Exhibit 2.8

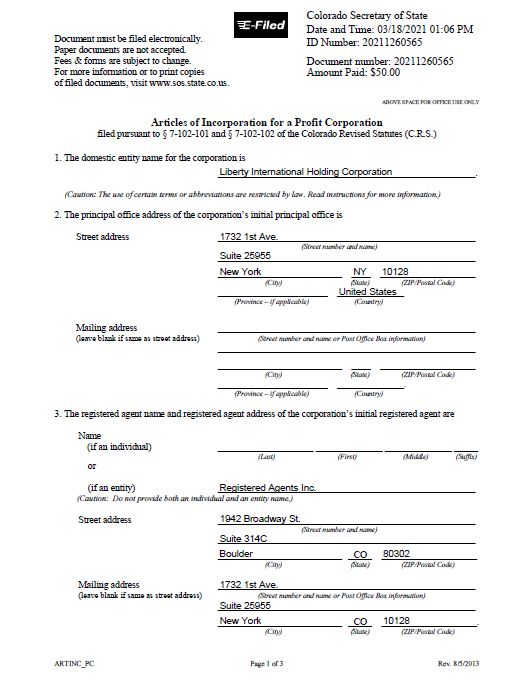

Document must be filed electronically. Paper documents are not accepted. Fees & forms are subject to change. For more information or to print copies of filed documents, visit www.sos.state.co.us. ABOVE SPACE FOR OFFICE USE ONLY Street address Mailing address (leave blank if same as street address) (State) (ZIP/Postal Code) (City) (Province – if applicable) (Street number and name or Post Office Box information) ( S t a t e) (ZIP/Postal Code) (City) (Province – if applicable) . (Country) 3. The registered agent name and registered agent address of the corporation’s initial registered agent are (Last) (First) (Middle) (Suffix) Na m e (if an individual) or (if an entity) (Caution: Do not provide both an individual and an entity name.) Street address Mailing address (leave blank if same as street address) Articles of Incorporation for a Profit Corporation filed pursuant to † 7 - 102 - 101 and † 7 - 102 - 102 of the Colorado Revised Statutes (C.R.S.) 1. The domestic entity name for the corporation is _ L _ i b e _ r t _ y _ I _ n _ t _ e _ r n a _ t i _ o _ n _ a _ l _ H o _ l d _ i _ n _ g C _ o _ r _ p _ o _ r _ a _ t i _ o _ n . (Caution : The use of certain terms or abbreviations are restricted by law. Read instructions for more information.) 2. The principal office address of the corporation’s initial principal office is _ U _ n _ i _ te d _ S ta _ t _ e _ s (Country) _ 1 _ 7 _ 3 _ 2 1 _ s _ t _ A _ v _ e . (Street number and name) _ S _ u _ i _ te 2 _ 5 _ 9 _ 5 _ 5 _ N _ e _ w Y o _ r _ k _ N _ Y _ 1 _ 0 _ 1 _ 2 _ 8 _ R _ e _ g _ i _ s _ te re _ d A _ g e _ n _ ts In c _ . _ 1 _ 9 _ 4 _ 2 B _ r _ o _ a _ d _ w a _ y _ S t. (Street number and name) _ S _ u _ i _ te 3 _ 1 _ 4 _ C _ B _ o _ u _ l _ d _ e _ r CO _ 8 _ 0 _ 3 _ 0 _ 2 (City) (State) (ZIP/Postal Code) _ 1 _ 7 _ 3 _ 2 1 _ s _ t _ A _ v _ e . (Street number and name or Post Office Box information) _ S _ u _ i _ te 2 _ 5 _ 9 _ 5 _ 5 _ N _ e _ w Y o _ r _ k C O _ 1 _ 0 _ 1 _ 2 _ 8 . (City) (State) (ZIP/Postal Code) Colorado Secretary of State Date and Time: 03/18/2021 01:06 PM ID Number: 20211260565 Document number: 20211260565 Amount Paid: $50.00 ARTINC_PC Page 1 of 3 Rev. 8/5/2013

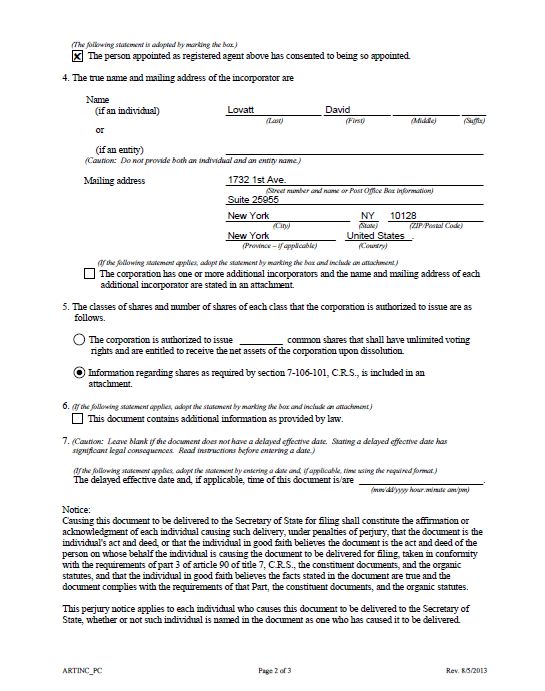

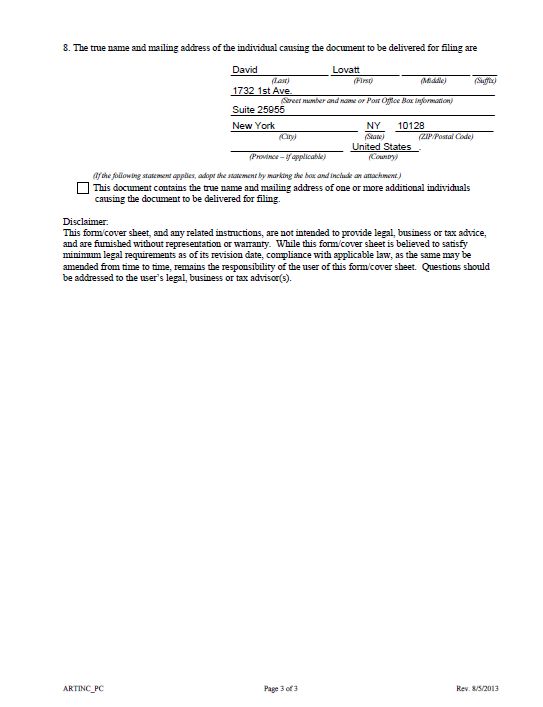

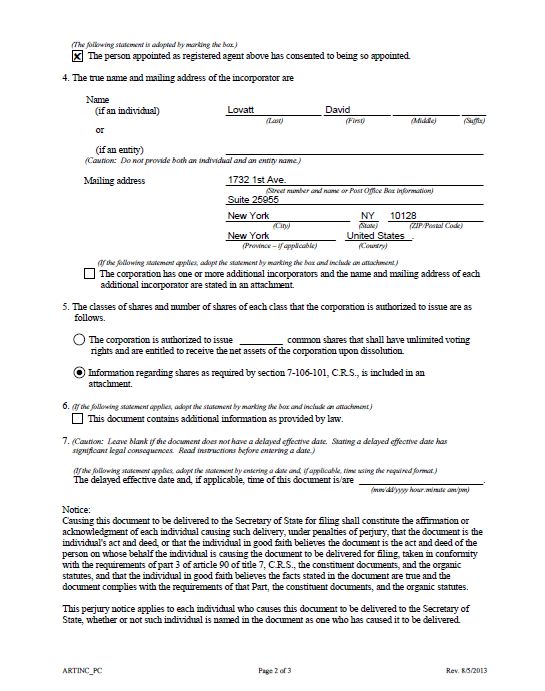

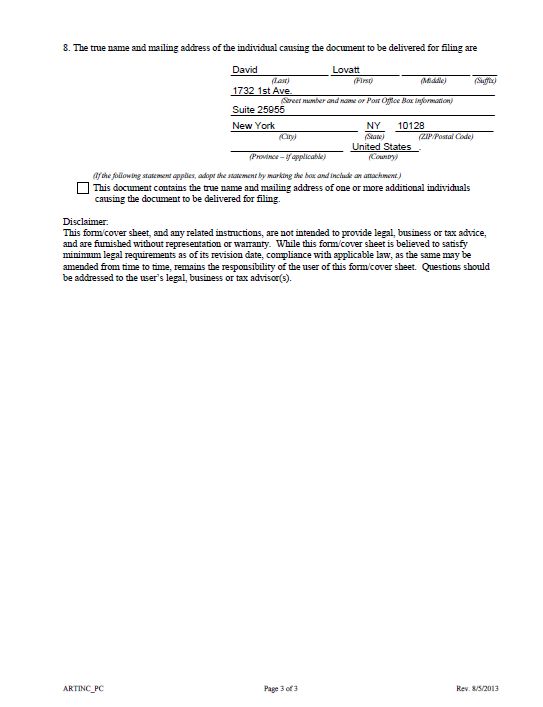

Na m e (if an individual) or (if an entity) (Caution : Do not provide both an individual and an entity name.) Mailing address (The following statement is adopted by marking the box.) ✓ The person appointed as registered agent above has consented to being so appointed. 4. The true name and mailing address of the incorporator are _ L _ o _ v _ a _ t _ t _ D _ a _ v _ i _ d (Last) (First) (Middle) (Suffix) (City) (State) (ZIP/Postal Code) _ N _ e _ w Y o _ r _ k _ U _ n _ i _ te d _ S ta _ t _ e _ s . (Province – if applicable) (Country) (If the following statement applies, adopt the statement by marking the box and include an attachment.) The corporation has one or more additional incorporators and the name and mailing address of each additional incorporator are stated in an attachment. 5. The classes of shares and number of shares of each class that the corporation is authorized to issue are as follows. The corporation is authorized to issue common shares that shall have unlimited voting rights and are entitled to receive the net assets of the corporation upon dissolution. Information regarding shares as required by section 7 - 106 - 101, C.R.S., is included in an attachment. 6. (If the following statement applies, adopt the statement by marking the box and include an attachment.) This document contains additional information as provided by law. 7. (Caution : Leave blank if the document does not have a delayed effective date. Stating a delayed effective date has significant legal consequences. Read instructions before entering a date.) (If the following statement applies, adopt the statement by entering a date and, if applicable, time using the required format.) The de l a y ed e f f ec ti v e date and, i f a p p li cab l e, ti m e of t h i s do c u m ent i s / a r e . (mm/dd/yyyy hour:minute am/pm) Notice: Causing this document to be delivered to the Secretary of State for filing shall constitute the affirmation or acknowledgment of each individual causing such delivery, under penalties of perjury, that the document is the individual's act and deed, or that the individual in good faith believes the document is the act and deed of the person on whose behalf the individual is causing the document to be delivered for filing, taken in conformity with the requirements of part 3 of article 90 of title 7, C.R.S., the constituent documents, and the organic statutes, and that the individual in good faith believes the facts stated in the document are true and the document complies with the requirements of that Part, the constituent documents, and the organic statutes. This perjury notice applies to each individual who causes this document to be delivered to the Secretary of State, whether or not such individual is named in the document as one who has caused it to be delivered. _ 1 _ 7 _ 3 _ 2 1 _ s _ t _ A _ v _ e . (Street number and name or Post Office Box information) _ S _ u _ i _ te 2 _ 5 _ 9 _ 5 _ 5 _ N _ e _ w Y o _ r _ k _ N _ Y _ 1 _ 0 _ 1 _ 2 _ 8 ARTINC_PC Page 2 of 3 Rev. 8/5/2013

ARTICLES OF INCORPORATION

OF

LIBERTY INTERNATIONA HOLDING CORPORATION

ARTICLE I. NAME

The name of the corporation is Liberty International Holding Corporation (the “Corporation”).

ARTICLE II. REGISTERED OFFICE

The name and address of the Corporation’s registered office in the State of Colorado is:

Registered Agents, Inc.

1942 Broadway St., Suite 314C

Boulder, CO 80302

ARTICLE III. PURPOSE

The purpose or purposes of the corporation is to engage in any lawful act or activity for which corporations may be organized under Colorado Law.

ARTICLE IV. CAPITAL STOCK

The Corporation is authorized to issue three classes of shares to be designated, respectively, "Preferred Stock" and "Common Stock." The number of shares of Common Stock authorized to be issued is 500,000,000 (500,000,000). The number of shares of Preferred Stock authorized to be issued is Twenty Million (20,000,000). The Preferred Stock and the Common Stock shall each have a par value of $0.0001 per share.

| (A) | Provisions Relating to the Common Stock. Each holder of Common Stock is entitled to one vote for each share of Common Stock standing in such holder's name on the records of the Corporation on each matter submitted to a vote of the stockholders, except as otherwise required by law. |

(B) Pursuant to Pursuant to § 7-106-102 of the Colorado Revised Statutes Title 7, Corporations and Associations of the Corporation’s Articles of Incorporation the following shall constitute the designations of the Corporation’s Preferred Stock:

(1) Designation of Series A Convertible Preferred Stock: 10,000,000 of the Corporation’s authorized shares of preferred stock are hereby designated as Series A Convertible Preferred Stock (the “Series A Stock”) having the following characteristics:

(i) The Series A Stock shall entitle the holders the right to vote, either together with holders of the Corporation’s common stock, or as a separate class of shares, on any matter upon which the shareholders of common stock of the Corporation may vote, including but not limited to any resolutions purporting to vary any of their rights or create any class of capital stock ranking in priority to them or effect any reorganization which would disadvantage the Series A Stock relative to the shares of the Corporation’s common stock;

(ii) Each share of Series A Stock shall be entitled to vote with the holders of common stock and holders of Series A Stock. The holder of each share of Series A Stock shall be entitled to the number of votes equal to the number of shares of Common Stock into which such share of Series A Stock could be converted at the record date for determination of the shareholders entitled to vote on such matters or, if no such record date is established at the date such vote is taken or any written consent of shareholders is solicited, such votes to be counted together with all other shares of the corporation having general voting power and not separately as a class to four times the sum of (a) all shares of Common Stock issued and outstanding at time of voting; plus (b) the total number of votes of all other classes of preferred stock which are issued and outstanding at the time of voting; divided by (c) the number of shares of Series AA Preferred Stock issued and outstanding at the time of voting.

(iii) The conversion rights for holders of Series A Stock shall be convertible without the payment of any additional consideration by the holder thereof and, at the option of the holder thereof, at any time after six months from the date hereof, after the date of issuance of such shares at the office of the Corporation or any transfer agent for the Preferred Stock. Each share of Series A Stock shall be convertible into one fully paid and nonassessable share of Common Stock of such series as has been determined by dividing the amount of Conversion Value ($1.50) by the Conversion Price ($1.50);

(2) Designation of Convertible Series B Preferred Stock: 10,000,000 of the Corporation’s authorized shares of preferred stock are hereby designated as Series A Convertible Preferred Stock (the “Series B Stock”) having the following characteristics:

(b) Authorized Shares. The number of authorized shares of Series B Stock shall be 10,000,000 (Ten Million) shares with a par value of $.0001.

(c) Liquidation Rights. In the event of any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary, after setting apart or paying in full the preferential amounts due to Holders of senior capital stock, if any, the Holders of Series B Stock and parity capital stock, if any, shall be entitled to receive, prior and in preference to any distribution of any of the assets or surplus funds of the Corporation to the Holders of junior capital stock, including Common Stock, an amount equal to $.0001 per share [the "Liquidation Preference"]. If upon such liquidation, dissolution or winding up of the Corporation, the assets of the Corporation available for distribution to the Holders of the Series B Stock and parity capital stock, if any, shall be insufficient to permit in full the payment of the Liquidation Preference, then all such assets of the Corporation shall be distributed ratably among the Holders of the Series B Stock and parity capital stock, if any. Neither the consolidation or merger of the Corporation nor the sale, lease or transfer by the Corporation of all or a part of its assets shall be deemed a liquidation, dissolution or winding up of the Corporation for purposes of this Section (c).

(d) Dividends. The Series B Stock is not entitled to receive any dividends in any amount during which such shares are outstanding.

(e) Conversion Rights. Each share of Series B Stock shall be convertible, at the option of the Holder, into 4 times the sum of all shares of Common Stock outstanding and all other Preferred shares outstanding, divided by the outstanding number of shares of Series B Stock.”

(i) Conversion Procedure. Upon written notice to the Holder, the Holder shall effect conversions by surrendering the certificate(s) representing the Preferred Series B Stock to be converted to the Corporation, together with a form of conversion notice satisfactory to the Corporation, which shall be irrevocable. Not later than five [5] business days after the conversion date, the Corporation will deliver to the Holder, (i) a certificate or certificates, which shall be subject to restrictive legends, representing the number of shares of Common Stock being acquired upon the conversion; provided, however, that the Corporation shall not be obligated to issue such certificates until the Series B Stock is delivered to the Corporation. If the Corporation does not deliver such certificate(s) by the date required under this paragraph (e) (i), the Holder shall be entitled by written notice to the Corporation at any time on or before receipt of such certificate(s), to receive 100 Series B Stock shares for every week the Corporations fails to deliver Common Stock to the Holder.

(ii) Adjustments on Stock Splits, Dividends and Distributions. If the Corporation, at any time while any Series B Stock is outstanding, (a) shall pay a stock dividend or otherwise make a distribution or distributions on shares of its Common Stock payable in shares of its capital stock [whether payable in shares of its Common Stock or of capital stock of any class], (b) subdivide outstanding shares of Common Stock into a larger number of shares, (c) combine outstanding shares of Common Stock into a smaller number of shares, or (d) issue reclassification of shares of Common Stock for any shares of capital stock of the Corporation, the Conversion Ratio shall be adjusted by multiplying the number of shares of Common Stock issuable by a fraction of which the numerator shall be the number of shares of Common Stock of the Corporation outstanding after such event and of which the denominator shall be the number of shares of Common Stock outstanding before such event. Any adjustment made pursuant to this paragraph (e)(iii) shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination or reclassification. Whenever the Conversion Ratio is adjusted pursuant to this paragraph, the Corporation shall promptly mail to the Holder a notice setting forth the Conversion Ratio after such adjustment and setting forth a brief statement of the facts requiring such adjustment.

(iii) Adjustments on Reclassifications, Consolidations and Mergers. In case of reclassification of the Common Stock, any consolidation or merger of the Corporation with or into another person, the sale or transfer of all or substantially all of the assets of the Corporation or any compulsory share exchange pursuant to which the Common Stock is converted into other securities, cash or property, then each Holder of Series B Stock then outstanding shall have the right thereafter to convert such Series B Stock only into the shares of stock and other securities and property receivable upon or deemed to be held by Holders of Common Stock following such reclassification, consolidation, merger, sale, transfer or share exchange, and the Holder shall be entitled upon such event to receive such amount of securities or property as the shares of the Common Stock into which such Series B Stock could have been converted immediately prior to such reclassification, consolidation, merger, sale, transfer or share exchange would have been entitled. The terms of any such consolidation, merger, sale, transfer or share exchange shall include such terms so as to continue to give to the Holder the right to receive the securities or property set forth in this paragraph (e)(iv) upon any conversion following such consolidation, merger, sale, transfer or share exchange. This provision shall similarly apply to successive reclassifications, consolidations, mergers, sales, transfers or share exchanges.

(iv) Fractional Shares; Issuance Expenses. Upon a conversion of Series B Stock, the Corporation shall not be required to issue stock certificates representing fractions of shares of Common Stock but shall issue that number of shares of Common Stock rounded to the nearest whole number. The issuance of certificates for shares of Common Stock on conversion of Series B Stock shall be made without charge to the Holder for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such certificate, provided that the Corporation shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery of any such certificate upon conversion in a name other than that of the Holder, and the Corporation shall not be required to issue or deliver such certificates unless or until the person or persons requesting the issuance thereof shall have paid to the Corporation the amount of such tax or shall have established to the satisfaction of the Corporation that such tax has been paid.

(f) Voting Rights. Except as otherwise expressly provided herein or as required by law, the Holders of shares of Series B Stock shall be entitled to vote on any and all matters considered and voted upon by the Corporation's Common Stock. The Holders of the Series B Stock shall be entitled to 4 times the sum of all shares of Common Stock outstanding and all other Preferred shares outstanding, divided by the outstanding number of shares of Series B Stock.

(g) Reservation of Shares of Common Stock. The Corporation covenants that it will at all times reserve and keep available out of its authorized and unissued Common Stock solely for the purpose of issuance upon conversion of Series B Stock as herein provided, free from preemptive rights or any other actual contingent purchase rights of persons other than the Holders of Series B Stock, such number of shares of Common Stock as shall be issuable upon the conversion of the outstanding Series B Stock. If at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all outstanding Series B Stock, the Corporation will take such corporate action necessary to increase its authorized shares of Common Stock to such number as shall be sufficient for such purpose. The Corporation covenants that all shares of Common Stock that shall be so issuable shall, upon issue, be duly and validly authorized, issued and fully paid and non-assessable.

All other aspects of Article V shall remain unchanged.

ARTICLE V. BOARD OF DIRECTORS

(A) Number. The number of directors constituting the entire Board shall be as fixed from time to time by vote of a majority of the entire Board, provided, however, that the number of directors shall not be reduced so as to shorten the term of any director at the time in office.

(B) Vacancies. Vacancies on the Board shall be filled by the affirmative vote of the majority of the remaining directors, though less than a quorum of the Board, or by election at an annual meeting or at a special meeting of the stockholders called for that purpose.

(C) The election of directors need not be by written ballot.

ARTICLE VI. BYLAWS

In furtherance and not in limitation of the powers conferred by statute, the Board is expressly authorized to make, alter, amend or repeal the Bylaws of the Corporation.

ARTICLE VII. LIABILITY

To the fullest extent permitted by Colorado law as the same exists or as may hereafter be amended, no director of the Corporation shall be personally liable to the Corporation or its stockholders for or with respect to any acts or omissions in the performance of his or her duties as a director of the Corporation. Any amendment or repeal of this Article VII will not eliminate or reduce the affect of any right or protection of a director of the Corporation existing immediately prior to such amendment or repeal.

ARTICLE VIII. STOCKHOLDER MEETINGS

Meetings of stockholders may be held within or without the State of Colorado as the Bylaws may provide. The books of the Corporation may be kept outside the State of Colorado at such place or places as may be designated from time to time by the Board or in the Bylaws of the Corporation.

ARTICLE IX. AMENDMENT OF ARTICLES OF INCORPORATION

The Corporation reserves the right to amend, alter, change or repeal any provision contained in these Articles of Incorporation, in the manner now or hereafter prescribed by statute, and all rights conferred upon stockholders herein are granted subject to this reservation.

I, THE UNDERSIGNED, being the Chief Executive Officer of Liberty International Holding Corporation I hereby declare and certify, under penalties of perjury, that this is my act and deed and the facts herein stated are true, and accordingly have hereunto set my hand this 18th day of March 2021.

| | /S/ David Lovatt David Lovatt, Chief Executive Officer |