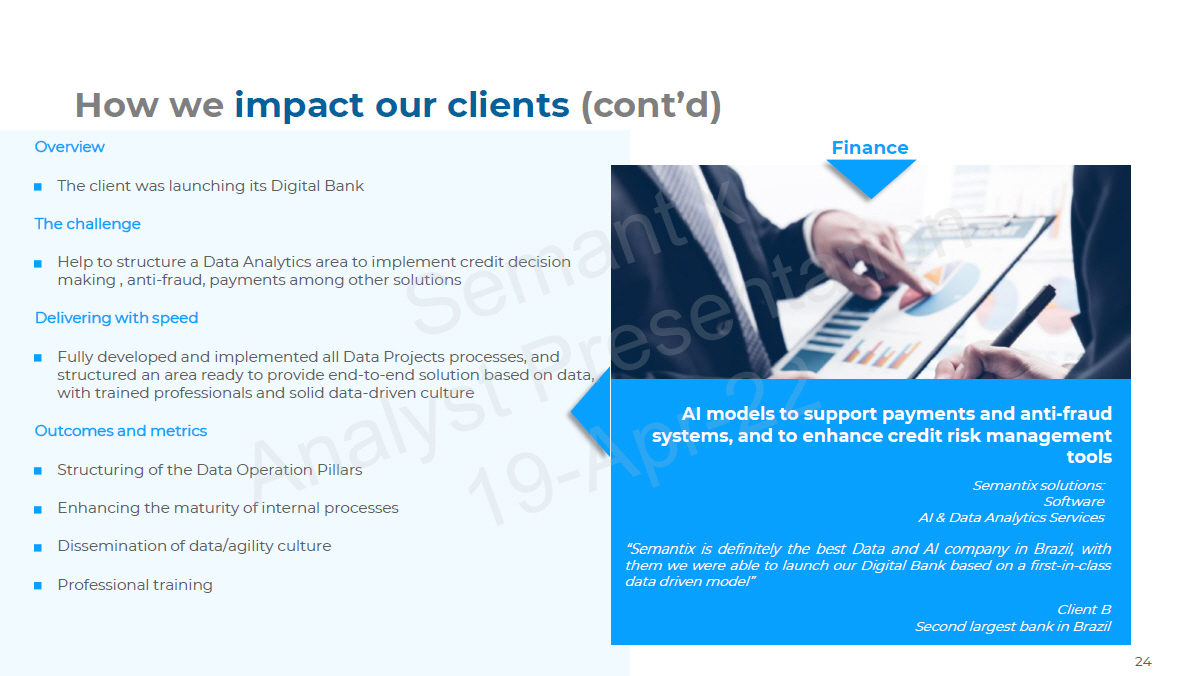

Overview The client was launching its Digital Bank The challenge Help to structure a Data Analytics area to implement credit decision making , anti - fraud, payments among other solutions Delivering with speed Fully developed and implemented all Data Projects processes, and structured an area ready to provide end - to - end solution based on data, with trained professionals and solid data - driven culture Outcomes and metrics Structuring of the Data Operation Pillars Enhancing the maturity of internal processes Dissemination of data/agility culture Professional training How we impact our clients (cont’d) AI models to support payments and anti - fraud systems, and to enhance credit risk management t oo l s Semantix solutions: S of t w a re AI & Data Analytics Services Finan c e “Semantix is definitely the best Data and AI company in Brazil, with them we were able to launch our Digital Bank based on a first - in - class data driven model” Client B Second largest bank in Brazil 24

25 Overview Develop an integrated marketplace model to scale up sales strategy and improve data integration to take assertive decisions The challenge Integrating client’s e - commerce with a massive variety of ERPs. Provide an agile and healthy pace to delivery in BI and E - commerce projects Delivering with speed Provide a unique extraction source of data for LatAm BI, accelerating the development of BI teams in other LatAm countries. Provide an integrated environment connecting E - commerce data Between VTEX (E - commerce solution vendor) and ERPs Outcomes and metrics Improvement of sales strategy Strong integration among ERPs in different geographies Reliable source of data for all BI and E - commerce in LatAm Safe and monitored way to track data Retail How we impact our clients (cont’d) Full data integration and optimization of the company’s e - commerce ecosystem in LatAm Trusted Semantix to build and run the data integration and optimization of its entire e - commerce in LatAm Client C One of the largest electronics conglomerates in the world

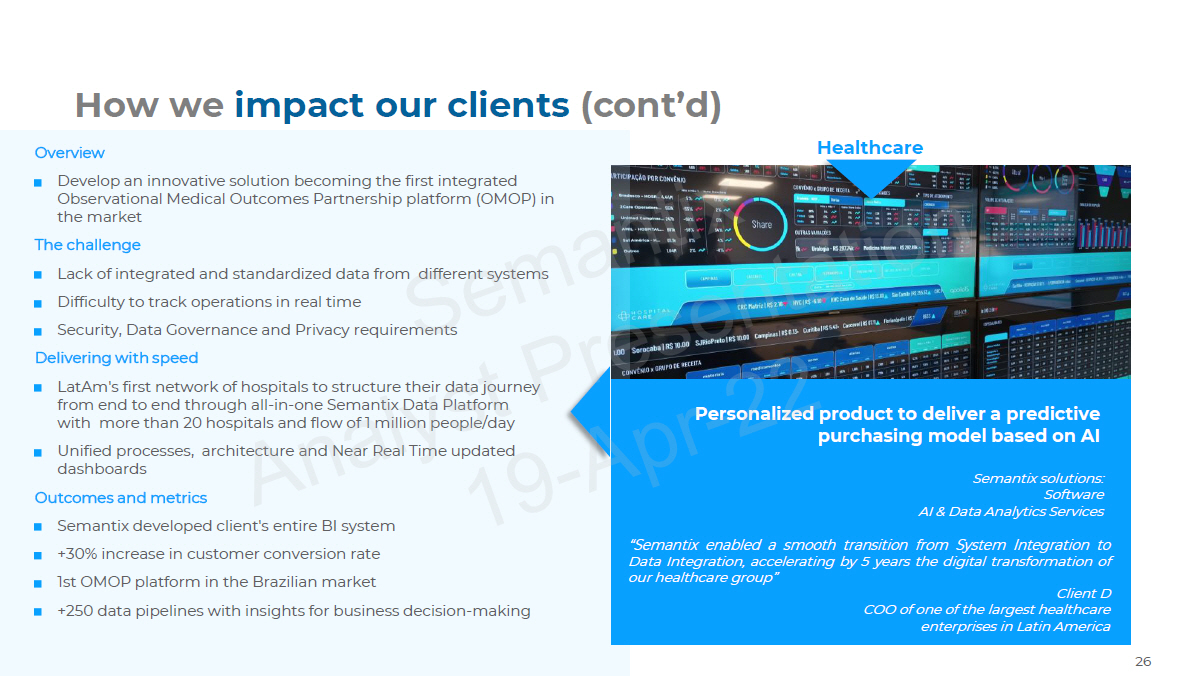

26 Overview Develop an innovative solution becoming the first integrated Observational Medical Outcomes Partnership platform (OMOP) in the market The challenge Lack of integrated and standardized data from different systems Difficulty to track operations in real time Security, Data Governance and Privacy requirements Delivering with speed LatAm's first network of hospitals to structure their data journey from end to end through all - in - one Semantix Data Platform with more than 20 hospitals and flow of 1 million people/day Unified processes, architecture and Near Real Time updated dashboards Outcomes and metrics Semantix developed client's entire BI system +30% increase in customer conversion rate 1st OMOP platform in the Brazilian market +250 data pipelines with insights for business decision - making How we impact our clients (cont’d) H ealth c are Semantix solutions: S of t w a re AI & Data Analytics Services Personalized product to deliver a predictive purchasing model based on AI “Semantix enabled a smooth transition from System Integration to Data Integration, accelerating by 5 years the digital transformation of our healthcare group” Client D COO of one of the largest healthcare enterprises in Latin America

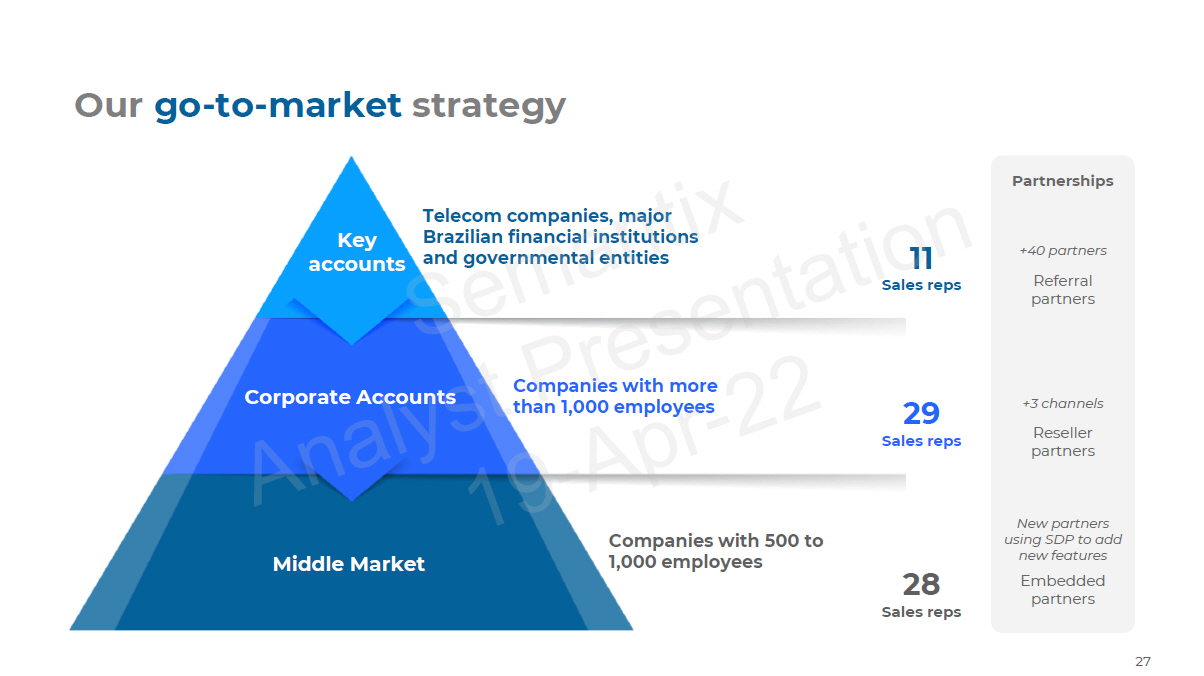

27 Our go - to - market strategy Telecom companies, major Brazilian financial institutions and governmental entities Companies with more than 1,000 employees Companies with 500 to 1,000 employees Middle Market Corporate Accounts Key accounts Partnerships +40 partners Referral par t n e rs +3 channels Reseller par t n e rs New partners using SDP to add new features Embedded partners 28 Sales reps 11 Sales reps 29 Sales reps

28 81% 19% Note: (1) Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these financial results. Powerful set of solutions Building data - driven solutions and placing clients one step ahead with frontier technology Sa a S AI & Data Analytics Services + 11 % 2021 r e v en u e growth % of 2021 revenue 1 + 96 %

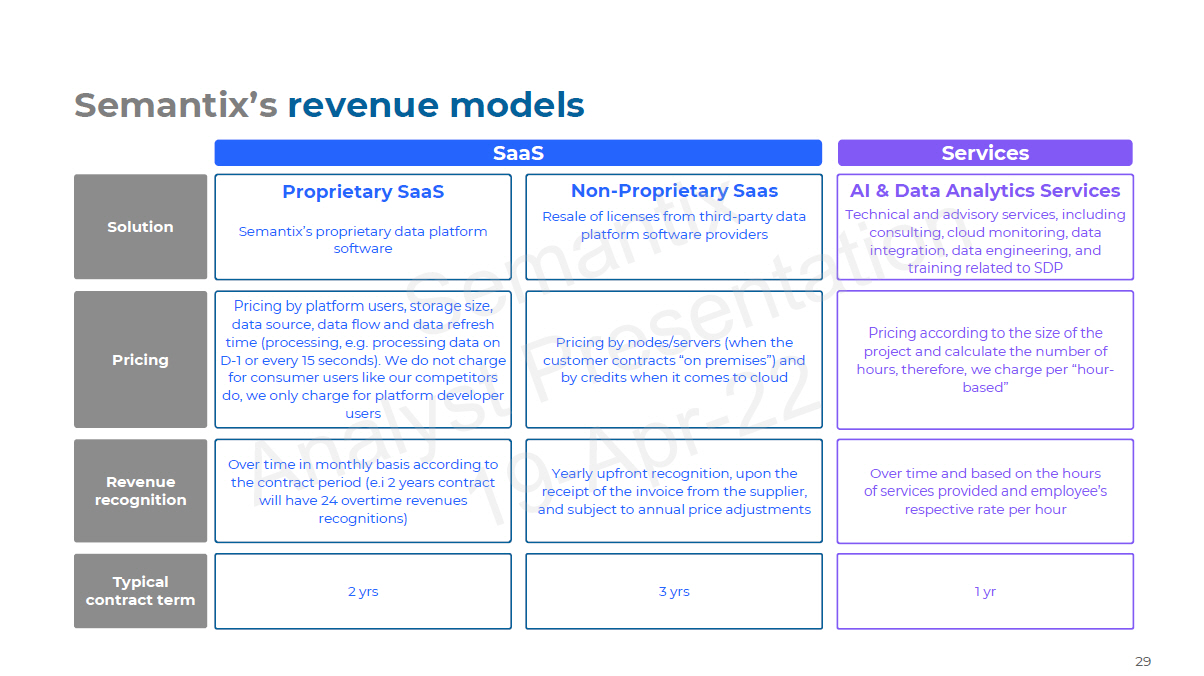

29 Semantix’s revenue models AI & Data Analytics Services Technical and advisory services, including consulting, cloud monitoring, data integration, data engineering, and training related to SDP Non - Proprietary Saas Resale of licenses from third - party data platform software providers Proprietary SaaS Semantix’s proprietary data platform software SaaS Services Over time and based on the hours of services provided and employee’s respective rate per hour Yearly upfront recognition, upon the receipt of the invoice from the supplier, and subject to annual price adjustments 3 yrs Over time in monthly basis according to the contract period (e.i 2 years contract will have 24 overtime revenues recognitions) 2 yrs Solution Pricing Typical contract term Pricing by nodes/servers (when the customer contracts “on premises”) and by credits when it comes to cloud Pricing by platform users, storage size, data source, data flow and data refresh time (processing, e.g. processing data on D - 1 or every 15 seconds). We do not charge for consumer users like our competitors do, we only charge for platform developer users Pricing according to the size of the project and calculate the number of hours, therefore, we charge per “hour - based” Revenue recognition 1 yr

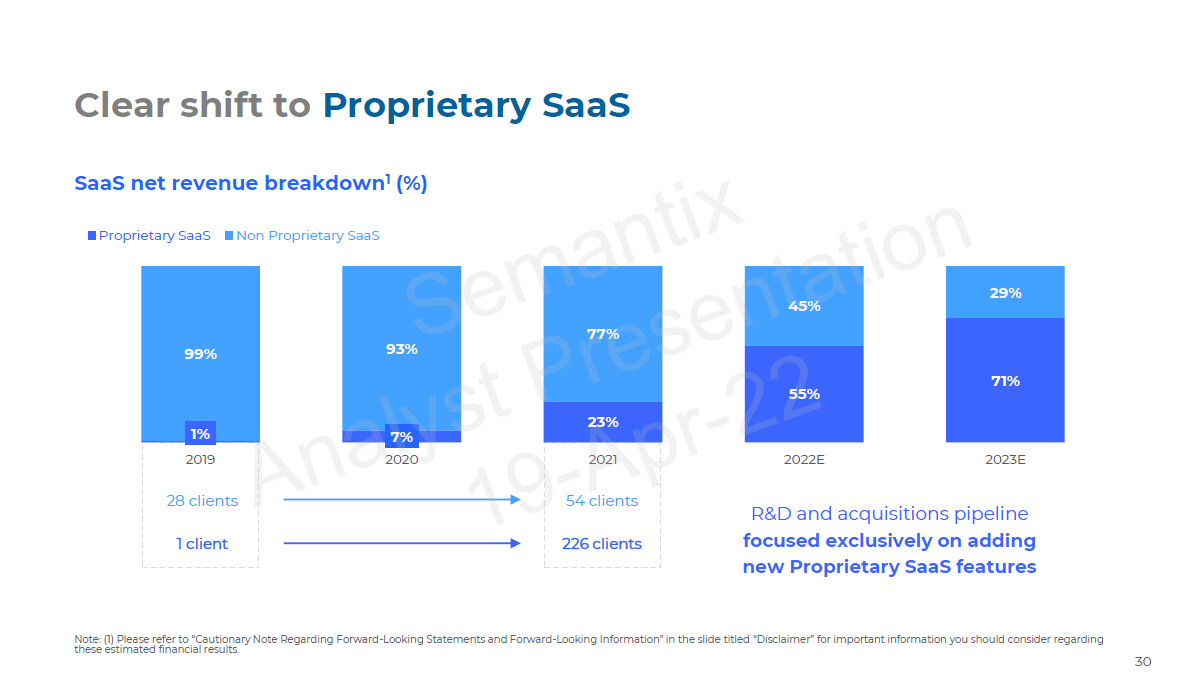

Note: (1) Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. 30 Clear shift to Proprietary SaaS 77% 23% 2021 54 clients 226 clients 1% 7% 55% 7 1 % 99% 93% 45% 29% 2019 28 clients 1 client 2 0 20 2 0 22E 2 0 2 3 E Proprietary SaaS Non Proprietary SaaS R&D and acquisitions pipeline focused exclusively on adding new Proprietary SaaS features SaaS net revenue breakdown 1 (%)

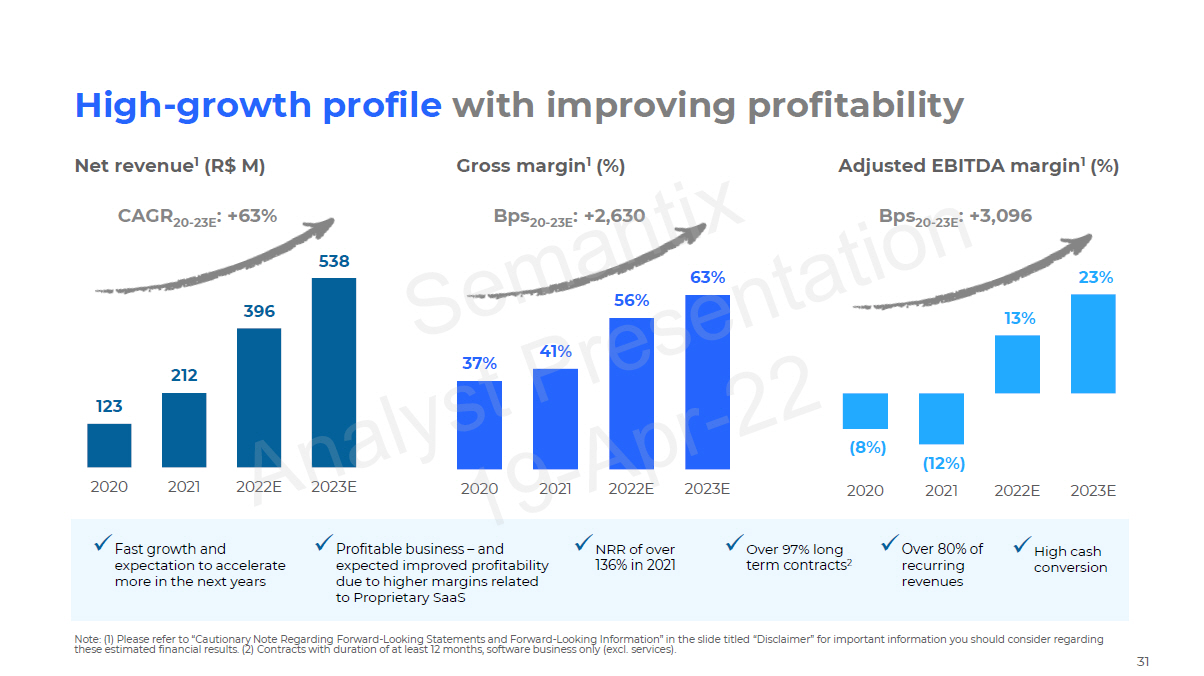

3 7 % 4 1 % 5 6% 63% 2 0 20 2 0 21 2 0 2 2 E 2 0 2 3 E 1 23 2 1 2 396 5 38 2 0 20 2 0 21 2 0 2 2 E 2 0 2 3 E Note: (1) Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. (2) Contracts with duration of at least 12 months, software business only (excl. services). 31 (8%) 1 3% 23% 2 0 20 ( 1 2%) 2021 2 0 2 2 E 2 0 2 3 E High - growth profile with improving profitability Net revenue 1 (R$ M) Gross margin 1 (%) Adjusted EBITDA margin 1 (%) CAGR 20 - 23E : +63% Bps 20 - 23E : +2,630 Bps 20 - 23E : +3,096 x Over 97% long term contracts 2 x Fast growth and expectation to accelerate more in the next years x Profitable business – and expected improved profitability due to higher margins related to Proprietary SaaS x High cash co nv e rsion x NRR of over 136% in 2021 x Over 80% of recurring revenues

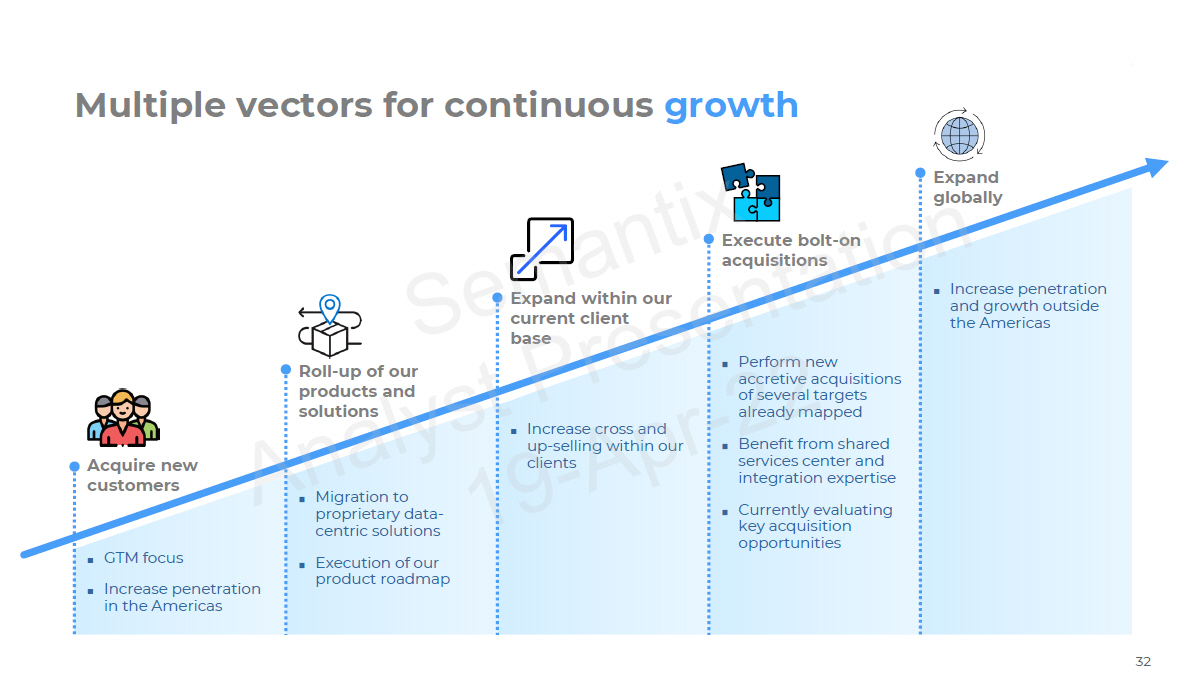

32 ■ GTM focus ■ Increase penetration in the Americas Acquire new customers Roll - up of our products and solutions Expand within our current client base E xp a n d gl ob ally Execute bolt - on acquisitions ■ Increase penetration and growth outside the Americas ■ Perform new accretive acquisitions of several targets already mapped ■ Benefit from shared services center and integration expertise ■ Currently evaluating key acquisition opportunities ■ Increase cross and up - selling within our clients ■ Migration to proprietary data - centric solutions ■ Execution of our product roadmap Multiple vectors for continuous growth

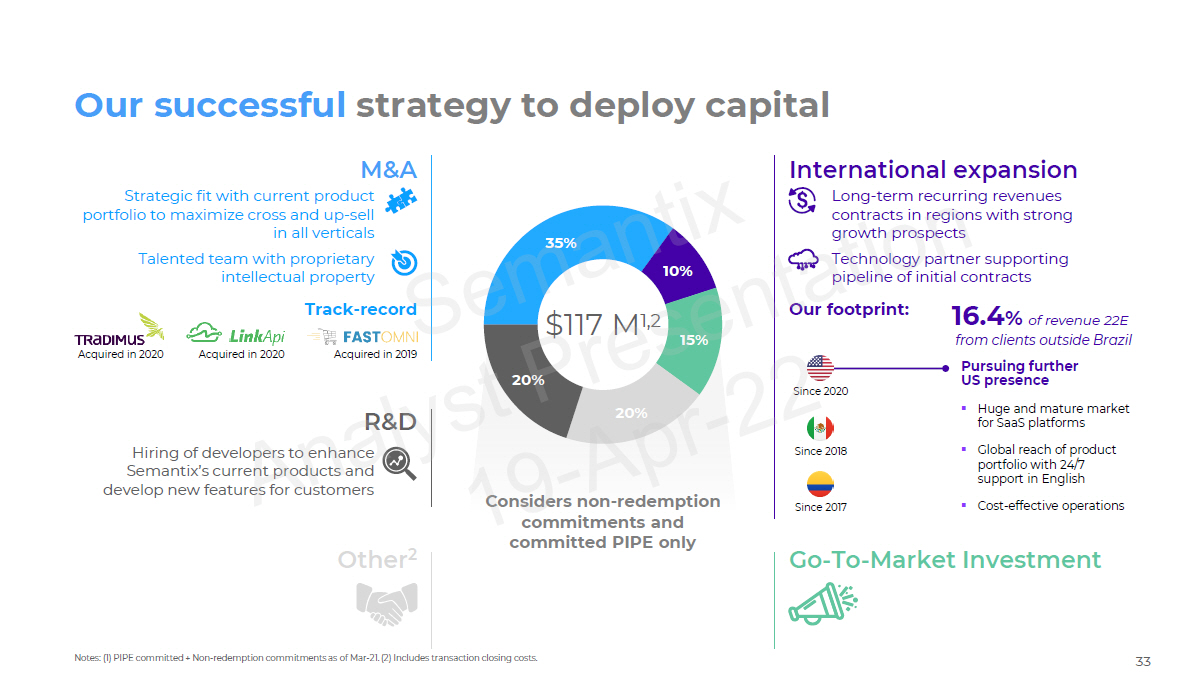

33 Notes: (1) PIPE committed + Non - redemption commitments as of Mar - 21. (2) Includes transaction closing costs. Our successful strategy to deploy capital $117 M 1,2 Considers non - redemption commitments and committed PIPE only 3 5% 1 0% 1 5% 2 0% 2 0% Since 2020 Since 2018 Since 2017 Acquired in 2019 Acquired in 2020 Acquired in 2020 M&A Strategic fit with current product portfolio to maximize cross and up - sell in all verticals Talented team with proprietary intellectual property T rack - rec o rd Our footprint: 4. % of revenue 22E from clients outside Brazil Pursuing further US presence ▪ Huge and mature market for SaaS platforms ▪ Global reach of product portfolio with 24/7 support in English ▪ Cost - effective operations International expansion Long - term recurring revenues contracts in regions with strong growth prospects Technology partner supporting pipeline of initial contracts Go - To - Market Investment Other 2 R&D Hiring of developers to enhance Semantix’s current products and develop new features for customers

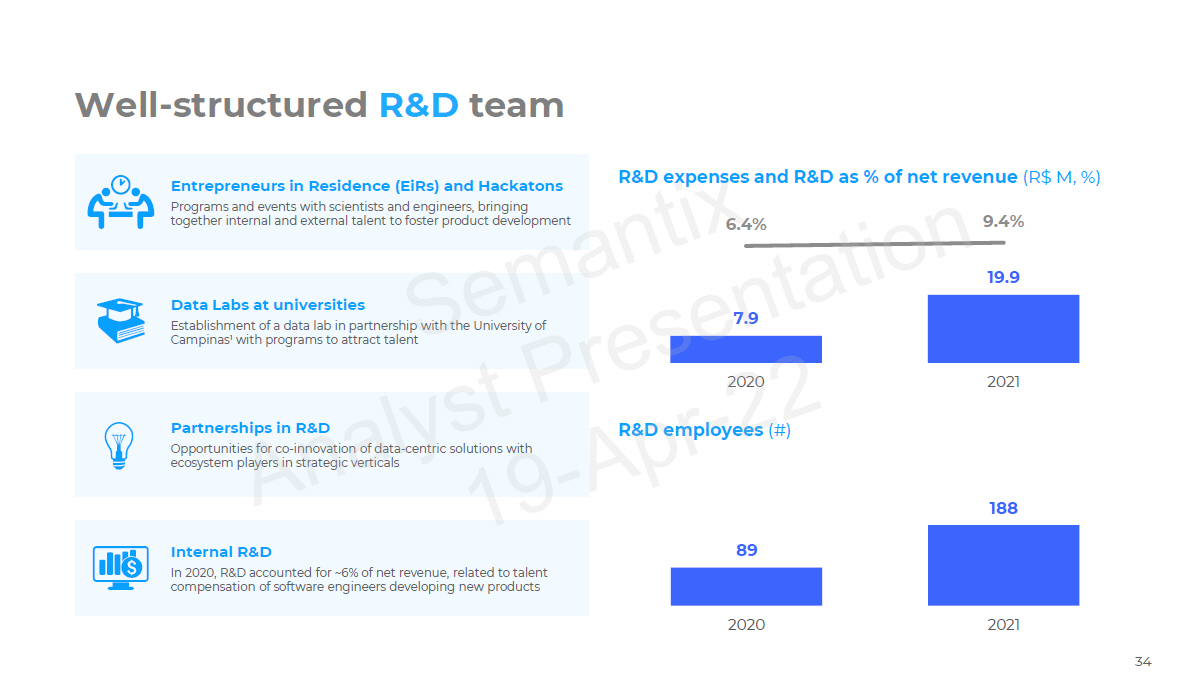

34 Well - structured R&D team R&D expenses and R&D as % of net revenue (R$ M, %) Entrepreneurs in Residence (EiRs) and Hackatons Programs and events with scientists and engineers, bringing together internal and external talent to foster product development Internal R&D In 2020, R&D accounted for ~6% of net revenue, related to talent compensation of software engineers developing new products Data Labs at universities Establishment of a data lab in partnership with the University of Campinas 1 with programs to attract talent Partnerships in R&D Opportunities for co - innovation of data - centric solutions with ecosystem players in strategic verticals 7 .9 1 9.9 6.4% 9.4% 2 0 20 2 0 21 89 1 88 2 0 20 2 0 21 R&D employees (#)

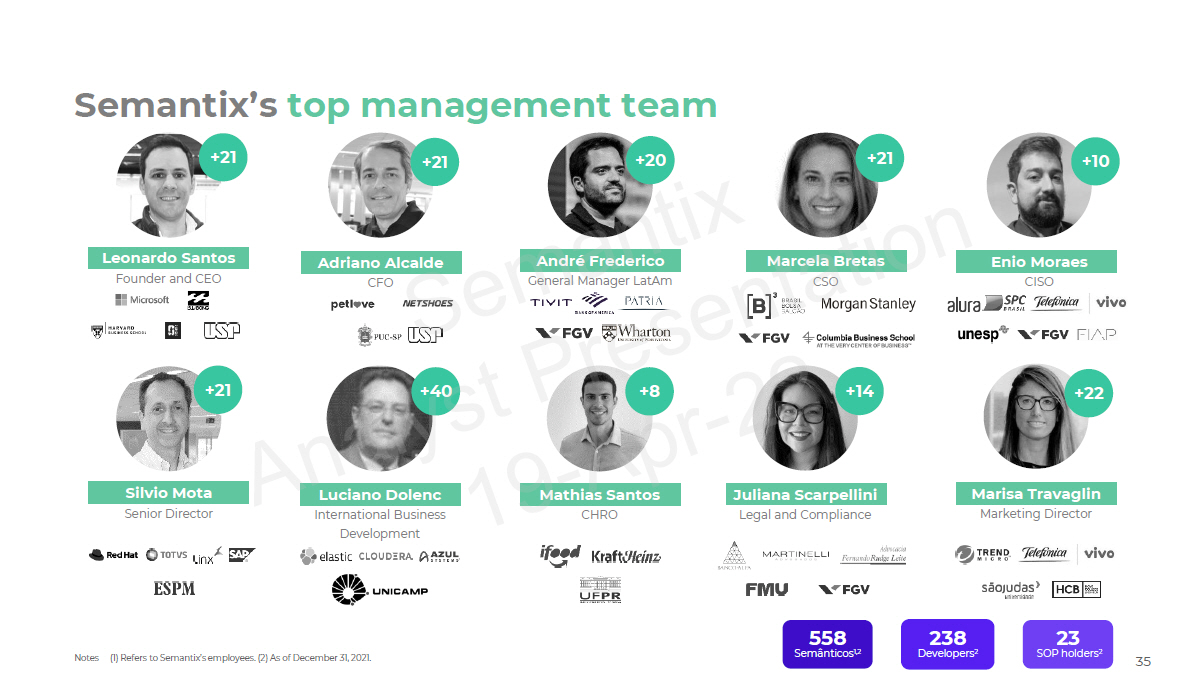

35 Notes (1) Refers to Semantix’s employees. (2) As of December 31, 2021. Semantix’s top management team 23 SOP holders 2 238 Developers 2 558 Semânticos 1,2 Leonardo Santos Founder and CEO +21 Adriano Alcalde CFO +21 André Frederico General Manager LatAm +20 Silvio Mota Senior Director +21 Luciano Dolenc International Business Development +40 Mathias Santos CHRO +8 Juliana Scarpellini Legal and Compliance + 1 4 Marisa Travaglin Marketing Director +22 Enio Moraes C I SO + 1 0 Marcela Bretas CSO +21

36 + 200 hours of training + 20 Classes throughout the year + 500 Trained employees Note: (1) Scale ranging from - 100 to 100. Values greater than 0 are considered good levels, val’es greater than 20 are considered outstanding levels. Human capital at the core of what we do Training highlights (2021) Building a delightful work environment

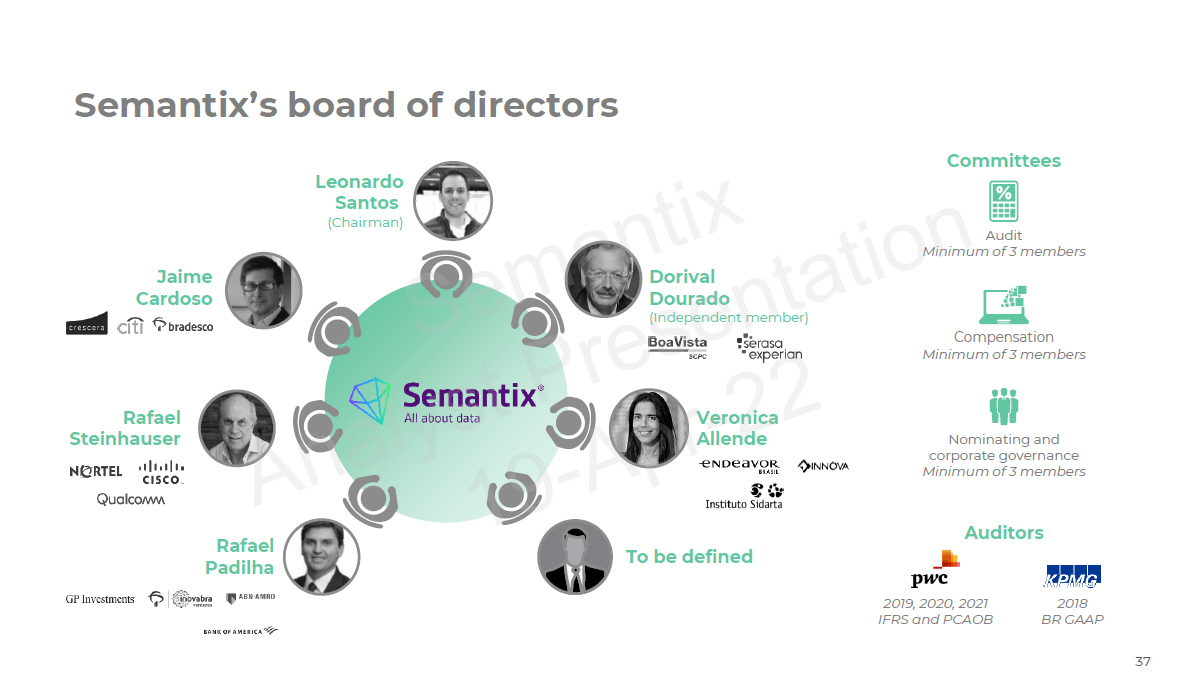

37 Semantix’s board of directors Compensation Minimum of 3 members Nominating and corporate governance Minimum of 3 members Audit Minimum of 3 members Dorival Dourado (Independent member) J aim e C a rd o so R a f a el P a d i l ha Leonardo Santos ( Ch airma n ) R a f a el S t e i nh a u ser Veron i ca Allende To be defined 2018 BR GAAP 2019, 2020, 2021 IFRS and PCAOB Committees Auditors

38 Source: (1) IDC (in terms of estimated potential revenue pool in 2024), Statista (in terms of estimated potential revenue pool in 2023, projected to 2024 using 2017 - 2023E CAGR). Note: (2) Calculated as revenue in Dec - 21 of clients that were in the base in Dec - 20 divided by the revenue with those clients in Dec - 20. Building a data leader: a truly end - to - end SaaS provider Scalable and recognized: LatAm market leadership Large and growing TAM: USD 89B in 2024 1 High customer retention: NRR > 136% 2 Structural competitive advantages: Own integrated platform Unmatched business model: End - to - end platform Proprietary technology built from scratch

A p p e ndix

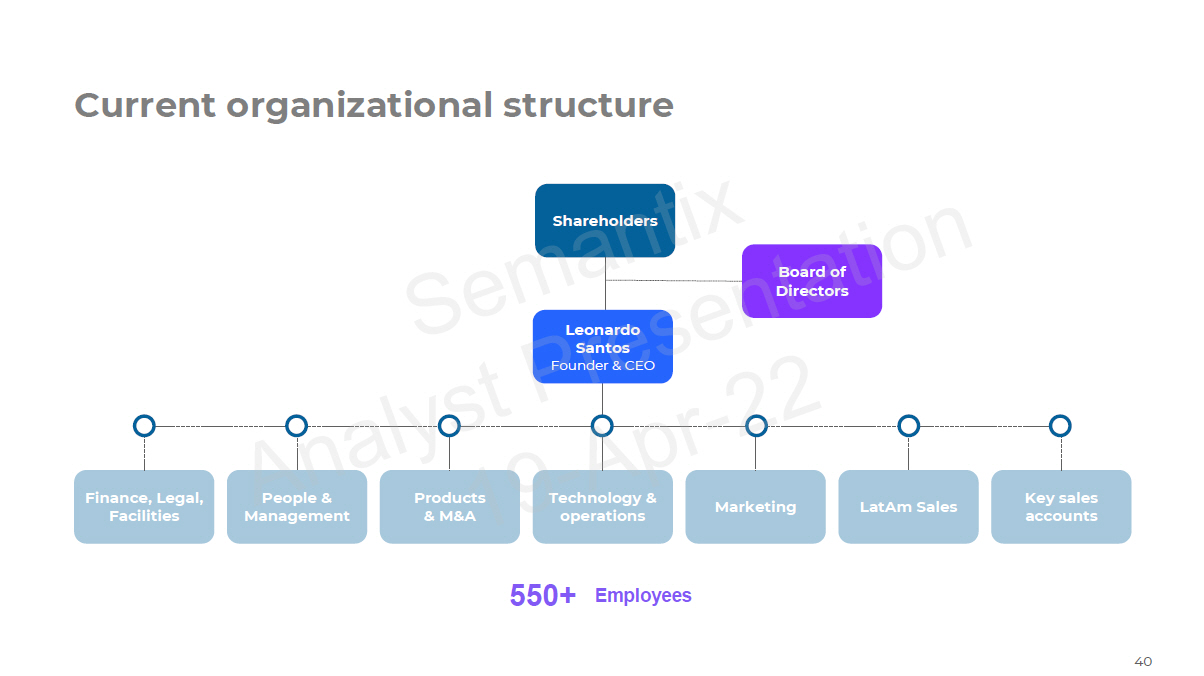

40 Current organizational structure Shareholders Board of Di rec to r s Finance, Legal, Facilities People & M a nag e m e nt Pr o d u c ts & M&A Technology & operations Marketing LatAm Sales Key sales acc oun t s E mplo y e e s 550+ Leonardo Santos Founder & CEO

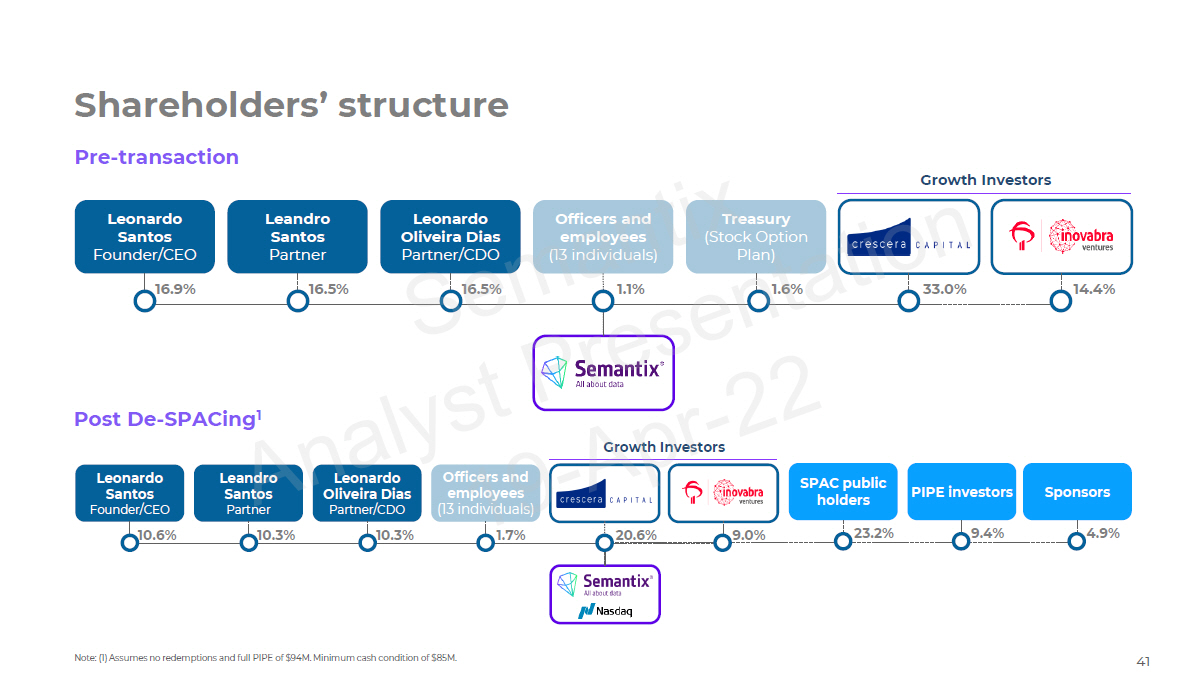

41 Note: (1) Assumes no redemptions and full PIPE of $94M. Minimum cash condition of $85M. Shareholders’ structure Leonardo Santos F ounder / CEO Lea nd r o Santos Partner Leonardo Oliveira Dias Partner/CDO Officers and employees (13 individuals) Treasury (Stock Option Plan) Growth Investors 16.9% 16.5% 16.5% 1.1% 1.6% 33.0% 1 4. 4% Pre - transaction Post De - SPACing 1 Leonardo Santos F o u nd e r/ CEO L eand ro Santos Partner Leonardo Oliveira Dias Partner/CDO Officers and employees (13 individuals) Growth Investors 10.6% 10.3% 10.3% 1.7% 20.6% 9.0% 23.2% 9.4% SPAC public holders PIPE investors S p onsors 4.9%

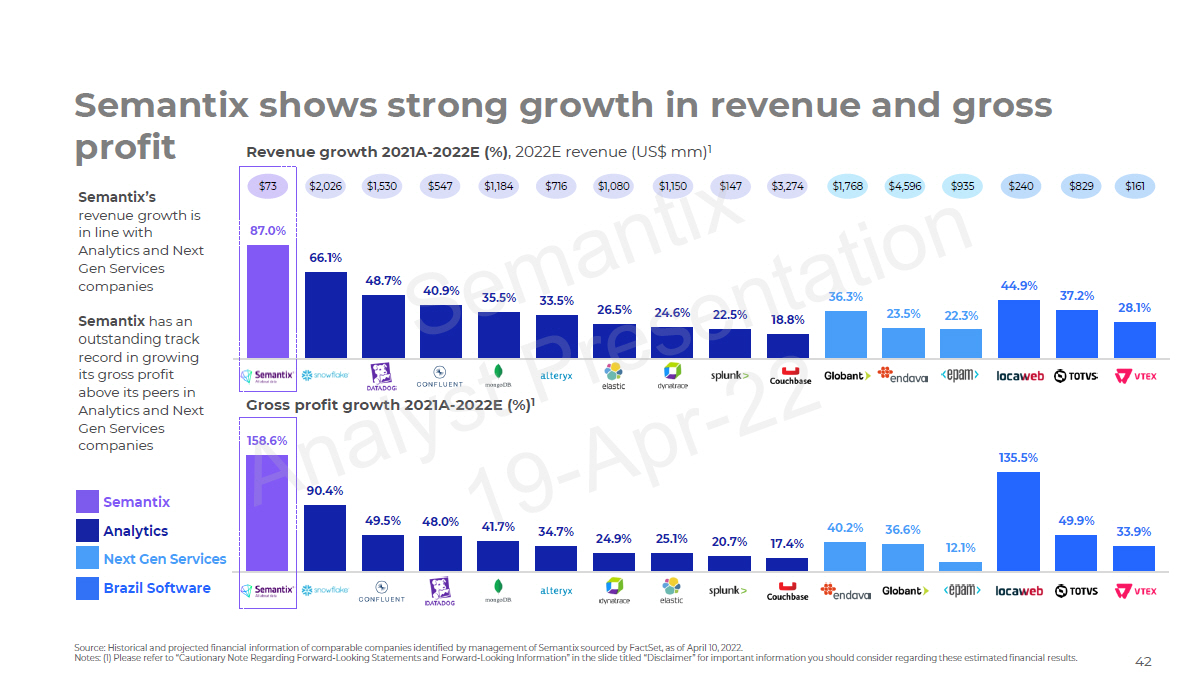

42 Source: Historical and projected financial information of comparable companies identified by management of Semantix sourced by FactSet, as of April 10, 2022. Notes: (1) Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. Semantix shows strong growth in revenue and gross profit Semantix’s revenue growth is in line with Analytics and Next Gen Services companies Semantix has an outstanding track record in growing its gross profit above its peers in Analytics and Next Gen Services companies Gross profit growth 2021A - 2022E (%) 1 66.1% 4 8. 7% 4 0. 9% 3 5 . 5% 33. 5% 2 6.5% 2 4.6% 22. 5% 1 8.8 % 3 6. 3 % 23.5% 22.3 % 44.9% 3 7. 2 % 28. 1% $1 4 7 $ 3 , 2 7 4 $ 2 40 $8 2 9 $1 6 1 Revenue growth 2021A - 2022E (%) , 2022E revenue (US$ mm) 1 $73 $2,026 $1,530 $547 $1,184 $716 $1,080 $1,150 87.0% $1, 76 8 $4, 5 9 6 $ 9 3 5 158.6% 9 0. 4% 49.5% 4 8.0 % 41 . 7% 3 4.7% 2 4.9% 2 5 . 1% 20. 7% 17.4% 4 0.2 % 3 6.6% 1 2. 1% 1 3 5 . 5% 49.9% 33. 9% Semantix Analytics Next Gen Services Brazil Software

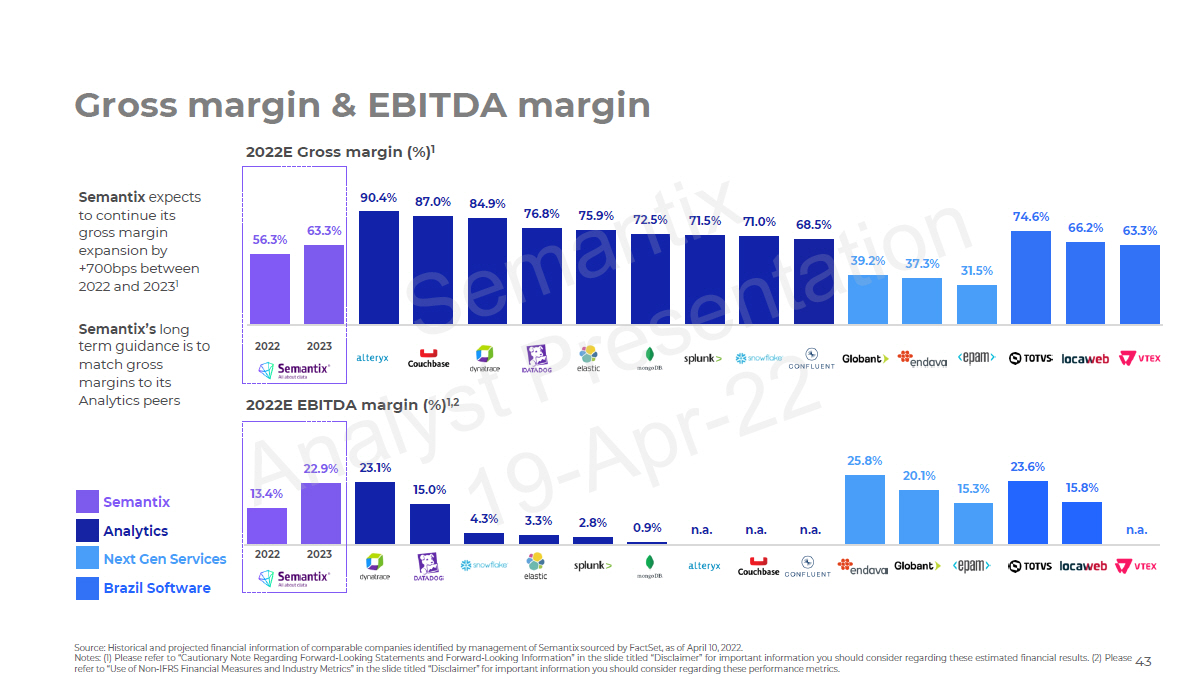

Source: Historical and projected financial information of comparable companies identified by management of Semantix sourced by FactSet, as of April 10, 2022. Notes: (1) Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. (2) Please 43 refer to “Use of Non - IFRS Financial Measures and Industry Metrics” in the slide titled “Disclaimer” for important information you should consider regarding these performance metrics. Gross margin & EBITDA margin 1 3. 4% 22. 9% 23. 1% 15 .0 % 4. 3 % 3.3 % 2.8 % 0. 9% n . a. n . a. n . a. 2 5 .8 % 20. 1% 15 .3 % 23. 6% 15 .8 % n . a. Semantix expects to continue its gross margin expansion by +700bps between 2022 and 2023 1 Semantix’s long term guidance is to match gross margins to its Analytics peers 2022E Gross margin (%) 1 2022E EBITDA margin (%) 1,2 56. 3 % 6 3.3 % 9 0. 4% 8 7. 0 % 8 4.9% 76. 8 % 7 5 . 9% 7 2. 5% 71 . 5% 71 .0 % 6 8. 5% 3 9. 2 % 3 7. 3 % 3 1 . 5% 7 4. 6% 66. 2 % 6 3.3 % 2 0 2 2 2 0 2 3 2 0 2 2 2 0 2 3 Semantix Analytics Next Gen Services Brazil Software

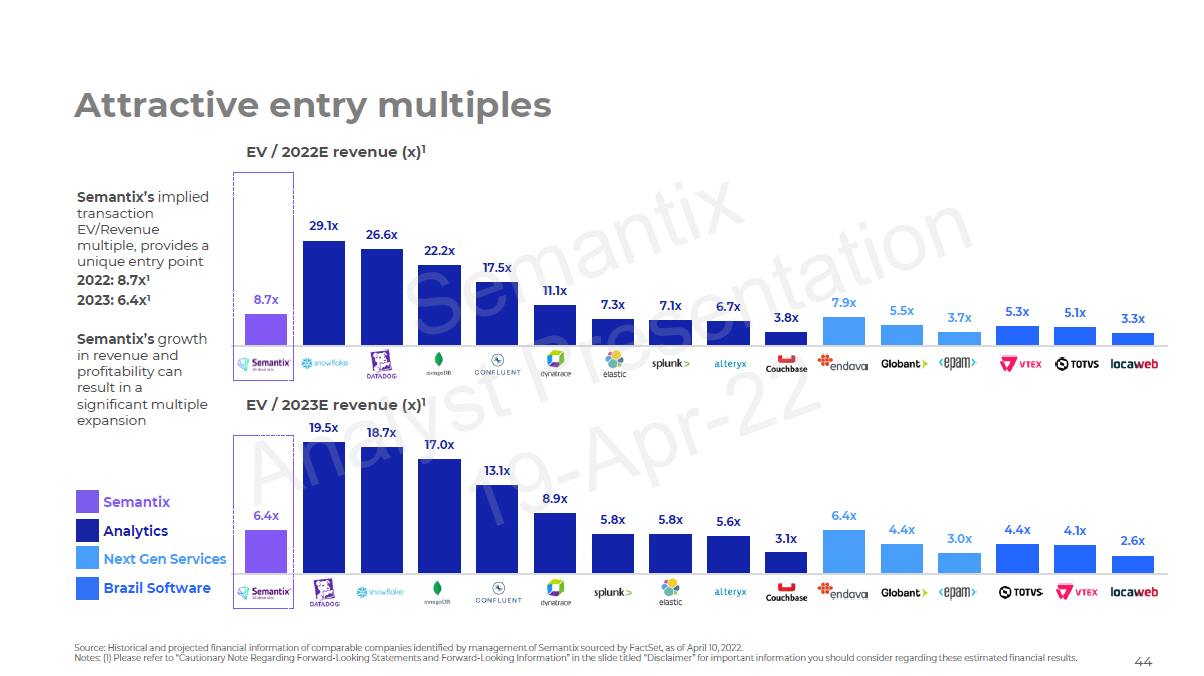

44 Source: Historical and projected financial information of comparable companies identified by management of Semantix sourced by FactSet, as of April 10, 2022. Notes: (1) Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. Attractive entry multiples EV / 2022E revenue (x) 1 EV / 2023E revenue (x) 1 Semantix’s implied transaction EV/Revenue multiple, provides a unique entry point 2022: 8.7x 1 2023: 6.4x 1 Semantix’s growth in revenue and profitability can result in a significant multiple expansion 8. 7x 2 9.1x 2 6.6x 22.2 x 17.5x 11 . 1x 7. 3 x 7.1x 6.7x 3 .8 x 7.9x 5 . 5x 3. 7x 5 .3 x 5 . 1x 3.3 x 6.4x 19.5x 1 8. 7x 17.0x 1 3 . 1x 8. 9x 5 .8 x 5 .8 x 5 . 6x 3. 1x 6.4x 4.4x 3.0 x 4.4x 4.1x 2. 6x Semantix Analytics Next Gen Services Brazil Software

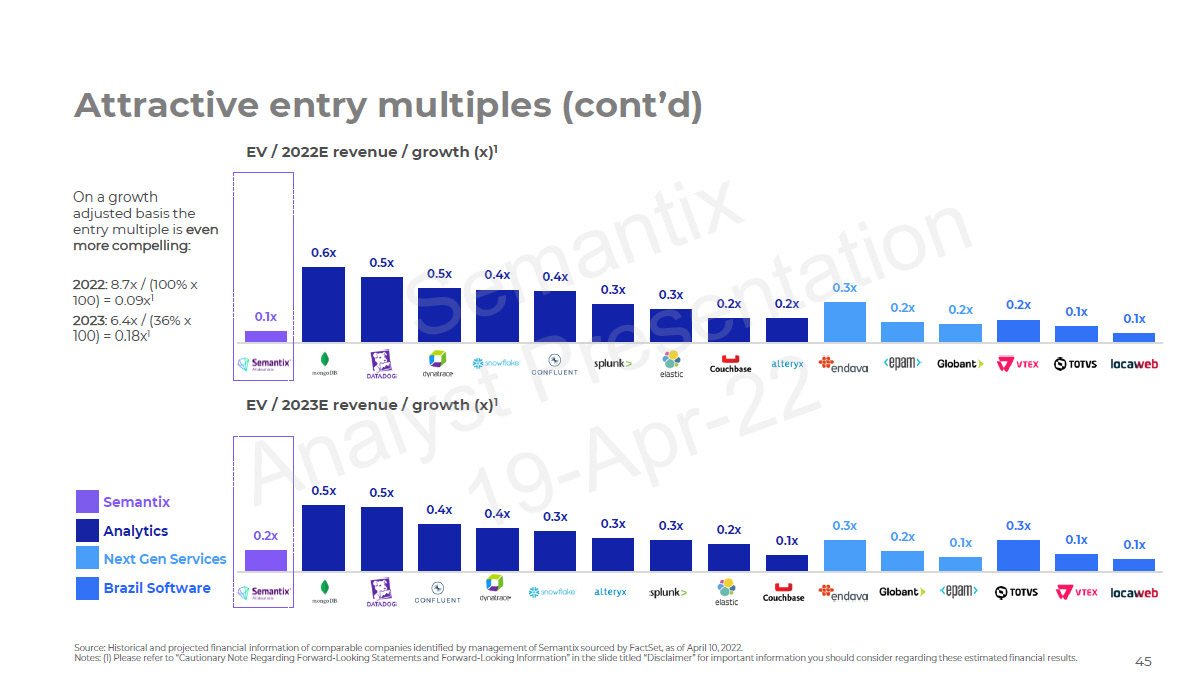

45 Source: Historical and projected financial information of comparable companies identified by management of Semantix sourced by FactSet, as of April 10, 2022. Notes: (1) Please refer to “Cautionary Note Regarding Forward - Looking Statements and Forward - Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. Attractive entry multiples (cont’d) EV / 2022E revenue / growth (x) 1 EV / 2023E revenue / growth (x) 1 On a growth adjusted basis the entry multiple is even more compelling: 2022: 8.7x / (100% x 100) = 0.09x 1 2023: 6.4x / (36% x 100) = 0.18x 1 Semantix Analytics Next Gen Services Brazil Software 0. 1x 0. 6x 0 . 5x 0. 5x 0. 4x 0. 4x 0.3 x 0.3 x 0.2 x 0.2 x 0.3 x 0.2 x 0.2 x 0.2 x 0 . 1x 0. 1x 0.2 x 0. 5x 0. 5x 0. 4x 0. 4x 0.3 x 0 . 3 x 0.3 x 0.2 x 0. 1x 0.3 x 0.2 x 0. 1x 0.3 x 0. 1x 0. 1x