UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23783

(Investment Company Act file number)

Opportunistic Credit Interval Fund

(Exact name of Registrant as specified in charter)

650 Madison Avenue, 23rd Floor

New York, NY 10022

(Address of principal executive offices)(Zip code)

The Corporation Trust Company

Corporation Trust Center, 1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 891-2880

Date of fiscal year end: September 30

Date of reporting period: October 1, 2023 - March 31, 2024

Item 1. Reports to Stockholders.

(a)

Table of Contents

| Shareholder Letter | 1 |

| Portfolio Update | 14 |

| Consolidated Schedule of Investments | 16 |

| Consolidated Statement of Assets and Liabilities | 22 |

| Consolidated Statement of Operations | 23 |

| Consolidated Statements of Changes in Net Assets | 24 |

| Consolidated Statement of Cash Flows | 25 |

| Consolidated Financial Highlights | |

| Class I | 26 |

| Notes to Consolidated Financial Statements | 27 |

| Additional Information | 36 |

| Consolidated Privacy Notice | 38 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

Dear Shareholders:

We are excited to share with our partners the latest letter for the Opportunistic Credit Interval Fund1 (ticker: SOFIX) for the semi-annual period ended March 31, 2024.

This letter comes at a particularly opportune time, in our view, given the decidedly murky macro backdrop. Public markets have been ebullient in recent months, boosted by the Fed’s dovish tilt in December 2023, which has amplified the “soft landing” narrative. Soft landing has become such a market buzzword that it requires examining what such an outcome would entail.

A soft-landing suggests that the market and the economy could escape the massive over-stimulus and inflationary spiral of COVID-19 and the resulting ~550bps of interest rate hikes—without experiencing economic pain or downturn. Such an optimistic outcome would seem to belie basic reason. More importantly, the soft-landing thesis ignores certain tremors at the foundation of our economy.

Macro Backdrop: The Concerning

Again, the Federal Reserve (the "Fed") alluding to cuts this year reignited the market’s animal spirits and loosened market conditions for many. However, not all corners of the economy have participated in the latest market celebration. As reflected in the chart below, small- and medium-sized banks have continued to tighten lending activity:

U.S. Bank Lending

Source: FRB, Haver Analytics, Apollo Chief Economist.

A range of (not-insignificant) challenges has contributed to muted bank lending, including marked-to-market losses on long duration assets, commercial real estate (“CRE”) concerns, regulatory overhang post-Silicon Valley Bank and depositor flight into Money Market Funds. In our view, none of these troubles appear likely to abate in the near-term.

| Semi-Annual Report | March 31, 2024 | 1 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

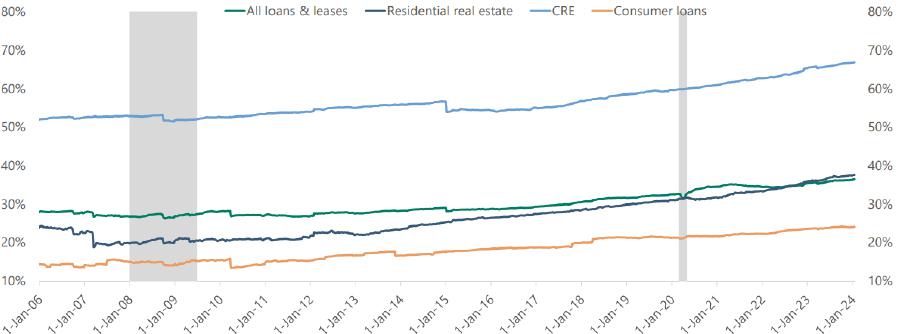

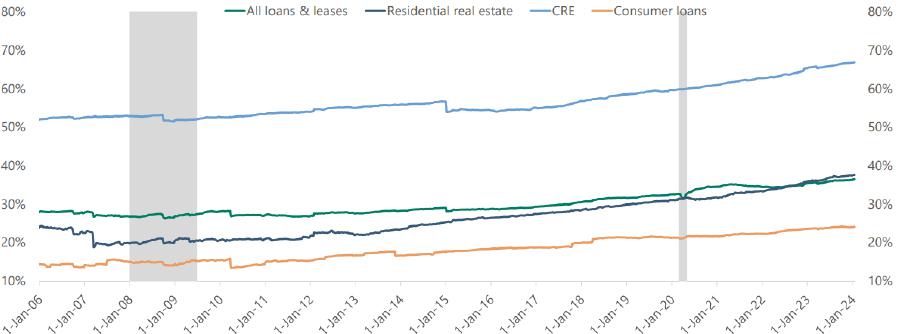

Further, as highlighted in the chart below, banks play a vital role in our economy, beyond just business lending. Small banks provide nearly 70% of CRE loans, nearly 40% of residential real estate debt and more than 20% of consumer loans:

Small banks’ share of total bank lending, by loan type

Source: FRB, Haver Analytics, Apollo Chief Economist.

There are few segments of the U.S. economy not touched by the traditional banking channel.

Banks have historically helped the gears of U.S. GDP to turn. Without lending, our economy will inevitably slow, as capital deprived businesses may forgo expansion plans or (worst case) struggle to stock their shelves. In short, if banks remain sidelined, we believe a soft-landing will ultimately prove elusive.

| 2 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

The health of the U.S. consumer represents another potential threat to the market’s current bull-run. As has been well documented, a lack of opportunities to spend during the pandemic as well as aggressive fiscal stimulus, enabled households to build “excess savings,” which has helped propel our post-COVID-19 economy. However, as this chart reveals, much of these savings have been exhausted—particularly among the most economically sensitive Americans:

U.S. Household “Excess Savings”

Source: Pantheon Research

Much of these remaining savings may remain trapped from an economic perspective. Given the lower marginal propensity to consume among wealthy households, these dollars may not be spent into our economy in the near-term, if at all.

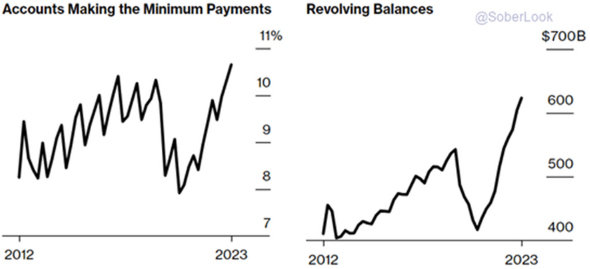

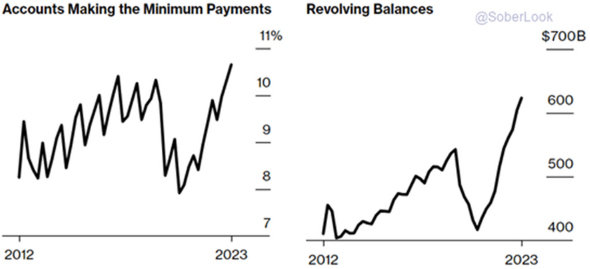

Economically sensitive households—those who have borne the brunt of inflationary pain—have also not participated in recent market-driven wealth effects. Hence, while many consumers appear to be doing quite well, many are not. Underscoring this dynamic, as reflected below, an increasing number of Americans are paying minimum monthly debt payments and leaving significant balances outstanding:

Household Payments and Revolving Balances

Source: Federal Reserve Bank of Philadelphia

Federal Reserve Bank of Philadelphia data for 4Q 2023 also reflected the highest credit card delinquency rate since 2012, with 3.5% of card balances at least 30 days past due at year end.

With segments of our population experiencing real pain from higher prices and higher cost of debt, consumer spending may shift from a tailwind to a headwind, which could upend the market’s latest tear.

| Semi-Annual Report | March 31, 2024 | 3 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

Business sentiment appears to reflect some of the underlying challenges in our economy. Notably, the NFIB Small Business Optimism Index for March registered the lowest reading since 2012:

NFIB Small Business Optimism

Source: NFIB and The Daily Dash

In our jobs, we confront seemingly endless amounts of information—much of which gets lost in the noise. However, we would argue the previous chart requires a pause for contemplation: despite a seemingly strong economy and an enthusiastic equity market, small business sentiment is worse than during the troughs of the pandemic. We find this fact, both stupefying and ominous.

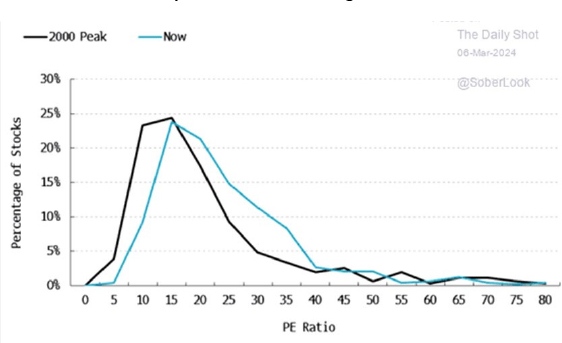

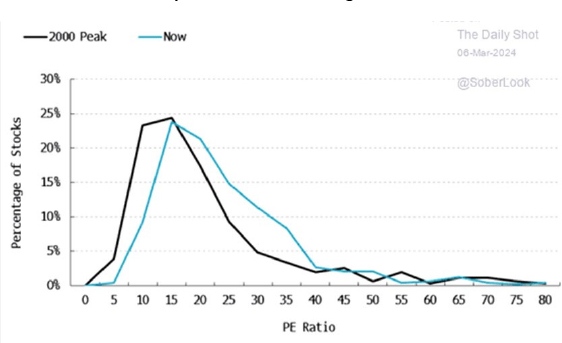

Interest rates represent a much-discussed market overhang as well. Relatedly, as evidenced in the graphs below, U.S. equity market valuations are near historic levels:

Distribution of S&P 500 P/E Ratios Now and During the “Dot-com” Peak

Source: Bloomberg

| 4 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

Market Cap of the Largest Stock Relative to the 75th Percentile of Stocks

Source: Compustat, CRSP, Goldman Sachs Investment Research (4/9/2024)

Artificial Intelligence ("AI") is centerstage of the stock market’s recent furious gains (contributing to the S&P 500’s concentration). Only time will reveal if artificial intelligence represents a paradigm shifting economic force—and therefore worthy of the market’s current lofty valuations.

Beyond AI, expectations for rate cuts have also catalyzed the latest market rally. However, these much-anticipated cuts have confronted the reality of an economy stronger than feared, a job market that continues to expand and inflation that refused to surrender (even before accounting for the latest rise in oil prices).

As the following chart shows, the S&P 500 Index ("S&P") has yet to recalibrate for a more realistic appraisal of the path of rates in 2024:

S&P 500 vs. Fed Fund Futures

Source: Oxford Economics / Haver Analytics (3/7/2024)

For economic and political reasons, we anticipate one 25bps cut this year—most likely in July; we believe September would be considered too close to the election.

| Semi-Annual Report | March 31, 2024 | 5 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

The economic case for cuts, in part, stems from concerns about real interest rates. Even with inflation lodged in the +3.0% context, inflation-adjusted Fed Funds remain at the highest level since the global financial crises ("GFC"):

Real Fed Funds Rate

Source: Bloomberg

High real rates have historically been associated with—if not the proximal cause of—things “breaking” in the market:

U.S. 10 Year Real Rates and Bubble “Pops”

Source: BofA Global Investment Strategist

Additionally, much of the globe appears to be entering a synchronous cutting cycle, with Bank of England, ECB and Bank of Canada all signaling cuts this summer. Other than Bank of Japan which may need to hike to defend its spiraling Yen, the trajectory of global rates is definitively downward. If the U.S. Federal Reserve does not cut, we risk an overheated dollar, which could weigh on GDP from lower export demand.

Finally, on the political front, the Fed will face increasing pressure from Washington to push rates lower in an election year—particularly with many consumers starting to feel the bite of higher rates. Hence, while perhaps not entirely economically justified, we expect one cut this summer.

| 6 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

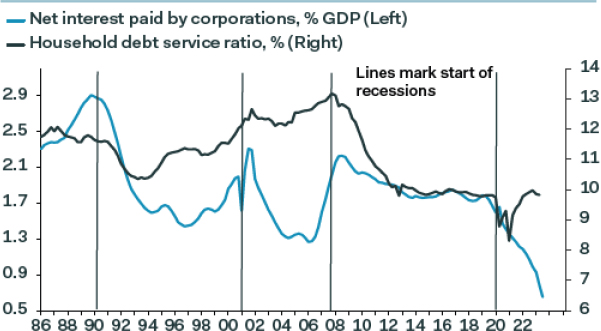

Macro Backdrop: The Positive

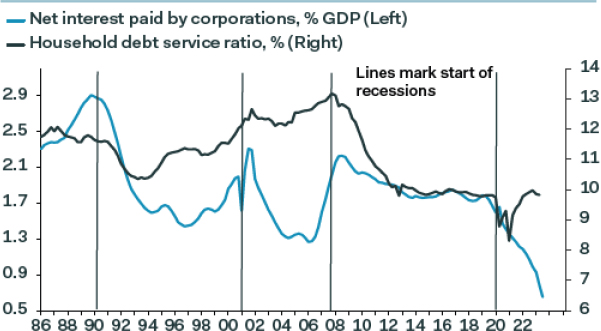

Tempering our decidedly guarded tone thus far, there are unquestionably many positive signals in the current backdrop. Namely, jobs are plentiful and—as demonstrated in the charts below— household and corporate balance sheets are historically strong:

Net Interest Paid by Corps. as % of GDP vs. Household Debt Service Ratio (%)

Source: Pantheon Macro

Household Balance Sheet (as % of GDP)

Source: Bridgewater Associates

| Semi-Annual Report | March 31, 2024 | 7 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

Cash Held by U.S. Corporations, All-Time High

Source: Bridgewater Associates

Additionally, circling back to artificial intelligence, AI enthusiasm could kick-off a wave of corporate investment and productivity reminiscent of the 1990s (hopefully without the resulting market bubble). We would note, however, that the 1990s productivity boom happened amid an era of budget surplus, unlike our current period of crushing fiscal deficits.

Another clear positive, should the economy weaken, the Fed has cuts at their disposal. Rate cuts provided diminishing efficacy during much of the post-GFC era. Because rates had been so low for so long (and the specter of inflation had become a faded memory), incremental cuts elicited little change in corporate or household behavior.

Now, after having experienced the discomfort (if not agony, for some) of higher rates, people will likely pounce when the cost of debt declines. People may race out to buy that car or dish washer, or other rate sensitive goods, for fear that rates may go up again, which could rekindle the economy.

| 8 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

Macro Backdrop: The Opportunity

The discordant signals in the market provide a challenging backdrop for investors, but credit, in our view, remains a haven. Unlike exuberantly priced equities, middle market credit remains rich with opportunity. Muted bank lending is troubling for the economy, broadly, but has unambiguously translated into an opportunity for our shareholders. Small and medium-sized businesses are increasingly turning to non-traditional platforms, like BC Partners, for capital solutions, a fact highlighted by the graph below:

Assets: Banks vs. Fund Managers

Source: Board of Governors of the Federal Reserve; ICI/Prequin/HFR

Blows to the U.S. banking system from COVID-19, rapidly interest rate increases, bad CRE loans and the Silicon Valley Bank collapse have accelerated the structural trend of increasing capital formation by non-bank institutions.

| Semi-Annual Report | March 31, 2024 | 9 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

From an investor standpoint, we believe it is instructive to highlight the benefits of our private credit solutions as an asset class. As reflected in the chart below, private credit has handily outpaced all categories of fixed income and produced returns competitive with the S&P 500 (with markedly lower volatility), in recent years:

Index Returns, Rebased to 2019

Source: Data through 3Q 2023, Prequin, Barclays Research (04/11/2024)

Much of this outperformance stems from the higher yield, greater issuance discounts and higher call protection available in private credit.

Not all private credit solutions are the same, of course. BC Partners’ focus on lending to companies with $10mn to $50mn of EBITDA uniquely positions us to capitalize on the pullback by small- and medium-sized banks. Many competing private credit funds—with billions of capital to deploy—must chase larger companies, which still have access to traditional lending channels. Hence, we believe we are uniquely positioned as a Fund and a firm to benefit from the structural decline of banks.

| 10 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

Relatedly, we would emphasize another key difference between BC Partners and many of our private credit peers. Given less competition, lower middle market deals still generally command covenants—or governing docs that help protect investors. As reflected in the chart below, covenants are becoming increasingly scarce in larger deals, a segment in which BC Partners does not compete:

Covenant-Lite Share of New Issue Private Credit Loans by Initial Loan Amount, 2020-2023

Source: Covenant Review, Barclays Research

What is the point of private credit without covenants? We would argue that competing large cap private funds have essentially become expensive and concentrated mutual funds.

| Semi-Annual Report | March 31, 2024 | 11 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

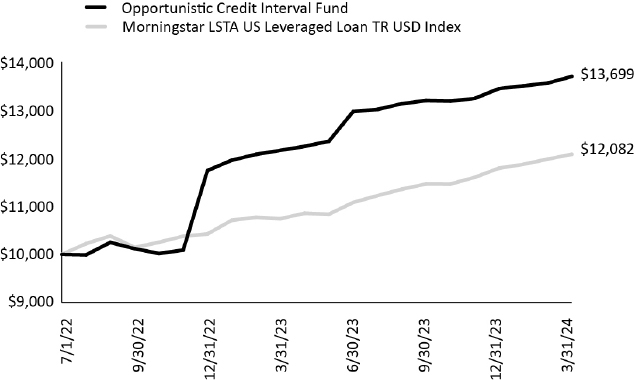

Fund Performance

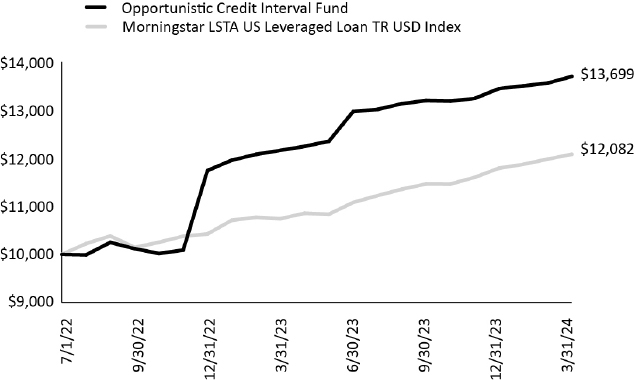

The Fund generated a gain of 3.8% during the six-month period ended 3/31/2024, which modestly trailed our benchmark (Morningstar LSTA US Leveraged Loan TR USD Index), largely due to cash drag during the quarter. The Fund was, in a sense, a victim of its own success, having grown AUM from $37.5M to $100M in the period.

Despite modest underperformance in the period, inception-to-date returns handily outpaces the Index (19.7% vs.11.4%).

Among the Fund’s positive contributors were its investment in Smart Start (Global IID Parent LLC) (+25.6%), acquired at attractive levels by way of liquidity bid. Loans backing Camino (Global Integrated Flooring Systems Inc.) gained 9.4% helped by lower costs and realization of previously deferred projects. As a detractor, the Fund’s investment in Hostway (HDC / HW Intermediate Holdings) restructured, resulting in a 14.4% decline.

Positioning

Amid a relatively muted primary market backdrop, the Fund’s portfolio has largely been evenly allocated between liquid and illiquid assets. As the calendar year turned, the Fund has weighted its incremental dollars toward privately originated deals—which we view as our core strategy; at the end of March, roughly 63% of our assets comprise private deals.

Recent investments we would highlight include Tactical Air Support, Inc., a provider of aviation services to the U.S. military across consulting, adversary air training and MRO services, Rockbridge Hospitality Fund VI (RHF VI FUNDING LLC), a portfolio of hospitality assets in winddown, and Autorola, a European online auction site for vehicle fleets.

Conclusion

I will end this letter like the previous: investors simply must rethink their orientation to fixed income as the era of turbo-charged equity performance is likely over.

Immediately prior to the reign of easy money, the S&P returned just 4.8% a year from 1996 to 2008. From 2009 to 2021—a time-period highlighted by negative real interest rates and QE by the Fed—the S&P gained 16.0% per annum. Put differently, the S&P generated a CAGR of 9.6% from 1928 to 20232. Clearly the last 13 years (prior to 2022) represent the outlier.

With equity returns likely to revert to the mean (because math always wins, in time), investors can no longer under-allocate to fixed income nor tolerate traditional underperforming vehicles.

With roughly $150bn of AUM, the PIMCO Income Fund represents the bell-weather fund in the fixed income universe. The Opportunistic Credit Interval Fund’s performance since inception tops PIMIX by a stunning 3.0x3. The Fund similarly outperforms the largest High Yield ETF, iShares High Yield Corporate Bonds ETF (ticker HYG), by a similarly eye-popping multiple4.

When equities generated double-digit annual returns, investors could perhaps tolerate such traditional laggards in their portfolio. With fixed income returns likely to rival the S&P going forward on an absolute basis (let alone on a risk adjusted basis), investors must reorientate their portfolio toward the best performing category in fixed income—private credit.

Regards,

Matthias Ederer

Portfolio Manager

Opportunistic Credit Interval Fund

| 1 | Fund performance refers to that of Class I. Reflects six-month returns through 03/31/2024. Past performance is not indicative of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. For performance information current to the most recent month-end, please call toll-free 1-833-404-4103. The Adviser and the Fund have entered into an Expense Limitation Agreement under which the Adviser has agreed, until at least February 1, 2025 to waive its management fees (excluding any incentive fee) and to pay or absorb the ordinary annual operating expenses of the Fund (excluding incentive fee, interest, dividends, amortization/accretion and interest on securities sold short, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that its management fees plus the Fund’s ordinary annual operating expenses exceed 2.50% per annum of the Fund’s average daily net assets attributable to Class I shares. Such Expense Limitation Agreement may not be terminated by the Adviser, but it may be terminated by the Board of Trustees, upon 60 days written notice to the Adviser. Any waiver or reimbursement by the Adviser is subject to repayment by the Fund within the three (3) years from the date the Adviser (or the previous investment adviser) waived any payment or reimbursed any expense, if the Fund is able to make the repayment without exceeding the lesser of the expense limitation in place at the time of the waiver or the current expense limitation and the repayment is approved by the Board of Trustees. See “Management of the Fund.” |

| 12 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

March 31, 2024 (Unaudited)

| 2 | “Cost of Capital and Capital Allocation, Investment in the Era of ‘Easy Money” Morgan Stanely (2/28/2024) |

| 3 | Bloomberg, Total Return 7/5/2022 through 3/31/2024 SOFIX vs. PIMIX. |

| 4 | Bloomberg, Total Return 7/5/2022 through 3/31/2024 SOFIX vs. HYG. |

| Semi-Annual Report | March 31, 2024 | 13 |

| Opportunistic Credit Interval Fund | Portfolio Update |

March 31, 2024 (Unaudited)

The Fund’s performance figures for the period ended March 31, 2024, compared to its benchmark:

| Opportunistic Credit Interval Fund | 1 Month | Quarter | 6 Month | YTD | 1 Year | Since

Inception | Inception |

| Opportunistic Credit Interval Fund - NAV | 1.02% | 1.88% | 3.88% | 1.88% | 12.62% | 19.73% | 7/1/2022 |

| Morningstar LSTA US Leveraged Loan TR USD Index | 0.85% | 2.46% | 5.40% | 2.46% | 12.47% | 11.43% | 7/1/2022 |

The Morningstar LSTA US Leveraged Loan TR USD Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Investors cannot invest directly in an index.

Past performance is not indicative of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. As of the Fund’s most recent prospectus dated January 26, 2024, the Fund’s total annual operating expenses, including acquired fund fees and expenses, before fee waivers is 11.17% for Class I. After fee waivers, the Fund’s total annual operating expense is 2.97% for Class I. For performance information current to the most recent month-end, please call toll-free 1-833-404-4103.

| 14 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Portfolio Update |

March 31, 2024 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

Consolidated Portfolio Composition as of March 31, 2024

| Asset Type | Percent of Net Assets |

| Bank Loan | 60.49% |

| Short-Term Investments | 24.96% |

| Preferred Stock | 7.19% |

| Joint Venture | 3.98% |

| Equipment Financing | 3.43% |

| Common Equity | 1.28% |

| Bonds & Notes | 0.40% |

| Warrants | 0.07% |

| Total Investments | 101.80% |

| Liabilities in Excess of Other Assets | (1.80)% |

| Net Assets | 100.00% |

Please see the Consolidated Schedule of Investments for a detailed listing of the Fund’s holdings.

| Semi-Annual Report | March 31, 2024 | 15 |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

March 31, 2024 (Unaudited)

| | | Coupon | | Reference Rate & Spread | | Maturity | | Principal | | Value |

| BANK LOANS (60.49%) | | | | | | | | | | |

| | | | | | | | | | | |

| Communication Services (5.04%) | | | | | | | | | | |

| Neptune Bidco US Inc., First Lien Term Loan A(a)(b) | | | 10.17 | % | | 3M SOFR + 4.75%, 0.50% Floor | | 10/11/2028 | | $ | 997,487 | | | $ | 916,267 | |

| Neptune Bidco US Inc., First Lien Term Loan(a)(b) | | | 10.42 | % | | 3M SOFR + 5.00%, 0.50% Floor | | 04/11/2029 | | | 1,641,729 | | | | 1,517,475 | |

| NextFlight Ventures, First Lien Term Loan(a)(c) | | | 10.00 | % | | 10.00%, PIK | | 12/26/2025 | | | 1,006,758 | | | | 980,683 | |

| NextFlight Ventures, Delayed Draw Term Loan(a)(c)(d) | | | – | % | | 10.00%, PIK | | 12/26/2025 | | | – | | | | 14 | |

| Synamedia Americas Holdings, Inc., First Lien Term Loan(a)(b) | | | 13.06 | % | | 3M SOFR + 7.75%, 1.00% Floor | | 12/05/2028 | | | 1,696,121 | | | | 1,649,477 | |

| | | | | | | | | | | | | | | | 5,063,916 | |

| Consumer Discretionary (0.88%) | | | | | | | | | | | | | | | | |

| Riddell Inc., First Lien Term Loan(a)(b) | | | 11.33 | % | | 1M SOFR + 6.00%, 1.00% Floor | | 03/29/2029 | | | 909,091 | | | | 886,364 | |

| Riddell Inc., Delayed Draw Term Loan(a)(b)(d) | | | – | % | | 1M SOFR + 6.00%, 1.00% Floor | | 03/29/2029 | | | – | | | | – | |

| | | | | | | | | | | | | | | | 886,364 | |

| Consumer Staples (3.96%) | | | | | | | | | | | | | | | | |

| Alphia, Inc., First Lien Term Loan(a)(b) | | | 10.31 | % | | 3M SOFR + 5.00% | | 10/03/2030 | | | 1,500,000 | | | | 1,379,197 | |

| Florida Food Products LLC, First Lien Term Loan(a)(b) | | | 10.44 | % | | 1M SOFR + 5.00%, 0.75% Floor | | 10/18/2028 | | | 2,087,353 | | | | 1,854,269 | |

| Global Integrated Flooring Systems Inc., First Lien Term Loan(a)(b)(c) | | | 14.69 | % | | 3M SOFR + 8.36%, 1.00% PIK, 1.25% Floor | | 05/15/2024 | | | 1,289,459 | | | | 736,539 | |

| Global Integrated Flooring Systems Inc., Revolver(a)(b)(c) | | | | | | 1M SOFR + 8.36%, 1.00% | | | | | | | | | | |

| | | | 14.69 | % | | PIK, 1.25% Floor | | 05/15/2024 | | | 12,099 | | | | 6,911 | |

| | | | | | | | | | | | | | | | 3,976,916 | |

| Financials (9.17%) | | | | | | | | | | | | | | | | |

| AIS Holdco LLC, First Lien Term Loan(a)(b) | | | 10.31 | % | | 3M SOFR + 5.00% | | 08/15/2025 | | | 1,954,198 | | | | 1,912,672 | |

| AIS Holdco, LLC, Second Lien Term Loan(a)(b) | | | 14.32 | % | | 3M SOFR + 8.75% | | 08/15/2026 | | | 250,000 | | | | 235,000 | |

| BetaNXT, Inc., First Lien Term Loan(a)(b) | | | 11.05 | % | | 3M SOFR + 5.75% | | 07/01/2029 | | | 2,992,424 | | | | 2,863,750 | |

| Cor Leonis Limited, Revolver(a)(b)(d) | | | 12.81 | % | | 3M SOFR + 7.50%, 1.50% Floor | | 05/15/2028 | | | 171,656 | | | | 172,408 | |

| Expert Experience Credit Motors, LLC, Revolver(a)(b)(d) | | | 5.32 | % | | 1M SOFR + 10.50% | | 03/29/2026 | | | – | | | | – | |

| Fortis Payment Systems, LLC, First Lien Term Loan(a)(b) | | | 11.15 | % | | 3M SOFR + 5.75%, 1.00% Floor | | 02/13/2026 | | | 1,875,000 | | | | 1,851,562 | |

| Fortis Payment Systems, LLC, Delayed Draw Term Loan(a)(b)(d) | | | 11.15 | % | | Prime + 5.75% | | 02/13/2026 | | | 93,750 | | | | 95,187 | |

| Lion FIV Debtco Limited, Revolver(a)(b)(d) | | | 16.31 | % | | 3M SOFR + 11.00% | | 10/18/2024 | | | 272,584 | | | | 237,583 | |

| Royal Palm Equity Partners I L.P., First Lien Term Loan(a)(b)(d) | | | 12.32 | % | | 3M SOFR + 7.00%, 2.50% Floor | | 10/24/2033 | | | 947 | | | | 947 | |

| Royal Palm Equity Partners I L.P., Delayed Draw Term Loan(a)(b)(d) | | | 12.32 | % | | 3M SOFR + 7.00%, 2.50% Floor | | 10/24/2033 | | | 4,734 | | | | 4,734 | |

| Royal Palm Equity Partners I L.P., Initial, First Lien Term Loan(a)(b) | | | 12.32 | % | | 3M SOFR + 7.00%, 12.32% PIK | | 10/24/2033 | | | 559,103 | | | | 559,103 | |

| Royal Palm Equity Partners II L.P., First Lien Term Loan(a)(b) | | | 13.32 | % | | 3M SOFR + 8.00%, 13.32% PIK | | 10/24/2028 | | | 38,164 | | | | 37,691 | |

| TA/WEG HOLDINGS, LLC, 2020 Delayed Draw Term Loan(a)(b) | | | 10.78 | % | | 3M SOFR + 5.50%, 1.00% Floor | | 10/04/2027 | | | 311,535 | | | | 311,535 | |

| TA/WEG HOLDINGS, LLC, 2021 Delayed Draw Term Loan(a)(b) | | | 10.81 | % | | 3M SOFR + 5.50%, 1.00% Floor | | 10/04/2027 | | | 465,738 | | | | 465,738 | |

| TA/WEG HOLDINGS, LLC, 2024 Delayed Draw Term Loan(a)(b)(d) | | | – | % | | 3M SOFR + 5.50%, 1.00% Floor | | 10/04/2027 | | | – | | | | 18,348 | |

| See Notes to Consolidated Financial Statements. | |

| 16 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

March 31, 2024 (Unaudited)

| | | Coupon | | Reference Rate & Spread | | Maturity | | Principal | | Value |

| TA/WEG HOLDINGS, LLC, May 2022 Delayed Draw Term Loan(a)(b)(d) | | | 10.81 | % | | 3M SOFR + 5.50%, 1.00% Floor | | 10/04/2027 | | $ | 446,738 | | | $ | 446,738 | |

| TA/WEG HOLDINGS, LLC, Revolver(a)(b)(d) | | | – | % | | 3M SOFR + 5.50%, 1.00% Floor | | 02/02/2032 | | | – | | | | – | |

| | | | | | | | | | | | | | | | 9,212,996 | |

| Health Care (4.03%) | | | | | | | | | | | | | | | | |

| Dentive LLC, First Lien Term Loan(a)(b) | | | 12.31 | % | | 3M SOFR + 7.00%, 1.00% Floor | | 12/26/2028 | | | 238,825 | | | | 234,645 | |

| Dentive LLC, Delayed Draw Term Loan(a)(b)(d) | | | 12.32 | % | | 3M SOFR + 7.00%, 1.00% Floor | | 12/26/2028 | | | 79,556 | | | | 78,076 | |

| IDC Infusion Services, Inc., First Lien Term Loan(a)(b) | | | 11.85 | % | | 6M SOFR + 6.50%, 0.50% Floor | | 07/07/2028 | | | 365,966 | | | | 360,879 | |

| IDC Infusion Services, Inc., Delayed Draw Term Loan(a)(b)(d) | | | 11.96 | % | | 1M SOFR + 6.50%, 0.50% Floor | | 07/07/2028 | | | 32,468 | | | | 32,630 | |

| PhyNet Dermatology LLC, First Lien Term Loan(a)(b) | | | 11.99 | % | | 6M SOFR + 6.50%, 1.00% Floor | | 10/20/2029 | | | 486,536 | | | | 481,087 | |

| PhyNet Dermatology LLC, Delayed Draw Term Loan(a)(b)(d) | | | – | % | | 6M SOFR + 6.50%, 1.00% Floor | | 10/20/2029 | | | – | | | | (1,216 | ) |

| South Florida ENT Associates, First Lien Term Loan(a)(b) | | | 12.40 | % | | 3M SOFR + 7.00%, 1.00% Floor | | 12/31/2025 | | | 393,471 | | | | 388,277 | |

| South Florida ENT Associates, Delayed Draw Term Loan(a)(b)(d) | | | – | % | | 3M SOFR + 7.00%, 1.00% Floor | | 12/31/2025 | | | – | | | | (2,516 | ) |

| USN Opco, LLC, First Lien Term Loan(a)(b) | | | 11.10 | % | | 3M SOFR + 5.75%, 1.00% Floor | | 12/21/2026 | | | 2,500,000 | | | | 2,475,000 | |

| | | | | | | | | | | | | | | | 4,046,862 | |

| Industrials (12.35%) | | | | | | | | | | | | | | | | |

| Accordion Partners, LLC, First Lien Term Loan(a)(b) | | | 11.30 | % | | 3M SOFR + 6.00%, 0.75% Floor | | 08/29/2029 | | | 82,741 | | | | 82,402 | |

| Accordion Partners, LLC, Delayed Draw Term Loan A(a)(b) | | | 11.55 | % | | 3M SOFR + 6.25%, 0.75% Floor | | 08/29/2029 | | | 7,263 | | | | 7,263 | |

| Accordion Partners, LLC, Delayed Draw Term Loan B(a)(b) | | | 11.31 | % | | 3M SOFR + 6.00%, 0.75% Floor | | 08/29/2029 | | | 9,101 | | | | 9,064 | |

| Accordion Partners, LLC, Third Amendment First Lien Term Loan(a)(b) | | | 11.59 | % | | 3M SOFR + 6.25%, 0.75% Floor | | 08/29/2029 | | | 99,500 | | | | 99,500 | |

| Accordion Partners, LLC, Third Amendment Delayed Draw Term Loan(a)(b)(d) | | | 11.57 | % | | 3M SOFR + 6.25%, 0.75% Floor | | 08/29/2029 | | | 116,500 | | | | 117,505 | |

| Arcline FM Holdings, LLC, First Lien Term Loan(a)(b) | | | 10.32 | % | | 3M SOFR + 4.75%, 0.75% Floor | | 06/23/2028 | | | 497,474 | | | | 498,407 | |

| Astro Acquisition, LLC, First Lien Term Loan(a)(b) | | | 10.80 | % | | 3M SOFR + 5.50%, 1.00% Floor | | 12/13/2027 | | | 4,000,000 | | | | 3,960,000 | |

| Inmar, Inc., First Lien Term Loan(a)(b) | | | 10.82 | % | | 1M SOFR + 5.50%, 1.00% Floor | | 05/01/2026 | | | 997,545 | | | | 999,884 | |

| Marvel APS (Autorola Group Holding A/S), Delayed Draw Term Loan(a)(c) | | | 10.00 | % | | PIK | | 12/21/2027 | | | 3,118,553 | | | | 3,364,462 | |

| Material Handling Systems, Inc., First Lien Term Loan(a)(b) | | | 10.83 | % | | 3M SOFR + 5.50%, 0.50% Floor | | 06/08/2029 | | | 1,347,817 | | | | 1,227,638 | |

| Qualtek LLC, First Lien Term Loan(a)(b)(c) | | | 15.16 | % | | 3M SOFR + 1.00%, 9.00% PIK, 1.00% Floor | | 07/14/2025 | | | 365,726 | | | | 330,371 | |

| Qualtek LLC, Second Lien Term Loan(a)(b)(c)(e) | | | – | % | | 6M SOFR + 1.00%, 9.00% PIK, 1.00% Floor | | 01/14/2027 | | | 253,063 | | | | 44,868 | |

| Tactical Air Support, Inc., First Lien Term Loan(a)(b) | | | 13.97 | % | | 3M SOFR + 8.50%, 1.00% Floor | | 12/22/2028 | | | 1,714,286 | | | | 1,673,657 | |

| Tactical Air Support, Inc., Delayed Draw Term Loan(a)(b)(d) | | | 8.50 | % | | 3M SOFR + 8.50%, 1.00% Floor | | 12/22/2028 | | | – | | | | (6,771 | ) |

| | | | | | | | | | | | | | | | 12,408,250 | |

| See Notes to Consolidated Financial Statements. | |

| Semi-Annual Report | March 31, 2024 | 17 |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

March 31, 2024 (Unaudited)

| | | Coupon | | Reference Rate & Spread | | Maturity | | Principal | | Value |

| Information Technology (20.33%) | | | | | | | | | | | | | | | | |

| Alegeus Technologies Holdings Corp., First Lien Term Loan(a)(b) | | | 13.75 | % | | 3M SOFR + 8.25%, 1.00% Floor | | 09/05/2024 | | $ | 365,000 | | | $ | 365,000 | |

| Athos Merger Sub LLC, First Lien Term Loan(a)(b) | | | 10.60 | % | | 3M SOFR + 5.00% | | 07/31/2026 | | | 236,146 | | | | 231,128 | |

| Athos Merger Sub LLC, Second Lien Term Loan(a)(b) | | | 13.85 | % | | 3M SOFR + 8.25% | | 07/30/2027 | | | 160,771 | | | | 155,401 | |

| DCert Buyer, Inc., First Amendment Term Loan Refinancing, Second Lien Term Loan(a)(b) | | | 12.33 | % | | 1M SOFR + 7.00% | | 02/16/2029 | | | 1,500,000 | | | | 1,362,300 | |

| DRI Holdings Inc., First Lien Term Loan(a)(b) | | | 10.68 | % | | 1M SOFR + 5.25%, 0.50% Floor | | 12/15/2028 | | | 503,304 | | | | 472,321 | |

| Enverus Holdings, Inc., Initial, First Lien Term Loan(a)(b) | | | 10.83 | % | | 1M SOFR + 5.50%, 0.75% Floor | | 12/12/2029 | | | 814,028 | | | | 805,237 | |

| Enverus Holdings, Inc., Revolver(a)(b)(d) | | | – | % | | 1M SOFR + 5.50%, 0.75% Floor | | 12/12/2029 | | | – | | | | (803 | ) |

| Global IID Parent LLC, Second Lien Term Loan(a)(b) | | | 13.31 | % | | 3M SOFR + 7.75%, 0.50% Floor | | 12/16/2029 | | | 165,000 | | | | 157,476 | |

| Global IID Parent LLC, First Lien Term Loan(a)(b) | | | 10.06 | % | | 3M SOFR + 4.50%, 0.50% Floor | | 12/08/2028 | | | 2,846,117 | | | | 2,749,463 | |

| HDC / HW Intermediate Holdings A, First Lien Term Loan(a)(b)(c) | | | 9.07 | % | | 3M SOFR + 1.00%, 2.50% PIK, 5.25% Floor | | 06/21/2026 | | | 920,785 | | | | 881,652 | |

| HDC / HW Intermediate Holdings B, Second Lien Term Loan(a)(b)(c)(e) | | | – | % | | 3M SOFR + 1.00%, 2.50% PIK, 5.25% Floor | | 06/21/2026 | | | 637,807 | | | | – | |

| Help Systems Holdings, Inc., First Lien Term Loan(a)(b) | | | 9.43 | % | | 1M SOFR + 4.00%, 0.75% Floor | | 11/19/2026 | | | 1,496,104 | | | | 1,450,660 | |

| Ivanti Software, Inc., First Lien Term Loan(a)(b) | | | 9.84 | % | | 3M SOFR + 4.25%, 0.75% Floor | | 12/01/2027 | | | 1,460,244 | | | | 1,370,804 | |

| Kofax, Inc., First Lien Term Loan(a)(b) | | | 10.66 | % | | 3M SOFR + 5.25%, 0.50% Floor | | 07/20/2029 | | | 2,581,921 | | | | 2,395,377 | |

| Morae Global Corporation, First Lien Term Loan(a)(b) | | | 13.47 | % | | 3M SOFR + 8.00%, 2.00% Floor | | 10/26/2026 | | | 1,366,406 | | | | 1,308,334 | |

| Morae Global Corporation, Revolver(a)(b)(d) | | | – | % | | 3M SOFR + 8.00%, 2.00% Floor | | 10/26/2026 | | | – | | | | (5,313 | ) |

| PEAK Technology Partners, Inc., First Lien Term Loan(a)(b) | | | 11.72 | % | | 3M SOFR + 6.40%, 1.00% Floor | | 07/22/2027 | | | 619,938 | | | | 609,833 | |

| Riskonnect Parent LLC, First Lien Term Loan(a)(b) | | | 10.95 | % | | 3M SOFR + 5.50%, 0.75% Floor | | 12/07/2028 | | | 1,228,463 | | | | 1,216,178 | |

| Riskonnect Parent LLC, Delayed Draw Term Loan(a)(b)(d) | | | – | % | | 3M SOFR + 5.50%, 0.75% Floor | | 12/07/2028 | | | – | | | | – | |

| Tank Holding Corp., First Lien Term Loan(a)(b) | | | 11.18 | % | | 1M SOFR + 5.75%, 0.75% Floor | | 03/31/2028 | | | 845,707 | | | | 837,385 | |

| Tank Holding Corp., Revolver(a)(b)(d) | | | 11.18 | % | | 1M SOFR + 5.75%, 0.75% Floor | | 03/31/2028 | | | 1,712 | | | | 1,645 | |

| Taoglas Group Holdings Limited, First Lien Term Loan(a)(b) | | | 12.55 | % | | 3M SOFR + 7.25%, 1.00% Floor | | 02/28/2029 | | | 310,863 | | | | 293,269 | |

| Taoglas Group Holdings Limited, Revolver(a)(b)(d) | | | 12.57 | % | | 3M SOFR + 7.25%, 1.00% Floor | | 02/28/2029 | | | 62,754 | | | | 57,887 | |

| VeriFone Systems, Inc., First Lien Term Loan(a)(b) | | | 9.59 | % | | 3M SOFR + 4.00% | | 08/20/2025 | | | 997,368 | | | | 887,039 | |

| Zywave, Inc., First Lien Term Loan(a)(b) | | | 9.95 | % | | 3M SOFR + 4.50% | | 11/12/2027 | | | 2,982,071 | | | | 2,821,785 | |

| | | | | | | | | | | | | | | | 20,424,058 | |

| Real Estate (4.73%) | | | | | | | | | | | | | | | | |

| RHF VI FUNDING LLC, Revolver(a)(b)(d) | | | 13.07 | % | | 3M SOFR + 7.50% | | 11/19/2024 | | | 4,750,000 | | | | 4,750,000 | |

| | | | | | | | | | | | | | | | 4,750,000 | |

| | | | | | | | | | | | | | | | | |

| TOTAL BANK LOANS | | | | | | | | | | | | | | | | |

| (Cost $60,106,833) | | | | | | | | | | | | | | | 60,769,362 | |

| See Notes to Consolidated Financial Statements. | |

| 18 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

March 31, 2024 (Unaudited)

| | | Coupon | | Reference Rate & Spread | | Maturity | | Principal | | Value |

| Bonds & Notes (3.83%) | | | | | | | | | | |

| Asset Backed Securities (0.40%) | | | | | | | | | | |

| Mount Logan Funding 2018-1 LP(a)(f) | | | 22.14 | % | | N/A | | 01/22/2033 | | $ | 479,858 | | | $ | 401,113 | |

| | | | | | | | | | | | | | | | | |

| Total Bonds & Notes | | | | | | | | | | | | | | | | |

| (Cost $404,253) | | | | | | | | | | | | | | | 401,113 | |

| EQUIPMENT FINANCING (3.43%) | | | | | | | | | | | | | | | | |

| Equipment Financing (3.43%) | | | | | | | | | | | | | | | | |

| White Oak Equipment Finance 1, LLC(a)(b)(g) | | | 10.75 | % | | | | 01/01/2027 | | | 3,447,552 | | | | 3,447,552 | |

| | | | | | | | | | | | | | | | | |

| Total Equipment Financing | | | | | | | | | | | | | | | | |

| (Cost $3,447,552) | | | | | | | | | | | | | | | 3,447,552 | |

| | | Shares | | Value |

| COMMON EQUITY (1.28%) | | | | |

| Communication Services (0.01%) | | | | |

| NextFlight Ventures(a)(h) | | | 23 | | | | 3,536 | |

| NFV Co-Pilot, Inc.(a)(h) | | | 114 | | | | 6,272 | |

| | | | | | | | 9,808 | |

| | | | | | | | | |

| Consumer Discretionary (1.27%) | | | | | | | | |

| IFRG Investor III, L.P.(a) | | | 1,250,000 | | | | 1,275,000 | |

| | | | | | | | 1,275,000 | |

| | | | | | | | | |

| Industrials (–%) | | | | | | | | |

| Qualtek LLC(a)(h)(g) | | | 28,521 | | | | – | |

| | | | | | | | – | |

| | | | | | | | | |

| Information Technology (–%) | | | | | | | | |

| HDC / HW Intermediate Holdings, LLC(a)(g)(h) | | | 24,803 | | | | – | |

| | | | | | | | – | |

| | | | | | | | | |

| TOTAL COMMON EQUITY | | | | | | | | |

| (Cost $1,502,236) | | | | | | | 1,284,808 | |

| | | Shares | | Value |

| JOINT VENTURE (3.98%) | | | | |

| Joint Venture (3.98%) | | | | |

| Great Lakes Funding II LLC, Series A(d)(f)(i)(j) | | | 3,896,357 | | | | 4,005,454 | |

| | | | | | | | 4,005,454 | |

| | | | | | | | | |

| TOTAL JOINT VENTURE | | | | | | | | |

| (Cost $3,896,357) | | | | | | | 4,005,454 | |

| | | Shares | | Value |

| PREFERRED STOCK (7.19%) | | | | |

| Communication Services (2.31%) | | | | |

| Highmount DP SPV, LLC, Class A, Preferred(a)(d)(g)(h) | | | 2,321,429 | | | | 2,321,429 | |

| | | | | | | | 2,321,429 | |

| See Notes to Consolidated Financial Statements. | |

| Semi-Annual Report | March 31, 2024 | 19 |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

March 31, 2024 (Unaudited)

| | | Dividend Rate | | Shares | | Value |

| PREFERRED STOCK (7.19%) (continued) | | | | | | |

| Consumer Discretionary (4.88%) | | | | | | | | | | |

| EBSC Holdings LLC (Riddell, Inc.), Preferred(a) | | 10.00% PIK | | | 5,000 | | | | 4,900,000 | |

| | | | | | | | | | 4,900,000 | |

| | | | | | | | | | | |

| TOTAL PREFERRED STOCK | | | | | | | | | | |

| (Cost $7,221,429) | | | | | | | | | 7,221,429 | |

| | | | | | | | | | | |

| WARRANTS (0.07%) | | | | | | | | | | |

| Morae Global Holdings Inc., Warrants(a) | | | | | 1 | | | $ | 65,428 | |

| | | | | | | | | | | |

| TOTAL WARRANTS | | | | | | | | | | |

| (Cost $52,195) | | | | | | | | | 65,428 | |

| | | | | | | | | | | |

| SHORT- TERM INVESTMENTS (24.96%) | | | | | | | | | | |

| US BANK MMDA - USBGFS 9, 5.24%(k) | | | | | 25,078,881 | | | | 25,078,881 | |

| | | | | | | | | | | |

| TOTAL SHORT- TERM INVESTMENTS | | | | | | | | | | |

| (Cost $25,078,881) | | | | | | | | | 25,078,881 | |

| | | | | | | | | | | |

| INVESTMENTS, AT VALUE (101.80%) | | | | | | | | | | |

| (Cost $101,709,736) | | | | | | | | $ | 102,274,027 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other Liabilities In Excess Of Other Assets (-1.80%) | | | | | | | | | (1,806,736 | ) |

| | | | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | | | $ | 100,467,291 | |

Investment Abbreviations:

SOFR - Secured Overnight Financing Rate

PIK - Payment in-kind

Libor Rates:

1M US SOFR - 1 Month US SOFR as of March 31, 2024 was 5.33%

3M US SOFR - 3 Month US SOFR as of March 31, 2024 was 5.30%

6M US SOFR - 6 Month US SOFR as of March 31, 2024 was 5.22%

PRIME - US Prime Rate as of March 31, 2024 was 8.50%

| (a) | As a result of the use of significant unobservable inputs to determine fair value, these investments have been classified as Level 3 assets. |

| (b) | Variable rate investment. Interest rates reset periodically. Interest rate shown reflects the rate in effect at March 31, 2024. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description above. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (c) | Payment in kind security which may pay interest in additional par. |

| (d) | All or a portion of this commitment was unfunded as of March 31, 2024. |

| (e) | Non-accrual investment. |

| (g) | Investment is held through SOFIX Master Blocker, LLC, wholly owned subsidiary. |

| (h) | Non-income producing security. |

| (j) | During the period ended March 31, 2024, the Fund invested $4,629,346 in Great Lakes Funding II, LLC - Series A units, received a return of capital distribution of $829,185, and reported change in unrealized appreciation of $111,190 on Great Lakes Funding II, LLC - Series A units. Additionally, Great Lakes Funding II LLC - Series A declared distributions of $333,674 during the period ended March 31, 2024. |

| (k) | Money market fund; interest rate reflects seven-day effective yield on March 31, 2024. |

| See Notes to Consolidated Financial Statements. | |

| 20 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

March 31, 2024 (Unaudited)

Additional information on investments in private investment funds:

| Security | | Value | | Redemption Frequency | | Redemption Notice(Days) | | Unfunded Commitments as of

March 31, 2024 |

| Great Lakes Funding II LLC, Series A | | $ | 4,005,454 | | | N/A | | N/A | | $ | 1,102,591 | |

| Total | | $ | 4,005,454 | | | | | | | $ | 1,102,591 | |

Unfunded Commitments:

| Security | | Value | | Maturity Date | | Unfunded Balance |

| Accordion Partners, LLC, Third Amendment Delayed Draw Term Loan | | $ | 117,505 | | | 08/29/2029 | | $ | 33,500 | |

| Cor Leonis Limited, Revolver | | | 172,408 | | | 05/15/2028 | | | 43,234 | |

| Dentive LLC, Delayed Draw Term Loan | | | 78,076 | | | 12/26/2028 | | | 38,969 | |

| Enverus Holdings, Inc., Revolver | | | (803 | ) | | 12/12/2029 | | | 74,324 | |

| Expert Experience Credit Motors, LLC, Revolver | | | – | | | 03/29/2026 | | | 5,250,000 | |

| Fortis Payment Systems, LLC, Delayed Draw Term Loan | | | 95,187 | | | 02/13/2026 | | | 531,250 | |

| Highmount DP SPV, LLC, Class A, Preferred | | | 2,321,429 | | | N/A | | | 2,678,571 | |

| IDC Infusion Services, Inc., Delayed Draw Term Loan | | | 32,630 | | | 07/07/2028 | | | 100,649 | |

| Lion FIV Debtco Limited, Revolver | | | 237,583 | | | 10/18/2024 | | | 1,477,416 | |

| Morae Global Corporation, Revolver | | | (5,313 | ) | | 10/26/2026 | | | 125,000 | |

| Next Flight Ventures, Delayed Draw Term Loan | | | 14 | | | 12/26/2025 | | | 309,375 | |

| PhyNet Dermatology LLC, Delayed Draw Term Loan | | | (1,216 | ) | | 10/20/2029 | | | 1,013,464 | |

| RHF VI FUNDING LLC, Revolver | | | 4,750,000 | | | 11/19/2024 | | | 250,000 | |

| Riddell Inc., Delayed Draw Term Loan | | | – | | | 03/29/2029 | | | 90,909 | |

| Riskonnect Parent LLC, Delayed Draw Term Loan | | | – | | | 12/07/2028 | | | 5,000,000 | |

| Royal Palm Equity Partners I L.P., Delayed Draw Term Loan | | | 4,734 | | | 10/24/2033 | | | 354,814 | |

| Royal Palm Equity Partners I L.P., First Lien Term Loan | | | 947 | | | 10/24/2033 | | | 70,963 | |

| South Florida ENT Associates, Delayed Draw Term Loan | | | (2,516 | ) | | 12/31/2025 | | | 168,878 | |

| TA/WEG HOLDINGS, LLC, 2024 Delayed Draw Term Loan | | | 18,348 | | | 10/04/2027 | | | 2,446,412 | |

| TA/WEG HOLDINGS, LLC, May 2022 Delayed Draw Term Loan | | | 446,738 | | | 10/04/2027 | | | 20,349 | |

| TA/WEG HOLDINGS, LLC, Revolver | | | – | | | 10/04/2027 | | | 207,900 | |

| Tactical Air Support, Inc., Delayed Draw Term Loan | | | (6,771 | ) | | 12/22/2028 | | | 285,714 | |

| Tank Holding Corp., Revolver | | | 1,645 | | | 03/31/2028 | | | 6,049 | |

| Taoglas Group Holdings Limited, Revolver | | | 57,887 | | | 02/28/2029 | | | 23,242 | |

| Total | | $ | 8,318,512 | | | | | $ | 20,600,982 | |

| Total Unfunded Commitments | | | | | | | | $ | 21,703,573 | |

| See Notes to Consolidated Financial Statements. | |

| Semi-Annual Report | March 31, 2024 | 21 |

| Opportunistic Credit Interval Fund | Consolidated Statement of Assets and Liabilities |

March 31, 2024 (Unaudited)

| ASSETS | | |

| Investments, at value (Cost $97,409,126) | | $ | 97,867,460 | |

| Affiliated investments, at value (Cost $4,300,610) | | | 4,406,567 | |

| Cash | | | 11,217 | |

| Interest and distributions receivable | | | 1,030,315 | |

| Receivable for investments sold | | | 2,200,730 | |

| Receivable for fund shares sold | | | 1,160,228 | |

| Prepaid expenses and other assets | | | 67,203 | |

| Total assets | | $ | 106,743,720 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for investments purchased | | | 5,867,613 | |

| Due to Adviser | | | 35,684 | |

| Administration fees payable | | | 46,340 | |

| Incentive fees payable | | | 270,566 | |

| Accrued expenses and other liabilities | | | 56,226 | |

| Total liabilities | | | 6,276,429 | |

| Commitments and contingencies (Note 2) | | | | |

| NET ASSETS | | $ | 100,467,291 | |

| | | | | |

| NET ASSETS CONSISTS OF | | | | |

| Paid-in capital | | $ | 100,890,887 | |

| Total accumulated deficit | | | (423,596 | ) |

| NET ASSETS | | $ | 100,467,291 | |

| | | | | |

| Common Shares: | | | | |

| Institutional | | | | |

| Net assets | | $ | 100,467,291 | |

| Shares of beneficial interest outstanding (no par value; unlimited shares) | | | 8,608,439 | |

| Net asset value | | $ | 11.67 | |

| See Notes to Consolidated Financial Statements. | |

| 22 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Consolidated Statement of Operations |

For the Six Months Ended March 31, 2024 (Unaudited)

| | | |

| INVESTMENT INCOME | | |

| Interest | | $ | 3,193,069 | |

| Interest from affiliated investments | | | 383,639 | |

| Dividends | | | 98,872 | |

| Dividends from affiliated investments | | | 335,674 | |

| Other income | | | 208,217 | |

| Total investment income | | | 4,219,471 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 4) | | | 445,557 | |

| Administrative fees (Note 4) | | | 210,952 | |

| Sub-administrative fees (Note 4) | | | 104,516 | |

| Incentive fees (Note 4) | | | 270,566 | |

| Transfer agent fees (Note 4) | | | 138,148 | |

| Professional fees | | | 90,480 | |

| Insurance expense | | | 81,704 | |

| Trustee fees and expenses (Note 4) | | | 19,152 | |

| Other expenses | | | 121,842 | |

| Total expenses | | | 1,482,917 | |

| Fees waived/expenses reimbursed by Adviser (Note 4) | | | (359,442 | ) |

| Total net expenses | | | 1,123,475 | |

| NET INVESTMENT INCOME | | | 3,095,996 | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | | |

| Net realized loss on investments | | | (121,542 | ) |

| Net realized gain on foreign currency transactions | | | 20,711 | |

| Total net realized loss | | | (100,831 | ) |

| Net change in unrealized depreciation on investments | | | (219,132 | ) |

| Net change in unrealized appreciation on affiliated investments | | | 77,233 | |

| Net change in unrealized depreciation on translation of assets and liabilities in foreign currencies | | | (24 | ) |

| Total net change in unrealized depreciation | | | (141,923 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (242,754 | ) |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 2,853,242 | |

| See Notes to Consolidated Financial Statements. | |

| Semi-Annual Report | March 31, 2024 | 23 |

| Opportunistic Credit Interval Fund | Consolidated Statements of Changes in Net Assets |

| | | For the Six Months Ended March 31, 2024 (Unaudited) | | For the Year Ended September 30, 2023 |

| OPERATIONS | | | | |

| Net investment income | | $ | 3,095,996 | | | $ | 1,658,486 | |

| Net realized gain/(loss) on investments | | | (121,542 | ) | | | 408,898 | |

| Net realized gain on foreign currency transactions | | | 20,711 | | | | – | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (141,923 | ) | | | 725,907 | |

| Net increase in net assets resulting from operations | | | 2,853,242 | | | | 2,793,291 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total Distributable Earnings | | | | | | | | |

| Institutional | | | (4,138,967 | )(a) | | | (1,944,979 | ) |

| Total distributions to shareholders | | | (4,138,967 | ) | | | (1,944,979 | ) |

| | | | | | | | | |

| COMMON SHARE TRANSACTIONS | | | | | | | | |

| Institutional | | | | | | | | |

| Proceeds from sales of shares | | | 64,685,907 | | | | 34,341,560 | |

| Distributions reinvested | | | 469,433 | | | | 427,622 | |

| Cost of shares redeemed | | | (1,297,596 | ) | | | (46,039 | ) |

| Net increase from share transactions | | | 63,857,744 | | | | 34,723,143 | |

| Total net increase from net assets | | | 62,572,019 | | | | 35,571,455 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 37,895,272 | | | | 2,323,817 | |

| End of period | | $ | 100,467,291 | | | $ | 37,895,272 | |

| | | | | | | | | |

| OTHER INFORMATION | | | | | | | | |

| Common Shares Transactions | | | | | | | | |

| Institutional | | | | | | | | |

| Issued | | | 5,472,245 | | | | 2,942,117 | |

| Distributions reinvested | | | 40,284 | | | | 38,178 | |

| Redeemed | | | (110,148 | ) | | | (3,945 | ) |

| Net increase in shares | | | 5,402,381 | | | | 2,976,350 | |

| (a) | A portion of the distributions from net investment income may be deemed a return of capital or net realized gain at fiscal year-end |

| See Notes to Consolidated Financial Statements. | |

| 24 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Consolidated Statement of Cash Flows |

For the Six Months Ended March 31, 2024 (Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES: | | |

| Net increase in net assets from operations | | $ | 2,853,242 | |

| Adjustments to reconcile net increase in net assets resulting from net cash used in operating activities: | | | | |

| Purchase of investment securities | | | (64,240,612 | ) |

| Payment-in-kind income | | | (204,259 | ) |

| Proceeds from sale of investment securities | | | 7,183,727 | |

| Purchase of short-term investment securities - net | | | (4,024,406 | ) |

| Amortization of discount and accretion of discount on investments | | | (461,115 | ) |

| Net realized (gain)/loss on: | | | | |

| Investments | | | 121,542 | |

| Net change in unrealized (appreciation)/depreciation on: | | | | |

| Investments | | | 141,923 | |

| (Increase)/Decrease in assets: | | | | |

| Due from advisor | | | 196,349 | |

| Interest and distributions receivable | | | (703,944 | ) |

| Prepaid expenses and other assets | | | 114,905 | |

| Increase/(Decrease) in liabilities: | | | | |

| Due to Adviser | | | 35,684 | |

| Administration fees payable | | | (78,071 | ) |

| Incentive fees payable | | | 232,169 | |

| Accrued expenses and other liabilities | | | (282,286 | ) |

| Net cash used in operating activities | | | (59,115,152 | ) |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from sales of shares | | | 64,093,583 | |

| Cost of shares redeemed | | | (1,297,596 | ) |

| Cash distributions paid | | | (3,669,618 | ) |

| Net cash provided by financing activities | | | 59,126,369 | |

| | | | | |

| Net change in cash & cash equivalents | | | 11,217 | |

| | | | | |

| Restricted and unrestricted cash, beginning of period | | $ | – | |

| Restricted and unrestricted cash, end of period | | $ | 11,217 | |

| | | | | |

| Non-cash financing activities not included herein consist of reinvestment of distributions of: | | $ | 469,433 | |

| See Notes to Consolidated Financial Statements. | |

| Semi-Annual Report | March 31, 2024 | 25 |

| Opportunistic Credit Interval Fund | Consolidated Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended March 31, 2024 (Unaudited) | | Year Ended September 30, 2023 | | For the Period Ended September 30, 2022(a) |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.82 | | | $ | 10.12 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

| Net investment income(b) | | | 0.54 | | | | 1.49 | | | | 0.05 | |

| Net realized and unrealized gain/(loss) on investments | | | (0.09 | ) | | | 1.48 | (c) | | | 0.07 | |

| Total income from investment operations | | | 0.45 | | | | 2.97 | | | | 0.12 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | |

| From net investment income | | | (0.60 | )(i) | | | (1.27 | ) | | | – | |

| From net realized gain on investments | | | – | | | | – | | | | – | |

| Total distributions | | | (0.60 | ) | | | (1.27 | ) | | | – | |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.15 | ) | | | 1.70 | | | | 0.12 | |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.67 | | | $ | 11.82 | | | $ | 10.12 | |

| | | | | | | | | | | | | |

| TOTAL RETURN(d) | | | 3.88 | %(e) | | | 30.31 | %(e) | | | 1.20 | % |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 100,467 | | | $ | 37,895 | | | $ | 2,324 | |

| | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS(f) | | | | | | | | | | | | |

| Expenses, gross | | | 4.35 | %(g) | | | 11.00 | % | | | 58.09 | %(g) |

| Expenses, net of fees waived/expenses reimbursed by Adviser | | | 3.29 | %(g) | | | 2.80 | % | | | 2.50 | %(g) |

| Expenses, net of fees waived/expenses reimbursed by Adviser and excluding the Incentive fee | | | 2.50 | %(g) | | | 2.50 | % | | | 2.50 | %(g) |

| | | | | | | | | | | | |

| Net investment income | | | 9.08 | %(g) | | | 12.79 | % | | | 2.24 | %(g) |

| | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 10 | %(h) | | | 63 | % | | | 106 | %(g) |

| (a) | The Fund's Class I commenced operations on July 5, 2022. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | The amount shown for a share outstanding throughout the period is not indicative of the aggregate net realized and unrealized gain on investments for that period because of the timing of sales and repurchases of the Fund shares in relation to fluctuating market value of the investments in the Fund. |

| (d) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Returns shown exclude applicable sales charges. |

| (e) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (f) | Ratios do not include expenses of underlying investment companies and private investment funds in which the Fund invests. |

| (h) | Portfolio turnover rate is calculated using the lesser of year-to-date sales or year-to-date purchases over the average of the invested assets at fair value. Portfolio turnover rates that cover less than a full period are not annualized. |

| (i) | A portion of the distributions from net investment income may be deemed a return of capital or net realized gain at fiscal year-end |

| See Notes to Consolidated Financial Statements. | |

| 26 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Notes to Consolidated Financial Statements |

March 31, 2024 (Unaudited)

1. ORGANIZATION

Opportunistic Credit Interval Fund (the “Fund”) is a closed-end, diversified management Investment Company that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is structured as an interval fund and continuously offers its shares. The Fund was organized as a Delaware statutory trust on January 21, 2022. The Fund inception date was July 1, 2022 and commenced operations on July 5, 2022.

The Fund may issue an unlimited number of shares of beneficial interest. All shares of the Fund have equal rights and privileges. Each share of the Fund is entitled to one vote on all matters as to which shares are entitled to vote. In addition, each share of the Fund is entitled to participate, equally with other shares (i) in dividends and distributions declared by the Fund and (ii) upon liquidation, in the distribution of its proportionate share of the assets remaining after satisfaction of outstanding liabilities. Shares of the Fund are fully paid, non-assessable and fully transferable when issued and have no pre-emptive, conversion or exchange rights. Fractional shares have proportionately the same rights, including voting rights, as are provided for a full share. The Fund offers one class of shares: Class I shares.

The Fund’s investment objectives are to produce current income and capital appreciation. The Fund will seek to meet its investment objectives by investing primarily in credit-related instruments of North American and European issuers. The Fund defines credit-related instruments as debt, loans, loan participations, credit facility commitments, asset and lease pool interests, mortgage servicing rights, preferred shares, and swaps linked to credit-related instruments. The Fund’s investments will focus on privately originated credit investments as well as secondary credit investments. The Fund will not invest in instruments of emerging market issuers. The Fund will invest without restriction as to an instrument’s maturity, structure, seniority, interest rate formula, currency, and without restriction as to issuer capitalization or credit quality. Lower credit quality debt instruments, such as leveraged loans and high yield bonds, are commonly referred to as “junk” bonds. The Fund defines junk bonds as those rated lower than Baa3 by Moody’s Investors Services, Inc. (“Moody’s”) or lower than BBB by Standard and Poor’s Rating Group (“S&P”), or, if unrated, determined by the Adviser to be of similar credit quality.

Under normal circumstances, the Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, in credit-related instruments. The Fund defines credit-related instruments as debt, loans, loan participations, credit facility commitments, asset and lease pool interests, mortgage servicing rights, preferred shares, and swaps linked to credit-related instruments.

Mount Logan Management LLC (the “Adviser”) serves as the Fund’s investment adviser.

On January 16, 2024, the Fund formed a wholly-owned taxable subsidiary, SOFIX Master Blocker, LLC (the “Taxable Subsidiary”), a Delaware limited liability company, which is taxed as a corporation for U.S. federal income tax purposes. The Taxable Subsidiary allows the Fund to make equity investments in companies organized as pass-through entities while continuing to satisfy the requirements of a Regulated Investment Company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”). The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies. These financial statements reflect adjustments that in the opinion of the Fund are necessary for the fair presentation of the financial position and results of operations as of and for the periods presented herein. The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the year. Actual results could differ from those estimates, and such difference could be material. In accordance with U.S. GAAP guidance on consolidation, the Fund will generally not consolidate its investment in a portfolio company other than an investment company subsidiary or a controlled operating company whose business consists of providing services to the Fund.

Securities Transactions and Investment Income – Investment transactions are recorded on the trade date. Realized gains or losses on investments are calculated using the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Premiums on securities are amortized to the earliest call date and purchase discounts are accreted over the life of the respective securities using the effective interest method.

Loans are generally placed on non-accrual status when there is reasonable doubt that principal or interest will be collected in full. The Fund considers many factors relevant to an investment when placing it on or removing it from non-accrual status including, but not limited to, the delinquency status of the investment, economic and business conditions, the overall financial condition of the underlying investment, the value of the underlying collateral, bankruptcy status, if any, and any other facts or circumstances relevant to the investment. Accrued interest is generally reversed when a loan is placed on non-accrual status. Payments received on non-accrual loans may be recognized as income or applied to principal depending upon management’s judgment regarding collectability of the outstanding principal and interest. Generally, non-accrual loans may be restored to accrual status when past due principal and interest is paid current and are likely to remain current based on management’s judgment.

| Semi-Annual Report | March 31, 2024 | 27 |

| Opportunistic Credit Interval Fund | Notes to Consolidated Financial Statements |

March 31, 2024 (Unaudited)

Securities Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price. In the absence of a sale, such securities shall be valued at the mid-price. Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value. Investments in money market funds are valued at their respective net asset value (“NAV”).

Structured credit and other similar debt securities including, but not limited to, collateralized loan obligations (“CLO”) debt and equity securities, asset-backed securities (“ABS”), commercial mortgage-backed securities (“CMBS”) and other securitized investments backed by certain debt or other receivables (collectively, “Structured Credit Securities”), are valued on the basis of valuations provided by dealers in those instruments and/or independent pricing services recommended by the Adviser and approved by the Fund’s board of trustees (the “Board” or “Trustees”). In determining fair value, dealers and pricing services will generally use information with respect to transactions in the securities being valued, quotations from other dealers, market transactions in comparable securities, analyses and evaluations of various relationships between securities and yield to maturity information. The Adviser will, based on its reasonable judgment, select the dealer or pricing service quotation that most accurately reflects the fair market value of the Structured Credit Security while taking into account the information utilized by the dealer or pricing service to formulate the quotation in addition to any other relevant factors. In the event that there is a material discrepancy between quotations received from third-party dealers or the pricing services, the Adviser may (i) use an average of the quotations received or (ii) select an individual quotation that the Adviser, based upon its reasonable judgment, determines to be reasonable.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Adviser, those securities will be valued at fair value as determined in good faith by the Adviser in its capacity as the Board's valuation designee pursuant to Rule 2a-5 under the 1940 Act. Fair valuation involves subjective judgments, the Fund cannot ensure that fair values determined by the Adviser would accurately reflect the price that the Fund could obtain for a security if the security was sold. As the valuation designee, the Adviser acts under the Board's oversight. The Adviser’s fair valuation policies and procedures are approved by the Board.

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its net asset value (“NAV”) when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

The fair value of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level and supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; and (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve and credit quality.

Valuation of Private Investment Funds – The Fund invests a portion of its assets in private investment funds (“Private Investment Funds”). Private Investment Funds, including a joint venture Great Lakes Funding II LLC (“Great Lakes II JV”), value their investment assets at fair value and generally report a NAV or its equivalent in accordance with U.S. GAAP on a calendar quarter basis. The Fund has elected to apply the practical expedient and to value its investments in Private Investment Funds at their respective NAVs at each quarter-end in accordance with U.S. GAAP. For non-calendar quarter-end days, the Valuation Committee estimates the fair value of each Private Investment Fund by adjusting the most recent NAV for such Private Investment Fund, as necessary, by the change in a relevant benchmark that the Valuation Committee has deemed to be representative of the underlying securities in the Private Investment Fund.

Loan Participation and Assignments – The Fund invests in debt instruments, which are interests in amounts owed to lenders (the “Lenders”) by corporate, governmental or other borrowers. The Fund’s investments in loans may be in the form of direct investments, loans originated by the Fund, participations in loans or assignments of all or a portion of the loans from third parties or exposure to investments in loans through investment in Private Investment Funds or other pooled investment vehicles. When the Fund purchases an interest in a loan in the form of an assignment, the Fund acquires all of the direct rights and obligations of a lender (as such term is defined in the related credit agreement), including the right to vote on amendments or waivers of such credit agreement. However, the Fund generally has no right to enforce compliance with the terms of the loan agreement with the borrower. Instead, the administration of the loan agreement is often performed by a bank or other financial institution (the “Agent”) that acts as agent for the Lenders. Circumstances may arise in connection with which the Agent takes action that contradicts the will of the Lenders. For example, under certain circumstances, an Agent may refuse to declare the borrower in default, despite having received a notice of default from the Lenders. When the Fund purchases an interest in a loan in the form of a participation, the Fund purchases such participation interest from another existing Lender, and consequently, the Fund does not obtain the rights and obligations of the Lenders under the credit agreement, such as the right to vote on amendments or waivers. The Fund has the right to receive payments of principal, interest and any fees to which it is entitled only from the Lender from which the Fund has received that participation interest. In this instance, the Fund is subject to both the credit risk of the borrower and the credit risk of the Lender that sold the Fund such participation interest.

| 28 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Notes to Consolidated Financial Statements |

March 31, 2024 (Unaudited)

Unfunded Commitments – The Fund may enter into unfunded loan commitments, which are contractual obligations for future funding, such as delayed draw term loans or revolving credit arrangements. Unfunded loan commitments represent a future obligation in full, even though a percentage of the notional loan amounts may not be utilized by the borrower. The Fund may receive a commitment fee based on the undrawn portion of the underlying line of credit portion of a floating rate loan.

Additionally, when the Fund invests in a Private Investment Fund, the Fund makes a commitment to invest a specified amount of capital in the applicable Private Investment Fund. The capital commitment may be drawn by the general partner of the Private Investment Fund either all at once or through a series of capital calls at the discretion of the general partner. The unfunded commitment represents the portion of the Fund’s overall capital commitment to a particular Private Investment Fund that has not yet been called by the general partner of the Private Investment Fund.

As of March 31, 2024, the Fund had unfunded commitments of $21,703,573.

Fair Value Measurements – A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with U.S. GAAP guidance on fair value measurements and disclosure, the Fund discloses the fair value of its investments in a hierarchy that categorizes the inputs to valuation techniques used to measure the fair value.

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date; |

| | |

| Level 2 – | Quoted prices in markets that are not active, or quoted prices for similar assets or liabilities in active markets, or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability at the measurement date; and |

| | |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Fund to measure fair value maximizes the use of observable inputs and minimizes the use of unobservable inputs.

| Semi-Annual Report | March 31, 2024 | 29 |

| Opportunistic Credit Interval Fund | Notes to Consolidated Financial Statements |

March 31, 2024 (Unaudited)

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the fair values according to the inputs used in valuing the Fund’s investments as of March 31, 2024

| Investments in Securities at Value | | Level 1 | | Level 2 | | Level 3 | | Total |

| Bank Loans(a) | | | | | | | | |

| Communication Services | | $ | – | | | $ | – | | | $ | 5,063,916 | | | $ | 5,063,916 | |

| Consumer Discretionary | | | – | | | | – | | | | 886,364 | | | | 886,364 | |

| Consumer Staples | | | – | | | | – | | | | 3,976,916 | | | | 3,976,916 | |

| Financials | | | – | | | | – | | | | 9,212,996 | | | | 9,212,996 | |

| Health Care | | | – | | | | – | | | | 4,046,862 | | | | 4,046,862 | |

| Industrials | | | – | | | | – | | | | 12,408,250 | | | | 12,408,250 | |

| Information Technology | | | – | | | | – | | | | 20,424,058 | | | | 20,424,058 | |

| Real Estate | | | – | | | | – | | | | 4,750,000 | | | | 4,750,000 | |

| Bonds & Notes(a) | | | | | | | | | | | | | | | | |

| Asset Backed Securities | | | – | | | | – | | | | 401,113 | | | | 401,113 | |

| Common Equity(a) | | | | | | | | | | | | | | | | |

| Communication Services | | | – | | | | – | | | | 9,808 | | | | 9,808 | |

| Consumer Discretionary | | | – | | | | – | | | | 1,275,000 | | | | 1,275,000 | |

| Industrials | | | – | | | | – | | | | – | | | | – | |

| Information Technology | | | – | | | | – | | | | – | | | | – | |

| Preferred Stocks(a) | | | | | | | | | | | | | | | | |

| Communication Services | | | – | | | | – | | | | 2,321,429 | | | | 2,321,429 | |

| Consumer Discretionary | | | – | | | | – | | | | 4,900,000 | | | | 4,900,000 | |

| Equipment Financing(a) | | | – | | | | – | | | | 3,447,552 | | | | 3,447,552 | |

| Short- Term Investments(a) | | | | | | | | | | | | | | | | |

| Money Market Funds | | | 25,078,881 | | | | – | | | | – | | | | 25,078,881 | |

| Warrants(a) | | | | | | | | | | | | | | | | |

| Information Technology | | | – | | | | – | | | | 65,428 | | | | 65,428 | |

| TOTAL | | $ | 25,078,881 | | | $ | – | | | $ | 73,189,692 | | | $ | 98,268,573 | |

| Investments measured at net asset value(a) | | | | | | | | | | | | | | $ | 4,005,454 | |