July 13, 2012 E X E C U T I V E C O M M E N T S

Agenda Agenda Presentation Start time I. Executive Comments − Jamie Dimon 7:30AM A. Overview B. Significant items in the quarter C. Update on synthetic credit portfolio D. Overview of Treasury and CIO E. Capital planning F. Wrap up II. Financial results − Doug Braunstein 7:45AM III. CIO Task Force Update − Mike Cavanagh 8:10AM IV. Q&A 8:30AM 1 E X E C U T I V E C O M M E N T S

Overview Solid underlying business performance – Why we are here Significantly reduced total synthetic credit risk in CIO Substantially all remaining synthetic credit positions transferred to the IB IB has the expertise, capacity, trading platforms and market franchise to effectively trade and manage these positions CIO synthetic credit group closed down Fortress balance sheet remains intact Extensive review of CIO trading losses; CIO management completely overhauled, governance standards enhanced; believe events isolated to CIO Exceptional people came to the call of duty Can now focus our full energy on what we do best – Serving our clients and communities around the world We’ve all learned some lessons – Will make us a stronger company 2 E X E C U T I V E C O M M E N T S

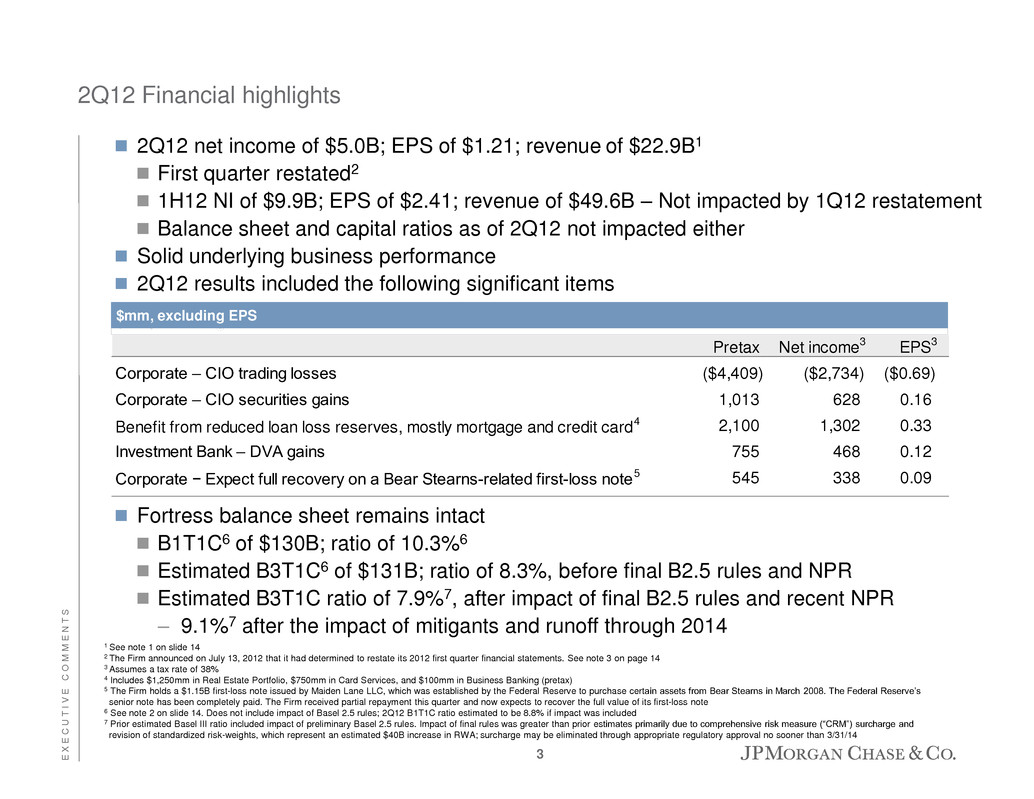

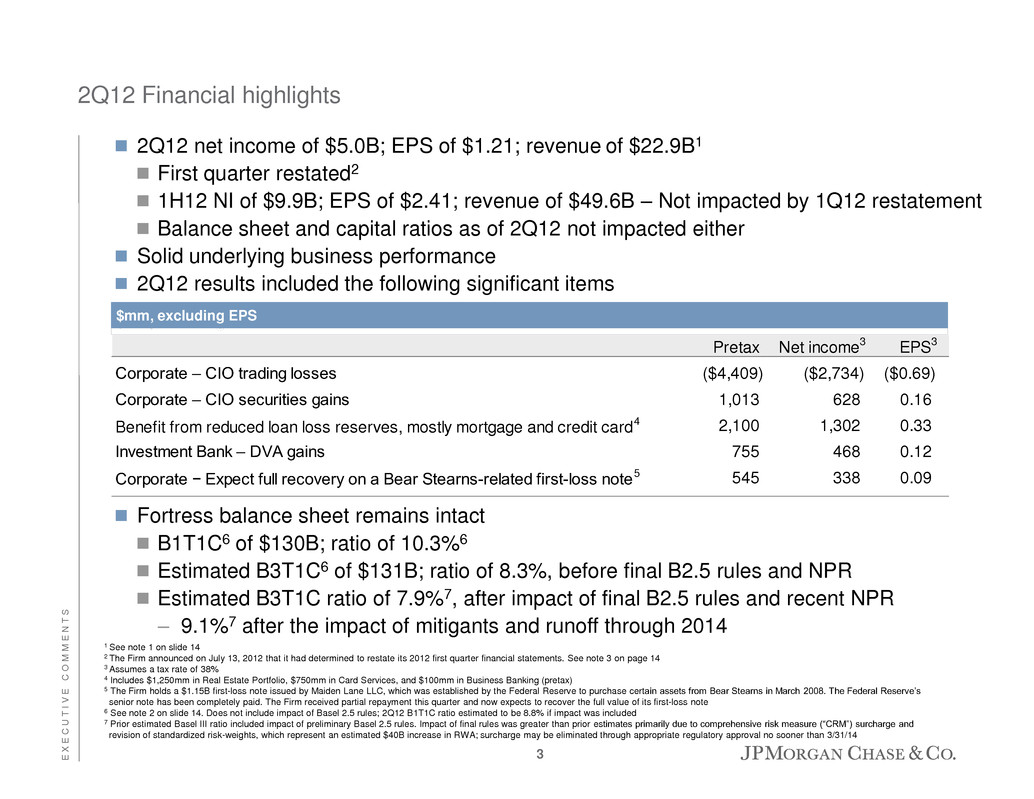

2Q12 net income of $5.0B; EPS of $1.21; revenue of $22.9B1 First quarter restated2 1H12 NI of $9.9B; EPS of $2.41; revenue of $49.6B – Not impacted by 1Q12 restatement Balance sheet and capital ratios as of 2Q12 not impacted either Solid underlying business performance 2Q12 results included the following significant items $mm, excluding EPS Fortress balance sheet remains intact B1T1C6 of $130B; ratio of 10.3%6 Estimated B3T1C6 of $131B; ratio of 8.3%, before final B2.5 rules and NPR Estimated B3T1C ratio of 7.9%7, after impact of final B2.5 rules and recent NPR – 9.1%7 after the impact of mitigants and runoff through 2014 2Q12 Financial highlights Pretax Net income3 EPS3 Corporate – CIO trading losses ($4,409) ($2,734) ($0.69) Corporate – CIO securities gains 1,013 628 0.16 Benefit from reduced loan loss reserves, mostly mortgage and credit card4 2,100 1,302 0.33 Investment Bank – DVA gains 755 468 0.12 Corporate − Expect full recovery on a Bear Stearns-related first-loss note5 545 338 0.09 1 See note 1 on slide 14 2 The Firm announced on July 13, 2012 that it had determined to restate its 2012 first quarter financial statements. See note 3 on page 14 3 Assumes a tax rate of 38% 4 Includes $1,250mm in Real Estate Portfolio, $750mm in Card Services, and $100mm in Business Banking (pretax) 5 The Firm holds a $1.15B first-loss note issued by Maiden Lane LLC, which was established by the Federal Reserve to purchase certain assets from Bear Stearns in March 2008. The Federal Reserve’s senior note has been completely paid. The Firm received partial repayment this quarter and now expects to recover the full value of its first-loss note 6 See note 2 on slide 14. Does not include impact of Basel 2.5 rules; 2Q12 B1T1C ratio estimated to be 8.8% if impact was included 7 Prior estimated Basel III ratio included impact of preliminary Basel 2.5 rules. Impact of final rules was greater than prior estimates primarily due to comprehensive risk measure (“CRM”) surcharge and revision of standardized risk-weights, which represent an estimated $40B increase in RWA; surcharge may be eliminated through appropriate regulatory approval no sooner than 3/31/14 3 E X E C U T I V E C O M M E N T S

Synthetic credit portfolio risk update Risk down substantially from peak Note: June 30 & July 9 data represent Residual Synthetic Credit Portfolio only (excluding AFS Hedge Portfolio); the combination of the Residual Synthetic Credit Portfolio and AFS Hedge Portfolio would result in lower net notional and CS01 amounts, and higher VaR; exposure includes notional and CS01 data for both indices and tranches combined 1 Credit spread sensitivity (CS01) represents change in value of a security due to a 1bp widening in credit spreads; positive/negative and CS01 data denotes long/short risk position ² Values estimated using positions for dates shown, but 1-year look-back period from 12/30/11; hypothetical simulations run in a test environment for the purpose of this analysis of the portfolio, and only using December 30th lookback data 31-Dec 31-Mar 30-Apr 30-Jun 9-Jul $82 $186 $191 $135 $82 $183 $196 $98 31-Dec 31-Mar 30-Apr 30-Jun RWA transfer to IB of $30B+, down substantially from peak, but has come down to where started on 12/30 Significantly reduced net notionals and credit spread sensitivities (CS01) Significant reduction in On-the-Run vs. Off-the-Run basis Reduced basis between high yield and high grade risk in Europe and U.S. indices by 70%+ Residual portfolio is largely a delta-hedged tranche portfolio Some positions are currently cheap to theoretical levels Extreme simulated scenarios indicate potential losses between $800mm-$1.6B VaR ($mm, standalone) – Spot Net notional ($B) – Spot VaR results with December 30th data² $1 $46 $51 $7 $7 31-Dec 31-Mar 30-Apr 30-Jun 9-Jul CS01 ($mm/bp)1 – Spot 4 E X E C U T I V E C O M M E N T S

Synthetic credit portfolio risk update Significant risk reduction has allowed us to transfer substantially all remaining synthetic credit positions to the IB CIO synthetic credit group closed down The IB has the expertise, capacity, trading platforms and market franchise to effectively trade and manage the remaining positions and maximize economic value going forward Expect combined IB & synthetic credit portfolio risks to be within IB’s historical VaR & stress risk levels IB RWA1 as of 7/2/12 will increase by ~$30B IB VaR2 as of 7/2/12 (spot) has increased from $74mm to $113mm Retained simple, transparent and easy to explain credit hedge within CIO Portfolio hedge position is short credit in a small number of indices (~$11B notional) Identified to hedge a subset of AFS assets – Hedge mitigates ~1/3 stress loss in several scenarios Hedge will be reduced over time, as macro-economic conditions change Standalone VaR for hedge portfolio $133mm3; Basel 2.5 RWA4 on portfolio hedge ~$34B 1 Based on Basel 2.5 pro forma calculations; does not reflect the impact of final Basel 2.5 rules and Basel III NPR 2 Net of diversification benefits and at a 95% confidence level 3 As of June 30, 2012 4 Represents RWA as of June 30, 2012 allocated to the AFS Hedge Portfolio based on its positions and diversification within the Firm. RWA measure is based on the pro-forma calculations per Basel 2.5, does not reflect the impact of final Basel 2.5 rules and Basel III NPR 5 E X E C U T I V E C O M M E N T S

JPM has $1.1T in deposits and $0.7T in loans Excess deposits of $423B, plus equity of $144B1 & other net assets of $45B create $522B investment need2 – $199B Treasury deployment – Cash and deposits at Central Banks, government reverse repos, etc. – $323B CIO AFS portfolio – Average rating of AA+ and weighted average life of 3.7 years3 Funds Transfer Pricing (“FTP”) transfers structural interest rate/duration risk from LOBs to Treasury and CIO JPM assets/liabilities, incl. deposits/loans, continually analyzed for rate, repricing and liquidity characteristics Based on analysis, LOBs paid/charged FTP interest, essentially at market rates (after allocation of debt & equity) Variances generated from AFS portfolio plus trading and securities gains/losses retained in CIO CIO invests to achieve desired ALM/duration position Currently, to be duration neutral, CIO would need to invest at a 3.7 year interest duration4 Current interest duration (1.2y4) allows assets to reprice quicker than liabilities (EaR +$2.4B – 100 bps increase) The composition of JPM balance sheet will change to meet new LCR and Basel III requirements CIO reinvestment of runoff and deposit growth, will be reinvested to meet LAB5, LCR6 and RWA targets These reinvestment plans could reduce NII; would also reduce RWA – Increasing duration over time will increase NII Treasury and CIO activities subordinated to and in support of Company needs Summary 1 Net of goodwill 2 See Appendix slide 24 of Financial Results presentation for detail 3 Represents the weighted average life of the expected principal payments 4 Represents the estimated change in a security’s value due to a 1% change in interest rates across the curve, expressed as number of years (i.e., normalized by the value of the security) 5 Liquid assets buffer 6 Liquidity coverage ratio 6 E X E C U T I V E C O M M E N T S

Cash, investment and duration management for Treasury and CIO 1 Data only includes Treasury and CIO; other lines of business comprise ~$6B in AFS 2 Certain US Gov’t and Agency products may not be externally rated, but are included in the AA+ categorization 3 Unrated/locally rated securities of ~$10B were omitted for purposes of calculating average rating 4 Represents the estimated change in a security’s value due to a 1% change in interest rates across the curve, expressed as a number of years (i.e., normalized by the value of the security) 5 Represents the weighted average of the interest rate duration for rate-sensitive instruments and the credit spread duration for credit-sensitive products. Credit spread duration represents the estimated change in a security’s value due to a 1% change in the related credit spread, expressed as a number of years (i.e., normalized by the value of the security) Any investment decision creates forms of risks Rates products create AOCI risks – Rising rate Credit products – Credit spreads and, if hedged, accounting asymmetry Treasury portfolio: liquid and short-dated 0.1 year4 Current CIO AFS portfolio balanced between rates and credit products AA+ avg. rating; 1.2 year avg. interest rate duration4; 2.6 year avg. duration5 ~80% of CIO AFS portfolio is either government backed or U.S. government agency credit2 or better; 88% inclusive of Treasury deployment Comments Treasury and CIO deployment: $522B (June 30, 2012) ($B) Fair value AOCI Avg. credit rating 2,3 Cash and deposits with banks $129 Reverse repo & securities borrowed 45 AFS securities 1 25 ($0.0) AA+ Treasury deployment $199 ($0.0) Mortgage-backed securities: U.S. government agencies $95 $5.0 AA+ Residential: Prime and Alt-A 3 (0.1) BBB- Subprime 0 0.0 A+ Non-U.S. 70 0.2 AAA Commercial 12 0.7 AA+ Total mortgage-backed securities 180 5.8 AA+ U.S. Treasury and government agencies 5 0.1 AA+ Obligations of U.S. states and municipalities 20 1.4 AA- Certificates of deposit 2 0.0 NR Non-U.S. government debt securities 34 0.4 AA Corporate debt securities 44 (0.2) A+ Asset-back d securities: Collateralized loan obligations 25 0.3 AA+ Other 12 0.1 AA+ CIO AFS portfolio $323 $7.9 AA+ Total Treasury and CIO deployment $522 $7.9 7 E X E C U T I V E C O M M E N T S

2Q12 Actual 3Q122,3 4Q122,3 20132,3 20142,3 Net income (analyst estimates; $mm)2 $4,960 $4,323 $4,551 ~$21,000 ~$22,000 RWA (JPM current estimates) $1,664 ~$1,600 ~$1,575 ~$1,475 ~$1,450 Estimated T1C ($) 132 136 139 155 172 Estimated T1C (%) 7.9% 8.5% 8.8% ~10.5% ~12.0% 9.0% $22 $42 9.5% $15 $34 B3 metrics4 after B2.5 & NPR Capital projections 1 Assumes current dividends of $1.20 per share in 2013 and 2014 2 3Q12, 4Q12, and 2013 net income reflects the average of 28 analyst estimates 3 Pre-share repurchase for forecast; net of preferred dividends of $629mm and excludes estimated impact of employee issuance ($2B each year) 4 Reflects impact of final Basel 2.5 rules and proposed NPR. Final Basel 2.5 rules include addition of comprehensive risk measure (“CRM”) surcharge and revision of standardized risk weights, which represents an estimated $40B increase in RWA; surcharge may be eliminated by appropriate regulatory approval no sooner than 3/31/14 5 B3 T1C ratio of 8.2% excluding impact of final Basel 2.5 rules and recent NPR. Comparable basis to 8.2% B3 T1C ratio reported in 1Q12 Basel III Capital Projections ($B) – Based on analyst estimates, after dividends¹, pre-share repurchases Cumulative excess capital4 Basel III level 5 8 E X E C U T I V E C O M M E N T S

Capital actions update Update Based upon our capital position, balance sheet and earnings power, we could resume our buyback now But after discussion with Federal Reserve, the Board has determined not to buyback stock until The Board completes its CIO review We submit new capital plan, to resume share repurchase Hope to complete these actions and reinstate repurchase program in early 4Q12 Will continue to pay quarterly dividend of $0.30 per share Expect dividend payout to trend to 30% of normalized earnings over time Clearly have ability to move to higher payout ratio over time On a strong trajectory to get to 9.5% Basel III Tier 1 Common 9 E X E C U T I V E C O M M E N T S

Conservative principles of balance sheet management Fortress balance sheet Strong reserves Balance sheet / liquidity Conservative portfolio and interest rate risk management Increased B1 T1C ratio from 7.2% in 1Q07 to 10.3% as of 2Q121; 7.9% B32 Even during the crisis, ratio never dropped below 6.8% (3Q08 – WaMu acquisition & Lehman failure) On average, JPMC’s Tier 1 common ratio (B1) has been ~1% higher than its peers1,3 during the period Conservative funding Strong deposit-to-loan ratio 2Q12 deposit-to-loan ratio of 153% – Compared to ~120% average among peers3 Stable funding: $192B equity & $240B long term debt $414B Global Liquidity Reserve Conservative $323B CIO AFS portfolio (average AA+ rating) largely excluded from liquidity reserve As of 2Q12, we had $24B in LLR Net charge-offs and nonperforming loans down ~70% and ~40% from peak levels, respectively Loan loss reserves down ~35% from peak and ~25% since 2009 LLRs/NPLs4 of 183% in 2Q12 Positioned conservatively to protect against an increase in interest rates As of 2Q12, a 100bps increase in rates would generate ~$2.4B in Firm’s additional annualized earnings Prioritized creating long-term economic value over realizing short-term profits 1 Does not include impact of Basel 2.5 rules; B1T1C ratio estimated to be 8.8% if impact were included 2 Reflects impact of final Basel 2.5 rules and proposed NPR. Final Basel 2.5 rules include addition of comprehensive risk measure (“CRM”) surcharge and revision of standardized risk weights, which represents an estimated $40B increase in RWA; surcharge may be eliminated by appropriate regulatory approval no sooner than 3/31/14 3 Peers include BAC, C and WFC; as of 3/31/12 4 NPLs include $1.5B of performing junior liens that are subordinate to nonaccrual senior liens; such junior liens are now being reported as nonaccrual loans based upon regulatory guidance issued in the first quarter of 2012. Of the total, $1.3B were current at June 30, 2012 10 E X E C U T I V E C O M M E N T S

Strong and diversified business model – Source of strength Diversified business model drove solid 2Q earnings despite CIO losses $5.0B of net income in 2Q12; $9.9B in 1H12 $1.21 EPS in 2Q12; $2.41 in 1H12 2011 net income of $19B – Highest among U.S. banks for the year Continue to believe that on an absolute and static basis earnings should be $24B+/- Strong capital generation: tangible book value per share YoY growth of ~12% in 1H12 Significant earnings power We manage our businesses conservatively We have a strong management team 263k employees in ~60 countries worldwide Strong management team & practices Each of our businesses is among the best in its peer sets Continue to gain market share Unparalleled client relationships – Always there for our clients, even in difficult times Strong corporate and IB, consumer and community banking and asset management franchises Excellent client franchise Estimated Basel III Tier 1 common1 of $132B, up from $122B for FY11 and $128B for 1Q12 Strong reserves – $24B of loan loss reserves Conservative funding – 153% deposit-to-loan ratio Positioned AFS and Firm portfolio to benefit from rising rates Fortress balance sheet 1 Reflects impact of final Basel 2.5 rules and proposed NPR. Final Basel 2.5 rules include addition of comprehensive risk measure (“CRM”) surcharge and revision of standardized risk weights, which represents an estimated $40B increase in RWA; surcharge may be eliminated by appropriate regulatory approval no sooner than 3/31/14 11 E X E C U T I V E C O M M E N T S

Earnings generation has the ability to sustain growth through difficult times Comments Ability to grow in difficult times is a sign of strength, not weakness Ability to grow driven by Diversified business model – Source of strength Constant investing Building market-leading franchises Conservative principles Key metrics since 2006 $33.45 $36.59 $36.15 $39.88 $43.04 $46.59 $48.40 $35.71 $18.88 $21.96 $22.52 $27.09 $30.18 $33.69 2006 2007 2008 2009 2010 2011 2Q12 Shares outstanding (EOP) 3.7B 3.9B 3.9B 3.8B 3.4B 3.5B 3.8B 1H12 2Q12 CAGR YoY 5Y 10Y BVPS 8% 7% 9% TBVPS 12% 12% 8% 12 E X E C U T I V E C O M M E N T S

Wrap up We are not proud of this moment – Very proud of the company We are not making light of this error but we believe this is an isolated event Capital is for known and unknown events Lessons learned – Will make us a better Company We can never say we won’t make mistakes – Hopefully they are small and few and far between We have a great franchise, which we have never stopped growing, serving our clients through tough times with great people and great earnings power The company has great growth opportunities – New world creates new opportunities Comments 13 E X E C U T I V E C O M M E N T S

Notes on non-GAAP financial measures 1. In addition to analyzing the Firm’s results on a reported basis, management reviews the Firm’s results and the results of the lines of business on a “managed” basis, which is a non-GAAP financial measure. The Firm’s definition of managed basis starts with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm (and each of the business segments) on a fully taxable-equivalent (“FTE”) basis. Accordingly, revenue from tax-exempt securities and investments that receive tax credits is presented in the managed results on a basis comparable to taxable securities and investments. This non-GAAP financial measure allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. 2. The Basel I Tier 1 common ratio is Tier 1 common divided by risk-weighted assets. Tier 1 common is defined as Tier 1 capital less elements of Tier 1 capital not in the form of common equity, such as perpetual preferred stock, noncontrolling interests in subsidiaries, and trust preferred capital debt securities. Tier 1 common, a non-GAAP financial measure, is used by banking regulators, investors and analysts to assess and compare the quality and composition of the Firm’s capital with the capital of other financial services companies. The Firm uses Tier 1 common along with other capital measures to assess and monitor its capital position. On December 16, 2010, the Basel Committee issued the final version of the Basel Capital Accord, commonly referred to as “Basel III.” The Firm’s estimate of its Tier 1 common ratio under Basel III is a non-GAAP financial measure and reflects the Firm’s current understanding of the Basel III rules and the application of such rules to its businesses as currently conducted, and therefore excludes the impact of any changes the Firm may make in the future to its businesses as a result of implementing the Basel III rules. The Firm’s estimates of its Basel III Tier 1 common ratio will evolve over time as the Firm’s businesses change, and as a result of further rule-making on Basel III implementation from U.S. federal banking agencies. Management considers this estimate as a key measure to assess the Firm’s capital position in conjunction with its capital ratios under Basel I requirements, in order to enable management, investors and analysts to compare the Firm’s capital under the Basel III capital standards with similar estimates provided by other financial services companies. The Firm’s understanding of the Basel III rules is based on information currently published by the Basel Committee and U.S. federal banking agencies. Financial restatement 3. On July 13, 2012, JPMorgan Chase & Co. reported that it will be restating its previously-filed interim financial statements for the first quarter 2012. The restatement will have the effect of reducing the Firm’s reported net income for 2012 first quarter by $459 million (after-tax). The first quarter 2012 amounts in this presentation reflect the effects of such restatement. For further information, see the Company’s Current Report on Form 8-K dated July 13, 2012, which has been filed with the Securities and Exchange Commission and is available on the Company’s website (http://investor.shareholder.com/jpmorganchase) and on the Securities and Exchange Commission’s website (www.sec.gov). Notes 14 E X E C U T I V E C O M M E N T S