Item 10. Recent Sales of Unregistered Securities

Private Placement Offering

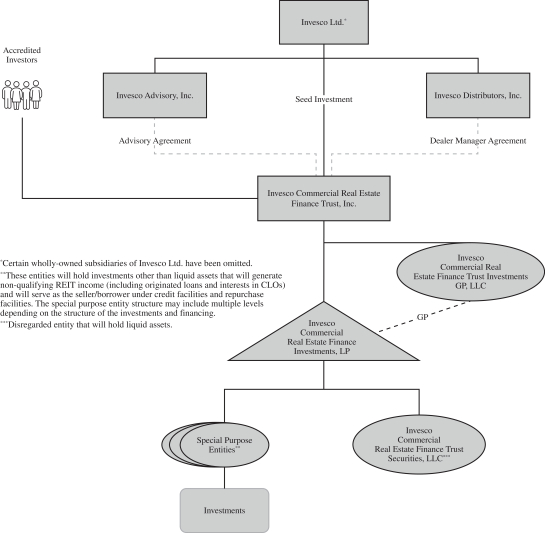

We are engaging in a continuous, unlimited private placement offering, which we refer to as the Continuous Offering, of our common stock to “accredited investors” (as defined in Rule 501 promulgated pursuant to the Securities Act) (the “Continuous Offering”), made pursuant to exemptions provided by Section 4(a)(2) of the Securities Act and applicable state securities laws. The Continuous Offering is pursuant to a confidential private placement memorandum dated May 8, 2023, as supplemented to date.

As of the date of the Registration Statement, there have been no purchases under the Continuous Offering.

Subscription Agreement

We entered into the Invesco Subscription Agreement with Invesco Realty, Inc. on March 23, 2023. Under the Invesco Subscription Agreement, Invesco Realty, Inc. agreed to purchase an aggregate of $150 million of Class D Shares, Class I Shares, Class S Shares and Class E Shares in one or more closings on or prior to March 23, 2028.

The aggregate offering proceeds to date from the Invesco Subscription Agreement is $40,000 from the sale of approximately 400 Shares each of Class S, Class D, Class I and Class E purchased on May 2, 2023, made in a private offering pursuant to Section 4(a)(2) of the Securities Act and applicable state securities laws.

The Stapled Units Offering

We entered into an Engagement Letter with REIT Investment Group, LLC (“RIG”) and a Selling Agreement with RIG’s affiliate, Iroquois Capital Advisors, LLC, to offer and sell Stapled Units to “accredited investors.” A “Stapled Unit” means a unit consisting of one share of each of the Series A Preferred Stock, Class D Share, Class I Share and Class S Share.

On June 15, 2013, we issued 111 Stapled Units, at a price of $1,075 per unit, in an unregistered private offering under Section 4(A)(2) of the Securities Act and Rule 506(b) of Regulation D promulgated by the SEC under the Securities Act.

The aggregate offering proceeds of the Stapled Units offering is approximately $119,000 and we have received net offering proceeds of approximately $107,000 after issuance costs.

Item 11. Description of Registrant’s Securities to Be Registered

Under our Charter, we have authority to issue a total of 2,050,000,000 Shares. Of the total Shares authorized, 2,000,000,000 Shares are classified as common stock with a par value of $0.01 per share, 500,000,000 of which are classified as Class S Shares, 500,000,000 of which are classified as Class D Shares, 500,000,000 of which are classified as Class I Shares and 500,000,000 of which are classified as Class E Shares, and 50,000,000 Shares are classified as preferred stock with a par value of $0.01 per share. In addition, the Board may amend our Charter from time to time, without stockholder approval, to increase or decrease the aggregate number of Shares or the number of Shares of any Class or series that we have authority to issue.

Common Stock

Subject to the restrictions on ownership and transfer of stock set forth in our Charter and except as may otherwise be specified in our Charter, the holders of Common Shares are entitled to one vote per share on all matters upon which stockholders are entitled to vote pursuant to our Charter and applicable law, including election of our directors. The holders of Common Shares vote together as a single Class on all actions to be taken

98