As of April 12, 2023, the Company had neither purchased nor contracted to purchase any investments.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Basis of Accounting—The financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and are presented in United States dollars, which is the Company’s functional currency. The Company’s fiscal year end is December 31.

The Company’s financial statements are prepared using the accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (ASC) 946, Financial Services—Investment Companies.

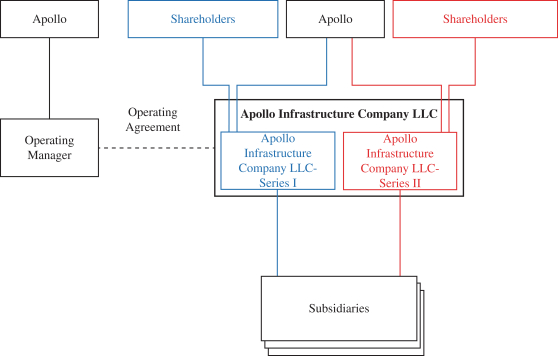

Basis of Presentation—Series I and Series II are intended to be treated as separate entities for U.S. federal income tax purposes with segregated assets, liabilities, and expenses. Allocation to each Series is based on attributable investment activity, NAV, or other equitable allocation methodologies as determined by the Operating Manager. These financial statements incorporate the assets and liabilities, and results of operations, of the Company as a whole, as well as each Series of membership interest in the Company.

Basis of Consolidation—As provided under Regulation S-X and ASC 946, the Company will generally not consolidate its investment in a company other than a wholly owned investment company or controlled operating company whose business consists of providing services to the Company.

Use of Estimates—The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could materially differ from those estimates.

Cash and Cash Equivalents—As of April 12, 2023, cash and cash equivalents were comprised of cash on hand.

Organizational and Offering Expenses—Organizational expenses are expensed as incurred. Organizational expenses consist of costs incurred to establish the Company and enable it legally to do business. Organizational expenses will be reimbursed by the Operating Manager, subject to potential recoupment as described in Note 3. For the period from April 3, 2023 (date of formation) to April 12, 2023, Series I and Series II incurred organizational expenses of $322,081 and $322,081, respectively.

Offering expenses include registration fees and legal fees regarding the preparation of the initial registration statement. Offering expenses are accounted for as deferred costs until operations begin. For continuous offerings, offering expenses are then amortized over the first twelve months of operations on a straight-line basis. For the period from April 3, 2023 (date of formation) to April 12, 2023, Series I and Series II incurred offering expenses of $252,859 and $252,859, respectively.

Investments, At Fair Value—ASC 820, Fair Value Measurement, defines fair value, establishes a framework for measuring fair value in accordance with GAAP and expands disclosures about fair value. The Company recognizes and accounts for its investments at fair value. The fair value of the investments does not reflect transactions costs that may be incurred upon disposition of investments.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters, or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation techniques involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity for disclosure purposes.

Assets and liabilities recorded at fair value on the Statement of Assets and Liabilities are categorized based upon the level of judgment associated with the inputs used to measure their value. Hierarchical levels, as

F-6