united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered

management investment companies

| Investment Company Act file number | 811-22655 | |

Grandeur Peak Global Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450,

Cincinnati, OH 45246

(Address of principal executive offices)

(Zip code)

CT Corporation Trust Company

1209 Orange Street,

Wilmington, DE 19801

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 631-490-4300 | |

| Date of fiscal year end: | 4/30 | |

| | | |

| Date of reporting period: | 10/31/24 | |

Item 1. Reports to Stockholders.

Grandeur Peak Emerging Markets Opportunities Fund

Institutional Class (GPEIX)

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak Emerging Markets Opportunities Fund for the period of May 1, 2024 to December 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK). This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $79 | 1.55%Footnote Reference |

|---|

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $307,736,846 |

|---|

| Number of Portfolio Holdings | 107 |

|---|

| Advisory Fee #ERROR:A result could not be returned because the conditional could not be evaluated to a True/False value ((history)) | $2,237,111 |

|---|

| Portfolio Turnover | 15% |

|---|

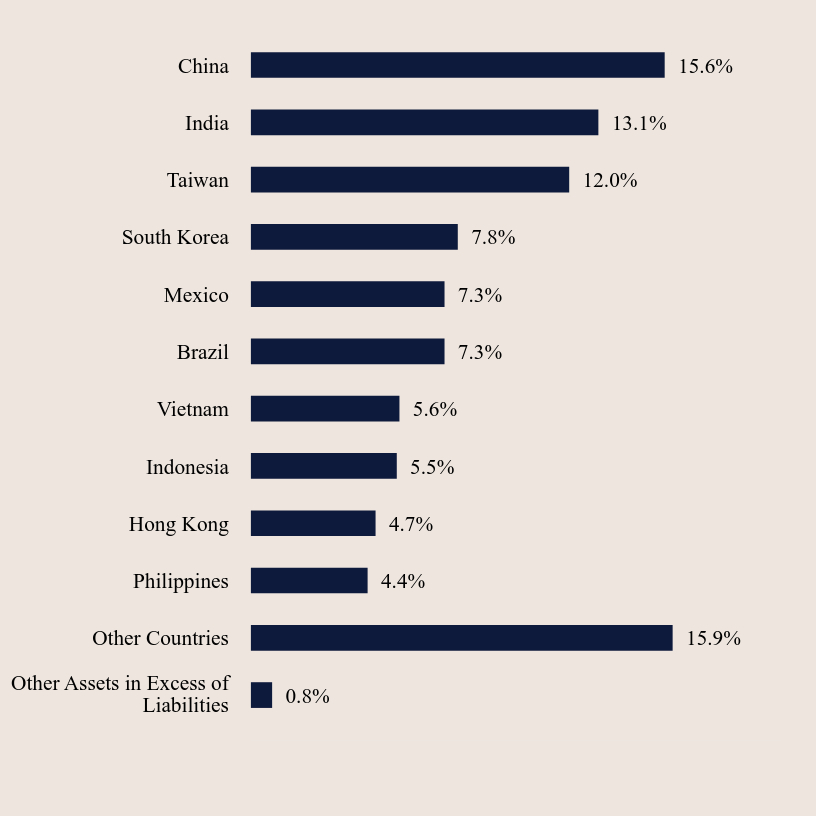

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.8% |

| Other Countries | 15.9% |

| Philippines | 4.4% |

| Hong Kong | 4.7% |

| Indonesia | 5.5% |

| Vietnam | 5.6% |

| Brazil | 7.3% |

| Mexico | 7.3% |

| South Korea | 7.8% |

| Taiwan | 12.0% |

| India | 13.1% |

| China | 15.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Silergy Corp | 4.3% |

| Techtronic Industries Co Limited | 2.6% |

| Sporton International, Inc. | 2.4% |

| FPT Corp | 2.3% |

| Sinbon Electronics Co., Limited | 2.3% |

| Globant S.A. | 2.2% |

| SJS Enterprises Ltd | 2.2% |

| Plover Bay Tech | 2.2% |

| Regional SAB de cv | 1.9% |

| iFast Corporation | 1.8% |

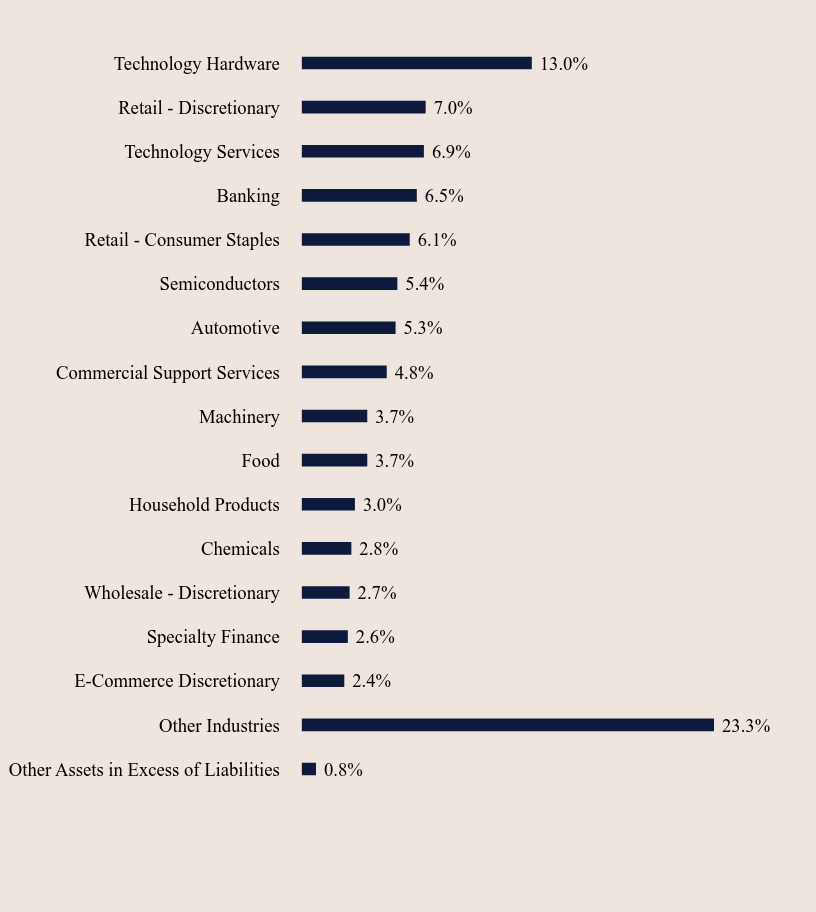

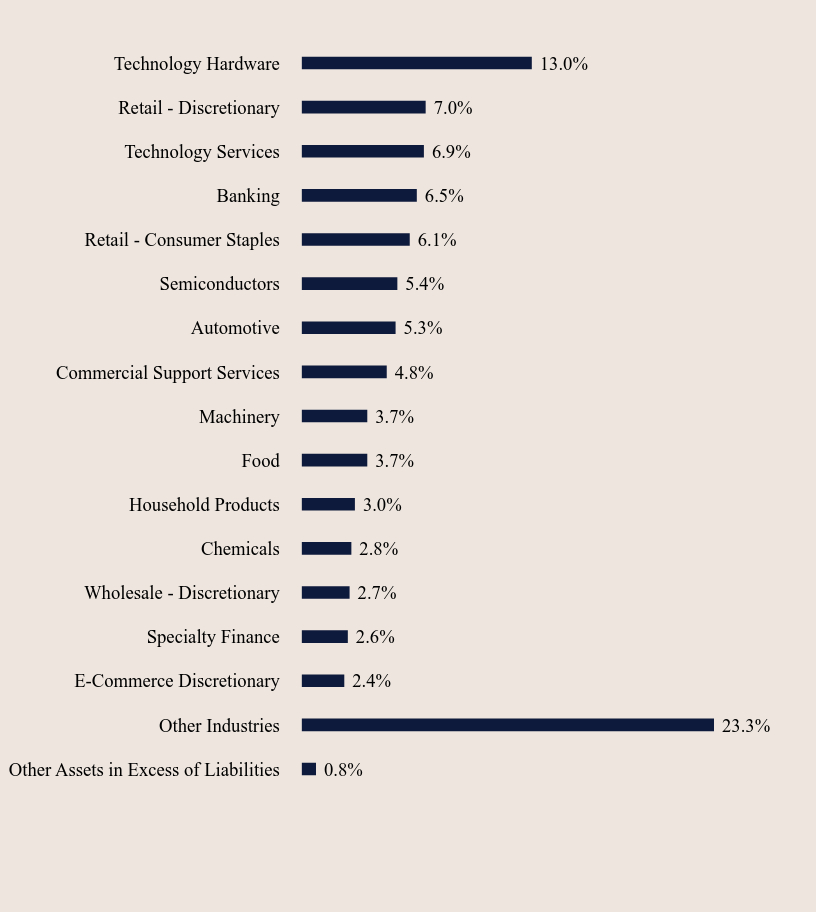

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.8% |

| Other Industries | 23.3% |

| E-Commerce Discretionary | 2.4% |

| Specialty Finance | 2.6% |

| Wholesale - Discretionary | 2.7% |

| Chemicals | 2.8% |

| Household Products | 3.0% |

| Food | 3.7% |

| Machinery | 3.7% |

| Commercial Support Services | 4.8% |

| Automotive | 5.3% |

| Semiconductors | 5.4% |

| Retail - Consumer Staples | 6.1% |

| Banking | 6.5% |

| Technology Services | 6.9% |

| Retail - Discretionary | 7.0% |

| Technology Hardware | 13.0% |

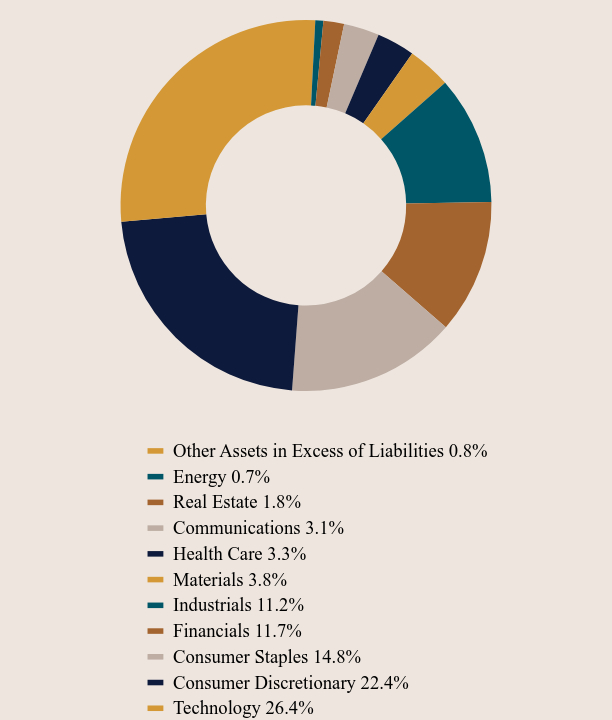

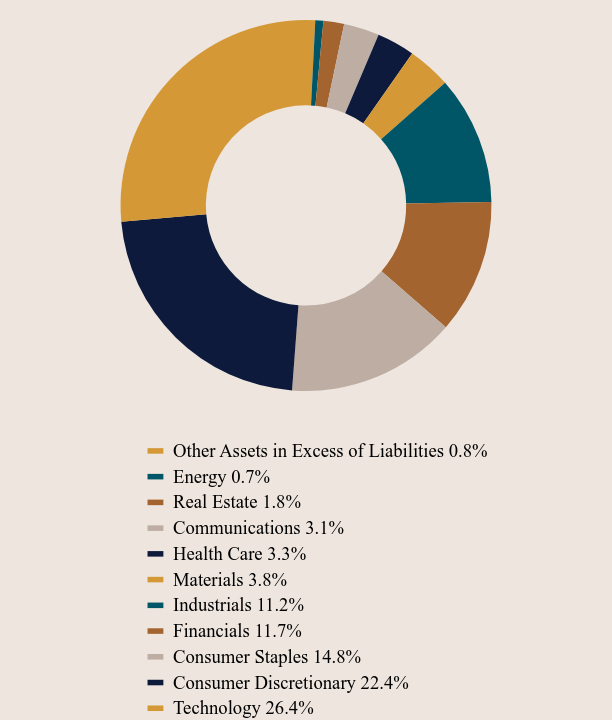

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.8% |

| Energy | 0.7% |

| Real Estate | 1.8% |

| Communications | 3.1% |

| Health Care | 3.3% |

| Materials | 3.8% |

| Industrials | 11.2% |

| Financials | 11.7% |

| Consumer Staples | 14.8% |

| Consumer Discretionary | 22.4% |

| Technology | 26.4% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak Emerging Markets Opportunities Fund - Institutional Class (GPEIX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak Emerging Markets Opportunities Fund

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak Emerging Markets Opportunities Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $91 | 1.80%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $307,736,846 |

| Number of Portfolio Holdings | 107 |

| Advisory Fee | $2,237,111 |

| Portfolio Turnover | 15% |

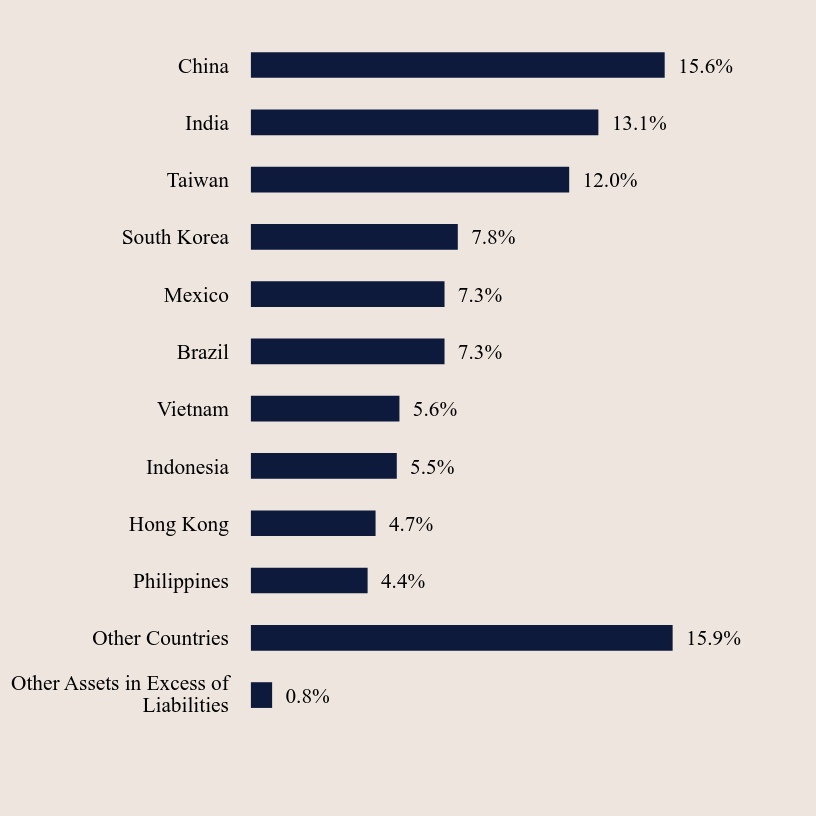

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.8% |

| Other Countries | 15.9% |

| Philippines | 4.4% |

| Hong Kong | 4.7% |

| Indonesia | 5.5% |

| Vietnam | 5.6% |

| Brazil | 7.3% |

| Mexico | 7.3% |

| South Korea | 7.8% |

| Taiwan | 12.0% |

| India | 13.1% |

| China | 15.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Silergy Corp | 4.3% |

| Techtronic Industries Co Limited | 2.6% |

| Sporton International, Inc. | 2.4% |

| FPT Corp | 2.3% |

| Sinbon Electronics Co., Limited | 2.3% |

| Globant S.A. | 2.2% |

| SJS Enterprises Ltd | 2.2% |

| Plover Bay Tech | 2.2% |

| Regional SAB de cv | 1.9% |

| iFast Corporation | 1.8% |

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.8% |

| Other Industries | 23.3% |

| E-Commerce Discretionary | 2.4% |

| Specialty Finance | 2.6% |

| Wholesale - Discretionary | 2.7% |

| Chemicals | 2.8% |

| Household Products | 3.0% |

| Food | 3.7% |

| Machinery | 3.7% |

| Commercial Support Services | 4.8% |

| Automotive | 5.3% |

| Semiconductors | 5.4% |

| Retail - Consumer Staples | 6.1% |

| Banking | 6.5% |

| Technology Services | 6.9% |

| Retail - Discretionary | 7.0% |

| Technology Hardware | 13.0% |

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.8% |

| Energy | 0.7% |

| Real Estate | 1.8% |

| Communications | 3.1% |

| Health Care | 3.3% |

| Materials | 3.8% |

| Industrials | 11.2% |

| Financials | 11.7% |

| Consumer Staples | 14.8% |

| Consumer Discretionary | 22.4% |

| Technology | 26.4% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak Emerging Markets Opportunities Fund - Investor Class (GPEOX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak Global Contrarian Fund

Institutional Class (GPGCX)

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak Global Contrarian Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $64 | 1.21%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $154,881,808 |

| Number of Portfolio Holdings | 90 |

| Advisory Fee | $756,618 |

| Portfolio Turnover | 30% |

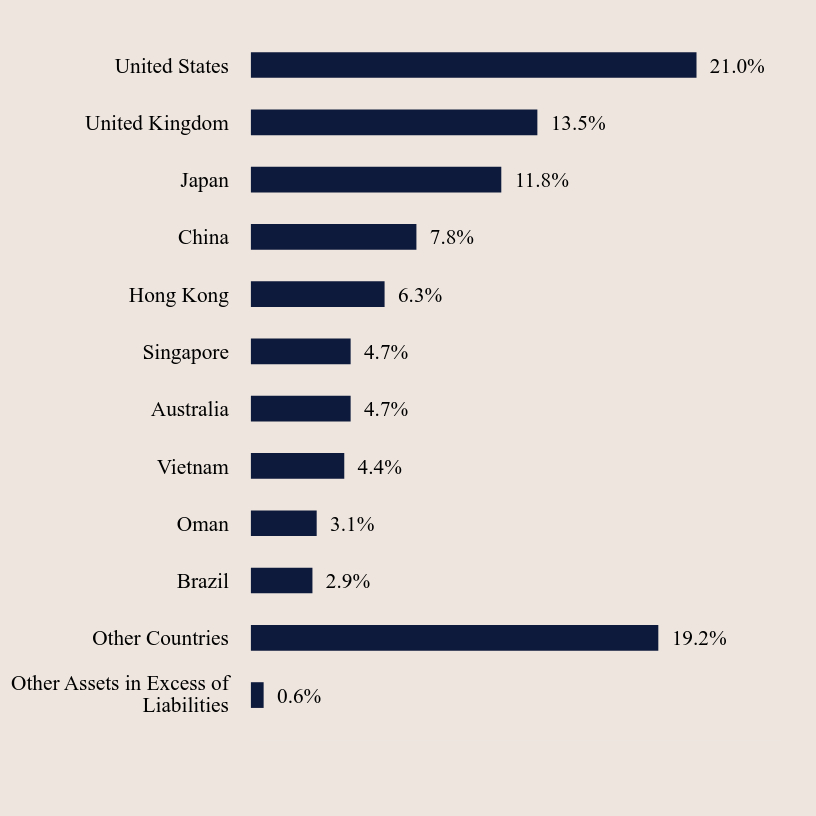

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Other Countries | 19.2% |

| Brazil | 2.9% |

| Oman | 3.1% |

| Vietnam | 4.4% |

| Australia | 4.7% |

| Singapore | 4.7% |

| Hong Kong | 6.3% |

| China | 7.8% |

| Japan | 11.8% |

| United Kingdom | 13.5% |

| United States | 21.0% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Plover Bay Tech | 6.3% |

| Riverstone Holdings Ltd. | 4.6% |

| Petershill Partners PLC | 4.1% |

| Tethys Oil AB | 3.1% |

| P10 Inc | 2.1% |

| BayCurrent Consulting, Inc. | 1.9% |

| Rise Consulting Group Inc | 1.8% |

| Vietnam Technological & Comm Joint-stock Bank | 1.8% |

| Five Below, Inc. | 1.8% |

| CVS Group plc | 1.6% |

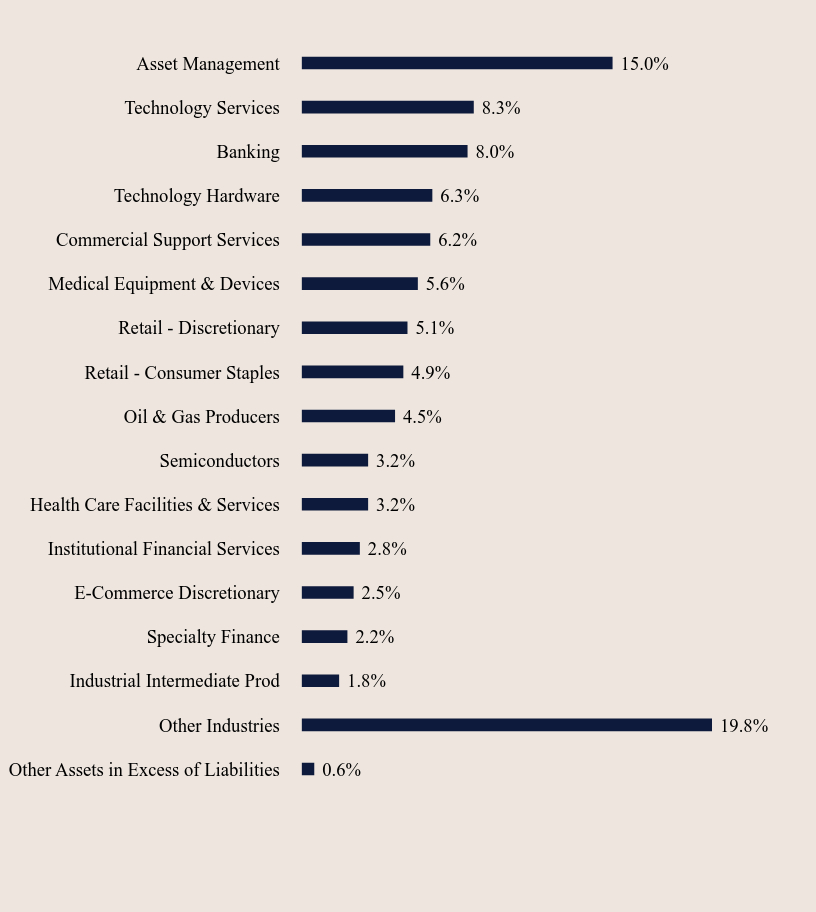

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Other Industries | 19.8% |

| Industrial Intermediate Prod | 1.8% |

| Specialty Finance | 2.2% |

| E-Commerce Discretionary | 2.5% |

| Institutional Financial Services | 2.8% |

| Health Care Facilities & Services | 3.2% |

| Semiconductors | 3.2% |

| Oil & Gas Producers | 4.5% |

| Retail - Consumer Staples | 4.9% |

| Retail - Discretionary | 5.1% |

| Medical Equipment & Devices | 5.6% |

| Commercial Support Services | 6.2% |

| Technology Hardware | 6.3% |

| Banking | 8.0% |

| Technology Services | 8.3% |

| Asset Management | 15.0% |

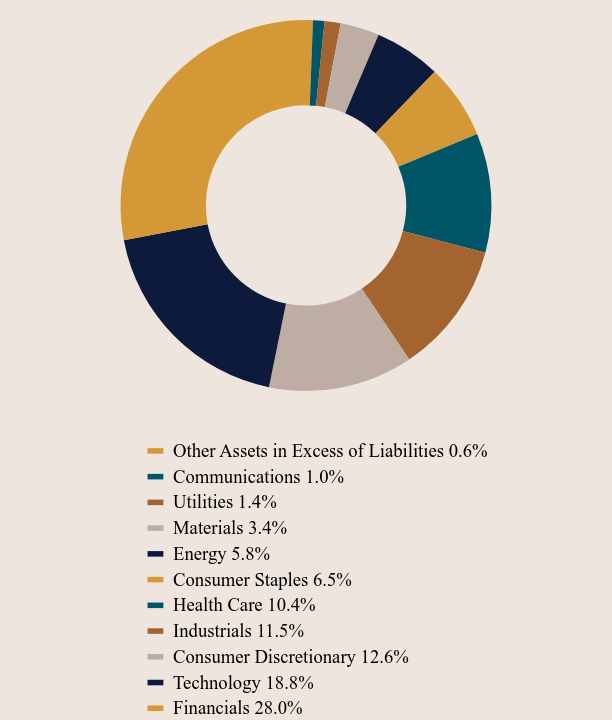

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Communications | 1.0% |

| Utilities | 1.4% |

| Materials | 3.4% |

| Energy | 5.8% |

| Consumer Staples | 6.5% |

| Health Care | 10.4% |

| Industrials | 11.5% |

| Consumer Discretionary | 12.6% |

| Technology | 18.8% |

| Financials | 28.0% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak Global Contrarian Fund - Institutional Class (GPGCX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak Global Explorer Fund

Institutional Class (GPGEX)

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak Global Explorer Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $64 | 1.25%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $12,243,884 |

| Number of Portfolio Holdings | 298 |

| Advisory Fee | $7,797 |

| Portfolio Turnover | 24% |

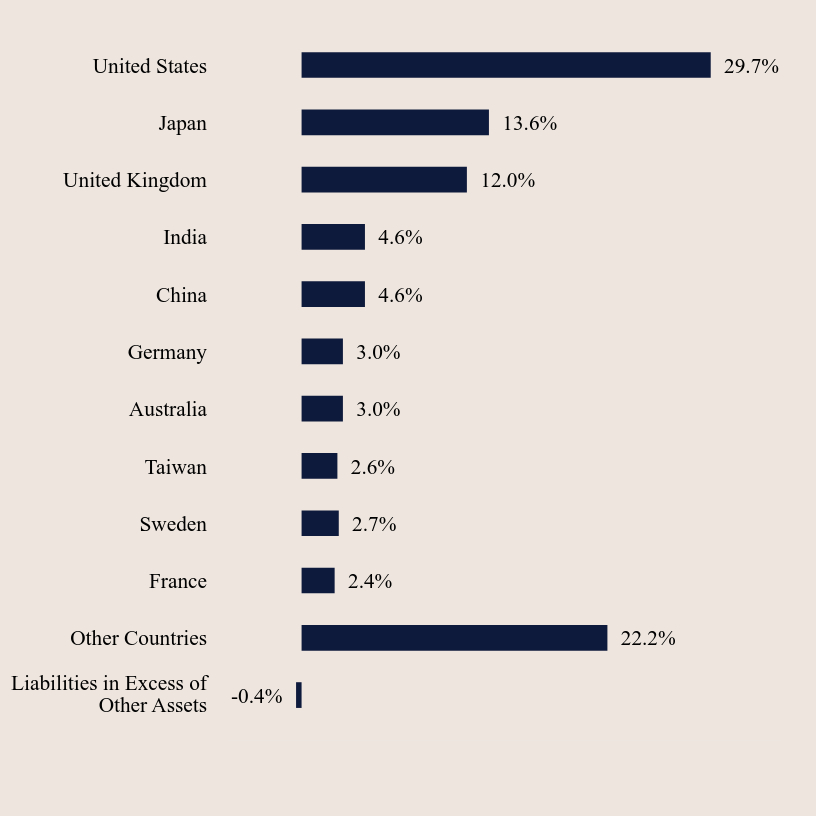

Country Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.4% |

| Other Countries | 22.2% |

| France | 2.4% |

| Sweden | 2.7% |

| Taiwan | 2.6% |

| Australia | 3.0% |

| Germany | 3.0% |

| China | 4.6% |

| India | 4.6% |

| United Kingdom | 12.0% |

| Japan | 13.6% |

| United States | 29.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| JTC plc | 1.1% |

| ULS Group Inc | 1.0% |

| Virbac SA | 1.0% |

| B & M European Value Retail SA | 0.9% |

| Silergy Corp | 0.9% |

| P10 Inc | 0.8% |

| Five Below, Inc. | 0.8% |

| Globant S.A. | 0.8% |

| Beenos Inc | 0.8% |

| Sporton International, Inc. | 0.8% |

What did the Fund invest in?

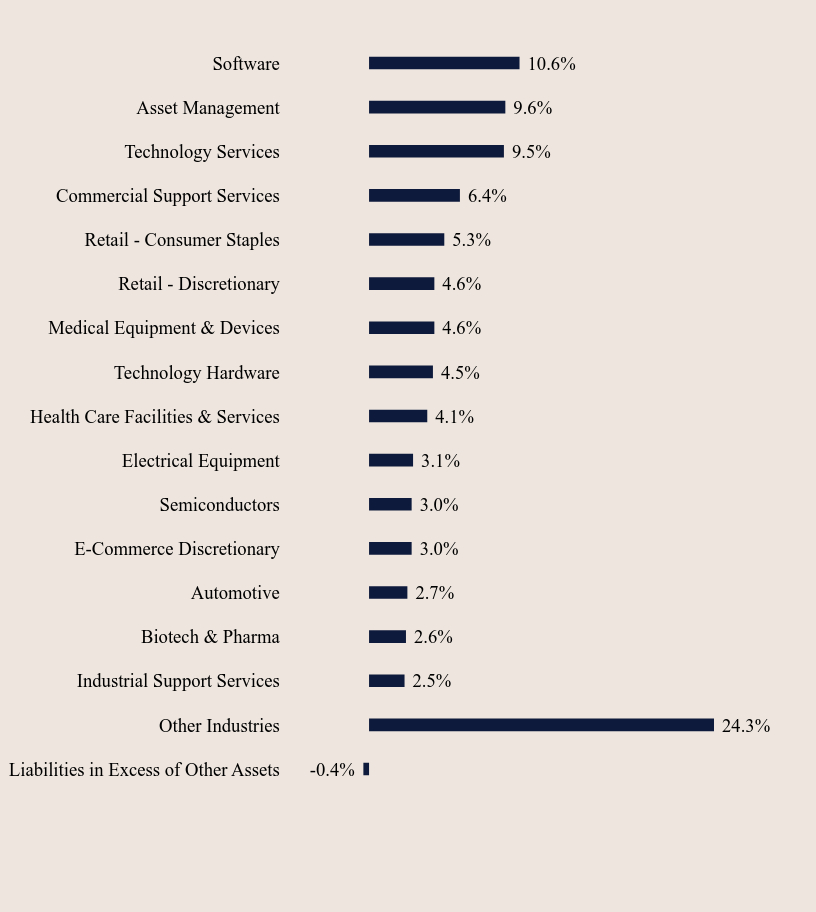

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.4% |

| Other Industries | 24.3% |

| Industrial Support Services | 2.5% |

| Biotech & Pharma | 2.6% |

| Automotive | 2.7% |

| E-Commerce Discretionary | 3.0% |

| Semiconductors | 3.0% |

| Electrical Equipment | 3.1% |

| Health Care Facilities & Services | 4.1% |

| Technology Hardware | 4.5% |

| Medical Equipment & Devices | 4.6% |

| Retail - Discretionary | 4.6% |

| Retail - Consumer Staples | 5.3% |

| Commercial Support Services | 6.4% |

| Technology Services | 9.5% |

| Asset Management | 9.6% |

| Software | 10.6% |

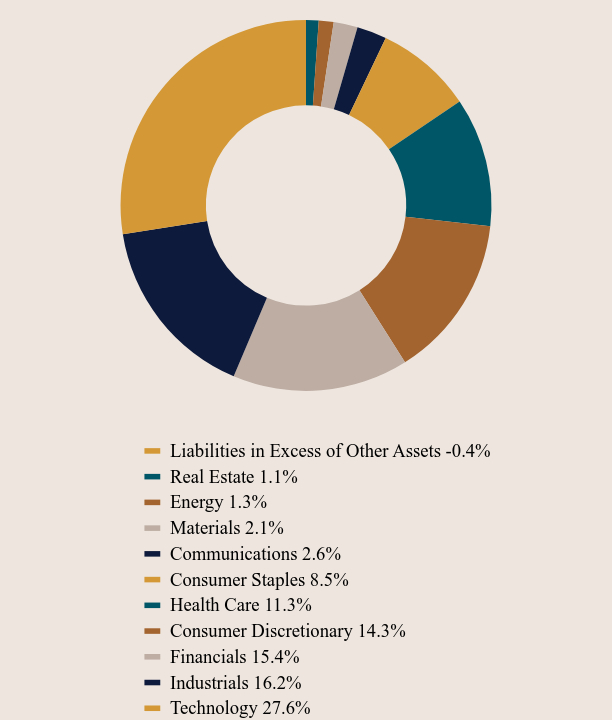

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.4% |

| Real Estate | 1.1% |

| Energy | 1.3% |

| Materials | 2.1% |

| Communications | 2.6% |

| Consumer Staples | 8.5% |

| Health Care | 11.3% |

| Consumer Discretionary | 14.3% |

| Financials | 15.4% |

| Industrials | 16.2% |

| Technology | 27.6% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak Global Explorer Fund - Institutional Class (GPGEX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak Global Micro Cap Fund

Institutional Class (GPMCX)

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak Global Micro Cap Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $104 | 2.00%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $44,788,890 |

| Number of Portfolio Holdings | 121 |

| Advisory Fee | $348,023 |

| Portfolio Turnover | 16% |

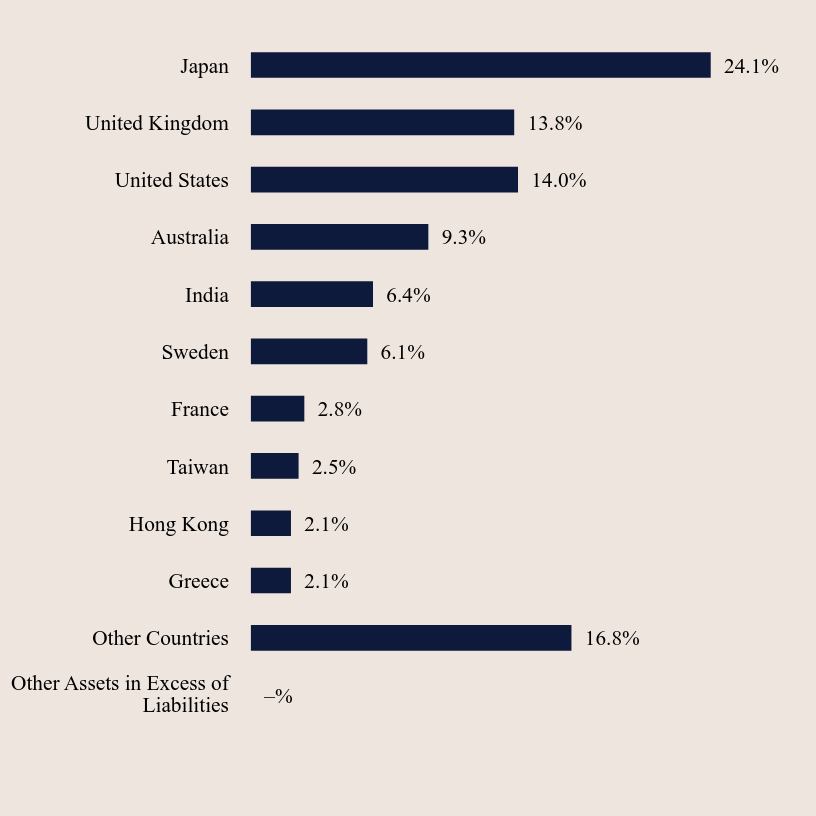

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | -% |

| Other Countries | 16.8% |

| Greece | 2.1% |

| Hong Kong | 2.1% |

| Taiwan | 2.5% |

| France | 2.8% |

| Sweden | 6.1% |

| India | 6.4% |

| Australia | 9.3% |

| United States | 14.0% |

| United Kingdom | 13.8% |

| Japan | 24.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Pennant Group, Inc. (The) | 4.1% |

| Fiducian Group Ltd | 2.8% |

| Beenos Inc | 2.7% |

| ULS Group Inc | 2.6% |

| Yatharth Hospital | 2.4% |

| Kogan.com Ltd | 2.2% |

| Plover Bay Tech | 2.2% |

| Swedencare AB | 2.1% |

| Barrett Business Services, Inc. | 2.1% |

| Elixirr International PLC | 2.0% |

What did the Fund invest in?

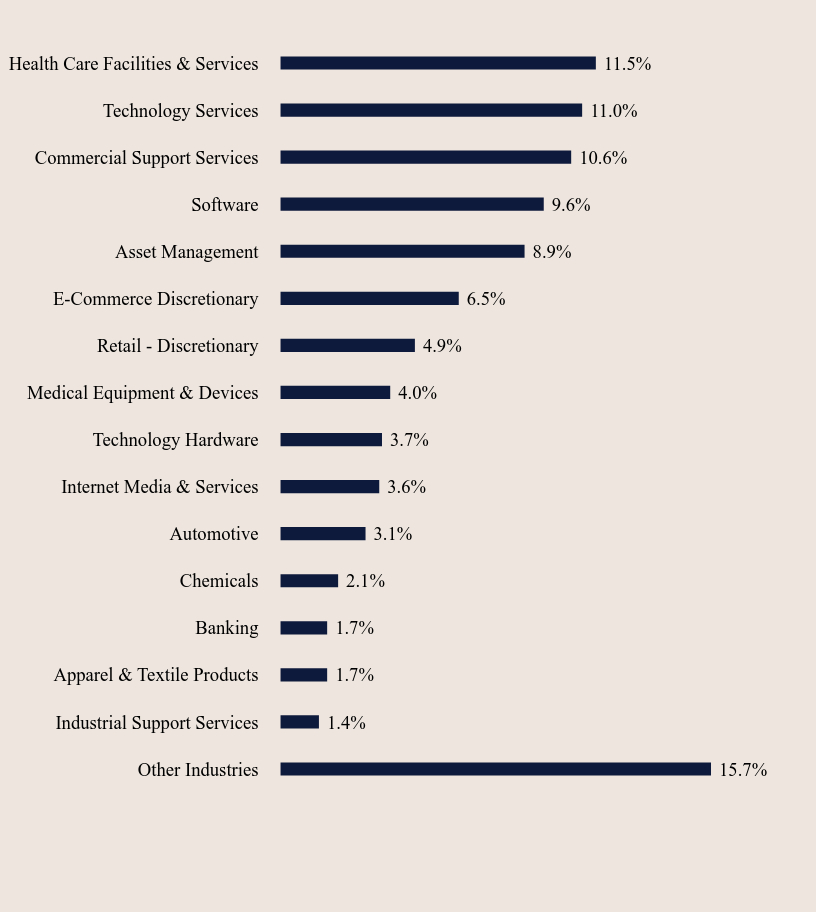

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Industries | 15.7% |

| Industrial Support Services | 1.4% |

| Apparel & Textile Products | 1.7% |

| Banking | 1.7% |

| Chemicals | 2.1% |

| Automotive | 3.1% |

| Internet Media & Services | 3.6% |

| Technology Hardware | 3.7% |

| Medical Equipment & Devices | 4.0% |

| Retail - Discretionary | 4.9% |

| E-Commerce Discretionary | 6.5% |

| Asset Management | 8.9% |

| Software | 9.6% |

| Commercial Support Services | 10.6% |

| Technology Services | 11.0% |

| Health Care Facilities & Services | 11.5% |

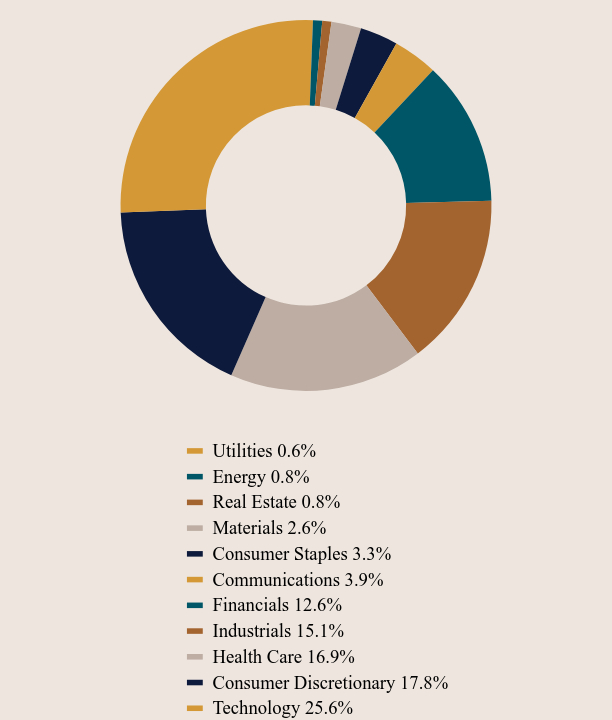

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Utilities | 0.6% |

| Energy | 0.8% |

| Real Estate | 0.8% |

| Materials | 2.6% |

| Consumer Staples | 3.3% |

| Communications | 3.9% |

| Financials | 12.6% |

| Industrials | 15.1% |

| Health Care | 16.9% |

| Consumer Discretionary | 17.8% |

| Technology | 25.6% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak Global Micro Cap Fund - Institutional Class (GPMCX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak Global Opportunities Fund

Institutional Class (GPGIX)

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak Global Opportunities Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $67 | 1.32%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $584,279,654 |

| Number of Portfolio Holdings | 157 |

| Advisory Fee | $3,548,925 |

| Portfolio Turnover | 22% |

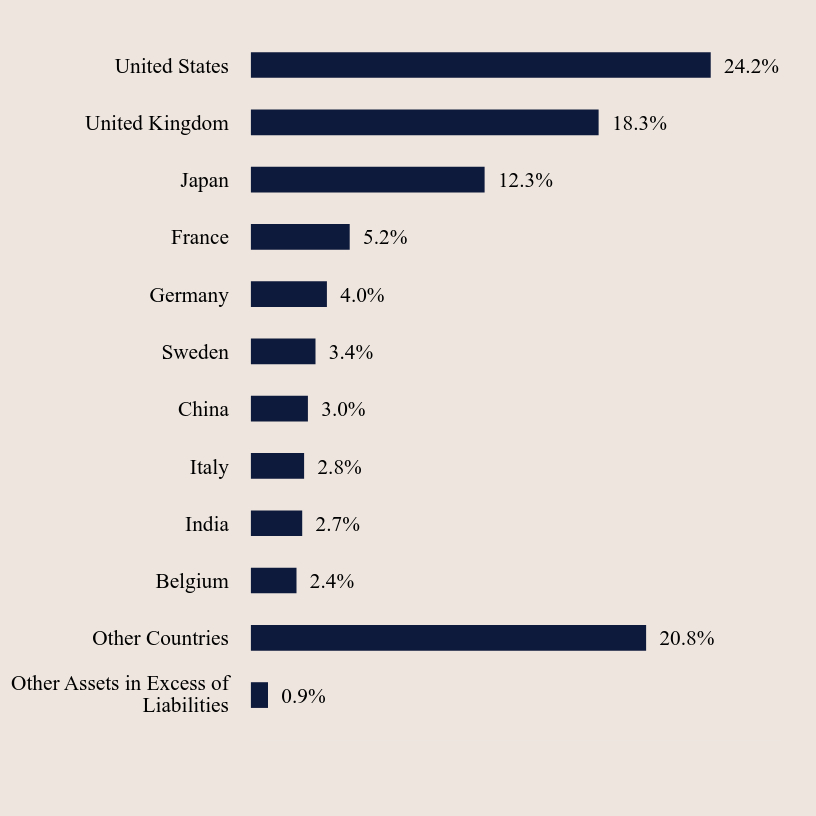

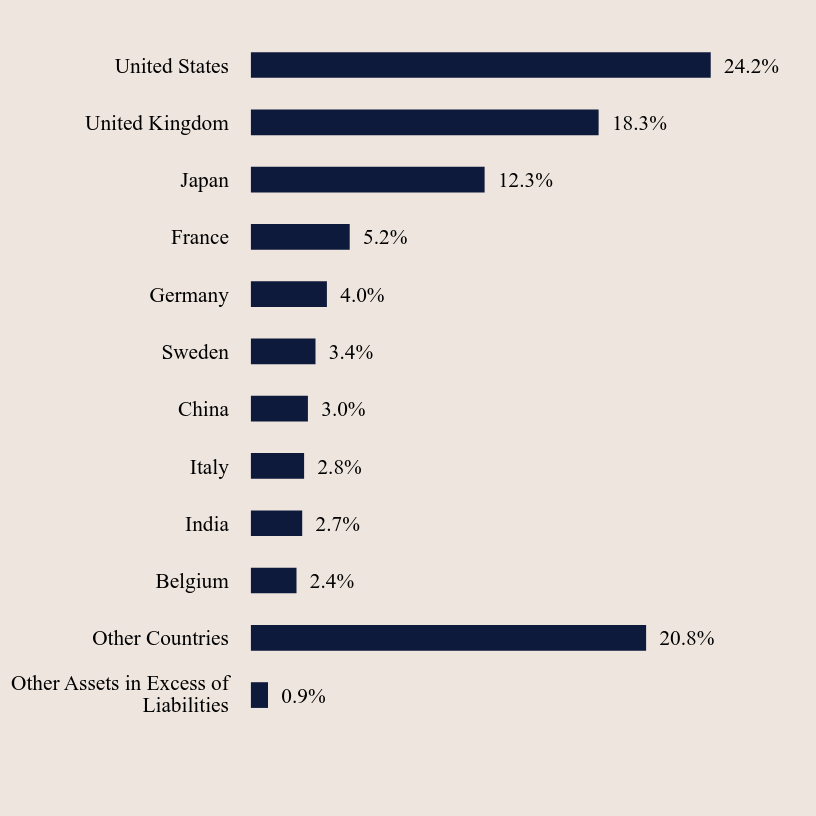

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.9% |

| Other Countries | 20.8% |

| Belgium | 2.4% |

| India | 2.7% |

| Italy | 2.8% |

| China | 3.0% |

| Sweden | 3.4% |

| Germany | 4.0% |

| France | 5.2% |

| Japan | 12.3% |

| United Kingdom | 18.3% |

| United States | 24.2% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| B & M European Value Retail SA | 3.3% |

| BayCurrent Consulting, Inc. | 2.7% |

| Virbac SA | 2.7% |

| Littelfuse, Inc. | 2.5% |

| CVS Group plc | 1.7% |

| Volution Group PLC | 1.6% |

| JTC plc | 1.5% |

| Silergy Corp | 1.5% |

| Diploma plc | 1.3% |

| Melexis NV | 1.3% |

What did the Fund invest in?

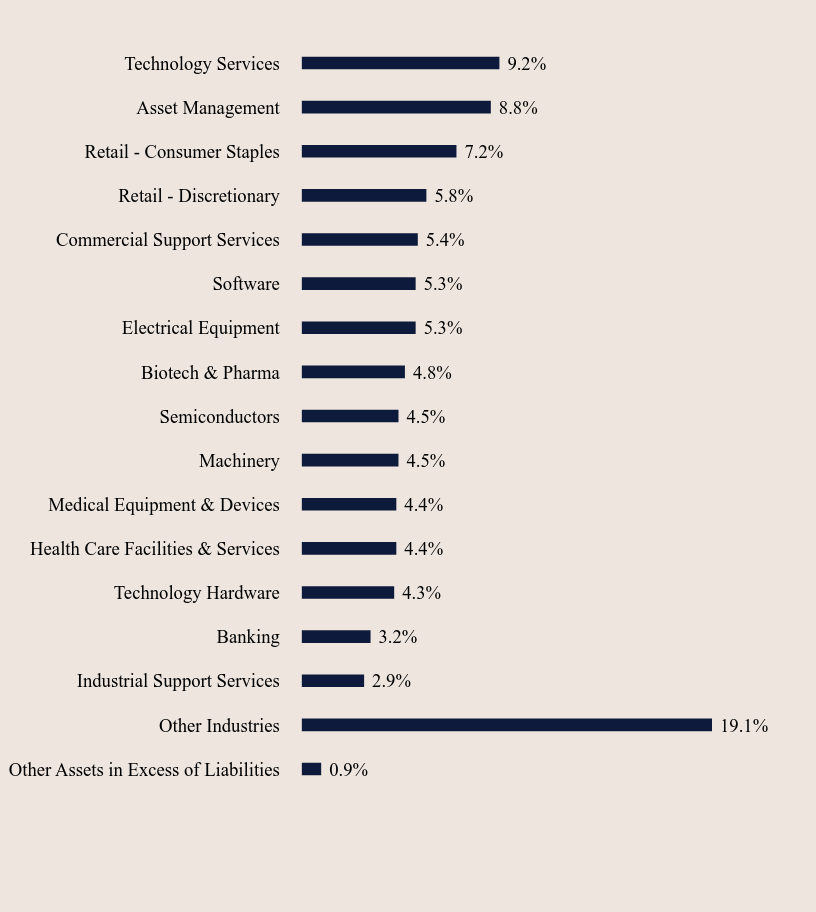

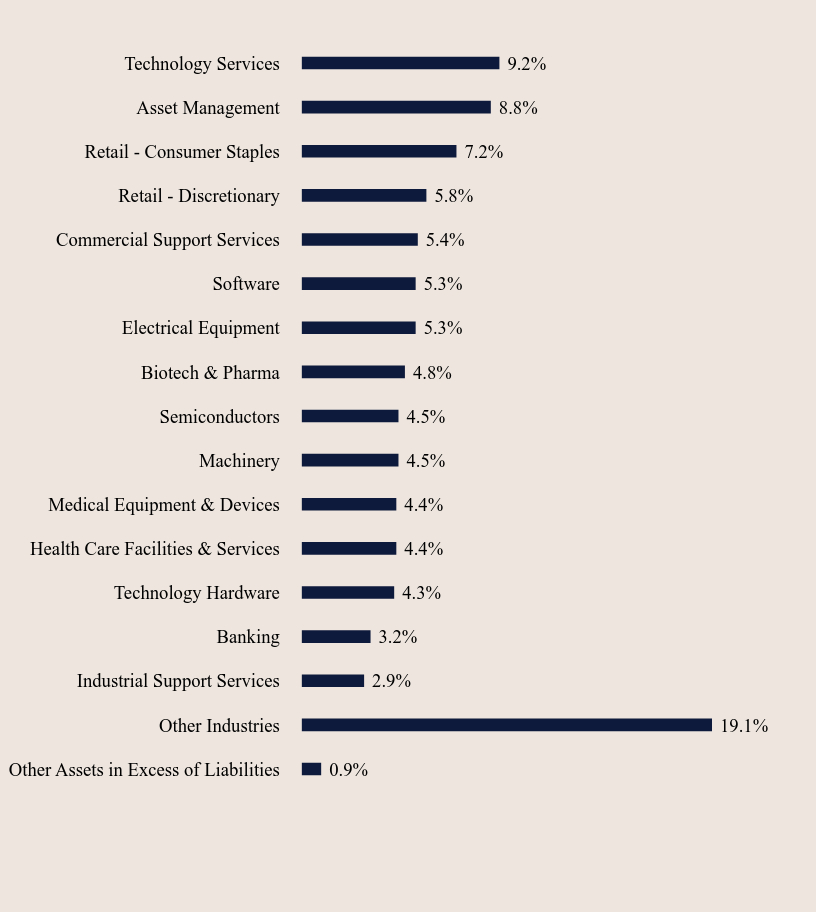

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.9% |

| Other Industries | 19.1% |

| Industrial Support Services | 2.9% |

| Banking | 3.2% |

| Technology Hardware | 4.3% |

| Health Care Facilities & Services | 4.4% |

| Medical Equipment & Devices | 4.4% |

| Machinery | 4.5% |

| Semiconductors | 4.5% |

| Biotech & Pharma | 4.8% |

| Electrical Equipment | 5.3% |

| Software | 5.3% |

| Commercial Support Services | 5.4% |

| Retail - Discretionary | 5.8% |

| Retail - Consumer Staples | 7.2% |

| Asset Management | 8.8% |

| Technology Services | 9.2% |

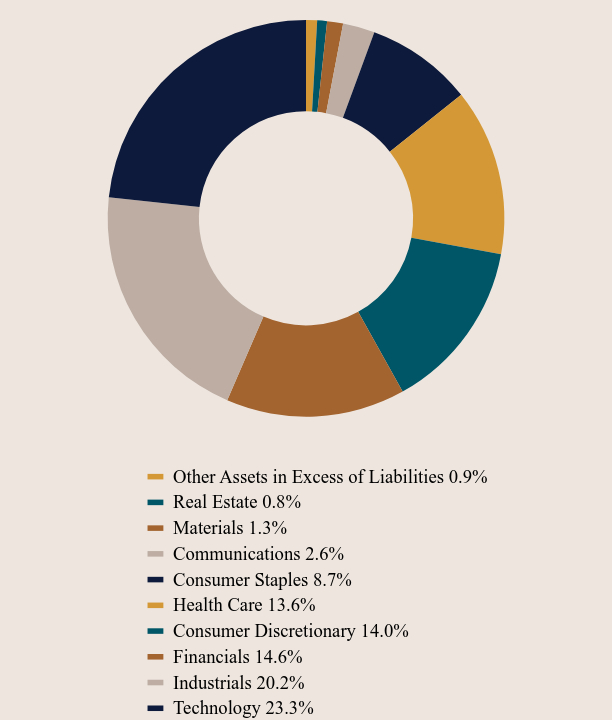

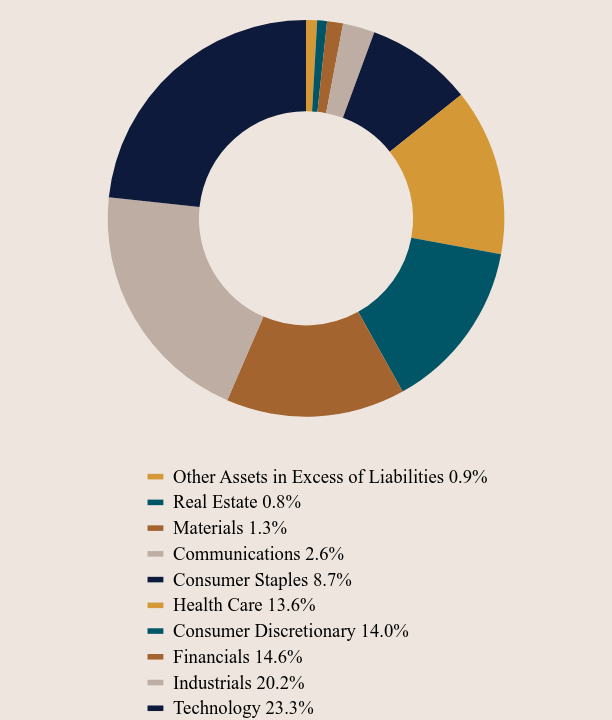

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.9% |

| Real Estate | 0.8% |

| Materials | 1.3% |

| Communications | 2.6% |

| Consumer Staples | 8.7% |

| Health Care | 13.6% |

| Consumer Discretionary | 14.0% |

| Financials | 14.6% |

| Industrials | 20.2% |

| Technology | 23.3% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak Global Opportunities Fund - Institutional Class (GPGIX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak Global Opportunities Fund

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak Global Opportunities Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $80 | 1.57%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $584,279,654 |

| Number of Portfolio Holdings | 157 |

| Advisory Fee | $3,548,925 |

| Portfolio Turnover | 22% |

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.9% |

| Other Countries | 20.8% |

| Belgium | 2.4% |

| India | 2.7% |

| Italy | 2.8% |

| China | 3.0% |

| Sweden | 3.4% |

| Germany | 4.0% |

| France | 5.2% |

| Japan | 12.3% |

| United Kingdom | 18.3% |

| United States | 24.2% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| B & M European Value Retail SA | 3.3% |

| BayCurrent Consulting, Inc. | 2.7% |

| Virbac SA | 2.7% |

| Littelfuse, Inc. | 2.5% |

| CVS Group plc | 1.7% |

| Volution Group PLC | 1.6% |

| JTC plc | 1.5% |

| Silergy Corp | 1.5% |

| Diploma plc | 1.3% |

| Melexis NV | 1.3% |

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.9% |

| Other Industries | 19.1% |

| Industrial Support Services | 2.9% |

| Banking | 3.2% |

| Technology Hardware | 4.3% |

| Health Care Facilities & Services | 4.4% |

| Medical Equipment & Devices | 4.4% |

| Machinery | 4.5% |

| Semiconductors | 4.5% |

| Biotech & Pharma | 4.8% |

| Electrical Equipment | 5.3% |

| Software | 5.3% |

| Commercial Support Services | 5.4% |

| Retail - Discretionary | 5.8% |

| Retail - Consumer Staples | 7.2% |

| Asset Management | 8.8% |

| Technology Services | 9.2% |

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.9% |

| Real Estate | 0.8% |

| Materials | 1.3% |

| Communications | 2.6% |

| Consumer Staples | 8.7% |

| Health Care | 13.6% |

| Consumer Discretionary | 14.0% |

| Financials | 14.6% |

| Industrials | 20.2% |

| Technology | 23.3% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak Global Opportunities Fund - Investor Class (GPGOX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak Global Reach Fund

Institutional Class (GPRIX)

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak Global Reach Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $65 | 1.25%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $187,809,491 |

| Number of Portfolio Holdings | 286 |

| Advisory Fee | $1,079,343 |

| Portfolio Turnover | 26% |

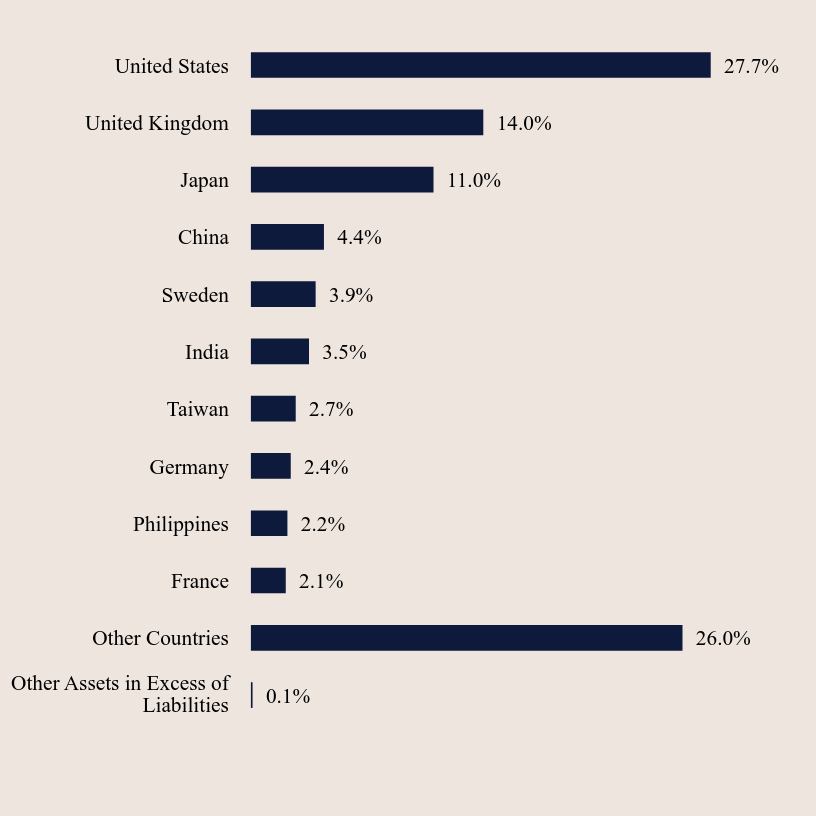

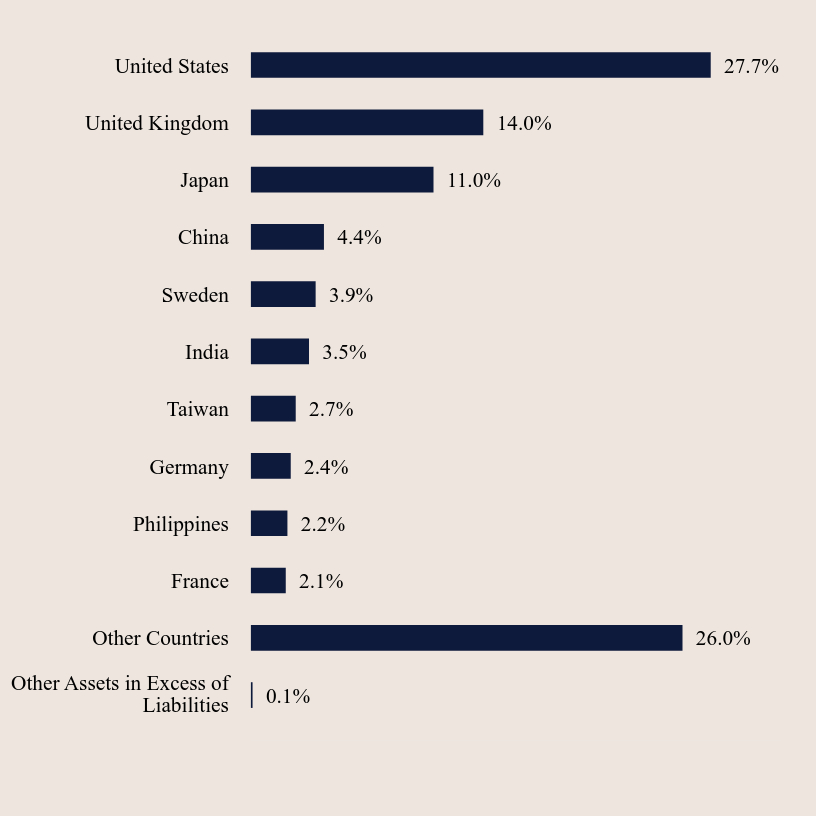

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Other Countries | 26.0% |

| France | 2.1% |

| Philippines | 2.2% |

| Germany | 2.4% |

| Taiwan | 2.7% |

| India | 3.5% |

| Sweden | 3.9% |

| China | 4.4% |

| Japan | 11.0% |

| United Kingdom | 14.0% |

| United States | 27.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| BayCurrent Consulting, Inc. | 1.7% |

| Plover Bay Tech | 1.5% |

| B & M European Value Retail SA | 1.1% |

| Virbac SA | 1.1% |

| JTC plc | 1.1% |

| Perella Weinberg Partners | 1.1% |

| Silergy Corp | 1.1% |

| Globant S.A. | 1.0% |

| CVS Group plc | 0.9% |

| Ace Hardware Indonesia Tbk P.T. | 0.9% |

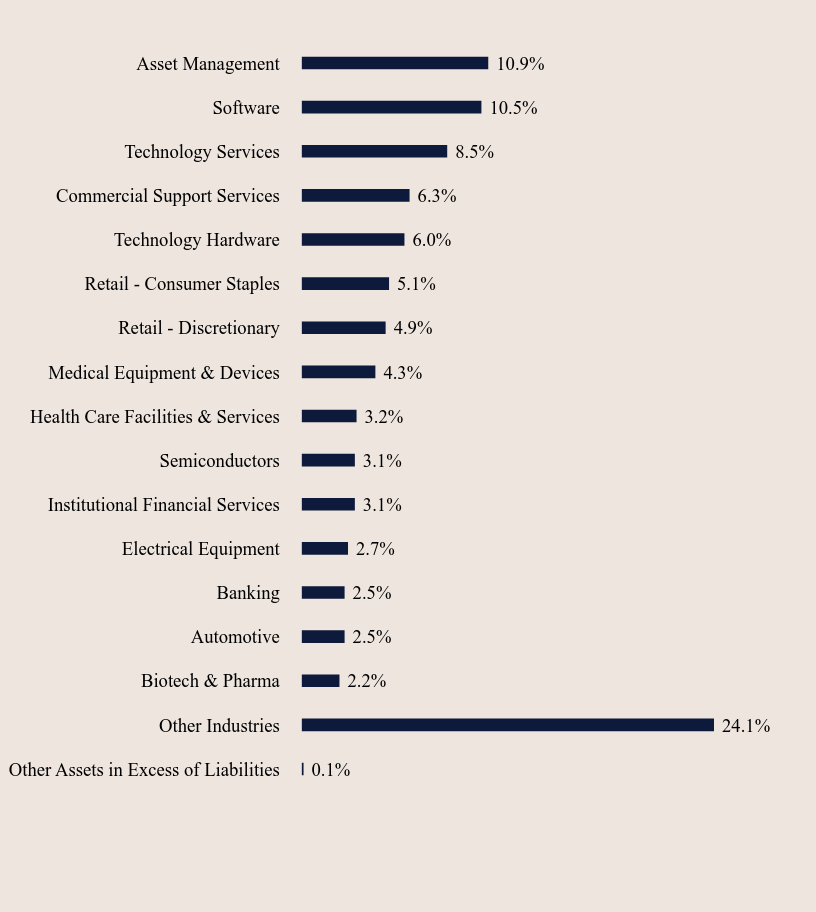

What did the Fund invest in?

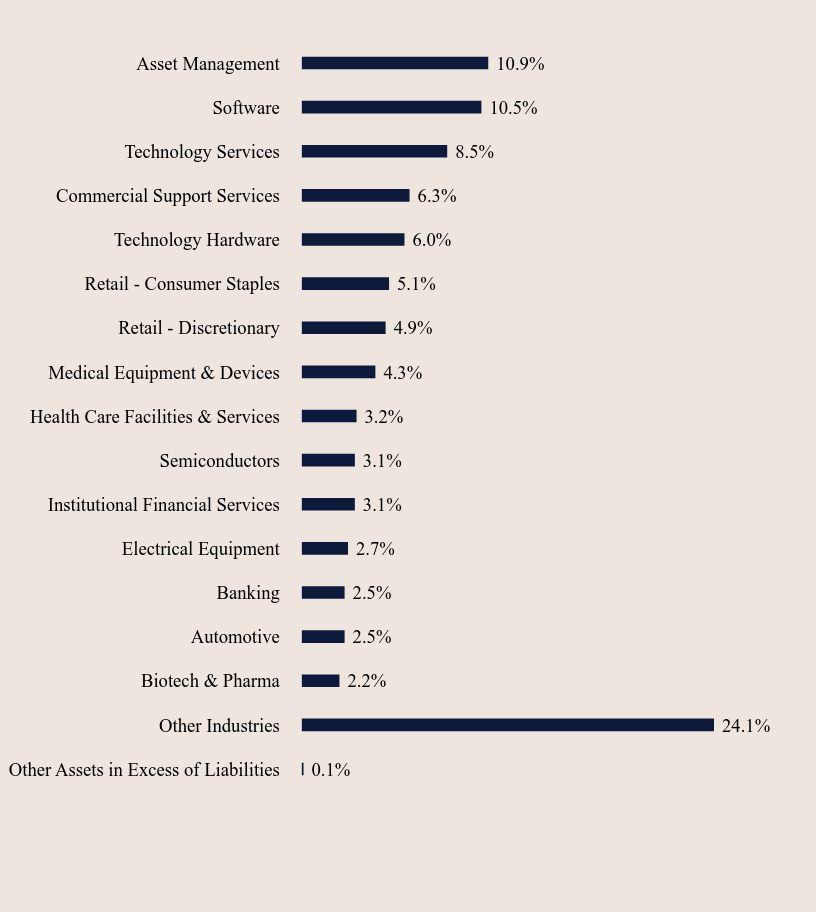

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Other Industries | 24.1% |

| Biotech & Pharma | 2.2% |

| Automotive | 2.5% |

| Banking | 2.5% |

| Electrical Equipment | 2.7% |

| Institutional Financial Services | 3.1% |

| Semiconductors | 3.1% |

| Health Care Facilities & Services | 3.2% |

| Medical Equipment & Devices | 4.3% |

| Retail - Discretionary | 4.9% |

| Retail - Consumer Staples | 5.1% |

| Technology Hardware | 6.0% |

| Commercial Support Services | 6.3% |

| Technology Services | 8.5% |

| Software | 10.5% |

| Asset Management | 10.9% |

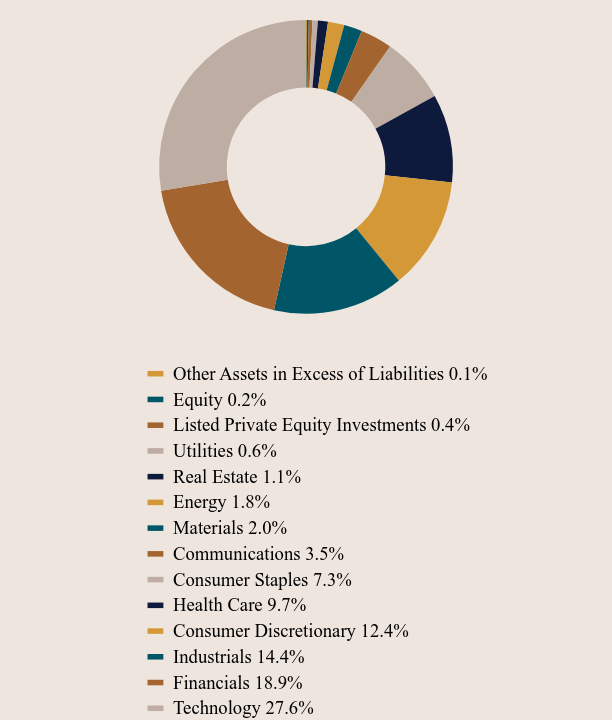

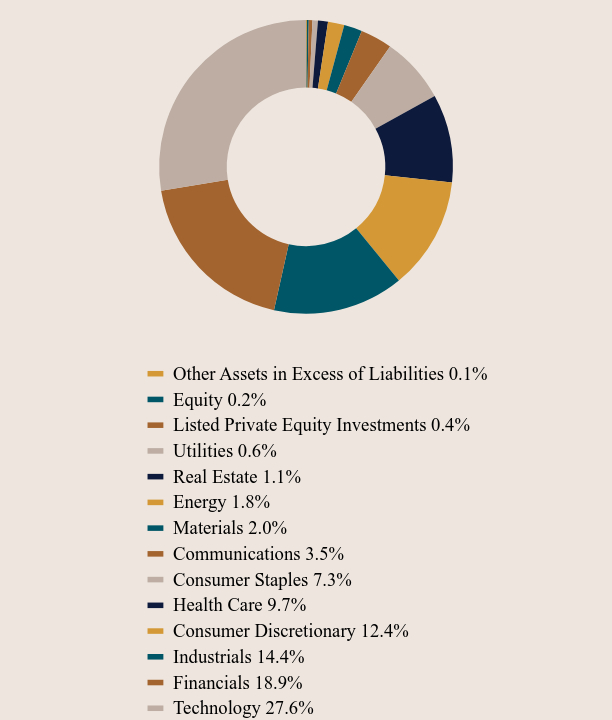

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Equity | 0.2% |

| Listed Private Equity Investments | 0.4% |

| Utilities | 0.6% |

| Real Estate | 1.1% |

| Energy | 1.8% |

| Materials | 2.0% |

| Communications | 3.5% |

| Consumer Staples | 7.3% |

| Health Care | 9.7% |

| Consumer Discretionary | 12.4% |

| Industrials | 14.4% |

| Financials | 18.9% |

| Technology | 27.6% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak Global Reach Fund - Institutional Class (GPRIX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak Global Reach Fund

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak Global Reach Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $78 | 1.50%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $187,809,491 |

| Number of Portfolio Holdings | 286 |

| Advisory Fee | $1,079,343 |

| Portfolio Turnover | 26% |

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Other Countries | 26.0% |

| France | 2.1% |

| Philippines | 2.2% |

| Germany | 2.4% |

| Taiwan | 2.7% |

| India | 3.5% |

| Sweden | 3.9% |

| China | 4.4% |

| Japan | 11.0% |

| United Kingdom | 14.0% |

| United States | 27.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| BayCurrent Consulting, Inc. | 1.7% |

| Plover Bay Tech | 1.5% |

| B & M European Value Retail SA | 1.1% |

| Virbac SA | 1.1% |

| JTC plc | 1.1% |

| Perella Weinberg Partners | 1.1% |

| Silergy Corp | 1.1% |

| Globant S.A. | 1.0% |

| CVS Group plc | 0.9% |

| Ace Hardware Indonesia Tbk P.T. | 0.9% |

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Other Industries | 24.1% |

| Biotech & Pharma | 2.2% |

| Automotive | 2.5% |

| Banking | 2.5% |

| Electrical Equipment | 2.7% |

| Institutional Financial Services | 3.1% |

| Semiconductors | 3.1% |

| Health Care Facilities & Services | 3.2% |

| Medical Equipment & Devices | 4.3% |

| Retail - Discretionary | 4.9% |

| Retail - Consumer Staples | 5.1% |

| Technology Hardware | 6.0% |

| Commercial Support Services | 6.3% |

| Technology Services | 8.5% |

| Software | 10.5% |

| Asset Management | 10.9% |

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Equity | 0.2% |

| Listed Private Equity Investments | 0.4% |

| Utilities | 0.6% |

| Real Estate | 1.1% |

| Energy | 1.8% |

| Materials | 2.0% |

| Communications | 3.5% |

| Consumer Staples | 7.3% |

| Health Care | 9.7% |

| Consumer Discretionary | 12.4% |

| Industrials | 14.4% |

| Financials | 18.9% |

| Technology | 27.6% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak Global Reach Fund - Investor Class (GPROX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak Global Stalwarts Fund

Institutional Class (GGSYX)

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak Global Stalwarts Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $56 | 1.09%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $120,295,277 |

| Number of Portfolio Holdings | 148 |

| Advisory Fee | $532,452 |

| Portfolio Turnover | 35% |

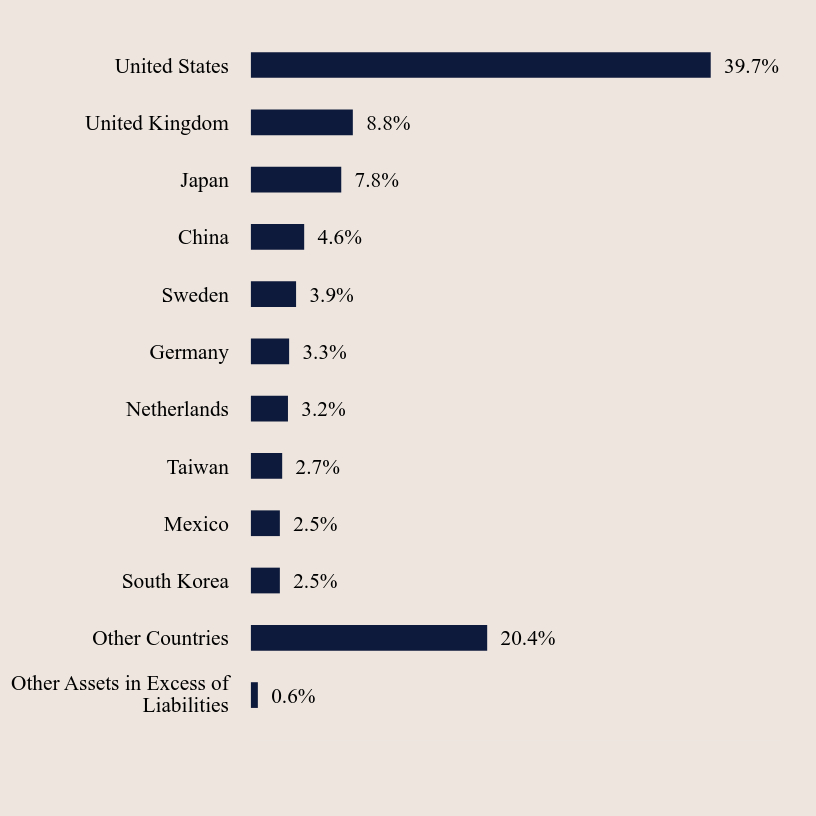

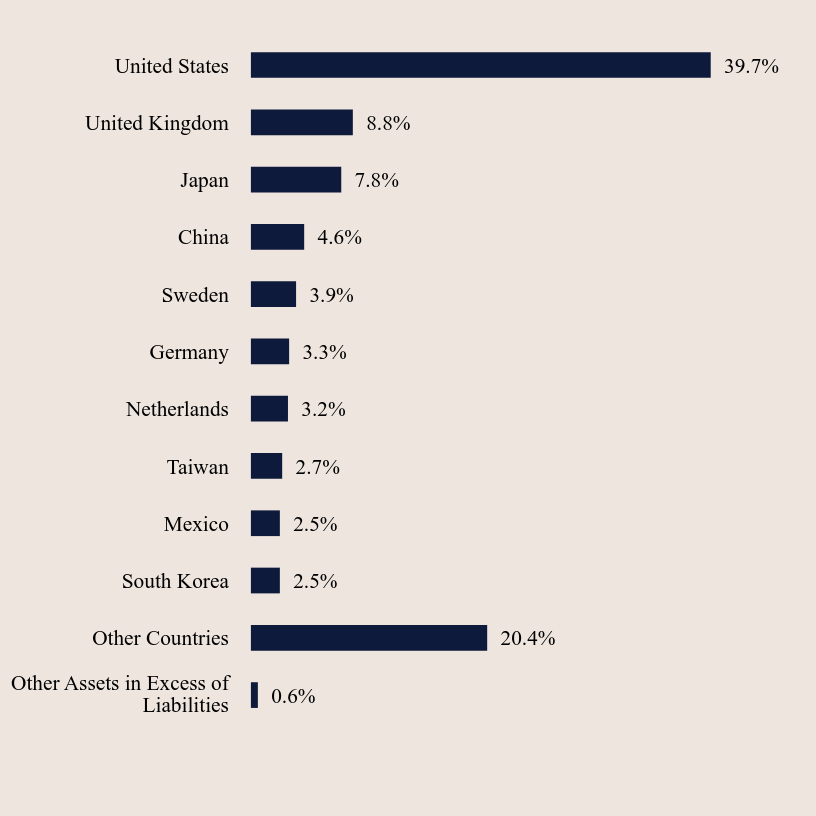

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Other Countries | 20.4% |

| South Korea | 2.5% |

| Mexico | 2.5% |

| Taiwan | 2.7% |

| Netherlands | 3.2% |

| Germany | 3.3% |

| Sweden | 3.9% |

| China | 4.6% |

| Japan | 7.8% |

| United Kingdom | 8.8% |

| United States | 39.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Silergy Corp | 3.3% |

| BayCurrent Consulting, Inc. | 3.1% |

| B & M European Value Retail SA | 3.1% |

| Littelfuse, Inc. | 2.7% |

| Globant S.A. | 1.8% |

| JTC plc | 1.8% |

| Lululemon Athletica, Inc. | 1.5% |

| Techtronic Industries Co Limited | 1.4% |

| Virbac SA | 1.3% |

| Silicon Laboratories, Inc. | 1.2% |

What did the Fund invest in?

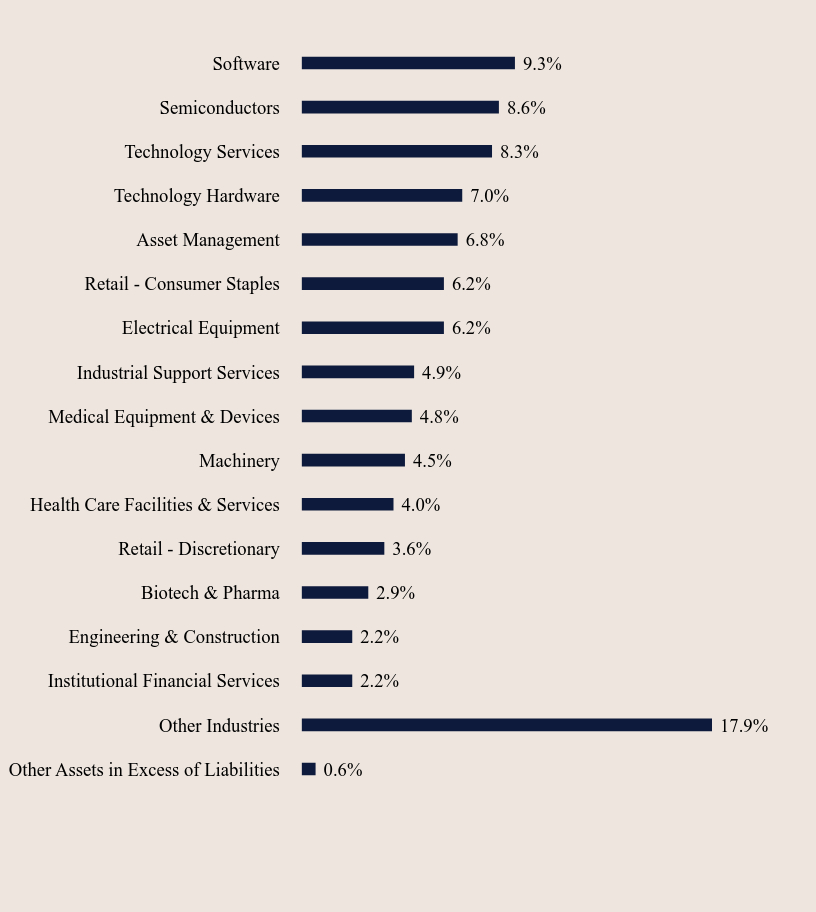

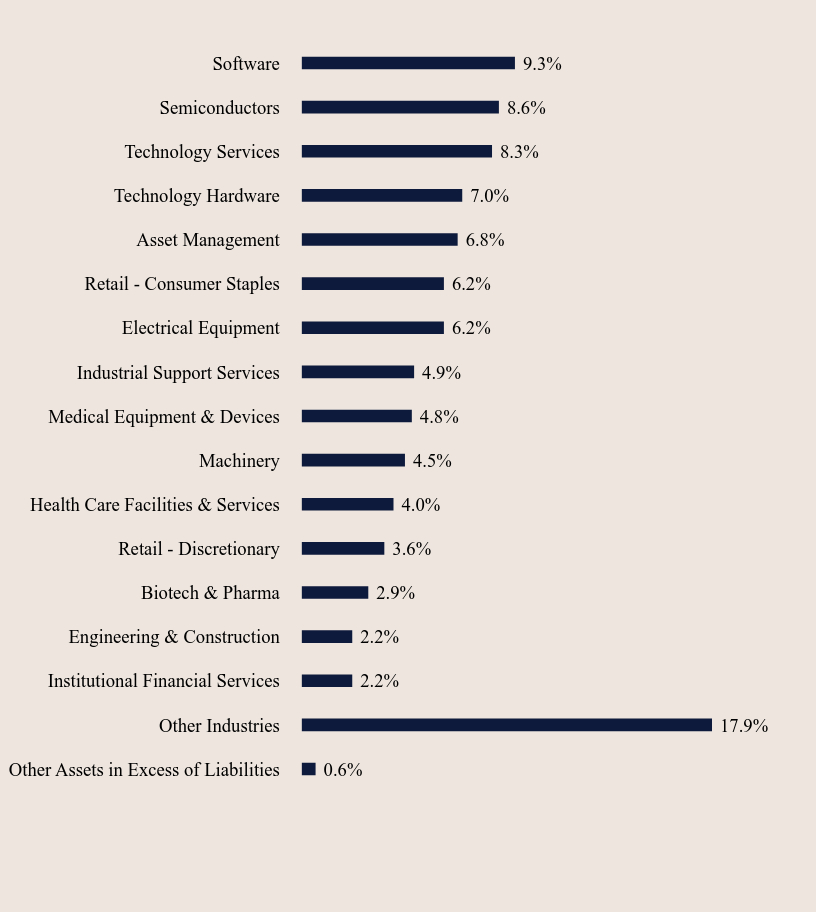

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Other Industries | 17.9% |

| Institutional Financial Services | 2.2% |

| Engineering & Construction | 2.2% |

| Biotech & Pharma | 2.9% |

| Retail - Discretionary | 3.6% |

| Health Care Facilities & Services | 4.0% |

| Machinery | 4.5% |

| Medical Equipment & Devices | 4.8% |

| Industrial Support Services | 4.9% |

| Electrical Equipment | 6.2% |

| Retail - Consumer Staples | 6.2% |

| Asset Management | 6.8% |

| Technology Hardware | 7.0% |

| Technology Services | 8.3% |

| Semiconductors | 8.6% |

| Software | 9.3% |

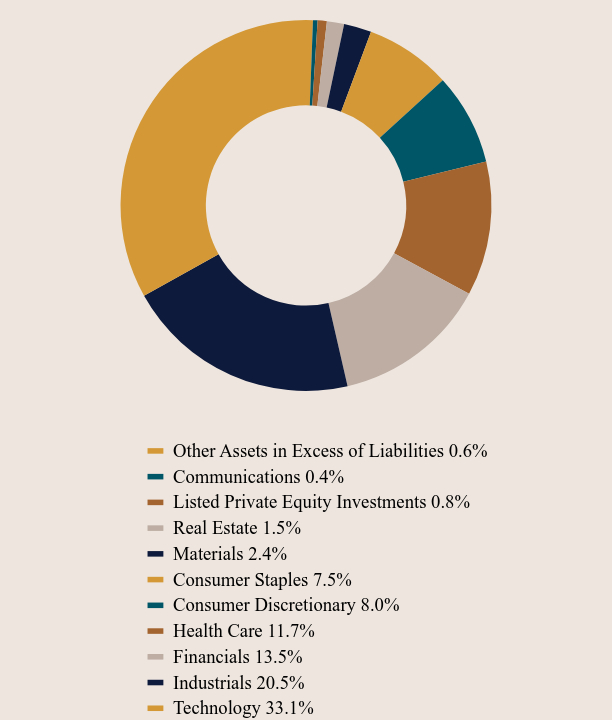

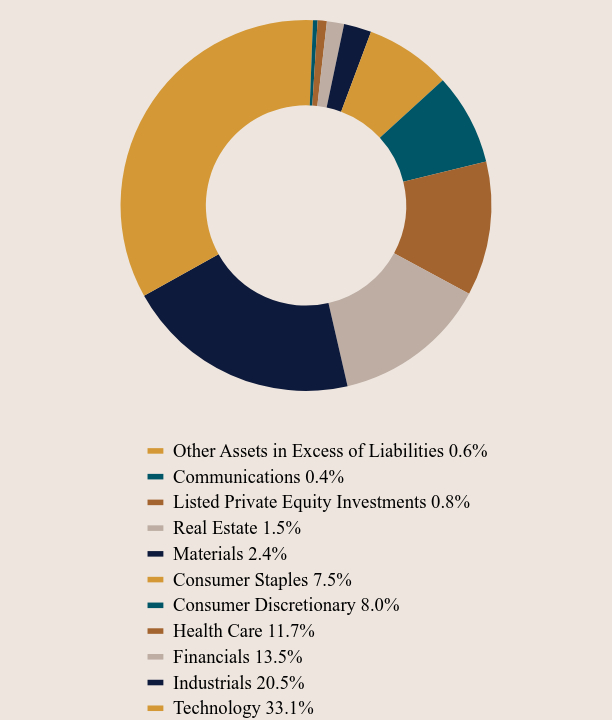

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Communications | 0.4% |

| Listed Private Equity Investments | 0.8% |

| Real Estate | 1.5% |

| Materials | 2.4% |

| Consumer Staples | 7.5% |

| Consumer Discretionary | 8.0% |

| Health Care | 11.7% |

| Financials | 13.5% |

| Industrials | 20.5% |

| Technology | 33.1% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak Global Stalwarts Fund - Institutional Class (GGSYX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak Global Stalwarts Fund

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak Global Stalwarts Fund for the period of May 1, 2024 to December 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK). This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $69 | 1.34%Footnote Reference |

|---|

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $120,295,277 |

|---|

| Number of Portfolio Holdings | 148 |

|---|

| Advisory Fee #ERROR:A result could not be returned because the conditional could not be evaluated to a True/False value ((history)) | $532,452 |

|---|

| Portfolio Turnover | 35% |

|---|

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Other Countries | 20.4% |

| South Korea | 2.5% |

| Mexico | 2.5% |

| Taiwan | 2.7% |

| Netherlands | 3.2% |

| Germany | 3.3% |

| Sweden | 3.9% |

| China | 4.6% |

| Japan | 7.8% |

| United Kingdom | 8.8% |

| United States | 39.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Silergy Corp | 3.3% |

| BayCurrent Consulting, Inc. | 3.1% |

| B & M European Value Retail SA | 3.1% |

| Littelfuse, Inc. | 2.7% |

| Globant S.A. | 1.8% |

| JTC plc | 1.8% |

| Lululemon Athletica, Inc. | 1.5% |

| Techtronic Industries Co Limited | 1.4% |

| Virbac SA | 1.3% |

| Silicon Laboratories, Inc. | 1.2% |

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Other Industries | 17.9% |

| Institutional Financial Services | 2.2% |

| Engineering & Construction | 2.2% |

| Biotech & Pharma | 2.9% |

| Retail - Discretionary | 3.6% |

| Health Care Facilities & Services | 4.0% |

| Machinery | 4.5% |

| Medical Equipment & Devices | 4.8% |

| Industrial Support Services | 4.9% |

| Electrical Equipment | 6.2% |

| Retail - Consumer Staples | 6.2% |

| Asset Management | 6.8% |

| Technology Hardware | 7.0% |

| Technology Services | 8.3% |

| Semiconductors | 8.6% |

| Software | 9.3% |

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Communications | 0.4% |

| Listed Private Equity Investments | 0.8% |

| Real Estate | 1.5% |

| Materials | 2.4% |

| Consumer Staples | 7.5% |

| Consumer Discretionary | 8.0% |

| Health Care | 11.7% |

| Financials | 13.5% |

| Industrials | 20.5% |

| Technology | 33.1% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak Global Stalwarts Fund - Investor Class (GGSOX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak International Opportunities Fund

Institutional Class (GPIIX)

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak International Opportunities Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $69 | 1.36%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $428,399,587 |

| Number of Portfolio Holdings | 142 |

| Advisory Fee | $3,131,917 |

| Portfolio Turnover | 15% |

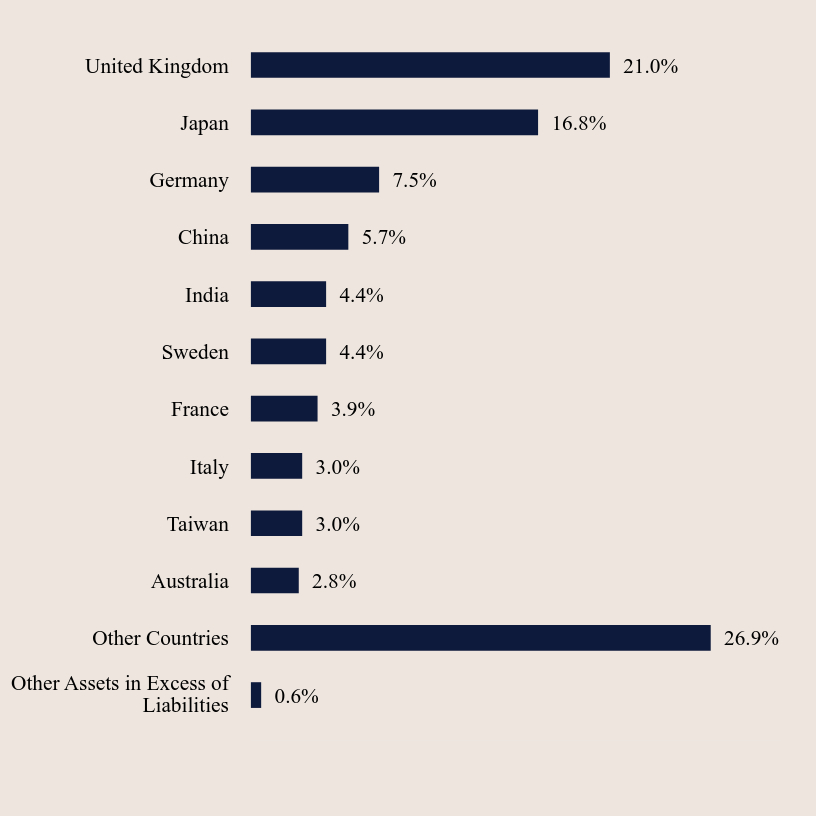

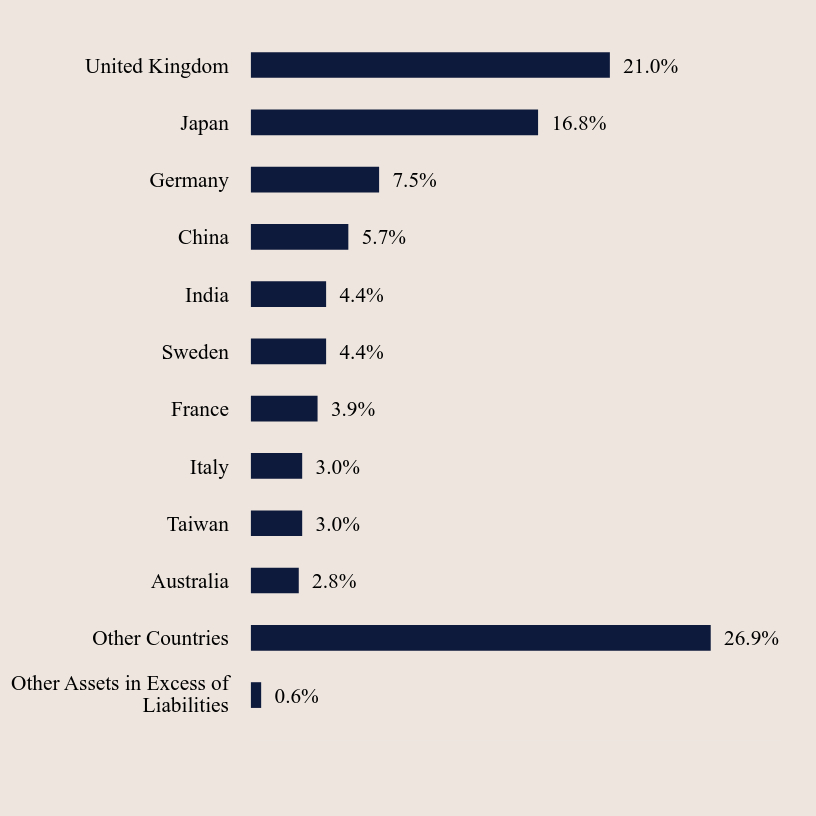

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Other Countries | 26.9% |

| Australia | 2.8% |

| Taiwan | 3.0% |

| Italy | 3.0% |

| France | 3.9% |

| Sweden | 4.4% |

| India | 4.4% |

| China | 5.7% |

| Germany | 7.5% |

| Japan | 16.8% |

| United Kingdom | 21.0% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| B & M European Value Retail SA | 3.0% |

| JTC plc | 2.7% |

| Silergy Corp | 2.6% |

| BayCurrent Consulting, Inc. | 2.6% |

| Virbac SA | 2.0% |

| Volution Group PLC | 2.0% |

| Sporton International, Inc. | 1.7% |

| CVS Group plc | 1.7% |

| Integral Corp | 1.6% |

| Interpump Group SpA | 1.4% |

What did the Fund invest in?

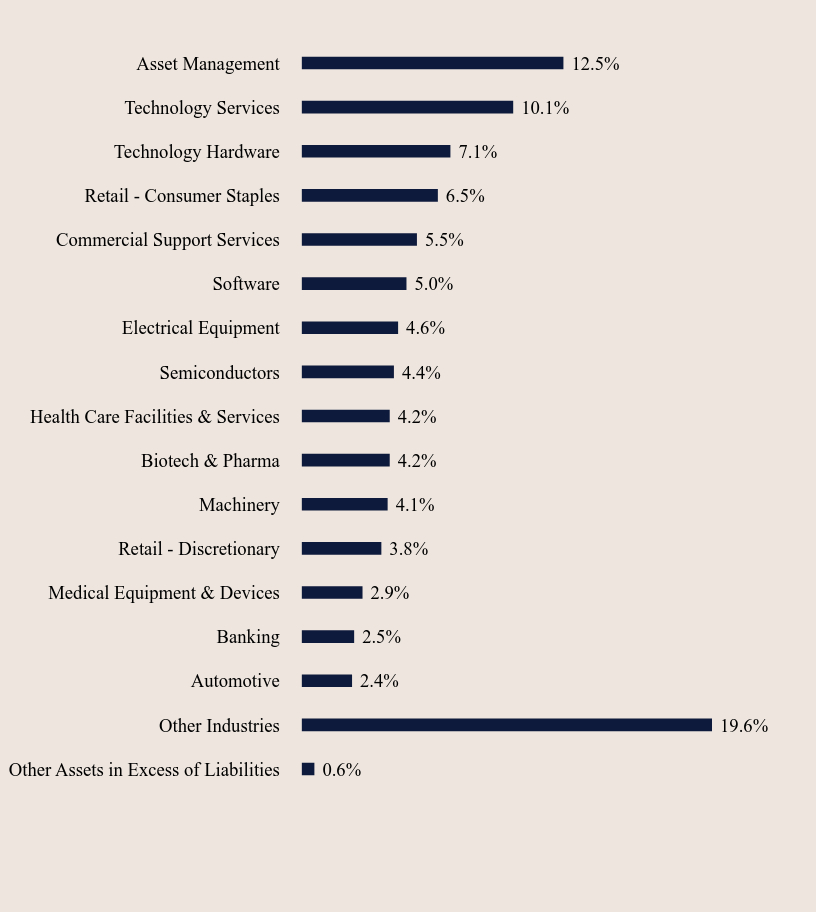

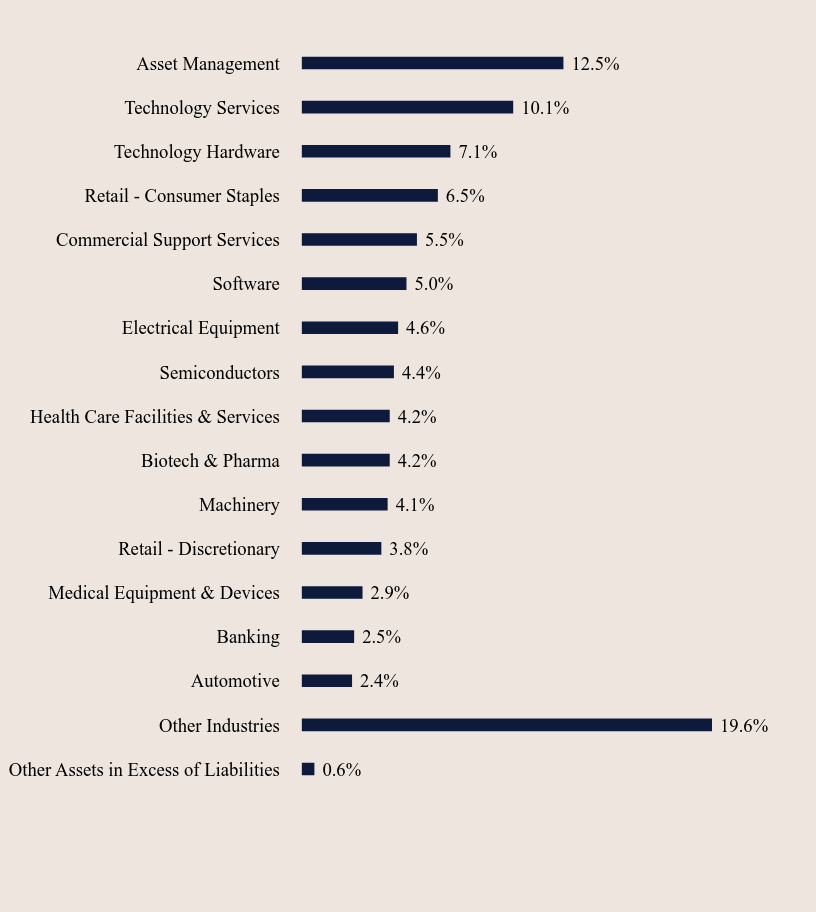

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Other Industries | 19.6% |

| Automotive | 2.4% |

| Banking | 2.5% |

| Medical Equipment & Devices | 2.9% |

| Retail - Discretionary | 3.8% |

| Machinery | 4.1% |

| Biotech & Pharma | 4.2% |

| Health Care Facilities & Services | 4.2% |

| Semiconductors | 4.4% |

| Electrical Equipment | 4.6% |

| Software | 5.0% |

| Commercial Support Services | 5.5% |

| Retail - Consumer Staples | 6.5% |

| Technology Hardware | 7.1% |

| Technology Services | 10.1% |

| Asset Management | 12.5% |

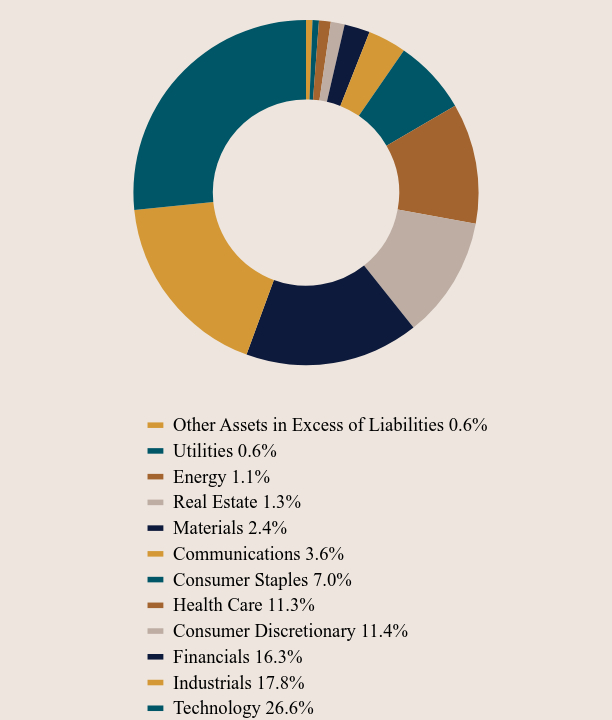

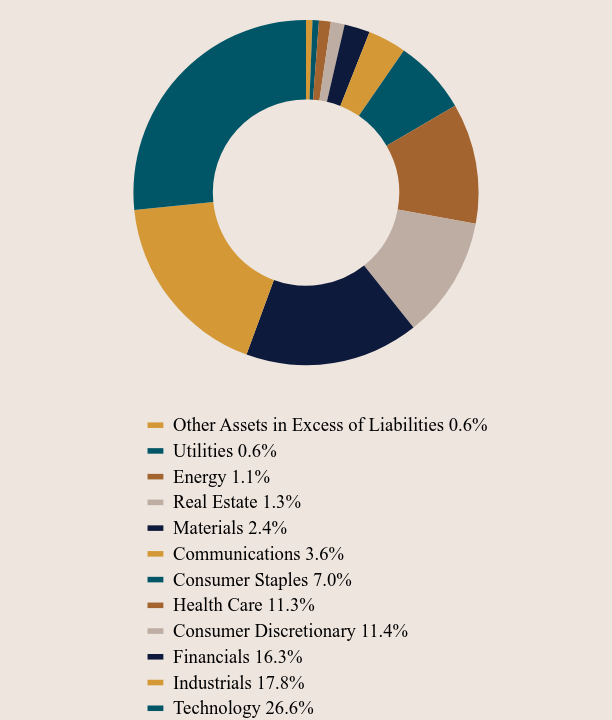

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Utilities | 0.6% |

| Energy | 1.1% |

| Real Estate | 1.3% |

| Materials | 2.4% |

| Communications | 3.6% |

| Consumer Staples | 7.0% |

| Health Care | 11.3% |

| Consumer Discretionary | 11.4% |

| Financials | 16.3% |

| Industrials | 17.8% |

| Technology | 26.6% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak International Opportunities Fund - Institutional Class (GPIIX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak International Opportunities Fund

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak International Opportunities Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $82 | 1.61%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $428,399,587 |

| Number of Portfolio Holdings | 142 |

| Advisory Fee | $3,131,917 |

| Portfolio Turnover | 15% |

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Other Countries | 26.9% |

| Australia | 2.8% |

| Taiwan | 3.0% |

| Italy | 3.0% |

| France | 3.9% |

| Sweden | 4.4% |

| India | 4.4% |

| China | 5.7% |

| Germany | 7.5% |

| Japan | 16.8% |

| United Kingdom | 21.0% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| B & M European Value Retail SA | 3.0% |

| JTC plc | 2.7% |

| Silergy Corp | 2.6% |

| BayCurrent Consulting, Inc. | 2.6% |

| Virbac SA | 2.0% |

| Volution Group PLC | 2.0% |

| Sporton International, Inc. | 1.7% |

| CVS Group plc | 1.7% |

| Integral Corp | 1.6% |

| Interpump Group SpA | 1.4% |

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Other Industries | 19.6% |

| Automotive | 2.4% |

| Banking | 2.5% |

| Medical Equipment & Devices | 2.9% |

| Retail - Discretionary | 3.8% |

| Machinery | 4.1% |

| Biotech & Pharma | 4.2% |

| Health Care Facilities & Services | 4.2% |

| Semiconductors | 4.4% |

| Electrical Equipment | 4.6% |

| Software | 5.0% |

| Commercial Support Services | 5.5% |

| Retail - Consumer Staples | 6.5% |

| Technology Hardware | 7.1% |

| Technology Services | 10.1% |

| Asset Management | 12.5% |

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Utilities | 0.6% |

| Energy | 1.1% |

| Real Estate | 1.3% |

| Materials | 2.4% |

| Communications | 3.6% |

| Consumer Staples | 7.0% |

| Health Care | 11.3% |

| Consumer Discretionary | 11.4% |

| Financials | 16.3% |

| Industrials | 17.8% |

| Technology | 26.6% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak International Opportunities Fund - Investor Class (GPIOX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak International Stalwarts Fund

Institutional Class (GISYX)

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak International Stalwarts Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $45 | 0.89%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $1,635,443,997 |

| Number of Portfolio Holdings | 118 |

| Advisory Fee | $6,742,283 |

| Portfolio Turnover | 27% |

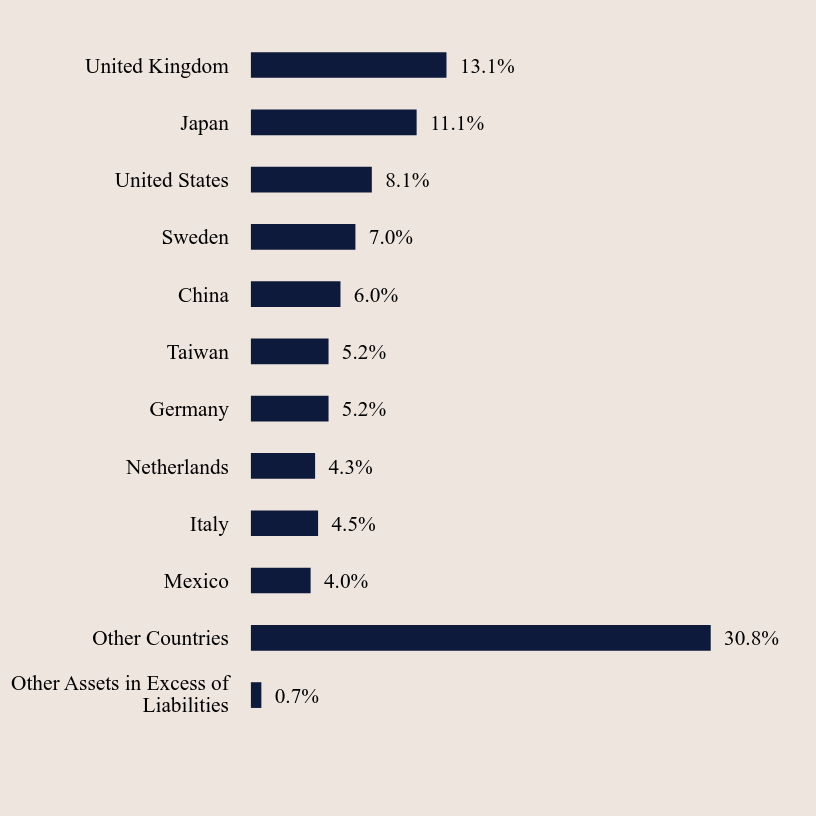

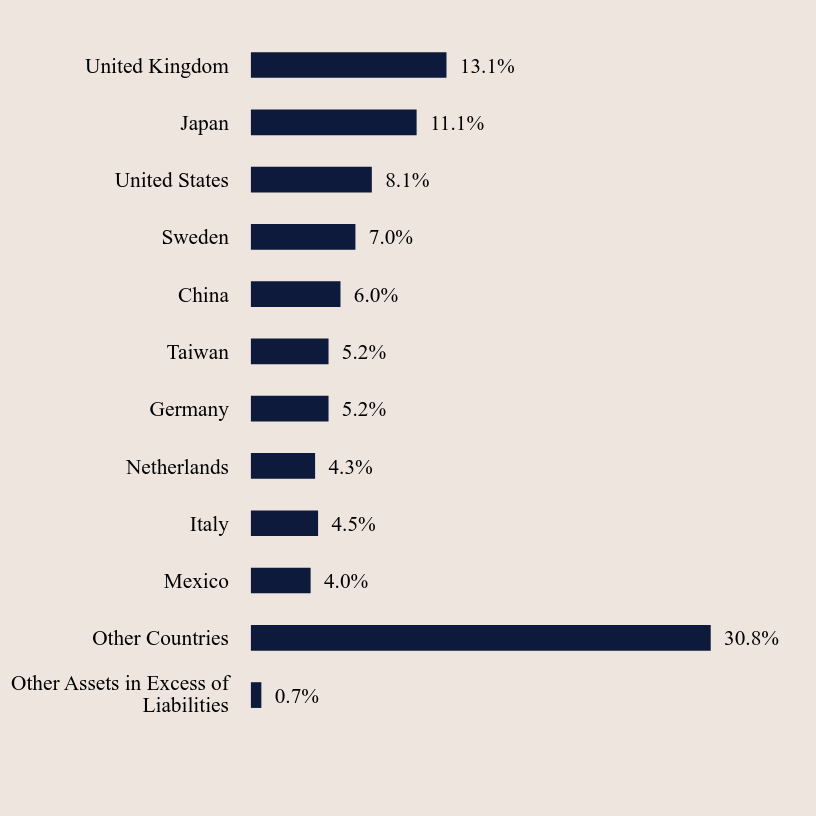

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.7% |

| Other Countries | 30.8% |

| Mexico | 4.0% |

| Italy | 4.5% |

| Netherlands | 4.3% |

| Germany | 5.2% |

| Taiwan | 5.2% |

| China | 6.0% |

| Sweden | 7.0% |

| United States | 8.1% |

| Japan | 11.1% |

| United Kingdom | 13.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| B & M European Value Retail SA | 4.2% |

| BayCurrent Consulting, Inc. | 3.6% |

| Silergy Corp | 3.6% |

| Diploma plc | 2.3% |

| Techtronic Industries Co Limited | 2.1% |

| JFrog Ltd. | 1.9% |

| Lululemon Athletica, Inc. | 1.9% |

| Melexis NV | 1.8% |

| Globant S.A. | 1.8% |

| Interpump Group SpA | 1.7% |

What did the Fund invest in?

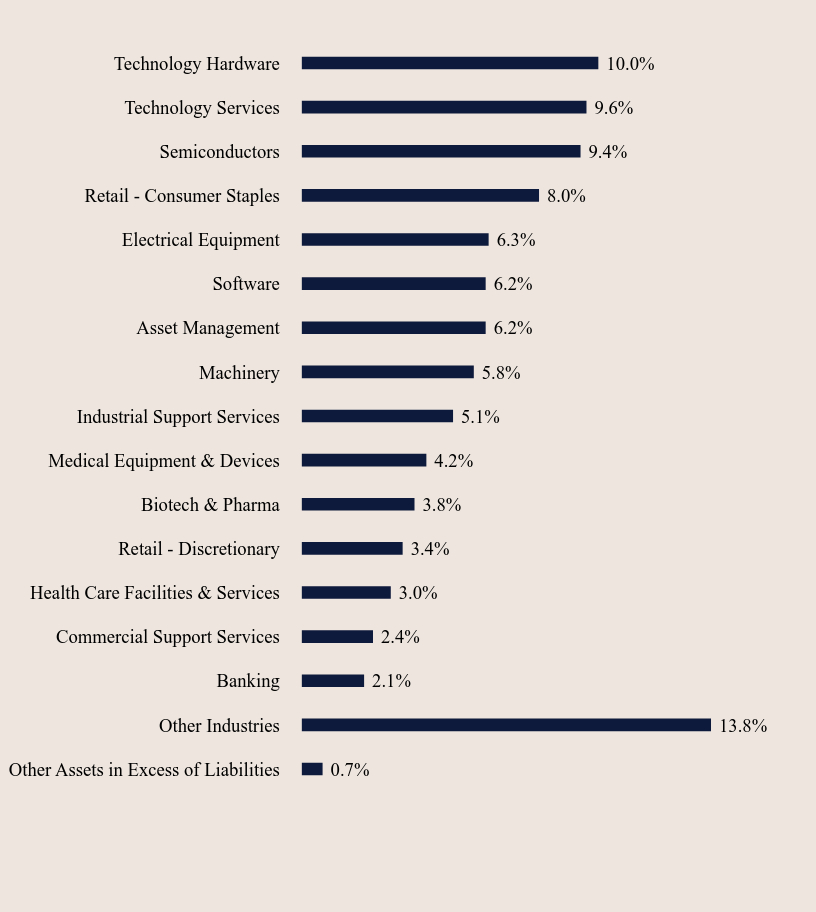

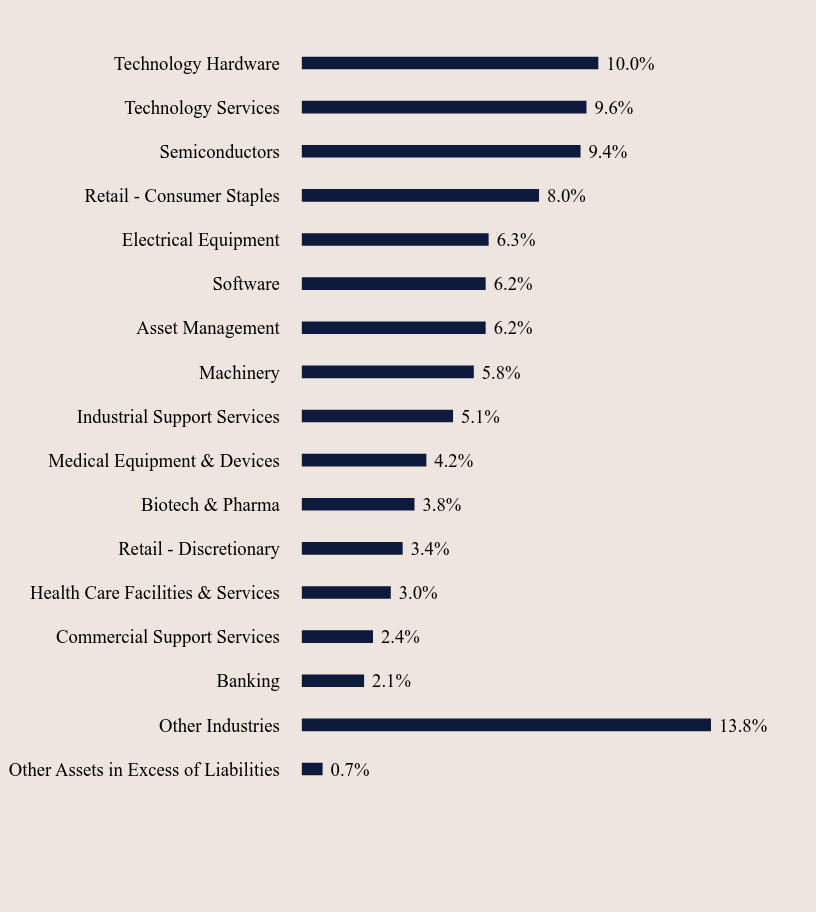

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.7% |

| Other Industries | 13.8% |

| Banking | 2.1% |

| Commercial Support Services | 2.4% |

| Health Care Facilities & Services | 3.0% |

| Retail - Discretionary | 3.4% |

| Biotech & Pharma | 3.8% |

| Medical Equipment & Devices | 4.2% |

| Industrial Support Services | 5.1% |

| Machinery | 5.8% |

| Asset Management | 6.2% |

| Software | 6.2% |

| Electrical Equipment | 6.3% |

| Retail - Consumer Staples | 8.0% |

| Semiconductors | 9.4% |

| Technology Services | 9.6% |

| Technology Hardware | 10.0% |

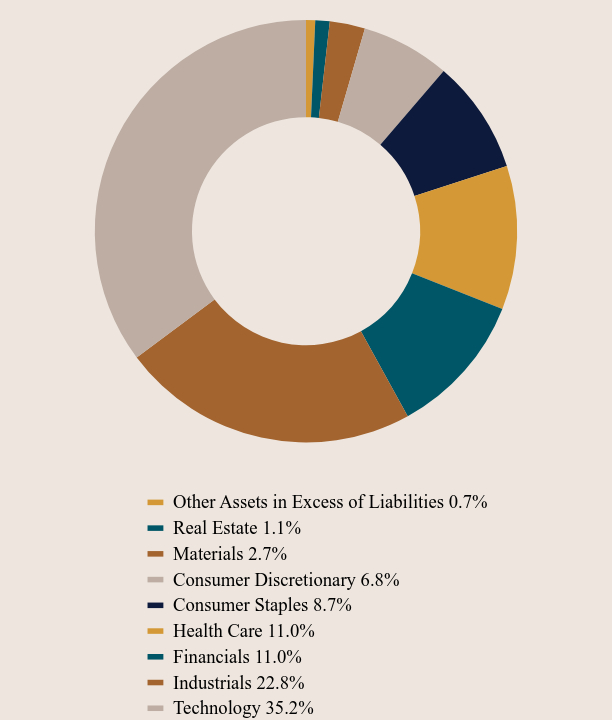

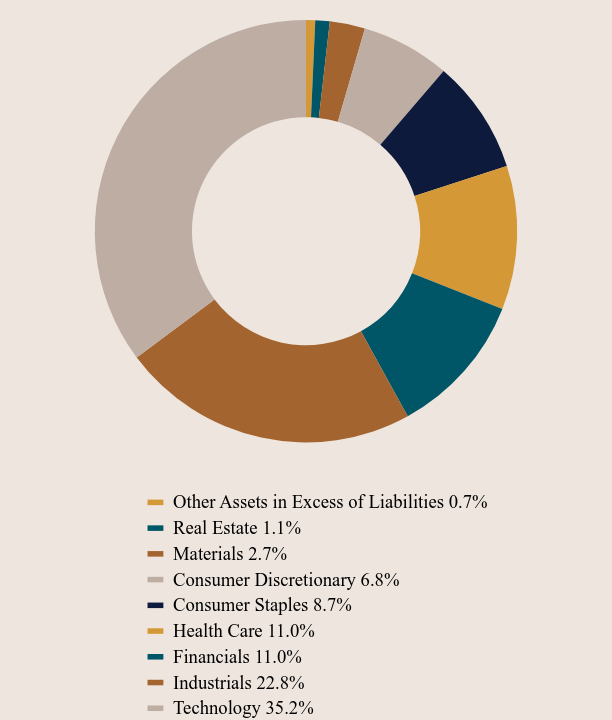

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.7% |

| Real Estate | 1.1% |

| Materials | 2.7% |

| Consumer Discretionary | 6.8% |

| Consumer Staples | 8.7% |

| Health Care | 11.0% |

| Financials | 11.0% |

| Industrials | 22.8% |

| Technology | 35.2% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak International Stalwarts Fund - Institutional Class (GISYX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak International Stalwarts Fund

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak International Stalwarts Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $58 | 1.15%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $1,635,443,997 |

| Number of Portfolio Holdings | 118 |

| Advisory Fee | $6,742,283 |

| Portfolio Turnover | 27% |

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.7% |

| Other Countries | 30.8% |

| Mexico | 4.0% |

| Italy | 4.5% |

| Netherlands | 4.3% |

| Germany | 5.2% |

| Taiwan | 5.2% |

| China | 6.0% |

| Sweden | 7.0% |

| United States | 8.1% |

| Japan | 11.1% |

| United Kingdom | 13.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| B & M European Value Retail SA | 4.2% |

| BayCurrent Consulting, Inc. | 3.6% |

| Silergy Corp | 3.6% |

| Diploma plc | 2.3% |

| Techtronic Industries Co Limited | 2.1% |

| JFrog Ltd. | 1.9% |

| Lululemon Athletica, Inc. | 1.9% |

| Melexis NV | 1.8% |

| Globant S.A. | 1.8% |

| Interpump Group SpA | 1.7% |

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.7% |

| Other Industries | 13.8% |

| Banking | 2.1% |

| Commercial Support Services | 2.4% |

| Health Care Facilities & Services | 3.0% |

| Retail - Discretionary | 3.4% |

| Biotech & Pharma | 3.8% |

| Medical Equipment & Devices | 4.2% |

| Industrial Support Services | 5.1% |

| Machinery | 5.8% |

| Asset Management | 6.2% |

| Software | 6.2% |

| Electrical Equipment | 6.3% |

| Retail - Consumer Staples | 8.0% |

| Semiconductors | 9.4% |

| Technology Services | 9.6% |

| Technology Hardware | 10.0% |

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.7% |

| Real Estate | 1.1% |

| Materials | 2.7% |

| Consumer Discretionary | 6.8% |

| Consumer Staples | 8.7% |

| Health Care | 11.0% |

| Financials | 11.0% |

| Industrials | 22.8% |

| Technology | 35.2% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak International Stalwarts Fund - Investor Class (GISOX)

Semi-Annual Shareholder Report - October 31, 2024

Grandeur Peak US Stalwarts Fund

Institutional Class (GUSYX)

Semi-Annual Shareholder Report - October 31, 2024

This semi-annual shareholder report contains important information about Grandeur Peak US Stalwarts Fund for the period of May 1, 2024 to October 31, 2024. You can find additional information about the Fund at https://grandeurpeakglobal.com/literature/. You can also request this information by contacting us at 1.855.377.7325 (PEAK).

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $48 | 0.92%Footnote Reference* |

How did the Fund perform during the reporting period?

For the latest management letter and Fund performance please visit grandeurpeakglobal.com.

| Net Assets | $139,557,654 |

| Number of Portfolio Holdings | 89 |

| Advisory Fee | $496,761 |

| Portfolio Turnover | 44% |

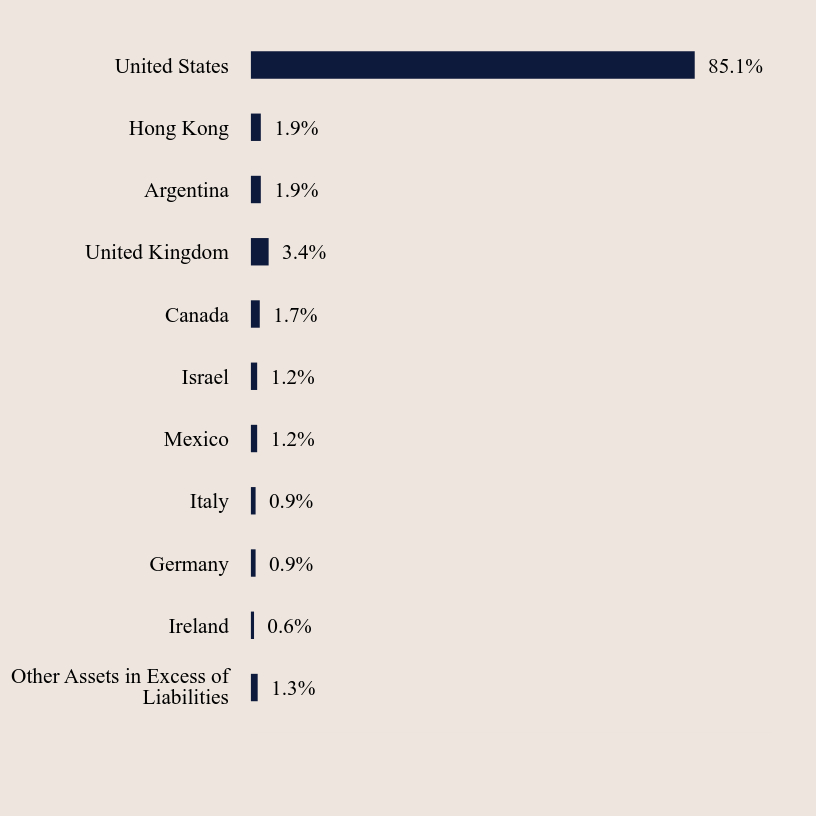

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.3% |

| Ireland | 0.6% |

| Germany | 0.9% |

| Italy | 0.9% |

| Mexico | 1.2% |

| Israel | 1.2% |

| Canada | 1.7% |

| United Kingdom | 3.4% |

| Argentina | 1.9% |

| Hong Kong | 1.9% |

| United States | 85.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Littelfuse, Inc. | 2.9% |

| Lululemon Athletica, Inc. | 2.3% |

| Silicon Laboratories, Inc. | 2.0% |

| JFrog Ltd. | 1.9% |

| Techtronic Industries Co Limited | 1.9% |

| Globant S.A. | 1.9% |

| Ares Management Corporation, CLASS A | 1.9% |

| Herc Holdings, Inc. | 1.8% |

| Goosehead Insurance, Inc., CLASS A | 1.8% |

| Primoris Services Corporation | 1.7% |

What did the Fund invest in?

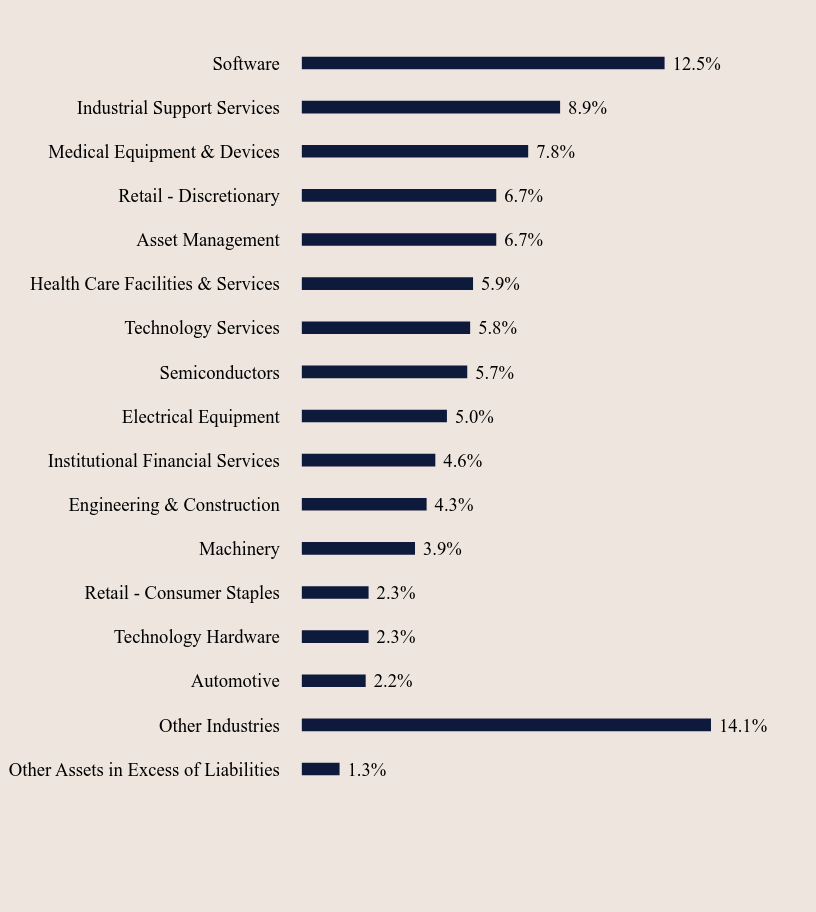

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.3% |

| Other Industries | 14.1% |

| Automotive | 2.2% |

| Technology Hardware | 2.3% |

| Retail - Consumer Staples | 2.3% |

| Machinery | 3.9% |

| Engineering & Construction | 4.3% |

| Institutional Financial Services | 4.6% |

| Electrical Equipment | 5.0% |

| Semiconductors | 5.7% |

| Technology Services | 5.8% |

| Health Care Facilities & Services | 5.9% |

| Asset Management | 6.7% |

| Retail - Discretionary | 6.7% |

| Medical Equipment & Devices | 7.8% |

| Industrial Support Services | 8.9% |

| Software | 12.5% |

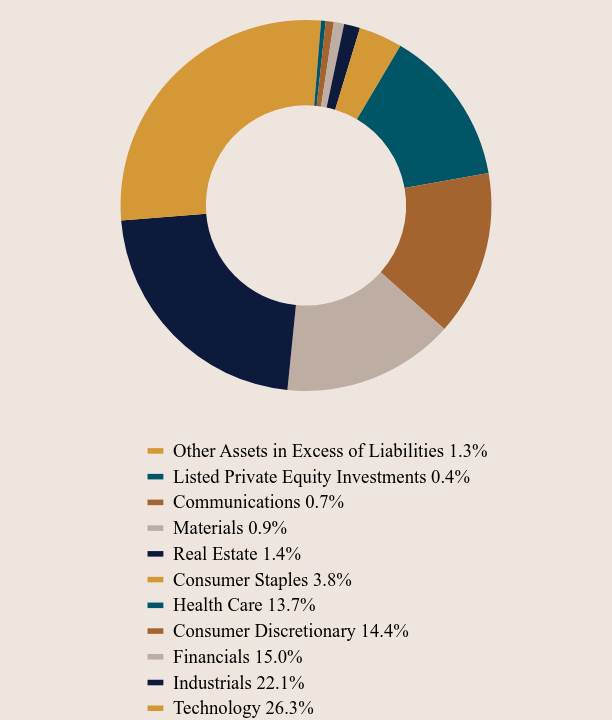

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.3% |

| Listed Private Equity Investments | 0.4% |

| Communications | 0.7% |

| Materials | 0.9% |

| Real Estate | 1.4% |

| Consumer Staples | 3.8% |

| Health Care | 13.7% |

| Consumer Discretionary | 14.4% |

| Financials | 15.0% |

| Industrials | 22.1% |

| Technology | 26.3% |

Go Paperless! Update your communication preferences on our website, www.grandeurpeakglobal.com, or call 1-855-377-7325 (PEAK).

No material changes occurred during the period ended October 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://grandeurpeakglobal.com/literature/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Grandeur Peak US Stalwarts Fund - Institutional (GUSYX)

Semi-Annual Shareholder Report - October 31, 2024

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

TABLE OF CONTENTS

| Schedule of Investments | | |

| Grandeur Peak Emerging Markets Opportunities Fund | | 1 |

| Grandeur Peak Global Contrarian Fund | | 4 |

| Grandeur Peak Global Explorer Fund | | 7 |

| Grandeur Peak Global Micro Cap Fund | | 12 |

| Grandeur Peak Global Opportunities Fund | | 15 |

| Grandeur Peak Global Reach Fund | | 18 |

| Grandeur Peak Global Stalwarts Fund | | 23 |

| Grandeur Peak International Opportunities Fund | | 26 |

| Grandeur Peak International Stalwarts Fund | | 29 |

| Grandeur Peak US Stalwarts Fund | | 32 |

| Statements of Assets and Liabilities | | 34 |

| Statements of Operations | | 36 |

| Statement of Changes in Net Assets | | |

| Grandeur Peak Emerging Markets Opportunities Fund | | 38 |

| Grandeur Peak Global Contrarian Fund | | 39 |

| Grandeur Peak Global Explorer Fund | | 40 |

| Grandeur Peak Global Micro Cap Fund | | 41 |

| Grandeur Peak Global Opportunities Fund | | 42 |

| Grandeur Peak Global Reach Fund | | 43 |

| Grandeur Peak Global Stalwarts Fund | | 44 |

| Grandeur Peak International Opportunities Fund | | 45 |

| Grandeur Peak International Stalwarts Fund | | 46 |

| Grandeur Peak US Stalwarts Fund | | 47 |

| Financial Highlights | | |

| Grandeur Peak Emerging Markets Opportunities Fund | | 48 |

| Grandeur Peak Global Contrarian Fund | | 50 |

| Grandeur Peak Global Explorer Fund | | 51 |

| Grandeur Peak Global Micro Cap Fund | | 52 |

| Grandeur Peak Global Opportunities Fund | | 53 |

| Grandeur Peak Global Reach Fund | | 55 |

| Grandeur Peak Global Stalwarts Fund | | 57 |

| Grandeur Peak International Opportunities Fund | | 59 |

| Grandeur Peak International Stalwarts Fund | | 61 |

| Grandeur Peak US Stalwarts Fund | | 63 |

TABLE OF CONTENTS

| Notes to Financial Statements | | 64 |

| Additional Information | | 78 |

Grandeur Peak Emerging Markets Opportunities Fund | Schedule of Investments |

| | October 31, 2024 (Unaudited) |

| | | Shares | | | Fair

Value | |

| COMMON STOCKS — 99.21% | | | | | | | | |

| Argentina — 2.19% | | | | | | | | |

| Globant S.A.(a) | | | 32,049 | | | $ | 6,726,765 | |

| | | | | | | | | |

| Brazil — 7.26% | | | | | | | | |

| Armac Locacao Logistica | | | 1,985,900 | | | | 2,569,410 | |

| BR Advisory Partners | | | 1,211,300 | | | | 3,140,710 | |

| Grupo Mateus SA(a) | | | 3,561,100 | | | | 4,656,723 | |

| Locaweb Servicos de Internet S(a)(b)(c) | | | 2,050,300 | | | | 1,475,317 | |

| MercadoLibre, Inc.(a) | | | 1,217 | | | | 2,479,248 | |

| Raia Drogasil S.A. | | | 490,008 | | | | 2,072,319 | |

| Track & Field Co SA | | | 500,800 | | | | 882,700 | |

| Vinci Partners Invest Ltd | | | 240,732 | | | | 2,469,910 | |

| XP, Inc., Class A() | | | 147,973 | | | | 2,583,609 | |

| | | | | | | | 22,329,946 | |

| China — 14.98% | | | | | | | | |

| Adicon Holdings Ltd(a) | | | 1,721,100 | | | | 1,413,144 | |

| Angelalign Technology, Inc. | | | 202,600 | | | | 1,591,885 | |

| ANTA Sports Products Ltd. | | | 453,500 | | | | 4,840,404 | |

| Beijing Huafeng Test & Control | | | 98,100 | | | | 1,649,553 | |

| Centre Testing Int | | | 1,245,500 | | | | 2,415,116 | |

| Chaoju Eye Care Holdings Ltd | | | 4,540,000 | | | | 1,667,326 | |

| Man Wah Holdings Limited(a) | | | 4,972,200 | | | | 3,612,577 | |

| ManpowerGroup Greater China Lt(c) | | | 1,494,050 | | | | 869,301 | |

| Proya Cosmetics Co Ltd | | | 131,120 | | | | 1,767,429 | |

| Shanghai Hanbell Precise Machi | | | 884,000 | | | | 2,287,639 | |

| Shenzhen Mindray Bio-Medical Electronics Co. | | | 66,100 | | | | 2,475,710 | |

| Silergy Corp | | | 848,288 | | | | 13,196,901 | |

| Suofeiya Home Collection Co., Ltd., Class A | | | 1,077,300 | | | | 2,936,889 | |

| TK Group Holdings Ltd(b)(c) | | | 6,623,117 | | | | 1,507,980 | |

| Yum China Holdings Inc | | | 86,900 | | | | 3,904,978 | |

| | | | | | | | 46,136,832 | |

| Colombia — 0.69% | | | | | | | | |

| Parex Resources, Inc.(a) | | | 227,431 | | | | 2,112,028 | |

| | | | | | | | | |

| Czech Republic — 0.49% | | | | | | | | |

| CTP NV(a) | | | 90,261 | | | | 1,509,801 | |

| | | | | | | | | |

| Greece — 1.54% | | | | | | | | |

| Sarantis SA | | | 396,405 | | | | 4,743,732 | |

| | | | | | | | | |

| Hong Kong — 4.73% | | | | | | | | |

| Plover Bay Tech(c) | | | 9,628,000 | | | | 6,679,788 | |

| Techtronic Industries Co Limited(a) | | | 543,500 | | | | 7,862,153 | |

| | | | | | | | 14,541,941 | |

| India — 13.09% | | | | | | | | |

| Bajaj Finance Ltd | | | 34,611 | | | | 2,827,519 | |

| Cera Sanitaryware Ltd | | | 18,118 | | | | 1,543,739 | |

| City Union Bank Ltd | | | 1,267,053 | | | | 2,638,934 | |

| Five-Star Business(a) | | | 248,604 | | | | 2,098,101 | |

| Gulf Oil Lubricants India Ltd. | | | 270,796 | | | | 3,804,325 | |

| Home First Finance Co India Ltd.(a)(b)(c) | | | 226,876 | | | | 3,176,289 | |

| IndiaMart InterMesh Ltd(b)(c) | | | 102,407 | | | | 3,037,736 | |

| Indigo Paints Ltd | | | 165,285 | | | | 3,229,325 | |

| | | Shares | | | Fair

Value | |

| COMMON STOCKS — 99.21% (continued) | | | | | | | | |

| India — 13.09% (continued) | | | | | | | | |

| Likhitha Infrastructure Ltd(a) | | | 257,257 | | | $ | 1,118,810 | |

| LT Foods Ltd | | | 846,851 | | | | 3,915,459 | |

| Mankind Pharma Ltd.(a)(b) | | | 72,227 | | | | 2,286,000 | |

| Marksans Pharma Ltd. | | | 162,906 | | | | 559,654 | |

| Motherson Sumi Wiring India Ltd. | | | 4,553,786 | | | | 3,391,122 | |

| SJS Enterprises Ltd(a) | | | 464,559 | | | | 6,693,848 | |

| | | | | | | | 40,320,861 | |

| Indonesia — 5.46% | | | | | | | | |

| Arwana Citramulia Tbk P.T. | | | 41,025,200 | | | | 1,998,119 | |

| Aspirasi Hidup Indonesia | | | 54,890,900 | | | | 3,144,515 | |

| Bank BTPN Syariah Tbk PT | | | 8,656,300 | | | | 587,419 | |

| Metrodata Electronics Tbk | | | 90,095,500 | | | | 3,650,888 | |

| Selamat Sempurna Tbk PT | | | 29,476,800 | | | | 3,624,966 | |

| Ultrajaya Milk Industry & Trad | | | 34,286,900 | | | | 3,801,402 | |

| | | | | | | | 16,807,309 | |

| Malaysia — 1.83% | | | | | | | | |

| Bermaz Auto Bhd | | | 3,174,000 | | | | 1,486,121 | |

| Mr D.I.Y. Group Berhad | | | 8,298,800 | | | | 4,135,716 | |

| | | | | | | | 5,621,837 | |

| Mexico — 7.32% | | | | | | | | |

| Arca Continental S.A.B. de C.V. | | | 534,500 | | | | 4,558,044 | |

| BBB Foods Inc(a) | | | 68,399 | | | | 2,184,664 | |

| Corporativo Fragua SAB de CV(a) | | | 33,400 | | | | 1,468,425 | |

| Grupo Cementos de Chihuahua, S.A.B. de C.V(a) | | | 190,500 | | | | 1,561,898 | |

| Grupo Financiero Banorte SAB de CV | | | 300,000 | | | | 2,093,076 | |

| Grupo Rotoplas SAB de CV(a) | | | 1,073,611 | | | | 1,095,817 | |

| Kimberly-Clark de Mexico S.A.B. de C.V. | | | 922,900 | | | | 1,329,297 | |

| Regional SAB de cv(a) | | | 921,600 | | | | 5,860,834 | |

| Vesta Real Estate Corp. - ADR (a) | | | 90,516 | | | | 2,358,847 | |

| | | | | | | | 22,510,902 | |

| Philippines — 4.37% | | | | | | | | |

| Century Pacific Food, Inc. | | | 5,124,400 | | | | 3,692,311 | |

| Philippine Seven Corp(a) | | | 1,582,100 | | | | 1,981,357 | |

| Puregold Price Club Inc | | | 5,516,100 | | | | 3,080,299 | |

| Robinsons Land Corporation | | | 5,753,900 | | | | 1,514,924 | |

| Wilcon Depot Inc | | | 11,517,700 | | | | 3,178,478 | |

| | | | | | | | 13,447,369 | |

| Poland — 4.13% | | | | | | | | |

| Auto Partner SA | | | 505,712 | | | | 2,691,033 | |

| Dino Polska SA(a)(b)(c) | | | 65,496 | | | | 5,427,456 | |

| Inter Cars SA | | | 38,906 | | | | 4,577,977 | |

| | | | | | | | 12,696,466 | |

| Singapore — 3.14% | | | | | | | | |

| iFast Corporation | | | 990,100 | | | | 5,602,051 | |

| Riverstone Holdings Ltd.(a) | | | 2,348,100 | | | | 1,607,729 | |

| Venture Corp LTD.(a) | | | 245,900 | | | | 2,466,500 | |

| | | | | | | | 9,676,280 | |

| South Africa — 0.53% | | | | | | | | |

| Italtile Limited | | | 2,206,898 | | | | 1,640,191 | |

See accompanying notes to financial statements.

Grandeur Peak Emerging Markets Opportunities Fund | Schedule of Investments |

| | October 31, 2024 (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 99.21% (continued) | | | | | | | | |

| South Korea — 7.84% | | | | | | | | |

| APR Corp/Korea(a) | | | 40,345 | | | $ | 1,452,220 | |

| Coupang Inc(a) | | | 66,417 | | | | 1,712,894 | |

| Eo Technics Co Ltd(a) | | | 22,189 | | | | 2,701,566 | |

| FNS Tech Co Ltd(a) | | | 209,673 | | | | 1,414,859 | |

| HPSP Company Ltd. | | | 67,925 | | | | 1,490,201 | |

| Hyundai Ezwel Co Ltd | | | 389,069 | | | | 1,578,924 | |

| iFamilySC Co Ltd(a) | | | 92,325 | | | | 1,255,787 | |

| Innox Advanced Materials | | | 62,025 | | | | 1,100,857 | |

| Kinx Inc. | | | 48,973 | | | | 2,474,993 | |

| LEENO Industrial Inc.(a) | | | 24,682 | | | | 3,228,750 | |

| Segyung Hitech Co Ltd | | | 378,214 | | | | 1,977,969 | |

| SOLUM Co Ltd(a) | | | 161,941 | | | | 2,244,684 | |

| Tokai Carbon Korea Co Ltd(a) | | | 24,086 | | | | 1,481,742 | |

| | | | | | | | 24,115,446 | |

| Taiwan — 12.57% | | | | | | | | |

| 91APP Inc | | | 598,000 | | | | 1,735,500 | |

| Acer E-Enabling Service Busine | | | 325,000 | | | | 2,500,044 | |

| Allied Supreme Corporation | | | 154,000 | | | | 1,585,169 | |

| Asia Vital Components Co., Ltd. | | | 149,000 | | | | 2,862,211 | |

| ASPEED Technology, Inc. | | | 23,000 | | | | 2,924,597 | |

| Gem Services Inc | | | 765,000 | | | | 1,718,766 | |

| M3 Technology Inc | | | 715,000 | | | | 2,314,116 | |

| Realtek Semiconductor Corporation(a) | | | 160,000 | | | | 2,354,061 | |

| Sinbon Electronics Co., Limited(a) | | | 848,000 | | | | 6,960,562 | |

| Sporton International, Inc.(a) | | | 1,139,805 | | | | 7,458,137 | |

| Voltronic Power Technology(a) | | | 56,108 | | | | 3,700,064 | |

| WITS Corp | | | 718,248 | | | | 2,566,968 | |

| | | | | | | | 38,680,195 | |

| Thailand — 1.41% | | | | | | | | |

| Humanica PCL | | | 8,383,900 | | | | 2,699,977 | |

| Sappe PCL(a) | | | 821,000 | | | | 1,648,626 | |

| | | | | | | | 4,348,603 | |

| Vietnam — 5.64% | | | | | | | | |

| Asia Commercial Bank JSC | | | 3,660,565 | | | | 3,670,772 | |

| FPT Corp | | | 1,327,109 | | | | 7,105,982 | |

| Hoa Phat Group(a) | | | 1,494,500 | | | | 1,585,748 | |

| Vietnam Technological & Comm Joint-stock Bank(a) | | | 5,285,138 | | | | 4,978,751 | |

| | | | | | | | 17,341,253 | |

| Total Common Stocks (Cost $250,059,977) | | | | | | | 305,307,757 | |

| | | | | | | | | |

| Total Common Stocks/ Investments — 99.21% (Cost $250,059,977) | | | | | | | 305,307,757 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.79% | | | | | | | 2,429,089 | |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 307,736,846 | |

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of October 31, 2024, these securities had a total aggregate market value of $16,910,778, representing 5.50% of net assets. |

| (c) | Security was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts securities offered and sold outside of the United States from registration. Such security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. As of October 31, 2024, these securities had a total aggregate market value of $22,173,867 representing 7.21% of net assets. |

| Sector Composition (October 31, 2024) |

| Technology | | | 26.4 | % |

| Consumer Discretionary | | | 22.4 | % |

| Consumer Staples | | | 14.8 | % |

| Financials | | | 11.7 | % |

| Industrials | | | 11.2 | % |

| Materials | | | 3.8 | % |

| Health Care | | | 3.3 | % |

| Communications | | | 3.1 | % |

| Real Estate | | | 1.8 | % |

| Energy | | | 0.7 | % |

| Other Assets in Excess of Liabilities | | | 0.8 | % |

| Total | | | 100 | % |

See accompanying notes to financial statements.

Grandeur Peak Emerging Markets Opportunities Fund | Schedule of Investments |

| | October 31, 2024 (Unaudited) |

| Industry Composition (October 31, 2024) |

| Banks | | | 6.4 | % |

| Electronics Components | | | 6.2 | % |

| IT Services | | | 6.2 | % |

| Food & Drug Stores | | | 6.1 | % |

| Auto Parts | | | 5.3 | % |

| Home Products Stores | | | 4.6 | % |

| Packaged Food | | | 3.7 | % |

| Other Commercial Support Services | | | 3.7 | % |

| Personal Care Products | | | 3.0 | % |

| Semiconductor Devices | | | 3.0 | % |

| Other Machinery & Equipment | | | 2.6 | % |

| Semiconductor Mfg | | | 2.5 | % |

| Online Marketplace | | | 2.4 | % |

| Internet Media & Services | | | 2.3 | % |

| Specialty Chemicals | | | 2.3 | % |

| Technology Distributors | | | 2.3 | % |

| Communications Equipment | | | 2.2 | % |

| Furniture | | | 2.1 | % |

| Non-Alcoholic Beverages | | | 2.0 | % |

| Electrical Components | | | 1.8 | % |

| Specialty Apparel Stores | | | 1.6 | % |

| Automotive Wholesalers | | | 1.5 | % |

| Restaurants | | | 1.3 | % |

| Industrial Owners & Developers | | | 1.3 | % |

| Consumer Elec & Applc Whslrs | | | 1.2 | % |

| Professional Services | | | 1.2 | % |

| Application Software | | | 1.1 | % |

| Mortgage Finance | | | 1.0 | % |

| Institutional Brokerage | | | 1.0 | % |

| Other Industries (each less than 1%) | | | 17.3 | % |

| Other Assets in Excess of Liabilities | | | 0.8 | % |

| Total | | | 100 | % |

See accompanying notes to financial statements.

Grandeur Peak Global Contrarian Fund | Schedule of Investments |

| | October 31, 2024 (Unaudited) |

| | | Shares | | | Fair

Value | |

| COMMON STOCKS — 99.38% | | | | | | | | |

| Australia — 4.65% | | | | | | | | |

| Atturra ltd(a) | | | 1,873,659 | | | $ | 1,430,180 | |

| Emeco Holdings Ltd.(a) | | | 4,287,041 | | | | 2,171,180 | |

| Fiducian Group Ltd | | | 364,458 | | | | 2,194,375 | |

| PeopleIN Ltd | | | 2,610,546 | | | | 1,413,209 | |

| | | | | | | | 7,208,944 | |

| Belgium — 2.07% | | | | | | | | |

| Melexis NV | | | 21,606 | | | | 1,410,946 | |

| X-Fab Silicon Foundries S.E.(a)(b)(c) | | | 378,221 | | | | 1,802,727 | |

| | | | | | | | 3,213,673 | |

| Brazil — 2.87% | | | | | | | | |

| Armac Locacao Logistica E Servicos SA | | | 979,900 | | | | 1,267,821 | |

| Patria Investments Limited(a) | | | 215,893 | | | | 2,512,994 | |

| Vinci Partners Invest Ltd | | | 65,000 | | | | 666,900 | |

| | | | | | | | 4,447,715 | |

| Canada — 2.13% | | | | | | | | |

| BioSyent Inc | | | 113,187 | | | | 878,767 | |

| Converge Technology Solutions Corporation | | | 545,779 | | | | 1,175,952 | |

| Winpak Ltd.(a) | | | 35,083 | | | | 1,250,022 | |

| | | | | | | | 3,304,741 | |

| China — 7.84% | | | | | | | | |

| Alibaba.Com Limited | | | 164,600 | | | | 2,013,486 | |

| Chaoju Eye Care Holdings Ltd | | | 6,026,500 | | | | 2,213,247 | |

| China Meidong Auto Holdings(a) | | | 5,155,000 | | | | 1,488,276 | |

China Yongda Automobiles Services Holdings Limited(a) | | | 6,874,500 | | | | 1,418,233 | |

| Li Ning Company Limited | | | 431,000 | | | | 879,437 | |

| TK Group Holdings Ltd | | | 8,707,283 | | | | 1,982,513 | |

| WH Group Ltd.(a) | | | 1,726,000 | | | | 1,343,405 | |

| Xin Point Holdings Ltd(c) | | | 1,719,984 | | | | 798,714 | |

| | | | | | | | 12,137,311 | |

| Colombia — 1.43% | | | | | | | | |

| Parex Resources, Inc.(a) | | | 239,203 | | | | 2,221,349 | |

| | | | | | | | | |

France — 2.00% | | | | | | | | |

| Antin Infrastructure Partners | | | 76,295 | | | | 877,806 | |

| Thermador Groupe | | | 8,677 | | | | 680,887 | |

| Virbac SA | | | 4,047 | | | | 1,538,021 | |

| | | | | | | | 3,096,714 | |