No one customer contributed greater than 10% of sales in fiscal year 2023. Walmart contributed 10% and 12% of sales during fiscal years 2022 and 2021, respectively. Further consolidation in the U.S. retail industry could increase the concentration of our retail store customer base in the future.

Although we have long-established relationships with many of our customers, as is typical in the markets in which we compete, we generally do not have long-term sales agreements with our customers. As such, we are dependent on individual purchase orders. As a result, prior to acceptance these customers are able to cancel their orders, change purchase quantities from forecast volumes, delay purchases, change other terms of our business relationship or cease to purchase our products entirely. Our customers’ purchasing activity may also be impacted by general economic conditions as well as natural disasters and public health crises or other significant catastrophic events, such as the global COVID-19 pandemic or another pandemic, epidemic or infectious disease outbreak.

The loss of any one or more of our large customers or significant or numerous cancellations, reductions, delays in purchases or payments, or changes in business practices by our large customers could have an adverse effect on our business, financial condition or results of operations, including but not limited to reductions in sales volumes and profits, inability to collect receivables and increases in inventory levels.

Insolvency, credit problems or other financial difficulties that could confront our retailers or distributors could expose us to financial risk.

We sell to the large majority of retail customers on open account terms and do not require collateral or a security interest in the inventory we sell them. Consequently, our accounts receivable for our retail customers are unsecured. We also rely on third-party distributors to distribute our products to our retail and direct-to-consumer customers. Insolvency, credit problems or other financial difficulties confronting our retailers or distributors could expose us to financial risk. These actions could expose us to risks if our distributors are unable to distribute our products to our customers and/or if our retail customers are unable to pay for the products that they purchase from us in a timely matter or at all. Financial difficulties of our retailers could also cause them to reduce their sales staff, use of attractive displays, number or size of stores or the amount of floor space dedicated to our products. Any reduction in sales by, or loss of, our current retailers or customer demand, or credit risks associated with our retailers or distributors, could harm our business, results of operations and financial condition.

Competition in our industry may hinder our ability to execute our business strategy, maintain profitability or maintain relationships with existing customers.

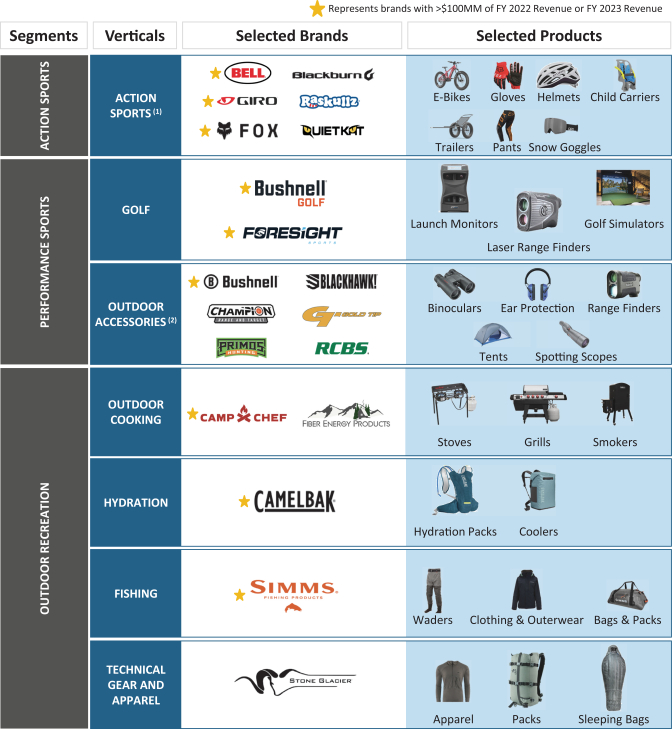

We operate in a highly competitive industry and we compete against other manufacturers that have well-established brand names and strong market positions. Given the diversity of our product portfolio, we have various significant competitors in each of our markets, including: Hydro Flask, Contigo, Yeti, Helen of Troy and Nalgene in our Hydration vertical; Callaway, Garmin, Nikon, SkyTrak and Trackman in our Golf vertical; Schwinn, Bontrager, Smith, Specialized, Canyon, Shoei and Alpine Stars in our Action Sports vertical; Traeger, Weber, Pit Boss, Blackstone, Solo Stove and Lodge in our Outdoor Cooking vertical; Nikon, Vortex, Leupold, Feradyne, American Outdoor Brands and Good Sportsman Marketing in our Outdoor Accessories vertical; Columbia, Huk, Patagonia, Orvis and American Fishing Tackle Company in our Fishing vertical; and Kuiu, Sitka, First Lite and Mystery Ranch in our Technical Gear and Apparel vertical.

Competition in the markets in which we operate is based on a number of factors, including price, quality, product innovation, performance, reliability, styling, product features and warranties, as well as sales and marketing programs. Competition could result in price reductions, reduced profits, extensions of credit or losses or loss of market share, any of which could have a material adverse effect on our business, financial condition or results of operations. Certain of our competitors may be more diversified than us or may have financial and marketing resources that are substantially greater than ours, which may allow them to invest more heavily in intellectual property, product development and advertising. Since many of our competitors also source their products from third parties, our ability to obtain a cost advantage through sourcing is limited.

Certain of our competitors may be willing to reduce prices and accept lower profit margins or extend more credit to compete with us. Further, retailers often demand that suppliers reduce their prices on mature products, which could lead to lower margins.

Our products typically face more competition internationally where foreign competitors manufacture and market products in their respective countries, which allows those competitors to sell products at lower prices, which could adversely affect our competitiveness.

In addition, our products compete with many other outdoor products for the discretionary spending of consumers. Failure to effectively compete with these competitors or alternative products could have a material adverse effect on our performance.

36