united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22655

Grandeur Peak Global Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: (631) 490-4300

Date of fiscal year end: 3/31

Date of reporting period: 10/31/23

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Performance Update | 13 |

| Disclosure of Fund Expenses | 43 |

| Portfolio of Investments | |

| Grandeur Peak Emerging Markets Opportunities Fund | 45 |

| Grandeur Peak Global Contrarian Fund | 48 |

| Grandeur Peak Global Explorer Fund | 51 |

| Grandeur Peak Global Micro Cap Fund | 56 |

| Grandeur Peak Global Opportunities Fund | 59 |

| Grandeur Peak Global Reach Fund | 62 |

| Grandeur Peak Global Stalwarts Fund | 67 |

| Grandeur Peak International Opportunities Fund | 70 |

| Grandeur Peak International Stalwarts Fund | 74 |

| Grandeur Peak US Stalwarts Fund | 77 |

| Statements of Assets and Liabilities | 79 |

| Statements of Operations | 81 |

| Statement of Changes in Net Assets | |

| Grandeur Peak Emerging Markets Opportunities Fund | 83 |

| Grandeur Peak Global Contrarian Fund | 84 |

| Grandeur Peak Global Explorer Fund | 85 |

| Grandeur Peak Global Micro Cap Fund | 86 |

| Grandeur Peak Global Opportunities Fund | 87 |

| Grandeur Peak Global Reach Fund | 88 |

| Grandeur Peak Global Stalwarts Fund | 89 |

| Grandeur Peak International Opportunities Fund | 90 |

| Grandeur Peak International Stalwarts Fund | 91 |

| Grandeur Peak US Stalwarts Fund | 92 |

| Financial Highlights | |

| Grandeur Peak Emerging Markets Opportunities Fund | 93 |

| Grandeur Peak Global Contrarian Fund | 95 |

| Grandeur Peak Global Explorer Fund | 96 |

| Grandeur Peak Global Micro Cap Fund | 97 |

| Grandeur Peak Global Opportunities Fund | 98 |

| Grandeur Peak Global Reach Fund | 100 |

| Grandeur Peak Global Stalwarts Fund | 102 |

| Grandeur Peak International Opportunities Fund | 104 |

| Grandeur Peak International Stalwarts Fund | 106 |

| Grandeur Peak US Stalwarts Fund | 108 |

| Notes to Financial Statements | 109 |

| Disclosure Regarding Approval of Fund Advisory Agreement | 124 |

| Privacy Policy | 130 |

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

Dear Fellow Shareholders,

High-Level Thoughts

| ● | Interest rates have been near a two-decade high, and the market is forecasting rates to remain high for an extended period. |

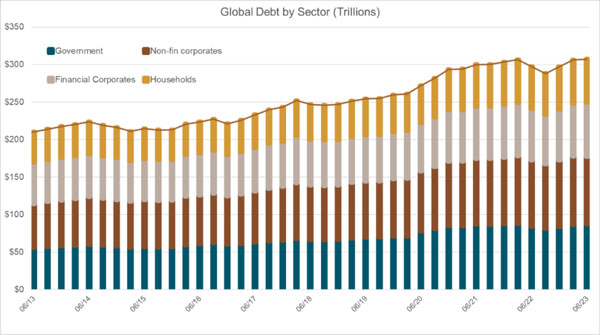

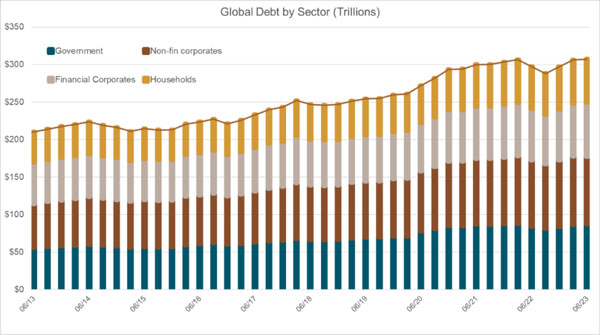

| ● | Global debt levels have reached a record high, increasing over $50 trillion in the past three years alone. |

| ● | High-quality companies (i.e., companies with high Return on Assets (ROA)1 and low leverage) have outperformed the broader market consistently over time. |

| ● | Historically, the outperformance of high-quality companies over the broader market has been prominent during periods when interest rates are relatively high. |

| ● | The Grandeur portfolios have significantly better fundamentals than their respective benchmarks. |

The Burger Bill Comes Due

E.C. Segar’s early 20th century comic strip, Popeye the Sailor, features a character named J. Wellington Wimpy. Wimpy, as he is known, is a stout man with a serious hamburger addiction and no money. As a result, he is commonly found trying to entice others into buying him a hamburger today for payment on Tuesday. Fortunately for Wimpy, “Tuesday”, or the day of repayment never comes thus allowing him to run up what seems like an endless burger tab.

Segar leaves readers with many questions when it comes to Wimpy and his “pull forward” burger consumption tactics. For example, what are the financing terms of Wimpy’s arrangement? Surely, his cost of burger capital isn’t free. His credit worthiness must be abysmal. How do his lenders get comfortable with extending his credit line to consume more burgers when he already has a lot of burger leverage on his balance sheet? We must assume that at some point Wimpy’s burger bill will come due. When it does, it won’t be pretty for him or his creditors. He will have to do a burger detox and find another, less expensive, source of sustenance. Perhaps a steady diet of spinach is in Wimpy’s future?

Over the past 15 years, many of the world’s largest central banks have implemented monetary policies that have kept the cost of capital exceptionally low. These policies have incentivized governments, corporations, and households to employ a “buy now, pay later” consumption strategy that would give even someone like Wimpy great pause. As of June 30, 2023, the Institute of International Finance reported that total global debt was $307 trillion dollars, an increase of 19.36% or $53 trillion dollars in the past 3 years alone2.

| 1 | Return on Assets (ROA) is a measure of how efficiently a company uses its assets to generate a profit and is calculated by dividing company’s net income by total assets. |

| 2 | Institute of International Finance, Global Debt, 6/30/2023 |

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

FIGURE 1

Low interest rates combined with the aggressive stimulus pumped into the global economy by many fiscal and monetary policy makers at the onset of Covid resulted in a meaningful inflation increase that did not recede nearly as much as was initially expected. This prompted policy makers to rapidly increase interest rates to stem the inflationary pressures. Interest rates have now reached two-decade highs in many economies3.

| 3 | Bank for International Settlements, GDP Policy rate calculated using country/region central bank policy rates and multiplying by their share of GDP. |

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

FIGURE 2

While inflationary pressures have abated somewhat, inflation continues to trend well above central bank targets. As a result, consensus expectations are that short-term lending rates will stay elevated for an extended period. If they do remain high, it will present serious long-term problems for borrowers at every level that have large outstanding “burger bills”. When their bills come due, and some already have, the consequences will likely be much more severe than Wimpy’s burger detox.

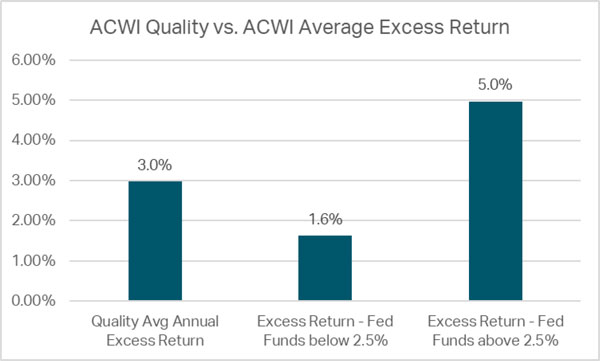

Historically, high-quality companies, those with attributes such as high return on assets (ROA) and lower leverage, have significantly outperformed in markets where the cost of capital is high. Why? Because companies with high leverage experience a material increase in debt service costs which erodes company earnings. Furthermore, companies with lower ROAs that finance growth with debt are less incentivized to do so, which can also negatively impact earnings growth potential and ultimately stock price performance.

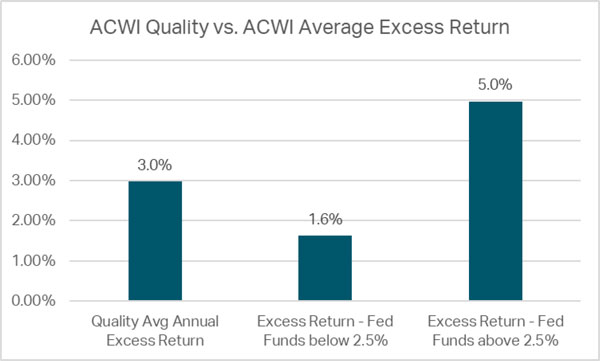

As illustrated in Figure 3 below, high-quality stocks, represented by the ACWI Quality index, have consistently outperformed the broad market over time. However, the level of outperformance has been three times higher during periods when the cost of capital is high, defined here as periods where the Fed Fund’s rate exceeds 2.5%4.

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

FIGURE 3

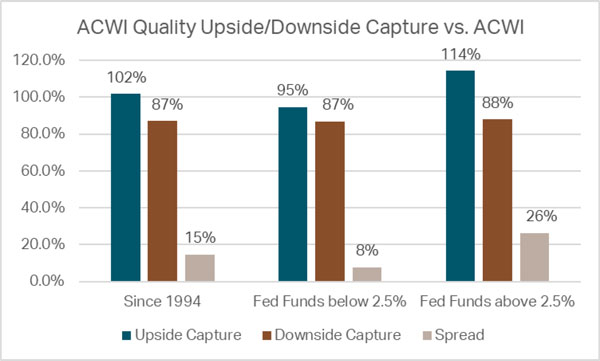

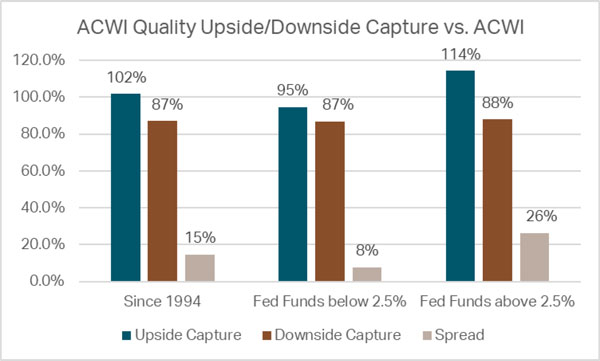

As seen in Figure 4, when interest rates are low, high-quality stocks realize or “capture” an average of 95% of the broader market’s monthly return when the return is positive. When the broader market’s monthly return is negative, high-quality stocks capture an average of 87% of the return. The differential between the upside capture percentage and the downside capture percentage, or the spread, is favorable at +8% when interest rates are low.

On the other hand, when interest rates are high, high-quality stocks capture an average of 114% of the market’s monthly return when it is positive and 88% when it is negative. So, the spread increases to +26%, a much more favorable outcome, with high-quality stocks capturing +19% more market upside without really sacrificing their lower downside capture5.

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

FIGURE 4

The sizable increase observed historically in the upside/downside capture spread when interest rates are high suggests that balance sheet fundamentals matter much more in high-rate environments. During these periods, it is not nearly as easy for companies with lower returns on assets, which rely on debt financing, to grow their earnings. Put differently, when rates are high, the size of a company’s burger tab and its reliance on debt to sustain its burger habit (i.e., growth plan) are much more significant factors in its future success. As a result, lower quality companies can’t keep up with more fundamentally stable, high-quality companies and high-quality companies tend to outperform.

As the market adapts to a “higher for longer” interest rate environment, where the cost of borrowed capital is no longer cheap, there will be much more performance dispersion across markets. Sound fundamentals will likely be a more significant determinant of success than they have been in the “lower for longer” interest rate world we have invested in over most of the past 15 years. As a result, we believe actively managed, fundamentally driven investment strategies, such as the Grandeur Peak portfolios, should have a clear advantage over strategies that disregard the fundamentals.

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

Portfolio Thoughts

| ● | Quality: We believe our portfolios are sound, on an absolute and relative basis. Technical market turbulence continues to offer us opportunities to gain exposure to high-quality companies that have historically been too expensive to own. |

| ● | Value: Despite disappointing 2022 and YTD price performance, our portfolios’ captured earnings growth continues to be resilient. |

| ● | Momentum: Business momentum within our portfolios has slowed but not as much as the broader market and global economy. Our portfolios’ earnings growth has been positive year-to-date, in contrast to the MSCI ACWI Small Index, where earnings have fallen 10% over the same period. We expect momentum for our portfolio companies to pick up in 2024. |

| ● | Given our high-quality bias, we are positioned for a return to quality growth being rewarded, but we also believe our portfolios should perform well on a relative basis should we realize a pronounced slowdown in global economic growth. |

QUALITY

As illustrated in Figure 5, our portfolios consistently display stronger fundamentals than their respective benchmarks, namely higher ROA and lower debt. Last year’s sell-off in quality stocks allowed us to upgrade our portfolios’ overall quality. This has resulted in a more concentrated portfolio, with increased exposure to higher conviction names. In addition, we have been able to add some stocks on our “Watch-A” list to the portfolio. These are stocks with very high quality that we felt were previously too expensive to buy.

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

| FIGURE 5 |

| | RETURN | DEBT / |

| | ON | EQUITY |

| | ASSETS | |

| Global Reach | 10.0% | 53% |

| Index Variance | 5.1% | -40% |

| Global Explorer | 9.9% | 52% |

| Index Variance | 5.0% | -41% |

| Global Opportunities | 11.5% | 56% |

| Index Variance | 6.6% | -37% |

| International Opportunities | 12.2% | 50% |

| Index Variance | 5.8% | -41% |

| Emerging Markets Opportunities | 12.3% | 50% |

| Index Variance | 4.4% | -36% |

| Global Micro Cap | 10.1% | 28% |

| Index Variance | 5.2% | -65% |

| Global Stalwarts | 10.7% | 60% |

| Index Variance | 4.0% | -37% |

| International Stalwarts | 12.8% | 56% |

| Index Variance | 6.3% | -30% |

| US Stalwarts | 7.4% | 61% |

| Index Variance | 0.5% | -41% |

| Global Contrarian | 9.6% | 46% |

| Index Variance | 4.9% | -54% |

| | | |

| Source: Internal Data as of 9/30/23 | | |

While quality is paramount throughout our portfolio, it may prove to be a more important risk factor in some sectors versus others given the current economic climate. For example, within the Financial sector broadly, we see a credit maturity wall coming, which could be painful for many small businesses and commercial real estate companies. We believe that numerous businesses previously had access to capital that they were likely not qualified for. Stricter lending standards and/or significantly higher borrowing costs will likely inflict pain on lower-quality companies. However, in our Financials portfolio, we are cautiously optimistic. We have shifted more risk-off over the course of the year, and we feel good about positioning for an economic slow-down. We’re avoiding investments with significant balance sheet risk, and we’re being careful to not overpay for our more growthy companies. Also, we believe our exposure is balanced enough so that we’ll keep up if the environment turns out to be better than expected.

The Consumer sector is another area where we remain very focused on owning high-quality names. Continued rate hikes and the combination of savings and aid programs drying up in the US and around the world have put many consumer businesses in more vulnerable positions. In building out the Consumer tranche within our portfolios, we have been very focused on understanding the sensitivities that each of our companies has to various potential economic environments, factoring in inflation, rates, consumer appetites, etc. With that understanding, we

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

have tried to strike the right balance of exposure across Consumer Staple and Discretionary names so that our portfolio will hold up amid various economic outcomes. Furthermore, we currently feel that it is more defensive to own more Consumer names outside of the US vs. inside. The basis for this view is that we believe the worst parts of the late economic cycle are mostly behind international markets, while things feel more uncertain in the US. Regardless of shorter-term positioning, we have confidence in our Consumer portfolio due to the attractive valuations and captured earnings growth in our companies.

VALUE

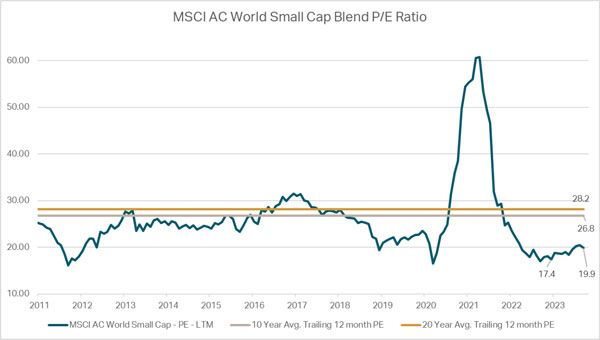

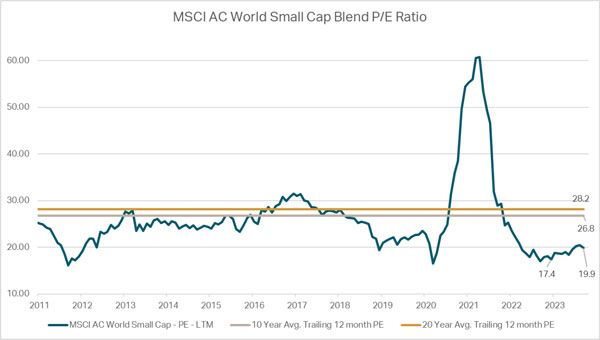

As shown in Figure 6, small cap stocks have most recently been trading at a price-earnings multiple6 that is 25-30% less than the long-term historical average (27-28x). The modest increase we’ve seen in the MSCI ACWI Small Cap Index multiple from the end of 2022, from 17.4x to 19.9x, is the result of a -10.13% decline in the index’s earnings relative to only a -0.26% drop in its price.

FIGURE 6

The depressed multiples and market turbulence continue to allow us to find stocks that offer attractive relative value. For example, our team is currently very excited about opportunities to invest in the Japanese market, where small cap growth stocks have underperformed on the year. As a result, the country has become a major focus of screening and travel for our team. Over the last year, we’ve had more company touches in Japan than any other country except for the US. We feel that captured earnings growth there has not been properly rewarded as it should, but that it’s only a matter of time before it will be.

| 6 | A Price-Earnings (P/E) multiple is a ratio of current share price to earnings per share (EPS) and is a measure of relative valuation of a company’s shares. |

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

Some of the attractive investment opportunities we see within Health Care have come as a result of volatility stemming from impact GLP-1 drugs (e.g., Ozempic), Large swaths of the sector, particularly those areas tied to obesity and Type-2 diabetes, have been significantly impacted. It will take years to grasp the full extent to which these drugs may reshape the industry, but the current uncertainty is producing large stock price fluctuations. We believe that much of our exposure will likely benefit from the shifting dynamics within Health Care.

MOMENTUM

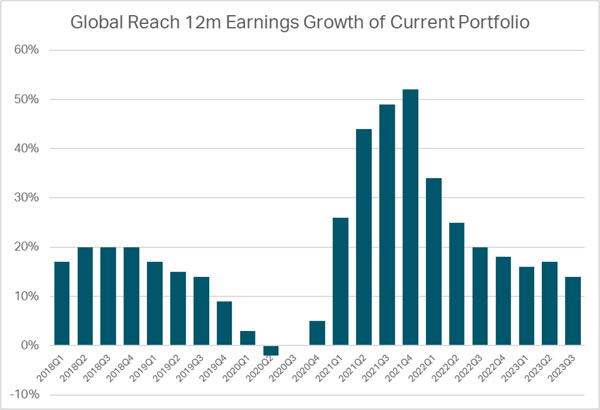

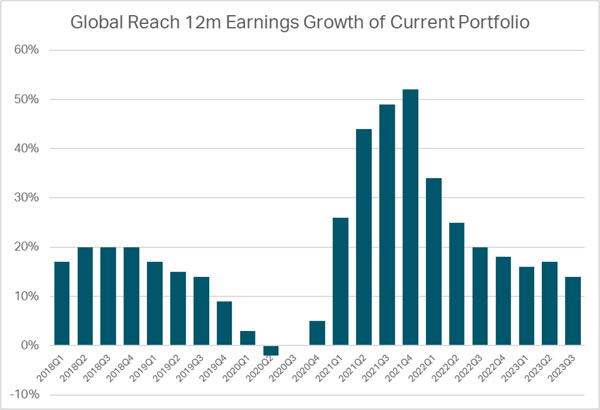

As previously noted, business momentum has slowed throughout the market this year, with earnings turning broadly negative year-to-date. We have seen the business momentum decline in our portfolio companies as well, however the slowdown has been much less pronounced. As illustrated in Figure 7, our portfolios continue to generate relatively strong, positive earnings growth amid slow market business momentum. Furthermore, we anticipate that momentum will pick back up in 2024 for our portfolio companies. As the momentum improves, we expect our portfolios to further distinguish their collective earnings strength.

FIGURE 7

One area within our portfolio where we have seen a significant decline in business momentum this year is in our Technology - Semiconductor names, which have detracted from performance. Business momentum within the space remains weak given excess inventories, but we believe we are getting close to an inflection point where things will turn favorably. In addition, we are starting to see some improvement in the monthly revenue numbers from some of our Taiwan-

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

based semiconductor companies. While this is a welcome sign, the recovery has come quite a bit later than we initially expected.

Many companies within Industrials that were able to increase their prices over the last several years are now experiencing some margin compression off high-priced inventory while their pricing power weakens. While they have generally worked through much of their backlogs, new orders haven’t quite kept up. Purchasing Managers’ Index (PMI) numbers across the world are weakening, which is hurting investment and capital expenditure-driven companies. However, our focus on higher-quality names within the sector has allowed us to avoid much of the cyclical earnings downturn.

To summarize, within our Quality, Valuation, and Momentum (QVM) Framework, our current portfolios exhibit high Quality, attractive Valuation, and lower but relatively resilient Business Momentum. In an environment of heightened macroeconomic and geopolitical uncertainty, we believe we are positioned to lessen downside risks should market conditions deteriorate further without giving up significant upside potetnial. As Business Momentum improves, we believe our portfolio companies will further strengthen their businesses and deliver attractive earnings growth. Furthermore, as favorable price momentum returns to the market, we believe our portfolios will be in position to reward shareholders for their patience.

Notes from the Road

Mark Madsen, Portfolio Manager – Global Contrarian, Tyler Glauser, Portfolio Manager – Global Reach, Lead Analyst – Consumer, and Karson Schrader, Lead Analyst – Financials, met with 26 companies in Sau Paulo, Brazil. In addition to meeting with several companies on our Owned list, they also visited every Watch A company in the country. Our Watch A names are what we consider to be high-quality companies we would like to own but are currently too expensive.

Here are some key thoughts from Mark Madsen about the visit:

Tyler, Karson, and I took another trip to Brazil recently as the market has experienced several favorable macro trends recently.

Inflation has come down meaningfully to 5% after peaking out at 10.1% in 2021 and is expected to trend even lower in coming years. Also, the currency has been relatively stable and interest rates have come down from 13% to 9%. Many of the companies we met with were cautiously optimistic about the future.

The Brazilian equity market realized double digit declines in 2020 and 2021 but has bounced back in 2022 and YTD in 2023. So, while we see signs of positive price momentum, net returns are flat to slightly negative over the past four years.

Most companies we met with have business plans that are very dependent on the Brazilian economy for success. Few were focused on exports or expanding sales efforts outside of the country.

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

Of the companies we visited, those that scored the highest were mostly service-oriented (e.g., investment management, payment processing, internet, etc.). A third of our visits felt like easy passes as we left – where neither the numbers nor the stories felt very compelling. The remaining two-thirds had a fairly balanced list of pluses and minuses, and we committed to follow them more closely in case the QVM profiles become more favorable.

It’s interesting to look at the differences and similarities between Brazil to India. Both countries have young populations and have had issues with corruption. Brazil is smaller geographically and GDP growth is slower, but it has more natural resources than India. Also, valuations on the ground level in Brazil seem much more reasonable than what we currently see in India.

In sum, we came back from the trip with heightened confidence in the companies we own in our portfolios and better understanding and appreciation for some of our Watch A names. While there are some great high-quality companies in Brazil that have real growth potential, Brazil continues to be a wildcard in our minds because of the challenge in assessing the currency risk. Will the Brazilian Real continue to be stable, or will it revert to being a volatile currency that has the potential to depreciate meaningfully and eat up solid investment returns? If the Brazilian government can maintain a stable currency for an extended period, it may eventually allow us to lower the currency risk premium we demand for investing in the Brazilian market and make the country a much more attractive area of our investment opportunity set.

Business Update

We completed the back-office provider transition for our mutual funds to Ultimus Fund Solutions. As a reminder, the reorganization of the Funds were non-taxable transactions for federal income tax purposes. The transition did not impact the ownership of Grandeur Peak Global Advisors, the composition of our team, or our investment research process.

We are happy to welcome Dane Nielson back to Salt Lake City after completing his MBA at Cambridge University in the UK. Dane continues his role as part of the Global Contrarian Fund team and as a member of the Resource Rich geography team. We appreciate the additional insights and expertise he brings to the firm from his educational experience.

As always, please feel free to reach out anytime with any questions, requests, or comments. We appreciate the opportunity to work on your behalf.

Sincerely,

Your Grandeur Peak Team

| Grandeur Peak Funds® | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

RISKS: Investing in small and micro-cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investments in emerging markets are subject to the same risks as other foreign securities and may be subject to greater risks than investments in foreign countries with more established economies and securities markets.

An investor should consider investment objectives, risks, charges, and expenses carefully before investing. To obtain a Grandeur Peak Funds prospectus, containing this and other information, visit www.grandeurpeakglobal.com or call 1-855-377-7325. Please read it carefully before investing.

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the Funds or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. The Funds do not accept any liability for losses either direct or consequential caused by the use of this information. Past performance does not guarantee future results.

Grandeur Peak Funds are distributed by Northern Lights Distributors, which is not affiliated with Grandeur Peak Global Advisors.

17758892-NLD-1/4/2024

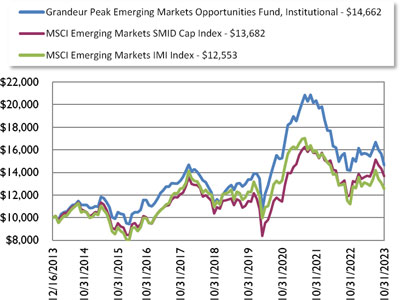

| Grandeur Peak Emerging Markets Opportunities Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Annualized Total Return Performance for the periods ended October 31, 2023

| | | | | | Since | Expense Ratio(b) |

| | Six Months | 1 Year | 3 Years | 5 Years | Inception(a) | Gross | Net(c) |

| Grandeur Peak Emerging Markets Opportunities Fund – Investor (GPEOX) | -6.27% | 3.22% | -1.57% | 5.24% | 3.72% | 1.75% | 1.72% |

| Grandeur Peak Emerging Markets Opportunities Fund – Institutional (GPEIX) | -6.13% | 3.43% | -1.35% | 5.48% | 3.95% | 1.50% | 1.47% |

| MSCI Emerging Markets SMID Cap Index(d) | -0.13% | 14.05% | 6.19% | 5.73% | 3.23% | | |

| MSCI Emerging Markets IMI Index(e) | -3.41% | 12.15% | -1.83% | 2.74% | 2.33% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of December 16, 2013. The Fund reorganized into the Trust on October 20, 2023. |

| (b) | Ratios as of the Prospectus dated October 20, 2023 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes, and extraordinary expenses, such as litigation expenses (which may increase indemnification of the Funds’ officers and trustees, contractual indemnification of the Fund’s service providers (other than the Advisor))) to 1.95% and 1.70% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement (the “Expense Agreement”) shall continue at least through October 6, 2024. The Adviser will be permitted to recapture, on a class-by-class basis, expenses it has borne the Expense Agreement to the extent that the Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement or in previous letter agreements; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not pay any such deferred fees and expenses more than three years after the date on which the fee and expenses were deferred. The Expense Agreement may not be terminated or modified prior to October 6, 2024, except with the approval of the Trust’s Board of Trustees. |

| (d) | The MSCI Emerging Markets SMID Cap Index is designed to measure the equity market performance of small and mid-cap companies across emerging markets. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI Emerging Markets IMI Index is designed to measure the equity market performance of large, mid, and small-cap companies across emerging markets. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Grandeur Peak Emerging Markets Opportunities Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

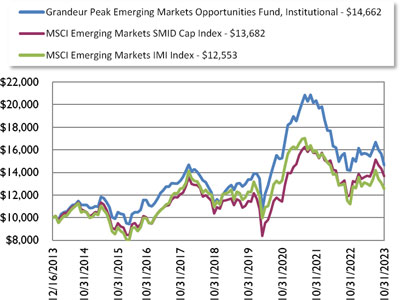

Growth of $10,000 for the period ended October 31, 2023

The chart shown above represent a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to October 31, 2023. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Investor Class shares, performance for which is not reflected in the graphs above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown in the graphs above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

| Grandeur Peak Emerging Markets Opportunities Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

| Regional Allocation (as a% of Net Assets)* | | % of Net Assets | |

| Asia ex Japan | | | 48.4 | % |

| Latin America | | | 15.7 | % |

| Africa/Middle East | | | 13.6 | % |

| North America | | | 8.1 | % |

| Europe | | | 6.1 | % |

| Cash, Cash Equivalents, & Other Net Assets | | | 8.1 | % |

| | | | 100.0 | % |

| | | | | |

| Top 10 Holdings (as a% of Net Assets) | | % of Net Assets | |

| Globant S.A. | | | 2.7 | % |

| WuXi AppTec Co., Ltd. | | | 2.6 | % |

| FPT Corporation | | | 2.2 | % |

| Dino Polska SA | | | 2.2 | % |

| Inter Cars SA | | | 1.9 | % |

| Sporton International, Inc. | | | 1.7 | % |

| Techtronic Industries Co., Ltd. | | | 1.7 | % |

| Regional SAB de CV | | | 1.7 | % |

| Sinbon Electronics Co., Ltd. | | | 1.6 | % |

| Silergy Corporation | | | 1.6 | % |

| | | | 20.0 | % |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

Please refer to the Schedule of Investments in this semi-annual report for a listing of the Fund’s holdings.

| Grandeur Peak Global Contrarian Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Annualized Total Return Performance for the periods ended October 31, 2023

| | | | | | |

| | | | | Since | Expense Ratio(b) |

| | Six Months | 1 Year | 3 Years | Inception(a) | Gross | Net(c) |

| Grandeur Peak Global Contrarian Fund – Institutional (GPGCX) | -1.36% | 10.97% | 9.78% | 9.54% | 1.35% | 1.35% |

| MSCI ACWI Small Cap Index(d) | -5.62% | 1.78% | 5.15% | 4.21% | | |

| MSCI ACWI ex-US Small Cap Index(e) | -6.42% | 9.36% | 3.43% | 3.44% | | |

| MSCI ACWI Small Cap Value Index(f) | -4.04% | 1.82% | 9.87% | 4.38% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of September 17, 2019. The Fund reorganized into the Trust on October 20, 2023. |

| (b) | Ratios as of the Prospectus dated October 20, 2023 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes, and extraordinary expenses, such as litigation expenses (which may increase indemnification of the Funds’ officers and trustees, contractual indemnification of the Fund’s service providers (other than the Advisor))) to 1.35% of the Fund’s average daily net assets for the Fund’s Institutional Class Shares. This agreement (the “Expense Agreement”) shall continue at least through October 6, 2024. The Adviser will be permitted to recapture, on a class-by-class basis, expenses it has borne the Expense Agreement to the extent that the Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement or in previous letter agreements; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not pay any such deferred fees and expenses more than three years after the date on which the fee and expenses were deferred. The Expense Agreement may not be terminated or modified prior to October 6, 2024, except with the approval of the Trust’s Board of Trustees. |

| (d) | The MSCI ACWI Small Cap Index is designed to measure the equity market performance of performance of small-cap companies across developed and emerging markets globally. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI ex USA Small Cap Index is designed to measure the equity market performance of small-cap companies across developed and emerging markets globally, excluding the United States. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (f) | The MSCI ACWI Small Cap Value Index is designed to measure small cap companies exhibiting overall value style characteristics across developed and emerging markets globally. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Grandeur Peak Global Contrarian Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Growth of $10,000 for the period ended October 31, 2023

The chart shown above represent a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to October 31, 2023. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

| Grandeur Peak Global Contrarian Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

| Regional Allocation (as a% of Net Assets)* | | % of Net Assets | |

| Asia ex Japan | | | 27.4 | % |

| Europe | | | 23.9 | % |

| North America | | | 21.0 | % |

| Japan | | | 9.3 | % |

| Australia/New Zealand | | | 5.7 | % |

| Africa/Middle East | | | 5.5 | % |

| Latin America | | | 4.9 | % |

| Cash, Cash Equivalents, & Other Net Assets | | | 2.3 | % |

| | | | 100.0 | % |

| | | | | |

| Top 10 Holdings (as a% of Net Assets) | | % of Net Assets | |

| Petershill Partners PLC | | | 4.3 | % |

| Riverstone Holdings Ltd. | | | 4.1 | % |

| Plover Bay Technologies Ltd. | | | 3.3 | % |

| China Yongda Automobiles Services Holdings Ltd. | | | 2.4 | % |

| Xin Point Holdings Ltd. | | | 2.3 | % |

| Beenos, Inc. | | | 2.3 | % |

| Gulf Oil Lubricants India Ltd. | | | 2.2 | % |

| B&M European Value Retail SA | | | 1.9 | % |

| Parex Resources, Inc. | | | 1.8 | % |

| FPT Corporation | | | 1.8 | % |

| | | | 26.3 | % |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

Please refer to the Schedule of Investments in this semi-annual report for a listing of the Fund’s holdings.

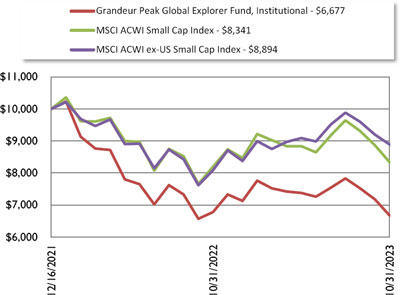

| Grandeur Peak Global Explorer Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Annualized Total Return Performance for the periods ended October 31, 2023

| | | | | |

| | | | Since | Expense Ratio(b) |

| | Six Months | 1 Year | Inception(a) | Gross | Net(c) |

| Grandeur Peak Global Explorer Fund – Institutional (GPGEX) | -9.51% | 1.52% | 19.39% | 3.45% | 1.25% |

| MSCI ACWI Small Cap Index(d) | -5.62% | 1.78% | -9.23% | | |

| MSCI ACWI IMI Index(e) | -2.13% | 9.98% | -6.06% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of December 16, 2021. The Fund reorganized into the Trust on October 20, 2023. |

| (b) | Ratios as of the Prospectus dated October 20, 2023 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes, and extraordinary expenses, such as litigation expenses (which may increase indemnification of the Funds’ officers and trustees, contractual indemnification of the Fund’s service providers (other than the Advisor))) to 1.25% of the Fund’s average daily net assets for the Fund’s Institutional Class Shares. This agreement (the “Expense Agreement”) is in effect through October 6, 2024. The Adviser will be permitted to recapture expenses it has borne through the Expense Agreement to the extent that the Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not pay any such deferred fees and expenses more than three years after the date on which the fee and expenses were deferred. The Expense Agreement may not be terminated or modified prior to October 6, 2024, except with the approval of the Trust’s Board of Trustees. |

| (d) | The MSCI ACWI Small Cap Index is designed to measure the equity market performance of performance of small-cap companies across developed and emerging markets globally. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI IMI Index captures large, mid and small cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 9,189 constituents, the index is comprehensive, covering approximately 99% of the global equity investment opportunity set. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Grandeur Peak Global Explorer Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

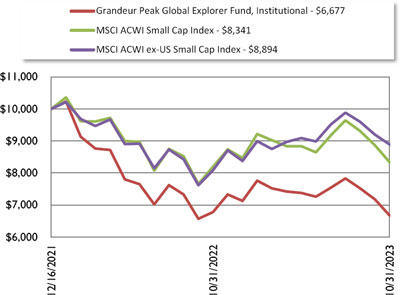

Growth of $10,000 for the period ended October 31, 2023

The chart shown above represent a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to October 31, 2023. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

| Grandeur Peak Global Explorer Fund | Performance Update |

| October 31, 2023 (Unaudited) |

| Regional Allocation (as a% of Net Assets)* | | % of Net Assets | |

| North America | | | 31.6 | % |

| Europe | | | 28.5 | % |

| Asia ex Japan | | | 15.6 | % |

| Japan | | | 12.3 | % |

| Latin America | | | 4.2 | % |

| Africa/Middle East | | | 3.9 | % |

| Australia/New Zealand | | | 3.3 | % |

| Cash, Cash Equivalents, & Other Net Assets | | | 0.6 | % |

| | | | 100.0 | % |

| | | | | |

| Top 10 Holdings (as a% of Net Assets) | | % of Net Assets | |

| Virbac SA | | | 1.0 | % |

| Globant SA | | | 1.0 | % |

| Parex Resources, Inc. | | | 1.0 | % |

| PJT Partners, Inc. | | | 1.0 | % |

| Endava plc, ADR | | | 0.9 | % |

| Volution Group PLC | | | 0.9 | % |

| Sporton International, Inc. | | | 0.9 | % |

| Ollie’s Bargain Outlet Holdings, Inc. | | | 0.9 | % |

| FPT Corporation | | | 0.9 | % |

| CVS Group plc | | | 0.9 | % |

| | | | 9.3 | % |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

Please refer to the Schedule of Investments in this semi-annual report for a listing of the Fund’s holdings.

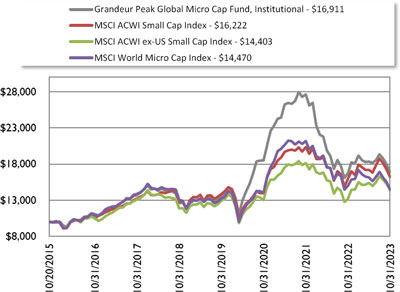

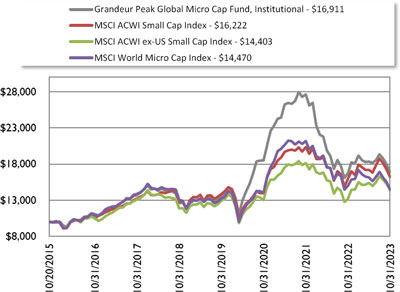

| Grandeur Peak Global Micro Cap Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Annualized Total Return Performance for the periods ended October 31, 2023

| | | | | | | |

| | | | | | Since | Expense Ratio(b) |

| | Six Months | 1 Year | 3 Years | 5 Years | Inception(a) | Gross | Net(c) |

| Grandeur Peak Global Micro Cap Fund – | | | | | | | |

| Institutional (GPMCX) | -7.72% | 1.15% | -2.96% | 6.11% | 6.76% | 1.85% | 1.85% |

| MSCI ACWI Small Cap Index(d) | -5.62% | 1.78% | 5.15% | 4.90% | 6.21% | | |

| MSCI ACWI ex-US Small Cap Index(e) | -5.62% | 1.78% | 5.15% | 4.90% | 6.21% | | |

| MSCI World Micro Cap Index(f) | -10.41% | -3.40% | 1.13% | 2.07% | 4.71% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of October 20, 2015. The Fund reorganized into the Trust on October 20, 2023. |

| (b) | Ratios as of the Prospectus dated October 20, 2023 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/ Expense Reimbursement (excluding any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes, and extraordinary expenses, such as litigation expenses (which may increase indemnification of the Funds’ officers and trustees, contractual indemnification of the Fund’s service providers (other than the Advisor))) to 2.00% of the Fund’s average daily net assets for the Fund’s Institutional Class Shares. This agreement (the “Expense Agreement”) is in effect through October 6, 2024. The Adviser will be permitted to recapture expenses it has borne through the Expense Agreement to the extent that the Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not pay any such deferred fees and expenses more than three years after the date on which the fee and expenses were deferred. The Expense Agreement may not be terminated or modified prior to October 6, 2024, except with the approval of the Trust’s Board of Trustees. |

| (d) | The MSCI ACWI Small Cap Index is designed to measure the equity market performance of performance of small-cap companies across developed and emerging markets globally. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI ex USA Small Cap Index is designed to measure the equity market performance of small-cap companies across developed and emerging markets globally, excluding the United States. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (f) | The MSCI World Micro Cap Index is designed to measure the equity market performance of micro-cap companies across developed markets globally. It does not include emerging markets. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Grandeur Peak Global Micro Cap Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Growth of $10,000 for the period ended October 31, 2023

The chart shown above represent a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to October 31, 2023. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

| Grandeur Peak Global Micro Cap Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

| Regional Allocation (as a% of Net Assets)* | | % of Net Assets | |

| Europe | | | 34.2 | % |

| Japan | | | 24.7 | % |

| North America | | | 12.8 | % |

| Asia ex Japan | | | 11.9 | % |

| Australia/New Zealand | | | 8.7 | % |

| Africa/Middle East | | | 6.5 | % |

| Latin America | | | 0.7 | % |

| Cash, Cash Equivalents, & Other Net Assets | | | 0.5 | % |

| | | | 100.0 | % |

| | | | | |

| Top 10 Holdings (as a% of Net Assets) | | % of Net Assets | |

| Swedencare AB | | | 3.1 | % |

| Beenos, Inc. | | | 2.3 | % |

| Kogan.com Ltd. | | | 2.2 | % |

| ULS Group, Inc. | | | 2.2 | % |

| Gulf Oil Lubricants India Ltd. | | | 1.9 | % |

| Hackett Group, Inc. (The) | | | 1.9 | % |

| Musti Group Oyj | | | 1.9 | % |

| Fiducian Group Ltd. | | | 1.9 | % |

| Barrett Business Services, Inc. | | | 1.8 | % |

| Bowman Consulting Group Ltd. | | | 1.6 | % |

| | | | 20.8 | % |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

Please refer to the Schedule of Investments in this semi-annual report for a listing of the Fund’s holdings.

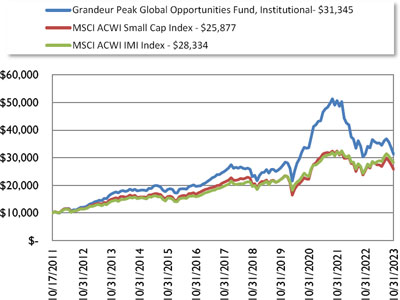

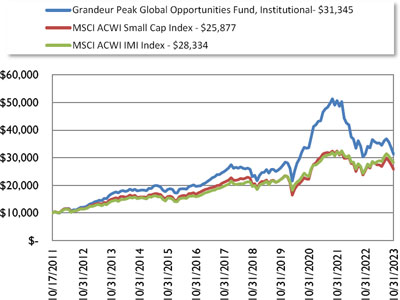

| Grandeur Peak Global Opportunities Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Annualized Total Return Performance for the periods ended October 31, 2023

| | | | | | | | |

| | | | | | | Since | Expense Ratio(b) |

| | Six Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception(a) | Gross | Net(c) |

| Grandeur Peak Global Opportunities Fund – Investor (GPGOX) | -11.40% | -0.27% | -2.51% | 6.02% | 6.15% | 9.68% | 1.60% | 1.54% |

| Grandeur Peak Global Opportunities Fund –Institutional (GPGIX) | -11.40% | -0.14% | -2.28% | 6.28% | 6.40% | 9.96% | 1.35% | 1.29% |

| MSCI ACWI Small Cap Index(d) | -5.62% | 1.78% | 5.15% | 4.90% | 5.64% | 8.22% | | |

| MSCI ACWI IMI Index(e) | -2.13% | 9.98% | 6.95% | 7.63% | 7.15% | 9.04% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of October 17, 2011. The Fund reorganized into the Trust on October 20, 2023. |

| (b) | Ratios as of the Prospectus dated October 20, 2023 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/ Expense Reimbursement (excluding any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes, and extraordinary expenses, such as litigation expenses (which may increase indemnification of the Funds’ officers and trustees, contractual indemnification of the Fund’s service providers (other than the Advisor))) to 1.75% and 1.50% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement (the “Expense Agreement”) shall continue at least through October 6, 2024. The Adviser will be permitted to recapture, on a class-by-class basis, expenses it has borne the Expense Agreement to the extent that the Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement or in previous letter agreements; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not pay any such deferred fees and expenses more than three years after the date on which the fee and expenses were deferred. The Expense Agreement may not be terminated or modified prior to October 6, 2024, except with the approval of the Trust’s Board of Trustees. |

| (d) | The MSCI ACWI Small Cap Index is designed to measure the equity market performance of performance of small-cap companies across developed and emerging markets globally. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI IMI Index is designed to measure the equity market performance of large, mid, and small-cap companies across developed and emerging markets globally. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Grandeur Peak Global Opportunities Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Growth of $10,000 for the period ended October 31, 2023

The chart shown above represent a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to October 31, 2023. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Investor Class shares, performance for which is not reflected in the graphs above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown in the graphs above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

| Grandeur Peak Global Opportunities Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

| Regional Allocation (as a% of Net Assets)* | | % of Net Assets | |

| Europe | | | 43.3 | % |

| North America | | | 26.2 | % |

| Japan | | | 12.4 | % |

| Asia ex Japan | | | 11.8 | % |

| Latin America | | | 3.2 | % |

| Africa/Middle East | | | 1.8 | % |

| Australia/New Zealand | | | 0.1 | % |

| Cash, Cash Equivalents, & Other Net Assets | | | 1.2 | % |

| | | | 100.0 | % |

| | | | | |

| Top 10 Holdings (as a% of Net Assets) | | % of Net Assets | |

| B&M European Value Retail SA | | | 4.1 | % |

| Littelfuse, Inc. | | | 2.8 | % |

| CVS Group plc | | | 2.4 | % |

| Endava plc, ADR | | | 2.3 | % |

| Virbac SA | | | 2.1 | % |

| Alten SA | | | 1.5 | % |

| Dino Polska SA | | | 1.5 | % |

| Qualys, Inc. | | | 1.5 | % |

| Musti Group Oyj | | | 1.4 | % |

| Melexis NV | | | 1.3 | % |

| | | | 20.9 | % |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

Please refer to the Schedule of Investments in this semi-annual report for a listing of the Fund’s holdings.

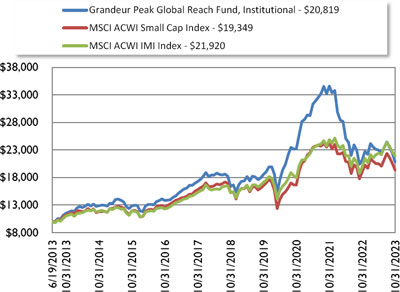

| Grandeur Peak Global Reach Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Annualized Total Return Performance for the periods ended October 31, 2023

| | | | | | | | |

| | | | | | | Since | Expense Ratio(b) |

| | Six Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception(a) | Gross | Net(c) |

| Grandeur Peak Global Reach Fund – Investor (GPROX) | -9.56% | -1.85% | -3.76% | -4.68% | 5.87% | 7.07% | 1.50% | 1.50% |

| Grandeur Peak Global Reach Fund –Institutional (GPRIX) | -9.38% | -1.56% | -3.52% | 4.95% | 6.13% | 7.33% | 1.25% | 1.25% |

| MSCI ACWI Small Cap Index(d) | -5.62% | 1.78% | 5.15% | 4.90% | 5.64% | 6.57% | | |

| MSCI ACWI IMI Index(e) | -2.13% | 9.98% | 6.95% | 7.63% | 7.15% | 7.86% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of June 19, 2013. The Fund reorganized into the Trust on October 20, 2023. |

| (b) | Ratios as of the Prospectus dated October 20, 2023 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes, and extraordinary expenses, such as litigation expenses (which may increase indemnification of the Funds’ officers and trustees, contractual indemnification of the Fund’s service providers (other than the Advisor))) to 1.50% and 1.25% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement (the “Expense Agreement”) shall continue at least through October 6, 2024. The Adviser will be permitted to recapture, on a class-by-class basis, expenses it has borne the Expense Agreement to the extent that the Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement or in previous letter agreements; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not pay any such deferred fees and expenses more than three years after the date on which the fee and expenses were deferred. The Expense Agreement may not be terminated or modified prior to October 6, 2024, except with the approval of the Trust’s Board of Trustees. |

| (d) | The MSCI ACWI Small Cap Index is designed to measure the equity market performance of performance of small-cap companies across developed and emerging markets globally. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI IMI Index is designed to measure the equity market performance of large, mid, and small-cap companies across developed and emerging markets globally. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Grandeur Peak Global Reach Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

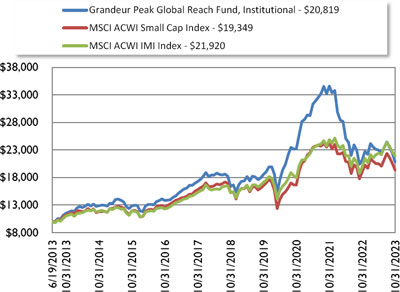

Growth of $10,000 for the period ended October 31, 2023

The chart shown above represent a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to October 31, 2023. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Investor Class shares, performance for which is not reflected in the graphs above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown in the graphs above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

| Grandeur Peak Global Reach Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

| Regional Allocation (as a% of Net Assets)* | | % of Net Assets | |

| North America | | | 29.9 | % |

| Europe | | | 31.8 | % |

| Asia ex Japan | | | 16.3 | % |

| Japan | | | 9.6 | % |

| Latin America | | | 4.0 | % |

| Africa/Middle East | | | 3.7 | % |

| Australia/New Zealand | | | 1.8 | % |

| Cash, Cash Equivalents, & Other Net Assets | | | 2.9 | % |

| | | | 100.0 | % |

| | | | | |

| Top 10 Holdings (as a% of Net Assets) | | % of Net Assets | |

| B&M European Value Retail SA | | | 1.7 | % |

| BayCurrent Consulting, Inc. | | | 1.5 | % |

| PJT Partners, Inc. | | | 1.2 | % |

| CVS Group plc | | | 1.1 | % |

| JTC plc | | | 1.0 | % |

| Parex Resources, Inc. | | | 1.0 | % |

| Endava plc, ADR | | | 1.0 | % |

| EQT AB | | | 1.0 | % |

| Vietnam Technological & Commercial Joint Stock Bank | | | 1.0 | % |

| Globant SA | | | 0.9 | % |

| | | | 11.4 | % |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

Please refer to the Schedule of Investments in this semi-annual report for a listing of the Fund’s holdings.

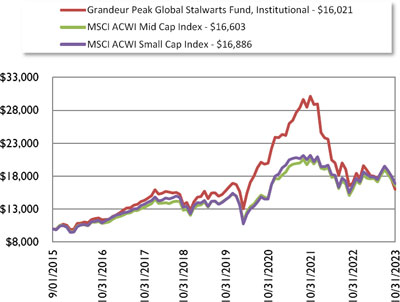

| Grandeur Peak Global Stalwarts Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Annualized Total Return Performance for the periods ended October 31, 2023

| | | | | | | |

| | | | | | Since | Expense Ratio(b) |

| | Six Months | 1 Year | 3 Years | 5 Years | Inception(a) | Gross | Net(c) |

| Grandeur Peak Global Stalwarts Fund –Investor (GGSOX) | -11.06% | -5.92% | -7.31% | 2.94% | 5.67% | 1.19% | 1.19% |

| Grandeur Peak Global Stalwarts Fund –Institutional (GGSYX) | -10.96% | -5.67% | -7.07% | 3.20% | 5.94% | 0.94% | 0.94% |

| MSCI ACWI Mid Cap Index(d) | -6.08% | 3.65% | 4.21% | 5.27% | 6.41% | | |

| MSCI ACWI Small Cap Index(e) | -5.62% | 1.78% | 5.15% | 4.92% | 6.63% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of September 1, 2015. The Fund reorganized into the Trust on October 20, 2023. |

| (b) | Ratios as of the Prospectus dated October 20, 2023 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/ Expense Reimbursement (excluding any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes, and extraordinary expenses, such as litigation expenses (which may increase indemnification of the Funds’ officers and trustees, contractual indemnification of the Fund’s service providers (other than the Advisor))) to 1.35% and 1.10% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively.This agreement (the “Expense Agreement”) shall continue at least through October 6, 2024. The Adviser will be permitted to recapture, on a class-by-class basis, expenses it has borne through the Expense Agreement to the extent that the Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement or in previous letter agreements; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Funds will not pay any such deferred fees and expenses more than three years after the date on which the fee and expenses were deferred. The Expense Agreement may not be terminated or modified prior to October 6, 2024, except with the approval of the Trust’s Board of Trustees. |

| (d) | The MSCI ACWI Mid Cap Index is designed to measure the equity market performance of performance of mid-cap companies across developed and emerging markets globally. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI Small Cap Index is designed to measure the equity market performance of small-cap companies across developed and emerging markets globally. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Grandeur Peak Global Stalwarts Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

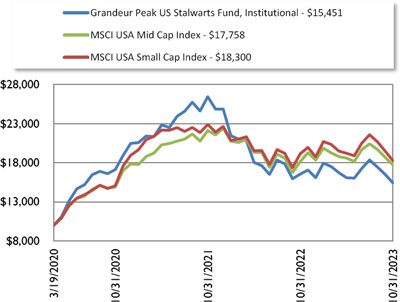

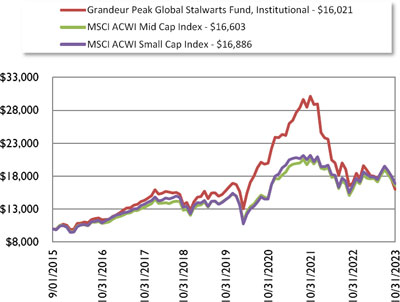

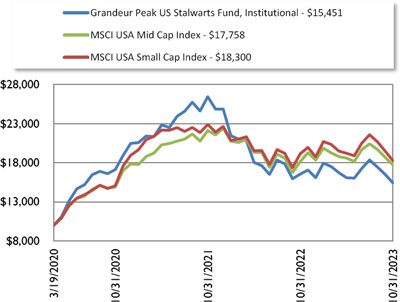

Growth of $10,000 for the period ended October 31, 2023

The chart shown above represent a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to October 31, 2023. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Investor Class shares, performance for which is not reflected in the graphs above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown in the graphs above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

| Grandeur Peak Global Stalwarts Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

| Regional Allocation (as a% of Net Assets)* | | % of Net Assets | |

| North America | | | 44.2 | % |

| Europe | | | 30.3 | % |

| Asia ex Japan | | | 12.9 | % |

| Latin America | | | 5.5 | % |

| Japan | | | 5.2 | % |

| Africa/Middle East | | | 1.8 | % |

| Cash, Cash Equivalents, & Other Net Assets | | | 0.1 | % |

| | | | 100.0 | % |

| | | | | |

| Top 10 Holdings (as a% of Net Assets) | | % of Net Assets | |

| B&M European Value Retail SA | | | 3.4 | % |

| Littelfuse, Inc. | | | 3.3 | % |

| Globant SA | | | 3.2 | % |

| PJT Partners, Inc. | | | 2.8 | % |

| BayCurrent Consulting, Inc. | | | 2.5 | % |

| EQT AB | | | 2.4 | % |

| Silergy Corporation | | | 2.3 | % |

| Endava plc, ADR | | | 2.3 | % |

| Techtronic Industries Co., Ltd. | | | 2.3 | % |

| CVS Group plc | | | 2.1 | % |

| | | | 26.6 | % |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

Please refer to the Schedule of Investments in this semi-annual report for a listing of the Fund’s holdings.

| Grandeur Peak International Opportunities Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Annualized Total Return Performance for the periods ended October 31, 2023

| | | | | | | | |

| | | | | | | Since | Expense Ratio(b) |

| | Six Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception(a) | Gross | Net(c) |

| Grandeur Peak International Opportunities Fund – Investor (GPIOX) | -14.88% | -2.68% | -6.04% | 2.64% | 4.00% | 7.67% | 1.60% | 1.55% |

| Grandeur Peak International Opportunities Fund – Institutional (GPIIX) | -14.45% | -2.48% | -5.77% | 2.85% | 4.25% | 7.91% | 1.35% | 1.30% |

| MSCI ACWI ex USA Small Cap Index(d) | -6.42% | 9.36% | 3.43% | 3.95% | 3.84% | 5.73% | | |

| MSCI ACWI IMI ex USA Index(e) | -6.80% | -8.14% | 3.52% | 3.95% | 3.13% | 4.96% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of October 17, 2011. The Fund reorganized into the Trust on October 20, 2023. |

| (b) | Ratios as of the Prospectus dated October 20, 2023 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursements (excluding any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes, and extraordinary expenses, such as litigation expenses (which may increase indemnification of the Funds’ officers and trustees, contractual indemnification of the Fund’s service providers (other than the Advisor))) to 1.75% and 1.50% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement (the “Expense Agreement”) shall continue at least through October 6, 2024. The Adviser will be permitted to recapture, on a class-by-class basis, expenses it has borne through the Expense Agreement to the extent that the Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement or in previous letter agreements; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not pay any such deferred fees and expenses more than three years after the date on which the fee and expenses were deferred. The Expense Agreement may not be terminated or modified prior to October 6, 2024, except with the approval of the Trust’s Board of Trustees. |

| (d) | The MSCI ACWI ex USA Small Cap Index is designed to measure the equity market performance of small-cap companies across developed and emerging markets globally, excluding the United States. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI ex USA IMI Index is designed to measure the equity market performance of large, mid, and small-cap companies across developed and emerging markets globally, excluding the United States. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Grandeur Peak International Opportunities Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

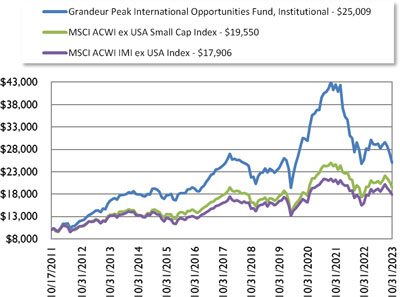

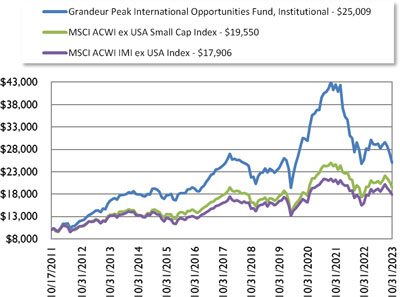

Growth of $10,000 for the period ended October 31, 2023

The chart shown above represent a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to October 31, 2023. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Investor Class shares, performance for which is not reflected in the graphs above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown in the graphs above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

| Grandeur Peak International Opportunities Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

| Regional Allocation (as a% of Net Assets)* | | % of Net Assets | |

| Europe | | | 48.2 | % |

| Asia ex Japan | | | 17.5 | % |

| Japan | | | 15.5 | % |

| North America | | | 7.8 | % |

| Africa/Middle East | | | 5.2 | % |

| Latin America | | | 3.5 | % |

| Australia/New Zealand | | | 0.7 | % |

| Cash, Cash Equivalents, & Other Net Assets | | | 1.6 | % |

| | | | 100.0 | % |

| | | | | |

| Top 10 Holdings (as a% of Net Assets) | | % of Net Assets | |

| B&M European Value Retail SA | | | 2.5 | % |

| CVS Group plc | | | 2.3 | % |

| Volution Group PLC | | | 2.2 | % |

| Virbac SA | | | 2.2 | % |

| Endava plc, ADR | | | 2.1 | % |

| Sporton International, Inc. | | | 1.5 | % |

| Alten SA | | | 1.5 | % |

| Musti Group Oyj | | | 1.5 | % |

| JTC plc | | | 1.4 | % |

| Melexis NV | | | 1.3 | % |

| | | | 18.4 | % |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

Please refer to the Schedule of Investments in this semi-annual report for a listing of the Fund’s holdings.

| Grandeur Peak International Stalwarts Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Annualized Total Return Performance for the periods ended October 31, 2023

| | | | | | | |

| | | | | | Since | Expense Ratio(b) |

| | Six Months | 1 Year | 3 Years | 5 Years | Inception(a) | Gross | Net(c) |