UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

FORM 10-K |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF |

THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended: December 31, 2006 |

Commission File Number: 001-11590 |

Chesapeake Utilities Corporation |

(Exact name of registrant as specified in its charter) |

State of Delaware | 51-0064146 |

(State or other jurisdiction of | (I.R.S. Employer |

incorporation or organization) | Identification No.) |

909 Silver Lake Boulevard, Dover, Delaware 19904 |

(Address of principal executive offices, including zip code) |

302-734-6799 |

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Name of each exchange on which registered |

Common Stock - par value per share $.4867 | New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act: |

8.25% Convertible Debentures Due 2014 |

(Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ]. No [X].

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ]. No [X].

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X]. No [ ].

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [X] Non-accelerated filer [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ]. No [X].

The aggregate market value of the common shares held by non-affiliates of Chesapeake Utilities Corporation as of June 30, 2006, the last business day of its most recently completed second fiscal quarter, based on the last trade price on that date, as reported by the New York Stock Exchange, was approximately $179.2 million.

As of March 8, 2007, 6,717,348 shares of common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2007 Annual Meeting of Stockholders are incorporated by reference in Part III.

Chesapeake Utilities Corporation

Form 10-K

YEAR ENDED DECEMBER 31, 2006

TABLE OF CONTENTS

Page | |

| Part I | 1 |

| Item 1. Business | 1 |

| Item 1A. Risk Factors | 8 |

| Item 1B. Unresolved Staff Comments | 12 |

| Item 2. Properties | 12 |

| Item 3. Legal Proceedings | 12 |

| Item 4. Submission of Matters to a Vote of Security Holders | 12 |

| Part II | 13 |

| Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 13 |

| Item 6. Selected Financial Data | 16 |

| Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations | 20 |

| Item 7A. Quantitative and Qualitative Disclosures About Market Risk | 45 |

| Item 8. Financial Statements and Supplementary Data | 45 |

| Item 9. Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | 76 |

| Item 9A. Controls and Procedures | 76 |

| Item 9B. Other Information | 76 |

| Part III | 77 |

| Item 10. Directors, Executive Officers of the Registrant and Corporate Governance | 77 |

| Item 11. Executive Compensation | 77 |

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 77 |

| Item 13. Certain Relationships and Related Transactions, and Director Independence | 78 |

| Item 14. Principal Accounting Fees and Services | 78 |

| Part IV | 79 |

Item 15. Exhibits, Financial Statement Schedules | 79 |

| Signatures | 83 |

Part I

References in this document to “Chesapeake,” “the Company,” “we,” “us” and “our” mean Chesapeake Utilities Corporation and/or its wholly owned subsidiaries, as appropriate.

Safe Harbor for Forward-Looking Statements

Chesapeake Utilities Corporation has made statements in this Form 10-K that are considered to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not matters of historical fact and are typically identified by words such as, but not limited to, “believes,” “expects,” “intends,” “plans,” and similar expressions, or future or conditional verbs such as “may,” “will,” “should,” “would,” and “could”. These statements relate to matters such as customer growth, changes in revenues or gross margins, capital expenditures, environmental remediation costs, regulatory trends and decisions, market risks associated with our propane operations, the competitive position of the Company and other matters. It is important to understand that these forward-looking statements are not guarantees, but are subject to certain risks and uncertainties and other important factors that could cause actual results to differ materially from those in the forward-looking statements. The factors that could cause actual results to differ materially from the Company’s expectations include, but are not limited to those discussed in Item 1A “Risk Factors.”

Item 1. Business.

| (a) | General Development of Business |

Chesapeake is a diversified utility company engaged directly or through subsidiaries in natural gas distribution, transmission and marketing, propane distribution and wholesale marketing, advanced information services and other related businesses. Chesapeake is a Delaware corporation that was formed in 1947.

Chesapeake’s three natural gas distribution divisions serve approximately 59,100 residential, commercial and industrial customers in central and southern Delaware, Maryland’s Eastern Shore and parts of Florida. The Company’s natural gas transmission subsidiary, Eastern Shore Natural Gas Company (“Eastern Shore” or “ESNG”), operates a 366-mile interstate pipeline system that transports gas from various points in Pennsylvania to the Company’s Delaware and Maryland distribution divisions, as well as to other utilities and industrial customers in southern Pennsylvania, Delaware and on the Eastern Shore of Maryland. Our propane distribution operation serves approximately 33,300 customers in central and southern Delaware, the Eastern Shore of Maryland and Virginia, southeastern Pennsylvania, and parts of Florida. The advanced information services segment provides domestic and international clients with information technology related business services and solutions for both enterprise and e-business applications.

| (b) | Financial Information about Industry Segments |

Financial information by business segment is included in Item 8 under the heading “Notes to Consolidated Financial Statements — Note C.”

| (c) | Narrative Description of Business |

Chesapeake is engaged in three primary business activities: natural gas distribution, transmission and marketing, propane distribution and wholesale marketing and advanced information services. In addition to the primary groups, Chesapeake has subsidiaries in other related businesses.

(i) (a) Natural Gas Distribution, Transmission and Marketing

General

Chesapeake distributes natural gas to residential, commercial and industrial customers in central and southern Delaware, the Salisbury and Cambridge, Maryland areas on Maryland’s Eastern Shore and parts of Florida. These activities are conducted through three utility divisions, one division in Delaware, another in Maryland and a third division in Florida. The Company also offers natural gas supply and supply management services in the state of Florida through its subsidiary, Peninsula Energy Services Company, Inc. (“PESCO”).

- Page 1 -

Delaware and Maryland. Chesapeake’s Delaware and Maryland utility divisions serve approximately 45,400 customers, of which approximately 45,200 are residential and commercial customers purchasing gas primarily for heating purposes. The remaining customers are industrial. For the year 2006, residential and commercial customers accounted for approximately 77% of the volume delivered by the divisions and 75% of the divisions’ revenue.

Florida. The Florida division distributes natural gas to approximately 13,630 residential and commercial and 100 industrial customers in the 13 Counties of Polk, Osceola, Hillsborough, Gadsden, Gilchrist, Union, Holmes, Jackson, Desoto, Suwannee, Liberty, Washington and Citrus. Currently, the industrial customers, which purchase and transport gas on a firm basis, account for approximately 92% of the volume delivered by the Florida division and 43% of the revenues. These customers are primarily engaged in the citrus and phosphate industries and in electric cogeneration.

PESCO provides natural gas supply and supply management services to commercial and industrial end users in Florida. During 2005, Chesapeake formed a wholly owned subsidiary, Peninsula Pipeline Company, Inc. to provide natural gas transportation services to industrial customers by an intra-state pipeline.

Eastern Shore. The Company’s wholly owned transmission subsidiary, Eastern Shore, owns and operates an interstate natural gas pipeline and provides open access transportation services for affiliated and non-affiliated companies through an integrated gas pipeline extending from southeastern Pennsylvania through Delaware to its terminus on the Eastern Shore of Maryland. Eastern Shore also provides swing transportation service and contract storage services. Eastern Shore’s rates and services are subject to regulation by the Federal Energy Regulatory Commission (“FERC”).

Adequacy of Resources

General. The Delaware and Maryland divisions have both firm and interruptible contracts with four interstate “open access” pipelines including Eastern Shore. The divisions are directly interconnected with Eastern Shore and services upstream of Eastern Shore are contracted with Transcontinental Gas Pipeline Corporation (“Transco”), Columbia Gas Transmission Corporation (“Columbia”) and Columbia Gulf Transmission Company (“Gulf”). None of the upstream service providers are affiliates of the Company. The divisions use their firm transportation supply resources to meet a significant percentage of their projected demand requirements. In order to meet the difference between firm supply and firm demand, the divisions purchase natural gas supply on the spot market from various suppliers. This gas is transported by the upstream pipelines and delivered to the divisions’ interconnects with Eastern Shore. The divisions also have the capability to use propane-air peak-shaving to supplement or displace the spot market purchases. The Company believes that the availability of gas supply and transportation to the Delaware and Maryland divisions is adequate under existing arrangements to meet the anticipated needs of their customers.

Delaware. The Delaware division’s contracts with Transco include: (a) firm transportation capacity of 9,029 dekatherms (“Dt”) per day, with provisions to continue from year to year, subject to 180 days notice for termination; (b) firm transportation capacity of 311 Dt per day for December through February, with provisions to continue such contract on a year to year basis, subject to 180 days notice for termination; (c) firm transportation capacity of 174 Dt per day, which expires in 2008; (d) firm transportation capacity of 1,842 Dt, which expires in 2009; (e) firm storage service, providing a peak day entitlement of 1,680 Dt and a total capacity of 142,830 Dt, with provisions to continue such contract on a year to year basis, subject to 180 days notice for termination; and (f) firm storage service, providing a peak day entitlement of 1,786 Dt and a total capacity of 17,967 Dt, which expires in 2013.

- Page 2 -

The Delaware division’s contracts with Columbia include: (a) firm transportation capacity of 880 Dt per day, which expires in 2014; (b) firm transportation capacity of 1,132 Dt per day, which expires in 2017; (c) firm transportation capacity of 549 Dt per day, which expires in 2018; (d) firm transportation capacity of 899 per day, which expires in 2019; (e) firm storage service providing a peak day entitlement of 6,193 Dt and a total capacity of 298,195 Dt, which expires in 2015; (f) firm storage service, providing a peak day entitlement of 635 Dt and a total capacity of 57,139 Dt, which expires in 2018; (g) firm storage service providing a peak day entitlement of 583 Dt and a total capacity of 52,460 Dt, which expires in 2019; (h) firm storage service providing a peak day entitlement of 583 Dt and a total capacity of 52,460 Dt, which expires in 2020; (i) firm storage service providing a peak day entitlement of 15 Dt and a total capacity of 1,350 Dt, which expires in 2018; and (j) firm storage service providing a peak day entitlement of 215 Dt and a total capacity of 10,646 Dt, which expires in 2010. Delaware’s contracts with Columbia for storage-related transportation provide quantities that are equivalent to the peak day entitlement for the period of October through March and are equivalent to fifty percent (50%) of the peak day entitlement for the period of April through September. The terms of the storage-related transportation contracts mirror the storage services that they support.

The Delaware division’s contract with Gulf, which expires in 2009, provides firm transportation capacity of 880 Dt per day for the period November through March and 809 Dt per day for the period April through October.

The Delaware division’s contracts with Eastern Shore include: (a) firm transportation capacity of 53,637 Dt per day for the period December through February, 52,415 Dt per day for the months of November, March and April, and 43,339 Dt per day for the period May through October, with various expiration dates ranging from 2007 to 2017; (b) firm storage capacity providing a peak day entitlement of 2,655 Dt and a total capacity of 131,370 Dt, which expires in 2013; (c) firm storage capacity providing a peak day entitlement of 580 Dt and a total capacity of 29,000 Dt, which expires in 2013; (d) firm storage capacity providing a peak day entitlement of 911 Dt and a total capacity of 5,708 Dt, with provisions to continue such contract on a year to year basis, subject to 180 days notice for termination.

The Delaware division currently has contracts for the purchase of firm natural gas supply with several suppliers. These supply contracts provide the availability of a maximum firm daily entitlement of 37,500 Dt and delivered on Transco, Columbia, and/or Gulf systems to Eastern Shore for redelivery under firm transportation contracts. The gas purchase contracts have various expiration dates and daily quantities may vary from day to day and month to month.

Maryland. The Maryland division’s contracts with Transco include: (a) firm transportation capacity of 4,738 Dt per day, with provisions to continue such contract on a year to year basis, subject to 180 days notice for termination; (b) firm transportation capacity of 155 Dt per day for December through February, with provisions to continue such contract on a year to year basis, subject to 180 days notice for termination; (c) firm transportation capacity of 973 Dt, which expires in 2009; (d) firm storage service providing a peak day entitlement of 390 Dt and a total capacity of 33,120 Dt, with provisions to continue such contract on a year to year basis, subject to 180 days notice for termination ; and (e) firm storage service, providing a peak day entitlement of 546 Dt and a total capacity of 5,489 Dt, which expires in 2013.

The Maryland division’s contracts with Columbia include: (a) firm transportation capacity of 442 Dt per day, which expires in 2014; (b) firm transportation capacity of 908 Dt per day, which expires in 2017; (c) firm transportation capacity of 350 Dt per day, which expires in 2018; (d) firm storage service providing a peak day entitlement of 3,142 Dt and a total capacity of 154,756 Dt, which expires in 2015; (e) firm storage service providing a peak day entitlement of 521 Dt and a total capacity of 46,881 Dt, which expires in 2018; and (f) firm transportation capacity of 1,832 Dt per day for the period April through September. The Maryland division’s contracts with Columbia for storage-related transportation provide quantities that are equivalent to the peak day entitlement for the period October through March and are equivalent to fifty percent (50%) of the peak day entitlement for the period April through September. The terms of the storage-related transportation contracts mirror the storage services that they support.

- Page 3 -

The Maryland division’s contract with Gulf, which expires in 2009, provides firm transportation capacity of 590 Dt per day for the period November through March and 543 Dt per day for the period April through October.

The Maryland division’s contracts with Eastern Shore include: (a) firm transportation capacity of 18,982 Dt per day for the period December through February, 18,254 Dt per day for the months of November, March and April and 13,674 Dt per day for the period May through October, with various expiration dates ranging from 2007 to 2015; (b) firm storage capacity providing a peak day entitlement of 1,428 Dt and a total capacity of 70,665 Dt, which expires in 2013; (c) firm storage capacity providing a peak day entitlement of 309 Dt and a total capacity of 15,500 Dt, which expires in 2013; and (d) firm storage capacity providing a peak day entitlement of 569 Dt and a total capacity of 3,560 Dt, with provisions to continue such contract on a year to year basis, subject to 180 days notice for termination.

The Maryland division currently has contracts for the purchase of firm natural gas supply with several suppliers. These supply contracts provide the availability of a maximum form daily entitlement of 11,500 Dt delivered on Transco, Columbia, and/or Gulf systems to Eastern Shore for redelivery under the Maryland division’s transportation contracts. The gas purchase contracts have various expiration dates and daily quantities may vary from day to day and month to month.

Florida. The Florida division receives natural gas from Florida Gas Transmission Company (“FGT”) and Gulfstream Natural Gas System (“Gulfstream”). The Florida division has firm transportation agreements with both of these interstate pipelines. All of the capacity under these agreements has been released to various third parties and PESCO, our natural gas marketing subsidiary. Under terms of these capacity release agreements, Chesapeake is contingently liable to FGT and Gulfstream should the party that acquired the capacity through release fail to pay for the service.

Chesapeake’s contracts with FGT include transportation service for: (a) daily firm transportation capacity of 27,519 Dt in November through April; 21,123 Dt in May through September, and 27,105 Dt in October, which expires in 2010; and (b) daily firm transportation capacity of 1,000 Dt daily, which expires in 2015.

Chesapeake’s contracts with Gulfstream include transportation service for daily firm transportation capacity of 10,000 Dt daily. The contract with Gulfstream expires May 31, 2022.

PESCO currently has contracts with Eagle Energy Partners and Prior Energy for the purchase of firm natural gas supply. The Eagle Energy Partners’ contract provides the availability of a maximum firm daily entitlement of 10,000 MMBtus and has an expiration date of May 2007. The Prior Energy contract provides the availability of a maximum firm daily entitlement of 7,500 MMBtus and has an expiration date of May 2007.

Eastern Shore. Eastern Shore also has contracts with Transco for: (a) 7,046 Mcf of firm peak day storage entitlements and total storage capacity of 278,264 Mcf, which expires in 2013.

Eastern Shore has retained the firm transportation capacity and firm storage services described above in order to provide swing transportation service and storage service to those customers that requested such service.

Competition

See discussion on competition in Item 7 under the heading “Management’s Discussion and Analysis — Competition.”

Rates and Regulation

General. Chesapeake’s natural gas distribution divisions are subject to regulation by the Delaware, Maryland and Florida Public Service Commissions with respect to various aspects of the business, including the rates for sales and transportation to all customers in each respective jurisdiction. All of Chesapeake’s firm distribution sales rates are subject to gas cost recovery mechanisms, which match revenues with gas costs and normally allow eventual full recovery of gas costs. Adjustments under these mechanisms, which are limited to gas costs, require periodic filings and hearings with the relevant regulatory authority.

- Page 4 -

Eastern Shore is subject to regulation by the FERC as an interstate pipeline. The FERC regulates the provision of service, terms and conditions of service, and the rates Eastern Shore can charge for its transportation and storage services.

Management monitors the achieved rate of return in each jurisdiction in order to ensure the timely filing of rate cases.

Regulatory Proceedings

See discussion of regulatory activities in Item 7 under the heading “Management’s Discussion and Analysis — Regulatory Activities.”

(i) (b) Propane Distribution and Wholesale Marketing

General

Chesapeake’s propane distribution group consists of (1) Sharp Energy, Inc. (“Sharp Energy”), a wholly owned subsidiary of Chesapeake, (2) Sharpgas, Inc. (“Sharpgas”), a wholly owned subsidiary of Sharp Energy, and (3) Tri-County Gas Co., Incorporated (“Tri-County”), a wholly owned subsidiary of Sharp Energy. The propane wholesale marketing group consists of Xeron, Inc. (“Xeron”), a wholly owned subsidiary of Chesapeake.

Propane is a form of liquefied petroleum gas, which is typically extracted from natural gas or separated during the crude oil refining process. Although propane is a gas at normal pressure, it is easily compressed into liquid form for storage and transportation. Propane is a clean-burning fuel, gaining increased recognition for its environmental superiority, safety, efficiency, transportability and ease of use relative to alternative forms of energy. Propane is sold primarily in suburban and rural areas, which are not served by natural gas distributors. Demand is typically much higher in the winter months and is significantly affected by seasonal variations, particularly the relative severity of winter temperatures, because of its use in residential and commercial heating.

During 2006, our propane distribution operations served approximately 33,300 propane customers on the Delmarva Peninsula, southeastern Pennsylvania and in Florida and delivered approximately 24.2 million retail and wholesale gallons of propane.

In May 1998, Chesapeake acquired Xeron, a natural gas liquids trading company located in Houston, Texas. Xeron markets propane to large independent and petrochemical companies, resellers and southeastern retail propane companies in the United States. Additional information on Xeron’s trading and wholesale marketing activities, market risks and the controls that limit and monitor the risks are included in Item 7 under the heading “Management’s Discussion and Analysis — Market Risk.”

The propane distribution business is affected by many factors, such as seasonality, the absence of price regulation, and competition among local providers. The propane wholesale marketing business is affected by wholesale price volatility and the supply and demand for propane at a wholesale level.

Adequacy of Resources

The Company’s propane distribution operations purchase propane primarily from suppliers, including major oil companies and independent producers of natural gas liquids. Supplies of propane from these and other sources are readily available for purchase by the Company. Supply contracts generally include minimum (not subject to take-or-pay premiums) and maximum purchase provisions.

- Page 5 -

The Company’s propane distribution operations use trucks and railroad cars to transport propane from refineries, natural gas processing plants or pipeline terminals to its bulk storage facilities. From these facilities, propane is delivered primarily by “bobtail” trucks, owned and operated by the Company, to tanks located at the customer’s premises.

Xeron does not own physical storage facilities or equipment to transport propane; however, it contracts for storage and pipeline capacity to facilitate the sale of propane on a wholesale basis.

Competition

See discussion on competition in Item 7 under the heading “Management’s Discussion and Analysis — Competition.”

Rates and Regulation

The propane distribution and wholesale marketing activities are not subject to any federal or state pricing regulation. Transport operations are subject to regulations concerning the transportation of hazardous materials promulgated under the Federal Motor Carrier Safety Act, which is administered by the United States Department of Transportation and enforced by the various states in which such operations take place. Propane distribution operations are also subject to state safety regulations relating to “hook-up” and placement of propane tanks.

The Company’s propane operations are subject to all operating hazards normally associated with the handling, storage and transportation of combustible liquids, such as the risk of personal injury and property damage caused by fire. The Company carries general liability insurance in the amount of $35 million, but there is no assurance that such insurance will be adequate.

(i) (c) Advanced Information Services

General

Chesapeake’s advanced information services segment consists of BravePoint, Inc. (“BravePoint”), a wholly owned subsidiary of the Company. BravePoint, headquartered in Norcross, Georgia, provides domestic and international clients with information technology related business services and solutions for both enterprise and e-business applications.

Competition

See discussion on competition in Item 7 under the heading “Management’s Discussion and Analysis — Competition.”

(i) (d) Other Subsidiaries

Skipjack, Inc. (“Skipjack”), Eastern Shore Real Estate, Inc. and Chesapeake Investment Company are wholly owned subsidiaries of Chesapeake Service Company. Skipjack and Eastern Shore Real Estate, Inc. own and lease office buildings in Delaware and Maryland to affiliates of Chesapeake. Chesapeake Investment Company is a Delaware affiliated investment company. During 2004, Chesapeake formed a new company, OnSight Energy, LLC (“OnSight”), to provide distributed energy solutions to customers requiring reliable, uninterrupted energy sources and/or those wishing to reduce energy costs.

(ii) Seasonal Nature of Business

Revenues from the Company’s residential and commercial natural gas sales and from its propane distribution activities are affected by seasonal variations, since the majority of these sales are to customers using the fuels for heating purposes. Revenues from these customers are accordingly affected by the mildness or severity of the heating season.

- Page 6 -

(iii) Capital Budget

A discussion of capital expenditures by business segment and capital expenditures for environmental control facilities are included in Item 7 under the heading “Management Discussion and Analysis — Liquidity and Capital Resources.”

(iv) Employees

As of December 31, 2006, Chesapeake had 437 employees, including 193 in natural gas, 142 in propane and 70 in advanced information services. The remaining 32 employees are considered general and administrative and include officers of the Company, treasury, accounting, internal audit, information technology, human resources and other administrative personnel.

(v) Executive Officers of the Registrant

Information pertaining to the executive officers of the Company is as follows:

John R. Schimkaitis (age 59) Mr. Schimkaitis is President and Chief Executive Officer of Chesapeake and its subsidiaries. Mr. Schimkaitis assumed the role of Chief Executive Officer on January 1, 1999. He has served as President since 1997. Prior to this, Mr. Schimkaitis served as President and Chief Operating Officer, Executive Vice President, Senior Vice President, Chief Financial Officer, Vice President, Treasurer, Assistant Treasurer and Assistant Secretary of Chesapeake.

Michael P. McMasters (age 48) Mr. McMasters is Senior Vice President and Chief Financial Officer of Chesapeake Utilities Corporation. He was appointed Senior Vice President in 2004 and has served as Chief Financial Officer since December 1996. He has previously held the positions of Vice President, Treasurer, Director of Accounting and Rates, and Controller. From 1992 to May 1994, Mr. McMasters was employed as Director of Operations Planning for Equitable Gas Company.

Stephen C. Thompson (age 46) Mr. Thompson is President of Eastern Shore Natural Gas Company and Senior Vice President of Chesapeake Utilities Corporation. Prior to becoming Senior Vice President in 2004, he served as Vice President of Chesapeake since May 1997. He has also served as Vice President, Director of Gas Supply and Marketing, Superintendent of Eastern Shore and Regional Manager for the Florida distribution operations.

Beth W. Cooper (age 40) Ms. Cooper is Vice President, Treasurer and Corporate Secretary of Chesapeake Utilities Corporation. Ms. Cooper has served as Corporate Secretary since July 2005. She previously served as Assistant Treasurer and Assistant Secretary, Director of Internal Audit, Director of Strategic Planning, Planning Consultant, Accounting Manager for Non-regulated Operations and Treasury Analyst. Prior to joining Chesapeake, she was employed as an auditor with Ernst & Young’s Entrepreneurial Services Group.

S. Robert Zola (age 54) Mr. Zola joined Sharp Energy in August of 2002 as President. Prior to joining Sharp Energy, Mr. Zola most recently served as Northeast Regional Manager of Synergy Gas, now Cornerstone MLP, in Philadelphia, PA. During his 26-year career in the propane industry, Mr. Zola also started Bluestreak Propane in Phoenix, AZ, which after successfully developing the business, was sold to Ferrell Gas.

(vi) Financial Information about Geographic Areas

All of the Company’s material operations, customers, and assets occur and are located in the United States.

| (d) | Available Information |

As a public company, Chesapeake files annual, quarterly and other reports, as well as its annual proxy statement and other information, with the Securities and Exchange Commission (“SEC”). The public may read and copy any materials that the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E. Washington, DC 20549-5546; and the public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements and other information regarding the Company. The address of the SEC’s Internet website is www.sec.gov. Chesapeake makes available, free of charge, on its Internet website its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. The address of Chesapeake’s Internet website is www.chpk.com. The content of this website is not part of this report.

- Page 7 -

Chesapeake has a Business Code of Ethics and Conduct applicable to all employees, officers and directors and a Code of Ethics for Financial Officers. Copies of the Business Code of Ethics and Conduct and the Financial Officer Code of Ethics are available on its internet website. Chesapeake also adopted Corporate Governance Guidelines and Charters for the Audit Committee, Compensation Committee, and Governance Committee of the Board of Directors, each of which satisfies the regulatory requirements established by the Securities and Exchange Commission and the New York Stock Exchange (“NYSE”). The Board of Directors has also adopted “Corporate Governance Guidelines on Director Independence,” which conform to the NYSE listing standards on director independence. Each of these documents also is available on Chesapeake’s Internet website or may be obtained by writing to: Corporate Secretary; c/o Chesapeake Utilities Corporation; 909 Silver Lake Blvd.; Dover, DE 19904.

If Chesapeake makes any amendment to, or grants a waiver of, any provision of the Business Code of Ethics and Conduct or the Financial Officer Code of Ethics applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, the amendment or waiver will be disclosed within five business days on the Company’s Internet website.

Item 1A. Risk Factors.

The following is a discussion of the primary factors that may affect the operations and/or financial performance of the regulated and unregulated businesses of Chesapeake. Refer to the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” under Item 7 of this report for an additional discussion of these and other related factors that affect the Company’s operations and/or financial performance. The principal business, economic and other factors that affect the operations and/or financial performance of the Company include:

Fluctuations in weather have the potential to adversely affect our results of operations, cash flows and financial condition.

Our utility and propane distribution operations are sensitive to fluctuations in weather, and weather conditions directly influence the volume of natural gas and propane delivered by our utility and propane distribution operations to customers. A significant portion of our utility and propane distribution operations’ revenues are derived from the delivery of natural gas and propane to residential and commercial heating customers during the five-month peak heating season of November through March. If the weather is warmer than normal, we deliver less natural gas and propane to customers, and earn less revenue. In addition, hurricanes or other extreme weather conditions could damage production or transportation facilities, which could result in decreased supplies of natural gas and propane, increased supply costs and higher prices for customers.

Regulation of the Company, including changes in the regulatory environment in general, may adversely affect our results of operations, cash flows and financial condition.

The state Public Service Commissions of Delaware, Maryland and Florida regulate our natural gas distribution operations. Eastern Shore, our natural gas transmission subsidiary, is regulated by the FERC. These regulatory agencies set the rates in their respective jurisdictions that we can charge customers for our rate-regulated services. Changes in these rates, as ordered by regulatory commissions, affect our financial performance. Our ability to obtain timely future rate increases and rate supplements to maintain current rates of return depends on regulatory discretion, and there can be no assurance that our divisions and Eastern Shore will be able to obtain rate increases or supplements or continue receiving currently authorized rates of return.

- Page 8 -

The amount and availability of natural gas and propane supplies are difficult to predict, which may reduce our earnings.

Natural gas and propane production can be impacted by factors outside of our control, such as weather and refinery closings. If we are unable to obtain sufficient natural gas and propane supplies to meet demand, our results of operations may be negatively impacted.

We rely on having access to interstate pipelines’ transportation and storage capacity. If these pipelines or storage facilities were not available, it may impair our ability to meet our customers’ full requirements.

We must acquire both sufficient natural gas supplies and interstate pipeline and storage capacity to meet customer requirements. We must contract for reliable and adequate delivery capacity for our distribution system, while considering the dynamics of the interstate pipeline and storage capacity market, our own on-system resources, as well as, the characteristics of our customer base. Local natural gas distribution companies, including us, and other participants in the energy industry, have raised concerns regarding the future availability of additional upstream interstate pipeline and storage capacity. Additional available pipeline and storage capacity is a business issue that must be managed by us, as our customer base grows.

Natural gas and propane commodity price changes may affect the operating costs and competitive positions of our natural gas and propane distribution operations, which may adversely affect our results of operations, cash flows and financial condition.

Natural Gas. Over the last four years, natural gas costs have increased significantly and become more volatile. In addition, the hurricane activity in 2005 reduced the natural gas available from the Gulf Coast region, further contributing to the volatility of natural gas prices. Higher natural gas prices can result in significant increases in the cost of gas billed to customers during the winter heating season. Under our regulated gas cost recovery mechanisms, we record cost of gas expense equal to the cost of gas recovered in revenues from customers. Therefore, an increase in the cost of gas due to an increase in the price of the natural gas commodity generally has no immediate effect on our revenues and net income. However, our net income may be reduced due to higher expenses that may be incurred for uncollectible customer accounts, as well as, lower volumes of natural gas deliveries to customers due to lower natural gas consumption caused by customer conservation. Increases in the price of natural gas also can affect our operating cash flows, as well as the competitiveness of natural gas as an energy source.

Propane. The level of profitability in the retail propane business is largely dependent on the difference between the cost of propane and the revenues derived from our sale of propane to our customers. Propane costs are subject to volatile changes as a result of product supply or other market conditions, including economic and political factors impacting crude oil and natural gas supply or pricing. Propane cost changes can occur rapidly over a short period of time and can impact profitability. There is no assurance that we will be able to pass on propane cost increases fully or immediately, particularly when propane costs increase or decrease rapidly. Therefore, average retail sales prices can vary significantly from year to year as product costs fluctuate with propane, fuel oil, crude oil and natural gas commodity market conditions. In addition, in periods of sustained higher commodity prices, retail sales volumes may be negatively impacted by customer conservation efforts and increased amounts of uncollectible accounts, which may adversely affect net income.

We compete in a competitive environment and may be faced with losing customers to a competitor.

We compete with third-party suppliers to sell gas to industrial customers. As it relates to transportation services, our competitors include the interstate pipelines if distribution customer is located close enough to the transmission company’s pipeline to make a connection economically feasible.

Our propane distribution operations compete with several other propane distributors in their service territories, primarily on the basis of service and price, emphasizing reliability of service and responsiveness. Some of our competitors have significantly greater resources. The retail propane industry is mature, and we foresee only modest growth in total demand. Given this limited growth, we expect that year-to-year industry volumes will be principally affected by weather patterns. Therefore, our ability to grow the propane distribution business is contingent upon execution of our community gas systems strategy to capture market share and to employ service pricing programs that retain and grow our customer base. Any failure to retain and grow our customer base would have an adverse effect on our results.

- Page 9 -

The propane wholesale marketing operation competes against various marketers, many of which have significantly greater resources and are able to obtain price or volumetric advantages.

The advanced information services business faces significant competition from a number of larger competitors having substantially greater resources available to them to compete on the basis of technological expertise, reputation and price.

Costs of compliance with environmental laws may be significant.

We are subject to federal, state and local laws and regulations governing environmental quality and pollution control. These evolving laws and regulations may require expenditures over a long period of time to control environmental effects at current and former operating sites, including former manufactured gas plant sites that we have acquired from third parties. Compliance with these legal requirements requires us to commit capital toward environmental compliance. If we fail to comply with environmental laws and regulations, even if such failure is caused by factors beyond our control, we may be assessed civil or criminal penalties and fines.

To date, we have been able to recover through approved rate mechanisms the costs of recovery associated with the remediation of former manufactured gas plant sites. However, there is no guarantee that we will be able to recover future remediation costs in the same manner or at all. A change in our approved rate mechanisms for recovery of environmental remediation costs at former manufactured gas plant sites could adversely affect our results of operations, cash flows and financial condition.

Further, existing environmental laws and regulations may be revised or new laws and regulations seeking to protect the environment may be adopted or become applicable to us. Revised or additional laws and regulations could result in additional operating restrictions on our facilities or increased compliance costs which may not be fully recoverable by us.

A change in the economic conditions and interest rates may adversely affect our results of operations and cash flows.

A downturn in the economies of the regions in which we operate, which we cannot accurately predict, might adversely affect our ability to increase our customer base and other businesses at the same rate they have grown in the recent past. Further, an increase in interest rates, without the recovery of the higher cost of debt in the sales and/or transportation rates we charge our utility customers, could adversely affect future earnings. An increase in short-term interest rates would negatively affect our results of operations, which depend on short-term debt to finance accounts receivable, storage gas inventories, and to temporarily finance capital expenditures.

Inflation may impact our results of operations, cash flows and financial position.

Inflation affects the cost of supply, labor, products and services required for operations, maintenance and capital improvements. While the impact of inflation has remained low in recent years, natural gas and propane prices are subject to rapid fluctuations. To help cope with the effects of inflation on our capital investments and returns, we seek rate relief from regulatory commissions for regulated operations while monitoring the returns of our unregulated business operations. There can be no assurance that we will be able to obtain adequate and timely rate relief to offset the effects of inflation. To compensate for fluctuations in propane gas prices, we adjust our propane selling prices to the extent allowed by the market. However, there can be no assurance that we will be able to increase propane sales prices sufficiently to fully compensate for such fluctuations in the cost of propane gas to us.

Changes in technology may adversely affect our advanced information services segment’s results of operations, cash flows and financial condition.

Our advanced information services segment participates in a market that is characterized by rapidly changing technology and accelerating product introduction cycles. The success of our advanced information services segment depends upon our ability to address the rapidly changing needs of our customers by developing and supplying high-quality, cost-effective products, product enhancements and services on a timely basis, and by keeping pace with technological developments and emerging industry standards. There can be no assurance that we will be able to keep up with technological advancements necessary to make our products competitive.

- Page 10 -

Our energy marketing subsidiaries have credit risk and credit requirements that may adversely affect our results of operations, cash flows and financial condition.

Xeron, our propane wholesale and marketing subsidiary, and PESCO, our natural gas marketing subsidiary in Florida, extend credit to counter-parties. While we believe Xeron and PESCO utilize prudent credit policies, each of these subsidiaries is exposed to the risk that it may not be able to collect amounts owed to it. If the counter-party to such a transaction fails to perform and any underlying collateral is inadequate, we could experience financial losses.

Xeron and PESCO are dependent upon the availability of credit to buy propane and natural gas for resale or to trade. If the financial condition of these subsidiaries declines, or if our financial condition declines, then the cost of credit available to these subsidiaries could increase. If credit is not available, or if credit is more costly, our results of operations, cash flows and financial condition may be adversely affected.

Our use of derivative instruments may adversely affect our results of operations.

Fluctuating commodity prices cause our earnings and financing costs to be impacted. Our propane distribution and wholesale marketing segment uses derivative instruments, including forwards, swaps and puts, to hedge price risk. In addition, we have utilized in the past, and may decide, after further evaluation, to continue to utilize derivative instruments to hedge price risk for our Delaware and Maryland divisions, as well as PESCO. While we have a risk management policy and operating procedures in place to control our exposure to risk, if we purchase derivative instruments that are not properly matched to our exposure, our results of operations, cash flows, and financial conditions may be adversely impacted.

Inability to access the capital markets may impair our future growth.

We rely on access to both short-term and longer-term capital markets as a significant source of liquidity for capital requirements not satisfied by the cash flow from our operations. Currently, $55 million of the total $80 million of short-term lines of credit utilized to satisfy our short-term financing requirements are discretionary, uncommitted lines of credit. We utilize discretionary lines of credit to reduce the cost associated with these short-term financing requirements. We are committed to maintaining a sound capital structure and strong credit ratings to provide the financial flexibility needed to access the capital markets when required. However, if we are not able to access capital at competitive rates, our ability to implement our strategic plan, undertake improvements and make other investments required for our future growth may be limited.

Construction of these facilities is subject to various regulatory, development and operational risks, include but not limited to our ability to obtain necessary approvals and permits by regulatory agencies on a timely basis and on terms that are acceptable to us; potential changes in federal, state and local statutes and regulations, including environmental requirements, that prevent a project from proceeding or increase the anticipated cost of the project; impediments on our ability to acquire rights-of-way or land rights on a timely basis on terms that are acceptable to us; lack of anticipated future growth in natural gas supply; and lack of transportation or throughput commitments.

We are subject to operating and litigation risks that may not be covered by insurance.

Our operations are subject to the operating hazards and risks normally incidental to handling, storing, transporting and otherwise providing natural gas and propane to end users. As a result, we are sometimes a defendant in legal proceedings and litigation arising in the ordinary course of business. We maintain insurance policies with insurers in such amounts and with such coverages and deductibles as we believe are reasonable and prudent. There can be no assurance; however, that such insurance will be adequate to protect us from all material expenses related to potential future claims for personal injury and property damage or that such levels of insurance will be available in the future at economical prices.

- Page 11 -

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties

| (a) | General |

The Company owns offices and operates facilities in the following locations: Pocomoke, Salisbury, Cambridge and Princess Anne, Maryland; Dover, Seaford, Laurel and Georgetown, Delaware; and Winter Haven, Florida. Chesapeake rents office space in Dover and Ocean View, Delaware; Jupiter and Lecanto, Florida; Chincoteague and Belle Haven, Virginia; Easton, and Salisbury, Maryland; Honey Brook and Allentown, Pennsylvania; Houston, Texas; and Norcross, Georgia. In general, the Company believes that its properties are adequate for the uses for which they are employed. Capacity and utilization of the Company’s facilities can vary significantly due to the seasonal nature of the natural gas and propane distribution businesses.

| (b) | Natural Gas Distribution |

Chesapeake owns over 965 miles of natural gas distribution mains (together with related service lines, meters and regulators) located in its Delaware and Maryland service areas and 726 miles of natural gas distribution mains (and related equipment) in its central Florida service areas. Chesapeake also owns facilities in Delaware and Maryland for propane-air injection during periods of peak demand.

| (c) | Natural Gas Transmission |

Eastern Shore owns and operates approximately 366 miles of transmission pipelines extending from supply interconnects at Parkesburg, Pennsylvania; Daleville, Pennsylvania and Hockessin, Delaware to approximately 75 delivery points in southeastern Pennsylvania, Delaware and the eastern shore of Maryland.

| (d) | Propane Distribution and Wholesale Marketing |

The company’s Delmarva-based propane distribution operation owns bulk propane storage facilities with an aggregate capacity of approximately 2.0 million gallons at 42 plant facilities in Delaware, Maryland and Virginia, located on real estate that is either owned or leased. The Company’s Florida-based propane distribution operation owns three bulk propane storage facilities with a total capacity of 66,000 gallons. Xeron does not own physical storage facilities or equipment to transport propane; however, it leases propane storage capacity and pipeline capacity.

Item 3. Legal Proceedings

| (a) | General |

The Company and its subsidiaries are involved in various legal actions and claims arising in the normal course of business. The Company is also involved in certain legal and administrative proceedings before various governmental agencies concerning rates. In the opinion of management, the ultimate disposition of these proceedings will not have a material effect on our consolidated financial position.

| (b) | Environmental |

See discussion of environmental commitments and contingencies in Item 8 under the heading “Notes to Consolidated Financial Statements — Note M.”

Item 4. Submission of Matters to a Vote of Security Holders.

None

- Page 12 -

Part II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

| (a) | Common Stock Price Ranges, Common Stock Dividends and Shareholder Information: |

The Company’s Common Stock is listed on the New York Stock Exchange under the symbol “CPK.” The high, low and closing prices of Chesapeake’s Common Stock and dividends declared per share for each calendar quarter during the years 2006 and 2005 were as follows:

Quarter Ended | High | Low | Close | Dividends Declared Per Share | |||||||||

2006 | |||||||||||||

March 31 | $ | 32.47 | $ | 29.97 | $ | 31.24 | $ | 0.285 | |||||

June 30 | 31.20 | 27.90 | 30.08 | $ | 0.290 | ||||||||

September 30 | 35.65 | 29.51 | 30.05 | $ | 0.290 | ||||||||

December 31 | 31.31 | 29.10 | 30.65 | $ | 0.290 | ||||||||

2005 | |||||||||||||

| March 31 | $ | 27.59 | $ | 25.83 | $ | 26.60 | $ | 0.280 | |||||

| June 30 | 30.95 | 23.60 | 30.58 | $ | 0.285 | ||||||||

| September 30 | 35.60 | 29.50 | 35.16 | $ | 0.285 | ||||||||

| December 31 | 35.78 | 30.32 | 30.80 | $ | 0.285 | ||||||||

Dividend payments are payable at the discretion of our Board of Directors. Future payment of dividends, and the amount of these dividends, will depend on our financial condition, results of operations, capital requirements, and other factors. We sold no securities during the year 2006 that were not registered under the Securities Act of 1933, as amended.

Indentures to the long-term debt of the Company contain various restrictions. The most stringent restrictions state that the Company must maintain equity of at least 40 percent of total capitalization and the pro-forma fixed charge coverage ratio must be at least 1.5 times. The Company was in compliance with these restrictions and the other debt covenants during 2006.

At December 31, 2006, there were 1,978 shareholders of record of the Common Stock.

- Page 13 -

| (b) | Purchases of Equity Securities by the Issuer |

The following table sets forth information on purchases by or on behalf of Chesapeake of shares of its Common Stock during the quarter ended December 31, 2006.

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (2) | Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs (2) | |||||||||

October 1, 2006 through October 31, 2006 (1) | 463 | $ | 29.92 | 0 | 0 | ||||||||

| November 1, 2006 through November 30, 2006 | 0 | $ | 0.00 | 0 | 0 | ||||||||

| December 1, 2006 through December 31, 2006 | 0 | $ | 0.00 | 0 | 0 | ||||||||

| Total | 463 | $ | 29.92 | 0 | 0 | ||||||||

(1) Chesapeake purchased shares of stock on the open market for the purpose of reinvesting the dividend on shares held in Rabbi Trust accounts for certain Senior Executives. During the quarter, 463 shares were purchased through executive dividend deferrals. | |||||||||||||

(2) Except for the purpose described in Footnote (1), Chesapeake has no publicly announced plans or programs to repurchase its shares. | |||||||||||||

Discussion on compensation plans of Chesapeake and its subsidiaries for which shares of Chesapeake common stock are authorized for issuance is incorporated herein by reference to the portion of the Proxy Statement captioned “Equity Compensation Plan Information” to be filed not later than March 31, 2007 in connection with the Company’s Annual Meeting to be held on May 2, 2007.

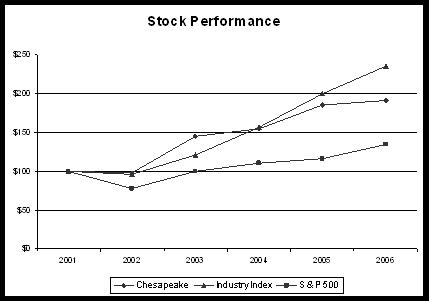

| (c) | Chesapeake Utilities Corporation Common Stock Performance Graph |

The following Performance Graph compares the yearly percentage change in cumulative total shareholder return on the Company’s common stock during the five fiscal years ended December 31, 2006, with the cumulative return on (i) the S&P 500 Index and (ii) an industry index consisting of 30 Natural Gas Distribution and Integrated Natural Gas Companies as published by C.A Turner Utility Reports.

The thirty companies in the C.A. Turner industry index are as follows: AGL Resources, Inc., Atmos Energy Corporation, Cascade Natural Gas Corporation, Chesapeake Utilities Corporation, Delta Natural Gas Company, Inc., El Paso Corporation, Energen Corporation, Energy West, Inc., EnergySouth. Inc., Equitable Resources, Inc., KeySpan Corporation, Kinder Morgan, Inc., The Laclede Group, Inc., National Fuel Gas Company, New Jersey Resources Corporation, NICOR, Inc., Northwest Natural Gas Company, ONEOK, Inc., Peoples Energy Corporation, Piedmont Natural Gas Co., Inc., Questar Corporation, RGC Resources, Inc., SEMCO Energy, Inc., South Jersey Industries, Inc., Southern Union Company, Southwest Gas Corporation, Southwest Energy Company, UGI Corporation, WGL Holdings, Inc., and The Williams Companies, Inc.

- Page 14 -

The comparison assumes $100 was invested on December 31, 2001 in the Company’s common stock and in each of the foregoing indices and assumes reinvested dividends. The comparisons in the Graph below are based on historical data and are not intended to forecast the possible future performance of the Company’s Common Stock.

Cumulative Total Stockholder Return | |||||||||||||||||||

2001 | 2002 | 2003 | 2004 | 2005 | 2006 | ||||||||||||||

Chesapeake | $100 | $98 | $145 | $155 | $186 | $192 | |||||||||||||

Industry Index | $100 | $96 | $121 | $156 | $200 | $236 | |||||||||||||

S & P 500 | $100 | $78 | $100 | $111 | $116 | $134 | |||||||||||||

- Page 15 -

Item 6. Selected Financial Data

For the Years Ended December 31, | 2006 (3) | 2005 | 2004 | 2003 | 2002 | |||||||||||

Operating (in thousands of dollars) (1) | ||||||||||||||||

| Revenues | ||||||||||||||||

| Natural gas | $ | 170,374 | $ | 166,582 | $ | 124,246 | $ | 110,247 | $ | 93,588 | ||||||

| Propane | 48,576 | 48,976 | 41,500 | 41,029 | 29,238 | |||||||||||

| Advanced informations systems | 12,568 | 14,140 | 12,427 | 12,578 | 12,764 | |||||||||||

| Other and eliminations | (317 | ) | (68 | ) | (218 | ) | (286 | ) | (334 | ) | ||||||

| Total revenues | $ | 231,201 | $ | 229,630 | $ | 177,955 | $ | 163,568 | $ | 135,256 | ||||||

| Operating income | ||||||||||||||||

| Natural gas | $ | 19,733 | $ | 17,236 | $ | 17,091 | $ | 16,653 | $ | 14,973 | ||||||

| Propane | 2,534 | 3,209 | 2,364 | 3,875 | 1,052 | |||||||||||

| Advanced informations systems | 767 | 1,197 | 387 | 692 | 343 | |||||||||||

| Other and eliminations | (103 | ) | (112 | ) | 128 | 359 | 237 | |||||||||

| Total operating income | $ | 22,931 | $ | 21,530 | $ | 19,970 | $ | 21,579 | $ | 16,605 | ||||||

| Net income from continuing operations | $ | 10,507 | $ | 10,468 | $ | 9,550 | $ | 10,079 | $ | 7,535 | ||||||

Assets (in thousands of dollars) | ||||||||||||||||

| Gross property, plant and equipment | $ | 325,836 | $ | 280,345 | $ | 250,267 | $ | 234,919 | $ | 229,128 | ||||||

Net property, plant and equipment (2) | $ | 240,825 | $ | 201,504 | $ | 177,053 | $ | 167,872 | $ | 166,846 | ||||||

Total assets (2) | $ | 324,994 | $ | 295,980 | $ | 241,938 | $ | 222,058 | $ | 223,721 | ||||||

Capital expenditures (1) | $ | 48,969 | $ | 33,423 | $ | 17,830 | $ | 11,822 | $ | 13,836 | ||||||

Capitalization (in thousands of dollars) | ||||||||||||||||

| Stockholders' equity | $ | 111,152 | $ | 84,757 | $ | 77,962 | $ | 72,939 | $ | 67,350 | ||||||

| Long-term debt, net of current maturities | 71,050 | 58,991 | 66,190 | 69,416 | 73,408 | |||||||||||

| Total capitalization | $ | 182,202 | $ | 143,748 | $ | 144,152 | $ | 142,355 | $ | 140,758 | ||||||

| Current portion of long-term debt | $ | 7,656 | $ | 4,929 | $ | 2,909 | $ | 3,665 | $ | 3,938 | ||||||

| Short-term debt | 27,554 | 35,482 | 5,002 | 3,515 | 10,900 | |||||||||||

| Total capitalization and short-term financing | $ | 217,412 | $ | 184,159 | $ | 152,063 | $ | 149,535 | $ | 155,596 | ||||||

(1) These amounts exclude the results of water services due to their reclassification to discontinued operations. The assets of all of the water businesses were sold in 2004 and 2003. | ||||||||||||||||

(2) SFAS 143 was adopted in the year 2001; therefore, SFAS 143 was not applicable for the years prior to 2001. | ||||||||||||||||

(3) SFAS 123R and SFAS 158 were adopted in the year 2006; therefore, they were not applicable for the years prior to 2006. | ||||||||||||||||

- Page 16 -

Item 6. Selected Financial Data

For the Years Ended December 31, | 2001 | 2000 | 1999 | 1998 | 1997 | |||||||||||

Operating (in thousands of dollars) (1) | ||||||||||||||||

| Revenues | ||||||||||||||||

| Natural gas | $ | 107,418 | $ | 101,138 | $ | 75,637 | $ | 68,770 | $ | 88,108 | ||||||

| Propane | 35,742 | 31,780 | 25,199 | 23,377 | 28,614 | |||||||||||

| Advanced informations systems | 14,104 | 12,390 | 13,531 | 10,331 | 7,786 | |||||||||||

| Other and eliminations | (113 | ) | (131 | ) | (14 | ) | (15 | ) | (182 | ) | ||||||

| Total revenues | $ | 157,151 | $ | 145,177 | $ | 114,353 | $ | 102,463 | $ | 124,326 | ||||||

| Operating income | ||||||||||||||||

| Natural gas | $ | 14,405 | $ | 12,798 | $ | 10,388 | $ | 8,820 | $ | 9,240 | ||||||

| Propane | 913 | 2,135 | 2,622 | 965 | 1,137 | |||||||||||

| Advanced informations systems | 517 | 336 | 1,470 | 1,316 | 1,046 | |||||||||||

| Other and eliminations | 386 | 816 | 495 | 485 | 558 | |||||||||||

| Total operating income | $ | 16,221 | $ | 16,085 | $ | 14,975 | $ | 11,586 | $ | 11,981 | ||||||

| Net income from continuing operations | $ | 7,341 | $ | 7,665 | $ | 8,372 | $ | 5,329 | $ | 5,812 | ||||||

Assets (in thousands of dollars) | ||||||||||||||||

| Gross property, plant and equipment | $ | 216,903 | $ | 192,925 | $ | 172,068 | $ | 152,991 | $ | 144,251 | ||||||

Net property, plant and equipment (2) | $ | 161,014 | $ | 131,466 | $ | 117,663 | $ | 104,266 | $ | 99,879 | ||||||

Total assets (2) | $ | 222,229 | $ | 211,764 | $ | 166,958 | $ | 145,029 | $ | 145,719 | ||||||

Capital expenditures (1) | $ | 26,293 | $ | 22,057 | $ | 21,365 | $ | 12,516 | $ | 13,471 | ||||||

Capitalization (in thousands of dollars) | ||||||||||||||||

| Stockholders' equity | $ | 67,517 | $ | 64,669 | $ | 60,714 | $ | 56,356 | $ | 53,656 | ||||||

| Long-term debt, net of current maturities | 48,409 | 50,921 | 33,777 | 37,597 | 38,226 | |||||||||||

| Total capitalization | $ | 115,926 | $ | 115,590 | $ | 94,491 | $ | 93,953 | $ | 91,882 | ||||||

| Current portion of long-term debt | $ | 2,686 | $ | 2,665 | $ | 2,665 | $ | 520 | $ | 1,051 | ||||||

| Short-term debt | 42,100 | 25,400 | 23,000 | 11,600 | 7,600 | |||||||||||

| Total capitalization and short-term financing | $ | 160,712 | $ | 143,655 | $ | 120,156 | $ | 106,073 | $ | 100,533 | ||||||

(1) These amounts exclude the results of water services due to their reclassification to discontinued operations. The assets of all of the water businesses were sold in 2004 and 2003. | ||||||||||||||||

(2) SFAS 143 was adopted in the year 2001; therefore, SFAS 143 was not applicable for the years prior to 2001. | ||||||||||||||||

(3) SFAS 123R and SFAS 158 were adopted in the year 2006; therefore, they were not applicable for the years prior to 2006. | ||||||||||||||||

- Page 17 -

Item 6. Selected Financial Data

For the Years Ended December 31, | 2006 (3) | 2005 | 2004 | 2003 | 2002 | |||||||||||

Common Stock Data and Ratios | ||||||||||||||||

Basic earnings per share from continuing operations (1) | $ | 1.74 | $ | 1.79 | $ | 1.66 | $ | 1.80 | $ | 1.37 | ||||||

Diluted earnings per share from continuing operations (1) | $ | 1.72 | $ | 1.77 | $ | 1.64 | $ | 1.76 | $ | 1.37 | ||||||

Return on average equity from continuing operations (1) | 10.7 | % | 12.9 | % | 12.7 | % | 14.4 | % | 11.2 | % | ||||||

| Common equity / total capitalization | 61.0 | % | 59.0 | % | 54.1 | % | 51.2 | % | 47.8 | % | ||||||

| Common equity / total capitalization and short-term financing | 51.1 | % | 46.0 | % | 51.3 | % | 48.8 | % | 43.3 | % | ||||||

| Book value per share | $ | 16.62 | $ | 14.41 | $ | 13.49 | $ | 12.89 | $ | 12.16 | ||||||

| Market price: | ||||||||||||||||

| High | $ | 35.650 | $ | 35.780 | $ | 27.550 | $ | 26.700 | $ | 21.990 | ||||||

| Low | $ | 27.900 | $ | 23.600 | $ | 20.420 | $ | 18.400 | $ | 16.500 | ||||||

| Close | $ | 30.650 | $ | 30.800 | $ | 26.700 | $ | 26.050 | $ | 18.300 | ||||||

| Average number of shares outstanding | 6,032,462 | 5,836,463 | 5,735,405 | 5,610,592 | 5,489,424 | |||||||||||

| Shares outstanding at year-end | 6,688,084 | 5,883,099 | 5,778,976 | 5,660,594 | 5,537,710 | |||||||||||

| Registered common shareholders | 1,978 | 2,026 | 2,026 | 2,069 | 2,130 | |||||||||||

| Cash dividends declared per share | $ | 1.16 | $ | 1.14 | $ | 1.12 | $ | 1.10 | $ | 1.10 | ||||||

Dividend yield (annualized) (2) | 3.8 | % | 3.7 | % | 4.2 | % | 4.2 | % | 6.0 | % | ||||||

Payout ratio from continuing operations (1) (4) | 66.7 | % | 63.7 | % | 67.5 | % | 61.1 | % | 80.3 | % | ||||||

Additional Data | ||||||||||||||||

| Customers | ||||||||||||||||

| Natural gas distribution and transmission | 59,132 | 54,786 | 50,878 | 47,649 | 45,133 | |||||||||||

| Propane distribution | 33,282 | 32,117 | 34,888 | 34,894 | 34,566 | |||||||||||

| Volumes | ||||||||||||||||

| Natural gas distribution and transmission deliveries (in MMCF) | 34,321 | 34,981 | 31,430 | 29,375 | 27,935 | |||||||||||

| Propane distribution (in thousands of gallons) | 24,243 | 26,178 | 24,979 | 25,147 | 21,185 | |||||||||||

| Heating degree-days (Delmarva Peninsula) | ||||||||||||||||

| Actual HDD | 3,931 | 4,792 | 4,553 | 4,715 | 4,161 | |||||||||||

| 10 -year average HDD (normal) | 4,372 | 4,436 | 4,389 | 4,409 | 4,393 | |||||||||||

| Propane bulk storage capacity (in thousands of gallons) | 2,315 | 2,315 | 2,045 | 2,195 | 2,151 | |||||||||||

Total employees (1) | 437 | 423 | 426 | 439 | 455 | |||||||||||

(1) These amounts exclude the results of water services due to their reclassification to discontinued operations. The assets of all of the water businesses were sold in 2004 and 2003. | ||||||||||||||||

(2) Dividend yield (annualized) is calculated by multiplying the fourth quarter dividend by four (4), then dividing that amount by the closing common stock price at December 31. | ||||||||||||||||

(3) SFAS 123R and SFAS 158 were adopted in the year 2006; therefore, they were not applicable for the years prior to 2006. | ||||||||||||||||

(4) The payout ratio from continuing operations is calculated by dividing cash dividends declared per share (for the year) by basic earnings per share from continuing operations. | ||||||||||||||||

- Page 18 -

Item 6. Selected Financial Data

For the Years Ended December 31, | 2001 | 2000 | 1999 | 1998 | 1997 | |||||||||||

Common Stock Data and Ratios | ||||||||||||||||

Basic earnings per share from continuing operations (1) | $ | 1.37 | $ | 1.46 | $ | 1.63 | $ | 1.05 | $ | 1.17 | ||||||

Diluted earnings per share from continuing operations (1) | $ | 1.35 | $ | 1.43 | $ | 1.59 | $ | 1.04 | $ | 1.15 | ||||||

Return on average equity from continuing operations (1) | 11.1 | % | 12.2 | % | 14.3 | % | 9.7 | % | 11.1 | % | ||||||

| Common equity / total capitalization | 58.2 | % | 55.9 | % | 64.3 | % | 60.0 | % | 58.4 | % | ||||||

| Common equity / total capitalization and short-term financing | 42.0 | % | 45.0 | % | 50.5 | % | 53.1 | % | 53.4 | % | ||||||

| Book value per share | $ | 12.45 | $ | 12.21 | $ | 11.71 | $ | 11.06 | $ | 10.72 | ||||||

| Market price: | ||||||||||||||||

| High | $ | 19.900 | $ | 18.875 | $ | 19.813 | $ | 20.500 | $ | 21.750 | ||||||

| Low | $ | 17.375 | $ | 16.250 | $ | 14.875 | $ | 16.500 | $ | 16.250 | ||||||

| Close | $ | 19.800 | $ | 18.625 | $ | 18.375 | $ | 18.313 | $ | 20.500 | ||||||

| Average number of shares outstanding | 5,367,433 | 5,249,439 | 5,144,449 | 5,060,328 | 4,972,086 | |||||||||||

| Shares outstanding at year-end | 5,424,962 | 5,297,443 | 5,186,546 | 5,093,788 | 5,004,078 | |||||||||||

| Registered common shareholders | 2,171 | 2,166 | 2,212 | 2,271 | 2,178 | |||||||||||

| Cash dividends declared per share | $ | 1.10 | $ | 1.07 | $ | 1.03 | $ | 1.00 | $ | 0.97 | ||||||

Dividend yield (annualized) (2) | 5.6 | % | 5.8 | % | 5.7 | % | 5.5 | % | 4.7 | % | ||||||

Payout ratio from continuing operations (1) (4) | 80.3 | % | 73.3 | % | 63.2 | % | 95.2 | % | 82.9 | % | ||||||

Additional Data | ||||||||||||||||

| Customers | ||||||||||||||||

| Natural gas distribution and transmission | 42,741 | 40,854 | 39,029 | 37,128 | 35,797 | |||||||||||

| Propane distribution | 35,530 | 32,117 | 35,267 | 34,113 | 33,123 | |||||||||||

| Volumes | ||||||||||||||||

| Natural gas distribution and transmission deliveries (in MMCF) | 27,264 | 30,830 | 27,383 | 21,400 | 23,297 | |||||||||||

| Propane distribution (in thousands of gallons) | 23,080 | 28,469 | 27,788 | 25,979 | 26,682 | |||||||||||

| Heating degree-days (Delmarva Peninsula) | ||||||||||||||||

| Actual HDD | 4,368 | 4,730 | 4,082 | 3,704 | 4,430 | |||||||||||

| 10 -year average HDD (normal) | 4,446 | 4,356 | 4,409 | 4,493 | 4,574 | |||||||||||

| Propane bulk storage capacity (in thousands of gallons) | 1,958 | 1,928 | 1,926 | 1,890 | 1,866 | |||||||||||

Total employees (1) | 458 | 471 | 466 | 431 | 397 | |||||||||||

(1) These amounts exclude the results of water services due to their reclassification to discontinued operations. The assets of all of the water businesses were sold in 2004 and 2003. | ||||||||||||||||

(2) Dividend yield (annualized) is calculated by multiplying the fourth quarter dividend by four (4), then dividing that amount by the closing common stock price at December 31. | ||||||||||||||||

(3) SFAS 123R and SFAS 158 were adopted in the year 2006; therefore, they were not applicable for the years prior to 2006. | ||||||||||||||||

(4) The payout ratio from continuing operations is calculated by dividing cash dividends declared per share (for the year) by basic earnings per share from continuing operations. | ||||||||||||||||

- Page 19 -

Management's Discussion and Analysis

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

INTRODUCTION

This section provides management’s discussion of Chesapeake Utilities Corporation and its consolidated subsidiaries with specific information on results of operations and liquidity and capital resources. It includes management’s interpretation of our financial results, the factors affecting these results, the major factors expected to affect future operating results and future investment and financing plans. This discussion should be read in conjunction with our consolidated financial statements and notes thereto.

Several factors exist that could influence our future financial performance, some of which are described in Item 1A above, “Risk Factors”. They should be considered in connection with evaluating forward-looking statements contained in this report or otherwise made by or on behalf of us since these factors could cause actual results and conditions to differ materially from those set out in such forward-looking statements.

EXECUTIVE OVERVIEW

Exec

Chesapeake is a diversified utility company engaged directly or through subsidiaries in natural gas distribution, transmission and marketing, propane distribution and wholesale marketing, advanced information services and other related businesses.

The Company’s strategy is focused on growing earnings from a stable utility foundation and investing in related businesses and services that provide opportunities for returns greater than traditional utility returns. The key elements of this strategy include:

| · | Executing a capital investment program in pursuit of organic growth opportunities that generate returns equal to or greater than our cost of capital. |

| · | Expanding the natural gas distribution and transmission business through expansion into new geographic areas in our current service territories. |

| · | Expanding the propane distribution business in existing and new markets through leveraging our community gas system services and our bulk delivery capabilities. |

| · | Utilizing the Company’s expertise across our various businesses to improve overall performance. |

| · | Enhancing marketing channels to attract new customers and providing reliable and responsive customer service to retain existing customers. |

| · | Maintaining a capital structure that enables the Company to access capital as needed. |

| · | Maintaining a consistent and competitive dividend. |

In 2006, the Company earned $10,507,000 in net income, or $1.72 per share (diluted), in spite of weather that was the second warmest in the last thirty years. In 2005, net income was $10,468,000, or $1.77 per diluted share. Overall, operating income in 2006 increased $1,401,000, or 6.5 percent from 2005, despite weather that was 18 percent warmer than in 2005. However, the increase in operating income was offset by a decline of $194,000, or 51 percent, in other income, net of other expenses, and increases in interest expense of $644,000, or 12.5 percent, and income taxes of $525,000, or 8.3 percent. The net result was that net income was up by only $39,000, or 0.4 percent.

The following discussions and those later in the document on operating income and segment results include use of the term “gross margin.” Gross margin is determined by deducting the cost of sales from operating revenue. Cost of sales includes the purchased gas cost for natural gas and propane and the cost of labor spent on direct revenue-producing activities. Gross margin should not be considered an alternative to operating income or net income, which are determined in accordance with Generally Accepted Accounting Principles (“GAAP”). Chesapeake believes that gross margin, although a non-GAAP measure, is useful and meaningful to investors as a basis for making investment decisions. It provides investors with information that demonstrates the profitability achieved by the Company under its allowed rates for regulated operations and under its competitive pricing structure for non-regulated segments. Chesapeake’s management uses gross margin in measuring its business units’ performance and has historically analyzed and reported gross margin information publicly. Other companies may calculate gross margin in a different manner.

- Page 20 -

Management's Discussion and Analysis

Operating Income

The year 2006 reflects the strong year-over-year operating income growth experienced by the Company’s natural gas operations of $2,497,000, or 14.5 percent. This growth was offset by reductions in operating income from propane and advanced information services. In 2006, both natural gas and propane segments were negatively impacted by weather that was 18 percent warmer than in 2005. The Company estimates that the warmer weather reduced gross margin by $3.4 million in 2006. The natural gas segment was able to overcome the weather impact and show an increase in operating income due to its growth and cost containment efforts. However, as the propane segment is more weather sensitive and is not experiencing the high level of growth of our natural gas segment, its operating income declined when compared to 2005.

Advanced information services experienced a decrease in operating income in 2006 as compared to the prior year due in part to the gain on the sale of Lightweight Association Management Processing System (“LAMPSTM”) during the fourth quarter of 2005. The LAMPS product was internally developed software that was developed and marketed specifically for REALTOR® Associations.

Key financial and operational highlights for fiscal year 2006 include the following:

| · | Customer growth in the natural gas and propane businesses remained strong, with the Delmarva and Florida natural gas distribution operations registering 9 and 8 percent increases in residential customers, respectively; and the Delmarva Community Gas Systems (“CGS”) generating a 34 percent increase in propane distribution customers. |

| · | In June 2006, Eastern Shore Natural Gas announced that it had received approval from the Federal Energy Regulatory Commission (“FERC”) to expand its pipeline system in the years 2006, 2007 and 2008. The entire project represents an investment of $33.6 million, with expected annualized revenue of $6.7 million after the full build-out of the facilities. |