Exhibit 10.6

CHANGE

IN

CONTROL

AGREEMENT

THIS

CHANGE

IN

CONTROL

AGREEMENT

(“CIC

Agreement”)

is

made

by

and

between

U.S.

Century

Bank,

with

Corporate

Offices

located

at

2301

NW

87

th

33172 (hereinafter called the

“Bank” or the “Company”),

its subsidiaries, divisions and associated

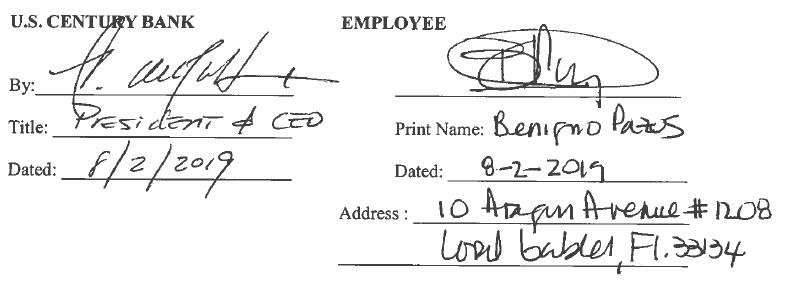

and affiliated entities (“Affiliates”) and Benigno Pazos (“Executive”).

WHEREAS,

as

consideration

for

Executive’s

continued

employment

with

the

Bank

as

Chief Credit

Officer,

which is

incorporated by

reference in

this Agreement),

the parties hereto,

intending to be

legally bound,

agree as follows:

1.

Payment Upon Change in Control.

In the event of a Change in

Control (as defined

herein) for the remaining term of Executive’s employment with the Bank, the

Company agrees to

issue

payment

to

Executive

in

the

total

amount

of

1.5

times

the

Base

Annual

Salary

of

the

Executive applicable for the one

(1) year period prior to

the Change in Control, to

be paid within

thirty (30) days

of the consummation

of the Change

in Control.

Bank’s

provision of this

benefit

to Executive

is

made

without

regard to

whether,

or for

how long,

Executive remains

employed

with the surviving company subsequent to the Change in Control.

2.

Change

in

Control.

“Change

in

Control

shall

mean

the

occurrence

of

an

event

described in (i), (ii), (iii), or (iv) below:

(i) Any person or group (within the meaning of Sections 13(d) and 14(d) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”)), other than

the Bank, an affiliate of the Bank or a trustee or other fiduciary holding securities

under an employee benefit plan of the Bank or a corporation owned directly or

indirectly by the stockholders of Bank in substantially the same proportions as

their ownership of stock of the Bank, becomes the beneficial

owner (within the

meaning of Rule 13(d)(3) under the Exchange Act, directly or indirectly (which

shall include securities issuable upon conversion, exchange or otherwise) or

securities representing 50% or more of the combined voting power of the Bank’s

then-outstanding securities entitled to vote for the election of directors.

(ii)

Consummation

of

an

agreement

to

merge or

consolidate

with

another

entity

(other

than

a

majority-controlled

subsidiary

of the

Bank)

unless

the

Bank’s

stockholders immediately before the

merger or

consolidation own more

than 50%

of

the

combined

voting

power

of

the

resulting

entity’s

voting

securities

(giving

effect to

the conversion

or exchange

of securities

issued in

the merger

consolidation

to the

other entity

that are

convertible or

exchangeable for

voting securities)

entitled

generally to vote for the election of directors.

(iii) Consummation

of an

agreement (including,

without limitation,

an agreement

of liquidation) to sell or otherwise dispose of all or substantially all of the business

or assets of the Bank (or a subsidiary thereof); or