| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-258342-01 |

| | | |

| | | | | |

| | | | | |

| | | JANUARY 21, 2022 | | |

| | | BENCHMARK 2022-B32 Commercial Mortgage Trust | | |

| | | | | |

| | | Free Writing Prospectus Structural and Collateral Term Sheet $1,774,834,674 (Approximate Mortgage Pool Balance) $1,246,160,000 (Approximate Offered Certificates) | | |

| | | J.P. Morgan Chase Commercial Mortgage

Securities Corp. Depositor | | |

| | | Commercial Mortgage Pass-Through Certificates Series 2022-B32 | | |

| | | | | |

| | | JPMorgan Chase Bank, National Association Citi Real Estate Funding Inc. Goldman Sachs Mortgage Company German American Capital Corporation | | |

| | | As Sponsors and Mortgage Loan Sellers | | |

| | | | | |

| | | J.P. Morgan | Goldman Sachs &

Co. LLC | Deutsche Bank Securities | Citigroup | | |

| | | Co-Lead Managers and Joint Bookrunners | | |

| | | Academy Securities | Drexel Hamilton | | |

| | | Co-Managers | | |

| | | | | |

| | | | | | | | |

| January 21, 2022 | BENCHMARK 2022-B32 |

This material is for your information, and none of J.P. Morgan Securities LLC (“JPMS”), Citigroup Global Markets Inc. (“CGMI”), Goldman Sachs & Co. LLC (“GS”), Deutsche Bank Securities Inc. (“DBSI”), Drexel Hamilton, LLC (“Drexel”) or Academy Securities, Inc. (“Academy Securities”) (each individually, an “Underwriter”, and together, the ‘‘Underwriters’’) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The Depositor has filed a registration statement (including a prospectus) with the SEC (SEC File no. 333-258342) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, the Depositor or any Underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling (800) 408-1016 or by emailing the ABS Syndicate Desk at abs_synd@jpmorgan.com. Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended), such Regulation as it forms part of the domestic law of the United Kingdom and/or Part VI of the Financial Services and Markets Act 2000 (as amended); and does not constitute an offering document for any other purpose.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) that have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected in this document. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the Computational Materials. The specific characteristics of the certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any certificate described in the Computational Materials are subject to change prior to issuance. None of the Underwriters nor any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the certificates.

This information is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change.

This document contains forward-looking statements. Those statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth in this document. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of their dates, the Depositor undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Investors should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the Depositor’s view only as of the date of this document.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE. Securities and investment banking activities in the United States are performed by Deutsche Bank Securities Inc., a member of NYSE, FINRA and SIPC, and its broker-dealer affiliates. Lending and other commercial banking activities in the United States are performed by Deutsche Bank AG, acting through its New York Branch.

Capitalized terms used in this material but not defined herein shall have the meanings ascribed to them in the Preliminary Prospectus (as defined below).

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Indicative Capital Structure |

Publicly Offered Certificates

| Class | Expected Ratings

(Moody’s / Fitch / KBRA) | Approximate Initial

Certificate Balance or

Notional Amount(1) | Approximate

Initial Credit

Support(2) | Expected

Weighted

Avg. Life

(years)(3) | Expected Principal

Window(3) | Certificate

Principal to

Value

Ratio(4) | Underwritten

NOI Debt

Yield(5) |

| A-1 | Aaa(sf) / AAAsf / AAA(sf) | $6,410,000 | 30.000% | 2.80 | 3/2022 – 11/2026 | 39.1% | 16.3% |

| A-2 | Aaa(sf) / AAAsf / AAA(sf) | $162,053,000 | 30.000% | 4.89 | 11/2026 – 1/2027 | 39.1% | 16.3% |

| A-3 | Aaa(sf) / AAAsf / AAA(sf) | $253,574,000 | 30.000% | 6.92 | 12/2028 – 2/2029 | 39.1% | 16.3% |

| A-4 | Aaa(sf) / AAAsf / AAA(sf) | (6) | 30.000% | (6) | (6) | 39.1% | 16.3% |

| A-5 | Aaa(sf) / AAAsf / AAA(sf) | (6) | 30.000% | (6) | (6) | 39.1% | 16.3% |

| A-SB | Aaa(sf) / AAAsf / AAA(sf) | $18,046,000 | 30.000% | 7.42 | 1/2027 – 11/2031 | 39.1% | 16.3% |

| X-A | Aa1(sf) / AAAsf / AAA(sf) | $1,359,412,000(7) | N/A | N/A | N/A | N/A | N/A |

| X-B | NR / A-sf / AAA(sf) | $151,748,000 (7) | N/A | N/A | N/A | N/A | N/A |

| A-S | Aa2(sf) / AAAsf / AAA(sf) | $179,147,000 | 19.375% | 9.91 | 1/2032 – 1/2032 | 45.1% | 14.1% |

| B | NR / AA-sf / AA-(sf) | $82,197,000 | 14.500% | 9.91 | 1/2032 – 1/2032 | 47.8% | 13.3% |

| C | NR / A-sf / A-(sf) | $69,551,000 | 10.375% | 9.91 | 1/2032 – 1/2032 | 50.1% | 12.7% |

Privately Offered Certificates(8)

| Class | Expected Ratings

(Moody’s / Fitch / KBRA) | Approximate Initial

Certificate Balance or

Notional Amount(1) | Approximate

Initial Credit

Support(2) | Expected

Weighted

Avg. Life

(years)(3) | Expected Principal

Window(3) | Certificate

Principal to

Value

Ratio(4) | Underwritten

NOI Debt

Yield(5) |

| A-2A1 | Aaa(sf) / AAAsf / AAA(sf) | $265,000,000 | 30.000% | 4.89 | 11/2026 – 1/2027 | 39.1% | 16.3% |

| X-D | NR / BBB-sf / BBB-(sf) | $65,336,000(7) | N/A | N/A | N/A | N/A | N/A |

| X-FG | NR / BB-sf / BB-(sf) | $37,937,000(7) | N/A | N/A | N/A | N/A | N/A |

| X-H | NR / B-sf / B-(sf) | $16,861,000(7) | N/A | N/A | N/A | N/A | N/A |

| X-NR | NR / NR / NR | $54,798,940(7) | N/A | N/A | N/A | N/A | N/A |

| D | NR / BBBsf / BBB(sf) | $44,260,000 | 7.750% | 9.91 | 1/2032 – 1/2032 | 51.6% | 12.4% |

| E | NR / BBB-sf / BBB-(sf) | $21,076,000 | 6.500% | 9.91 | 1/2032 – 1/2032 | 52.3% | 12.2% |

| F | NR / BB+sf / BB+(sf) | $18,969,000 | 5.375% | 9.91 | 1/2032 – 1/2032 | 52.9% | 12.0% |

| G | NR / BB-sf / BB-(sf) | $18,968,000 | 4.250% | 9.91 | 1/2032 – 1/2032 | 53.5% | 11.9% |

| H | NR / B-sf / B-(sf) | $16,861,000 | 3.250% | 9.91 | 1/2032 – 1/2032 | 54.1% | 11.8% |

| J | NR / NR / NR | $16,861,000 | 2.250% | 9.91 | 1/2032 – 1/2032 | 54.6% | 11.7% |

| K | NR / NR / NR | $37,937,940 | 0.000% | 9.93 | 1/2032 – 2/2032 | 55.9% | 11.4% |

Non-Offered Vertical Risk Retention Interest(8)

Non-Offered Vertical Risk

Retention Interest | Expected

Ratings

(Moody’s / Fitch / KBRA) | Approximate Initial

VRR Interest

Balance (1) | Approximate

Initial Credit

Support(2) | Expected

Weighted

Avg. Life

(years)(3)(9) | Expected

Principal

Window(3)(9) | Certificate Principal

to Value

Ratio(4) | Underwritten

NOI Debt

Yield(5) |

| Class RR Certificates(10)(11) | NR / NR / NR | $37,252,097 | N/A | 8.10 | 3/2022 – 2/2032 | N/A | N/A |

| RR Interest(10)(11) | NR / NR / NR | $51,489,637 | N/A | 8.10 | 3/2022 – 2/2032 | N/A | N/A |

| (1) | In the case of each such Class or the RR Interest, subject to a permitted variance of plus or minus 5%. The VRR interest balance of the VRR Interest is not included in the certificate balance or notional amount of any class of certificates set forth under “Publicly Offered Certificates” or “Privately Offered Certificates in the table above, and the VRR Interest is not offered by this Term Sheet. In addition, the notional amounts of the Class X-A, Class X-B, Class X-D, Class X-FG, Class X-H and Class X-NR Certificates may vary depending upon the final pricing of the Classes of Principal Balance Certificates whose Certificate Balances comprise such notional amounts, and, if as a result of such pricing the pass-through rate of any Class of the Class X-A, Class X-B, Class X-D, Class X-FG, Class X-H or Class X-NR Certificates, as applicable, would be equal to zero at all times, such Class of Certificates will not be issued on the closing date of this securitization. |

| (2) | The approximate initial credit support percentages set forth for the certificates are approximate and for the Class A-1, Class A-2, Class A-2A1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates are represented in the aggregate. The VRR interest provides credit support only to the limited extent that it is allocated a portion of any losses incurred on the mortgage loans which such losses are allocated between it on the one hand, and the non-VRR certificates (other than the Class X-A, Class X-B, Class X-D, Class X-FG, Class X-H and Class X-NR Certificates) on the other hand, pro rata in accordance with their respective percentage allocation entitlement. See “Description of the Certificates” in the Preliminary Prospectus. |

| (3) | Assumes 0% CPR / 0% CDR and February 16, 2022 closing date. Based on modeling assumptions as described in the Preliminary Prospectus dated January 21, 2022 (the “Preliminary Prospectus”). |

| (4) | The “Certificate Principal to Value Ratio” for any Class of Principal Balance Certificates (other than the Class A-1, Class A-2, Class A-2A1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV for the mortgage loans, and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates. The Class A-1, Class A-2, Class A-2A1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificate Principal to Value Ratios are calculated in the aggregate for those Classes as if they were a single class. Investors should note, however, that excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (5) | The “Underwritten NOI Debt Yield” for any Class of Principal Balance Certificates (other than the Class A-1, Class A-2, Class A-2A1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates) is calculated as the product of (a) the weighted average UW NOI DY for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance for such Class and all |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Indicative Capital Structure |

| | Classes of Principal Balance Certificates senior to such Class of Certificates. The Underwritten NOI Debt Yield for each of the Class A-1, Class A-2, Class A-2A1, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that net operating income from any mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (6) | The exact initial certificate balances of the Class A-4 and Class A-5 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial certificate balances, weighted average lives and principal windows of the Class A-4 and Class A-5 certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial certificate balance of the Class A-4 and Class A-5 certificates is expected to be approximately $475,182,000, subject to a variance of plus or minus 5%. |

| Class of Certificates | Expected Range of Initial Certificate

Balance | Expected Range of Weighted Avg.

Life (years) | Expected Range of Principal

Window |

| A-4 | $0 – $225,000,000 | NAP – 9.61 | NAP / 1/2030 – 12/2031 |

| A-5 | $250,182,000 – $475,182,000 | 9.77 – 9.91 | 1/2030 – 1/2032 / 12/2031 – 1/2032 |

| (7) | The Class X-A, Class X-B, Class X-D, Class X-FG, Class X-H and Class X-NR Notional Amounts are defined in the Preliminary Prospectus. |

| (8) | The Classes of Certificates set forth under “Privately Offered Certificates”, “Non-Offered Vertical Risk Retention Interest” in the tables above are not being offered by the Preliminary Prospectus or this Term Sheet. The Class S and Class R Certificates are not shown above. |

| (9) | The expected weighted average life and expected principal window during which distributions of principal would be received as set forth in the foregoing table with respect to the VRR Interest are based on the assumptions set forth under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans. |

| (10) | JPMorgan Chase Bank, National Association, as the retaining sponsor for this securitization is expected to acquire from the depositor, on the Closing Date, an “eligible vertical interest” (as defined in Regulation RR) comprised of the Class RR Certificates and the RR Interest (collectively, the “VRR Interest”), which is expected to represent approximately 5.00% of all Principal Balance Certificates and the VRR Interest. Portions of the VRR Interest will be acquired by each of Citi Real Estate Funding Inc., DBR Investments Co. Limited (or its "majority-owned affiliate") and Goldman Sachs Bank USA (or its "majority-owned affiliate") (together with JPMorgan Chase Bank, National Association in such capacity, the “VRR Interest Owners”) in accordance with the U.S. credit risk retention rules applicable to this securitization transaction. See “Credit Risk Retention” in the Preliminary Prospectus. |

| (11) | Although it does not have a specified pass-through rate (other than for tax reporting purposes), the effective interest rate for the VRR Interest will be the WAC rate. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Indicative Capital Structure |

| Securities Offered: | $1,246,160,000 monthly pay, multi-class, commercial mortgage REMIC Pass-Through Certificates. |

| Co-Lead Managers and Joint Bookrunners: | J.P. Morgan Securities LLC, Citigroup Global Markets Inc., Goldman Sachs & Co. LLC and Deutsche Bank Securities Inc. |

| Co-Managers: | Drexel Hamilton, LLC and Academy Securities, Inc. |

| Mortgage Loan Sellers: | Citi Real Estate Funding Inc. (“CREFI”) (35.6%), Goldman Sachs Mortgage Company (“GSMC”) (24.3%), German American Capital Corporation (“GACC”) (22.0%), and JPMorgan Chase Bank, National Association (“JPMCB”) (18.1%). |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association. |

| Special Servicer: | KeyBank National Association. |

| Directing Certificateholder: | Ellington Management Group, LLC. |

| Trustee: | Wilmington Trust, N.A. |

| Certificate Administrator: | Computershare Trust Company, N.A. |

| Operating Advisor: | Pentalpha Surveillance LLC. |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC. |

| Rating Agencies: | Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency, LLC (“KBRA”). |

| U.S. Credit Risk Retention: | JPMCB is expected to act as the “retaining sponsor” for this securitization and intends to satisfy the U.S. credit risk retention requirement by acquiring (either through itself or through one or more of its “majority owned affiliates” (as defined in Regulation RR)) from the depositor, on the Closing Date, an “eligible vertical interest” which will be comprised of the VRR Interest and portions of which will be transferred by JPMCB to each of CREFI, DBRI (or its “majority-owned affiliate”) and GSBI (or its “majority-owned affiliate”). The restrictions on hedging and transfer under the U.S. credit risk retention rules as in effect on the closing date of this transaction will expire on and after the date that is the latest of (i) the date on which the aggregate principal balance of the mortgage loans has been reduced to 33% of the aggregate principal balance of the mortgage loans as of the Cut-off Date; (ii) the date on which the total unpaid principal obligations under the Certificates has been reduced to 33% of the aggregate total unpaid principal obligations under the Certificates as of the Closing Date; or (iii) two years after the Closing Date. Notwithstanding any references in this term sheet to the credit risk retention rules, Regulation RR, the retaining sponsor and other risk retention related matters, in the event the credit risk retention rules and/or Regulation RR (or any relevant portion thereof) are repealed or determined by applicable regulatory agencies to be no longer applicable to this securitization transaction, none of the retaining sponsor or any other party will be required to comply with or act in accordance with the U.S. credit risk retention rules and/or Regulation RR (or such relevant portion thereof). For additional information, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU/UK Credit Risk Retention: | The transaction is not structured to satisfy any requirements in effect in the European Union or the United Kingdom as regards risk retention, transparency/reporting and due diligence. |

| Pricing Date: | On or about January 27, 2022. |

| Closing Date: | On or about February 16, 2022. |

| Cut-off Date: | With respect to each mortgage loan, the related due date in February 2022 or with respect to any mortgage loan that has its first due date after February 2022, the date that would otherwise have been the related due date in February 2022. |

| Distribution Date: | The 4th business day after the Determination Date in each month, commencing in March 2022. |

| Determination Date: | 11th day of each month, or if the 11th day is not a business day, the next succeeding business day, commencing in March 2022. |

| Assumed Final Distribution Date: | The Distribution Date in February 2032, which is the latest anticipated repayment date of the Certificates. |

| Rated Final Distribution Date: | The Distribution Date in January 2055. |

| Tax Treatment: | The Publicly Offered Certificates are expected to be treated as REMIC “regular interests” for U.S. federal income tax purposes. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Indicative Capital Structure |

| Form of Offering: | The Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-SB, Class X-A, Class X-B, Class A-S, Class B and Class C Certificates (the “Publicly Offered Certificates”) will be offered publicly. The Class A-2A1, Class X-D, Class X-FG, Class X-H, Class X-NR, Class D, Class E, Class F, Class G, Class H, Class J, Class K, Class S and Class R Certificates (the “Privately Offered Certificates”) will be offered domestically to Qualified Institutional Buyers and to Institutional Accredited Investors (other than the Class R Certificates) and to institutions that are not U.S. Persons pursuant to Regulation S. |

| SMMEA Status: | The Publicly Offered Certificates will not constitute “mortgage related securities” for purposes of SMMEA. |

| ERISA: | The Publicly Offered Certificates are expected to be ERISA eligible. |

| Optional Termination: | On any Distribution Date on which the aggregate principal balance of the pool of mortgage loans is less than 1% of the aggregate principal balance of the mortgage loans as of the Cut-off Date (solely for the purposes of this calculation, if a mortgage loan with an anticipated repayment date is still an asset of the issuing entity and such right is being exercised after its respective anticipated repayment date, then such mortgage loan will be excluded from the then-aggregate stated principal balance of the pool of mortgage loans and from the initial pool balance), certain entities specified in the Preliminary Prospectus will have the option to purchase all of the remaining mortgage loans (and all property acquired through exercise of remedies in respect of any mortgage loan) at the price specified in the Preliminary Prospectus. Refer to “Pooling and Servicing Agreement—Termination; Retirement of Certificates” in the Preliminary Prospectus. |

| Minimum Denominations: | The Publicly Offered Certificates (other than the Class X-A and Class X-B Certificates) will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A and Class X-B Certificates will be issued in minimum denominations of $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

| Settlement Terms: | DTC, Euroclear and Clearstream Banking. |

| Analytics: | The transaction is expected to be modeled by Intex Solutions, Inc. and Trepp, LLC and is expected to be available on Bloomberg L.P., Blackrock Financial Management, Inc., Interactive Data Corporation, CMBS.com, Inc., Markit Group Limited, Moody’s Analytics, MBS Data, LLC, RealINSIGHT, KBRA Analytics, LLC, Thomson Reuters Corporation and DealView Technologies Ltd. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. REFER TO “RISK FACTORS” IN THE PRELIMINARY PROSPECTUS. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Collateral Characteristics |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $1,774,834,674 |

| | Number of Mortgage Loans: | 47 |

| | Number of Mortgaged Properties: | 171 |

| | Average Cut-off Date Balance per Mortgage Loan: | $37,762,440 |

| | Weighted Average Current Mortgage Rate: | 3.53779% |

| | 10 Largest Mortgage Loans as % of IPB: | 51.7% |

| | Weighted Average Remaining Term to Maturity(1): | 98 months |

| | Weighted Average Seasoning: | 1 month |

| | | |

| Credit Statistics | |

| | Weighted Average UW NCF DSCR(2): | 2.98x |

| | Weighted Average UW NOI DY(2): | 11.4% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(2)(3): | 55.9% |

| | Weighted Average Maturity Date LTV(1)(2)(3): | 54.9% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt(4): | 19.9% |

| | % of Mortgaged Properties with Single Tenants: | 31.8% |

| | | |

| Amortization | |

| | Weighted Average Original Amortization Term(5): | 360 months |

| | Weighted Average Remaining Amortization Term(5): | 360 months |

| | % of Mortgage Loans with Interest-Only: | 74.1% |

| | % of Mortgage Loans with Interest Only-ARD: | 14.1% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 8.2% |

| | % of Mortgage Loans with Amortizing Balloon: | 3.5% |

| Lockbox / Cash Management(6) | |

| | % of Mortgage Loans with In-Place, Hard Lockboxes: | 67.3% |

| | % of Mortgage Loans with Springing Lockboxes: | 20.6% |

| | % of Mortgage Loans with Springing (Residential) / Hard (Commercial) Lockboxes: | 7.0% |

| | % of Mortgage Loans with In-Place, Soft Lockboxes: | 4.7% |

| | % of Mortgage Loans with Soft (Residential) / Hard (Commercial) Lockboxes: | 0.5% |

| | % of Mortgage Loans with Springing Cash Management: | 91.7% |

| | % of Mortgage Loans with In-Place Cash Management: | 8.3% |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 66.9% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 37.2% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves(7): | 55.8% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves(8): | 30.1% |

| (1) | In the case of Loan Nos. 4, 5 and 12, each with an anticipated repayment date, Remaining Term to Maturity and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos . 1, 2, 4, 5, 7, 8, 10, 11, 12, 13, 17, 19, 20, 21, 23, 25, 27 and 28, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 4, 10, 18 and 23, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s), related mezzanine loan(s) and/or related additional secured subordinate debt. |

| (3) | In the case of Loan Nos. 1, 3, 4, 8 and 22, Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | Excludes Loan No. 8 with respect to an exchange transaction note in connection with, and to partially fund, the acquisition of the related Mortgaged Property. For a more detailed description, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Additional Indebtedness” in the Preliminary Prospectus. |

| (5) | Excludes 38 mortgage loans that are interest-only for the entire term. |

| (6) | For a more detailed description of Lockbox / Cash Management, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (7) | CapEx Reserves include FF&E reserves for hotel properties. |

| (8) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by retail, office, industrial and mixed use properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Collateral Characteristics |

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate

Cut-off Date

Balance | % of IPB |

| CREFI(1) | 24 | 72 | $620,477,473 | 35.0% |

| GSMC(1)(2) | 11 | 18 | 431,702,201 | 24.3_ |

| GACC(1)(3) | 6 | 60 | 377,275,000 | 21.3_ |

| JPMCB(1) | 5 | 20 | 320,380,000 | 18.1_ |

| GACC / CREFI(1)(4) | 1 | 1 | 25,000,000 | 1.4_ |

| Total | 47 | 171 | $1,774,834,674 | 100.0% |

| (1) | In the case of Loan No. 2, the whole loan was co-originated by JPMCB and Starwood Mortgage Capital LLC. In the case of Loan No. 4, the whole loan was co-originated by DBR Investments Co. Limited (“DBRI”), JPMCB, Bank of America, N.A. (“BANA”), and 3650 Cal Bridge Lending, LLC. In the case of Loan No. 10, the whole loan was co-originated by Goldman Sachs Bank USA (“GSBI”) and Barclays Capital Real Estate Inc. (“BCREI”). In the case of Loan No. 11, the whole loan was co-originated by CREFI and BCREI. In the case of Loan No. 23, the whole loan was co-originated by DBRI, Morgan Stanley Bank, N.A (“MSBNA”), CREFI and Wells Fargo Bank, National Association (“WFBNA”). |

| (2) | Each mortgage loan being sold by Goldman Sachs Mortgage Company (“GSMC”) was originated or co-originated by GSBI, an affiliate of GSMC, and will be transferred to GSMC on or prior to the Closing Date. |

| (3) | Each mortgage loan being sold by German American Capital Corporation (“GACC”) was originated or co-originated by DBRI, an affiliate of GACC, and will be transferred to GACC on or prior to the Closing Date. |

| (4) | In the case of Loan No. 23, the whole loan was co-originated by DBRI, MSBNA, CREFI and WFBNA. Loan No. 23 is evidenced by two promissory notes: (i) Note A-2-C2-2 with a principal balance of $12,800,000 as of the Cut-off Date, as to which GACC is acting as mortgage loan seller, and (ii) Note A-4-C2-2, with a principal balance of $12,200,000 as of the Cut-off Date, as to which CREFI is acting as mortgage loan seller. |

Ten Largest Mortgage Loans |

| |

| No. | Loan Name | Mortgage

Loan Seller | No.

of Prop. | Cut-off Date

Balance | % of

IPB | SF /

Units | Property

Type | UW

NCF

DSCR(1) | UW NOI

DY(1) | Cut-off

Date

LTV(1)(2) | Maturity

Date

LTV(1)(2) |

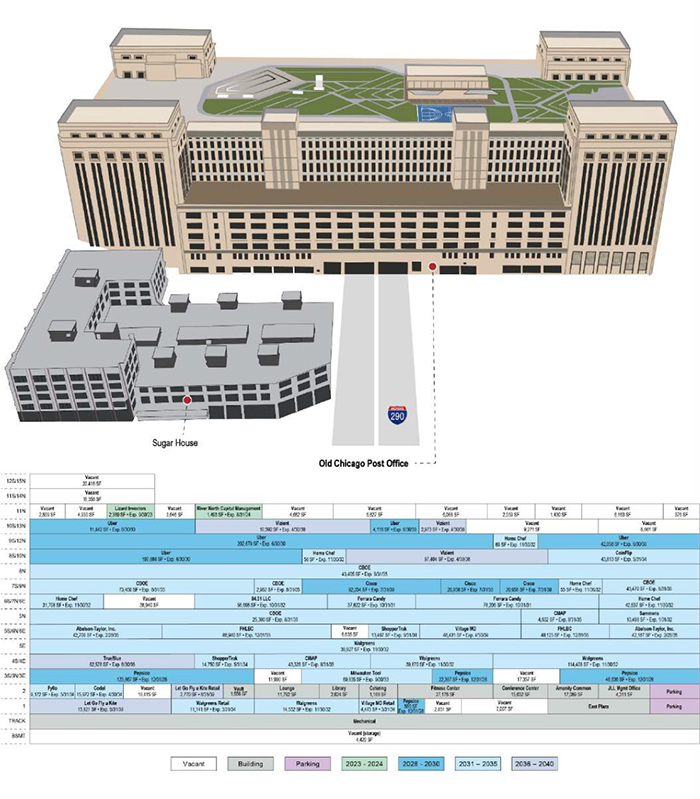

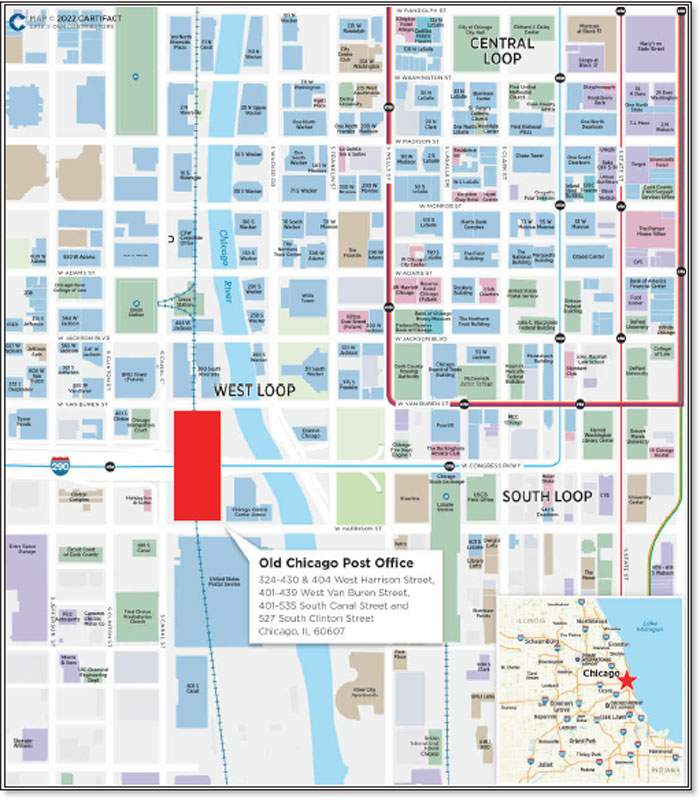

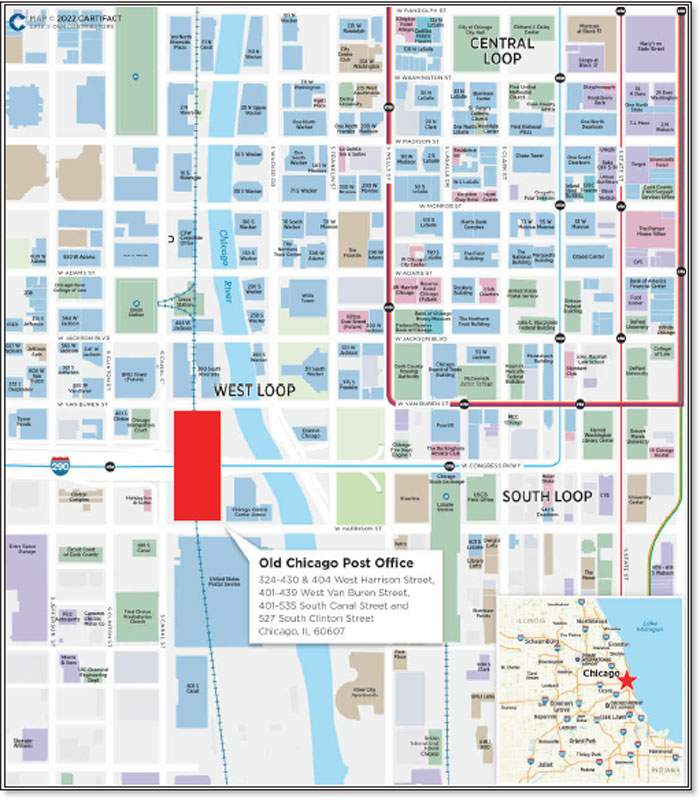

| 1 | Old Chicago Post Office | JPMCB | 1 | $125,000,000 | 7.0% | 2,331,477 | Office | 4.22x | 14.9% | 43.1% | 43.1% |

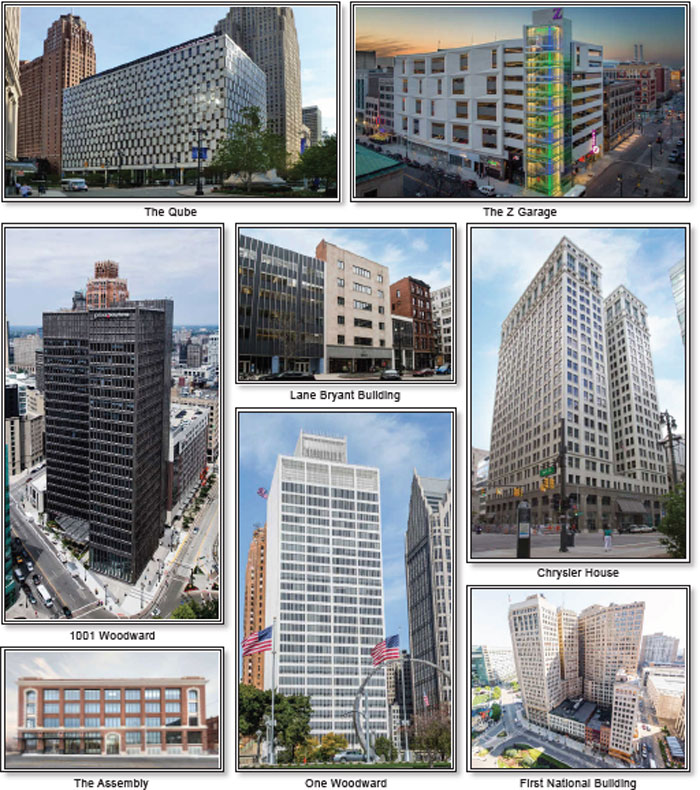

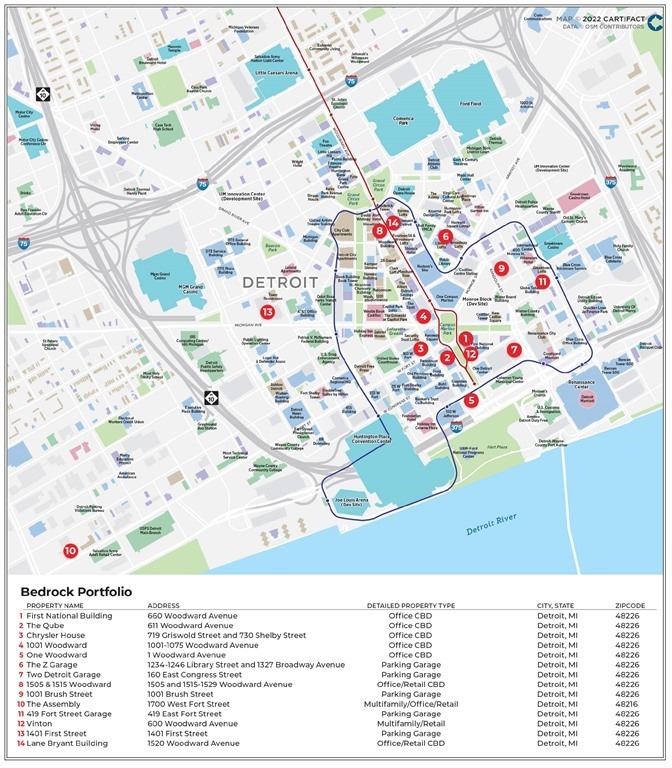

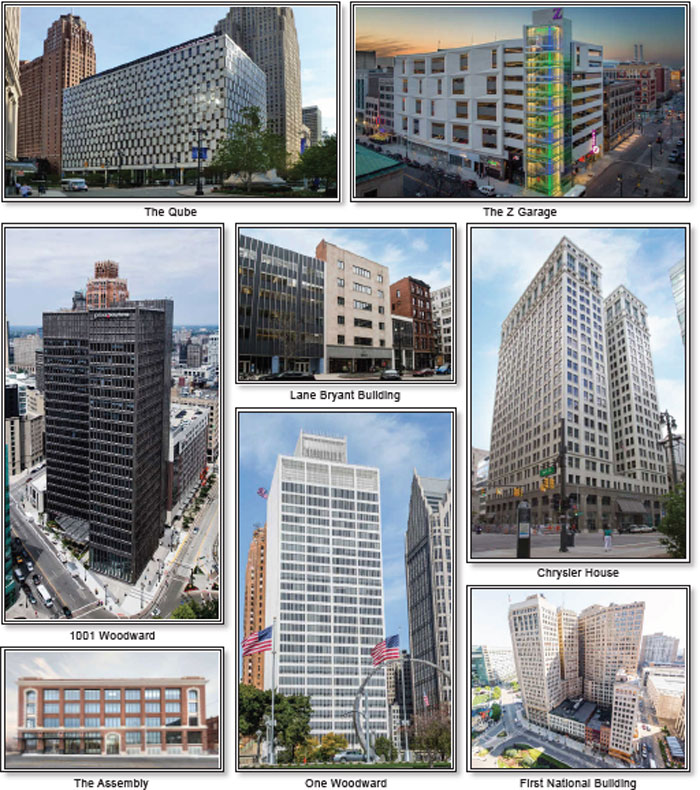

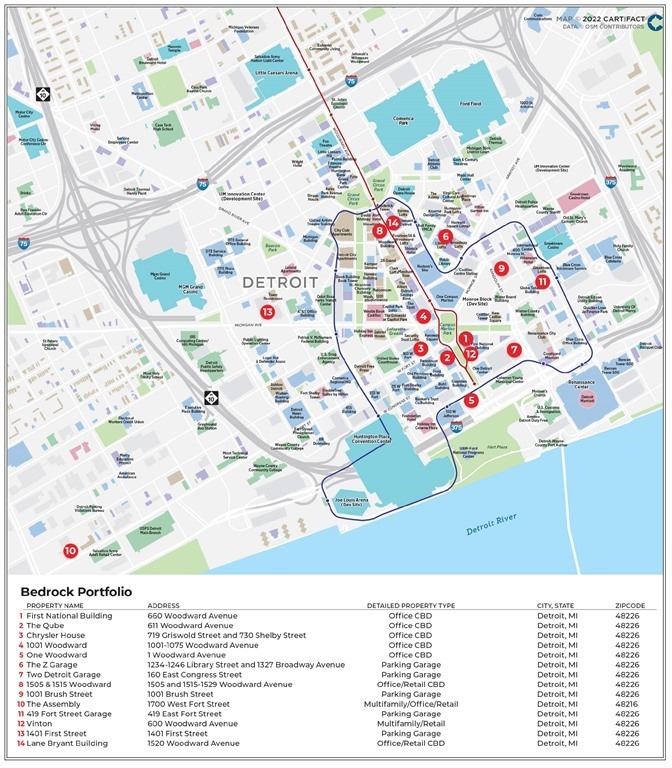

| 2 | Bedrock Portfolio | JPMCB | 14 | $125,000,000 | 7.0% | 2,694,627 | Various | 3.30x | 13.6% | 59.4% | 59.4% |

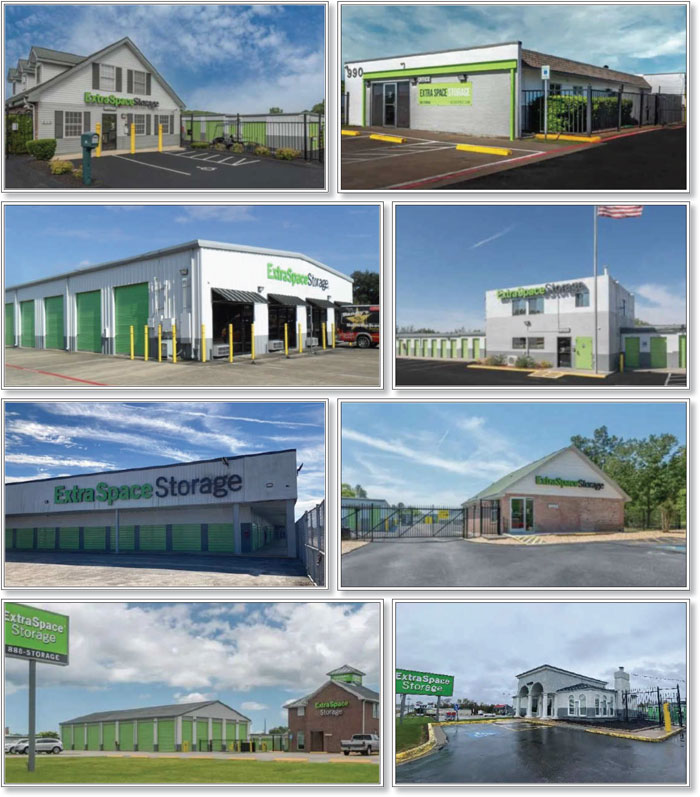

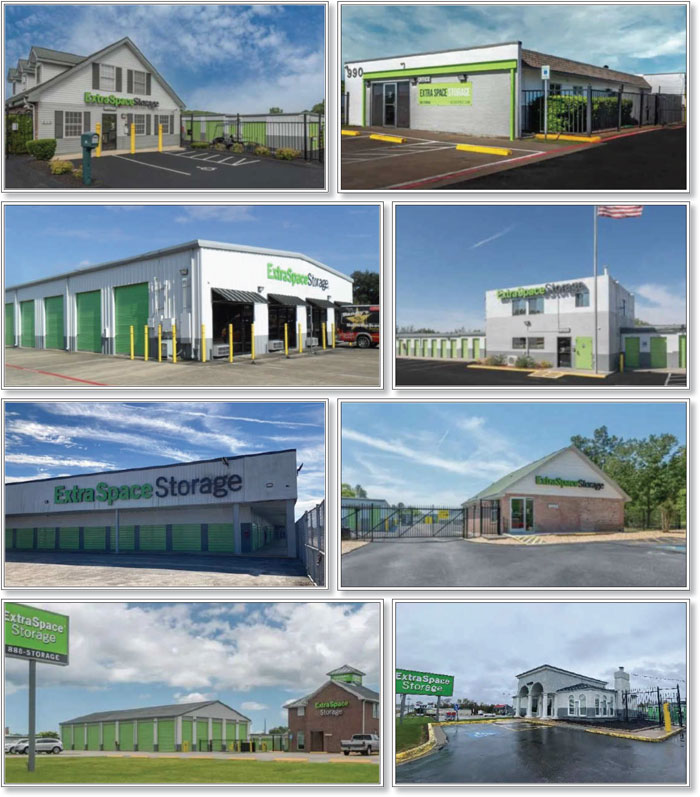

| 3 | Rosewood National Storage 13 | GACC | 13 | $108,575,000 | 6.1% | 1,564,651 | Self Storage | 3.13x | 9.8% | 59.7% | 59.7% |

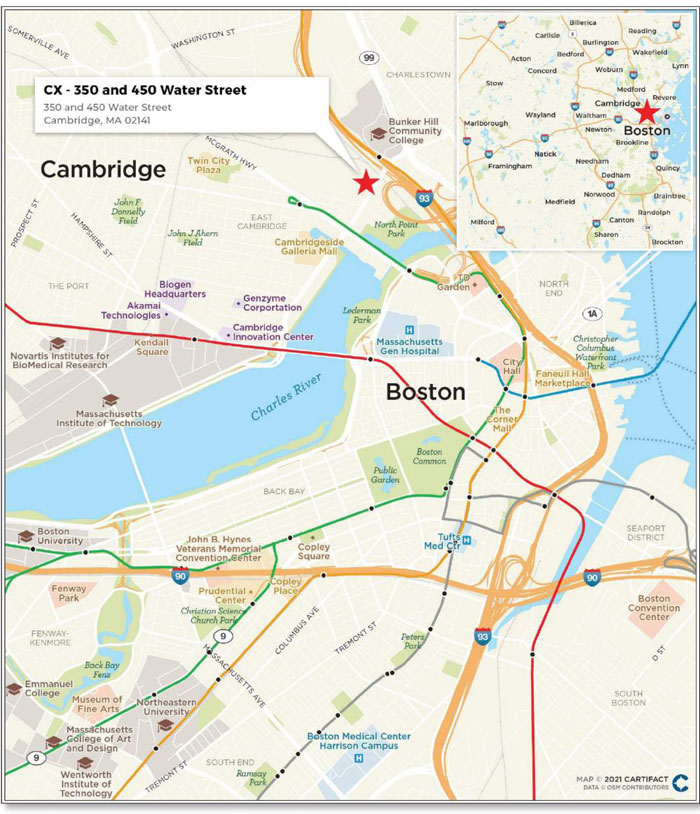

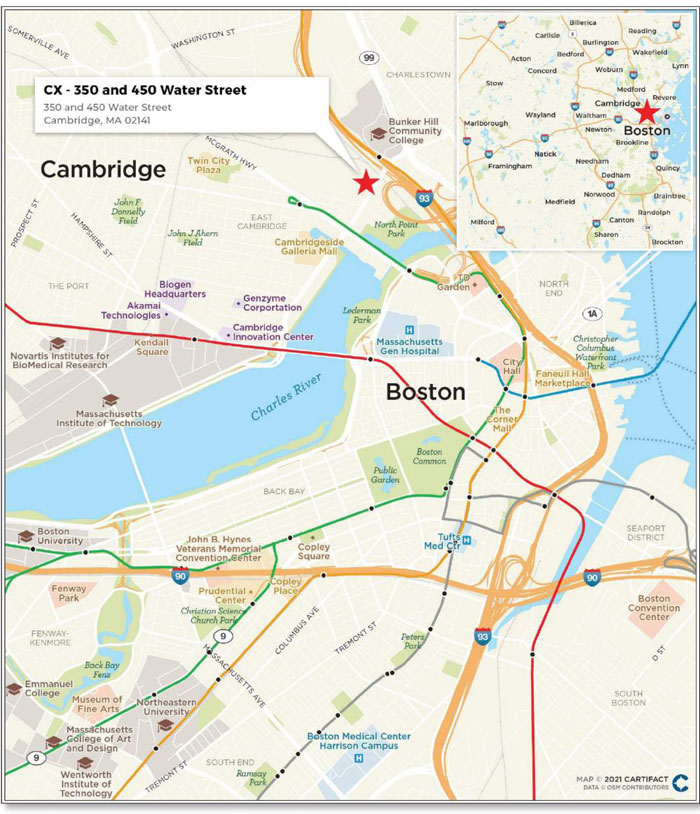

| 4 | CX - 350 & 450 Water Street | GACC | 1 | $101,000,000 | 5.7% | 915,233 | Mixed Use | 3.50x | 9.9% | 41.7% | 41.7% |

| 5 | One Wilshire | GSMC | 1 | $90,000,000 | 5.1% | 661,553 | Office | 3.37x | 9.6% | 42.6% | 42.6% |

| 6 | SVEA New Mexico Portfolio | GACC | 40 | $78,550,000 | 4.4% | 652,850 | Office | 2.95x | 12.4% | 65.0% | 65.0% |

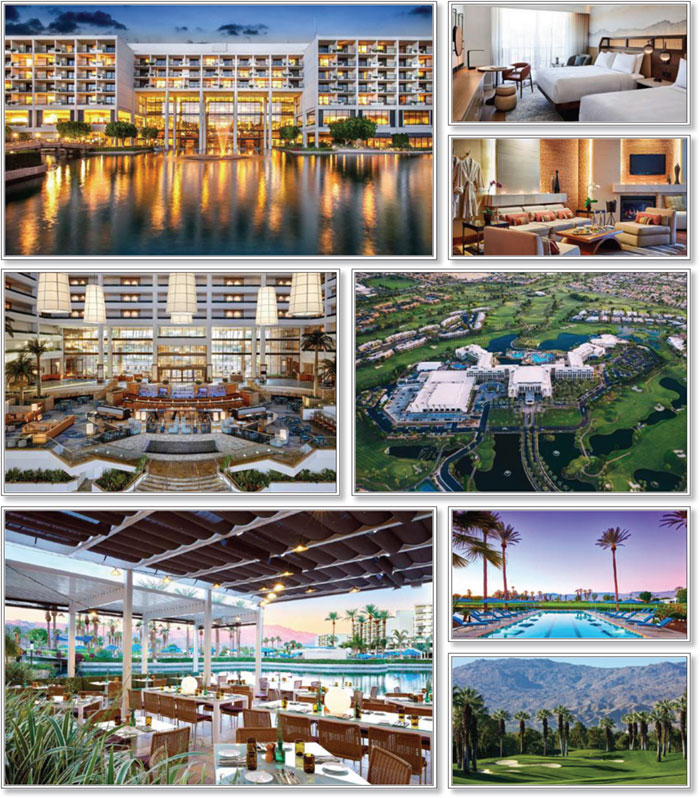

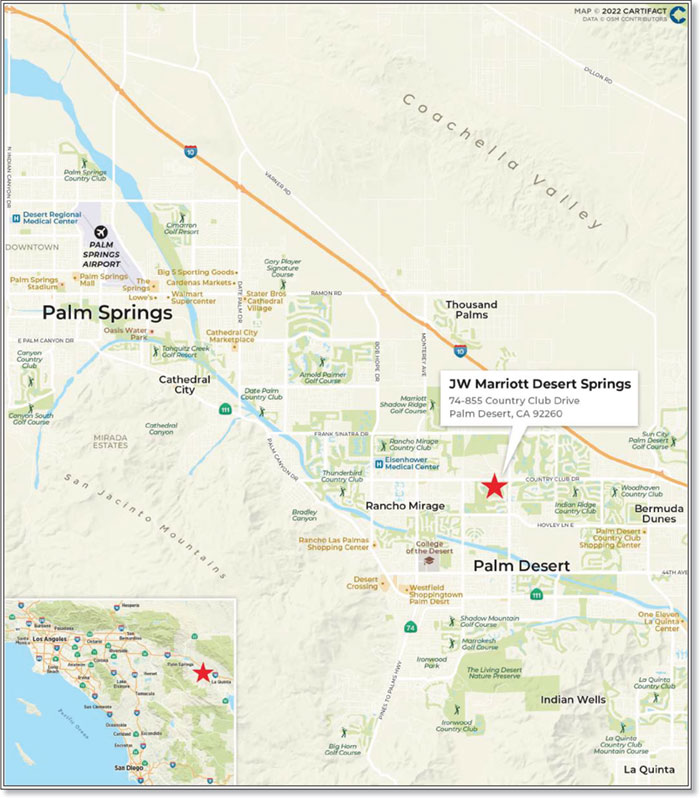

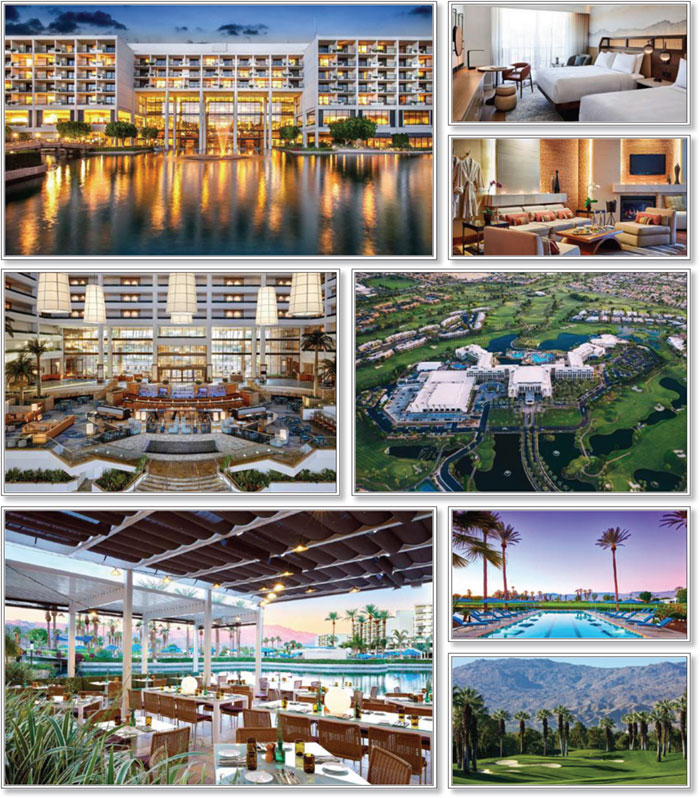

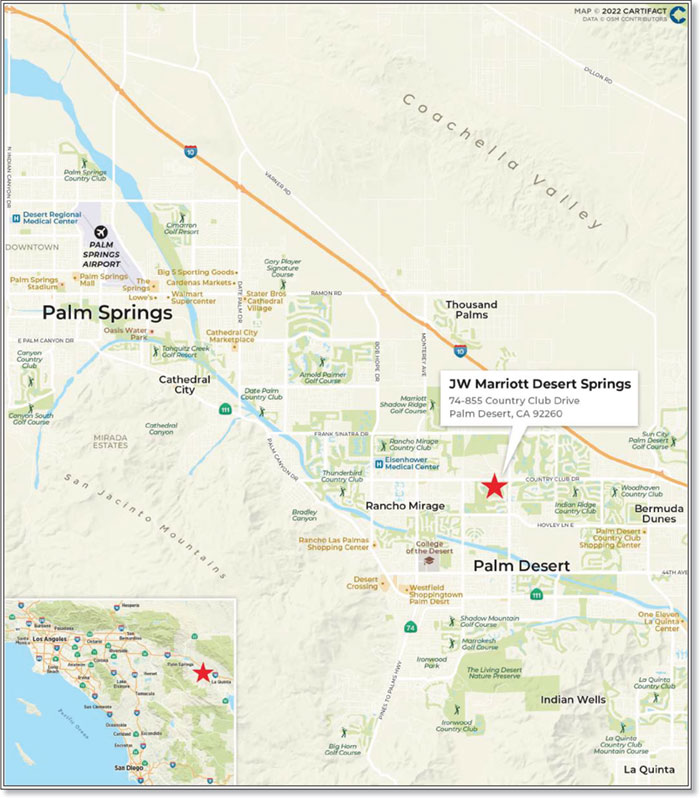

| 7 | JW Marriott Desert Springs | GSMC | 1 | $75,000,000 | 4.2% | 884 | Hospitality | 3.14x | 20.4% | 41.8% | 41.8% |

| 8 | Woodmore Towne Centre | GSMC | 1 | $75,000,000 | 4.2% | 712,091 | Retail | 2.96x | 10.4% | 59.5% | 59.5% |

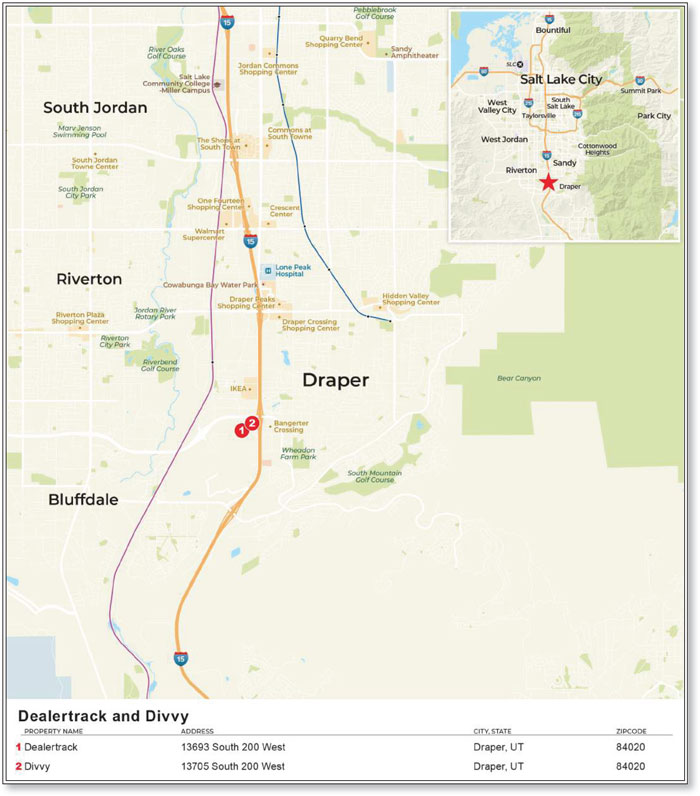

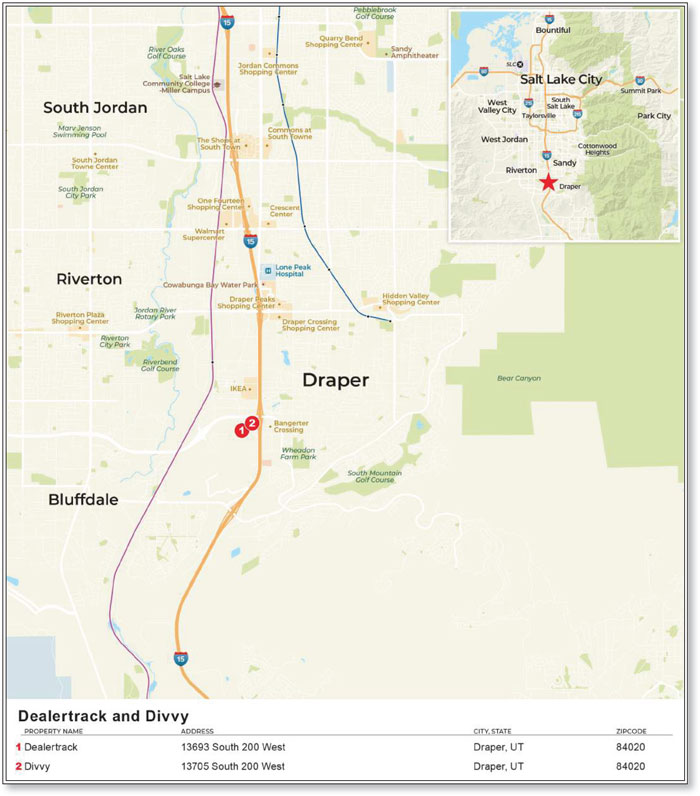

| 9 | Dealertrack and Divvy | CREFI | 2 | $74,500,000 | 4.2% | 318,832 | Office | 1.96x | 9.4% | 68.0% | 68.0% |

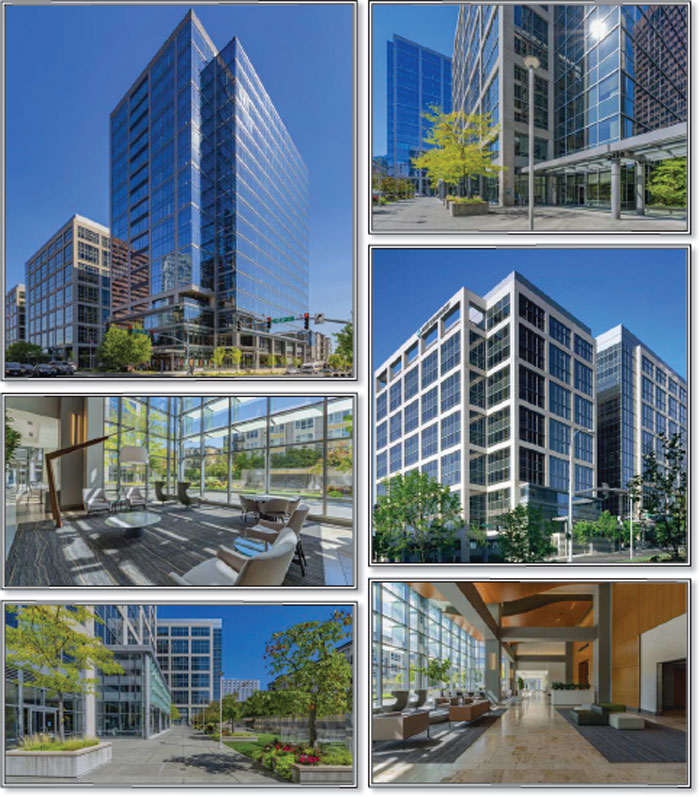

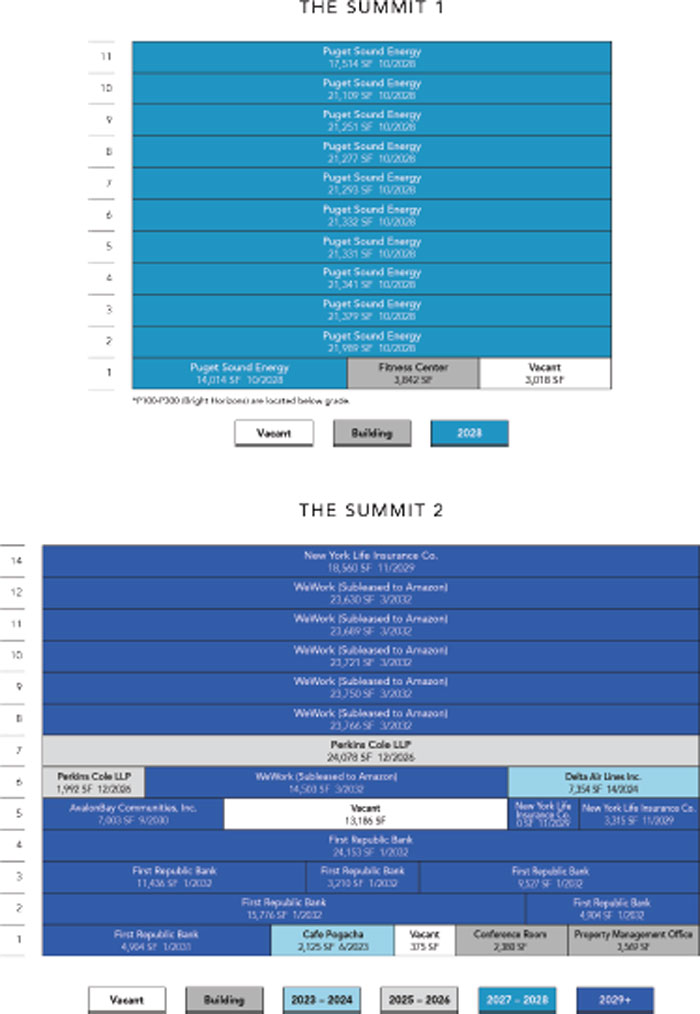

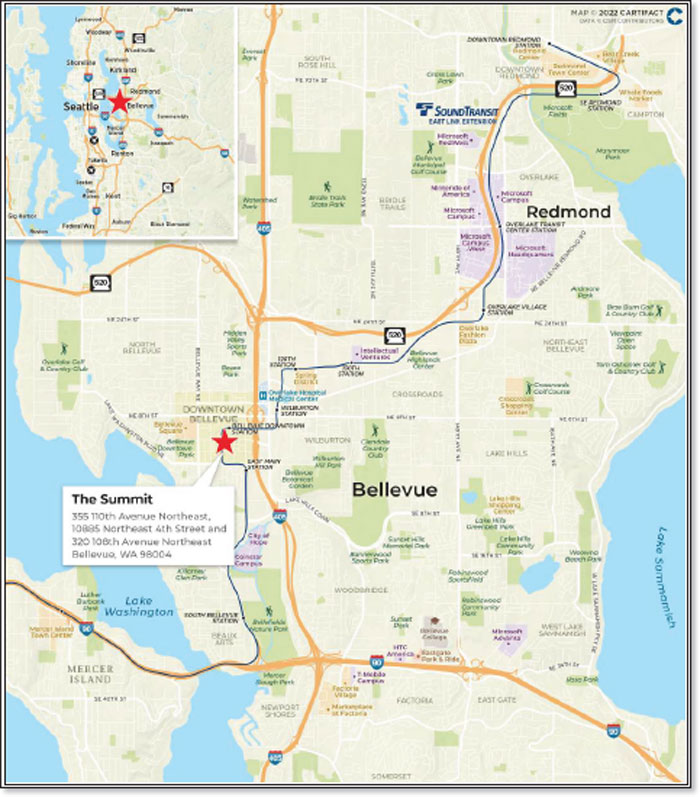

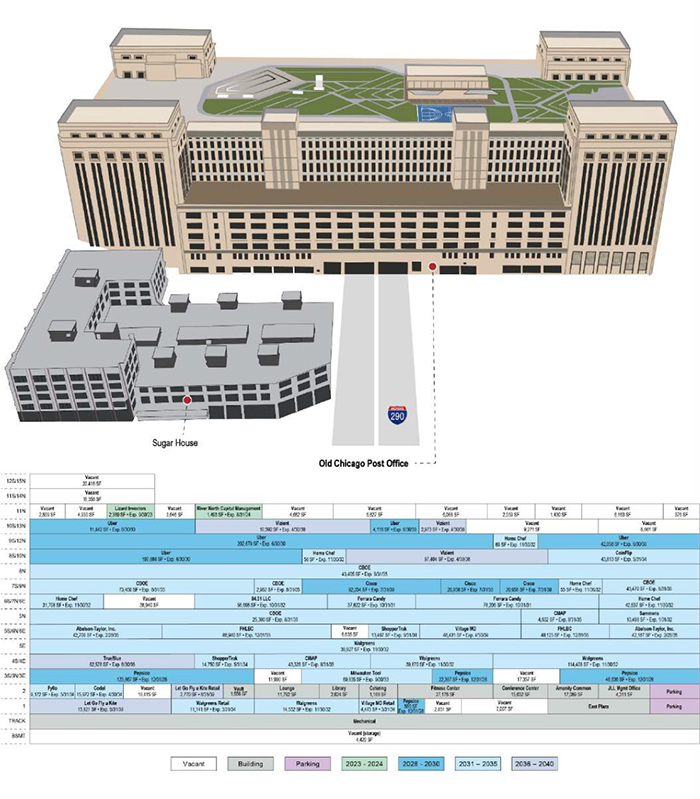

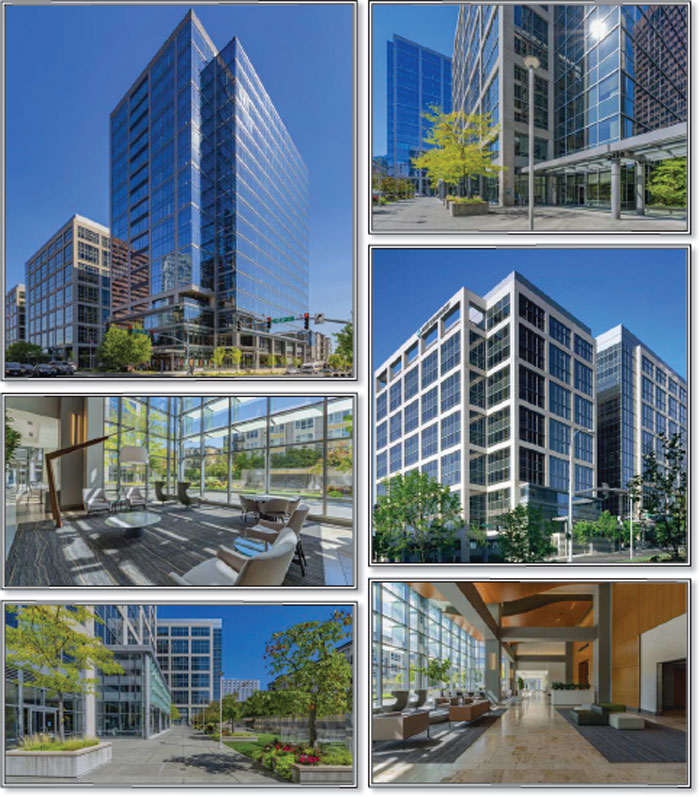

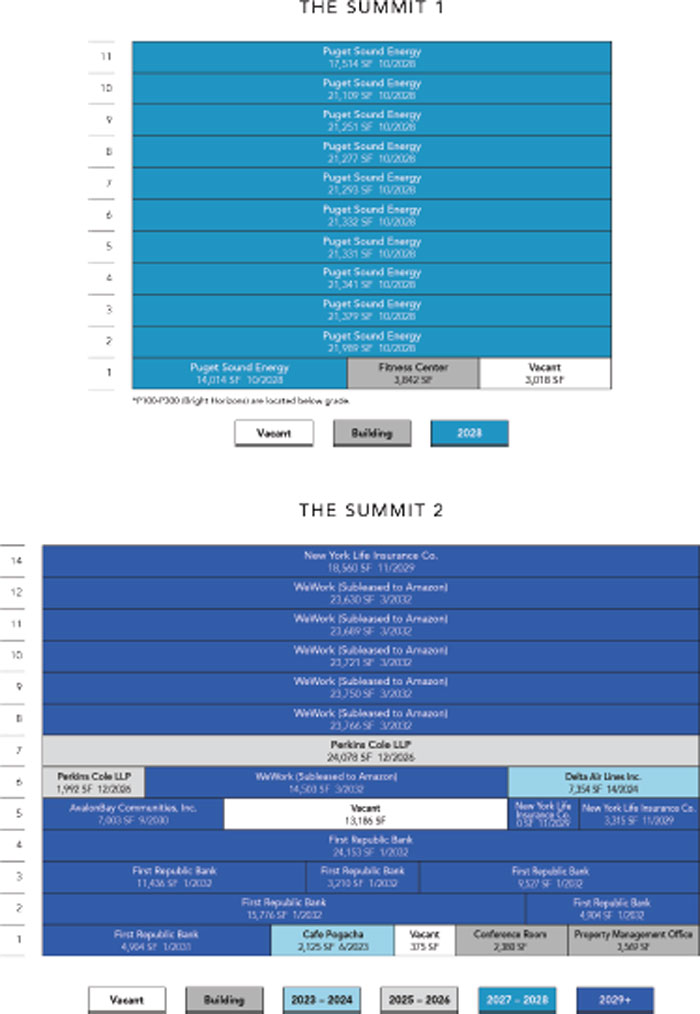

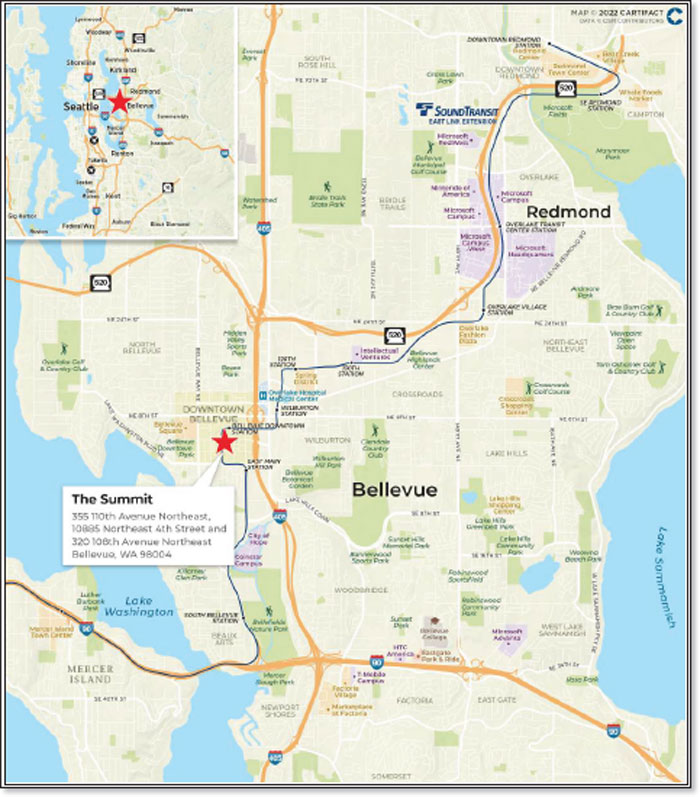

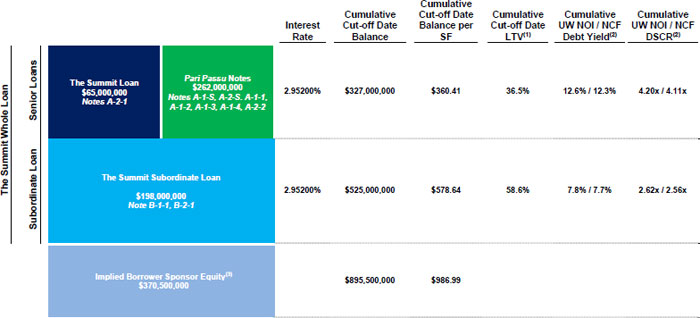

| 10 | The Summit | GSMC | 1 | $65,000,000 | 3.7% | 907,306 | Office | 4.11x | 12.6% | 36.5% | 36.5% |

| | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | 28 | $358,575,000 | 20.2% | | | 3.57x | 12.9% | 53.8% | 53.8% |

| | Top 5 Total/Weighted Average | 30 | $549,575,000 | 31.0% | | | 3.52x | 11.8% | 49.7% | 49.7% |

| | Top 10 Total/Weighted Average | 75 | $917,625,000 | 51.7% | | | 3.31x | 12.3% | 51.7% | 51.7% |

| (1) | In the case of Loan Nos. 1, 2, 4, 7, 8 and 10, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 4, and 10, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s), related mezzanine loan(s) and/or related additional secured subordinate debt. |

| (2) | In the case of Loan Nos. 1, 3, 4, and 8, Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Collateral Characteristics |

| Companion Loan Summary |

| |

Loan

No. | Mortgage Loan | Note(s) | Original

Balance ($) | Cut-off Date

Balance ($) | Holder of Note | Lead

Servicer

for Whole

Loan (Y/N) | Master

Servicer

Under Lead Securitization | Special Servicer

Under Lead

Securitization |

| 1 | Old Chicago Post Office | A-1, A-2, A-3, A-4, A-7, B (1) | $705,000,000 | $705,000,000 | JPMCC 2022-OPO | Yes | KeyBank | KeyBank |

| |

| | | A-5, A-6 | $125,000,000 | $125,000,000 | Benchmark 2022-B32 | No | | |

| | | Total | $830,000,000 | $830,000,000 | | | | |

| 2 | Bedrock Portfolio | A-1-1 | $125,000,000 | $125,000,000 | Benchmark 2022-B32 | Yes | Midland | KeyBank |

| | | A-1-2 | $50,000,000 | $50,000,000 | JPMCB | No | | |

| | | A-1-3 | $50,000,000 | $50,000,000 | JPMCB | No | | |

| | | A-1-4 | $50,000,000 | $50,000,000 | JPMCB | No | | |

| | | A-1-5 | $30,000,000 | $30,000,000 | JPMCB | No | | |

| | | A-1-6 | $39,000,000 | $39,000,000 | JPMCB | No | | |

| | | A-2-1 | $40,000,000 | $40,000,000 | SMC | No | | |

| | | A-2-2 | $26,000,000 | $26,000,000 | SMC | No | | |

| | | A-2-3 | $10,000,000 | $10,000,000 | SMC | No | | |

| | | A-2-4 | $10,000,000 | $10,000,000 | SMC | No | | |

| | | Total | $430,000,000 | $430,000,000 | | | | |

| 4 | CX – 350 & 450 Water Street | A-1-1, A-2-1, A-3-1, A-4-1, B-1(1), B-2(1), B-3(1), B-4(1) | $696,000,000 | $696,000,000 | CAMB 2021-CX2 | Yes | KeyBank | Situs |

| | A-1-2, A-1-4, A-1-9, A-3-3 | $148,140,816 | $148,140,816 | Benchmark 2021-B31 | No | | |

| | | A-1-3, A-3-2 | $94,000,000 | $94,000,000 | Benchmark 2021-B30 | No | | |

| | | A-1-5, A-1-6, A-1-8 | $101,000,000 | $101,000,000 | Benchmark 2022-B32 | No | | |

| | | A-1-7, A-4-2, A-4-3 | $77,900,000 | $77,900,000 | 3650R 2021-PF1 | No | | |

| | | A-2-2 | $50,000,000 | $50,000,000 | BANK 2022-BNK39 | No | | |

| | | A-2-3, A-2-4 | $55,000,000 | $55,000,000 | BANK 2021-BNK38 | No | | |

| | | A-2-5 | $2,959,184 | $2,959,184 | BANK 2022-BNK39 | No | | |

| | | Total | $1,225,000,000 | $1,225,000,000 | | | | |

| 5 | One Wilshire | A-1 | $90,000,000 | $90,000,000 | Benchmark 2022-B32 | Yes | Midland | KeyBank |

| | | A-2 | $120,000,00 | $120,000,00 | GSBI | No | | |

| | | A-3 | $85,000,000 | $85,000,000 | GSBI | No | | |

| | | A-4 | $94,250,000 | $94,250,000 | GSBI | No | | |

| | | Total | $389,250,000 | $389,250,000 | | | | |

| 7 | JW Marriott Desert Springs | A-1 | $75,000,000 | $75,000,000 | Benchmark 2022-B32 | Yes | Midland | KeyBank |

| | A-2 | $53,000,000 | $53,000,000 | GSBI | No | | |

| | Total | $128,000,000 | $128,000,000 | | | | |

| 8 | Woodmore Towne Centre | A-1 | $75,000,000 | $75,000,000 | Benchmark 2022-B32 | Yes | Midland | KeyBank |

| | A-2 | $39,066,666.67 | $39,066,666.67 | GSBI | No | | |

| | | A-3 | $3,133,333.33 | $3,133,333.33 | GSBI | No | | |

| | | Total | $117,200,000 | $117,200,000 | | | | |

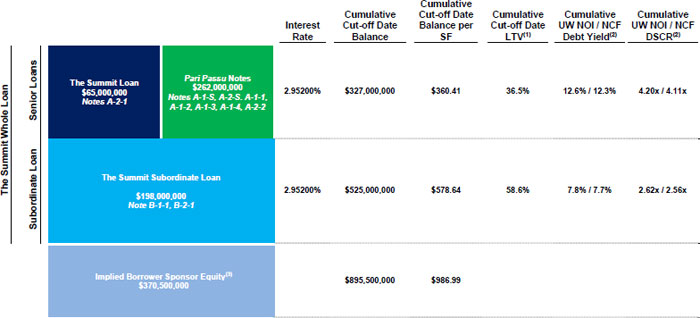

| 10 | The Summit | A-1-S, A-2-S, B-1-1(1), B-2-1(1) | $305,000,000 | $305,000,000 | SUMIT 2022-BVUE | Yes | KeyBank | KeyBank |

| | | A-1-1 | $50,000,000 | $50,000,000 | BCREI | No | | |

| | | A-1-2 | $50,000,000 | $50,000,000 | BCREI | No | | |

| | | A-1-3 | $25,000,000 | $25,000,000 | BCREI | No | | |

| | | A-1-4 | $7,000,000 | $7,000,000 | BCREI | No | | |

| | | A-2-1 | $65,000,000 | $65,000,000 | Benchmark 2022-B32 | No | | |

| | | A-2-2 | $23,000,000 | $23,000,000 | GSBI | No | | |

| | | Total | $525,000,000 | $525,000,000 | | | | |

| 11 | Moonwater Office Portfolio | A-1, A-2 | $63,000,000 | $63,000,000 | Benchmark 2022-B32 | Yes | Midland | KeyBank |

| | A-3 | $35,000,000 | $35,000,000 | BCREI | | | |

| | | A-4 | $18,000,000 | $18,000,000 | BCREI | | | |

| | | Total | $116,000,000 | $116,000,000 | | | | |

| 12 | Novo Nordisk HQ | A-1 | $75,000,000 | $75,000,000 | Benchmark 2021-B31 | Yes | Midland | Rialto |

| | | A-2, A-3-1 | $60,000,000 | $60,000,000 | Benchmark 2022-B32 | No | | |

| | | A-3-2, A-4 | $75,667,000 | $75,667,000 | DBRI | No | | |

| | | Total | $210,667,000 | $210,667,000 | | | | |

| 13 | The Kirby Collection | A-1 | $55,000,000 | $55,000,000 | Benchmark 2022-B32 | Yes | Midland | KeyBank |

| | | A-2 | $40,661,369 | $40,661,369 | CREFI | No | | |

| | | Total | $95,661,469 | $95,661,469 | | | | |

| 17 | 425 Eye Street | A-1 | $62,400,000 | $62,400,000 | GSMS 2021-GSA3 | Yes | Wells | Argentic |

| | | A-2 | $39,818,000 | $39,818,000 | Benchmark 2022-B32 | No | | |

| | | Total | $102,218,000 | $102,218,000 | | | | |

| 19 | ExchangeRight Net Leased Portfolio #53 | A-1 | $30,000,000 | $30,000,000 | Benchmark 2022-B32 | No(2) | | |

| | A-2 | $56,000,000 | $56,000,000 | CREFI | Yes | (2) | (2) |

| | | Total | $86,000,000 | $86,000,000 | | | | |

| 20 | Glen Forest Office Portfolio | A-1 | $30,000,000 | $30,000,000 | Benchmark 2022-B32 | Yes | Midland | KeyBank |

| | A-2 | $29,000,000 | $29,000,000 | CREFI | No | | |

| | | Total | $59,000,000 | $59,000,000 | | | | |

| 21 | Grede Casting Industrial Portfolio | A-1 | $30,000,000 | $30,000,000 | Benchmark 2022-B32 | Yes | Midland | KeyBank |

| | A-2 | $18,225,000 | $18,225,000 | GSBI | No | | |

| | | Total | $48,225,000 | $48,225,000 | | | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Collateral Characteristics |

Loan

No. | Mortgage Loan | Note(s) | Original

Balance ($) | Cut-off Date

Balance ($) | Holder of Note | Lead

Servicer

for Whole

Loan (Y/N) | Master

Servicer

Under Lead Securitization | Special Servicer

Under Lead

Securitization |

| 23 | 601 Lexington Avenue | A-1-S1, A-2-S1, A-3-S1, A-4-S1, B-1(1), B-2(1), B-3(1), B-4(1) | $426,700,000 | $426,700,000 | BXP 2021-601L | Yes | Wells Fargo | Situs |

| | | A-1-C1 | $17,500,000 | $17,500,000 | WFNA | No | | |

| | | A-1-C2 | $67,543,860 | $67,543,860 | BANK 2022-BNK39 | No | | |

| | | A-1-C3 | $67,543,860 | $67,543,860 | WFNA | No | | |

| | | A-1-C4 | $48,067,280 | $48,067,280 | WFNA | No | | |

| | | A-2-C1 | $11,000,000 | $11,000,000 | DBRI | No | | |

| | | A-2-C2-1 | $43,479,070 | $43,479,070 | DBRI | No | | |

| | | A-2-C2-2, A-4-C2-2 | $25,000,000 | $25,000,000 | Benchmark 2022-B32 | No | | |

| | | A-2-C3 | $56,279,070 | $56,279,070 | DBRI | No | | |

| | | A-2-C4 | $2,567,860 | $2,567,860 | DBRI | No | | |

| | | A-3-C1 | $11,000,000 | $11,000,000 | MSBNA | No | | |

| | | A-3-C2 | $42,456,140 | $42,456,140 | BANK 2022-BNK39 | No | | |

| | | A-3-C3 | $42,456,140 | $42,456,140 | MSBNA | No | | |

| | | A-3-C4 | $30,213,720 | $30,213,720 | MSBNA | No | | |

| | | A-4-C1 | $10,500,000 | $10,500,000 | CREFI | No | | |

| | | A-4-C2-1 | $41,520,930 | $41,520,930 | CREFI | No | | |

| | | A-4-C3 | $53,720,930 | $53,720,930 | CREFI | No | | |

| | | A-4-C4 | $2,451,140 | $2,451,140 | CREFI | No | | |

| | | Total | $1,000,000,000 | $1,000,000,000 | | | | |

| 25 | Nyberg Portfolio | A-1 | $40,000,000 | $40,000,000 | Benchmark 2021-B31 | Yes | Midland | Rialto |

| | | A-2 | $23,900,000 | $23,900,000 | Benchmark 2022-B32 | No | | |

| | | Total | $63,900,000 | $63,900,000 | | | | |

| 27 | Sara Lee Portfolio | A-1 | $40,000,000 | $40,000,000 | Benchmark 2021-B31 | Yes | Midland | Rialto |

| | | A-2 | $23,150,000 | $23,150,000 | Benchmark 2022-B32 | No | | |

| | | Total | $63,150,000 | $63,150,000 | | | | |

| 28 | Charcuterie Artisans SLB | A-1 | $40,000,000 | $40,000,000 | Benchmark 2021-B31 | Yes | Midland | Rialto |

| | A-2 | $23,000,000 | $23,000,000 | Benchmark 2022-B32 | No | | |

| | Total | $63,000,000 | $63,000,000 | | | | |

| (1) | Each note represents a subordinate companion loan. |

| (2) | In the case of Loan No. 19, the related whole loan is expected to be serviced under the Benchmark 2022-B32 pooling and servicing agreement until such time as the related controlling note has been securitized, at which point the related whole loan will be serviced under the pooling and servicing agreement related to such securitization. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Collateral Characteristics |

No. | Loan Name | Trust

Cut-off

Date

Balance | Subordinate

Debt Cut-off

Date

Balance(1) | Total Debt

Cut-off Date

Balance | Mortgage

Loan UW

NCF

DSCR(2) | Total Debt UW NCF DSCR | Mortgage

Loan

Cut-off

Date

LTV(2)(3) | Total

Debt

Cut-off

Date

LTV(3) | Mortgage

Loan UW

NOI DY(2) | Total

Debt

UW NOI

DY |

| 1 | Old Chicago Post Office | $125,000,000 | $317,200,000 | $955,000,000 | 4.22x | 1.90x | 43.1% | 80.3% | 14.9% | 8.0% |

| 4 | CX - 350 & 450 Water Street | $101,000,000 | $411,000,000 | $1,225,000,000 | 3.50x | 2.32x | 41.7% | 62.7% | 9.9% | 6.6% |

| 10 | The Summit | $65,000,000 | $198,000,000 | $525,000,000 | 4.11x | 2.56x | 36.5% | 58.6% | 12.6% | 7.8% |

| 18 | The Onyx | $38,000,000 | $7,000,000 | $45,000,000 | 2.28x | 1.58x | 63.1% | 74.8% | 9.4% | 7.9% |

| 23 | 601 Lexington Avenue | $25,000,000 | $276,700,000 | $1,000,000,000 | 4.50x | 3.25x | 42.5% | 58.8% | 13.2% | 9.5% |

| (1) | In the case of Loan Nos., 1, 4, 10 and 23, Subordinate Debt Cut-off Date Balance represents one or more Subordinate Companion Loan(s) and/or related mezzanine loan(s). In the case of Loan No. 18, Subordinate Debt Cut-off Date Balance represents one or more mezzanine loans. |

| (2) | In the case of Loan Nos. 1, 4, 10 and 23, Mortgage Loan UW NCF DSCR, Mortgage Loan UW NOI DY and Mortgage Loan Cut-off Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). In the case of Loan No. 18, Mortgage Loan UW NCF DSCR, Mortgage Loan UW NOI DY and Mortgage Loan Cut-off Date LTV calculations exclude the related mezzanine loan(s). |

| (3) | In the case of Loan Nos. 1 and 4, Mortgage Loan Cut-Off Date LTV and Total Debt Cut-Off Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Collateral Characteristics |

| Mortgaged Properties by Type(1) |

| |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number of Properties | Cut-off Date

Principal

Balance | % of IPB | Occupancy | UW

NCF

DSCR(2) | UW

NOI DY(2) | Cut-off

Date

LTV(2)(3) | Maturity

Date LTV

(2)(3)(4) |

| Office | Suburban | 67 | $475,865,606 | 26.8% | 95.6% | 2.31x | 10.2% | 64.3% | 62.4% |

| | CBD | 10 | 308,130,000 | 17.4 | 93.2% | 3.94x | 13.9% | 46.6% | 46.6% |

| | CBD/Data Center | 1 | 90,000,000 | 5.1 | 87.3% | 3.37x | 9.6% | 42.6% | 42.6% |

| | Urban | 1 | 39,818,000 | 2.2 | 76.7% | 3.66x | 11.0% | 56.8% | 56.8% |

| | Medical | 2 | 5,089,794 | 0.3 | 56.6% | 2.80x | 10.8% | 59.6% | 59.6% |

| | Subtotal: | 81 | $918,903,400 | 51.8% | 92.9% | 3.02x | 11.4% | 55.9% | 54.9% |

| | | | | | | | | | |

| Retail | Anchored | 7 | $177,190,916 | 10.0% | 96.3% | 2.90x | 10.7% | 60.8% | 59.5% |

| | Single Tenant | 23 | 17,089,535 | 1.0 | 100.0% | 2.68x | 9.6% | 53.9% | 53.9% |

| | Subtotal: | 30 | $194,280,451 | 10.9% | 96.6% | 2.88x | 10.6% | 60.2% | 59.0% |

| | | | | | | | | | |

| Mixed Use | Office/Lab | 1 | $101,000,000 | 5.7% | 100.0% | 3.50x | 9.9% | 41.7% | 41.7% |

| | Multifamily/Office/Retail | 2 | 58,987,500 | 3.3 | 90.8% | 3.82x | 12.1% | 48.9% | 48.9% |

| | Retail/Office | 1 | 23,467,534 | 1.3 | 89.6% | 1.56x | 9.5% | 65.7% | 51.9% |

| | Multifamily/Retail | 3 | 10,237,500 | 0.6 | 91.9% | 2.34x | 9.6% | 55.2% | 55.2% |

| | Subtotal: | 7 | $193,692,534 | 10.9% | 95.5% | 3.30x | 10.5% | 47.5% | 45.8% |

| | | | | | | | | | |

| Self Storage | Self Storage | 21 | $151,975,000 | 8.6% | 95.3% | 2.93x | 9.5% | 60.6% | 60.6% |

| | Subtotal: | 21 | $151,975,000 | 8.6% | 95.3% | 2.93x | 9.5% | 60.6% | 60.6% |

| | | | | | | | | | |

| Industrial | Flex | 5 | $59,367,344 | 3.3% | 96.0% | 2.30x | 9.5% | 60.3% | 58.4% |

| | Manufacturing | 12 | 46,816,730 | 2.6 | 100.0% | 2.79x | 11.9% | 59.9% | 58.1% |

| | Warehouse | 1 | 14,912,656 | 0.8 | 100.0% | 2.34x | 9.3% | 62.8% | 62.8% |

| | Cold Storage | 2 | 12,434,794 | 0.7 | 100.0% | 2.06x | 8.9% | 60.6% | 60.6% |

| | Subtotal: | 20 | $133,531,523 | 7.5% | 98.2% | 2.45x | 10.3% | 60.5% | 59.0% |

| | | | | | | | | | |

| Hospitality | Full Service | 1 | $75,000,000 | 4.2% | 36.8% | 3.14x | 20.4% | 41.8% | 41.8% |

| | Limited Service | 1 | 18,000,000 | 1.0 | 61.0% | 3.68x | 16.1% | 53.7% | 53.7% |

| | Extended Stay | 1 | 7,991,766 | 0.5 | 96.2% | 2.45x | 17.4% | 65.0% | 57.7% |

| | Subtotal: | 3 | $100,991,766 | 5.7% | 45.8% | 3.18x | 19.4% | 45.8% | 45.2% |

| | | | | | | | | | |

| Multifamily | Garden | 3 | $53,490,000 | 3.0% | 95.4% | 2.23x | 9.4% | 63.1% | 63.1% |

| | Mid Rise | 1 | 2,275,000 | 0.1 | 100.0% | 2.09x | 8.0% | 64.6% | 64.6% |

| | Subtotal: | 4 | $55,765,000 | 3.1% | 95.6% | 2.23x | 9.3% | 63.2% | 63.2% |

| | | | | | | | | | |

| Other | Parking Garage | 5 | $25,695,000 | 1.4% | NAP | 3.30x | 13.6% | 59.4% | 59.4% |

| | Subtotal: | 5 | $25,695,000 | 1.4% | NAP | 3.30x | 13.6% | 59.4% | 59.4% |

| | | | | | | | | | |

| | Total / Weighted Average: | 171 | $1,774,834,674 | 100.0% | 91.6%(5) | 2.98x | 11.4% | 55.9% | 54.9% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 4, 5, 7, 8, 10, 11, 12, 13, 17, 19, 20, 21, 23, 25, 27 and 28, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 4, 10, 18 and 23, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s), related mezzanine loan(s) and/or related additional secured subordinate debt. |

| (3) | In the case of Loan Nos. 1, 3, 4, 8 and 22, Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | In the case of Loan Nos. 4, 5 and 12, each with an anticipated repayment date, Maturity Date LTV is calculated as of the related anticipated repayment date. |

| (5) | Excludes occupancy for five properties in connection with Loan No. 2 as the collateral consists of parking garages with no attributable occupancy. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Collateral Characteristics |

| Mortgaged Properties by Location(1) |

| |

| | | | | Weighted Average |

State | Number of Properties | Cut-off Date Principal Balance | % of IPB | Occupancy | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (2)(3)(4) |

| California | 3 | $171,000,000 | 9.6% | 65.6% | 3.27x | 14.4% | 41.8% | 41.8% |

| Illinois | 4 | 148,066,512 | 8.3 | 93.1% | 4.00x | 14.2% | 45.3% | 45.3% |

| Michigan | 18 | 145,541,005 | 8.2 | 91.4% | 3.15x | 13.1% | 59.6% | 59.2% |

| Texas | 7 | 138,612,065 | 7.8 | 94.4% | 3.11x | 10.5% | 56.2% | 56.2% |

| Massachusetts | 2 | 101,495,437 | 5.7 | 100.0% | 3.49x | 9.9% | 41.8% | 41.8% |

| New Mexico | 41 | 85,910,100 | 4.8 | 97.4% | 2.97x | 12.2% | 64.5% | 64.5% |

| Ohio | 6 | 82,676,488 | 4.7 | 99.2% | 1.95x | 9.4% | 65.8% | 61.6% |

| Virginia | 12 | 78,490,000 | 4.4 | 90.9% | 2.97x | 10.6% | 64.3% | 64.3% |

| Maryland | 1 | 75,000,000 | 4.2 | 96.7% | 2.96x | 10.4% | 59.5% | 59.5% |

| Utah | 2 | 74,500,000 | 4.2 | 100.0% | 1.96x | 9.4% | 68.0% | 68.0% |

| Washington | 2 | 66,148,613 | 3.7 | 98.2% | 4.07x | 12.5% | 36.9% | 36.9% |

| Nevada | 6 | 63,000,000 | 3.5 | 97.6% | 1.42x | 9.0% | 59.1% | 52.7% |

| New Jersey | 1 | 60,000,000 | 3.4 | 77.0% | 3.16x | 9.2% | 63.8% | 63.8% |

| Florida | 4 | 56,240,856 | 3.2 | 95.8% | 2.72x | 9.4% | 61.7% | 61.7% |

| Pennsylvania | 11 | 51,856,058 | 2.9 | 95.1% | 2.05x | 9.7% | 64.4% | 60.9% |

| South Carolina | 3 | 49,756,165 | 2.8 | 99.6% | 2.57x | 10.5% | 63.7% | 63.7% |

| Georgia | 5 | 45,828,343 | 2.6 | 79.1% | 2.99x | 13.5% | 59.1% | 57.9% |

| New York | 7 | 44,166,279 | 2.5 | 97.9% | 3.58x | 11.5% | 48.9% | 48.9% |

| Connecticut | 4 | 39,991,141 | 2.3 | 93.2% | 2.16x | 10.0% | 63.4% | 55.3% |

| District of Columbia | 1 | 39,818,000 | 2.2 | 76.7% | 3.66x | 11.0% | 56.8% | 56.8% |

| North Carolina | 4 | 26,552,510 | 1.5 | 100.0% | 2.27x | 9.3% | 59.4% | 59.4% |

| Oregon | 2 | 23,900,000 | 1.3 | 95.8% | 3.14x | 12.5% | 60.0% | 60.0% |

| Rhode Island | 1 | 23,000,000 | 1.3 | 100.0% | 2.35x | 9.2% | 57.7% | 57.7% |

| Minnesota | 3 | 17,706,502 | 1.0 | 96.9% | 2.29x | 11.4% | 65.3% | 58.9% |

| Arizona | 1 | 16,975,916 | 1.0 | 97.3% | 1.77x | 10.3% | 65.3% | 51.4% |

| Wisconsin | 4 | 11,855,439 | 0.7 | 100.0% | 3.23x | 13.1% | 58.4% | 58.4% |

| Indiana | 3 | 10,331,061 | 0.6 | 99.6% | 3.17x | 11.4% | 58.9% | 58.9% |

| Missouri | 2 | 7,612,423 | 0.4 | 97.7% | 3.01x | 9.7% | 58.1% | 58.1% |

| Tennessee | 2 | 7,428,140 | 0.4 | 97.0% | 2.37x | 10.0% | 62.6% | 62.6% |

| Kentucky | 1 | 5,241,400 | 0.3 | 89.2% | 3.13x | 9.8% | 59.7% | 59.7% |

| Alabama | 1 | 1,827,826 | 0.1 | 100.0% | 3.25x | 13.2% | 58.5% | 58.5% |

| Oklahoma | 2 | 1,594,186 | 0.1 | 100.0% | 2.68x | 9.6% | 53.9% | 53.9% |

| Kansas | 1 | 1,037,791 | 0.1 | 100.0% | 2.68x | 9.6% | 53.9% | 53.9% |

| Arkansas | 2 | 959,302 | 0.1 | 100.0% | 2.68x | 9.6% | 53.9% | 53.9% |

| Louisiana | 2 | 715,116 | 0.0 | 100.0% | 2.68x | 9.6% | 53.9% | 53.9% |

| Total / Weighted Average: | 171 | $1,774,834,674 | 100.0% | 91.6%(5) | 2.98x | 11.4% | 55.9% | 54.9% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 4, 5, 7, 8, 10, 11, 12, 13, 17, 19, 20, 21, 23, 25, 27 and 28, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 4, 10, 18 and 23, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s), related mezzanine loan(s) and/or related additional secured subordinate debt. |

| (3) | In the case of Loan Nos. 1, 3, 4, 8 and 22, Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | In the case of Loan Nos. 4, 5 and 12, each with an anticipated repayment date, Maturity Date LTV is calculated as of the related anticipated repayment date. |

| (5) | Excludes occupancy for five properties in connection with Loan No. 2 as the collateral consists of parking garages with no attributable occupancy. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Collateral Characteristics |

| Cut-off Date Principal Balance |

| | | | | Weighted Average |

| Range of Cut-off Date Principal Balances | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| $2,275,000 | - | $9,999,999 | 10 | $69,073,224 | 3.9% | 4.00504% | 102 | 2.34x | 11.1% | 59.6% | 56.9% |

| $10,000,000 | - | $19,999,999 | 8 | 112,665,916 | 6.3 | 3.67491% | 119 | 2.48x | 10.6% | 62.0% | 58.9% |

| $20,000,000 | - | $29,999,999 | 8 | 193,762,534 | 10.9 | 3.56866% | 116 | 2.56x | 10.4% | 60.0% | 57.5% |

| $30,000,000 | - | $49,999,999 | 8 | 303,708,000 | 17.1 | 3.56079% | 91 | 2.68x | 10.4% | 62.0% | 61.0% |

| $50,000,000 | - | $125,000,000 | 13 | 1,095,625,000 | 61.7 | 3.48240% | 94 | 3.22x | 11.9% | 52.6% | 52.3% |

Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| | | | | | | | | | | | |

| | | | | Weighted Average |

Range of

Mortgage Interest Rates | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| 2.77600% | - | 3.00000% | 7 | $435,818,000 | 24.6% | 2.85118% | 101 | 3.63x | 10.7% | 46.4% | 46.4% |

| 3.00001% | - | 3.50000% | 9 | 456,577,500 | 25.7 | 3.32050% | 93 | 3.30x | 11.4% | 55.6% | 55.4% |

| 3.50001% | - | 4.00000% | 24 | 627,487,473 | 35.4 | 3.77242% | 105 | 2.56x | 11.0% | 62.3% | 60.6% |

| 4.00001% | - | 5.13500% | 7 | 254,951,701 | 14.4 | 4.52315% | 81 | 2.30x | 13.3% | 56.9% | 54.9% |

| Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| Original Term to Maturity in Months(1) |

| | | | | Weighted Average |

Original Term to

Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| 60 | 9 | $449,809,935 | 25.3% | 3.85901% | 59 | 3.10x | 13.0% | 54.5% | 54.3% |

| 84 | 4 | 202,809,766 | 11.4 | 3.66049% | 83 | 3.33x | 13.2% | 59.0% | 58.7% |

| 86 | 1 | 65,000,000 | 3.7 | 2.95200% | 84 | 4.11x | 12.6% | 36.5% | 36.5% |

| 96 | 1 | 22,262,500 | 1.3 | 3.42100% | 95 | 2.74x | 9.6% | 64.8% | 64.8% |

| 120 | 32 | 1,034,952,473 | 58.3 | 3.41344% | 119 | 2.79x | 10.3% | 57.0% | 55.4% |

Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| | | | | | | | | | |

| Remaining Term to Maturity in Months(1) |

| | | | | Weighted Average |

| Range of Remaining Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| 57 | - | 60 | 9 | $449,809,935 | 25.3% | 3.85901% | 59 | 3.10x | 13.0% | 54.5% | 54.3% |

| 61 | - | 84 | 5 | 267,809,766 | 15.1 | 3.48853% | 83 | 3.52x | 13.0% | 53.5% | 53.3% |

| 85 | - | 119 | 32 | 1,049,164,973 | 59.1 | 3.41010% | 118 | 2.79x | 10.3% | 57.2% | 55.6% |

| 120 | - | 120 | 1 | 8,050,000 | 0.5 | 3.87000% | 120 | 2.08x | 8.5% | 54.0% | 54.0% |

| Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| (1) | In the case of Loan Nos. 4, 5 and 12, each with an anticipated repayment date, Original Term to Maturity, Remaining Loan Term and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 2, 4, 5, 7, 8, 10, 11, 12, 13, 17, 19, 20, 21, 23, 25, 27 and 28, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 4, 10, 18 and 23, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s), related mezzanine loan(s) and/or related additional secured subordinate debt. |

| (3) | In the case of Loan Nos. Nos. 1, 3, 4, 8 and 22, Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Collateral Characteristics |

| Original Amortization Term in Months |

| | | | | Weighted Average |

| Original Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| | Interest Only | | 38 | $1,566,005,500 | 88.2% | 3.48109% | 95 | 3.16x | 11.6% | 54.8% | 54.8% |

| 360 | - | 360 | 9 | 208,829,174 | 11.8 | 3.96298% | 115 | 1.60x | 9.9% | 64.2% | 55.9% |

| Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| | | | | | | | | | | | | | |

| Remaining Amortization Term in Months |

| | | | | Weighted Average |

| Range of Remaining Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| | Interest Only | | 38 | $1,566,005,500 | 88.2% | 3.48109% | 95 | 3.16x | 11.6% | 54.8% | 54.8% |

| 359 | - | 360 | 9 | 208,829,174 | 11.8 | 3.96298% | 115 | 1.60x | 9.9% | 64.2% | 55.9% |

| Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| | | | | | | | | | | | | | |

| | | | | Weighted Average |

| Amortization Types | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| Interest Only | 35 | $1,315,005,500 | 74.1% | 3.61162% | 94 | 3.12x | 12.0% | 56.2% | 56.2% |

| Interest Only - ARD | 3 | 251,000,000 | 14.1 | 2.79726% | 103 | 3.37x | 9.6% | 47.3% | 47.3% |

| Interest Only, Amortizing Balloon | 4 | 146,152,500 | 8.2 | 3.93820% | 119 | 1.53x | 9.4% | 63.5% | 56.8% |

| Amortizing Balloon | 5 | 62,676,674 | 3.5 | 4.02076% | 107 | 1.77x | 11.1% | 65.9% | 53.9% |

| Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(2) |

| | | | | Weighted Average |

| Range of Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| 1.42x | - | 1.79x | 7 | $194,735,885 | 11.0% | 3.91999% | 116 | 1.56x | 9.5% | 64.1% | 56.0% |

| 1.80x | - | 2.09x | 6 | 122,396,523 | 6.9 | 4.19638% | 82 | 1.98x | 9.2% | 65.2% | 64.5% |

| 2.10x | - | 2.29x | 2 | 50,870,000 | 2.9 | 3.87749% | 118 | 2.27x | 9.3% | 62.1% | 62.1% |

| 2.30x | - | 2.59x | 8 | 150,041,766 | 8.5 | 3.82874% | 98 | 2.40x | 10.0% | 62.8% | 62.4% |

| 2.60x | | 2.99x | 8 | 261,007,500 | 14.7 | 3.56319% | 103 | 2.88x | 11.0% | 61.3% | 61.3% |

| 3.00x | - | 4.50x | 16 | 995,783,000 | 56.1 | 3.31425% | 94 | 3.52x | 12.4% | 50.4% | 50.4% |

| Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| (1) | In the case of Loan Nos. 4, 5 and 12, each with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 2, 4, 5, 7, 8, 10, 11, 12, 13, 17, 19, 20, 21, 23, 25, 27 and 28, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 4, 10, 18 and 23, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s), related mezzanine loan(s) and/or related additional secured subordinate debt. |

| (3) | In the case of Loan Nos. Nos. 1, 3, 4, 8 and 22, Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Collateral Characteristics |

| LTV Ratios as of the Cut-off Date(2)(3) |

| | | | | Weighted Average |

Range of

Cut-off Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| 29.3% | - | 39.9% | 2 | $71,000,000 | 4.0% | 2.98986% | 87 | 4.06x | 12.6% | 35.9% | 35.9% |

| 40.0% | - | 49.9% | 6 | 471,000,000 | 26.5 | 3.33684% | 93 | 3.70x | 13.3% | 43.0% | 43.0% |

| 50.0% | - | 59.9% | 12 | 540,138,000 | 30.4 | 3.55425% | 103 | 2.91x | 11.1% | 58.5% | 57.8% |

| 60.0% | - | 69.2% | 27 | 692,696,674 | 39.0 | 3.71775% | 98 | 2.42x | 10.2% | 64.6% | 62.7% |

Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| LTV Ratios as of the Maturity Date(1)(2)(3) |

| | | | | Weighted Average |

Range of

Maturity Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| 29.3% | - | 39.9% | 2 | $71,000,000 | 4.0% | 2.98986% | 87 | 4.06x | 12.6% | 35.9% | 35.9% |

| 40.0% | - | 44.9% | 5 | 416,000,000 | 23.4 | 3.38931% | 90 | 3.68x | 13.4% | 42.4% | 42.4% |

| 45.0% | - | 49.9% | 1 | 55,000,000 | 3.1 | 2.94000% | 119 | 3.86x | 12.0% | 48.1% | 48.1% |

| 50.0% | - | 54.9% | 7 | 165,594,973 | 9.3 | 3.93171% | 108 | 2.00x | 10.1% | 59.1% | 52.8% |

| 55.0% | - | 68.0% | 32 | 1,067,239,701 | 60.1 | 3.60180% | 99 | 2.73x | 10.7% | 62.4% | 61.8% |

Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| | | | | Weighted Average |

| Prepayment Protection | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| Defeasance | 40 | $1,423,513,151 | 80.2% | 3.58702% | 98 | 2.88x | 11.3% | 57.3% | 56.1% |

| Yield Maintenance or Defeasance | 5 | 219,151,523 | 12.3 | 3.07240% | 107 | 3.44x | 10.9% | 44.8% | 44.4% |

| Yield Maintenance | 2 | 132,170,000 | 7.4 | 3.77919% | 82 | 3.25x | 13.4% | 59.6% | 59.6% |

Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| | | | | Weighted Average |

| Loan Purpose | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2) | UW

NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV (1)(2)(3) |

| Refinance | 19 | $872,817,235 | 49.2% | 3.43964% | 90 | 3.30x | 12.3% | 50.5% | 49.7% |

| Acquisition | 24 | 730,117,439 | 41.1 | 3.63881% | 105 | 2.66x | 10.5% | 62.6% | 61.8% |

| Recapitalization | 4 | 171,900,000 | 9.7 | 3.60710% | 108 | 2.66x | 10.6% | 54.8% | 52.5% |

| Total / Wtd. Avg: | 47 | $1,774,834,674 | 100.0% | 3.53779% | 98 | 2.98x | 11.4% | 55.9% | 54.9% |

| (1) | In the case of Loan Nos. 4, 5 and 12, each with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 2, 4, 5, 7, 8, 10, 11, 12, 13, 17, 19, 20, 21, 23, 25, 27 and 28, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 4, 10, 18 and 23, UW NCF DSCR, UW NOI DY, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s), related mezzanine loan(s) and/or related additional secured subordinate debt. |

| (3) | In the case of Loan Nos. Nos. 1, 3, 4, 8 and 22, Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Collateral Characteristics |

| Previous Securitization History(1) |

| No. | Mortgaged Property | Cut-off Date Principal Balance(2) | % of IPB | Location | Property Type | Previous Securitization |

| 1 | Old Chicago Post Office | $125,000,000 | 7.0% | Chicago, IL | Office | BXMT 2021-FL4, BXMT 2020-FL3, BXMT 2020-FL2 |

| 2.01 | Bedrock Portfolio - First National Building | $28,820,000 | 1.6% | Detroit, MI | Office | JPMBB 2015-C32, JPMCC 2015-JP1 |

| 2.03 | Bedrock Portfolio - Chrysler House | $14,325,000 | 0.8% | Detroit, MI | Office | WFRBS 2013-C16 |

| 2.04 | Bedrock Portfolio - 1001 Woodward | $14,232,500 | 0.8% | Detroit, MI | Office | JPMBB 2014-C19 |

| 2.05 | Bedrock Portfolio - One Woodward | $10,317,500 | 0.6% | Detroit, MI | Office | COMM 2014-UBS6 |

| 5 | One Wilshire | $90,000,000 | 5.1% | Los Angeles, CA | Office | COMM 2013-CR10 |

| 7 | JW Marriott Desert Springs | $75,000,000 | 4.2% | Palm Desert, CA | Hospitality | BACM 2017-BNK3, BANK 2017-BNK4 |

| 12 | Novo Nordisk HQ | $60,000,000 | 3.4% | Plainsboro, NJ | Office | WFCM 2016-NXS6, CSMC 2016-NXSR, CGCMT 2017-P7 |

| 13 | The Kirby Collection | $55,000,000 | 3.1% | Houston, TX | Mixed Use | TRTX 2018-FL2 |

| 18 | The Onyx | $38,000,000 | 2.1% | Houston, TX | Multifamily | RAITF 2017-FL8 |

| 19.11 | ExchangeRight Net Leased Portfolio #53 - Walgreens - Watervliet (2nd), NY | $969,767 | 0.1% | Watervliet, NY | Retail | COMM 2013-LC13 |

| 20.01 | Glen Forest Office Portfolio - Hillcrest | $5,702,338 | 0.3% | Richmond, VA | Office | BCORE 2019-CORE |

| 20.02 | Glen Forest Office Portfolio - Arrington | $5,360,198 | 0.3% | Richmond, VA | Office | BCORE 2019-CORE |

| 20.03 | Glen Forest Office Portfolio - Highland II | $3,729,329 | 0.2% | Richmond, VA | Office | BCORE 2019-CORE |

| 20.04 | Glen Forest Office Portfolio - Meridian | $3,506,938 | 0.2% | Richmond, VA | Office | BCORE 2019-CORE |

| 20.05 | Glen Forest Office Portfolio - Bayberry | $2,452,005 | 0.1% | Richmond, VA | Office | BCORE 2019-CORE |

| 20.06 | Glen Forest Office Portfolio - Highland I | $2,278,084 | 0.1% | Richmond, VA | Office | BCORE 2019-CORE |

| 20.07 | Glen Forest Office Portfolio - Capstone | $2,155,484 | 0.1% | Richmond, VA | Office | BCORE 2019-CORE |

| 20.08 | Glen Forest Office Portfolio - Forest Plaza I | $1,767,725 | 0.1% | Richmond, VA | Office | BCORE 2019-CORE |

| 20.09 | Glen Forest Office Portfolio - Forest Plaza II | $1,482,608 | 0.1% | Richmond, VA | Office | BCORE 2019-CORE |

| 25.01 | Nyberg Portfolio - Nyberg Rivers | $12,522,254 | 0.7% | Tualatin, OR | Retail | COMM 2015-LC21 |

| 25.02 | Nyberg Portfolio - Nyberg Woods | $11,377,746 | 0.6% | Tualatin, OR | Retail | COMM 2015-LC21 |

| 43 | Lakeville Townhomes | $7,170,000 | 0.4% | Memphis, TN | Multifamily | BANC 2019-CRE5 |

| (1) | The table above represents the properties for which the previously existing debt was securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

| (2) | Cut-off Date Principal Balance represents the allocated loan amount for each respective mortgaged property. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17 of 158

| Structural and Collateral Term Sheet | | Benchmark 2022-B32 |

| |

| Class A-2 and Class A-2A1(1) |

No. | Loan Name | Location | Cut-off Date Balance | % of IPB | Maturity Date Balance | % of Certificate Class(2) | Original Loan Term | Remaining Loan Term | UW NCF DSCR(3) | UW NOI Debt Yield(3) | Cut-off Date LTV(3) | Maturity Date LTV(3) |

| 1 | Old Chicago Post Office | Chicago, IL | $125,000,000 | 7.0% | $125,000,000 | 29.3% | 60 | 59 | 4.22 | 14.9% | 43.1% | 43.1% |

| 7 | JW Marriott Desert Springs | Palm Desert, CA | $75,000,000 | 4.2% | $75,000,000 | 17.6% | 60 | 59 | 3.14 | 20.4% | 41.8% | 41.8% |

| 9 | Dealertrack and Divvy | Draper, UT | $74,500,000 | 4.2% | $74,500,000 | 17.4% | 60 | 59 | 1.96 | 9.4% | 68.0% | 68.0% |

| 12 | Novo Nordisk HQ | Plainsboro, NJ | $60,000,000 | 3.4% | $60,000,000 | 14.0% | 60 | 57 | 3.16 | 9.2% | 63.8% | 63.8% |

| 16 | Benefitfocus HQ | Charleston, SC | $40,000,000 | 2.3% | $40,000,000 | 9.4% | 60 | 59 | 2.45 | 10.7% | 64.9% | 64.9% |

| 19 | ExchangeRight Net Leased Portfolio #53 | Various | $30,000,000 | 1.7% | $30,000,000 | 7.0% | 60 | 59 | 2.68 | 9.6% | 53.9% | 53.9% |

| 20 | Glen Forest Office Portfolio | Richmond, VA | $30,000,000 | 1.7% | $30,000,000 | 7.0% | 60 | 58 | 2.85 | 11.3% | 61.7% | 61.7% |

| 40 | Metro Place | Dublin, OH | $8,139,935 | 0.5% | $7,438,296 | 1.7% | 60 | 59 | 1.66 | 11.1% | 69.0% | 63.0% |

| 43 | Lakeville Townhomes | Memphis, TN | $7,170,000 | 0.4% | $7,170,000 | 1.7% | 60 | 59 | 2.36 | 10.0% | 62.9% | 62.9% |

| Total / Weighted Average: | | $449,809,935 | 25.3% | $449,108,296 | 105.2% | 60 | 59 | 3.10x | 13.0% | 54.5% | 54.3% |