Title and Risks

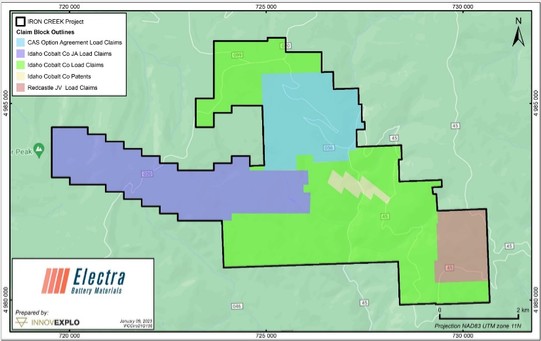

The Iron Creek Project consists of seven patented lode mining claims that straddle Iron Creek, and a surrounding group of 416 unpatented lode mining claims. Together the patented and unpatented claims cover an area of 8,075 acres (32.68km2).

The patented mining claims, which are 100% held by Idaho Cobalt (as defined below), are described as Iron No.118, Iron No.135, Iron No.136, Iron No.143, Iron No.144, Iron No.182 and Iron No.189 of the Idaho Mineral Survey No. 3613, located in portions of Section 20 and Section 21, Township 19 North, Range 20 East, B.M., Parcel #RP9900000109A, Blackbird Mining District, Lemhi County, Idaho.

On March 12, 2021, the Company, through Idaho Cobalt Company (“Idaho Cobalt”), a wholly-owned subsidiary of the Company, purchased the JA1 to 103 unpatented mining claims, and as such holds 100% of such claims, from with Arizona Lithium Company (“Arizona”). Arizona retains a 1.0% NSR royalty, and the Company has the right to purchase 0.5% of the royalty for $750,000 and an unrestricted right of first refusal to acquire the remaining 0.5% of the NSR royalty.

On March 21, 2021, the Company, through Idaho Cobalt, entered into an earn-in and joint venture agreement with Borah Resources and Phoenix Copper for the SCOB1 to 30 unpatented mineral claims (“Redcastle”). Under the agreement, the Company may earn a 51% interest in Redcastle by investing US$1,500,000 on or before the third anniversary of the effective date of the agreement. It may earn a 75% interest by investing an additional US$1,500,000 on or before the by the fifth anniversary. If, after the joint venture is formed, the ownership interest of a party is reduced to 10% or below, such interest will be converted to a 2.5% NSR dilution royalty. The other party will have the right to buy-down the dilution royalty at a rate of US$500,000 per 0.5%, and shall retain a right of first refusal on any proposed sale of the dilution royalty to a third party. The Redcastle agreement is subject to a mutual area of interest provision.

On March 22, 2022, the Issuer through Idaho Cobalt entered into a Property option agreement with Richard Fox to acquire the CAS1-46, IRON1-7, IRON14-15 and IRON31-61 unpatented mining claims for US$1.5 million (“CAS”), payable over 10 years upon completion of specific milestones. Richard Fox retains a 1.5% NSR royalty which the Issuer may purchase for US$500,000 within one year of commercial production from the CAS property. The Fox agreement is subject to a mutual area of interest provision.

The unpatented mining claims included within the Iron Creek Project have no expiration date if the annual claim maintenance fees are paid by August 31 of each year. These fees have been paid in full to September 1, 2023. The patents are not subject to annual claim-maintenance fees, but applicable real and immovable property taxes are payable to Lemhi County annually. The total annual land holding costs are estimated to be US$68,984.34.

The Company does not know of any significant factors or risks that might affect access or title, or the right or ability to perform work on, the Iron Creek Project, including permitting and environmental liabilities to which the Iron Creek Project is subject. The company may not meet is JV expenditure obligation for the Redcastle JV which would forefit their rights to the SCOB claims and additional claims within the Redcastle AOI. The company may not meet its work commitment and milestone payments under the CAS option agreement which would forefit their rights to the optioned claims and additional claims located within the CAS AOI.

History

The area of the Iron Creek Project zone initially drew interest as an iron prospect in 1946. In 1967, during construction of a logging road, Mr. L. Abbey staked 14 claims on copper-stained material in what later became known as the “No Name” zone. In May 1970, these claims were leased to Sachem Prospects Corporation (“Sachem”), a division of the POM Corporation of Salt Lake City, Utah.

Sachem carried out claim staking, geologic mapping, aerial photography, and induced polarization, self- potential, magnetic and geochemical surveys of the No Name zone.

Hanna Mining (“Hanna”) optioned the historical Iron Creek Project in 1972 through its wholly owned subsidiaries, Coastal Mining Co. (“Coastal”) and Idaho Mining Co. and acquired it outright through a legal action in 1973. Between 1972 and 1974, Hanna conducted a preliminary evaluation of the No Name zone for copper and cobalt, as well as areas outside the current Iron Creek Project. Coastal’s work for Hanna included construction of topographic base maps, a soil-geochemical survey for copper and cobalt, and a reconnaissance induced-polarization and resistivity survey, a stream sediment survey, an aeromagnetic survey, geologic mapping, diamond-core drilling, underground development and metallurgical testing.

In 1979, Noranda Exploration, Inc. (“Noranda”) optioned the nearby Blackbird mine from Hanna that included a 75% interest in the Iron Creek Project. Noranda conducted geologic mapping, re-logged three of the Coastal drill holes, conducted a soil-sample orientation