UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------------------------------------------------

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23787

----------------------------------------------------------------

Constitution Capital Access Fund, LLC

(Exact name of registrant as specified in charter)

----------------------------------------------------------------

300 Brickstone Square, 7th Floor

Andover, Massachusetts 01810

(Address of principal executive offices) (Zip code)

Rob Hatch

Constitution Capital PM, LP

300 Brickstone Square, 7th Floor

Andover, Massachusetts 01810

(Name and address of agent for service)

----------------------------------------------------------------

Registrant’s telephone number, including area code: (855) 551-2276

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) The Report to Shareholders is attached herewith.

Constitution Capital Access Fund, LLC |

Table of Contents For the Period October 1, 2022 (Commencement of Operations) through March 31, 2023 |

1

Constitution Capital Access Fund, LLC |

Manager’s Discussion and Analysis of Fund Performance March 31, 2023 (Unaudited) |

Dear Shareholders,

Constitution Capital Partners (an affiliate of Constitution Capital PM, L.P.) is pleased to present the inaugural Constitution Capital Access Fund, LLC (the “Fund”) annual report for its six months of operations during the fiscal year ended March 31, 2023. The Fund launched on October 1, 2022 and produced a six month return of 6.10% (12.83% annualized return*) during a turbulent market environment. The Fund finished the fiscal year with net assets of $595.71 million and fair market value of investments of $632.71 million.

Management commentary

The fourth quarter 2022 and first quarter 2023 were characterized by a tapering of post-pandemic growth momentum, commodity and labor inflation weighing on corporate margins, increased cost of debt constricting free cash flow and lower transaction volumes. During this time, public markets exhibited volatility with the MSCI World Index (the “Index”) returning -5.0% and -3.3% two out of the six months since the Fund’s launch. We are pleased to report that the Fund exhibited lower volatility than the Index over this timeframe, and delivered positive returns despite the turbulent macroeconomic environment.

The Fund’s performance during the six-month period ended March 31, 2023 was driven primarily by increases in the fair market value of Direct Equity Investments, followed by performance of Primary Investments and augmented by favorable movements in foreign exchange.

The Fund was able to execute on its mandate of providing a seasoned, diversified portfolio to its investors. In the first six months of operations, the Fund’s Primary and Secondary Investments generated $65 million in distributions against $19 million of capital calls, producing net cash flows of $46 million. This net cash flow is a testament to the Fund’s focus on mitigating the “J-curve” through portfolio construction and vintage diversification (although past performance is no guarantee of future results).

The Fund completed five Direct Equity Investments in the six months since its launch on October 1, 2022 through new platform and follow-on activity, resulting in $53 million of new capital commitments. The Direct Equity Investment activity reflects the Fund’s commitment to its target asset allocation of 60% Direct Investments, 20% Primary Investments and 10-20% Secondary Investments. Subsequent to the fiscal year ended March 31, 2023, the Fund completed three additional Direct Equity Investments totaling $15 million in commitments.

Of the new investments completed during the fiscal year partial period, four were in North America and one was in Europe. The Fund continues to seek opportunities on a global basis with primary exposure in North America. As of March 31, 2023, the top four sector exposures in the Fund are as follows: Healthcare (19%), Industrials (17.0%)2, Information Technology (16%) and Consumer Discretionary (15%). Constitution Capital Partners continues to favor investments in the healthcare, industrials & business services and consumer sectors.

Outlook and portfolio positioning

In times of economic uncertainty, we remain focused on our cycle-tested approach of investing in middle market opportunities with (i) well-established leadership, (ii) organizational depth, (iii) secular tailwinds and durability, (iv) attractive financial profile with regard to growth, profitability, capital intensity and liquidity, (v) prudent levels of debt relative to comparable companies, (vi) entry enterprise valuations at a discount to public comparable companies and precedent transactions, and (vii) clear and actionable value creation plans that minimize downside exposure.

We continue to have conviction in this approach and are prepared to capitalize on market dislocation that may yield opportunities for outsized growth and returns.

We appreciate the trust and confidence you have demonstrated in Constitution Capital Partners by your investment in the Fund. Thank you for your continued support. If you have any additional questions or comments, we invite you to contact us at info@ccaf.com.

Sincerely,

Constitution Capital Partners

2

Constitution Capital Access Fund, LLC |

Manager’s Discussion and Analysis of Fund Performance March 31, 2023 (Unaudited) (Continued) |

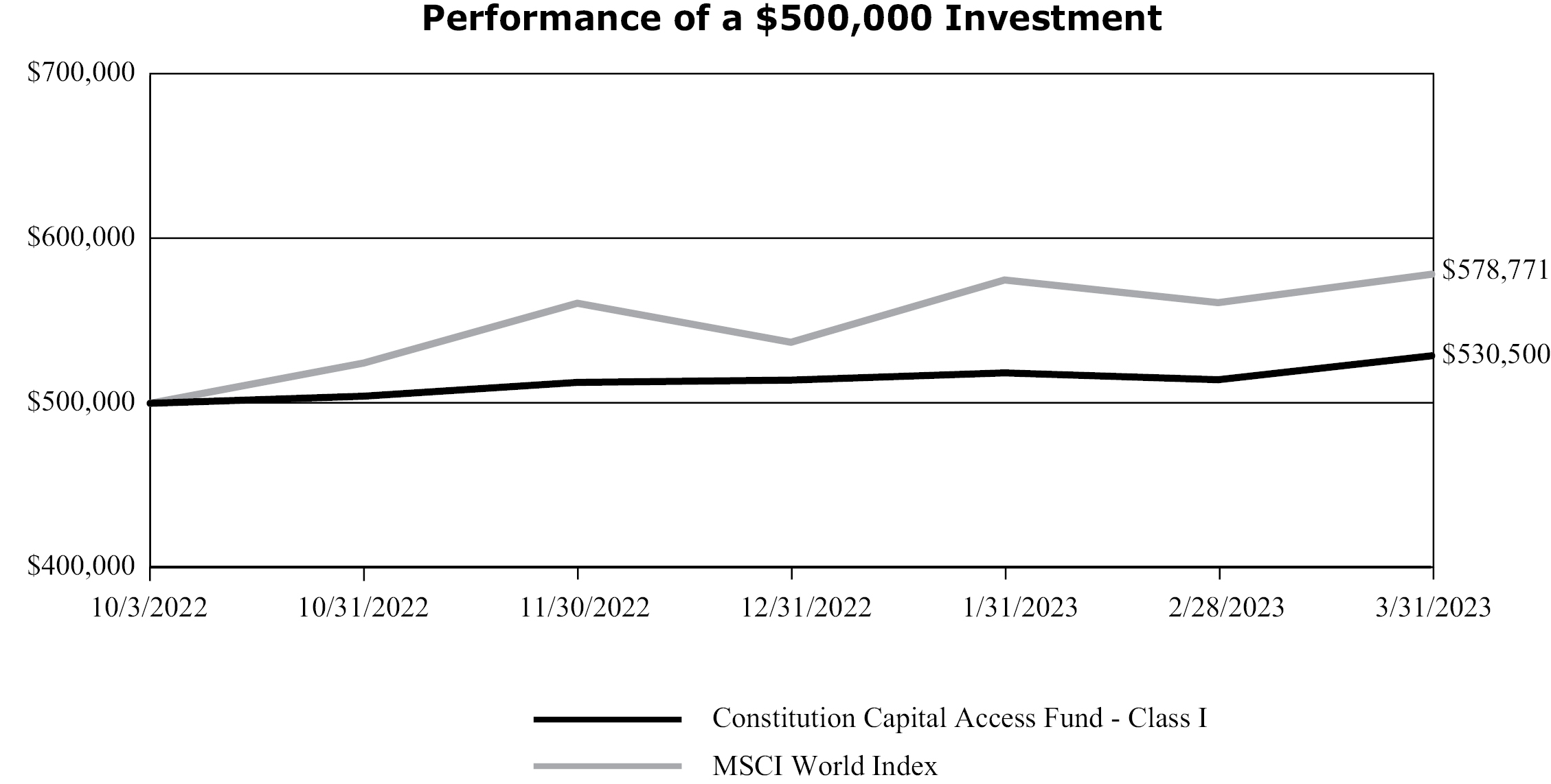

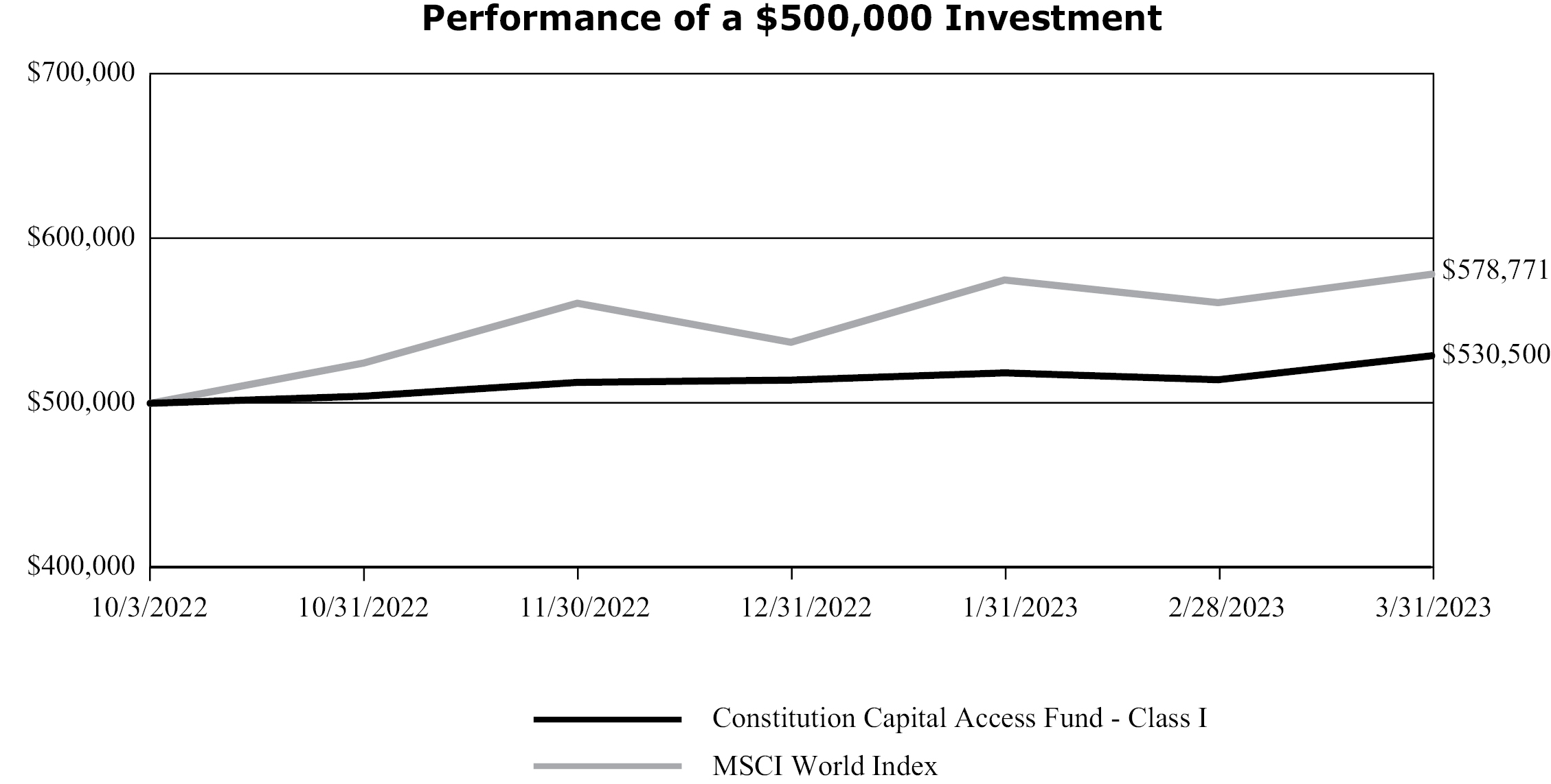

This graph compares a hypothetical $500,000 investment in the Fund’s Class I Shares with a similar investment in the MSCI World Index. This index does not serve as a benchmark for the Fund and is shown for illustrative purposes only. The Fund does not have a designated performance benchmark. Results include the reinvestment of all dividends and capital gains. The index does not reflect expenses, fees, or sales charges, which would lower performance.

The MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries. With 1,507 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The index is unmanaged and it is not available for investment.

Total Returns as of March 31, 2023 | | Since Inception |

Class A Shares (Inception Date 11/01/2022) | | 5.19% |

Class D Shares (Inception Date 11/01/2022) | | 5.19% |

Class I Shares (Inception Date 10/01/2022) | | 6.10% |

MSCI World Index (Inception Date 10/01/2022) | | 15.75% |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Performance reflects waivers and reimbursements in effect, without which performance would have been lower. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent quarter end performance may be obtained by calling 1-855-551-2276.

3

Constitution Capital Access Fund, LLC |

Manager’s Discussion and Analysis of Fund Performance March 31, 2023 (Unaudited) (Continued) |

Constitution Capital PM, LP (the “Adviser”) has entered into an expense limitation agreement and reimbursement agreement (the “Expense Limitation Agreement”) with the Fund, whereby, for at least one-year from commencement of operations, the Adviser has agreed to waive fees that it would otherwise be paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure the Total Annual Expenses (excluding taxes, interest, brokerage commissions, certain transaction related expenses arising out of investments made by the Fund, extraordinary expenses, the Incentive Fee, and any acquired fund fees and expenses (as determined in accordance with SEC Form N-2), expenses incurred in connection with any merger or reorganization, and extraordinary expenses, such as litigation expenses) do not exceed 2.95%, 2.25% and 2.50% of the average daily net assets of Class A Shares, Class I Shares and Class D Shares, respectively (the “Expense Limit”). Because taxes, leverage interest, brokerage commissions, dividend, and interest expenses on short sales, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, and extraordinary expenses are excluded from the Expense Limit, Total Annual Expenses (after fee waivers and expense reimbursements) are expected to exceed 2.95%, 2.25% and 2.50% for the Class A Shares, Class I Shares and Class D Shares, respectively. For the Fund’s current expense ratios, please refer to the Financial Highlights Section of this report.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

4

Report of Independent Registered Public Accounting Firm

To the Board of Managers and Shareholders of

Constitution Capital Access Fund, LLC

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities, including the consolidated schedule of investments, of Constitution Capital Access Fund, LLC and its subsidiaries (the “Fund”) as of March 31, 2023, and the related consolidated statements of operations, changes in net assets, and cash flows for the period October 1, 2022 through March 31, 2023, including the related notes, and the consolidated financial highlights for each of the periods indicated therein (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2023, and the results of its operations, changes in its net assets, its cash flows for the period October 1, 2022 through March 31, 2023 and the financial highlights for each of the periods indicated therein in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s consolidated financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit of these consolidated financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. Our procedures included confirmation of securities owned as of March 31, 2023 by correspondence with the custodian and underlying investment fund managers; when replies were not received from the underlying investment fund managers, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Boston, Massachusetts

May 30, 2023

We have served as the Fund’s auditor since 2022.

5

Constitution Capital Access Fund, LLC |

Consolidated Schedule of Investments March 31, 2023 |

Investments — 106.3% | | Sector | | Investment Type | | Acquisition

Date | | Shares | | Fair Value |

Direct Investments — 37.9% | | | | | | | | | | | |

Direct Equity — 37.9% | | | | | | | | | | | |

Asia — Pacific — 3.4% | | | | | | | | | | | |

SLP Rainbow Co-Invest,

L.P.*1,2,7 | | Consumer Staples | | Limited partnership interest | | 10/1/2022 | | | | $ | 11,308,208 |

SLP Redwood Co-Invest,

L.P.*1,2,7 | | Communication Services | | Limited partnership interest | | 10/1/2022 | | | | | 8,780,234 |

Total Asia — Pacific | | | 20,088,442 |

| | | | | | | | | | | | |

Europe — 15.8% | | | | | | | | | | | |

Bach Co-investment L.P.1*1,2,7 | | Consumer Discretionary | | Limited partnership interest | | 10/1/2022 | | | | | 27,636,427 |

EQT VIII Co-Investment (D) SCSp*1,2,7,8 | | Health Care | | Limited partnership interest | | 10/1/2022 | | | | | 14,561,386 |

Kirk Beauty Co-Investment Limited Partnership*1,2,7,8 | | Consumer Discretionary | | Limited partnership interest | | 10/1/2022 | | | | | 6,641,513 |

Mayfair Olympic Holdco Limited*1,2,7,8 | | Utilities | | Ordinary Shares | | 10/1/2022 | | 1,243,556 | | | 9,383,867 |

Neptune Co-Investment,

L.P.1,2,3,7 | | Energy | | Limited partnership interest | | 10/1/2022 | | | | | 7,677,873 |

SLP Jewel Co-Invest, L.P.*1,2,7 | | Consumer Discretionary | | Limited partnership interest | | 10/1/2022 | | | | | 5,401,198 |

SLP Mistral Co-Invest,

L.P.*1,2,7 | | Financials | | Limited partnership interest | | 10/1/2022 | | | | | 16,197,023 |

SLP Zephyr Investors,

L.P.*1,2,7 | | Communication Services | | Limited partnership interest | | 10/1/2022 | | | | | 6,723,906 |

Total Europe | | | 94,223,193 |

| | | | | | | | | | | | |

North America — 18.7% | | | | | | | | | | | |

ACP Canopy Co-Invest

LLC*1,2,7 | | Health Care | | Limited liability company interest | | 11/1/2022 | | 20,182 | | | 20,081,967 |

Ares EPIC Co-Invest Delaware Feeder, L.P.*1,2,3 | | Energy | | Limited partnership interest | | 10/1/2022 | | | | | 5,060,614 |

Ares EPIC Co-Invest II

L.P.*1,2,3,7 | | Energy | | Limited partnership interest | | 10/1/2022 | | | | | 10,328,144 |

Carlyle Sabre Coinvestment, L.P.*1,2,7 | | Industrials | | Limited partnership interest | | 10/1/2022 | | | | | 11,209,835 |

CC AEC Co-Invest L.P.*1,2,7 | | Health Care | | Limited partnership interest | | 10/1/2022 | | 5,000 | | | 5,001,002 |

Ergotron Investments,

LLC*1,2,7 | | Industrials | | Common Shares | | 10/1/2022 | | 50,000 | | | 6,104,917 |

Ishtar Co-Invest-B LP*1,2,3,7 | | Consumer Staples | | Limited partnership interest | | 11/4/2022 | | | | | 16,395,447 |

Oshun Co-Invest-B LP*1,2,3,7 | | Consumer Staples | | Limited partnership interest | | 11/4/2022 | | | | | 4,684,353 |

SLP Blue Co-Invest, L.P.*1,2,7 | | Information Technology | | Limited partnership interest | | 10/1/2022 | | | | | 8,356,235 |

SLP West Holdings Co-Invest II, L.P.1,2,5 | | Communication Services | | Limited partnership interest | | 10/1/2022 | | | | | 7,518,809 |

See accompanying notes to the consolidated financial statements.

6

Constitution Capital Access Fund, LLC |

Consolidated Schedule of Investments March 31, 2023 (Continued) |

Investments — 106.3% | | Sector | | Investment Type | | Acquisition

Date | | Shares | | Fair Value |

Direct Investments (Continued) | | | | | | | | | |

Direct Equity (Continued) | | | | | | | | | | | |

North America (Continued) | | | | | | | | | | | |

TPG VII Renown Co-Invest II, L.P.*1,2,7 | | Consumer Discretionary | | Limited partnership interest | | 10/1/2022 | | | | $ | 3,596,579 |

WPP Fairway Aggregator B, L.P. — Class A*1,2,7 | | Consumer Staples | | Preferred Units | | 10/1/2022 | | 12,500 | | | 13,120,380 |

WPP Fairway Aggregator B, L.P. — Class B*1,2,7 | | Consumer Staples | | Common Units | | 10/1/2022 | | 12,500 | | | 214,201 |

Total North America | | | 111,672,483 |

Total Direct Equity | | | 225,984,118 |

Total Direct Investments (Cost $211,097,781) — 37.9% | | | 225,984,118 |

| | | | | | | | | | | | |

Investment Funds — 67.0% | | | | | | | | | | | |

Asia — Pacific — 5.9% | | | | | | | | | | | |

The Baring Asia Private Equity Fund VI, L.P.2*1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 11,222,862 |

The Baring Asia Private Equity Fund VII, SCSp1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 23,820,533 |

Total Asia — Pacific | | | 35,043,395 |

| | | | | | | | | | | | |

Europe — 18.6% | | | | | | | | | | | |

CVC Capital Partners VI (D) S.L.P.1,2,3,7,8 | | Limited partnership interest | | 10/1/2022 | | | | | 13,691,883 |

CVC Capital Partners VII (A) L.P.1,2,3,7,8 | | Limited partnership interest | | 10/1/2022 | | | | | 23,376,402 |

EQT IX (No.1) EUR SCSp*1,2,3,7,8 | | Limited partnership interest | | 10/1/2022 | | | | | 13,005,331 |

EQT VII (No.1) Limited Partnership*1,2,3,7,8 | | Limited partnership interest | | 10/1/2022 | | | | | 8,557,045 |

EQT VIII (No.1) SCSp*1,2,3,7,8 | | Limited partnership interest | | 10/1/2022 | | | | | 20,377,062 |

Sixth Cinven Fund (No. 2) Limited Partnership*1,2,3,7,8 | | Limited partnership interest | | 10/1/2022 | | | | | 31,518,118 |

Total Europe | | | 110,525,841 |

| | | | | | | | | | | | |

North America — 42.5% | | | | | | | | | | | |

Ares Corporate Opportunities Fund V, L.P.1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 14,463,845 |

Ares Corporate Opportunities Fund VI Parallel (TE), L.P.*1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 17,237,784 |

Ares Energy Opportunities Fund B, L.P.1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 10,264,192 |

Avista Capital Partners (Offshore) II, L.P.*1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 1,459,010 |

Carlyle International Energy Partners II S.C.Sp.1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 8,446,566 |

Carlyle Partners VI, L.P.1,2,3,4 | | Limited partnership interest | | 10/1/2022 | | | | | 4,588,160 |

Carlyle Partners VII, L.P.1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 10,479,808 |

Catterton Partners VII, L.P.*1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 14,191,130 |

Insignia Capital Partners, L.P.1,2,3,5 | | Limited partnership interest | | 10/1/2022 | | | | | 18,753,941 |

Kinderhook Capital Fund IV, L.P.*1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 10,012,956 |

Lightyear Fund III, L.P.*1,2,3,4 | | Limited partnership interest | | 10/1/2022 | | | | | 1,743,124 |

Nautic Partners VI-A, L.P.*1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 2,095,757 |

See accompanying notes to the consolidated financial statements.

7

Constitution Capital Access Fund, LLC |

Consolidated Schedule of Investments March 31, 2023 (Continued) |

Investments — 106.3% | | | | Investment Type | | Acquisition

Date | | Shares | | Fair Value |

Investment Funds (Continued) | | | | | | | | | | |

North America (Continued) | | | | | | | | | | | | |

Riverstone Non-ECI Partners, L.P.1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | $ | 15,660,410 | |

Riverstone TE/SWF Partners VI, L.P.1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 6,157,320 | |

Silver Lake Partners IV, L.P.1,2,3,4 | | Limited partnership interest | | 10/1/2022 | | | | | 17,782,234 | |

Silver Lake Partners V, L.P.1,2,3,4 | | Limited partnership interest | | 10/1/2022 | | | | | 20,384,749 | |

SK Capital Partners III, L.P.*1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 23,151,066 | |

SL SPV-2, L.P.1,2,7 | | Limited partnership interest | | 10/1/2022 | | | | | 7,942,782 | |

SunTx Capital Partners II, L.P.*1,2,7 | | Limited partnership interest | | 10/1/2022 | | | | | 6,814,019 | |

TPG HealthCare Partners, L.P.*1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 4,926,960 | |

TPG Partners VI, L.P.1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 2,189,486 | |

TPG Partners VIII, L.P.1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 17,674,040 | |

WestView Capital Partners III, L.P.*1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 15,075,048 | |

Wind Point Partners VII-B, L.P.*1,2,3,7 | | Limited partnership interest | | 10/1/2022 | | | | | 1,435,250 | |

Total North America | | | 252,929,637 | |

Total Investment Funds (Cost $400,858,018) — 67.0% | | | 398,498,873 | |

| | |

Short-Term Investments — 1.4% | |

North America — 1.4% | |

Fidelity Institutional Government Portfolio — Class I, 4.65%6 | | 8,311,636 | | | 8,311,636 | |

Total Short-Term Investments (Cost $8,311,636) — 1.4% | | | 8,311,636 | |

| | | | | | | | | | | | | |

Total Investments (Cost $620,267,435) — 106.3% | | | 632,794,627 | |

Net Other Assets (Liabilites) — (6.3%) | | | (37,055,336 | ) |

Total Net Assets — 100.0% | | $ | 595,739,291 | |

See accompanying notes to the consolidated financial statements.

8

Constitution Capital Access Fund, LLC |

Consolidated Schedule of Investments March 31, 2023 (Continued) |

Summary of Investments (as a percentage of total net assets) |

Direct Investments | | | |

Direct Equity | | | |

North America | | 18.7 | % |

Europe | | 15.8 | % |

Asia — Pacific | | 3.4 | % |

Total Direct Equity | | 37.9 | % |

Total Direct Investments | | 37.9 | % |

Investment Funds | | | |

North America | | 42.5 | % |

Europe | | 18.6 | % |

Asia — Pacific | | 5.9 | % |

Total Investment Funds | | 67.0 | % |

Short-Term Investments | | 1.4 | % |

Total Investments | | 106.3 | % |

Net Other Assets (Liabilites) | | (6.3 | )% |

Total Net Assets | | 100.0 | % |

See accompanying notes to the consolidated financial statements.

9

Constitution Capital Access Fund, LLC |

Consolidated Statement of Assets and Liabilities March 31, 2023 |

Assets | | | |

Investments, at fair value (cost $620,267,435) | | $ | 632,794,627 |

Cash | | | 72,410 |

Foreign currency, at fair value (cost $1,592,238) | | | 1,591,623 |

Cash equivalents held in escrow for shares received in advance | | | 1,713,500 |

Deferred loan issuance costs | | | 603,055 |

Prepaid offering costs | | | 230,542 |

Prepaid expenses and other assets | | | 43,799 |

Total Assets | | | 637,049,556 |

| | | | |

Liabilities | | | |

Line of credit payable | | | 37,200,000 |

Proceeds from subscriptions received in advance | | | 1,713,500 |

Line of credit interest payable | | | 952,536 |

Investment management fee payable | | | 414,916 |

Audit and tax fees payable | | | 275,100 |

Legal fees payable | | | 271,598 |

Accounting and administration fees payable | | | 203,617 |

Payable for shares repurchased | | | 100,000 |

Due to related parties | | | 91,920 |

Organizational cost payable | | | 27,859 |

Custody fees payable | | | 20,679 |

Transfer agent fees payable | | | 9,507 |

Offering cost payable | | | 7,879 |

Payable for investments in securities purchased | | | 3,647 |

Accounts payable and other accrued expenses | | | 17,507 |

Total Liabilities | | | 41,310,265 |

| | | | |

Commitments and contingencies (see Note 12) | | | |

| | | | |

Net Assets | | $ | 595,739,291 |

| | | | |

Composition of Net Assets: | | | |

Paid-in capital | | $ | 561,567,589 |

Total distributable earnings | | | 34,171,702 |

Net Assets | | $ | 595,739,291 |

| | | | |

Net Assets Attributable to: | | | |

Class A Shares | | $ | 11 |

Class D Shares | | | 11 |

Class I Shares | | | 595,739,269 |

| | | $ | 595,739,291 |

Shares of Beneficial Interests (unlimited number of shares authorized) | | | |

Class A Shares | | | 0.991 |

Class D Shares | | | 0.991 |

Class I Shares | | | 56,156,724 |

| | | | 56,156,726 |

Net Asset Value per Share: | | | |

Class A Shares1 | | $ | 10.61 |

Class D Shares | | $ | 10.61 |

Class I Shares | | $ | 10.61 |

See accompanying notes to the consolidated financial statements.

10

Constitution Capital Access Fund, LLC |

Consolidated Statement of Operations For the Period October 1, 2022* through March 31, 2023 |

Investment Income | | | | |

Dividend income (net of witholding tax of $55,459) | | $ | 4,346,446 | |

Interest income | | | 89,213 | |

Total Income | | | 4,435,659 | |

| | | | | |

Expenses | | | | |

Investment management fees | | | 4,931,454 | |

Incentive fees | | | 3,417,170 | |

Interest expense | | | 1,808,922 | |

Organizational costs | | | 884,303 | |

Accounting and administration fees | | | 359,399 | |

Audit and tax fees | | | 275,100 | |

Legal fees | | | 271,598 | |

Offering costs | | | 230,541 | |

Managers’ fees and expenses | | | 125,000 | |

Deferred loan issuance expense | | | 67,006 | |

Chief compliance officer fees | | | 45,011 | |

Custodian fees | | | 39,167 | |

Transfer Agency fees | | | 12,671 | |

Other operating expenses | | | 154,304 | |

Total Expenses | | | 12,621,646 | |

Management fees voluntary waiver | | | (3,687,764 | ) |

Incentive fees voluntary waiver | | | (3,417,170 | ) |

Net Expenses | | | 5,516,712 | |

Net Investment Loss | | | (1,081,053 | ) |

| | | | | |

Net Realized Gain and Change in Unrealized Appreciation/Depreciation on Investments and Foreign Currency | | | | |

Net realized gain on investments | | | 22,698,818 | |

Net realized gain on foreign currency transactions | | | 26,130 | |

Net change in unrealized appreciation/depreciation on investments | | | 12,527,192 | |

Net change in unrealized appreciation/depreciation on currency transactions | | | 615 | |

Net Realized Gain and Change in Unrealized Appreciation/Depreciation on Investments and Foreign Currency | | | 35,252,755 | |

| | | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 34,171,702 | |

See accompanying notes to the consolidated financial statements.

11

Constitution Capital Access Fund, LLC |

Consolidated Statement of Changes in Net Assets |

| | For the Period

October 1,

2022*

through

March 31, 2023 |

Changes in Net Assets Resulting from Operations | | | | |

Net investment loss | | $ | (1,081,053 | ) |

Net realized gain (loss) on investments and foreign currency translations | | | 22,724,948 | |

Net change in unrealized appreciation/(depreciation) on investments and foreign currency translations | | | 12,527,807 | |

Net Change in Net Assets Resulting from Operations | | | 34,171,702 | |

| | | | | |

Change in Net Assets Resulting from Capital Transactions (see note 6) | | | | |

Class A | | | | |

Proceeds from issuance of shares | | | 10 | |

Total Class A Transactions | | | 10 | |

| | | | | |

Class D | | | | |

Proceeds from issuance of shares | | | 10 | |

Total Class D Transactions | | | 10 | |

| | | | | |

Class I | | | | |

Proceeds from issuance of shares1 | | | 561,667,569 | |

Shares tendered | | | (100,000 | ) |

Total Class I Transactions | | | 561,567,569 | |

| | | | | |

Net Change in Net Assets Resulting from Capital Transactions | | | 561,567,589 | |

| | | | | |

Total Net Increase in Net Assets | | | 595,739,291 | |

| | | | | |

Net Assets | | | | |

Beginning of period | | | — | |

End of period | | $ | 595,739,291 | |

See accompanying notes to the consolidated financial statements.

12

Constitution Capital Access Fund, LLC |

Consolidated Statement of Cash Flows For the Period October 1, 2022* through March 31, 2023 |

Cash Flows From Operating Activities | | | | |

Net increase in net assets from operations | | $ | 34,171,702 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

Purchases of investments | | | (46,578,633 | ) |

Distributions received from investments | | | 37,414,209 | |

Sales of investments | | | 128,024 | |

Change in short-term investments, net | | | (8,311,636 | ) |

Net realized gain on investments | | | (22,698,818 | ) |

Net change in unrealized appreciation/depreciation on investments | | | (12,527,192 | ) |

(Increase)/Decrease in Assets: | | | | |

Deferred loan issuance costs amortization | | | 67,006 | |

Prepaid offering costs amortization | | | 230,541 | |

Prepaid expenses and other assets | | | (43,799 | ) |

Increase/(Decrease) in Liabilities: | | | | |

Line of credit interest payable | | | 952,536 | |

Investment management fee payable | | | 414,916 | |

Legal fees payable | | | 271,598 | |

Audit and tax fees payable | | | 275,100 | |

Accounting and administration fees payable | | | 203,617 | |

Due to related parties | | | 91,920 | |

Organizational cost payable | | | 27,859 | |

Custody fees payable | | | 20,679 | |

Transfer agent fees payable | | | 9,507 | |

Offering cost payable | | | 7,879 | |

Payable for investments in securities purchased | | | 3,647 | |

Accounts payable and other accrued expenses | | | 17,507 | |

Net Cash Used in Operating Activities | | | (15,851,831 | ) |

| | | | | |

Cash Flows from Financing Activities | | | | |

Proceeds from subscriptions of shares, net of change in payable for proceeds from subscriptions received in advance | | | 1,938,593 | |

Cash Transferred from the Acquired Fund* | | | 1,321,758 | |

Proceeds from line of credit | | | 39,187,899 | |

Payments made on line of credit | | | (22,087,742 | ) |

Payments made for loan issuance costs | | | (670,061 | ) |

Payments made for offering costs | | | (461,083 | ) |

Net Cash Provided by Financing Activities | | | 19,229,364 | |

| | | | | |

Net change in Cash, foreign currency, and cash equivalents | | | 3,377,533 | |

Cash, foreign currency, and cash equivalents – Beginning of Period | | | — | |

Cash, foreign currency, and cash equivalents – End of Period | | $ | 3,377,533 | |

| | | | | |

Supplemental disclosure of non-cash activities | | | | |

Contributions from U/C Seed Partnership Fund, L.P. | | | 578,948,748 | |

| | | | | |

Supplemental disclosure of cash flow information | | | | |

Interest payments on line of credit | | $ | 856,386 | |

See accompanying notes to the consolidated financial statements.

13

Constitution Capital Access Fund, LLC |

Consolidated Financial Highlights Class A Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the Period

November 1,

2022*

through

March 31, 2023 |

Per Share Operating Performance: | | | | |

Net Asset Value per share, beginning of period | | $ | 10.09 | |

Activity from investment operations: | | | | |

Net investment loss1 | | | 0.01 | |

Net realized and unrealized gain/(loss) on investments | | | 0.51 | |

Total from investment operations | | | 0.52 | |

| | | | | |

Net Asset Value per share, end of period | | $ | 10.61 | |

| | | | | |

Net Assets, end of year | | $ | 11 | |

| | | | | |

Ratios to average shareholders’ equity: | | | | |

Net investment loss2,3 | | | (1.38 | )% |

| | | | | |

Gross expenses4 | | | 3.23 | % |

Expense Recoupment/(Reimbursement) | | | (1.71 | )%5 |

Net expenses9 | | | 1.52 | % |

| | | | | |

Total Return6 | | | 5.19 | %7 |

| | | | | |

Portfolio turnover rate | | | 0 | %7 |

| | | | | |

Senior Securities | | | | |

Total borrowings (000s) | | $ | 37,200 | |

Asset coverage per $1,000 unit of senior indebtedness8 | | $ | 17,014 | |

See accompanying notes to the consolidated financial statements.

14

Constitution Capital Access Fund, LLC |

Consolidated Financial Highlights Class D Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the Period

November 1,

2022*

through

March 31, 2023 |

Per Share Operating Performance: | | | | |

Net Asset Value per share, beginning of period | | $ | 10.09 | |

Activity from investment operations: | | | | |

Net investment loss1 | | | 0.01 | |

Net realized and unrealized gain/(loss) on investments | | | 0.51 | |

Total from investment operations | | | 0.52 | |

| | | | | |

Net Asset Value per share, end of period | | $ | 10.61 | |

| | | | | |

Net Assets, end of year | | $ | 11 | |

| | | | | |

Ratios to average shareholders’ equity: | | | | |

Net investment loss2,3 | | | (1.38 | )% |

| | | | | |

Gross expenses4 | | | 3.23 | % |

Expense Recoupment/(Reimbursement) | | | (1.71 | )%5 |

Net expenses9 | | | 1.52 | % |

| | | | | |

Total Return6 | | | 5.19 | %7 |

| | | | | |

Portfolio turnover rate | | | 0 | %7 |

| | | | | |

Senior Securities | | | | |

Total borrowings (000s) | | $ | 37,200 | |

Asset coverage per $1,000 unit of senior indebtedness8 | | $ | 17,014 | |

See accompanying notes to the consolidated financial statements.

15

Constitution Capital Access Fund, LLC |

Consolidated Financial Highlights Class I Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the Period

October 1,

2022*

through

March 31, 2023 |

Per Share Operating Performance: | | | | |

Net Asset Value per share, beginning of period | | $ | 10.00 | |

Activity from investment operations: | | | | |

Net investment loss1 | | | (0.02 | ) |

Net realized and unrealized gain/(loss) on investments | | | 0.63 | |

Total from investment operations | | | 0.61 | |

| | | | | |

Net Asset Value per share, end of period | | $ | 10.61 | |

| | | | | |

Net Assets, end of year | | $ | 595,739,269 | |

| | | | | |

Ratios to average shareholders’ equity: | | | | |

Net investment loss2,3 | | | (2.10 | )% |

| | | | | |

Gross expenses4 | | | 3.64 | % |

Expense Recoupment/(Reimbursement) | | | (1.88 | )%5 |

Net expenses9 | | | 1.76 | % |

| | | | | |

Total Return6 | | | 6.10 | %7 |

| | | | | |

Portfolio turnover rate | | | 0 | %7 |

| | | | | |

Senior Securities | | | | |

Total borrowings (000s) | | $ | 37,200 | |

Asset coverage per $1,000 unit of senior indebtedness8 | | $ | 17,014 | |

See accompanying notes to the consolidated financial statements.

16

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements March 31, 2023 |

Note 1 – Organization |

Constitution Capital Access Fund, LLC (the “Fund”) is a newly organized Delaware limited liability company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), as a non-diversified closed-end management investment company. Constitution Capital PM, LP serves as the investment adviser (the “Adviser”) of the Fund. The Adviser is an investment adviser registered with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended. The Fund was organized as a Delaware Trust on March 3, 2022 and commenced operations on October 1, 2022. Simultaneous with the commencement of the Fund’s operations (“Commencement of Operations”), the U/C Seed Partnership Fund, L.P. (the “Predecessor Fund”), reorganized and transferred substantially all its portfolio securities into the Fund with a transfer value policy election to use fair market value as opening cost for a non-taxable transaction. The Predecessor Fund maintained an investment objective, strategies and investment policies, guidelines and restrictions that were, in all material respects, equivalent to those of the Fund. The Fund and the Predecessor Fund share the same investment adviser and portfolio managers. The tax-free reorganization was accomplished at close of business on September 30, 2022. The reorganization was accomplished by the following tax-free exchange in which each limited partner of the Predecessor Fund received the same aggregate share net asset value (“NAV”) in the corresponding classes as noted below:

| | Shares

Issued | | Net

Assets |

Class I | | 56,144,250 | | $ | 561,442,496 |

Subsequent to September 30, 2022, transfers of 12,195 shares and net assets of $125,073 from the Predecessor Fund into the Fund were completed as cash transactions.

For financial reporting purposes, net assets received by the Fund were recorded at fair value, cost basis of investments received were recorded at fair value of investments as of the transfer date, and the investments received by the Fund were evaluated using fair value procedures adopted by the Board of Managers (“the Board”). For tax purposes, the historical cost basis of the investments was carried forward to align ongoing reporting of the Fund’s realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes; as a result, the net unrealized appreciation of investments transferred was $134,747,926 as of the date of the transfer for tax purposes.

The Fund’s investment objective is to generate long-term capital appreciation. The Fund seeks its investment objective by investing in a broad portfolio of investments in private assets (collectively, “Private Assets”) that the Adviser believes provide attractive risk-adjusted return potential. The Fund’s investments will include (i) direct investments (i.e. positions in the equity or debt of operating companies) (“Direct Equity Investments” or “Direct Credit Investments,” respectively, and together, “Direct Investments”); (ii) secondary purchases (i.e. purchases of existing interests that are acquired on the secondary market) (“Secondary Investments”) of closed-end private funds (“Portfolio Funds”) managed by third-party managers (“Portfolio Fund Managers”); (iii) primary investments (i.e. commitments to new private equity or other private funds) (“Primary Investments”); (iv) direct or secondary purchases of liquid credit instruments; (v) other liquid investments (i.e. strategies with a higher liquidity profile than direct investments or investments in funds, including listed private equity); and (vi) short-term investments (together, “Short-term Investments”).

The Fund offers three separate classes of shares of beneficial interest (“Shares”) designated as Class A Shares, Class D Shares and Class I Shares. Each class of Shares will have differing characteristics, particularly in terms of the sales charges that Shareholders in that class may bear, and the distribution and service fees that each class may be charged. The Fund has received an exemptive order from the SEC with respect to the Fund’s multi-class structure.

a. Consolidation of Subsidiaries

The Fund may make investments through wholly-owned subsidiaries (each a “Subsidiary” and together, the “Subsidiaries”). Such Subsidiaries will not be registered under the Investment Company Act; however, the Fund will wholly own and control any Subsidiaries. The Board has oversight responsibility for the investment activities of the Fund, including its investment in any Subsidiary, and the Fund’s role as sole shareholder of any Subsidiary. To the extent applicable to the investment activities of a Subsidiary, the Subsidiary will follow the same compliance policies and procedures as the Fund. The Fund would “look through” any such Subsidiary to determine compliance with its investment policies. The Fund complies with Section 8 of the Investment Company Act governing investment policies on an aggregate basis with any Subsidiary. The Fund also complies with Section 18 of the Investment Company Act governing capital structure and

17

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements March 31, 2023 (Continued) |

Note 1 – Organization (continued) |

leverage on an aggregate basis with each Subsidiary so that the Fund treats a Subsidiary’s debt as its own for purposes of Section 18. Further, each Subsidiary complies with the provisions of Section 17 of the Investment Company Act relating to affiliated transactions and custody. Any Subsidiary would use UMB Bank, n.a. as custodian. The Fund will not create or acquire primary control of any entity which engages in investment activities in securities or other assets, other than entities wholly-owned by the Fund.

As of March 31, 2023, there are three active Subsidiaries, CC PMF Holdings, LLC, formed in Delaware on March 17, 2022, CC PMF Blocker, LLC, formed in Delaware on March 21, 2022, and CC PMF Splitter Partnership, formed as a Delaware partnership on August 5, 2022. The Consolidated Schedule of Investments, Consolidated Statement of Assets and Liabilities, Consolidated Statement of Operations, Consolidated Statement of Changes in Net Assets, Consolidated Statement of Cash Flows and Consolidated Financial Highlights of the Fund include the accounts of the Subsidiaries. All inter-company accounts and transactions have been eliminated in the consolidation for the Fund.

Note 2 – Significant Accounting Policies

The Fund is an investment company and applies the guidance set forth in Accounting Standards Codification (“ASC”) 946, Financial Services — Investment Companies. The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

a. Basis of Accounting

The Fund’s accounting and reporting policies conform with U.S. generally accepted accounting principles (“U.S. GAAP”).

b. Valuation of Investments

In December 2020, the SEC adopted a new rule providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5 establishes requirements for determining fair value in good faith for purposes of the Investment Company Act. Rule 2a-5 permits fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other conditions. Rule 2a-5 also defines when market quotations are “readily available” for purposes of the Investment Company Act and the threshold for determining whether a fund must fair value a security. Pursuant to the requirements of Rule 2a-5, the Board designated the Adviser as its valuation designee to perform fair value determinations and approved valuation procedures for the Fund.

The Fund invests, under normal circumstances, in a broad portfolio of private assets. To determine the estimated value of the Funds’ interests or shares in Investment Funds, the Adviser considers, among other things, information provided by the Investment Funds, including quarterly unaudited financial statements. The Adviser will review the appropriateness of the valuation based on any new information or changes in assumptions regarding the security, reliable public information, actual trade prices or other information that becomes available subsequent to the most recent quarterly valuation determination. If changes are required, the Adviser will make a market adjustment and provide an updated valuation to the Administrator to revise it accordingly.

The Funds’ Direct Investments are generally not publicly traded, and thus, market quotations are not available to be used for valuation purposes. Therefore, the Adviser is required to value these Direct Investments at estimated fair values, using present value and other subjective valuation techniques. These may include references to market multiples, valuations for comparable companies, public market or private transactions, subsequent developments concerning the companies to which the securities relate, results of operations, financial condition, cash flows, and projections of such companies provided to the Adviser and such other factors as the Firm may deem relevant. Depending on the circumstances, company multiples will not always be comparable due to the size of the related companies or associated transactions being used as comparable data in valuation. If the Adviser determines that the estimated fair value does not represent fair value, a fair value determination is made by the Adviser in accordance with the Adviser’s Valuation Procedure.

18

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements March 31, 2023 (Continued) |

Note 2 – Significant Accounting Policies (continued) |

c. Cash and Cash Equivalents

In order to maintain liquidity, the Fund holds cash, including amounts held in foreign currencies, in short-term interest-bearing deposit accounts. At times, those amounts may exceed any applicable federally insured limits. The Fund has not experienced any losses in such accounts and does not believe that it is exposed to any significant credit risk on such accounts. Cash equivalents are disclosed under short-term investments on the Consolidated Schedule of Investments.

d. Cash Escrow

Subscriptions are generally subject to the receipt of cleared funds on or prior to the acceptance date set by the Fund and notified to prospective investors. Pending any closing, funds received from prospective investors will be placed in an interest bearing escrow account with UMB Bank, n.a., the Fund’s escrow agent, and are restricted for use otherwise. On the date of any closing, the balance in the escrow account with respect to each investor whose investment is accepted will be invested in the Fund on behalf of such investor. Interest, if any, earned on escrowed amounts will be credited to the Fund for the benefit of all Shareholders. As of March 31, 2023, the Fund had $1,713,500 of cash held in escrow related to Class I subscriptions that were received prior to closing.

e. Foreign Currency Translation

The books and records of the Fund are maintained in U.S. Dollars. Generally, valuations of assets and liabilities denominated in currencies other than the U.S. Dollar are translated into U.S. Dollar equivalents using valuation date exchange rates, while purchases, realized gains and losses, income and expenses are translated at transaction date exchange rates. The Fund does not isolate the effects of changes in foreign currency rates on the valuation of portfolio investments. Such fluctuations in exchange rates are included with and form part of the net realized and unrealized gain (loss) from investments. As of March 31, 2023, the Fund’s investments denominated in foreign currencies were as follows:

Currency | | Number of

Investments |

Euros | | 7 |

Pounds Sterling | | 1 |

Swiss Francs | | 1 |

f. Investment Income

The Fund’s primary sources of income are investment income and gains recognized upon distributions from portfolio investments and unrealized appreciation in the fair value of its portfolio investments. The Fund generally recognizes investment income and realized gains based on the characterization of distributions provided by the portfolio investments at the time of distributions.

Realized gains and losses from the sale of portfolio investments represent the difference between the original cost of the portfolio investments, as adjusted for return of capital distributions (net cost), and the net proceeds received at the time of the sale, disposition or distribution date. The Fund records realized gains and losses on portfolio investments when securities are sold, distributed to the partners or written-off as worthless. The Fund recognizes the difference between the net cost and the estimated fair value of portfolio investments owned as the net change in unrealized appreciation/depreciation on investments in the Statement of Operations.

Interest income, including amortization of premium or discount using the effective interest method and interest on paid-in-kind instruments, is recorded on an accrual basis. Dividend income is recognized on preferred equity securities on an accrual basis (to the extent that such amounts are expected to be collected) and on common equity securities on the record date (for private companies) or on the ex-dividend date (for publicly traded companies). Other income from portfolio investments, which represents operating income from investment partnerships or other flow through entities received by the Fund, is recorded on the date received.

19

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements March 31, 2023 (Continued) |

Note 2 – Significant Accounting Policies (continued) |

g. Fund Expenses

The Fund bears all expenses incurred in the business of the Fund on an accrual basis, including, but not limited to, the following: all costs and expenses related to portfolio transactions and positions for the Fund’s account; legal fees; accounting, auditing, and tax preparation fees; custodial fees; fees for lines of credit; fees for data providers; costs of insurance; registration expenses; fees paid to Managers of the Board who are not “interested persons,” as defined in Section 2(a)(19) of the Investment Company Act (the “Independent Managers”); and expenses of meetings of the Board, including reimbursement of the Independent Managers for their expenses in attending meetings of the Board.

h. Income Taxes

The Fund is and intends to continue to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986. If so qualified, the Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and capital gains to shareholders. Therefore, no federal income tax provision is required. Management of the Fund is required to determine whether a tax position taken by the Fund is more likely than not to be sustained upon examination by the applicable taxing authority, based on the technical merits of the position. Based on its analysis, there were no tax positions identified by management of the Fund which did not meet the “more likely than not” standard as of March 31, 2023.

i. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in capital from operations during the reporting period. Actual results may differ from those estimates.

Note 3 – Fair Value Measurements

In general, fair value represents a good faith approximation of the current value of an asset and will be used when there is no public market or possibly no market at all for the asset. The fair values of one or more assets may not be the prices at which those assets are ultimately sold, and the differences may be significant. The Fund values its portfolio investments in accordance with the provisions of ASC Topic 820, Fair Value Measurements and Disclosures. The codification defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price) and sets out a fair value hierarchy. The codification establishes a fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are those that market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Adviser. Unobservable inputs reflect the Adviser’s assumption about the inputs market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The fair value hierarchy is categorized into three levels based on the inputs as follows:

Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date. The types of financial instruments included in Level 1 are listed unrestricted securities, equities and listed derivatives, if any, listed in active markets.

Level 2 — Inputs other than quoted prices within Level 1 that are observable for the asset or liability, either directly or indirectly in active markets as of the reporting date, and fair value that is determined using models or other valuation methodologies. Financial instruments in this category generally include corporate bonds and loans, less liquid and restricted securities listed in active markets, securities traded in other than active markets, government and agency securities, certain over-the-counter derivatives and redeemable investments in alternative investment funds, if any, where the fair value is based on observable inputs. A significant adjustment to a Level 2 input could result in the Level 2 measurement becoming a Level 3 measurement.

20

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements March 31, 2023 (Continued) |

Note 3 – Fair Value Measurements (continued) |

Level 3 — Inputs that are unobservable for the asset or liability and that include situations where there is little, if any, market activity for the asset or liability. The inputs into the determination of fair value are based upon the best information in the circumstances and may require significant management judgment or estimation. Financial instruments in this category generally include equity and debt positions in private companies, and nonredeemable investments in alternative investment funds, non-investment grade residual interests in securitizations, collateralized loan obligations, and certain over-the-counter derivatives, if any, where the fair value is based on unobservable inputs.

Certain investments in Investment Funds are recorded at fair value, using the Investment Funds’ NAV as a “practical expedient,” in accordance with ASC 820.

Due to the inherent uncertainty of estimates, fair value determinations based on estimates may materially differ from the values that would have been used had a ready market for the securities existed.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following table is a summary of information about the levels within the fair value hierarchy at which the Fund’s investments are measured as of March 31, 2023:

| | Level 1 | | Level 2 | | Level 3 | | Total |

Investments | | | | | | | | | | | | |

Direct Investments | | $ | — | | $ | 7,518,809 | | $ | 195,398,678 | | $ | 202,917,487 |

Investment Funds | | | — | | | — | | | 61,887,475 | | | 61,887,475 |

Short-Term Investments | | | 8,311,636 | | | — | | | — | | | 8,311,636 |

NAV as a practical expedient | | | — | | | — | | | — | | | 359,678,029 |

Total Investments | | $ | 8,311,636 | | $ | 7,518,809 | | $ | 257,286,153 | | $ | 632,794,627 |

The following table is a summary of information about investments that are measured at fair value using net asset value per share as a practical expedient as of March 31, 2023:

Category of Investment | | Investment Strategy | | Fair Value

Determined

Using NAV

(USD $) | | Unfunded

Commitments

(USD $) | | Redemption

Terms | | Redemption Notice Period |

Investment Funds | | Buyouts, Growth Capital, and Special Situations | | $ | 336,611,398 | | $ | 79,490,367 | | Subject to GP consent | | Not Applicable |

Direct Investments* | | Direct Equity — Energy | | $ | 23,066,631 | | $ | 787,512 | | Subject to GP consent | | Not Applicable |

21

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements March 31, 2023 (Continued) |

Note 3 – Fair Value Measurements (continued) |

The following is a reconciliation of the amount of the account balances on October 1, 2022 and March 31, 2023 of those investments in which significant unobservable inputs (Level 3) were used in determining value:

| | Direct

Investments | | Investment

Funds |

Balance as of October 1, 2022 | | $ | — | | $ | — |

Transfers into Level 3 | | | | | | — |

Transfers out of Level 3 | | | — | | | — |

Total gains or losses for the period | | | | | | |

Included in earnings (or changes in partners’ capital) | | | 16,123,395 | | | 4,304,501 |

Purchases* | | | 179,275,283 | | | 58,449,632 |

Return of capital distributions | | | — | | | (866,658) |

Balance as of March 31, 2023 | | $ | 195,398,678 | | $ | 61,887,475 |

| | | | | | | |

Change in unrealized gains or losses for the period included in earnings (or changes in partners’ capital) for Level 3 assets held at the end of the reporting period | | $ | 16,123,395 | | $ | 4,304,501 |

Changes in inputs or methodologies used for valuing investments may result in a transfer in or out of levels within the fair value hierarchy. The inputs or methodologies used for valuing investments may not necessarily be an indication of the risk associated with investing in those investments. Transfers between levels of the fair value hierarchy are reported at the end of the reporting period in which they occur.

The following table presents additional quantitative information about valuation methodologies and inputs used for investments that are measured at fair value and categorized within Level 3 as of March 31, 2023:

Asset Class | Fair

Value at

3/31/2023 | Valuation

Technique(s) | Unobservable

Input(1) | Range of

Input | Weighted

Average

of Input |

Direct Investments | $ 195,398,678 | Market Approach | EBITDA Multiple | 9.0x – 56.5x | 18.6x |

Investment Funds | $ 61,887,475 | Adjusted reported

net asset value | Reported net asset value/Fair value adjustments | N/A | N/A |

Level 3 Direct Investments valued using an unobservable input are directly affected by a change in that input. Significant increases or decreases in these inputs in isolation would result in significantly higher or lower fair value measurements.

Note 4 – Organizational and Offering Costs

Organizational costs consist of the costs of forming the Fund, drafting of bylaws, administration, custody and transfer agency agreements, legal services in connection with the initial meeting of the Board and the Fund’s seed audit costs. Offering costs consist of the costs of preparation, review and filing with the SEC the Fund’s registration statement, the costs of preparation, review and filing of any associated marketing or similar materials, the costs associated with the printing, mailing or other distribution of the Prospectus, Statement of Additional Information (“SAI”) and/or marketing

22

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements March 31, 2023 (Continued) |

Note 4 – Organizational and Offering Costs (continued) |

materials, and the amounts of associated filing fees and legal fees associated with the offering. The aggregate amount of the organizational costs and offering costs as of the date of the accompanying financial statements are $884,303 and $461,083, respectively.

Organizational costs are expensed as incurred and are subject to recoupment by the Investment Manager in accordance with the Fund’s expense limitation agreement discussed in Note 7. Offering costs, which are also subject to the Fund’s expense limitation agreement discussed in Note 7, were accounted for as a deferred charge until Fund Shares were offered to the public and will thereafter, be amortized to expense over twelve months on a straight-line basis.

Note 5 – Distributions/Allocation of Shareholders Capital

Because the Fund intends to qualify annually as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”), the Fund intends to distribute at least 90% of its annual net taxable income to its Shareholders. Nevertheless, there can be no assurance that the Fund will pay distributions to Shareholders at any particular rate. From time to time, the Fund may also pay special interim distributions in the form of cash or Shares at the discretion of the Board. Unless Shareholders elect to receive distributions in the form of cash, the Fund intends to make its ordinary distributions in the form of additional Shares under the dividend reinvestment plan (“DRIP”). Any distributions reinvested under the DRIP will nevertheless remain subject to U.S. federal (and applicable state and local) taxation to Shareholders. Income, expenses, realized and unrealized capital gains and losses of the Fund are allocated on a pro rata basis to each class of shares relative net assets, except for distribution fees which are unique to each class of shares.

Note 6 – Share Transactions/Subscription and Repurchase of Shares

Shares will generally be offered for purchase as of the first day of each calendar month, except that Shares may be offered more or less frequently as determined by the Board in its sole discretion.

The Fund has adopted Distribution and Servicing Plan (the “Distribution Plans”) for each Class A Shares and Class D Shares which allows the Fund to pay distribution fees for the sale and distribution of its Class A Shares and Class D Shares. Under the Distribution Plans, the Fund may pay as compensation up to 0.70% on an annualized basis of the Fund’s net asset value attributable to Class A Shares and up to 0.25% on an annualized basis of the Fund’s net asset value attributable to Class D Shares (the “Distribution Fee”) to the Fund’s Distributor or other qualified recipients. Payment of the Distribution Fee will be governed by the respective Distribution Plan for Class A Shares or Class D Shares. The Distribution Fee will be paid out of the Fund’s assets and decreases the net profits or increases the net losses of the Fund solely with respect to Class A Shares and Class D Shares. For the period ended March 31, 2023, there were no distribution fees accrued. Class I Shares are not subject to the Distribution Fee and do not bear any expenses associated therewith.

The Board, from time to time and in its sole discretion, may determine to cause the Fund to offer to repurchase Shares from Shareholders, including the Adviser and its affiliates, pursuant to written tenders by Shareholders. The Adviser anticipates recommending to the Board that, under normal market circumstances, the Fund conduct repurchase offers of no more than 5% of the Fund’s net assets quarterly on or about each February 28, May 31, August 31, and November 30. The Fund will make repurchase offers, if any, to all holders of Shares. The Fund is entitled to charge early repurchase fee with respect to any repurchase of Shares from a Shareholder at any time prior to the day immediately preceding the one-year anniversary of the Shareholder’s purchase of the Shares.

During the period ended March 31, 2023, the Fund completed one tender offer. Payable for Shares Repurchased shown on Consolidated Statement of Assets and Liabilities, reflects the cash payment due that resulted from the February tender.

Upon request of a shareholder, a promissory note (“Promissory Note”) shall be issued if the Fund has accepted the shareholders repurchase submission. The Promissory Note will be non-interest bearing and non-transferable. The initial payment (the “Initial Payment”) of the Promissory Note will be in an amount equal to at least 90% of the estimated aggregate value of the repurchased Shares, determined as of the valuation date (“Valuation Date”). The Initial Payment will be made on or before the 65th day after the expiration date (“Expiration Date”). The second and final payment is expected to be in an amount equal to the excess, if any, of (i) the aggregate value of the repurchased Shares, determined as of the Valuation Date in the manner specified above based upon the results of the annual audit of the financial

23

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements March 31, 2023 (Continued) |

Note 6 – Share Transactions/Subscription and Repurchase of Shares (continued) |

statements of the Fund for the fiscal year in which the Valuation Date of such repurchase occurred, over (ii) the Initial Payment. It is anticipated that the annual audit of the financial statements of the Fund will be completed within 60 days after the end of each fiscal year of the Fund and that the Final Payment will be made no later than five (5) business days after the completion of such audit.

Class A Shares will be subject to a sales charge of up to 3.50% while Class D and Class I Shares will not be subject to any initial sales charge. For some investors, the sales charge may be waived or reduced. For the period ended March 31, 2023, no sales loads were charged.

Transactions in Shares were as follows:

| | For the

Period Ended

March 31,

2023 |

| | | Shares |

Class A Shares | | | |

Sales | | 0.991 | |

Net increase (decrease) | | 0.991 | |

Class D Shares | | | |

Sales | | 0.991 | |

Net increase (decrease) | | 0.991 | |

Class I Shares | | | |

Sales | | 56,166,444 | |

Redemptions | | (9,720 | ) |

Net increase (decrease) | | 56,156,724 | |

Note 7 – Management Fee, Incentive Fee and Fees and Expenses of Managers

The Fund pays the Adviser an investment management fee (the “Investment Management Fee”) in consideration of the advisory and other services provided by the Adviser to the Fund. Pursuant to the Investment Management Agreement, the Fund pays the Adviser a monthly Investment Management Fee equal to 1/12th of 1.50% (1.50% on an annualized basis) of the greater of (i) the Fund’s net asset value and (ii) the Fund’s net asset value less cash and cash equivalents plus the total of all commitments made by the Fund that have not yet been drawn for investment.

For purposes of calculating the Investment Management Fee, a commitment is defined as a contractual obligation to acquire an interest in, or provide the total commitment amount over time to, a pooled investment vehicle or registered investment company (a “Portfolio Fund”), when called by the Portfolio Fund. The Investment Management Fee is paid to the Adviser out of the Fund’s assets and decreases the net profits or increases the net losses of the Fund. “Net asset value” means the total value of all assets of the Fund, less an amount equal to all accrued debts, liabilities and obligations of the Fund; provided that, for purposes of determining the Investment Management Fee payable to the Adviser for any month, net asset value will be calculated prior to any reduction for any fees and expenses of the Fund for that month, including, without limitation, the Investment Management Fee payable to the Adviser for that month. The Investment Management Fee will be computed as of the last day of each month and will be due and payable in arrears within fifteen business days after the end of the month. For the period January 1, 2023 through March 31, 2023, the Adviser has agreed to voluntarily waive 50.00% of their Investment Management Fee. Prior to January 1, 2023, the Adviser had agreed to voluntarily waive 100.00% of their Investment Management Fee. For the period ended October 1, 2022 through March 31, 2023, the Fund incurred $4,931,454 in Management Fees, and the Adviser voluntarily waived $3,687,764.

In addition, at the end of each calendar quarter (and at certain other times), the Adviser will be entitled to receive an amount (the “Incentive Fee”) equal to 10% of the excess, if any, of (i) the net profits of the Fund for the relevant period over (ii) the then balance, if any, of the Loss Recovery Account (as defined below). For the purposes of the Incentive Fee,

24

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements March 31, 2023 (Continued) |

Note 7 – Management Fee, Incentive Fee and Fees and Expenses of Managers (continued) |

the term “net profits” shall mean the amount by which the net asset value of the Fund on the last day of the relevant period exceeds the net asset value of the Fund as of the commencement of the same period, including any net change in unrealized appreciation or depreciation of investments and realized income and gains or losses and expenses (including offering and organizational expenses). The Fund will maintain a memorandum account (the “Loss Recovery Account”), which will have an initial balance of zero and will be (i) increased upon the close of each calendar quarter of the Fund by the amount of the net losses of the Fund for the quarter, and (ii) decreased (but not below zero) upon the close of each calendar quarter by the amount of the net profits of the Fund for the quarter. Shareholders will benefit from the Loss Recovery Account in proportion to their holdings of Shares. Currently, the Adviser has agreed to waive their Incentive Fee. For the period ended October 1, 2022 through March 31, 2023, the Fund incurred $3,417,170 in Incentive Fees, and voluntarily waived $3,417,170.

The Adviser has entered into an expense limitation agreement and reimbursement agreement (the “Expense Limitation Agreement”) with the Fund, whereby, for at least one-year from commencement of operations, the Adviser has agreed to waive fees that it would otherwise be paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure the Total Annual Expenses (excluding taxes, interest, brokerage commissions, certain transaction related expenses arising out of investments made by the Fund, extraordinary expenses, the Incentive Fee, and any acquired fund fees and expenses (as determined in accordance with SEC Form N-2), expenses incurred in connection with any merger or reorganization, and extraordinary expenses, such as litigation expenses) do not exceed 2.95%, 2.25% and 2.50% of the average daily net assets of Class A Shares, Class I Shares and Class D Shares, respectively (the “Expense Limit”). Because taxes, leverage interest, brokerage commissions, dividend, and interest expenses on short sales, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, and extraordinary expenses are excluded from the Expense Limit, Total Annual Expenses (after fee waivers and expense reimbursements) are expected to exceed 2.95%, 2.25% and 2.50% for the Class A Shares, Class I Shares and Class D Shares, respectively. The Expense Limitation Agreement automatically renews for consecutive one-year terms unless terminated by the Fund or Adviser. For a period not to exceed three years from the date on which a Waiver is made, the Manager may recoup amounts waived or assumed, provided it is able to effect such recoupment and remain in compliance with the Expense Limit. Any recoupment would be limited to the lesser of (1) the expense limitation in effect at the time of waiver, or (2) the expense limitation in effect at the time of recoupment. For the period ended March 31, 2023, the total amount of waived fees that are subject to recoupment are $0.

In consideration of the services rendered by each Independent Manager, effective October 1, 2022, the Fund has agreed to compensate each Independent Manager, an annual retainer fee of $50,000. In addition, the Fund reimburses the expenses of the Independent Managers in connection with their services as Managers. The Managers do not receive any pension or retirement benefits from the Fund.

Note 8 – Affiliated Investments

Under Section 2(a)(3) of the Investment Company Act, a portfolio company is defined as “affiliated” with the Fund if the Fund owns five percent or more of its outstanding voting securities. At March 31, 2023, the Fund did not hold any affiliated investments.

Note 9 – Related Party Transactions

The Adviser is an affiliate of the Fund. As of March 31, 2023, “Due to related parties” of $91,920 comprised of various fund expenses and that were paid by the Adviser, such as filing fees and investment related expenses.

Note 10 – Other Agreements

UMB Fund Services, Inc. (“UMBFS”) serves as the Fund’s fund accountant, transfer agent and administrator; UMB Bank, n.a., an affiliate of UMBFS, serves as the Fund’s custodian. The Fund’s allocated fees incurred for administrative and custodian services for the fiscal period ended March 31, 2023, are reported on the Consolidated Statement of Operations.

Vigilant Compliance, LLC provides Chief Compliance Officer (“CCO”) services to the Fund. The Fund’s allocated fees incurred for CCO services for the fiscal period ended March 31, 2023 are reported on the Statement of Operations.

25

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements March 31, 2023 (Continued) |

| |

Note 11 – Investment Transactions

Total purchases of investments for the period ended March 31, 2023 amounted to $64,084,884 (excluding non-cash transactions). Total distribution proceeds from sale, redemption, or other disposition of investments for the period ended March 31, 2023 amounted to $37,542,233.

Note 12 – Indemnification

In the normal course of business, the Fund may enter into contracts that provide general indemnification. The Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Fund under such agreements, and therefore cannot be established; however, based on management’s experience, the risk of loss from such claims is considered remote.

Note 13 – Commitments

As of March 31, 2023, the Fund had funded $746,395,406 or 89.6% of the $833,155,612 of its total commitments to Direct Investments and Investment Funds.

Note 14 – Risk Factors

An investment in the Fund involves significant risks, including industry risk, liquidity risk, interest rate risk and economic conditions risk, that should be carefully considered prior to investing and should only be considered by persons financially able to maintain their investment and who can afford a loss of a substantial part or all of such investment. The Fund invests substantially all of its available capital in Direct Investments and Investment Funds. Typically, Direct Investments and Investment Funds are in restricted securities that are not traded in public markets and are subject to substantial holding periods, so that the Fund may not be able to resell some of its holdings for extended periods, which may be several years. The Fund may have a concentration of Direct Investments and Investment Funds in a particular industry or sector. Investment performance of the sector may have a significant impact on the performance of the Fund. The Fund’s investments are also subject to the risk associated with investing in private securities. Investments in private securities are illiquid and can be subject to various restrictions on resale, and there is no assurance that the Fund will be able to realize the value of such investments in a timely manner. Except where a market exists for the securities in which the Fund is directly or indirectly invested, the valuations of the Fund’s investments are estimated. As a consequence of the inherent uncertainty in estimated valuations, those valuations may differ from the valuations that would have been used had a ready market for the securities existed, and the differences could be material.

Investments in Shares provide limited liquidity. It is currently intended that Shareholders will be able to redeem Shares only through quarterly offers by the Fund to purchase a limited number of Shares. Those offers are at the discretion of the Board on the recommendation of the Adviser. Therefore, an investment in the Fund is suitable only for investors who can bear the risks associated with the limited liquidity of Shares and should be viewed as a long-term investment. No guarantee or representation is made that the Fund’s investment objective will be met.