| 4 |

| 5

|

| 7

|

| | ITEM 1 | | 7

|

| | ITEM 2 | | 7 |

| | ITEM 3 | | 7

|

| | | A. | | 7

|

| | | B. | | 7 |

| | | C. | | 8 |

| | | D. | | 8 |

| | ITEM 4 | | 24

|

| | | A. | | 24

|

| | | B. | | 24

|

| | | C. | | 46 |

| | | D. | | 46 |

| | ITEM 4A. | | 54 |

| | ITEM 5. | | 54 |

| | | A. | | 55 |

| | | B. | | 56 |

| | | C. | | 59 |

| | | D. | | 59 |

| | | E. | | 59 |

| | ITEM 6. | | 60 |

| | | A. | | 60 |

| | | B. | | 63 |

| | | C. | | 76 |

| | | D. | | 78 |

| | | E. | | 78 |

| | ITEM 7. | | 79 |

| | | A. | | 79 |

| | | B. | | 81 |

| | | C. | | 81

|

| | ITEM 8. | | 81 |

| | | A. | | 81 |

| | | B. | | 82 |

| | ITEM 9. | | 82 |

| | | A. | | 82 |

| | | B. | | 82 |

| | | C. | | 82 |

| | | D. | | 82 |

| | | E. | | 82 |

| | | F. | | 82 |

| | ITEM 10. | | 82 |

| | | A. | | 82 |

| | | B. | | 82 |

| | | C. | | 98 |

| | | D. | | 98 |

| | | E. | | 98 |

| | | F. | | 106 |

| | | G. | | 106 |

| | | H. | | 106 |

| | | I. | | 107 |

| | | J. | | 107 |

| | ITEM 11. | | 107 |

| | ITEM 12. | | 108 |

| | | A. | | 108 |

| | | B. | | 108 |

| | | C. | | 108 |

| | | D. | | 108 |

| | 110 |

| | ITEM 13. | | 110 |

| | ITEM 14. | | 110 |

| | ITEM 15. | | 110 |

| | ITEM 16. | | 112 |

| | ITEM 16A. | | 112 |

| | ITEM 16B. | | 112 |

| | ITEM 16C. | | 112 |

| | ITEM 16D. | | 113 |

| | ITEM 16E. | | 113 |

| | ITEM 16F. | | 113 |

| | ITEM 16G. | | 113 |

| | ITEM 16H. | | 114 |

| | ITEM 16J. | | 114 |

| | ITEM 16K. | | 114 |

| | 114 |

| | ITEM 17. | | 114 |

| | ITEM 18. | | 114 |

| | ITEM 19. | | 114 |

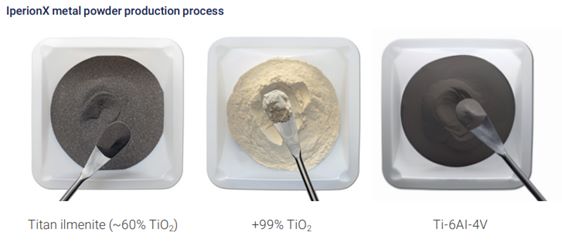

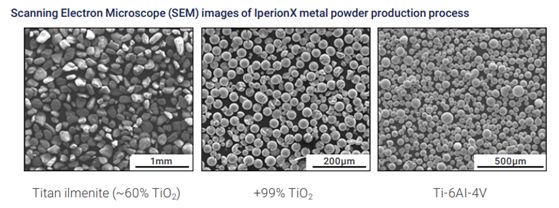

IperionX aims to be a leading American titanium metal and critical materials company – using patented titanium technologies to produce high performance titanium alloys, from titanium minerals or scrap titanium, at lower energy, cost and carbon emissions.

IperionX holds an exclusive license for an award-winning patented technology portfolio that we believe will enable us to produce and sell high strength forged titanium alloy products at low cost, with class-leading sustainability and superior process energy efficiencies when compared to current industry methods such as the Kroll process.

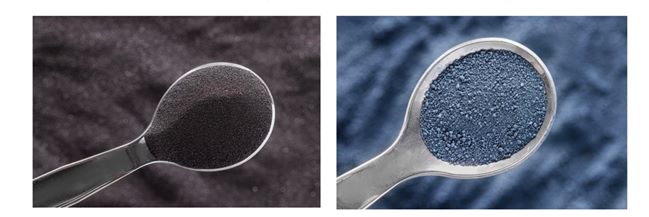

Using these technologies, we intend to produce low-cost and high-quality angular and spherical titanium powder, which can be used to produce near-net-shape and final titanium parts through powder metallurgy or additive manufacturing.

These technologies are expected to provide IperionX with a sustainable competitive advantage and create significant value uplift from upgrading raw titanium materials through to finished high-performance titanium products when compared to traditional titanium industry supply chains.

Re-shoring a low cost, sustainable, U.S. titanium supply chain

Titanium has superior material properties that are prized across advanced industries, including high strength, light weight and corrosion resistance. However, the U.S. no longer produces any primary titanium metal (i.e. titanium sponge), including for defense, with China and Russia controlling around 75% of global supply. IperionX aims to re-shore a low-cost, sustainable U.S. titanium supply chain, through the commercialization of its titanium technologies.

Commissioning of commercial operations is underway

IperionX has demonstrated a pathway to commercial-scale titanium production, and our goal is the near-term commissioning and commencement of commercial operations at the Titanium Manufacturing Campus in Virginia, United States.

Rapid, low-cost near-term growth potential

IperionX aims to be a leading U.S. titanium producer of approximately 10,000 metric tons per annum by 2030. Our goal is to re-shore a fully integrated titanium supply chain to the United States, lowering costs for our customers and delivering the most sustainable high-performance titanium products on the market.

Unless otherwise indicated or the context implies otherwise, any reference in this annual report on Form 20-F to:

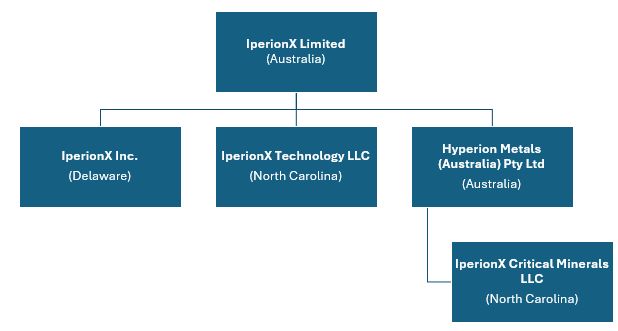

| • | “IperionX” refers to IperionX Limited, an Australian corporation; |

| • | “the Company,” “we,” “us,” or “our” refer to IperionX and its consolidated subsidiaries, through which it conducts its business, unless otherwise indicated; |

| • | “shares” or “ordinary shares” refers to ordinary shares of IperionX; |

| • | “ADS” refers to the American depositary shares; and |

| • | “ASX” refers to the Australian Securities Exchange. |

Unless otherwise indicated, all references to “A$” are to Australian dollars, and all references to “US$” are to United States dollars. Our financial statements are presented in U.S. dollars which is the Company’s presentation currency. This annual report on Form 20-F contains references to U.S. dollars where the underlying transaction or event was denominated in U.S. dollars. This annual report on Form 20-F contains forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements.”

CAUTIONARY NOTE TO UNITED STATES INVESTORS

We are subject to the reporting requirements of the applicable U.S. and Australian securities laws, and as a result we will report any mineral reserves and mineral resources as required by both of these standards. As an Australian listed public company, we will be required to report any estimates of mineral resources and ore reserves in terms of “Measured, Indicated and Inferred” Mineral Resources and “Proved and Probable” Ore Reserves in compliance with the JORC 2012, Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the “JORC Code”). The JORC Code was prepared by the Joint Ore Reserves Committee of The Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia. These defined terms contained within the JORC Code differ in some respects from the definitions under the U.S. Securities Act of 1933, as amended (the “Securities Act”), including in Regulation S-K, Subpart 1300 (“Subpart 1300”).

Information about mineral reserves and resources, if any, contained in our filings with the SEC also will be presented in compliance with Subpart 1300. While guidelines for reporting mineral resources, including subcategories of measured, indicated and inferred resources, are largely similar between JORC Code and Subpart 1300 standards, information contained in our future SEC filings that describes mineral deposits may not be directly comparable to similar information made public by other U.S. companies under the SEC’s old reporting standard, Industry Guide 7, or to similar information published by other ASX-listed companies. Investors are cautioned that any public disclosure we make in Australia as to mineral reserves or resources in accordance with ASX Listing Rules will not form a part of our SEC filings except to the extent stated therein.

INDUSTRY AND MARKET DATA

This annual report includes information with respect to market and industry conditions and market share from third-party sources or that is based upon estimates using such sources when available. We believe that such information and estimates are reasonable and reliable. We also believe the information extracted from publications of third-party sources has been accurately reproduced. However, we have not independently verified any of the data from third-party sources. Similarly, our internal research is based upon the understanding of industry conditions, and such information has not been verified by any independent sources.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included in this annual report on Form 20-F may be deemed to be “forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements concern our anticipated results and progress of our operations in future periods, planned exploration and, if warranted, development of our properties, plans related to our business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. All statements contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate”, “believe”, “expect”, “estimate”, “may”, “will”, “could”, “leading”, “intend”, “contemplate”, “shall” and similar expressions are generally intended to identify forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements. Forward-looking statements in this annual report on Form 20-F include, but are not limited to, statements with respect to: risks related to the effects of health epidemics; risks related to our limited operating history in the titanium metal manufacturing industry; risks related to our ability to commercialize our titanium technologies; risks related to our ability to produce titanium metal powders and products to customers’ exact specification; risks related to our ability to identify and contract long-term offtake customers for our titanium metal products; risks related to our limited operating history in the minerals extraction industry; risks related to our status as an exploration stage company; risks related to our ability to identify mineralization and achieve commercial minerals extraction; risks related to minerals extraction, exploration and extraction site construction, if warranted, on our properties; risks related to our ability to achieve and maintain profitability and to develop positive cash flow from any minerals extraction activities; risks related to investment risk and operational costs associated with our exploration activities; risks related to our ability to access capital and the financial markets; risks related to compliance with government regulations; risks related to our ability to acquire necessary minerals extraction licenses, permits or access rights; risks related to environmental liabilities and reclamation costs; risks related to volatility in minerals and metals prices or demand for minerals and metals; risks related to stock price and trading volume volatility; risks relating to the development of an active trading market for the ADSs; risks related to ADS holders not having certain shareholder rights; risks related to ADS holders not receiving certain distributions; risks related to our status as a foreign private issuer and emerging growth company; and risks related to the other matters described in the section titled “Risk Factors.”

All forward-looking statements reflect our beliefs and assumptions based on information available at the time the assumption was made. These forward-looking statements are not based on historical facts but rather on management’s expectations regarding future activities, results of operations, performance, future capital and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business prospects and opportunities. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, known and unknown, that contribute to the possibility that the predictions, forecasts, projections or other forward-looking statements will not occur. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as otherwise required by the securities laws of the United States and Australia, we disclaim any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. We qualify all the forward-looking statements contained in this annual report on Form 20-F by the foregoing cautionary statements.

PRESENTATION OF FINANCIAL INFORMATION

Our fiscal year ends on June 30. We designate our fiscal year by the year in which that fiscal year ends; for example, fiscal 2024 refers to our fiscal year ended June 30, 2024. All dates in this annual report refer to calendar years, except where a fiscal year is indicated.

Unless otherwise indicated, the consolidated financial statements and related notes included in this annual report are presented in U.S. dollars and have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) which differ in certain significant respects from generally accepted accounting principles in the United States, or U.S. GAAP. As a result, our financial statements may not be comparable to the financial statements of U.S. companies. Because the U.S. Securities and Exchange Commission (“SEC”) has adopted rules to accept financial statements prepared in accordance with IFRS as issued by the IASB without reconciliation to U.S. GAAP from foreign private issuers such as us, we will not be providing a description of the principal differences between U.S. GAAP and IFRS.

Our financial statements are presented in U.S. dollars, which is the Company’s presentation currency. This annual report contains translations of some Australian dollar amounts into U.S. dollars. Except as otherwise stated in this annual report, all translations from Australian dollars to U.S. dollars are based on the rates published by the Reserve Bank of Australia. No representation is made that the Australian dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars at such rate.

QUALIFIED PERSON

Unless otherwise indicated, the disclosure of exploration results and mineral resources included in this annual report is based on, and accurately reflects, information and supporting documentation prepared, reviewed and approved by Karst Geo Solutions, LLC, who is a qualified person (“QP”) within the meaning of Item 1300 of Regulation S-K and is not affiliated with the Company.

COMPETENT PERSONS STATEMENT

As required by Australian securities laws and the ASX Listing Rules, we hereby notify Australian investors that the information in this annual report that relates to Exploration Results and Mineral Resources was extracted from our ASX announcement dated October 6, 2021 which is available to view on the Company’s website at www.iperionx.com. We confirm to Australian investors that (a) we are not aware of any new information or data that materially affect the information included in the original ASX announcement; (b) all material assumptions and technical parameters underpinning the Mineral Resource estimate included in the original ASX announcement continue to apply and have not materially changed; and (c) the form and context in which the relevant Competent Persons’ findings are presented in this annual report have not been materially changed from the original ASX announcement. “Competent Person” under the Australian rules is a minerals industry professional who is a Member or Fellow of The Australasian Institute of Mining and Metallurgy, or of the Australian Institute of Geoscientists, or of a “Recognized Professional Organization”, as included in a list available on the JORC and ASX websites.

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

You should carefully consider the risks described below, together with all of the other information in this annual report on Form 20-F. If any of the following risks occur, our business, financial condition and results of operations could be seriously harmed, and you could lose all or part of your investment. Further, if we fail to meet the expectations of the public market in any given period, the market price of the ADSs could decline. We operate in a competitive environment that involves significant risks and uncertainties, some of which are outside of our control. If any of these risks actually occurs, our business and financial condition could suffer and the price of the ADSs could decline.

Risks Related to Our Business

We have a history of financial losses and expect to incur continuing losses in the near future.

We incurred net losses of US$21.8 million and US$17.4 million for fiscal 2024 and fiscal 2023, respectively. We incurred net cash outflows from operating and investing activities of US$25.1 million and US$21.6 million for fiscal 2024 and fiscal 2023, respectively. We believe that we will continue to incur net losses until such time as we commence commercial scale production of titanium metals and/or critical minerals. At June 30, 2024, we had cash reserves of US$33.2 million and net assets of US$51.3 million.

The ongoing operation of the Company will remain dependent upon the Company raising further additional funding from shareholders or other parties. There is no assurance that the Company will be able to raise additional funds on reasonable terms or at all. If the Company does not obtain additional funding, it may not be able to continue its operations as a going concern and therefore may not be able to realize its assets and extinguish its liabilities in the ordinary course of operations and at the amounts stated in the financial statements.

In the longer term, the successful commercialization and scale-up of the Company’s titanium metal production capacity and/or the development of economically recoverable mineral deposits on the Company’s mineral properties depends on the ability of the Company to obtain financing through equity financing, debt financing or other means. If the Company’s titanium metal production and/or exploration programs are ultimately successful, additional funds will be required to scale-up of the Company’s titanium metal production capacity and/or develop the Company’s mineral properties and to place them into commercial production. The Company is dependent on obtaining future funds through equity financing, debt financing or other means. The ability to arrange such funding in the future will depend in part upon the prevailing capital market conditions as well as the business performance of the Company. There can be no assurance that the Company will be successful in its efforts to raise additional funding on terms satisfactory to the Company. If adequate funding is not available, the Company may be required to delay, reduce the scope of, or eliminate its current or future business activities or relinquish rights to certain of its interests.

Failure to obtain additional funding on a timely basis could cause the Company to forfeit its interests in some or all of its assets and reduce or terminate its operations. As a result, there is a material uncertainty that may cast significant doubt or substantial doubt as contemplated by Public Company Accounting Oversight Board (“PCAOB”) standards about the Company’s ability to continue as a going concern and therefore the Company may be unable to realize its assets and discharge its liabilities in the normal course of business.

Our continued growth depends on our ability to fully commercialize and scale-up our commercial titanium metal production capacity.

Sustained growth of our company relies on our ability to fully commercialize and scale up our titanium metal production capacity. Examples of things that could jeopardize that production progress include: an adverse event at a production facility; a delay in procuring necessary equipment for processing our titanium; and/or difficulty hiring and training qualified employees. If we are unsuccessful in reaching and maintaining expected production rates, including by failing to reach anticipated throughput, recoveries, uptimes, yields, or any combination thereof, within expected time frames or at all, we may not be able to build a sustainable or profitable metals technology business as currently expected or at all.

Our access to key titanium technologies depends on our ability to comply with the terms of third-party agreements.

We do not currently own our key titanium technologies. We have access to such technologies through an agreement (the “Blacksand Option Agreement”) with Blacksand Technology, LLC (“Blacksand”), pursuant to which we exclusively license a portfolio of patented technologies for the processing of titanium ore or feedstock and the production of titanium alloys or products. The Blacksand Option Agreement also provides us with (1) an exclusive option either to purchase 100% of Blacksand’s assets, including Blacksand’s intellectual property assets (“Purchase Option”), or (2) at our sole election, an exclusive option to continue to license Blacksand’s intellectual property (“Exclusive License Option”). The Company expects to exercise the Purchase Option or Exclusive License Option by the end of 2024. While the Blacksand Option Agreement contains provisions that protect us against non-compliance by Blacksand, if (i) we or Blacksand fail or fails to comply with the terms of the Blacksand Option Agreement, or (ii) we are unable to pay the exercise price of the Blacksand Option Agreement, or otherwise decide not to exercise either option in the agreement, we may lose access to the Technologies which would adversely affect our business, prospects, financial condition and operating results. For more information on our agreements with Blacksand, see “Item 4. Information on the Company – B. Business Overview – Additional Business Information – Potential Acquisition of Blacksand’s Intellectual Property Rights”,

Failure to commercially scale our closed-loop titanium production processes may result in material adverse impacts to, or failure to achieve, our growth projections.

We announced in August 2024, that we had successfully commissioned our HAMR furnace, marking the first titanium de-oxygenation product run at our Virginia facility. Despite this success, it remains possible that we may have difficulty commercially scaling up our production processes at new or existing facilities at a sufficient level to generate meaningful revenue. Failure to do so may result in material adverse impacts to, or failure to achieve, our growth projections. This could be due to a variety of factors, including hiring and training new personnel, implementing new production processes, recalibrating and re-qualifying existing processes, the inability to achieve repeatable processes, impurities, defects with respect to the equipment or facilities. and the inability to achieve required yield levels. In the future, we may face construction delays or interruptions, infrastructure failure, or delays in upgrading or expanding existing facilities or changing our process technologies, which may adversely affect our ability to scale up production in accordance with our plans. Our failure to scale up our production on a timely basis could cause delays in product deliveries, which may result in the loss of customers and sales. For products that cannot meet the quality standards of our customers, we may suffer indemnification losses in addition to the production cost. It could also prevent us from recouping our investments in a timely manner or at all, and otherwise adversely affect our business and operating results.

Unanticipated costs or delays associated with our ongoing titanium metal commercialization may materially and adversely affect our financial condition or results of operations.

The commercialization and scale-up of the Technologies will require the commitment of substantial resources and capital expenditures. Our future expenditures may increase as consultants, personnel and equipment associated with our efforts are added. The success of the commercialization and scale-up of the Technologies and the amounts and timing of expenditures to commercialize and scale-up the Technologies will depend in part on the following: our ability to timely procure equipment or repair existing equipment, certain of which may involve long lead-times; maintaining, and procuring, as required, applicable federal, state and local permits; the results of consultants’ analysis and recommendations; negotiating contracts for equipment, earthwork, construction, equipment installation, labor and completing infrastructure and construction work; effects of planned and unplanned shut-downs and delays in our production; effects of stoppages or delays on construction projects; disputes with contractors or other third parties; negotiating sales and offtake contracts for our planned production; the execution of any joint venture agreements or similar arrangements with strategic partners; the impact of pandemics on our business, our strategic partners’ or suppliers’ businesses, logistics or the global economy; the impact of the wars on the global economy; the effects of inflation; and other factors, many of which are beyond our control. Most of these activities require significant lead times and must be advanced concurrently. Unanticipated costs or delays associated with the commercialization and scale-up of the Technologies could materially and adversely affect our financial condition or results of operations and could require us to seek additional capital.

If our titanium metal products fail to perform as expected in our customers’ desired applications, our ability to develop, market and sell our products could be adversely affected.

Even if we reach full scale commercial production of titanium metal products, our products may contain defects in design and manufacture that may cause them to not perform as expected or that may require repairs, recalls, and design changes. Our products incorporate technology and components that may have not been used for other applications and that may contain defects and errors, particularly when first introduced. We have a limited frame of reference from which to evaluate the long-term performance of our planned products. We cannot assure you that we will be able to detect and fix any defects in our products prior to sale. If our products fail to perform as expected, we may lose customers or customers may delay or terminate orders, each of which could adversely affect our business, prospects and results of operations.

We may be unable to adequately control the costs associated with continued expansion of our titanium metal production capacity.

We require significant capital to develop and grow our business, and we expect to incur significant expenses, including those relating to research and development, raw material procurement, leases, sales and distribution, as we grow our titanium metal production capacity. Our ability to become profitable will depend on successfully marketing our titanium metal products while controlling our costs. If we are unable to cost effectively design, manufacture, market, sell and distribute our titanium metal products, our margins, profitability and prospects would be materially and adversely affected.

Titanium mineral extraction and processing and the production of titanium products involves complex safety and operational risks.

The extraction and processing of titanium minerals and the production of titanium metal products involves serious safety and operational risks. Operational problems or error with the machinery could result in personal injury to or death of workers, the loss of production equipment, damage to manufacturing facilities, monetary losses, delays and unanticipated fluctuations in production. In addition, operational problems may result in environmental damage, administrative fines, increased insurance costs and potential legal liabilities. All of these safety and operational problems could materially and adversely affect our business, results of operations, cash flows, financial condition or prospects.

If we fail to accurately predict our manufacturing requirements and timelines, we could incur additional costs or experience delays.

We are in the early stages of commercializing our products, and we have limited historical information to accurately assess demand for our ability to extract and process titanium and to develop, manufacture and deliver titanium metal products. As a result, it is difficult to predict our future revenues and expenses or trends in such revenues or expenses.

We may be adversely affected by fluctuations in demand for, and prices of, titanium metal and products.

We expect to generate revenue from the sale of titanium alloys and titanium products. As a result, our profitability could be adversely affected by changes in demand for, and the market price of, titanium alloys and products.

The success of our business will depend on the growth of existing and emerging uses for titanium.

The success of our business will depend on the growth of existing and emerging uses for titanium. Our business strategy principally relies on commercializing the Technologies to produce titanium products for markets including consumer electronics, aerospace, space, defense, medical, additive manufacturing, hydrogen and automotive. Our long-term success depends on the continued growth of these markets and successfully commercializing titanium metal products in such markets. Our estimates of market opportunity and market growth, whether derived from third-party sources or developed internally, are subject to significant uncertainty and are based on assumptions and estimates that may prove to be inaccurate. If these markets do not grow as we expect or if the demand for our intended products decreases, then our business, prospects, financial condition and operating results could be adversely affected.

If we are unable to protect our right to Blacksand’s technologies, or Blacksand is unable to defend its rights to such technologies, our business and competitive position could be adversely affected.

We expect to rely heavily on our right to use our licensed technologies to grow our business. We may not be able to prevent unauthorized use of such technology, which could harm our business and competitive position. We will rely upon a combination of license agreements, patents, trademarks and trade secret laws in the United States, as well as other contractual protections, to establish, maintain and enforce our rights. Despite our efforts to protect our rights to the technologies, third parties may attempt to copy or otherwise obtain and use such technology. Monitoring unauthorized use of such technologies is difficult and costly, and any steps take to prevent misappropriation may not be sufficient, could be time-consuming and expensive and could divert management’s attention, which could harm our business, results of operations and financial condition.

In addition, companies holding patents or other intellectual property rights relating to titanium technologies may bring suits alleging infringement of such rights by us or Blacksand or otherwise asserting rights in or licenses to the technologies. If we or Blacksand are determined to have infringed upon a third party’s intellectual property rights, we may be required to cease using the challenged intellectual property, to pay substantial damages or to obtain a license from the holder of the infringed rights. In the event of a successful claim of infringement against us or Blacksand, our business, prospects, operating results and financial condition could be materially adversely affected. In addition, any litigation or claims, whether or not valid, could result in substantial costs and diversion of resources and management’s attention.

Patent, trademark and trade secret laws vary significantly throughout the world. A number of foreign countries do not protect intellectual property rights to the same extent as do the laws of the United States. Therefore, our intellectual property rights may not be as strong or as easily enforced outside of the United States and efforts to protect against the unauthorized use of our intellectual property rights, technology and other proprietary rights may be more expensive and difficult outside of the United States. Failure to adequately protect our intellectual property rights could result in our competitors using our intellectual property to offer products, potentially resulting in the loss of some of our competitive advantage and a decrease in its revenue which would adversely affect our business, prospects, financial condition and operating results.

Changes in the U.S. political environment and federal policies, including changes in research grant funding policy or the potential critical materials designation of titanium metal may adversely affect our financial condition and results of operations.

Our business may be adversely affected by the current and future political environment in the United States and the policies of the U.S. federal government, including changes in research grant funding policy or the potential critical materials designation of titanium metal.

There is no guarantee that our properties contain mineral deposits that are economically extractable.

We currently have no reserves, and we cannot assure you about the existence of economically extractable mineralization at this time, nor about the quantity or grade of any mineralization we may have found. In our upstream operations, we are engaged in the business of exploring and developing mineral properties with the intention of locating economic deposits of titanium metal. We cannot assure you that, to the extent economic deposits of minerals are located, such minerals can be commercially extracted. The exploration and development of mineral deposits involves a high degree of financial risk over a significant period of time which a combination of careful evaluation, experience and knowledge of management may not eliminate. While discovery of additional ore-bearing deposits may result in substantial rewards, few properties which are explored are ultimately developed into producing extraction sites. Major expenses may be required to establish reserves by drilling and to construct extraction and processing facilities. Exploration project items, such as any future estimates of reserves, metal recoveries or cash operating costs will to a large extent be based upon the interpretation of geologic data, obtained from a limited number of drill holes and other sampling techniques, and future feasibility studies. Because the probability of an individual prospect ever having reserves is uncertain, our properties may not contain any reserves and any funds spent on evaluation and exploration may be lost. Even if we confirm reserves on our properties, any quantity or grade of reserves we indicate must be considered as estimates only until such reserves are actually extracted. We do not know with certainty that economically recoverable metals exist on our properties.

We face operational risks related to minerals extraction, exploration and site construction.

We are subject to the operational risks normally encountered in the minerals extraction industry, such as: the discovery of unusual or unexpected geological formations; accidental fires, floods, earthquakes or other natural disasters; unplanned power outages and water shortages; controlling water and other similar extraction hazards; operating labor disruptions and labor disputes; the ability to obtain suitable or adequate machinery, equipment, or labor; our liability for pollution or other hazards; and other known and unknown risks involved in the conduct of exploration and operation of minerals extraction sites. The nature of these risks is such that liabilities could exceed any applicable insurance policy limits or could be excluded from coverage. There are also risks against which we cannot insure or against which we may elect not to insure. The potential costs which could be associated with any liabilities not covered by insurance, or in excess of insurance coverage, or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our results of operations and financial viability.

We depend on our ability to successfully access the capital and financial markets. Any inability to access the capital or financial markets may limit our ability to fund our ongoing operations, execute our business plan or pursue investments that we may rely on for future profit and growth.

Until we achieve commercial production of critical minerals or titanium products, we will continue to incur operating and investing net cash outflows. As a result, we rely on access to capital markets as a significant source of funding for our capital and operating requirements. We will require substantial additional capital to fund ongoing operations. We cannot assure you that such additional funding will be available to us on satisfactory terms, or at all. If we are unable to obtain additional financing, as needed and at competitive rates, our ability to implement our business plan and strategy will be adversely affected. Certain market disruptions may increase our cost of borrowing or affect our ability to access financial markets. Such market disruptions could result from: rising inflation; bank failures and the potential adverse effect on the credit market; adverse economic conditions; adverse general capital market conditions; poor performance and health of the minerals and metals industry or minerals extraction in general; bankruptcy or financial distress of other metals companies; significant decrease in the demand for metals; or adverse regulatory actions that affect our business plans.

Climate change may adversely affect our business operations.

We are subject to risks associated with climate change which could harm our results of operations and increase our costs and expenses. The occurrence of severe adverse weather conditions, including increased temperatures, hail, droughts, fires or floods, may have a potentially devastating impact on our operations. Adverse weather may result in physical damage to our operations, instability of our infrastructure and equipment, washed-out roads to our projects, and alter the supply of water and electricity to our mining sites. Increased temperatures may also decrease worker productivity at our projects and raise cooling costs. Should the impacts of climate change be material in nature or occur for lengthy periods of time, our financial condition or results of operations would be adversely affected.

Cybersecurity risks and cyber incidents may adversely affect our business.

Attempts to gain unauthorized access to our information technology systems become more sophisticated over time. These attempts, which might be related to industrial or other espionage, include covertly introducing malware to our computers and networks and impersonating authorized users, among others. We seek to detect and investigate all security incidents and to prevent their recurrence, but in some cases, we might be unaware of an incident or its magnitude and effects. The theft, unauthorized use, or publication of our intellectual property and/or confidential business information could harm our competitive position, reduce the value of our investment in research and development and other strategic initiatives or otherwise adversely affect our business. In addition, the devotion of additional resources to the security of our information technology systems in the future could significantly increase the cost of doing business or otherwise adversely impact our financial results.

We depend on key management employees.

The responsibility of overseeing the day-to-day operations and strategic management of our business depends substantially on our senior management and key personnel. Loss of such personnel may have an adverse effect on our performance. The success of our operations will depend upon numerous factors, many of which are beyond our control, including our ability to attract and retain key employees and hire qualified management, technical, engineering and sales personnel. We currently depend upon a relatively small number of key persons to seek out and form strategic alliances and find and retain additional employees. We may not be successful in attracting and retaining the personnel required to grow and operate our business profitably.

Our success will depend in part on developing and maintaining relationships with local communities and other stakeholders.

Our success may depend in part on developing and maintaining productive relationships with the communities surrounding our operations and other stakeholders in our operating locations. Notwithstanding our ongoing efforts, local communities and stakeholders can become dissatisfied with our activities, which may result in legal or administrative proceedings or campaigns against us, which could materially adversely affect our financial condition, results of operations and cash flows.

Our business could be adversely affected if our reputation is harmed.

Our reputation is important to the success of our business. If our reputation is damaged as a result of our actions or by events outside of our control, our business and results of operations could be adversely affected. If we fail to address, or appear to fail to address, successfully and promptly, the underlying causes of any reputational harm, we may be unsuccessful in repairing any damage to our reputation and our future business prospects would likely be adversely affected.

Our mineral properties may be subject to defects in title.

The ownership and validity or title of unpatented minerals extraction claims and concessions are often uncertain and may be contested. We also may not have, or may not be able to obtain, all necessary surface rights to develop a property. Although we have taken reasonable measures to ensure proper title to our properties, there is no guarantee that title to any of our properties will not be challenged or impugned. Title insurance is generally not available for mineral properties and our ability to ensure that we have obtained a secure claim to individual mineral properties or extraction concessions may be severely constrained. Our mineral properties may be subject to prior unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. We may incur significant costs related to defending the title to our properties. A successful claim contesting our title to a property may cause us to compensate other persons or perhaps reduce our interest in the affected property or lose our rights to explore and, if warranted, develop that property. This could result in us not being compensated for our prior expenditures relating to the property.

Our directors and officers may be in a position of conflict of interest.

Some of our directors and officers currently also serve as directors and officers of other companies involved in similar industries and any of our directors may in the future serve in such positions. There exists the possibility that they may in the future be in a position of conflict of interest. Any decision made by such persons involving us will be made in accordance with their duties and obligations to deal fairly and in good faith with us and such other companies. In addition, any such directors will declare, and refrain from voting on, any matter in which such directors may have a material interest.

Lawsuits may be filed against us and an adverse ruling in any such lawsuit may adversely affect our business, financial condition or liquidity or the market price of the ADSs.

The products we intend to supply may be used in potentially hazardous or critical applications that could result in death, personal injury, property damage, loss of production, punitive damages and consequential damages. Actual or claimed defects in the products we supply could result in our being named as a defendant in lawsuits asserting potentially large claims. The outcome of outstanding, pending or future proceedings cannot be predicted with certainty and may be determined adversely to us and as a result, could have a material adverse effect on our assets, liabilities, business, financial condition or results of operations. Even if we prevail in any such legal proceeding, the proceedings could be costly and time-consuming and may divert the attention of management and key personnel from our business operations, which could adversely affect our financial condition.

Risks Related to Regulatory and Industry Matters

We will be subject to significant governmental regulations, including the U.S. Federal Mine Safety and Health Act.

Minerals extraction activities in the United States are subject to extensive federal, state, local and foreign laws and regulations governing environmental protection, natural resources, prospecting, development, production, post-closure reclamation, taxes, labor standards and occupational health and safety laws and regulations, including mine safety, toxic substances and other matters. The costs associated with compliance with such laws and regulations are substantial. In addition, changes in such laws and regulations, or more restrictive interpretations of current laws and regulations by governmental authorities, could result in unanticipated capital expenditures, expenses or restrictions on or suspensions of our operations and delays in the development of our properties.

We will be required to obtain and renew governmental permits in order to achieve our business plans, a process that is often costly and time-consuming.

Obtaining and renewing governmental permits is a complex and time-consuming process. The timeliness and success of permitting efforts are contingent upon many variables not within our control, including the interpretation of permit approval requirements administered by the applicable permitting authority. We may not be able to obtain or renew permits that are necessary to our planned operations or we may find that the cost and time required to obtain or renew such permits exceeds our expectations, which in turn could materially adversely affect our business plans or our prospective or actual revenues and profitability. In addition, private parties, such as environmental activists, frequently attempt to intervene in the permitting process and to persuade regulators to deny necessary permits or seek to overturn permits that have been issued. These third-party actions can materially increase the costs and cause delays in the permitting process and could cause us to not proceed with the development or operation of a property.

Compliance with environmental regulations and litigation based on environmental regulations could require significant expenditures.

Environmental regulations mandate, among other things, the maintenance of air and water quality standards, land development and land reclamation, and set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. In connection with our current business activities operations, we may incur environmental costs that could have a material adverse effect on financial condition and results of operations. Any failure to remedy an environmental problem could require us to suspend operations or enter into interim compliance measures pending completion of the required remedy. Moreover, governmental authorities and private parties may bring lawsuits based upon damage to property and injury to persons resulting from the environmental, health and safety impacts of prior and current operations, including operations conducted by other extraction companies many years ago at sites located on properties that we currently own or formerly owned. We cannot assure you that any such law, regulation, enforcement or private claim would not have a material adverse effect on our financial condition, results of operations or cash flows. If we violate or fail to comply with applicable environmental laws and regulations, we could be subject to penalties, restrictions on operations or other sanctions. Such liability could materially adversely affect our reputation, business, results of operations and financial condition.

Mineral and metal prices are subject to unpredictable fluctuations.

We expect our future revenues, if any, to be derived from the production and sale of titanium and titanium products and also in part from the extraction and sale of critical minerals including titanium, rare earth element, and zircon containing minerals. The price of such minerals and metals may fluctuate widely and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities, increased production due to new extraction developments and improved extraction and production methods and technological changes in the markets for the end products. The effect of these factors on metals prices, and therefore the economic viability of any of our exploration properties, cannot accurately be predicted. Additionally, new production of critical minerals including titanium, rare earth elements, and zircon from current or new competitors in the critical minerals markets could adversely affect prices. In recent years, new and existing competitors have increased the supply of certain critical minerals including titanium, rare earth elements, and zircon, which may have negatively affected its price. Further production increases could negatively affect prices. We cannot make accurate projections regarding the capacities of possible new entrants into the market and the dates on which they could become operational.

We are subject to risks associated with currency fluctuations, and changes in foreign currency exchange rates could impact our results of operations.

Our operating expenses are denominated in U.S. dollars and Australian dollars. Our cash and cash equivalents are denominated in U.S. dollars and Australian dollars. Because we have multiple functional currencies across different jurisdictions, changes in the exchange rate between these currencies and the foreign currencies of the transactions recorded in our accounts could materially impact our reported results of operations and distort period-to-period comparisons. More specifically, as a result of our cash and cash equivalents that are denominated in Australian dollars, any appreciation of the U.S. dollar against the Australian dollar would have a negative effect on the U.S. dollar amount available to us. Appreciation or depreciation in the value of the Australian dollar relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. As a result of such foreign currency fluctuations, it could be more difficult to detect underlying trends in our business and results of operations.

Risks Related to Our ADSs

An active trading market for the ADSs may not be developed or sustained, and the trading price for the ADSs may be volatile and affected by economic conditions beyond our control.

We listed the ADSs on Nasdaq in June 2022. However, a liquid public market in the United States for your ADSs may not develop or be sustained, which means you may experience a decrease in the value of the ADSs regardless of our operating performance. In addition, the market price of the ADSs may be highly volatile and subject to wide fluctuations. For instance, during fiscal 2024, the closing price of our ADSs ranged from US$6.70 to US$15.96. We cannot assure you that the market price of the ADSs will not fluctuate or decline significantly in the future. Some specific factors that could adversely affect the price of the ADSs or trading volumes include actual or expected changes in our prospects or operating results; changes in actual or anticipated demand for our products; general economic conditions; and the liquidity of U.S. and Australian trading markets. In the past, following periods of volatility in the market price of a company’s securities, shareholders often instituted securities class action litigation against that company. If we were involved in a class action suit, it could divert the attention of senior management and, if adversely determined, could have a material adverse effect on our results of operations and financial condition.

ADS holders are not shareholders and do not have shareholder rights.

The Bank of New York Mellon, as depositary, issues and delivers ADSs. ADS holders will not be treated as shareholders and will not have shareholders rights. The depositary will be the holder of our ordinary shares represented by the ADSs. Holders of ADSs will have ADS holder rights. A deposit agreement among us, the depositary, and the beneficial owners and holders of ADSs, sets out ADS holder rights as well as the rights and obligations of the depositary. New York law governs the deposit agreement and the ADSs. We and the depositary may amend or terminate the deposit agreement without the ADS holders’ consent in a manner that could prejudice ADS holders. For a description of ADS holder rights, see “Item 12. Description of Securities Other Than Equity Securities-D. American Depositary Shares.” Our shareholders have shareholder rights. Australian law and our Constitution govern shareholder rights. For a description of ADS holder rights and the rights of our ordinary shares, see “Item 10. Additional Information-A. Share Capital.”

ADS holders do not have the same voting rights as our shareholders. Shareholders are entitled to receive our notices of general meetings and to attend and vote at our general meetings of shareholders. At a general meeting, every shareholder present (in person or by proxy, attorney or representative) and entitled to vote has one vote on a show of hands. Every shareholder present (in person or by proxy, attorney or representative) and entitled to vote has one vote per fully paid ordinary share on a poll. This is subject to any other rights or restrictions which may be attached to any shares. ADS holders may instruct the depositary to vote the ordinary shares underlying their ADSs, but only if we ask the depositary to ask for their instructions. If we do not ask the depositary to ask for the instructions, our ADS holders are not entitled to receive our notices of general meeting. ADS holders will not be entitled to attend and vote at a general meeting unless they surrender their ADSs and withdraw the ordinary shares. However, our ADS holders may not have sufficient advance notice about the meeting to surrender their ADSs and withdraw the shares. If we ask for ADS holders’ instructions, the depositary will notify ADS holders of the upcoming vote and arrange to deliver our voting materials and form of notice to them. The depositary will try, as far as practical, subject to Australian law and the provisions of the deposit agreement, to vote the shares as ADS holders instruct. The depositary will not vote or attempt to exercise the right to vote other than in accordance with the instructions of the ADS holders. We cannot assure ADS holders that they will receive the voting materials in time to ensure that they can instruct the depositary to vote their shares. In addition, there may be other circumstances in which ADS holders may not be able to exercise voting rights.

ADS holders do not have the same rights to receive dividends or other distributions as our shareholders. Subject to any special rights or restrictions attached to any shares, the directors may determine that a dividend will be payable on our ordinary shares and fix the amount, the time for payment and the method for payment (although we have never declared or paid any cash dividends on our ordinary shares, and we do not anticipate paying any cash dividends in the foreseeable future). Dividends may be paid on our ordinary shares of one class but not another and at different rates for different classes. Dividends and other distributions payable to our shareholders with respect to our ordinary shares generally will be payable directly to them. Any dividends or distributions payable with respect to ordinary shares will be paid to the depositary, which has agreed to pay to ADS holders the cash dividends or other distributions it or the custodian receives on shares or other deposited securities, after deducting its fees and expenses and subject to the provisions of the deposit agreement. Before the depositary makes a distribution to you on behalf of your ADSs, any withholding taxes that must be paid will be deducted. Additionally, if the exchange rate fluctuates during a time when the ADS depositary cannot convert the foreign currency, you may lose some or all of the value of the distribution. ADS holders will receive these distributions in proportion to the number of ordinary shares their ADSs represent. In addition, there may be certain circumstances in which the depositary may not pay to ADS holders amounts distributed by us as a dividend or distribution.

There are circumstances where it may be unlawful or impractical to make distributions to the holders of ADSs.

The deposit agreement allows the depositary to distribute the foreign currency only to those ADS holders to whom it is possible to do so. If a distribution is payable by us in Australian dollars, the depositary will hold the foreign currency it cannot convert for the account of the ADS holders who have not been paid. It will not invest the foreign currency and it will not be liable for any interest. If the exchange rates fluctuate during a time when the depositary cannot convert the foreign currency, ADS holders may lose some of the value of the distribution. The depositary is not responsible if it decides that it is unlawful or impractical to make a distribution available to any ADS holders. This means that ADS holders may not receive the distributions we make on our ordinary shares or any value for them if it is illegal or impractical for us to make them available to them.

Holders of the ADSs may have difficulty in effecting service of process in the United States or enforcing judgments obtained in the United States.

We are a public company incorporated under the laws of Australia. Therefore, the rights of holders of our ordinary shares are governed by Australian law and our Constitution. These rights differ from the typical rights of shareholders in U.S. corporations. The rights of holders of ADSs are affected by Australian law and our Constitution but are governed by U.S. law. Circumstances that under U.S. law may entitle a shareholder in a U.S. company to claim damages may also give rise to a cause of action under Australian law entitling a shareholder in an Australian company to claim damages. However, this will not always be the case.

Holders of the ADSs may have difficulties enforcing, in actions brought in courts in jurisdictions located outside the United States, liabilities under U.S. securities laws. In particular, if such a holder sought to bring proceedings in Australia based on U.S. securities laws, the Australian court might consider whether:

| • | it did not have jurisdiction; |

| • | it was not an appropriate forum for such proceedings; |

| • | applying Australian conflict of laws rule, U.S. law (including U.S. securities laws) did not apply to the relationship between holders of our ordinary shares or ADSs and us or our directors and officers; or |

| • | the U.S. securities laws were of a public or penal nature and should not be enforced by the Australian court. |

Certain of our directors and executive officers are residents of countries other than the United States. Furthermore, a portion of our and their assets are located outside the United States. As a result, it may not be possible for a holder of our ordinary shares or ADSs to:

| • | effect service of process within the United States upon certain directors and executive officers or on us; |

| • | enforce in U.S. courts judgments obtained against any of our directors and executive officers or us in the U.S. courts in any action, including actions under the civil liability provisions of U.S. securities laws; |

| • | enforce in U.S. courts judgments obtained against any of our directors and senior management or us in courts of jurisdictions outside the United States in any action, including actions under the civil liability provisions of U.S. securities laws; or |

| • | bring an action in an Australian court to enforce liabilities against any of our directors and executive officers or us based upon U.S. securities laws. |

Holders of our ordinary shares and ADSs may also have difficulties enforcing in courts outside the U.S. judgments obtained in the U.S. courts against any of our directors and executive officers or us, including actions under the civil liability provisions of the U.S. securities laws.

ADSs holders may not be entitled to a jury trial with respect to claims arising under the deposit agreement, which could result in less favorable outcomes to the plaintiff(s) in any such action.

The deposit agreement governing the ADSs provides that, to the fullest extent permitted by law, ADS holders waive the right to a jury trial of any claim they may have against us or the depositary arising out of or relating to our ordinary shares, the ADSs or the deposit agreement, including any claim under the U.S. federal securities laws. The waiver of jury trial provision applies to all holders of ADSs, including purchasers who acquire the ADSs on the open market. If we or the depositary opposed a jury trial demand based on the waiver, the court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. To our knowledge, the enforceability of a contractual pre-dispute jury trial waiver in connection with claims arising under the federal securities laws has not been finally adjudicated by the United States Supreme Court. However, we believe that a contractual pre-dispute jury trial waiver provision is generally enforceable, including under the laws of the State of New York, which govern the deposit agreement, by a federal or state court in the City of New York, which has non-exclusive jurisdiction over matters arising under the deposit agreement. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether a party knowingly, intelligently and voluntarily waived the right to a jury trial. We believe that this is the case with respect to the deposit agreement and the ADSs. In addition, New York courts will not enforce a jury trial waiver provision in order to bar a viable setoff or counterclaim sounding in fraud or one which is based upon a creditor’s negligence in failing to liquidate collateral upon a guarantor’s demand, or in the case of an intentional tort claim (as opposed to a contract dispute), none of which we believe are applicable in the case of the deposit agreement or the ADSs. It is advisable that you consult legal counsel regarding the jury waiver provision before entering into the deposit agreement.

If you or any other owner or holder of ADSs bring a claim against us or the depositary in connection with matters arising under the deposit agreement or the ADSs, including claims under federal securities laws, you or such other owner or holder may not be entitled to a jury trial with respect to such claims, which may have the effect of limiting and discouraging lawsuits against us and/or the depositary. If a lawsuit is brought against us and/or the depositary under the deposit agreement, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in any such action. Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the deposit agreement with a jury trial. No condition, stipulation or provision of the deposit agreement or ADSs serves as a waiver by any owner or holder of ADSs or by us or the depositary of compliance with any substantive provision of the U.S. federal securities laws and the rules and regulations promulgated thereunder. By agreeing to the jury trial waiver provision in the deposit agreement, investors will not be deemed to have waived our compliance with or the depositary’s compliance with the federal securities laws and the rules and regulations promulgated thereunder.

The dual listing of our ordinary shares and the ADSs may adversely affect the liquidity and value of the ADSs.

Our ordinary shares are listed on the ASX and the ADSs are listed on Nasdaq. We cannot predict the effect of this dual listing on the value of our ordinary shares and ADSs. However, the dual listing of our ordinary shares and ADSs may dilute the liquidity of these securities in one or both markets and may adversely affect the development of an active trading market for the ADSs in the United States. The price of the ADSs could also be adversely affected by trading in our ordinary shares on the ASX.

Certain of outstanding securities may dilute the value of our ordinary shares.

As of June 30, 2024, we had 257,244,759 ordinary shares outstanding and 39,600,000 ordinary shares reserved for issuance upon conversion of performance shares upon the satisfaction of certain performance conditions. To the extent that the conditions to the vesting of such securities are satisfied, the value of our ordinary shares may be diluted.

Currency fluctuations may adversely affect the price of the ADSs relative to the price of our ordinary shares.

The price of our ordinary shares is quoted in Australian dollars, and the price of the ADSs is quoted in U.S. dollars. Movements in the Australian dollar/U.S. dollar exchange rate may adversely affect the U.S. dollar price of the ADSs and the U.S. dollar equivalent of the price of our ordinary shares. If the Australian dollar weakens against the U.S. dollar, the U.S. dollar price of the ADSs could decline, even if the price of our ordinary shares in Australian dollars increases or remains unchanged. If we pay dividends, we will likely calculate and pay any cash dividends in Australian dollars and, as a result, exchange rate movements will affect the U.S. dollar amount of any dividends holders of the ADSs will receive from the depositary.

As a foreign private issuer, we are permitted and expect to follow certain home country corporate governance practices in lieu of certain Nasdaq requirements applicable to domestic issuers.

As a foreign private issuer listed on Nasdaq, we are permitted to follow certain home country corporate governance practices in lieu of certain Nasdaq practices. Following our home country corporate governance practices, as opposed to the requirements that would otherwise apply to a U.S. company listed on Nasdaq, may provide less protection than is afforded to investors under the Nasdaq rules applicable to domestic issuers.

In particular, we follow home country law instead of Nasdaq practice regarding:

| • | Nasdaq’s requirement that our independent directors meet regularly in executive sessions. The ASX Listing Rules and the Corporations Act do not require the independent directors of an Australian company to have such executive sessions and, accordingly, we have claimed this exemption. |

| • | Nasdaq’s requirement that an issuer provide for a quorum as specified in its bylaws for any meeting of the holders of ordinary shares, which quorum may not be less than 33 1/3% of the outstanding shares of an issuer’s voting ordinary shares. In compliance with Australian law, our Constitution provides that two shareholders present shall constitute a quorum for a general meeting. |

| • | Nasdaq’s requirement that issuers obtain shareholder approval prior to the issuance of securities in connection with certain acquisitions, changes of control or private placements of securities, or the establishment or amendment of certain stock option, purchase or other compensation plans. Applicable Australian law and rules differ from Nasdaq requirements, with the ASX Listing Rules providing generally for prior shareholder approval in numerous circumstances, including (i) issuance of equity securities exceeding 15% (or an additional 10% capacity to issue equity securities for the proceeding 12-month period if shareholder approval by special resolution is sought at the Company’s annual general meeting) of our issued share capital in any 12-month period (but, in determining the available issue limit, securities issued under an exception to the rule or with shareholder approval are not counted), (ii) issuance of equity securities to related parties (as defined in the ASX Listing Rules) and (iii) directors or their associates acquiring securities under an employee incentive plan. |

As a foreign private issuer, we are permitted to file less information with the SEC than a domestic issuer.

As a foreign private issuer, we are exempt from certain rules under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), that impose requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as a domestic issuer, nor are we generally required to comply with the SEC’s Regulation FD, which restricts the selective disclosure of material non-public information.

Under Australian law, we prepare financial statements on an annual and semi-annual basis, we are not required to prepare or file quarterly financial information other than quarterly updates. Our quarterly updates have consisted of a brief review of operations for the quarter together with a statement of cash expenditure during the quarter and the cash and cash equivalents balance as at the end of the quarter.

For as long as we are a “foreign private issuer,” we intend to file our annual financial statements on Form 20-F and furnish our semi-annual financial statements and quarterly updates on Form 6-K to the SEC as long as we are subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act. However, the information we file or furnish is not the same as the information that is required in annual and quarterly reports on Form 10-K or Form 10-Q for U.S. domestic issuers. Accordingly, there may be less information publicly available concerning us than there is for a company that files as a domestic issuer.

We may lose our foreign private issuer status, which would then require us to comply with the Exchange Act’s domestic reporting regime and cause us to incur additional legal, accounting and other expenses.

We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter. In order to maintain our current status as a foreign private issuer, either (1) a majority of our ordinary shares must be either directly or indirectly owned of record by non-residents of the United States or (2) (a) a majority of our executive officers or directors must not be U.S. citizens or residents, (b) more than 50 percent of our assets cannot be located in the United States; and (c) our business must be administered principally outside the United States. If we lost this status, we would be required to comply with the Exchange Act reporting and other requirements applicable to U.S. domestic issuers, which are more detailed and extensive than the requirements for foreign private issuers. We may also be required to make changes in our corporate governance practices and to comply with United States generally accepted accounting principles, as opposed to IFRS. The regulatory and compliance costs to us under U.S. securities laws if we are required to comply with the reporting requirements applicable to a U.S. domestic issuer may be higher than the cost we would incur as a foreign private issuer. As a result, we expect that a loss of foreign private issuer status would increase our legal and financial compliance costs.

We are an emerging growth company, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies may make the ADSs less attractive to investors and, as a result, adversely affect the price of the ADSs and result in a less active trading market for the ADSs.

We are an emerging growth company as defined in the U.S. Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. For example, we have elected to rely on an exemption from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) relating to internal control over financial reporting, and we will not provide such an attestation from our auditors.

We may avail ourselves of these disclosure exemptions until we are no longer an emerging growth company. We cannot predict whether investors will find the ADSs less attractive because of our reliance on some or all of these exemptions. If investors find the ADSs less attractive, it may adversely affect the price of the ADSs and there may be a less active trading market for the ADSs.

We will cease to be an emerging growth company upon the earliest of:

| • | the last day of the fiscal year during which we have total annual gross revenues of US$1,235,000,000 (as such amount is indexed for inflation every five years by the SEC) or more; |

| • | the last day of our fiscal year following the fifth anniversary of the completion of our first sale of common equity securities pursuant to an effective registration statement under the Securities Act, which is expected to be June 30, 2028, unless we change our fiscal year; |

| • | the date on which we have, during the previous three-year period, issued more than US$1,000,000,000 in non-convertible debt; or |

| • | the date on which we are deemed to be a “large accelerated filer,” as defined in Rule 12b-2 of the Exchange Act, which would occur as of the end of any fiscal year in which the market value of our ordinary shares and ADSs that are held by non-affiliates exceeds US$700,000,000 as of the last day of our most recently completed second fiscal quarter. |

We will incur significant costs as a result of operating as a company whose ADSs are publicly traded in the United States, and our management is required to devote substantial time to compliance initiatives.

We originally listed the ADSs in the United States in June 2022 and, as a result, we expect to incur significant legal, accounting, insurance and other expenses in the future periods that we did not incur prior to listing in the United States. In addition, the Sarbanes-Oxley Act, Dodd-Frank Wall Street Reform and Consumer Protection Act and related rules implemented by the SEC, have imposed various requirements on public companies including requiring establishment and maintenance of effective disclosure and internal controls. Our management and other personnel will need to devote a substantial amount of time to these compliance initiatives, and we may need to add additional personnel and build our internal compliance infrastructure. Moreover, these rules and regulations increase our legal and financial compliance costs and make some activities more time consuming and costly. These laws and regulations could also make it more difficult and expensive for us to attract and retain qualified persons to serve on our board of directors, our board committees or as our senior management. Furthermore, if we are unable to satisfy our obligations as a public company in the United States, we could be subject to delisting of the ADSs, fines, sanctions and other regulatory action and potentially civil litigation.

We do not anticipate paying dividends in the foreseeable future.

We have not declared any dividends during the last three fiscal years and do not anticipate that we will do so in the foreseeable future. We currently intend to retain future earnings, if any, to finance the development of our business. Dividends, if any, on our outstanding ordinary shares will be declared by and subject to the discretion of the Board on the basis of our earnings, financial requirements and other relevant factors, and subject to Australian law. As a result, a return on your investment will only occur if the ADS price appreciates. We cannot assure you that the ADSs will appreciate in value or even maintain the price at which you purchase the ADSs. You may not realize a return on your investment in the ADSs and you may even lose your entire investment in the ADSs.

If U.S. securities or industry analysts do not publish research reports about our business, or if they issue an adverse opinion about our business, the market price and trading volume of our ordinary shares or ADSs could decline.