0000019034 aimfg:C000188906Member oef:IndustrialSectorMember 2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

AIM Funds Group (Invesco Funds Group)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Glenn Brightman, Principal Executive Officer

11 Greenway Plaza, Suite 1000

Houston, Texas 77046

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Reports to Stockholders.

(a) The Registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the "Act") is as follows:

Invesco EQV European Small Company Fund

Class A: ESMAX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco EQV European Small Company Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV European Small Company Fund

(Class A) | $150 | 1.48% |

How Did The Fund Perform During The Period?

• European equity markets rose modestly during the fiscal year ended December 31, 2024. Returns were more muted in Europe compared to other regions due to economic weakness and limited exposure to artificial intelligence (AI). Large-cap stocks outperformed small-cap stocks, and value stocks outperformed growth stocks. UK equities also outperformed those of continental Europe, driven by a cyclical rebound. Within continental Europe, France was among the weakest markets, hurt by political instability as December brought the country’s fourth new government of 2024.

• For the fiscal year ended December 31, 2024, Class A shares of the Fund, excluding sales charge, returned 2.50%. For the same time period, the MSCI Europe Small Cap Index returned -0.96%.

What contributed to performance?

ME Group International PLC | A UK-based vending machine operator. The company reported strong earnings primarily driven by its fast-growing automated laundry machines during the fiscal year.

IG Group Holdings PLC | A UK-based online trading provider. Management provided a robust trading update showing attractive growth, and, under the new CEO Breon Corcoran, shares rose from very low levels. We believe Corcoran’s record is strong and has reignited excitement about the company’s business potential.

Clarkson PLC | A British global leading shipping broker. The company benefited from a strong US economy and the disruption from Houthi attacks in the Red Sea and Gulf of Aden. The attacks led to many vessels taking the longer route around South Africa, which effectively suppressed supply and pushed prices up.

What detracted from performance?

Carlo Gavazzi Holding AG | A Switzerland-based manufacturer of niche switches, controls and sensors for building and industrial automation. The company experienced weakened demand due to destocking and macro weakness in Europe and China. However, we still believe that Carlo Gavazzi may benefit from the secular trends of automation, electrification and supply chain de-globalization.

CompuGroup Medical SE & Co. KGaA | A German health care information technology provider. The company cut fiscal year 2024 guidance due to project delays and reduced customer spending due to macroeconomic uncertainties. The stock fell to near all-time lows due to lack of visibility and earnings momentum. During the fourth quarter 2024, the company received an offer by CVC Capital Partners to be taken private, and that offer is supported by the company’s founder and largest shareholder.

Text S.A. | A Polish software company. Text’s core business of call center software solutions is projected to be most disrupted by AI and large language models (LLMs) in the short term, which we believe muddles the medium term visibility of the company’s prospects. Text has been investing in its proprietary AI solution but is dwarfed by the leading AI players.

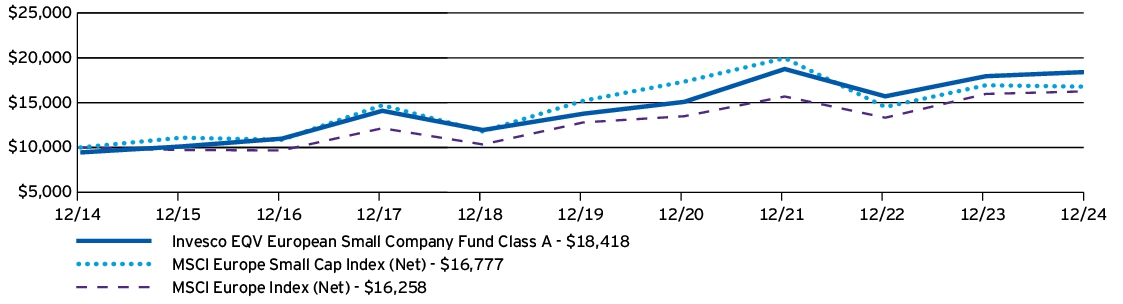

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV European Small Company Fund (Class A) —including sales charge | (3.03)% | 4.80% | 6.30% |

| Invesco EQV European Small Company Fund (Class A) —excluding sales charge | 2.50% | 6.00% | 6.90% |

| MSCI Europe Small Cap Index (Net) | (0.96)% | 1.98% | 5.31% |

| MSCI Europe Index (Net) | 1.79% | 4.90% | 4.98% |

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the MSCI Europe Small Cap Index (Net) to the MSCI Europe Index (Net) to reflect that the MSCI Europe Index (Net) can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $165,025,203 |

| Total number of portfolio holdings | 59 |

| Total advisory fees paid | $1,695,137 |

| Portfolio turnover rate | 14% |

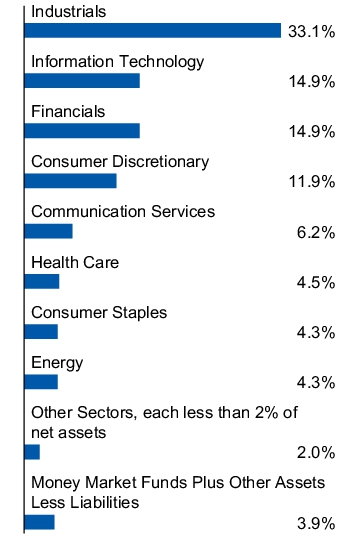

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Renew Holdings PLC | 4.10% |

| IG Group Holdings PLC | 3.89% |

| Diploma PLC | 3.82% |

| Neurones | 3.74% |

| ME Group International PLC | 3.36% |

| Kardex Holding AG | 3.30% |

| Kaufman & Broad S.A. | 3.21% |

| DCC PLC | 3.13% |

| Clarkson PLC | 2.91% |

| flatexDEGIRO AG | 2.79% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco EQV European Small Company Fund

Class C: ESMCX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco EQV European Small Company Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV European Small Company Fund

(Class C) | $225 | 2.23% |

How Did The Fund Perform During The Period?

• European equity markets rose modestly during the fiscal year ended December 31, 2024. Returns were more muted in Europe compared to other regions due to economic weakness and limited exposure to artificial intelligence (AI). Large-cap stocks outperformed small-cap stocks, and value stocks outperformed growth stocks. UK equities also outperformed those of continental Europe, driven by a cyclical rebound. Within continental Europe, France was among the weakest markets, hurt by political instability as December brought the country’s fourth new government of 2024.

• For the fiscal year ended December 31, 2024, Class C shares of the Fund, excluding sales charge, returned 1.72%. For the same time period, the MSCI Europe Small Cap Index returned -0.96%.

What contributed to performance?

ME Group International PLC | A UK-based vending machine operator. The company reported strong earnings primarily driven by its fast-growing automated laundry machines during the fiscal year.

IG Group Holdings PLC | A UK-based online trading provider. Management provided a robust trading update showing attractive growth, and, under the new CEO Breon Corcoran, shares rose from very low levels. We believe Corcoran’s record is strong and has reignited excitement about the company’s business potential.

Clarkson PLC | A British global leading shipping broker. The company benefited from a strong US economy and the disruption from Houthi attacks in the Red Sea and Gulf of Aden. The attacks led to many vessels taking the longer route around South Africa, which effectively suppressed supply and pushed prices up.

What detracted from performance?

Carlo Gavazzi Holding AG | A Switzerland-based manufacturer of niche switches, controls and sensors for building and industrial automation. The company experienced weakened demand due to destocking and macro weakness in Europe and China. However, we still believe that Carlo Gavazzi may benefit from the secular trends of automation, electrification and supply chain de-globalization.

CompuGroup Medical SE & Co. KGaA | A German health care information technology provider. The company cut fiscal year 2024 guidance due to project delays and reduced customer spending due to macroeconomic uncertainties. The stock fell to near all-time lows due to lack of visibility and earnings momentum. During the fourth quarter 2024, the company received an offer by CVC Capital Partners to be taken private, and that offer is supported by the company’s founder and largest shareholder.

Text S.A. | A Polish software company. Text’s core business of call center software solutions is projected to be most disrupted by AI and large language models (LLMs) in the short term, which we believe muddles the medium term visibility of the company’s prospects. Text has been investing in its proprietary AI solution but is dwarfed by the leading AI players.

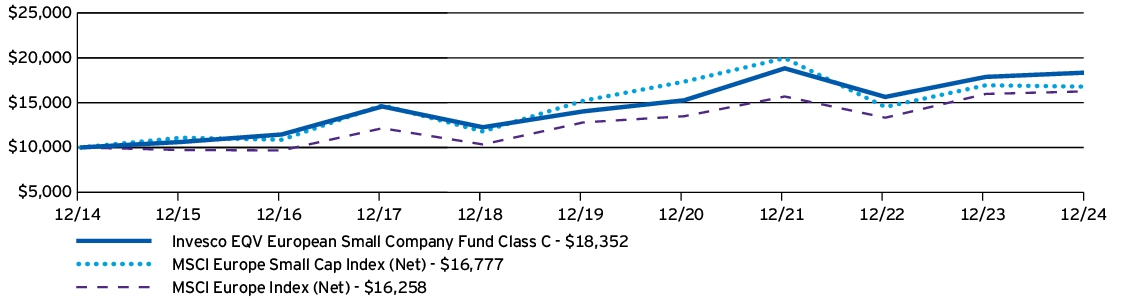

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV European Small Company Fund (Class C) —including sales charge | 0.94% | 5.20% | 6.26% |

| Invesco EQV European Small Company Fund (Class C) —excluding sales charge | 1.72% | 5.20% | 6.26% |

| MSCI Europe Small Cap Index (Net) | (0.96)% | 1.98% | 5.31% |

| MSCI Europe Index (Net) | 1.79% | 4.90% | 4.98% |

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the MSCI Europe Small Cap Index (Net) to the MSCI Europe Index (Net) to reflect that the MSCI Europe Index (Net) can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $165,025,203 |

| Total number of portfolio holdings | 59 |

| Total advisory fees paid | $1,695,137 |

| Portfolio turnover rate | 14% |

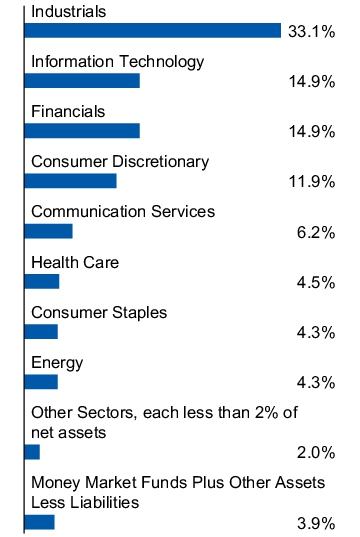

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Renew Holdings PLC | 4.10% |

| IG Group Holdings PLC | 3.89% |

| Diploma PLC | 3.82% |

| Neurones | 3.74% |

| ME Group International PLC | 3.36% |

| Kardex Holding AG | 3.30% |

| Kaufman & Broad S.A. | 3.21% |

| DCC PLC | 3.13% |

| Clarkson PLC | 2.91% |

| flatexDEGIRO AG | 2.79% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco EQV European Small Company Fund

Class Y: ESMYX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco EQV European Small Company Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV European Small Company Fund

(Class Y) | $125 | 1.23% |

How Did The Fund Perform During The Period?

• European equity markets rose modestly during the fiscal year ended December 31, 2024. Returns were more muted in Europe compared to other regions due to economic weakness and limited exposure to artificial intelligence (AI). Large-cap stocks outperformed small-cap stocks, and value stocks outperformed growth stocks. UK equities also outperformed those of continental Europe, driven by a cyclical rebound. Within continental Europe, France was among the weakest markets, hurt by political instability as December brought the country’s fourth new government of 2024.

• For the fiscal year ended December 31, 2024, Class Y shares of the Fund returned 2.70%. For the same time period, the MSCI Europe Small Cap Index returned -0.96%.

What contributed to performance?

ME Group International PLC | A UK-based vending machine operator. The company reported strong earnings primarily driven by its fast-growing automated laundry machines during the fiscal year.

IG Group Holdings PLC | A UK-based online trading provider. Management provided a robust trading update showing attractive growth, and, under the new CEO Breon Corcoran, shares rose from very low levels. We believe Corcoran’s record is strong and has reignited excitement about the company’s business potential.

Clarkson PLC | A British global leading shipping broker. The company benefited from a strong US economy and the disruption from Houthi attacks in the Red Sea and Gulf of Aden. The attacks led to many vessels taking the longer route around South Africa, which effectively suppressed supply and pushed prices up.

What detracted from performance?

Carlo Gavazzi Holding AG | A Switzerland-based manufacturer of niche switches, controls and sensors for building and industrial automation. The company experienced weakened demand due to destocking and macro weakness in Europe and China. However, we still believe that Carlo Gavazzi may benefit from the secular trends of automation, electrification and supply chain de-globalization.

CompuGroup Medical SE & Co. KGaA | A German health care information technology provider. The company cut fiscal year 2024 guidance due to project delays and reduced customer spending due to macroeconomic uncertainties. The stock fell to near all-time lows due to lack of visibility and earnings momentum. During the fourth quarter 2024, the company received an offer by CVC Capital Partners to be taken private, and that offer is supported by the company’s founder and largest shareholder.

Text S.A. | A Polish software company. Text’s core business of call center software solutions is projected to be most disrupted by AI and large language models (LLMs) in the short term, which we believe muddles the medium term visibility of the company’s prospects. Text has been investing in its proprietary AI solution but is dwarfed by the leading AI players.

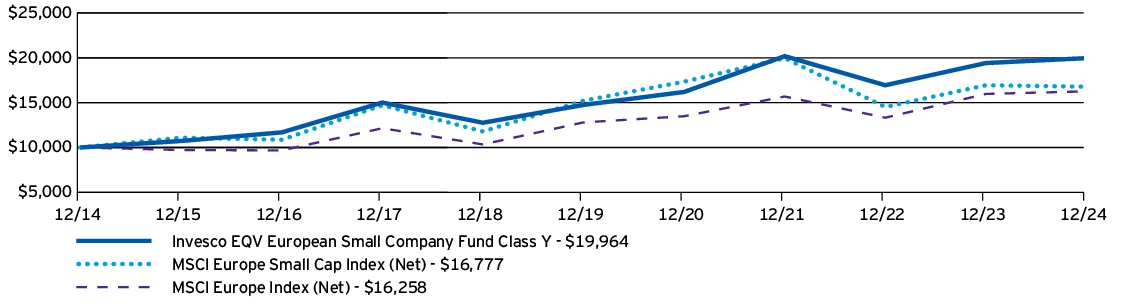

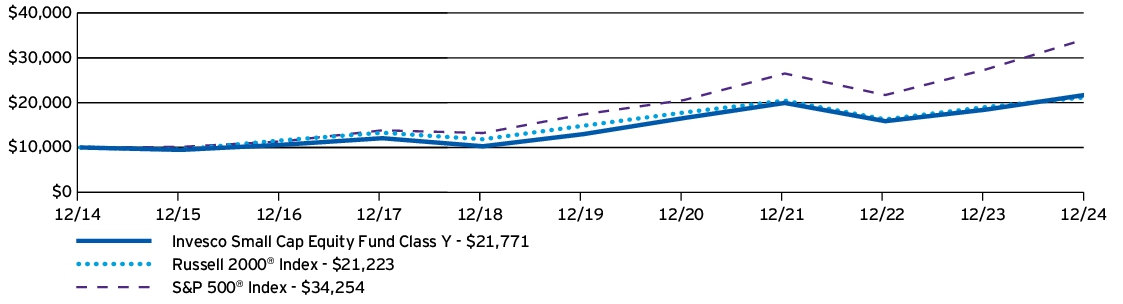

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV European Small Company Fund (Class Y) | 2.70% | 6.25% | 7.16% |

| MSCI Europe Small Cap Index (Net) | (0.96)% | 1.98% | 5.31% |

| MSCI Europe Index (Net) | 1.79% | 4.90% | 4.98% |

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the MSCI Europe Small Cap Index (Net) to the MSCI Europe Index (Net) to reflect that the MSCI Europe Index (Net) can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $165,025,203 |

| Total number of portfolio holdings | 59 |

| Total advisory fees paid | $1,695,137 |

| Portfolio turnover rate | 14% |

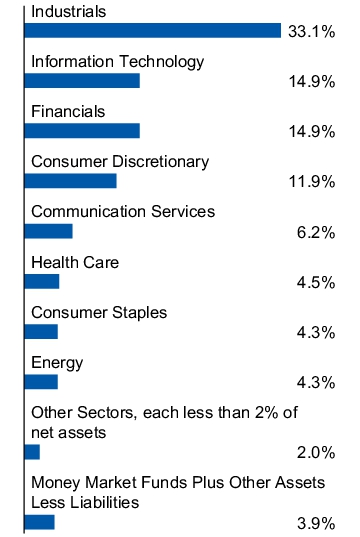

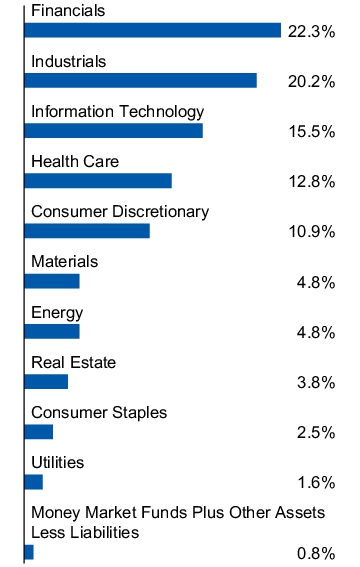

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Renew Holdings PLC | 4.10% |

| IG Group Holdings PLC | 3.89% |

| Diploma PLC | 3.82% |

| Neurones | 3.74% |

| ME Group International PLC | 3.36% |

| Kardex Holding AG | 3.30% |

| Kaufman & Broad S.A. | 3.21% |

| DCC PLC | 3.13% |

| Clarkson PLC | 2.91% |

| flatexDEGIRO AG | 2.79% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco EQV European Small Company Fund

Class R6: ESMSX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco EQV European Small Company Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV European Small Company Fund

(Class R6) | $114 | 1.12% |

How Did The Fund Perform During The Period?

• European equity markets rose modestly during the fiscal year ended December 31, 2024. Returns were more muted in Europe compared to other regions due to economic weakness and limited exposure to artificial intelligence (AI). Large-cap stocks outperformed small-cap stocks, and value stocks outperformed growth stocks. UK equities also outperformed those of continental Europe, driven by a cyclical rebound. Within continental Europe, France was among the weakest markets, hurt by political instability as December brought the country’s fourth new government of 2024.

• For the fiscal year ended December 31, 2024, Class R6 shares of the Fund returned 2.82%. For the same time period, the MSCI Europe Small Cap Index returned -0.96%.

What contributed to performance?

ME Group International PLC | A UK-based vending machine operator. The company reported strong earnings primarily driven by its fast-growing automated laundry machines during the fiscal year.

IG Group Holdings PLC | A UK-based online trading provider. Management provided a robust trading update showing attractive growth, and, under the new CEO Breon Corcoran, shares rose from very low levels. We believe Corcoran’s record is strong and has reignited excitement about the company’s business potential.

Clarkson PLC | A British global leading shipping broker. The company benefited from a strong US economy and the disruption from Houthi attacks in the Red Sea and Gulf of Aden. The attacks led to many vessels taking the longer route around South Africa, which effectively suppressed supply and pushed prices up.

What detracted from performance?

Carlo Gavazzi Holding AG | A Switzerland-based manufacturer of niche switches, controls and sensors for building and industrial automation. The company experienced weakened demand due to destocking and macro weakness in Europe and China. However, we still believe that Carlo Gavazzi may benefit from the secular trends of automation, electrification and supply chain de-globalization.

CompuGroup Medical SE & Co. KGaA | A German health care information technology provider. The company cut fiscal year 2024 guidance due to project delays and reduced customer spending due to macroeconomic uncertainties. The stock fell to near all-time lows due to lack of visibility and earnings momentum. During the fourth quarter 2024, the company received an offer by CVC Capital Partners to be taken private, and that offer is supported by the company’s founder and largest shareholder.

Text S.A. | A Polish software company. Text’s core business of call center software solutions is projected to be most disrupted by AI and large language models (LLMs) in the short term, which we believe muddles the medium term visibility of the company’s prospects. Text has been investing in its proprietary AI solution but is dwarfed by the leading AI players.

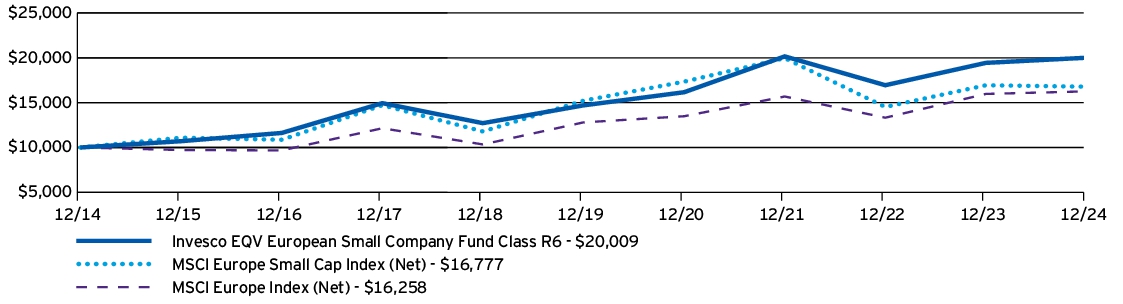

How Has The Fund Historically Performed?

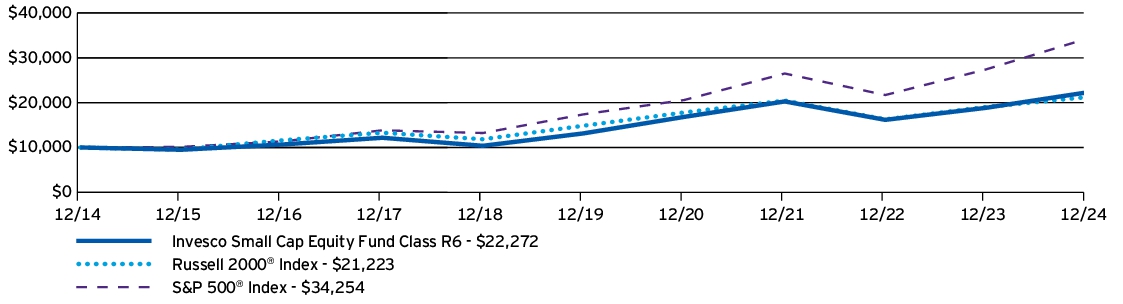

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV European Small Company Fund (Class R6) | 2.82% | 6.37% | 7.18% |

| MSCI Europe Small Cap Index (Net) | (0.96)% | 1.98% | 5.31% |

| MSCI Europe Index (Net) | 1.79% | 4.90% | 4.98% |

Class R6 shares incepted on April 4, 2017. Performance shown prior to that date is that of Class A shares at net asset value and includes the 12b-1 fees applicable to Class A shares. Class R6 shares' returns of the Fund will be different from Class A shares' returns of the Fund as they have different expenses.

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the MSCI Europe Small Cap Index (Net) to the MSCI Europe Index (Net) to reflect that the MSCI Europe Index (Net) can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $165,025,203 |

| Total number of portfolio holdings | 59 |

| Total advisory fees paid | $1,695,137 |

| Portfolio turnover rate | 14% |

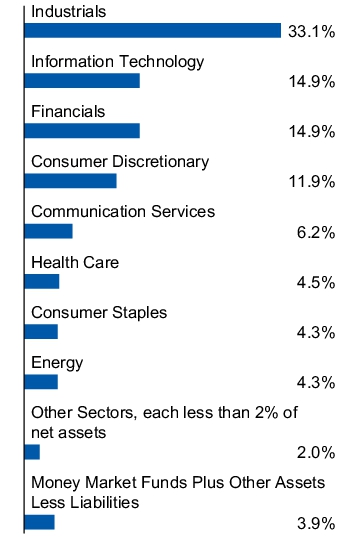

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Renew Holdings PLC | 4.10% |

| IG Group Holdings PLC | 3.89% |

| Diploma PLC | 3.82% |

| Neurones | 3.74% |

| ME Group International PLC | 3.36% |

| Kardex Holding AG | 3.30% |

| Kaufman & Broad S.A. | 3.21% |

| DCC PLC | 3.13% |

| Clarkson PLC | 2.91% |

| flatexDEGIRO AG | 2.79% |

| * Excluding money market fund holdings, if any. | |

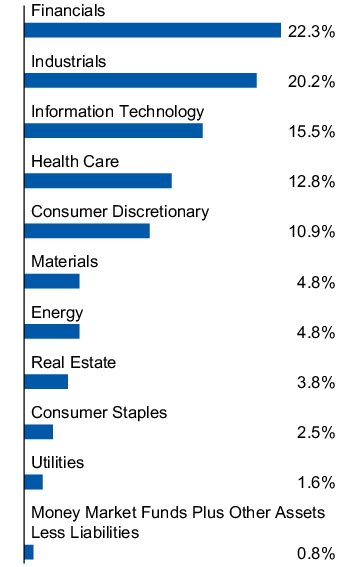

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco EQV International Small Company Fund

Class A: IEGAX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco EQV International Small Company Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV International Small Company Fund

(Class A) | $158 | 1.60%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• Global equity markets rose during the fiscal year ended December 31, 2024. In the US, enthusiasm around artificial intelligence led to concentrated market leadership in the mega cap technology space with small-caps lagging large-caps but still posting a respectable double-digit positive return. Outside of the US, returns were more muted with international small-caps posting a modest positive return. Emerging market small-caps outperformed international developed small-caps, but particular weakness was seen in Brazilian equities as Brazil’s rising interest rates and a stronger US dollar dampened investor confidence.

• For the fiscal year ended December 31, 2024, Class A shares of the Fund, exluding sales charge, returned -2.62%. For the same time period, the MSCI ACWI ex USA Small Cap Index returned 3.36%.

What contributed to performance?

ME Group International PLC | A UK-based vending machine operator. The company reported strong earnings primarily driven by its fast-growing automated laundry machines during the fiscal year.

MakeMyTrip Ltd. | An India-based online travel booking services company with what we believe is a strong management team and sustainable advantages. In our view India’s travel industry is still in the nascent stage of development with potential multi-decade growth opportunities ahead. The stock benefited from increased bookings, as travel in India has recovered beyond pre-pandemic levels.

IG Group Holdings PLC | A UK-based online trading provider. Management provided a robust trading update showing attractive growth, and, under the new CEO Breon Corcoran, shares rose from very low levels. We believe Corcoran’s record is strong and has reignited excitement about the company’s business potential.

What detracted from performance?

Hamamatsu Photonics K.K. | A Japan-based scientific research led company focused on cutting-edge light technology (photonics) and its applications. Several of Hamamatsu’s end markets have been going through a cyclical downturn, leading to guidance cuts and an earnings downgrade.

Multiplan Empreendimentos Imobiliarios S.A. | An owner and operator of malls in Brazil. Interest rates in Brazil have been rising due to increasing budget deficits. Multiplan has been affected due to its negative valuation correlation with interest rates.

CompuGroup Medical SE & Co. KGaA | A German health care information technology provider. The company cut fiscal year 2024 guidance due to project delays and reduced customer spending due to macroeconomic uncertainties. The stock fell to near all-time lows due to lack of visibility and earnings momentum. During the fourth quarter of 2024, the company received an offer by CVC Capital Partners to be taken private, and that offer is supported by the company’s founder and largest shareholder.

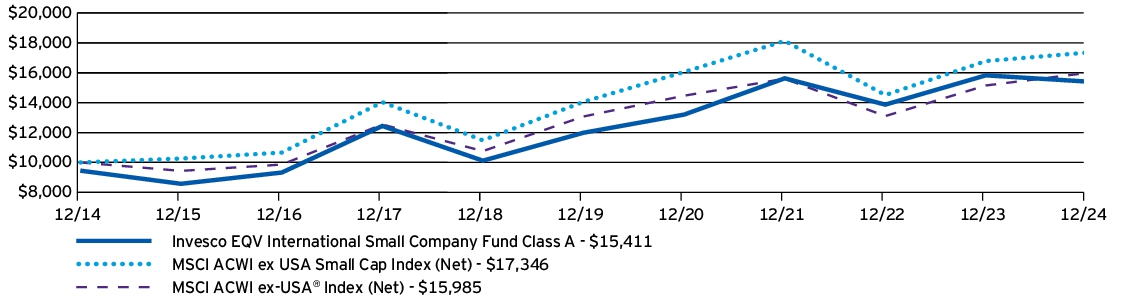

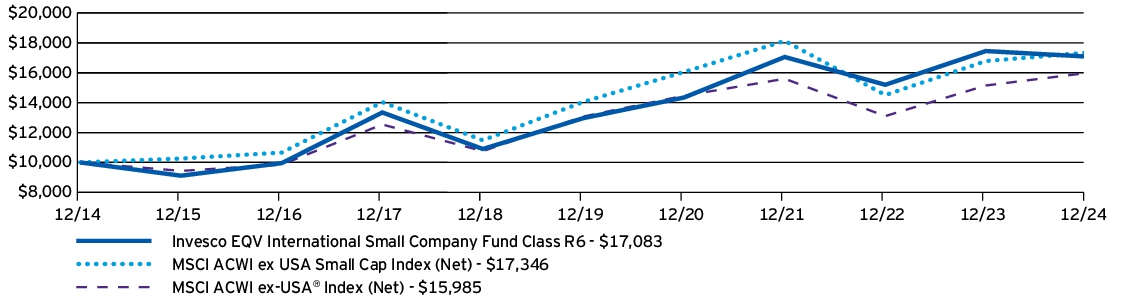

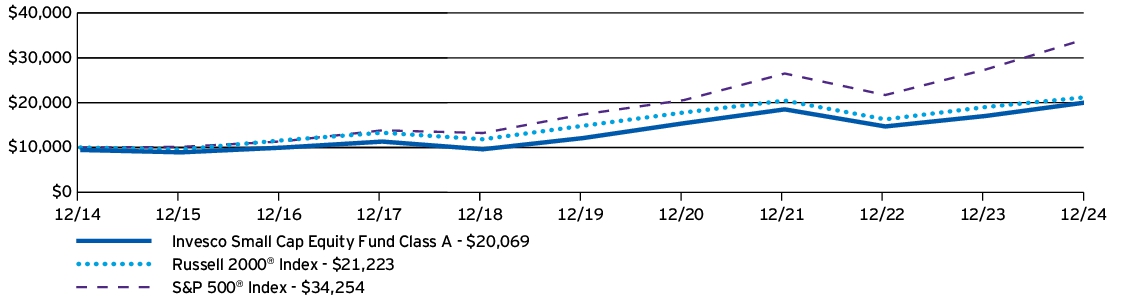

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV International Small Company Fund (Class A) —including sales charge | (7.96)% | 3.97% | 4.42% |

| Invesco EQV International Small Company Fund (Class A) —excluding sales charge | (2.62)% | 5.16% | 5.01% |

| MSCI ACWI ex USA Small Cap Index (Net) | 3.36% | 4.30% | 5.66% |

| MSCI ACWI ex-USA® Index (Net) | 5.53% | 4.10% | 4.80% |

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the MSCI ACWI ex USA Small Cap Index (Net) to the MSCI ACWI ex-USA® Index (Net) to reflect that the MSCI ACWI ex-USA® Index (Net) can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $494,272,821 |

| Total number of portfolio holdings | 77 |

| Total advisory fees paid | $4,328,647 |

| Portfolio turnover rate | 23% |

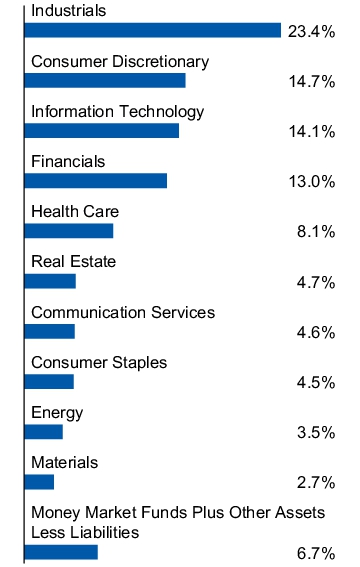

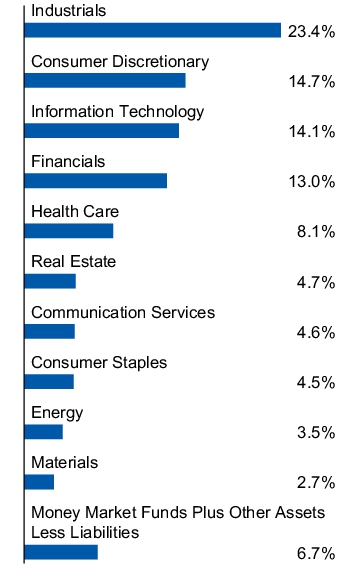

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| IG Group Holdings PLC | 2.97% |

| Tongcheng Travel Holdings Ltd. | 2.77% |

| ME Group International PLC | 2.72% |

| E-L Financial Corp. Ltd. | 2.41% |

| Renew Holdings PLC | 2.34% |

| CTS Eventim AG & Co. KGaA | 2.22% |

| flatexDEGIRO AG | 2.17% |

| DCC PLC | 2.11% |

| 4imprint Group PLC | 1.97% |

| Zuken, Inc. | 1.90% |

| * Excluding money market fund holdings, if any. | |

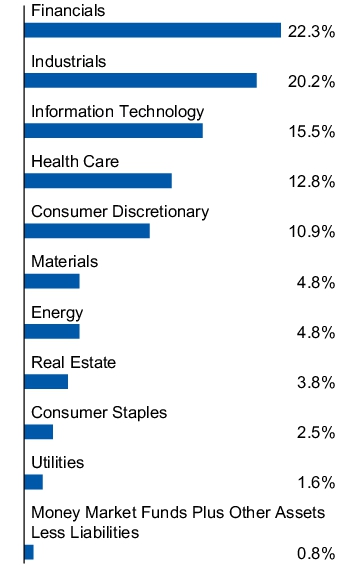

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective April 26, 2024, the expense limitation for Class A shares changed from 2.25% to 1.55% of the Fund's average daily net assets. Unless Invesco continues the fee waiver agreement, it will terminate on April 30, 2026.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco EQV International Small Company Fund

Class C: IEGCX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco EQV International Small Company Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV International Small Company Fund

(Class C) | $231 | 2.35%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• Global equity markets rose during the fiscal year ended December 31, 2024. In the US, enthusiasm around artificial intelligence led to concentrated market leadership in the mega cap technology space with small-caps lagging large-caps but still posting a respectable double-digit positive return. Outside of the US, returns were more muted with international small-caps posting a modest positive return. Emerging market small-caps outperformed international developed small-caps, but particular weakness was seen in Brazilian equities as Brazil’s rising interest rates and a stronger US dollar dampened investor confidence.

• For the fiscal year ended December 31, 2024, Class C shares of the Fund, exluding sales charge, returned -3.34%. For the same time period, the MSCI ACWI ex USA Small Cap Index returned 3.36%.

What contributed to performance?

ME Group International PLC | A UK-based vending machine operator. The company reported strong earnings primarily driven by its fast-growing automated laundry machines during the fiscal year.

MakeMyTrip Ltd. | An India-based online travel booking services company with what we believe is a strong management team and sustainable advantages. In our view India’s travel industry is still in the nascent stage of development with potential multi-decade growth opportunities ahead. The stock benefited from increased bookings, as travel in India has recovered beyond pre-pandemic levels.

IG Group Holdings PLC | A UK-based online trading provider. Management provided a robust trading update showing attractive growth, and, under the new CEO Breon Corcoran, shares rose from very low levels. We believe Corcoran’s record is strong and has reignited excitement about the company’s business potential.

What detracted from performance?

Hamamatsu Photonics K.K. | A Japan-based scientific research led company focused on cutting-edge light technology (photonics) and its applications. Several of Hamamatsu’s end markets have been going through a cyclical downturn, leading to guidance cuts and an earnings downgrade.

Multiplan Empreendimentos Imobiliarios S.A. | An owner and operator of malls in Brazil. Interest rates in Brazil have been rising due to increasing budget deficits. Multiplan has been affected due to its negative valuation correlation with interest rates.

CompuGroup Medical SE & Co. KGaA | A German health care information technology provider. The company cut fiscal year 2024 guidance due to project delays and reduced customer spending due to macroeconomic uncertainties. The stock fell to near all-time lows due to lack of visibility and earnings momentum. During the fourth quarter of 2024, the company received an offer by CVC Capital Partners to be taken private, and that offer is supported by the company’s founder and largest shareholder.

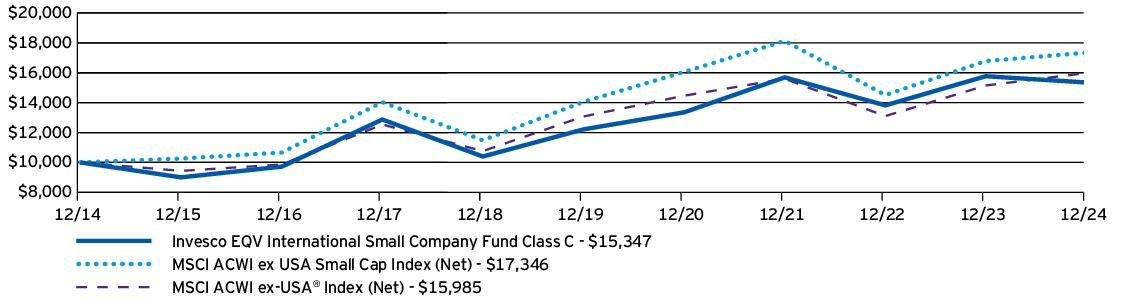

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV International Small Company Fund (Class C) —including sales charge | (4.33)% | 4.37% | 4.38% |

| Invesco EQV International Small Company Fund (Class C) —excluding sales charge | (3.34)% | 4.37% | 4.38% |

| MSCI ACWI ex USA Small Cap Index (Net) | 3.36% | 4.30% | 5.66% |

| MSCI ACWI ex-USA® Index (Net) | 5.53% | 4.10% | 4.80% |

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the MSCI ACWI ex USA Small Cap Index (Net) to the MSCI ACWI ex-USA® Index (Net) to reflect that the MSCI ACWI ex-USA® Index (Net) can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $494,272,821 |

| Total number of portfolio holdings | 77 |

| Total advisory fees paid | $4,328,647 |

| Portfolio turnover rate | 23% |

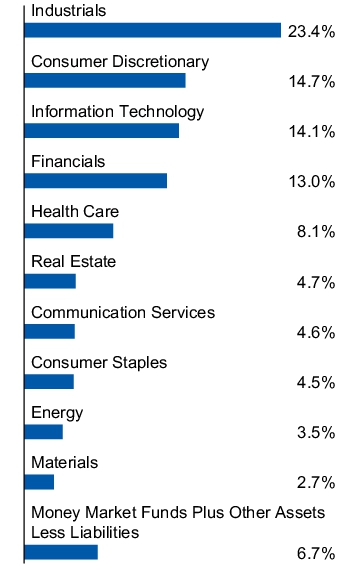

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| IG Group Holdings PLC | 2.97% |

| Tongcheng Travel Holdings Ltd. | 2.77% |

| ME Group International PLC | 2.72% |

| E-L Financial Corp. Ltd. | 2.41% |

| Renew Holdings PLC | 2.34% |

| CTS Eventim AG & Co. KGaA | 2.22% |

| flatexDEGIRO AG | 2.17% |

| DCC PLC | 2.11% |

| 4imprint Group PLC | 1.97% |

| Zuken, Inc. | 1.90% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective April 26, 2024, the expense limitation for Class C shares changed from 3.00% to 2.30% of the Fund's average daily net assets. Unless Invesco continues the fee waiver agreement, it will terminate on April 30, 2026.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco EQV International Small Company Fund

Class Y: IEGYX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco EQV International Small Company Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV International Small Company Fund

(Class Y) | $133 | 1.35%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• Global equity markets rose during the fiscal year ended December 31, 2024. In the US, enthusiasm around artificial intelligence led to concentrated market leadership in the mega cap technology space with small-caps lagging large-caps but still posting a respectable double-digit positive return. Outside of the US, returns were more muted with international small-caps posting a modest positive return. Emerging market small-caps outperformed international developed small-caps, but particular weakness was seen in Brazilian equities as Brazil’s rising interest rates and a stronger US dollar dampened investor confidence.

• For the fiscal year ended December 31, 2024, Class Y shares of the Fund returned -2.37%. For the same time period, the MSCI ACWI ex USA Small Cap Index returned 3.36%.

What contributed to performance?

ME Group International PLC | A UK-based vending machine operator. The company reported strong earnings primarily driven by its fast-growing automated laundry machines during the fiscal year.

MakeMyTrip Ltd. | An India-based online travel booking services company with what we believe is a strong management team and sustainable advantages. In our view India’s travel industry is still in the nascent stage of development with potential multi-decade growth opportunities ahead. The stock benefited from increased bookings, as travel in India has recovered beyond pre-pandemic levels.

IG Group Holdings PLC | A UK-based online trading provider. Management provided a robust trading update showing attractive growth, and, under the new CEO Breon Corcoran, shares rose from very low levels. We believe Corcoran’s record is strong and has reignited excitement about the company’s business potential.

What detracted from performance?

Hamamatsu Photonics K.K. | A Japan-based scientific research led company focused on cutting-edge light technology (photonics) and its applications. Several of Hamamatsu’s end markets have been going through a cyclical downturn, leading to guidance cuts and an earnings downgrade.

Multiplan Empreendimentos Imobiliarios S.A. | An owner and operator of malls in Brazil. Interest rates in Brazil have been rising due to increasing budget deficits. Multiplan has been affected due to its negative valuation correlation with interest rates.

CompuGroup Medical SE & Co. KGaA | A German health care information technology provider. The company cut fiscal year 2024 guidance due to project delays and reduced customer spending due to macroeconomic uncertainties. The stock fell to near all-time lows due to lack of visibility and earnings momentum. During the fourth quarter of 2024, the company received an offer by CVC Capital Partners to be taken private, and that offer is supported by the company’s founder and largest shareholder.

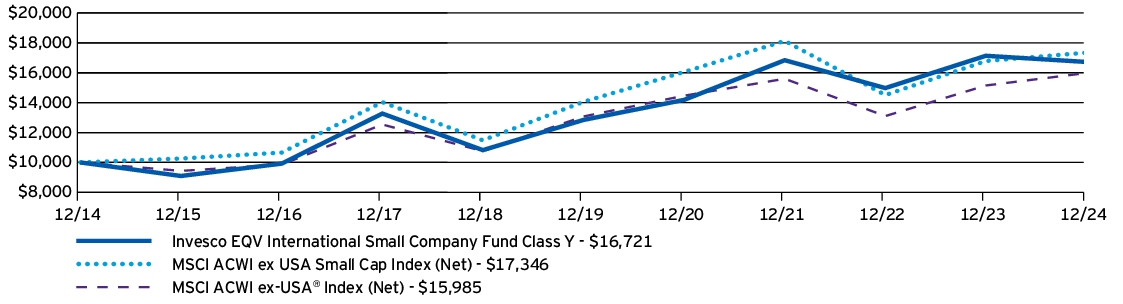

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV International Small Company Fund (Class Y) | (2.37)% | 5.42% | 5.28% |

| MSCI ACWI ex USA Small Cap Index (Net) | 3.36% | 4.30% | 5.66% |

| MSCI ACWI ex-USA® Index (Net) | 5.53% | 4.10% | 4.80% |

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the MSCI ACWI ex USA Small Cap Index (Net) to the MSCI ACWI ex-USA® Index (Net) to reflect that the MSCI ACWI ex-USA® Index (Net) can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $494,272,821 |

| Total number of portfolio holdings | 77 |

| Total advisory fees paid | $4,328,647 |

| Portfolio turnover rate | 23% |

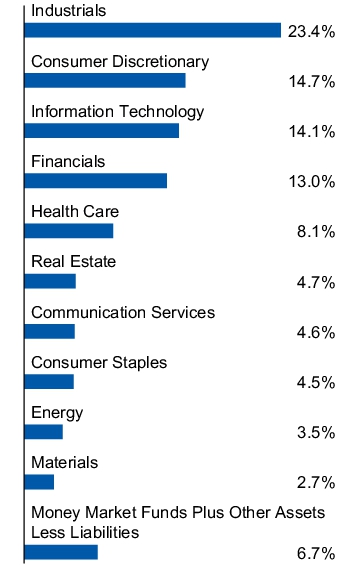

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| IG Group Holdings PLC | 2.97% |

| Tongcheng Travel Holdings Ltd. | 2.77% |

| ME Group International PLC | 2.72% |

| E-L Financial Corp. Ltd. | 2.41% |

| Renew Holdings PLC | 2.34% |

| CTS Eventim AG & Co. KGaA | 2.22% |

| flatexDEGIRO AG | 2.17% |

| DCC PLC | 2.11% |

| 4imprint Group PLC | 1.97% |

| Zuken, Inc. | 1.90% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective April 26, 2024, the expense limitation for Class Y shares changed from 2.00% to 1.30% of the Fund's average daily net assets. Unless Invesco continues the fee waiver agreement, it will terminate on April 30, 2026.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco EQV International Small Company Fund

Class R5: IEGIX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco EQV International Small Company Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV International Small Company Fund

(Class R5) | $113 | 1.14%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• Global equity markets rose during the fiscal year ended December 31, 2024. In the US, enthusiasm around artificial intelligence led to concentrated market leadership in the mega cap technology space with small-caps lagging large-caps but still posting a respectable double-digit positive return. Outside of the US, returns were more muted with international small-caps posting a modest positive return. Emerging market small-caps outperformed international developed small-caps, but particular weakness was seen in Brazilian equities as Brazil’s rising interest rates and a stronger US dollar dampened investor confidence.

• For the fiscal year ended December 31, 2024, Class R5 shares of the Fund returned -2.13%. For the same time period, the MSCI ACWI ex USA Small Cap Index returned 3.36%.

What contributed to performance?

ME Group International PLC | A UK-based vending machine operator. The company reported strong earnings primarily driven by its fast-growing automated laundry machines during the fiscal year.

MakeMyTrip Ltd. | An India-based online travel booking services company with what we believe is a strong management team and sustainable advantages. In our view India’s travel industry is still in the nascent stage of development with potential multi-decade growth opportunities ahead. The stock benefited from increased bookings, as travel in India has recovered beyond pre-pandemic levels.

IG Group Holdings PLC | A UK-based online trading provider. Management provided a robust trading update showing attractive growth, and, under the new CEO Breon Corcoran, shares rose from very low levels. We believe Corcoran’s record is strong and has reignited excitement about the company’s business potential.

What detracted from performance?

Hamamatsu Photonics K.K. | A Japan-based scientific research led company focused on cutting-edge light technology (photonics) and its applications. Several of Hamamatsu’s end markets have been going through a cyclical downturn, leading to guidance cuts and an earnings downgrade.

Multiplan Empreendimentos Imobiliarios S.A. | An owner and operator of malls in Brazil. Interest rates in Brazil have been rising due to increasing budget deficits. Multiplan has been affected due to its negative valuation correlation with interest rates.

CompuGroup Medical SE & Co. KGaA | A German health care information technology provider. The company cut fiscal year 2024 guidance due to project delays and reduced customer spending due to macroeconomic uncertainties. The stock fell to near all-time lows due to lack of visibility and earnings momentum. During the fourth quarter of 2024, the company received an offer by CVC Capital Partners to be taken private, and that offer is supported by the company’s founder and largest shareholder.

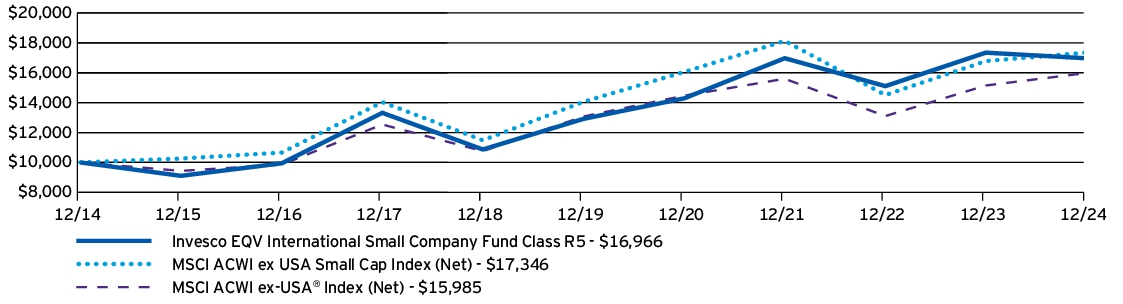

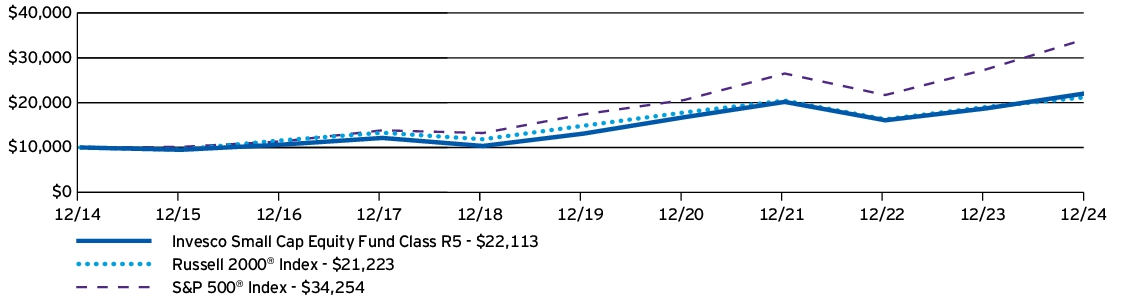

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV International Small Company Fund (Class R5) | (2.13)% | 5.61% | 5.43% |

| MSCI ACWI ex USA Small Cap Index (Net) | 3.36% | 4.30% | 5.66% |

| MSCI ACWI ex-USA® Index (Net) | 5.53% | 4.10% | 4.80% |

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the MSCI ACWI ex USA Small Cap Index (Net) to the MSCI ACWI ex-USA® Index (Net) to reflect that the MSCI ACWI ex-USA® Index (Net) can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $494,272,821 |

| Total number of portfolio holdings | 77 |

| Total advisory fees paid | $4,328,647 |

| Portfolio turnover rate | 23% |

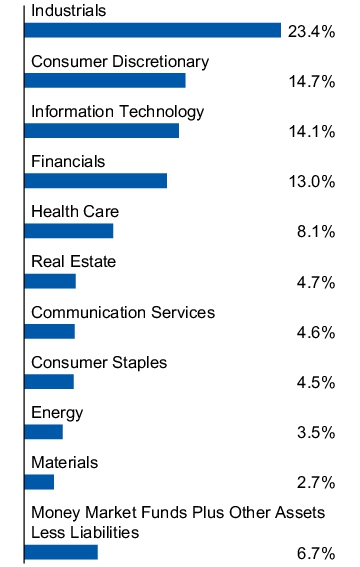

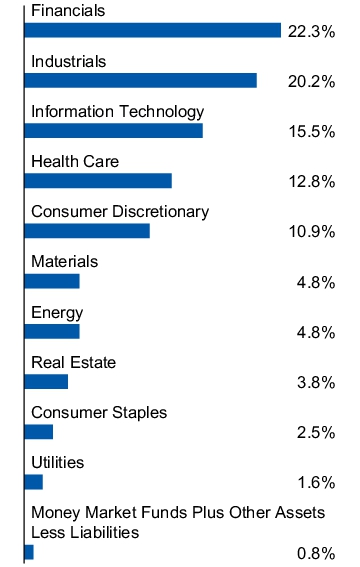

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| IG Group Holdings PLC | 2.97% |

| Tongcheng Travel Holdings Ltd. | 2.77% |

| ME Group International PLC | 2.72% |

| E-L Financial Corp. Ltd. | 2.41% |

| Renew Holdings PLC | 2.34% |

| CTS Eventim AG & Co. KGaA | 2.22% |

| flatexDEGIRO AG | 2.17% |

| DCC PLC | 2.11% |

| 4imprint Group PLC | 1.97% |

| Zuken, Inc. | 1.90% |

| * Excluding money market fund holdings, if any. | |

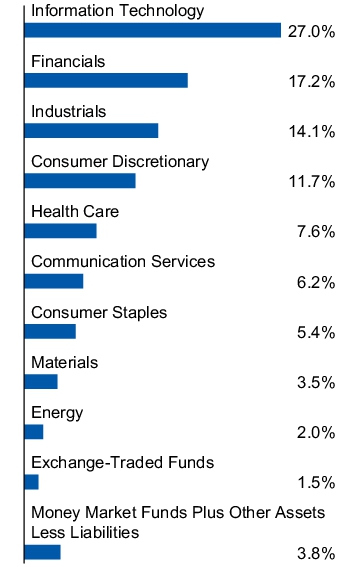

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective April 26, 2024, the expense limitation for Class R5 shares changed from 2.00% to 1.30% of the Fund's average daily net assest. Unless Invesco continues the fee waiver agreement, it will terminate on April 30, 2026.

Effective after the close of business on September 30, 2024, the Fund has limited public sales of its Class R5 shares to certain investors who were previously invested in Class R5 shares of the Fund.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco EQV International Small Company Fund

Class R6: IEGFX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco EQV International Small Company Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco EQV International Small Company Fund

(Class R6) | $106 | 1.07%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• Global equity markets rose during the fiscal year ended December 31, 2024. In the US, enthusiasm around artificial intelligence led to concentrated market leadership in the mega cap technology space with small-caps lagging large-caps but still posting a respectable double-digit positive return. Outside of the US, returns were more muted with international small-caps posting a modest positive return. Emerging market small-caps outperformed international developed small-caps, but particular weakness was seen in Brazilian equities as Brazil’s rising interest rates and a stronger US dollar dampened investor confidence.

• For the fiscal year ended December 31, 2024, Class R6 shares of the Fund returned -2.12%. For the same time period, the MSCI ACWI ex USA Small Cap Index returned 3.36%.

What contributed to performance?

ME Group International PLC | A UK-based vending machine operator. The company reported strong earnings primarily driven by its fast-growing automated laundry machines during the fiscal year.

MakeMyTrip Ltd. | An India-based online travel booking services company with what we believe is a strong management team and sustainable advantages. In our view India’s travel industry is still in the nascent stage of development with potential multi-decade growth opportunities ahead. The stock benefited from increased bookings, as travel in India has recovered beyond pre-pandemic levels.

IG Group Holdings PLC | A UK-based online trading provider. Management provided a robust trading update showing attractive growth, and, under the new CEO Breon Corcoran, shares rose from very low levels. We believe Corcoran’s record is strong and has reignited excitement about the company’s business potential.

What detracted from performance?

Hamamatsu Photonics K.K. | A Japan-based scientific research led company focused on cutting-edge light technology (photonics) and its applications. Several of Hamamatsu’s end markets have been going through a cyclical downturn, leading to guidance cuts and an earnings downgrade.

Multiplan Empreendimentos Imobiliarios S.A. | An owner and operator of malls in Brazil. Interest rates in Brazil have been rising due to increasing budget deficits. Multiplan has been affected due to its negative valuation correlation with interest rates.

CompuGroup Medical SE & Co. KGaA | A German health care information technology provider. The company cut fiscal year 2024 guidance due to project delays and reduced customer spending due to macroeconomic uncertainties. The stock fell to near all-time lows due to lack of visibility and earnings momentum. During the fourth quarter of 2024, the company received an offer by CVC Capital Partners to be taken private, and that offer is supported by the company’s founder and largest shareholder.

How Has The Fund Historically Performed?

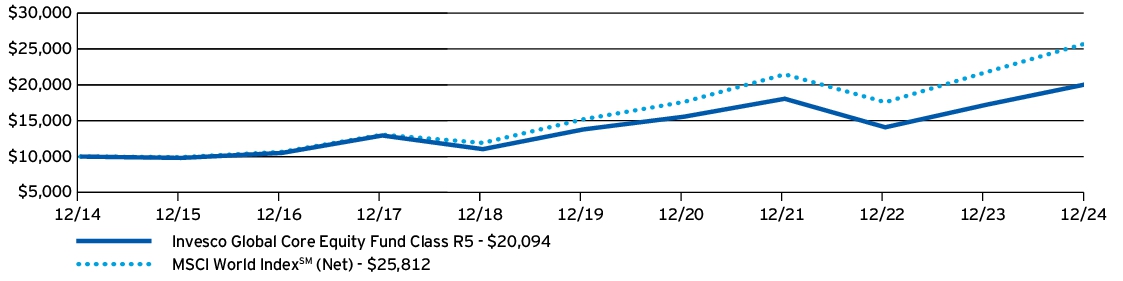

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco EQV International Small Company Fund (Class R6) | (2.12)% | 5.67% | 5.50% |

| MSCI ACWI ex USA Small Cap Index (Net) | 3.36% | 4.30% | 5.66% |

| MSCI ACWI ex-USA® Index (Net) | 5.53% | 4.10% | 4.80% |

Effective April 26, 2024, the Fund changed its broad-based securities market benchmark from the MSCI ACWI ex USA Small Cap Index (Net) to the MSCI ACWI ex-USA® Index (Net) to reflect that the MSCI ACWI ex-USA® Index (Net) can be considered more broadly representative of the overall applicable securities market.

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $494,272,821 |

| Total number of portfolio holdings | 77 |

| Total advisory fees paid | $4,328,647 |

| Portfolio turnover rate | 23% |

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| IG Group Holdings PLC | 2.97% |

| Tongcheng Travel Holdings Ltd. | 2.77% |

| ME Group International PLC | 2.72% |

| E-L Financial Corp. Ltd. | 2.41% |

| Renew Holdings PLC | 2.34% |

| CTS Eventim AG & Co. KGaA | 2.22% |

| flatexDEGIRO AG | 2.17% |

| DCC PLC | 2.11% |

| 4imprint Group PLC | 1.97% |

| Zuken, Inc. | 1.90% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

Effective April 26, 2024, the expense limitation for Class R6 shares changed from 2.00% to 1.30% of the Fund's average daily net assets. Unless Invesco continues the fee waiver agreement, it will terminate on April 30, 2026.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Global Core Equity Fund

Class A: AWSAX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Global Core Equity Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Global Core Equity Fund

(Class A) | $135 | 1.25%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• Global equity markets rose strongly during the fiscal year ended December 31, 2024. In the US, enthusiasm around the artificial intelligence (AI) investment wave led to concentrated market leadership in the mega cap technology space and to outperformance relative to non-US equities. Outside of the US, emerging markets (EM) outperformed developed markets as news of fiscal stimulus by the Chinese government drove better sentiment towards the EM asset class. Conversely, potential trade policy risks related to the incoming US administration and a stronger US dollar spurred losses in Latin America.

• For the fiscal year ended December 31, 2024, Class A shares of the Fund, excluding sales charge, returned 16.47%. For the same time period, the MSCI World IndexSM (Net) returned 18.67%.

What contributed to performance?

3i Group PLC | 3i benefited from the strong performance of its pan-European discount retail format, Action, which is well-positioned for further store expansion across Europe.

Broadcom, Inc. | Broadcom shares rose on strong operating results supported by accelerated demand for its AI-oriented data center chips and early benefits from its acquisition of VMware.

What detracted from performance?

NVIDIA Corp. | The rise of AI has accelerated demand for NVIDIA's industry-leading datacenter computer chips. The Fund continued to hold shares in NVIDIA, but at an underweight position, which detracted from relative performance.

Samsung Electronics Co. Ltd. | Samsung underperformed on apparent concerns that the memory chip cycle has begun to turn down. The company also continued to suffer from execution challenges in advanced high-bandwidth memory for AI.

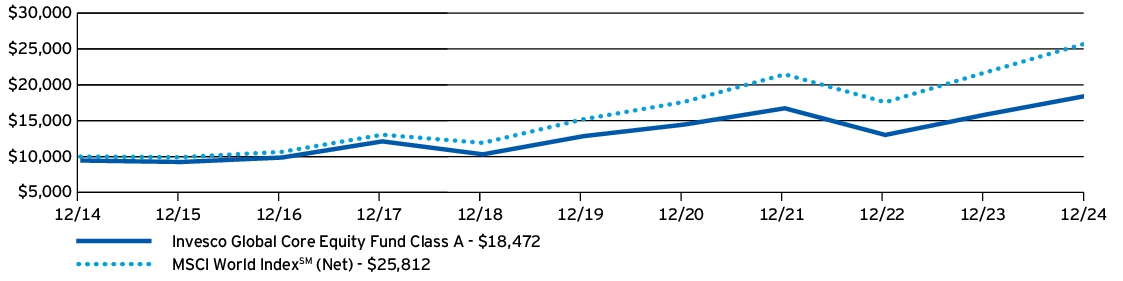

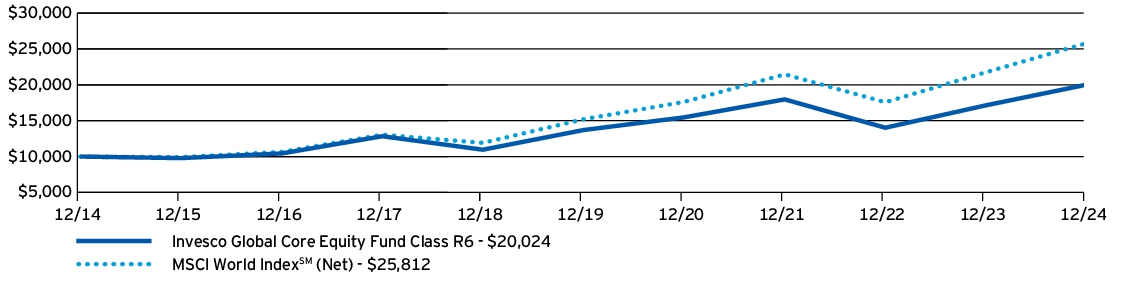

How Has The Fund Historically Performed?

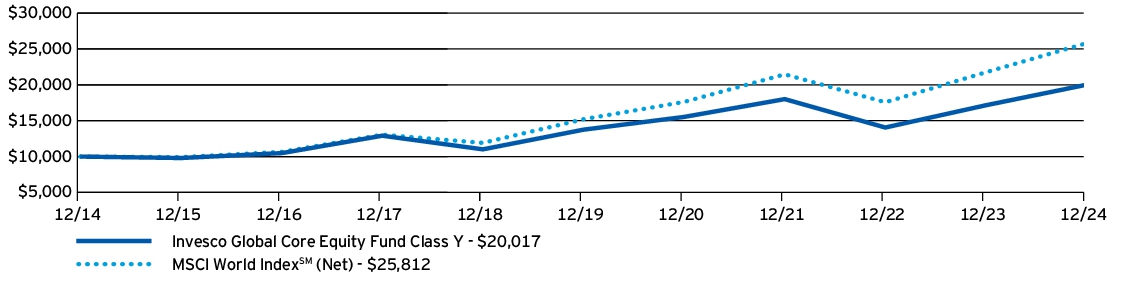

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Global Core Equity Fund (Class A) —including sales charge | 10.10% | 6.33% | 6.33% |

| Invesco Global Core Equity Fund (Class A) —excluding sales charge | 16.47% | 7.53% | 6.93% |

| MSCI World IndexSM (Net) | 18.67% | 11.17% | 9.95% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $597,237,500 |

| Total number of portfolio holdings | 65 |

| Total advisory fees paid | $4,626,572 |

| Portfolio turnover rate | 46% |

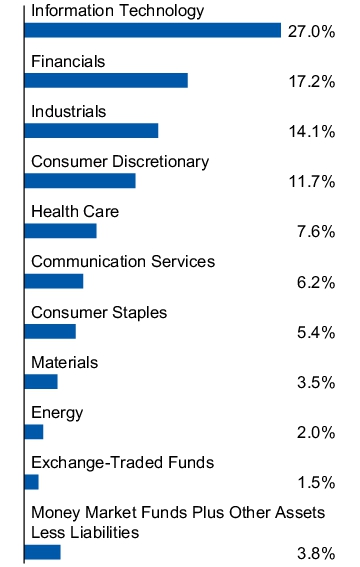

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Microsoft Corp. | 6.54% |

| Amazon.com, Inc. | 3.78% |

| Apple, Inc. | 3.06% |

| 3i Group PLC | 2.99% |

| Mastercard, Inc., Class A | 2.93% |

| Thermo Fisher Scientific, Inc. | 2.86% |

| NVIDIA Corp. | 2.79% |

| RELX PLC | 2.60% |

| Broadcom, Inc. | 2.49% |

| O'Reilly Automotive, Inc. | 2.34% |

| * Excluding money market fund holdings, if any. | |

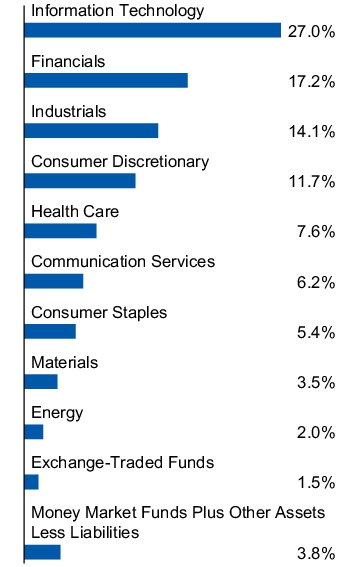

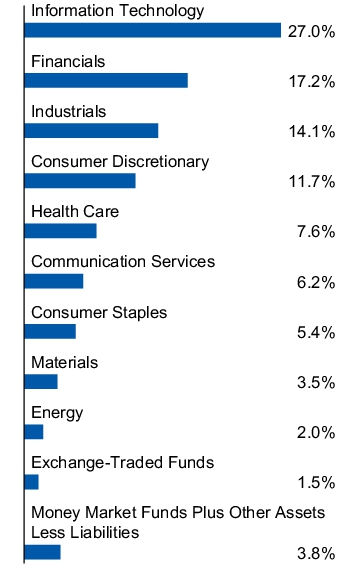

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

The Fund added active trading risk to its principal risks to reflect that active trading of portfolio securities may result in added expenses, a lower return and increased tax liability.

The Fund modified its principal investment strategies with respect to the amount of its net assets required to be invested in investments that are economically tied to countries other than the US.

Effective May 1, 2024, Class A shares' expense limitation of 1.22% changed to a boundary limit of 2.25% of the Fund's average daily net assets. The new boundary limit will remain in effect for an indefinite period. Invesco may amend and/or terminate the boundary limit at any time in its sole discretion.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Global Core Equity Fund

Class C: AWSCX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Global Core Equity Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Global Core Equity Fund

(Class C) | $216 | 2.00%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• Global equity markets rose strongly during the fiscal year ended December 31, 2024. In the US, enthusiasm around the artificial intelligence (AI) investment wave led to concentrated market leadership in the mega cap technology space and to outperformance relative to non-US equities. Outside of the US, emerging markets (EM) outperformed developed markets as news of fiscal stimulus by the Chinese government drove better sentiment towards the EM asset class. Conversely, potential trade policy risks related to the incoming US administration and a stronger US dollar spurred losses in Latin America.

• For the fiscal year ended December 31, 2024, Class C shares of the Fund, excluding sales charge, returned 15.59%. For the same time period, the MSCI World IndexSM (Net) returned 18.67%.

What contributed to performance?

3i Group PLC | 3i benefited from the strong performance of its pan-European discount retail format, Action, which is well-positioned for further store expansion across Europe.

Broadcom, Inc. | Broadcom shares rose on strong operating results supported by accelerated demand for its AI-oriented data center chips and early benefits from its acquisition of VMware.

What detracted from performance?

NVIDIA Corp. | The rise of AI has accelerated demand for NVIDIA's industry-leading datacenter computer chips. The Fund continued to hold shares in NVIDIA, but at an underweight position, which detracted from relative performance.

Samsung Electronics Co. Ltd. | Samsung underperformed on apparent concerns that the memory chip cycle has begun to turn down. The company also continued to suffer from execution challenges in advanced high-bandwidth memory for AI.

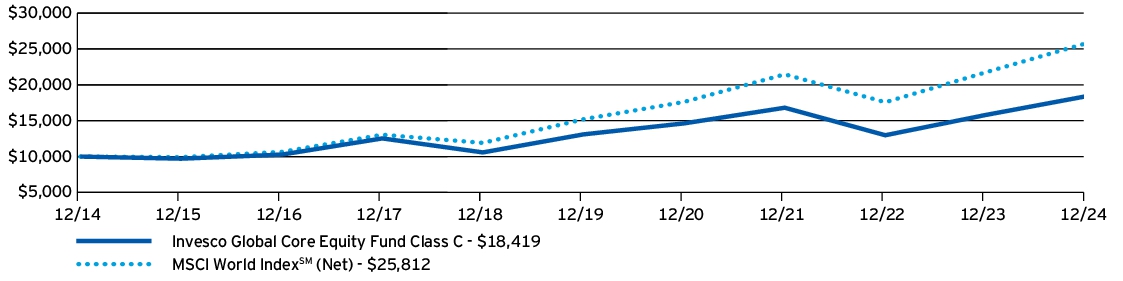

How Has The Fund Historically Performed?

Growth of $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Invesco Global Core Equity Fund (Class C) —including sales charge | 14.59% | 6.74% | 6.30% |

| Invesco Global Core Equity Fund (Class C) —excluding sales charge | 15.59% | 6.74% | 6.30% |

| MSCI World IndexSM (Net) | 18.67% | 11.17% | 9.95% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of December 31, 2024)

| Fund net assets | $597,237,500 |

| Total number of portfolio holdings | 65 |

| Total advisory fees paid | $4,626,572 |

| Portfolio turnover rate | 46% |

What Comprised The Fund's Holdings?

(as of December 31, 2024)

Top ten holdings*

(% of net assets)

| Microsoft Corp. | 6.54% |

| Amazon.com, Inc. | 3.78% |

| Apple, Inc. | 3.06% |

| 3i Group PLC | 2.99% |

| Mastercard, Inc., Class A | 2.93% |

| Thermo Fisher Scientific, Inc. | 2.86% |

| NVIDIA Corp. | 2.79% |

| RELX PLC | 2.60% |

| Broadcom, Inc. | 2.49% |

| O'Reilly Automotive, Inc. | 2.34% |

| * Excluding money market fund holdings, if any. | |

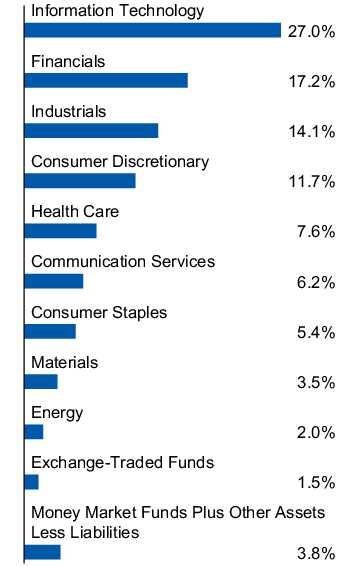

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since December 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 959-4246.

The Fund added active trading risk to its principal risks to reflect that active trading of portfolio securities may result in added expenses, a lower return and increased tax liability.

The Fund modified its principal investment strategies with respect to the amount of its net assets required to be invested in investments that are economically tied to countries other than the US.

Effective May 1, 2024, Class C shares' expense limitation of 1.97% changed to a boundary limit of 3.00% of the Fund's average daily net assets. The new boundary limit will remain in effect for an indefinite period. Invesco may amend and/or terminate the boundary limit at any time in its sole discretion.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Global Core Equity Fund

Class R: AWSRX

ANNUAL SHAREHOLDER REPORT | December 31, 2024

This annual shareholder report contains important information about Invesco Global Core Equity Fund (the “Fund”) for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Invesco Global Core Equity Fund

(Class R) | $162 | 1.50%† |

† | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

How Did The Fund Perform During The Period?

• Global equity markets rose strongly during the fiscal year ended December 31, 2024. In the US, enthusiasm around the artificial intelligence (AI) investment wave led to concentrated market leadership in the mega cap technology space and to outperformance relative to non-US equities. Outside of the US, emerging markets (EM) outperformed developed markets as news of fiscal stimulus by the Chinese government drove better sentiment towards the EM asset class. Conversely, potential trade policy risks related to the incoming US administration and a stronger US dollar spurred losses in Latin America.

• For the fiscal year ended December 31, 2024, Class R shares of the Fund returned 16.14%. For the same time period, the MSCI World IndexSM (Net) returned 18.67%.

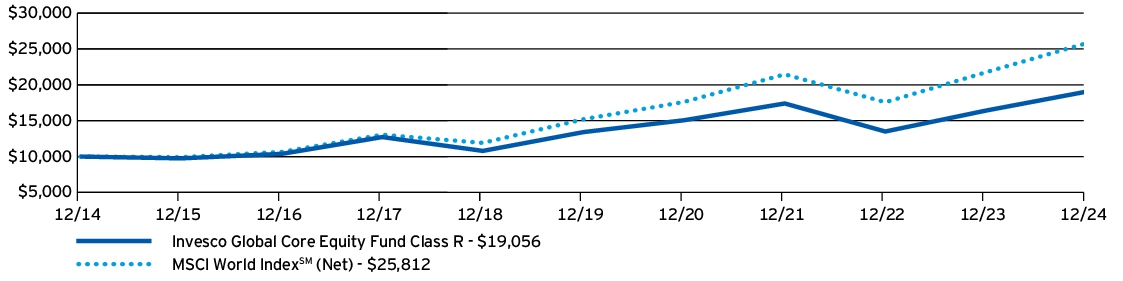

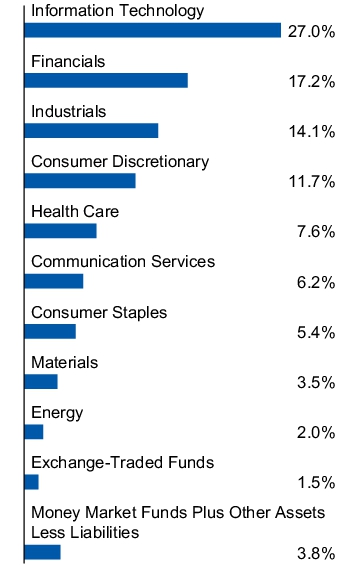

What contributed to performance?