UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------------------------------------------------

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23787

----------------------------------------------------------------

Constitution Capital Access Fund, LLC

(Exact name of registrant as specified in charter)

----------------------------------------------------------------

300 Brickstone Square, 7th Floor

Andover, Massachusetts 01810

(Address of principal executive offices) (Zip code)

Rob Hatch

Constitution Capital PM, LP

300 Brickstone Square, 7th Floor

Andover, Massachusetts 01810

(Name and address of agent for service)

----------------------------------------------------------------

Registrant’s telephone number, including area code: (855) 551-2276

Date of fiscal year end: March 31

Date of reporting period: March 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) The Report to Shareholders is attached herewith.

Constitution Capital Access Fund, LLC |

Table of Contents For the Year Ended March 31, 2024 |

1

Constitution Capital Access Fund, LLC |

Manager’s Discussion and Analysis of Fund Performance March 31, 2024 (Unaudited) |

Dear Shareholders,

Constitution Capital Partners1 is pleased to present the annual report for the Constitution Capital Access Fund, LLC (the “Fund”) for the fiscal year ended March 31, 2024. The Fund produced an 10.24% (Class I) total return for the fiscal year. The Fund finished the fiscal year with net assets of $645 million and fair market value of investments of $691 million. The Fund today is composed of 64 investments into over 330 underlying companies. These investments are managed by 27 unique sponsors with proven value-producing strategies and are tactically weighted across geography and sector.

Management Commentary

The fiscal year ended March 31, 2024, pleasantly surprised from a macroeconomic standpoint, as the US economy resisted a recession, which was the consensus expectation at the year’s outset. Instead, market indicators today including real GDP growth, steady and low unemployment rates, decelerating inflation, and improved consumer sentiment, taken together, depict a growing economy.

The private equity market, however, faced headwinds over the course of the same period, driven by an increasing cost of capital and a valuation gap between buyers and sellers. The broader market exhibited a decline in overall deal activity. However, these headwinds were not felt evenly across the entire private equity industry which saw the middle market outperform the broader private equity market due to its relative independence from the cost of debt and ability to create value through operational improvements and grow companies via both organic performance and “add-on” acquisitions.

The Fund’s Institutional Share Class generated an 10.24% total return on a NAV basis for the fiscal year ended March 31, 2024. The Fund’s performance during the trailing fiscal year ended March 31, 2024, was driven primarily by increases in the fair market value of Direct Equity Investments, followed by performance of Primary Investments, offset slightly by unfavorable movements in foreign exchange. The Fund intends to declare dividends each year equal to all or substantially all of its taxable income. As such, in December 2023 the Fund distributed $0.52 per share to investors, mostly composed of long-term capital gains2. The Fund was able to execute on its mandate of providing a seasoned, diversified portfolio to its investors. In the trailing twelve months of operations, the Fund’s Primary and Secondary Investments generated $83 million in distributions against $30 million of capital calls, producing net cash flows of $53 million related to Fund Investments. The Fund received an additional $11 million in distributions related to the sale of the Fund’s European E&P Direct Equity Investment and the dividend recapitalization of its fast growing, sustainably minded haircare products company. This net cash flow is a testament to the Fund’s focus on mitigating the “J-curve”3 through portfolio construction and vintage diversification (although past performance is no guarantee of future results).

The Fund completed twelve new investments in the trailing twelve months totaling approximately $62 million in commitments, including six Direct Equity Investments through new platform and follow-on activity, resulting in $41 million of new capital commitments. The Fund also deployed approximately $1 million into its first two Direct Credit Investments. In addition, the Fund made four new Primary Investments to North American, sector-focused Fund Managers totaling $20 million in commitments. The Investment activity reflects the Fund’s commitment to its target asset allocation of 60% Direct Investments, 20% Primary Investments and 10-20% Secondary Investments.

All of the new investments completed during the fiscal year were in North America. However, the Fund continues to seek opportunities on a global basis with primary exposure in North America. As of March 31, 2024, the top four sector exposures in the Fund are as follows: Healthcare (22.1%), Consumer Staples (15.4%), Consumer Discretionary (13.4%), and Industrials (12.5%)4. Constitution Capital Partners continues to favor investments in the healthcare, industrials & business services and consumer sectors.

2

Constitution Capital Access Fund, LLC |

Manager’s Discussion and Analysis of Fund Performance (Continued) March 31, 2024 (Unaudited) |

Outlook and Portfolio Positioning

Against the backdrop of wider market uncertainty and slowed deal activity, we remain certain in our cycle-tested approach of investing in middle market opportunities with (i) well-established leadership, (ii) organizational depth, (iii) secular tailwinds and durability, (iv) attractive financial profile with regard to growth, profitability, capital intensity and liquidity, (v) prudent levels of debt relative to comparable companies, (vi) entry enterprise valuations at a discount to public comparable companies and precedent transactions, and (vii) clear and actionable value creation plans that minimize downside exposure.

We continue to have conviction to this approach, and remain prepared to capitalize on opportunities for outsized growth and returns.

We appreciate the trust and confidence you have demonstrated in Constitution Capital Partners by your investment in the Fund. Thank you for your continued support. If you have any additional questions or comments, we invite you to contact us at info@ccaf.com.

Sincerely,

Constitution Capital Partners

Past performance is no guarantee of future results.

Risk Considerations: An investment in the Fund involves risk, including the possible loss of principal.

An investment in the Fund should be considered illiquid. An investment in the Fund is not suitable for investors who need access to the money they invest. Current and future portfolio holdings are subject to change and risk. Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Please see the Schedule of Investments in this report for a complete list of Fund holdings.

3

Constitution Capital Access Fund, LLC |

Manager’s Discussion and Analysis of Fund Performance (Continued) March 31, 2024 (Unaudited) |

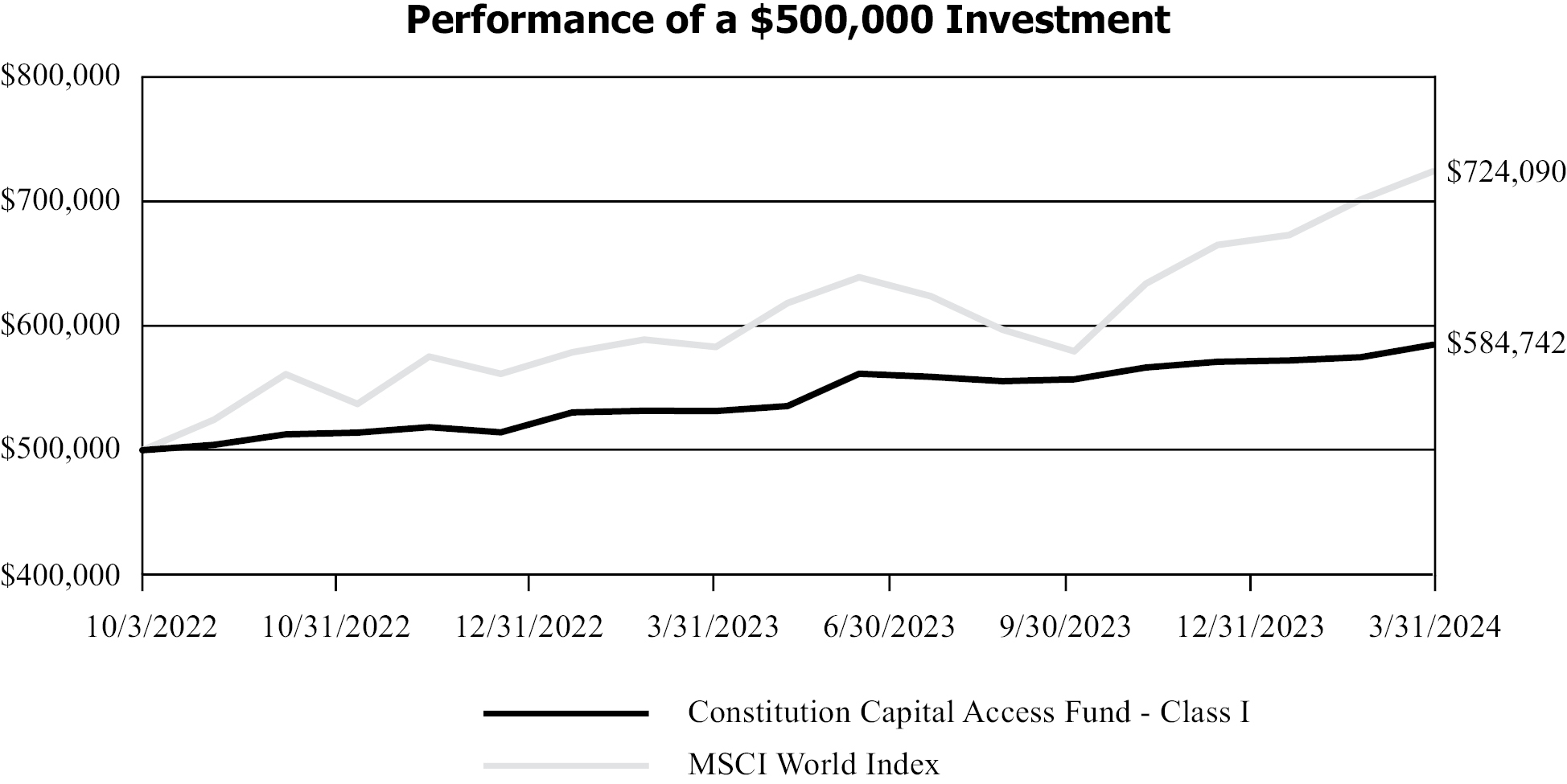

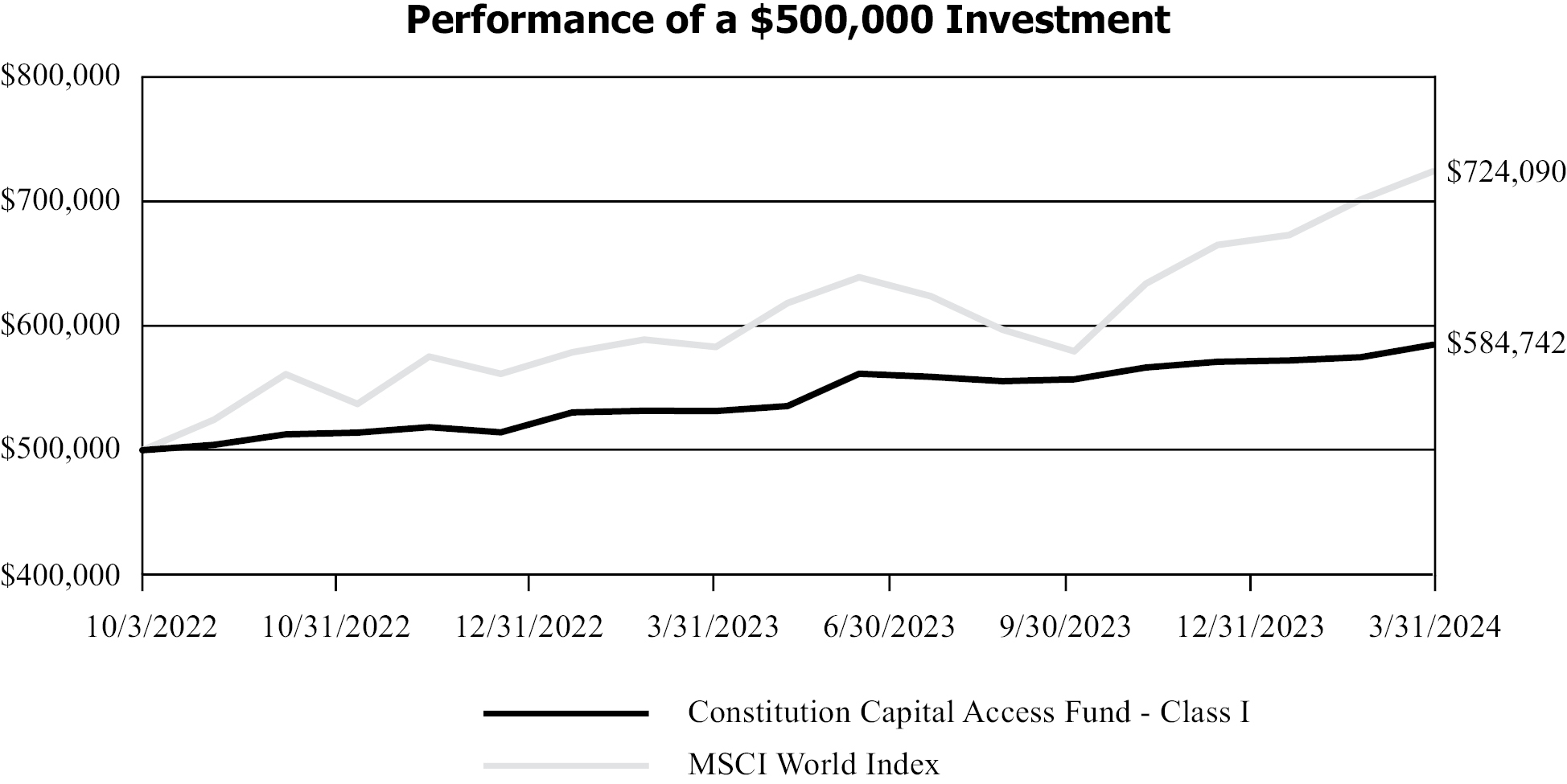

This graph compares a hypothetical $500,000 investment in the Fund’s Class I Shares with a similar investment in the MSCI World Index. This index does not serve as a benchmark for the Fund and is shown for illustrative purposes only. The Fund does not have a designated performance benchmark. Results include the reinvestment of all dividends and capital gains. The index does not reflect expenses, fees, or sales charges, which would lower performance.

The MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries. With 1,507 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The index is unmanaged and it is not available for investment.

Total Returns as of March 31, 2024 | | 1 Year | | Since Inception |

Class A Shares (Inception Date 11/01/2022) | | 10.22% | | 11.04% |

Class D Shares (Inception Date 11/01/2022) | | 10.01% | | 10.89% |

Class I Shares (Inception Date 10/01/2022) | | 10.24% | | 11.08% |

MSCI World Index (Inception Date 10/01/2022) | | 25.11% | | 39.96% |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Performance reflects waivers and reimbursements in effect, without which performance would have been lower. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent quarter end performance may be obtained by calling 1-855-551-2276.

4

Constitution Capital Access Fund, LLC |

Manager’s Discussion and Analysis of Fund Performance (Continued) March 31, 2024 (Unaudited) |

Constitution Capital PM, LP (the “Adviser”) has entered into an expense limitation agreement and reimbursement agreement (the “Expense Limitation Agreement”) with the Fund, whereby, for at least one-year from commencement of operations, the Adviser has agreed to waive fees that it would otherwise be paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure the Total Annual Expenses (excluding taxes, interest, brokerage commissions, certain transaction related expenses arising out of investments made by the Fund, extraordinary expenses, the Incentive Fee, and any acquired fund fees and expenses (as determined in accordance with SEC Form N-2), expenses incurred in connection with any merger or reorganization, and extraordinary expenses, such as litigation expenses) do not exceed 2.95%, 2.25% and 2.50% of the average daily net assets of Class A Shares, Class I Shares and Class D Shares, respectively (the “Expense Limit”). Because taxes, leverage interest, brokerage commissions, dividend, and interest expenses on short sales, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, and extraordinary expenses are excluded from the Expense Limit, Total Annual Expenses (after fee waivers and expense reimbursements) are expected to exceed 2.95%, 2.25% and 2.50% for the Class A Shares, Class I Shares and Class D Shares, respectively. The Expense Limitation Agreement automatically renews for consecutive one-year terms unless terminated by the Fund or Adviser. Gross and net expenses were both 3.95%, 3.25%, and 3.50% for the Class A Shares, Class I Shares and Class D Shares, respectively, which were stated in the current prospectus dated July 28, 2023. For the Fund’s current expense ratios, please refer to the Financial Highlights Section of this report.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

5

Report of Independent Registered Public Accounting Firm

To the Board of Managers and Shareholders of Constitution Capital Access Fund, LLC

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities, including the consolidated schedule of investments, of Constitution Capital Access Fund, LLC and its subsidiaries (the “Fund”) as of March 31, 2024, and the related consolidated statements of operations and cash flows for the year ended March 31, 2024, the consolidated statement of changes in net assets for the year ended March 31, 2024 and for the period October 1, 2022 (commencement of operations) through March 31, 2023, including the related notes, and the consolidated financial highlights for each of the periods indicated therein (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2024, the results of its operations and its cash flows for the year ended March 31, 2024, the changes in its net assets for the year ended March 31, 2024 and for the period October 1, 2022 (commencement of operations) through March 31, 2023 and the financial highlights for each of the periods indicated therein in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these consolidated financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. Our procedures included confirmation of securities owned as of March 31, 2024 by correspondence with the custodian and underlying investment fund managers; when replies were not received from the underlying investment fund managers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

May 30, 2024

We have served as the Fund’s auditor since 2022.

6

Constitution Capital Access Fund, LLC |

Consolidated Schedule of Investments March 31, 2024 |

Investments — 107.1%⁷

| |

Sector

| |

Investment Type

| | Acquisition Date | |

Shares

| |

Fair Value

|

Direct Investments — 49.3%¹,² | | | | | | | | | |

Direct Credit — 0.2% | | | | | | | | | | | |

North America — 0.2% | | | | | | | | | | | |

COP Exterminators

Acquisitions, Inc.3,9

($250,000 principal

amount, 9% Cash 4% PIK, 1/28/2030) | | Consumer Staples | | Subordinated debt | | 7/31/2023 | | | | $ | 409,885 |

PracticeTek Midco, LLC9

($1,000,000 principal

amount, 14% PIK, 8/30/2030) | | Financial Technology | | Subordinated debt | | 8/30/2023 | | | | | 1,058,333 |

Total Direct Credit | | | 1,468,218 |

| | | | | | | | | | | | |

Direct Equity — 49.1% | | | | | | | | | | | |

Asia — Pacific — 3.2% | | | | | | | | | | | |

SLP Rainbow Co-Invest,

L.P.*9 | | Consumer Staples | | Limited partnership interest | | 10/1/2022 | | | | | 11,820,597 |

SLP Redwood Co-Invest, L.P.*9 | | Communication Services | | Limited partnership interest | | 10/1/2022 | | | | | 8,632,166 |

Total Asia — Pacific | | | 20,452,763 |

| | | | | | | | | | | | |

Europe — 16.4% | | | | | | | | | | | |

Bach Co-investment

L.P.1*9 | | Consumer Discretionary | | Limited partnership interest | | 10/1/2022 | | | | | 37,830,280 |

EQT VIII Co-Investment (D)

SCSp*8 | | Health Care | | Limited partnership interest | | 10/1/2022 | | | | | 16,805,319 |

Kirk Beauty Co-Investment Limited Partnership*8 | | Consumer Discretionary | | Limited partnership interest | | 10/1/2022 | | | | | 7,746,204 |

Mayfair Olympic Holdco Limited*8,9 | | Utilities | | Ordinary Shares | | 10/1/2022 | | 1,243,556 | | | 11,734,229 |

Neptune Co-Investment, L.P.*3 | | Energy | | Limited partnership interest | | 10/1/2022 | | | | | 1,500,687 |

SLP Jewel Co-Invest, L.P.*9 | | Consumer Discretionary | | Limited partnership interest | | 10/1/2022 | | | | | 6,616,574 |

SLP Mistral Co-Invest, L.P.*9 | | Financials | | Limited partnership interest | | 10/1/2022 | | | | | 16,625,266 |

SLP Zephyr Investors, L.P.*9 | | Communication Services | | Limited partnership interest | | 10/1/2022 | | | | | 6,959,505 |

Total Europe | | | 105,818,064 |

| | | | | | | | | | | | |

North America — 29.5% | | | | | | | | | | | |

ACP Canopy Co-Invest

LLC*9 | | Health Care | | Limited liability company interest | | 11/1/2022 | | 20,082 | | | 26,945,839 |

ACP Ukulele Co-Invest LP*9 | | Health Care | | Limited partnership interest | | 3/4/2024 | | 25,671 | | | 5,947,983 |

Ares EPIC Co-Invest Delaware Feeder, L.P.*3 | | Energy | | Limited partnership interest | | 10/1/2022 | | | | | 4,259,906 |

Ares EPIC Co-Invest II

L.P.*3 | | Energy | | Limited partnership interest | | 10/1/2022 | | | | | 11,990,731 |

Carlyle Sabre Coinvestment, L.P.* | | Industrials | | Limited partnership interest | | 10/1/2022 | | | | | 13,446,727 |

CC AEC Co-Invest L.P.*9 | | Health Care | | Limited partnership interest | | 10/1/2022 | | 5,000 | | | 4,611,971 |

Centeotl Co-Invest B, L.P.* | | Consumer Staples | | Limited partnership interest | | 5/15/2023 | | | | | 5,725,210 |

COP Exterminators Investment, LLC *9 | | Consumer Staples | | Limited liability company interest | | 7/28/2023 | | 8,035,714 | | | 9,426,686 |

Ergotron Investments,

LLC*9 | | Industrials | | Limited liability company interest | | 10/1/2022 | | 50,000 | | | 6,740,833 |

See accompanying notes to the Consolidated Financial Statements.

7

Constitution Capital Access Fund, LLC |

Consolidated Schedule of Investments (Continued) March 31, 2024 |

Investments — 107.1%⁷

| |

Sector

| |

Investment Type

| | Acquisition Date | |

Shares

| |

Fair Value

|

Direct Investments (Continued) | | | | | | | | | |

Direct Equity (Continued) | | | | | | | | | | | |

North America (Continued) | | | | | | | | | | | |

Ishtar Co-Invest-B LP3 | | Consumer Staples | | Limited partnership interest | | 11/4/2022 | | | | $ | 36,451,037 |

LB Vacation Blocker LLC*9 | | Real Estate | | Limited liability company interest | | 4/10/2023 | | 2,793,296 | | | 5,736,014 |

Oshun Co-Invest-B LP*3 | | Consumer Staples | | Limited partnership interest | | 11/4/2022 | | | | | 5,739,681 |

PT Co-Invest II, L.P.*9 | | Financial Technology | | Limited partnership interest | | 8/28/2023 | | | | | 13,318,840 |

RCP Monte Nido Co-Investment Fund, L.P.*9 | | Health Care | | Limited partnership interest | | 4/10/2023 | | | | | 5,748,000 |

SLP Blue Co-Invest, L.P.* | | Information Technology | | Limited partnership interest | | 10/1/2022 | | | | | 8,925,166 |

SLP West Holdings Co-Invest II, L.P.5 | | Communication Services | | Limited partnership interest | | 10/1/2022 | | | | | 7,804,843 |

TPG VII Renown Co-Invest II, L.P.* | | Consumer Discretionary | | Limited partnership interest | | 10/1/2022 | | | | | 1,186,132 |

WPP Fairway Aggregator B, L.P.*9 | | Consumer Staples | | Class A Preferred Units | | 10/1/2022 | | 12,761 | | | 14,757,019 |

WPP Fairway Aggregator B, L.P.*9 | | Consumer Staples | | Class B Common Units | | 10/1/2022 | | 12,761 | | | 1,404,733 |

Total North America | | | 190,167,351 |

Total Direct Equity | | | 316,438,178 |

Total Direct Investments (Cost $249,287,754) — 49.3% | | | 317,906,396 |

| | | | | | | | | | | | |

Investment Funds — 55.7%¹,² | | | | | | | | | |

Asia — Pacific — 4.3% | | | | | | | | | | | |

BPEA Private Equity Fund VI, L.P.3 | | Limited partnership interest | | 10/1/2022 | | | | | 7,337,740 |

BPEA Private Equity Fund VII, SCSp3 | | Limited partnership interest | | 10/1/2022 | | | | | 20,212,582 |

Total Asia — Pacific | | | 27,550,322 |

| | | | | | | | | | | | |

Europe — 15.2% | | | | | | | | | | | |

CVC Capital Partners VI (D) S.L.P.3,8 | | Limited partnership interest | | 10/1/2022 | | | | | 11,452,419 |

CVC Capital Partners VII (A) L.P.3,8 | | Limited partnership interest | | 10/1/2022 | | | | | 22,371,265 |

EQT IX (No.1) EUR SCSp*3,8,9 | | Limited partnership interest | | 10/1/2022 | | | | | 12,460,283 |

EQT VII (No.1) Limited Partnership*3,8,9 | | Limited partnership interest | | 10/1/2022 | | | | | 6,998,296 |

EQT VIII (No.1) SCSp*3,8,9 | | Limited partnership interest | | 10/1/2022 | | | | | 18,045,413 |

Sixth Cinven Fund (No. 2) Limited Partnership3,8,9 | | Limited partnership interest | | 10/1/2022 | | | | | 26,752,636 |

Total Europe | | | 98,080,312 |

| | | | | | | | | | | | |

North America — 36.2% | | | | | | | | | | | |

Ares Corporate Opportunities Fund V, L.P.*3 | | Limited partnership interest | | 10/1/2022 | | | | | 14,905,263 |

Ares Corporate Opportunities Fund VI Parallel (TE), L.P.3 | | Limited partnership interest | | 10/1/2022 | | | | | 22,928,170 |

Ares Energy Opportunities Fund B, L.P.3 | | Limited partnership interest | | 10/1/2022 | | | | | 9,649,773 |

Bansk Fund I-B, L.P.3,9 | | Limited partnership interest | | 9/13/2023 | | | | | 4,894,413 |

Carlyle International Energy Partners II

S.C.Sp.3 | | Limited partnership interest | | 10/1/2022 | | | | | 9,629,723 |

Carlyle Partners VI, L.P.3,4 | | Limited partnership interest | | 10/1/2022 | | | | | 3,138,039 |

Carlyle Partners VII, L.P.3 | | Limited partnership interest | | 10/1/2022 | | | | | 11,126,236 |

Catterton Partners VII, L.P.*3 | | Limited partnership interest | | 10/1/2022 | | | | | 11,298,570 |

Gridiron Capital (Parallel) Fund V, L.P.*3 | | Limited partnership interest | | 11/27/2023 | | | | | 2,268,617 |

Insignia Capital Partners, L.P.3,4 | | Limited partnership interest | | 10/1/2022 | | | | | 11,241,084 |

See accompanying notes to the Consolidated Financial Statements.

8

Constitution Capital Access Fund, LLC |

Consolidated Schedule of Investments (Continued) March 31, 2024 |

Investments — 107.1%⁷

| |

Sector

| |

Investment Type

| | Acquisition Date | |

Shares

| |

Fair Value

|

Investment Funds (Continued) | | | | | | | | | | |

North America (Continued) | | | | | | | | | | | | |

Kinderhook Capital Fund IV, L.P.*9 | | Limited partnership interest | | 10/1/2022 | | | | $ | 27,236 | |

Kinderhook Reinvestment Fund IV2, L.P.*9 | | Limited partnership interest | | 12/28/2023 | | | | | 312,193 | |

Lightyear Fund III, L.P.3,4 | | Limited partnership interest | | 10/1/2022 | | | | | 1,871,033 | |

Nautic Partners VI-A, L.P.3 | | Limited partnership interest | | 10/1/2022 | | | | | 1,899,051 | |

Revelstoke Capital Partners Fund III, L.P.3,9 | | Limited partnership interest | | 8/22/2023 | | | | | 2,864,811 | |

Riverstone Global Energy and Power Fund VI, L.P.3 | | Limited partnership interest | | 10/1/2022 | | | | | 4,646,015 | |

Riverstone Non-ECI Partners, L.P.3 | | Limited partnership interest | | 10/1/2022 | | | | | 10,455,779 | |

Silver Lake Partners IV, L.P.3,4 | | Limited partnership interest | | 10/1/2022 | | | | | 17,249,517 | |

Silver Lake Partners V, L.P.3,4 | | Limited partnership interest | | 10/1/2022 | | | | | 18,945,342 | |

SK Capital Partners III, L.P.*3 | | Limited partnership interest | | 10/1/2022 | | | | | 16,833,177 | |

SL SPV-2, L.P. | | Limited partnership interest | | 10/1/2022 | | | | | 7,315,913 | |

SunTx Capital Partners II, L.P.* | | Limited partnership interest | | 10/1/2022 | | | | | 14,089,062 | |

TPG HealthCare Partners, L.P.3 | | Limited partnership interest | | 10/1/2022 | | | | | 5,964,223 | |

TPG Partners VI, L.P.3 | | Limited partnership interest | | 10/1/2022 | | | | | 1,579,537 | |

TPG Partners VIII, L.P.3 | | Limited partnership interest | | 10/1/2022 | | | | | 20,595,837 | |

WestView Capital Partners III, L.P.*3,9 | | Limited partnership interest | | 10/1/2022 | | | | | 5,928,525 | |

Wind Point Partners VII-B, L.P.*3,9 | | Limited partnership interest | | 10/1/2022 | | | | | 1,828,750 | |

Total North America | | | 233,485,889 | |

Total Investment Funds (Cost $399,710,062) — 55.7% | | | 359,116,523 | |

| | | | | | | | | | | | | |

Short-Term Investments — 2.1% | | | | | | | | | | |

North America — 2.1% | | | | | | | | | | | | |

Fidelity Institutional Government Portfolio — Class I, 5.21%6 | | 13,820,275 | | | 13,820,275 | |

Total Short-Term Investments (Cost $13,820,275) — 2.1% | | | 13,820,275 | |

| | | | | | | | | | | | | |

Total Investments (Cost $662,818,091) — 107.1% | | | 690,843,194 | |

Net Other Assets (Liabilites) — (7.1%) | | | (45,666,594 | ) |

Total Net Assets — 100.0% | | $ | 645,176,600 | |

See accompanying notes to the Consolidated Financial Statements.

9

Constitution Capital Access Fund, LLC |

Consolidated Schedule of Investments (Continued) March 31, 2024 |

Summary of Investments (as a percentage of total net assets) |

Direct Investments | | 49.3 | % |

Investment Funds | | 55.7 | % |

Short-Term Investments | | 2.1 | % |

Total Investments | | 107.1 | % |

Net Other Assets (Liabilites) | | (7.1 | )% |

Total Net Assets | | 100.0 | % |

See accompanying notes to the Consolidated Financial Statements.

10

Constitution Capital Access Fund, LLC |

Consolidated Statement of Assets and Liabilities March 31, 2024 |

Assets | | | |

Investments, at fair value (cost $662,818,091) | | $ | 690,843,194 |

Cash equivalents held in escrow for subscriptions received in advance | | | 2,020,000 |

Cash | | | 1,547,156 |

Foreign currency, at fair value (cost $499,262) | | | 506,277 |

Deferred loan issuance costs | | | 469,042 |

Interest receivable | | | 7,473 |

Prepaid expenses and other assets | | | 203,863 |

Total Assets | | | 695,597,005 |

| | | | |

Liabilities | | | |

Line of credit payable | | | 37,301,018 |

Subscriptions received in advance | | | 10,230,000 |

Line of credit interest payable | | | 1,244,727 |

Deferred tax liability | | | 428,729 |

Investment management fee payable | | | 435,164 |

Audit and tax fees payable | | | 432,750 |

Accounting and administration fees payable | | | 155,536 |

Legal fees payable | | | 132,234 |

Due to Adviser | | | 27,641 |

Custody fees payable | | | 14,555 |

Transfer agent fees payable | | | 8,801 |

Distribution and servicing fees payable (Class D) | | | 80 |

Other accrued expenses | | | 9,170 |

Total Liabilities | | | 50,420,405 |

| | | | |

Commitments and contingencies (see Note 3) | | | |

| | | | |

Net Assets | | $ | 645,176,600 |

| | | | |

Composition of Net Assets: | | | |

Paid-in capital | | $ | 482,191,824 |

Total distributable earnings | | | 162,984,776 |

Net Assets | | $ | 645,176,600 |

| | | | |

Net Assets Attributable to: | | | |

Class A Shares | | $ | 12 |

Class D Shares | | | 103,890 |

Class I Shares | | | 645,072,698 |

| | | $ | 645,176,600 |

Shares of Beneficial Interests (unlimited number of shares authorized) | | | |

Class A Shares | | | 1 |

Class D Shares | | | 9,317 |

Class I Shares | | | 57,816,816 |

| | | | 57,826,134 |

Net Asset Value per Share: | | | |

Class A Shares1 | | $ | 11.16 |

Class D Shares | | $ | 11.15 |

Class I Shares | | $ | 11.16 |

See accompanying notes to the consolidated financial statements.

11

Constitution Capital Access Fund, LLC |

Consolidated Statement of Operations For the Year Ended March 31, 2024 |

Investment Income | | | | |

Dividend income (net of withholding tax of $301,039) | | $ | 6,611,098 | |

Interest income | | | 275,277 | |

Total Investment Income | | | 6,886,375 | |

| | | | | |

Expenses | | | | |

Investment management fees | | | 10,333,704 | |

Incentive fees | | | 6,031,898 | |

Line of credit fees and expenses1 | | | 4,546,977 | |

Accounting and administration fees | | | 867,728 | |

Legal fees | | | 536,840 | |

Audit and tax fees | | | 345,750 | |

Board fees and expenses | | | 333,690 | |

Offering costs | | | 230,541 | |

Custodian fees | | | 86,017 | |

Chief compliance officer fees | | | 63,540 | |

Transfer agency fees | | | 48,207 | |

Distribution and servicing fee (Class D) | | | 80 | |

Other operating expenses | | | 565,237 | |

Total expenses before waivers | | | 23,990,209 | |

Voluntary waiver of Investment Management fees (Note 6) | | | (5,166,852 | ) |

Voluntary waiver of Incentive fees (Note 6) | | | (6,031,898 | ) |

Net expenses | | | 12,791,459 | |

Net investment loss | | | (5,905,084 | ) |

| | | | | |

Net Realized Gain (Loss) and Change in Unrealized Appreciation/Depreciation | | | | |

Net realized gain on distributions from investments (net of withholding tax of $2,079,972) | | | 51,359,399 | |

Net realized loss on investments | | | (156,320 | ) |

Net realized gain on foreign currency transactions | | | 6,987 | |

Net change in unrealized appreciation/depreciation on investments | | | 15,497,911 | |

Net change in unrealized appreciation/depreciation on foreign currency transactions | | | (6,400 | ) |

Net change on deferred tax liability | | | (428,729 | ) |

Net Realized Gain (Loss) and Change in Unrealized Appreciation/Depreciation | | | 66,272,848 | |

| | | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 60,367,764 | |

See accompanying notes to the consolidated financial statements.

12

Constitution Capital Access Fund, LLC |

Consolidated Statements of Changes in Net Assets |

| | For the

Year Ended

March 31, 2024 | | For the Period

October 1,

2022*

through

March 31,

2023 |

Changes in Net Assets Resulting from Operations | | | | | | | | |

Net investment loss | | $ | (5,905,084 | ) | | $ | (1,081,053 | ) |

Net realized gain (loss) on investments and foreign currency transactions | | | 51,210,066 | | | | 22,724,948 | |

Net change in unrealized appreciation/(depreciation) on investments and foreign currency transactions, net of deferred taxes | | | 15,062,782 | | | | 12,527,807 | |

Net Change in Net Assets Resulting from Operations | | | 60,367,764 | | | | 34,171,702 | |

| | | | | | | | | |

Distributions to investors | | | | | | | | |

Class A | | | (1 | ) | | | — | |

Class D | | | (1,178 | ) | | | — | |

Class I | | | (27,717,599 | ) | | | — | |

Net Change in Net Assets from Distributions to Investors | | | (27,718,778 | ) | | | — | |

| | | | | | | | | |

Change in Net Assets Resulting from Capital Transactions (see Note 6) | | | | | | | | |

Class A | | | | | | | | |

Proceeds from issuance of shares | | | — | | | | 10 | |

Reinvested distributions | | | 1 | | | | — | |

Total Class A Transactions | | | 1 | | | | 10 | |

| | | | | | | | | |

Class D | | | | | | | | |

Proceeds from issuance of shares | | | 225,000 | | | | 10 | |

Reinvested distributions | | | 1,178 | | | | — | |

Exchange of shares | | | (125,000 | ) | | | — | |

Total Class D Transactions | | | 101,178 | | | | 10 | |

| | | | | | | | | |

Class I | | | | | | | | |

Proceeds from issuance of shares | | | 25,639,652 | | | | 561,667,5691 | |

Reinvested distributions | | | 27,636,156 | | | | — | |

Exchange of shares | | | 125,000 | | | | — | |

Shares repurchased | | | (36,713,664 | ) | | | (100,000 | ) |

Total Class I Transactions | | | 16,687,144 | | | | 561,567,569 | |

| | | | | | | | | |

Net Change in Net Assets Resulting from Capital Transactions | | | 16,788,323 | | | | 561,567,589 | |

| | | | | | | | | |

Total Net Increase in Net Assets | | | 49,437,309 | | | | 595,739,291 | |

| | | | | | | | | |

Net Assets | | | | | | | | |

Beginning of period | | | 595,739,291 | | | | — | |

End of period | | $ | 645,176,600 | | | $ | 595,739,291 | |

See accompanying notes to the consolidated financial statements.

13

Constitution Capital Access Fund, LLC |

Consolidated Statement of Cash Flows For the Year Ended March 31, 2024 |

Cash Flows From Operating Activities | | | | |

Net increase in net assets from operations | | $ | 60,367,764 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: | | | | |

Purchases of investments | | | (79,532,793 | ) |

Payment in kind interest income added to principal amount of investments | | | (85,303 | ) |

Return of Capital distributions received from investments | | | 32,059,939 | |

Sales of investments | | | 10,359,819 | |

Change in short-term investments, net | | | (5,508,637 | ) |

Net realized loss on investments | | | 156,320 | |

Net change in unrealized appreciation/depreciation on investments | | | (15,497,911 | ) |

Net change in deferred tax liability | | | 428,729 | |

(Increase)/Decrease in Assets: | | | | |

Deferred loan issuance costs amortization | | | 134,012 | |

Prepaid offering costs amortization | | | 230,541 | |

Prepaid expenses and other assets | | | (160,064 | ) |

Interest receivable | | | (7,473 | ) |

Increase/(Decrease) in Liabilities: | | | | |

Line of credit interest payable | | | 2,243,210 | |

Investment management fee payable | | | 20,248 | |

Legal fees payable | | | (139,364 | ) |

Audit and tax fees payable | | | 157,650 | |

Accounting and administration fees payable | | | (48,081 | ) |

Due to Adviser | | | (64,279 | ) |

Organizational cost payable | | | (27,859 | ) |

Custody fees payable | | | (6,124 | ) |

Transfer agent fees payable | | | (706 | ) |

Payable for investments in securities purchased | | | (3,647 | ) |

Distribution and servicing fees payable (Class D) | | | 80 | |

Other accrued expenses | | | (8,337 | ) |

Net Cash Provided by Operating Activities | | | 5,067,734 | |

| | | | | |

Cash Flows from Financing Activities | | | | |

Proceeds from subscriptions of shares, net of change in payable for proceeds from subscriptions received in advance | | | 34,381,152 | |

Proceeds from line of credit | | | 51,350,000 | |

Payments made on line of credit | | | (53,200,000 | ) |

Payments made for offering costs | | | (7,879 | ) |

Distributions to shareholders, net of reinvestments of distributions | | | (81,443 | ) |

Payments for shares repurchased, net of increase in payable for shares repurchased | | | (36,813,664 | ) |

Net Cash Used in Financing Activities | | | (4,371,834 | ) |

| | | | | |

Net change in Cash, foreign currency, and cash equivalents | | | 695,900 | |

Cash, foreign currency, and cash equivalents – Beginning of Period | | | 3,377,533 | |

Cash, foreign currency, and cash equivalents – End of Period | | $ | 4,073,433 | |

| | | | | |

Supplemental disclosure of non-cash activities | | | | |

Reinvestment of distribtuions made to shareholders | | $ | 27,637,336 | |

Stock distributions received in-kind from investments | | | 10,516,139 | |

Payment in kind interest income | | | 85,303 | |

Exchanges into Class I (11,243 shares) | | | 125,000 | |

Exchanges out of Class D (11,245 shares) | | | (125,000 | ) |

Line of credit used to pay line of credit interest expense | | | 998,482 | |

| | | | | |

Supplemental disclosure of cash flow information | | | | |

Interest payments on line of credit | | $ | 3,996,793 | |

See accompanying notes to the consolidated financial statements.

14

Constitution Capital Access Fund, LLC |

Consolidated Financial Highlights Class A Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the

Year Ended

March 31, 2024 | | For the Period

November 1,

2022*

through

March 31, 2023 |

Per Share Operating Performance1: | | | | | | | | |

Net Asset Value per share, beginning of period | | $ | 10.61 | | | $ | 10.09 | |

Activity from investment operations: | | | | | | | | |

Net investment income/(loss) | | | (0.11 | ) | | | 0.01 | |

Net realized and unrealized gain/(loss) on investments | | | 1.18 | | | | 0.51 | |

Total from investment operations | | | 1.07 | | | | 0.52 | |

| | | | | | | | | |

Distributions to shareholders | | | | | | | | |

From net investment income | | | (0.10 | ) | | | — | |

From net realized gains | | | (0.42 | ) | | | — | |

Total distributions to shareholders | | | (0.52 | ) | | | — | |

| | | | | | | | | |

Net Asset Value per share, end of period | | $ | 11.16 | | | $ | 10.61 | |

| | | | | | | | | |

Net Assets, end of year | | $ | 12 | | | $ | 11 | |

| | | | | | | | | |

Ratios to average shareholders’ equity2: | | | | | | | | |

Net investment loss3 | | | (2.79 | )% | | | (1.38 | )% |

| | | | | | | | | |

Gross expenses before voluntary waivers4 | | | 3.90 | % | | | 3.23 | % |

Voluntary waivers of Investment management fees and Incentive fees | | | (1.82 | )% | | | (1.71 | )% |

Net expenses5 | | | 2.08 | % | | | 1.52 | % |

| | | | | | | | | |

Total Return6 | | | 10.22 | %7 | | | 5.19 | %7 |

| | | | | | | | | |

Portfolio turnover rate | | | 2 | % | | | 0 | %9 |

| | | | | | | | | |

Senior Securities | | | | | | | | |

Total borrowings (000s) | | $ | 37,301 | | | $ | 37,200 | |

Asset coverage per $1,000 unit of senior indebtedness8 | | $ | 18,296 | | | $ | 17,014 | |

See accompanying notes to the Consolidated Financial Statements.

15

Constitution Capital Access Fund, LLC |

Consolidated Financial Highlights Class D Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the

Year Ended

March 31, 2024 | | For the Period

November 1,

2022*

through

March 31, 2023 |

Per Share Operating Performance1: | | | | | | | | |

Net Asset Value per share, beginning of period | | $ | 10.61 | | | $ | 10.09 | |

Activity from investment operations: | | | | | | | | |

Net investment income/(loss) | | | (0.14 | ) | | | 0.01 | |

Net realized and unrealized gain/(loss) on investments | | | 1.19 | | | | 0.51 | |

Total from investment operations | | | 1.05 | | | | 0.52 | |

| | | | | | | | | |

Distributions to shareholders | | | | | | | | |

From net investment income | | | (0.09 | ) | | | — | |

From net realized gains | | | (0.42 | ) | | | — | |

Total distributions to shareholders | | | (0.51 | ) | | | — | |

| | | | | | | | | |

Net Asset Value per share, end of period | | $ | 11.15 | | | $ | 10.61 | |

| | | | | | | | | |

Net Assets, end of year | | $ | 103,890 | | | $ | 11 | |

| | | | | | | | | |

Ratios to average shareholders’ equity2: | | | | | | | | |

Net investment loss3 | | | (3.06 | )% | | | (1.38 | )% |

| | | | | | | | | |

Gross expenses before voluntary waivers4 | | | 4.17 | % | | | 3.23 | % |

Voluntary waivers of Investment management fees and Incentive fees | | | (1.82 | )% | | | (1.71 | )% |

Net expenses5 | | | 2.35 | % | | | 1.52 | % |

| | | | | | | | | |

Total Return6 | | | 10.01 | %7 | | | 5.19 | %7 |

| | | | | | | | | |

Portfolio turnover rate | | | 2 | % | | | 0 | %9 |

| | | | | | | | | |

Senior Securities | | | | | | | | |

Total borrowings (000s) | | $ | 37,301 | | | $ | 37,200 | |

Asset coverage per $1,000 unit of senior indebtedness8 | | $ | 18,296 | | | $ | 17,014 | |

See accompanying notes to the Consolidated Financial Statements.

16

Constitution Capital Access Fund, LLC |

Consolidated Financial Highlights Class I Shares |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the

Year Ended

March 31, 2024 | | For the Period

October 1,

2022*

through

March 31, 2023 |

Per Share Operating Performance1: | | | | | | | | |

Net Asset Value per share, beginning of period | | $ | 10.61 | | | $ | 10.00 | |

Activity from investment operations: | | | | | | | | |

Net investment loss | | | (0.11 | ) | | | (0.02 | ) |

Net realized and unrealized gain/(loss) on investments | | | 1.18 | | | | 0.63 | |

Total from investment operations | | | 1.07 | | | | 0.61 | |

| | | | | | | | | |

Distributions to shareholders | | | | | | | | |

From net investment income | | | (0.10 | ) | | | — | |

From net realized gains | | | (0.42 | ) | | | — | |

Total distributions to shareholders | | | (0.52 | ) | | | — | |

| | | | | | | | | |

Net Asset Value per share, end of period | | $ | 11.16 | | | $ | 10.61 | |

| | | | | | | | | |

Net Assets, end of year | | $ | 645,072,698 | | | $ | 595,739,269 | |

| | | | | | | | | |

Ratios to average shareholders’ equity2: | | | | | | | | |

Net investment loss3 | | | (2.79 | )% | | | (2.10 | )% |

| | | | | | | | | |

Gross expenses before voluntary waivers4 | | | 3.90 | % | | | 3.64 | % |

Voluntary waivers of Investment management fees and Incentive fees | | | (1.82 | )% | | | (1.88 | )% |

Net expenses5 | | | 2.08 | % | | | 1.76 | % |

| | | | | | | | | |

Total Return6 | | | 10.24 | %7 | | | 6.10 | %7 |

| | | | | | | | | |

Portfolio turnover rate | | | 2 | % | | | 0 | %9 |

| | | | | | | | | |

Senior Securities | | | | | | | | |

Total borrowings (000s) | | $ | 37,301 | | | $ | 37,200 | |

Asset coverage per $1,000 unit of senior indebtedness8 | | $ | 18,296 | | | $ | 17,014 | |

See accompanying notes to the Consolidated Financial Statements.

17

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements March 31, 2024 |

Note 1 – Organization |

Constitution Capital Access Fund, LLC (the “Fund”) is a Delaware limited liability company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), as a non-diversified closed-end management investment company. The Fund was organized on March 3, 2022 and commenced operations on October 1, 2022 (“Commencement of Operations”). Constitution Capital PM, LP serves as the investment adviser (the “Adviser”) of the Fund. The Adviser is an investment adviser registered with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended.

Simultaneous with the Commencement of Operations, the U/C Seed Partnership Fund, L.P. (the “Predecessor Fund”), reorganized and transferred substantially all its portfolio securities into the Fund with a transfer value policy election to use fair market value as opening cost for a non-taxable transaction.

The Fund’s investment objective is to generate long-term capital appreciation. The Fund seeks its investment objective by investing in a broad portfolio of investments in private assets (collectively, “Private Assets”) that the Adviser believes provide attractive risk-adjusted return potential. The Fund’s investments include (i) direct investments and co-investments in the equity or debt of operating companies (“Direct Equity Investments” or “Direct Credit Investments,” respectively, and together, “Direct Investments”); (ii) primary commitments to new private equity or other closed-end private funds and purchases of existing interests of private equity or other closed-end private funds that are acquired on the secondary market (“Primary Investments” and “Secondary Investments”, respectively, and together, “Investment Funds”), which are managed by third-party managers (“Investment Fund Managers”); (iii) direct or secondary purchases of liquid credit instruments; (iv) other liquid investments (i.e. strategies with a higher liquidity profile than direct investments or investments in funds, including listed private equity); and (v) short-term investments (together, “Short-term Investments”).

The Fund offers three separate classes of shares of beneficial interest (“Shares”) designated as Class A Shares, Class D Shares and Class I Shares. Each class of Shares have differing characteristics, particularly in terms of the sales charges that Shareholders in that class may bear, and the distribution and service fees that each class may be charged. The Fund has received an exemptive order from the SEC with respect to the Fund’s multi-class structure.

a. Consolidation of Subsidiaries

The Fund may make investments through wholly owned subsidiaries (each a “Subsidiary” and together, the “Subsidiaries”). Such Subsidiaries will not be registered under the Investment Company Act; however, the Fund will wholly own and control any Subsidiaries. The Fund’s Board of Managers (the “Board”) has oversight responsibility for the investment activities of the Fund, including its investment in any Subsidiary, and the Fund’s role as sole owner of any Subsidiary. To the extent applicable to the investment activities of a Subsidiary, the Subsidiary will follow the same compliance policies and procedures as the Fund. The Fund would “look through” any such Subsidiary to determine compliance with its investment policies. The Fund complies with Section 8 of the Investment Company Act governing investment policies on an aggregate basis with any Subsidiary. The Fund also complies with Section 18 of the Investment Company Act governing capital structure and leverage on an aggregate basis with each Subsidiary so that the Fund treats a Subsidiary’s debt as its own for purposes of Section 18. Further, each Subsidiary complies with the provisions of Section 17 of the Investment Company Act relating to affiliated transactions and custody. The Fund will not create or acquire primary control of any entity which engages in investment activities in securities or other assets, other than entities wholly owned by the Fund.

As of March 31, 2024, there are three active Subsidiaries:

Subsidiary | Formation Date | Domicile | % of

Investments |

CC PMF Holdings, LLC | March 17, 2022 | United States | 91.28 |

CC PMF Blocker, LLC | March 21, 2022 | United States | 1.13 |

CC PMF Splitter Partnership | August 5, 2022 | United States | 7.59 |

The Consolidated Financial Statements of the Fund include the accounts of the Subsidiaries. All intercompany accounts and transactions have been eliminated.

18

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements (Continued) March 31, 2024 |

| |

Note 2 – Significant Accounting Policies

The following is a summary of the significant accounting and reporting policies used by the Fund in preparing its Consolidated Financial Statements.

a. Basis of Accounting

The Fund is an investment company and applies the guidance set forth in Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. The Fund’s accounting and reporting policies conform with U.S. generally accepted accounting principles (“U.S. GAAP”).

b. Valuation of Investments

The Fund invests, under normal circumstances, in a broad portfolio of Private Assets and values them at fair value in accordance with the provisions of ASC Topic 820, Fair Value Measurements and Disclosures (“ASC 820”).

In December 2020, the SEC adopted a new rule providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5 establishes requirements for determining fair value in good faith for purposes of the Investment Company Act. Rule 2a-5 permits fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other conditions. Rule 2a-5 also defines when market quotations are “readily available” for purposes of the Investment Company Act and the threshold for determining whether a fund must fair value a security. Pursuant to the requirements of Rule 2a-5, the Board has designated the Adviser as its valuation designee to perform fair value determinations and has approved the valuation procedures for the Fund.

Where available, the Fund uses the net asset value (“NAV”) reported by the Direct Investments and Investment Funds as a practical expedient in determining their fair values. If the Adviser determines that the most recent NAV reported is not indicative of fair value or if a NAV is not reported to the Fund, a fair value determination is made by the Adviser in accordance with the Fund’s valuation procedures. In making a fair value determination for the Fund’s interests or shares in Investment Funds, the Adviser considers, among other things, information provided by the Investment Funds, including quarterly unaudited financial statements and cash flow activity observed during the valuation period. The Adviser will review the appropriateness of the valuation based on any new information or changes in assumptions regarding the security, reliable public information, actual trade prices or other information that becomes available subsequent to the most recently reported NAV.

The Fund’s Direct Investments are generally not publicly traded, and thus, market quotations are not available to be used for valuation purposes. Therefore, in making a fair value determination for the Direct Investments, the Adviser may utilize information provided by the sponsor of the Direct Investment, including quarterly unaudited financial statements, financial forecasts, and cash flow activity observed during the valuation period. The Adviser may also utilize the cost of the investment, present value or other subjective income and market based valuation techniques. These techniques may include references to market multiples, valuations for comparable companies, public market or private transactions, subsequent developments concerning the companies to which the securities relate, results of operations, financial condition, cash flows, and projections of such companies provided to the Adviser and such other factors as the Adviser may deem relevant. Depending on the circumstances, company multiples will not always be comparable due to the size of the related companies or associated transactions being used as comparable data in valuation.

The Adviser has established an internal valuation committee consisting of senior members of the organization to review and approve valuations related to the Direct Investments and Investment Funds as of each valuation date.

For investments that are publicly traded and have market quotations readily available on one or more of the U.S. national securities exchanges, the Nasdaq Stock Market or any foreign stock exchange, valuations will be based on their respective market price and may be further adjusted for potential restrictions on the transfer or sale of such securities.

c. Cash and Cash Held in Escrow

In order to maintain liquidity, the Fund holds cash, including amounts held in foreign currencies and in short-term interest-bearing deposit accounts with UMB Bank, n.a. (the “Custodian”). At times, those amounts may exceed any applicable federally insured limits. The Fund has not experienced any losses in such accounts and does not believe that it is exposed to any significant credit risk on such accounts.

19

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements (Continued) March 31, 2024 |

Note 2 – Significant Accounting Policies (continued) |

Subscriptions are generally subject to the receipt of cleared funds on or prior to the acceptance date set by the Fund and notified to prospective investors. Cash held in escrow represents funds received from prospective investors prior to the effective date of the subscriptions, which are restricted for use and placed in an interest-bearing escrow account with the Custodian, who also serves as the Fund’s escrow agent. On the effective date of the subscription, the balance in the escrow account with respect to each investor whose investment is accepted will be invested in the Fund on behalf of such investor. Interest, if any, earned on escrowed amounts will be credited to the Fund for the benefit of all Shareholders. As of March 31, 2024, the Fund had $2,020,000 of cash equivalents (defined below) held in escrow related to subscriptions that were received prior to the effective date of the subscriptions and are disclosed on the Consolidated Statement of Assets.

d. Cash Equivalents

Cash equivalents represent short-term investments in high quality money market instruments and money market mutual funds and are recorded at NAV per share which approximates fair value. Money market instruments are high quality, short-term fixed-income obligations, with a low risk of loss and which generally have remaining maturities of one year or less. Such short-term investments may include U.S. Government securities, commercial paper, certificates of deposit and bankers’ acceptances issued by domestic branches of U.S. banks that are members of the Federal Deposit Insurance Corporation. Cash equivalents held by the Fund are disclosed under short-term investments on the Consolidated Schedule of Investments.

e. Foreign Currency

Valuations of assets and liabilities denominated in currencies other than the U.S. Dollar are translated into U.S. Dollar equivalents using valuation date exchange rates, while purchases, realized gains and losses, income and expenses are translated at transaction date exchange rates. The Fund does not isolate the effects of changes in foreign currency rates on the valuation of Private Assets. Such fluctuations in exchange rates are included with and form part of the net realized and unrealized gain (loss) from investments and net realized and unrealized gain (loss) currency transactions on the Consolidated Statement of Operations.

f. Investment Income

The Fund’s primary sources of income are investment income and gains recognized upon distributions from Private Assets and unrealized appreciation in the fair value of its Private Assets. The Fund generally recognizes investment income and realized gains based on the characterization of distributions provided by the Private Assets at the time of distributions.

Realized gains and losses from the sale of Private Assets represent the difference between the original cost of the Private Assets, as adjusted for return of capital distributions (net cost), and the net proceeds received at the time of the sale, disposition or distribution. The Fund records realized gains and losses on Private Assets when securities are sold, distributed to the partners or written-off as worthless. The Fund recognizes the difference between the net cost and the estimated fair value of Private Assets owned as the net change in unrealized appreciation/depreciation on investments in the Consolidated Statement of Operations.

Interest income, including amortization of premium or discount using the effective interest method and interest on paid-in-kind instruments, is recorded on an accrual basis. Dividend income is recognized on preferred equity securities on an accrual basis, and on common equity securities on the record date (for private companies) or on the ex-dividend date (for publicly traded companies). Other income from Private Assets, which represents operating income from investment partnerships or other flow through entities received by the Fund, is recorded on the date received.

g. Income Taxes

The Fund elects to be treated, and continues to qualify, as a Regulated Investment Company as defined under Subchapter M of the Internal revenue Code of 1986, as amended (the “Code”), by distributing substantially all of its taxable income and net realized gains (after reduction for any capital loss carryforwards) to Shareholders, and by meeting certain diversification and income requirements with respect to its investments. Therefore, no federal income tax provision has been recorded for the Fund.

20

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements (Continued) March 31, 2024 |

Note 2 – Significant Accounting Policies (continued) |

The Fund recognizes the tax benefits of certain uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities in accordance with ASC Topic 740, Accounting for Uncertainty in Income Taxes (“ASC 740”). The Adviser has analyzed the Fund’s tax positions and has concluded that the Fund does not have any uncertain tax positions that met the recognition criteria of ASC 740 as of March 31, 2024. The tax year ending September 30, 2023 for the Fund and certain of its subsidiaries are open and subject to examination by the IRS.

A Subsidiary of the Fund, CC PMF Blocker, LLC (the “Blocker”), is a domestic limited liability company that elects to be treated as a C-corporation for federal and state income tax purposes and is required to account for its estimate of income taxes through the establishment of a deferred tax asset or liability. The Blocker recognizes deferred income taxes for temporary differences in the basis of assets and liabilities for financial and income tax purposes. Deferred tax assets are recognized for deductible temporary differences, tax credit carryforwards or net operating loss carryforwards and deferred tax liabilities are recognized for taxable temporary differences. To the extent the Blocker has a deferred tax asset, the Adviser considers whether a valuation allowance is required. Detailed tax information for the Fund and the Blocker is included in Note 14.

h. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Consolidated Financial Statements and the reported amounts of increases and decreases in capital from operations during the reporting period. Actual results may differ from those estimates.

The Fund bears all expenses incurred in the course of its operations, including, but not limited to, the following: all fees and expenses of the Private Assets in which the Fund invests, fees and expenses associated with a credit facility, legal fees, administrator fees, audit and tax preparation fees, custodial fees, transfer agency fees, registration expenses, expenses of the Board and other administrative expenses. Certain of these operating expenses, other than class-specific expenses, are subject to an expense limitation agreement and reimbursement agreement (the “Expense Limitation Agreement”, as further discussed in Note 4). Expenses are recorded on an accrual basis and allocated to Shares based upon ownership percentage.

i. Offering Costs

Offering costs consist of the costs of preparation, review and filing with the SEC the Fund’s registration statement, the costs of preparation, review and filing of any associated marketing or similar materials, the costs associated with the printing, mailing or other distribution of the Prospectus, Statement of Additional Information (“SAI”) and/or marketing, and the amounts of associated filing fees and legal fees associated with the offering. Offering costs, which are subject to the Fund’s Expense Limitation Agreement discussed in Note 4, are accounted for as a deferred charge until Fund Shares are offered to the public and thereafter are amortized to expense over twelve months on a straight-line basis.

Note 3 – Fair Value Measurements

ASC 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price), or in the absence of a principal market, the most advantageous market for the asset, and establishes a fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are those that market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Adviser. Unobservable inputs reflect the Adviser’s assumption about the inputs market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The fair value hierarchy is categorized into three levels based on the inputs as follows:

Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date. The types of financial instruments included in Level 1 are listed unrestricted securities, equities and listed derivatives, if any, listed in active markets.

21

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements (Continued) March 31, 2024 |

Note 3 – Fair Value Measurements (continued) |

Level 2 — Inputs other than quoted prices within Level 1 that are observable for the asset or liability, either directly or indirectly in active markets as of the reporting date, and fair value that is determined using models or other valuation methodologies. Financial instruments in this category generally include corporate bonds and loans, less liquid and restricted securities listed in active markets, securities traded in other than active markets, government and agency securities, certain over-the-counter derivatives and interests in Private Assets whose fair value is predominantly attributable to investments in Level 1 type securities. A significant adjustment to a Level 2 input could result in the Level 2 measurement becoming a Level 3 measurement.

Level 3 — Inputs that are unobservable for the asset or liability and that include situations where there is little, if any, market activity for the asset or liability. The inputs into the determination of fair value are based upon the best information in the circumstances and may require significant management judgment or estimation. Financial instruments in this category generally include equity and debt positions in private companies, and nonredeemable investments in alternative investment funds, non-investment grade residual interests in securitizations, collateralized loan obligations, and certain over-the-counter derivatives, if any, where the fair value is based on unobservable inputs.

ASC 820 also permits a reporting entity to measure the fair value of an asset that does not have a readily determinable fair value based on the reported NAV per share, or its equivalent, without further adjustment as a practical expedient for its fair value. Accordingly, the Fund may utilize the NAV per share as reported by certain Private Assets as of a valuation date as a practical expedient for its fair value.

Due to the inherent uncertainty of estimates, fair value determinations based on estimates may materially differ from the values that would have been used had a ready market for the securities existed.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following table is a summary of information about the levels within the fair value hierarchy at which the Fund’s investments are measured as of March 31, 2024:

| | Level 1 | | Level 2 | | Level 3 | | Total |

Investments | | | | | | | | | | | | |

Direct Investments | | $ | — | | $ | 32,356,366 | | $ | 196,324,753 | | $ | 228,681,119 |

Investment Funds | | | — | | | — | | | 80,112,556 | | | 80,112,556 |

Short-Term Investments | | | 13,820,275 | | | — | | | — | | | 13,820,275 |

NAV as a practical expedient | | | — | | | — | | | — | | | 368,229,244 |

Total Investments | | $ | 13,820,275 | | $ | 32,356,366 | | $ | 276,437,309 | | $ | 690,843,194 |

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value:

| | Direct

Investments | | Investment

Funds |

Balance as of March 31, 2023 | $ | 195,398,678 | $ | 61,887,475 |

Transfers into Level 3 | | — | | 38,093,335 |

Transfers out of Level 3 | | (65,445,348) | | — |

Total gains or losses for the period | | | | |

Included in earnings (or changes in net assets) | | 29,064,524 | | (14,037,127) |

Purchases | | 37,306,899 | | 18,095,617 |

Return of capital distributions | | — | | (23,926,744) |

Balance as of March 31, 2024 | $ | 196,324,753 | $ | 80,112,556 |

Change in unrealized gains or losses for the period included in earnings (or changes in net assets) for Level 3 assets held at the end of the reporting period | $ | 29,063,208 | $ | (15,887,644) |

22

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements (Continued) March 31, 2024 |

Note 3 – Fair Value Measurements (continued) |

Changes in inputs or methodologies used for valuing investments, including timing of reported net asset values of Direct Investments reported by their sponsor, and of Investment Funds reported by the Investment Fund Managers, may result in transfers in or out of levels within the fair value hierarchy. Such changes made by the Adviser during the year ending March 31, 2024 include certain Direct Investments now utilizing an income approach towards valuation to more accurately reflect the long-term value of the underlying portfolio company, and relying on a reported NAVs as a practical expedient for fair value for certain Private Assets which were not available in the prior year. The inputs or methodologies used for valuing investments may not necessarily be an indication of the risk associated with investing in those investments. All transfers into Level 3 during the year ended March 31, 2024 were the result of NAV as a practical expedient not being utilized for certain Investment Funds. All transfers out of Level 3 during the year ended March 31, 2024 were the result of portfolio companies of certain Direct Investments becoming publicly traded during the period and an unadjusted price in an active market was readily available or a reported NAV as of March 31, 2024 being available to utilize the practical expedient.

The following table presents additional quantitative information about valuation methodologies and inputs used for investments that are measured at fair value and categorized within Level 3 as of March 31, 2024:

Investments | Asset Class | Fair

Value at

3/31/2024 | Valuation

Technique(s) | Unobservable

Input(1) | Range of

Input | Weighted

Average

of Input(2) | Impact to

Valuation

from an

Increase

in Input |

Direct Investments | Direct Equity | $ | 152,414,285 | Market Approach | EBITDA Multiple | 9.0x – 47.3x | 17.6x | Increase |

Direct Investments | Direct Equity | $ | 37,830,279 | Adjusted reported

net asset value | Reported

net asset

value/Fair value adjustments | N/A | N/A | N/A |

Direct Investments | Direct Equity | $ | 4,611,970 | Income Approach | Weighted average cost of capital | 17.0% | 17.0% | Decrease |

| | | | | | Exit multiple | 12.0x | 12.0x | Increase |

Direct Investments | Direct Credit | $ | 1,468,219 | Income Approach | Market yield | 4.0% – 14.0% | 13.2% | Increase |

Investment Funds | Buyouts, Growth Capital, and Special Situations | $ | 80,112,556 | Adjusted reported net asset value | Reported net asset value/Fair value adjustments | N/A | N/A | N/A |

Level 3 Direct Investments valued using an unobservable input are directly affected by a change in that input. Significant increases or decreases in these inputs in isolation would result in significantly higher or lower fair value measurements.

23

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements (Continued) March 31, 2024 |

Note 3 – Fair Value Measurements (continued) |

The Fund’s investments in Direct Investments and Investment Funds, along with their corresponding unfunded commitments and other attributes as of March 31, 2024, are briefly summarized in the table below:

Investment Category | Strategy | Fair Value | Unfunded

Commitments | Redemption

Frequency* | Notice

Period

(In Days) | Redemption

Restriction

Terms** |

Direct Investments | Investments in an operating company alongside other investors | $ 317,906,396 | $ 1,118,510 | None | N/A | Liquidity in the form of distributions |

Primary Investments | Investments in newly launched Investment Funds | 223,614,587 | 55,544,715 | None | N/A | Liquidity in the form of distributions |

Secondary Investments | Investments in mature Investment Funds. | 135,501,936 | 22,095,065 | None | N/A | Liquidity in the form of distributions |

Note 4 – Investment Management Services and Other Agreements

a. Investment Management Fee

The Fund pays the Adviser an investment management fee (the “Investment Management Fee”) in consideration of the advisory and other services provided by the Adviser to the Fund. Pursuant to the Investment Management Agreement, the Fund pays the Adviser a monthly Investment Management Fee equal to 0.125% (1.50% on an annualized basis) of the greater of (i) the Fund’s NAV as of the beginning of the month and (ii) the Fund’s NAV as of the beginning of the month less cash and cash equivalents plus the total of all commitments made by the Fund that have not yet been drawn for investment as of the beginning of the month.

The Investment Management Fee is paid to the Adviser out of the Fund’s assets and therefore decreases the net profits or increases the net losses of the Fund and is due and payable in arrears within fifteen business days after the end of each month.

For the year ended March 31, 2024, the Investment Management Fee totaled $10,333,704. Since January 1, 2023, the Adviser has agreed to voluntarily waive 50.00% of the Investment Management Fee. Under the terms of that waiver, the Adviser voluntarily waived $5,166,852 of the Investment Management Fee during the year ended March 31, 2024.

b. Incentive Fee

At the end of each calendar quarter (and at certain other times), the Adviser will be entitled to receive an amount (the “Incentive Fee”) equal to 10% of the excess, if any, of (i) the net profits of the Fund for the relevant period over (ii) the then balance, if any, of the Loss Recovery Account (as defined below). For the purposes of the Incentive Fee, the term “net profits” shall mean the amount by which the NAV of the Fund on the last day of the relevant period exceeds the

24

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements (Continued) March 31, 2024 |

Note 4 – Investment Management Services and Other Agreements (continued) |

NAV of the Fund as of the commencement of the same period, including any net change in unrealized appreciation or depreciation of investments and realized income and gains or losses and expenses (including offering and organizational expenses).

The Fund will maintain a memorandum account (the “Loss Recovery Account”), which will have an initial balance of zero and will be (i) increased upon the close of each calendar quarter of the Fund by the amount of the net losses of the Fund for the quarter, and (ii) decreased (but not below zero) upon the close of each calendar quarter by the amount of the net profits of the Fund for the quarter. Shareholders will benefit from the Loss Recovery Account in proportion to their holdings of Shares.

For the year ended March 31, 2024, the Fund incurred $6,031,898 in Incentive Fees. Currently, the Adviser has agreed to voluntarily waive 100% of the Incentive Fee. Under the terms of this waiver, the Adviser voluntarily waived $6,031,898 of the Incentive Fee during the year ended March 31, 2024.

c. Expense Limitation Agreement

The Adviser has entered into an Expense Limitation Agreement with the Fund whereby, for at least one-year from Commencement of Operations, the Adviser has agreed to waive fees that it would otherwise be paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure its total annual expenses (excluding taxes, interest, brokerage commissions, certain transaction related expenses arising out of investments made by the Fund, the Incentive Fee, and any acquired fund fees and expenses as determined in accordance with SEC Form N-2, expenses incurred in connection with any merger or reorganization, and extraordinary expenses, such as litigation expenses) do not exceed 2.95%, 2.25% and 2.50% of the average daily net assets of Class A Shares, Class I Shares and Class D Shares, respectively (the “Expense Limit”). Because taxes, leverage interest, brokerage commissions, certain transaction related expenses arising out of investments made by the Fund, the Incentive Fee, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, and extraordinary expenses are excluded from the Expense Limit, total annual expenses of the Fund (after fee waivers and expense reimbursements) are expected to exceed 2.95%, 2.25% and 2.50% for the Class A Shares, Class I Shares and Class D Shares, respectively. The Expense Limitation Agreement automatically renews for consecutive one-year terms unless terminated by the Fund or Adviser. For the year ended March 31, 2024, the total amount of expenses that were reimbursed by the Adviser under the terms of the Expense Limitation Agreement was $0.

For a period not to exceed three years from the date on which a Waiver is made, the Adviser may recoup amounts waived or assumed, provided it is able to effect such recoupment and remain in compliance with the Expense Limit. Any recoupment would be limited to the lesser of (1) the expense limitation in effect at the time of waiver, or (2) the expense limitation in effect at the time of recoupment. For the year ended March 31, 2024, the total amount of waived fees that are subject to recoupment are $0.

d. Distribution Agreement

Foreside Financial Services, LLC serves as the Fund’s distributor (the “Distributor”) pursuant to a distribution agreement. The Distributor distributes the Shares of the Fund on a best-effort basis.

The Fund has adopted a Distribution and Service Plan in compliance with Rule 12b-1 of the Investment Company Act for Class A Shares and Class D Shares (the “Distribution Plan”) which allows the Fund to pay distribution fees for the sale and distribution of its Class A Shares and Class D Shares.

Under the Distribution Plan, the Fund may pay as compensation up to 0.70% on an annualized basis of the Fund’s net asset value attributable to Class A Shares and up to 0.25% on an annualized basis of the Fund’s net asset value attributable to Class D Shares (each, a “Distribution Fee”) to the Fund’s Distributor or other qualified recipients. Payment of the Distribution Fee will be governed by the Distribution Plan for Class A Shares and Class D Shares. The Distribution Fee will be paid out of the Fund’s assets and decreases the net profits or increases the net losses of the Fund solely with respect to Class A Shares and Class D Shares. Class I Shares are not subject to a distribution fee.

25

Constitution Capital Access Fund, LLC |

Notes to Consolidated Financial Statements (Continued) March 31, 2024 |

Note 4 – Investment Management Services and Other Agreements (continued) |

For the year ended March 31, 2024, distribution fees totaled $80 and are shown on the Consolidated Statement of Operations.

e. Board Fees