UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 18, 2022

ALPHA CAPITAL ACQUISITION COMPANY

(Exact name of registrant as specified in its charter)

| Cayman Islands | 001-40080 | N/A | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1230 Avenue of the Americas, Fl. 16 New York, NY | 10020 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: +1 (732) 838-4533

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one share of Class A ordinary shares and one-half of one Warrant | ASPCU | Nasdaq Capital Market | ||

| Class A ordinary shares, par value $0.0001 per share | ASPC | Nasdaq Capital Market | ||

| Warrants, each whole warrant exercisable for one share of Class A ordinary shares at an exercise price of $11.50 per share | ASPCW | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 8.01. | Other Events. |

On May 18, 2022, Alpha Capital Acquisition Company (“Alpha Capital”) and Semantix Tecnologia em Sistema de Informção S.A. (“Semantix”) made a presentation to investors and research analysts. A copy of the presentation is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Important Information About the Business Combination and Where to Find It

The proposed business combination will be submitted to the shareholders of Alpha Capital for their consideration. Alpha Capital has filed a registration statement on Form F-4 (the “Registration Statement”) with the SEC which includes a preliminary proxy statement to be distributed to Alpha Capital’s shareholders in connection with Alpha Capital’s solicitation for proxies for the vote by Alpha Capital’s shareholders in connection with the proposed transaction and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued in connection with the completion of the proposed business combination. After the Registration Statement has been declared effective, Alpha Capital will mail a definitive proxy statement and other relevant documents to its shareholders as of the record date established for voting on the proposed business combination. Alpha Capital’s shareholders and other interested persons are advised to read the preliminary proxy statement / prospectus and any amendments thereto and, once available, the definitive proxy statement / prospectus, in connection with Alpha Capital’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things, the proposed transaction, because these documents will contain important information about Alpha Capital, Semantix and the proposed business combination. Shareholders may also obtain a copy of the preliminary or definitive proxy statement, once available, as well as other documents filed with the SEC regarding the proposed business combination and other documents filed with the SEC by Alpha Capital, without charge, at the SEC’s website located at sec.report or by directing a request to 1230 Avenue of the Americas, Fl. 16, New York, New York 10020.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

Alpha Capital, Semantix and certain of their respective directors, executive officers and other members of management, employees and consultants may, under SEC rules, be deemed to be participants in the solicitations of proxies from Alpha Capital’s shareholders in connection with the proposed business combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Alpha Capital’s shareholders in connection with the proposed business combination will be set forth in Alpha Capital’s proxy statement / prospectus when it is filed with the SEC. You can find more information about Alpha Capital’s directors and executive officers in the Prospectus. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be included in the proxy statement / prospectus when it becomes available. Shareholders, potential investors and other interested persons should read the proxy statement / prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. No assurance can be given that the Business Combination discussed above will be completed on the terms described, or at all. These statements are based on various assumptions, whether or not identified in this Current Report, and on the current expectations of Semantix’s and Alpha Capital’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Semantix and Alpha Capital. These forward-looking statements are subject to a number of risks and uncertainties, including those factors discussed in Alpha Capital’s final prospectus that forms a part of Alpha Capital’s Registration Statement on Form S-1 (Reg. No. 333-252596), filed with the SEC pursuant to Rule 424(b)(4) on February 18, 2021 (the “Prospectus”) under the heading “Risk Factors,” and other documents of Alpha Capital filed, or to be filed, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. There may be additional risks that neither Alpha Capital nor Semantix presently know or that Alpha Capital nor Semantix currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Alpha Capital’s and Semantix’s expectations, plans or forecasts of future events and views as of the date of this Current Report. Alpha Capital and Semantix anticipate that subsequent events and developments will cause Alpha Capital’s or Semantix’s assessments to change. However, while Alpha Capital and Semantix may elect to update these forward-looking statements at some point in the future, Alpha Capital and Semantix specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Alpha Capital’s or Semantix’s assessments as of any date subsequent to the date of this Current Report. Accordingly, undue reliance should not be placed upon the forward-looking statements.

No Offer or Solicitation

This Current Report does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

| Item 9.01. | Financial Statements and Exhibits. |

(a) Exhibits. The following exhibits are filed with this Form 8-K:

Exhibit | Description of Exhibits | |

| 99.1 | Company Presentation dated May 18, 2022. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 18, 2022

| ALPHA CAPITAL ACQUISITION COMPANY | ||

| By: | /s/ Rahim Lakhani | |

| Name: | Rahim Lakhani | |

| Title: | Chief Financial Officer | |

Exhibit 99.1 The truly unified data platform Company Presentation May 2022 1

Disclaimer These materials and the related presentation (together with oral statements made in connection herewith, this “Presentation”) have been prepared solely for use at a presentation to research analysts with respect to a potential business combination and related transactions (the “Business Combination”) between Alpha Capital Acquisition Company (“Alpha Capital”) and Semantix Tecnologia em Sistema de Informação S.A. together with its subsidiaries, (“Semantix”). The information contained herein does not purport to be all inclusive or to contain all of the information that may be required to make a full analysis of Semantix or the Business Combination, and none of Alpha Capital, Semantix or any of their respective affiliates or control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. Each of Alpha Capital and Semantix and their respective affiliates and control persons, officers, directors, employees and representatives expressly disclaim any and all representations or warranties, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. Nothing herein should be construed as legal, financial, tax or other advice. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein. You are also reminded that the United States securities laws restrict persons with material non-public information about a company obtained directly or indirectly from the company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information. The reader shall not rely upon any statement, representation or warranty made by any other person, firm or corporation in making its investment decision. None of Alpha Capital, Semantix or any of their respective affiliates or control persons, officers, directors, employees or representatives, shall be liable to the reader for any information set forth herein or any action taken or not taken by any reader, including any investment in shares of any Alpha Capital or Semantix. Certain information contained in this Presentation relates to or is based on studies, publications, surveys and Semantix’s or Alpha Capital’s own internal estimates and research. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while Semantix and Alpha Capital believe their internal research is reliable, such research has not been verified by any independent source and Semantix and Alpha Capital cannot guarantee and make no representation or warranty, express or implied, as to its accuracy and completeness. This Presentation contains preliminary information only, is subject to change at any time and, is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with Semantix and Alpha Capital. This meeting and any information communicated at this meeting are strictly confidential and should not be distributed, disclosed or used for any purpose other than for the purpose of your firm’s participation in the potential private placement of securities, that you will not distribute, disclose or use such information in any way detrimental to Semantix or Alpha Capital, and that you will return to Semantix and Alpha Capital, delete or destroy this Presentation upon request. Neither Semantix nor Alpha Capital undertakes any obligation to update this Presentation unless otherwise required by law. Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information. This presentation supersedes and supplements any prior presentation and any oral or written communication with respect to Semantix and its business. Certain statements in this Presentation may be considered forward-looking statements and forward-looking information within the meaning of applicable United States securities legislation (collectively herein referred to as “forward-looking statements”). Forward-looking statements generally relate to future events or future financial or operating performance of Semantix or Alpha Capital. For example, statements concerning the following include forward-looking statements: the growth of Semantix’s business and its ability to realize expected results, including with respect to its net revenue, EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA margin; the viability of its growth strategy, including with respect to its ability to grow market share in Brazil and internationally, grow revenue from existing customers, and consummate acquisitions; opportunities, trends and developments in the data industry, including with respect to future financial performance in the industry; the size of Semantix’s total addressable market; the expected benefits of the proposed Business Combination; any indications of interest in the proposed PIPE financing; the satisfaction of closing conditions to the potential Business Combination and any related financing, the amount of redemption requests made by Alpha Capital’s public stockholders and the completion of the potential Business Combination, including the anticipated structure and closing date of the proposed Business Combination and the use of the cash proceeds therefrom; anticipated management and directors of the resulting issuer; any anticipated shareholder approvals; and the pro forma ownership of the resulting issuer. In some cases, you can identify forward looking statements by terminology such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “could,” “plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target,” “trend” or other similar expressions (or the negative versions of such words or expressions). Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements and could adversely affect the outcome and financial effects of the plans and events described herein. In addition, even if the outcome and financial effects of the plans and events described herein are consistent with the forward-looking statements contained in this Presentation, those results or developments may not be indicative of results or developments in subsequent periods. Although Semantix and Alpha Capital have attempted to identify important risks and factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors and risks that cause actions, events or results not to be as anticipated, estimated or intended. Forward-looking information contained in this Presentation are based on current estimates, assumptions, expectations and projections, including with respect to the management’s expectations regarding Semantix’s growth based on historical financial results and anticipated commercial developments, the anticipated success of current strategies for market penetration and capture in Brazil and globally in light of competition from existing market participants and the emergence of competitors in the future, management’s expectations with respect to the development of technology and other proprietary intellectual property by Semantix based on existing technological realities and strategies with respect to intellectual property development, management’s expectations regarding the likelihood Semantix will be able to enter into commercial arrangements with relevant third-parties and customers, Semantix’s ability to maintain adequate margins based on financial metrics available to management, the ability of Semantix and Alpha Capital to complete the transactions described in this Presentation, the ability of Semantix to finance its ongoing capital needs, the continued involvement of Semantix’s management in Semantix’s operations and the ability of Semantix to attract and retain talent in the future, which are based on the information available as of the date of this document, and, while considered reasonable by Semantix or Alpha Capital, as applicable, are inherently uncertain. Historical statements contained in this document regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. In this regard, certain financial information contained herein has been extracted from, or based upon, information available in the public domain and/or provided by Semantix. In particular, historical results should not be taken as a representation that such trends will be replicated in the future. No statement in this document is intended to be nor may be construed as a profit forecast. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, factors beyond the control of Semantix and Alpha Capital including: general economic conditions; factors associated with companies, such as Semantix, that are engaged in the data industry, including the impact of the COVID-19 pandemic and a wide variety of other significant business, economic and competitive risks and uncertainties; the ability to obtain approval of the stockholders of Alpha Capital; legal or regulatory developments (such as any SEC statements or enforcement or other actions relating to SPACs); the ability to maintain the listing of the combined company’s securities on a U.S. exchange; the inability to complete the proposed PIPE financing; the risk that the proposed business combination disrupts current plans and operations of Alpha Capital or Semantix as a result of the announcement and consummation of the transaction described herein; the risk that any of the conditions to closing the Business Combination are not satisfied in the anticipated manner or on the anticipated timeline; the failure to realize the anticipated benefits of the proposed Business Combination; risks relating to the uncertainty of the projected financial information with respect to Semantix and costs related to the proposed business combination; the outcome of any legal proceedings or regulatory action that may be instituted against Alpha Capital or Semantix, or any of their respective directors or officers, following the announcement of the potential transaction; the amount of redemption requests made by Alpha Capital’s public stockholders; and those factors discussed in this Presentation, Alpha Capital Holdco Co's registration statement on Form F-4, Alpha Capital’s final prospectus dated February 18, 2021 and any Annual Report on Form 10-K or Quarterly Report on Form 10-Q, in each case, under the heading “Risk Factors,” and other documents of Alpha Capital filed, or to be filed, with the SEC. If any of these risks materialize or Alpha Capital or Semantix’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. . 2

Disclaimer (cont’d) Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. This Presentation also contains certain financial forecast information of Semantix. Such financial forecast information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. You must make your own determinations as to the reasonableness of these projections, estimates, goals, trends and other statements and should also note that if one or more estimates change, or one or more assumptions are not met, or one or more unexpected events occur, the performance and results set forth in such projections, estimates, goals, trends and other statements may not be achieved. We can give no assurance as to future operations, performance, results or events. Use of Non-IFRS Financial Measures and Industry Metrics. This Presentation, includes certain non-IFRS financial measures (including on a forward-looking basis) and industry metrics such as EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, and net revenue retention. These measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with IFRS and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with IFRS. Semantix believes that these measures (including on a forward-looking basis) provide useful supplemental information to investors about Semantix. Semantix’s management does not consider these non-IFRS measures in isolation or as an alternative to financial measures determined in accordance with IFRS. Semantix’s management uses forward-looking non-IFRS measures to evaluate Semantix’s projected financials and operating performance. However, there are a number of limitations related to the use of these measures, including that they exclude significant expenses that are required by IFRS to be recorded in Semantix’s financial measures. In addition, other companies may calculate non-IFRS measures or industry metrics differently, or may use other measures to calculate their financial performance, and therefore, Semantix’s non-IFRS measures and industry metrics may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-IFRS financial measures are provided, they are presented on a non-IFRS basis without reconciliations of such forward-looking non-IFRS measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Additional Information. In connection with the proposed Business Combination, Alpha Capital Holdco Co has filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form F-4, containing a preliminary proxy statement/prospectus of Alpha Capital, and after the registration statement is declared effective, Semantix expects that Alpha Capital will mail a definitive proxy statement/prospectus relating to the proposed Business Combination to its shareholders. This Presentation does not contain all the information that should be considered concerning the potential Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. Shareholders of Alpha Capital and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed by Alpha Capital or Semantix in connection with the proposed Business Combination, as these materials will contain important information about Semantix, Alpha Capital and the potential Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to shareholders of Alpha Capital as of a record date to be established for voting on the proposed Business Combination. Shareholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed by Alpha Capital with the SEC, without charge, once available, at the SEC’s website at www.sec.gov. No Offer or Solicitation. This Presentation shall not constitute a “solicitation” as defined in Section 14 of the Securities Exchange Act of 1934, as amended. This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any offering of securities (the “Securities”) will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and will be offered as a private placement to a limited number of institutional “accredited investors” as defined in Rule 501(a)(1), (2), (3) or (7) under the Act and “Institutional Accounts” as defined in FINRA Rule 4512(c). Accordingly, the Securities must continue to be held unless a subsequent disposition is exempt from the registration requirements of the Securities Act. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Securities Act. The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to be issued. Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. Alpha Capital, Semantix and their respective directors and executive officers may be deemed participants in the solicitation of proxies from Alpha Capital’s stockholders with respect to the potential Business Combination. A list of the names of Alpha Capital’s directors and executive officers and a description of their interests in Alpha Capital is contained in Alpha Capital’s final prospectus relating to its initial public offering, which was filed with the SEC on February 18, 2021 and is available free of charge at the SEC’s web site at www sec gov, or by directing a request to Alpha Capital. Additional information regarding the interests of the participants in the solicitation of proxies from the shareholders of Alpha Capital with respect to the proposed Business Combination will be contained in the proxy statement/prospectus for the proposed Business Combination filed by Alpha Capital when available. Trademarks. This Presentation contains trademarks, service marks, trade names and copyrights of Semantix, Alpha Capital and other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade name or products in this Presentation is not intended to, and does not imply, a relationship with Alpha Capital or Semantix, or an endorsement of sponsorship by or of Alpha Capital or Semantix. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Alpha Capital or Semantix will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. 3

Semantix and Alpha Capital to combine creating LatAm’s fully integrated data platform Leonardo Santos Adriano Alcalde André Frederico Marcela Bretas Rafael Steinhauser General Manager Founder CFO CSO and IR Founder & Sponsor LatAm CEO President and Director 4

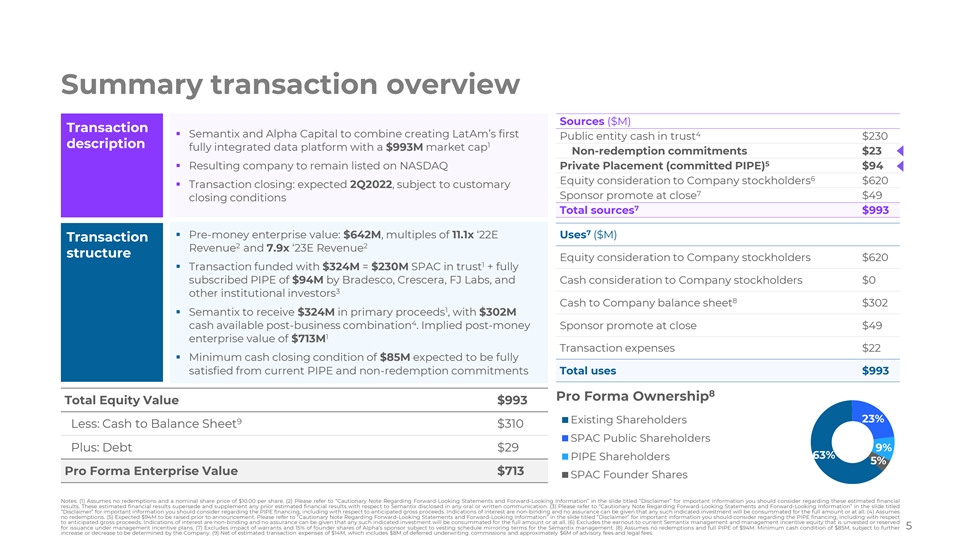

Summary transaction overview Sources ($M) Transaction ▪ Semantix and Alpha Capital to combine creating LatAm’s first 4 Public entity cash in trust $230 description 1 fully integrated data platform with a $993M market cap Non-redemption commitments $23 5 ▪ Resulting company to remain listed on NASDAQ Private Placement (committed PIPE) $94 6 Equity consideration to Company stockholders $620 ▪ Transaction closing: expected 2Q2022, subject to customary 7 Sponsor promote at close $49 closing conditions 7 Total sources $993 7 ▪ Pre-money enterprise value: $642M, multiples of 11.1x ‘22E Uses ($M) Transaction 2 2 Revenue and 7.9x ‘23E Revenue structure Equity consideration to Company stockholders $620 1 ▪ Transaction funded with $324M = $230M SPAC in trust + fully subscribed PIPE of $94M by Bradesco, Crescera, FJ Labs, and Cash consideration to Company stockholders $0 3 other institutional investors 8 Cash to Company balance sheet $302 1 ▪ Semantix to receive $324M in primary proceeds , with $302M 4 cash available post-business combination . Implied post-money Sponsor promote at close $49 1 enterprise value of $713M Transaction expenses $22 ▪ Minimum cash closing condition of $85M expected to be fully satisfied from current PIPE and non-redemption commitments Total uses $993 8 Pro Forma Ownership Total Equity Value $993 23% 9 Existing Shareholders Less: Cash to Balance Sheet $310 SPAC Public Shareholders Plus: Debt $29 9% 63% PIPE Shareholders 5% Pro Forma Enterprise Value $713 SPAC Founder Shares Notes: (1) Assumes no redemptions and a nominal share price of $10.00 per share. (2) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. (3) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding the PIPE financing, including with respect to anticipated gross proceeds. Indications of interest are non-binding and no assurance can be given that any such indicated investment will be consummated for the full amount or at all. (4) Assumes no redemptions. (5) Expected $94M to be raised prior to announcement. Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding the PIPE financing, including with respect to anticipated gross proceeds. Indications of interest are non-binding and no assurance can be given that any such indicated investment will be consummated for the full amount or at all. (6) Excludes the earnout to current Semantix management and management incentive equity that is unvested or reserved for issuance under management incentive plans. (7) Excludes impact of warrants and 15% of founder shares of Alpha’s sponsor subject to vesting schedule mirroring terms for the Semantix management. (8) Assumes no redemptions and full PIPE of $94M. Minimum cash condition of $85M, subject to further 5 increase or decrease to be determined by the Company. (9) Net of estimated transaction expenses of $14M, which includes $8M of deferred underwriting commissions and approximately $6M of advisory fees and legal fees.

End-to-end SaaS platform that enables a complete data analytics and AI journey Low code, low touch and cost- Leadership position in LatAm going effective solution global through Nasdaq listing 6

Semantix snapshot R$290M +300 39% +136% ($58M) 1,2,3 Clients as of Dec-21 Net revenue NRR in Dec-21 1 Net revenue 2022E 1 CAGR 2021-2023E 46% 0.4% 8.4x 83%+ 1 1,2 2,4 Gross margin 2022E Adj. EBITDA margin 2022E LTV/CAC 2021 Long-term contracts 5 in 2021 Notes: (1) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. (2) Please refer to “Use of Non-IFRS Financial Measures and Industry Metrics” in the slide titled “Disclaimer” for important information you should consider regarding these performance metrics. (3) NRR is calculated as gross revenue in the month of December 2021 from clients that were in Semantix’s client base as of December 2020 divided by gross revenue from these clients in the month of December 2020. (4) LTV is calculated as average gross margin contribution by client in 2021 multiplied by margin multiple, which is calculated as retention rate divided by the following formula: (1 - retention rate + discount rate). CAC is calculated as average sales and marketing expenses in 2021 divided by the number of new clients in 2021. (5) Contracts with duration of at least 12 months, software business only. 7

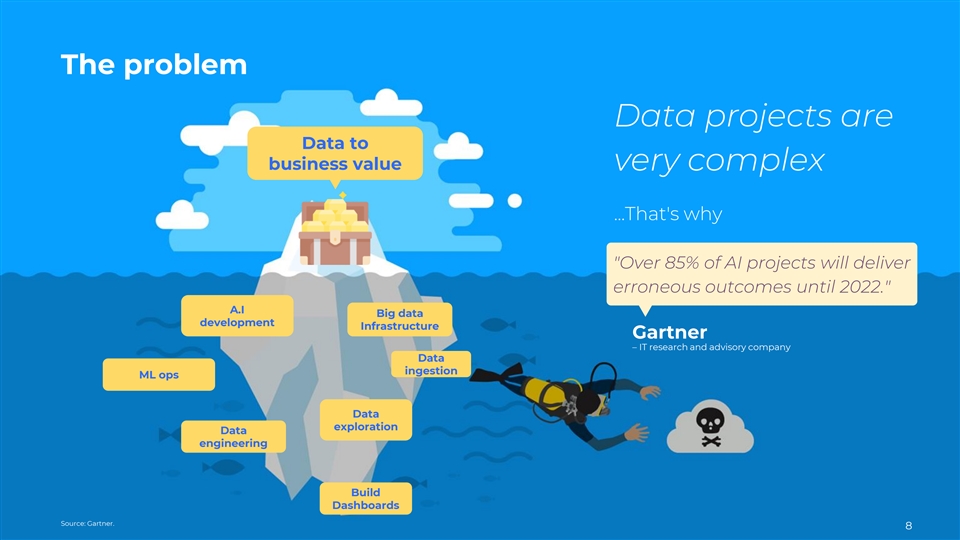

The problem Data projects are Data to business value very complex ....That's why Over 85% of AI projects will deliver erroneous outcomes until 2022. A.I Big data development Infrastructure Gartner – IT research and advisory company Data ingestion ML ops Data exploration Data engineering Build Dashboards Source: Gartner. 8 8

Rebuilding data journey in a frictionless way All-in-one Simple & Agile Enterprise Ready Infrastructure automation Intuitive interface Stack agnostic Data integration Extensible via APIs Data governance Data engineering Plug-and-play algorithms Scalable and safe Data visualization Multi-cloud Premium 24x7 support AI lifecycle 9

+10 years executing disruptive initiatives Multi-year relationships 2022 with +300 clients using Expected to go public 2 our solutions in +15 countries 2021 Accelerated growth 1,2 +550 Semânticos of proprietary SaaS products 2019 2 +230 Developers nd 2 investor: Launch of SDP 2.0 2017 and integration with st 2015 1 investor: 2010 Start of Semantix data Company Foundation platform development consolidation of Semantix Merger Agreement with Alpha Launch of SDP 1.0 st 1 step to global expansion Notes (1) Refers to Semantix’s employees. (2) As of December 31, 2021. 10

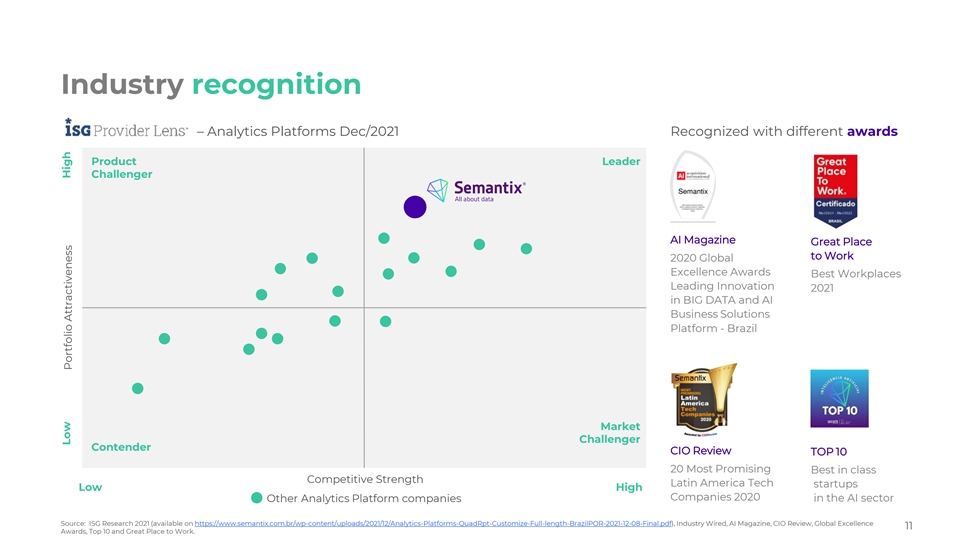

Industry recognition ISG Provider Lens™ – Analytics Platforms Dec/2021 Recognized with different awards Product Leader Challenger AI Magazine Great Place to Work 2020 Global Excellence Awards Best Workplaces Leading Innovation 2021 in BIG DATA and AI Business Solutions Platform - Brazil Market Challenger Contender CIO Review TOP 10 20 Most Promising Best in class Competitive Strength Latin America Tech startups Low High Companies 2020 in the AI sector Other Analytics Platform companies Source: ISG Research 2021 (available on https://www.semantix.com.br/wp-content/uploads/2021/12/Analytics-Platforms-QuadRpt-Customize-Full-length-BrazilPOR-2021-12-08-Final.pdf), Industry Wired, AI Magazine, CIO Review, Global Excellence 11 Awards, Top 10 and Great Place to Work. Low High Portfolio Attractiveness

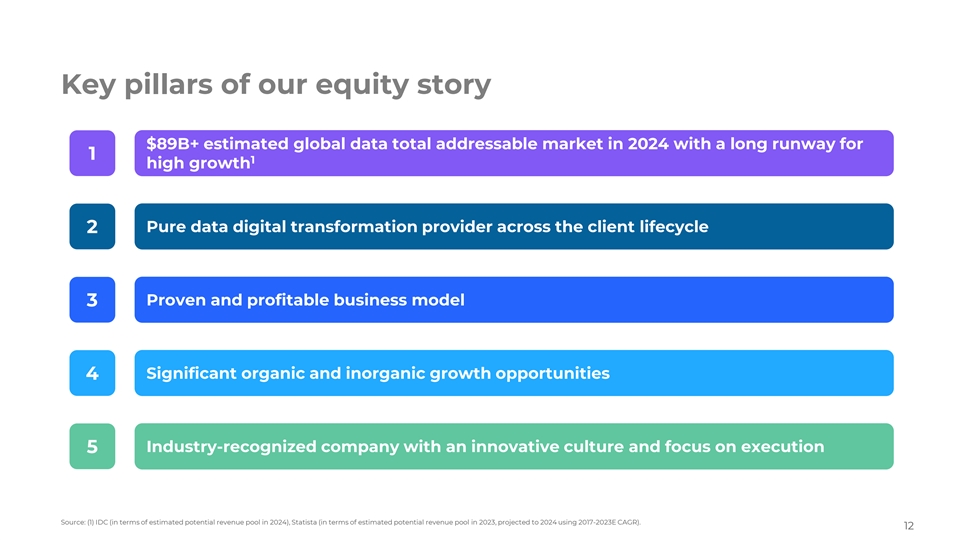

Key pillars of our equity story $89B+ estimated global data total addressable market in 2024 with a long runway for 1 1 high growth Pure data digital transformation provider across the client lifecycle 2 Proven and profitable business model 3 Significant organic and inorganic growth opportunities 4 Industry-recognized company with an innovative culture and focus on execution 5 Source: (1) IDC (in terms of estimated potential revenue pool in 2024), Statista (in terms of estimated potential revenue pool in 2023, projected to 2024 using 2017-2023E CAGR). 12

The global opportunity ahead of us Analytical data Transactional Data Estimated global 1 stores databases integration TAM in 2024 0.2% estimated 1 global share in 2024 Estimated Global TAM 1 in 2024 $89 B Estimated LatAm TAM 1 in 2024 $10 B 14.2% 6.2% 2.6% 9.5% [x%] CAGR 19-24 Source: IDC (in terms of estimated potential revenue pool in 2024), Statista (in terms of estimated potential revenue pool in 2023, projected to 2024 using 2017-2023E CAGR). Notes: (1) Please refer to “Forward-Looking Statements” in the slide titled “Disclaimer” for important information you should consider regarding the size of Semantix’s total addressable market.. (2) Considering Semantix 2024E gross revenue. Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. 13

Snapshot of our solutions Proprietary SaaS Data visualization Data lake automation Data preparation Data ingestion & integration Data lab Access Management Third-party Software Marketplace and managed services of 3rd party components focused on data lake creation, data search and visualization AI & Data Analytics Services Technical and advisory services, including data analytics consulting, cloud monitoring, data integration and data engineering services Building data-driven solutions and placing clients one step ahead with frontier technology 14

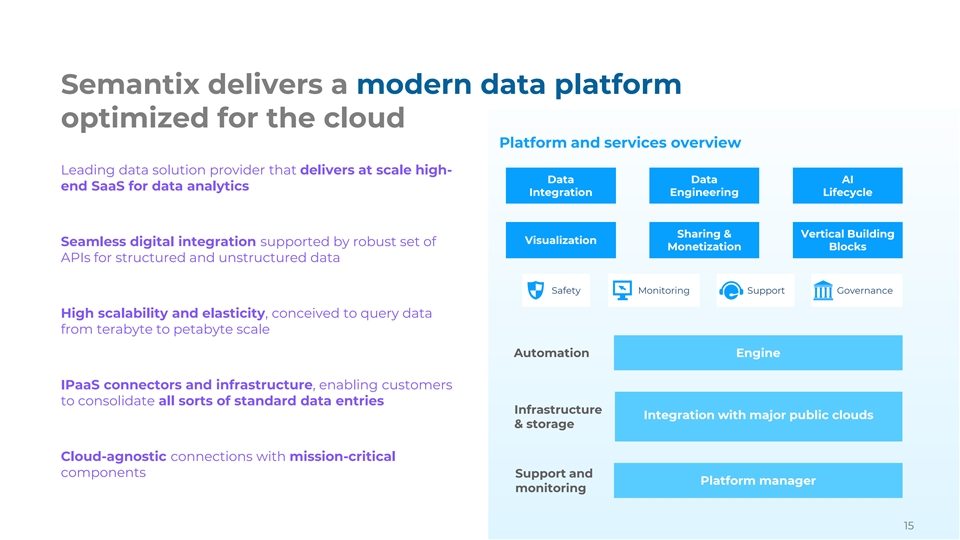

Semantix delivers a modern data platform optimized for the cloud Platform and services overview Leading data solution provider that delivers at scale high- Data Data AI end SaaS for data analytics Integration Engineering Lifecycle Sharing & Vertical Building Visualization Seamless digital integration supported by robust set of Monetization Blocks APIs for structured and unstructured data Safety Monitoring Support Governance High scalability and elasticity, conceived to query data from terabyte to petabyte scale Automation Engine IPaaS connectors and infrastructure, enabling customers to consolidate all sorts of standard data entries Infrastructure Integration with major public clouds & storage Cloud-agnostic connections with mission-critical components Support and Platform manager monitoring 15

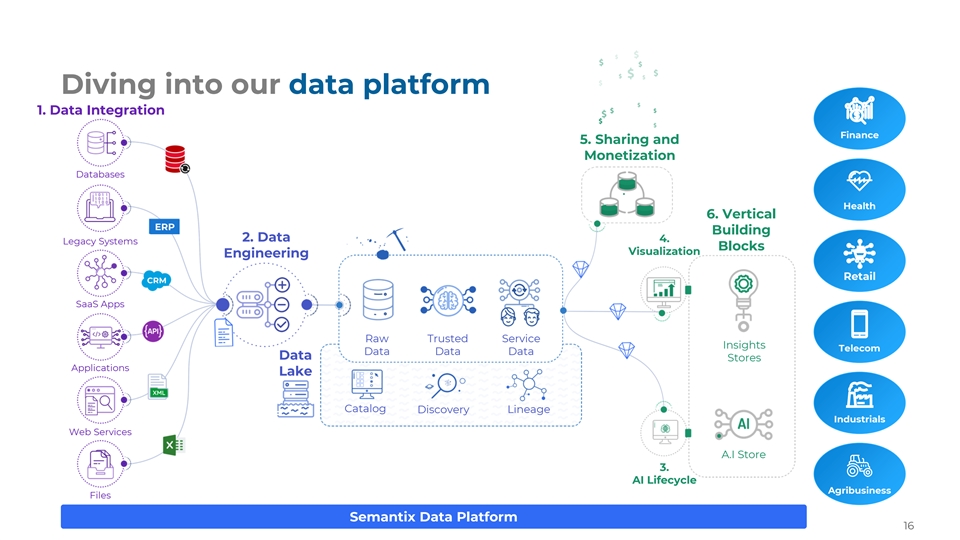

Diving into our data platform 1. Data Integration Finance 5. Sharing and Monetization Databases Health 6. Vertical ERP Building 2. Data 4. Legacy Systems Blocks Visualization Engineering Retail CRM SaaS Apps Raw Trusted Service Insights Telecom Data Data Data Data Stores Applications Lake Catalog Discovery Lineage Industrials Web Services A.I Store 3. AI Lifecycle Agribusiness Files Semantix Data Platform 16

Selected Data Apps solutions Finance Health Retail Key offerings ▪ Use of data to predict customer behavior▪ Use of data to collect patients’ records and ▪ Consumer spending habits insights monitor hospital performance ▪ Real time stock market insights▪ Provision of targeted marketing to consumers ▪ Automation of authorization requests for health and product recommendation ▪ Fraud detection and prevention plans operators ▪ Tool that enables live video streaming shopping ▪ Risk analysis ▪ Request monitoring and control experience ▪ Manual processes automation ▪ Billing automation▪ Easy, safe and fast customer authentication, e- service registration and digital approval ▪ Support of the operational flow of credit, credit ▪ Electronic files validation scoring, portfolio management ▪ Tool for real-time chat among companies, ▪ Medical loss ratio management and analysis customers, partners, vendors, suppliers and ▪ Industry datasets other external parties ▪ Industry datasets ▪ Industry datasets Target customers ▪ Asset managers and brokerage firms in ▪ Hospital, clinics, imaging and diagnostics ▪ Retailers and medium to large retail industry multimarket, equity and credit funds facilities, health plan operators 17

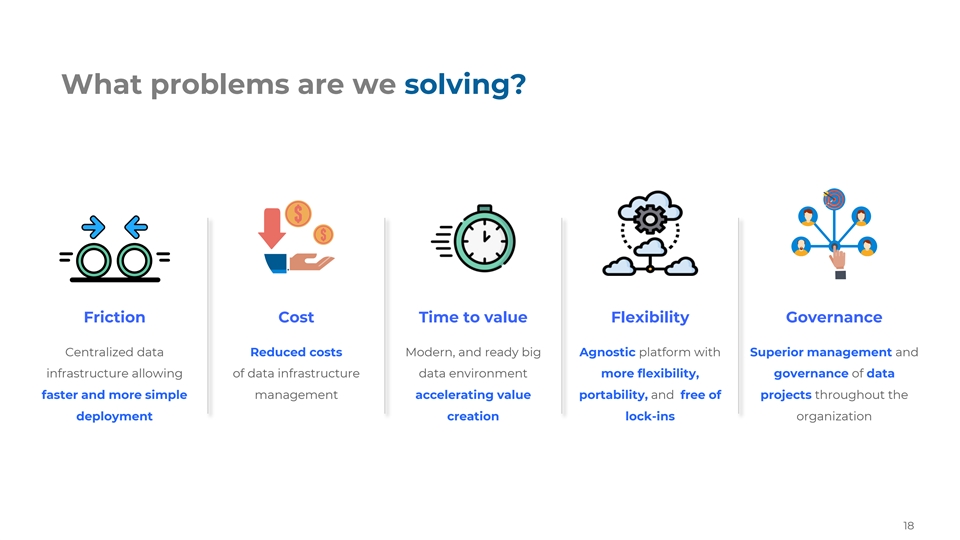

What problems are we solving? Friction Cost Time to value Flexibility Governance Centralized data Reduced costs Modern, and ready big Agnostic platform with Superior management and infrastructure allowing of data infrastructure data environment more flexibility, governance of data faster and more simple management accelerating value portability, and free of projects throughout the deployment creation lock-ins organization 18

Semantix is crucial for key stakeholders in any organization Key industries Data Architects Data Scientists C-level and Engineers and Product Owners Executives Emphasize the value of data Cost reduction Improved leverage already present in the company vs. market competitors Predictable reports and advanced Promote decisions aligned analytics through AI Data-driven digital with Business Intelligence transformation Semantix’s solutions Data Integration AI LifeCycle, Vertical Building Data and Data Engineering Blocks and Sharing/Monetization Visualization 19

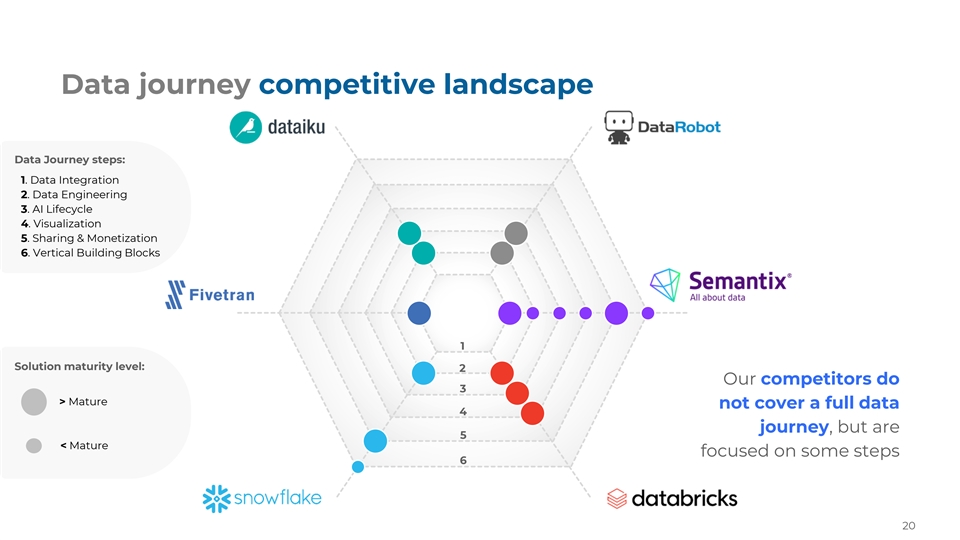

Data journey competitive landscape Data Journey steps: 1. Data Integration 2. Data Engineering 3. AI Lifecycle 4. Visualization 5. Sharing & Monetization 6. Vertical Building Blocks 1 Solution maturity level: 2 Our competitors do 3 > Mature not cover a full data 4 journey, but are 5 < Mature focused on some steps 6 20

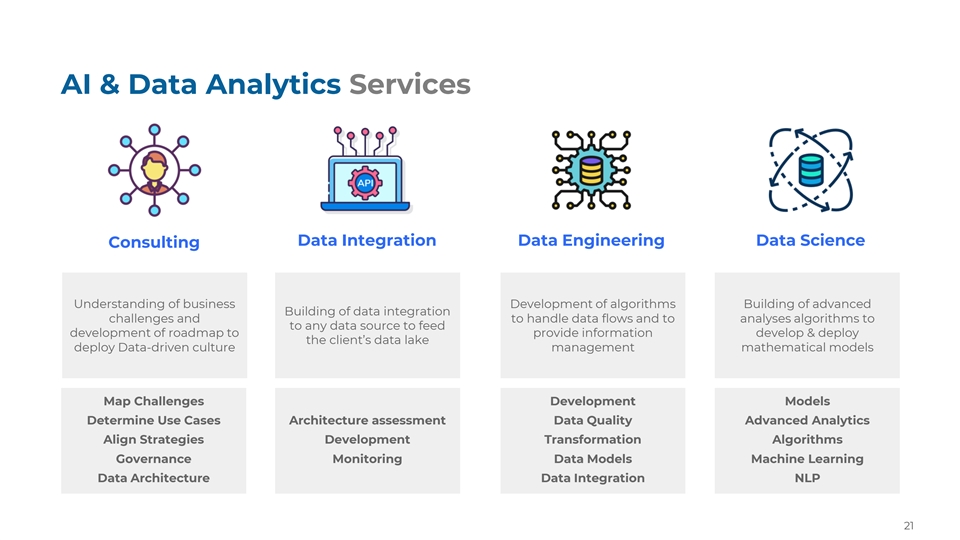

AI & Data Analytics Services Data Integration Data Engineering Data Science Consulting Understanding of business Development of algorithms Building of advanced Building of data integration challenges and to handle data flows and to analyses algorithms to to any data source to feed development of roadmap to provide information develop & deploy the client’s data lake deploy Data-driven culture management mathematical models Map Challenges Development Models Determine Use Cases Architecture assessment Data Quality Advanced Analytics Align Strategies Development Transformation Algorithms Governance Monitoring Data Models Machine Learning Data Architecture Data Integration NLP 21

How we impact our clients The Challenge Industry How can we use data to reduce disruption in the Mercedes’ truck production line and improve inspection processes to reduce insurance claims? Delivering with speed Apriori Algorithm ML to track production line Relative Risk using WOE Algorithm to map risks prior to the production ML Analysis of truck’s production line Neural Network algorithms to treat on-road truck data AI models to monitor production disruption and identify the problem source Information theory + Logistic Regression algorithms Semantix solutions: Outcomes and metrics Software AI & Data Analytics Services Significant reduction in production lines disruption “The SDP Semantix Data Platform enabled us to improve manufacturing efficiency, resulting in a 6% productivity increase Higher efficiency in vehicle delivery audit over the last 2 years” Reduction of assembly problems; and Mauricio Mazza CIO of Mercedes Benz LatAm Accelerated identification of defective parts in the production process 22

How we impact our clients (cont’d) Overview Finance Bradesco was launching Next, its digital bank The challenge Help to structure a Data Analytics area to implement credit decision making , anti-fraud, payments among other solutions Delivering with speed Fully developed and implemented all Data Projects processes, and structured an area ready to provide end-to-end solution based on data, with trained professionals and solid data-driven culture AI models to support payments and anti-fraud Outcomes and metrics systems, and to enhance credit risk management tools Structuring of the Data Operation Pillars Semantix solutions: Software Enhancing the maturity of internal processes AI & Data Analytics Services “Semantix is definitely the best Data and AI company in Brazil, with Dissemination of data/agility culture them we were able to launch our Digital Bank based on a first-in-class data driven model” Professional training Jeferson Honorato Director at Next, digital bank of Bradesco, the second largest bank in Brazil 23

How we impact our clients (cont’d) Retail Overview Develop an integrated marketplace model to scale up sales strategy and improve data integration to take assertive decisions The challenge Integrating client’s e-commerce with a massive variety of ERPs. Provide an agile and healthy pace to delivery in BI and E-commerce projects Delivering with speed Provide a unique extraction source of data for LatAm BI, accelerating the development of BI teams in other LatAm countries. Full data integration and optimization of the company’s e-commerce ecosystem in LatAm Provide an integrated environment connecting E-commerce data Between VTEX (E-commerce solution vendor) and ERPs Semantix solution: Outcomes and metrics Software Improvement of sales strategy Trusted Semantix to build and run the data integration and Strong integration among ERPs in different geographies optimization of its entire e-commerce in LatAm Reliable source of data for all BI and E-commerce in LatAm Client One of the largest electronics Safe and monitored way to track data conglomerates in the world 24

How we impact our clients (cont’d) Overview Healthcare Hospital Care wanted to enhance its data management capabilities resulting in an innovative and pioneer solution to be the first integrated OMOP (Observational Medical Outcomes Partnership) platform in the Market The challenge Lack of integrated and standardized data from different systems There were multiple data views, and it was not possible to follow most of its operations in real time Security, Data Governance and Privacy requirements Delivering with speed Latam’s first health care group, with 30+ assets and thousands of daily patients, to structure their data journey end to end through Personalized product to deliver predictive Semantix Data Platform data sets based on AI Enhanced process standardization, comparable KPIs, real time dashboards and call to action capabilities Semantix solutions: Data sources integration reduced from weeks to few days Software Outcomes and metrics AI & Data Analytics Services Fully integrated Command Center serving corporate and local “Semantix enabled a smooth transition from System Integration to organizations Data Integration, accelerating by 5 years the digital transformation of + 30% gain in revenue cycle efficiency our healthcare group” Herbert Cepera + 250 data pipelines and + 400 KPIs to business decision making COO of Hospital Care Group, implemented in the first wave one of the largest healthcare enterprises in LatAm 1st OMOP platform in the Brazilian market 25

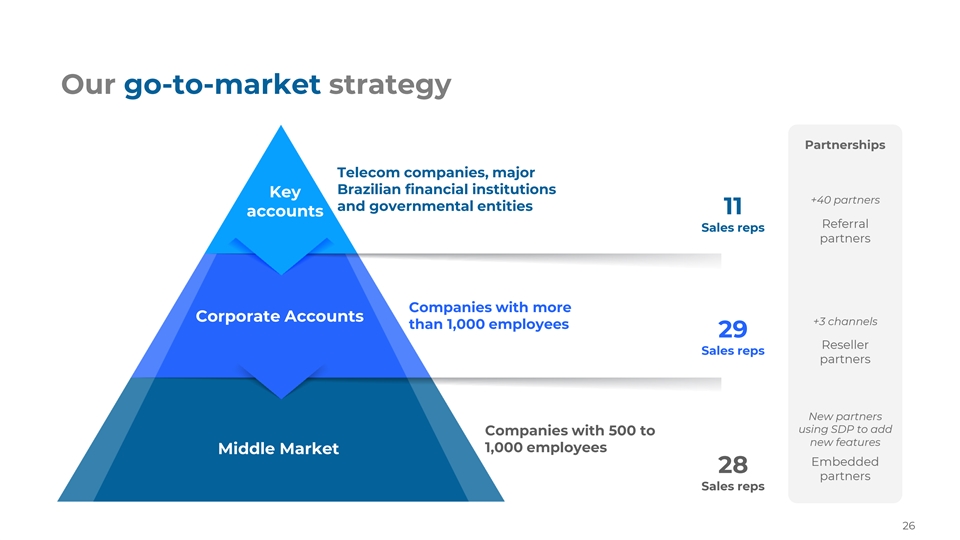

Our go-to-market strategy Partnerships Telecom companies, major Brazilian financial institutions Key +40 partners and governmental entities 11 accounts Referral Sales reps partners Companies with more Corporate Accounts +3 channels than 1,000 employees 29 Reseller Sales reps partners New partners using SDP to add Companies with 500 to new features 1,000 employees Middle Market Embedded 28 partners Sales reps 26

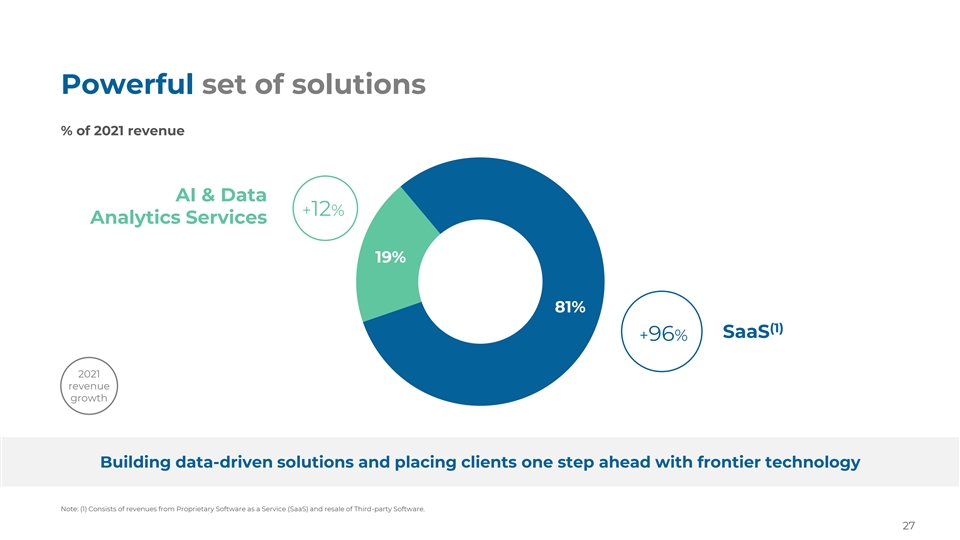

Powerful set of solutions % of 2021 revenue AI & Data +12% Analytics Services 19% 81% (1) SaaS +96% 2021 revenue growth Building data-driven solutions and placing clients one step ahead with frontier technology Note: (1) Consists of revenues from Proprietary Software as a Service (SaaS) and resale of Third-party Software. 27

Semantix’s revenue models SaaS Services Proprietary SaaS Non-Proprietary Saas AI & Data Analytics Services Resale of licenses from third-party data Technical and advisory services, including Semantix’s proprietary data platform Solution platform software providers consulting, cloud monitoring, data software integration, data engineering, and training related to SDP Pricing by platform users, storage size, data source, data flow and data refresh Pricing according to the size of the time (processing, e.g. processing data on Pricing by nodes/servers (when the project and calculate the number of Pricing D-1 or every 15 seconds). We do not charge customer contracts “on premises”) and hours, therefore, we charge per “hour- for consumer users like our competitors by credits when it comes to cloud based” do, we only charge for platform developer users Over time in monthly basis according to Yearly upfront recognition, upon the Over time and based on the hours Revenue the contract period (e.i 2 years contract receipt of the invoice from the supplier, of services provided and employee’s recognition will have 24 overtime revenues and subject to annual price adjustments respective rate per hour recognitions) Typical 3 yrs 3 yrs 3 months – 2 years contract term 28

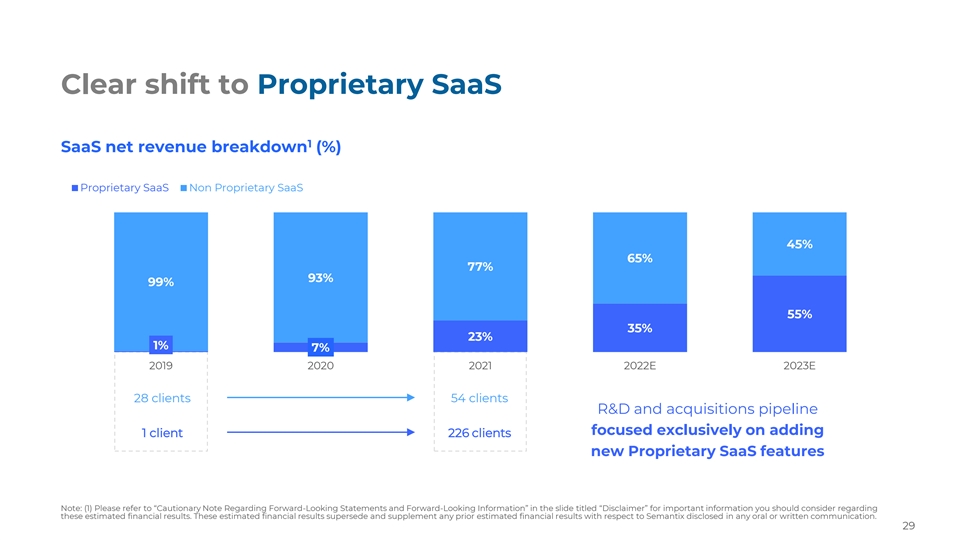

Clear shift to Proprietary SaaS 1 SaaS net revenue breakdown (%) Proprietary SaaS Non Proprietary SaaS 45% 65% 77% 93% 99% 55% 35% 23% 1% 7% 2019 2020 2021 2022E 2023E 28 clients 54 clients R&D and acquisitions pipeline focused exclusively on adding 1 client 226 clients new Proprietary SaaS features Note: (1) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. 29

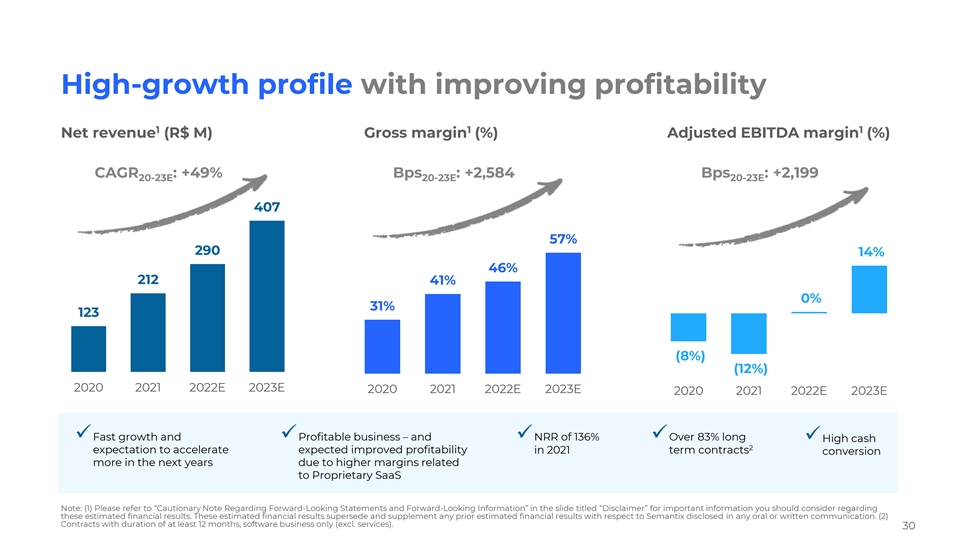

High-growth profile with improving profitability 1 1 1 Net revenue (R$ M) Gross margin (%) Adjusted EBITDA margin (%) CAGR : +49% Bps : +2,584 Bps : +2,199 20-23E 20-23E 20-23E 407 57% 290 14% 46% 212 41% 0% 31% 123 (8%) (12%) 2020 2021 2022E 2023E 2020 2021 2022E 2023E 2020 2021 2022E 2023E ✓Fast growth and ✓Profitable business – and ✓NRR of 136% ✓Over 83% long ✓High cash 2 expectation to accelerate expected improved profitability in 2021 term contracts conversion more in the next years due to higher margins related to Proprietary SaaS Note: (1) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. (2) Contracts with duration of at least 12 months, software business only (excl. services). 30

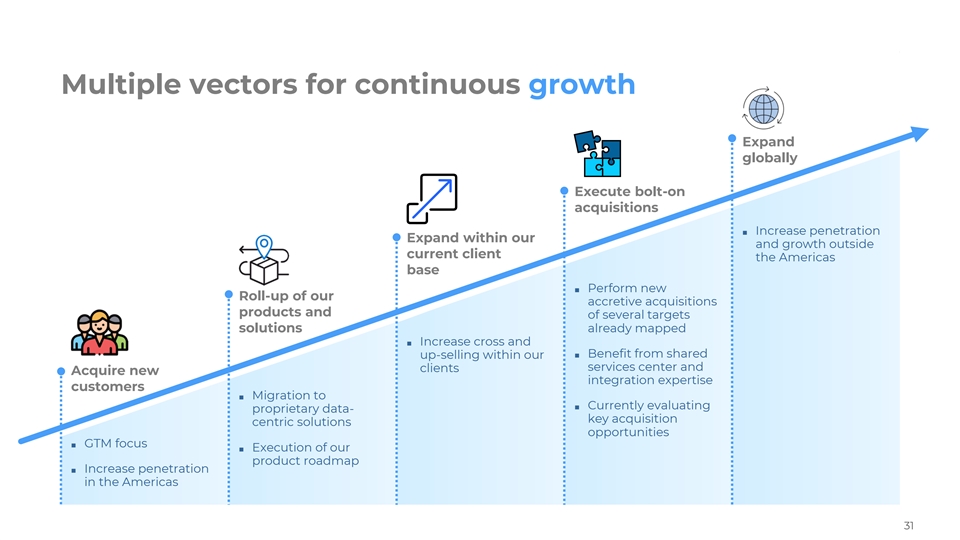

Multiple vectors for continuous growth Expand globally Execute bolt-on acquisitions ■ Increase penetration Expand within our and growth outside current client the Americas base ■ Perform new Roll-up of our accretive acquisitions products and of several targets already mapped solutions ■ Increase cross and ■ Benefit from shared up-selling within our services center and clients Acquire new integration expertise customers ■ Migration to ■ Currently evaluating proprietary data- key acquisition centric solutions opportunities ■ GTM focus ■ Execution of our product roadmap ■ Increase penetration in the Americas 31

Our successful strategy to deploy capital M&A Use of proceeds: International expansion Strategic fit with current product Long-term recurring revenues portfolio to maximize cross and up-sell contracts in regions with strong in all verticals growth prospects 35% Talented team with proprietary Technology partner supporting 10% intellectual property pipeline of initial contracts Track-record Our footprint: 1,2 $117 M 15% Acquired in 2020 Acquired in 2020 Acquired in 2019 Pursuing further US presence Since 2020 20% ▪ Huge and mature market for SaaS platforms 20% R&D ▪ Global reach of product Since 2018 portfolio with 24/7 Hiring of developers to enhance support in English Semantix’s current products and develop new features for customers ▪ Cost-effective operations Since 2017 Considers non-redemption commitments and committed PIPE only 2 Other Go-To-Market Investment Notes: (1) PIPE committed + Non-redemption commitments as of Apr-22. (2) Includes transaction closing costs. 32

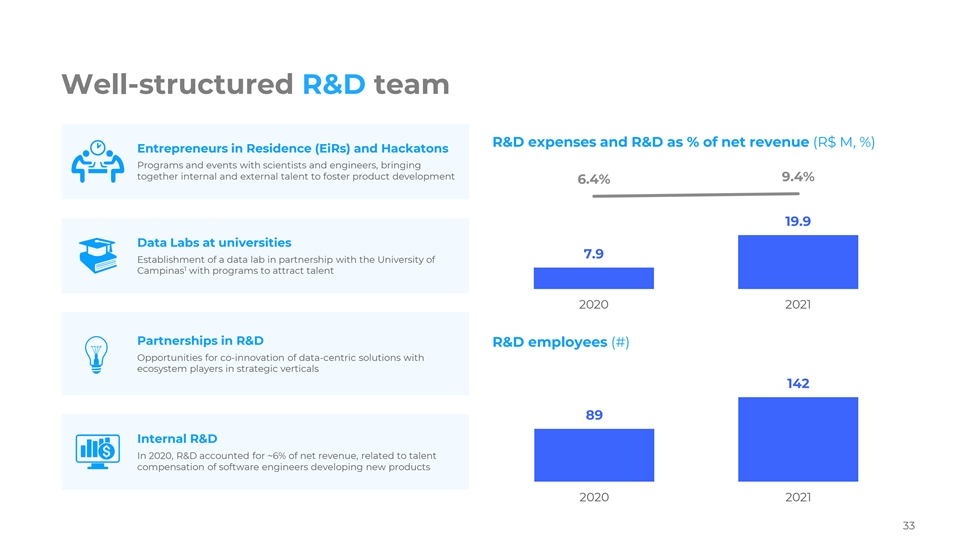

Well-structured R&D team R&D expenses and R&D as % of net revenue (R$ M, %) Entrepreneurs in Residence (EiRs) and Hackatons Programs and events with scientists and engineers, bringing together internal and external talent to foster product development 9.4% 6.4% 19.9 Data Labs at universities 7.9 Establishment of a data lab in partnership with the University of 1 Campinas with programs to attract talent 2020 2021 Partnerships in R&D R&D employees (#) Opportunities for co-innovation of data-centric solutions with ecosystem players in strategic verticals 142 89 Internal R&D In 2020, R&D accounted for ~6% of net revenue, related to talent compensation of software engineers developing new products 2020 2021 33

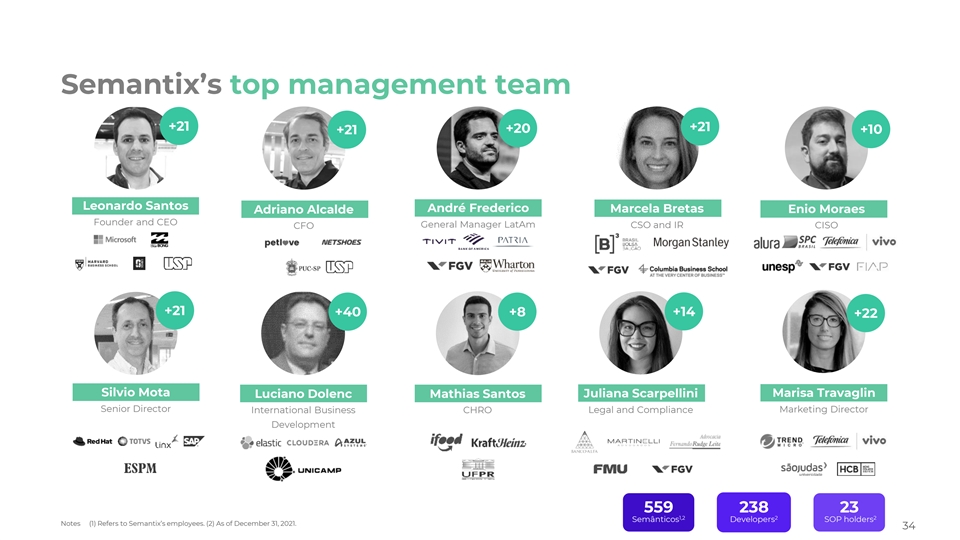

Semantix’s top management team +21 +21 +20 +21 +10 Leonardo Santos André Frederico Adriano Alcalde Marcela Bretas Enio Moraes Founder and CEO General Manager LatAm CSO and IR CFO CISO +21 +14 +40 +8 +22 Silvio Mota Juliana Scarpellini Marisa Travaglin Luciano Dolenc Mathias Santos Senior Director International Business CHRO Legal and Compliance Marketing Director Development 559 238 23 1,2 2 2 Semânticos Developers SOP holders Notes (1) Refers to Semantix’s employees. (2) As of December 31, 2021. 34

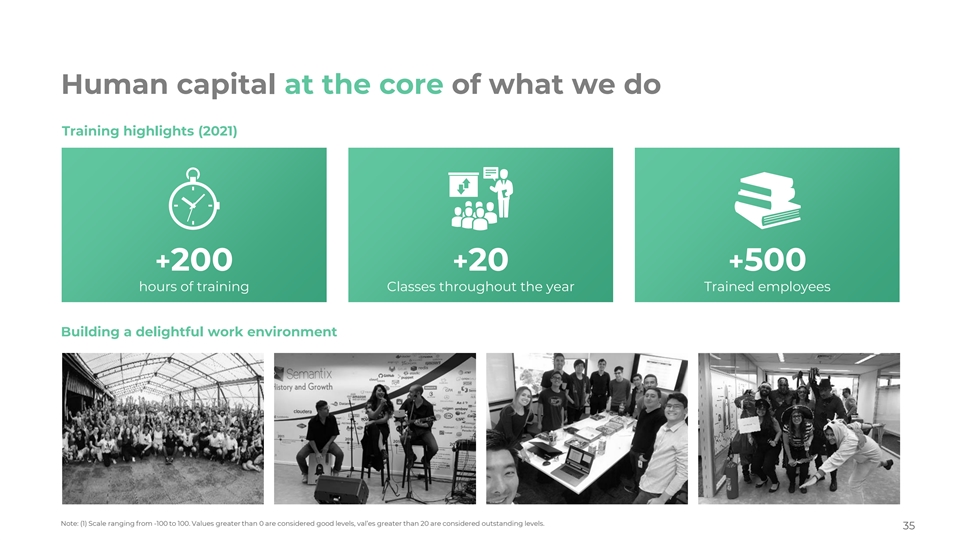

Human capital at the core of what we do Training highlights (2021) +200 +20 +500 hours of training Classes throughout the year Trained employees Building a delightful work environment Note: (1) Scale ranging from -100 to 100. Values greater than 0 are considered good levels, val’es greater than 20 are considered outstanding levels. 35

Semantix’s board of directors Committees Leonardo Santos (Chairman) Audit Minimum of 3 members Jaime Dorival Cardoso Dourado (Independent member) Compensation Minimum of 3 members Rafael Veronica Nominating and Steinhauser Allende corporate governance (Independent member) Minimum of 3 members Auditors Rafael Ariel Padilha Lebowits (Independent member) 2019, 2020, 2021 2018 IFRS and PCAOB BR GAAP 36

Building a data leader: a truly end-to-end SaaS provider Scalable and recognized: Large and growing TAM: High customer retention: 1 2 USD 89B in 2024 NRR = 136% LatAm market leadership Unmatched business model: Structural competitive advantages: Proprietary technology End-to-end platform built from scratch Own integrated platform Source: (1) IDC (in terms of estimated potential revenue pool in 2024), Statista (in terms of estimated potential revenue pool in 2023, projected to 2024 using 2017-2023E CAGR). Note: (2) Calculated as revenue in Dec-21 of clients that were in the base in Dec-20 divided by the revenue with those clients in Dec-20. 37

Financial overview

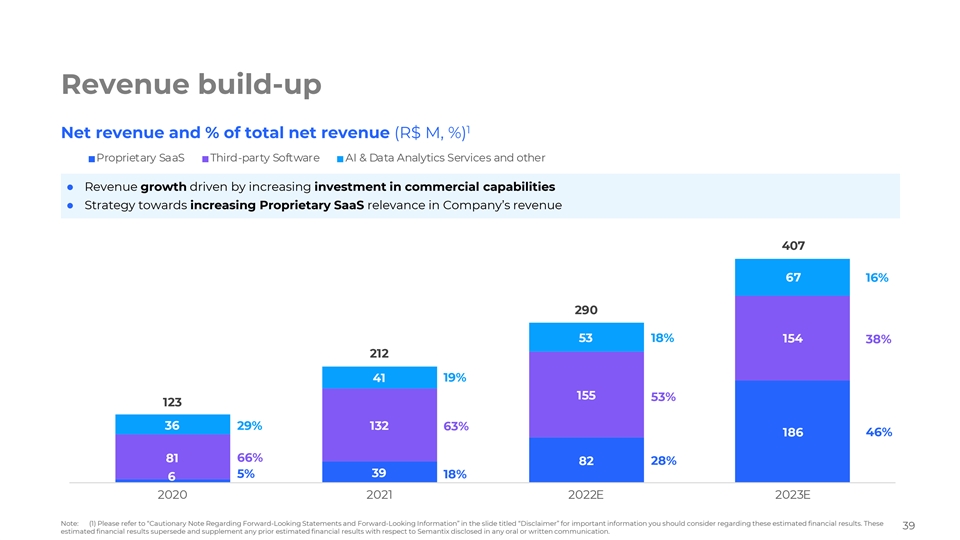

Revenue build-up 1 Net revenue and % of total net revenue (R$ M, %) Proprietary SaaS Third-party Software AI & Data Analytics Services and other ⚫ Revenue growth driven by increasing investment in commercial capabilities ⚫ Strategy towards increasing Proprietary SaaS relevance in Company’s revenue 407 67 16% 290 53 18% 154 38% 212 19% 41 155 53% 123 36 29% 132 63% 46% 186 81 66% 82 28% 39 5% 18% 6 2020 2021 2022E 2023E Note: (1) Please refer to ��Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These 39 estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication.

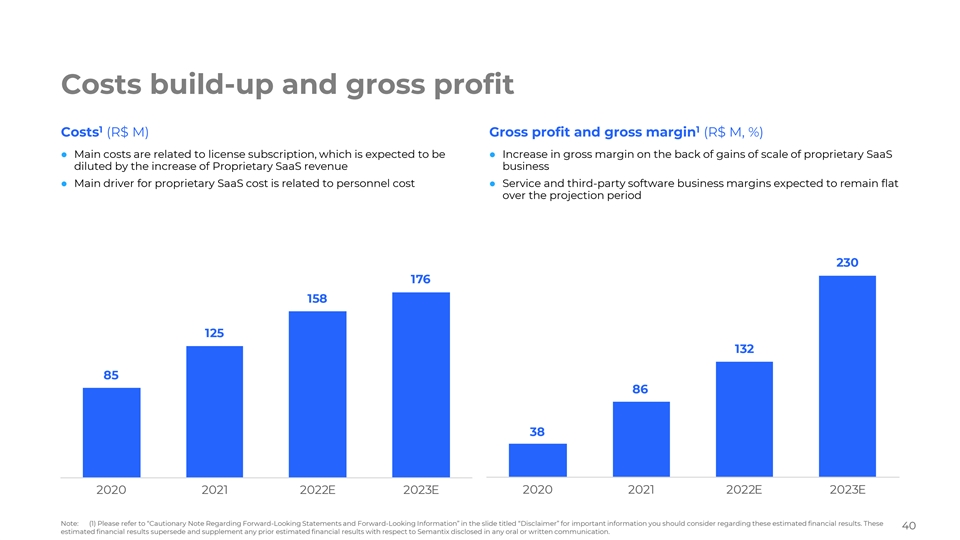

Costs build-up and gross profit 1 1 Costs (R$ M) Gross profit and gross margin (R$ M, %) ⚫ Main costs are related to license subscription, which is expected to be ⚫ Increase in gross margin on the back of gains of scale of proprietary SaaS diluted by the increase of Proprietary SaaS revenue business ⚫ Main driver for proprietary SaaS cost is related to personnel cost⚫ Service and third-party software business margins expected to remain flat over the projection period 230 176 158 125 132 85 86 38 2020 2021 2022E 2023E 2020 2021 2022E 2023E Note: (1) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These 40 estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication.

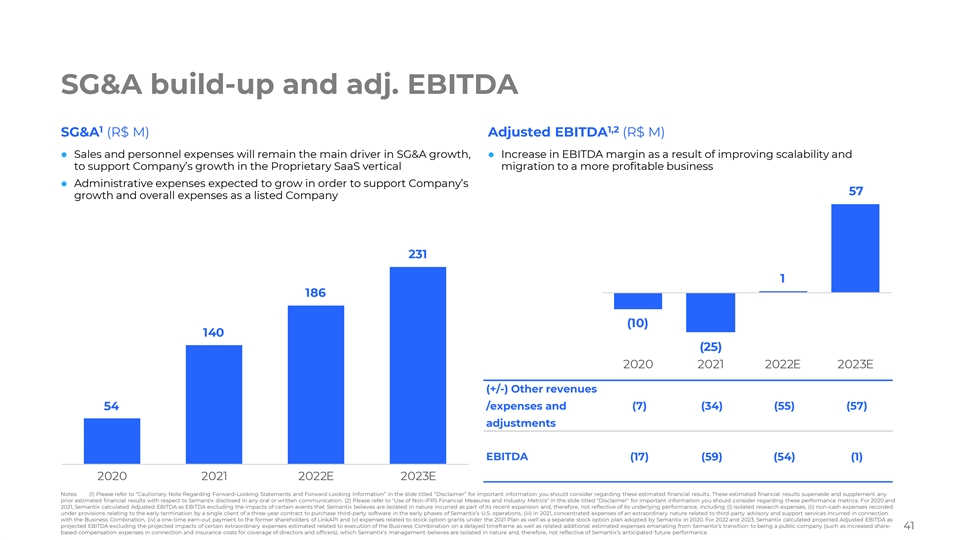

SG&A build-up and adj. EBITDA 1 1,2 SG&A (R$ M) Adjusted EBITDA (R$ M) ⚫ Sales and personnel expenses will remain the main driver in SG&A growth, ⚫ Increase in EBITDA margin as a result of improving scalability and to support Company’s growth in the Proprietary SaaS vertical migration to a more profitable business ⚫ Administrative expenses expected to grow in order to support Company’s 57 growth and overall expenses as a listed Company 231 1 186 (10) 140 (25) 2020 2021 2022E 2023E (+/-) Other revenues /expenses and (7) (34) (55) (57) 54 adjustments EBITDA (17) (59) (54) (1) 2020 2021 2022E 2023E Notes: (1) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. (2) Please refer to Use of Non-IFRS Financial Measures and Industry Metrics in the slide titled Disclaimer for important information you should consider regarding these performance metrics. For 2020 and 2021, Semantix calculated Adjusted EBITDA as EBITDA excluding the impacts of certain events that Semantix believes are isolated in nature incurred as part of its recent expansion and, therefore, not reflective of its underlying performance, including (i) isolated research expenses, (ii) non-cash expenses recorded under provisions relating to the early termination by a single client of a three-year contract to purchase third-party software in the early phases of Semantix’s U.S. operations, (iii) in 2021, concentrated expenses of an extraordinary nature related to third-party advisory and support services incurred in connection with the Business Combination, (iv) a one-time earn-out payment to the former shareholders of LinkAPI and (v) expenses related to stock option grants under the 2021 Plan as well as a separate stock option plan adopted by Semantix in 2020. For 2022 and 2023, Semantix calculated projected Adjusted EBITDA as projected EBITDA excluding the projected impacts of certain extraordinary expenses estimated related to execution of the Business Combination on a delayed timeframe as well as related additional estimated expenses emanating from Semantix’s transition to being a public company (such as increased share- 41 based compensation expenses in connection and insurance costs for coverage of directors and officers), which Semantix’s management believes are isolated in nature and, therefore, not reflective of Semantix’s anticipated future performance.

Income statement 1 3 3 2020 2021 (R$ 'mn, except otherwise stated) 2022E 2023E Net revenue 123 212 290 407 Proprietary SaaS 6 39 82 186 Third-Party software 81 132 155 154 AI & Data Analytics Services 36 41 53 67 (-) Costs (85) (125) (158) (176) Gross profit 38 86 132 230 % gross margin 30.8% 40.7% 45.5% 56.6% (-) SG&A (54) (140) (186) (231) EBITDA (17) (59) (54) (1) % EBITDA margin (13.8%) (27.7%) (18.6%) (0.2%) (+/-) Other revenues/expenses (non-recurring) (7) (34) (55) (57) 2 (10) (25) 1 57 Adj. EBITDA % Adj. EBITDA margin (8.1%) (11.8%) 0.4% 13.9% Notes: (1) Management numbers and does not directly derive from its historical consolidated financial statements. (2) Please refer to Use of Non-IFRS Financial Measures and Industry Metrics in the slide titled Disclaimer for important information you should consider regarding these performance metrics. For 2020 and 2021, Semantix calculated Adjusted EBITDA as EBITDA excluding the impacts of certain events that Semantix believes are isolated in nature incurred as part of its recent expansion and, therefore, not reflective of its underlying performance, including (i) isolated research expenses, (ii) non-cash expenses recorded under provisions relating to the early termination by a single client of a three-year contract to purchase third-party software in the early phases of Semantix’s U.S. operations, (iii) in 2021, concentrated expenses of an extraordinary nature related to third-party advisory and support services incurred in connection with the Business Combination, (iv) a one- time earn-out payment to the former shareholders of LinkAPI and (v) expenses related to stock option grants under the 2021 Plan as well as a separate stock option plan adopted by Semantix in 2020. For 2022 and 2023, Semantix calculated projected Adjusted EBITDA as projected EBITDA excluding the projected impacts of certain extraordinary expenses estimated related to execution of the Business Combination on a delayed timeframe as well as related additional estimated expenses emanating from Semantix’s transition to being a public company (such as increased share-based compensation expenses in connection and insurance costs for coverage of directors and officers), which Semantix’s management believes are isolated in nature and, therefore, not reflective of Semantix’s anticipated future performance. (3) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. 42

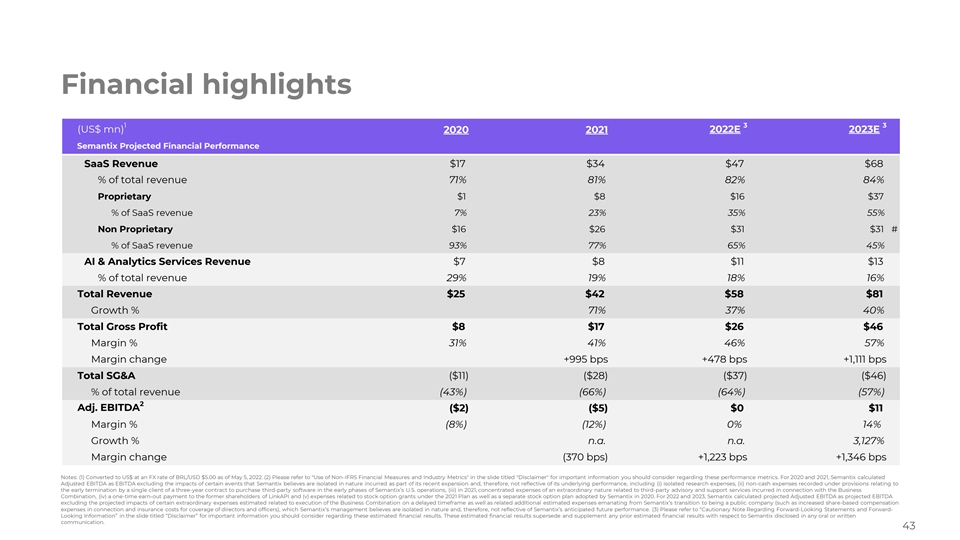

Financial highlights 1 3 3 (US$ mn) 2020 2021 2022E 2023E Semantix Projected Financial Performance SaaS Revenue $17 $34 $47 $68 % of total revenue 71% 81% 82% 84% Proprietary $1 $8 $16 $37 % of SaaS revenue 7% 23% 35% 55% Non Proprietary $16 $26 $31 $31 # % of SaaS revenue 93% 77% 65% 45% AI & Analytics Services Revenue $7 $8 $11 $13 % of total revenue 29% 19% 18% 16% Total Revenue $25 $42 $58 $81 Growth % 71% 37% 40% Total Gross Profit $8 $17 $26 $46 Margin % 31% 41% 46% 57% Margin change +995 bps +478 bps +1,111 bps Total SG&A ($11) ($28) ($37) ($46) % of total revenue (43%) (66%) (64%) (57%) 2 Adj. EBITDA ($2) ($5) $0 $11 Margin % (8%) (12%) 0% 14% Growth % n.a. n.a. 3,127% Margin change (370 bps) +1,223 bps +1,346 bps Notes: (1) Converted to US$ at an FX rate of BRL/USD $5.00 as of May 5, 2022. (2) Please refer to Use of Non-IFRS Financial Measures and Industry Metrics in the slide titled Disclaimer for important information you should consider regarding these performance metrics. For 2020 and 2021, Semantix calculated Adjusted EBITDA as EBITDA excluding the impacts of certain events that Semantix believes are isolated in nature incurred as part of its recent expansion and, therefore, not reflective of its underlying performance, including (i) isolated research expenses, (ii) non-cash expenses recorded under provisions relating to the early termination by a single client of a three-year contract to purchase third-party software in the early phases of Semantix’s U.S. operations, (iii) in 2021, concentrated expenses of an extraordinary nature related to third-party advisory and support services incurred in connection with the Business Combination, (iv) a one-time earn-out payment to the former shareholders of LinkAPI and (v) expenses related to stock option grants under the 2021 Plan as well as a separate stock option plan adopted by Semantix in 2020. For 2022 and 2023, Semantix calculated projected Adjusted EBITDA as projected EBITDA excluding the projected impacts of certain extraordinary expenses estimated related to execution of the Business Combination on a delayed timeframe as well as related additional estimated expenses emanating from Semantix’s transition to being a public company (such as increased share-based compensation expenses in connection and insurance costs for coverage of directors and officers), which Semantix’s management believes are isolated in nature and, therefore, not reflective of Semantix’s anticipated future performance. (3) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward- Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. 43

Appendix

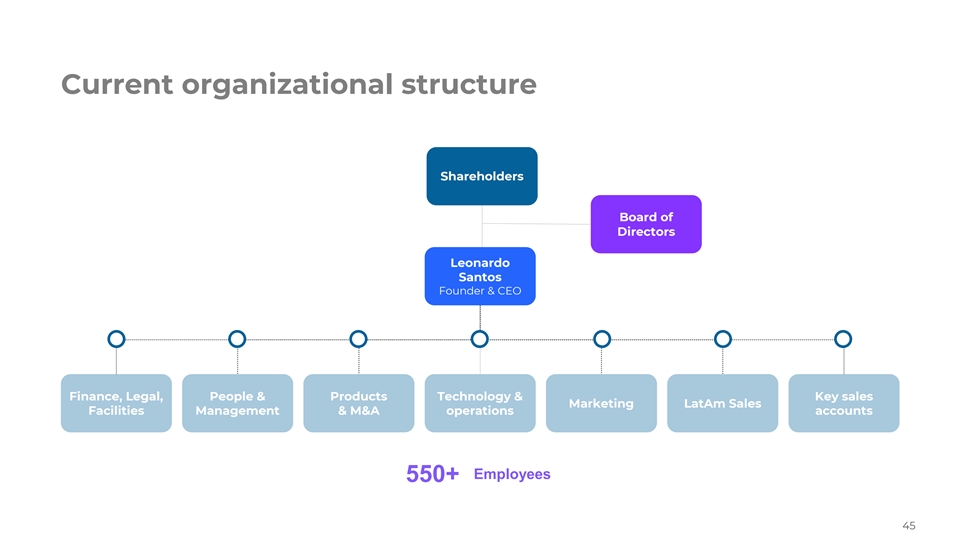

Current organizational structure Shareholders Board of Directors Leonardo Santos Founder & CEO Finance, Legal, People & Products Technology & Key sales Marketing LatAm Sales Facilities Management & M&A operations accounts Employees 550+ 45

Shareholders’ structure Pre-transaction Growth Investors Leonardo Leandro Leonardo Officers and Treasury Santos Santos Oliveira Dias employees (Stock Option Founder/CEO Partner Partner/CDO (13 individuals) Plan) 16.9% 16.5% 16.5% 1.1% 1.6% 33.0% 14.4% 1 Post De-SPACing Growth Investors Leonardo Leandro Officers and SPAC public Leonardo Dias PIPE investors Sponsors Santos Santos employees holders Partner/CDO Founder/CEO Partner (14 individuals) 20.7% 3.2% 5.7% 10.7% 10.4% 10.4% 0.4% 21.1% 14.9% 2.3% Note: (1) Assumes no redemptions and full PIPE of $94M. Minimum cash condition of $85M (does not consider warrants and options that will become exercisable after the Business Combination). 46

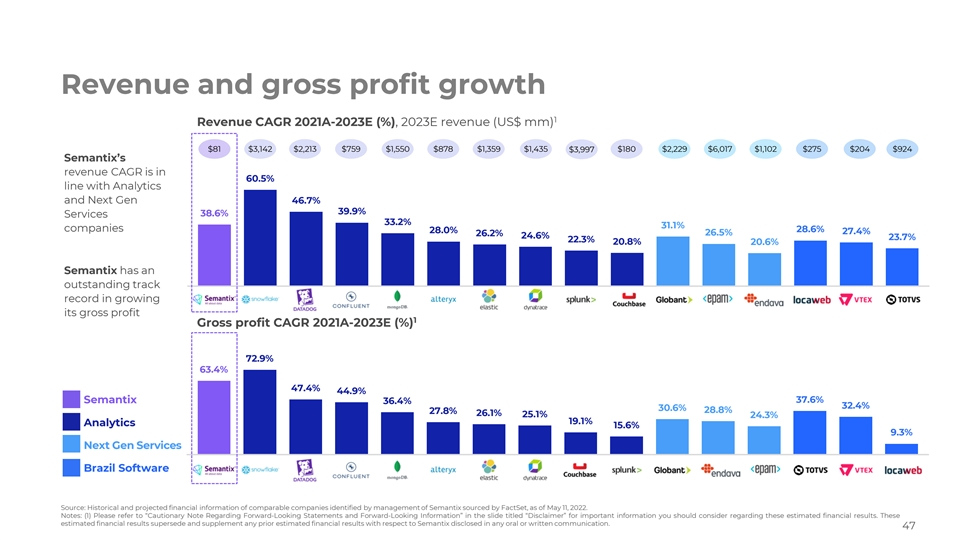

Revenue and gross profit growth 1 Revenue CAGR 2021A-2023E (%), 2023E revenue (US$ mm) $81 $3,142 $2,213 $759 $1,550 $878 $1,359 $1,435 $3,997 $180 $2,229 $6,017 $1,102 $275 $204 $924 Semantix’s revenue CAGR is in 60.5% line with Analytics and Next Gen 46.7% 39.9% 38.6% Services 33.2% 31.1% companies 28.6% 28.0% 27.4% 26.2% 26.5% 24.6% 23.7% 22.3% 20.8% 20.6% Semantix has an outstanding track record in growing its gross profit 1 Gross profit CAGR 2021A-2023E (%) 72.9% 63.4% 47.4% 44.9% 37.6% Semantix 36.4% 32.4% 30.6% 28.8% 27.8% 26.1% 25.1% 24.3% 19.1% Analytics 15.6% 9.3% Next Gen Services Brazil Software Source: Historical and projected financial information of comparable companies identified by management of Semantix sourced by FactSet, as of May 11, 2022. Notes: (1) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. 47

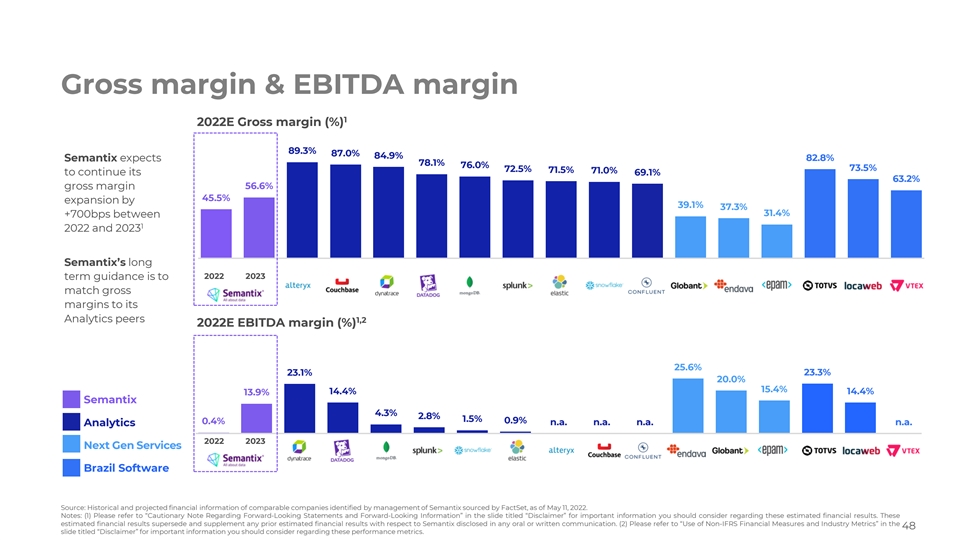

Gross margin & EBITDA margin 1 2022E Gross margin (%) 89.3% 87.0% 84.9% Semantix expects 82.8% 78.1% 76.0% 73.5% 72.5% 71.5% 71.0% to continue its 69.1% 63.2% gross margin 56.6% 45.5% expansion by 39.1% 37.3% 31.4% +700bps between 1 2022 and 2023 Semantix’s long 2022 2023 term guidance is to match gross margins to its Analytics peers 1,2 2022E EBITDA margin (%) 25.6% 23.1% 23.3% 20.0% 15.4% 14.4% 14.4% 13.9% Semantix 4.3% 2.8% 1.5% 0.4% 0.9% n.a. n.a. n.a. n.a. Analytics 2022 2023 Next Gen Services Brazil Software Source: Historical and projected financial information of comparable companies identified by management of Semantix sourced by FactSet, as of May 11, 2022. Notes: (1) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. (2) Please refer to “Use of Non-IFRS Financial Measures and Industry Metrics” in the 48 slide titled “Disclaimer” for important information you should consider regarding these performance metrics.

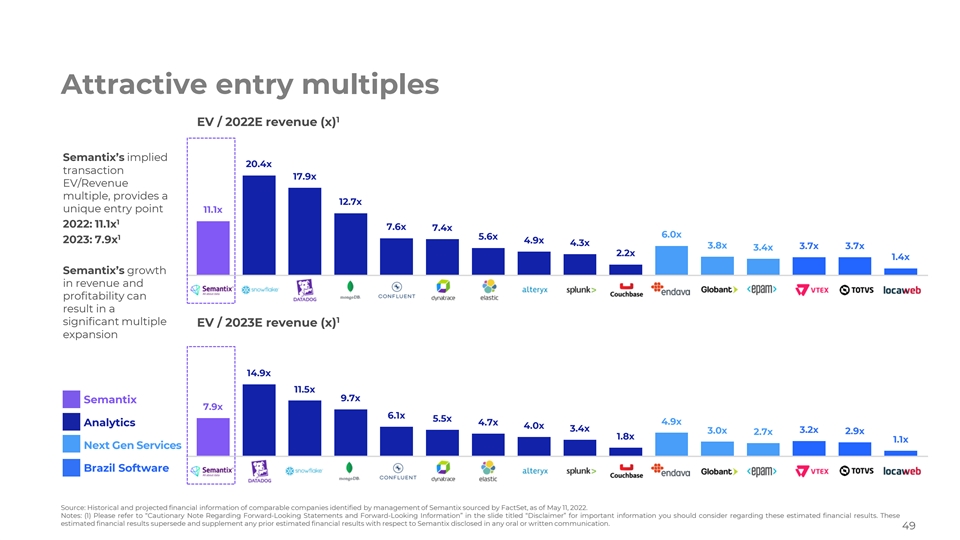

Attractive entry multiples 1 EV / 2022E revenue (x) Semantix’s implied 20.4x transaction 17.9x EV/Revenue multiple, provides a 12.7x unique entry point 11.1x 1 2022: 11.1x 7.6x 7.4x 6.0x 1 5.6x 2023: 7.9x 4.9x 4.3x 3.8x 3.7x 3.7x 3.4x 2.2x 1.4x Semantix’s growth in revenue and profitability can result in a 1 significant multiple EV / 2023E revenue (x) expansion 14.9x 11.5x 9.7x Semantix 7.9x 6.1x 5.5x 4.7x 4.9x Analytics 4.0x 3.4x 3.0x 3.2x 2.7x 2.9x 1.8x 1.1x Next Gen Services Brazil Software Source: Historical and projected financial information of comparable companies identified by management of Semantix sourced by FactSet, as of May 11, 2022. Notes: (1) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. 49

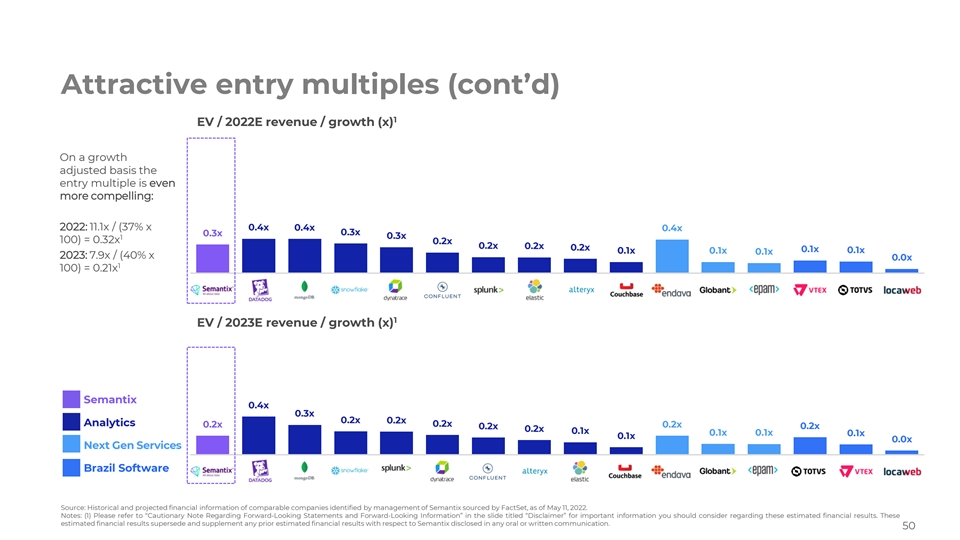

Attractive entry multiples (cont’d) 1 EV / 2022E revenue / growth (x) On a growth adjusted basis the entry multiple is even more compelling: 2022: 11.1x / (37% x 0.4x 0.4x 0.4x 0.3x 0.3x 0.3x 1 100) = 0.32x 0.2x 0.2x 0.2x 0.2x 0.1x 0.1x 0.1x 0.1x 0.1x 2023: 7.9x / (40% x 0.0x 1 100) = 0.21x 1 EV / 2023E revenue / growth (x) Semantix 0.4x 0.3x 0.2x 0.2x Analytics 0.2x 0.2x 0.2x 0.2x 0.2x 0.2x 0.1x 0.1x 0.1x 0.1x 0.1x 0.0x Next Gen Services Brazil Software Source: Historical and projected financial information of comparable companies identified by management of Semantix sourced by FactSet, as of May 11, 2022. Notes: (1) Please refer to “Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information” in the slide titled “Disclaimer” for important information you should consider regarding these estimated financial results. These estimated financial results supersede and supplement any prior estimated financial results with respect to Semantix disclosed in any oral or written communication. 50