UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-01540 |

AIM Funds Group (Invesco Funds Group)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 12/31

Date of reporting period: 12/31/22

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

(b) Not applicable.

| | |

| Annual Report to Shareholders | | December 31, 2022 |

Invesco EQV European Small Company Fund

Nasdaq:

A: ESMAX ∎ C: ESMCX ∎ Y: ESMYX ∎ R6: ESMSX

Management’s Discussion of Fund Performance

| | | | |

| |

Performance summary | |

For the year ended December 31, 2022, Class A shares of Invesco EQV European Small Company Fund (the Fund) outperformed the MSCI Europe Small Cap Index, the Fund’s broad market/style-specific benchmark. | |

Your Fund’s long-term performance appears later in this report. | |

| |

Fund vs. Indexes | |

Total returns, 12/31/21 to 12/31/22, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. | |

Class A Shares | | | -16.25 | % |

Class C Shares | | | -16.94 | |

Class Y Shares | | | -16.06 | |

Class R6 Shares | | | -15.95 | |

MSCI Europe Indexq (Broad Market Index)* | | | -15.06 | |

MSCI Europe Small Cap Indexq (Broad Market/Style-Specific Index)* | | | -27.27 | |

| |

Source(s): qRIMES Technologies Corp. | | | | |

* Effective April 29, 2022, the Fund changed its benchmark index from the MSCI Europe Index to the MSCI Europe Small Cap Index. The Fund’s investment adviser believes the MSCI Europe Small Cap Index provides a more appropriate comparison for evaluating the Fund’s performance. | |

Market conditions and your Fund

Global equity markets declined in the first half of 2022 amid volatility sparked by Russia’s invasion of Ukraine, rising commodity prices, rampant global inflation and central banks shifting toward tighter monetary policy. Russia’s invasion exacerbated inflationary pressures, disrupting already strained supply chains, and increasing shortages of oil, gas and raw materials, with the price of oil rising sharply.

Inflation headwinds continued into the third quarter of 2022. The US Federal Reserve (the Fed), the European Central Bank and the Bank of England all raised interest rates. In contrast, the People’s Bank of China lowered its policy rate and the Bank of Japan kept rates the same. Emerging market equities, hampered by the strong US dollar, underperformed developed market equities.

Global equity markets posted gains for the fourth quarter of 2022, after better inflation data sparked a rally in October and November. However, investor sentiment worsened in December after central banks signaled continued interest rate hikes into 2023 as inflation remained above target levels. International stocks outperformed US stocks in the fourth quarter, led by results in Europe and the UK. Emerging market equities also posted gains for the fourth quarter of 2022, boosted by China, which eased its zero-COVID-19 policy and started to reopen even as COVID-19 infections surged.

Despite the rebound in the fourth quarter of 2022, at the end of the fiscal year ended December 31, 2022, trailing one-year returns for developed market equities and emerging market equities were both in negative territory.

We remain focused on our bottom-up investment approach of identifying attractive companies that fit our earnings, quality and

valuation (EQV) process regardless of the macroeconomic environment.

During the fiscal year ended December 31, 2022, strong stock selection in the information technology (IT) and consumer discretionary sectors were among the largest contributors to the Fund’s relative outperformance versus the broad market/style-specific benchmark, MSCI Europe Small Cap Index. Within the IT sector, France-based financial software and services company Linedata Services was a notable contributor to absolute and relative results. In addition, we saw particular strength in France-based industrial and office equipment company Manutan International in the consumer discretionary sector. Strong stock selection in consumer staples also added to the Fund’s relative performance. Conversely, stock selection in the financials and industrials sectors detracted from the Fund’s relative performance during the fiscal year. Within the financials sector, UK-based Mortgage Advice Bureau detracted from both absolute and relative Fund performance. An underweight in financials and lack of exposure to materials and utilities sectors hampered relative results.

On a geographic basis, strong security selection in France was a key contributor to the Fund’s relative return during the fiscal year. In addition, an underweight in Sweden and the Fund’s exposure to Romania, a country not represented in the broad market/style-specific benchmark, added to relative performance after posting positive absolute results. In contrast, stock selection in Denmark and Switzerland detracted from the Fund’s relative performance. Exposure to Russia, underweights in Denmark and Switzerland and having no exposure to Spain also hampered relative results.

The Fund’s cash position in a declining market environment was additive to performance versus the broad market/style-specific benchmark. It is important to note that similar to

the Fund’s sector and regional allocations, cash is a residual of our bottom-up investment process and not the result of any top-down tactical asset allocation or risk-management allocation decision.

From an individual securities perspective, France-based energy company TotalEnergies EP Gabon was among the most significant contributors to the Fund’s performance during the fiscal year. The energy producer offers among the most attractive cash returns to investors in the industry.

In contrast, UK-based real estate company Savills was a key detractor from the Fund’s relative performance during the fiscal year. Savills is one of the world’s leading commercial real estate brokers. The stock sold off due to fears of a real estate market slowdown driven by macro weakness and higher interest rates. We believe the secular trends of outsourcing property management and demand for yield generating assets will persist.

Over the fiscal year, we continued to look for opportunities to improve the growth potential and quality of the Fund’s portfolio by adding companies based on our EQV outlook for each company. We initiated a few new positions, including multinational industrials company Signify and France-based IT company Claranova. We exited the Fund’s position in Globaltrans Investment during the fiscal year. We also had a couple of Fund positions that were acquired by other companies during the fiscal year; Vivo Energy was acquired by Vitol and Ultra Electronics was acquired by Cobham (not Fund holdings).

As always, we remain focused on a bottom-up investment approach of identifying attractive companies that fit our EQV-focused investment process. We continue to look for high-quality companies that exhibit the following characteristics: strong organic growth; high returns on capital; pricing power; strong balance sheets; cash generation; and reasonable valuations. In addition, we continue to favor companies that are able to consistently generate cash during weak economic environments. Our balanced EQV-focused approach aligns with our goal of delivering attractive risk-adjusted returns over the long term.

We thank you for your continued investment in Invesco EQV European Small Company Fund.

| | |

| 2 | | Invesco EQV European Small Company Fund |

Portfolio manager(s):

Borge Endresen - Lead

Minkun Zhang

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. and its affiliates. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| 3 | | Invesco EQV European Small Company Fund |

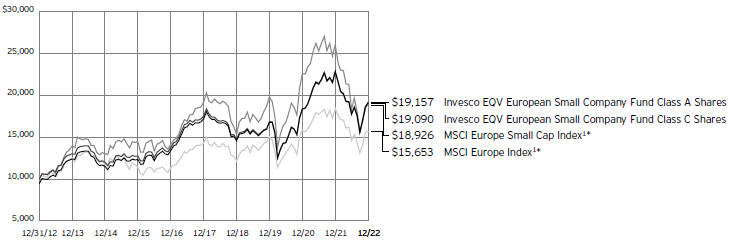

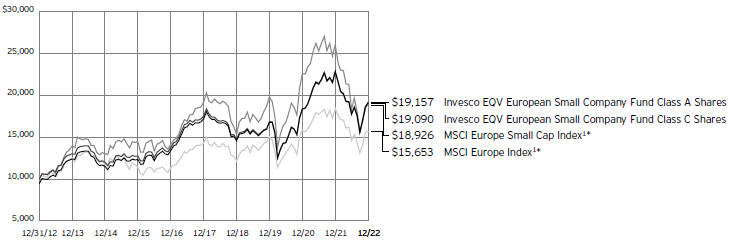

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 12/31/12

1 Source: RIMES Technologies Corp.

| | * | Effective April 29, 2022, the Fund changed its benchmark index from the MSCI Europe Index to the MSCI Europe Small Cap Index. The Fund’s investment adviser believes the MSCI Europe Small Cap Index provides a more appropriate comparison for evaluating the Fund’s performance. |

Past performance cannot guarantee future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including management

fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees;

performance of a market index does not. Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

| | |

| 4 | | Invesco EQV European Small Company Fund |

| | | | |

| |

Average Annual Total Returns | |

As of 12/31/22, including maximum applicable sales charges | |

| |

Class A Shares | | | | |

Inception (8/31/00) | | | 9.28 | % |

10 Years | | | 6.72 | |

5 Years | | | 1.05 | |

1 Year | | | -20.84 | |

| |

Class C Shares | | | | |

Inception (8/31/00) | | | 9.28 | % |

10 Years | | | 6.68 | |

5 Years | | | 1.42 | |

1 Year | | | -17.68 | |

| |

Class Y Shares | | | | |

Inception (10/3/08) | | | 8.72 | % |

10 Years | | | 7.58 | |

5 Years | | | 2.45 | |

1 Year | | | -16.06 | |

| |

Class R6 Shares | | | | |

10 Years | | | 7.53 | % |

5 Years | | | 2.54 | |

1 Year | | | -15.95 | |

Class R6 shares incepted on April 4, 2017. Performance shown prior to that date is that of Class A shares at net asset value and includes the 12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

Class A share performance reflects the maximum 5.50% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class Y and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

| | |

| 5 | | Invesco EQV European Small Company Fund |

Supplemental Information

Invesco EQV European Small Company Fund’s investment objective is long-term growth of capital.

| ∎ | Unless otherwise stated, information presented in this report is as of December 31, 2022, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data is provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About indexes used in this report

| ∎ | The MSCI Europe Index is an unmanaged index considered representative of stocks of developed European countries. The index is computed using the net return, which withholds applicable taxes for non-resident investors. |

| ∎ | The MSCI Europe Small Cap Index is an unmanaged index considered representative of small-cap European stocks. The index is computed using the net return, which withholds applicable taxes for non-resident investors. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

|

|

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. |

|

| NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| | |

| 6 | | Invesco EQV European Small Company Fund |

Fund Information

Portfolio Composition

| | | | | |

| By sector | | % of total net assets |

| |

Industrials | | | | 30.24 | % |

| |

Information Technology | | | | 20.90 | |

| |

Consumer Discretionary | | | | 15.29 | |

| |

Financials | | | | 12.63 | |

| |

Consumer Staples | | | | 4.82 | |

| |

Energy | | | | 4.10 | |

| |

Real Estate | | | | 2.60 | |

| |

Health Care | | | | 0.25 | |

| |

Money Market Funds Plus Other Assets Less Liabilities | | | | 9.17 | |

Top 10 Equity Holdings*

| | | | | | | |

| | | | | % of total net assets |

| | |

| 1. | | Neurones | | | | 5.37 | % |

| | |

| 2. | | Infotel S.A. | | | | 5.11 | |

| | |

| 3. | | Diploma PLC | | | | 4.90 | |

| | |

| 4. | | Fondul Proprietatea S.A. | | | | 4.58 | |

| | |

| 5. | | Gerard Perrier Industrie S.A. | | | | 4.36 | |

| | |

| 6. | | Renew Holdings PLC | | | | 4.20 | |

| | |

| 7. | | Clarkson PLC | | | | 4.05 | |

| | |

| 8. | | Kaufman & Broad S.A. | | | | 3.92 | |

| | |

| 9. | | Hilan Ltd. | | | | 3.90 | |

| | |

| 10. | | TBC Bank Group PLC | | | | 3.46 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

| * | Excluding money market fund holdings, if any. |

Data presented here are as of December 31, 2022.

| | |

| 7 | | Invesco EQV European Small Company Fund |

Schedule of Investments

December 31, 2022

| | | | | | | | |

| | | Shares | | | Value | |

|

| |

Common Stocks & Other Equity Interests–90.83% | |

Denmark–0.87% | | | | | | | | |

TCM Group A/S(a) | | | 151,388 | | | $ | 1,588,307 | |

|

| |

| | |

France–28.71% | | | | | | | | |

Claranova SE | | | 465,372 | | | | 1,373,933 | |

|

| |

Exail Technologies S.A.(b) | | | 114,696 | | | | 2,451,117 | |

|

| |

Gerard Perrier Industrie S.A. | | | 81,971 | | | | 7,933,443 | |

|

| |

HEXAOM | | | 132,990 | | | | 2,646,648 | |

|

| |

Infotel S.A. | | | 157,203 | | | | 9,287,592 | |

|

| |

Kaufman & Broad S.A. | | | 242,700 | | | | 7,126,786 | |

|

| |

Linedata Services | | | 40,177 | | | | 1,982,392 | |

|

| |

Manutan International | | | 46,230 | | | | 5,098,591 | |

|

| |

Neurones | | | 232,283 | | | | 9,758,818 | |

|

| |

Totalenergies EP Gabon | | | 26,924 | | | | 4,553,483 | |

|

| |

| | | | | | | 52,212,803 | |

|

| |

| | |

Georgia–3.46% | | | | | | | | |

TBC Bank Group PLC | | | 229,577 | | | | 6,294,247 | |

|

| |

| | |

Germany–0.25% | | | | | | | | |

MorphoSys AG(b) | | | 31,430 | | | | 444,119 | |

|

| |

| | |

Greece–1.75% | | | | | | | | |

Karelia Tobacco Co., Inc. S.A. | | | 10,265 | | | | 3,187,278 | |

|

| |

| | |

Ireland–3.07% | | | | | | | | |

Origin Enterprises PLC | | | 1,210,635 | | | | 5,589,558 | |

|

| |

| | |

Israel–4.60% | | | | | | | | |

Hilan Ltd. | | | 142,809 | | | | 7,092,776 | |

|

| |

MIND C.T.I. Ltd. | | | 609,450 | | | | 1,279,845 | |

|

| |

| | | | | | | 8,372,621 | |

|

| |

| | |

Italy–2.85% | | | | | | | | |

Gruppo MutuiOnline S.p.A. | | | 75,783 | | | | 2,138,275 | |

|

| |

Technogym S.p.A.(a) | | | 397,739 | | | | 3,038,183 | |

|

| |

| | | | | | | 5,176,458 | |

|

| |

| | |

Netherlands–1.60% | | | | | | | | |

SBM Offshore N.V. | | | 185,296 | | | | 2,911,612 | |

|

| |

| | |

Norway–0.95% | | | | | | | | |

Bouvet ASA | | | 284,184 | | | | 1,728,513 | |

|

| |

| | |

Poland–4.87% | | | | | | | | |

LiveChat Software S.A. | | | 131,000 | | | | 3,201,987 | |

|

| |

Mo-BRUK S.A. | | | 38,176 | | | | 2,590,795 | |

|

| |

Warsaw Stock Exchange | | | 378,420 | | | | 3,055,795 | |

|

| |

| | | | | | | 8,848,577 | |

|

| |

Investment Abbreviations:

BR – Bearer Shares

| | | | | | | | |

| | | Shares | | | Value | |

|

| |

Portugal–0.65% | | | | | | | | |

Conduril - Engenharia S.A. | | | 46,308 | | | $ | 1,189,689 | |

|

| |

| | |

Romania–4.58% | | | | | | | | |

Fondul Proprietatea S.A. | | | 18,836,533 | | | | 8,323,305 | |

|

| |

| | |

Singapore–0.98% | | | | | | | | |

XP Power Ltd. | | | 72,347 | | | | 1,778,524 | |

|

| |

| | |

Sweden–1.26% | | | | | | | | |

Proact IT Group AB | | | 287,095 | | | | 2,281,059 | |

|

| |

| | |

Switzerland–3.43% | | | | | | | | |

Carlo Gavazzi Holding AG, BR | | | 9,525 | | | | 3,098,195 | |

|

| |

Kardex Holding AG | | | 19,018 | | | | 3,138,614 | |

|

| |

| | | | | | | 6,236,809 | |

|

| |

| | |

United Kingdom–25.59% | | | | | | | | |

City of London Investment Group PLC | | | 900,000 | | | | 4,552,763 | |

|

| |

Clarkson PLC | | | 188,808 | | | | 7,359,759 | |

|

| |

DCC PLC | | | 74,233 | | | | 3,664,612 | |

|

| |

Diploma PLC | | | 265,427 | | | | 8,919,574 | |

|

| |

Eurocell PLC | | | 721,500 | | | | 1,286,735 | |

|

| |

IG Group Holdings PLC | | | 555,264 | | | | 5,252,583 | |

|

| |

Mortgage Advice Bureau Holdings Ltd. | | | 260,274 | | | | 1,678,120 | |

|

| |

Renew Holdings PLC | | | 860,626 | | | | 7,635,124 | |

|

| |

SafeStyle UK PLC | | | 4,465,000 | | | | 1,456,791 | |

|

| |

Savills PLC | | | 473,369 | | | | 4,728,547 | |

|

| |

| | | | | | | 46,534,608 | |

|

| |

| | |

United States–1.36% | | | | | | | | |

Signify N.V. | | | 73,555 | | | | 2,476,395 | |

|

| |

Total Common Stocks & Other Equity Interests

(Cost $138,086,209) | | | | 165,174,482 | |

|

| |

| | |

Money Market Funds–4.50% | | | | | | | | |

Invesco Government & Agency Portfolio, Institutional Class,

4.22%(c)(d) | | | 2,641,820 | | | | 2,641,820 | |

|

| |

Invesco Liquid Assets Portfolio, Institutional Class,

4.42%(c)(d) | | | 2,523,995 | | | | 2,524,753 | |

|

| |

Invesco Treasury Portfolio, Institutional Class, 4.20%(c)(d) | | | 3,019,224 | | | | 3,019,224 | |

|

| |

Total Money Market Funds (Cost $8,184,259) | | | | 8,185,797 | |

|

| |

TOTAL INVESTMENTS IN SECURITIES–95.33%

(Cost $146,270,468) | | | | 173,360,279 | |

|

| |

OTHER ASSETS LESS LIABILITIES–4.67% | | | | 8,498,711 | |

|

| |

NET ASSETS–100.00% | | | | | | $ | 181,858,990 | |

|

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 8 | | Invesco EQV European Small Company Fund |

Notes to Schedule of Investments:

| (a) | Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”). The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The aggregate value of these securities at December 31, 2022 was $4,626,490, which represented 2.54% of the Fund’s Net Assets. |

| (b) | Non-income producing security. |

| (c) | Affiliated issuer. The issuer and/or the Fund is a wholly-owned subsidiary of Invesco Ltd., or is affiliated by having an investment adviser that is under common control of Invesco Ltd. The table below shows the Fund’s transactions in, and earnings from, its investments in affiliates for the fiscal year ended December 31, 2022. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value

December 31, 2021 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Change in Unrealized Appreciation (Depreciation) | | Realized Gain (Loss) | | | Value December 31, 2022 | | | Dividend Income | |

| Investments in Affiliated Money Market Funds: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco Government & Agency Portfolio, Institutional Class | | $ | 3,916,384 | | | | | | | $ | 18,394,583 | | | $ | (19,669,147 | ) | | $ | - | | | | | | | $ | - | | | $ | 2,641,820 | | | | | | | $ | 61,556 | |

Invesco Liquid Assets Portfolio, Institutional Class | | | 3,434,147 | | | | | | | | 13,138,988 | | | | (14,049,389 | ) | | | 1,167 | | | | | | | | (160) | | | | 2,524,753 | | | | | | | | 65,555 | |

Invesco Treasury Portfolio, Institutional Class | | | 4,475,867 | | | | | | | | 21,022,381 | | | | (22,479,024 | ) | | | - | | | | | | | | - | | | | 3,019,224 | | | | | | | | 83,296 | |

| Investments Purchased with Cash Collateral from Securities on Loan: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco Private Government Fund | | | 34,852 | | | | | | | | 5,254,208 | | | | (5,289,060 | ) | | | - | | | | | | | | - | | | | - | | | | | | | | 4,102* | |

Invesco Private Prime Fund | | | 81,321 | | | | | | | | 12,568,286 | | | | (12,649,925 | ) | | | - | | | | | | | | 318 | | | | - | | | | | | | | 10,921* | |

| Investments in Other Affiliates: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MIND C.T.I. Ltd.** | | | 3,770,995 | | | | | | | | - | | | | (1,638,241 | ) | | | (846,726 | ) | | | | | | | (6,183) | | | | 1,279,845 | | | | | | | | 182,814 | |

Total | | $ | 15,713,566 | | | | | | | $ | 70,378,446 | | | $ | (75,774,786 | ) | | $ | (845,559 | ) | | | | | | $ | (6,025) | | | $ | 9,465,642 | | | | | | | $ | 408,244 | |

| * | Represents the income earned on the investment of cash collateral, which is included in securities lending income on the Statement of Operations. Does not include rebates and fees paid to lending agent or premiums received from borrowers, if any. |

| ** | As of December 31, 2022, this security was not considered as an affiliate of the Fund. |

| (d) | The rate shown is the 7-day SEC standardized yield as of December 31, 2022. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 9 | | Invesco EQV European Small Company Fund |

Statement of Assets and Liabilities

December 31, 2022

| | | | |

Assets: | | | | |

Investments in unaffiliated securities, at value

(Cost $138,086,209) | | $ | 165,174,482 | |

|

| |

Investments in affiliated money market funds, at value (Cost $8,184,259) | | | 8,185,797 | |

|

| |

Foreign currencies, at value (Cost $8,296,380) | | | 8,367,688 | |

|

| |

Receivable for: | | | | |

Fund shares sold | | | 17,152 | |

|

| |

Dividends | | | 560,756 | |

|

| |

Investment for trustee deferred compensation and retirement plans | | | 51,848 | |

|

| |

Other assets | | | 35,826 | |

|

| |

Total assets | | | 182,393,549 | |

|

| |

| |

Liabilities: | | | | |

Payable for: | | | | |

Fund shares reacquired | | | 299,509 | |

|

| |

Accrued fees to affiliates | | | 94,138 | |

|

| |

Accrued trustees’ and officers’ fees and benefits | | | 3,013 | |

|

| |

Accrued other operating expenses | | | 79,181 | |

|

| |

Trustee deferred compensation and retirement plans | | | 58,718 | |

|

| |

Total liabilities | | | 534,559 | |

|

| |

Net assets applicable to shares outstanding | | $ | 181,858,990 | |

|

| |

| |

Net assets consist of: | | | | |

Shares of beneficial interest | | $ | 156,926,029 | |

|

| |

Distributable earnings | | | 24,932,961 | |

|

| |

| | $ | 181,858,990 | |

|

| |

| | | | |

Net Assets: | | | | |

| |

Class A | | $ | 94,975,498 | |

|

| |

Class C | | $ | 2,567,815 | |

|

| |

Class Y | | $ | 75,528,898 | |

|

| |

Class R6 | | $ | 8,786,779 | |

|

| |

|

Shares outstanding, no par value, with an unlimited number of shares authorized: | |

| |

Class A | | | 6,939,673 | |

|

| |

Class C | | | 202,788 | |

|

| |

Class Y | | | 5,493,882 | |

|

| |

Class R6 | | | 639,160 | |

|

| |

Class A: | | | | |

Net asset value per share | | $ | 13.69 | |

|

| |

Maximum offering price per share

(Net asset value of $13.69 ÷ 94.50%) | | $ | 14.49 | |

|

| |

Class C: | | | | |

Net asset value and offering price per share | | $ | 12.66 | |

|

| |

Class Y: | | | | |

Net asset value and offering price per share | | $ | 13.75 | |

|

| |

Class R6: | | | | |

Net asset value and offering price per share | | $ | 13.75 | |

|

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 10 | | Invesco EQV European Small Company Fund |

Statement of Operations

For the year ended December 31, 2022

| | | | |

Investment income: | | | | |

| |

Dividends (net of foreign withholding taxes of $589,658) | | $ | 8,639,514 | |

|

| |

Dividends from affiliates (includes net securities lending income of $189,685) | | | 582,906 | |

|

| |

Total investment income | | | 9,222,420 | |

|

| |

| |

Expenses: | | | | |

Advisory fees | | | 1,897,479 | |

|

| |

Administrative services fees | | | 29,816 | |

|

| |

Custodian fees | | | 51,775 | |

|

| |

Distribution fees: | | | | |

Class A | | | 246,939 | |

|

| |

Class C | | | 31,671 | |

|

| |

Transfer agent fees – A, C and Y | | | 297,077 | |

|

| |

Transfer agent fees – R6 | | | 2,491 | |

|

| |

Trustees’ and officers’ fees and benefits | | | 18,932 | |

|

| |

Registration and filing fees | | | 57,997 | |

|

| |

Reports to shareholders | | | 44,047 | |

|

| |

Professional services fees | | | 83,304 | |

|

| |

Other | | | 13,748 | |

|

| |

Total expenses | | | 2,775,276 | |

|

| |

Less: Fees waived and/or expense offset arrangement(s) | | | (13,906 | ) |

|

| |

Net expenses | | | 2,761,370 | |

|

| |

Net investment income | | | 6,461,050 | |

|

| |

| |

Realized and unrealized gain (loss) from: | | | | |

Net realized gain (loss) from: | | | | |

Unaffiliated investment securities | | | 17,780,504 | |

|

| |

Affiliated investment securities | | | (6,025 | ) |

|

| |

Foreign currencies | | | (198,839 | ) |

|

| |

| | | 17,575,640 | |

|

| |

Change in net unrealized appreciation (depreciation) of: | | | | |

Unaffiliated investment securities | | | (68,135,398 | ) |

|

| |

Affiliated investment securities | | | (845,559 | ) |

|

| |

Foreign currencies | | | 47,122 | |

|

| |

| | | (68,933,835 | ) |

|

| |

Net realized and unrealized gain (loss) | | | (51,358,195 | ) |

|

| |

Net increase (decrease) in net assets resulting from operations | | $ | (44,897,145 | ) |

|

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 11 | | Invesco EQV European Small Company Fund |

Statement of Changes in Net Assets

For the years ended December 31, 2022 and 2021

| | | | | | | | |

| | | 2022 | | | 2021 | |

|

| |

Operations: | | | | | | | | |

Net investment income | | $ | 6,461,050 | | | $ | 3,529,286 | |

|

| |

Net realized gain | | | 17,575,640 | | | | 21,908,904 | |

|

| |

Change in net unrealized appreciation (depreciation) | | | (68,933,835 | ) | | | 29,211,631 | |

|

| |

Net increase (decrease) in net assets resulting from operations | | | (44,897,145 | ) | | | 54,649,821 | |

|

| |

| | |

Distributions to shareholders from distributable earnings: | | | | | | | | |

Class A | | | (9,757,917 | ) | | | (3,871,714 | ) |

|

| |

Class C | | | (269,202 | ) | | | (56,942 | ) |

|

| |

Class Y | | | (8,046,073 | ) | | | (4,828,280 | ) |

|

| |

Class R6 | | | (933,877 | ) | | | (454,663 | ) |

|

| |

Total distributions from distributable earnings | | | (19,007,069 | ) | | | (9,211,599 | ) |

|

| |

| | |

Share transactions–net: | | | | | | | | |

Class A | | | 1,995,292 | | | | 4,080,917 | |

|

| |

Class C | | | (619,774 | ) | | | (3,325,561 | ) |

|

| |

Class Y | | | (27,224,590 | ) | | | (11,561,580 | ) |

|

| |

Class R6 | | | (622,420 | ) | | | (714,094 | ) |

|

| |

Net increase (decrease) in net assets resulting from share transactions | | | (26,471,492 | ) | | | (11,520,318 | ) |

|

| |

Net increase (decrease) in net assets | | | (90,375,706 | ) | | | 33,917,904 | |

|

| |

| | |

Net assets: | | | | | | | | |

Beginning of year | | | 272,234,696 | | | | 238,316,792 | |

|

| |

End of year | | $ | 181,858,990 | | | $ | 272,234,696 | |

|

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 12 | | Invesco EQV European Small Company Fund |

Financial Highlights

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset value, beginning of period | | Net investment income(a) | | Net gains (losses) on securities (both realized and unrealized) | | Total from investment operations | | Dividends from net investment income | | Distributions from net realized gains | | Total distributions | | Net asset value, end of period | | Total return (b) | | Net assets, end of period (000’s omitted) | | Ratio of expenses to average net assets with fee waivers and/or expenses absorbed | | Ratio of expenses to average net

assets without fee waivers and/or expenses absorbed | | Ratio of net investment income to average net assets | | Portfolio turnover (c) |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/22 | | | $18.25 | | | | $0.46 | (d) | | | $(3.48 | ) | | | $(3.02 | ) | | | $(0.36 | ) | | | $(1.18 | ) | | | $(1.54 | ) | | | $13.69 | | | | (16.25 | )% | | | $ 94,975 | | | | 1.48 | % | | | 1.49 | % | | | 3.06 | %(d) | | | 5 | % |

Year ended 12/31/21 | | | 15.18 | | | | 0.21 | | | | 3.46 | | | | 3.67 | | | | (0.53 | ) | | | (0.07 | ) | | | (0.60 | ) | | | 18.25 | | | | 24.27 | | | | 123,121 | | | | 1.33 | | | | 1.33 | | | | 1.22 | | | | 10 | |

Year ended 12/31/20 | | | 14.24 | | | | 0.14 | (d) | | | 1.21 | | | | 1.35 | | | | (0.17 | ) | | | (0.24 | ) | | | (0.41 | ) | | | 15.18 | | | | 9.60 | | | | 99,172 | | | | 1.53 | | | | 1.54 | | | | 1.09 | (d) | | | 6 | |

Year ended 12/31/19 | | | 13.23 | | | | 0.34 | (d) | | | 1.67 | | | | 2.01 | | | | (0.63 | ) | | | (0.37 | ) | | | (1.00 | ) | | | 14.24 | | | | 15.23 | | | | 121,763 | | | | 1.42 | | | | 1.43 | | | | 2.40 | (d) | | | 1 | |

Year ended 12/31/18 | | | 16.58 | | | | 0.28 | | | | (2.80 | ) | | | (2.52 | ) | | | (0.29 | ) | | | (0.54 | ) | | | (0.83 | ) | | | 13.23 | | | | (15.21 | ) | | | 127,904 | | | | 1.35 | | | | 1.38 | | | | 1.73 | | | | 11 | |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/22 | | | 17.04 | | | | 0.33 | (d) | | | (3.27 | ) | | | (2.94 | ) | | | (0.26 | ) | | | (1.18 | ) | | | (1.44 | ) | | | 12.66 | | | | (16.94 | ) | | | 2,568 | | | | 2.23 | | | | 2.24 | | | | 2.31 | (d) | | | 5 | |

Year ended 12/31/21 | | | 14.01 | | | | 0.08 | | | | 3.19 | | | | 3.27 | | | | (0.17 | ) | | | (0.07 | ) | | | (0.24 | ) | | | 17.04 | | | | 23.35 | | | | 4,215 | | | | 2.08 | | | | 2.08 | | | | 0.47 | | | | 10 | |

Year ended 12/31/20 | | | 13.27 | | | | 0.04 | (d) | | | 1.11 | | | | 1.15 | | | | (0.17 | ) | | | (0.24 | ) | | | (0.41 | ) | | | 14.01 | | | | 8.80 | | | | 6,370 | | | | 2.28 | | | | 2.29 | | | | 0.34 | (d) | | | 6 | |

Year ended 12/31/19 | | | 12.36 | | | | 0.22 | (d) | | | 1.56 | | | | 1.78 | | | | (0.50 | ) | | | (0.37 | ) | | | (0.87 | ) | | | 13.27 | | | | 14.44 | | | | 12,200 | | | | 2.17 | | | | 2.18 | | | | 1.65 | (d) | | | 1 | |

Year ended 12/31/18 | | | 15.52 | | | | 0.15 | | | | (2.61 | ) | | | (2.46 | ) | | | (0.16 | ) | | | (0.54 | ) | | | (0.70 | ) | | | 12.36 | | | | (15.89 | ) | | | 22,684 | | | | 2.10 | | | | 2.13 | | | | 0.98 | | | | 11 | |

| Class Y | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/22 | | | 18.33 | | | | 0.51 | (d) | | | (3.51 | ) | | | (3.00 | ) | | | (0.40 | ) | | | (1.18 | ) | | | (1.58 | ) | | | 13.75 | | | | (16.06 | ) | | | 75,529 | | | | 1.23 | | | | 1.24 | | | | 3.31 | (d) | | | 5 | |

Year ended 12/31/21 | | | 15.27 | | | | 0.26 | | | | 3.48 | | | | 3.74 | | | | (0.61 | ) | | | (0.07 | ) | | | (0.68 | ) | | | 18.33 | | | | 24.62 | | | | 132,546 | | | | 1.08 | | | | 1.08 | | | | 1.47 | | | | 10 | |

Year ended 12/31/20 | | | 14.29 | | | | 0.18 | (d) | | | 1.21 | | | | 1.39 | | | | (0.17 | ) | | | (0.24 | ) | | | (0.41 | ) | | | 15.27 | | | | 9.85 | | | | 121,746 | | | | 1.28 | | | | 1.29 | | | | 1.34 | (d) | | | 6 | |

Year ended 12/31/19 | | | 13.27 | | | | 0.38 | (d) | | | 1.68 | | | | 2.06 | | | | (0.67 | ) | | | (0.37 | ) | | | (1.04 | ) | | | 14.29 | | | | 15.56 | | | | 230,577 | | | | 1.17 | | | | 1.18 | | | | 2.65 | (d) | | | 1 | |

Year ended 12/31/18 | | | 16.64 | | | | 0.32 | | | | (2.81 | ) | | | (2.49 | ) | | | (0.34 | ) | | | (0.54 | ) | | | (0.88 | ) | | | 13.27 | | | | (15.01 | ) | | | 410,107 | | | | 1.10 | | | | 1.13 | | | | 1.98 | | | | 11 | |

| Class R6 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/22 | | | 18.33 | | | | 0.52 | (d) | | | (3.50 | ) | | | (2.98 | ) | | | (0.42 | ) | | | (1.18 | ) | | | (1.60 | ) | | | 13.75 | | | | (15.95 | ) | | | 8,787 | | | | 1.11 | | | | 1.12 | | | | 3.43 | (d) | | | 5 | |

Year ended 12/31/21 | | | 15.28 | | | | 0.27 | | | | 3.48 | | | | 3.75 | | | | (0.63 | ) | | | (0.07 | ) | | | (0.70 | ) | | | 18.33 | | | | 24.72 | | | | 12,353 | | | | 1.00 | | | | 1.00 | | | | 1.55 | | | | 10 | |

Year ended 12/31/20 | | | 14.28 | | | | 0.19 | (d) | | | 1.22 | | | | 1.41 | | | | (0.17 | ) | | | (0.24 | ) | | | (0.41 | ) | | | 15.28 | | | | 9.99 | | | | 11,029 | | | | 1.19 | | | | 1.20 | | | | 1.43 | (d) | | | 6 | |

Year ended 12/31/19 | | | 13.27 | | | | 0.39 | (d) | | | 1.67 | | | | 2.06 | | | | (0.68 | ) | | | (0.37 | ) | | | (1.05 | ) | | | 14.28 | | | | 15.59 | | | | 14,875 | | | | 1.09 | | | | 1.10 | | | | 2.73 | (d) | | | 1 | |

Year ended 12/31/18 | | | 16.64 | | | | 0.33 | | | | (2.81 | ) | | | (2.48 | ) | | | (0.35 | ) | | | (0.54 | ) | | | (0.89 | ) | | | 13.27 | | | | (14.93 | ) | | | 18,243 | | | | 1.04 | | | | 1.07 | | | | 2.04 | | | | 11 | |

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Does not include sales charges and is not annualized for periods less than one year, if applicable. |

| (c) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. |

| (d) | Net investment income per share and the ratio of net investment income to average net assets include significant dividends received during the year ended December 31, 2022. Net investment income per share and the ratio of net investment income to average net assets excluding the significant dividends are $0.35 and 2.33%, $0.22 and 1.58%, $0.40 and 2.58% and $0.41 and 2.70% for Class A, Class C, Class Y and Class R6 shares, respectively. Net investment income per share and the ratio of net investment income to average net assets include significant dividends received during the year ended December 31, 2020. Net investment income per share and the ratio of net investment income to average net assets excluding the significant dividends are $0.08 and 0.62%, $(0.02) and (0.13)%, $0.12 and 0.87% and $0.13 and 0.96% for Class A, Class C, Class Y and Class R6 shares, respectively. Net investment income per share and the ratio of net investment income to average net assets include significant dividends received during the year ended December 31, 2019. Net investment income per share and the ratio of net investment income to average net assets excluding the significant dividends are $0.24 and 1.66%, $0.12 and 0.91%, $0.28 and 1.91% and $0.29 and 1.99% for Class A, Class C, Class Y and Class R6 shares, respectively. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 13 | | Invesco EQV European Small Company Fund |

Notes to Financial Statements

December 31, 2022

NOTE 1–Significant Accounting Policies

Invesco EQV European Small Company Fund, formerly Invesco European Small Company Fund, (the “Fund”) is a series portfolio of AIM Funds Group (Invesco Funds Group) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company authorized to issue an unlimited number of shares of beneficial interest. Information presented in these financial statements pertains only to the Fund. Matters affecting the Fund or each class will be voted on exclusively by the shareholders of the Fund or each class.

The Fund’s investment objective is long-term growth of capital.

The Fund currently consists of four different classes of shares: Class A, Class C, Class Y and Class R6. Class Y shares are available only to certain investors. Class A shares are sold with a front-end sales charge unless certain waiver criteria are met. Under certain circumstances, load waived shares may be subject to contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class Y and Class R6 shares are sold at net asset value. Class C shares held for eight years after purchase are eligible for automatic conversion into Class A shares of the same Fund (the “Conversion Feature”). The automatic conversion pursuant to the Conversion Feature will generally occur at the end of the month following the eighth anniversary after a purchase of Class C shares.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations - Securities, including restricted securities, are valued according to the following policy. |

A security listed or traded on an exchange is generally valued at its trade price or official closing price that day as of the close of the exchange where the security is principally traded, or lacking any trades or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued using prices provided by an independent pricing service they may be considered fair valued. Futures contracts are valued at the daily settlement price set by an exchange on which they are principally traded. U.S. exchange-traded options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Non-U.S. exchange-traded options are valued at the final settlement price set by the exchange on which they trade. Options not listed on an exchange and swaps generally are valued using pricing provided from independent pricing services.

Securities of investment companies that are not exchange-traded (e.g., open-end mutual funds) are valued using such company’s end-of-business-day net asset value per share.

Deposits, other obligations of U.S. and non-U.S. banks and financial institutions are valued at their daily account value.

Fixed income securities (including convertible debt securities) generally are valued on the basis of prices provided by independent pricing services. Prices provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Pricing services generally value debt obligations assuming orderly transactions of institutional round lot size, but a fund may hold or transact in the same securities in smaller, odd lot sizes. Odd lots often trade at lower prices than institutional round lots, and their value may be adjusted accordingly. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the New York Stock Exchange (“NYSE”). If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Invesco Advisers, Inc. (the “Adviser” or “Invesco”) may use various pricing services to obtain market quotations as well as fair value prices. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become not representative of market value in the Adviser’s judgment (“unreliable”). If, between the time trading ends on a particular security and the close of the customary trading session on the NYSE, a significant event occurs that makes the closing price of the security unreliable, the Adviser may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith in accordance with Board- approved policies and related Adviser procedures (“Valuation Procedures”). Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Unlisted securities will be valued using prices provided by independent pricing services or by another method that the Adviser, in its judgment, believes better reflects the security’s fair value in accordance with the Valuation Procedures.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices may be used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available are fair valued by the Adviser in accordance with the Valuation Procedures. If a fair value price provided by a pricing service is unreliable, the Adviser will fair value the security using the Valuation Procedures. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general market conditions which are not specifically related to the particular issuer, such as real or perceived adverse economic conditions, changes in the general outlook for revenues or corporate earnings, changes in interest or currency rates, regional or global instability, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism, significant governmental actions or adverse investor sentiment generally and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

The price the Fund could receive upon the sale of any investment may differ from the Adviser’s valuation of the investment, particularly for securities that are valued using a fair valuation technique. When fair valuation techniques are applied, the Adviser uses available information, including both observable and unobservable inputs and assumptions, to determine a methodology that will result in a valuation that the Adviser believes approximates market value. Fund securities that are fair valued may be subject to greater fluctuation in their value from one day to the next than would be the case if market quotations were used. Because of the inherent uncertainties of valuation, and the degree of subjectivity in such decisions, the Fund could realize a greater or lesser than expected gain or loss upon the sale of the investment.

| | |

| 14 | | Invesco EQV European Small Company Fund |

| B. | Securities Transactions and Investment Income - Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on an accrual basis from settlement date and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. |

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and the Statement of Changes in Net Assets, or the net investment income per share and the ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser.

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

| C. | Country Determination - For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues, the country that has the primary market for the issuer’s securities and its “country of risk” as determined by a third party service provider, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

| D. | Distributions - Distributions from net investment income and net realized capital gain, if any, are generally declared and paid annually and recorded on the ex-dividend date. The Fund may elect to treat a portion of the proceeds from redemptions as distributions for federal income tax purposes. |

| E. | Federal Income Taxes - The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| F. | Expenses - Fees provided for under the Rule 12b-1 plan of a particular class of the Fund are charged to the operations of such class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses attributable to Class R6 are charged to such class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses relating to all other classes are allocated among those classes based on relative net assets. All other expenses are allocated among the classes based on relative net assets. |

| G. | Accounting Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

| H. | Indemnifications - Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

| I. | Securities Lending - The Fund may lend portfolio securities having a market value up to one-third of the Fund’s total assets. Such loans are secured by collateral equal to no less than the market value of the loaned securities determined daily by the securities lending provider. Such collateral will be cash or debt securities issued or guaranteed by the U.S. Government or any of its sponsored agencies. Cash collateral received in connection with these loans is invested in short-term money market instruments or affiliated, unregistered investment companies that comply with Rule 2a-7 under the 1940 Act and money market funds (collectively, “affiliated money market funds”) and is shown as such on the Schedule of Investments. The Fund bears the risk of loss with respect to the investment of collateral. It is the Fund’s policy to obtain additional collateral from or return excess collateral to the borrower by the end of the next business day, following the valuation date of the securities loaned. Therefore, the value of the collateral held may be temporarily less than the value of the securities on loan. When loaning securities, the Fund retains certain benefits of owning the securities, including the economic equivalent of dividends or interest generated by the security. Lending securities entails a risk of loss to the Fund if, and to the extent that, the market value of the securities loaned were to increase and the borrower did not increase the collateral accordingly, and the borrower failed to return the securities. The securities loaned are subject to termination at the option of the borrower or the Fund. Upon termination, the borrower will return to the Fund the securities loaned and the Fund will return the collateral. Upon the failure of the borrower to return the securities, collateral may be liquidated and the securities may be purchased on the open market to replace the loaned securities. The Fund could experience delays and costs in gaining access to the collateral and the securities may lose value during the delay which could result in potential losses to the Fund. Some of these losses may be indemnified by the lending agent. The Fund bears the risk of any deficiency in the amount of the collateral available for return to the borrower due to any loss on the collateral invested. Dividends received on cash collateral investments for securities lending transactions, which are net of compensation to counterparties, are included in Dividends from affiliates on the Statement of Operations. The aggregate value of securities out on loan, if any, is shown as a footnote on the Statement of Assets and Liabilities. |

The Adviser serves as an affiliated securities lending agent for the Fund. The Bank of New York Mellon also serves as a lending agent. To the extent the Fund utilizes the Adviser as an affiliated securities lending agent, the Fund conducts its securities lending in accordance with, and in reliance upon, no-action letters issued by the SEC staff that provide guidance on how an affiliate may act as a direct agent lender and receive compensation for those services in a manner consistent with the federal securities laws. For the year ended December 31, 2022, there were no securities lending transactions with the Adviser. Fees paid to the Adviser for securities lending agent services, if any, are included in Dividends from affiliates on the Statement of Operations.

| J. | Foreign Currency Translations - Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar |

| | |

| 15 | | Invesco EQV European Small Company Fund |

| | amounts on the respective dates of such transactions. The Fund does not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statement of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |

The Fund may invest in foreign securities, which may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests and are shown in the Statement of Operations.

| K. | Forward Foreign Currency Contracts – The Fund may engage in foreign currency transactions either on a spot (i.e. for prompt delivery and settlement) basis, or through forward foreign currency contracts, to manage or minimize currency or exchange rate risk. |

The Fund may also enter into forward foreign currency contracts for the purchase or sale of a security denominated in a foreign currency in order to “lock in” the U.S. dollar price of that security, or the Fund may also enter into forward foreign currency contracts that do not provide for physical exchange of the two currencies on the settlement date, but instead are settled by a single cash payment calculated as the difference between the agreed upon exchange rate and the spot rate at settlement based upon an agreed upon notional amount (non-deliverable forwards).

A forward foreign currency contract is an obligation between two parties (“Counterparties”) to purchase or sell a specific currency for an agreed-upon price at a future date. The use of forward foreign currency contracts for hedging does not eliminate fluctuations in the price of the underlying securities the Fund owns or intends to acquire but establishes a rate of exchange in advance. Fluctuations in the value of these contracts are measured by the difference in the contract date and reporting date exchange rates and are recorded as unrealized appreciation (depreciation) until the contracts are closed. When the contracts are closed, realized gains (losses) are recorded. Realized and unrealized gains (losses) on the contracts are included in the Statement of Operations. The primary risks associated with forward foreign currency contracts include failure of the Counterparty to meet the terms of the contract and the value of the foreign currency changing unfavorably. These risks may be in excess of the amounts reflected in the Statement of Assets and Liabilities.

| L. | Other Risks - Emerging markets (also referred to as developing markets) are generally subject to greater market volatility, political, social and economic instability, uncertainty regarding the existence of trading markets and more governmental limitations on foreign investment than more developed markets. In addition, companies operating in emerging markets may be subject to lower trading volume and greater price fluctuations than companies in more developed markets. Securities law in many emerging market countries is relatively new and unsettled. Therefore, laws regarding foreign investment in emerging market securities, securities regulation, title to securities, and shareholder rights may change quickly and unpredictably. In addition, the enforcement of systems of taxation at federal, regional and local levels in emerging market countries may be inconsistent, and subject to sudden change. Other risks of investing in emerging markets securities may include additional transaction costs, delays in settlement procedures, and lack of timely information. |

| M. | COVID-19 Risk - The COVID-19 strain of coronavirus has resulted in instances of market closures and dislocations, extreme volatility, liquidity constraints and increased trading costs. Efforts to contain its spread have resulted in travel restrictions, disruptions of healthcare systems, business operations (including business closures) and supply chains, layoffs, lower consumer demand and employee availability, and defaults and credit downgrades, among other significant economic impacts that have disrupted global economic activity across many industries. Such economic impacts may exacerbate other pre-existing political, social and economic risks locally or globally and cause general concern and uncertainty. The full economic impact and ongoing effects of COVID-19 (or other future epidemics or pandemics) at the macro-level and on individual businesses are unpredictable and may result in significant and prolonged effects on the Fund’s performance. |

NOTE 2–Advisory Fees and Other Fees Paid to Affiliates

The Trust has entered into a master investment advisory agreement with the Adviser. Under the terms of the investment advisory agreement, the Fund accrues daily and pays monthly an advisory fee to the Adviser based on the annual rate of the Fund’s average daily net assets as follows:

| | | | | | |

| Average Daily Net Assets | | Rate | |

|

| |

First $ 250 million | | | 0.935% | |

|

| |

Next $250 million | | | 0.910% | |

|

| |

Next $500 million | | | 0.885% | |

|

| |

Next $1.5 billion | | | 0.860% | |

|

| |

Next $2.5 billion | | | 0.835% | |

|

| |

Next $2.5 billion | | | 0.810% | |

|

| |

Next $2.5 billion | | | 0.785% | |

|

| |

Over $10 billion | | | 0.760% | |

|

| |

For the year ended December 31, 2022, the effective advisory fee rate incurred by the Fund was 0.93%.

Under the terms of a master sub-advisory agreement between the Adviser and each of Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc. and Invesco Canada Ltd. and separate sub-advisory agreements with Invesco Capital Management LLC and Invesco Asset Management (India) Private Limited (collectively, the “Affiliated Sub-Advisers”) the Adviser, not the Fund, will pay 40% of the fees paid to the Adviser to any such Affiliated Sub-Adviser(s) that provide(s) discretionary investment management services to the Fund based on the percentage of assets allocated to such Affiliated Sub-Adviser(s).

The Adviser has contractually agreed, through at least June 30, 2023, to waive advisory fees and/or reimburse expenses of all shares to the extent necessary to limit total annual fund operating expenses after fee waiver and/or expense reimbursement (excluding certain items discussed below) of Class A, Class C, Class Y and Class R6 shares to 2.25%, 3.00%, 2.00% and 2.00%, respectively, of the Fund’s average daily net assets (the “expense limits”). In determining the Adviser’s obligation to waive advisory fees and/or reimburse expenses, the following expenses are not taken into account, and could cause the total annual fund operating expenses after fee waiver and/or expense reimbursement to exceed the numbers reflected above: (1) interest; (2) taxes; (3) dividend expense on short sales; (4) extraordinary or non-routine items, including litigation expenses; and (5) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement. Unless Invesco continues the fee waiver agreement, it will terminate on June 30, 2023. During its term, the fee waiver agreement cannot be terminated or amended to increase the expense limits or reduce the advisory fee waiver without approval of the Board of Trustees. The Adviser did not waive fees and/or reimburse expenses during the period under these expense limits.

Further, the Adviser has contractually agreed, through at least June 30, 2024, to waive the advisory fee payable by the Fund in an amount equal to 100% of the net advisory fees the Adviser receives from the affiliated money market funds on investments by the Fund of uninvested cash (excluding investments of cash collateral from securities lending) in such affiliated money market funds.

| | |

| 16 | | Invesco EQV European Small Company Fund |

For the year ended December 31, 2022, the Adviser waived advisory fees of $12,726.

The Trust has entered into a master administrative services agreement with Invesco pursuant to which the Fund has agreed to pay Invesco for certain administrative costs incurred in providing accounting services to the Fund. For the year ended December 31, 2022, expenses incurred under the agreement are shown in the Statement of Operations as Administrative services fees. Invesco has entered into a sub-administration agreement whereby State Street Bank and Trust Company (“SSB”) serves as fund accountant and provides certain administrative services to the Fund. Pursuant to a custody agreement with the Trust on behalf of the Fund, SSB also serves as the Fund’s custodian.

The Trust has entered into a transfer agency and service agreement with Invesco Investment Services, Inc. (“IIS”) pursuant to which the Fund has agreed to pay IIS a fee for providing transfer agency and shareholder services to the Fund and reimburse IIS for certain expenses incurred by IIS in the course of providing such services. IIS may make payments to intermediaries that provide omnibus account services, sub-accounting services and/or networking services. All fees payable by IIS to intermediaries that provide omnibus account services or sub-accounting services are charged back to the Fund, subject to certain limitations approved by the Trust’s Board of Trustees. For the year ended December 31, 2022, expenses incurred under the agreement are shown in the Statement of Operations as Transfer agent fees.

The Trust has entered into master distribution agreements with Invesco Distributors, Inc. (“IDI”) to serve as the distributor for the Class A, Class C, Class Y and Class R6 shares of the Fund. The Trust has adopted plans pursuant to Rule 12b-1 under the 1940 Act with respect to the Fund’s Class A and Class C shares (collectively, the “Plans”). The Fund, pursuant to the Plans, pays IDI compensation at the annual rate of 0.25% of the Fund’s average daily net assets of Class A shares and 1.00% of the average daily net assets of Class C shares. The fees are accrued daily and paid monthly. Of the Plan payments, up to 0.25% of the average daily net assets of each class of shares may be paid to furnish continuing personal shareholder services to customers who purchase and own shares of such classes. Any amounts not paid as a service fee under the Plans would constitute an asset-based sales charge. Rules of the Financial Industry Regulatory Authority (“FINRA”) impose a cap on the total sales charges, including asset-based sales charges, that may be paid by any class of shares of the Fund. For the year ended December 31, 2022, expenses incurred under the Plans are shown in the Statement of Operations as Distribution fees.

Front-end sales commissions and CDSC (collectively, the “sales charges”) are not recorded as expenses of the Fund. Front-end sales commissions are deducted from proceeds from the sales of Fund shares prior to investment in Class A shares of the Fund. CDSC are deducted from redemption proceeds prior to remittance to the shareholder. During the year ended December 31, 2022, IDI advised the Fund that IDI retained $6,711 in front-end sales commissions from the sale of Class A shares and $1,109 and $1,020 from Class A and Class C shares, respectively, for CDSC imposed upon redemptions by shareholders.

For the year ended December 31, 2022, the Fund incurred $646 in brokerage commissions with Invesco Capital Markets, Inc., an affiliate of the Adviser and IDI, for portfolio transactions executed on behalf of the Fund.

Certain officers and trustees of the Trust are officers and directors of the Adviser, IIS and/or IDI.

NOTE 3–Additional Valuation Information

GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods may result in transfers in or out of an investment’s assigned level:

| | |

| Level 1 - | | Prices are determined using quoted prices in an active market for identical assets. |

| Level 2 - | | Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others. |

| Level 3 - | | Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect the Adviser’s assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information. |

The following is a summary of the tiered valuation input levels, as of December 31, 2022. The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | Total | |

|

| |

Investments in Securities | | | | | | | | | | | | | | |

|

| |

Denmark | | $ | – | | | $ | 1,588,307 | | | $– | | $ | 1,588,307 | |

|

| |

France | | | – | | | | 52,212,803 | | | – | | | 52,212,803 | |

|

| |

Georgia | | | – | | | | 6,294,247 | | | – | | | 6,294,247 | |

|

| |

Germany | | | – | | | | 444,119 | | | – | | | 444,119 | |

|

| |

Greece | | | – | | | | 3,187,278 | | | – | | | 3,187,278 | |

|

| |

Ireland | | | – | | | | 5,589,558 | | | – | | | 5,589,558 | |

|

| |

Israel | | | 1,279,845 | | | | 7,092,776 | | | – | | | 8,372,621 | |

|

| |

Italy | | | – | | | | 5,176,458 | | | – | | | 5,176,458 | |

|

| |

Netherlands | | | – | | | | 2,911,612 | | | – | | | 2,911,612 | |

|

| |

Norway | | | – | | | | 1,728,513 | | | – | | | 1,728,513 | |

|

| |

Poland | | | – | | | | 8,848,577 | | | – | | | 8,848,577 | |

|

| |

Portugal | | | 1,189,689 | | | | – | | | – | | | 1,189,689 | |

|

| |

Romania | | | – | | | | 8,323,305 | | | – | | | 8,323,305 | |

|

| |

Singapore | | | – | | | | 1,778,524 | | | – | | | 1,778,524 | |

|

| |

Sweden | | | – | | | | 2,281,059 | | | – | | | 2,281,059 | |

|

| |

Switzerland | | | – | | | | 6,236,809 | | | – | | | 6,236,809 | |

|

| |

United Kingdom | | | – | | | | 46,534,608 | | | – | | | 46,534,608 | |

|

| |

United States | | | – | | | | 2,476,395 | | | – | | | 2,476,395 | |

|

| |

Money Market Funds | | | 8,185,797 | | | | – | | | – | | | 8,185,797 | |

|

| |

Total Investments | | $ | 10,655,331 | | | $ | 162,704,948 | | | $– | | $ | 173,360,279 | |

|

| |

| | |

| 17 | | Invesco EQV European Small Company Fund |

NOTE 4–Expense Offset Arrangement(s)