Related Party Financings

Bio X Transactions

GLAAM and Bio X, a company founded by Ho Joon Lee, GLAAM’s co-founder, and for which Mr. Lee formerly acted as Chief Executive Officer, entered into 14 loan agreements during the period from January 4, 2023 to April 21, 2023, where the effective period for each agreement was one year, whereby Bio X lent an aggregate ofW2,417,000,000 to GLAAM, accruing at a rate of 5% per annum. As of April 30, 2023, an aggregate ofW442,774,383, including accrued interest, was outstanding under the loan agreement.

On May 21, 2022, GLAAM entered into a supply agreement with Bio X. Per the agreement, GLAAM supplied G-Glass in the amount ofW600,000,000 to Bio X on June 30, 2022.

Houngki Kim Credit Agreement

GLAAM and Houngki Kim, GLAAM’s co-founder, entered into a credit agreement dated January 2, 2023, that provides for a revolving line of credit to GLAAM in an amount ofW2,000,000,000 with no interest and no maturity date. As of April 30, 2023, an aggregate ofW885,333,680 was outstanding under the credit agreement.

Ho Joon Lee Loan Agreement

GLAAM and Mr. Lee, GLAAM’s co-founder, entered into a loan agreement dated July 21, 2021, whereby Mr. Lee lent an aggregate ofW30,000,000 to GLAAM, accruing at a rate of 0% per annum and maturing July 20, 2023. As of April 30, 2023, the outstanding balance payable to Mr. Lee under the loan agreement wasW30,000,000.

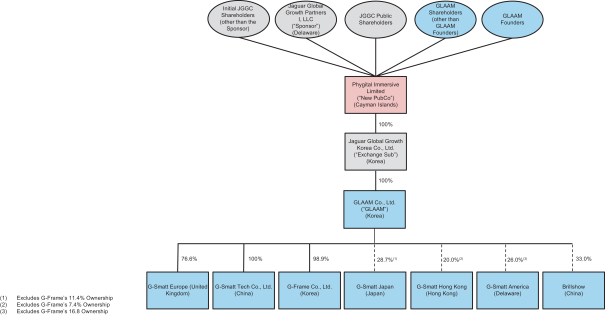

G-Smatt America Financings

G-Smatt America Co., Ltd., a partly owned subsidiary of GLAAM (“G-Smatt America”), and GLAAM entered into a loan agreement dated April 5, 2018, whereby GLAAM lent an aggregate of $795,500 to G-Smatt America, accruing at a rate of 5% per annum and maturing April 23, 2023. As of April 30, 2023, an aggregate of $1,142,530 including accrued interest, was outstanding under the loan agreement.

G-Smatt America and G-Frame Co., Ltd., a wholly-owned subsidiary of GLAAM (“G-Frame”), entered into a loan agreement dated July 18, 2018, whereby G-Frame lent an aggregate of $170,000 to G-Smatt America, accruing at a rate of 5% per annum and maturing July 18, 2023. As of April 30, 2023, an aggregate of $206,173, including accrued interest, was outstanding under the loan agreement.

G-Smatt America and G-SMATT Europe Limited, a partly-owned subsidiary of GLAAM (“G-SMATT Europe”), entered into a loan agreement dated March 26, 2020, whereby G-SMATT Europe let an aggregate of $242,885.47 to G-Smatt America, accruing at a rate of 5% per annum and maturing September 29, 2023. As of April 30, 2023, an aggregate of $269,756, including accrued interest, was outstanding under the loan agreement.

G-SMATT Europe Financings

G-SMATT Europe and Orhan Ertughrul, G-SMATT Europe’s Managing Director, entered into a loan agreement dated January 31, 2021, whereby Mr. Ertughrul lent an aggregate of £ 256,316.98 to G-SMATT Europe, accruing at a rate of 5% per annum and maturing January 31, 2024. As of April 30, 2023, an aggregate of £28,757, including accrued interest, was outstanding under the loan agreement.

G-SMATT Europe and GLAAM entered into a loan agreement dated May 11, 2018, whereby GLAAM lent an aggregate of £682,000 to G-SMATT Europe, accruing at a rate of 5% per annum and maturing May 11, 2023. As of April 30, 2023, an aggregate of £884,040, including accrued interest, was outstanding under the loan agreement.

308

(Charm Savings Bank) in an aggregate principal amount of KRW2.5 billion, with interest accruing at an annual rate of 10% and maturing on March 23, 2024. Charm Savings Bank may exercise its conversion right once three months have elapsed since the date of issue, subject to converting 100% of the amount of the CB into Class A Ordinary Shares. This CB is partially guaranteed by GLAAM stock held by Bio X Co. Ltd. (“Bio X”), a related party of GLAAM.

(Charm Savings Bank) in an aggregate principal amount of KRW2.5 billion, with interest accruing at an annual rate of 10% and maturing on March 23, 2024. Charm Savings Bank may exercise its conversion right once three months have elapsed since the date of issue, subject to converting 100% of the amount of the CB into Class A Ordinary Shares. This CB is partially guaranteed by GLAAM stock held by Bio X Co. Ltd. (“Bio X”), a related party of GLAAM.