Faegre Drinker Biddle & Reath LLP

320 South Canal Street, Suite 3300

Chicago, IL 60606

www.faegredrinker.com

March 20, 2023

Via EDGAR Transmission

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Attention: Yoon Choo

Re: Nomura Alternative Income Fund (the “Fund”)

Initial Registration Statement on Form N-2

File Nos. 333-267402 and 811-23826

Dear Ms. Choo,

The following responds to the comments provided via telephone on March 16, 2023, in connection with the Securities and Exchange Commission (“SEC”) staff’s review of a registration statement (the “Registration Statement”) filed by the Fund on Form N-2 on March 10, 2023 under the Investment Company Act of 1940, as amended (the “1940 Act”) and Securities Act of 1933, as amended (the “1933 Act”). These follow-up comments and responses relate to the comment letter filed by the Registrant concurrently with the Registration Statement on March 10, 2023 (the “Comment Letter”). The changes to the Fund’s disclosure discussed below will be reflected in a filing under Rule 424(b)(3) of the Securities Act of 1933, as amended (the “Revised Registration Statement”).

For your convenience, we have repeated each comment below, and the Fund’s responses follow your comments. Capitalized terms not otherwise defined herein shall have the meaning ascribed to them in the Registration Statement, unless otherwise indicated.

PROSPECTUS

| 1. | Comment: The “Investment Objectives and Strategies” section of the Prospectus states the following: “The Fund may enter into derivatives transactions, including options, swaps, futures contracts, forward agreements and reverse repurchase agreements.” Please state for what purposes the Fund may use derivatives. Please also consider adding disclosure to discuss the hedging of currency risk. |

Response: The above-referenced disclosure will be revised as follows throughout the Revised Registration Statement (new language underlined):

“The Fund may enter into derivatives transactions, including options, swaps, futures contracts, forward agreements and reverse repurchase agreements. Derivatives may be used for hedging purposes and non-hedging (or speculative) purposes.”

With respect to the hedging of currency risk, the Fund respectfully directs the Staff to the following disclosure included in the “Investment Objectives and Strategies” sections of the Prospectus:

“The Fund may purchase securities denominated in U.S. or foreign currencies, and the Investment Manager may hedge any foreign currency exposure through the use of currency-related derivatives.”

| 2. | Comment: The fourth paragraph of the “Warehouse Investment Risk” section states the following: “The Fund may be an investor in Warehouse Investments and in CLOs or CDOs that acquire warehoused assets, including from Warehouses in which the Fund has directly or indirectly invested. This involves certain conflicts and risks.” Please disclose these conflicts and risks in this section, and if appropriate, under the “Conflicts of Interest” section of the Prospectus. |

Response: The Registrant will revise the “Warehouse Investment Risk” as follows (new language underlined):

“WAREHOUSE INVESTMENT RISK. The Fund may invest in Warehouses, which are financing structures created prior to and in anticipation of CLO or CDO closings and issuing securities and are intended to aggregate direct loans, corporate loans and/or other debt obligations that may be used to form the basis of CLO or CDO vehicles. To finance the acquisition of a Warehouse’s assets, a financing facility (a “Warehouse Facility”) is often opened by (i) the entity or affiliates of the entity that will become the collateral manager of the CLO or CDO upon its closing and/or (ii) third-party investors that may or may not invest in the CLO or CDO. The period from the date that a Warehouse is opened and asset accumulation begins to the date that the CLO or CDO closes is commonly referred to as the “warehousing period.” In practice, investments in Warehouses (“Warehouse Investments”) are structured in a variety of legal forms, including subscriptions for equity interests or subordinated debt investments in SPVs that obtain a Warehouse Facility secured by the assets acquired in anticipation of a CLO or CDO closing.

A Warehouse Investment generally bears the risk that (i) the warehoused assets (typically senior secured corporate loans) will drop in value during the warehousing period, (ii) certain of the warehoused assets default or for another reason are not permitted to be included in a CLO or CDO and a loss is incurred upon their disposition, and (iii) the anticipated CLO or CDO is delayed past the maturity date of the related Warehouse Facility or does not close at all, and, in either case, losses are incurred upon disposition of all of the warehoused assets. In the case of (iii), a particular CLO or CDO may not close for many reasons, including as a result of a market-wide material adverse change, a manager-related material adverse change or the discretion of the manager or the underwriter.

There can be no assurance that a CLO or CDO related to Warehouse Investments will be consummated. In the event a planned CLO or CDO is not consummated, investors in a Warehouse (which may include the Fund) may be responsible for either holding or disposing of the warehoused assets. Because leverage is typically used in Warehouses, the potential risk of loss may be increased for the owners of Warehouse Investments. This could expose the Fund to losses, including in some cases a complete loss of all capital invested in a Warehouse Investment.

The Fund may be an investor in Warehouse Investments and in CLOs or CDOs that acquire warehoused assets, including from Warehouses in which the Fund has

directly or indirectly invested. This involves certain conflicts and risks. Because the Fund would hold a direct interest in the warehoused assets and an interest through its investment in the CDO/CLO, there is a potential for the Fund to have exposure to the same portfolio company through two structures with interests that do not completely align. In such cases, the Investment Manager would make any investment management decisions with respect to such investments in a manner that it believes is in the Fund’s best interests overall.

The Warehouse Investments represent leveraged investments in the underlying assets of a Warehouse. Therefore, the value of a Warehouse Investment is often affected by, among other things, (i) changes in the market value of the underlying assets of the Warehouse; (ii) distributions, defaults, recoveries, capital gains, capital losses and prepayments on the underlying assets of the Warehouse; and (iii) the prices, interest rates and availability of eligible assets for reinvestment. Due to the leveraged nature of a Warehouse Investment, a significant portion (and in some circumstances all) of the Warehouse Investments made by the Fund may not be repaid.”

COMMENT LETTER

| 3. | Comment: The Staff reiterates Comment 27 of the Comment Letter. Accordingly, please provide a graphic depicting the Incentive Fee and examples demonstrating the operation of the Incentive Fee. |

Response: The following disclosure has been added to the “Investment Management Fees” section of the Prospectus in the Revised Registration Statement:

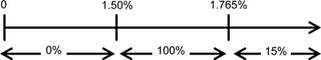

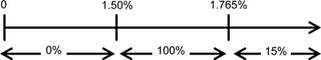

“The following is a graphical representation of the calculation of the Incentive Fee:

Quarterly Incentive Fee

Class’s Pre-Incentive Fee Net Investment Income

(expressed as a percentage of the Class’s average daily net asset value)

Percentage of each Class’s Pre-Incentive Fee Net Investment Income allocated to the Incentive Fee.”

Examples of Quarterly Incentive Fee Calculation:

Example 1 - Income Earned on Direct Investments Incentive Fee(1):

Assumptions

| · | Management fee(3) = 0.2375% |

| · | Other expenses (legal, accounting, custodian, transfer agent, etc.)(4) = 0.20% |

(1) The hypothetical amount of pre-incentive fee net investment income shown is based on a percentage of net assets.

(2) Represents the 1.5% quarterly hurdle rate.

(3) Represents a quarter of the 0.95% annualized management fee.

(4) Hypothetical other expenses. Excludes organization and offering expenses.

Alternative 1

Additional Assumptions

| · | Investment income on direct investments (including interest, dividends, fees, etc.) = 1.00% |

| · | Pre-incentive fee net investment income (investment income - (management fee + other expenses)) = 0.5625% |

Pre-incentive fee net investment income does not exceed the hurdle rate, therefore there is no income based fee.

Alternative 2

Additional Assumptions

| · | Investment income (including interest, dividends, fees, etc.) = 2% |

| · | Pre-incentive fee net investment income (investment income - (management fee + other expenses)) = 1.5625% |

Pre-incentive fee net investment income exceeds hurdle rate, therefore there is an income based fee.

Income Based Fee = 100% × “Catch-Up” + the greater of 0% AND (15% × (pre-incentive fee net investment income - 1.765%))

= (100% × (1.5625% - 1.5%)) + 0%

= 100% × 0.0625%

= 0.0625%

Alternative 3

Additional Assumptions

| · | Investment income (including interest, dividends, fees, etc.) = 4% |

| · | Pre-incentive fee net investment income (investment income - (management fee + other expenses)) = 3.5625% |

Pre-incentive fee net investment income exceeds hurdle rate, therefore there is an income based fee.

Income Based Fee = 100% × “Catch-Up” + the greater of 0% AND (15% × (pre-incentive fee net investment income - 1.765%))

= (100% × (1.765% - 1.5%)) + (15% × (3.5625% - 1.765%))

= 0.265% + (15% × 1.7975%)

= 0.265% + 0.2696%

= 0.5346%

| 4. | Comment: The Staff reiterates Comment 25 of the Comment Letter. Accordingly, per the Fund’s By-Laws, please disclose in an appropriate location in the Prospectus that each Shareholder irrevocably agrees that any claims, suits, actions or proceedings arising out of or relating in any way to the Fund will be exclusively brought in the Court of Chancery of the State of Delaware or, if such court does not have subject matter jurisdiction then, any other court in the State of Delaware with subject matter jurisdiction, and irrevocably waives any right to trial by jury, and that the forum and jury waiver provisions do not apply to claims arising under the federal securities laws. Please also disclose the corresponding risks of the forum provision even as to non-federal securities law claims (e.g., that shareholders may have to bring suit in an inconvenient and less favorable forum). |

Response: The following disclosure has been added to the section of the Prospectus entitled “Derivative Actions/Exclusive Form” in the Revised Registration Statement:

“The Fund’s By-Laws provide that each Shareholder irrevocably agrees that any claims, suits, actions or proceedings arising out of or relating in any way to the Fund will be exclusively brought in the Court of Chancery of the State of Delaware or, if such court does not have subject matter jurisdiction, then any other court in the State of Delaware with subject matter jurisdiction, and irrevocably waives any right to trial by jury. The exclusive forum provision may require shareholders to bring an action in an inconvenient or less favorable forum. The exclusive forum and jury waiver provisions do not apply to claims arising under the Federal securities laws.”

* * * *

We trust that the foregoing is responsive to your comments. Questions and further comments concerning this filing may be directed to the undersigned at 215-988-2700.

Sincerely,

/s/ Joshua B. Deringer

Joshua B. Deringer