July 13, 2012 F I N A N C I A L R E S U L T S 2Q12

2Q12 net income of $5.0B; EPS of $1.21; revenue of $22.9B1 First quarter restated2 1H12 NI of $9.9B; EPS of $2.41; revenue of $49.6B – Not impacted by 1Q12 restatement Balance sheet and capital ratios as of 2Q12 not impacted either Solid underlying business performance 2Q12 results included the following significant items $mm, excluding EPS 1 See note 1 on slide 26 2 The Firm announced on July 13, 2012 that it had determined to restate its 2012 first quarter financial statements. See note 11 on page 26 3 Assumes a tax rate of 38% 4 Includes $1,250mm in Real Estate Portfolio, $750mm in Card Services, and $100mm in Business Banking (pretax) 5 The Firm holds a $1.15B first-loss note issued by Maiden Lane LLC, which was established by the Federal Reserve to purchase certain assets from Bear Stearns in March 2008. The Federal Reserve’s senior note has been completely paid. The Firm received partial repayment this quarter and now expects to recover the full value of its first-loss note 6 See note 4 on slide 26. Does not include impact of Basel 2.5 rules; 2Q12 B1T1C ratio estimated to be 8.8% if impact was included 7 Prior estimated Basel III ratio included impact of preliminary Basel 2.5 rules. Impact of final rules was greater than prior estimates primarily due to comprehensive risk measure (“CRM”) surcharge and revision of standardized risk weights, which represent an estimated $40B increase in RWA; surcharge may be eliminated through appropriate regulatory approval no sooner than 3/31/14 Fortress balance sheet remains intact B1T1C6 of $130B; ratio of 10.3%6 Estimated B3T1C6 of $131B; ratio of 8.3%, before final B2.5 rules and NPR Estimated B3T1C ratio of 7.9%7, after impact of final B2.5 rules and recent NPR – 9.1%7 after the impact of mitigants and runoff through 2014 2Q12 Financial highlights Pretax Net income3 EPS3 Corp ra e – CIO trading losses ($4,409) ($2,734) ($0.69) Corporate – CIO securities gains 1,013 628 0.16 Benefit from reduced loan loss reserves, mostly mortgage and credit card4 2,100 1,302 0.33 Investment Bank – DVA gains 755 468 0.12 Corporate − Expect full recovery on a Bear Stearns-related first-loss note5 545 338 0.09 1 F I N A N C I A L R E S U L T S

2Q12 1Q12 2Q11 Revenue (FTE)1 $22,892 ($3,865) ($4,518) Credit costs 214 (512) (1,596) Expense 14,966 (3,379) (1,876) Reported net income $4,960 $36 ($471) Net income applicable to common stock $4,634 $57 ($433) Reported EPS $1.21 $0.02 ($0.06) ROE3 11% 11% 12% ROTCE3,4 15 15 17 $ O/(U) 2Q12 Financial results1 1 See note 1 on slide 26 2 The Firm announced on July 13, 2012 that it had determined to restate its 2012 first quarter financial statements. See note 11 on page 26 3 Actual numbers for all periods, not over/under 4 See note 3 on slide 26 2 $mm, excluding EPS 2 F I N A N C I A L R E S U L T S

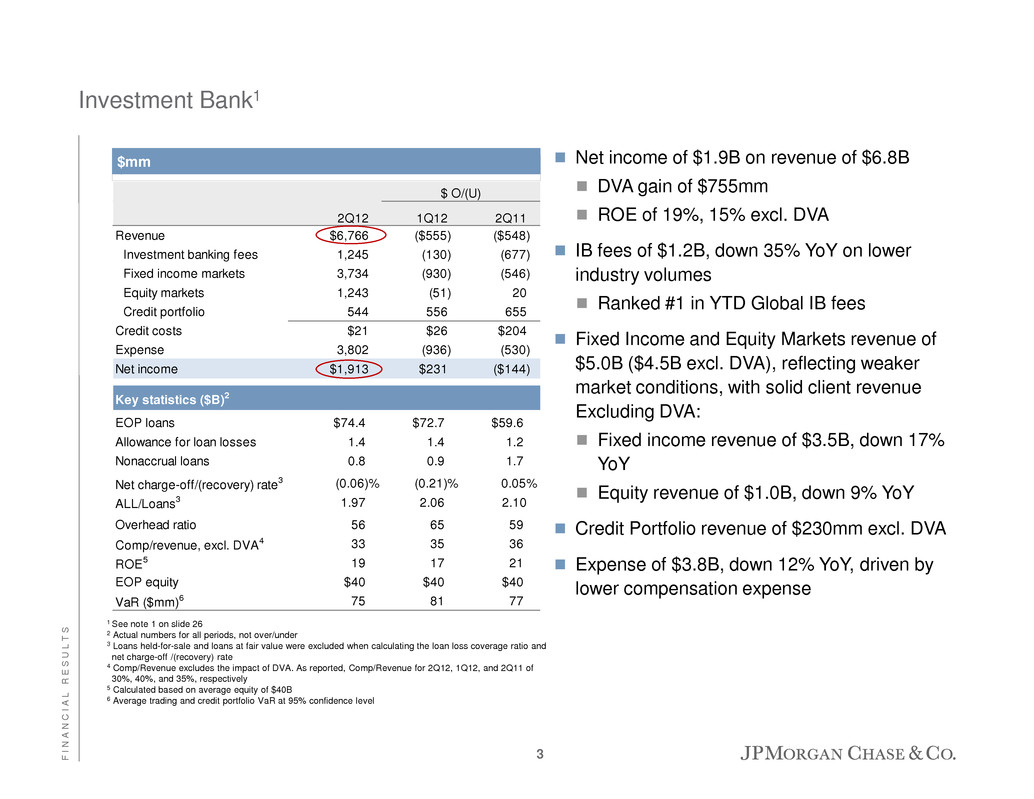

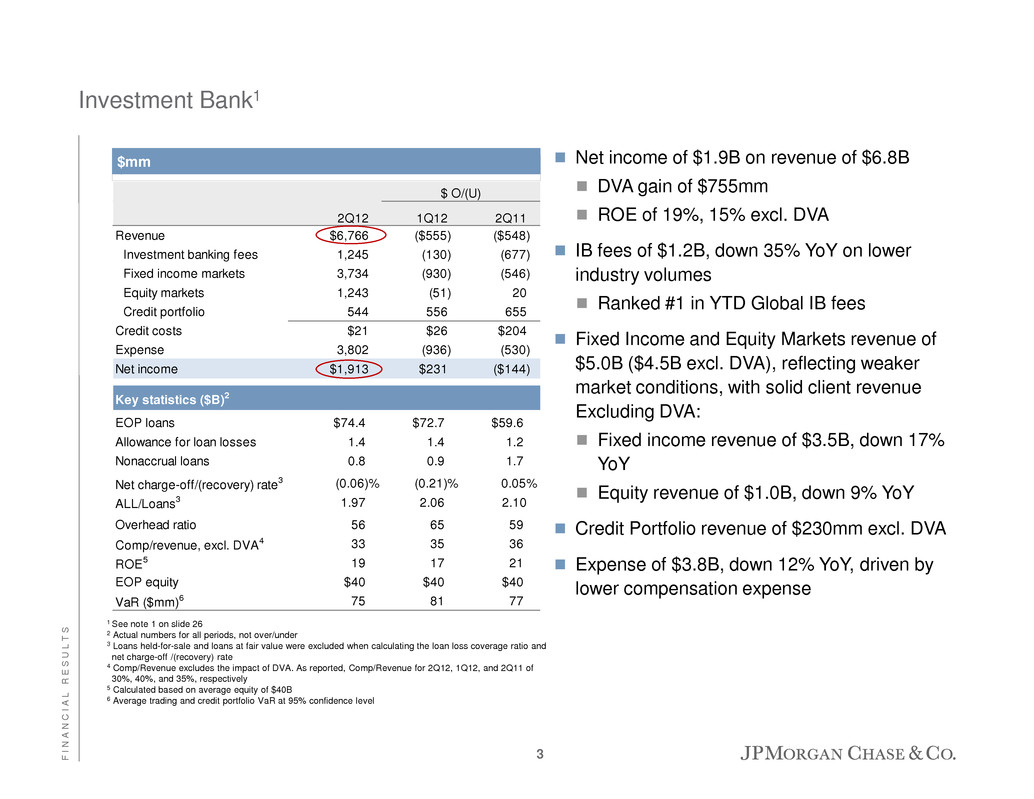

2Q12 1Q12 2Q11 Revenue $6,766 ($555) ($548) Investment banking fees 1,245 (130) (677) Fixed income markets 3,734 (930) (546) Equity markets 1,243 (51) 20 Credit portfolio 544 556 655 Credit costs $21 $26 $204 Expense 3,802 (936) (530) Net income $1,913 $231 ($144) Key statistics ($B)2 EOP loans $74.4 $72.7 $59.6 Allowance for loan losses 1.4 1.4 1.2 Nonaccrual loans 0.8 0.9 1.7 Net charge-off/(recovery) rate3 (0.06)% (0.21)% 0.05% ALL/Loans3 1.97 2.06 2.10 Overhead ratio 56 65 59 Comp/revenue, excl. DVA4 33 35 36 ROE5 19 17 21 EOP equity $40 $40 $40 VaR ($mm)6 75 81 77 $ O/(U) Investment Bank1 Net income of $1.9B on revenue of $6.8B DVA gain of $755mm ROE of 19%, 15% excl. DVA IB fees of $1.2B, down 35% YoY on lower industry volumes Ranked #1 in YTD Global IB fees Fixed Income and Equity Markets revenue of $5.0B ($4.5B excl. DVA), reflecting weaker market conditions, with solid client revenue Excluding DVA: Fixed income revenue of $3.5B, down 17% YoY Equity revenue of $1.0B, down 9% YoY Credit Portfolio revenue of $230mm excl. DVA Expense of $3.8B, down 12% YoY, driven by lower compensation expense $mm 1 See note 1 on slide 26 2 Actual numbers for all periods, not over/under 3 Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off /(recovery) rate 4 Comp/Revenue excludes the impact of DVA. As reported, Comp/Revenue for 2Q12, 1Q12, and 2Q11 of 30%, 40%, and 35%, respectively 5 Calculated based on average equity of $40B 6 Average trading and credit portfolio VaR at 95% confidence level 3 F I N A N C I A L R E S U L T S

2Q12 1Q12 2Q11 Net interest income $3,901 ($24) ($126) Noninterest revenue 4,034 310 919 Revenue $7,935 $286 $793 Expense 4,726 (283) (545) Pre-provision profit $3,209 $569 $1,338 Credit costs (555) (459) (1,549) Net income $2,267 $514 $1,884 ROE2,3 34% 27% 6% EOP equity ($B)2 $26.5 $26.5 $25.0 Memo: RFS net income excl. Real Estate Portfolios $1,550 $315 $1,101 ROE excl. Real Estate Portfolios 2,4 42% 34% 12% $ O/(U) Retail Financial Services1 Net income of $2.3B, compared with $383mm in the prior year Revenue of $7.9B, up 11% YoY Credit cost benefit of $555mm reflected a $1.4B reduction in the allowance for loan losses and lower net charge-offs Expense of $4.7B, down 10% YoY 1 See note 1 on slide 26 2 Actual numbers for all periods, not over/under 3 Calculated based on average equity; average equity for 2Q12, 1Q12 and 2Q11 was $26.5B, $26.5B and $25.0B, respectively 4 Calculated based on average equity; average equity for 2Q12, 1Q12 and 2Q11 was $14.8B, $14.8B and $14.5B, respectively $mm 4 F I N A N C I A L R E S U L T S

2Q12 1Q12 2Q11 Net interest income $2,680 $5 ($26) Noninterest revenue 1,646 61 (243) Revenue $4,326 $66 ($269) Expense 2,742 (124) 29 Pre-provision profit $1,584 $190 ($298) Credit costs (2) (98) (44) Net income $946 $172 ($152) Key drivers1 ($B) Average total deposits $389.5 $380.8 $360.5 Deposit margin 2.62% 2.68% 2.83% Checking accounts (mm) 27.4 27.0 26.3 # of branches 5,563 5,541 5,340 Business Banking originations $1.8 $1.5 $1.6 Business Banking loans (EOP) 18.2 17.8 17.1 Investment sales 6.2 6.6 6.3 Client investment assets (EOP) 147.6 147.1 140.3 # of active mobile customers (mm) 9.1 8.6 6.6 $ O/(U) Retail Financial Services Consumer & Business Banking Key drivers Financial performance 1 Actual numbers for all periods, not over/under Consumer & Business Banking net income of $946mm, down 14% YoY Net revenue of $4.3B, down 6% YoY, driven by lower debit card revenue, reflecting the impact of the Durbin Amendment Expense up 1% YoY but includes benefit from certain adjustments in the current quarter Credit costs include $100mm reduction in the allowance for loan losses 2Q11 reflected a $75mm reduction in the allowance for loan losses Average total deposits of $389.5B, up 8% YoY and 2% QoQ Checking accounts up 4% YoY and 1% QoQ Business Banking originations up 14% YoY and 16% QoQ Client investment assets up 5% YoY and flat QoQ $mm 5 F I N A N C I A L R E S U L T S

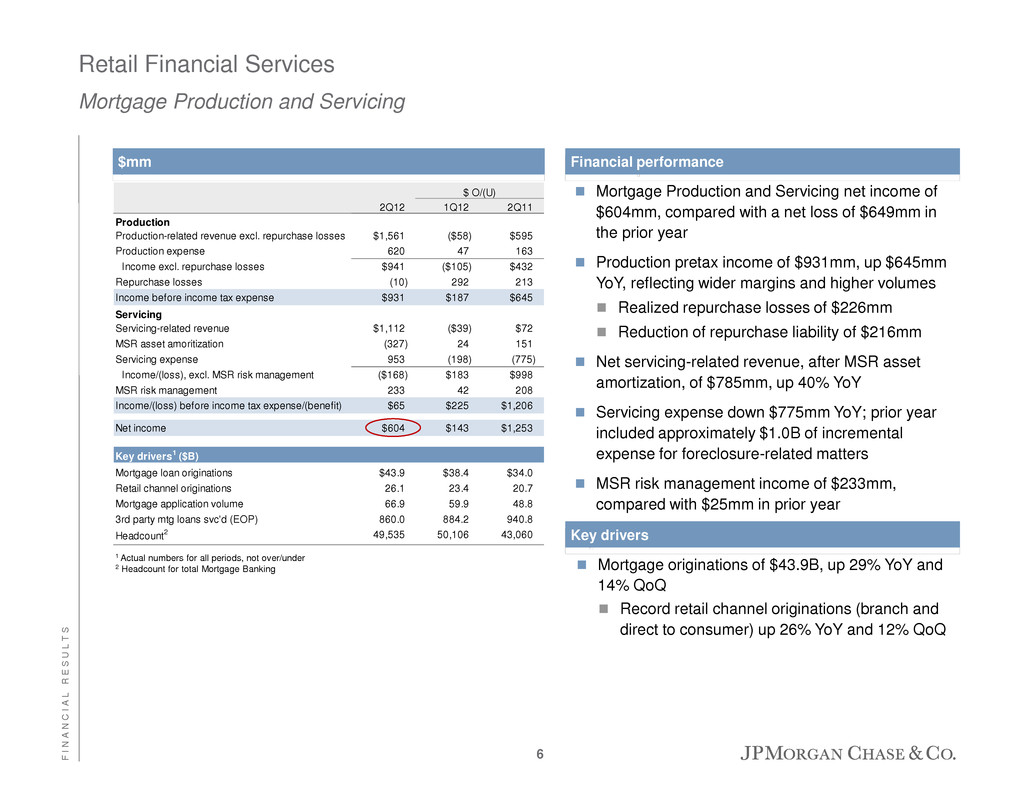

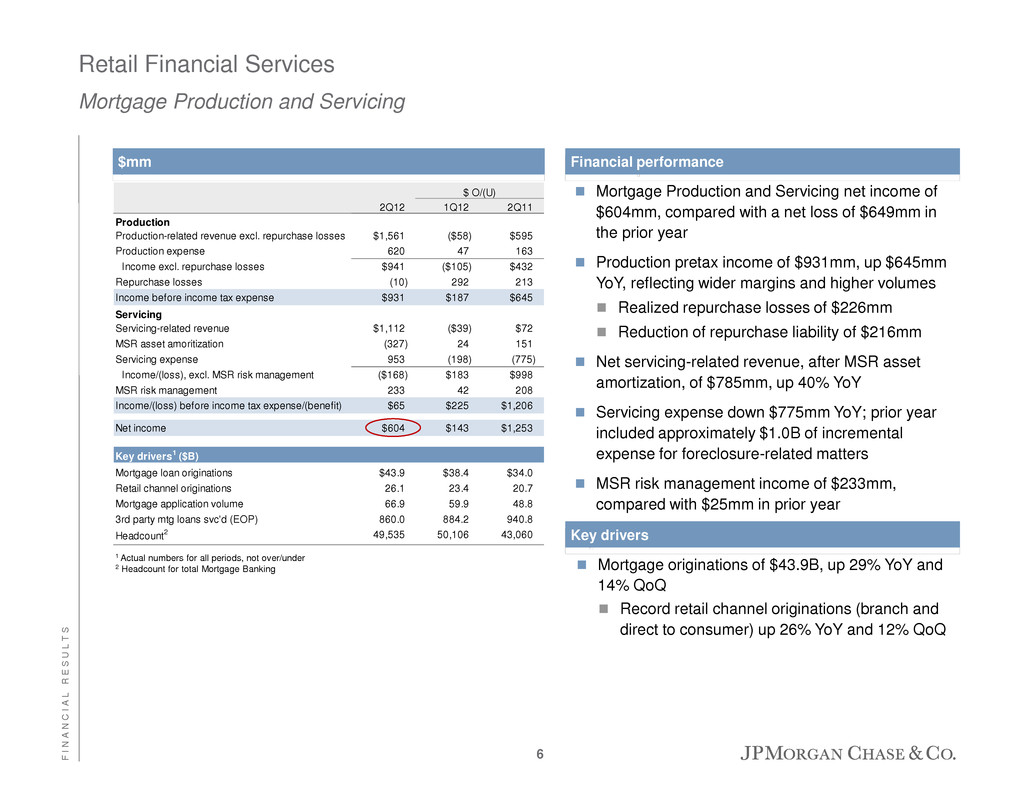

2Q12 1Q12 2Q11 Production Production-related revenue excl. repurchase losses $1,561 ($58) $595 Production expense 620 47 163 Income excl. repurchase losses $941 ($105) $432 Repurchase losses (10) 292 213 Income before income tax expense $931 $187 $645 Servicing Servicing-related revenue $1,112 ($39) $72 MSR asset amoritization (327) 24 151 Servicing expense 953 (198) (775) Income/(loss), excl. MSR risk management ($168) $183 $998 MSR risk management 233 42 208 Income/(loss) before income tax expense/(benefit) $65 $225 $1,206 Net income $604 $143 $1,253 Key drivers1 ($B) Mortgage loan originations $43.9 $38.4 $34.0 Retail channel originations 26.1 23.4 20.7 Mortgage application volume 66.9 59.9 48.8 3rd party mtg loans svc'd (EOP) 860.0 884.2 940.8 Headcount2 49,535 50,106 43,060 $ O/(U) Retail Financial Services Mortgage Production and Servicing Financial performance 1 Actual numbers for all periods, not over/under 2 Headcount for total Mortgage Banking Mortgage Production and Servicing net income of $604mm, compared with a net loss of $649mm in the prior year Production pretax income of $931mm, up $645mm YoY, reflecting wider margins and higher volumes Realized repurchase losses of $226mm Reduction of repurchase liability of $216mm Net servicing-related revenue, after MSR asset amortization, of $785mm, up 40% YoY Servicing expense down $775mm YoY; prior year included approximately $1.0B of incremental expense for foreclosure-related matters MSR risk management income of $233mm, compared with $25mm in prior year Mortgage originations of $43.9B, up 29% YoY and 14% QoQ Record retail channel originations (branch and direct to consumer) up 26% YoY and 12% QoQ Key drivers $mm 6 F I N A N C I A L R E S U L T S

2Q12 1Q12 2Q11 Revenue $1,040 ($41) ($177) Expense 412 (7) 41 Pre-provision profit $628 ($34) ($218) Net charge-offs 696 (112) (258) Change in allowance (1,250) (250) (1,250) Credit costs (554) (362) (1,508) Net income $717 $199 $783 Key statistics1 ($B) Average home equity loans owned2 $96.1 $99.1 $107.8 Average mortgage loans owned2 92.9 95.5 104.4 EOP NCI owned portfolio 124.5 128.3 141.0 ALL/ EOP loans3 5.20% 6.01% 6.90% Nonaccrual loans ($mm)4 $6,725 $7,018 $6,871 Net charge-offs ($mm) 696 808 954 Home equity 466 542 592 Prime mortgage, including option ARMs 114 131 198 Subprime mortgage and other 116 135 164 Net charge-off rate3 2.21% 2.49% 2.67% Home equity 2.53 2.85 2.83 Prime mortgage, including option ARMs 1.08 1.21 1.67 Subprime mortgage and other 4.76 5.33 5.72 $ O/(U) Retail Financial Services Real Estate Portfolios Real Estate Portfolios net income of $717mm, compared with a net loss of $66mm in the prior year Total net revenue of $1.0B, down 15% YoY driven by a decline in net interest income, resulting from portfolio runoff Credit cost benefit of $554mm Delinquency trends continued to improve in 2Q12 Net charge-offs continued to improve compared to 1Q12, but remain at elevated levels Reduction in allowance for loan losses of $1.25B Expect total quarterly net charge-offs below $750mm 1 Actual numbers for all periods, not over/under 2 Includes purchased credit-impaired loans acquired as part of the WaMu transaction 3 Excludes the impact of purchased credit-impaired loans acquired as part of the WaMu transaction. An allowance for loan losses of $5.7B, $5.7B and $4.9B was recorded for these loans as of 2Q12, 1Q12 and 2Q11, respectively. To date, no charge-offs have been recorded for these loans 4 Includes performing junior liens that are subordinate to nonaccrual senior liens of $1.5B and $1.6B in 2Q12 and 1Q12, respectively; such junior liens are being reported as nonaccrual loans based upon regulatory guidance issued in 1Q12. Prior year has not been restated for this reporting change $mm Excl. perf. junior liens $mm 2Q12 1Q12 NPLs $5,271 $5,459 7 F I N A N C I A L R E S U L T S

2Q12 1Q12 2Q11 Revenue $4,525 ($189) ($236) Credit costs 734 (4) (210) Expense 2,096 67 108 Net income $1,030 ($153) ($80) ROE2,3 25% 29% 28% EOP Equity ($B)3 $16.5 $16.5 $16.0 Card Services — Key drivers3 ($B) Avg outstandings $125.2 $127.6 $125.0 Sales volume4 96.0 86.9 85.5 New accts opened (mm)4 1.6 1.7 2.0 - Net revenue rate 11.91% 12.22% 12.60% Net charge-off rate5 4.32 4.37 5.81 30+ Day delinquency rate5 2.13 2.55 2.98 Merchant Services — Key drivers3 (B) Bank card volume $160.2 $152.8 $137.3 # of total transactions 7.1 6.8 5.9 Auto — Key drivers3 ($B) Avg outstandings – Auto $48.3 $47.7 $47.0 Avg outstandings – Student 12.9 13.3 14.1 Auto originations 5.8 5.8 5.4 $ O/(U) Card Services & Auto1 Net income of $1.0B, down 7% YoY Net income, excluding the reduction to the allowance for loan losses, up 18%5,6 YoY Revenue of $4.5B, down 5% YoY and 4% QoQ Credit costs of $734mm Reduction in allowance for loan losses of $751mm, compared with reduction of $1.0B in the prior year Net charge-offs are down 24% YoY and flat QoQ Expense of $2.1B, up 5% YoY and 3% QoQ due to additional expense related to a non-core product that is being exited 1 See note 1 on slide 26 2 Calculated based on average equity; average equity for 2Q12, 1Q12 and 2Q11 was $16.5B, $16.5B and $16.0B, respectively 3 Actual numbers for all periods, not over/under 4 Excludes Commercial Card 5 See note 5 on slide 26 6 Assumes a tax rate of 38% 7 Non-GAAP measure Card Services & Auto Key drivers Card Services Average outstandings of $125.2B, flat YoY and down 2% QoQ Sales volume4 of $96.0B, up 12% YoY and 10% QoQ Net charge-off rate5 of 4.32%, down from 5.81% in 2Q11 and 4.37% in 1Q12 2Q12 rate of 4.03%7, adjusted for change in charge-off policy for troubled debt restructured loans Auto Average auto outstandings up 3% YoY and 1% QoQ Auto originations up 7% YoY and flat QoQ $mm 8 F I N A N C I A L R E S U L T S

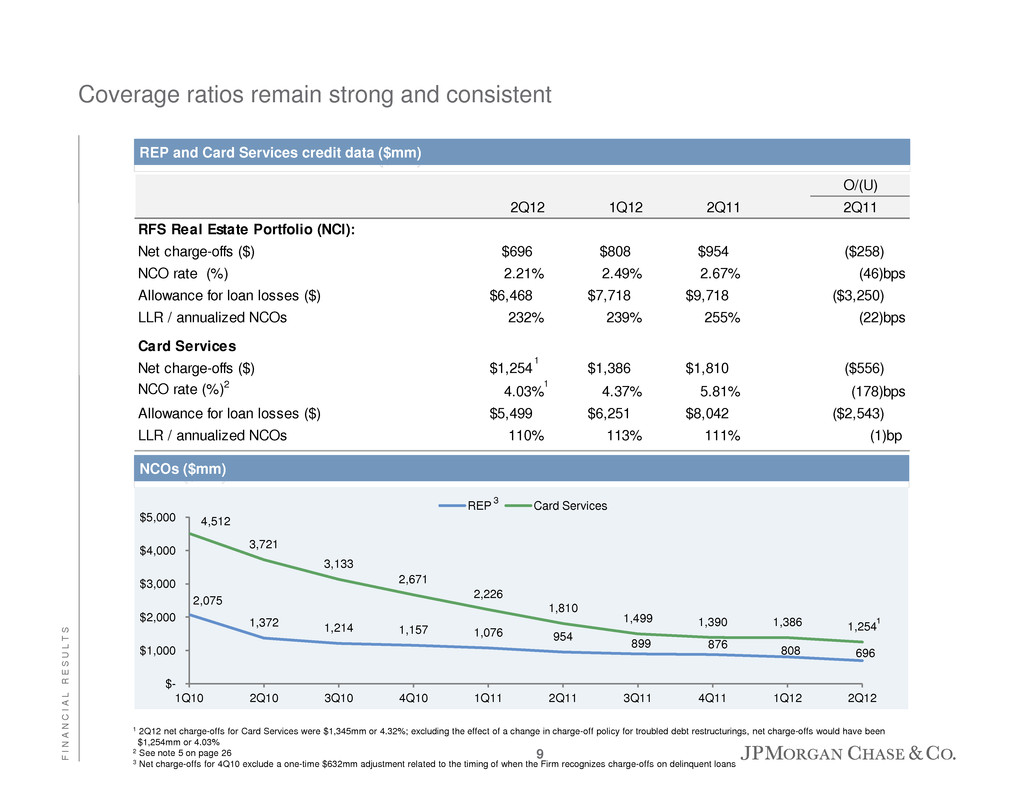

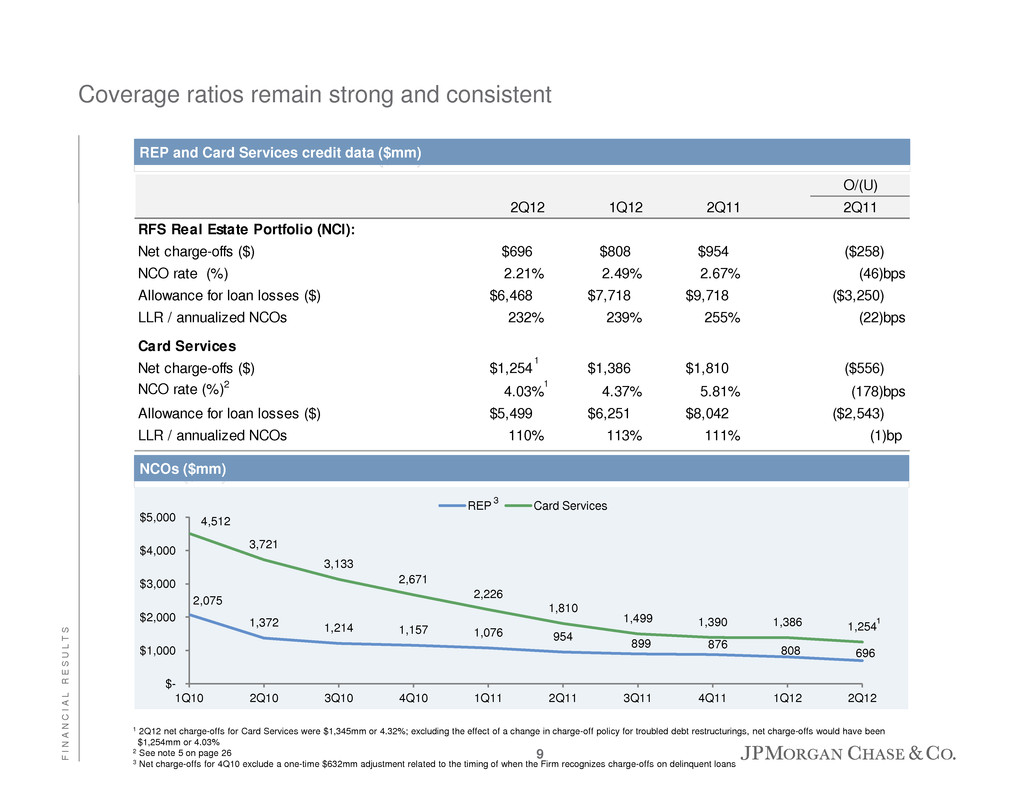

Coverage ratios remain strong and consistent 1 2Q12 net charge-offs for Card Services were $1,345mm or 4.32%; excluding the effect of a change in charge-off policy for troubled debt restructurings, net charge-offs would have been $1,254mm or 4.03% 2 See note 5 on page 26 3 Net charge-offs for 4Q10 exclude a one-time $632mm adjustment related to the timing of when the Firm recognizes charge-offs on delinquent loans O/(U) 2Q12 1Q12 2Q11 2Q11 RFS Real Estate Portfolio (NCI): Net charge-offs ($) $696 $808 $954 ($258) NCO rate (%) 2.21% 2.49% 2.67% (46)bps Allowance for loan losses ($) $6,468 $7,718 $9,718 ($3,250) LLR / annualized NCOs 232% 239% 255% (22)bps Card Services Net charge-offs ($) $1,254 $1,386 $1,810 ($556) NCO rate (%)2 4.03% 4.37% 5.81% (178)bps Allowance for loan losses ($) $5,499 $6,251 $8,042 ($2,543) LLR / annualized NCOs 110% 113% 111% (1)bp 1 REP and Card Services credit data ($mm) 1 NCOs ($mm) 2,075 1,372 1,214 1,157 1,076 954 899 876 808 696 4,512 3,721 3,133 2,671 2,226 1,810 1,499 1,390 1,386 1,254 $- $1,000 $2,000 $3,000 $4,000 $5,000 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 REP Card Services 3 1 9 F I N A N C I A L R E S U L T S

2Q12 1Q12 2Q11 Revenue $1,691 $34 $64 Middle Market Banking 833 8 44 Corporate Client Banking 343 6 4 Commercial Term Lending 291 (2) 5 Real Estate Banking 114 9 5 Other 110 13 6 Credit costs ($17) ($94) ($71) Expense 591 (7) 28 Net income $673 $82 $66 Key statistics ($B)2 Average loans and leases $118.4 $113.8 $101.9 EOP loans and leases 120.5 115.8 102.7 Average liability balances3 193.3 200.2 162.8 Allowance for loan losses 2.6 2.7 2.6 Nonaccrual loans 0.9 1.0 1.6 Net charge-off/(recovery) rate4 (0.03)% 0.04% 0.16% ALL/loans4 2.20 2.32 2.56 Overhead ratio 35 36 35 ROE5 28 25 30 EOP equity $9.5 $9.5 $8.0 $ O/(U) Commercial Banking1 1 See note 1 on slide 26 2 Actual numbers for all periods, not over/under 3 Includes deposits and deposits swept to on-balance sheet liabilities 4 Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off/(recovery) rate 5 Calculated based on average equity of $9.5B, $9.5B and $8.0B for 2Q12, 1Q12 and 2Q11, respectively Net income of $673mm, up 11% YoY Record revenue of $1.7B, up 4% YoY Record EOP loan balances up 17% YoY and 4% QoQ; record Middle Market loans up 18% YoY 8th consecutive quarter of increased loan balances; 9th for Middle Market Average liability balances of $193.3B, up 19% YoY Credit cost benefit of $17mm Net charge-off/(recovery) rate of (0.03)% Excluding recoveries, charge-off rate of 0.13% Expense up 5% YoY; overhead ratio of 35% $mm 10 F I N A N C I A L R E S U L T S

2Q12 1Q12 2Q11 Revenue $2,152 $138 $220 Treasury Services 1,074 22 144 Worldwide Securities Services 1,078 116 76 Expense 1,491 18 38 Credit costs 8 6 10 Credit allocation income/(expense)2 68 65 36 Net income $463 $112 $130 Key statistics3 Average liability balances ($B)4 $348.1 $357.0 $302.9 Assets under custody ($T) 17.7 17.9 16.9 EOP trade finance loans ($B) 35.3 35.7 27.5 Pretax margin 34% 27% 27% ROE5 25 19 19 EOP equity ($B) $7.5 $7.5 $7.0 TSS firmwide revenue 2,823 2,685 2,553 TS firmwide revenue 1,745 1,723 1,551 TSS firmwide average liab bal ($B)4 541.4 557.1 465.6 $ O/(U) Treasury & Securities Services1 Net income of $463mm, up 39% YoY and 32% QoQ Pretax margin of 34% Revenue of $2.2B, up 11% YoY and 7% QoQ TS revenue of $1.1B, up 15% YoY WSS revenue of $1.1B, up 8% YoY Liability balances up 15% YoY Assets under custody of $17.7T, up 4% YoY Expense up 3% YoY, driven by continued expansion into new markets, and up 1% QoQ 1 See note 1, 7 and 8 on slide 26 2 IB and TSS share the economics related to the Firm’s GCB clients. Included within this allocation are net revenue, provision for credit losses as well as expense 3 Actual numbers for all periods, not over/under 4 Includes deposits and deposits swept to on-balance sheet liabilities 5 Calculated based on average equity; 2Q12, 1Q12, and 2Q11 average equity was $7.5B, $7.5B, and $7.0B respectively $mm 11 F I N A N C I A L R E S U L T S

2Q12 1Q12 2Q11 Revenue $2,364 ($6) ($173) Private Banking 1,341 62 52 Institutional 537 (20) (157) Retail 486 (48) (68) Credit costs $34 $15 $22 Expense 1,701 (28) (93) Net income $391 $5 ($48) Key statistics ($B)2 Assets under management $1,347 $1,382 $1,342 Assets under supervision 1,968 2,013 1,924 Average loans 67.1 59.3 48.8 EOP loans 70.5 64.3 51.7 Average deposits 128.1 127.5 97.5 Pretax margin3 27% 26% 29% ROE4 22 22 27 EOP equity $7.0 $7.0 $6.5 $ O/(U) Asset Management1 1 See note 1 on slide 26 2 Actual numbers for all periods, not over/under 3 See note 8 on slide 26 4 Calculated based on average equity; average equity of $7.0B, $7.0B and $6.5B for 2Q12, 1Q12 and 2Q11 respectively Net income of $391mm, down 11% YoY and up 1% QoQ Revenue of $2.4B, down 7% YoY Assets under management of $1.3T, flat YoY QoQ, AUM net outflows of $11B due to net outflows of $25B from liquidity products, largely offset by net inflows of $14B to long-term products Assets under supervision of $2.0T, up 2% YoY Strong investment performance 74% of mutual fund AUM ranked in the 1st or 2nd quartiles over 5 years Expense down 5% YoY and 2% QoQ $mm 12 F I N A N C I A L R E S U L T S

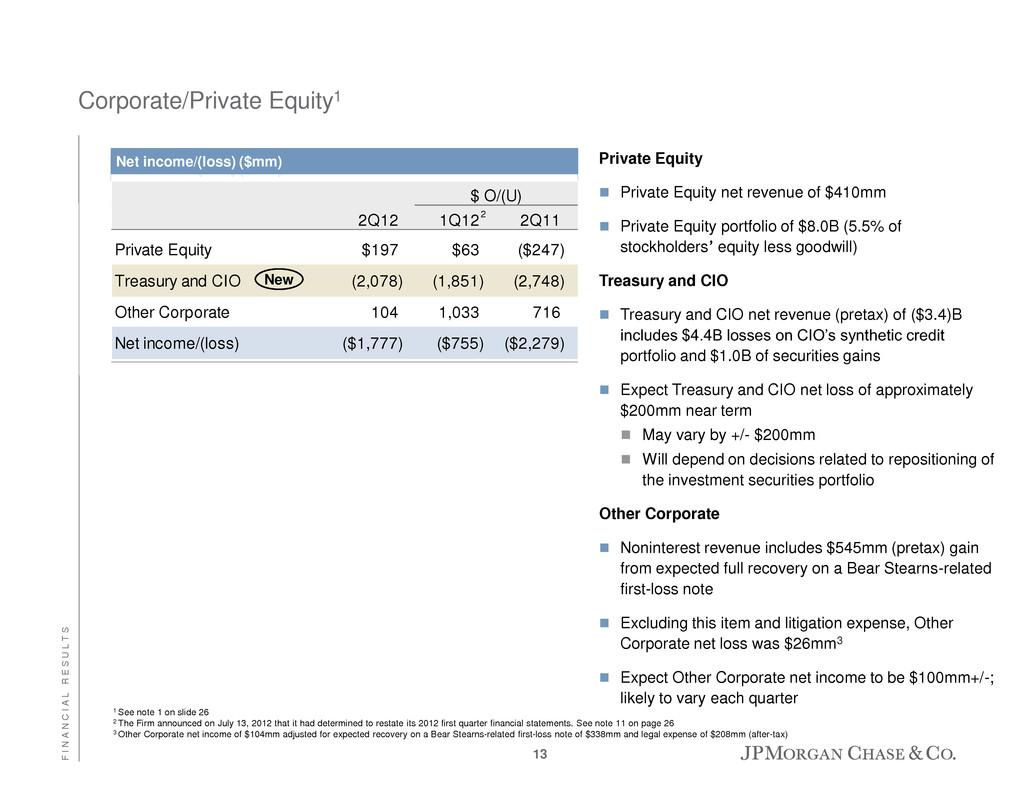

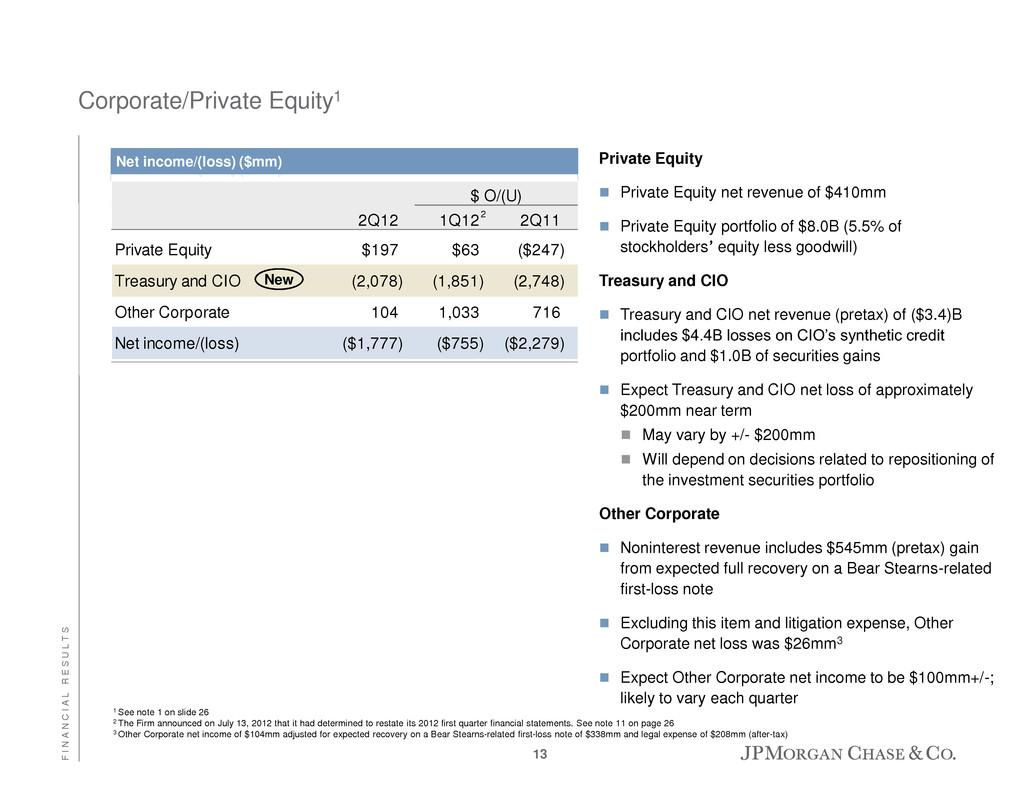

2Q12 1Q12 2Q11 Private Equity $197 $63 ($247) Treasury and CIO (2,078) (1,851) (2,748) Other Corporate 104 1,033 716 Net income/(loss) ($1,777) ($755) ($2,279) $ O/(U) Corporate/Private Equity1 Private Equity Private Equity net revenue of $410mm Private Equity portfolio of $8.0B (5.5% of stockholders’ equity less goodwill) Treasury and CIO Treasury and CIO net revenue (pretax) of ($3.4)B includes $4.4B losses on CIO’s synthetic credit portfolio and $1.0B of securities gains Expect Treasury and CIO net loss of approximately $200mm near term May vary by +/- $200mm Will depend on decisions related to repositioning of the investment securities portfolio Other Corporate Noninterest revenue includes $545mm (pretax) gain from expected full recovery on a Bear Stearns-related first-loss note Excluding this item and litigation expense, Other Corporate net loss was $26mm3 Expect Other Corporate net income to be $100mm+/-; likely to vary each quarter 1 See note 1 on slide 26 2 The Firm announced on July 13, 2012 that it had determined to restate its 2012 first quarter financial statements. See note 11 on page 26 3 Other Corporate net income of $104mm adjusted for expected recovery on a Bear Stearns-related first-loss note of $338mm and legal expense of $208mm (after-tax) New 2 Net income/(loss) ($mm) 13 F I N A N C I A L R E S U L T S

$mm 2009 2010 2011 1Q12 2Q12 Total net revenue Private Equity $18 $1,239 $836 $254 $410 Treasury and CIO 7,462 6,642 3,196 (233) (3,434) Other Corporate (846) (459) 111 1,008 415 Total net revenue $6,634 7,422 $4,143 $1,029 ($2,609) Net income/(loss) Private Equity ($78) $588 $391 $134 $197 Treasury and CIO 4,288 3,576 1,349 (227) (2,078) Other Corporate (1,180) (2,906) (938) (929) 104 Total net income/(loss) $3,030 $1,258 $802 ($1,022) ($1,777) Total assets (period-end) $595,877 $526,588 $693,153 $713,326 $667,206 Treasury and CIO financial performance New New Firmwide trading assets – Debt and equity securities of $332B include CIO securities of $19B Treasury and CIO information – Existing disclosure Corporate/PE financial highlights – Existing and new disclosure1 1 The Firm announced on July 13, 2012 that it had determined to restate its 2012 first quarter financial statements. See note 11 on page 26 2 Restated to reflect recognition of $660mm of trading losses (principal transactions) in 1Q12 3 CIO principal transactions for 1Q12 was ($868)mm, including $1,378mm of synthetic credit losses (including the impact of the ($660)mm restatement adjustment) and $510mm of other mark-to- market gains 4 95% confidence level Spot VaR ($mm)4 2 $mm 2009 2010 2011 1Q12 2Q12 Securities gains $1,147 $2,897 $1,385 $453 $1,013 Investment securities portfolio (average) 324,037 323,673 330,885 361,601 359,130 Investment securities portfolio (ending) 340,163 310,801 355,605 374,588 348,610 Mortgage loans (average) 7,427 9,004 13,006 12,636 11,012 Mortgage loans (ending) 8,023 10,739 13,375 11,819 10,332 Average VaR4 $103 $61 $57 $129 $1776/29/12 7/2/12 7/10/12 $180 $130 $123 1Q12 Reported Adjustment $427 ($660) $134 − 157 (384) (854) (75) ($563) ($459) Pre-restatement 3 14 F I N A N C I A L R E S U L T S

Fortress balance sheet Firmwide total credit reserves of $24.6B; loan loss coverage ratio of 2.74%5 Global liquidity reserve in excess of $414B6 Pre-final B2.5 and NPR 1 Does not include impact of Basel 2.5 rules; 2Q12 B1T1C ratio estimated to be 8.8% if impact was included 2 See note 4 on slide 26, and the Basel I Tier 1 capital and Tier 1 capital ratio on page 43 of the Firm’s second quarter 2012 earnings release financial supplement 3 Reflects impact of final Basel 2.5 rules and proposed NPR. Final Basel 2.5 rules include addition of comprehensive risk measure (“CRM”) surcharge and revision of standardized risk weights, which represents an estimated $40B increase in RWA; surcharge may be eliminated by appropriate regulatory approval no sooner than 3/31/14 4 Includes the effect of bringing forward mitigants and run-off 5 See note 2 on slide 26 6 The Global Liquidity Reserve represents cash on deposit at central banks, and the cash proceeds expected to be received in connection with secured financing of highly liquid, unencumbered securities (such as sovereigns, FDIC and government guaranteed, agency and agency MBS). In addition, the Global Liquidity Reserve includes the Firm’s borrowing capacity at the Federal Reserve Bank discount window and various other central banks and from various Federal Home Loan Banks, which capacity is maintained by the Firm having pledged collateral to all such banks. These amounts represent preliminary estimates which may be revised in the Firm’s 10-Q for the quarter ending June 30, 2012 Note: estimated for 2Q12 Note: firmwide level 3 assets, reported at fair value, are estimated to be 5% of total Firm assets as of June 30, 2012 Note: NPR in comment period until 9/7/12; estimates subject to change based on regulatory clarifications, further analysis, confirmation of netting assumptions, and timing of model approvals 2Q12 1Q12 2Q11 Basel I Tier 1 common capital1,2 $130 $128 $121 Basel III Tier 1 common capital2,3 132 − − Basel I Risk-weighted assets1 1,269 1,235 1,199 Basel III Risk-weighted assets2,3 1,664 − − Total assets 2,290 2,320 2,247 Basel I Tier 1 common ratio1,2 10.3% 10.3% 10.1% Basel III Tier 1 common ratio − Final B2.5 rules and NPR3 7.9 − − Basel III Tier 1 common ratio − Post-mitigants3,4 9.1 − − Return on Basel I RWA 1.6% 1.6% 1.8% 2Q12 1Q12 2Q11 B3T1C2 8.3% 8.1% 7.6% $B, except where noted 15 F I N A N C I A L R E S U L T S

Outlook Expect flat operating expense, relative to 1H12 In excess of prior estimates Predominantly due to Mortgage – Half related to higher Production; half related to default servicing, including consent order and Independent Foreclosure Review Also includes higher costs associated with compliance, legal fees and FDIC assessments Firmwide guidance Corporate / Private Equity Expect Treasury and CIO net loss of approximately $200mm near term May vary by +/- $200mm Will depend on decisions related to repositioning of the investment securities portfolio Expect Other Corporate net income to be $100mm+/; likely to vary each quarter TRuPs redemption economic (pretax) impact ~$900mm one-time gain due to swap termination associated with TruPS redemption in 3Q12 ~$300mm and ~$650mm gross NII savings in 2012 and 20131 Retail Financial Services Consumer & Business Banking Deposit spread compression, given low interest rates, will negatively impact net income by $400mm+/-, but this may be offset by strong deposit balance growth Mortgage Banking Total quarterly net charge-offs likely to be below $750mm and to continue to trend down thereafter, subject to economic uncertainty As a result, expect reserve reductions in Mortgage Based on current trends, realized repurchase losses may be offset by reserve reductions Card Services Expect 3Q12 Credit Card losses to be 3.75% +/- Expect reserve releases are near the end 1 Does not take into account cost associated with other term funding alternatives 16 F I N A N C I A L R E S U L T S

Core net interest margin1 1 See note 1 on slide 26 2 The core and market-based NII presented for 2009 represent the quarterly average for 2009 (total for 2009 divided by 4); the yield for all periods represent the annualized yield 3 FAS 133 ineffectiveness Both Firmwide and Core NIM lower (14 bps and 10 bps respectively) QoQ due to Lower rates affecting trading assets Changes in loan mix and lower customer rates Accounting impact3 from swapping fixed rate investment securities and long-term debt to floating rate Investment securities Yield decrease from 2.60% in 1Q12 to 2.42% in 2Q12, primarily due to accounting3 Securities sales and portfolio activity during the quarter did not materially impact portfolio yield Long-term debt Firm’s long-term debt yield decreased from 2.71% in 1Q12 to 2.47% in 2Q12 due to accounting3 Expect continued modest pressure on NIM in 3Q12 Comments Net interest income trend 3.91% 3.85% 3.66% 3.66% 3.51% 3.54% 3.33% 3.14% 3.19% 3.10% 3.00% 1.92% 1.77% 1.47% 1.42% 1.42% 1.43% 1.35% 1.45% 1.42% 1.29% 1.07% 3.42% 3.32% 3.06% 3.01% 2.88% 2.89% 2.72% 2.66% 2.70% 2.61% 2.47% FY2009 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 Core NII Market-based NII Core NIM Market-based NIM JPM NIM 2 17 F I N A N C I A L R E S U L T S

Peripheral European exposure1 As of June 30, 2012 ($B) Securities and trading Lending AFS securities Trading Derivative collateral Portfolio hedging Net exposure Spain $3.5 $0.7 $2.6 ($2.9) ($0.4) $3.5 Sovereign 0.0 0.4 0.1 0.0 (0.1) 0.4 Non-sovereign 3.5 0.3 2.5 (2.9) (0.3) 3.1 Italy $2.9 $0.1 $7.6 ($2.6) ($4.9) $3.1 Sovereign 0.0 0.0 8.6 (1.4) (4.4) 2.8 Non-sovereign 2.8 0.1 (1.0) (1.2) (0.5) 0.3 Other (Ireland, Portugal, and Greece) $1.1 $0.3 $0.4 ($1.4) ($0.7) ($0.3) Sovereign 0.0 0.3 0.5 0.0 (0.6) 0.2 Non-sovereign 1.1 0.0 (0.1) (1.4) (0.1) (0.5) Total firmwide exposure $7.5 $1.1 $10.6 ($6.9) ($6.0) $6.3 Total firmwide exposure decreased primarily due to market impact on certain hedge positions; will be impacted by markets, portfolio activity and roll-off of positions Net exposure could return to recent historical levels over time 1 Exposure is a risk management view. Lending is net of liquid collateral. Trading includes net inventory, derivative netting under legally enforceable trading agreements, net CDS underlying exposure from market-making flows, unsecured net derivative receivables and under collateralized securities financing counterparty exposure 18 F I N A N C I A L R E S U L T S

Agenda Page 19 Appendix Financial results Treasury and CIO overview 19 F I N A N C I A L R E S U L T S

Impact of recent NPR Appendix – Financial results Estimated RWA impact of final B2.5 rules and recent NPR ($B) Basel I Basel III Tier 1 common (T1C) $130 T1C $131 RWA 1,269 RWA 1,584 T1C ratio1 10.3% T1C ratio 8.3% Average RWA Impact RWA impact2 ~+215 RWA impact2 ~+45 Pro-forma T1C ratio 8.8% Pro-forma T1C ratio 8.1% Average RWA Impact T1C incremental impact3 ~-120bps T1C incremental impact4 ~-15bps Pro-forma T1C ratio 7.6% Pro-forma T1C ratio 7.9% T1C incremental impact ~+60bps T1C incremental impact ~+120bps Pro-forma T1C ratio 8.1% Pro-forma T1C ratio 9.1% Preliminary Estimate of NPR Impact Pre-Mitigants (effective 2015+) Estimated Impact of Basel 2.5 Market Risk Rules (effective 1/1/13) 2Q12 T1C Ratio (pre-final 2.5 rules and NPR) Impact of Mitigants and Run-off 1 Does not include impact of Basel 2.5 rules; 2Q12 B1T1C ratio estimated to be 8.8% if impact was included 2 Reflects impact of final Basel 2.5 rules in Basel I and Basel III. Final Basel 2.5 rules include addition of comprehensive risk measure (“CRM”) surcharge and revision of standardized risk weights, which represents an estimated $40B increase in RWA; surcharge may be eliminated through appropriate regulatory approval no sooner than 3/31/14 3 Primarily driven by mortgages, derivatives and securitizations 4 Primarily driven by securitizations, partially offset by pension asset Note: NPR in comment period until 9/7/12; estimates subject to change based on regulatory clarifications, further analysis, confirmation of netting assumptions, and timing of model approvals 20 A P P E N D I X

Note: Delinquencies prior to September 2008 are heritage Chase Prime Mortgage excludes held-for-sale, Asset Management and Government Insured loans 1 Excluding purchased credit-impaired loans and WaMu and Commercial Card portfolios 2 See note 1 on slide 26 3 “Payment holiday” in 2Q09 impacted 30+ day and 30-89 day delinquency trends in 3Q09 Consumer credit – Delinquency trends1 Appendix – Financial results $1,000 $2,400 $3,800 $5,200 $6,600 $8,000 Sep-08 Feb-09 Jul-09 Dec-09 May-10 Oct-10 Mar-11 Aug-11 Jan-12 Jun-12 30+ day delinquencies 30-89 day delinquencies Credit card delinquency trend2,3 ($mm) $0 $1,000 $2,000 $3,000 Sep-08 Feb-09 Jul-09 Dec-09 May-10 Oct-10 Mar-11 Aug-11 Jan-12 Jun-12 $0 1,3 $2,600 $3,900 Sep-08 Feb-09 Jul-09 Dec-09 May-10 Oct-10 Mar-11 Aug-11 Jan-12 Jun-12 30 – 149 day delinquencies 150+ day delinquencies 30 – 149 day delinquencies 150+ day delinquencies $0 $1,000 $2,000 $3,000 Sep-08 Feb-09 Jul-09 Dec-09 May-10 Oct-10 Mar-11 Aug-11 Jan-12 Jun- 2 30 – 149 day delinquencies 150+ day delinquencies Subprime Mortgage delinquency trend ($mm) Prime Mortgage delinquency trend ($mm) Home Equity delinquency trend ($mm) 21 A P P E N D I X

Coverage ratios remain strong Appendix – Financial results $23.8B of loan loss reserves in 2Q12, down ~$4.7B from $28.5B one year ago reflecting improved portfolio credit quality; loan loss coverage ratio of 2.74%1 1 See note 2 on slide 26 2 NPLs include $1.5B of performing junior liens that are subordinate to nonaccrual senior liens; such junior liens are now being reported as nonaccrual loans based upon regulatory guidance issued in the first quarter of 2012. Of the total, $1.3B were current at June 30, 2012 3 Peer average reflects equivalent metrics for key competitors. Peers are defined as C, BAC and WFC $mm 2 Q12 1 Q 12 JPM 1 JPM 1 Peer avg. 3 Consumer LLR/Total loans 3.79% 4.34% 4.37% LLR/NPLs 2 170 187 163 Wholesale LLR/Total loans 1.46% 1.52% 1.39% LLR/NPLs 241 223 80 Firmwide LLR/Total loans 2.74% 3.11% 3.25% LLR/NPLs 2 183 194 142 Peer comparison 16,179 15,503 14,841 13,441 11,928 11,005 9,993 10,605 10,068 35,836 34,161 32,266 29,750 28,520 28,350 27,609 25,871 23,791 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 0% 100% 200% 300% 400% 500% 600% Loan loss reserve Nonperforming loans Loan loss reserve/Total loans1 Loan loss reserve/NPLs1 2 22 A P P E N D I X

IB League Tables – YTD June 30, 2012 Appendix – Financial results For the 6 months ended 6/30/12, JPM ranked: #1 in Global IB fees #1 in Global Debt, Equity & Equity-related #1 in Global Long-term Debt #3 in Global Equity & Equity-related #2 in Global M&A Announced #1 in Global Loan Syndications League table results Rank Share Rank Share Based on fees: Global IB fees 1 1 7.6% 1 8.0% Based on volumes: Global Debt, Equity & Equity-related 1 7.1% 1 6.7% US Debt, Equity & Equity-related 1 11.3% 1 11.1% Global Long-term Debt ' 2 1 7.0% 1 6.7% US Long-term Debt 1 11.2% 1 11.2% Global Equity & Equity-related 3 3 8.2% 3 6.8% US Equity & Equity-related 4 11.1% 1 12.5% Global M&A Announced 4 2 20.0% 2 18.2% US M&A Announced 2 20.7% 2 26.7% Global Loan Syndications 1 9.9% 1 10.8% US Loan Syndications 1 18.2% 1 21.2% 6 months ended 6/30/12 FY11 Source: Dealogic. Global Investment Banking fees reflects ranking of fees and market share. Remainder of rankings reflects transaction volume rank and market share. Global announced M&A is based on transaction value at announcement; because of joint M&A assignments, M&A market share of all participants will add up to more than 100%. All other transaction volume-based rankings are based on proceeds, with full credit to each book manager/equal if joint 1 Global Investment Banking fees rankings exclude money market, short-term debt and shelf deals 2 Long-term debt rankings include investment-grade, high-yield, supranational, sovereigns, agencies, covered bonds, asset-backed securities (“ABS”) and mortgage-backed securities; and exclude money market, short-term debt, and U.S. municipal securities 3 Global Equity and equity-related ranking includes rights offerings and Chinese A- Shares 4 U.S. announced M&A represents any U.S. involvement ranking 23 A P P E N D I X

JPMorgan balance sheet Appendix – Treasury and CIO overview 48 192 693 1,116 965 62 982 323 199 Assets Liabilities/equity $2,290B $2,290B CIO AFS securities Treasury deployment1 Total Treasury and CIO deployment $522B Equity Deposits VIEs, CPs, repos, trading liabilities, LT debt and other liabilities2 $144B Equity net of goodwill $423B Deposit to loan gap Net of ($45)B6 Treasury and CIO other assets3 Goodwill Loans7 Reverse repos & securities borrowed4, trading assets, LOB cash and other assets5 Investment requirements for Treasury and CIO are driven by excess liabilities (and equity) JPMorgan balance sheet – June 30, 2012 1 Treasury deployment includes ~$129B of cash and deposits with banks, ~$45B of reverse repos and securities borrowed and ~$25B of AFS securities 2 Other liabilities include accounts payable and other borrowed funds 3 Treasury and CIO assets include CIO cash and deposits with banks, CIO reverse repos and securities borrowed, trading assets, loans, net of allowance for loan losses, FRB and FHLB stock and accrued interest and accounts receivable 4 Reverse repos and securities borrowed exclude Treasury and CIO reverse repos and securities borrowed 5 Other assets include non-Treasury and CIO intangibles, MSR, premises and equipment, accrued interest & accounts receivables and securities (mostly AM of $6B) 6 Includes $62B of other Treasury and CIO assets 7 Excludes loans, net of allowance for loan losses, that are in Treasury and CIO other assets 24 A P P E N D I X

FTP process – An example Appendix – Treasury and CIO overview An example CBB originates a $100K 5-year deposit in June1 Interest rate, duration and liquidity parameters associated with the $100K 5-year deposit are delivered to Treasury Treasury transfers LT interest rate and duration risks to CIO CIO invests $100K Treasury and CIO transfer back to CBB $1,470 NII per year for 5 years (on basis of swaps + 50 bps, rate set by Treasury per FTP2) Earnings on $100K investment above or below $1,470 retained in CIO and not allocated to CBB 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 5yr swap rate + spread 5yr AA composite index 5yr swap 1 CD for the purpose of the example 2 Based on average 2Q12 FTP 5-year FTP rate for 2Q12 0.97% 0.50% 5-year Swap rate Spread 1.47% 5-year fixed FTP rate over multiple years (deposits and loans) FTP rate 25 A P P E N D I X

Notes on non-GAAP financial measures 1. In addition to analyzing the Firm’s results on a reported basis, management reviews the Firm’s results and the results of the lines of business on a “managed” basis, which is a non-GAAP financial measure. The Firm’s definition of managed basis starts with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm (and each of the business segments) on a fully taxable-equivalent (“FTE”) basis. Accordingly, revenue from tax-exempt securities and investments that receive tax credits is presented in the managed results on a basis comparable to taxable securities and investments. This non-GAAP financial measure allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. 2. The ratio of the allowance for loan losses to end-of-period loans excludes the following: loans accounted for at fair value and loans held-for-sale; purchased credit-impaired (“PCI”) loans; and the allowance for loan losses related to PCI loans. Additionally, Real Estate Portfolios net charge-off rates exclude the impact of PCI loans. The allowance for loan losses related to the PCI portfolio totaled $5.7 billion, $5.7 billion and $4.9 billion at June 30, 2012, March 31, 2012, and June 30, 2011, respectively. 3. Tangible common equity (“TCE”) represents common stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable intangible assets (other than MSRs), net of related deferred tax liabilities. Return on tangible common equity measures the Firm’s earnings as a percentage of TCE. In management’s view, these measures are meaningful to the Firm, as well as analysts and investors, in assessing the Firm’s use of equity, and in facilitating comparisons with peers. 4. The Basel I Tier 1 common ratio is Tier 1 common divided by risk-weighted assets. Tier 1 common is defined as Tier 1 capital less elements of Tier 1 capital not in the form of common equity, such as perpetual preferred stock, noncontrolling interests in subsidiaries, and trust preferred capital debt securities. Tier 1 common, a non-GAAP financial measure, is used by banking regulators, investors and analysts to assess and compare the quality and composition of the Firm’s capital with the capital of other financial services companies. The Firm uses Tier 1 common along with other capital measures to assess and monitor its capital position. On December 16, 2010, the Basel Committee issued the final version of the Basel Capital Accord, commonly referred to as “Basel III.” The Firm’s estimate of its Tier 1 common ratio under Basel III is a non-GAAP financial measure and reflects the Firm’s current understanding of the Basel III rules and the application of such rules to its businesses as currently conducted, and therefore excludes the impact of any changes the Firm may make in the future to its businesses as a result of implementing the Basel III rules. The Firm’s estimates of its Basel III Tier 1 common ratio will evolve over time as the Firm’s businesses change, and as a result of further rule-making on Basel III implementation from U.S. federal banking agencies. Management considers this estimate as a key measure to assess the Firm’s capital position in conjunction with its capital ratios under Basel I requirements, in order to enable management, investors and analysts to compare the Firm’s capital under the Basel III capital standards with similar estimates provided by other financial services companies. The Firm’s understanding of the Basel III rules is based on information currently published by the Basel Committee and U.S. federal banking agencies. 5. In Card Services & Auto, supplemental information is provided for Card Services, to provide more meaningful measures that enable comparability with prior periods. The change in net income is presented excluding the change in the allowance. The net charge-off rate and 30+ day delinquency rate presented include loans held-for-sale. Additional notes on financial measures 6. Headcount-related expense includes salary and benefits (excluding performance-based incentives), and other noncompensation costs related to employees. 7. Treasury & Securities Services firmwide metrics include certain TSS product revenue and liability balances reported in other lines of business related to customers who are also customers of those other lines of business. In order to capture the firmwide impact of TSS products and revenue, management reviews firmwide metrics such as liability balances, revenue and overhead ratios in assessing financial performance for TSS. Firmwide metrics are necessary, in management’s view, in order to understand the aggregate TSS business. 8. Pretax margin represents income before income tax expense divided by total net revenue, which is, in management’s view, a comprehensive measure of pretax performance derived by measuring earnings after all costs are taken into consideration. It is, therefore, another basis that management uses to evaluate the performance of TSS and AM against the performance of their respective peers. 9. Credit card sales volume is presented excluding Commercial Card. Rankings and comparison of general purpose credit card sales volume are based on disclosures by peers and internal estimates. Rankings are as of 1Q12. 10. The amount of credit provided to clients represents new and renewed credit, including loans and commitments. The amount of credit provided to small businesses reflects loans and increased lines of credit provided by Consumer & Business Banking, Card Services & Auto and Commercial Banking. The amount of credit provided to not-for-profit and government entities, including states, municipalities, hospitals and universities, represents that provided by the Investment Bank. Financial restatement 11. On July 13, 2012, JPMorgan Chase & Co. reported that it will be restating its previously-filed interim financial statements for the first quarter 2012. The restatement will have the effect of reducing the Firm’s reported net income for 2012 first quarter by $459 million. The first quarter 2012 amounts in this supplement reflect the effects of such restatement. For further information, see the Company’s Current Report on Form 8-K dated July 13, 2012, which has been filed with the Securities and Exchange Commission and is available on the Company’s website (http://investor.shareholder.com/jpmorganchase) and on the Securities and Exchange Commission’s website (www.sec.gov). Notes 26 A P P E N D I X

Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2011, and Quarterly Report on Form 10-Q for the quarter ended March 31, 2012, which have been filed with the Securities and Exchange Commission and are available on JPMorgan Chase & Co.’s website (www.jpmorganchase.com), and on the Securities and Exchange Commission’s website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements. 27 A P P E N D I X