UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:

811-23812

Elevation Series Trust

(Exact Name of Registrant as Specified in Charter)

1700 Broadway, Suite 1850

Denver, CO 80290

(Address of Principal Executive Offices) (Zip Code)

Chris Moore

Elevation Series Trust

1700 Broadway, Suite 1850

Denver, CO 80290

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code:

303-226-4150

With a copy to:

JoAnn M. Strasser

Thompson Hine LLP

17th Floor

41 South High Street

Columbus, Ohio 43215

Date of Fiscal Year End: July 31st

Date of Reporting Period: September 29, 2023 – July 31, 2024

| Item 1. | Reports to Shareholders. |

| (a) | The Report to Shareholders is attached herewith. |

This annual shareholder report contains important information about the Sovereign's Capital Flourish Fund - for the period of September 29, 2023 (commencement of operations) to July 31, 2024. Please contact us at +1 (800) 465-1403 or info@sovereignscapital.com or visit our website at https://www.scetfs.com/sovf for additional information.

ANNUAL SHAREHOLDER REPORT

July 31, 2024

WHAT WERE THE FUND'S COSTS FOR THE PAST YEAR?

(based on a hypothetical $10,000 investment)

| FUND NAME | COSTS OF A $10,000 INVESTMENTFootnote Reference1 | COSTS PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Sovereign's Capital Flourish Fund | $70 | 0.75% |

| Footnote | Description |

Footnote1 | The costs paid by the Fund reflect the period of September 29, 2023 (commencement of operations) to July 31, 2024. Such costs would be higher for a full year. |

HOW DID THE FUND PERFORM THE PAST YEAR?

In the ten months since its 9/29/2023 launch through 07/31/2024, the Flourish Fund’s (SOVF) total return was 23.94%, exceeding the S&P 1500 Equal Weight Index by 55 basis points. From a sector attribution standpoint, stock selection within the Consumer Staples, Healthcare and Information Technology sectors was the largest tailwind to relative performance during the period. This was partially offset by underperformance in the Industrials, Financials and Consumer Discretionary sectors.

While we are generally encouraged with the relative performance for the Fund, we recognize that the performance period and the time since Fund inception is still too short to draw any conclusions about the Fund’s strategy. Longer term, we believe the Fund’s process of identifying, evaluating and investing in companies with strong cultures led by faith-driven CEOs, as determined by our proprietary process, collectively provides a foundation for outperformance versus the broader market.

Finally, after over a decade of significant outperformance from large-caps in the domestic stock market, that part of the market has led to a swelling in price-to-earnings valuation for the cap-weighted indices, including the S&P 500 Index and Russell 3000 Index. We believe the Sovereign's Flourish Fund, which is benchmarked against the S&P 1500 Equal Weight Index, offers investors exposure to small- and mid-cap equities that possess attractive valuations while also offering stronger growth prospects versus large caps.

On May 29th in Chicago, we hosted 6 public company CEOs from the ETF portfolio in-person for six hours to talk about culture. We spent the majority of our time hearing about the best cultural practices from each CEO. In total, the CEOs in attendance accounted for 250,000 team members between their six companies. Thus far, as a direct outcome of the meeting, two public company CEOs are planning to adopt chaplaincy for their 222,000 employees, providing spiritual and mental health counseling (at work). When crisis inevitably arrives among their team members, we believe chaplains will provide invaluable counseling. Employees will be cared for, and we believe this will contribute to the long-term success of the companies for all stakeholders. This is what impact looks like in public equities. This is what is possible.

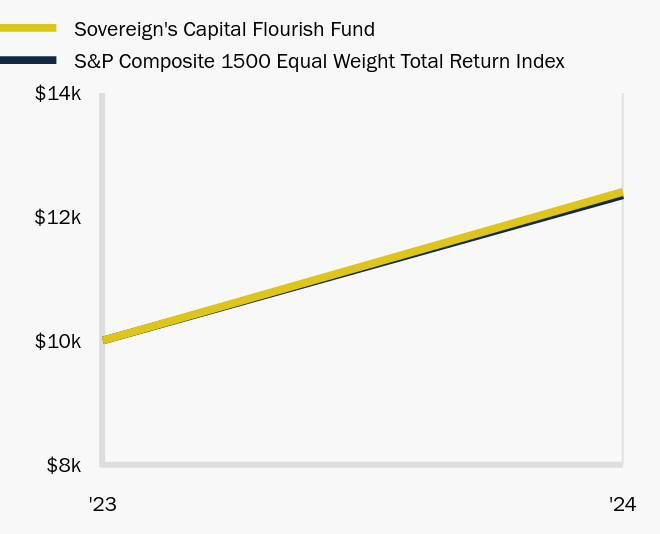

HOW DID THE FUND PERFORM SINCE INCEPTION?

This chart shows the value of a $10,000 investment in the share class noted since inception. The result is compared with the Fund's benchmark.

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| Sovereign's Capital Flourish Fund | S&P Composite 1500 Equal Weight Total Return Index |

|---|

| '23 | 10,000 | 10,000 |

| '24 | 12,394 | 12,339 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table presented below and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| Total Net Assets | $58,497,226 |

| # of Portfolio Holdings | 81 |

| Portfolio Turnover Rate | 41% |

| Total Advisory Fees Paid | $204,531 |

AVERAGE ANNUAL TOTAL RETURNS

| . | Since Inception (September 29, 2023) |

|---|

| Sovereign's Capital Flourish Fund | 23.94% |

| S&P Composite 1500 Equal Weight Total Return Index | 23.39% |

Past performance does not guarantee future results. Call +1 (800) 465-1403 or visit https://www.scetfs.com/sovf for current month-end performance.

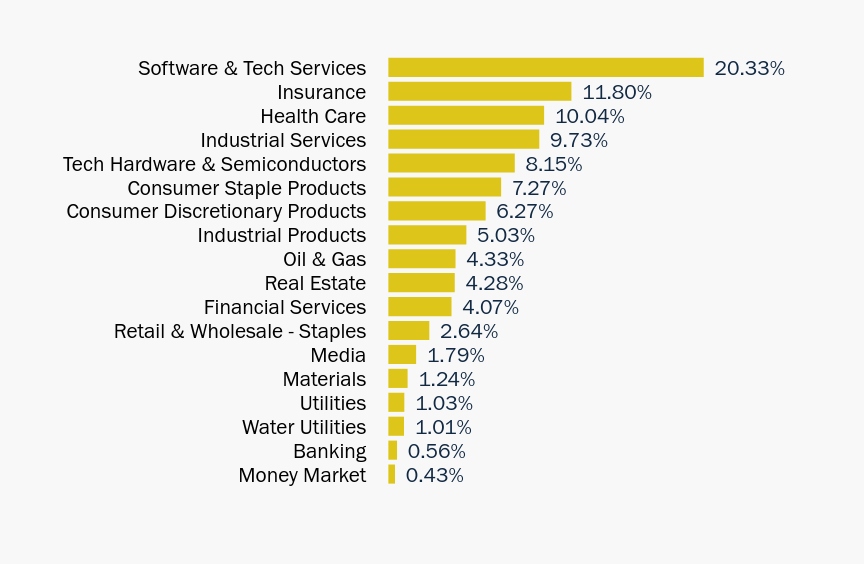

WHAT DID THE FUND INVEST IN?

INDUSTRY

(Expressed as % of Total Investments)

| Value | Value |

|---|

| Money Market | 0.43% |

| Banking | 0.56% |

| Water Utilities | 1.01% |

| Utilities | 1.03% |

| Materials | 1.24% |

| Media | 1.79% |

| Retail & Wholesale - Staples | 2.64% |

| Financial Services | 4.07% |

| Real Estate | 4.28% |

| Oil & Gas | 4.33% |

| Industrial Products | 5.03% |

| Consumer Discretionary Products | 6.27% |

| Consumer Staple Products | 7.27% |

| Tech Hardware & Semiconductors | 8.15% |

| Industrial Services | 9.73% |

| Health Care | 10.04% |

| Insurance | 11.80% |

| Software & Tech Services | 20.33% |

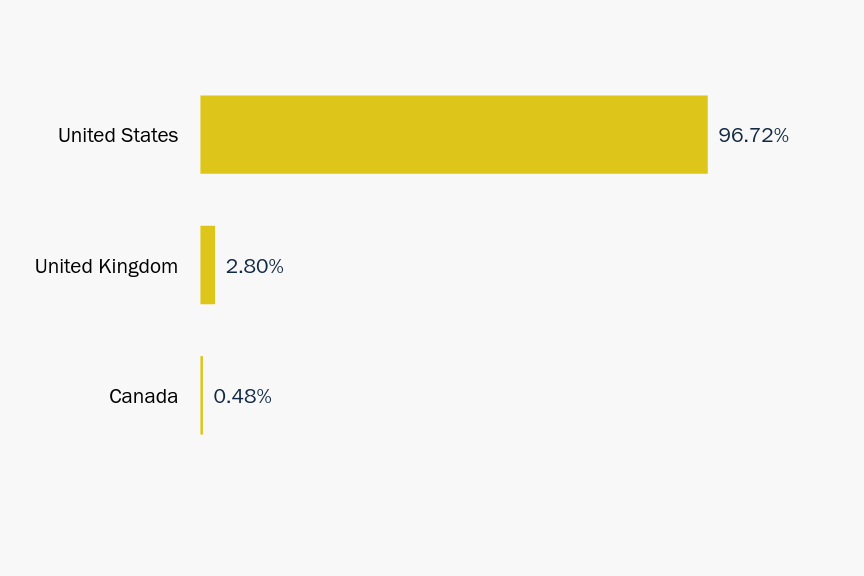

COUNTRY

(Expressed as % of Total Investments)

| Value | Value |

|---|

| Canada | 0.48% |

| United Kingdom | 2.80% |

| United States | 96.72% |

Sovereign's Capital Flourish Fund

ANNUAL SHAREHOLDER REPORT

July 31, 2024

+1 (800) 465-1403

info@sovereignscapital.com

If you wish to view additional information about the Fund; including but not limited to fund prospectus, financial statements, or holdings, please visit https://www.scetfs.com/sovf.

| (a) | As of the end of the period covered by this report, the Registrant has adopted a code of ethics that applies to the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party. |

| (b) | For purposes of this item, “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote: |

(1) Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

(2) Full, fair, accurate, timely, and understandable disclosure in reports and documents that a Registrant files with, or submits to, the Commission and in other public communications made by the Registrant;

(3) Compliance with applicable governmental laws, rules, and regulations;

(4) The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

(5) Accountability for adherence to the code.

| (c) | During the period covered by this report, there were no amendments to the provisions of the code of ethics adopted in Item 2(a) of this report. |

| (d) | During the period covered by this report, the Registrant had not granted any express or implicit waivers from the provisions of the code of ethics adopted in Item 2(a) of this report. |

| (f) | The Registrant's code of ethics referred to in Item 2(a) above is attached as Exhibit 19(a)(l), hereto. |

| Item 3. | Audit Committee Financial Expert. |

As of the end of the period covered by the report, the Registrant’s Board of Trustees has determined that Kimberly Storms is qualified to serve as an audit committee financial expert serving on its audit committee and that she is “independent,” as defined in paragraph (a)(2) of Item 3 to Form N-CSR.

| Item 4. | Principal Accountant Fees and Services. |

| (a) | Audit Fees: The aggregate fees billed for professional services rendered by the principal accountant for the audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $18,500 for the fiscal period from September 29, 2023 – July 31, 2024. |

| (b) | Audit-Related Fees: The aggregate fees billed for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the Registrant’s financial statements and which are not reported under (a) of this Item were $0 for the fiscal period from September 29, 2023 – July 31, 2024. |

| (c) | Tax Fees: The aggregate fees billed for professional services rendered by the principal accountant for the review of the Registrant’s income tax returns, excise tax returns and dividend calculations were $3,500 for the fiscal period from September 29, 2023 – July 31, 2024. |

| (d) | All Other Fees: The aggregate fees billed for products and services provided by the principal accountant, other than the services reported in (a) through (c) of this Item were $0 for the fiscal period from September 29, 2023 – July 31, 2024. |

| (e)(1) | The Registrant’s audit committee pre-approves all audit and non-audit services to be performed by the Registrant’s accountant before the accountant is engaged by the Registrant to perform such services. Under the audit committee’s charter, pre-approval of permitted non-audit services by the Registrant’s accountant is not required if: (i) the aggregate amount of all permitted non-audit services is not more than 5% of the total revenues paid by the Registrant to the accountant in the fiscal year in which the non-audit services are provided; (ii) such services were not recognized by the Registrant at the time of the engagement to be non-audit services; and (iii) such services are promptly brought to the attention of the audit committee and approved by the audit committee or a designated audit committee member prior to the completion of the audit of the Registrant’s annual financial statements. |

| (e)(2) | There were no services described in (b) through (d) above (including services required to be approved by the audit committee pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X) that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (g) | The aggregate non-audit fees billed by the Registrant’s accountant for services rendered to the Registrant, and rendered to the Registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Registrant were $0 for the fiscal period from September 29, 2023 – July 31, 2024. |

| (h) | The Registrant’s Audit Committee has considered whether the provision of non-audit services by Registrant’s independent registered public accounting firm to the Registrant’s investment advisor, and any entity controlling, controlled, or under common control with the investment advisor that provided ongoing services to the Registrant that were not pre-approved by the Committee was compatible with maintaining the independence of the independent registered public accounting firm. |

| Item 5. | Audit Committee of Listed Registrants. |

The Registrant has an audit committee which was established by its Board of Trustees in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 as amended. The members of the Registrant’s audit committee are Kimberly Storms and Steven Norgaard.

| (a) | The Registrant’s full schedule of investments is included as part of the report to shareholders filed under Item 7 of this Form. |

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies |

(NYSE ARCA, Inc.: SOVF)

Annual Financial Statements

July 31, 2024

TABLE OF CONTENTS

Sovereign’s Capital Flourish Fund

SCHEDULE OF INVESTMENTS

July 31, 2024

| | | Shares | | | Value | |

| COMMON STOCKS - 99.60% | | | | | | | | |

| Banking - 0.56% | | | | | | | | |

| Triumph Financial, Inc.(a) | | | 3,624 | | | $ | 328,806 | |

| | | | | | | | | |

| Consumer Discretionary Products - 6.27% | | | | | | | | |

| Columbia Sportswear Co. | | | 9,847 | | | | 804,500 | |

| Grand Canyon Education, Inc.(a) | | | 9,584 | | | | 1,494,625 | |

| LCI Industries | | | 11,729 | | | | 1,368,657 | |

| | | | | | | | 3,667,782 | |

| | | | | | | | | |

| Consumer Staple Products - 7.27% | | | | | | | | |

| Coca-Cola Consolidated, Inc. | | | 1,319 | | | | 1,511,429 | |

| J & J Snack Foods Corp. | | | 1,576 | | | | 265,871 | |

| Pilgrim's Pride Corp.(a) | | | 18,963 | | | | 781,845 | |

| Spectrum Brands Holdings, Inc. | | | 2,966 | | | | 250,953 | |

| Tyson Foods, Inc., Class A | | | 18,970 | | | | 1,155,273 | |

| Westrock Coffee Co.(a) | | | 28,953 | | | | 286,635 | |

| | | | | | | | 4,252,006 | |

| | | | | | | | | |

| Financial Services - 4.07% | | | | | | | | |

| Charles Schwab Corp. | | | 9,073 | | | | 591,469 | |

| P10, Inc., Class A | | | 100,276 | | | | 999,752 | |

| Raymond James Financial, Inc. | | | 6,817 | | | | 790,772 | |

| | | | | | | | 2,381,993 | |

| | | | | | | | | |

| Health Care - 10.04% | | | | | | | | |

| Amedisys, Inc.(a) | | | 5,822 | | | | 570,847 | |

| Amicus Therapeutics, Inc.(a) | | | 112,650 | | | | 1,161,421 | |

| Becton, Dickinson and Co. | | | 3,441 | | | | 829,487 | |

| Molina Healthcare, Inc.(a) | | | 3,376 | | | | 1,152,128 | |

| National HealthCare Corp. | | | 6,476 | | | | 881,772 | |

| NeoGenomics, Inc.(a) | | | 40,512 | | | | 718,278 | |

| Option Care Health, Inc.(a) | | | 9,794 | | | | 290,784 | |

| ResMed, Inc. | | | 1,271 | | | | 271,041 | |

| | | | | | | | 5,875,758 | |

| | | | | | | | | |

| Industrial Products - 5.03% | | | | | | | | |

| AZZ, Inc. | | | 3,416 | | | | 273,143 | |

| CSW Industrials, Inc. | | | 997 | | | | 323,447 | |

| Douglas Dynamics, Inc. | | | 16,657 | | | | 481,554 | |

| Graco, Inc. | | | 3,289 | | | | 279,729 | |

| IDEX Corp. | | | 1,955 | | | | 407,578 | |

| ITT, Inc. | | | 4,143 | | | | 586,069 | |

| Lincoln Electric Holdings, Inc. | | | 2,868 | | | | 589,116 | |

| | | | | | | | 2,940,636 | |

| | | Shares | | | Value | |

| Industrial Services - 9.73% | | | | | | | | |

| APi Group Corp.(a) | | | 21,132 | | | $ | 800,691 | |

| Fastenal Co. | | | 4,197 | | | | 296,938 | |

| Healthcare Services Group, Inc.(a) | | | 26,406 | | | | 301,821 | |

| Insperity, Inc. | | | 11,557 | | | | 1,187,135 | |

| J.B. Hunt Transport Services, Inc. | | | 1,682 | | | | 291,238 | |

| Kforce, Inc. | | | 4,310 | | | | 299,416 | |

| Korn Ferry | | | 11,841 | | | | 872,919 | |

| SiteOne Landscape Supply, Inc.(a) | | | 4,028 | | | | 590,827 | |

| United Parcel Service, Inc., Class B | | | 5,917 | | | | 771,399 | |

| Waste Connections, Inc. | | | 1,582 | | | | 281,232 | |

| | | | | | | | 5,693,616 | |

| | | | | | | | | |

| Insurance - 11.81% | | | | | | | | |

| American Financial Group, Inc. | | | 9,645 | | | | 1,263,109 | |

| Arthur J. Gallagher & Co. | | | 4,110 | | | | 1,165,144 | |

| Erie Indemnity Co., Class A | | | 762 | | | | 336,156 | |

| Goosehead Insurance, Inc., Class A(a) | | | 18,332 | | | | 1,655,196 | |

| Primerica, Inc. | | | 5,411 | | | | 1,362,328 | |

| The Progressive Corp. | | | 5,251 | | | | 1,124,344 | |

| | | | | | | | 6,906,277 | |

| | | | | | | | | |

| Materials - 1.23% | | | | | | | | |

| Greif, Inc., Class A | | | 10,838 | | | | 722,678 | |

| Media - 1.79% | | | | | | | | |

| Advantage Solutions, Inc.(a) | | | 185,972 | | | | 745,748 | |

| VeriSign, Inc.(a) | | | 1,628 | | | | 304,452 | |

| | | | | | | | 1,050,200 | |

| | | | | | | | | |

| Oil & Gas - 4.33% | | | | | | | | |

| APA Corp. | | | 27,796 | | | | 866,957 | |

| Devon Energy Corp. | | | 17,364 | | | | 816,629 | |

| Diamondback Energy, Inc. | | | 4,189 | | | | 847,477 | |

| | | | | | | | 2,531,063 | |

| | | | | | | | | |

| Real Estate - 4.28% | | | | | | | | |

| Camden Property Trust | | | 2,472 | | | | 273,774 | |

| CBRE Group, Inc., Class A(a) | | | 11,941 | | | | 1,345,870 | |

| SBA Communications Corp., Class A | | | 4,034 | | | | 885,624 | |

| | | | | | | | 2,505,268 | |

| | | | | | | | | |

| Retail & Wholesale - Staples - 2.65% | | | | | | | | |

| Copart, Inc.(a) | | | 4,979 | | | | 260,551 | |

| O'Reilly Automotive, Inc.(a) | | | 246 | | | | 277,080 | |

| SpartanNash Co. | | | 14,986 | | | | 316,504 | |

| US Foods Holding Corp.(a) | | | 7,699 | | | | 418,748 | |

| Walmart, Inc. | | | 4,001 | | | | 274,629 | |

| | | | | | | | 1,547,512 | |

See Notes to Financial Statements

Sovereign’s Capital Flourish Fund

SCHEDULE OF INVESTMENTS

July 31, 2024 (Continued)

| | | Shares | | | Value | |

| Software & Tech Services - 20.34% | | | | | | | | |

| Alkami Technology, Inc.(a) | | | 45,585 | | | $ | 1,491,997 | |

| Automatic Data Processing, Inc. | | | 1,107 | | | | 290,720 | |

| BigCommerce Holdings, Inc.(a) | | | 152,054 | | | | 1,231,638 | |

| Endava PLC - Sponsored ADR(a) | | | 51,387 | | | | 1,637,190 | |

| Euronet Worldwide, Inc.(a) | | | 10,942 | | | | 1,115,975 | |

| Fiserv, Inc.(a) | | | 7,218 | | | | 1,180,648 | |

| HubSpot, Inc.(a) | | | 432 | | | | 214,717 | |

| Paycom Software, Inc. | | | 7,556 | | | | 1,260,265 | |

| Paylocity Holding Corp.(a) | | | 7,732 | | | | 1,160,341 | |

| Repay Holdings Corp., Class A(a) | | | 98,173 | | | | 944,424 | |

| Science Applications International Corp. | | | 2,252 | | | | 280,149 | |

| SPS Commerce, Inc.(a) | | | 1,461 | | | | 314,729 | |

| Verra Mobility Corp., Class A(a) | | | 25,687 | | | | 773,949 | |

| | | | | | | | 11,896,742 | |

| | | | | | | |

| Tech Hardware & Semiconductors - 8.16% | | | | | | |

| Arista Networks, Inc.(a) | | | 1,649 | | | | 571,461 | |

| Cisco Systems, Inc. | | | 12,061 | | | | 584,355 | |

| Diodes, Inc.(a) | | | 16,211 | | | | 1,267,700 | |

| Intel Corp. | | | 17,435 | | | | 535,952 | |

| NetApp, Inc. | | | 2,091 | | | | 265,515 | |

| Qualcomm, Inc. | | | 4,309 | | | | 779,714 | |

| Super Micro Computer, Inc.(a) | | | 1,092 | | | | 766,202 | |

| | | | | | | | 4,770,899 | |

| | | | | | | |

| Utilities - 1.03% | | | | | | |

| Black Hills Corp. | | | 10,185 | | | | 601,424 | |

| | | | | | | |

| Water Utilities - 1.01% | | | | | | |

| American Water Works Co., Inc. | | | 4,141 | | | | 589,513 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $52,537,655) | | | | | | | 58,262,173 | |

| | | | | | | | | |

| MONEY MARKET FUNDS - 0.43% | | | | | | | | |

| Invesco Government & Agency Portfolio, Institutional Class, 7-Day Yield - 5.22%(b) | | | 251,894 | | | | 251,894 | |

| | | | | | | | | |

| TOTAL MONEY MARKET FUNDS | | | | | | | | |

| (Cost $251,894) | | | | | | | 251,894 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 100.03% | | | | | | | | |

| (Cost $52,789,549) | | | | | | $ | 58,514,067 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.03%) | | | | | | | (16,841 | ) |

| | | | | | | | | |

| | | | | | | | | |

| NET ASSETS - 100.00% | | | | | | $ | 58,497,226 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is 7-Day Yield as of July 31, 2024. |

Investment Abbreviations:

ADR – American Depositary Receipt

Percentages are stated as a percent of net assets.

See Notes to Financial Statements

| Sovereign’s Capital Flourish Fund |

| | | | | |

| STATEMENT OF ASSETS AND LIABILITIES | | | | |

| July 31, 2024 | | | | |

| | | | | |

| ASSETS: | | | | |

| Investments, at value | | $ | 58,514,067 | |

| Dividends receivable | | | 12,528 | |

| Total Assets | | | 58,526,595 | |

| LIABILITIES: | | | | |

| Payable to Investment Advisor | | | 29,369 | |

| Total Liabilities | | | 29,369 | |

| NET ASSETS | | $ | 58,497,226 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid in capital | | $ | 53,336,831 | |

| Total distributable earnings | | | 5,160,395 | |

| NET ASSETS | | $ | 58,497,226 | |

| | | | | |

| INVESTMENTS, AT COST | | | $ | 52,789,549 | |

| | | | | | |

| Net asset value: | | | | | |

| Net assets | | | $ | 58,497,226 | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | | 1,891,164 | |

| Net asset value, price per share | | | $ | 30.93 | |

See Notes to Financial Statements

Sovereign’s Capital Flourish Fund

STATEMENT OF OPERATIONS

For the Period September 29, 2023 (Commencement of Operations) through July 31, 2024

| INVESTMENT INCOME: | | | | |

| Dividends* | | $ | 341,199 | |

| Total Investment Income | | | 341,199 | |

| EXPENSES: | | | | |

| Investment advisory fees (Note 3) | | | 204,531 | |

| Total Expenses | | | 204,531 | |

| NET INVESTMENT INCOME | | | 136,668 | |

| Net realized gain/(loss) on: | | | | | |

| Investments | | | | (684,459 | ) |

| Investments sold in-kind | | | | 3,137,667 | |

| Total Net Realized Gain | | | | 2,453,208 | |

| Net change in unrealized appreciation/depreciation on: | | | | | |

| Investments | | | | 5,124,123 | |

| Total Net Change in Unrealized Appreciation/Depreciation | | | | 5,124,123 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | 7,577,331 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $ | 7,713,999 | |

| *Foreign taxes withheld on dividends | | | $ | 193 | |

See Notes to Financial Statements

Sovereign’s Capital Flourish Fund

STATEMENT OF CHANGES IN NET ASSETS

| | | For the Period | |

| | | September 29, 2023 | |

| | | (Commencement of | |

| | | Operations) through | |

| | | July 31, 2024 | |

| OPERATIONS | | | |

| Net investment income | | $ | 136,668 | |

| Net realized gain | | | 2,453,208 | |

| Net change in unrealized appreciation/depreciation | | | 5,124,123 | |

| Net increase in net assets resulting from operations | | | 7,713,999 | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | |

| From distributable earnings | | | (51,290 | ) |

| Net decrease in net assets from distributions | | | (51,290 | ) |

| BENEFICIAL INTEREST TRANSACTIONS (NOTE 5) | | | | |

| Shares sold | | | 64,616,216 | |

| Shares redeemed | | | (13,781,699 | ) |

| Net increase in net assets derived from share transactions | | | 50,834,517 | |

| Net increase in net assets | | | 58,497,226 | |

| NET ASSETS | | | | |

| Beginning of period | | | — | |

| End of period | | $ | 58,497,226 | |

See Notes to Financial Statements

| Sovereign’s Capital Flourish Fund |

| |

| FINANCIAL HIGHLIGHTS |

| | | For the Period | |

| | | Ended | |

| | | July 31, 2024 (a) | |

| Net Asset Value, Beginning of Period | | $ | 25.00 | |

| | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | |

| Net investment income(b) | | | 0.12 | |

| Net realized and unrealized gain on investments | | | 5.86 | |

| Total from Investment Operations | | | 5.98 | |

| | | | | |

| DISTRIBUTIONS: | | | | |

| From distributable earnings | | | (0.05 | ) |

| Total Distributions | | | (0.05 | ) |

| | | | | |

| Net Increase in net asset value | | | 5.93 | |

| Net Asset Value - End of Period | | $ | 30.93 | |

| TOTAL RETURN(c) | | | 23.94 | % |

| | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | |

| Net Assets, end of period (000s) | | $ | 58,497 | |

| Ratio of net operating expenses to average net assets | | | 0.75 | %(d) |

| Ratio of net investment income to average net assets | | | 0.49 | %(d) |

| Portfolio turnover rate(e)(f) | | | 41 | % |

| (a) | The net asset value at the beginning of the period represents the initial shares outstanding on September 29, 2023 (Commencement of Operations). |

| (b) | Calculated based on the average number of Fund shares outstanding during each fiscal period. |

| (c) | Total return is calculated assuming an initial investment made at the net asset value at the beginning of the period and redemption at the net asset value on the last day of the period and assuming all distributions are reinvested. Total return calculated for a period of less than one year is not annualized. |

| (e) | Excludes the impact of in-kind transactions. |

| (f) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

Sovereign’s Capital Flourish Fund

NOTES TO FINANCIAL STATEMENTS

July 31, 2024

NOTE 1 - ORGANIZATION

Elevation Series Trust (the “Trust”) was organized on March 7, 2022, as a Delaware statutory trust, and is authorized to issue multiple investment series. The Trust is registered with the Securities and Exchange Commission under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. These financial statements relate to one series of the Trust, Sovereign’s Capital Flourish Fund (the “Fund”). The Fund’s investment objective is to provide long-term capital appreciation. The Fund invests primarily in common stock of publicly traded U.S. companies that are selected by Sovereign’s Capital Management, LLC (the “Adviser”). The Adviser selects companies that are led by faith-driven CEOs that seek to build exceptional corporate cultures based on biblical values that allow employees to flourish. A company is considered a “U.S. company” if (i) the security is listed on a U.S. national securities exchange, (ii) the issuer is headquartered in the U.S., or (iii) the issuer derives a substantial portion of their revenues from, or has a substantial portion of its operations in, the U.S. The Fund commenced operations on September 29, 2023.

The Fund currently offers an unlimited number of shares of a single class, without par value, which are listed and traded on the NYSE Arca, Inc (the “Exchange”). The Fund issues and redeems shares only in creation units (“Creation Units”) which are offered on a continuous basis through Paralel Distributors LLC (the “Distributor”), without a sales load (but subject to transaction fees, if applicable), at the net asset value (“NAV”) per share next determined after receipt of an order in proper form pursuant to the terms of the Authorized Participant Agreement, calculated as of the scheduled close of regular trading on the Exchange on any day on which the Exchange is open for business. The Fund does not issue fractional Creation Units. The offering of the Fund’s shares is registered under the Securities Act of 1933, as amended.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). This requires management to make estimates and assumptions that affect the reported amounts in the financial statements. Actual results could differ from those estimates. The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standards Update 2013-08.

Portfolio Valuation: The NAV of the Fund is determined no less frequently than daily, on each day that the New York Stock Exchange (“NYSE”) is open for trading, as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern time). The NAV is determined by dividing the value of the Fund’s total assets less its liabilities by the number of shares outstanding.

Domestic equity securities traded on any exchange other than the NASDAQ Stock Market LLC (“NASDAQ”) are valued at the last sale price on the business day. If there has been no sale that business day, the securities are valued at the mean of the most recent bid and ask prices on the business day. Securities traded on NASDAQ are valued at the NASDAQ Official Closing Price as determined by NASDAQ. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day. Portfolio securities traded in the over-the-counter market, but excluding NASDAQ, are valued at the last quoted sale price in such market. Debt obligations with maturities of 60 days or less are valued at amortized cost.

Securities for which market quotations are not readily available, including circumstances under which the Adviser determines that prices received are unreliable, are valued at fair value according to procedures established and adopted by the Fund’s Board of Trustees (the “Board”). Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Adviser as the Fund’s valuation designee with respect to the fair valuation of the Fund's portfolio securities, subject to oversight by and periodic reporting to the Board.

The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

Level 1 – Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date;

Level 2 – Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and

Level 3 – Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date.

The following is a summary of the Fund’s investments in the fair value hierarchy as of July 31, 2024:

| Investments in Securities at Value(a) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 58,262,173 | | | $ | — | | | $ | — | | | $ | 58,262,173 | |

| Money Market Funds | | | 251,894 | | | | — | | | | — | | | | 251,894 | |

| Total | | $ | 58,514,067 | | | $ | — | | | $ | — | | | $ | 58,514,067 | |

| (a) | For detailed descriptions and other security classifications, see the accompanying Schedule of Investments. |

Sovereign’s Capital Flourish Fund

NOTES TO FINANCIAL STATEMENTS

July 31, 2024 (Continued)

In-Kind Seeding: The capital required to purchase the initial shares of the Fund was provided by in-kind seeding. The Fund was seeded through the exchange of ETF shares for securities held by a revocable trust and a limited liability company (the "Transferors") on September 29, 2023. The transactions were structured as tax-free exchanges of shares. The Fund carried forward the historical cost basis of investments and cumulative unrealized gains and losses as reported by the Transferors prior to the in-kind seeding to align ongoing financial reporting. Investment companies carry substantially all their assets at fair value for periodic and ongoing reporting. The primary use of historical cost basis is to determine both realized and unrealized gains and losses.

| The transaction resulted in the following: | | | |

| | | | |

| Initial Fair Value of Securities Acquired by Fund | | $ | 5,279,120 | |

| Cost Basis | | | 4,678,725 | |

| Net Unrealized Gain | | $ | 600,395 | |

The above securities were contributed in exchange for 211,164 shares at a NAV of $25.00.

Securities Transactions and Investment Income: Securities transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded as of the ex-dividend date or for certain foreign securities when the information becomes available to the Fund. Certain dividend income from foreign securities will be recorded, in the exercise of reasonable diligence, as soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date and may be subject to withholding taxes in these jurisdictions. Withholding taxes on foreign dividends have been provided for in accordance with the Fund's understanding of the applicable country's tax rules and rates. Non-cash dividends included in dividend income, if any, are recorded at the fair value of the securities received. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis using the effective yield method.

Cash and Cash Equivalents: Cash and cash equivalents may include demand deposits and highly liquid investments, typically with original maturities of three months or less. Cash and cash equivalents are carried at cost, which approximates fair value.

Distributions to Shareholders: Dividends from net investment income of the Fund, if any, are declared and paid annually or as the Board may determine from time to time. Distributions of net realized capital gains earned by the Fund, if any, are declared and distributed at least annually.

Federal Income Tax: For federal income tax purposes, the Fund currently intends to qualify, as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, by distributing substantially all of its earnings to its shareholders. Accordingly, no provision for federal income or excise taxes has been made.

Income and capital gain distributions are determined and characterized in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund as a whole.

As of and during the period ended July 31, 2024, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expenses, in the Statement of Operations. As of July 31, 2024, there were no interest or penalties incurred by the Fund. The Fund files U.S. federal, state, and local tax returns as required. The Fund's tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. There are no uncertain tax positions that require a provision for income taxes.

NOTE 3 - ADVISORY FEES AND OTHER AFFILIATED TRANSACTIONS

The Adviser serves as the investment adviser to the Fund. Pursuant to the Investment Advisory Agreement, the Fund pays the Adviser a unitary management fee, which is calculated daily and paid monthly, at an annual rate of 0.75% of the Fund’s average daily net assets. Out of the unitary management fee, the Adviser has agreed to pay substantially all of the expenses of the Fund, including the cost of transfer agency, custody, fund administration, securities lending and other non-distribution related services necessary for the Fund to operate, except for: the fee paid to the Adviser pursuant to the Investment Advisory Agreement, interest charges on any borrowings, dividends and other expense on securities sold short, taxes and related services, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, and extraordinary expenses.

Vident Advisory, LLC (“VA” or the “Sub-Adviser”), which shares a parent company with the Adviser, serves as the sub-adviser to the Fund. Pursuant to a Sub- Advisory Agreement between the Trust, the Adviser, and the Sub-Adviser, the Sub-Adviser is responsible for trading portfolio securities on behalf of the Fund. For the services it provides to the Fund, the Sub-Adviser is compensated by the Adviser out of its unitary management fee.

Paralel Technologies LLC (the “Administrator”), the parent company of the Distributor, serves as the Fund’s administrator and fund accountant pursuant to an Administration and Fund Accounting Agreement. The Administrator provides the Fund with certain administrative, tax and accounting services. Fees for these services are paid by the Adviser out of its unitary management fee.

The Distributor, a wholly owned subsidiary of the Administrator, acts as the principal underwriter for the Fund and distributes shares pursuant to a Distribution Agreement. Shares are continuously offered for sale by the Distributor only in Creation Units as described in Note 1. The Distributor is a broker-dealer registered under the Securities Exchange Act of 1934, as amended, and is a member of the Financial Industry Regulatory Authority.

State Street Bank and Trust Company (“State Street”) serves as the custodian of the Fund’s assets pursuant to a Custody Agreement and as the transfer agent pursuant to a Transfer Agent Agreement. Fees for these services are paid by the Adviser out of its unitary management fee.

Sovereign’s Capital Flourish Fund

NOTES TO FINANCIAL STATEMENTS

July 31, 2024 (Continued)

The officers and the Interested Trustee of the Trust are officers or employees of the Administrator and/or Distributor. No persons (other than the Independent Trustees) receive compensation for acting as a trustee or officer. For their services, Independent Trustees receive a quarterly retainer, meeting fees, as well as reimbursement for reasonable travel, lodging and other expenses in connection with attendance at meetings. Trustee fees and expenses are paid by the Adviser out of its unitary management fee.

NOTE 4 - PURCHASES AND SALES OF SECURITIES

For the period September 29, 2023 (commencement of operations) through July 31, 2024, the cost of purchases and proceeds from sales of investment securities, excluding short-term investments and in-kind transactions, were as follows:

| Fund | | Purchases | | | Sales | |

| Sovereign’s Capital Flourish Fund | | $ | 21,775,038 | | | $ | 13,411,875 | |

For the period September 29, 2023 (commencement of operations) through July 31, 2024, in-kind transactions associated with creations and redemptions were as follows:

| Fund | | In-Kind Purchases | | | In-Kind Sales | |

| Sovereign’s Capital Flourish Fund | | $ | 55,439,375 | | | $ | 13,711,330 | |

NOTE 5 - BENEFICIAL INTEREST TRANSACTIONS

Shares are purchased from or redeemed by the Fund only in Creation Unit size aggregations generally of 10,000 Shares with Authorized Participants. Authorized Participants must be either broker-dealers or other participants in the clearing process through the Continuous Net Settlement System of the NSCC, clearing agencies registered with the SEC, or DTC Participants and must execute a Participant Agreement with the Distributor and accepted by State Street. Transactions of Creation Units generally consist of an in-kind designated portfolio of securities (“Deposit Securities”), with a cash component equal to the difference between the Deposit Securities and the NAV per unit of the Fund on the transaction date. The Fund may require cash to replace Deposit Securities if such securities are not available in sufficient quantities for delivery, are not eligible to be transferred or traded, are restricted under securities laws, or as a result of other situations.

Beneficial Interest transactions were as follows:

| | | For the Period | |

| | | September 29, 2023 | |

| | | (Commencement of | |

| | | Operations) through | |

| | | July 31, 2024 | |

| Shares sold | | | 2,381,164 | |

| Shares redeemed | | | (490,000 | ) |

| Net increase in shares outstanding | | | 1,891,164 | |

NOTE 6 - TAX BASIS DISTRIBUTIONS AND TAX BASIS INFORMATION

As determined on July 31, 2024, permanent differences resulting primarily from in-kind redemptions were reclassified at fiscal year-end. These reclassifications had no effect on net increase in net assets resulting from operations, net assets applicable to common stockholders or net asset value per common share outstanding. Permanent book and tax basis differences of $3,102,709 and $(3,102,709) were reclassified at July 31, 2024 among paid-in capital and total distributable earnings, respectively, for the Fund.

The character of distributions paid on a tax basis during the period ended July 31, 2024 were as follows:

| | | | | | Long-Term | |

| | | Ordinary | | | Capital | |

| Fund | | Income | | | Gain | |

| Sovereigns Capital Flourish Fund | | $ | 51,290 | | | $ | — | |

Sovereign’s Capital Flourish Fund

NOTES TO FINANCIAL STATEMENTS

July 31, 2024 (Continued)

The amount of net unrealized appreciation/depreciation and the cost of investment securities for tax purposes at July 31, 2024 were as follows:

| | | Gross | | | Gross | | | Net | | | | | | Cost of |

| | | Appreciation | | | Depreciation | | | Appreciation/ | | | Net Unrealized | | | Investments for |

| | | (excess of value | | | (excess of tax | | | (Depreciation) | | | Appreciation/ | | | Income Tax |

| | | over tax cost) | | | cost over value) | | | of Foreign Currency | | | (Depreciation) | | | Purposes(a) |

| Sovereigns Capital Flourish Fund | | $ | 6,758,919 | | | $ | (1,102,633 | ) | | $ | — | | | $ | 5,656,286 | | | $ | 52,857,781 |

| (a) | Represents cost for federal income tax purposes and differs from the cost for financial reporting purposes due to various book-to-tax differences. Those differences primarily relate to wash sales for the Fund. |

As of July 31, 2024, the components of distributable earnings on a tax basis were as follows:

| | | Undistributed Net | | | Accumulated Net | | | Unrealized | | | | |

| | | Investment | | | Realized | | | Appreciation/ | | | | |

| | | Income/(Loss) | | | Gain/(Loss) | | | (Depreciation) | | | Total | |

| Sovereigns Capital Flourish Fund | | $ | 85,378 | | | $ | (581,269 | ) | | $ | 5,656,286 | | | $ | 5,160,395 | |

As of July 31, 2024, the following amount is available as capital loss carry forwards to the next tax year:

| | | | | | | |

| | | No Expiration | | | No Expiration | |

| Fund | | Short-Term | | | Long-Term | |

| Sovereigns Capital Flourish Fund | | $ | (481,519 | ) | | $ | (99,750 | ) |

| | | | | | | | | |

NOTE 7 - INDEMNIFICATIONS

In the normal course of business, the Trust or Fund enters into contracts that contain a variety of representations which provide general indemnifications. Additionally, the Declaration of Trust provides that the Trust shall indemnify each person who is, or has been, a Trustee, officer, employee or agent of the Trust against certain liabilities arising out of the performance of their duties. The Fund’s maximum exposure under these arrangements is unknown, however, the Fund expects the risk of loss to be remote.

NOTE 8 - SUBSEQUENT EVENTS

Management has evaluated subsequent events through the date these financial statements were issued and has determined that there were no subsequent events to report through the issuance of these financial statements.

Sovereign’s Capital Flourish Fund

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Sovereign’s Capital Flourish Fund and Board of Trustees of Elevation Series Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Sovereign’s Capital Flourish Fund (the “Fund”), a series of Elevation Series Trust, as of July 31, 2024, the related statements of operations and changes in net assets, the financial highlights, and the related notes for the period September 29, 2023 (commencement of operations) through July 31, 2024, (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of July 31, 2024, the results of its operations, the changes in net assets, and the financial highlights for the period September 29, 2023 (commencement of operations) through July 31, 2024, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of July 31, 2024, by correspondence with the custodian. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2023.

COHEN & COMPANY, LTD.

Cleveland, Ohio

September 26, 2024

Sovereign’s Capital Flourish Fund

UNAUDITED TAX DESIGNATIONS

July 31, 2024 (Unaudited)

The Fund designated the following as a percentage of taxable ordinary income distributions, or up to the maximum amount allowable, for the calendar year ended December 31, 2023:

| Qualified Dividend Income Percentage | 89.83% |

| | |

| Dividends Received Deduction | 89.99% |

In early 2024, if applicable, shareholders of record received this information for the distributions paid to them by the Fund during the calendar year 2023 via Form 1099. The Fund will notify shareholders in early 2025 of amounts paid to them by the Fund, if any, during the calendar year 2024.

Fund distributed by Paralel Distributors LLC

Must be accompanied or preceded by a prospectus.

| Item 8. | Changes in and Disagreements with Accountants for Open-End Management Investment Companies. |

There were no changes in or disagreements with accountants on accounting and financial disclosure during the period covered by this report.

| Item 9. | Proxy Disclosures for Open-End Management Investment Companies. |

There were no matters submitted to a vote of shareholders during the period covered by this report.

| Item 10. | Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies. |

The aggregate remuneration paid by the Registrant is included in the financial statements as part of the report to shareholders filed under Item 7 of this Form.

| Item 11. | Statement Regarding Basis for Approval of Investment Advisory Contract. |

Not applicable.

| Item 12. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

Not applicable to open-end investment companies.

| Item 13. | Portfolio Managers of Closed-End Management Investment Companies. |

Not applicable to open-end investment companies.

| Item 14. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. |

Not applicable to open-end investment companies.

| Item 15. | Submission of Matters to a Vote of Security Holders. |

No material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees have been implemented after the Registrant last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K (17 CFR 229.407) (as required by Item 22(b)(15) of Schedule 14A (17 CFR 240.14a-101)), or this Item.

| Item 16. | Controls and Procedures. |

| (a) | The Registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)). |

| (b) | There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

| Item 17. | Disclosure of Securities Lending Activities for Closed-End Management Investment Companies. |

Not applicable to open-end investment companies.

| Item 18. | Recovery of Erroneously Awarded Compensation. |

| (a)(5) | There was no change in the Registrant’s independent public accountant during the period covered by the report. |

| SIGNATURES |

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. |

| | |

| ELEVATION SERIES TRUST | |

| | |

| By: | /s/ Bradley Swenson | |

| | Bradley Swenson, President (Principal Executive Officer) |

| | | |

| Date: | October 2, 2024 | |

| | |

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the date indicated. |

| | |

| By: | /s/ Bradley Swenson | |

| | Bradley Swenson, President (Principal Executive Officer) |

| | | |

| Date: | October 2, 2024 | |

| |

| By: | /s/ Nicholas Austin | |

| Nicholas Austin, Treasurer (Principal Financial Officer) |

| | | | |

| Date: | October 2, 2024 | | |

| | | | | |