UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23783

(Investment Company Act file number)

Opportunistic Credit Interval Fund

(Exact name of Registrant as specified in charter)

650 Madison Avenue, 23rd Floor

New York, NY 10022

(Address of principal executive offices)(Zip code)

The Corporation Trust Company

Corporation Trust Center, 1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 891-2880

Date of fiscal year end: September 30

Date of reporting period: October 1, 2022 - March 31, 2023

Item 1. Reports to Stockholders.

Table of Contents

| Shareholder Letter | 1 |

| Portfolio Update | 5 |

| Schedule of Investments | 7 |

| Statement of Assets and Liabilities | 10 |

| Statement of Operations | 11 |

| Statements of Changes in Net Assets | 12 |

| Statement of Cash Flows | 13 |

| Financial Highlights | |

| Class I | 14 |

| Notes to Financial Statements | 15 |

| Additional Information | 24 |

| Privacy Notice | 25 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

| | March 31, 2023 (Unaudited) |

Dear Shareholders:

We are pleased to share the performance and market perspective for the Opportunistic Credit Interval Fund (the “Fund”), for the half year ended March 31, 2023.

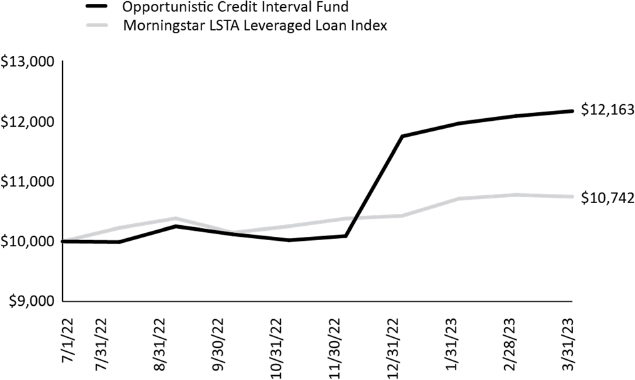

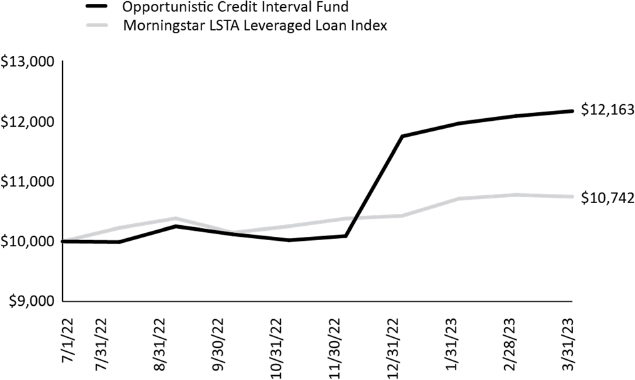

The Fund1 dramatically outperformed in the six-month period (up 20.19%)1, well ahead of the S&P/LSTA Leveraged Loan Total Return Index2 (5.94%).

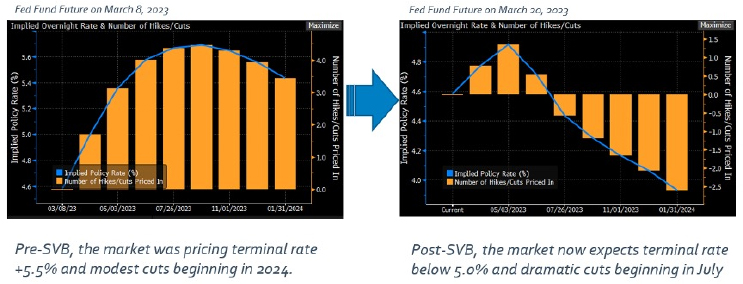

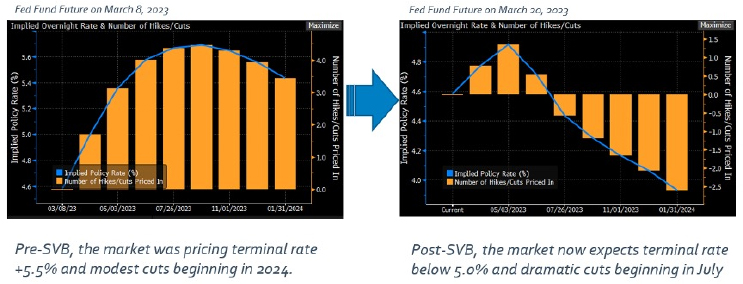

As noted in our year-end letter, in early 2023 the market had been anticipating higher interest rates as the U.S. Federal Reserve battled to arrest inflation. The mini-banking panic prompted by the collapse of Silicon Value Bank (SVB) has dramatically shifted this expectation.

As highlighted in the graphs below, immediately before SVB, the market anticipated hikes that would bring the Fed Funds rates to roughly 5.5%. In the wake of recent banking stress, the market now expects two interest rates cuts this year:

We believe this dramatic shift provides a troubling backdrop for markets.

| Semi-Annual Report | March 31, 2023 | 1 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

| | March 31, 2023 (Unaudited) |

First, we highlight the logical inconsistency implied by current market signals. As illustrated below, the S&P 5003 is currently trading at 29.5 times earnings versus long-term mean of 17.02 based on the Schiller PE Ratio (our preferred benchmark) which measures earnings per share over a 10 year period to adjust for changes of a business cycle:

This lofty multiple signals an optimistic view from the equity market, implying little risk of economic storm on the horizon. The credit markets, however, are sending a markedly different message by pricing-in two cuts this year.

The Fed is not going to cut rates for the sake of cutting rates. In fact, the Fed has an incentive to push interest rates as high as possible. Each hike represents future cuts whenever the economy eventually rolls-over. Diminished capacity and muted political appetite for Quantitative Easing (QE)(6)—not to mention the inflationary implications—elevates the importance of these hikes. Employing the hackneyed metaphor, the Fed needs to reload the gun while it can.

Hence, we cannot envision the Fed cutting in 2023 unless the economy essentially collapses (a scenario we find unlikely). This dynamic nevertheless underscores the incongruent messages by equity and interest rate markets.

Additionally, if credit market signals prove correct and the economy deteriorates to an extent that cuts are warranted, equity markets would likely re-price lower. If credit markets are proven wrong and the economy remains stable, and the Fed does not cut, this would suggest inflation remains persistent, likely requiring long-duration assets and PE-multiples(7) to contract as well.

Either scenario would suggest equity markets currently are broadly mispriced.

Time will determine which signal is “right.” In our view, inflation, which shapes the direction of rates, will ultimately dictate the path.

| 2 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

| | March 31, 2023 (Unaudited) |

As we previously highlighted, inflation has continued to cool from its peak as pressure on “goods” has abated. March CPI of 5.0% reflected material improvement from the high single digit levels evident in summer 2022. We would emphasize that 5.0% remains materially above the Fed's longterm 2.0% target.

In our view, even if U.S. GDP dips into negative territory in the coming quarters, the Fed will not be able to cut if inflation remains elevated. This dynamic heightened our view the cuts in 2023 feel very unlikely.

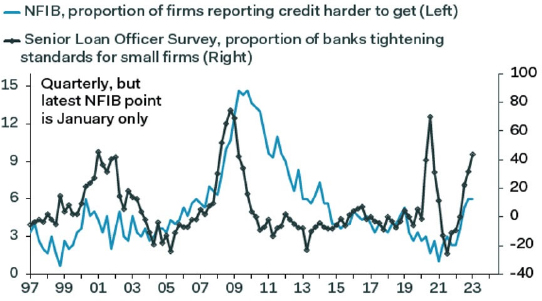

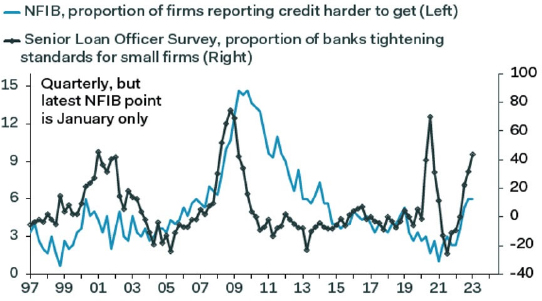

Away from monetary policy, another significant factor shaping the path of markets will be the impact of the recent banking panic. As evident in the graph below, credit conditions had already begun to tighten prior to SVB:

Source: Senior Loan Officer Opinion Survey, National Federation of Independent Businesses and Pantheon Macroeconomics (3/31/2023)

Following the collapse of SVB, credit conditions have deteriorated as banks have halted lending to shore-up their balance sheets. Only time will tell how long banks remain on the sidelines, but we expect this pullback will weigh on economic growth.

From a Fund standpoint, we view this as an opportunity.

In recent weeks, inbound calls from bankers and management teams seeking capital have increased dramatically. Our pipeline of deals has reached levels we haven't seen since the pandemic peak.

As an example, earlier this week we submitted a Term Sheet to a small public company that would yield the Fund a return of greater than 50%. This potential transaction does not suggest that all of our deals imply such eye-popping returns, nor does a Term Sheet suggest a deal will ultimately get executed; further diligence is unquestionably required. However, this Term Sheet in emblematic of the current market.

We do not cheer economic turmoil, given the uncertainty that often besets businesses and investor. Nevertheless, periods of market stress have consistently translated into opportunities for the BC Credit platform.

Fund Updates

The Fund launched in July 2022 amid a volatile market backdrop, particularly in fixed income due to the Fed's dramatic shift in rate policy. Mindful of the unsettled backdrop and the Fed's efforts to tame inflation, the Fund's ramp has focused on 1st lien senior secured risk.

With banks in retreat and muted secondary activity, we sought uniquely dislocated opportunities which helped to drive significant outperformance during the period.

In addition to several “hung” first lien opportunities that the Fund identified in the back half of calendar 2022, BC's proprietary pipeline uncovered two opportunities that drove Fund's near-term performance.

In connection with the wind-down of a private credit fund (with whom BC Partners has enjoyed a long-term relationship), the Fund acquired first lien term loans for Camino, a manufacturer and distributor of raised access flooring for office buildings, as well as Hostway, a provider of domain hosting, security and managed private and public cloud services, at 11¢ and 25¢, respectively. Due to the circumstances, these positions were acquired meaningfully below fair market value as validated by subsequent third-party valuations. For further context, top contributors included Camino, Hostway, and Ivanti (traded up to 82c from 77c at investment). The three positions that detracted most from Fund performance during the period included BCP Great Lakes (traded off from par to 97c), CIMSense (99c to 95c), and Source Advisors (99c to 98c).

| Semi-Annual Report | March 31, 2023 | 3 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

| | March 31, 2023 (Unaudited) |

With the portfolio fully ramped and actionable dislocated opportunities increasingly difficult to come by, the Fund has begun to layer in privately originated deals. The Fund added investments in Grindr, the manager and operator of a mobile dating app, and Dentive, a multi-specialty dental service organization, during the period. We expect these private deals, while less liquid, to provide some intra-quarter NAV stability which we view as increasingly important as we progress through a volatile 2023.

Conclusion

While spreads remain muted, higher rates and bouts of volatility have created a much more attractive investment environment for non-traditional fixed income. As a result, we are seeing more opportunities than there is capital in the current market.

Market crashes are an unpredictable inevitability. When they happen, prices often become divorced from reality. Leveraging today both amplifies downside in periods of stress and reduces the ability buy at fire sale prices.

Other managers may boast of higher short-term yields. We would boast our patience and discipline.

We thank our shareholders for their continued partnership. As always, we are always available to you and your clients.

Regards,

Matthias Ederer

Portfolio Manager

Opportunistic Credit Interval Fund

| 1 | Fund performance refers to that of Class I. Unless otherwise stated, all performance figures provided are for the period July 1, 2022 (inception date) through March 31, 2023. Past performance is not indicative of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. For performance information current to the most recent month-end, please call toll-free 1-833-404-4103. |

The Adviser and the Fund have entered into an Expense Limitation Agreement under which the Adviser has agreed, until at least August 30, 2023 to waive its management fees (excluding any incentive fee) and to pay or absorb the ordinary operating expenses, of the Fund (excluding interest, dividends, amortization/accretion and interest on securities sold short, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that its management fees plus the Fund’s ordinary annual operating expenses exceed 2.50% per annum of the Fund's average daily net assets attributable to Class I shares. Such Expense Limitation Agreement may not be terminated by the Adviser, but it may be terminated by the Board of Trustees, upon 60 days written notice to the Adviser. Any waiver or reimbursement by the Adviser is subject to repayment by the Fund within the three (3) years from the date the Adviser waived any payment or reimbursed any expense, if the Fund is able to make the repayment without exceeding the lesser of the expense limitation in place at the time of the waiver or the current expense limitation and the repayment is approved by the Board of Trustees. See “Management of the Fund.”

| 2 | S&P/LSTA Leveraged Loan Total Return Index - S&P/LSTA Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Investors cannot invest directly in an index. |

| 3 | S&P 500 - The S&P 500 is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S. Investors cannot invest directly in an index. |

| 6 | Quantitative easing is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to increase the domestic money supply and stimulate economic activity. |

| 7 | The PE Multiple, price-to-earnings multiple, is the ratio for valuing a company that measures its current share price relative to its per-share earnings." |

| 4 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Portfolio Update |

| March 31, 2023 (Unaudited) |

The Fund’s performance figures for the period ended March 31, 2023, compared to its benchmark:

| Opportunistic Credit Interval Fund | 1 Month | Quarter | 6 Month | YTD | Since Inception | Inception |

| Opportunistic Credit Interval Fund - NAV | 0.69% | 3.57% | 20.19% | 3.57% | 21.63% | 7/1/2022 |

| Morningstar LSTA Leveraged Loan Index | -0.27% | 3.05% | 5.87% | 3.05% | 7.42% | 7/1/2022 |

The S&P/LSTA Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Investors cannot invest directly in an index.

Past performance is not indicative of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. As of the Fund’s most recent prospectus dated January 27, 2023, the Fund’s total annual operating expenses, including acquired fund fees and expenses, before fee waivers is 58.89% for Class I. After fee waivers, the Fund’s total annual operating expense is 3.30% for Class I. For performance information current to the most recent month-end, please call toll-free 1-833-404-4103.

| Semi-Annual Report | March 31, 2023 | 5 |

| Opportunistic Credit Interval Fund | Portfolio Update |

| March 31, 2023 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

Consolidated Portfolio Composition as of March 31, 2023

| Asset Type | Percent of Net Assets |

| Bank Loans | 87.04% |

| Short-Term Investment | 8.60% |

| Joint Venture | 0.92% |

| Total Investments | 96.56% |

| Other Assets In Excess Of Liabilities | 3.44% |

| Net Assets | 100.00% |

Please see the Schedule of Investments for a detailed listing of the Fund’s holdings.

| 6 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Schedule of Investments |

| | March 31, 2023 (Unaudited) |

| | | Coupon | | | Reference Rate & Spread | | Maturity | | | Principal | | | Value | |

| BANK LOANS (87.04%) | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Consumer Discretionary (0.91%) | | | | | | | | | | | | | | | | | | |

| Shock Doctor Sports Inc., First Lien Term Loan(a)(b) | | | 10.20 | % | | 3M SOFR + 5.25%, 1.00% Floor | | | 05/14/2024 | | | $ | 91,336 | | | $ | 89,965 | |

| | | | | | | | | | | | | | | | | | | |

| Consumer Staples (11.57%) | | | | | | | | | | | | | | | | | | |

| Florida Food Products LLC, First Lien Term Loan(a)(b) | | | 9.84 | % | | 1M US L + 5.00%, 0.75% Floor | | | 10/06/2028 | | | | 398,992 | | | | 387,262 | |

| Patriot Pickle, Inc., First Lien Term Loan(a)(b) | | | 9.55 | % | | 3M SOFR + 4.50% | | | 04/13/2027 | | | | 99,244 | | | | 98,003 | |

| Global Integrated Flooring Systems Inc., First Lien Term Loan(a)(b) | | | 13.27 | % | | 3M SOFR +8.36%, 1.25% Floor | | | 05/15/2024 | | | | 1,312,500 | | | | 658,481 | |

| Global Integrated Flooring Systems Inc., Revolver(a)(b)(c) | | | 12.63 | % | | 3M SOFR +7.36%, 1.25% Floor | | | 05/15/2024 | | | | 7,937 | | | | 2,004 | |

| | | | | | | | | | | | | | | | | | 1,145,750 | |

| Financials (2.93%) | | | | | | | | | | | | | | | | | | |

| Fortis Payment Systems, LLC, First Lien Term Loan(a)(b) | | | 10.25 | % | | 3M US L + 5.25% | | | 02/13/2026 | | | | 52,339 | | | | 52,014 | |

| Fortis Payment Systems, LLC, Delayed Draw Term Loan(a)(b) | | | 10.25 | % | | 3M US L + 5.25% | | | 02/13/2026 | | | | 46,900 | | | | 46,609 | |

| Source Advisors, LLC, First Lien Term Loan(a)(b) | | | 9.79 | % | | 6M SOFR + 4.50% | | | 04/06/2028 | | | | 99,250 | | | | 96,769 | |

| CIM Sense, LLC, First Lien Term Loan(a)(b) | | | 10.54 | % | | 3M SOFR + 5.50% | | | 12/17/2026 | | | | 99,378 | | | | 94,906 | |

| | | | | | | | | | | | | | | | | | 290,298 | |

| Health Care (8.23%) | | | | | | | | | | | | | | | | | | |

| Aspen Surgical, Inc. First Lien Term Loan(a)(b) | | | 9.89 | % | | 6M SOFR + 5.00% | | | 08/01/2025 | | | | 99,499 | | | | 97,419 | |

| Global Nephrology Solutions, LLC, First Lien Term Loan(a)(b) | | | 10.80 | % | | 3M SOFR + 5.75% | | | 12/22/2026 | | | | 24,233 | | | | 23,841 | |

| Global Nephrology Solutions, LLC, Delayed Draw Term Loan(a)(b) | | | 10.80 | % | | 3M SOFR + 5.75% | | | 12/22/2026 | | | | 75,154 | | | | 73,937 | |

| South Florida ENT Associates, First Lien Term Loan(a)(b) | | | 12.06 | % | | 3M SOFR + 7.00% | | | 03/04/2025 | | | | 396,444 | | | | 386,930 | |

| Dentive LLC, Delayed Draw Term Loan(a)(c) | | | -% | | | 3M SOFR + 7.00%, 0.75% Floor | | | 12/26/2028 | | | | - | | | | (1,781 | ) |

| Dentive LLC, First Lien Term Loan(a)(b) | | | 11.90 | % | | 1M SOFR + 7.00%, 0.75% Floor | | | 12/26/2028 | | | | 241,237 | | | | 234,000 | |

| | | | | | | | | | | | | | | | | | 814,346 | |

| Industrials (6.32%) | | | | | | | | | | | | | | | | | | |

| Accordion Partners, LLC, Delayed Draw Term Loan A(a)(b) | | | 11.39 | % | | 3M SOFR + 6.50%, 0.75% Floor | | | 08/29/2029 | | | | 7,299 | | | | 7,163 | |

| Accordion Partners, LLC, Delayed Draw Term Loan B(a)(c) | | | -% | | | 3M SOFR + 6.25%, 0.75% Floor | | | 08/29/2029 | | | | - | | | | (171 | ) |

| Accordion Partners, LLC, First Lien Term Loan A(a)(b) | | | 11.15 | % | | 3M SOFR + 6.25%, 0.75% Floor | | | 08/29/2029 | | | | 83,368 | | | | 81,809 | |

| Material Handling Systems, Inc., First Lien Term Loan (a)(b) | | | 12.37 | % | | P + 5.50%, 0.50% Floor | | | 06/08/2029 | | | | 497,500 | | | | 438,895 | |

| Heads Up Technology, LLC, First Lien Term Loan(a)(b) | | | 10.55 | % | | 3M SOFR + 5.50%, 0.75% Floor | | | 08/10/2028 | | | | 99,500 | | | | 98,008 | |

| | | | | | | | | | | | | | | | | | 625,704 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2023 | 7 |

| Opportunistic Credit Interval Fund | Schedule of Investments |

| | March 31, 2023 (Unaudited) |

| | | Coupon | | | Reference Rate & Spread | | Maturity | | | Principal | | | Value | |

| Information Technology (57.08%) | | | | | | | | | | | | | | | | | | |

| Alegeus Technologies Holdings Corp., First Lien Term Loan(a)(b) | | | 10.95 | % | | 3M US L + 8.25% | | | 09/05/2024 $ | | | | 365,000 | | | $ | 365,000 | |

| Athos Merger Sub LLC, First Lien Term Loan(a)(b) | | | 9.84 | % | | 1M US L + 5.00% | | | 07/31/2026 | | | | 238,612 | | | | 232,461 | |

| Athos Merger Sub LLC, Second Lien TermLoan(a)(b) | | | 13.09 | % | | 1M US L + 8.25% | | | 07/31/2027 | | | | 160,771 | | | | 153,537 | |

| Help Systems Purchaser LLC, First Lien Term Loan(b) | | | 8.78 | % | | 3M SOFR + 4.00%, 0.75% Floor | | | 11/19/2026 | | | | 407,897 | | | | 364,966 | |

| Ivanti Software, Inc., First Lien TermLoan(a)(b) | | | 9.21 | % | | 3M US L + 4.25%, 0.75% Floor | | | 12/01/2027 | | | | 473,807 | | | | 390,765 | |

| Kofax, Inc., First Lien Term Loan(a)(b) | | | 9.80 | % | | 6M SOFR + 5.25% | | | 06/15/2029 | | | | 500,000 | | | | 462,580 | |

| Smartdata Solutions, LLC, First Lien TermLoan(a)(b) | | | 9.66 | % | | 1M SOFR + 4.75% | | | 09/30/2027 | | | | 99,244 | | | | 97,140 | |

| Taoglas Group Holdings Limited, First Lien Term Loan(a)(b) | | | 11.90 | % | | 3M SOFR + 7.00% | | | 02/28/2029 | | | | 314,003 | | | | 304,583 | |

| Taoglas Group Holdings Limited, Revolver(a)(c) | | | -% | | | 3M SOFR + 7.00% | | | 02/28/2029 | | | | - | | | | (2,580 | ) |

| Grindr Capital LLC, Delayed Draw Term Loan(a)(b) | | | 13.02 | % | | 3M SOFR + 8.00%, 1.50% Floor | | | 11/14/2027 | | | | 1,750,000 | | | | 1,732,500 | |

| HDC / HW Intermediate Holdings, LLC, First Lien Term Loan(a)(h) | | | 14.34 | % | | 3M SOFR + 7.50%, 2.00% PIK, 1.00% Floor | | | 12/21/2023 | | | | 1,254,113 | | | | 971,938 | |

| HDC / HW Intermediate Holdings, LLC, Revolver(a)(h) | | | 14.34 | % | | 3M SOFR + 7.50%, 2.00% PIK, 1.00% Floor | | | 12/21/2023 | | | | 128,792 | | | | 99,814 | |

PEAK Technology Partners, Inc., First Lien Term Loan(a)(b) | | | 11.06 | % | | 3M SOFR + 6.40% | | | 07/22/2027 | | | | 99,750 | | | | 97,535 | |

| Tank Holding Corp., Revolver(a)(b)(c) | | | 10.62 | % | | 1M SOFR + 5.75% | | | 03/31/2028 | | | | 1,940 | | | | 1,193 | |

| Tank Holding Corp., First Lien Term Loan(a)(b) | | | 10.66 | % | | 1M SOFR + 5.75% | | | 03/31/2028 | | | | 395,187 | | | | 380,861 | |

| | | | | | | | | | | | | | | | | | 5,652,293 | |

| TOTAL BANK LOANS | | | | | | | | | | | | | | | | | | |

| (Cost $7,457,981) | | | | | | | | | | | | | | | | | 8,618,356 | |

| | | Shares | | | Value | |

| JOINT VENTURE (0.92%) | | | | | | | | |

| Great Lakes Funding II LLC, Series A(c)(d)(e)(f) | | | 93,960 | | | | 91,395 | |

| | | | | | | | | |

| TOTAL JOINT VENTURE | | | | | | | | |

| (Cost $93,960) | | | | | | | 91,395 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT (8.60%) | | | | | | | | |

| First American Government Obligations Fund, 4.62%(g) | | | 851,346 | | | | 851,346 | |

| | | | | | | | | |

| TOTAL SHORT-TERM | | | | | | | | |

| INVESTMENT | | | | | | | | |

| (Cost $851,346) | | | | | | | 851,346 | |

| | | | | | | | | |

| INVESTMENTS, AT VALUE | | | | | | | | |

| (96.56%) | | | | | | | | |

| (Cost $8,403,287) | | | | | | $ | 9,561,097 | |

| | | | | | | | | |

| Other Assets In Excess Of Liabilities (3.44%) | | | | | | | 340,588 | |

| NET ASSETS (100.00%) | | | | | | $ | 9,901,685 | |

| Investment Abbreviations: | | | | | | | | |

| LIBOR - London Interbank Offered Rate | | | | | | | | |

| See Notes to Financial Statements. | |

| 8 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Schedule of Investments |

| | March 31, 2023 (Unaudited) |

SOFR - Secured Overnight Financing Rate

P - Prime Rate

Reference Rates:

1M US L - 1 Month LIBOR as of March 31, 2023 was 4.86%

3M US L - 3 Month LIBOR as of March 31, 2023 was 5.19%

6M US L - 6 Month LIBOR as of March 31, 2023 was 5.31%

3M US SOFR - 3 Month US SOFR as of March 31, 2023 was 4.91%

6M US SOFR - 6 Month US SOFR as of March 31, 2023 was 4.90%

12M US SOFR - 12 Month US SOFR as of March 31, 2023 was 4.73%

P - Prime rate as of March 31, 2023 was 8.00%

| (a) | As a result of the use of significant unobservable inputs to determine fair value, these investments have been classified as Level 3 assets. |

| (b) | Variable rate investment. Interest rates reset periodically. Interest rate shown reflects the rate in effect at March 31, 2023. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description above. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (c) | All or a portion of this commitment was unfunded as of March 31, 2023. |

| (e) | Non-income producing security. |

| (f) | During the period ended March 31, 2023, the Fund invested $38,659 in Great Lakes Funding II LLC - Series A units, received a return of capital distribution of $148, and reported change in unrealized depreciation of $-1,018 on Great Lakes Funding II LLC - Series A units. Additionally, Great Lakes Funding II LLC - Series A declared distributions of $5,470 during the period ended March 31, 2023. |

| (g) | Money market fund; interest rate reflects seven-day effective yield on March 31, 2023. |

Additional information on investments in private investment funds:

Security |

|

Value |

|

| Redemption

Frequency |

|

| Redemption

Notice(Days) |

|

| Unfunded Commitments

as of March 31, 2023 |

|

| Great Lakes Funding II LLC, Series A | | $ | 91,395 | | | | N/A | | | | N/A | | | $ | 4,988 | |

| Total | | $ | 91,395 | | | | | | | | | | | $ | 4,988 | |

Unfunded Commitments

| Security | | Value | | | Maturity Date | | | Unfunded Commitments as of March 31, 2023 | |

| Accordion Partners, LLC, Delayed Draw Term Loan B | | $ | (171 | ) | | | 8/29/2029 | | | $ | 9,124 | |

| Global Integrated Flooring Systems Inc., Revolver | | | 2,004 | | | | 5/15/2024 | | | | 3,968 | |

| Dentive LLC, Delayed Draw Term Loan | | | (1,781 | ) | | | 12/26/2028 | | | | 118,763 | |

| Tank Holding Corp., Revolver | | | 1,193 | | | | 03/31/2028 | | | | 4,908 | |

| Taoglas Group Holdings Limited, Revolver | | | (2,580 | ) | | | 2/28/2029 | | | | 85,997 | |

| Total | | $ | (1,335 | ) | | | | | | $ | 222,760 | |

| Total Unfunded Commitments | | | | | | | | | | $ | 227,748 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2023 | 9 |

| Opportunistic Credit Interval Fund | Statement of Assets and Liabilities |

| | March 31, 2023 (Unaudited) |

| ASSETS | | | |

| Investments, at value (Cost $8,403,287) | | $ | 9,561,097 | |

| Interest and distributions receivable | | | 175,025 | |

| Receivable for investments sold | | | 258,125 | |

| Due from Adviser | | | 222,059 | |

| Prepaid expenses and other assets | | | 9,918 | |

| Total assets | | | 10,226,224 | |

| | | | | |

| LIABILITIES | | | | |

| Accrued expenses and other liabilities | | | 324,539 | |

| Total liabilities | | | 324,539 | |

| NET ASSETS | | $ | 9,901,685 | |

| | | | | |

| NET ASSETS CONSISTS OF | | | | |

| Paid-in capital | | $ | 8,567,741 | |

| Total distributable earnings | | | 1,333,944 | |

| NET ASSETS | | $ | 9,901,685 | |

| | | | | |

| Common Shares: | | | | |

| Institutional | | | | |

| Net assets | | $ | 9,901,685 | |

| Shares of beneficial interest outstanding (no par value; unlimited shares) | | | 849,582 | |

| Net asset value | | $ | 11.65 | |

| See Notes to Financial Statements. | |

| 10 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Statement of Operations |

| For the Six Months Ended March 31, 2023 (Unaudited) |

| INVESTMENT INCOME | | | |

| Interest | | $ | 569,421 | |

| Dividends | | | 5,470 | |

| Other Income | | | 11,916 | |

| Total investment income | | | 586,807 | |

| EXPENSES | | | | |

| Investment advisory fees (Note 4) | | | 59,817 | |

| Administrative fees (Note 4) | | | 234,564 | |

| Transfer agent fees (Note 4) | | | 7,637 | |

| Professional fees | | | 115,359 | |

| Printing expense | | | 5,937 | |

| Custody fees | | | 24,855 | |

| Insurance expense | | | 79,283 | |

| Trustee fees and expenses (Note 4) | | | 25,969 | |

| Other expenses | | | 17,678 | |

| Total expenses | | | 571,099 | |

| Fees waived/expenses reimbursed by Adviser (Note 4) | | | (464,173 | ) |

| Total net expenses | | | 106,926 | |

| NET INVESTMENT INCOME | | | 479,881 | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | | |

| Net realized gain on investments | | | 54,887 | |

| Total net realized gain | | | 54,887 | |

| Net change in unrealized appreciation on investments | | | 1,178,545 | |

| Net change in unrealized depreciation on affiliated investments | | | (1,018 | ) |

| Total net change in unrealized appreciation | | | 1,177,527 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 1,232,414 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 1,712,295 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2023 | 11 |

| Opportunistic Credit Interval Fund | Statements of Changes in Net Assets | |

| | | For the Six Months Ended March 31,2023 (Unaudited) | | | For the Period July 5, 2022 to September 30, 2022(a) | |

| OPERATIONS | | | | | | |

| Net investment income | | $ | 479,881 | | | $ | 8,043 | |

| Net realized gain on investments | | | 54,887 | | | | 25,491 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | 1,177,527 | | | | (19,717 | ) |

| Net increase in net assets resulting from operations | | | 1,712,295 | | | | 13,817 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total Distributable Earnings Institutional | | | (392,168 | ) | | | - | |

| Total distributions to shareholders | | | (392,168 | ) | | | - | |

| | | | | | | | | |

| COMMON SHARE TRANSACTIONS | | | | | | | | |

| Institutional | | | | | | | | |

| Proceeds from sales of shares | | | 6,088,000 | | | | 2,210,000 | |

| Distributions reinvested | | | 169,741 | | | | - | |

| Net increase from share transactions | | | 6,257,741 | | | | 2,210,000 | |

| Total net increase from in net assets | | | 7,577,868 | | | | 2,223,817 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 2,323,817 | | | | 100,000 | |

| End of period | | $ | 9,901,685 | | | $ | 2,323,817 | |

| | | | | | | | | |

| OTHER INFORMATION | | | | | | | | |

| Common Shares Transactions | | | | | | | | |

| Institutional | | | | | | | | |

| Issued | | | 603,469 | | | | 219,708 | |

| Distributions reinvested | | | 16,405 | | | | - | |

| Net increase in shares | | | 619,874 | | | | 219,708 | |

| (a) | The Fund commenced operations on July 5, 2022. |

| See Notes to Financial Statements. | |

| 12 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Statement of Cash Flows |

| For the Six Months Ended March 31, 2023 (Unaudited) |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net increase in net assets from operations | | $ | 1,712,295 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchase of investment securities | | | (8,547,783 | ) |

| Proceeds from sale of investment securities | | | 3,250,706 | |

| Purchase of short-term investment securities - net | | | (386,508 | ) |

| Amortization of discount and accretion of discount on investments | | | (159,949 | ) |

| Net realized (gain)/loss on: | | | | |

| Investments | | | (54,877 | ) |

| Net change in unrealized (appreciation)/depreciation on: | | | | |

| Investments | | | (1,177,527 | ) |

| (Increase)/Decrease in assets: | | | | |

| Due from Advisor | | | (27,187 | ) |

| Interest and distributions receivable | | | (143,450 | ) |

| Prepaid expenses and other assets | | | (4,018 | ) |

| Receivable for investments sold | | | 258,125 | |

| Increase/(Decrease) in liabilities: | | | | |

| Payable for investments purchased | | | (274,457 | ) |

| Accrued expenses and other liabilities | | | 205,318 | |

| Net cash used in operating activities | | | (5,865,573 | ) |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from sales of shares | | | 6,088,000 | |

| Cash distributions paid | | | (222,427 | ) |

| Net cash provided by financing activities | | | 5,865,573 | |

| | | | | |

| Net change in cash & cash equivalents | | | - | |

| | | | | |

| Restricted and unrestricted cash, end of period | | $ | - | |

| Non-cash financing activities not included herein consist of reinvestment of distributions of: | | $ | 169,741 | |

| | | | | |

| Net increase in cash | | | - | |

| Cash, beginning balance | | $ | - | |

| Cash, ending balance | | $ | - | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2023 | 13 |

| Opportunistic Credit Interval Fund | Financial Highlights |

| For a Share Outstanding Throughout the Periods Presented |

| | | For the Six Months Ended March 31, 2023 (Unaudited) | | | For the Period Ended September 30, 2022(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.12 | | | $ | 10.00 | |

| | | | | | | | | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS | | | | | | | | |

| Net investment income(b) | | | 0.61 | | | | 0.05 | |

| Net realized and unrealized gain on investments | | | 1.39 | | | | 0.07 | |

| Total income from investment operations | | | 2.00 | | | | 0.12 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (0.47 | ) | | | — | |

| From net realized gain on investments | | | — | | | | — | |

| Total distributions | | | (0.47 | ) | | | — | |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | 1.53 | | | | 0.12 | |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.65 | | | $ | 10.12 | |

| | | | | | | | | |

| TOTAL RETURN(c) | | | 20.19 | % | | | 1.20 | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 9,902 | | | $ | 2,324 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS(d) | | | | | | | | |

| Expenses, gross | | | 13.35 | %(e) | | | 56.18 | %(e) |

| Expenses, net of fees waived/expenses reimbursed by Adviser | | | 2.50 | %(e) | | | 2.42 | %(e) |

| Net investment income | | | 11.22 | %(e) | | | 2.17 | %(e) |

| | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 99.79 | %(e) | | | 106 | %(e) |

| (a) | The Fund's Class I commenced operations on July 5, 2022. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Returns shown exclude applicable sales charges. |

| (d) | Ratios do not include expenses of underlying investment companies and private investment funds in which the Fund invests. |

| See Notes to Financial Statements. | |

| 14 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Notes to Financial Statements |

| March 31, 2023 (Unaudited) |

1. ORGANIZATION

Opportunistic Credit Interval Fund (the “Fund”) is a closed-end, diversified management Investment Company that is registered under the Investment Company Act of 1940, as amended (the "1940 Act"). The Fund is structured as an interval fund and continuously offers its shares. The Fund was organized as a Delaware statutory trust on January 21, 2022. The Fund inception date was July 1, 2022 and commenced operations on July 5, 2022.

The Fund may issue an unlimited number of shares of beneficial interest. All shares of the Fund have equal rights and privileges. Each share of the Fund is entitled to one vote on all matters as to which shares are entitled to vote. In addition, each share of the Fund is entitled to participate, equally with other shares (i) in dividends and distributions declared by the Fund and (ii) upon liquidation, in the distribution of its proportionate share of the assets remaining after satisfaction of outstanding liabilities. Shares of the Fund are fully paid, non-assessable and fully transferable when issued and have no pre-emptive, conversion or exchange rights. Fractional shares have proportionately the same rights, including voting rights, as are provided for a full share. The Fund offers one class of shares: Class I shares.

The Fund's investment objectives are to produce current income and capital appreciation. The Fund will seek to meet its investment objectives by investing primarily in credit-related instruments of North American and European issuers. The Fund defines credit-related instruments as debt, loans, loan participations, credit facility commitments, asset and lease pool interests, mortgage servicing rights, preferred shares, and swaps linked to credit- related instruments. The Fund's investments will focus on privately originated credit investments as well as secondary credit investments. The Fund will not invest in instruments of emerging market issuers. The Fund will invest without restriction as to an instrument's maturity, structure, seniority, interest rate formula, currency, and without restriction as to issuer capitalization or credit quality. Lower credit quality debt instruments, such as leveraged loans and high yield bonds, are commonly referred to as “junk” bonds. The Fund defines junk bonds as those rated lower than Baa3 by Moody's Investors Services, Inc. (“Moody's”) or lower than BBB by Standard and Poor's Rating Group (“S&P”), or, if unrated, determined by the Adviser to be of similar credit quality.

Under normal circumstances, the Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, in credit-related instruments. The Fund defines credit-related instruments as debt, loans, loan participations, credit facility commitments, asset and lease pool interests, mortgage servicing rights, preferred shares, and swaps linked to credit-related instruments.

Mount Logan Management LLC (the “Adviser”) serves as the Fund's investment adviser.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”). The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services - Investment Companies. These financial statements reflect adjustments that in the opinion of the Fund are necessary for the fair presentation of the financial position and results of operations as of and for the periods presented herein. The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the year. Actual results could differ from those estimates, and such difference could be material. In accordance with U.S. GAAP guidance on consolidation, the Fund will generally not consolidate its investment in a portfolio company other than an investment company subsidiary or a controlled operating company whose business consists of providing services to the Fund.

Securities Transactions and Investment Income - Investment transactions are recorded on the trade date. Realized gains or losses on investments are calculated using the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Premiums on securities are amortized to the earliest call date and purchase discounts are accreted over the life of the respective securities using the effective interest method.

Loans are generally placed on non-accrual status when there is reasonable doubt that principal or interest will be collected in full. The Fund considers many factors relevant to an investment when placing it on or removing it from non-accrual status including, but not limited to, the delinquency status of the investment, economic and business conditions, the overall financial condition of the underlying investment, the value of the underlying collateral, bankruptcy status, if any, and any other facts or circumstances relevant to the investment. Accrued interest is generally reversed when a loan is placed on non-accrual status. Payments received on non-accrual loans may be recognized as income or applied to principal depending upon management's judgment regarding collectability of the outstanding principal and interest. Generally, non-accrual loans may be restored to accrual status when past due principal and interest is paid current and are likely to remain current based on management's judgment.

| Semi-Annual Report | March 31, 2023 | 15 |

| Opportunistic Credit Interval Fund | Notes to Financial Statements |

| | March 31, 2023 (Unaudited) |

Securities Valuation - Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price. In the absence of a sale, such securities shall be valued at the mid-price. Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value. Investments in money market funds are valued at their respective NAVs.

Structured credit and other similar debt securities including, but not limited to, collateralized loan obligations (“CLO”) debt and equity securities, asset-backed securities (“ABS”), commercial mortgage-backed securities (“CMBS”) and other securitized investments backed by certain debt or other receivables (collectively, “Structured Credit Securities”), are valued on the basis of valuations provided by dealers in those instruments and/or independent pricing services recommended by the Adviser and approved by the Fund's board of trustees (the “Board” or “Trustees”). In determining fair value, dealers and pricing services will generally use information with respect to transactions in the securities being valued, quotations from other dealers, market transactions in comparable securities, analyses and evaluations of various relationships between securities and yield to maturity information. The Adviser will, based on its reasonable judgment, select the dealer or pricing service quotation that most accurately reflects the fair market value of the Structured Credit Security while taking into account the information utilized by the dealer or pricing service to formulate the quotation in addition to any other relevant factors. In the event that there is a material discrepancy between quotations received from third-party dealers or the pricing services, the Adviser may (i) use an average of the quotations received or (ii) select an individual quotation that the Adviser, based upon its reasonable judgment, determines to be reasonable. In any instance in which the Adviser selects an individual quotation, the Adviser will provide to the relevant valuation review committee (the “Valuation Committee”) an analysis of the factors relied upon in the selection of the relevant quotation.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Adviser, those securities will be valued at fair value as determined in good faith by the Adviser or the Valuation Committee using procedures adopted by and under the supervision of the Board. The Fund cannot ensure that fair values determined by the Valuation Committee or the Adviser or persons acting in their direction would accurately reflect the price that the Fund could obtain for a security if the security was sold.

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its net asset value (“NAV”) when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

The fair value of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level and supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; and (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve and credit quality.

Valuation of Private Investment Funds - The Fund invests a portion of its assets in private investment funds (“Private Investment Funds”). Private Investment Funds, including a joint venture Great Lakes Funding II LLC (“Great Lakes II JV”), value their investment assets at fair value and generally report a NAV or its equivalent in accordance with U.S. GAAP on a calendar quarter basis. The Fund has elected to apply the practical expedient and to value its investments in Private Investment Funds at their respective NAVs at each quarter-end in accordance with U.S. GAAP. For non-calendar quarter-end days, the Valuation Committee estimates the fair value of each Private Investment Fund by adjusting the most recent NAV for such Private Investment Fund, as necessary, by the change in a relevant benchmark that the Valuation Committee has deemed to be representative of the underlying securities in the Private Investment Fund.

Loan Participation and Assignments - The Fund invests in debt instruments, which are interests in amounts owed to lenders (the “Lenders”) by corporate, governmental or other borrowers. The Fund's investments in loans may be in the form of direct investments, loans originated by the Fund, participations in loans or assignments of all or a portion of the loans from third-parties or exposure to investments in loans through investment in Private Investment Funds or other pooled investment vehicles. When the Fund purchases an interest in a loan in the form of an assignment, the Fund acquires all of the direct rights and obligations of a lender (as such term is defined in the related credit agreement), including the right to vote on amendments or waivers of such credit agreement. However, the Fund generally has no right to enforce compliance with the terms of the loan agreement with the borrower. Instead, the administration of the loan agreement is often performed by a bank or other financial institution (the “Agent”) that acts as agent for the Lenders. Circumstances may arise in connection with which the Agent takes action that contradicts the will of the Lenders. For example, under certain circumstances, an Agent may refuse to declare the borrower in default, despite having received a notice of default from the Lenders. When the Fund purchases an interest in a loan in the form of a participation, the Fund purchases such participation interest from another existing Lender, and consequently, the Fund does not obtain the rights and obligations of the Lenders under the credit agreement, such as the right to vote on amendments or waivers. The Fund has the right to receive payments of principal, interest and any fees to which it is entitled only from the Lender from which the Fund has received that participation interest. In this instance, the Fund is subject to both the credit risk of the borrower and the credit risk of the Lender that sold the Fund such participation interest.

| 16 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Notes to Financial Statements |

| | March 31, 2023 (Unaudited) |

Unfunded Commitments - The Fund may enter into unfunded loan commitments, which are contractual obligations for future funding, such as delayed draw term loans or revolving credit arrangements. Unfunded loan commitments represent a future obligation in full, even though a percentage of the notional loan amounts may not be utilized by the borrower. The Fund may receive a commitment fee based on the undrawn portion of the underlying line of credit portion of a floating rate loan.

Additionally, when the Fund invests in a Private Investment Fund, the Fund makes a commitment to invest a specified amount of capital in the applicable Private Investment Fund. The capital commitment may be drawn by the general partner of the Private Investment Fund either all at once or through a series of capital calls at the discretion of the general partner. The unfunded commitment represents the portion of the Fund's overall capital commitment to a particular Private Investment Fund that has not yet been called by the general partner of the Private Investment Fund.

As of March 31, 2023, the Fund had unfunded commitments of $227,478.

Fair Value Measurements - A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with U.S. GAAP guidance on fair value measurements and disclosure, the Fund discloses the fair value of its investments in a hierarchy that categorizes the inputs to valuation techniques used to measure the fair value.

| Level 1 - | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 - | Quoted prices in markets that are not active, or quoted prices for similar assets or liabilities in active markets, or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability at the measurement date; and |

| Level 3 - | Significant unobservable prices or inputs (including the Fund's own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Fund to measure fair value maximizes the use of observable inputs and minimizes the use of unobservable inputs.

| Semi-Annual Report | March 31, 2023 | 17 |

| Opportunistic Credit Interval Fund | Notes to Financial Statements |

| March 31, 2023 (Unaudited) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the fair values according to the inputs used in valuing the Fund's investments as of March 31, 2023:

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Bank Loans(a) | | | | | | | | | | | | | | | | |

| Consumer Discretionary | | $ | - | | | $ | - | | | $ | 89,965 | | | $ | 89,965 | |

| Consumer Staples | | | - | | | | - | | | | 1,145,750 | | | | 1,145,750 | |

| Financials | | | - | | | | - | | | | 290,298 | | | | 290,298 | |

| Health Care | | | - | | | | - | | | | 814,346 | | | | 814,346 | |

| Industrials | | | - | | | | - | | | | 625,704 | | | | 625,704 | |

| Information Technology | | | - | | | | - | | | | 5,652,293 | | | | 5,652,293 | |

| Short-Term Investment(a) | | | 851,346 | | | | - | | | | - | | | | 851,346 | |

| TOTAL | | $ | 851,346 | $ | | $ | - | | | $ | 8,618,356 | | | $ | 9,469,702 | |

| Investments measured at net asset value(a) | | | | | | | | | | | | | | $ | 91,395 | |

| Total Investments, at fair value | | | | | | | | | | | | | | $ | 9,561,097 | |

(a) For detailed descriptions, see the accompanying Schedule of Investments.

The following table provides a reconciliation of the beginning and ending balances of investments for which the Fund has used Level 3 inputs to determine the fair value:

| Asset Type | | Balance as of September 30, 2022 | | | Accrued Discount/ premium | | | Realized Gain/(Loss) | | | Change in Unrealized Appreciation/ Deperciation | | | Purchases | | | Sales Proceeds | | | Transfer into Level 3 | | | Transfer Out of Level 3 | | | Balance as of March 31, 2023 | | | Net change in unrealized appreciation/ (depreciation) included in the Statements of Operations attributable to Level 3 investments held at March 31, 2023 | |

| Bank Loans | | $ | 1,966,409 | | | $ | 159,949 | | | $ | 54,887 | | | $ | 1,178,545 | | | $ | 8,509,124 | | | $ | (3,250,558 | ) | | $ | - | | | $ | - | | | $ | 8,618,356 | | | $ | 1,178,545 | |

| | | $ | 1,966,409 | | | $ | 159,949 | | | $ | 54,887 | | | $ | 1,178,545 | | | $ | 8,509,124 | | | $ | (3,250,558 | ) | | $ | - | | | $ | - | | | $ | 8,618,356 | | | $ | 1,178,545 | |

| 18 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Notes to Financial Statements |

| March 31, 2023 (Unaudited) |

There are significant unobservable valuation inputs for material Level 3 investments, and a change to the unobservable input may result in a significant change to the value of the investment. Level 3 investment valuation techniques and inputs as of March 31, 2023 are as follows:

| | | | | | Quantitative Information about Level 3 Fair Value Measurements |

| Asset Category | | Fair value at March 31, 2023 | | | Valuation Technique | | Unobservable Input(a) | | Range of Input (Weighted Average) |

| Bank loans | | | | | | | | | |

| Consumer Discretionary | | $ | 89,965 | | | Discounted Cash Flows | | Market Yield | | 12.1% |

| Consumer Staples | | $ | 485,265 | | | Discounted Cash Flows | | Market Yield | | 6.5% - 9.3% (7.1%) |

| Consumer Staples | | $ | 660,485 | | | Enterprise Market Value | | Revenue Multiple | | 0.3x |

| Financials | | $ | 290,298 | | | Discounted Cash Flows | | Market Yield | | 9.3% - 12.6% (10.6%) |

| Healthcare | | $ | 814,346 | | | Discounted Cash Flows | | Market Yield | | 6.4% - 12.2% (10.9%) |

| Industrials | | $ | 625,704 | | | Discounted Cash Flows | | Market Yield | | 9.7% - 11.5% (11.0%) |

| InformationTechnology | | $ | 5,652,293 | | | Discounted Cash Flows | | Market Yield | | 10.4% - 17.9% (13.7%) |

| Total Level 3 investments | | $ | 8,618,356 | | | | | | | |

| (a) | An increase in market yield would result in a decrease in fair value. A decrease in market yield would result in an increase in fair value. An increase in revenue multiple would result in an increase in fair value. A decrease in revenue multiple would result in a decrease in fair value. |

Concentration of Credit Risk - The Fund places its cash with one banking institution, which is insured by the Federal Deposit Insurance Corporation (“FDIC”). The FDIC limit is $250,000. At various times throughout the year, the amount on deposit may exceed the FDIC limit and subject the Fund to a credit risk.

Federal and Other Taxes - No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies.

The Fund evaluates tax positions taken (or expected to be taken) in the course of preparing the Fund's tax provisions to determine whether these positions meet a "more-likely-than-not" standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the "more-likely-than-not" recognition threshold is measured to determine the amount of benefit to recognize in the financial statements.

As of and during the period ended March 31, 2023, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state and local tax returns as required. The Fund's tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for federal purposes and four years for most state returns.

Distributions to Shareholders - Distributions from net investment income, if any, are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from U.S. GAAP.

Indemnification - The Fund indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on industry experience, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

Recent Accounting Pronouncements - In June 2022, the Financial Accounting Standards Board issued Accounting Standards Update 2022-03, Fair Value Measurement (Topic 820) - Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions (ASU 2022-03). The accounting standard update clarifies the guidance in Topic 820 when measuring the fair value of an equity security subject to contractual restrictions that prohibit the sale of an equity security and introduces new disclosure requirements for equity securities subject to contractual sale restrictions and measured at fair value in accordance with Topic 820. The amendments are effective for fiscal years beginning after December 15, 2023, and interim periods within those fiscal years. The Company is currently evaluating the impact that adoption of this new accounting standard will have on its financial statements, but the impact of the adoption is not expected to be material.

| Semi-Annual Report | March 31, 2023 | 19 |

| Opportunistic Credit Interval Fund | Notes to Financial Statements |

| March 31, 2023 (Unaudited) |

3. GREAT LAKES FUNDING II LLC

In August 2022, the Fund invested in Series A of Great Lakes II JV, a joint venture with an investment strategy to underwrite and hold senior, secured loans made to middle-market companies. The Fund treats its investment in Great Lakes II JV as a joint venture because an affiliate of the Adviser controls a 50% voting interest in Great Lakes II JV.

Great Lakes II JV is a Delaware series limited liability company and, pursuant to the terms of its membership agreement (the “Great Lakes II LLC Agreement”), each member of the predecessor series was offered the opportunity to roll its interests into any subsequent series of the Great Lakes II JV prior to the end of the investment period with respect to each series established under the Great Lakes II LLC Agreement. The Fund does not pay any advisory fees in connection with its investment in Great Lakes II JV. Certain other funds managed by the Adviser or its affiliates have also invested in Great Lakes II JV.

The fair value of the Fund's investment in Great Lakes II JV as of March 31, 2023 was $91,395. Fair value has been determined utilizing the practical expedient in accordance with U.S. GAAP. Pursuant to the terms of the Great Lakes II LLC Agreement, the Fund generally may not effect any direct or indirect sale, transfer, assignment, hypothecation, pledge or other disposition of or encumbrance upon its interests in Great Lakes II JV, except that the Fund may sell or otherwise transfer its interests with the consent of the managing members of Great Lakes II JV or to an affiliate or a successor to substantially all of the assets of the Fund.

As of March 31, 2023, the Fund has a $4,988 unfunded commitment to Great Lakes II JV.

4. ADVISORY FEES AND OTHER TRANSACTIONS WITH SERVICE PROVIDERS

Advisory Fees - On May 14, 2022, the Fund entered into a management agreement (the “Management Agreement”) with the Adviser. Under the terms of the Management Agreement, the Adviser provides certain investment advisory and administrative services to the Fund and in consideration of the advisory services provided, the Adviser is entitled to a fee consisting of two components — a base management fee and an incentive, or collectively "investment advisory fees".

The base management fee is payable monthly in arrears at an annual rate of 1.25% of the average daily gross assets of the Fund. For the six months ended March 31, 2023, the Fund incurred $59,817 in base management fees.

The incentive fee is calculated and payable quarterly in arrears based upon the Fund's “pre-incentive fee net investment income” for the immediately preceding quarter and is subject to a hurdle rate, expressed as a rate of return on the Fund's “adjusted capital,” equal to 1.50% per quarter (or an annualized hurdle rate of 6.0%), subject to a “catch-up” feature. For this purpose, “pre-incentive fee net investment income” means interest income, dividend income and any other income accrued during the calendar quarter, less the Fund's operating expenses for the quarter (including the management fee, expenses reimbursed to the Adviser and any interest expenses and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as OID, debt instruments with paid-in-kind (“PIK”) interest and zero-coupon securities), accrued income that the Fund has not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. “Adjusted capital” means the cumulative gross proceeds received by the Fund from the sale of shares (including pursuant to the Fund's distribution reinvestment plan), reduced by amounts paid in connection with purchases of shares pursuant to the Fund's share repurchase program.

No incentive fee is payable in any calendar quarter in which the Fund's pre-incentive fee net investment income does not exceed the quarterly hurdle rate of 1.7647%. For any calendar quarter in which the Fund's pre-incentive fee net investment income is greater than the hurdle rate, but less than or equal to 1.7647%, the incentive fee will equal the amount of the Fund's pre-incentive fee net investment income in excess of the hurdle rate. This portion of the Fund's pre-incentive fee net investment income which exceeds the hurdle rate but is less than or equal to 1.7646% is referred to as the “catch-up.” The “catch-up” provision is intended to provide the Adviser with an incentive fee of 15.0% on all of the Fund's pre-incentive fee net investment income when the Fund's pre-incentive fee net investment income reaches 1.7647% in any calendar quarter. For any calendar quarter in which the Fund's pre-incentive fee net investment income exceeds 1.7647% of adjusted capital, the incentive fee will equal 15.0% of pre-incentive fee net investment income. For the six months ended March 31, 2023, the Advisor did not earn an incentive fee.

Under the Expense Limitation Agreement, dated May 14, 2022, the Adviser has contractually agreed, until at least February 1, 2024, to waive its management fees (excluding any incentive fee) and to pay or absorb the ordinary operating expenses of the Fund expenses (excluding incentive fee, interest, dividends, amortization/accretion and interest on securities sold short, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) to the extent that its management fees plus the Fund's ordinary annual operating expenses exceed 2.50% per annum of the Fund's average daily net assets attributable to Class I shares. Any waiver or reimbursement by the Adviser is subject to repayment by the Fund within three years from the date the Adviser waived any payment or reimbursed any expense, if the Fund is able to make the repayment without exceeding the expense limitation in place at the time of waiver and the repayment is approved by the Board. For the six months ended March 31, 2023, the Adviser waived fees of $464,173.

| 20 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Notes to Financial Statements |

| March 31, 2023 (Unaudited) |

As of March 31, 2023, the following amounts that may be subject to reimbursement to the Adviser based upon their potential expiration dates:

| Fund | | 2025 | | | 2026 | |

| Opportunistic Credit Interval Fund | | $ | 405,935 | | | $ | 254,655 | |

Fund Administration and Accounting Fees and Expenses - BC Partners Management LLC (the “Administrator”), an affiliate of the Adviser, and serves as administrator to the Fund. Pursuant to the Administration Agreement between the Administrator and the Fund, the Administrator furnishes the Fund with office facilities, equipment and clerical, bookkeeping and record keeping services at such facilities. Under the Administration Agreement, the Administrator also performs, or oversees the performance of, the Fund's required administrative services, which include, among other things, being responsible for the financial records that the Fund is required to maintain and preparing reports to our shareholders. In addition, the Administrator assists the Fund in determining and publishing its net asset value, oversees the preparation and filing of the Fund's tax returns and the printing and dissemination of reports to the Fund's shareholders, and generally oversees the payment of Fund expenses and the performance of administrative and professional services rendered to the Fund by others. Payments under the Administration Agreement are equal to an amount based upon the Fund's allocable portion of the Administrator's overhead in performing its obligations under the Administration Agreement, including rent, the fees and expenses associated with performing compliance functions and the Fund's allocable portion of the compensation of the Fund's chief financial officer, chief compliance officer and the Fund's allocable portion of the compensation of their respective administrative support staff. The Administration Agreement may be terminated by either party without penalty upon 60 days' written notice to the other party. To the extent that the Administrator outsources any of its functions, the Fund will pay the fees associated with such functions on a direct basis without any incremental profit to the Administrator. During the six months ended March 31, 2023, the Fund accrued $136,292 for administration fees pursuant to the Administration Agreement.

ALPS Fund Services, Inc. (“ALPS”) serves as sub-administrator to the Fund. During the six months ended March 31, 2023, the Fund accrued $97,282 for sub-administration fees payable to ALPS.

Transfer Agent - SS&C Global Investor & Distribution Solutions, Inc. (“SS&C GIDS”) (the “Transfer Agent”), an affiliate of ALPS, serves as transfer, dividend paying and shareholder servicing agent for the Fund.

Distributor - The Fund has entered into a distribution agreement with ALPS Distributors, Inc. (the “Distributor”), an affiliate of ALPS, to provide distribution services to the Fund. There are no fees paid to the Distributor pursuant to the distribution agreement. The Board has adopted, on behalf of the Fund, a shareholder servicing plan under which the Fund may compensate financial industry professionals for providing ongoing services in respect of clients with whom they have distributed shares of the Fund.

Trustees - Each Trustee who is not affiliated with the Fund or the Adviser receives an annual fee of $10,000, an additional $2,000 for attending the annual in-person meeting of the Board, and $500 for attending each of the remaining telephonic meetings, as well as reimbursement for any reasonable expenses incurred attending the meetings. None of the executive officers or interested Trustees receives compensation from the Fund.

5. INVESTMENT TRANSACTIONS

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the six months ended March 31, 2023 amounted to $8,547,784 and $3,250,706, respectively.

6. CAPITAL SHARES

The Fund commenced operations on July 5, 2022 and currently offers Class I shares at NAV.

Share Repurchase Program

As an interval fund, the Fund offers its shareholders the option of redeeming shares on a quarterly basis, at NAV, no less than 5% of the Fund's issued and outstanding shares as of the close of regular business hours on the New York Stock Exchange on the Repurchase Pricing Date. If shareholders tender for repurchase more than 5% of the outstanding shares of the Fund, the Fund may, but is not required to, repurchase up to an additional 2% of the outstanding shares of the Fund. If the Fund determines not to repurchase up to an additional 2% of the outstanding shares of the Fund, or if more than 7% of the outstanding shares of the Fund are tendered, then the Fund will repurchase shares on a pro rata basis based upon the number of shares tendered by each shareholder. There can be no assurance that the Fund will be able to repurchase all shares that each shareholder has tendered. In the event of an oversubscribed offer, shareholder may not be able to tender all shares that you wish to tender and you may have to wait until the next quarterly repurchase offer to tender the remaining shares, subject to any proration. Subsequent repurchase requests will not be given priority over other shareholder requests.

| Semi-Annual Report | March 31, 2023 | 21 |

| Opportunistic Credit Interval Fund | Notes to Financial Statements |

| | March 31, 2023 (Unaudited) |

For the six months ended March 31, 2023, the Fund completed two quarterly repurchase offers. In these repurchase offers, the Fund offered to repurchase up to 5% of the number of its outstanding shares (up to 7% at the discretion of the officers of the Fund) as of the Repurchase Pricing Dates. For the six months ended March 31, 2023, none of the quarterly repurchase offers were oversubscribed such that pro-ration was required.

The result of those repurchase offers were as follows:

| | Repurchase Offer #1 | Repurchase Offer #2 |

| Commencement Date | September 12, 2022 | December 12, 2022 |

| Repurchase Request Deadline | October 12, 2022 | January 11, 2023 |

| Repurchase Pricing Date | October 12, 2022 | January 11, 2023 |

| Amount Repurchased | $ - | $ - |

| Shares Repurchased | - | - |

7. TAX BASIS INFORMATION

For the six months ended March 31, 2023, there were no permanent book- and tax-basis differences that resulted in reclassifications to paid in capital. The following information is computed on a tax basis for each item as of March 31, 2023:

| | | Gross Appreciation | | | Gross Depreciation (excess of tax cost over value) | | | Net Depreciation | | | Cost of Investments for Income Tax Purposes | |

| | | $ | 1,237,945 | | | $ | (44,058 | ) | | $ | 1,193,887 | | | $ | 8,365,833 | |

The difference between book basis and tax basis distributable earnings and unrealized appreciation/(depreciation) is primarily attributable to the tax deferral of losses on wash sales, investments in partnerships and certain other investments.

As of September 30, 2022 the components of accumulated earnings on a tax basis were as follows:

| Undistributed ordinary income | | $ | 33,534 | |

| Accumulated capital gains | | | — | |

| Net unrealized appreciation on securities | | | (19,717 | ) |

| Total distributable earnings | | $ | 13,817 | |

8. RISK FACTORS

LIBOR Risk

Changes in the level of LIBOR will affect the amount of interest payable on the LIBOR-based floating rate debt instruments, and it is impossible to predict whether LIBOR will rise or fall. A decline in the level of LIBOR would likely result in a reduction of interest collections on such debt instruments, which would have an adverse effect on the return of the Fund. Some floating rate debt instruments held by the Fund may have LIBOR floors (or minimum interest rates to which the spread or margin is added, to calculate the debt instrument's overall interest rate), but there is no guarantee that any such LIBOR floor will fully mitigate the risk of falling LIBOR.

Most LIBOR settings are no longer published, and the UK Financial Conduct Authority (the "FCA") and LIBOR's administrator, ICE Benchmark Administration (the "IBA"), have announced that a majority of U.S. dollar LIBOR settings will no longer be published after June 30, 2023. While some instruments may address a scenario where LIBOR is no longer available by providing for an alternative rate setting methodology, and an increasing number of existing U.S. dollar debt instruments will be amended to provide for a benchmark reference rate other than LIBOR, not all instruments will have such provisions and there is significant uncertainty regarding the effectiveness of alternative methodologies and the potential for short-term and long-term market instability. These matters may result in a sudden or prolonged increase or decrease in reported benchmark rates, benchmark rates being more volatile than they have been in the past, and/or fewer debt instruments utilizing given benchmark rates as a component of interest payments. Additionally, in connection with the adoption of another benchmark as a replacement for LIBOR in a debt instrument's documentation, the interest rate (or method for calculating the interest rate) applicable to that debt instrument may be modified to account for differences between LIBOR and the applicable replacement benchmark used to calculate the rate of interest payable in respect of that instrument, which modification may be based on industry-accepted spread adjustments or recommendations from various governmental and non-governmental bodies. Because of the uncertainty regarding the nature of any replacement rate, the Fund cannot reasonably estimate the impact of the anticipated transition away from LIBOR at this time. If the LIBOR replacement rate is lower than market expectations, there could be an adverse impact on the value of debt instruments with floating or fixed-to-floating rate coupons and, in turn, a material adverse impact on the value of the Fund.

| 22 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Notes to Financial Statements |

| | March 31, 2023 (Unaudited) |

The transition away from LIBOR may affect the cost of capital, may require amending or restructuring debt instruments for the Fund, and may impact the liquidity and/or value of floating rate instruments based on LIBOR that are held or may be held by the Fund in the future, which may result in additional costs or adversely affect the Fund's liquidity, results of operations, and financial condition. Any such effects of the transition away from LIBOR, as well as other unforeseen effects, could result in losses to the Fund. Since the usefulness of LIBOR as a benchmark could also deteriorate during the transition period, effects could occur at any time.

Market Disruption Risk

Unexpected local, regional or global events, such as war; acts of terrorism; financial, political or social disruptions; natural, environmental or manmade disasters; climate-change and climate-related events; the spread of infectious illnesses or other public health issues; recessions and depressions; or other events may result in market volatility, may have long-term effects on the United States and worldwide financial markets and may cause further economic uncertainties in the United States and worldwide. The Fund cannot predict the effects of such events in the future on the U.S. economy and securities.

9. SUBSEQUENT EVENTS

The Fund has determined that there have been no events that have occurred that would require adjustments to our disclosures of the financial statements.

| Semi-Annual Report | March 31, 2023 | 23 |

| Opportunistic Credit Interval Fund | Additional Information |

| March 31, 2023 (Unaudited) |

1. PROXY VOTING POLICIES AND VOTING RECORD