united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-23826

Nomura Alternative Income Fund

(Exact name of registrant as specified in charter)

c/o Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Timothy Burdick, Ultimus Fund Solutions, LLC

4221 North 203rd Street, Suite 100 Elkhorn, NE 68022

(Name and address of agent for service)

Registrant's telephone number, including area code: 212-667-9000

Date of fiscal year end: 3/31

Date of reporting period: 3/31/24

Item 1. Reports to Stockholders.

|

| Nomura Alternative Income Fund |

| Class I Shares (NAIFX) |

| Annual Report |

| March 31, 2024 |

| This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which contains information about the Fund’s investment objective, risks, fees and expenses. Investors are reminded to read the prospectus carefully before investing in the Fund. |

TABLE OF CONTENTS

| Letter to Shareholders | Page 1 |

| Portfolio Review | Page 3 |

| Consolidated Schedule of Investments | Page 4 |

| Consolidated Statement of Assets and Liabilities | Page 6 |

| Consolidated Statement of Operations | Page 7 |

| Consolidated Statements of Changes in Net Assets | Page 8 |

| Consolidated Statement of Cash Flows | Page 9 |

| Consolidated Financial Highlights | Page 11 |

| Notes to Consolidated Financial Statements | Page 12 |

| Report of Independent Registered Public Accounting Firm | Page 22 |

| Supplemental Information | Page 23 |

| Privacy Notice | Page 28 |

| Proxy Voting Policy & Portfolio Holdings | Page 30 |

NOMURA ALTERNATIVE INCOME FUND

LETTER TO SHAREHOLDERS

March 31, 2024

Dear Shareholder,

Nomura Capital Management LLC (formerly, Nomura Private Capital LLC) is pleased to provide the audited annual financial statements for the Nomura Alternative Income Fund (the “Fund”) for the fiscal period beginning April 1st, 2023 through March 31st, 2024.

The market environment was volatile during this period, generated by an uncertainty in both the U.S. Federal Reserve’s monetary policy and the macroeconomic climate. Despite uncertainty, the Fund has stayed the course and gradually deployed capital into private opportunities via limited partnership commitments and direct deal participations with third party asset managers as well as a collateralized loan obligation (“CLO”). The public investments portion of the Fund’s portfolio has remained conservative by investing in short duration Treasury instruments (“T-Bills”) and agency mortgage backed securities. As the public investments portion of the Fund’s portfolio funded the growth of the private investments portion of the Fund’s portfolio, measurable portfolio duration at the Fund-level decreased as a result of the Fund’s duration hedging program. This led to a covering of the US Treasury Futures short position in Q1 2024.

Over the fiscal period, the Fund’s institutional share class (NAIFX) delivered a net total return of +5.97%. The Fund’s performance benefited from a conservative allocation during a period of volatile public markets, in part with the goal of capital preservation to fund compelling private opportunities.

Fund assets remained relatively stable during the period, with subscriptions of approximately $4.9M, no redemptions, and approximately 98% reinvestment of shares from distributed income per the Fund’s dividend reinvestment program as outlined in the prospectus. In December 2023, the Fund paid out its first distribution of 4.9% of fund assets on payment date. Beginning in Q1 2024, the quarterly distribution policy was implemented along with a daily accrual for investors. This resulted in a distribution of 1.2% (4.9% annualized) in Q1 2024. This practice has not impacted the Fund’s investment strategy, as dividends were funded via excess cash or T-Bills.

The Fund remained invested in high quality, short duration assets in addition to the private markets through limited partnership positions in external managers, as well as direct participation opportunities. As of the end of the period, the Fund had committed $106.6M (c. 96%) to seven external managers and seven separate opportunities. Of this committed amount, $78.3M has been invested. This represents 73.4% of capital allocated to private markets. These partnerships add exposure across a range of sectors within the private credit markets, including real estate, asset based lending, specialty finance, and corporate lending (e.g. direct lending). A complete listing of the Fund’s investments can be found in the Schedule of Investments.

On behalf of the entire Nomura Capital Management team, we thank you for your interest and investment in the Fund. We believe that market dislocations may continue and provide opportunities, and we are excited and honored to be making investments as your guide in private credit markets.

Sincerely,

Matthew Pallai

Chief Investment Officer

Nomura Capital Management LLC

1

NOMURA ALTERNATIVE INCOME FUND

LETTER TO SHAREHOLDERS (Continued)

March 31, 2024

Past performance does not guarantee future results.

The Nomura Alternative Income Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity.

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

The Fund’s investment program is speculative and entails substantial risks. There can be no assurance that the Fund’s investment objectives will be achieved or that its investment program will be successful. Investors should consider the Fund as a supplement to an overall investment program and should invest only if they are willing to undertake the risks involved. Investors could lose some or all of their investment.

| ● | The Fund’s shares (the “Shares”) are not listed on any stock exchange, and we do not expect a secondary market in the Shares to develop. |

| ● | You should generally not expect to be able to sell your Shares (other than through the limited repurchase process), regardless of how we perform. |

| ● | Although we are required to and have implemented a Share repurchase program, only a limited number of Shares will be eligible for repurchase by us. |

| ● | You should consider that you may not have access to the money you invest for an indefinite period of time. |

| ● | An investment in the Shares is not suitable for you if you have foreseeable need to access the money you invest. |

| ● | Because you will be unable to sell your Shares or have them repurchased immediately, you will find it difficult to reduce your exposure on a timely basis during a market downturn. |

| ● | The Fund has no operating history and the Shares have no history of public trading. |

An investment in the Fund involves risk. The Fund may leverage its investments by borrowing. The use of leverage increases both risk of loss and profit potential. Alternative investments provide limited liquidity and include, among other things, the risks inherent in investing in securities, futures, commodities and derivatives, using leverage and engaging in short sales. The Fund’s investment performance depends, at least in part, on how its assets are allocated and reallocated among asset classes and strategies. Such allocation could result in the Fund holding asset classes or investments that perform poorly or underperform.

The Nomura Alternative Income Fund is distributed by Foreside Financial Services, LLC.

2

Nomura Alternative Income Fund

PORTFOLIO REVIEW (Unaudited)

March 31, 2024

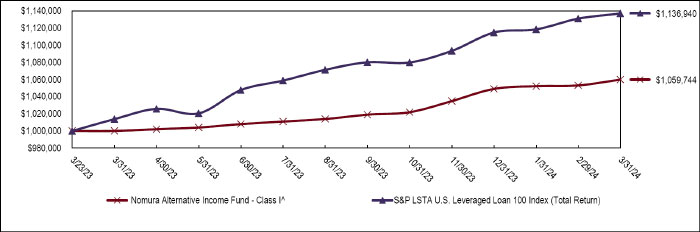

The Fund's performance figures for the periods ended March 31, 2024, compared to its benchmark are below:

| Annualized | ||

| Since Inception* | ||

| One Year | (3/23/2023) | |

| Nomura Alternative Income Fund - Class I^ | 5.86% | 5.73% |

| S&P LSTA U.S. Leveraged Loan 100 Index (Total Return) ** | 12.16% | 13.14% |

| * | Effective date of Fund. The Fund commenced operations on February 13, 2023. |

| ^ | The Fund’s total returns assume reinvestment of dividends and capital gains, and do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Fund returns would have been lower if a portion of the fees had not been waived. The performance shown represents past performance and does not guarantee future results. |

| ** | The S&P LSTA U.S. Leveraged Loan 100 Index (Total Return) is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market. It is designed to reflect the largest facilities in the leveraged loan market. It mirrors the market-weighted performance of the largest institutional leveraged loans based upon market weightings, spreads and interest payments. The index consists of 100 loan facilities drawn from a larger benchmark – the S&P/LSTA (Loan Syndications and Trading Association) Leveraged Loan Index (LLI). Investors cannot invest directly into an index. |

Performance of a $1,000,000 Investment

The graph shown above represents historical performance of a hypothetical investment of $1,000,000 in the Class I Shares of the Fund since inception. The performance shown represents past performance and does not guarantee future results. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.. All returns reflect reinvested distributions, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be higher or lower than the performance data quoted. For performance information current to the most recent month-end, please call 1-833-836-0206.

| Consolidated Holdings by Type of Investment | % of Net Assets | |||

| Private Investment Funds | 61.6 | % | ||

| Collateralized Loan Obligations Debt | 4.5 | % | ||

| Loans | 4.6 | % | ||

| United States Government & Agencies: | ||||

| Agency Hybrid ARMS | 2.3 | % | ||

| Collateralized Mortgage Obligations | 7.9 | % | ||

| Government National Mortgage Association | 2.3 | % | ||

| Short Term Investments | ||||

| Money Market Fund | 1.2 | % | ||

| United States Treasury Bills | 14.8 | % | ||

| Other Assets in Excess of Liabilities | 0.8 | % | ||

| 100.0 | % | |||

Please refer to the Consolidated Schedule of Investments that follows in this annual report for a detailed list of the Fund's holdings.

3

| NOMURA ALTERNATIVE INCOME FUND |

| CONSOLIDATED SCHEDULE OF INVESTMENTS |

| March 31, 2024 |

| Shares/Principal | ||||||||||

| Amount ($) | Fair Value | |||||||||

| PRIVATE INVESTMENT FUNDS — 61.6%(a) | ||||||||||

| — | ACORE Credit Partners II, LP(b) | $ | 4,378,932 | |||||||

| — | AG Asset Based Credit Fund, L.P. (b) | 15,910,880 | ||||||||

| — | Alcova Capital Yield Premium Fund, L.P.(c) | 1,500,000 | ||||||||

| — | Atalaya A4 Evergreen (Cayman) LP(b) | 8,104,955 | ||||||||

| — | Crestline Opportunity Fund V Offshore TE/SWF, L.P. (b) | 2,051,584 | ||||||||

| — | Maranon Senior Credit Strategies Fund XIV, L.P. (b) | 20,027,260 | ||||||||

| — | Medalist Partners Asset Based Private Credit Fund III LP Onshore Feeder, L.P. – Class B(b) (d) | 16,544,223 | ||||||||

| TOTAL PRIVATE INVESTMENT FUNDS (Cost $67,786,835) | 68,517,834 | |||||||||

| Spread | ||||||||||

| COLLATERALIZED LOAN OBLIGATIONS DEBT — 4.5%(e)(f)(g) | ||||||||||

| $ | 3,000,000 | Maranon Loan Funding Ltd. Series 2A A1, 01/15/36 | TSFR3M + 2.50% | 3,037,014 | ||||||

| $ | 1,500,000 | Maranon Loan Funding Ltd. Series 2A D, 01/15/36 | TSFR3M + 6.75% | 1,512,257 | ||||||

| $ | 500,000 | Maranon Loan Funding Ltd. Series 2A E, 01/15/36 | TSFR3M + 10.00% | 501,968 | ||||||

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $5,000,000) | 5,051,239 | |||||||||

| LOANS — 4.6%(a)(c) | ||||||||||

| $ | 1,250,000 | Bristol Industrial Senior Loan, 15.00%, 07/01/24 | 1,250,000 | |||||||

| $ | 750,000 | CR Steak LV LLC, 12.00%, 08/04/26 | 740,382 | |||||||

| $ | 1,400,000 | Royersford Industrial Senior Loan, 13.00%, 06/23/24 | 1,391,522 | |||||||

| $ | 250,000 | Tampa Industrial Senior Loan, 12.00%, 02/28/25 | 248,391 | |||||||

| $ | 750,000 | Ultra Padel Club, 13.00%, 11/27/27 | 735,452 | |||||||

| $ | 750,000 | Yacht Management Services, 12.00%, 07/21/24 | 746,750 | |||||||

| TOTAL LOANS (Cost $5,115,584) | 5,112,497 | |||||||||

| U.S. GOVERNMENT & AGENCIES — 12.5% | ||||||||||

| AGENCY HYBRID ARMS — 2.3% | ||||||||||

| $ | 2,509,950 | Fannie Mae REMICS Series 23-17 JA, 5.50%, 06/25/50 | 2,519,742 | |||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS — 7.9% | ||||||||||

| $ | 2,964,480 | Government National Mortgage Association Series 2023-170 HC, 6.00%, 11/20/41 | 2,983,085 | |||||||

| $ | 2,919,989 | Government National Mortgage Association Series 2023-141 LC, 6.00%, 01/20/43 | 2,949,197 | |||||||

| $ | 2,347,315 | Government National Mortgage Association Series 2022-209 PL, 5.50%, 11/20/50 | 2,355,464 | |||||||

| $ | 5,474,459 | Government National Mortgage Association Series 2021-49 IP, 2.50%, 01/20/51 | 552,178 | |||||||

| 8,839,924 | ||||||||||

See accompanying notes to consolidated financial statements.

4

| NOMURA ALTERNATIVE INCOME FUND |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued) |

| March 31, 2024 |

| Shares/Principal | ||||||||||

| Amount ($) | Spread | Fair Value | ||||||||

| GOVERNMENT NATIONAL MORTGAGE ASSOCIATION — 2.3% | ||||||||||

| $ | 2,603,669 | Ginnie Mae II Pool 786445, 3.70%, 08/20/49(g) | H15T1Y + 1.507 | $ | 2,584,059 | |||||

| TOTAL U.S. GOVERNMENT & AGENCIES (Cost $13,884,767) | 13,943,725 | |||||||||

| SHORT-TERM INVESTMENTS — 16.0% | ||||||||||

| MONEY MARKET FUND - 1.2% | ||||||||||

| 1,335,285 | First American Treasury Obligations Fund, Class X, 5.22%(h) | 1,335,285 | ||||||||

| UNITED STATES TREASURY BILLS — 14.8% | ||||||||||

| $ | 1,250,000 | United States Treasury Bill, 5.16%, 05/09/24 | 1,243,054 | |||||||

| $ | 6,500,000 | United States Treasury Bill, 5.20%, 05/28/24 | 6,446,028 | |||||||

| $ | 8,900,000 | United States Treasury Bill, 5.21%, 08/01/24 | 8,744,256 | |||||||

| 16,433,338 | ||||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $17,773,034) | 17,768,623 | |||||||||

| TOTAL INVESTMENTS - 99.2% (Cost $109,560,220) | $ | 110,393,918 | ||||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES - 0.8%(i) | 859,813 | |||||||||

| NET ASSETS - 100.0% | $ | 111,253,731 | ||||||||

Investment Abbreviations:

| LLC | - Limited Liability Company |

| LP | - Limited Partnership |

| Ltd. | - Limited Company |

| REMIC | - Real Estate Mortgage Investment Conduit |

| TSFR3M | - 3 Month Term Secured Overnight Financing Rate |

Reference Rates:

3 Month Term Secured Overnight Financing Rate as of March 31, 2024 was 5.30%.

| (a) | Restricted Security. See Note 2. |

| (b) | Investment is valued using the Fund’s pro rata net asset value (or its equivalent) as a practical expedient. |

| (c) | Level 3 securities fair valued using significant unobservable inputs. See Note 2. |

| (d) | The Fund’s interest in this investment is held through a wholly-owned subsidiary of the Fund, NAIF Splitter LLC. |

| (e) | Variable rate investment. Interest rate shown reflects the rate in effect at March 31, 2024 is based on the reference rate plus the displayed spread as of the security's last reset date. Interest rates reset periodically. |

| (f) | Security exempt from registration under Rule 144A of the Securities Act of 1933. The security may be resold in transactions exempt from registration under Rule 144A, normally to qualified institutional buyers. As of March 31, 2024 these securities had an aggregate value of $5,051,239 or 4.5% of net assets. |

| (g) | Variable rate security. |

| (h) | Rate disclosed is the seven day effective yield as of March 31, 2024. |

| (i) | Includes cash held as collateral for futures contracts. |

See accompanying notes to consolidated financial statements.

5

| Nomura Alternative Income Fund |

| CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES |

| March 31, 2024 |

| ASSETS | ||||

| Investments in securities, at cost | $ | 109,560,220 | ||

| Investments in securities, at value | 110,393,918 | |||

| Collateral Cash for derivative instruments | 5,082 | |||

| Dividends receivable | 657,146 | |||

| Interest receivable | 264,998 | |||

| Due from Investment Manager | 81,337 | |||

| Receivable for Fund shares sold | 4,925 | |||

| Prepaid registration expense | 30,791 | |||

| TOTAL ASSETS | 111,438,197 | |||

| LIABILITIES | ||||

| Distributions payable | 19,963 | |||

| Legal fees payable | 86,710 | |||

| Audit fees payable | 50,000 | |||

| Administrative services fees payable | 20,010 | |||

| Accrued expenses and other liabilities | 7,783 | |||

| TOTAL LIABILITIES | 184,466 | |||

| NET ASSETS | $ | 111,253,731 | ||

| CONTINGENCIES AND COMMITMENTS (NOTE 3) | ||||

| NET ASSETS CONSIST OF: | ||||

| Paid in capital | $ | 111,240,239 | ||

| Accumulated earnings | 13,492 | |||

| NET ASSETS | $ | 111,253,731 | ||

| PRICING OF CLASS I SHARES: | ||||

| Net Assets applicable to Class I Shares | $ | 111,253,731 | ||

| Class I Shares outstanding ($0 par value, unlimited shares authorized) | 11,113,389 | |||

| Net asset value, offering price and redemption price per share | $ | 10.01 |

See accompanying notes to consolidated financial statements.

6

| Nomura Alternative Income Fund |

| CONSOLIDATED STATEMENT OF OPERATIONS |

| For the Year Ended March 31, 2024 |

| INVESTMENT INCOME | ||||

| Dividend income | $ | 3,321,943 | ||

| Interest | 3,029,812 | |||

| TOTAL INVESTMENT INCOME | 6,351,755 | |||

| EXPENSES | ||||

| Investment management fees (Note 4) | 989,440 | |||

| Legal fees | 631,758 | |||

| Administrative services fees (Note 4) | 150,264 | |||

| Professional fees (Note 4) | 125,191 | |||

| Trustees fees and expenses | 101,250 | |||

| Audit and tax fees | 40,000 | |||

| Registration expenses | 38,718 | |||

| Transfer agent fees | 35,726 | |||

| Printing and postage expenses | 14,275 | |||

| Custodian fees | 10,977 | |||

| Line of credit expenses | 9,801 | |||

| Other expenses | 15,713 | |||

| TOTAL EXPENSES | 2,163,113 | |||

| Less: Fees waived by the Investment Manager (Note 4) | (905,952 | ) | ||

| NET EXPENSES | 1,257,161 | |||

| NET INVESTMENT INCOME | 5,094,594 | |||

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | ||||

| Net realized loss on: | ||||

| Investments | (810 | ) | ||

| Futures contracts | (14,502 | ) | ||

| (15,312 | ) | |||

| Net change in unrealized appreciation/(depreciation) on: | ||||

| Investments | 875,517 | |||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 860,205 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 5,954,799 |

See accompanying notes to consolidated financial statements.

7

| Nomura Alternative Income Fund |

| CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS |

| Year Ended | Period* Ended | |||||||

| March 31, 2024 | March 31, 2023 | |||||||

| INCREASE IN NET ASSETS FROM OPERATIONS | ||||||||

| Net investment income | $ | 5,094,594 | $ | 447,784 | ||||

| Net realized gain/(loss) from investments and futures contracts | (15,312 | ) | 5,923 | |||||

| Net change in unrealized appreciation/(depreciation) on investments | 875,517 | (41,819 | ) | |||||

| Net increase in net assets resulting from operations | 5,954,799 | 411,888 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Total distributions paid | (6,361,542 | ) | — | |||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

| Class I: | ||||||||

| Proceeds from shares sold: | 4,945,719 | 99,900,000 | ||||||

| Reinvestment of distributions: | 6,302,867 | — | ||||||

| Net increase in Class I net assets from capital share transactions | 11,248,586 | 99,900,000 | ||||||

| TOTAL INCREASE IN NET ASSETS | 10,841,843 | 100,311,888 | ||||||

| NET ASSETS | ||||||||

| Beginning of year/period | 100,411,888 | 100,000 | ||||||

| End of year/period | $ | 111,253,731 | $ | 100,411,888 | ||||

| SHARE ACTIVITY | ||||||||

| Class I: | ||||||||

| Beginning of year/period | 10,000,000 | 10,000 | ||||||

| Shares sold | 484,857 | 9,990,000 | ||||||

| Shares Reinvested | 628,532 | — | ||||||

| End of year/period | 11,113,389 | 10,000,000 | ||||||

| * | Nomura Alternative Income Fund commenced operations on February 13, 2023. |

See accompanying notes to consolidated financial statements.

8

| Nomura Alternative Income Fund |

| CONSOLIDATED STATEMENT OF CASH FLOWS |

| For the Year Ended March 31, 2024 |

| Cash Flows From Operating Activities: | ||||

| Net increase in Net Assets resulting from operations | $ | 5,954,799 | ||

| Adjustments to Reconcile Net Increase in Net Assets Resulting From Operations to Net Cash Used for Operating Activities: | ||||

| Purchases of long-term portfolio investments | (80,206,288 | ) | ||

| Proceeds from sale of long-term portfolio investments | 6,139,171 | |||

| Proceeds from paydowns of investments | (5,659 | ) | ||

| Return of capital from investments | 756,422 | |||

| Net short term investment purchases (net of amortization) | 64,266,590 | |||

| Net realized loss on investments | 810 | |||

| Net realized loss on futures contracts | 14,502 | |||

| Change in unrealized appreciation/(depreciation) on investments | (875,517 | ) | ||

| Net accretion of discounts | (4,897 | ) | ||

| Changes in Assets and Liabilities: | ||||

| (Increase)/Decrease in Assets: | ||||

| Receivable fund shares sold | (4,925 | ) | ||

| Due from Investment Manager | 26,348 | |||

| Dividends and interest receivable | (882,834 | ) | ||

| Deposits with Broker | (5,082 | ) | ||

| Prepaid expenses and other assets | (30,791 | ) | ||

| Increase/(Decrease) in Liabilities: | ||||

| Distributions payable | 19,963 | |||

| Legal fees payable | (48,196 | ) | ||

| Administrative services fees payable | 9,553 | |||

| Other accrued expenses | (5,931 | ) | ||

| Net Cash Used for Operating Activities | (4,881,962 | ) | ||

| Cash Flows From Financing Activities: | ||||

| Proceeds from shares issued | 4,945,719 | |||

| Cash distributions paid to shareholders, net of reinvestments | (58,675 | ) | ||

| Net Cash Provided by Financing Activities | 4,887,044 | |||

| Net increase in cash and restricted cash | 5,082 | |||

| Cash and restricted cash at beginning of period | — | |||

| Cash and Restricted Cash at End of Period | $ | 5,082 | ||

| Supplemental Disclosure of Non-Cash Activity: | ||||

| Non-cash financing activities not included above consists of reinvestment of distributions | $ | 6,302,867 |

See accompanying notes to consolidated financial statements.

9

| Nomura Alternative Income Fund |

| CONSOLIDATED STATEMENT OF CASH FLOWS (Continued) |

| For the Year Ended March 31, 2024 |

| Supplemental Disclosure of Cash Flow Information: | ||||

| Reconciliation of Cash and Restricted Cash at the Beginning of Period to the Consolidated Statement of Assets and Liabilities | ||||

| Cash | $ | — | ||

| Restricted Cash | $ | — | ||

| Cash and Restricted Cash, beginning balance | $ | — | ||

| Reconciliation of Cash and Restricted Cash at the End of Period to the Consolidated Statement of Assets and Liabilities | ||||

| Cash | $ | — | ||

| Restricted Cash | $ | 5,082 | ||

| Cash and Restricted Cash, ending balance | $ | 5,082 |

See accompanying notes to consolidated financial statements.

10

| Nomura Alternative Income Fund |

| CONSOLIDATED FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout each Year/Period

| Class I | ||||||||

| Year Ended | Period* Ended | |||||||

| March 31, 2024 | March 31, 2023 | |||||||

| Net asset value, beginning of year/period | $ | 10.04 | $ | 10.00 | ||||

| Activity from investment operations: | ||||||||

| Net investment income (a) | 0.50 | 0.04 | ||||||

| Net realized and unrealized gain/(loss) on investments | 0.09 | (0.00 | ) (b) | |||||

| Total from investment operations | 0.59 | 0.04 | ||||||

| Less distributions from: | ||||||||

| Net investment income | (0.52 | ) | — | |||||

| Net realized gains | (0.10 | ) | — | |||||

| Total distributions | (0.62 | ) | — | |||||

| Net asset value, end of year/period | $ | 10.01 | $ | 10.04 | ||||

| Total return (c) | 5.86 | % | 0.40 | % (d) | ||||

| Net assets, end of year/period (000's) | $ | 111,254 | $ | 100,412 | ||||

| Ratios and Supplemental Data: | ||||||||

| Ratio of gross expenses to average net assets (e)(f) | 2.08 | % (g) | 3.01 | % (h) | ||||

| Ratio of net expenses to average net assets (f) | 1.21 | % (g) | 1.20 | % (h) | ||||

| Ratio of net investment income to average net assets (f)(i) | 4.90 | % | 3.47 | % (h) | ||||

| Portfolio Turnover Rate | 11 | % | 0 | % (d) | ||||

| * | The Nomura Alternative Income Fund commenced operations on February 13, 2023. |

| (a) | Per share amounts calculated using the average daily shares method, which more appropriately presents the per share data for the year/period. |

| (b) | Amount represents less than $0.005. |

| (c) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends and capital gain distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The returns would have been lower if certain expenses had not been waived or reimbursed by the Investment Manager. |

| (d) | Not Annualized. |

| (e) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the Investment Manager. |

| (f) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests, including management and performance fees. As of March 31, 2024 the Fund’s underlying investment companies included a range of management fee from 0.07% to 1.75% (unaudited) and performance fees from 10% to 20% (unaudited). |

| (g) | Includes line of credit expenses. If this had been excluded, the ratio of gross expenses to average net assets and the ratio of net expenses to average net assets would have been 2.07% and 1.20%, respectively. |

| (h) | Annualized. |

| (i) | Recognition of net investment income by the Fund is affected by the timing of declaration of dividends by underlying investment companies in which the Fund invests. |

See accompanying notes to consolidated financial statements.

11

| Nomura Alternative Income Fund |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| March 31, 2024 |

| 1. | ORGANIZATION |

Nomura Alternative Income Fund (the “Fund”) was organized as a Delaware statutory trust on August 24, 2022 and is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a non-diversified, closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares. The primary investment objective of the Fund is to maximize risk-adjusted total return and the Fund will seek to provide current income as a secondary investment objective. The Fund is managed by Nomura Capital Management (formerly known as Nomura Private Capital LLC) (the “Investment Manager”).

The Fund commenced operations on February 13, 2023. The Fund has been granted exemptive relief (the “Exemptive Relief”) from the Securities and Exchange Commission (the “SEC”) that permits the Fund to issue multiple classes of shares and to impose asset-based distribution fees and early-withdrawal fees. As of March 31, 2024, only Class I Shares were available for purchase. Pursuant to the Exemptive Relief, the Fund will offer Class D Shares and Class A Shares, and may offer additional classes of shares in the future. Please refer to the Fund’s prospectus for additional information.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its consolidated financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standard Update ASU 2013-08.

Fund Valuation – The Fund’s net asset value (“NAV”) per share is calculated, on a class-specific basis, by dividing the value of the Fund’s total assets (the value of the securities the Fund holds plus cash or other assets, including interest accrued but not yet received), less accrued expenses and other liabilities of the Fund by the total number of shares outstanding. During the continuous offering, the price of the shares will increase or decrease on a daily basis according to the NAV of the shares.

Security Valuation – The Fund’s Board of Trustees (the “Board”) has designated the Investment Manager as the Fund’s valuation designee pursuant to Rule 2a-5 under the 1940 Act, to perform the fair value determination relating to any and all Fund investments, subject to the conditions and oversight requirements described in the Fund’s Fair Valuation of Investments Policy. In furtherance of its duties as valuation designee, the Investment Manager has formed a valuation committee (the “Valuation Committee”), to perform fair value determinations and oversee the day-to-day functions related to the fair valuation of the Fund’s investments. The Valuation Committee may consult with representatives from the Fund’s outside legal counsel or other third-party consultants in its discussions and deliberations.

Investments in securities that are listed on the New York Stock Exchange (“NYSE”) are valued, except as indicated below, at the last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices for the day or, if no asked price is available, at the bid price. Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined as reflected on the tape at the close of the exchange representing the principal market for such securities.

Many of the Fund’s portfolio investments are expected to be loans and other securities that are not publicly traded and for which no market-based price quotation is available. As a general matter, to value the Fund’s investments, the Investment Manager will use current market values when available, and otherwise value the Fund’s investments with fair value methodologies that the Investment Manager believes to be consistent with those used by the Fund for valuing its investments. These fair value calculations will involve significant professional judgment by the Investment Manager in the application of both observable and unobservable attributes, and it is possible that the fair value determined for a security may differ materially from the value that could be realized upon the sale of the security. There is no single standard for determining fair value of an investment. Likewise, there can be no assurance that the Fund will be able to purchase or sell an investment at the fair value price used to calculate the Fund’s NAV.

12

| Nomura Alternative Income Fund |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| March 31, 2024 |

In validating market quotations, the Valuation Committee considers different factors such as the source and the nature of the quotation in order to determine whether the quotation represents fair value. The Valuation Committee makes use of reputable financial information providers in order to obtain the relevant quotations.

Private investment companies in which the Fund invests its assets (collectively “Portfolio Funds”) are generally valued based on the latest NAV reported by the Portfolio Fund’s investment manager (the “Portfolio Fund Manager”). New purchases of Portfolio Funds may be valued at acquisition cost initially until a NAV is provided by the Portfolio Fund’s investment manager (the “Portfolio Fund Manager”). If the NAV of an investment in a Portfolio Fund is not available at the time the Fund is calculating its NAV, the Valuation Committee will consider any cash flows since the reference date of the last NAV reported by the Portfolio Fund Manager by (i) adding the nominal amount of the investment related capital calls and (ii) deducting the nominal amount of investment related distributions from the last NAV reported by the Portfolio Fund Manager.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of March 31, 2024 for the Fund’s assets measured at fair value:

| Investments | ||||||||||||||||||||

| Valued Using | ||||||||||||||||||||

| Practical | ||||||||||||||||||||

| Assets | Level I | Level 2 | Level 3 | Expedient | Total | |||||||||||||||

| Private Investment Funds | $ | — | $ | — | $ | 1,500,000 | $ | 67,017,834 | $ | 68,517,834 | ||||||||||

| Collateralized Loan Obligations Debt | — | 5,051,239 | — | — | 5,051,239 | |||||||||||||||

| Loans | — | — | 5,112,497 | — | 5,112,497 | |||||||||||||||

| United States Government & Agencies | — | 13,943,725 | — | — | 13,943,725 | |||||||||||||||

| Short-Term Investments | 1,335,285 | 16,433,338 | — | — | 17,768,623 | |||||||||||||||

| Total | $ | 1,335,285 | $ | 35,428,302 | $ | 6,612,497 | $ | 67,017,834 | $ | 110,393,918 | ||||||||||

13

| Nomura Alternative Income Fund |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| March 31, 2024 |

The following is the fair value measurement of investments that are measured at fair value using the Fund’s pro rata NAV (or its equivalent) as a practical expedient:

| Unfunded | Redemption | |||||||||||

| Portfolio Fund | Fair Value | Commitments | Frequency | Notice Period | ||||||||

| ACORE Credit Partners II, LP | $ | 4,378,932 | $ | 10,478,870 | N/A | N/A | ||||||

| AG Asset Based Credit Fund, LP | 15,910,880 | 5,000,000 | 3 Years | 3 Years | ||||||||

| Atalaya A4 Evergreen (Cayman) LP | 8,104,955 | 7,211,182 | N/A | N/A | ||||||||

| Crestline Opportunity Fund V Offshore TE/SWF, LP | 2,051,584 | 3,156,614 | N/A | N/A | ||||||||

| Maranon Senior Credit Strategies Fund XIV, LP | 20,027,260 | — | Quarterly | 90 days | ||||||||

| Medalist Partners Asset Based Private Credit Fund IIILP Onshore Feeder, LP | 16,544,223 | 3,543,836 | Annually | 180 Days | ||||||||

| $ | 67,017,834 | $ | 29,390,502 | |||||||||

The organizational documents of the private funds in which the Fund invests typically have set redemption schedules and notification requirements. As such, the Redemption Frequency column above reflects the frequency in which the private fund accepts redemption requests and the Notice Period column reflects the number of days of advanced notice required. While redemptions can be requested at the frequency listed above, there is no guarantee the Fund will be paid all or any of the redemption amount at the time requested.

The changes of fair value of investments for which the Fund has used Level 3 inputs to determine the fair value are as follows:

| Private | ||||

| Investment Funds | ||||

| and Loans | ||||

| Beginning Balance as of March 31, 2023 | $ | 12,103,747 | ||

| Total realized gain/(loss) | — | |||

| Change in Unrealized Appreciation/(Depreciation) | — | |||

| Purchases or Contributions | 6,612,497 | |||

| Sales or Distributions | — | |||

| Transfers out of Level 3 during the period | (12,103,747 | ) | ||

| Ending Balance as of March 31, 2024 | $ | 6,612,497 | ||

Transfers out of Level 3 during the period represent investments that are being measured at fair value using the Fund’s pro rata NAV (or its equivalent) as a practical expedient.

The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 Fair Value Measurements for investments held as of March 31, 2024:

| Valuation | Unobservable | Range on | ||||||||

| Level 3 Investment(a) | Fair Value(b) | Technique | Inputs | Inputs | ||||||

| Alcova Capital Yield Premium Fund, L.P. | $ | 1,500,000 | Cost Approach | Transaction Price | Not Applicable | |||||

| Bristol Industrial Senior Loan | 1,250,000 | Cost Approach | Transaction Price | Not Applicable | ||||||

| CR Steak LV LLC | 740,382 | Cost Approach | Transaction Price | Not Applicable | ||||||

| Royersford Industrial Senior Loan | 1,391,522 | Cost Approach | Transaction Price | Not Applicable | ||||||

| Tampa Industrial Senior Loan | 248,391 | Cost Approach | Transaction Price | Not Applicable | ||||||

| Ultra Padel Club | 735,452 | Cost Approach | Transaction Price | Not Applicable | ||||||

| Yacht Management Services | 746,750 | Cost Approach | Transaction Price | Not Applicable | ||||||

| $ | 6,612,497 | |||||||||

| (a) | Refer to the Consolidated Schedule of Investments for classifications of individual securities. |

| (b) | As there was no range for each significant unobservable input, weighted average is not reported. |

14

| Nomura Alternative Income Fund |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| March 31, 2024 |

Restricted Securities – Restricted securities are securities that may be resold only upon registration under federal securities laws or in transactions exempt from such registration. In some cases, the issuer of restricted securities has agreed to register such securities for resale, at the issuer’s expense either upon demand by the Fund or in connection with another registered offering of the securities. Many restricted securities may be resold in the secondary market in transactions exempt from registration. Such restricted securities may be determined to be liquid under criteria established by the Board. The restricted securities may be valued at the price provided by dealers in the secondary market or, if no market prices are available, the fair value as determined in good faith using methods approved by the Board. The Portfolio Funds generally are restricted securities that are subject to substantial holding periods and are not traded in public markets, so that the Fund may not be able to resell some of its investments for extended periods, which may be several years.

Additional information on each restricted investment held by the Fund at March 31, 2024 is as follows:

| Security | Acquisition Date | Cost | Value | % of Net Assets | ||||||||

| ACORE Credit Partners II, LP | 3/24/2023 | $ | 4,429,789 | $ | 4,378,932 | 3.9% | ||||||

| AG Asset Based Credit Fund LP | 9/13/2023 | 15,451,603 | 15,910,880 | 14.3% | ||||||||

| Alcova Capital Yield Premium Fund, LP | 3/18/2024 | 1,500,000 | 1,500,000 | 1.3% | ||||||||

| Atalaya A4 Evergreen (Cayman) LP | 4/4/2023 | 7,788,818 | 8,104,955 | 7.3% | ||||||||

| Crestline Opportunity Fund V Offshore TE/SWF, LP | 9/21/2023 | 1,881,517 | 2,051,584 | 1.8% | ||||||||

| Maranon Senior Credit Strategies Fund XIV, LP | 6/1/2023 | 20,000,000 | 20,027,260 | 18.0% | ||||||||

| Medalist Partners Asset Based Private Credit Fund III LP Onshore Feeder, LP – Class B | 3/21/2023 | 16,685,108 | 16,544,223 | 14.9% | ||||||||

| Bristol Industrial Senior Loan | 3/13/2024 | 1,250,000 | 1,250,000 | 1.1% | ||||||||

| CR Steak LV LLC | 1/10/2024 | 741,110 | 740,382 | 0.7% | ||||||||

| Royersford Industrial Senior Loan | 3/13/2024 | 1,391,832 | 1,391,522 | 1.3% | ||||||||

| Tampa Industrial Senior Loan | 3/13/2024 | 248,428 | 248,391 | 0.2% | ||||||||

| Ultra Padel Club | 1/10/2024 | 736,105 | 735,452 | 0.7% | ||||||||

| Yacht Management Services | 1/10/2024 | 748,109 | 746,750 | 0.7% | ||||||||

| $ | 72,852,419 | $ | 73,630,331 | 66.2% | ||||||||

Consolidation of Subsidiary – The Fund has established a limited liability company, NAIF Splitter LLC (“Subsidiary”), which is wholly owned and controlled by the Fund. The Subsidiary is a disregarded entity for tax purposes. The operations of the Subsidiary have been consolidated with the Fund’s for financial reporting purposes. Accordingly, all inter-company transactions and balances have been eliminated.

Futures – The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. To manage equity price risk, the Fund may enter into futures contracts. Upon entering a futures contract with a broker, the Fund deposits a “cash deposit” with the broker as recorded in the accompanying Consolidated Statements of Assets and Liabilities. Futures contracts are marked-to-market daily and subsequent daily payments (variation margin) are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin on futures contracts in the Consolidated Statement of Assets and Liabilities. When a contract is closed, the Fund recognizes a realized gain or loss. Futures contracts have market risks, including the risk that the change in the value of the contract may not correlate with changes in the value of the underlying securities. With futures contracts, there is minimal counterparty credit risk to the Fund since futures are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default. There were no futures contracts outstanding as of March 31, 2024.

For the fiscal year ended March 31, 2024, the Fund had realized losses of $ 14,502 from futures contracts subject to equity price risk as disclosed in the Consolidated Statement of Operations. As of March 31, 2024, the Fund had an unrealized appreciation of $0 from futures contracts subject to equity price risk as disclosed in the Consolidated Statement of Operations.

Cash and Cash Equivalents – The Fund places its cash with one banking institution, which is insured by the Federal Deposit Insurance Corporation (“FDIC”). The FDIC limit is $250,000. At various times throughout the year, the amount on deposit may exceed the FDIC limit and subject the Fund to a credit risk. The Fund does not believe that such deposits are subject to any unusual risk associated with investment activities.

15

| Nomura Alternative Income Fund |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| March 31, 2024 |

Restricted Cash – Restricted cash is subject to legal or contractual restriction by third parties as well as a restriction to withdrawal or use, including restrictions that require the funds to be used for a specified purpose and restrictions that limit the purpose for which the funds can be used.

The Fund held cash in the amount of $5,082 as of March 31, 2024 related to collateral requirements for futures contracts.

Security Transactions and Investment Income – Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Federal Income Taxes – The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Fund’s September 30, 2023 year-end tax return. Generally, tax authorities can examine tax returns filed for the last three tax years. The Fund identifies its major tax jurisdictions as U.S. Federal, state, local and foreign, where applicable. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Consolidated Statement of Operations. During the tax year ended September 30, 2023, the Fund did not incur any interest or penalties.

Distributions to Shareholders – Distributions from investment income are declared and recorded on a daily basis and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (e.g., deferred losses) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification.

Indemnification – The Fund indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

| 3. | CONTINGENCIES AND COMMITMENTS |

As of March 31, 2024, the Fund had unfunded commitments and/or contingencies as follows:

| Unfunded | ||||||||

| Portfolio Fund | Fair Value | Commitments | ||||||

| Investments valued at NAV as practical expedient* | $ | 67,017,834 | $ | 29,390,502 | ||||

| Alcova Capital Yield Premium Fund, L.P. | 1,500,000 | — | ||||||

| $ | 68,517,834 | $ | 29,390,502 | |||||

| * | See Note 2 for investments valued at NAV as a practical expedient. |

Typically, when the Fund invests in a private investment fund, it makes a binding commitment to invest a specified amount of capital in the applicable private fund. The capital commitment may be drawn by the general partner of the private fund either all at once, or over time through a series of capital calls at the discretion of the general partner. As such, the unfunded commitments column above reflects the remaining amount of the Fund’s commitments to be called by the general partner of the private fund. At March 31, 2024, the Fund reasonably believes its assets will provide adequate cover to satisfy all its unfunded commitments.

| 4. | INVESTMENT MANAGEMENT AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

Investment Management Fees – Pursuant to an investment management agreement with the Fund, the Investment Manager, under the oversight of the Board, directs the daily operations of the Fund and supervises the performance of administrative and

16

| Nomura Alternative Income Fund |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| March 31, 2024 |

professional services provided by others. As compensation for these services and the related expenses borne by the Investment Manager, the Fund has agreed to pay the Investment Manager as compensation under the Investment Management Agreement a fee consisting of two components — a base management fee (the “Management Fee”) and, if earned, an incentive fee (the “Incentive Fee”). The base management fee is calculated and payable monthly in arrears at the annual rate of 0.95% of the Fund’s average daily net assets. During the fiscal year ended March 31, 2024, the Fund accrued $989,440 of management fees included on the Consolidated Statement of Operations.

The incentive fee is calculated and payable quarterly in arrears based upon the Fund’s “Pre-Incentive Fee Net Investment Income” (as defined below) for the immediately preceding quarter, and is calculated as follows:

| ● | No incentive fee is payable in any fiscal quarter in which the Pre-Incentive Fee Net Investment Income attributable to the Class does not exceed a quarterly return of 1.50% per quarter based on the Class’s average daily net assets (calculated in accordance with GAAP) (the “Quarterly Return”). |

| ● | All Pre-Incentive Fee Net Investment Income attributable to the Class (if any) that exceeds the Quarterly Return, but is less than or equal to 1.765% of the average daily net assets of that Class (calculated in accordance with GAAP) for the fiscal quarter will be payable to the Investment Manager. |

| ● | For any fiscal quarter in which Pre-Incentive Fee Net Investment Income attributable to the Class exceeds 1.765% of the Class’s average daily net assets (calculated in accordance with GAAP), the Incentive Fee with respect to that Class will equal 15% of Pre-Incentive Fee Net Investment Income attributable to the Class. |

“Pre-Incentive Fee Net Investment Income” for a Class means interest income, dividend income and any other income accrued (including any other fees, such as commitment, origination, structuring, diligence and consulting fees or other fees that the Fund receives from an investment) during the fiscal quarter and allocated to the Class, minus the Class’s operating expenses for the quarter and the distribution and/or shareholder servicing fees (if any) applicable to the Class accrued during the quarter. For such purposes, the Fund’s operating expenses will include the Management Fee but will exclude the Incentive Fee. Pre-Incentive Fee Net Investment Income does not include income earned on short-term investments or investments in underlying private funds but does include income on investments in all other Portfolio Funds.

The Investment Manager has entered into an expense limitation and reimbursement agreement with the Fund, whereby the Investment Manager has agreed to waive fees that it would otherwise have been paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure the Total Annual Expenses (excluding any taxes, fees and interest payments on borrowed funds, distribution and servicing fees, brokerage and distribution costs and expenses, acquired fund fees and expenses (as determined in accordance with SEC Form N-2), the Incentive Fee, expenses incurred in connection with any merger or reorganization, and extraordinary or non-routine expenses, such as litigation expenses) do not exceed 1.20% of the average daily net assets of Class I Shares (the “Expense Limit”) at least until July 28, 2025. For a period not to exceed three years from the date on which a Waiver is made, the Investment Manager may recoup amounts waived or assumed, provided it is able to effect such recoupment and remain in compliance with the Expense Limit in place at the time of the Waiver and any then-existing expense limit.

During the year ended March 31, 2024, the Investment Manager waived fees and reimbursed the Fund for expenses in the amount of $905,952.

Cumulative waivers and expense reimbursements subject to the aforementioned recoupment will expire on March 31 of the following years:

| 2026 | $ | 233,524 | ||

| 2027 | $ | 905,952 |

PINE Advisors LLC (“PINE”) – PINE provides compliance and treasury services to the Fund pursuant to service agreements. In consideration for these services and as disclosed in the Consolidated Statement of Operations, PINE is paid a monthly fee out of the assets of the Fund. The Fund also reimburses PINE for certain out-of-pocket expenses.

Ultimus Fund Solutions, LLC (“UFS”) – UFS provides administration, fund accounting, and transfer agent services to the Fund. Pursuant to separate servicing agreements with UFS and as disclosed in the Consolidated Statement of Operations, the Fund pays UFS customary fees for providing administration, fund accounting and transfer agency services to the Fund. Certain officers of the Fund are also officers of UFS and are not paid any fees directly by the Fund for servicing in such capacities.

17

| Nomura Alternative Income Fund |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| March 31, 2024 |

In addition, an affiliate of UFS provides services to the Fund as follows:

Blu Giant, LLC (“Blu Giant”) – Blu Giant, an affiliate of UFS, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund.

Distributor – The distributor of the Fund is Foreside Financial Services, LLC (the “Distributor”). Under a distribution agreement with the Fund, the Distributor acts as the agent of the Fund in connection with the continuous offering of shares of the Fund. The Distributor continually distributes shares of the Fund on a best-efforts basis. The Distributor has no obligation to sell any specific quantity of Fund shares. The Distributor and its officers have no role in determining the investment policies or which securities are to be purchased or sold by the Fund.

The Distributor may enter into agreements with selected broker-dealers, banks or other financial intermediaries for distribution of shares of the Fund. With respect to certain financial intermediaries and related fund “supermarket” platform arrangements, the Fund and/or the Investment Manager typically enter into such agreements alongside the Distributor. These financial intermediaries may charge a fee for their services and may receive shareholder service or other fees from parties other than the Distributor. These financial intermediaries may otherwise act as processing agents and are responsible for promptly transmitting purchase, redemption and other requests to the Fund.

During the fiscal year ended March 31, 2024, the Fund did not pay distribution related charges pursuant to the distribution agreement.

| 5. | INVESTMENT TRANSACTIONS |

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the fiscal year ended March 31, 2024, was as follows:

| Purchases | Sales | |||||||

| Non-U.S. Government Securities | $ | 67,810,434 | $ | 1,242,405 | ||||

| U.S. Government Securities | 12,395,854 | 4,896,767 | ||||||

| Total | $ | 80,206,288 | $ | 6,139,172 | ||||

| 6. | RISK FACTORS |

Risk is inherent in all investing. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. The following list is not intended to be a comprehensive listing of all the potential risks associated with the Fund. The Fund’s prospectus provides further details regarding the Fund’s risks and considerations.

Liquidity Risk – There is currently no secondary market for the shares and the Fund expects that no secondary market will develop. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the shares outstanding at NAV. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. The Fund’s structured notes and other investments are also subject to liquidity risk. Liquidity risk exists when investments of the Fund would be difficult to purchase or sell, possibly preventing the Fund from selling such illiquid securities at an advantageous time or price, or possibly requiring the Fund to dispose of other investments at unfavorable times or prices in order to satisfy its obligations.

Market Risk – An investment in Fund shares is subject to investment risk, including the possible loss of the entire principal amount invested. An investment in Fund shares represents an indirect investment in the securities owned by the Fund. The value of these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably. The value of your shares at any point in time may be worth less than the value of your original investment, even after taking into account any reinvestment of dividends and distributions.

The Fund and the Investment Manager have in place business continuity plans reasonably designed to ensure that they maintain normal business operations, and that the Fund, its portfolio and assets are protected. However, in the event of a pandemic or an

18

| Nomura Alternative Income Fund |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| March 31, 2024 |

outbreak, such as COVID-19, there can be no assurance that the Fund, its investment manager and service providers, or the Fund’s portfolio companies, will be able to maintain normal business operations for an extended period of time or will not lose the services of key personnel on a temporary or long-term basis due to illness or other reasons. A pandemic or other outbreak of disease could also impair the information technology and other operational systems upon which the Fund’s Investment Manager relies and could otherwise disrupt the ability of the Fund’s service providers to perform essential tasks.

Limited Operating History – The Trust is a newly organized, non-diversified, closed-end management investment company with limited operating history.

Private Investment Fund Risk – The Fund may invest in private investment funds that are not registered as investment companies. As a result, the Fund as an investor in these funds would not have the benefit of certain protections afforded to investors in registered investment companies. The Fund may not have the same amount of information about the identity, value, or performance of the private investment funds’ investments as such private investment funds’ managers. Investments in private investment funds generally will be illiquid and generally may not be transferred without the consent of the fund. The Fund may be unable to liquidate its investment in a private investment fund when desired (and may incur losses as a result) or may be required to sell such investment regardless of whether it desires to do so. Upon its withdrawal of all or a portion of its interest in a private investment fund, the Fund may receive securities that are illiquid or difficult to value. The Fund may not be able to withdraw from a private investment fund except at certain designated times, thereby limiting the ability of the Fund to withdraw assets from the private fund due to poor performance or other reasons. The fees paid by private investment funds to their advisers and general partners or managing members often are higher than those paid by registered funds and generally include a percentage of gains. The Fund will bear its proportionate share of the management fees and other expenses that are charged by a private investment fund in addition to the management fees and other expenses paid by the Fund. Certain private investment funds may be newly formed entities that have no operating histories or limited operating histories and the information the Fund will obtain about such investments may be limited. As such, the ability of the Investment Manager to evaluate past performance or to validate the investment strategies of such private investment will be limited. Moreover, even to the extent a private investment has a longer operating history, the past investment performance of any of the private investments should not be construed as an indication of the future results of such investments or the Fund, particularly as the investment professionals responsible for the performance of such investments may change over time. This risk is related to, and enhanced by, the risks created by the fact that the Investment Manager relies upon information provided to it by the issuer of the securities it receives or the Portfolio Fund Managers (as applicable) that is not, and cannot be, independently verified.

Valuation Risk – Unlike publicly traded common stock which trades on national exchanges, there is no central place or exchange for most of the Fund’s investments to trade. Due to the lack of centralized information and trading, the valuation of loans or fixed-income instruments may result in more risk than that of common stock. Uncertainties in the conditions of the financial market, unreliable reference data, lack of transparency and inconsistency of valuation models and processes may lead to inaccurate asset pricing. In addition, other market participants may value securities differently than the Fund. As a result, the Fund may be subject to the risk that when an instrument is sold in the market, the amount received by the Fund is less than the value of such loans or fixed-income instruments carried on the Fund’s books.

Shareholders should recognize that valuations of illiquid assets involve various judgments and consideration of factors that may be subjective. As a result, the NAV of the Fund, as determined based on the fair value of its investments, may vary from the amount ultimately received by the Fund from its investments. This could adversely affect shareholders whose shares are repurchased as well as new shareholders and remaining shareholders. For example, in certain cases, the Fund might receive less than the fair value of its investment, resulting in a dilution of the value of the shares of shareholders who do not tender their shares in any coincident tender offer and a windfall to tendering shareholders; in other cases, the Fund might receive more than the fair value of its investment, resulting in a windfall to shareholders remaining in the Fund, but a shortfall to tendering shareholders.

Risk of Bank Impairment Failure – The impairment or failure of one or more banks with whom the Fund transacts may inhibit the Fund’s ability to access depository accounts. In such cases, the Fund may be forced to delay or forgo investments, resulting in lower Fund performance. In the event of such a failure of a banking institution where the Fund holds depository accounts, access to such accounts could be restricted and U.S. Federal Deposit Insurance Corporation (“FDIC”) protection may not be available for balances in excess of amounts insured by the FDIC. In such instances, the Fund may not recover such excess, uninsured amounts.

19

| Nomura Alternative Income Fund |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| March 31, 2024 |

| 7. | CONTROL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a portfolio creates a presumption of control of the portfolio under section 2(a)(9) of the 1940 Act. As of March 31, 2024, Nomura Holding America Inc. held 95.5% of the Fund and may be deemed to control the Fund.

| 8. | TAX BASIS INFORMATION |

The Fund has selected a tax year end of September 30. The Fund intends to elect to be treated as a registered investment company (“RIC”) for U.S. federal income tax purposes and expects each year to continue to qualify as a RIC for U.S. federal income tax purposes. As such, the Fund generally will not be subject to U.S. federal corporate income tax, provided that it distributes all of its net taxable income and gains each year. As of September 30, 2023, the Fund continues to qualify as a regulated investment company.

To avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The Fund had no distributions for the period through tax year end September 30, 2023.

The following information is computed on a tax basis for each item as of September 30, 2023:

| Undistributed | Undistributed | Post October Loss | Capital Loss | Other | Unrealized | Total | ||||||||||||||||||||

| Ordinary | Long-Term | and | Carry | Book/Tax | Appreciation/ | Distributable Earnings/ | ||||||||||||||||||||

| Income | Gains | Late Year Loss | Forwards | Differences | (Depreciation) | (Accumulated Deficit) | ||||||||||||||||||||

| $ | 1,651,650 | $ | — | $ | (11,550 | ) | $ | — | $ | — | $ | 687,783 | $ | 2,327,883 | ||||||||||||

The difference between book basis and tax basis unrealized appreciation(depreciation) from investments is primarily attributable to the tax adjustments for partnerships and mark to market of Section 1256 contracts.

Capital losses incurred after October 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes. The Fund incurred and elected to defer such capital losses of $11,550.

Permanent book and tax differences, primarily attributable to the book/tax basis treatment of non-deductible expenses, resulted in reclassifications for the tax period ended September 30, 2023 adjusted for March 31, 2024 activity and which had no effect on operations or net assets. The reclassifications were as follows:

| Paid in Capital | Distributable Earnings | |||||

| $ | (8,347 | ) | $ | 8,347 | ||

The tax cost and unrealized appreciation(depreciation) for the tax period-ended September 30, 2023 adjusted for March 31, 2024 activity, were as follows:

| Cost for Federal Tax purposes | $ | 108,703,913 | ||

| Unrealized Appreciation | $ | 2,156,537 | ||

| Unrealized Depreciation | (466,532 | ) | ||

| Tax Net Unrealized Appreciation | $ | 1,690,005 |

20

| Nomura Alternative Income Fund |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| March 31, 2024 |

| 9. | REPURCHASE OFFERS |

Pursuant to Rule 23c-3 under the 1940 Act, the Fund offers shareholders on a quarterly basis the option of redeeming shares, at NAV, of no less than 5% and no more than 25% of the shares outstanding. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer, although each shareholder will have the right to require the Fund to purchase up to and including 5% of such shareholder’s shares in each quarterly repurchase. Limited liquidity will be provided to shareholders only through the Fund’s quarterly repurchases.

During the fiscal year ended March 31, 2024, the Fund completed three quarterly repurchase offers. In these offers, the Fund offered to repurchase up to 5% of its issued and outstanding Shares at a price equal to the NAV as of the Repurchase Pricing Date. The results of the completed repurchase offers were as follows:

| Net Asset | Percentage of | |||||||||||||||||

| Value as of | Outstanding | |||||||||||||||||

| Commencement | Repurchase Request | Repurchase Pricing | Repurchase | Amount | Shares | |||||||||||||

| Date | Deadline | Date | Offer Date | Repurchased | Repurchased | |||||||||||||

| Repurchase Offer #1 | July 24, 2023 | August 24, 2023 | August 24, 2023 | $ | 10.17 | $ | — | 0.00 | % | |||||||||

| Repurchase Offer #2 | October 23, 2023 | November 22, 2023 | November 22, 2023 | $ | 10.31 | $ | — | 0.00 | % | |||||||||

| Repurchase Offer #3 | January 26, 2024 | February 22, 2024 | February 22, 2024 | $ | 10.01 | $ | — | 0.00 | % | |||||||||

| 10. | CREDIT FACILITY |

On July 11, 2023, the Fund entered into a secured, revolving line of credit facility with U.S. Bank National Association (the “Credit Facility”). The Fund may borrow an amount up to the lesser of the Credit Facility maximum commitment financing of $10,000,000 or one-third of the gross market value of the unencumbered assets of the Fund. The interest rate on borrowings from the Credit Facility is calculated at a rate per annum equal to the prime rate and is payable monthly in arrears. During the fiscal year ended March 31, 2024, the Fund did not borrow from the Credit Facility or pay any interest.

| 11. | SUBSEQUENT EVENTS |

Subsequent events after the date of the Consolidated Statement of Assets and Liabilities have been evaluated through the date the consolidated financial statements were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the consolidated financial statements except the following:

At a special meeting held on April 3, 2024, shareholders of the Fund approved a sub-advisory agreement by and among the Fund, the Investment Manager and Nomura Corporate Research and Asset Management Inc. (“NCRAM”), as described in the Proxy Statement provided in advance of the special meeting to shareholders of the Fund. Accordingly, as of April 3, 2024, NCRAM serves as a sub-adviser to the Fund.

21

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

Nomura Alternative Income Fund

Opinion on the Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities, including the consolidated schedule of investments, of Nomura Alternative Income Fund (the “Fund”) as of March 31, 2024, the related consolidated statements of operations and cash flows for the year then ended, and the statements of changes in net assets and the financial highlights for the year then ended and for the period February 13, 2023 (commencement of operations) through March 31, 2023, the related notes, (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2024, the results of its operations and its cash flows the year then ended, the changes in net assets and the financial highlights the year then ended and for the period February 13, 2023 through March 31, 2024, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our procedures included confirmation of securities owned as of March 31, 2024, by correspondence with the custodian, broker and private issuers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2023.

COHEN & COMPANY, LTD.

Philadelphia, Pennsylvania

May 30, 2024

22

| Nomura Alternative Income Fund |

| SUPPLEMENTAL INFORMATION |

| March 31, 2024 (Unaudited) |

Board of Trustees’ Considerations in Approving Sub-Advisory Agreement

At a meeting of the Board of Trustees (the “Board” and the members thereof, “Trustees”) of the Nomura Alternative Income Fund (the “Fund”) held on January 18, 2024, the Board, including all Trustees who are not “interested persons” (as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) (the “Independent Trustees”), considered and approved the sub-advisory agreement (the “Sub -Advisory Agreement”) by and among the Fund, Nomura Capital Management LLC (“NCM”) and Nomura Corporate Research and Management Inc. (the “Sub-Advisor” or “NCRAM”). In considering the approval of the Sub-Advisory Agreement, the Board received materials specifically relating to the Sub-Advisory Agreement.

In connection with its consideration of the Sub-Advisory Agreement, the Board considered information provided by NCRAM specifically in relation to the consideration of the initial approval of the Sub-Advisory Agreement in response to requests of the Independent Trustees and their independent legal counsel. The Board considered a range of materials and information regarding the nature, extent and quality of services to be provided by NCRAM; the performance of NCRAM’s relevant strategies versus indices and peers; the proposed sub-advisory fee structure; and information related to anticipated profitability and economies of scale. The Board also considered information related to potential ancillary benefits that may be enjoyed by NPC (and its affiliates) as a result of its relationship with the Fund.