THE SECURITIES OFFERED HEREBY AND THE SECURITIES ISSUABLE UPON EXERCISE HEREOF HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "ACT"), OR ANY STATUTES OR REGULATIONS OF NON-U.S. JURISDICTIONS OR ANY STATE SECURITIES OR BLUE SKY LAWS, AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THE ACT AND APPLICABLE STATE SECURITIES OR BLUE SKY LAWS. ALTHOUGH AN OFFERING CIRCULAR ON FORM 1-A FOR A TIER II OFFERING HAS BEEN FILED AND QUALIFIED WITH THE SECURITIES AND EXCHANGE COMMISSION (THE "SEC"), THAT OFFERING STATEMENT DOES NOT INCLUDE THE SAME INFORMATION THAT WOULD BE INCLUDED IN A REGISTRATION STATEMENT UNDER THE ACT.

THE REGISTERED HOLDER OF THESE WARRANTS AGREES BY ITS ACCEPTANCE HEREOF, THAT SUCH HOLDER WILL NOT FOR A PERIOD OF ONE HUNDRED EIGHTY (180) DAYS FOLLOWING [*], 2024, WHICH IS THE CLOSING DATE OF THE OFFERING OF SHARES OF COMMON STOCK TO WHICH THESE WARRANTS RELATE: (A) SELL, TRANSFER, ASSIGN, PLEDGE OR HYPOTHECATE THESE WARRANTS TO ANYONE OTHER THAN OFFICERS OR PARTNERS OF DIGITAL OFFERING, LLC, OR AN UNDERWRITER, PLACEMENT AGENT, OR A SELECTED DEALER PARTICIPATING IN THE OFFERING FOR WHICH THESE WARRANTS WERE ISSUED TO THE AGENT AS CONSIDERATION (THE "OFFERING"), OR (II) A BONA FIDE OFFICER, PARTNER OR REGISTERED REPRESENTATIVE OF ANY SUCH UNDERWRITER, PLACEMENT AGENT OR SELECTED DEALER, EACH OF WHOM SHALL HAVE AGREED TO THE RESTRICTIONS CONTAINED HEREIN, IN ACCORDANCE WITH FINRA CONDUCT RULE 5110(E)(1), OR (B) CAUSE THESE WARRANTS OR THE SECURITIES ISSUABLE HEREUNDER TO BE THE SUBJECT OF ANY HEDGING, SHORT SALE, DERIVATIVE, PUT OR CALL TRANSACTION THAT WOULD RESULT IN THE EFFECTIVE ECONOMIC DISPOSITION OF THESE WARRANTS OR THE SECURITIES HEREUNDER, EXCEPT AS PROVIDED FOR IN FINRA RULE 5110(E)(2).

THE WARRANTS REPRESENTED HEREBY WILL BE VOID AND OF NO VALUE AFTER 5:00 PM (PACIFIC TIME) ON [*], 2029 (THE DATE THAT IS FIVE YEARS FROM COMMENCEMENT OF SALES OF SHARES OF COMMON STOCK IN THE OFFERING).

STARFIGHTERS SPACE, INC.

(a Delaware Corporation)

WARRANT CERTIFICATE

WARRANT TO PURCHASE SHARES OF COMMON STOCK

| Warrant Certificate Number: 2024-[*]-[*] | Number of Warrants: [*] |

THIS IS TO CERTIFY THAT for value received, Digital Offering, LLC of 1461 Glenneyre Street #D, Laguna Beach, California 92651 (the "Warrantholder" or "Digital Offering") has the right to purchase in respect of each warrant (the "Warrants") represented by this certificate or by a replacement certificate (in either case this "Warrant Certificate"), at any time or from time to time from the date of issuance (the "Effective Date"), and up to 5:00 p.m. (Pacific time) on [*], 2029 (the "Expiry Time") one fully paid and non-assessable share of common stock (each, a "Common Share") of Starfighters Space, Inc. (the "Corporation"), a corporation incorporated under the laws of the State of Delaware, as constituted on the date hereof, at an exercise purchase price (the purchase price in effect from time to time being called the "Exercise Price") of US$3.59 per Common Share if exercised on or before the Expiry Time, subject to adjustment as provided herein.

The Corporation agrees that the Common Shares purchased pursuant to the exercise of the Warrants shall be and be deemed to be issued to the Warrantholder as of the close of business on the date on which this Warrant Certificate shall have been surrendered and payment made for such Common Shares as aforesaid.

Nothing contained herein shall confer any right upon the Warrantholder to subscribe for or purchase any Common Shares at any time after the Expiry Time and from and after the Expiry Time the Warrants and all rights under this Warrant Certificate shall be void and of no value.

The above provisions are subject to the following:

1. Exercise

1.1 Cash Exercise. In the event that the Warrantholder desires to exercise the right to purchase Common Shares conferred hereby, the Warrantholder shall (a) surrender this Warrant Certificate to the Corporation in accordance with section 10 hereof, (b) complete and execute a subscription form in the form attached as Schedule A to this Warrant Certificate, and (c) pay the amount payable on the exercise of this Warrant in respect of the Common Shares subscribed for either by bank draft or certified cheque payable to the Corporation. Upon such surrender and payment as aforesaid, the Warrantholder shall be deemed for all purposes to be the holder of record of the number of Common Shares to be so issued and the Warrantholder shall be entitled to delivery of a certificate or certificates representing such Common Shares and the Corporation shall cause such certificate or certificates to be delivered to the Warrantholder at the address specified in the subscription form within five (5) business days after such surrender and payment as aforesaid. No fractional Common Shares will be issuable upon any exercise of this Warrant and the Warrantholder will not be entitled to any cash payment or compensation in lieu of a fractional Common Share.

1.2 Cashless Exercise. In the event that the Warrantholder desires to exercise the right to purchase Common Shares conferred hereby through a cashless exercise, and subject to the approval (if required) of any stock exchange on which the Common Shares may then be listed, the Warrantholder shall (a) surrender this Warrant Certificate to the Corporation in accordance with section 10 hereof, and (b) complete and execute a subscription form in the form attached as Schedule A to this Warrant Certificate, to denote a "cashless exercise. Upon such surrender as aforesaid, the Warrantholder shall be deemed for all purposes to be the holder of record of the number of Common Shares as calculated in accordance with the table below, which Common Shares will be deemed issued upon exercise and the Warrantholder shall be entitled to delivery of a certificate or certificates representing such Common Shares and the Corporation shall cause such certificate or certificates to be delivered to the Warrantholder at the address specified in the subscription form within five (5) business days after such surrender and payment as aforesaid. No fractional Shares will be issuable upon any exercise of this Warrant and the Warrantholder will not be entitled to any cash payment or compensation in lieu of a fractional Common Share.

CASHLESS EXERCISE

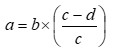

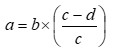

If this Warrant is exercised through a "cashless exercise", the Corporation shall issue to the undersigned the net number of Common Shares determined as follows:

where:

a = the net Common Shares to be issued to the undersigned;

b = the number of Common Shares in respect of which the Warrant is being exercised;

c = the Current Market Price; and

d = the Exercise Price of this Warrant.

For purposes hereof, "Current Market Price" has the meaning set forth in Section 6.1(b).

2. Partial Exercise

2.1 The Warrantholder may from time to time subscribe for and purchase any lesser number of Common Shares than the number of Common Shares expressed in this Warrant Certificate. In the event that the Warrantholder subscribes for and purchases any such lesser number of Common Shares prior to the Expiry Time, the Warrantholder shall be entitled to receive a replacement certificate representing the unexercised balance of the Warrants.

3. Piggyback Offering Rights

3.1 Grant of Right. In the event that there is not an qualified offering statement covering the Warrants or the underlying Common Shares, whenever the Corporation proposes to register or qualify any of its Common Shares under the U.S. Securities Act after the date hereof (other than (i) a registration effected solely to implement an employee benefit plan or a transaction to which Rule 145 under the U.S. Securities Act is applicable, or (ii) a registration or offering statement on Form S-4, S-8 or any successor form thereto or another form not available for registering the Common Shares issuable upon exercise of these Warrants) for sale to the public, whether for its own account or for the account of one or more shareholders of the Corporation (a “Piggyback Offering”), the Corporation shall give prompt written notice (in any event no later than ten (10) business days prior to the filing of such registration or offering statement ) to the Warrantholder of the Corporation’s intention to effect such a registration or qualification and, subject to the remaining provisions of this Section 3, shall include in such registration or qualification such number of Common Shares underlying these Warrants (the “Registrable Securities”) that the Warrantholder and any other holder of these duly transferred Warrants pursuant to Section 12 or other holders of interests in or represented by these Warrants as otherwise permitted by these Warrants (collectively, the “Warrantholders”) have (within ten (10) business days of the respective Warrantholder’s receipt of such notice) requested in writing (including such number) to be included within such registration or qualification. If a Piggyback Offering is an underwritten offering and the managing underwriter advises the Corporation that it has determined in good faith that marketing factors require a limit on the number of Common Shares to be included in such registration, including all Common Shares issuable upon exercise of these Warrants (if the Warrantholder has elected to include such shares in such Piggyback Offering) and all other Common Shares proposed to be included in such underwritten offering, the Corporation shall include in such registration or qualification (i) first, the number of Common Shares that the Corporation proposes to issue and sell pursuant to such underwritten offering and (ii) second, the number of Common Shares, if any, requested to be included therein by selling shareholders (including the Warrantholders) allocated pro rata among all such persons on the basis of the number of Common Shares then owned by each such person. If any Piggyback Offering is initiated as a primary underwritten offering on behalf of the Corporation, the Corporation shall select the investment banking firm or firms to act as the managing underwriter or underwriters in connection with such offering. Notwithstanding anything to the contrary, the obligations of the Corporation pursuant to this Section 3 shall terminate on the earlier of (i) the fifth anniversary of the Effective Date and (ii) the date that Rule 144 would allow the Warrantholder to sell its Registrable Securities (assuming a cashless exercise of these Warrant) during any ninety (90) day period, and shall not be applicable so long as the Corporation’s Offering Statement on Form 1-A covering the Registrable Securities remains qualified at such time. The duration of the Piggyback Offering right shall not exceed seven years from the commencement of sales of the public offering.

3.2 Indemnification. The Corporation shall indemnify the Warrantholder(s) of the Registrable Securities to be sold pursuant to any registration or offering statement hereunder and each person, if any, who controls such Warrantholders within the meaning of Section 15 of the Act or Section 20(a) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), against all loss, claim, damage, expense or liability (including all reasonable attorneys’ fees and other out-of-pocket expenses reasonably incurred in investigating, preparing or defending against any claim whatsoever) to which any of them may become subject under the U.S. Securities Act, the Exchange Act or otherwise, arising from such registration or offering statement but only to the same extent and with the same effect as the provisions pursuant to which the Corporation has agreed to indemnify Digital Offering contained in the Engagement Agreement between Digital Offering and the Corporation, dated as of October 27, 2023. Warrantholder(s) of the Registrable Securities to be sold pursuant to such registration or offering statement, and their successors and assigns, shall severally, and not jointly, indemnify the Corporation, against all loss, claim, damage, expense or liability (including all reasonable attorneys’ fees and other expenses reasonably incurred in investigating, preparing or defending against any claim whatsoever) to which they may become subject under the U.S. Securities Act, the Exchange Act or otherwise, arising from information furnished by or on behalf of such Warrantholders, or their successors or assigns, in writing, for specific inclusion in such registration or offering statement to the same extent and with the same effect as the provisions contained in the Engagement Agreement pursuant to which Digital Offering has agreed to indemnify the Corporation.

3.3 Exercise of Warrants. Nothing contained in this Warrant Certificate shall be construed as requiring the Warrantholder(s) to exercise their Warrants prior to or after the initial filing of any registration or offering statement or the effectiveness or qualification thereof.

3.4 Documents Delivered to Warrantholders. The Corporation shall deliver promptly to each Warrantholder participating in the offering requesting the correspondence and memoranda described below, copies of all correspondence between the Commission and the Corporation, its counsel or auditors and all memoranda relating to discussions with the Commission or its staff with respect to the registration or offering statement and permit each Warrantholder and underwriter to do such investigation, upon reasonable advance notice, with respect to information contained in or omitted from the registration or offering statement as it deems reasonably necessary to comply with applicable securities laws or rules of FINRA. Such investigation shall include access to books, records and properties and opportunities to discuss the business of the Corporation with its officers and independent auditors, all to such reasonable extent and at such reasonable times, during normal business hours, as any such Warrantholder shall reasonably request.

3.5 Underwriting Agreement. The Warrantholders shall be parties to any Underwriting Agreement relating to a Piggyback Offering. Such Holders shall not be required to make any representations or warranties to or agreements with the Corporation or the underwriters except as they may relate to such Warrantholders, their Common Shares and the amount and nature of their ownership thereof and their intended methods of distribution.

3.6 Documents to be Delivered by Warrantholder(s). Each of the Warrantholder(s) participating in any of the foregoing offerings shall furnish to the Corporation a completed and executed questionnaire provided by the Corporation requesting information customarily sought of selling security holders.

3.7 Damages. Should the Corporation fail to comply with such provisions, the Warrantolder(s) shall, in addition to any other legal or other relief available to the Warrantholder(s), be entitled to obtain specific performance or other equitable (including injunctive) relief against the threatened breach of such provisions or the continuation of any such breach, without the necessity of proving actual damages and without the necessity of posting bond or other security.

4. Not a Shareholder

4.1 The holding of the Warrants shall not constitute the Warrantholder a shareholder of the Corporation nor entitle the Warrantholder to any right or interest in respect thereof except as expressly provided in this Warrant Certificate.

5. Covenants and Representations

5.1 The Corporation hereby represents and warrants that it is authorized to issue and that it will cause the Common Shares from time to time subscribed for and purchased in the manner provided in this Warrant Certificate and the certificate representing such Common Shares to be issued and that, at all times prior to the Expiry Time, it will reserve and there will remain unissued a sufficient number of Common Shares to satisfy the right of purchase provided in this Warrant Certificate. All Common Shares which are issued upon the exercise of the right of purchase provided in this Warrant Certificate, upon payment therefor of the amount at which such Common Shares may be purchased pursuant to the provisions of this Warrant Certificate, shall be and be deemed to be fully paid and non-assessable shares and free from all taxes, liens and charges with respect to the issue thereof. The Corporation hereby represents and warrants that this Warrant Certificate is a valid and enforceable obligation of the Corporation, enforceable in accordance with the provisions of this Warrant Certificate. The Corporation hereby represents and warrants that it will at all times prior to the Expiry Time of any Warrants hereunder maintain its existence, will carry on and conduct its business in a prudent manner in accordance with industry standards and good business practice, and will keep or cause to be kept proper books of account in accordance with applicable law.

6. Anti-Dilution Protection:

6.1 Definitions: For the purposes of this section 5, unless there is something in the subject matter or context inconsistent therewith, the words and terms defined below shall have the respective meanings specified therefor in this subsection 6.1:

(a) "Adjustment Period" means the period commencing on November 21, 2022 and ending at the Expiry Time;

(b) "Current Market Price" of the Corporation's Common Shares at any date means, if the Common Shares are traded on a stock exchange or in the over-the-counter market, the price per share equal to the weighted average price at which the Common Shares have traded in the over-the-counter market, during the period of any 20 consecutive trading days ending not more than five business days before such date; provided that the weighted average price shall be determined by dividing the aggregate sale price of all Common Shares sold on the said exchange or market, as the case may be, during such 20 consecutive trading days by the total number of Common Shares so sold; and provided further that if the Common Shares are not then traded on a stock exchange or in the over-the-counter market, then the Current Market Price shall be determined by such firm of independent chartered accountants as may be selected by the directors of the Corporation;

(c) "director" means a director of the Corporation for the time being and, unless otherwise specified herein, a reference to action "by the directors" means action by the directors of the Corporation as a board or, whenever empowered, action by any committee of the directors of the Corporation; and

(d) "trading day" with respect to a stock exchange or over-the-counter market means a day on which such stock exchange or market is open for business.

6.2 Adjustments: The Exercise Price and the number of Common Shares issuable to the Warrantholder pursuant to this Warrant Certificate shall be subject to adjustment from time to time in the events and in the manner provided as follows:

(a) If at any time during the Adjustment Period the Corporation shall:

(i) fix a record date for the issue of, or issue, Common Shares to the holders of all or substantially all of the outstanding Common Shares by way of a stock dividend;

(ii) fix a record date for the distribution to, or make a distribution to, the holders of all or substantially all of the outstanding Common Shares payable in Common Shares or securities exchangeable for or convertible into Common Shares;

(iii) subdivide the outstanding Common Shares into a greater number of Common Shares; or

(iv) consolidate the outstanding Common Shares into a lesser number of Common Shares;

(any of such events in subclauses 6.2(a)(i), 6.2(a)(ii), 6.2(a)(iii) and 6.2(a)(iv) above being herein called a "Share Reorganization"), the Exercise Price shall be adjusted on the earlier of the record date on which holders of Common Shares are determined for the purposes of the Share Reorganization and the effective date of the Share Reorganization to the amount determined by multiplying the Exercise Price in effect immediately prior to such record date or effective date, as the case may be, by a fraction:

(A) the numerator of which shall be the number of Common Shares outstanding on such record date or effective date, as the case may be, before giving effect to such Share Reorganization; and

(B) the denominator of which shall be the number of Common Shares which will be outstanding immediately after giving effect to such Share Reorganization (including in the case of a distribution of securities exchangeable for or convertible into Common Shares the number of Common Shares that would have been outstanding had such securities been exchanged for or converted into Common Shares on such date).

To the extent that any adjustment in the Exercise Price occurs pursuant to this clause 6.2(a) as a result of the fixing by the Corporation of a record date for the distribution of securities exchangeable for or convertible into Common Shares, the Exercise Price shall be readjusted immediately after the expiry of any relevant exchange or conversion right to the Exercise Price which would then be in effect based upon the number of Common Shares actually issued and remaining issuable after such expiry and shall be further readjusted in such manner upon the expiry of any further such right. If the Warrantholder has not exercised its right to subscribe for and purchase Common Shares on or prior to the record date of such stock dividend or distribution or the effective date of such subdivision or consolidation, as the case may be, upon the exercise of such right thereafter shall be entitled to receive and shall accept in lieu of the number of Common Shares then subscribed for and purchased by the Warrantholder, at the Exercise Price determined in accordance with this clause 6.2(a) the aggregate number of Common Shares that the Warrantholder would have been entitled to receive as a result of such Share Reorganization, if, on such record date or effective date, as the case may be, the Warrantholder had been the holder of record of the number of Common Shares so subscribed for and purchased.

(b) If at any time during the Adjustment Period the Corporation shall fix a record date for the issue or distribution to the holders of all or substantially all of the outstanding Common Shares of rights, options or warrants pursuant to which such holders are entitled, during a period expiring not more than 45 days after the record date for such issue (such period being the "Rights Period"), to subscribe for or purchase Common Shares or securities exchangeable for or convertible into Common Shares at a price per share to the holder (or in the case of securities exchangeable for or convertible into Common Shares, at an exchange or conversion price per share) at the date of issue of such securities of less than 95% of the Current Market Price of the Common Shares on such record date (any of such events being called a "Rights Offering"), the Exercise Price shall be adjusted effective immediately after the record date for such Rights Offering to the amount determined by multiplying the Exercise Price in effect on such record date by a fraction:

(i) the numerator of which shall be the aggregate of:

(A) the number of Common Shares outstanding on the record date for the Rights Offering; and

(B) the quotient determined by dividing:

(I) either (a) the product of the number of Common Shares offered during the Rights Period pursuant to the Rights Offering and the price at which such Common Shares are offered, or, (b) the product of the exchange, exercise or conversion price of the securities so offered and the number of Common Shares for or into which the securities offered pursuant to the Rights Offering may be exchanged, exercised or converted, as the case may be; by

(II) the Current Market Price of the Common Shares as of the record date for the Rights Offering; and

(ii) the denominator of which shall be the aggregate of the number of Common Shares outstanding on such record date and the number of Common Shares offered pursuant to the Rights Offering (including in the case of the issue or distribution of securities exchangeable or exercisable for or convertible into Common Shares the number of Common Shares into which such securities may be exchanged, exercised or converted).

If by the terms of the rights, options, or warrants referred to in this clause 6.2(b), there is more than one purchase, conversion or exchange price per Common Share, the aggregate price of the total number of additional Common Shares offered for subscription or purchase, or the aggregate conversion or exchange price of the convertible or exchangeable securities so offered, shall be calculated for purposes of the adjustment on the basis of the lowest purchase, conversion or exchange price per Common Share, as the case may be. Any Common Shares owned by or held for the account of the Corporation shall be deemed not to be outstanding for the purpose of any such calculation. To the extent that any adjustment in the Exercise Price occurs pursuant to this clause 6.2(b) as a result of the fixing by the Corporation of a record date for the issue or distribution of rights, options or warrants referred to in this clause 6.2(b), the Exercise Price shall be readjusted immediately after the expiry of any relevant exchange, conversion or exercise right to the Exercise Price which would then be in effect based upon the number of Common Shares actually issued and remaining issuable after such expiry and shall be further readjusted in such manner upon the expiry of any further such right.

(c) If at any time during the Adjustment Period the Corporation shall fix a record date for the issue or distribution to the holders of all or substantially all of the Common Shares of:

(i) shares of the Corporation of any class other than Common Shares;

(ii) rights, options or warrants to acquire Common Shares or securities exchangeable or exercisable for or convertible into Common Shares (other than rights, options or warrants pursuant to which holders of Common Shares are entitled, during a period expiring not more than 45 days after the record date for such issue, to subscribe for or purchase Common Shares or securities exchangeable for or convertible into Common Shares at a price per share (or in the case of securities exchangeable or exercisable for or convertible into Common Shares at an exchange, exercise or conversion price per share on the record date for the issue of such securities) of at least 95% of the Current Market Price of the Common Shares on such record date);

(iii) evidences of indebtedness of the Corporation; or

(iv) any property or assets of the Corporation;

and if such issue or distribution does not constitute a Share Reorganization or a Rights Offering (any of such non-excluded events being herein called a "Special Distribution"), the Exercise Price shall be adjusted effective immediately after the record date for the Special Distribution to the amount determined by multiplying the Exercise Price in effect on the record date for the Special Distribution by a fraction:

(A) the numerator of which shall be the difference between:

(I) the product of the number of Common Shares outstanding on such record date and the Current Market Price of the Common Shares on such record date; and

(II) the fair value, as determined by a recognized independent firm of valuators, to the holders of Common Shares of the shares, rights, options, warrants, evidences of indebtedness or property or assets to be issued or distributed in the Special Distribution; and

(B) the denominator of which shall be the product obtained by multiplying the number of Common Shares outstanding on such record date by the Current Market Price of the Common Shares on such record date.

Any Common Shares owned by or held for the account of the Corporation shall be deemed not to be outstanding for the purpose of such calculation. To the extent that any adjustment in the Exercise Price occurs pursuant to this clause 6.2(c) as a result of the fixing by the Corporation of a record date for the issue or distribution of rights, options or warrants to acquire Common Shares or securities exchangeable or exercisable for or convertible into Common Shares referred to in this clause 6.2(c), the Exercise Price shall be readjusted immediately after the expiry of any relevant exchange, exercise or conversion right to the amount which would then be in effect if the current market value of the Common Shares had been determined on the basis of the number of Common Shares issued and remaining issuable immediately after such expiry, and shall be further readjusted in such manner upon the expiry of any further such right.

(d) If at any time during the Adjustment Period there shall occur:

(i) a reclassification or redesignation of the Common Shares, any change of the Common Shares into other shares or securities or any other capital reorganization involving the Common Shares other than a Share Reorganization;

(ii) a consolidation, amalgamation or merger of the Corporation with or into any other body corporate which results in a reclassification or redesignation of the Common Shares or a change of the Common Shares into other shares or securities; or

(iii) the transfer of the undertaking or assets of the Corporation as an entirety or substantially as an entirety to another corporation or entity;

(any of such events being herein called a "Capital Reorganization"), after the effective date of the Capital Reorganization:

(iv) the Warrantholder shall be entitled to receive, and shall accept, for the same aggregate consideration, upon exercise of this Warrant, in lieu of the number of Common Shares which the Warrantholder was theretofore entitled to purchase or receive upon the exercise of this Warrant, the kind and aggregate number of shares and other securities or property resulting from the Capital Reorganization which the Warrantholder would have been entitled to receive as a result of the Capital Reorganization if, on the effective date thereof, the Warrantholder had been the registered holder of the number of Common Shares to which the Warrantholder was theretofore entitled to purchase or receive upon the exercise of this Warrant; and

(v) the Exercise Price shall, on the effective date of the Capital Reorganization, be adjusted by multiplying the Exercise Price in effect immediately prior to such Capital Reorganization by the number of Common Shares purchasable pursuant to this Warrant Certificate immediately prior to the Capital Reorganization, and dividing the product thereof by the number of successor securities determined in Section 6.2(d)(iv) above.

(e) If necessary, as a result of any Capital Reorganization, appropriate adjustments shall be made in the application of the provisions of this Warrant Certificate with respect to the rights and interest thereafter of the Warrantholder to the end that the provisions of this Warrant Certificate shall thereafter correspondingly be made applicable as nearly as may reasonably be possible in relation to any shares or other securities or property thereafter deliverable upon the exercise of this Warrant.

(f) If at any time during the Adjustment Period any adjustment or readjustment in the Exercise Price shall occur pursuant to the provisions of clauses 6.2(a), 6.2(b) or 6.2(c) hereof, then the number of Common Shares purchasable upon the subsequent exercise of this Warrant shall be simultaneously adjusted or readjusted, as the case may be, by multiplying the number of Common Shares purchasable upon the exercise of this Warrant immediately prior to such adjustment or readjustment by a fraction which shall be the reciprocal of the fraction used in the adjustment or readjustment of the Exercise Price.

6.3 Rules: The following rules and procedures shall be applicable to adjustments made pursuant to subsection 6.2 hereof.

(a) Subject to the following provisions of this subsection 6.3, any adjustment made pursuant to subsection 6.2 hereof shall be made successively whenever an event referred to therein shall occur.

(b) No adjustment in the Exercise Price shall be required unless such adjustment would result in a change of at least one per cent in the then Exercise Price and no adjustment shall be made in the number of Common Shares purchasable or issuable on the exercise of this Warrant unless it would result in a change of at least one one-hundredth of a Common Share; provided, however, that any adjustments which except for the provision of this clause 6.3(b) would otherwise have been required to be made shall be carried forward and taken into account in any subsequent adjustment. Notwithstanding any other provision of subsection 6.2 hereof, no adjustment of the Exercise Price shall be made which would result in an increase in the Exercise Price or a decrease in the number of Common Shares issuable upon the exercise of this Warrant (except in respect of the Share Reorganization described in subclause 6.2(a)(iv) hereof or a Capital Reorganization described in subclause 6.2(d)(ii) hereof).

(c) No adjustment in the Exercise Price or in the number or kind of securities purchasable upon the exercise of this Warrant shall be made in respect of any event described in section 6 hereof if the Warrantholder is entitled to participate in such event on the same terms mutatis mutandis as if the Warrantholder had exercised this Warrant prior to or on the record date or effective date, as the case may be, of such event.

(d) No adjustment in the Exercise Price or in the number of Common Shares purchasable upon the exercise of this Warrant shall be made pursuant to subsection 6.2 hereof in respect of the issue from time to time of Common Shares pursuant to this Warrant Certificate or pursuant to any stock option, stock purchase or stock bonus plan in effect from time to time for directors, officers or employees of the Corporation and/or any subsidiary of the Corporation and any such issue, and any grant of options in connection therewith, shall be deemed not to be a Share Reorganization, a Rights Offering nor any other event described in subsection 6.2 hereof.

(e) If at any time during the Adjustment Period the Corporation shall take any action affecting the Common Shares, other than an action described in subsection 6.2 hereof, which in the opinion of the directors would have a material adverse effect upon the rights of the Warrantholder, either or both the Exercise Price and the number of Common Shares purchasable upon exercise of this Warrant shall be adjusted in such manner and at such time by action by the directors, in their sole discretion, as may be equitable in the circumstances. Failure of the taking of action by the directors so as to provide for an adjustment prior to the effective date of any action by the Corporation affecting the Common Shares shall be deemed to be conclusive evidence that the directors have determined that it is equitable to make no adjustment in the circumstances.

(f) If the Corporation shall set a record date to determine holders of Common Shares for the purpose of entitling such holders to receive any dividend or distribution or any subscription or purchase rights and shall, thereafter and before the distribution to such holders of any such dividend, distribution or subscription or purchase rights, legally abandon its plan to pay or deliver such dividend, distribution or subscription or purchase rights, then no adjustment in the Exercise Price or the number of Common Shares purchasable upon exercise of this Warrant shall be required by reason of the setting of such record date.

(g) In any case in which this Warrant shall require that an adjustment shall become effective immediately after a record date for an event referred to in subsection 6.2 hereof, the Corporation may defer, until the occurrence of such event:

(i) issuing to the Warrantholder, to the extent that this Warrant is exercised after such record date and before the occurrence of such event, the additional Common Shares issuable upon such exercise by reason of the adjustment required by such event; and

(ii) delivering to the Warrantholder any distribution declared with respect to such additional Common Shares after such record date and before such event;

provided, however, that the Corporation shall deliver to the Warrantholder an appropriate instrument evidencing the right of the Warrantholder, upon the occurrence of the event requiring the adjustment, to an adjustment in the Exercise Price and the number of Common Shares purchasable upon the exercise of this Warrant and to such distribution declared with respect to any such additional Common Shares issuable on this exercise of this Warrant.

(h) In the absence of a resolution of the directors fixing a record date for a Rights Offering, the Corporation shall be deemed to have fixed as the record date therefor the date of the issue of the rights, options or warrants issued pursuant to the Rights Offering.

(i) If a dispute shall at any time arise with respect to adjustments of the Exercise Price or the number of Common Shares purchasable upon the exercise of this Warrant, such disputes shall be conclusively determined by the auditors of the Corporation or if they are unable or unwilling to act, by such other firm of independent chartered accountants as may be selected by the directors and any such determination shall be conclusive evidence of the correctness of any adjustment made pursuant to subsection 6.2 hereof and shall be binding upon the Corporation and the Warrantholder.

(j) As a condition precedent to the taking of any action which would require an adjustment pursuant to subsection 6.2 hereof, including the Exercise Price and the number or class of Common Shares or other securities which are to be received upon the exercise thereof, the Corporation shall take any action which may, in the opinion of counsel to the Corporation, be necessary in order that the Corporation may validly and legally issue as fully paid and non-assessable shares all of the Common Shares or other securities which the Warrantholder is entitled to receive in accordance with the provisions of this Warrant Certificate.

6.4 Notice: At least 21 days prior to any record date or effective date, as the case may be, for any event which requires or might require an adjustment in any of the rights of the Warrantholder under this Warrant, including the Exercise Price and the number of Common Shares which are purchasable under this Warrant, the Corporation shall deliver to the Warrantholder a certificate of the Corporation specifying the particulars of such event and, if determinable, the required adjustment and the calculation of such adjustment. In case any adjustment for which a notice in this subsection 6.4 has been given is not then determinable, the Corporation shall promptly after such adjustment is determinable deliver to the Warrantholder a certificate providing the calculation of such adjustment. The Corporation hereby covenants and agrees that the register of transfers and transfer books for the Common Shares will be open, and that the Corporation will not take any action which might deprive the Warrantholder of the opportunity of exercising the rights of subscription contained in this Warrant Certificate, during such 21 day period.

7. Further Assurances

The Corporation hereby covenants and agrees that it will do, execute, acknowledge and deliver, or cause to be done, executed, acknowledged and delivered, all and every such other act, deed and assurance as the Warrantholder shall reasonably require for the better accomplishing and effectuating of the intentions and provisions of this Warrant Certificate.

8. Time of Essence

Time is of the essence of this Warrant Certificate.

9. Governing Laws

This Warrant Certificate shall be construed in accordance with the laws of the State of Delaware. In the event that any dispute shall occur between the parties arising out of or resulting from the construction, interpretation, enforcement or any other aspect of this Certificate, the parties hereby irrevocably and unconditionally submit to the jurisdiction of the state courts of Delaware and to the jurisdiction of the United States District Court for the District of Delaware for the purpose of any suit, action or other proceeding arising out of or based upon this Warrant.

10. Notices

All notices or other communications to be given under this Warrant Certificate shall be delivered by hand, by telecopier, or by email and, if delivered by hand, shall be deemed to have been given on the delivery date and, if sent by telecopier or email, on the date of transmission if sent before 4:00 p.m. on a business day or, if such day is not a business day, on the first business day following the date of transmission.

Notices to the Corporation shall be addressed to:

Starfighters Space, Inc.

Reusable Launch Vehicle Hangar, Hangar Rd.

Cape Canaveral, FL 32920

Attention: David Whitney, CFO

Email: dwhitney@starfightersspace.com

The Corporation or the Warrantholder may change its address for service by notice in writing to the other of them specifying its new address for service under this Warrant Certificate.

11. Legends on Common Shares and Resales of Common Shares

11.1 The Warrants and the Common Shares to be issued upon its exercise have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or the securities laws of any state of the United States, and are being offered and sold in reliance on exemptions from the registration requirements of the U.S. Securities Act and applicable state securities laws. Although an offering circular on Form 1-A for a Tier II offering has been filed and qualified with the SEC, which offering statement does not include the same information that would be included in a registration statement under the U.S. Securities Act.

Each certificate for Common Shares purchased under these Warrants shall bear a legend as follows unless such Common Shares have been registered under the U.S. Securities Act:

"THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "U.S. SECURITIES ACT") OR APPLICABLE STATE SECURITIES LAWS. NEITHER THE SECURITIES NOR ANY INTEREST THEREIN MAY BE OFFERED FOR SALE, SOLD OR OTHERWISE TRANSFERRED EXCEPT PURUSANT TO AN EFFECTIVE REGISTRATION OR OFFERING STATEMENT UNDER THE U.S. SECURITIES ACT, OR PURSUANT TO AN EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS, WHICH IN THE OPINION OF COUNSEL TO THE COMPANY, IS AVAILABLE."

11.2 Warrantholder and the Corporation acknowledge that as of the date hereof the Staff of the Division of Corporation Finance of the SEC has published Compliance & Disclosure Interpretation 528.04 in the Securities Act Rules section thereof, stating that the holder of securities issued in connection with a public offering may not rely upon Rule 144 promulgated under the U.S. Securities Act to establish an exemption from registration requirements under Section 4(a)(1) under the Act, but may nonetheless apply Rule 144 constructively for the resale of such shares in the following manner: (a) provided that six months has elapsed since the last sale under the registration or offering statement, an underwriter or finder may resell the securities in accordance with the provisions of Rule 144(c), (e), and (f), except for the notice requirement; (b) a purchaser of the shares from an underwriter receives restricted securities unless the sale is made with an appropriate, current prospectus, or unless the sale is made pursuant to the conditions contained in (a) above; (c) a purchaser of the shares from an underwriter who receives restricted securities may include the underwriter's holding period, provided that the underwriter or finder is not an affiliate of the issuer; and (d) if an underwriter transfers the shares to its employees, the employees may tack the firm's holding period for purposes of Rule 144(d), but they must aggregate sales of the distributed shares with those of other employees, as well as those of the underwriter or finder, for a six-month period from the date of the transfer to the employees. Warrantholder and the Corporation also acknowledge that the Staff of the Division of Corporation Finance of the SEC has advised in various no-action letters that the holding period associated with securities issued without registration to a service provider commences upon the completion of the services, which the Corporation agrees and acknowledges shall be the final closing of the Offering, and that Rule 144(d)(3)(ii) provides that securities acquired from the issuer solely in exchange for other securities of the same issuer shall be deemed to have been acquired at the same time as the securities surrendered for conversion (which the Corporation agrees is the date of the initial issuance of these Warrants). In the event that following a reasonably-timed written request by Warrantholder to transfer the Common Shares in accordance with Compliance & Disclosure Interpretation 528.04 counsel for the Corporation in good faith concludes that Compliance & Disclosure Interpretation 528.04 no longer may be relied upon as a result of changes in applicable laws, regulations, or interpretations of the SEC Division of Corporation Finance, or as a result of judicial interpretations not known by the Corporation or its counsel on the date hereof, then the Corporation shall promptly, and in any event within five (5) business days following the request, provide written notice to Warrantholder of such determination. As a condition to giving such notice, the parties shall negotiate in good faith a single demand registration right pursuant to an agreement in customary form reasonably acceptable to the parties; provided that notwithstanding anything to the contrary, the obligations of the Corporation pursuant to this Section 10.2 shall terminate on the fifth anniversary of the Effective Date. In the absence of such conclusion by counsel for the Corporation, the Corporation shall, upon such a request of Warrantholder given no earlier than six months after the final closing of the Offering, instruct its transfer agent to permit the transfer of such shares in accordance with Compliance & Disclosure Interpretation 528.04, provided that Warrantholder has provided such documentation as shall be reasonably be requested by the Corporation to establish compliance with the conditions of Compliance & Disclosure Interpretation 528.04. Notwithstanding anything to the contrary, pursuant to FINRA Rule 5110(g)(8)(B)-(D), Warrantholder shall not be entitled to more than one demand registration right hereunder and the duration of the registration rights hereunder shall not exceed five years from the Effective Date.

12. Transfer

12.1 The registered Warrantholder of these Warrants agrees by his, her or its acceptance hereof, that such Warrantholder will not for a period of one hundred eighty (180) days following the Effective Date: (a) sell, transfer, assign, pledge or hypothecate these Warrants to anyone other than: (i) Digital Offering or an underwriter, placement agent, or a selected dealer participating in the Offering, or (ii) a bona fide officer, partner or registered representative of Digital Offering or of any such underwriter, placement agent or selected dealer, in each case in accordance with FINRA Corporate Financing Rule 5110(e)(1), or (b) cause these Warrants or the securities issuable hereunder to be the subject of any hedging, short sale, derivative, put or call transaction that would result in the effective economic disposition of this Purchase Warrant or the securities hereunder, except as provided for in FINRA Rule 5110(e)(2). After 180 days after the Effective Date, transfers to others may be made subject to compliance with or exemptions from applicable securities laws. In order to make any permitted assignment, Warrantholder must deliver to the Company the assignment form attached hereto duly executed and completed, together with the Warrants and payment of all transfer taxes, if any, payable in connection therewith. The Corporation shall within five (5) Business Days transfer these Warrants on the books of the Corporation and shall execute and deliver a new Warrant Certificate representing the Warrants of like tenor to the appropriate assignee(s) expressly evidencing the right to purchase the aggregate number of Common Shares purchasable hereunder or such portion of such number as shall be contemplated by any such assignment.

12.2 The securities evidenced by these Warrants shall not be transferred unless and until: (i) if required by applicable law, the Warrantholder has delivered to the Corporation an opinion of counsel, of recognized standing reasonably satisfactory to the Corporation, that the securities may be transferred pursuant to an exemption from registration under the U.S. Securities Act and applicable state securities laws, or (ii) a offering statement or a post-qualification amendment to the offering Statement relating to the offer and sale of such securities has been filed by the Corporation and declared qualified by the SEC and compliance with applicable state securities law has been established.

13. Lost Certificate

13.1 If this Warrant Certificate or any replacement hereof becomes stolen, lost, mutilated or destroyed, the Corporation shall, on such terms as it may in its discretion impose, acting reasonably, issue and deliver a new certificate, in form identical hereto but with appropriate changes, representing any unexercised portion of the subscription rights represented hereby to replace the certificate so stolen, lost, mutilated or destroyed.

14. Language

14.1 The parties hereto acknowledge and confirm that they have requested that this Warrant Certificate as well as all notices and other documents contemplated hereby be drawn up in the English language. Les parties aux présentes reconnaissent et confirment qu'elles ont exigé que la présente convention ainsi que tous les avis et documents qui s'y rattachent soient rédigés dans la langue anglaise.

15. Successors and Assigns

15.1 This Warrant Certificate shall enure to the benefit of the Warrantholder and the successors and assignees thereof and shall be binding upon the Corporation and the successors thereof.

IN WITNESS WHEREOF, the Corporation has caused this Warrant Certificate to be signed by an authorized officer as of the [*] day of [*], 2024.

STARFIGHTERS SPACE, INC.

Per: ________________________________________

Rick Svetkoff, CEO

Schedule A

SUBSCRIPTION FORM

To: Starfighters Space, Inc.

The undersigned hereby subscribes for ____________ shares of common stock ("Common Shares") of Starfighters Space, Inc. (the "Corporation") (or such other number of Common Shares or other securities to which such subscription entitles the undersigned in lieu thereof or in addition thereto) pursuant to the provisions of the warrant certificate (the "Warrant Certificate") dated as of the [*] day of [*], 2024 issued by the Corporation to the Warrantholder (as defined in the Warrant Certificate) at the purchase price of US$3.59 per Common Share if exercised on or before 5:00 p.m. (Pacific time) on [*], 2029, (or at such other purchase price as may then be in effect under the provisions of the Warrant Certificate) and on and subject to the other terms and conditions specified in the Warrant.

The Warrant Holder hereby elects to exercise the Warrant as follows:

A. Cash Exercise ☐ [Check box as applicable]

The undersigned hereby tenders a certificate check or bank draft for such aggregate purchase price, and directs such Common Shares to be registered and a certificate therefore to be issued as directed below.

Or

B. Cashless Exercise ☐ [Check box as applicable]

The undersigned elects to complete a cashless exercise of the Warrants and agrees to the cancellation of that number of Warrants as is necessary, in accordance with the formula set forth in Warrant Certificate, to exercise the Warrants with respect to the number of Common Shares being purchased by means of a cashless exercise (the "Cashless Exercise Method").

The undersigned hereby directs that the Common Shares subscribed for be registered and delivered as follows:

| Name in Full | Address (include Postal/Zip Code) | Number of Common Shares |

| | | |

| | | |

If the Warrants are being exercised at a time when there is no effective registration statement or offering statement covering the Common Shares underlying the Warrants, then at the time of exercise hereunder, the undersigned Warrantholder represents, warrants and certifies as follows (check one):

(A) ☐ the undersigned Warrantholder at the time of exercise of the Warrant is not in the United States, is not a "U.S. person" as defined in Regulation S under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), and is not exercising the Warrant for the account or benefit of a U.S. person or a person in the United States (as defined in Regulation S), and did not execute or deliver this subscription form in the United States; OR

(B) ☐ the undersigned Warrantholder is resident in the United States, is a U.S. person, or is exercising the Warrant for the account or benefit of a U.S. person or a person in the United States (a "U.S. Holder"), and is an "accredited investor", as defined in Rule 501(a) of Regulation D under the U.S. Securities Act (a "U.S. Accredited Investor"), and has completed the U.S. Accredited Investor Status Certificate in the form attached to this subscription form; OR

(C) ☐ if the undersigned Warrantholder is a U.S. Holder, the undersigned Warrantholder has delivered to the Corporation and the Corporation's transfer agent, if applicable, an opinion of counsel (which will not be sufficient unless it is in form and substance satisfactory to the Corporation) or such other evidence satisfactory to the Corporation to the effect that with respect to the common shares to be delivered upon exercise of the Warrant, the issuance of such securities has been registered under the U.S. Securities Act and applicable state securities laws, or an exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws is available.

"United States" and "U.S. person" are as defined in Rule 902 of Regulation S under the U.S. Securities Act ("Regulation S").

If the undersigned has checked box (A) immediately above the undersigned:

(a) agrees not to engage in hedging transactions with regard to the Common Shares prior to the expiration of the applicable distribution compliance period set forth in Rule 903(b)(3) of Regulation S;

(b) acknowledges that the Common Shares issuable upon exercise of the Warrants are "restricted securities" as defined in Rule 144 of the U.S. Securities Act, and upon the issuance thereof, and until such time as the same is no longer required under the applicable requirements of the U.S. Securities Act or applicable state securities laws and regulations, the certificates representing the Common Shares shall bear the applicable restrictive legends substantially in the forms set forth in sections 10.2 or 10.3 of the Warrant Certificate, as applicable;

(c) agrees not to resell the Common Shares except (i) pursuant to registration under the U.S. Securities Act and any applicable state securities laws, (ii) pursuant to an available exemption from registration under the U.S. Securities Act and any applicable state securities laws, or (iii) pursuant to the provisions of Regulation S of the U.S. Securities Act; and

(d) subject to compliance with the Corporation's constating documents and any other applicable agreements between the undersigned and the Corporation, the undersigned acknowledges that the Corporation shall refuse to register any transfer of the Common Shares not made in accordance with the provisions of Regulation S, pursuant to registration under the U.S. Securities Act and any applicable state securities laws, or pursuant to an available exemption from registration under the U.S. Securities Act and any applicable state securities laws.

Note: If the Warrants are being exercised at a time when there is no effective registration statement or offering statement covering the Common Shares underlying the Warrants, certificates representing Common Shares will not be registered or delivered to an address in the United States unless box (B) or (C) immediately above is checked.

If the undersigned Warrantholder has indicated that the undersigned Warrantholder is a U.S. Accredited Investor by marking box (B) above, the undersigned Warrantholder additionally represents and warrants to the Corporation that:

1 the undersigned Warrantholder has such knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of an investment in the Common Shares, and the undersigned is able to bear the economic risk of loss of his or her entire investment;

2. the undersigned is: (i) purchasing the Common Shares for his or her own account or for the account of one or more U.S. Accredited Investors with respect to which the undersigned is exercising sole investment discretion, and not on behalf of any other person; (ii) is purchasing the Common Shares for investment purposes only and not with a view to resale, distribution or other disposition in violation of United States federal or state securities laws; and (iii) in the case of the purchase by the undersigned of the Common Shares as agent or trustee for any other person or persons (each a "Beneficial Owner"), the undersigned Warrantholder has due and proper authority to act as agent or trustee for and on behalf of each such Beneficial Owner in connection with the transactions contemplated hereby; provided that: (x) if the undersigned Warrantholder, or any Beneficial Owner, is a corporation or a partnership, syndicate, trust or other form of unincorporated organization, the undersigned Warrantholder or each such Beneficial Owner was not incorporated or created solely, nor is it being used primarily to permit purchases without a prospectus or registration statement under applicable law; and (y) each Beneficial Owner, if any, is a U.S. Accredited Investor; and

3. the undersigned has not exercised the Warrants as a result of any form of general solicitation or general advertising (as such terms are used in Rule 502 of Regulation D under the U.S. Securities Act), including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media, or broadcast over radio, television, the Internet or other form of telecommunications, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising.

If the undersigned has indicated that the undersigned is a U.S. Accredited Investor by marking box (B) above, the undersigned also acknowledges and agrees that:

1. the Corporation has provided to the undersigned the opportunity to ask questions and receive answers concerning the terms and conditions of the offering, and the undersigned has had access to such information concerning the Corporation as the undersigned has considered necessary or appropriate in connection with the undersigned's investment decision to acquire the Common Shares;

2. if the undersigned decides to offer, sell or otherwise transfer any of the Common Shares, the undersigned must not, and will not, offer, sell or otherwise transfer any of such Common Shares directly or indirectly, unless:

(a) the sale is to the Corporation;

(b) the sale is made outside the United States in a transaction meeting the requirements of Rule 904 of Regulation S under the U.S. Securities Act and in compliance with applicable local laws and regulations;

(c) the sale is made pursuant to the exemption from the registration requirements under the U.S. Securities Act provided by Rule 144 thereunder, if available, and in accordance with any applicable state securities or "blue sky" laws; or

(d) the Common Shares are sold in a transaction that does not require registration under the U.S. Securities Act or any applicable state laws and regulations governing the offer and sale of securities,

and in the case of (c) and (d) above, it has prior to such sale furnished to the Corporation and the Corporation's registrar and transfer agent an opinion of counsel of recognized standing in form and substance reasonably satisfactory to the Corporation and the Corporation's registrar and transfer agent;

3. the Common Shares are "restricted securities" under applicable federal securities laws and that the U.S. Securities Act and the rules of the United States Securities and Exchange Commission provide in substance that the undersigned may dispose of the Common Shares only pursuant to an effective registration statement under the U.S. Securities Act or an exemption therefrom;

4. the Corporation has no obligation to register any of the Common Shares;

5. the certificates representing the Common Shares (and any certificates issued in exchange or substitution for the Common Shares) will bear a legend stating that such securities have not been registered under the U.S. Securities Act or the securities laws of any state of the United States, and may not be offered for sale or sold unless registered under the U.S. Securities Act and the securities laws of all applicable states of the United States, or unless an exemption from such registration requirements is available;

6. the legend may be removed by delivery to the Corporation's registrar and transfer agent and the Corporation of an opinion of counsel, of recognized standing reasonably satisfactory to the Corporation, that such legend is no longer required under applicable requirements of the U.S. Securities Act or state securities laws;

7. there may be material tax consequences to the undersigned of an acquisition or disposition of the Common Shares;

8. the Corporation gives no opinion and makes no representation with respect to the tax consequences to the undersigned under United States, state, local or foreign tax law of the undersigned's acquisition or disposition of any Common Shares;

9. funds representing the subscription price for the Common Shares which will be advanced by the undersigned to the Corporation upon exercise of the Warrants will not represent proceeds of crime for the purposes of the United States Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act (the "PATRIOT Act"), and the undersigned acknowledges that the Corporation may in the future be required by law to disclose the undersigned's name and other information relating to this exercise form and the undersigned's subscription hereunder, on a confidential basis, pursuant to the PATRIOT Act. No portion of the subscription price to be provided by the undersigned (i) has been or will be derived from or related to any activity that is deemed criminal under the laws of the United States of America, or any other jurisdiction, or (ii) is being tendered on behalf of a person or entity who has not been identified to or by the undersigned, and it shall promptly notify the Corporation if the undersigned discovers that any of such representations ceases to be true and provide the Corporation with appropriate information in connection therewith; and

10. the undersigned consents to the Corporation making a notation on its records or giving instructions to any transfer agent of the Corporation in order to implement the restrictions on transfer set forth and described in this subscription form or the Warrant Certificate.

In the absence of instructions to the contrary, the securities or other property will be issued in the name of or to the Warrantholder hereof and will be sent by first class mail to the last address of the Warrantholder appearing on the register maintained for the Warrants.

[Signature page follows]

DATED this _________ day of _______________, 20___.

In the presence of:

| | | |

| Signature of Witness | | Signature of Warrantholder |

| | | |

| | | |

| Witness's Name | | Name and Title of Authorized Signatory for the Warrantholder |

Please print below your name and address in full.

INSTRUCTIONS FOR SUBSCRIPTION

The signature to the subscription must correspond in every particular with the name written upon the face of the Warrant Certificate without alteration. If the certificates representing the Common Shares to be issued upon exercise of the Warrants differs from the registration of the Warrant Certificates the signature of the registered Warrantholder must be guaranteed by an authorized officer of a Canadian chartered bank, or of a major Canadian trust company, or by a medallion signature guarantee from a member recognized under the Signature Medallion Guarantee Program, or from a similar entity in the United States, if this transfer is executed in the United States, or in accordance with industry standards.

In the case of persons signing by agent or attorney or by personal representative(s), the authority of such agent, attorney or representative(s) to sign must be proven to the satisfaction of the Corporation.

If the Warrant Certificate and the form of subscription are being forwarded by mail, registered mail must be employed.

__________

U.S. ACCREDITED INVESTOR STATUS CERTIFICATE

In connection with the exercise of certain outstanding warrants of STARFIGHTERS SPACE, INC. (the "Company") by the Warrantholder, the Warrantholder hereby represents and warrants to the Company that the Warrantholder, and each beneficial owner (each a "Beneficial Owner"), if any, on whose behalf the Warrantholder is exercising such warrants, satisfies one or more of the following categories of Accredited Investor (please write "W/H" for the undersigned Warrantholder, and "B/O" for each beneficial owner, if any, on each line that applies):

_______ Category 1. A bank, as defined in Section 3(a)(2) of the U.S. Securities Act, whether acting in its individual or fiduciary capacity; or

_______ Category 2. A savings and loan association or other institution as defined in Section 3(a)(5)(A) of the U.S. Securities Act, whether acting in its individual or fiduciary capacity; or

_______ Category 3. A broker or dealer registered pursuant to Section 15 of the United States Securities Exchange Act of 1934, as amended; or

_______ Category 4. An investment adviser registered pursuant to section 203 of the Investment Advisers Act of 1940 or registered pursuant to the laws of a state; or

_______ Category 5. An investment adviser relying on the exemption from registering with the United States Securities and Exchange Commission (the "Commission") under section 203(l) or (m) of the Investment Advisers Act of 1940; or

_______ Category 6. An insurance company as defined in Section 2(a)(13) of the U.S. Securities Act; or

_______ Category 7. An investment company registered under the United States Investment Corporation Act of 1940; or

_______ Category 8. A business development company as defined in Section 2(a)(48) of the United States Investment Corporation Act of 1940; or

_______ Category 9. A small business investment company licensed by the U.S. Small Business Administration under Section 301 (c) or (d) of the United States Small Business Investment Act of 1958; or

_______ Category 10. A rural business investment company as defined in section 384A of the Consolidated Farm and Rural Development Act; or

_______ Category 11. A plan established and maintained by a state, its political subdivisions or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, with total assets in excess of US$5,000,000; or

_______ Category 12. An employee benefit plan within the meaning of the United States Employee Retirement Income Security Act of 1974 in which the investment decision is made by a plan fiduciary, as defined in Section 3(21) of such Act, which is either a bank, savings and loan association, insurance company or registered investment adviser, or an employee benefit plan with total assets in excess of US$5,000,000 or, if a self-directed plan, with investment decisions made solely by persons who are U.S. Accredited Investors; or

_______ Category 13. A private business development company as defined in Section 202(a)(22) of the United States Investment Advisers Act of 1940; or

_______ Category 14. An organization described in Section 501(c)(3) of the United States Internal Revenue Code of 1986, as amended, a corporation, a limited liability company, a Massachusetts or similar business trust, a partnership, or limited liability company, not formed for the specific purpose of acquiring the securities offered, with total assets in excess of US$5,000,000; or

_______ Category 15. Any director or executive officer of the Company; or

_______ Category 16. A natural person (including an IRA (Individual Retirement Account) owned by such person) whose individual net worth, or joint net worth with that person's spouse or spousal equivalent (being a cohabitant occupying a relationship generally equivalent to that of a spouse), excluding the value of that person's primary residence net of any mortgage obligation secured by the property, exceeds US$ 1,000,000 (note: for the purposes of calculating net worth: (i) the person's primary residence shall not be included as an asset; (ii) indebtedness that is secured by the person's primary residence, up to the estimated fair market value of the primary residence at the time of the sale of the securities, shall not be included as a liability (except that if the amount of such indebtedness outstanding at the time of the sale of the securities exceeds the amount outstanding 60 days before such time, other than as a result of the acquisition of the primary residence, the amount of such excess shall be included as a liability); (iii) indebtedness that is secured by the person's primary residence in excess of the estimated fair market value of the primary residence shall be included as a liability; (iv) for the purposes of calculating joint net worth of the person and that person's spouse or spousal equivalent, (A)joint net worth can be the aggregate net worth of the investor and spouse or spousal equivalent, and (B) assets need not be held jointly to be included in the calculation; and (v) reliance by the person and that person's spouse or spousal equivalent on the joint net worth standard does not require that the securities be purchased jointly); or

_______ Category 17. A natural person (including an IRA (Individual Retirement Account) owned by such person) who had an individual income in excess of US$200,000 in each of the two most recent years or joint income with that person's spouse or spousal equivalent in excess of US$300,000 in each of those years and has a reasonable expectation of reaching the same income level in the current year; or

_______ Category 18. A trust, with total assets in excess of US$5,000,000, not formed for the specific purpose of acquiring the securities offered, whose purchase is directed by a sophisticated person as described in Rule 506(b)(2)(ii) under the U.S. Securities Act; or

_______ Category 18a. A revocable trust which may be revoked or amended by its settlors (creators), each of whom is a U.S. Accredited Investor (note: if this category is selected, you must furnish a supplementary representation letter from each settlor confirming how such settlor qualifies as a U.S. Accredited Investor); or

_______ Category 19. Any entity in which all of the equity owners meet the requirements of at least one of the above categories.

If you checked Category 19, please indicate the name and category of U.S Accredited Investor (by reference to the applicable number in this section 2(e)) of each equity owner:

Name of Equity Owner | Category of U.S.

Accredited Investor |

| |

| |

| |

| |

Note: It is permissible to look through various forms of equity ownership to natural persons in determining the U.S. Accredited Investor status of entities under this category. If those natural persons are themselves U.S. Accredited Investors, and if all other equity owners of the entity seeking U.S. Accredited Investor status are U.S. Accredited Investors, then this category will be available.

_______ Category 20. An entity, of a type not listed in Categories 1-14, 18 or 19, not formed for the specific purpose of acquiring the securities offered, owning investments in excess of US$5,000,000 (note: for the purposes of this Category 20, "investments is defined in Rule 2a51-1(b) under the Investment Company Act of 1940); or

_______ Category 21. A natural person holding in good standing one or more of the following professional certifications or designations or credentials from an accredited educational institution that the Commission has designated as qualifying an individual for U.S. Accredited Investor status, including an IRA (Individual Retirement Account) owned by such person: The General Securities Representative license (Series 7), the Private Securities Offerings Representative license (Series 82), and the Licensed Investment Adviser Representative (Series 65); or

_______ Category 22. A "family office," as defined in rule 202(a)(11)(G)-1 under the Investment Advisers Act of 1940: (i) with assets under management in excess of US$5,000,000, (ii) that is not formed for the specific purpose of acquiring the securities offered, and (iii) whose prospective investment is directed by a person (a "Knowledgeable Family Office Administrator") who has such knowledge and experience in financial and business matters that such family office is capable of evaluating the merits and risks of the prospective investment; or

_______ Category 23. A "family client," as defined in rule 202(a)(11)(G)-1 under the Investment Advisers Act of 1940, of a family office meeting the requirements set forth in Category 23 above and whose prospective investment in the Company is directed by such family office with the involvement of the Knowledgeable Family Office Administrator.

__________

Schedule B

FORM OF TRANSFER

TO BE EXECUTED BY THE REGISTERED WARRANTHOLDER TO TRANSFER THESE

WARRANTS TO PURCHASE SHARES OF COMMON STOCK ISSUED ON [*], 2024

(THE "WARRANTS")

To: Starfighters Space, Inc. (the "Corporation")

FOR VALUE RECEIVED, the undersigned (the "Transferor") hereby sells, assigns and transfers unto __________________________________ (the "Transferee") ________________ Warrants exercisable for shares of common stock of the Corporation registered in the name of the Transferor on the register of the Corporation. The Transferor irrevocably constitute and appoint ______________________ as attorney to make such transfer on the books of the Corporation, maintained for the purpose, with full power of substitution in the premises.

The Transferor hereby directs that the Warrants hereby transferred be issued and delivered as follows:

NAME IN FULL | ADDRESS | NUMBER OF WARRANTS |

| | |

If the Warrants are being transferred at a time when there is no effective registration statement or offering statement covering the Warrants, the undersigned hereby certifies that (check either A or B, as applicable):

____ (A) if the Transferee is (i) a U.S. person, (ii) a person in the United States, or (ii) a person who is acting for the account or benefit of a U.S. person or a person in the United States, the transfer of the Warrants is being completed pursuant to an exemption from the registration requirements of the U.S. Securities Act and any applicable state securities laws, in which case the Transferor has delivered or caused to be delivered a written opinion of U.S. legal counsel or recognized standing in form and substance reasonably acceptable to the Corporation and the transfer agent to such effect; OR

____ (B) the transfer of the Warrants is being made outside the United States in accordance with Rule 904 of Regulation S ("Regulation S") under the U.S. Securities Act, and certifies that:

(1) the undersigned is not an "affiliate" (as defined in Rule 405 under the U.S. Securities Act) of the Corporation (except solely by virtue of being an officer or director of the Corporation) or a "distributor", as defined in Regulation S, or an affiliate of a "distributor";

(2) the offer of such securities was not made to a person in the United States and either (a) at the time the buy order was originated, the buyer was outside the United States, or the seller and any person acting on its behalf reasonably believe that the buyer was outside the United States or (b) the transaction was executed on or through the facilities of a designated offshore securities market within the meaning of Rule 902(b) of Regulation S under the U.S. Securities Act, and neither the seller nor any person acting on its behalf knows that the transaction has been prearranged with a buyer in the United States;

(3) neither the Transferor nor any affiliate of the Transferor nor any person acting on their behalf engaged in any directed selling efforts in connection with the offer and sale of the Warrants;

(4) the sale is bona fide and not for the purpose of "washing off" the resale restrictions imposed because the Warrants are "restricted securities" (as such term is defined in Rule 144(a)(3) under the U.S. Securities Act);

(5) the Transferor does not intend to replace the securities sold in reliance on Rule 904 of the U.S. Securities Act with fungible unrestricted securities; and

(6) the contemplated sale is not a transaction, or part of a series of transactions which, although in technical compliance with Regulation S, is part of a plan or a scheme to evade the registration provisions of the U.S. Securities Act.

Unless otherwise specified, terms used herein have the meanings given to them by Regulation S under the U.S. Securities Act. If Option B is checked, the Corporation may, in its sole discretion, require the Transferor or the Transferee to furnish a written opinion of U.S. legal counsel or other documentation acceptable to the Corporation to the effect that the transfer of the Warrants is excluded from the registration requirements of the U.S. Securities Act.