Item 11. Description of Registrant’s Securities to Be Registered

Under our Charter, we have authority to issue a total of 3,050,000,000 Shares. Of the total Shares authorized, 3,000,000,00 Shares are classified as common stock with a par value of $0.01 per share, 500,000,000 of which are classified as Class S Shares, 500,000,000 of which are classified as Class S-1 Shares, 500,000,000 of which are classified as Class D Shares, 500,000,000 of which are classified as Class I Shares and 500,000,000 of which are classified as Class E Shares, and 50,000,000 Shares are classified as preferred stock with a par value of $0.01 per share. In addition, the Board may amend our Charter from time to time, without stockholder approval, to increase or decrease the aggregate number of Shares or the number of Shares of any Class or series that we have authority to issue.

Common Stock

Subject to the restrictions on ownership and transfer of stock set forth in our Charter and except as may otherwise be specified in our Charter, the holders of Common Shares are entitled to one vote per share on all matters upon which stockholders are entitled to vote pursuant to our Charter and applicable law, including election of our directors. The holders of Common Shares vote together as a single Class on all actions to be taken by the stockholders; provided, however, that with respect to (1) any amendment of our Charter that would materially and adversely affect the rights, preferences and privileges of only a particular Class of common stock, (2) any matter submitted to stockholders that relates solely to a particular Class of common stock or (3) any matter submitted to stockholders in which the interests of a particular Class of common stock differs from the interests of all other Classes of common stock, only the affirmative vote of the holders of a majority of such affected Class of common stock, with no other Class of common stock voting except such affected Class of common stock voting as a separate Class, will be required.

Our Charter does not provide for cumulative voting in the election of our directors. Therefore, the holders of a majority of the outstanding Common Shares can elect our entire Board. Subject to any preferential rights of any outstanding Class or series of Shares and to the provisions in our Charter regarding the restriction on ownership and transfer of Shares, the holders of Shares are entitled to such distributions as may be authorized from time to time by the Board and declared by us out of legally available funds and, upon liquidation, are entitled to receive all assets available for distribution to our stockholders. Holders of Common Shares will not have preemptive rights, meaning that our stockholders will not have an automatic option to purchase any new Shares that we issue.

Our Charter also contains a provision permitting the Board, without any action by our stockholders, to classify or reclassify any unissued Shares into one or more Classes or series by setting or changing the preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends and other distributions, qualifications and terms or conditions of redemption of any new Class or series of shares.

We will not issue certificates for our shares. Shares will be held in “uncertificated” form, which will eliminate the physical handling and safekeeping responsibilities inherent in owning transferable stock certificates and eliminate the need to return a duly executed stock certificate to effect a transfer. SS&C GIDS, Inc. acts as our registrar and as the transfer agent for our Common Shares. Transfers can be effected by mailing to our transfer agent a transfer and assignment form, which we will provide to our stockholders at no charge upon written request.

Class S, S-1, D, I and E Shares

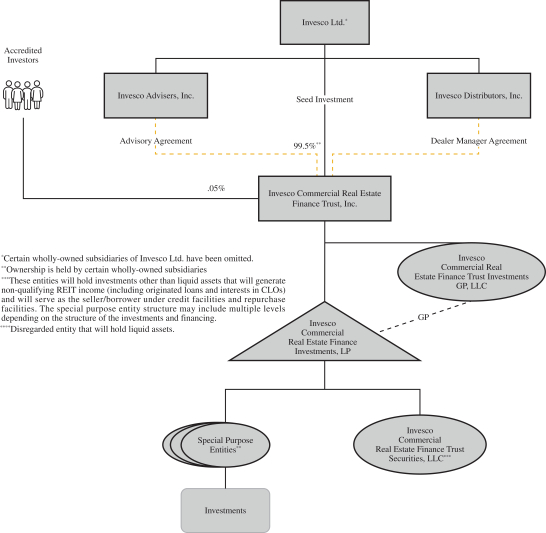

We currently offer Class S, Class D, Class I and Class E Shares via the Continuous Offering to “accredited investors” (as defined in Rule 501 promulgated pursuant to the Securities Act), for an indefinite period. Shares issued in any other offerings may have class-specific changes and different management fees than the Shares sold in the Continuous Offering.

The differences among the Classes of common stock relate to upfront selling commissions and ongoing stockholder servicing fees, as well as management and performance fees. No upfront selling commissions, dealer

109