UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

AOG INSTITUTIONAL DIVERSIFIED FUND

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

AOG INSTITUTIONAL DIVERSIFIED FUND

11911 Freedom Drive, Suite 730

Reston, VA 20190

May 12, 2023

Dear Shareholder,

We are writing to inform you of the upcoming special meeting of shareholders (the “Special Meeting”) of AOG Institutional Diversified Fund (the “Fund”). At the Special Meeting, shareholders will have the opportunity to vote on important proposals affecting the Fund. The Special Meeting will be held on May 26, 2023, at 10:00 a.m. E.T. at the offices of Alpha Omega Group, Inc. dba AOG Wealth Management at 11911 Freedom Drive, Suite 730, Reston, Virginia 20190.

| · | First, the Board has approved, subject to Shareholder approval, a new fundamental investment policy under which the Fund will periodically offer to repurchase Fund shares. Pursuant to Rule 23c-3 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), the Fund is proposing to adopt a fundamental policy to offer to repurchase not less than 5% and not more than 25% of the Fund’s outstanding common stock at net asset value once every twelve (12) months. |

| · | Second, and in connection with the adoption of the fundamental policy pursuant to Rule 23c-3, the Board has approved a new investment management agreement (the “New Advisory Agreement”) changing the payor of the investment management advisory fee from AOG Institutional Diversified Master Fund (the “Master Fund”) to the Fund, and removing AOG Institutional Diversified Tender Fund (the “Tender Fund”) as a party thereto. All of the terms of the existing investment management agreement (the “Existing Advisory Agreement”) remain substantially the same. |

| · | Third, Shareholders of the Fund are being asked to vote for the election of a fifth Trustee of the Fund. |

The question and answer section that follows briefly discusses the proposals. Detailed information about each of the proposals is contained in the enclosed Proxy Statement.

Your vote is important no matter how many shares you own. Voting your shares early will help prevent costly follow-up mail and telephone solicitation. This Proxy Statement provides greater detail about the proposals. The Board of Trustees of the Fund (the “Board”) recommends that you read the enclosed materials carefully and vote in favor of each proposal.

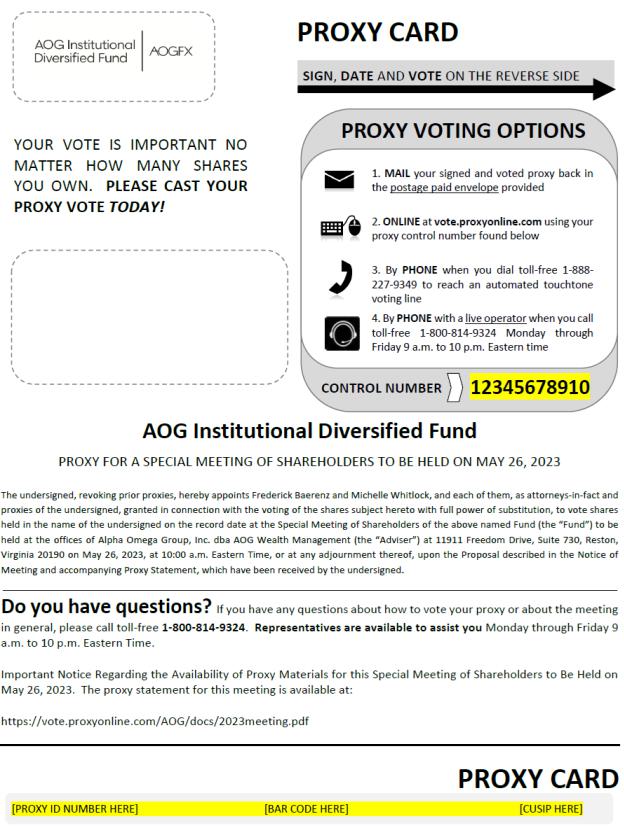

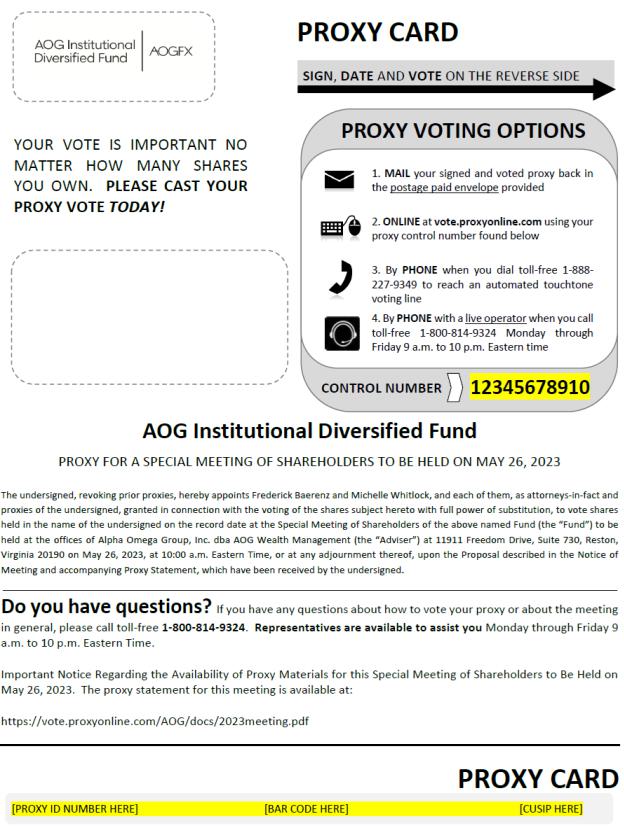

You may choose one of the following options to authorize a proxy to vote your shares (which is commonly known as proxy voting) or to vote in person at the Special Meeting:

| · | Mail: Complete and return the enclosed proxy card. |

| · | Internet: Access the website shown on your proxy card and follow the online instructions. |

| · | Telephone (automated service): Call the toll-free number shown on your proxy card and follow the recorded instructions. |

| · | In person: Attend the Special Meeting on May 26, 2023. |

Thank you for your response and for your continued investment in the Fund.

| | Sincerely, /s/ Frederick Baerenz Frederick Baerenz Chief Executive Officer |

PROXY STATEMENT

May 12, 2023

AOG INSTITUTIONAL DIVERSIFIED FUND

11911 Freedom Drive, Suite 730

Reston, VA 20190

Relating to a Special Meeting of Shareholders

to be held on May 26, 2023

This Proxy Statement is being furnished to you by AOG Institutional Diversified Fund (the “Fund”) in connection with the solicitation, on behalf of the Board of Trustees (the “Board”) of the Fund, of proxies from the holders of the outstanding shares of the Fund (each, a “Shareholder”), with respect to the special meeting (the “Special Meeting”) of Shareholders. The Special Meeting will be held so that Shareholders can consider the following proposals (the “Proposals”) and transact such other business as may be properly brought before the Special Meeting (and any adjournments or postponements thereof):

| 1. | To approve the adoption of the following fundamental investment policy: |

Adoption of a fundamental policy to conduct periodic repurchases of the Fund’s outstanding Shares, in accordance with Rule 23c-3 under the Investment Company Act of 1940, as amended (the “Investment Company Act”); and

| 2. | To approve a new investment advisory agreement (the “New Advisory Agreement”) between the Fund and the Adviser, changing the payor of the investment management advisory fee from AOG Institutional Diversified Master Fund (the “Master Fund”) to the Fund, and removing AOG Institutional Diversified Tender Fund (the “Tender Fund”) as a party thereto. All of the terms of the existing investment management agreement (the “Existing Advisory Agreement”) remain substantially the same. |

| 3. | To elect Maureen E. O’Toole as a new independent Trustee of the Fund for an indefinite term. |

Shareholders of record of the Fund at the close of business on the record date, April 28, 2023, are entitled to notice of the proxy solicitation and to vote at the Special Meeting and any adjournments or postponements thereof.

The Board unanimously recommends that you vote in favor of the Proposals.

| | By Order of the Board of Trustees, /s/ Frederick Baerenz Frederick Baerenz President and Chief Executive Officer |

Questions and Answers

We encourage you to read the full text of the enclosed Proxy Statement, but, for your convenience, we have provided a brief overview of the Proposals.

Q. Why am I receiving this Proxy Statement?

| A. | You are receiving this Proxy Statement because you were a Shareholder of the Fund on April 28, 2023, and therefore have the right to vote on several important Proposals concerning the Fund. |

Q. What are the Proposals about?

A. This Proxy Statement presents three proposals.

Proposal 1

This proposal relates to adopting a new fundamental investment policy.

You are being asked to approve the adoption of a new fundamental policy regarding annual offers to repurchase Fund shares (the “Repurchase Policy”) at net asset value (“NAV”). Based on the recommendation of the Fund’s investment adviser, Alpha Omega Group, Inc. dba AOG Wealth Management (“AOG” or the “Adviser”), the Fund intends to begin operating as an “interval fund” pursuant to Rule 23c-3 under the Investment Company Act of 1940, as amended (the “Investment Company Act”). As a result, the Board has adopted (subject to Shareholder approval) a fundamental policy to offer to repurchase not less than 5% and not more than 25% of its shares at NAV each calendar year. The Fund is seeking Shareholder approval to adopt the Repurchase Policy.

Proposal 2

This proposal relates to the approval of a new investment advisory agreement (the “New Advisory Agreement”) between the Fund and the Adviser. The New Advisory Agreement is being proposed for approval in connection with the adoption of a new fundamental policy regarding annual repurchase offers pursuant to Rule 23c-3. The New Advisory Agreement changes the payor of the annual investment management advisory fee rate (the “Management Fee”) of 1.49% of the AOG Institutional Diversified Master Fund’s (the “Master Fund”) average daily Managed Assets (as defined in the New Advisory Agreement), from the Master Fund to the Fund, and removes AOG Institutional Diversified Tender Fund (the “Tender Fund”) as a party thereto. All of the terms of the existing investment management agreement (the “Existing Advisory Agreement”) remain substantially the same.

Proposal 3

Finally, you are being asked to elect a new Trustee of the Fund. There are currently four members of the Board that have been elected by Fund Shareholders: Frederick Baerenz, Kate DiGeronimo, John Grady, and Michell Whitlock. Each of Mses. DiGeronimo and

Whitlock, and Messrs. Baerenz and Grady, were previously elected by the Board’s initial Shareholder. On April 17, 2023, the Board expanded its membership from four Trustees to five Trustees to comply with the requirements of Rule 23c-3. Maureen E. O’Toole, the nominee for a Board seat, was nominated by the Nominating Committee of the Board on April 17, 2023 to fill the fifth seat on the Board pending Shareholder approval. Ms. O’Toole is not currently a member of the Board.

| Q. | Will operating the Fund as an interval fund affect my account with the Fund? |

| A. | No. You will still own the same number of shares in the Fund and the value of your investment will not change as a result of adopting the Repurchase Policy. Adopting the Repurchase Policy will allow Shareholders to sell shares of the Fund back to the Fund at NAV once every twelve months. Subject to Board approval, the Fund intends to offer to repurchase 5% of its outstanding shares every twelve months if Shareholders approve Proposal 1. |

| Q. | Why does AOG recommend changing to an interval fund rather than continuing to operate as a tender offer fund? |

| A. | Under the current structure of the Fund, the Fund expects to conduct tender offers during June and December of each calendar year. The Fund believes that adopting the Repurchase Policy under Rule 23c-3 of the Investment Company Act will provide Shareholders with additional liquidity and greater certainty as they will have an opportunity to liquidate a portion of their shares on a periodic basis pursuant to repurchase offers. Rule 23c-3 requires the Fund to maintain adequate liquidity to make such repurchase. The Board believes that this additional certainty regarding liquidity will also benefit the Fund’s Shareholders. |

Under the proposed fundamental policy, the Board will be required to make an annual repurchase offer for between 5% and 25% of the Fund’s outstanding shares. The Board currently expects to make a repurchase offer for 5% of the Fund’s outstanding shares every twelve months. If a repurchase offer by the Fund is oversubscribed, the Fund may purchase additional shares up to a maximum amount of 2% of the outstanding shares of the Fund. If the Fund determines not to repurchase more than the repurchase offer amount, or if security holders tender shares in an amount exceeding the repurchase offer amount plus 2% of the common stock outstanding on the repurchase request deadline, the Fund will repurchase shares on a pro rata basis. In this event, Shareholders may be unable to liquidate all or a given percentage of their investment in the Fund during a particular repurchase offer.

| Q. | Why is AOG recommending the approval of the New Advisory Agreement? |

| A. | The Fund currently operates as a “feeder fund” in a master feeder structure. The Fund’s portfolio consists solely of the Master Fund’s shares. In connection with the adoption of the Repurchase Policy and the Fund’s proposed operation as an interval fund rather than as a feeder fund in a master feeder structure, the Fund intends that its portfolio will consist of investments held directly by it or indirectly through wholly owned or majority owned subsidiaries. As a result, and to eliminate an unnecessarily complex structure, AOG is recommending approval of the New Advisory Agreement, whereby the Fund will pay the |

Management Fee to the Adviser directly, as opposed to paying the Management Fee indirectly through the Fund’s ownership of the Master Fund. The Master Fund will be deregistered under the Investment Company Act and will continue to exist as a wholly owned subsidiary of the Fund. Also, in connection with the Fund’s intended operation as a standalone interval fund, the New Advisory Agreement will remove the Tender Fund as a party. All of the terms of the Existing Advisory Agreement remain substantially the same.

| Q. | How does Proposal 3 affect the composition of the Board? |

| A. | Proposal 3 will result in the Board being composed of five Trustees. Currently the Board is composed of four persons, two of whom are not “interested persons” of the Fund as defined in the Investment Company Act (the “Independent Trustees”): Kate DiGeronimo and John Grady. Mr. Baerenz, the Chief Executive Officer of AOG, the Fund’s investment adviser, and Ms. Whitlock, the Chief Financial Officer of AOG, are “interested persons” of the Fund and therefore serve as the interested Trustees of the Fund. Rule 23c-3 requires at least a majority of the directors of the fund are not “interested persons” of the fund, or Independent Trustees, for the fund to operate as an interval fund. If Shareholders elect Maureen E. O’Toole as proposed, each of the Trustees will have been elected by Shareholders, which will provide the Board with the flexibility to fill a vacancy or add an additional Trustee without incurring the cost associated with seeking Shareholder approval. In addition, at least a majority of the Board will qualify as Independent Trustees as required for the Fund to operate as an interval fund. |

| Q. | How long will the Trustees serve on the Board? |

| A. | Each Trustee may serve on the Board until he or she dies, resigns, is declared bankrupt or incompetent by a court of appropriate jurisdiction, or is removed. |

| Q. | Who will pay for the proxy solicitation and related legal costs? |

| A. | The Adviser will pay for the proxy solicitation and related legal costs. The Adviser estimates that the cost of preparing, printing and mailing the Proxy Statement and soliciting Shareholder votes will be $8,000. |

| Q. | What will happen if Shareholders do not approve the Proposals? |

| A. | Approval of Proposals 1 and 2 require the vote of a majority of the outstanding shares of the Fund. If Shareholders do not approve Proposals 1 and 2, the Fund will not be able to operate as an interval fund and will continue to operate as a tender offer fund that offers to repurchase Fund shares on a periodic basis at the discretion of the Board. |

Approval of Proposal 3 requires a plurality of votes cast on the matter in favor the nominee. If Maureen E. O’Toole receives a plurality of votes cast on Proposal 3, Ms. O’Toole will be elected to serve as an Independent Trustee. If Ms. O’Toole does not receive a plurality of votes cast on Proposal 3, Ms. O’Toole will be unable to serve as an Independent Trustee of the Fund.

Proposals 1 and 2 are contingent upon the approval of Proposal 3. If Proposal 3 is not approved, the remaining proposals will not be adopted.

If approved, Proposals 1 and 2 will be implemented upon the effective date of an amendment to the Fund’s registration statement disclosing the changes. If approved, Proposal 3 will be implemented upon Shareholder approval.

| Q. | What is the Board’s recommendation? |

| A. | After careful consideration, the Board unanimously recommends that Shareholders vote FOR all Proposals. |

TABLE OF CONTENTS

| PROPOSAL 1: ADOPTION OF FUNDAMENTAL POLICY TO CONDUCT PERIODIC REPURCHASE OFFERS | 4 |

| PROPOSAL 2: APPROVAL OF THE NEW INVESTMENT ADVISORY AGREEMENT BETWEEN THE FUND AND THE ADVISOR | 9 |

| PROPOSAL 3: ELECTION OF TRUSTEES | 15 |

| ADDITIONAL INFORMATION | 25 |

PROXY STATEMENT

May 12, 2023

AOG INSTITUTIONAL DIVERSIFIED FUND

11911 Freedom Drive, Suite 730

Reston, VA 20190

This Proxy Statement is being provided to you in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of AOG Institutional Diversified Fund, a Delaware statutory trust (the “Fund”), with respect to the special meeting (the “Special Meeting”) of shareholders of the Fund. The Special Meeting will be held for the shareholders to consider three proposals (the “Proposals”):

| 1. | To approve the adoption of the following fundamental investment policy: |

| a. | Adoption of a fundamental policy to conduct periodic repurchases of the Fund’s outstanding shares, in accordance with Rule 23c-3 under the Investment Company Act of 1940, as amended (the “Investment Company Act”); and |

| 2. | To approve a new investment advisory agreement (the “New Advisory Agreement”) between the Fund and the Adviser, changing the payor of the investment management advisory fee from AOG Institutional Diversified Master Fund (the “Master Fund”) to the Fund, and removing AOG Institutional Diversified Tender Fund (the “Tender Fund”) as a party thereto. All of the terms of the existing investment management agreement (the “Existing Advisory Agreement”) remain substantially the same. |

| 3. | To elect Maureen E. O’Toole as a new Trustee of the Fund for an indefinite term. |

We anticipate that the notice of Special Meeting of shareholders, this Proxy Statement and the proxy card (collectively, the “Proxy Materials”) will be mailed to shareholders beginning on or about May 12, 2023.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on May 26, 2023:

The Notice of Special Meeting and Proxy Statement are available at:

https://vote.proxyonline.com/AOG/docs/2023meeting.pdf.

Please read the Proxy Statement before voting on the proposals. If you need additional copies of this Proxy Statement or the proxy card, please contact American Stock Transfer Fund Solutions at (800) 814-9324 or in writing at Alpha Omega Group, Inc. dba AOG Wealth Management, 11911 Freedom Drive, Suite 730, Reston, VA 20190. Additional copies of this Proxy Statement will be delivered to you promptly upon request. To obtain directions to attend the meeting, please call (800) 814-9324. Shareholders of record of the Fund at the close of business on the record date, April 28, 2023 (the “Record Date”), are entitled to notice of and to vote at the Special Meeting and

any adjournments or postponements thereof. As of the Record Date, the Fund had 3,773,838.745 shares outstanding. Each share entitles its holder to one vote at the Special Meeting.

PROPOSAL 1:

ADOPTION OF FUNDAMENTAL POLICY TO CONDUCT PERIODIC

REPURCHASE OFFERS

On April 17, 2023, the Board unanimously voted to convert the Fund to an interval fund, subject to Shareholder approval. An interval fund is a closed-end management investment company that has adopted a fundamental policy to conduct periodic repurchases of its outstanding common shares pursuant to Rule 23c-3 under the Investment Company Act. Rule 23c-3 requires that a majority of the Fund’s Shareholders adopt such fundamental policy. Therefore, the Board is seeking your approval to adopt a fundamental policy to conduct periodic repurchases of the Fund’s common shares as described below (the “Repurchase Policy”).

Background and Reasons

The Board recommends a vote for the proposal to approve the adoption of the Repurchase Policy because such repurchase offers will ensure greater and more consistent liquidity for the Fund’s Shareholders. As described in greater detail below, upon adopting the Repurchase Policy, the Fund will be required to conduct annual repurchase offers unless limited exceptions (as discussed below) apply. Currently, the Fund is permitted to conduct up to two tender offers each calendar year and under the Repurchase Policy, the Fund will only be required to conduct an annual repurchase offer. Although the Fund is currently permitted to conduct voluntary share repurchases pursuant to a tender offer process, adopting the Repurchase Policy will enable the Fund to take advantage of a more efficient and less costly repurchase offer process pursuant to Rule 23c-3. Shareholders will benefit from the lower cost burden on the Fund and assurance that repurchases will be conducted in each calendar year.

Pursuant to the Repurchase Policy, the Fund intends to offer to make one repurchase offer of no less than 5% and no more than 25% of its shares outstanding in each calendar year at a price equal to the net asset value per share (“NAV”). Such repurchases are referred to as “Mandatory Repurchases” because the Fund is required to conduct the repurchase offer unless certain limited circumstances occur (as set forth below under the heading “Suspension or Postponement of Mandatory Repurchase”). The Board currently intends to make a repurchase offer for 5% of the Fund’s outstanding shares each calendar year. If a repurchase offer by the Fund is oversubscribed, the Fund may purchase additional shares up to a maximum amount of an additional 2% of the outstanding shares of the Fund. If the Fund determines not to repurchase more than the repurchase offer amount, or if security holders tender stock in an amount exceeding the repurchase offer amount plus 2% of the common shares outstanding on the Repurchase Request Deadline (as defined below), the Fund will repurchase shares on a pro rata basis. There is no guarantee that Shareholders will be able to sell all of the shares they desire in a Mandatory Repurchase. The Fund intends to maintain liquid securities, cash or access to a bank line of credit in amounts sufficient to meet the annual redemption offer requirements.

If the Repurchase Policy is adopted, the offer to repurchase shares will be a fundamental policy that may not be changed without the vote of the holders of a majority of the Fund’s outstanding voting securities (as defined in the Investment Company Act). Shareholders will be notified in writing of each Mandatory Repurchase and the date the repurchase offer will end (the “Repurchase Request Deadline”). Shares will be repurchased at the NAV per share determined as of the close

of regular trading on the New York Stock Exchange (“NYSE”) no later than the 14th day after the Repurchase Request Deadline, or the next business day if the 14th day is not a business day (each a “Repurchase Pricing Date”).

Shareholders will be notified in writing about each Mandatory Repurchase offer and how they may request that the Fund repurchase their shares and the Repurchase Request Deadline, which is the date the repurchase offer ends. Shares tendered for repurchase by Shareholders prior to any Repurchase Request Deadline will be repurchased subject to the aggregate repurchase amounts established for that Repurchase Request Deadline. The time between the notification to Shareholders and the Repurchase Request Deadline is generally 30 days but may vary from no more than 42 days to no less than 21 days. Payment pursuant to the repurchase will be made by checks to the Shareholder’s address of record or credited directly to a predetermined bank account on the purchase payment date, which will be no more than seven days after the Repurchase Pricing Date.

The Board may establish other policies for repurchases of shares that are consistent with the Investment Company Act, regulations thereunder and other pertinent laws.

Determination of Repurchase Offer Amount

The Board, in its sole discretion, will determine the number of shares that the Fund will offer to repurchase (the “Repurchase Offer Amount”) for the given Repurchase Request Deadline. The Repurchase Offer Amount will be no less than 5% and no more than 25% of the total number of shares outstanding on the Repurchase Request Deadline. Currently, the Board intends to make a repurchase offer for 5% of the Fund’s then outstanding shares each calendar year. Accordingly, investors should not rely on Mandatory Repurchases being made in amounts in excess of 5% of the total number of shares outstanding. If a repurchase offer by the Fund is oversubscribed, the Fund may purchase additional shares up to a maximum amount of an additional 2% of the outstanding shares of the Fund. If Shareholders tender for repurchase more than the Repurchase Offer Amount plus an additional 2% (if applicable), the Fund will repurchase the shares on a pro rata basis, provided that the Fund may accept all shares tendered for Mandatory Repurchase by Shareholders who own less than 100 shares and who tender all of their shares, before prorating other amounts tendered. In addition, the Fund will accept the total number of shares tendered in connection with required minimum distributions from an individual retirement account (“IRA”) or other qualified retirement plan. It is the Shareholder’s obligation to both notify and provide the Fund supporting documentation of a required minimum distribution from an IRA or other qualified retirement plan.

Notice to Shareholders

Approximately 30 days (but no less than 21 days and more than 42 days) before each Repurchase Request Deadline, the Fund shall send to each Shareholder of record and to each beneficial owner of the shares that are the subject of the repurchase offer a notification (“Shareholder Notice”). The Shareholder Notice will contain information Shareholders should consider when deciding whether or not to tender their shares for Mandatory Repurchase. The notice also will include detailed instructions on how to tender shares for the Mandatory Repurchase, state the Repurchase Offer Amount and identify the dates of the Repurchase Request Deadline, the scheduled Repurchase

Pricing Date, and the date the repurchase proceeds are scheduled for payment (the “Repurchase Payment Deadline”). The notice also will set forth the NAV computed by the Fund no more than seven days before the date of the Shareholder Notice, and how Shareholders may ascertain the NAV after the notification date.

Repurchase Price

The share repurchase price will be the NAV as of the close of regular trading on the NYSE on the Repurchase Pricing Date. You may call 877-600-3573, Monday through Friday, except holidays, during normal business hours of 8:30 a.m. to 5:30 p.m. (Eastern Time) to learn the NAV for each of the five days before the Repurchase Pricing Date. The Shareholder Notice also will provide information concerning the NAV, such as the NAV as of a recent date or a sampling of recent NAVs, and a toll-free number for information regarding the Mandatory Repurchase.

Repurchase Amounts and Payment of Proceeds

Shares tendered for Mandatory Repurchase by Shareholders prior to any Repurchase Request Deadline will be repurchased subject to the aggregate Repurchase Offer Amount established for that Repurchase Request Deadline. Payment pursuant to the Mandatory Repurchase will be made by check to the Shareholder’s address of record or credited directly to a predetermined bank account on the purchase payment date, which will be no more than seven days after the Repurchase Pricing Date. The Board may establish other policies for repurchases of shares that are consistent with the Investment Company Act, regulations thereunder and other pertinent laws.

If Shareholders tender for repurchase more than the Repurchase Offer Amount for a given Mandatory Repurchase, the Fund may, but is not required to, repurchase an additional amount of shares not to exceed 2% of the outstanding shares of the Fund on the Repurchase Request Deadline. If the Fund determines not to repurchase more than the Repurchase Offer Amount, or if Shareholders tender shares in an amount exceeding the Repurchase Offer Amount plus 2% of the outstanding shares on the Repurchase Request Deadline, the Fund will repurchase the shares on a pro rata basis. However, the Fund may accept all shares tendered for repurchase by Shareholders who own less than one hundred shares and who tender all of their shares, before prorating other amounts tendered. In addition, the Fund will accept the total number of shares tendered in connection with required minimum distributions from an IRA or other qualified retirement plan.

Suspension or Postponement of Mandatory Repurchase

The Fund may suspend or postpone a Mandatory Repurchase pursuant to a vote by a majority of the Fund’s Trustees, including a majority of its Independent Trustees, and only: (a) if making or effecting the Mandatory Repurchase would cause the Fund to lose its status as a RIC under the Internal Revenue Code of 1986, as amended; (b) for any period during which the NYSE or any market on which the securities owned by the Fund are principally traded is closed, other than customary weekend and holiday closings, or during which trading in such market is restricted; (c) for any period during which an emergency exists as a result of which disposal by the Fund of securities owned by it is not reasonably practicable, or during which it is not reasonably practicable for the Fund fairly to determine the value of its net assets; or (d) for such other periods as the Securities and Exchange Commission (the “SEC”) may by order permit for the protection of

Shareholders of the Fund. If a Mandatory Repurchase is suspended or postponed, the Fund will provide notice to its Shareholders of such suspension or postponement. If the Fund renews the Mandatory Repurchase, the Fund will send a new notification to its Shareholders in compliance with Rule 23c-3.

Liquidity Requirements

The Fund must maintain liquid assets equal to the Repurchase Offer Amount from the time that the Shareholder Notice is sent until the Repurchase Pricing Date. The Fund will ensure that a percentage of its net assets equal to at least 100% of the Repurchase Offer Amount consists of assets that can be sold or disposed of in the ordinary course of business at approximately the price at which the Fund has valued the investment within the time period between the Repurchase Request Deadline and the Repurchase Payment Deadline. The Board will adopt procedures that are reasonably designed to ensure that the Fund’s assets are sufficiently liquid so that the Fund can comply with a Mandatory Repurchase and the liquidity requirements described in the previous paragraph. If, at any time, the Fund falls out of compliance with these liquidity requirements, the Board will take whatever action it deems appropriate to ensure compliance.

Risks Related to the Approval of Proposal 1

Mandatory Repurchases will typically be funded from available cash or access to a bank line of credit in amounts sufficient to meet the annual repurchase offer requirements. Payment for repurchased shares, however, may require the Fund to liquidate portfolio holdings earlier than the Adviser otherwise would, thus increasing the Fund’s portfolio turnover and potentially causing the Fund to realize losses. The Adviser intends to take measures to attempt to avoid or minimize such potential losses and turnover, and instead of liquidating portfolio holdings, may borrow money to finance repurchases of shares. If the Fund borrows to finance repurchases, interest on that borrowing will negatively affect Shareholders who do not tender their shares in a Mandatory Repurchase by increasing the Fund’s expenses and reducing any net investment income. To the extent the Fund finances repurchase amounts by selling Fund investments, the Fund may hold a larger proportion of its assets in less liquid securities. The sale of portfolio securities to fund Mandatory Repurchases also could reduce the market price of those underlying securities, which in turn would reduce the Fund’s NAV. In addition, the Fund may sell portfolio securities at an inopportune time and may suffer losses or unexpected tax liabilities. Repurchase of the Fund’s shares will tend to reduce the amount of outstanding shares and, depending upon the Fund’s investment performance, its net assets. A reduction in the Fund’s net assets would increase the Fund’s expense ratio, to the extent that additional shares are not sold and expenses otherwise remain the same (or increase). In addition, the repurchase of shares by the Fund will be a taxable event to Shareholders.

The Fund is intended as a long-term investment. The Mandatory Repurchases will be the only means of liquidity provided by the Fund through which Shareholders have a right to redeem their shares, subject to a limited number of extenuating circumstances. Because the Fund will provide liquidity through the Mandatory Repurchases, it does not anticipate seeking to complete a liquidation event in the future. Additionally, under the Repurchase Policy, the Mandatory Repurchase will only occur annually, which will reduce shareholders’ options for liquidity through repurchases to once a year. Other than Mandatory Repurchases, shareholders do not have the right

to have their shares redeemed by the Fund or transfer or exchange their shares, other than limited rights of a Shareholder’s descendants to redeem shares in the event of such Shareholder’s death pursuant to certain conditions and restrictions. The Fund’s shares are not traded on a national securities exchange. Beginning approximately 12-18 months after the Fund commences operations, the Fund will make its shares available for secondary transfers on a periodic basis through an auction conducted via Nasdaq Fund Secondaries.

Vote Required

Adoption of the fundamental policy requires the affirmative vote of a majority of the Fund’s outstanding voting shares. The Investment Company Act defines a “majority vote” as the vote of Shareholders owning the lesser of (a) 67% or more of the shares present at a meeting of Shareholders, if the holders of more than 50% of a fund’s outstanding shares are present or represented by proxy at such meeting; or (b) more than 50% of a fund’s outstanding voting shares. For purposes of the Shareholder vote solicited here, a majority vote means the vote of more than 50% of the outstanding shares of the Fund on the Record Date.

The Board recommends a vote “FOR” Proposal 1.

PROPOSAL 2:

APPROVAL OF THE NEW INVESTMENT ADVISORY AGREEMENT BETWEEN THE FUND AND THE ADVISOR

Shareholders are being asked to approve the New Advisory Agreement between the Fund and the Adviser. The New Advisory Agreement is being proposed for approval in connection with the adoption of a new fundamental policy regarding annual tender offers pursuant to Rule 23c-3. The New Advisory Agreement changes the payor of the annual advisory fee rate (the “Management Fee”) of 1.49% of the Master Fund’s average daily Managed Assets (as defined in the New Advisory Agreement), from the Master Fund to the Fund, and removing the Tender Fund as a party thereto. All of the terms of the Existing Advisory Agreement remain substantially the same.

Existing Advisory Agreement

The Adviser has served as the investment adviser to the Fund pursuant to the Existing Advisory Agreement. The Existing Advisory Agreement was approved by shareholders of the Fund on October 14, 2022.

New Advisory Agreement

The Board approved the New Advisory Agreement on April 17, 2023. In accordance with the Investment Company Act, the New Advisory Agreement requires the approval of (1) the Board, including a majority of the Independent Trustees, and (2) the shareholders of the Fund.

The terms of the New Advisory Agreement are substantially the same to those of the Existing Advisory Agreement for the Fund, except for change in payor of the Management Fee and the removal of the Tender Fund as a party thereto. If approved by shareholders of the Fund, the New Advisory Agreement will be effective upon the effective date of an amendment to the Fund’s registration statement that discloses the changes to an interval fund structure and will have an initial term of two years. The New Advisory Agreement will continue in effect from year to year thereafter if its continuance is approved, on behalf of the Fund, at least annually in the manner required by the Investment Company Act and the rules and regulations of the SEC thereunder.

In the course of its evaluation of the terms and conditions of the New Advisory Agreement, the Board was provided with the materials previously submitted to it for approval of the Existing Advisory Agreement, along with any material updates, if any, necessary for the Board's consideration. The Board also considered the substantially similar terms, including the Management Fee, of the Existing and New Advisory Agreements.

Based on the considerations described below under “Board Considerations,” the Board, including all of the Independent Trustees, unanimously approved the New Advisory Agreement on behalf of the Fund.

Summary of Existing Advisory Agreement and New Advisory Agreement

Other than the change of the payor of the Management Fee from the Master Fund to the Fund, and the removal of the Tender Fund as a party, there are no material differences between the terms of

the New Advisory Agreement and the terms of the Existing Advisory Agreement. The form of the New Advisory Agreement is attached as Attachment A, and the description of the New Advisory Agreement is qualified in its entirety by reference to Attachment A.

Advisory Duties. Under the Existing Advisory Agreement and the New Advisory Agreement, the Adviser manages the investment and reinvestment of the assets, including the regular furnishing of advice with respect to the Fund’s portfolio transactions subject at all times to the control and oversight of the Board. Under both agreements, officers of the Adviser are required to create and maintain all necessary books and records in accordance with all applicable laws, rules and regulations, including but not limited to records required by Section 31(a) of the Investment Company Act and the rules thereunder.

Compensation. Under the New Advisory Agreement, the Fund will pay the Adviser the Management Fee of 1.49% of the Fund’s average daily Managed Assets (as defined above and in the New Advisory Agreement). Under the Existing Advisory Agreement, the Management Fee is paid by the Master Fund. Under both agreements, the Management Fee is accrued daily and paid monthly. Both agreements provide that the Fund will reimburse the Adviser for certain expenses that it pays on behalf of the Fund.

Brokerage. Both the Existing Advisory Agreement and the New Advisory Agreement authorize the Adviser to direct portfolio transactions to broker-dealers for execution on terms and at rates which it believes, in good faith, to be reasonable in view of the overall nature and quality of services provided by a particular broker-dealer, including brokerage and research services. Both agreements provide that the Adviser will seek best execution of securities transactions and in compliance with Section 28(e) of the Securities Exchange Act of 1934, as amended. Under both agreements, the Adviser may pay a broker or a dealer a commission in excess of the amount of commission another broker or dealer would have charged if the Adviser determines in good faith that the commission paid was reasonable in relation to the brokerage and research services provided.

Expenses. Both the Existing Advisory Agreement and the New Advisory Agreement provide that the Fund assumes and shall pay all the expenses required for the conduct of its business, including expenses borne indirectly through the Fund’s investments in funds, all costs and expenses directly related to portfolio transactions and positions for the Fund, fees of the Adviser, fees and commissions in connection with the purchase and sale of portfolio securities for the Fund, costs, including the interest expense, of borrowing money, salaries and other compensation of (1) any of the Fund’s officers and employees who are not officers, trustees, members or employees of the Adviser or any of its affiliates, and (2) the Fund’s chief compliance officer to the extent determined by those trustees of the Fund who are not interested persons of the Adviser or its affiliates, and auditing and legal fees and expenses. Both agreements provide that the Fund will reimburse the Adviser for any of the above expenses that it pays on behalf of the Fund.

Limitation on Liability. Both the Existing Advisory Agreement and the New Advisory Agreement provide that the Adviser shall not be liable to the Fund or any shareholder of the Fund for any error of judgment or mistake of law or for any loss suffered by the Fund or the Fund’s shareholders, except in the case of willful misfeasance, bad faith, or gross negligence in the performance of the

Advisor’s duties or by reason of its reckless disregard of obligations and duties under the agreement.

Term. The Existing Advisory Agreement was in effect for an initial two-year term and was eligible to be continued thereafter for successive one-year periods if such continuance was specifically approved at least annually in the manner required by the Investment Company Act. If the shareholders of the Fund approve the New Advisory Agreement, the New Advisory Agreement with respect to the Fund will be effective upon the effective date of an amendment to the Fund’s registration statement that discloses the changes to an interval fund structure and have an initial term, with respect to the Fund, ending two years after the effective date. Thereafter, the New Advisory Agreement for the Fund may be continued for successive one-year periods if approved at least annually in the manner required by the Investment Company Act.

Termination. Both the Existing Advisory Agreement and the New Advisory Agreement terminate automatically in the event of assignment, at any time by the majority of the shareholders of the Fund or the Board upon 60 days’ written notice to the Adviser or by the Adviser upon 60 days’ written notice.

Amendments. Both the Existing Advisory Agreement and the New Advisory Agreement provide that the agreement may be amended only by written agreement between the Adviser and the Fund, which amendment has been authorized by the Board, including the vote of a majority of the Independent Trustees and, where required by the Investment Company Act, the shareholders of the Fund.

Information about the Advisor

The Adviser, located at 11911 Freedom Drive, Suite 730, Reston, VA 20190, furnishes investment management services to the Funds, subject to the supervision and direction of the Board. Affiliates of the Adviser also manage other investment accounts. In the course of discharging its non-portfolio management duties under the advisory contract, the Adviser may delegate to affiliates certain administrative, non-investment advisory functions. As of March 31, 2023, the Adviser managed approximately $329 million in assets for individuals (including high net worth individuals), pension and profit sharing plans, charitable organizations, and corporations and other businesses.

The names and principal occupations of the principal executive officers of the Adviser are listed below:

Name and Principal Occupation/Title for each executive officer of the Adviser

| Name | Position with the Advisor | Position with the Fund |

| Frederick Baerenz | President and Chief Executive Officer | President and Chief Executive Officer |

| Michelle Whitlock | Chief Financial Officer | Chief Financial Officer |

| James Ortlip | Chief Investment Officer | None |

The address for the Adviser and the principal executive officers of the Adviser is 11911 Freedom Drive, Suite 730, Reston, VA 20190.

Board Considerations - Approval of New Advisory Agreement

The Board previously approved the Existing Advisory Agreement on July 6, 2022, which increased the Management Fee from 0.50% to 1.49%. On September 20, 2022, the Fund commenced solicitation of, and on October 14, 2022 received, the vote of the outstanding voting securities of the Fund needed to approve the Existing Advisory Agreement, and on or about November 16¸2022, the Fund entered into the Existing Advisory Agreement with the Adviser. Other than the change of the payor of the Management Fee from the Master Fund to the Fund, and the removal of the Tender Fund as a party, the terms of the Existing Advisory Agreement and the New Advisory Agreement are substantially similar. In considering the approval and recommendation to the shareholders of the Fund of the New Advisory Agreement, the Board reconsidered those factors previously reviewed by it at the July 6 meeting, and the substantially similar terms of the Existing Advisory Agreement and the New Advisory Agreement.

The Board, half of which is comprised solely of trustees who are not “interested persons” (as defined under the Investment Company Act) of the Fund (“Independent Trustees”), reviewed the New Advisory Agreement at a special meeting held on April 17, 2023. In determining whether to approve the New Advisory Agreement, the Board evaluated information relevant to its consideration of the New Advisory Agreement at this meeting. The Board also considered its regular discussions with management regarding the viability and performance challenges of the Fund.

In considering the New Advisory Agreement, the Board reviewed and analyzed various factors with respect to the Fund that it determined were relevant, including the factors below, and made the following conclusions. In their deliberations, the Board did not identify any single factor as determinative but considered all factors together.

In addition to the specific factors considered by the Board below, the Board also considered broader factors, such as the responsibility, attention, and diligence the Adviser would need to devote to the Fund, the fees charged by comparable funds, and ensuring that the Management Fee was competitive to attract portfolio management talent and expand the personnel needed to support a fund whose investor based extended beyond the Advisor’s existing clients. In addition, the Board considered the superior performance of the Fund relative to its peers, the long-term strategic direction for the Fund, and the administrative and operational demands of operating a fund utilizing the Fund’s unique liquidity feature supplied by Nasdaq Fund Secondaries LLC, in its evaluation of the Management Fee.

Nature and Quality of Services Provided to the Fund

The Board analyzed the nature, extent and quality of the services provided by the Adviser to the Fund, noting that the Adviser has served as the Fund’s investment adviser since its inception in 2021. The Board concluded that the nature and quality of the services provided by the Adviser to

the Fund was appropriate and that the Fund was likely to continue to benefit from services provided under the New Advisory Agreement.

Scope and Costs of Services Provided

As part of its review at the meeting, the Board considered the fees realized, and the costs incurred, by the Adviser in providing investment advisory services to the Fund and the profitability to the Adviser of having a relationship with the Fund, as well as the projected profitability information provided. The Board noted the fee waivers and unreimbursed expenses for the Fund since inception. At the meeting, the Board considered the financial information and condition of the Adviser and determined it to be sound. In light of all of the information that it received and considered; the Board concluded that the Management Fee was reasonable.

Economies of Scale and Fee Levels Reflecting Those Economies

The Board compared the Fund’s proposed fees under the New Advisory Agreement to the comparative data provided and discussed potential economies of scale. The Board noted that the Fund’s proposed advisory fee structure under the New Advisory Agreement does not contain any breakpoint reductions as the Fund grows in size. However, the Board noted that the Adviser had committed to review the possibility of incorporating breakpoints in the future should assets grow significantly. The Board concluded that the proposed fee structure under the New Advisory Agreement was reasonable given the Fund’s current and projected asset size under the New Advisory Agreement.

Benefits Derived from the Relationship with the Fund

The Board noted that the Adviser currently derives ancillary benefits from its association with the Fund in the form of research products and services received from unaffiliated broker-dealers who execute portfolio trades for the Fund. The Board determined such products and services have been used for legitimate purposes relating to the Fund by providing assistance in the investment decision-making space.

In addition to the above factors, the Board also discussed certain considerations adverse to the proposal, including: the time and expense associated with conducting a proxy solicitation among investors for the various proposals; the uncertainty of obtaining the requisite vote to approve the proposals; the confusion the proposals might cause investors following the 2022 proposal to amend and restate the investment management agreement; the uncertainty regarding the outcome of the proposals and the impact on the Fund’s capital raising efforts; the attention and time that the proposals would require from the personnel of the Adviser which would potentially distract from investment management duties; and the competition among interval funds if the proposals were adopted and the Fund began to compete with other interval funds.

Based on its evaluation of the above factors, as well as other factors relevant to their consideration of the New Advisory Agreement, the trustees, all of whom are Independent Trustees, concluded that the approval of the New Advisory Agreement was in the best interest of the Fund and its shareholders.

Based on all of the foregoing, the Board recommends that shareholders of the Fund vote FOR the approval of the New Advisory Agreement.

Vote Required

The approval of the New Advisory Agreement requires the affirmative vote of a majority of the Fund’s outstanding voting shares. The Investment Company Act defines a “majority vote” as the vote of Shareholders owning the lesser of (a) 67% or more of the shares present at a meeting of Shareholders, if the holders of more than 50% of a fund’s outstanding shares are present or represented by proxy at such meeting; or (b) more than 50% of a fund’s outstanding voting shares. For purposes of the Shareholder vote solicited here, a majority vote means the vote of more than 50% of the outstanding shares of the Fund on the Record Date.

The Board recommends a vote “FOR” Proposal 2.

PROPOSAL 3:

ELECTION OF TRUSTEE

The Fund currently has four Trustees on its Board that have been elected by its Shareholders. On April 17, 2023, the Board expanded its membership from four Trustees to five Trustees to comply with the requirements of Rule 23c-3. The Fund’s Nominating Committee nominated the one new Trustee to stand for election. A Trustee duly elected will serve an indefinite term unless he or she resigns or is removed in accordance with the Fund’s Declaration of Trust.

A Shareholder can vote for or against the nominee. The Board has no reason to believe that the persons named below will be unable or unwilling to serve, and such person has consented to being named in this Proxy Statement and to serve if elected.

Information about the Trustee Nominees and Officers of the Fund

Certain information with respect to the nominees for election and the officers of the Fund is set forth below, including their names, ages, a brief description of their recent business experience, including present occupations and employment and certain trusteeships that each person holds, and the length of time served in such capacity with the Fund.

Trustee Independence

Under the Investment Company Act, in order for a Trustee to be deemed independent, he or she, among other things, generally must not: own, control or hold power to vote, 5% or more of the voting securities or be an officer or employee of the Fund or of an investment adviser or principal underwriter to the Fund; control the Fund or an investment adviser or principal underwriter to the Fund; be an officer, trustee or employee of an investment adviser or principal underwriter to the Fund; be a member of the immediate family of any of the foregoing persons; knowingly have a direct or indirect beneficial interest in, or be designated as an executor, guardian or trustee of an interest in, any security issued by an investment adviser or principal underwriter to the Fund; be a partner or employee of any firm that has acted as legal counsel to the Fund or an investment adviser or principal underwriter to the Fund during the last two years; or have certain relationships with a broker-dealer or other person that has engaged in agency transactions, principal transactions, lent money or other property to, or distributed shares on behalf of the Fund.

The Board, pursuant to the Investment Company Act and with advice of counsel to the Independent Trustees, has considered the independence of existing members of and nominees to the Board who are not employed by the Adviser, or UMB Distribution Services, LLC, the Fund’s distributor (the “Distributor”), or any of their respective affiliates, and has concluded that Ms. O’Toole is not an “interested person” of the Fund, the Adviser, or the Distributor, as defined by the Investment Company Act and therefore qualify as an Independent Trustee under the standards promulgated by the Investment Company Act.

| Independent Trustee Nominee | | | | | |

Name, Address,* Year of Birth | Position(s) Held with Fund | Term of Office** and Length of Time Served | Principal Occupation During the Past Five Years | Number of Portfolios in Fund Complex*** to be Overseen by Trustee Nominee | Other Trusteeships held by Trustee during Last Five Years |

| Maureen E. O’Toole (1957) | Independent Trustee | N/A | Managing Director at Actis since 2019, and Morgan Stanley Investment Management since 2016 | N/A | None |

* The address for the Trustee listed above is 11911 Freedom Drive, Suite 730, Reston, VA 20190.

* * The term of office for the Trustee listed above will continue indefinitely.

* * * The term “Fund Complex” refers to all present and future funds advised by the Investment Adviser or its affiliates.

Maureen E. O’Toole has more than 40 years of experience in the financial services industry, including substantial involvement with alternative asset management. From 1982 to 1989, Ms. O’Toole served as a Vice President of the Institutional Financial Futures Research Department of Drexel Burnham Lambert in Chicago, working to develop quantitative models to create pioneering financial futures hedging and trading strategies. From 1989 to 1993, Ms. O’Toole served as Senior Vice President of the Managed Futures Research Department of Rodman and Renshaw, performing quantitative analysis on Commodity Trading Advisers and constructing managed futures portfolios. From 1993 to 2010, Ms. O’Toole held Director and Managing Director roles at the investment groups of numerous prominent banks and investment management firms. From 2010 to 2012, Ms. O’Toole served as Managing Director of K2 Advisors, expanding its hedge fund of funds investment platform. Since 2012, Ms. O’Toole has served as Managing Director of K2 Advisors, Morgan Stanley Investment Management, and now presently Actis, with responsibility for the managed futures activity of each of these prominent firms. Ms. O’Toole has had numerous board positions, including a current role as an Independent Trustee of the Alti Private Equity Access Fund. Ms. O’Toole graduated from California State University with a degree in Economics, going on to receive a Master’s in Management from Northwestern University with a focus on Finance. We believe Ms. O’Toole’s experience in the financial services industry qualifies her to serve as a trustee of our Board.

| Interested Trustees | | | | |

Name, Address,* Year of Birth | Position and Length of Time Served (Term of Office) | Principal Occupation During the Past Five Years | Number of Portfolios in Fund Complex*** to be Overseen by Trustee | Other Directorships Held in the Past 5 Years |

| Frederick Baerenz (1961) | President and Chief Executive Officer; Since Inception | President and Chief Executive Officer of AOG Wealth Management since 2000. | N/A | None |

| Michelle Whitlock (1990) | Chief Financial Officer and Treasurer; Since Inception | Chief Financial Officer of AOG Wealth Management since 2019; Director of Client Services, 2014-2019. | N/A | None |

* The address for each Trustee listed above is 11911 Freedom Drive, Suite 730, Reston, VA 20190.

* * The term of office for the Trustees listed above will continue indefinitely.

* * * The term “Fund Complex” refers to all present and future funds advised by the Investment Adviser or its affiliates.

Frederick Baerenz has served as the President and Chief Executive Officer of the Fund and an Interested Trustee of our Board since inception. Mr. Baerenz is the President and Chief Executive Officer of AOG Wealth Management, an SEC registered investment advisory firm located in Reston, Virginia. He is an accredited investment fiduciary and has been a FINRA registered principal, and has held Series 6, 7, 26, 63, 65, and 79 licenses. Prior to joining AOG Wealth Management, Mr. Baerenz served as Vice President for both Commonwealth Land Title Insurance Company and First American Title Company. At both companies, he prepared and reviewed title examinations, served as a Branch Manager, Risk Officer, and Underwriter of commercial title insurance policies. Mr. Baerenz is a frequent speaker and panelist at professional associations and advisor practice management meetings. In 2013, Mr. Baerenz was elected to the board of directors of the Alternative & Direct Investment Securities Association and has been a member of the Policy, Regulatory and Legal Affairs Committee for the Institute for Portfolio Alternatives since 2013. Mr. Baerenz has served in many local and regional capacities for Crown Financial Ministries over the past twenty years and has served as Chairman of the Board of Directors for David’s Hope International, as a Trustee for Fork Union Military and the International DeMolay Foundation. He graduated from The College of William and Mary with an interdisciplinary major in government, history, and economics. We believe Mr. Baerenz’ s experience in the financial services industry qualifies him to serve as a trustee of our Board.

Michelle Whitlock has served as the Chief Financial Officer and Treasurer of the Fund and an Interested Trustee of our Board since inception. Ms. Whitlock has worked at AOG Wealth Management since 2012, where she serves as a private wealth advisor and Chief Operating Officer. Ms. Whitlock is a certified financial planner and has held Series 7 and 66 licenses. She currently holds the Series 65 license. Ms. Whitlock also oversees the daily business operations of AOG Wealth Management and is part of the investment committee, where she performs in-depth investment research and due diligence. Ms. Whitlock graduated from Virginia Tech with a bachelors degree in finance. We believe Ms. Whitlock’s financial background and experience qualifies her to serve as a trustee of our Board.

Independent Trustees

Name, Address,* Year of Birth | Position and Length of Time Served (Term of Office) | Principal Occupation During the Past Five Years | Number of Portfolios in Fund Complex*** to be Overseen by Trustee | Other Directorships Held in the Past 5 Years |

| John Grady (1961) | Trustee; Since Inception | Attorney/Partner at DLA Piper LLP, 2016-2019; Practus LLP, 2019 – January 2021. Chief Operating Officer of ABR Dynamic Funds, January 2021-Present. | N/A | None |

Kate DiGeronimo (1984) | Trustee; Since Inception | Attorney/Partner at Mound Cotton Wollan & Greengrass LLP. | N/A | None |

* The address for each Trustee listed above is 11911 Freedom Drive, Suite 730, Reston, VA 20190.

* * The term of office for the Trustees listed above will continue indefinitely.

* * * The term “Fund Complex” refers to all present and future funds advised by the Investment Adviser or its affiliates.

John Grady has served as an Independent Trustee of our Board since inception. Mr. Grady has over 35 years of investment management experience, both as a lawyer and an executive. Mr. Grady has been the Chief Operating Officer and General Counsel at ABR Dynamic Fund since February 2021. Prior to joining ABR, Mr. Grady was a Partner at both Practus, LLP and DLA Piper, LLP. Before joining DLA Piper, LLP, Mr. Grady held legal and executive positions with RCS Capital Corporation, Steben & Company and the Nationwide Funds Group, as well as the Constellation Funds Group and Turner Investment Partners. Mr. Grady began his career as an attorney with Ropes & Gray, then moved to Morgan Lewis LLP, where he was named Partner. He currently serves as a member of the board of directors of the Alternative & Direct Investment Securities Association and the Mann Center for the Performing Arts. Mr. Grady received his J.D. at the University of Pennsylvania Law School and received his undergraduate degree from Colgate University with a bachelors in history, magna cum laude. While at Colgate, he was awarded high honors by the History Department and was elected to Phi Beta Kappa. We believe Mr. Grady’s experience and expertise qualifies him to serve as an Independent Trustee of our Board.

Kate DiGeronimo has served as an Independent Trustee of our Board since inception. Ms. DiGeronimo has been an attorney at Mound Cotton Wollan & Greengrass LLP since 2010, where she started as an associate and is currently a Partner. Ms. DiGeronimo has co-authored multiple industry articles related to FINRA and company plan fiduciaries. Ms. DiGeronimo received her J.D. at Fordham University School of Law, where she was editor of the 2009 Mulligan Moot Court Competition and a staff member of the Fordham Law Intellectual Property Law Journal. Ms. DiGeronimo received her undergraduate degree from Fordham University, magna cum laude, and is a member of Phi Betta Kappa. We believe Ms. DiGeronimo’s experience and expertise qualifies her to serve as Independent Trustee of our Board.

Officers

Name, Address,* Year of Birth | Position and Length of Time Served (Term of Office) | Principal Occupation During the Past Five Years |

Frederick Baerenz (1961) | President and Chief Executive Officer; Since Inception | President and Chief Executive Officer of AOG Wealth Management since 2000. |

| Michelle Whitlock (1990) | Chief Financial Officer and Treasurer; Since Inception | Chief Financial Officer of AOG Wealth Management since 2019; Director of Client Services, 2014-2019. |

Jesse Hallee (1976) | Secretary; Since Inception | Senior Vice President and Associate General Counsel; Ultimus Fund Solutions, LLC, 2022-Present; Vice President and Senior Managing Counsel, Ultimus Fund Solutions, LLC, 2019-2022; Vice President and Managing Counsel, State Street Bank and Trust Company, 2013-2019. |

Alexander Woodcock (1989) | Chief Compliance Officer; Indefinite; Since 2022 | Director of PINE Advisor Solutions since 2022; CEO and CCO of PINE Distributors LLC since 2022; Fund Chief Compliance Officer of Redwood Real Estate Income Fund since 2023, Fund Chief Compliance Officer of Nomura Alternative Income Fund since 2022; Adviser Chief Compliance Officer of Destiny Advisors LLC since 2022; Fund Chief Compliance Officer of THOR Financial Technologies Trust since 2022; Vice President of Compliance Services, SS&C ALPS from 2019 to 2022; Manager of Global Operations Oversight, Oppenheimer Funds from 2014 to 2019. |

* The address for each officer listed above is 11911 Freedom Drive, Suite 730, Reston, VA 20190.

* * The term of office for the officers listed above will continue indefinitely.

* * * The term “Fund Complex” refers to all present and future funds advised by the Investment Adviser or its affiliates.

Corporate Governance – Board Committees

In addition to serving on the Board, Trustees may also serve on the Fund’s Audit Committee or Nominating Committee, both of which have been established by the Board to handle certain designated responsibilities. The Board has designated a chairman of the Audit Committee and the Nominating Committee. Subject to applicable laws, the Board may establish additional committees, change the membership of any committee, fill all vacancies and designate alternate members to replace any absent or disqualified member of any committee, or to dissolve any committee as it deems necessary and in the Fund’s best interest.

Audit Committee. The Board has an Audit Committee (the “Audit Committee”) that consists exclusively of Independent Trustees. The Audit Committee operates under a written charter approved by the Board. The principal responsibilities of the Audit Committee include: (i) recommending which firm to engage as the Funds’ independent registered public accounting firm and whether to terminate this relationship; (ii) reviewing the independent registered public accounting firm’s compensation, the proposed scope and terms of its engagement, and the firm’s independence; (iii) pre-approving audit and non-audit services provided by the Funds’ independent registered public accounting firm to the Funds and certain other affiliated entities; (iv) serving as a channel of communication between the independent registered public accounting firm and the Trustees; (v) reviewing the results of each external audit, including any qualifications in the independent registered public accounting firm’s opinion, any related management letter, management’s responses to recommendations made by the independent registered public accounting firm in connection with the audit, reports submitted to the Committee by the internal auditing department of the Administrator that are material to the Funds as a whole, if any, and management’s responses to any such reports; (vi) reviewing the Funds’ audited financial statements and considering any significant disputes between the Funds’ management and the independent registered public accounting firm that arose in connection with the preparation of those financial statements; (vii) considering, in consultation with the independent registered public accounting firm and the Funds’ senior internal accounting executive, if any, the independent registered public accounting firms’ reports on the adequacy of the Funds’ internal financial controls; (viii) reviewing, in consultation with the Funds’ independent registered public accounting firm, major changes regarding auditing and accounting principles and practices to be followed when preparing the Funds’ financial statements; and (ix) other audit related matters. Ms. DiGeronimo and Mr. Grady currently serve as members of the Audit Committee. Mr. Grady serves as the Chair of the Audit Committee. The Board has determined that Mr. Grady is an “Audit Committee Financial Expert” as defined under SEC rules. The Audit Committee charter is attached hereto as Attachment B. During the last fiscal year, the Audit Committee held three committee meetings.

Nominating Committee. The Board has a Nominating Committee (the “Nominating Committee”) that consists exclusively of Independent Trustees. The Nominating Committee operates under a written charter approved by the Board. The principal responsibilities of the Nominating Committee include: (i) considering and reviewing Board governance and compensation issues; (ii) conducting a self-assessment of the Board’s operations; (iii) selecting and nominating all persons to serve as Independent Trustees and considering proposals of and making recommendations for “interested” Trustee candidates to the Board; and (iv) reviewing Shareholder recommendations for nominations to fill vacancies on the Board if such recommendations are submitted in writing and addressed to

the Nominating Committee at a Fund’s office. Ms. DiGeronimo and Mr. Grady currently serve as members of the Nominating Committee. Ms. DiGeronimo serves as the Chair of the Nominating Committee. The Nominating Committee charter is attached hereto as Attachment C. During the last fiscal year, the Nominating Committee did not meet.

Corporate Governance - Fund Committees

The Investment Committee consists of the following members: Frederick Baerenz, James Ortlip, and Aaron Rosen. Biographical information with respect to each member of the Investment Committee is set forth below.

Name | Principal Occupation During the Past Five Years |

| Frederick Baerenz | President and Chief Executive Officer of AOG Wealth Management since 2000. |

| James Ortlip | Chief Investment Officer and a Senior Wealth Advisor since 2009. |

| Aaron Rosen | Portfolio Manager of the Fund since April 2023; Principal of Copia Wealth Services from August 2021 to January 2023; Director of Sky & Ray from August 2021 to January 2023; Managing Director and Portfolio Manager of Validus Growth Investors from November 2014 to August 2021. |

*For information concerning Frederick Baerenz’s background, see above.

Trustee Beneficial Ownership Table

The following table indicates the dollar range of equity securities that the Trustee Nominee and each Trustee beneficially owns in the Fund as of the date hereof.

Name of Trustee Nominee/Trustee | Dollar Range of Equity Securities in the Fund(1) | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Trustee in Family of Investment Companies |

| Trustee Nominee | | |

| Maureen E. O’Toole | None | None |

| Interested Trustees | | |

| Frederick Baerenz | Over $100,000 | Over $100,000 |

| Michelle Whitlock | $50,001-$100,000 | $50,001-$100,000 |

| Independent Trustees | | |

| Kate DiGeronimo | None | None |

| John Grady | None | None |

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC. Under SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote, or to direct the voting of, such security, or “investment power,” which includes the right to dispose of or to direct the disposition of such security. A person also is deemed to be a beneficial owner of any securities which that person has a right to acquire within 60 days. |

Board Responsibilities

The management and affairs of the Fund are overseen by the Trustees. The Board has approved contracts, as described above, under which certain companies provide essential management services to the Fund. During the fiscal year ended September 30, 2022, the Board held seven meetings.

The day-to-day business of the Fund, including the management of risk, is performed by third party service providers, such as the Adviser and the Administrator. The Trustees are responsible for overseeing the Fund’s service providers and, thus, have oversight responsibility with respect to risk management performed by those service providers. Risk management seeks to identify and address risks, i.e., events or circumstances that could have material adverse effects on the business, operations, Shareholder services, investment performance or reputation of the Fund. The Funds and their service providers employ a variety of processes, procedures and controls to identify various possible events or circumstances, to lessen the probability of their occurrence and/or to mitigate the effects of such events or circumstances if they do occur. Each service provider is responsible for one or more discrete aspects of the Fund’s business (e.g., the Adviser is responsible for the day-to-day management of the Fund’s portfolio investments) and, consequently, for managing the risks associated with that business. The Board has emphasized to the Fund’s service providers the importance of maintaining vigorous risk management.

The Trustees’ role in risk oversight begins before the inception of a Fund, at which time certain of the Fund’s service providers present the Board with information concerning the investment objective, strategies and risks of the Fund as well as proposed investment limitations for the Fund. Additionally, the Adviser provides the Board with an overview of, among other things, their respective investment philosophies, brokerage practices and compliance infrastructures. Thereafter, the Board continues its oversight function as various personnel, including the Fund’s Chief Compliance Officer (the “Chief Compliance Officer”), as well as personnel of the Adviser and other service providers such as the Funds’ independent accountants, make periodic reports to the Audit Committee or to the Board with respect to various aspects of risk management. The Board and the Audit Committee oversee efforts by management and service providers to manage risks to which the Funds may be exposed.

The Board is responsible for overseeing the services provided to the Funds by the Adviser and receives information about those services at its regular meetings. In addition, following an initial two-year term, on an annual basis, in connection with its consideration of whether to renew the Advisory Agreements, the Board meets with the Adviser to review such services. Among other things, the Board regularly considers the Adviser’s adherence to the Fund’s investment restrictions and compliance with various Fund policies and procedures and with applicable securities regulations. The Board also reviews information about the Fund’s investments, including, for example, reports on the Adviser’s use of derivatives in managing the Funds, if any, as well as reports on the Fund’s investments in other investment companies, if any.

The Chief Compliance Officer reports regularly to the Board to review and discuss compliance issues and Fund and Adviser risk assessments. At least annually, the Chief Compliance Officer provides the Board with a report reviewing the adequacy and effectiveness of the Fund’s policies and procedures and those of its service providers, including the Adviser. The report addresses the

operation of the policies and procedures of the Fund and each service provider since the date of the last report; any material changes to the policies and procedures since the date of the last report; any recommendations for material changes to the policies and procedures; and any material compliance matters since the date of the last report.

The Board receives reports from the Fund’s service providers regarding operational risks and risks related to the valuation and liquidity of portfolio securities. The Adviser’s Fair Valuation Committee makes regular reports to the Board concerning investments for which market quotations are not readily available. Annually, the Fund’s independent registered public accounting firm reviews with the Audit Committee its audit of the Fund’s financial statements, focusing on major areas of risk encountered by the Funds and noting any significant deficiencies or material weaknesses in the Fund’s internal controls. Additionally, in connection with its oversight function, the Board oversees Fund management’s implementation of disclosure controls and procedures, which are designed to ensure that information required to be disclosed by the Funds in their periodic reports with the SEC are recorded, processed, summarized, and reported within the required time periods. The Board also oversees the Fund’s internal controls over financial reporting, which comprise policies and procedures designed to provide reasonable assurance regarding the reliability of the Fund’s financial reporting and the preparation of the Fund’s financial statements.

From their review of these reports and discussions with the Adviser, the Chief Compliance Officer, the independent registered public accounting firm and other service providers, the Board and the Audit Committee learn in detail about the material risks of the Fund, thereby facilitating a dialogue about how management and service providers identify and mitigate those risks.

The Board recognizes that not all risks that may affect the Fund can be identified and/or quantified, that it may not be practical or cost-effective to eliminate or mitigate certain risks, that it may be necessary to bear certain risks (such as investment-related risks) to achieve the Fund’s goals, and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness. Moreover, reports received by the Trustees as to risk management matters are typically summaries of the relevant information. Most of the Fund’s investment management and business affairs are carried out by or through the Adviser and other service providers each of which has an independent interest in risk management but whose policies and the methods by which one or more risk management functions are carried out may differ from the Fund’s and each other’s in the setting of priorities, the resources available or the effectiveness of relevant controls. As a result of the foregoing and other factors, the Board’s ability to monitor and manage risk, as a practical matter, is subject to limitations.

Board Leadership Structure

Fred Baerenz is the Chairman of the Board. Under the Declaration of Trust and Bylaws, the Chairman of the Board is responsible for (a) presiding at Board meetings, (b) calling special meetings on an as-needed basis, (c) execution and administration of Fund policies, including (i) setting the agendas for Board meetings and (ii) providing information to Board members in advance of each Board meeting and between Board meetings.

Board’s Role in Risk Oversight

The Board has a standing independent Audit Committee with a separate chair. The Board is responsible for overseeing risk management, and the full Board regularly engages in discussions of risk management and receives compliance reports that inform its oversight of risk management from its Chief Compliance Officer at quarterly meetings and on an ad hoc basis, when and if necessary. The Audit Committee considers financial and reporting risk within its area of responsibilities. Generally, the Board believes that its oversight of material risks is adequately maintained through the compliance-reporting chain where the Chief Compliance Officer is the primary recipient and communicator of such risk-related information.

Communication with the Board