UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

AOG INSTITUTIONAL FUND

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

AOG INSTITUTIONAL FUND

11911 Freedom Drive, Suite 730

Reston, VA 20190

[●], 2025

Dear Shareholder,

We are writing to inform you of the upcoming special meeting of shareholders (the “Special Meeting”) of AOG Institutional Fund (the “Fund”). At the Special Meeting, holders of the outstanding shares of the Fund (each, a “Shareholder”) will have the opportunity to vote on important proposals affecting the Fund. The Special Meeting will be held on [●], 2025, at 10:00 a.m. E.T. at the offices of Alpha Omega Group, Inc. dba AOG Wealth Management at 11911 Freedom Drive, Suite 730, Reston, Virginia 20190 and in a “town hall” format by video conference. The information regarding how to participate in the video conference is included in your proxy card included with this statement.

| · | First, the Board of Trustees of the Fund (the “Board”) has approved, subject to the approval of the Shareholders, a new fundamental investment policy under which the Fund will periodically offer to repurchase shares. Pursuant to Rule 23c-3 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), the Fund is proposing to adopt a fundamental policy to offer to repurchase not less than 5% and not more than 25% of the Fund’s outstanding common stock at net asset value once every calendar quarter. |

| · | Second, in connection with the acquisition of the assets of Alpha Omega Group, Inc. dba AOG Wealth Management (“AOG” or the “Adviser”), including its investment management business, by F.L. Putnam Investment Management Company, Inc. (the “New Adviser”), the Board approved a new investment management agreement with the New Adviser (the “New Advisory Agreement”), which agreement the Shareholders are also being asked to approve. |

The question and answer section that follows briefly discusses the proposals. Detailed information about each of the proposals is contained in the enclosed Proxy Statement.

Your vote is important no matter how many shares you own. Voting your shares early will help prevent costly follow-up mail and telephone solicitation. This Proxy Statement provides greater detail about the proposals. The Board recommends that you read the enclosed materials carefully and vote in favor of each proposal.

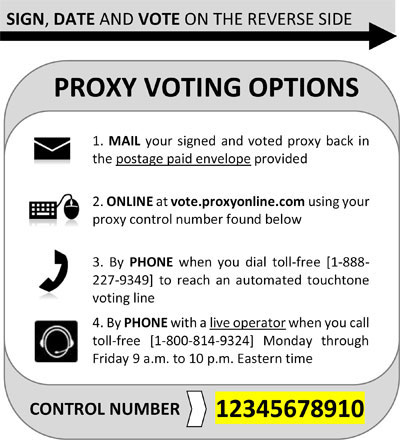

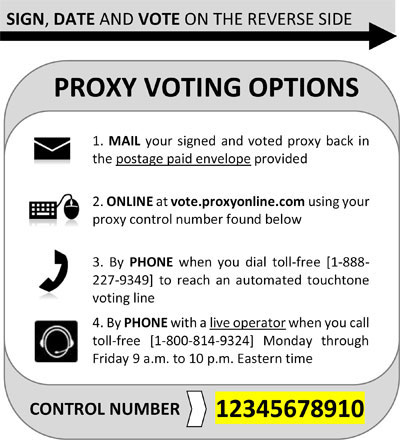

You may choose one of the following options to authorize a proxy to vote your shares (which is commonly known as proxy voting) or to vote in person at the Special Meeting:

| · | Mail: Complete and return the enclosed proxy card. |

| · | Internet: Access the website shown on your proxy card and follow the online instructions. |

| · | Telephone (automated service): Call the toll-free number shown on your proxy card and follow the recorded instructions. |

| · | In person: Attend the Special Meeting on [●], 2025. |

Thank you for your response and for your continued investment in the Fund.

Sincerely,

/s/ Frederick Baerenz

Frederick Baerenz President and Chief Executive Officer

PROXY STATEMENT [●], 2025

AOG INSTITUTIONAL FUND

11911 Freedom Drive, Suite 730

Reston, VA 20190

Relating to a Special Meeting of Shareholders to be held on [●], 2025

This Proxy Statement is being furnished to you by AOG Institutional Fund (the “Fund”) in connection with the solicitation, on behalf of the Board of Trustees (the “Board”) of the Fund, of proxies from the holders of the outstanding shares of the Fund (each, a “Shareholder”), with respect to the special meeting (the “Special Meeting”) of Shareholders. The Special Meeting will be held so that Shareholders can consider the following proposals (the “Proposals”) and transact such other business as may be properly brought before the Special Meeting (and any adjournments or postponements thereof):

| 1. | To approve the adoption of the following fundamental investment policy: to conduct quarterly repurchases of the Fund’s outstanding Shares, in accordance with Rule 23c-3 under the Investment Company Act of 1940, as amended (the “Investment Company Act”); and |

| 2. | To approve a new investment management agreement (the “New Advisory Agreement”) with F.L. Putnam Investment Management Company, Inc. (the “New Adviser”) in connection with its acquisition of the assets of Alpha Omega Group, Inc. dba AOG Wealth Management (“AOG” or the “Adviser”), including its investment management business. |

Shareholders of record at the close of business on the record date, [●], 2025, are entitled to notice of the proxy solicitation and to vote at the Special Meeting and any adjournments or postponements thereof.

The Board unanimously recommends that you vote in favor of the Proposals.

By Order of the Board of Trustees,

/s/ Frederick Baerenz

Frederick Baerenz

President and Chief Executive Officer

Questions and Answers

We encourage you to read the full text of the enclosed Proxy Statement, but, for your convenience, we have provided a brief overview of the Proposals.

Q. Why am I receiving this Proxy Statement?

| A. | You are receiving this Proxy Statement because you were a Shareholder on [●], 2025 and therefore have the right to vote on several important Proposals concerning the Fund. |

Q. What are the Proposals about?

A. This Proxy Statement presents two proposals.

Proposal 1

This proposal relates to adopting a new fundamental investment policy.

You are being asked to approve the adoption of a new fundamental policy regarding quarterly offers to repurchase Fund shares (the “Repurchase Policy”) at the then-current net asset value (“NAV”). Based on the recommendation of the Adviser, the Fund is operating as an “interval fund” pursuant to Rule 23c-3 under the Investment Company Act. As a result, the Board has adopted (subject to Shareholder approval) a fundamental policy to offer to repurchase not less than 5% and not more than 25% of its shares at the then-current NAV each calendar quarter. The Fund is seeking Shareholder approval to adopt the Repurchase Policy.

Proposal 2

You are being asked to approve the New Advisory Agreement in connection with the acquisition of substantially all of the assets of Alpha Omega Group, Inc. dba AOG Wealth Management ("AOG" or the "Adviser"), including its investment management business, by F.L. Putnam Investment Management Company, Inc. (the “New Adviser” or “FLP”). The acquisition of the Adviser's investment management business will result in the termination of the current investment management agreement, dated August 25, 2023, between the Fund and the Adviser (the “Existing Advisory Agreement”) in accordance with the Investment Company Act. The Investment Company Act requires that a new investment advisory agreement be approved by Shareholders.

The Board unanimously recommends that you vote in favor of the Proposals.

Q. Will revising the Repurchase Policy of the Fund affect my account with the Fund?

| A. | No. You will still own the same number of shares in the Fund and the value of your investment will not change as a result of adopting the Repurchase Policy. The Repurchase Policy will allow Shareholders to sell their shares back to the Fund at the then-current NAV once every calendar quarter. Subject to Board approval, the Fund intends to offer to repurchase 5% of its outstanding shares every calendar quarter. |

| Q. | Will the Fund’s investment management fee change under the New Advisory Agreement? |

| A. | No. All material terms (including the investment management fee) of the Existing Advisory Agreement will remain unchanged under the New Advisory Agreement. |

| Q. | Will my shares in the Fund change under the New Advisory Agreement? |

No. Shareholders will still own the same amount and type of shares in the Fund. The shares of common stock of the Fund will continue to be listed on NASDAQ and the ticker symbol (AOGFX) will remain the same. Further details regarding the business to be conducted at the Special Meeting are more fully described in the accompanying Notice of Special Meeting and Proxy Statement.

| Q. | Why is the Board recommending the approval of the New Advisory Agreement? |

| A. | The managers and senior staff of the Adviser conducted an extensive review of firms that could acquire its investment management business, and the Adviser believes that it would be in the best interest of the Fund's Shareholders to have the Fund managed by the New Adviser after the proposed acquisition of its assets by the New Adviser. Substantially all of the investment team currently responsible for managing the Fund will move to the New Adviser as part of the acquisition transaction and will continue to manage the Fund thereafter. The New Adviser has significant research capacity, with a team of more than 20 CFAs, and has over $6 billion in assets under management, including the net assets of the Fund. The New Adviser also provides a deep suite of management expertise to add to the existing AOG team. Based on an extensive review of the New Adviser, the Board, including a majority of independent trustees, approved the New Advisory Agreement and believes it to be in the best interests of the Fund and its Shareholders. |

| Q. | Who is FLP, the New Adviser? |

| A. | FLP was founded in 1983 and has been registered as an investment adviser with the Securities and Exchange Commission since 1984. Registration as an investment adviser does not imply a certain level of skill or training. FLP is majority-owned by F.L. Putnam Securities Company, Inc., a domestic corporation incorporated under the laws of the Commonwealth of Massachusetts. FLP provides discretionary and non-discretionary investment management, investment advisory, investment consulting, and financial planning services. FLP has a diverse clientele that includes individuals and their families as well as foundations, endowments, secondary schools, educational institutions, religious organizations, corporations, and other investment advisers. Many of FLP’s client relationships span decades and generations. Certain key employees of FLP are also FLP shareholders. FLP’s wholly owned subsidiary, Darwin Trust Company of New Hampshire, LLC (“Darwin Trust”), is a New Hampshire chartered trust company that provides non-depository trust services to its clients. FLP’s offices are located in Lynnfield, Needham, and Boston, Massachusetts; Portland, Maine; Wolfeboro, New Hampshire; Providence, Rhode Island; and Amherst, and New York, New York. |

Q. Who will pay for the proxy solicitation and related legal costs?

| A. | The Adviser will pay for the proxy solicitation and related legal costs. The Adviser estimates that the cost of preparing, printing and mailing the Proxy Statement and soliciting Shareholder votes will be approximately $9,912. |

Q. What will happen if Shareholders do not approve the Proposals?

A. Approval of Proposals 1 and 2 requires the vote of a “majority” of the Fund’s outstanding shares, which is a vote by the holders of the lesser of: (i) 67% or more of the voting securities present in person or by proxy at a meeting, if the holders of more than 50% of the outstanding voting securities are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities. If Shareholders do not approve Proposals 1 and 2, the Fund (i) will not be able to offer periodic repurchases of the Fund’s outstanding shares on a quarterly basis and (ii) will not enter into the New Advisory Agreement. If Shareholders approve one of the two Proposals, the approved Proposal will be implemented and the Proposal that does not receive the requisite number of Shareholder votes will not be implemented.

If approved, Proposals 1 and 2 will be implemented upon the date of a post-effective amendment to the Fund’s registration statement disclosing the changes and filed with the Securities and Exchange Commission.

Q. What is the Board’s recommendation?

| A. | After careful consideration, the Board unanimously recommends that Shareholders vote FOR all Proposals. |

TABLE OF CONTENTS

| PROPOSAL 1: ADOPTION OF FUNDAMENTAL POLICY TO CONDUCT PERIODIC REPURCHASE OFFERS | 2 |

| PROPOSAL 2: APPROVAL OF THE NEW ADVISORY AGREEMENT BETWEEN THE FUND AND THE NEW ADVISER | 7 |

| ADDITIONAL INFORMATION | 13 |

PROXY STATEMENT

[●], 2025

AOG INSTITUTIONAL FUND

11911 Freedom Drive, Suite 730

Reston, VA 20190

Relating to a Special Meeting of Shareholders to be held on [●], 2025

This Proxy Statement is being furnished to you by AOG Institutional Fund (the “Fund”) in connection with the solicitation, on behalf of the Board of Trustees (the “Board”) of the Fund, of proxies from the holders of the outstanding shares of the Fund (each, a “Shareholder”), with respect to the special meeting (the “Special Meeting”) of Shareholders. The Special Meeting will be held so that Shareholders can consider the following proposals (the “Proposals”) and transact such other business as may be properly brought before the Special Meeting (and any adjournments or postponements thereof):

| 1. | To approve the adoption of the following fundamental investment policy: to conduct quarterly repurchases of the Fund’s outstanding Shares, in accordance with Rule 23c-3 under the Investment Company Act of 1940, as amended (the “Investment Company Act”); and |

| 2. | To approve a new investment management agreement (the “New Advisory Agreement”) with F.L. Putnam Investment Management Company, Inc. (the “New Adviser”) in connection with its acquisition of the assets of Alpha Omega Group, Inc. dba AOG Wealth Management ("AOG" or the "Adviser"), including its investment management business. |

We anticipate that the notice of Special Meeting of Shareholders, this Proxy Statement and the proxy card (collectively, the “Proxy Materials”) will be mailed to Shareholders beginning on or about [●].

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on [●], 2025:

The Notice of Special Meeting and Proxy Statement are available at:

vote.proxyonline.com/AOG/docs/2023meeting.pdf

Please read the Proxy Statement before voting on the proposals. If you need additional copies of this Proxy Statement or the proxy card, please contact American Stock Transfer Fund Solutions at (800) 814-9324 or in writing at Alpha Omega Group, Inc. dba AOG Wealth Management, 11911 Freedom Drive, Suite 730, Reston, VA 20190. Additional copies of this Proxy Statement will be delivered to you promptly upon request. To obtain directions to attend the meeting, please call (800) 814-9324. Shareholders of record at the close of business on the record date, [●] (the “Record Date”), are entitled to notice of and to vote at the Special Meeting and any adjournments or postponements thereof. As of the Record Date, the Fund had [●] shares outstanding. Each share entitles its holder to one vote at the Special Meeting.

PROPOSAL 1:

ADOPTION OF FUNDAMENTAL POLICY TO CONDUCT PERIODIC REPURCHASE OFFERS

On April 17, 2023, the Board unanimously voted to convert the Fund to an interval fund, subject to Shareholder approval. An interval fund is a closed-end investment management company that has adopted a fundamental policy to conduct periodic repurchases of its outstanding common shares pursuant to Rule 23c-3 under the Investment Company Act. The Board is seeking your approval to amend the policy to conduct periodic repurchases of the Fund’s common shares on a quarterly basis (the “Repurchase Policy”).

Background and Reasons

The Board recommends a vote for the proposal to approve the Repurchase Policy, because such repurchase offers will ensure greater and more consistent liquidity for Shareholders. As described in greater detail below, upon implementing the Repurchase Policy, the Fund will be required to conduct quarterly repurchase offers unless limited exceptions, as discussed below, apply. Currently, the Fund is required to conduct annual repurchase offers.

Pursuant to the Repurchase Policy, the Fund intends to offer to make one repurchase offer of no less than 5% and no more than 25% of its shares outstanding in each calendar quarter at a price equal to the then-current net asset value per share (“NAV”). Such repurchases are referred to as “Mandatory Repurchases” because the Fund is required to conduct the repurchase offer unless certain limited circumstances occur (as set forth below under the heading “Suspension or Postponement of Mandatory Repurchase”). The Board currently intends to make a repurchase offer for 5% of the Fund’s outstanding shares each calendar quarter. If a repurchase offer by the Fund is oversubscribed, the Fund may purchase additional shares up to a maximum amount of an additional 2% of the outstanding shares of the Fund. If the Fund determines not to repurchase more than the repurchase offer amount, or if security holders tender stock in an amount exceeding the repurchase offer amount plus 2% of the common shares outstanding on the Repurchase Request Deadline (as defined below), the Fund will repurchase shares on a pro rata basis. There is no guarantee that Shareholders will be able to sell all of the shares they desire in a Mandatory Repurchase. The Fund intends to maintain liquid securities, cash or access to a bank line of credit in amounts sufficient to meet the quarterly redemption offer requirements.

If the Repurchase Policy is approved, the offer to repurchase shares will be a fundamental policy of the Fund that may not be changed without the vote of the holders of a majority of the Fund’s outstanding voting securities (as defined in the Investment Company Act). Shareholders will be notified in writing of each Mandatory Repurchase and the date that the repurchase offer will end (the “Repurchase Request Deadline”). Shares will be repurchased at the then-current NAV per share determined as of the close of regular trading on the New York Stock Exchange (“NYSE”) no later than the 14th day after the Repurchase Request Deadline, or the next business day if the 14th day is not a business day (each a “Repurchase Pricing Date”).

Shares tendered for repurchase by Shareholders prior to any Repurchase Request Deadline will be repurchased subject to the aggregate repurchase amounts established for that Repurchase Request Deadline. The time between the notification to Shareholders and the Repurchase Request Deadline is generally 30 days but may vary from no more than 42 days to no less than 21 days. Payment pursuant to the repurchase will be made by checks to the Shareholder’s address of record or credited directly to a predetermined bank account on the purchase payment date, which will be no more than seven days after the Repurchase Pricing Date.

The Board may establish other policies for repurchases of shares that are consistent with the Investment Company Act, regulations thereunder and other pertinent laws.

Determination of Repurchase Offer Amount

The Board, in its sole discretion, will determine the number of shares that the Fund will offer to repurchase (the “Repurchase Offer Amount”) for the given Repurchase Request Deadline. The Repurchase Offer Amount will be no less than 5% and no more than 25% of the total number of shares outstanding on the Repurchase Request Deadline. Investors should not rely on Mandatory Repurchases being made in amounts in excess of 5% of the total number of shares outstanding. If a repurchase offer by the Fund is oversubscribed, the Fund may purchase additional shares up to a maximum amount of an additional 2% of the outstanding shares of the Fund. If Shareholders tender for repurchase more than the Repurchase Offer Amount plus an additional 2% (if applicable), the Fund will repurchase the shares on a pro rata basis, provided that the Fund may accept all shares tendered for Mandatory Repurchase by Shareholders who own less than one hundred shares and who tender all of their shares, before prorating other amounts tendered. In addition, the Fund will accept the total number of shares tendered in connection with required minimum distributions from an individual retirement account (“IRA”) or other qualified retirement plan. It is the Shareholder’s obligation to both notify and provide the Fund supporting documentation of a required minimum distribution from an IRA or other qualified retirement plan.

Notice to Shareholders

Approximately 30 days (but no less than 21 days and more than 42 days) before each Repurchase Request Deadline, the Fund shall send to each Shareholder of record and to each beneficial owner of the shares that are the subject of the repurchase offer a notification (“Shareholder Notice”). The Shareholder Notice will contain information Shareholders should consider when deciding whether or not to tender their shares for Mandatory Repurchase. The notice also will include detailed instructions on how to tender shares for the Mandatory Repurchase, state the Repurchase Offer Amount and identify the dates of the Repurchase Request Deadline, the scheduled Repurchase Pricing Date, and the date the repurchase proceeds are scheduled for payment (the “Repurchase Payment Deadline”). The notice also will set forth the NAV computed by the Fund no more than seven days before the date of the Shareholder Notice, and how Shareholders may ascertain the NAV after the notification date.

Repurchase Price

The share repurchase price will be the then-current NAV as of the close of regular trading on the NYSE on the Repurchase Pricing Date. You may call 877-600-3573, Monday through Friday, except holidays, during normal business hours of 8:30 a.m. to 5:30 p.m. (Eastern Time) to learn the then-current NAV for each of the five days before the Repurchase Pricing Date. The Shareholder Notice also will provide information concerning the NAV, such as the NAV as of a recent date or a sampling of recent NAVs, and a toll-free number for information regarding the Mandatory Repurchase.

Repurchase Amounts and Payment of Proceeds

Shares tendered for Mandatory Repurchase by Shareholders prior to any Repurchase Request Deadline will be repurchased subject to the aggregate Repurchase Offer Amount established for that Repurchase Request Deadline. Payment pursuant to the Mandatory Repurchase will be made by check to the Shareholder’s address of record or credited directly to a predetermined bank account on the purchase payment date, which will be no more than seven days after the Repurchase Pricing Date. The Board may establish other policies for repurchases of shares that are consistent with the Investment Company Act, regulations thereunder and other pertinent laws.

If Shareholders tender for repurchase more than the Repurchase Offer Amount for a given Mandatory Repurchase, the Fund may, but is not required to, repurchase an additional amount of shares not to exceed 2% of the outstanding shares of the Fund on the Repurchase Request Deadline. If the Fund determines not to repurchase more than the Repurchase Offer Amount, or if Shareholders tender shares in an amount exceeding the Repurchase Offer Amount plus 2% of the outstanding shares on the Repurchase Request Deadline, the Fund will repurchase the shares on a pro rata basis. However, the Fund may accept all shares tendered for repurchase by Shareholders who own less than one hundred shares and who tender all of their shares, before prorating other amounts tendered. In addition, the Fund will accept the total number of shares tendered in connection with required minimum distributions from an IRA or other qualified retirement plan.

Suspension or Postponement of Mandatory Repurchase

The Fund may suspend or postpone a Mandatory Repurchase pursuant to a vote by a majority of the Board, including a majority of its independent trustees, and only: (i) if making or effecting the Mandatory Repurchase would cause the Fund to lose its status as a RIC under the Internal Revenue Code of 1986, as amended; (ii) for any period during which the NYSE or any market on which the securities owned by the Fund are principally traded is closed, other than customary weekend and holiday closings, or during which trading in such market is restricted; (iii) for any period during which an emergency exists as a result of which disposal by the Fund of securities owned by it is not reasonably practicable, or during which it is not reasonably practicable for the Fund fairly to determine the value of its net assets; or (iv) for such other periods as the Securities and Exchange Commission (the “SEC”) may by order permit for the protection of Shareholders of the Fund. If a Mandatory Repurchase is suspended or postponed, the Fund will provide notice to its Shareholders of such suspension or postponement. If the Fund renews the Mandatory Repurchase, the Fund will send a new notification to its Shareholders in compliance with Rule 23c-3.

Liquidity Requirements

The Fund must maintain liquid assets equal to the Repurchase Offer Amount from the time that the Shareholder Notice is sent until the Repurchase Pricing Date. The Fund will ensure that a percentage of its net assets equal to at least 100% of the Repurchase Offer Amount consists of assets that can be sold or disposed of in the ordinary course of business at approximately the price at which the Fund has valued the investment within the time period between the Repurchase Request Deadline and the Repurchase Payment Deadline. The Board will adopt procedures that are reasonably designed to ensure that the Fund’s assets are sufficiently liquid so that the Fund can comply with a Mandatory Repurchase and the liquidity requirements described in this section. If, at any time, the Fund falls out of compliance with these liquidity requirements, the Board will take whatever action it deems appropriate to ensure compliance.

Risks Related to the Approval of Proposal 1

Mandatory Repurchases will typically be funded from available cash or access to a bank line of credit in amounts sufficient to meet the quarterly repurchase offer requirements. Payment for repurchased shares, however, may require the Fund to liquidate portfolio holdings earlier than the Adviser, or the New Adviser if Proposal 2 is approved, otherwise would, thus increasing the Fund’s portfolio turnover and potentially causing the Fund to realize losses. The Adviser, or the New Adviser if Proposal 2 is approved, intends to take measures to attempt to avoid or minimize such potential losses and turnover, and instead of liquidating portfolio holdings, may borrow money to finance repurchases of shares. If the Fund borrows to finance repurchases, interest on that borrowing will negatively affect Shareholders who do not tender their shares in a Mandatory Repurchase by increasing the Fund’s expenses and reducing any net investment income. To the extent the Fund finances repurchase amounts by selling Fund investments, the Fund may hold a larger proportion of its assets in less liquid securities. The sale of portfolio securities to fund Mandatory Repurchases also could reduce the market price of those underlying securities, which in turn would reduce the Fund’s NAV. In addition, the Fund may sell portfolio securities at an inopportune time and may suffer losses or unexpected tax liabilities. Repurchase of the Fund’s shares will tend to reduce the amount of outstanding shares and, depending upon the Fund’s investment performance, its net assets. A reduction in the Fund’s net assets would increase the Fund’s expense ratio, to the extent that additional shares are not sold and expenses otherwise remain the same (or increase). In addition, the repurchase of shares by the Fund will be a taxable event to Shareholders.

The Fund is intended as a long-term investment. The Mandatory Repurchases will be the only means of liquidity provided by the Fund through which Shareholders have a right to redeem their shares, subject to a limited number of extenuating circumstances. Because the Fund will provide liquidity through the Mandatory Repurchases, it does not anticipate seeking to complete a liquidation event in the future. Additionally, under the Repurchase Policy, the Mandatory Repurchase will only occur quarterly, which will limit Shareholders’ options for liquidity through repurchases to once a quarter. Other than Mandatory Repurchases, Shareholders do not have the right to have their shares redeemed by the Fund or transfer or exchange their shares, other than limited rights of a Shareholder’s descendants to redeem shares in the event of such Shareholder’s death pursuant to certain conditions and restrictions. The Fund’s shares are not traded on a national securities exchange. In the future and upon obtaining Board approval, the Fund anticipates that it will make its shares available for secondary transfers on a periodic basis through an auction conducted via Nasdaq Fund Secondaries.

Vote Required

Approval of Proposal 1 requires the affirmative vote of a majority of the Fund’s outstanding voting shares. The Investment Company Act defines a “majority vote” as the vote of Shareholders owning the lesser of (a) 67% or more of the shares present at a meeting of Shareholders, if the holders of more than 50% of a fund’s outstanding shares are present or represented by proxy at such meeting; or (b) more than 50% of a fund’s outstanding voting shares. For purposes of the Shareholder vote solicited here, a majority vote means the vote of more than 50% of the outstanding shares of the Fund on the Record Date.

The Board recommends a vote “FOR” Proposal 1.

PROPOSAL 2:

APPROVAL OF NEW ADVISORY AGREEMENT WITH THE NEW ADVISER

The Adviser has entered into a purchase agreement with F.L. Putnam Investment Management Company, Inc., a Maine Corporation (“New Adviser” or “FLP”), pursuant to which FLP will acquire the assets of the Adviser, including its investment management business related to the Fund (the “Transaction”). The Transaction would result in the termination of the current investment management agreement, dated August 25, 2023, between the Fund and the Adviser (the “Existing Advisory Agreement”) in accordance with the Investment Company Act. Accordingly, Shareholders are being asked to approve the New Advisory Agreement between the Fund and the New Adviser.

Existing Advisory Agreement

The Adviser has served as the investment adviser to the Fund pursuant to the Existing Advisory Agreement. The Existing Advisory Agreement was approved by Shareholders on June 23, 2023.

New Advisory Agreement

The Adviser has entered into an asset purchase agreement with FLP, pursuant to which FLP will acquire all or substantially all of the assets of the Adviser (the “Transaction”), including its investment management business. The Transaction will result in the termination of the Existing Advisory Agreement, in accordance with Section 15(b)(2) the Investment Company Act. In connection with the Transaction, the Fund is relying on the safe harbor provided by Section 15(f) of the Investment Company Act.

Shareholders are being asked to approve the New Advisory Agreement. All material terms of the Existing Advisory Agreement will remain unchanged under the New Advisory Agreement. The Investment Company Act requires that a new investment advisory agreement be approved by both a majority of an investment company’s trustees who are not “interested persons,” as defined by Section 2(a)(19) of the Investment Company Act, and “a majority of the outstanding voting securities,” as such terms are defined under the Investment Company Act. The Board consulted independent legal counsel with respect to its review and analysis of the Transaction. The Board, including a majority of independent trustees, has approved the New Advisory Agreement and believes it to be in the best interests of the Fund and its Shareholders. If approved by the required majority of the Shareholders, the New Advisory Agreement will become effective upon the closing of the Transaction, which is expected to occur as soon as practicable following the Special Meeting.

At the closing of the Transaction, one of the Fund’s two current interested trustees, Michelle Whitlock, will resign from the Board. As a result, upon the closing of the Transaction, the Board will consist of the three current independent trustees and one interested trustee. Therefore, the Fund would satisfy the 75% independent director requirement under Section 15(f) of the Investment Company Act upon the closing of the Transaction. In addition, upon the closing of the Transaction, the officers of the Fund and certain members of the investment committee of the Adviser will continue in their existing roles. The Fund is also expected to maintain its service arrangements with its fund administrator, fund accountant, transfer agent, distributor, custodian, and legal counsel to provide further continuity.

Following the completion of the Transaction, the Fund’s name will remain the same and the Fund will continue to operate as an interval fund. Mr. Baerenz will continue as CEO and as an interested trustee of the Fund. He will also be named an FLP Principal and Managing Director of Interval Funds. Aaron Rosen and Jim Ortlip, each a member of the Adviser’s investment committee, will also be named as

Principals of FLP. Additionally, Mr. Rosen will continue to serve as the Fund’s Chief Investment Officer and will serve as a co-Portfolio Manager of the Fund with Michael Boensch, Principal and Managing Director of Investment Manager Research at FLP.

Following the Transaction, Shareholders will still own the same amount and type of shares in the Fund. The shares of common stock of the Fund will continue to be listed on NASDAQ and the ticker symbol (AOGFX) will remain the same.

The managers and senior staff of the Adviser conducted an extensive review of firms that would acquire its assets and concluded that it would be in the best interest of the firm's clients and staff to sell all or substantially all of its assets, including its investment management business, to FLP. Substantially all of the investment team currently responsible for managing the Fund will move to the New Adviser as part of the acquisition transaction and will continue to manage the Fund thereafter. FLP has extensive research capacity, with a team of more than 20 CFAs and over $6 billion in assets under management. FLP also provides a deep suite of management expertise to add to the existing AOG team. Based on a thorough review of FLP and its capabilities, the Board, including a majority of independent trustees, has approved the New Advisory Agreement and believes it to be in the best interests of the Fund and its Shareholders.

Based on the considerations described below under “Board Considerations,” the Board, including all of the Independent Trustees, unanimously approved the New Advisory Agreement on behalf of the Fund.

Information about the New Adviser

FLP is located at 6 Kimball Lane, Lynnfield, Massachusetts, 01940. FLP was founded in 1983 and has been registered as an investment adviser with the Securities and Exchange Commission since 1984. FLP is majority-owned by F.L. Putnam Securities Company, Inc., a domestic corporation incorporated under the laws of the Commonwealth of Massachusetts. FLP provides discretionary and non-discretionary investment management, investment advisory, investment consulting, and financial planning services. FLP has a diverse clientele that includes individuals and their families as well as foundations, endowments, secondary schools, educational institutions, religious organizations, corporations, and other investment advisers. Many of FLP’s client relationships span decades and generations. Certain key employees of FLP are also FLP shareholders. FLP’s offices are located in Lynnfield, Needham, and Boston, Massachusetts; Portland, Maine; Wolfeboro, New Hampshire; Providence, Rhode Island; and Amherst, and New York, New York.

The names and principal occupations of the principal executive officers and directors of FLP are listed below:

| Name | Title |

| R. Thomas Manning, Jr., CFA | President and Chief Executive Officer |

| Ellen Flaherty | Chief Operating Officer, Director |

| Chris Parker | Chief Administrative Officer |

| Albert Parent | Chief Technology Officer and Chief Information Security Officer |

| Michael Timmermans | General Counsel, Chief Compliance Officer |

| Molly O’Connor | Chief People Officer |

| Susanne Stauffer | Director |

| Lee Alan Gosule | Director |

| Meredith Lepper | Director |

| Richard Osterberg | Director |

The address for FLP and the principal executive officers and directors of FLP is 6 Kimball Lane, Lynnfield, MA, 01940.

Summary of Existing Advisory Agreement and New Advisory Agreement

There are no material differences between the terms of the New Advisory Agreement and the terms of the Existing Advisory Agreement, which will terminate at the close of the Transaction. The form of the New Advisory Agreement is attached as Attachment A, and the description of the New Advisory Agreement is qualified in its entirety by reference to Attachment A.

Advisory Duties. Under the New Advisory Agreement, similar to the Existing Advisory Agreement, the New Adviser will manage the investment and reinvestment of the assets, including the regular furnishing of advice with respect to the Fund’s portfolio transactions subject at all times to the oversight of the Board. Under the New Advisory Agreement, similar to the Existing Advisory Agreement, officers of the New Adviser are required to create and maintain all necessary books and records in accordance with all applicable laws, rules and regulations, including but not limited to records required by Section 31(a) of the Investment Company Act and the rules thereunder.

Compensation. Under the New Advisory Agreement, the Fund will pay the New Adviser the management fee of 1.49% of the Fund’s average daily Managed Assets (as defined in the New Advisory Agreement). Under both agreements, the management fee is accrued daily and paid monthly. Under the New Advisory Agreement, similar to the Existing Advisory Agreement, the Fund will reimburse the New Adviser for certain expenses that it pays on behalf of the Fund.

Brokerage. Under the New Advisory Agreement, similar to the Existing Advisory Agreement, the New Adviser is authorized to direct portfolio transactions to broker-dealers for execution on terms and at rates which it believes, in good faith, to be reasonable in view of the overall nature and quality of services provided by a particular broker-dealer, including brokerage and research services. Under the New Advisory Agreement, similar to the Existing Advisory Agreement, the New Adviser will seek best execution of securities transactions and in compliance with Section 28(e) of the Securities Exchange Act of 1934, as amended. Under the New Advisory Agreement, similar to the Existing Advisory Agreement, the New Adviser may pay a broker or a dealer a commission in excess of the amount of commission another broker or dealer would have charged if the New Adviser determines in good faith that the commission paid was reasonable in relation to the brokerage and research services provided.

Expenses. Similar to the Existing Advisory Agreement, the New Advisory Agreement provides that the Fund assumes and shall pay all the expenses required for the conduct of its business, including expenses borne indirectly through the Fund’s investments in funds, all costs and expenses directly related to portfolio transactions and positions for the Fund, fees of the New Adviser, fees and commissions in connection with the purchase and sale of portfolio securities for the Fund, costs, including the interest expense, of borrowing money, salaries and other compensation of (1) any of the Fund’s officers and employees who are not officers, trustees, members or employees of the New Adviser, or any of their affiliates, and (2) the Fund’s chief compliance officer to the extent determined by those trustees of the Fund who are not interested persons of the New Adviser, or any of their affiliates, and auditing and

legal fees and expenses. Similar to the Existing Advisory Agreement, the New Advisory Agreement provides that the Fund will reimburse the New Adviser for any of the above expenses that it pays on behalf of the Fund, unless agreed otherwise.

Limitation on Liability. Similar to the Existing Advisory Agreement, the New Advisory Agreement provides that the New Adviser shall not be liable to the Fund or any Shareholder for any error of judgment or mistake of law or for any loss suffered by the Fund or the Shareholders, except in the case of willful misfeasance, bad faith, or gross negligence in the performance of the New Adviser’s duties or by reason of its reckless disregard of obligations and duties under the agreement.

Term. The Existing Advisory Agreement was in effect for an initial two-year term and was eligible to be continued thereafter for successive one-year periods if such continuance was specifically approved at least annually in the manner required by the Investment Company Act. The Existing Advisory Agreement will terminate at the close of the Transaction. If the Shareholders approve the New Advisory Agreement, the New Advisory Agreement will be effective upon the effective date of a post-effective amendment to the Fund’s registration statement that discloses the New Advisory Agreement and will have an initial term ending two years after the effective date. Thereafter, the New Advisory Agreement may be continued for successive one-year periods if approved at least annually in the manner required by the Investment Company Act.

Termination. Similar to the Existing Advisory Agreement, the New Advisory Agreement will terminate automatically in the event of assignment, at any time by the majority of the Shareholders or the Board upon 60 days’ written notice to the New Adviser or by the New Adviser upon 60 days’ written notice.

Amendments. Similar to the Existing Advisory Agreement, the New Advisory Agreement provides that the New Advisory Agreement may be amended only by written agreement between the New Adviser and the Fund, which amendment must be authorized by the Board, including the vote of a majority of the Independent Trustees and, where required by the Investment Company Act, the Shareholders.

Board Considerations - Approval of New Advisory Agreement

The Board previously approved the Existing Advisory Agreement on April 17, 2023, which changed the payor of the management fee and removed AOG Institutional Diversified Tender Fund as a party thereto. On June 2, 2023, the Fund commenced solicitation of, and on June 23, 2023 received, the vote of the outstanding voting securities of the Fund needed to approve the Existing Advisory Agreement. All material terms of the Existing Advisory Agreement will remain unchanged under the New Advisory Agreement. In considering the approval and recommendation to the Shareholders of the New Advisory Agreement, the Board reconsidered certain of those factors previously reviewed by it at the April 17, 2023 meeting, the substantially similar terms of the Existing Advisory Agreement and the New Advisory Agreement, and the qualifications of FLP to serve as the New Adviser.

The Board, which is comprised of five trustees, three of whom are not “interested persons” (as defined under the Investment Company Act) of the Fund (“Independent Trustees”), reviewed the New Advisory Agreement at a special meeting held on January 13, 2025. In determining whether to approve New Advisory Agreement, the Board evaluated information relevant to its consideration of the New Advisory Agreement and how the capabilities of the New Adviser would enhance the management of the Fund for the benefit of Shareholders.

In considering the New Advisory Agreement, the Board reviewed and analyzed various factors with respect to the Fund that it determined were relevant, including the factors below, and made the following conclusions. In their deliberations, the Board did not identify any single factor as determinative but considered all factors together. The Board was aided in its deliberations by independent legal counsel.

In addition to the specific factors considered by the Board below, the Board also considered broader factors, such as the responsibility, attention, and diligence the New Adviser would need to devote to the Fund and the ability of the New Adviser to attract portfolio management talent and expand the personnel to meet the Fund’s investment objective. In addition, the Board considered whether the New Adviser would be able to deliver services that would promote the long-term strategic direction for the Fund.

Nature and Quality of Services Provided to the Fund

The Board analyzed the nature, extent and quality of the services to be provided to the Fund by FLP and, given the intent to retain the majority of the AOG professionals, the services that AOG has provided to the Fund since its inception in 2021. In particular, the Board considered the added benefits of FLP’s personnel and advisory services to the Fund. The Board also considered FLP’s expertise in providing sub-advisory investment management services to semi-liquid funds registered under the Investment Company Act. The Board concluded that the nature and quality of the services to be provided by FLP and the additional resources for the AOG team, are appropriate and that the Fund will benefit from the services provided under the New Advisory Agreement.

Scope and Costs of Services Provided

As part of its review at the meeting, the Board considered that the fees realized and the costs incurred, by the New Adviser in providing investment advisory services to the Fund are expected to be the same or less than the fees incurred under the Existing Advisory Agreement. The Board considered the willingness of the New Adviser to service the Fund pursuant to the expense limit cap under the Form of Expense Limitation Agreement, approved by the Board on January 13, 2024, while potentially lowering fees and expenses over time in line with asset growth and greater efficiencies. The Form of Expense Limitation Agreement approved by the Board on January 13, 2025 will go into effect if Shareholders approve the New Advisory Agreement. In light of all of the information it received and considered, the Board concluded that the management fee to be paid to the New Adviser under the New Advisory Agreement is reasonable.

Economies of Scale and Fee Levels Reflecting Those Economies

The Board compared the Fund’s proposed fees under the New Advisory Agreement to the comparative data provided and discussed potential economies of scale. The Board considered FLP’s willingness to potentially reduce fees and expenses over time as the Fund grows in size. The Board concluded that the proposed fee structure under the New Advisory Agreement is reasonable given the Fund’s current asset size.

Benefits Derived from the Relationship with the Fund

The Board was informed that the Fund would potentially fill an important role in FLP’s delivery of services to its advisory clients.

To a lesser extent, the Board also discussed the following adverse considerations: the uncertainty of obtaining the requisite vote to approve the proposals; the uncertainty regarding the outcome of the proposals and the impact on the Fund’s capital raising efforts; the attention and time that the proposals will require from the personnel of AOG and FLP which could potentially distract from investment management duties.

Based on its evaluation of the above factors, as well as other factors relevant to their consideration of the New Advisory Agreement, the Board, three of whom are independent trustees, concluded that the approval of the New Advisory Agreement was in the best interest of the Fund and its Shareholders.

Based on all of the foregoing, the Board recommends that Shareholders vote FOR the approval of the New Advisory Agreement.

Vote Required

Approval of the New Advisory Agreement requires the affirmative vote of a majority of the Fund’s outstanding voting shares. The Investment Company Act defines a “majority vote” as the vote of Shareholders owning the lesser of (a) 67% or more of the shares present at a meeting of Shareholders, if the holders of more than 50% of a fund’s outstanding shares are present or represented by proxy at such meeting; or (b) more than 50% of a fund’s outstanding voting shares. For purposes of the Shareholder vote solicited here, a majority vote means the vote of more than 50% of the outstanding shares of the Fund on the Record Date.

The Board recommends a vote “FOR” Proposal 2.

ADDITIONAL INFORMATION

Service Providers

Ultimus Fund Solutions, LLC serves as the Fund’s administrator, transfer agent and dividend paying agent. Pine Advisor Solutions LLC provides the Fund with an outsourced chief compliance officer, as well as related compliance services. Ultimus Fund Solutions, LLC is located at 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. Pine Advisor Solutions LLC is located at 501 South Cherry Street, Suite 610, Denver, CO 80246.

Fifth Third Bank, N.A., with its principal place of business located at 38 Fountain Square Plaza, Cincinnati, Ohio 45263, serves as Custodian for the securities and cash of the Fund’s portfolio.

Shares Outstanding

As of the Record Date, [●] shares of the Fund were issued and outstanding and entitled to vote on the Proposals.

Security Ownership of Certain Beneficial Owners and Management

The Fund’s trustees are divided into two groups – interested trustees and independent trustees. Interested trustees are “interested persons” of the Fund, as defined in the Investment Company Act.

The following table sets forth, as of the Record Date, certain ownership information with respect to the Fund’s common shares for those persons who may, insofar as is known to us, directly or indirectly own, control or hold with the power to vote, 5% or more of the Fund’s outstanding common shares and the beneficial ownership of each current trustee, the nominees for trustee, the Fund’s executive officers, and the executive officers and trustees as a group.

Unless otherwise indicated, we believe that each person set forth in the table below has sole voting and investment power with respect to all shares of the Fund’s common shares he or she beneficially owns and has the same address as the Fund. The Fund’s address is 11911 Freedom Drive, Suite 730, Reston, VA 20190.

| Name and Address of Beneficial Owner(1) | Number of Shares Beneficially Owned | Percentage of Shares Outstanding(2) |

| 5% or more holders | | |

| N/A | - | - |

| Interested Trustees | | |

| Frederick Baerenz | 54,444.432 | 1.44% |

| Michelle Whitlock | 5,263.158 | * |

| Independent Trustees | | |

| Betsy Cochrane | - | - |

| John Grady | - | - |

| Maureen E. O’Toole | | |

| Executive Officers | | |

| Frederick Baerenz | 54,444.432 | 1.44% |

| Michelle Whitlock | 5,263.158 | * |

| Jesse Hallee | - | - |

| Alexander Woodcock | - | - |

| Executive officers and Trustees as a group(3) | 59,707.59 | 1.58% |

* Represents less than one percent

| (1) | The business address of each Trustee and executive officer of the Fund is c/o AOG Wealth Management, 11911 Freedom Drive, Suite 730, Reston, VA 20190. |

| (2) | Based on a total of 3,773,838.745 of the Fund’s common shares issued and outstanding as of the Record Date. |

| (3) | As of the date of this Proxy Statement, certain trustees, officers, and members of the Investment Committee collectively owned 1.66% of the Fund but no individual trustee, officer or member of the Investment Committee owned 5% or more of the outstanding shares of the Fund. |

Required Vote

In order for Proposals 1 and 2 to be approved, holders of a “majority of the outstanding voting securities” of the Fund must vote to approve Proposal 1 and Proposal 2. The term “majority of the outstanding voting securities,” as defined in the Investment Company Act and as used in this Proxy Statement, means the vote of Shareholders owning the lesser of (a) 67% or more of the shares present at a meeting of Shareholders, if the holders of more than 50% of a fund’s outstanding shares are present or represented by proxy at such meeting; or (b) more than 50% of a fund’s outstanding voting shares. Abstentions will have the effect of a “vote withheld” on Proposals 1 and 2 and are effectively a vote against a proposal.

A “broker non-vote” occurs when Shareholders are asked to consider both “routine” and “non-routine” proposals. In such a case, if a broker-dealer votes on the “routine” proposal, but does not vote on the “non-routine” proposal because (a) the shares entitled to cast the vote are held by the broker-dealer in “street name” for the beneficial owner, (b) the broker-dealer lacks discretionary authority to vote the shares, and (c) the broker-dealer has not received voting instructions from the beneficial owner, a broker non-vote is said to occur with respect to the “non-routine” proposal. Although Proposals 1 and 2 are “non-routine” proposals, the Fund does not anticipate any broker non-votes in connection with this Proxy Statement because, as of the Record Date, all of the Fund’s outstanding shares were held directly with the Fund through the Fund’s transfer agent.

You may revoke your proxy at any time prior to its exercise and vote in person at the Special Meeting. You may revoke your proxy by written notice to the Secretary of the Fund at AOG Institutional Fund, c/o Secretary, 11911 Freedom Drive, Suite 730, Reston, VA 20190.

Shareholders do not have dissenters’ rights of appraisal in connection with the Proposals. If sufficient proxies are not obtained to approve the Proposals, the Board will consider what other action is appropriate and in the best interests of Shareholders.

Method and Cost of Proxy Solicitation

Proxies will be solicited by the Fund primarily by mail. The solicitation may also include telephone, facsimile, Internet, video or oral communication by certain officers of the Fund or officers or employees of the Adviser, who will not be paid for these services. Any telephonic solicitations will follow procedures designed to ensure accuracy and prevent fraud, including requiring identifying Shareholder information and recording the Shareholder’s instruction.

The Adviser will bear the costs of preparing, printing and mailing this Proxy Statement, and all other costs incurred in connection with the solicitation of written proxies. The Adviser estimates that the cost of printing and mailing the Proxy Statement and soliciting Shareholder proxies will be $9,912.

Section 16(a) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended, the trustees and executive officers, and any persons holding more than 10% of a Fund’s common shares, are required to report their beneficial ownership and any changes therein to the SEC and to the Fund. Specific due dates for those reports have been established, and we are required to report herein any failure to file such reports by those due dates.

Financial Statements and Other Information

The Fund will furnish, without charge, a copy of its annual report to any Shareholder upon request. Requests should be directed to AOG Institutional Fund, c/o Secretary, 11911 Freedom Drive, Suite 730, Reston, VA 20190 (telephone number: 877-600-3573).

Householding of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more Shareholders sharing the same address by delivering a single proxy statement and annual report addressed to those Shareholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for Shareholders and cost savings for companies.

Please note that only one proxy statement or annual report may be delivered to two or more Shareholders who share an address, unless the Fund has received instructions to the contrary. To request a separate copy of this proxy statement or annual report or for instructions as to how to request a separate copy of this document or annual report or as to how to request a single copy if multiple copies of this document or annual report are received, Shareholders should contact the Fund at the address and phone number set forth below.

Requests should be directed to AOG Institutional Fund, 11911 Freedom Drive, Suite 730, Reston, VA 20190 (telephone number: 703-757-8020). Copies of these documents may also be accessed electronically by means of the SEC’s webpage at www.sec.gov.

Future Meetings; Shareholder Proposals

The Fund is generally not required to hold annual meetings of Shareholders and the Fund generally does not hold a meeting of Shareholders in any year unless certain specified Shareholder actions such as election of trustees or approval of a new investment management agreement are required to be taken under the Investment Company Act or the Fund’s Declaration of Trust and Amended and Restated Bylaws. As such, the Fund has no policy regarding Board members’ attendance at annual meetings of Shareholders. By observing this practice, the Fund seeks to avoid the expenses customarily incurred in the preparation of proxy material and the holding of Shareholder meetings. A Shareholder desiring to submit a proposal intended to be presented at any meeting of Shareholders of the Fund hereafter called should send the proposal to the Secretary of the Fund at the Fund’s principal offices within a reasonable time before the solicitation of the proxies for such meeting. Shareholders who wish to recommend a nominee for election to the Board may do so by submitting the appropriate information about the candidate to the Fund’s Secretary. The mere submission of a proposal by a Shareholder does not guarantee that such proposal will be included in the proxy statement because certain rules under the federal securities laws must be complied with before inclusion of the proposal is required. Also, the submission does not mean that the proposal will be presented at the meeting. For a Shareholder proposal to be considered at a Shareholder meeting, it must be a proper matter for consideration under Delaware law.

By Order of the Board of Trustees,

/s/ Frederick Baerenz

Frederick Baerenz

President and Chief Executive Officer

Reston, Virginia [●]

ATTACHMENT A

NEW ADVISORY AGREEMENT

INVESTMENT MANAGEMENT AGREEMENT

AGREEMENT made as of Month, DD, YYYY by and between AOG Institutional Fund, a Delaware statutory trust (the “Fund”), and F.L. Putnam Investment Management Company, a Maine Corporation (the “Investment Manager”).

WHEREAS, the Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end management investment company; and

WHEREAS, the Fund desires to retain the Investment Manager to furnish certain investment advisory and portfolio management services to the Fund, and the Investment Manager desires to furnish such services;

NOW THEREFORE, in consideration of the mutual promises and agreements herein contained and other good and valuable consideration, the receipt of which is hereby acknowledged, it is hereby agreed between the parties hereto as follows:

1. The Fund hereby employs the Investment Manager to manage the investment and reinvestment of its assets, including the regular furnishing of advice with respect to the Fund’s portfolio transactions subject at all times to the control and oversight of the Fund’s Board of Trustees (the “Investment Advisory Services”), for the period and on the terms set forth in this Agreement. The Investment Manager hereby accepts such employment and agrees during such period to render the Investment Advisory Services and, if requested, any other services contemplated herein and to assume the obligations herein set forth, for the compensation herein provided. The Investment Manager shall, for all purposes herein, be deemed to be an independent contractor and shall, unless otherwise expressly provided or authorized, have no authority to act for or represent the Fund in any way, or otherwise be deemed an agent of the Fund.

2. The Fund assumes and shall pay all the expenses required for the conduct of its business including, but not limited to:

a. expenses borne indirectly through the Fund’s investments in various funds (including privately offered pooled investment vehicles, such as hedge funds, which are issued in private placements to investors that meet certain suitability standards (“Private Markets Investment Funds”)), including, without limitation, any fees and expenses charged by the managers of the Private Markets Investment Funds (such as management fees, performance, carried interests or incentive fees or allocations, monitoring fees, property management fees, and redemption or withdrawal fees);

b. all costs and expenses directly related to portfolio transactions and positions for the Fund’s accounts, such as direct and indirect expenses and enforcing the Fund’s rights in respect of such investments;

c. fees of the Investment Manager;

d. fees and commissions in connection with the purchase and sale of portfolio securities for the Fund;

e. costs, including the interest expense, of borrowing money;

f. fees and premiums for the fidelity bond required by Section 17(g) of the 1940 Act, or other insurance;

g. taxes levied against the Fund and the expenses of preparing tax returns and reports;

h. auditing fees and expenses;

i. legal fees and expenses (including reasonable fees for legal services rendered to the Fund by the Investment Manager or its affiliates);

j. salaries and other compensation of (1) any of the Fund’s officers and employees who are not officers, trustees, members or employees of the Investment Manager or any of its affiliates, and (2) the Fund’s chief compliance officer to the extent determined by those trustees of the Fund who are not interested persons of the Investment Manager or its affiliates (the “Independent Trustees”);

k. fees and expenses incidental to trustee and shareholder meetings of the Fund, the preparation and mailings of proxy material, prospectuses, and reports of the Fund to its shareholders, the filing of reports with regulatory bodies, and the maintenance of the Fund’s legal existence;

l. costs of the listing (and maintenance of such listing) of the Fund’s shares on stock exchanges, and the registration of shares with Federal and state securities authorities;

m. payment of dividends;

n. costs of stock certificates;

o. fees and expenses of the Independent Trustees;

p. fees and expenses for accounting, administration, bookkeeping, broker/dealer record keeping, clerical, compliance, custody, dividend disbursing, fulfillment of requests for Fund information, proxy soliciting, securities pricing, registrar, and transfer agent services (including costs and out-of-pocket expenses payable to the Investment Manager or its affiliates for such services);

q. costs of necessary office space rental and Fund web site development and maintenance;

r. costs of membership dues and charges of investment company industry trade associations;

s. such non-recurring expenses as may arise, including, without limitation, reorganizations, liquidations, actions, suits or proceedings affecting the Fund and the legal obligation which the Fund may have to indemnify its officers and trustees or settlements made;

t. all costs and expenses associated with the operation and ongoing registration of the Fund, including, without limitation, all costs and expenses associated with the repurchase offers, offering costs, and the costs of compliance with any applicable Federal or state laws;

u. costs and charges related to electronic platforms through which investors may access, complete and submit subscription and other Fund documents or otherwise facilitate activity with respect to their investment in the Fund; and

v. such other types of expenses as may be approved from time to time by the Fund’s Board of Trustees.

The Fund will reimburse the Investment Manager for any of the above expenses that it pays on behalf of the Fund.

3. The Investment Manager shall supply the Fund and the Board of Trustees with reports and statistical data, as reasonably requested. In addition, if requested by the Fund’s Board of Trustees, the Investment Manager or its affiliates may provide services to the Fund such as, without limitation, accounting, administration, bookkeeping, broker/dealer record keeping, clerical, compliance, custody, dividend disbursing, fulfillment of requests for Fund information, proxy soliciting, securities pricing, registrar, and transfer agent services. Any reports, statistical data, and services so requested, or approved by the Board

of Trustees, and supplied or performed will be for the account of the Fund and the costs and out-of-pocket charges of the Investment Manager and its affiliates in providing such reports, statistical data or services shall be paid by the Fund, subject to periodic reporting to and examination by the Independent Trustees.

4. The services of the Investment Manager are not to be deemed exclusive, and the Investment Manager shall be free to render similar services to others in addition to the Fund so long as its services hereunder are not impaired thereby.

5. The Investment Manager shall create and maintain all necessary books and records in accordance with all applicable laws, rules and regulations, including but not limited to records required by Section 31(a) of the 1940 Act and the rules thereunder, as the same may be amended from time to time, pertaining to the Investment Advisory Services and other services, if any, performed by it hereunder and not otherwise created and maintained by another party pursuant to a written contract with the Fund. Where applicable, such records shall be maintained by the Investment Manager for the periods and in the places required by Rule 3la-2 under the 1940 Act. The books and records pertaining to the Fund which are in the possession of the Investment Manager shall be the property of the Fund and shall be surrendered promptly upon the Fund’s request, and the Fund shall have access to such books and records at all times during the Investment Manager’s normal business hours. Upon the reasonable request of the Fund, copies of any such books and records shall be promptly provided by the Investment Manager to the Fund or the Fund’s authorized representatives. The Investment Manager shall keep confidential any information obtained in connection with its duties hereunder provided, however, if the Fund has authorized and directed certain disclosure or if such disclosure is expressly required or lawfully requested by applicable Federal or state regulatory authorities or otherwise, the Fund shall reimburse the Investment Manager for its expenses in connection therewith, including the reasonable fees and expenses of the Investment Manager’s outside legal counsel.

6. For the Investment Advisory Services provided to the Fund pursuant to this Agreement, the Fund will pay to the Investment Manager and the Investment Manager will accept as full compensation therefor, a fee, payable on or before the tenth (10th) day of each calendar month, at the annual rate of 1.49% of the Fund’s Managed Assets (as defined below). Such fees shall be reduced as required by expense limitations imposed upon the Fund by any state in which shares of the Fund are sold. Reductions shall be made at the time of each monthly payment on an estimated basis, if appropriate, and an adjustment to reflect the reduction on an annual basis shall be made, if necessary, in the fee payable with respect to the last month in any calendar year of the Fund. The Investment Manager shall within ten (10) days after the end of each calendar year refund any amount paid in excess of the fee determined to be due for such year.

7. If this Agreement shall become effective subsequent to the first day of a month, or shall terminate before the last day of a month, the Investment Manager’s compensation for such fraction of the month shall be determined by applying the foregoing percentage to the Fund’s Managed Assets during such fraction of a month (calculated on an average daily basis if such fraction of a month is less than a week) and in the proportion that such fraction of a month bears to the entire month.

8. “Managed Assets” means the total assets of the Fund (including any assets attributable to money borrowed for investment purposes) minus the sum of the Fund’s accrued liabilities (other than money borrowed for investment purposes) and calculated before giving effect to any repurchase of shares on such date.

9. The Investment Manager shall direct portfolio transactions to broker/dealers for execution on terms and at rates which it believes, in good faith, to be reasonable in view of the overall nature and quality of services provided by a particular broker/dealer, including brokerage and research services. Subject to the

foregoing and applicable laws, rules and regulations, the Investment Manager may also allocate portfolio transactions to broker/dealers that remit a portion of their commissions as a credit against Fund expenses. With respect to brokerage and research services, the Investment Manager may consider in the selection of broker/dealers brokerage or research provided and payment may be made of a fee higher than that charged by another broker/dealer which does not furnish brokerage or research services or which furnishes brokerage or research services deemed to be of lesser value, so long as the criteria of Section 28(e) of the Securities Exchange Act of 1934, as amended, or other applicable laws are met. Although the Investment Manager may direct portfolio transactions without necessarily obtaining the lowest price at which such broker/dealer, or another, may be willing to do business, the Investment Manager shall seek the best value for the Fund on each trade that circumstances in the marketplace permit, including the value inherent in on-going relationships with quality brokers. To the extent any such brokerage or research services may be deemed to be additional compensation to the Investment Manager from the Fund, it is authorized by this Agreement. The Investment Manager may place brokerage for the Fund through an affiliate of the Investment Manager, provided that such brokerage be undertaken in compliance with applicable law. The Investment Manager’s fees under this Agreement shall not be reduced by reason of any commissions, fees or other remuneration received by such affiliate from the Fund.

10. Subject to and in accordance with the Certificate of Trust, as amended (the “Charter”), Declaration of Trust and Bylaws of the Fund and similar documents of the Investment Manager, it is understood that trustees, officers, agents and shareholders of the Fund are or may be interested in the Fund as trustees, officers, shareholders and otherwise, that the Investment Manager is or may be interested in the Fund as a shareholder or otherwise and that the effect and nature of any such interests shall be governed by law and by the provisions, if any, of said Charter, Declaration of Trust or Bylaws of the Fund or similar documents of the Investment Manager.

11. This Agreement shall become effective upon the date hereinabove written and, unless sooner terminated as provided herein, this Agreement shall continue in effect for two years from the above written date. Thereafter, if not terminated, this Agreement shall continue automatically for successive periods of twelve months each, provided that such continuance is specifically approved at least annually (a) by a vote of a majority of the Trustees of the Fund or by vote of the holders of a majority of the Fund’s outstanding voting securities of the Fund as defined in the 1940 Act and (b) by a vote of a majority of the Trustees of the Fund who are not parties to this Agreement, or interested persons of such party. This Agreement may be terminated without penalty at any time either by vote of the Board of Trustees of the Fund or by a vote of the holders of a majority of the outstanding voting securities of the Fund on 60 days’ written notice to the Investment Manager, or by the Investment Manager on 60 days’ written notice to the Fund. This Agreement shall immediately terminate in the event of its assignment.

12. The Investment Manager shall not be liable to the Fund or any shareholder of the Fund for any error of judgment or mistake of law or for any loss suffered by the Fund or the Fund’s shareholders in connection with the matters to which this Agreement relates, but nothing herein contained shall be construed to protect the Investment Manager against any liability to the Fund or the Fund’s shareholders by reason of a loss resulting from willful misfeasance, bad faith, or gross negligence in the performance of its duties or by reason of its reckless disregard of obligations and duties under this Agreement.

13. The Investment Manager shall not be liable for delays or errors occurring by reason of circumstances beyond its control, including but not limited to acts of civil or military authority, national emergencies, work stoppages, fire, flood, catastrophe, acts of God, insurrection, war, riot, or failure of communication

or power supply. In the event of equipment breakdowns beyond its control, the Investment Manager shall take reasonable steps to minimize service interruptions but shall have no liability with respect thereto. Notwithstanding anything herein to the contrary, the Investment Manager shall have in place at all times a reasonable disaster recovery plan and program.

14. As used in this Agreement, the terms “interested person,” “assignment,” and “majority of the outstanding voting securities” shall have the meanings provided therefore in the 1940 Act, and the rules and regulations thereunder.

15. This Agreement shall be construed in accordance with and governed by the laws of the State of Delaware, provided, however, that nothing herein shall be construed in a manner inconsistent with the 1940 Act or any rule or regulation promulgated thereunder.

16. This Agreement constitutes the entire agreement between the parties hereto and supersedes any prior agreement, with respect to the subject hereof whether oral or written. If any provision of this Agreement shall be held or made invalid by a court or regulatory agency, decision, statute, rule or otherwise, the remainder of this Agreement shall not be affected thereby. This Agreement may be amended at any time, but only by written agreement between the Investment Manager and the Fund, which amendment has been authorized by the Board, including the vote of a majority of the Independent Trustees and, where required by the 1940 Act, the shareholders of the Fund.

[Signature Page to AOG Institutional Fund Investment Management Agreement]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the day and year first above written.

AOG Institutional Fund

By:

__________________________________________

F.L. Putnam Investment Management Company

By: Michael Timmermans

General Counsel, CCO

___________________________________________

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. PLEASE CAST YOUR PROXY VOTE TODAY!

PROXY CARD

AOG Institutional Fund

PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON [●], 2025

The undersigned, revoking prior proxies, hereby appoints Frederick Baerenz and Peter Sattelmair, and each of them, as attorneys-in-fact and proxies of the undersigned, granted in connection with the voting of the shares subject hereto with full power of substitution, to vote shares held in the name of the undersigned on the record date at the Special Meeting of Shareholders of the above named Fund (the “Fund”) to be held at the offices of Alpha Omega Group, Inc. dba AOG Wealth Management (the “Adviser”) at 11911 Freedom Drive, Suite 730, Reston, Virginia 20190 on [●], 2025, at [●] a.m. Eastern Time, or at any adjournment thereof, upon the Proposal described in the Notice of Meeting and accompanying Proxy Statement, which have been received by the undersigned.

Do you have questions? If you have any questions about how to vote your proxy or about the meeting in general, please call toll-free [1-800-814-9324]. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to Be Held on [●], 2025. The proxy statement for this meeting is available at:

https://vote.proxyonline.com/AOG/docs/2025meeting.pdf

| | | |

| | | |

| | | |

| | | |

| [PROXY ID NUMBER HERE] | [BAR CODE HERE] | [CUSIP HERE] |

| |

| |

| AOG Institutional Fund |

| |

| YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED. The signer(s) acknowledges receipt with this Proxy Statement of the Board of Trustees. Your signature(s) on this should be exactly as your name(s) appear on this Proxy (reverse side). If the shares are held jointly, each holder should sign this Proxy. Attorneys-in-fact, executors, administrators, trustees or guardians should indicate the full title and capacity in which they are signing. |

| PROXY CARD |

| | |

| | |

| | |