As filed with the U.S. Securities and Exchange Commission on February 3, 2025.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BBB Foods Inc.

(Exact Name of Registrant as Specified in its Charter)

British Virgin Islands (State or Other Jurisdiction of Incorporation or Organization) | 5411 (Primary Standard Industrial Classification Code Number) | N/A (I.R.S. Employer Identification No.) |

Av. Presidente Masaryk 8

Polanco V Sección, Miguel Hidalgo

Mexico City, Mexico 11560

+52 (55) 1102-1200

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Cogency Global Inc.

122 East 42nd Street, 18th floor

New York, NY 10168

+1 (212) 947-7200

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

Copies to:

S. Todd Crider Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 + 1 (212) 455-2000 | Jorge U. Juantorena Manuel Silva Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 +1 (212) 225-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the U.S. Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We and the selling shareholders may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 3, 2025

PRELIMINARY PROSPECTUS

17,500,000 Class A common shares

BBB Foods Inc.

(incorporated in the British Virgin Islands)

The selling shareholders identified in this prospectus are offering 17,500,000 Class A common shares of BBB Foods Inc., consisting of (i) 15,500,000 Class A common shares issuable upon conversion of 15,500,000 Class C common shares held by existing holders of our Class C common shares and (ii) 2,000,000 Class A common shares issuable upon conversion of 2,000,000 Class C common shares acquired upon the net exercise of stock options under our 2004 Option Plan (the “Exercised Stock Options”). We will not receive any proceeds from the sale of Class A common shares by the selling shareholders.

Our Class A common shares are listed and trade on the New York Stock Exchange under the symbol “TBBB.” On January 31, 2025, the last reported sale price of our Class A common shares on the New York Stock Exchange was US$31.02. The public offering price will be determined through negotiations among us, the selling shareholders and the lead underwriters in this offering and therefore the recent market price used throughout this prospectus may not be indicative of the public offering price.

We have three classes of common shares: Class A common shares, Class B common shares and Class C common shares. The rights of the holders of each class of our common shares are identical, except with respect to voting, conversion, preemptive rights and transfer restrictions applicable to the Class B common shares and conversion and transfer restrictions applicable to our Class C common shares. Each Class A common share is entitled to one vote. Each Class B common share is entitled to 15 votes and is convertible into one Class A common share automatically upon transfer, subject to certain exceptions. Each Class C common share is entitled to one vote and is convertible into one Class A common share in certain circumstances, including automatically upon certain transfers and the expiry of the transfer restrictions that apply to the Class C common shares. Class B common shares and Class C common shares are not listed on any stock exchange and are not publicly traded. Holders of Class A common shares, Class B common shares and Class C common shares vote together as a single class on all matters unless otherwise required by law and subject to certain exceptions set forth in our memorandum and articles of association.

Following this offering, our issued and outstanding Class B common shares, will represent 41.7% of the combined voting power of our outstanding common shares and 4.6% of our total equity ownership, assuming no exercise of the underwriters’ option to purchase additional Class A common shares from the selling shareholders. For further information, see “Description of Share Capital.” Prior to this offering, Bolton Partners Ltd., a vehicle affiliated with our founder, Chairman and Chief Executive Officer, owned, directly or indirectly, all of our Class B common shares and a portion of our Class C common shares. As a result, Bolton Partners Ltd. beneficially owned approximately 46.4% of the combined voting power of our outstanding common shares prior to this offering, and will beneficially own approximately 44.9% of the combined voting power of our outstanding common shares following this offering, assuming no exercise of the underwirters' option to purchase additional Class A common shares from the selling shareholders, and therefore has significant influence over matters requiring shareholder approval.

We are a “foreign private issuer” under the U.S. federal securities laws and, as a result, have elected to comply with certain reduced public company disclosure and reporting requirements. See “Risk Factors—Risks Relating to this Offering and Our Class A Common Shares—Our status as a foreign private issuer exempts us from certain of the corporate governance standards of the New York Stock Exchange, limiting the protections afforded to investors” and “Risk Factors—Risks Relating to this Offering and Our Class A Common Shares—As a foreign private issuer, we have different disclosure and other requirements from U.S. domestic registrants. We may take advantage of exemptions from certain corporate governance regulations of the New York Stock Exchange, and this may result in less protection for the holders of our Class A common shares.”

Investing in our Class A common shares involves a high degree of risk. See “Risk Factors” beginning on page 26 of this prospectus.

|

| Per Class A |

| Total | ||

Public offering price |

| US$ |

|

| US$ |

|

Underwriting discount and commissions(1) |

| US$ |

|

| US$ |

|

Proceeds to the selling shareholders (before expenses)(2) (3) |

| US$ |

|

| US$ |

|

The selling shareholders have granted the underwriters the right to purchase up to an aggregate of 2,625,000 additional Class A common shares from the selling shareholders within 30 days from the date of this prospectus, at the public offering price, less underwriting discounts and commissions. We will not receive any proceeds from the sale of Class A common shares by the selling shareholders.

Neither the U.S. Securities and Exchange Commission (the “SEC”), nor any state securities commission has approved or disapproved of these securities or determined if this prospectus, including the documents incorporated by reference into this prospectus, is truthful or complete. Any representation to the contrary is a criminal offense.

We expect to deliver the Class A common shares to purchasers against payment in New York, New York, on or about , 2025, through the book-entry facilities of The Depository Trust Company.

| Global Coordinators |

| |

|

|

| |

|

|

| |

J.P. Morgan |

| Morgan Stanley | |

|

| ||

| Joint Bookrunners |

| |

|

|

|

|

|

|

| |

BTG Pactual | Santander | Scotiabank | |

|

| ||

The date of this prospectus is , 2025. | |||

Tiendas 3B

We are the pioneers and leaders of hard discount grocery retail in Mexico. Our name, 3B means: “Bueno, Bonito y Barato” or “Good, Nice and Affordable”. It summarizes our mission of offering irresistible value to budget savvy consumers.

Simple, yet disruptive business model that drives customer savings and improves our value proposition.

We have absolute confidence in our product quality, backed up by our no-questions-asked no-receipt-needed money-back return policy.

Private label products are core to our strategy. High-quality and low prices enhance our customers’ value for money and allow us to maintain everyday low prices.

Our 2,772 stores are strategically located close to our customers’ homes to provide a more efficient and cost-effective shopping experience.

TABLE OF CONTENTS

|

| Page |

| iii | |

| 1 | |

| 28 | |

| 53 | |

| 55 | |

| 56 | |

| 57 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

| 58 |

| 76 | |

| 109 | |

| 119 | |

| 122 | |

| 126 | |

| 128 | |

| 144 | |

| 146 | |

| 150 | |

| 163 | |

| 163 | |

| 163 | |

| 164 | |

| 165 | |

| 166 | |

| F-1 |

None of we, the selling shareholders, the underwriters, nor any of our or their respective agents have authorized anyone to give any information or make any representation about this offering that is different from, or in addition to that contained in this prospectus, including in the documents incorporated by reference in this prospectus, the related registration statement, any free writing prospectus prepared by or on behalf of us or we may refer to you. None of we, the selling shareholders, the underwriters, nor any of our or their respective agents will have or take responsibility and can provide no assurance as to the reliability of any other information that others may give you.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the SEC before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

This prospectus is being used in connection with this offering of the Class A common shares in the United States and, to the extent described below, elsewhere. This offering is being made in the United States and elsewhere based solely on the information contained in this prospectus, including the documents incorporated by reference into this prospectus. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Class A common shares. Our business, financial condition, results of operations, cash flows and prospects may have changed since the date on the front cover of this prospectus.

None of we, the selling shareholders, the underwriters, nor any of our or their respective agents are offering or seeking offers to purchase the Class A common shares in any jurisdiction where such offers or sales are not permitted. We have not undertaken any efforts to qualify this offering for offers and sales to the public in any

i

jurisdiction outside the United States, and we do not expect to make offers and sales to the public in jurisdictions located outside the United States (including Mexico). However, we may make offers and sales outside the United States in circumstances that do not constitute a public offer or distribution under applicable laws and regulations.

This offering is being made in the United States and elsewhere based solely on the information contained or incorporated by reference in this prospectus.

Notice to Investors Outside the United States. None of we, the selling shareholders, the underwriters, nor any of our or their respective agents have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus in connection with this offering in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus or any such free writing prospectus must inform themselves about, and observe any restrictions relating to, this offering of our Class A common shares and the distribution of this prospectus and any such free writing prospectus outside the United States.

Notice to Mexican Investors. The Class A common shares have not been and will not be registered with the Mexican National Securities Registry (Registro Nacional de Valores, or the “RNV”) maintained by the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, or the “CNBV”), and therefore, the Class A common shares may not be offered or sold publicly in Mexico or otherwise be subject to brokerage activities in Mexico, the Class A common shares may be offered and sold in Mexico, on a private placement basis, solely to investors that qualify as institutional or qualified investors pursuant to the private placement exemption set forth in Article 8 of the Mexican Securities Market Law (Ley del Mercado de Valores) and regulations thereunder. The information contained or incorporated by reference in this prospectus is solely our responsibility and has not been reviewed or authorized by the CNBV and may not be publicly distributed in Mexico. In making an investment decision, all investors, including any Mexican investor, who may acquire Class A common shares from time to time, must rely on their own examination of the Issuer and the terms of this offering, including the merits and risks involved.

ii

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Certain Definitions

Unless the context otherwise requires, references in this prospectus to “Tiendas 3B,” the “Company,” “we,” “our,” “us” and similar terms are to BBB Foods Inc., together with its consolidated subsidiaries; references to the “Issuer” are to BBB Foods Inc., the company whose Class A common shares are being offered by this prospectus, and not to any of its subsidiaries; references to our “principal shareholder” are to Bolton Partners Ltd., a vehicle affiliated with Mr. K. Anthony Hatoum, our founder, Chairman and Chief Executive Officer; and references to the “selling shareholders” are to those shareholders listed as selling shareholders under “Selling Shareholders.”

The term “Companies Act” refers to the BVI Business Companies Act, 2004 (as amended) of the British Virgin Islands.

The term “sales” refers to our Revenue from sales of merchandise.

Currency Information

The term “Mexican peso” and the symbol “Ps.” refer to the legal currency of Mexico, and the term “U.S. dollar” and the symbol “US$” refer to the legal currency of the United States.

This prospectus contains translations of certain Mexican peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. These translations should not be construed as representations that the Mexican peso amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated as of the dates mentioned herein or at any other rate. Unless otherwise indicated, we have translated Mexican peso amounts into U.S. dollars at the rate of Ps.19.629 per US$1.00, the exchange rate to pay foreign currency denominated obligations due on September 30, 2024 published by the Mexican Central Bank in the Mexican Federal Official Gazette (Diario Oficial de la Federación, or the “Official Gazette”). In addition, we have translated the U.S. dollar amounts outstanding on the Promissory Notes and the Convertible Notes (described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Promissory Notes and Convertible Notes”) as of December 31, 2023 into Mexican pesos at the rate of Ps.16.89 per US$1.00 (the exchange rate to pay foreign currency denominated obligations due on December 31, 2023, published by the Mexican Central Bank in the Official Gazette).

Financial Statement Presentation

The Issuer, the company whose Class A common shares are being offered in this prospectus, was incorporated on July 9, 2004 in the British Virgin Islands with company number 605635.

The financial information presented or incorporated by reference herein has been derived from our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021, together with the notes thereto, and our unaudited interim condensed consolidated financial statements as of September 30, 2024 and for the three and nine months ended September 30, 2024 and 2023, together with the notes thereto, prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), and included elsewhere in this prospectus.

The summary consolidated historical financial data should be read in conjunction with “Special Note Regarding Non-IFRS Financial Measures,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021, together with the notes thereto, incorporated by reference in this prospectus, and our unaudited interim condensed consolidated financial statements as of September 30, 2024 and for the three and nine months ended September 30, 2024 and 2023, together with the notes thereto, included elsewhere in this prospectus.

iii

Special Note Regarding Non-IFRS Financial Measures

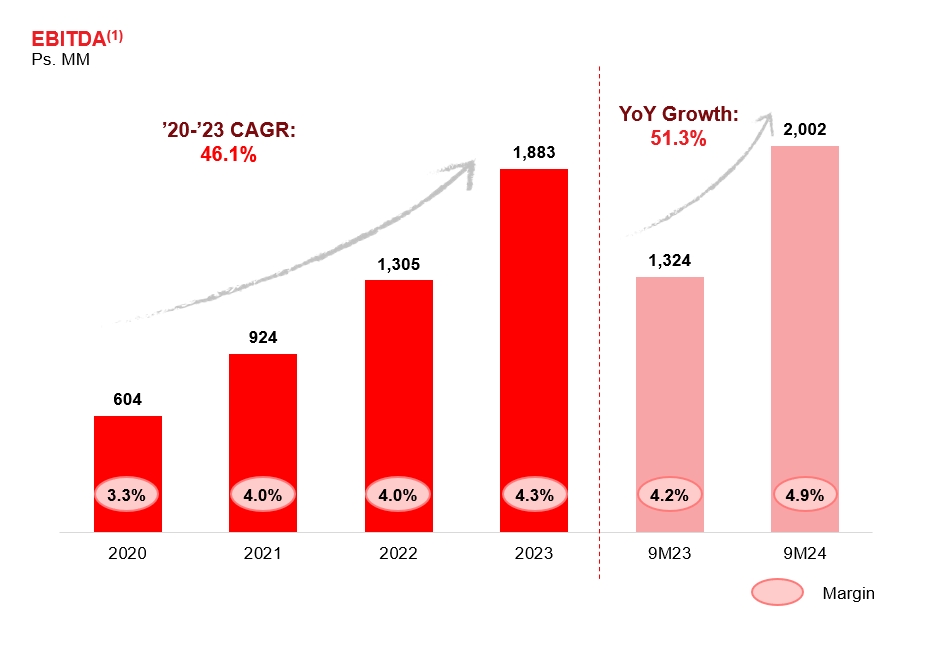

For convenience of investors, this prospectus presents certain non-IFRS financial measures, which are not recognized under IFRS. A non-IFRS financial measure is generally defined as one that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure. Specifically we present:

For a discussion on the use of these measures and a reconciliation of the most directly comparable IFRS measures, see “Summary Financial and Other Information —Non-IFRS Financial Measures and Key Operating Metrics—Non-IFRS Financial Measures.”

Non-IFRS financial measures do not have standardized meanings and may not be directly comparable to similarly-titled measures adopted by other companies. These non-IFRS financial measures are used by our management for decision-making purposes and to assess our financial and operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. The non-IFRS measures presented have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results of operations presented in accordance with IFRS. Additionally, our calculations of non-IFRS measures may be different from the calculations used by other companies, including our competitors, and therefore, our measures may not be comparable to those of other companies.

Rounding Adjustments

We have made rounding adjustments to certain numbers presented in this prospectus. As a result, numerical figures presented as totals may not always be the exact arithmetic results of their components. Percentage figures included in this prospectus have not, in all cases, been calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding. For this reason, certain percentage amounts in this prospectus may vary from those obtained by performing the same calculations using the figures in our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021, together with the notes thereto, incorporated by reference in this prospectus, and our unaudited interim condensed consolidated financial statements as of September 30, 2024 and for the three and nine months ended September 30, 2024 and 2023, together with the notes thereto, included elsewhere or incorporated by reference in this prospectus.

Market and Industry Data

This prospectus contains data related to economic conditions in the market in which we operate. The information contained in this prospectus concerning economic conditions is based on publicly available information from third-party sources that we believe to be reliable. Market data and certain industry forecast data used in this prospectus were derived from our management’s knowledge and our experience in the industry, internal reports and studies, where appropriate, as well as estimates, market research, publicly available information and industry publications. We obtained the information included in this prospectus relating to the industry in which we operate, as well as the estimates concerning market shares, through internal research, public information and publications on the industry prepared by official public sources, such as: the Mexican Central Bank (Banco de México), the World Bank, the National Minimum Wage Commission (Comisión Nacional de Salarios Mínimos), the Mexican Statistic and National Geography Institute (Instituto Nacional de Estadística y Geografía, or “INEGI”), the Central Intelligence Agency World Factbook, Euromonitor International Passport: Retail, 2024 edition, and NielsenIQ México Services.

Industry publications, governmental publications, and other market sources, including those referred to above, generally state that the information they include has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have no reason to believe any of this information or these reports are inaccurate in any material respect and believe and act as if they are reliable. Neither we, the underwriters, nor their respective agents have independently verified it and they are subject to change based on various factors, including those discussed in the section entitled “Risk Factors.” Estimates of market and industry

iv

data are based on statistical models, key assumptions and limited data sampling, and actual market and industry data may differ significantly from estimated industry data. In addition, the data that we compile internally, and our estimates have not been verified by an independent source. Information derived from management’s knowledge and our experience is presented on a reasonable, good faith basis. Except as disclosed in this prospectus, none of the publications, reports or other published industry sources referred to in this prospectus were commissioned by us or prepared at our request. Except as disclosed in this prospectus, we have not sought or obtained the consent of any of these sources to include such market data in this prospectus.

Information in this prospectus mentioning “Euromonitor” as a source is from independent market research carried out by Euromonitor International Limited but should not be relied upon in making, or refraining from making, any investment decision. All figures related to the development of the grocery retail industry in Mexico presented in this prospectus that are sourced from Euromonitor have been quoted from Euromonitor International, Retail, 2024 edition. Unless otherwise stated, all value data citations are in retail selling prices to consumers, excluding value added tax, in U.S. dollars, at year-on-year exchange rates and at current prices for the year.

Trademarks and Trade Names

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos, and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

v

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus. This summary may not contain all the information that may be important or relevant to you in making your investment decision. Before you decide to invest in our Class A common shares, we urge you to read this entire prospectus and the documents incorporated by reference in this prospectus carefully, including our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021, together with the notes thereto, and our unaudited interim condensed consolidated financial statements as of September 30, 2024 and for the three and nine months ended September 30, 2024 and 2023, together with the notes thereto, included elsewhere in or incorporated by reference in this prospectus and the information set forth under “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Overview

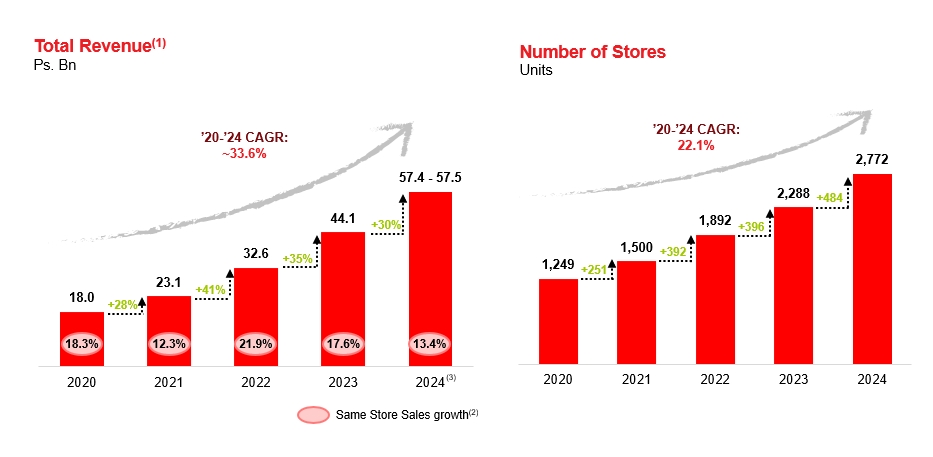

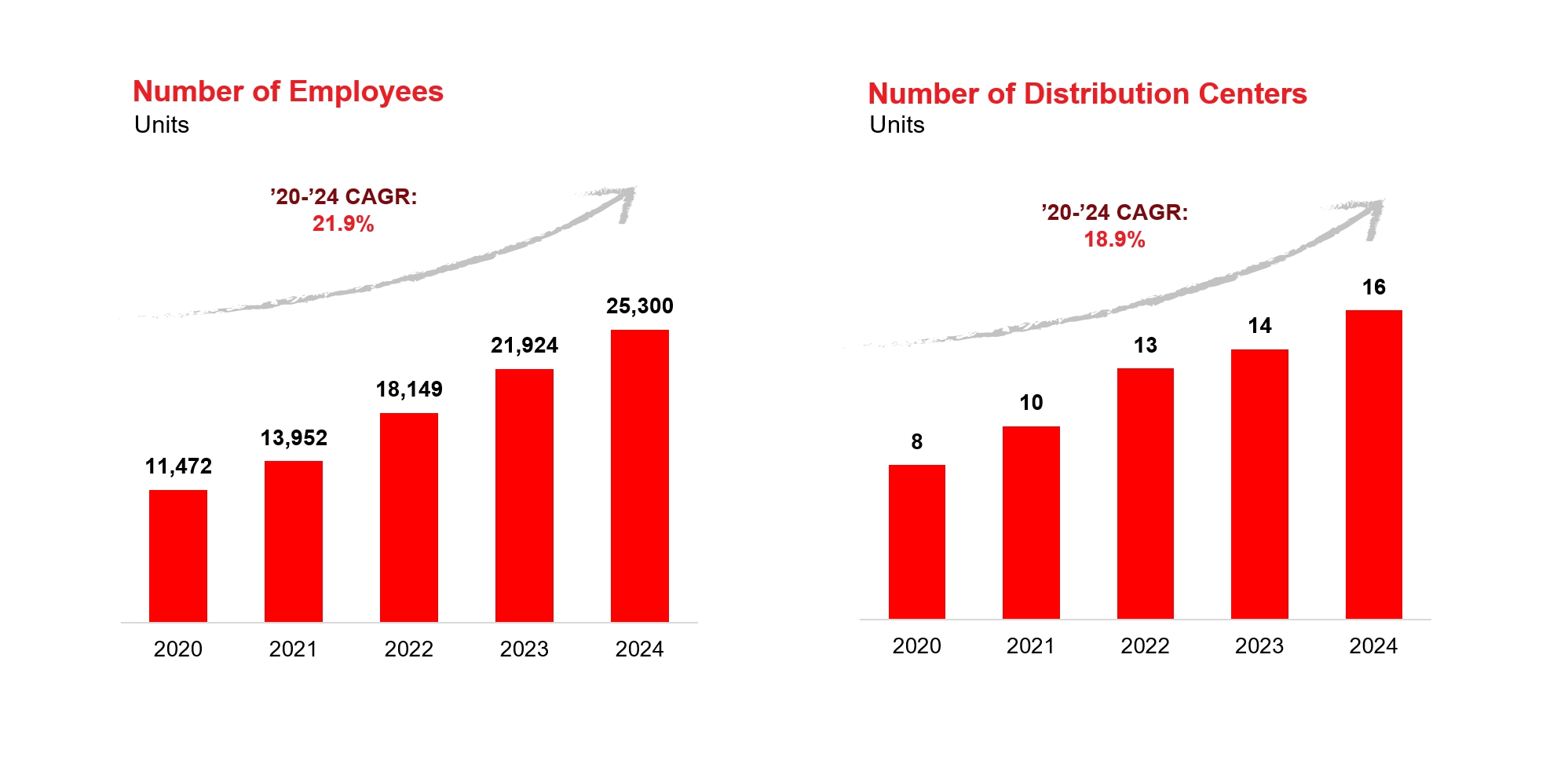

We are pioneers and leaders of the grocery hard discount model in Mexico and one of the fastest growing retailers in the country as measured by our sales and store growth rates. The 3B name, which references “Bueno, Bonito y Barato” – a Mexican saying which translates to “Good, Nice and Affordable”– summarizes our mission of offering irresistible value to budget savvy consumers through great quality products at bargain prices. From 2020 to 2023, our total revenue grew at a compounded annual growth rate (“CAGR”) of 34.7%, reaching Ps.44.1 billion (US$2.2 billion) for 2023, and our number of stores increased from 1,249 as of year-end 2020 to 2,772 as of year-end 2024, which represents a CAGR of 22.1%. Our total revenue for the 12-month period ended September 30, 2024 was Ps.53.4 billion (US$2.7 billion), with a total of 2,772 stores in operation as of December 31, 2024.

Our business model is simple yet disruptive: we offer a limited assortment of products that cover the daily grocery needs of our clients. We price our products to offer what is generally market-leading value for money: the lowest sustainable price in the market for a given quality. Our stores also offer convenience, since they are generally located within central neighborhoods that allow for daily visits and minimize transportation needs for our customers. Our customers visit us on average three to four times per week to fulfill one or two days of groceries.

The Tiendas 3B product range consists of approximately 800 stock keeping units (“SKUs”) of branded, private label and spot products.

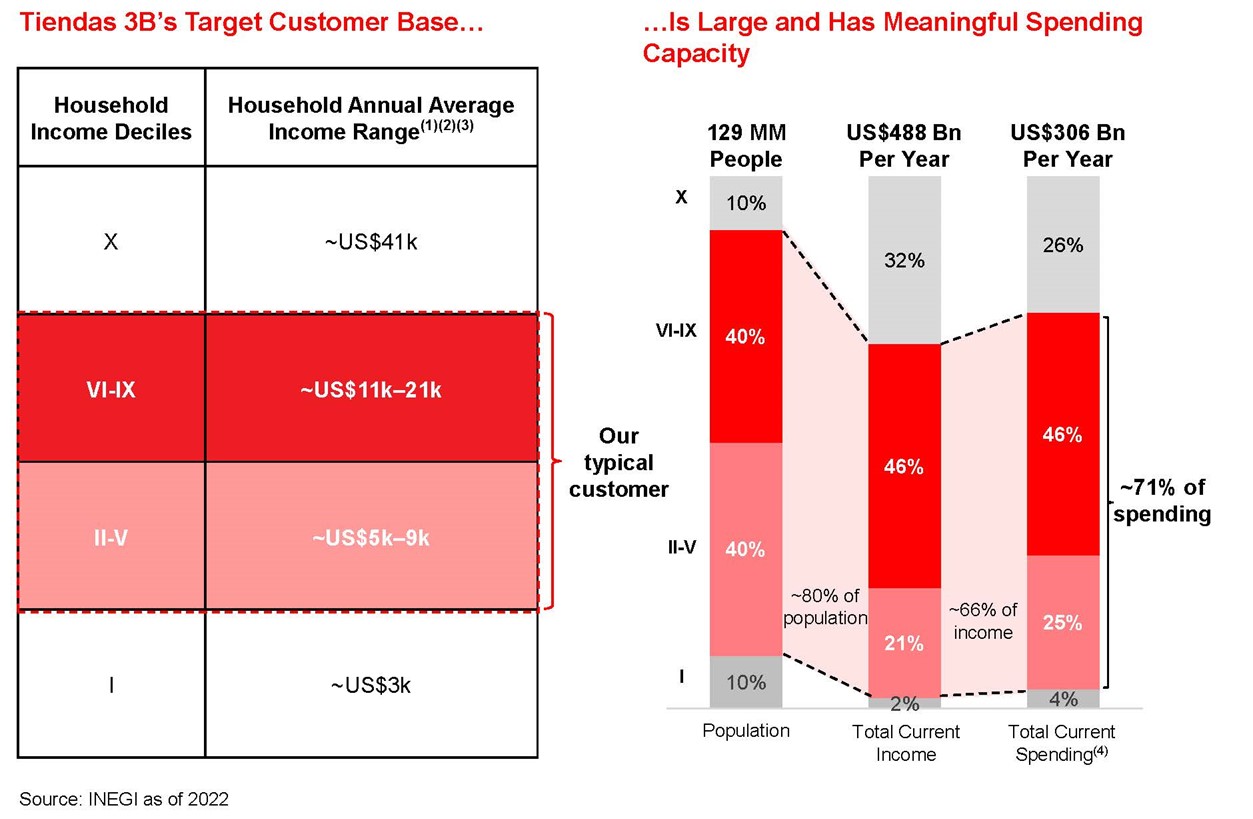

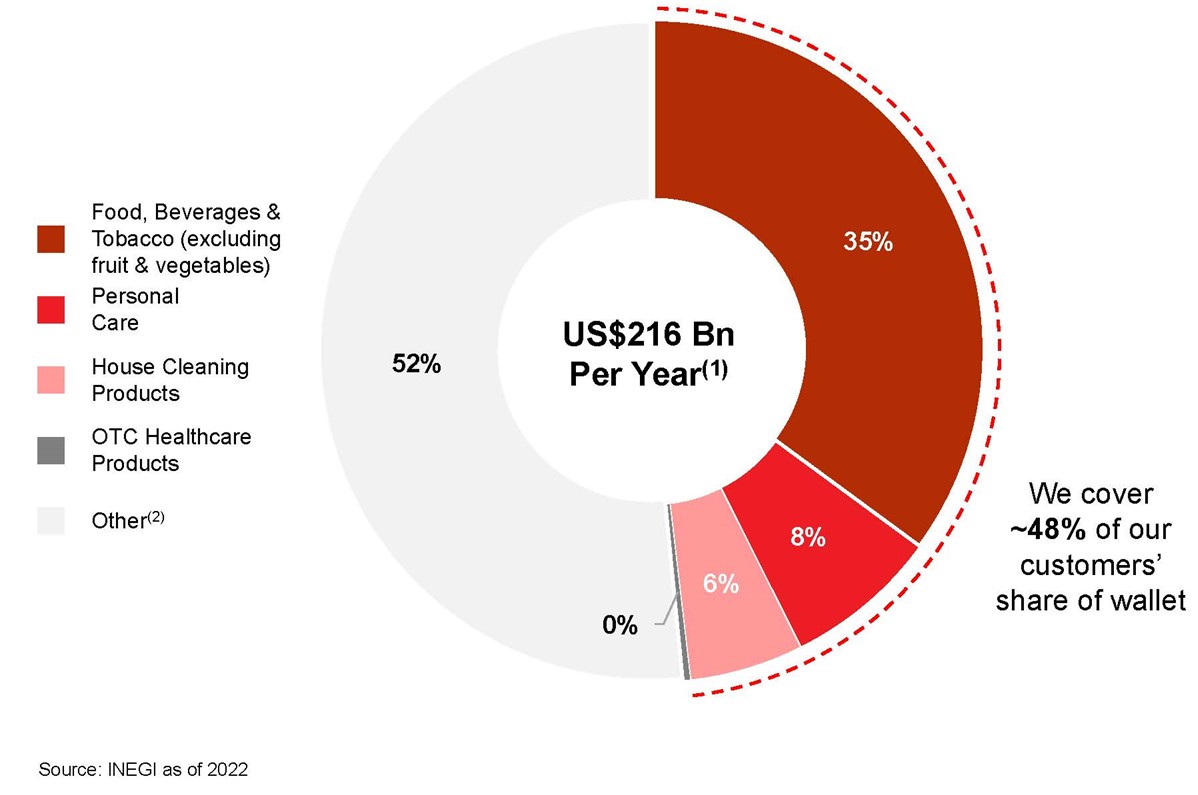

Our stores serve low-to-middle income households, which according to the National Survey of Household Income and Expenditure conducted by INEGI in 2022, spent US$216 billion in 2022, or 70.7% of the Mexican population’s total current monetary spend, defined by INEGI as a households’ expenditure on food, beverages and tobacco, personal care, house cleaning products and over the counter healthcare products, among other categories other than rent and financial expenditures. We believe that our business model, which focuses on both value and convenience, allows us to serve our target market better than incumbent competitors and maintain real and sustainable competitive advantages.

Due to our low number of SKUs and focus on serving daily grocery needs, we have been able to achieve a high ratio of sales per SKU and a ratio of 3.1 Payable Days to Inventory Days during 2023, driving significant cash

1

flow generation. We are also able to benefit from a virtuous cycle, where the ever-increasing scale of our purchases per SKU allows us to negotiate increasingly lower prices with our suppliers and, in turn, we are able to transfer those savings to our customers, therefore increasing customer loyalty and our sales.

The Tiendas 3B business model is highly efficient, allowing us to operate with gross margins that are lower than those of leading grocery retailers in Mexico, based on publicly available information. The strength of our model is underpinned by our limited product assortment, our decentralized organization, and our culture that values efficiency and simplicity. Efficiency translates into savings that can be passed on to our customers.

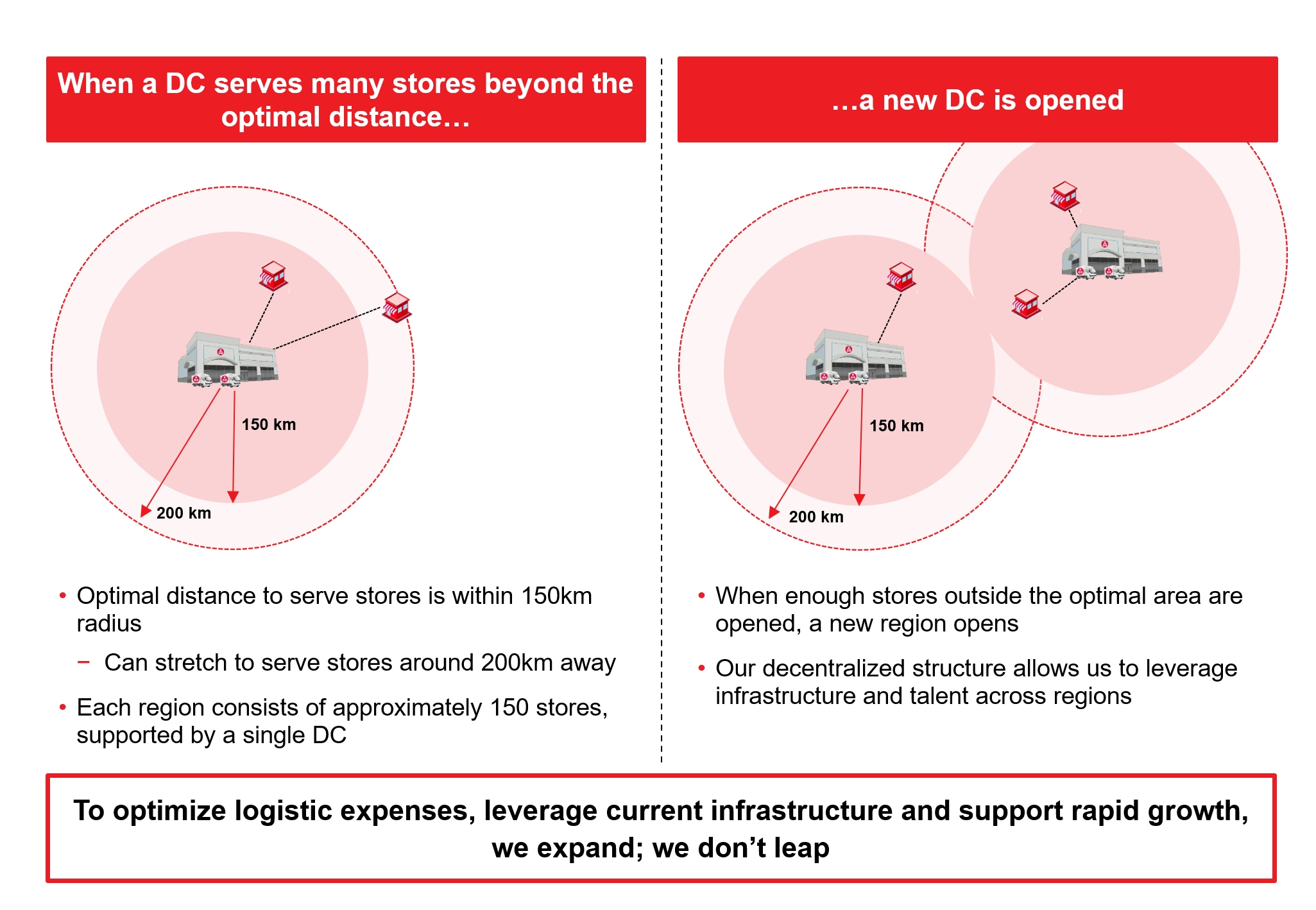

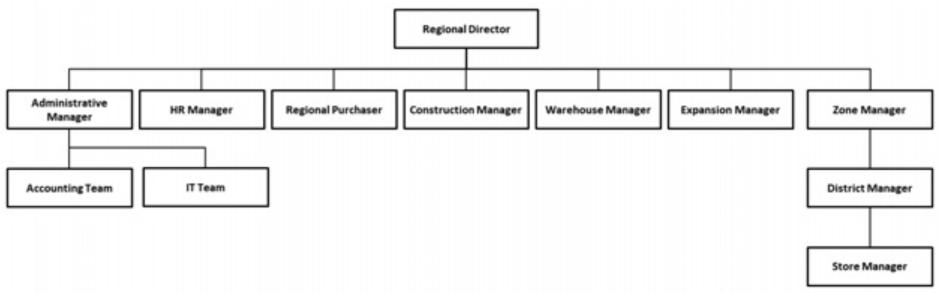

Our management is decentralized and organized into regions, each run by a regional director, and built around a distribution center that serves approximately 150 stores. Each region has sufficient functional resources to operate autonomously and efficiently. This structure, supported by nimble central headquarters, has enabled us to scale efficiently by allowing us to dynamically select new store locations in a constant pursuit of scale and expansion, while achieving positive gross and operating profit. Additionally, it enables suppliers to reach our decision makers quickly, fostering collaboration and accelerating the development of private label products.

Developing and retaining talent, as well as fostering a strong corporate culture, are key components of our business model and essential to sustaining our rapid growth rates and achieving efficiencies. We anticipate our personnel needs several years in advance and invest significant resources to ensure that we have the right talent at the right time.

We believe that the hard discount segment in Mexico has significant entry barriers for new participants, including: (i) the time and capital it takes to achieve scale and profitability given the inherent low gross margins of a hard discounter; (ii) the knowledge required to find competitive real estate and qualified personnel; (iii) the investment and know-how required to develop a meaningful private label product offering; and (iv) obtaining access to highly qualified senior management and experienced teams.

Our Business Model

Our business model is based on the following pillars:

2

The Grocery Retail Industry in Mexico

Large and growing market

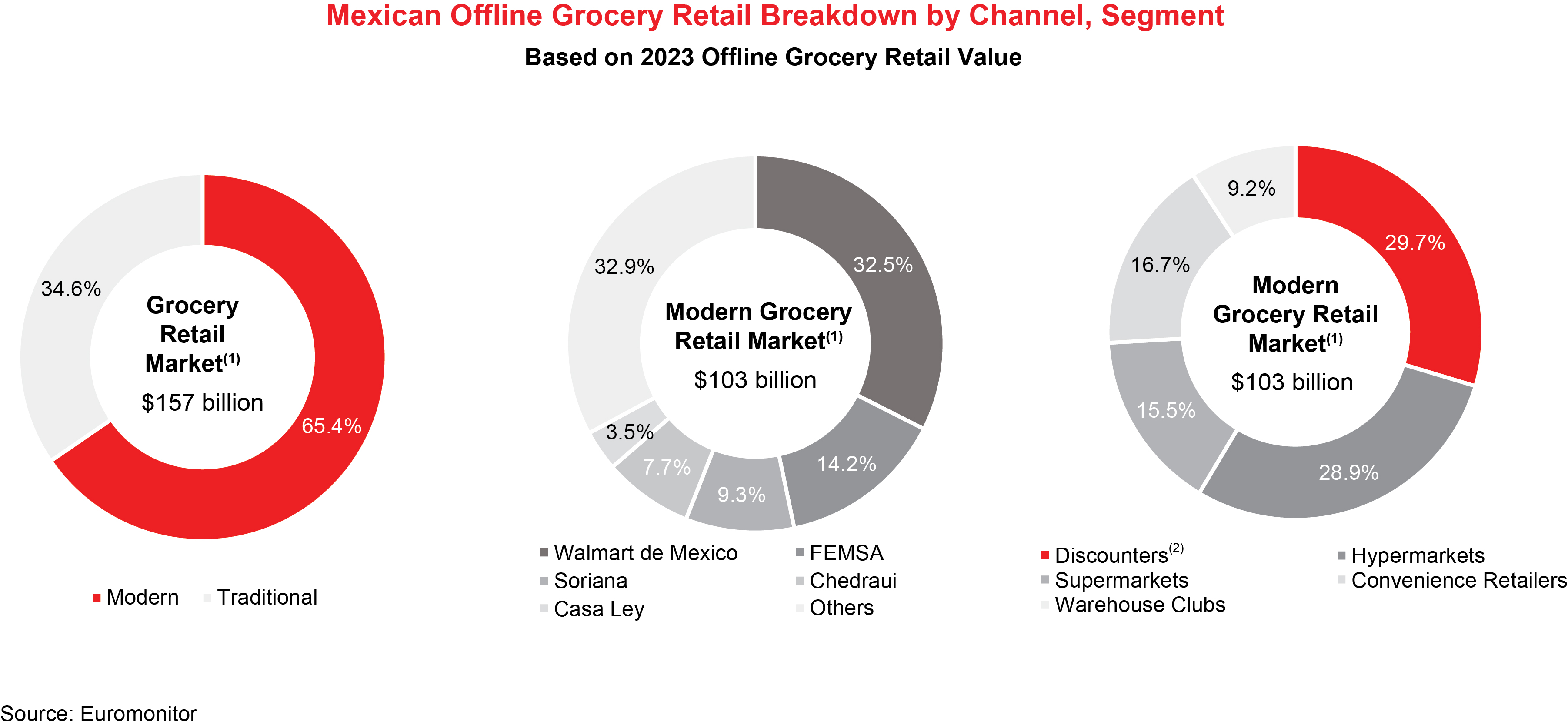

The Mexican formal grocery market had approximately US$157 billion annual sales for 2023 and is projected to grow at a 8.8% compounded annual rate from 2023 to 2028, according to Euromonitor. The market is expected to reach US$239 billion in annual sales by 2028.

Fragmented market: One dominant player but otherwise highly fragmented

The grocery market in Mexico is best viewed in two channels: the Modern (or organized) channel, which is a sub-set of the formal grocery market and which we define to include discounters, hypermarkets, supermarkets, convenience retailers and warehouse clubs, and the Traditional (or informal) channel, which we define to include, among others, local grocers and food, drink, and tobacco specialty stores. The Modern channel, which represented US$103 billion in annual sales for 2023 based on data from Euromonitor, can be further divided into full-price retailers and discounters (including soft discounters and hard discounters, such as Tiendas 3B). Discounters represented 29.7% of the Modern channel for the year ended December 31, 2023, according to data from Euromonitor.

Walmex is the dominant player in the Modern channel, representing 32.5% of that channel’s total sales for 2023 based on data from Euromonitor. Walmex’s most successful format is Bodega Aurrera, a discounter which represented 16.0% of sales in the Modern channel. Beyond that, the market is highly fragmented.

The hard discount business model

Hard discount is still a nascent business model in Mexico within the Modern channel. According to NielsenIQ, hard discounters, such as Tiendas 3B and Tiendas Neto, only represented 3.0% of sales in the Mexican grocery market for 2023. Although large retail players, such as Walmex (through Bodega Aurrera Express) or FEMSA (through Tiendas BARA), have presence in discount formats, since inception, Tiendas 3B has successfully competed with those formats as well as with other established grocery players as shown by our growth track record.

Hard discount grocery retailers, like ourselves, are different from other retailers in the Modern channel. The hard discount model focuses on a limited assortment of high value for money, high rotation branded and private label products that address the consumer’s essential daily needs. A hard discounters operations seek to be highly efficient and simple, with streamlined logistics, distribution, storefront operations and standardized no-frill store layouts with flexible locations. As a result of the efficiencies in the business model, hard discounters who achieve scale tend to have low gross margins and yet can achieve high returns on invested capital.

3

Tiendas 3B’s addressable market

Our stores serve low-to-middle income households, which according to the National Survey of Household Income and Expenditure conducted by INEGI in 2022, spent US$216 billion in 2022, or 70.7% of the Mexican population’s total current monetary spend. According to data from INEGI, approximately 48.4% of annual average Mexican household total current monetary spend within the second to ninth income decile is destined to food (excluding fruits and vegetables), beverages and tobacco, personal care products, house cleaning products and over the counter medicines. Our product offering covers all of these categories. Further, approximately 35.1% of annual average Mexican household current monetary spend within the second to ninth income decile is destined to food (excluding fruits and vegetables) and beverage products alone, such as the ones we sell.

|

|

|

|

| ||

Notes: |

| Notes: | ||

1. 2. 3. 4.

| Considers an exchange rate of Ps.19.629 per US$1.00. Each household has on average 3.43 members Range considers average income by income decile Excludes non-monetary expenses with an estimated value of US$83.7 billion. Non-monetary expenses include self-consumption, payments in kind, gifts, and the estimated rent households would have had to pay if they didn’t own their house |

| 1. 2. | Total current monetary spend for income deciles II to IX Includes transportation & communications, education, housing, clothing, fruit and vegetables, and healthcare (excl. OTC products) |

Tiendas 3B’s whitespace opportunity

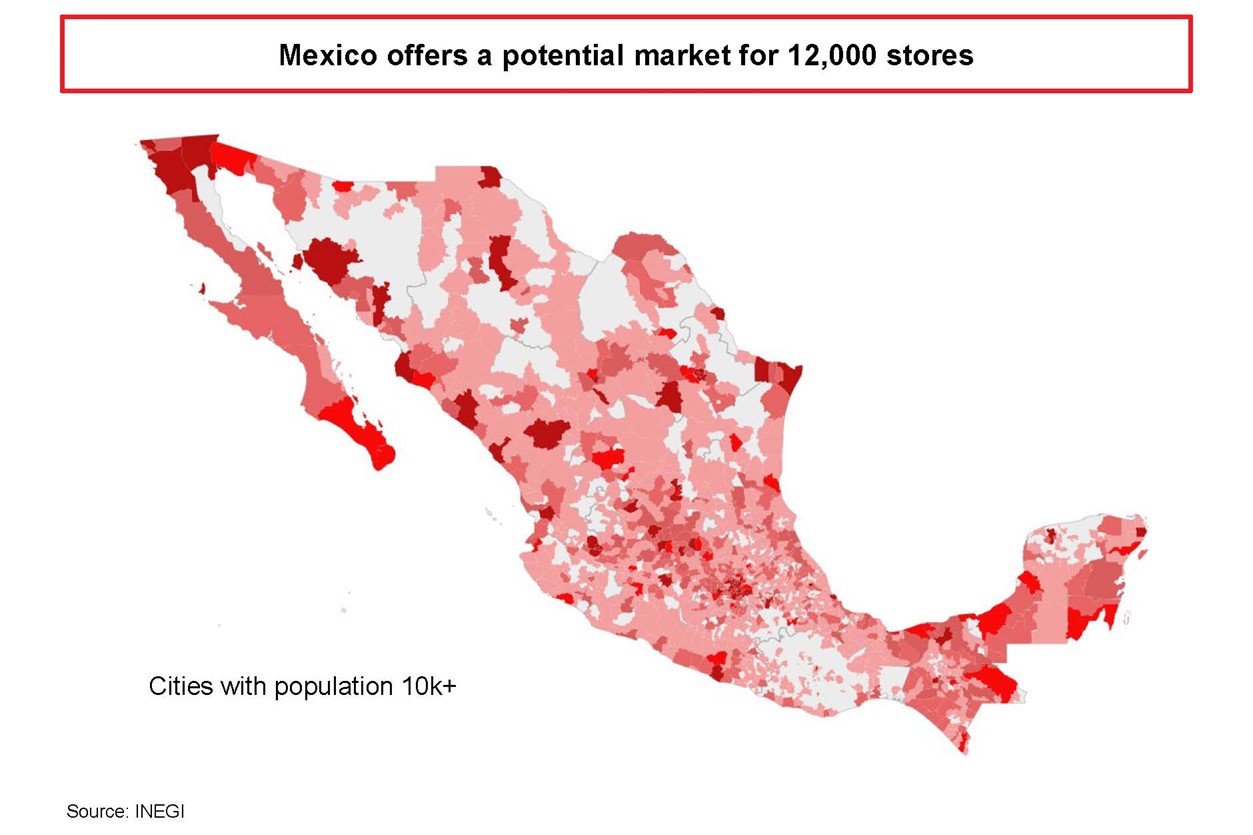

We believe that there is a large whitespace opportunity for Tiendas 3B. This opportunity will be driven by market expansion as a result of favorable demographic trends, the under-penetration of hard discount stores in the Mexican grocery market, and hard discount’s growing appeal with the Mexican consumers. Tiendas 3B’s addressable market is large and poised for continued growth.

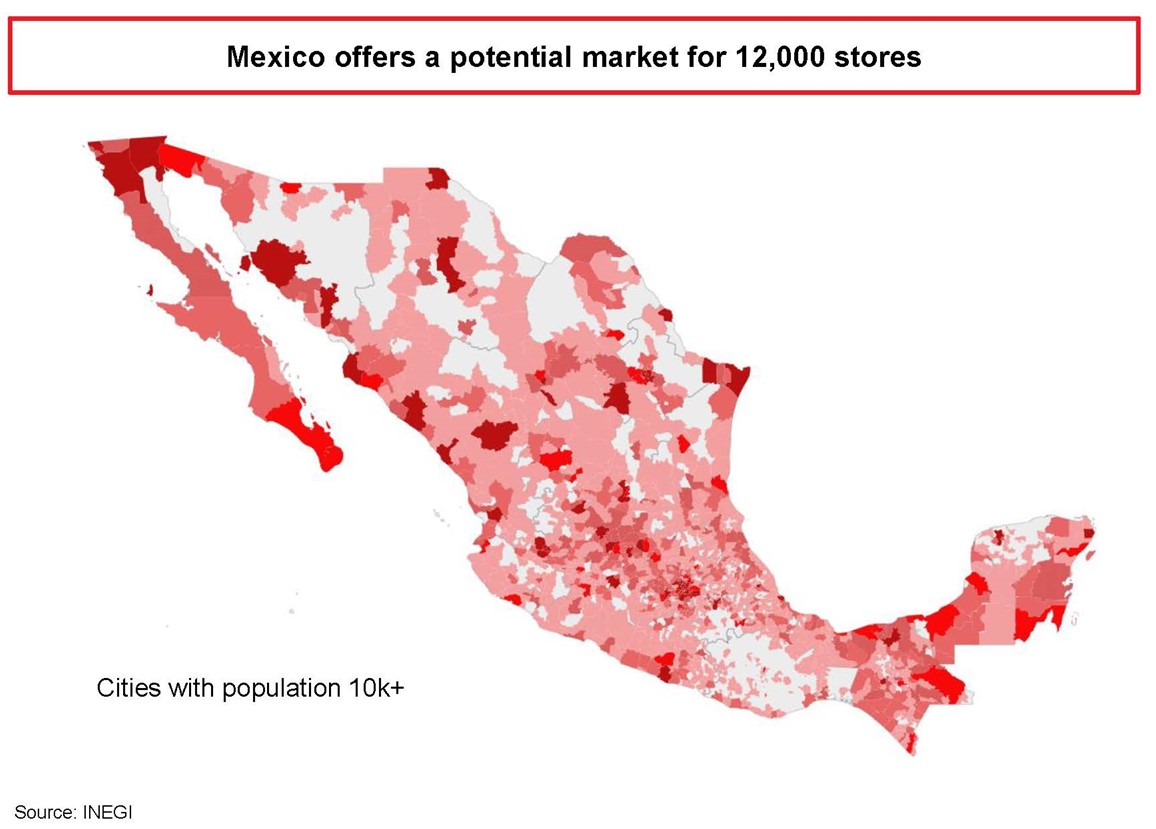

Based on our estimates at December 31, 2023, we believe there is a potential to open at least 12,000 additional Tiendas 3B stores in Mexico at current population levels in urban areas alone. We have mapped out whitespace by identifying communities with over 10,000 inhabitants as our stores are designed to adequately serve that number of people in a trade area of 800 meters from each store. This would represent almost a five-fold increase over our 2,772 stores as of December 31, 2024.

4

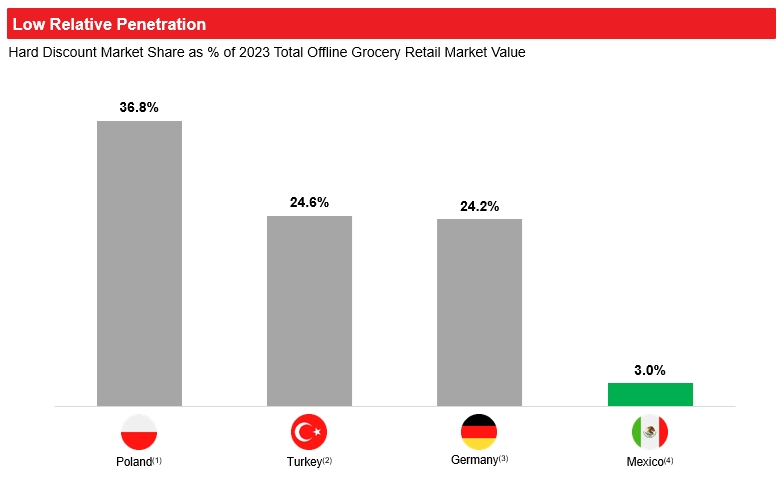

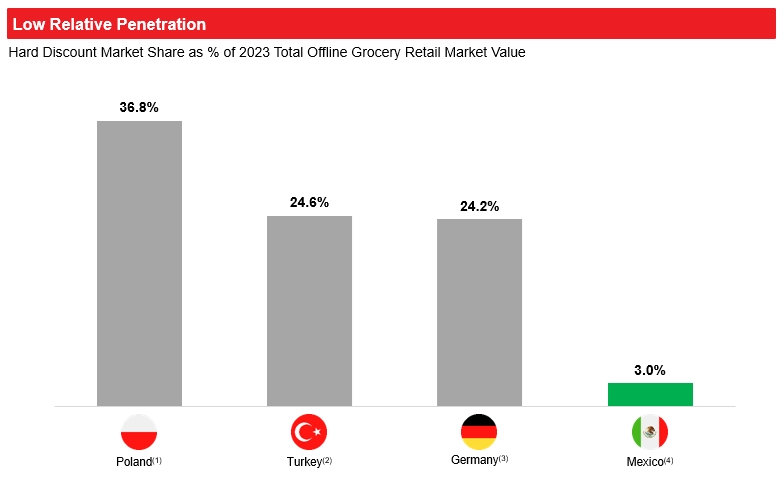

Hard discount in Mexico has significant growth potential when compared to other countries

The hard discount retail market in Mexico appears to be underpenetrated when compared to other countries with more established hard discount retail markets.

According to NielsenIQ, in 2023, the hard discount market in Mexico represented only 3.0% of NielsenIQ’s measurement of the Mexican grocery market. In contrast, grocery retailers which we consider hard discounters in Germany (i.e., Aldi and Lidl), in Poland (i.e., Biedronka, Aldi and Lidl), and in Turkey (i.e., BIM and A101), which are countries with successful and mature hard-discount markets, represented 24.2%, 36.8% and 24.6%, respectively, of their corresponding grocery market’s annual sales in 2023 based on data from Euromonitor.

5

Notes:

1. | Considers Biedronka, Lidl and Aldi | 3. | Considers Aldi and Lidl |

2. | Considers BIM and A101 | 4.

| Information from "NielsenIQ Homescan Hard Discounters Report" |

Although the Mexican food retail market has other features that differentiates it from that of Germany, Poland and Turkey at the time the hard discount model was introduced in those countries, including having a highly developed and efficient food retailers, we believe that these markets exemplify how the hard discount model can prosper even as countries grow richer. Initially, similar to Mexico, German and Polish consumers were attracted to hard discount given the great value proposition. At the time hard discount was introduced in Germany (1946 following the Second World War), in Poland (1990 following the fall of the Soviet Union) and Turkey (in 1995), German real gross domestic product (“GDP”) per capita, adjusted for inflation to date and price differences between countries was US$7,195, Poland’s was US$8,150 and Turkey’s was US$9,963. Even as per capita income ramped up in those countries, hard discounter penetration continued to increase. Although there is no assurance that the Mexican market will develop in the same fashion, we believe Mexican consumers are increasingly attracted to the hard discount model’s value proposition.

Our Competitive Strengths

Since inception, we have successfully competed with well-established grocery retailers and our sustainable competitive advantages have allowed us to thrive. We believe that as we continue to grow, our advantages will become more pronounced:

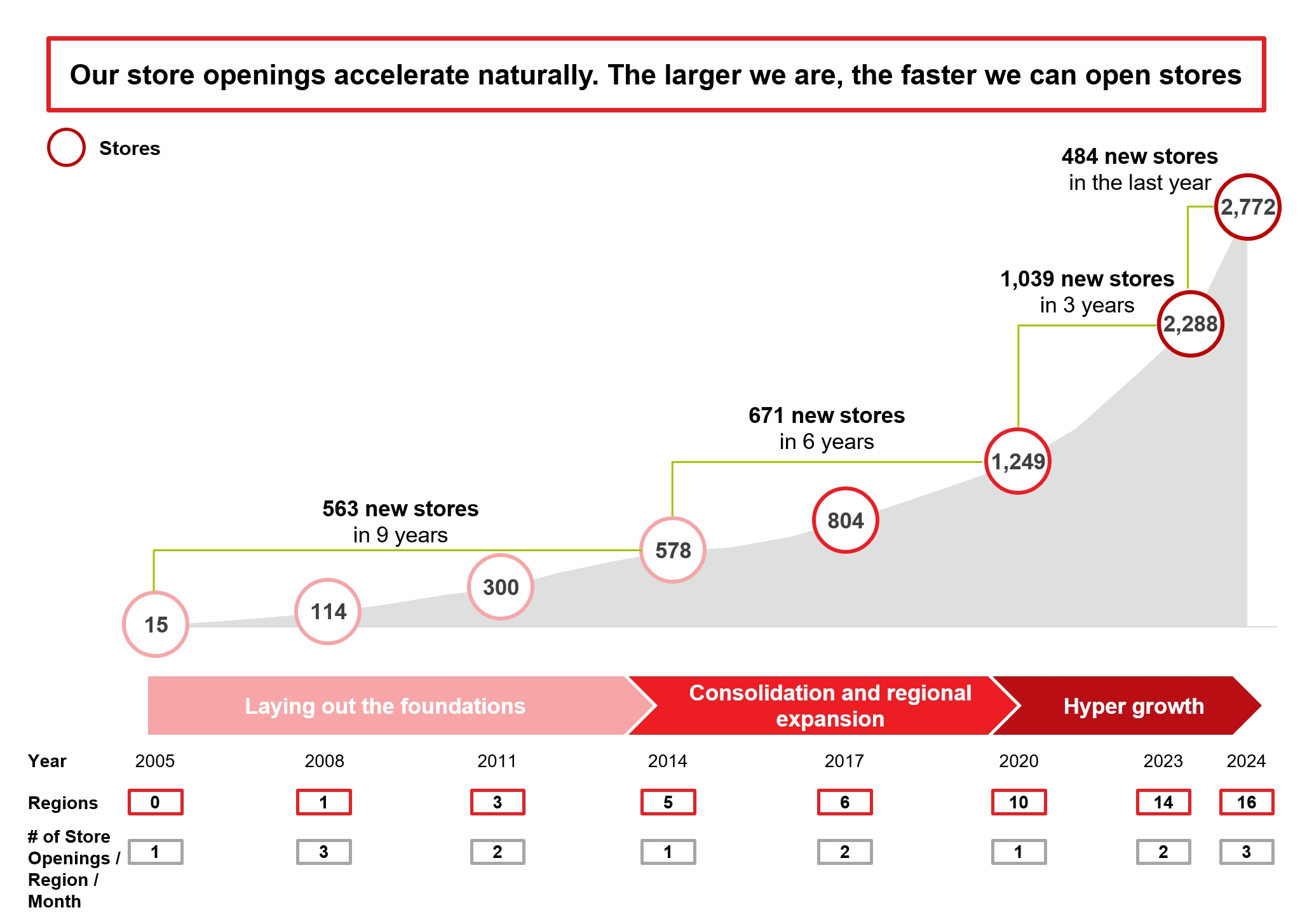

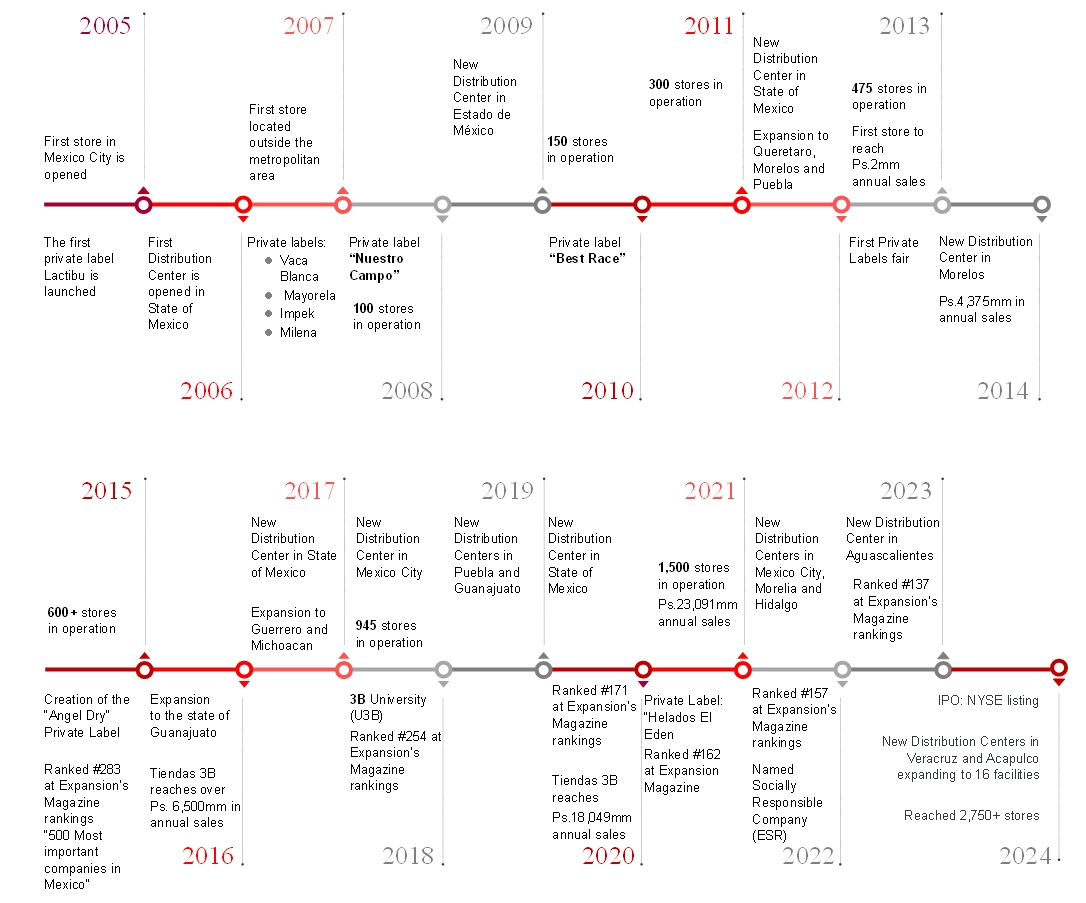

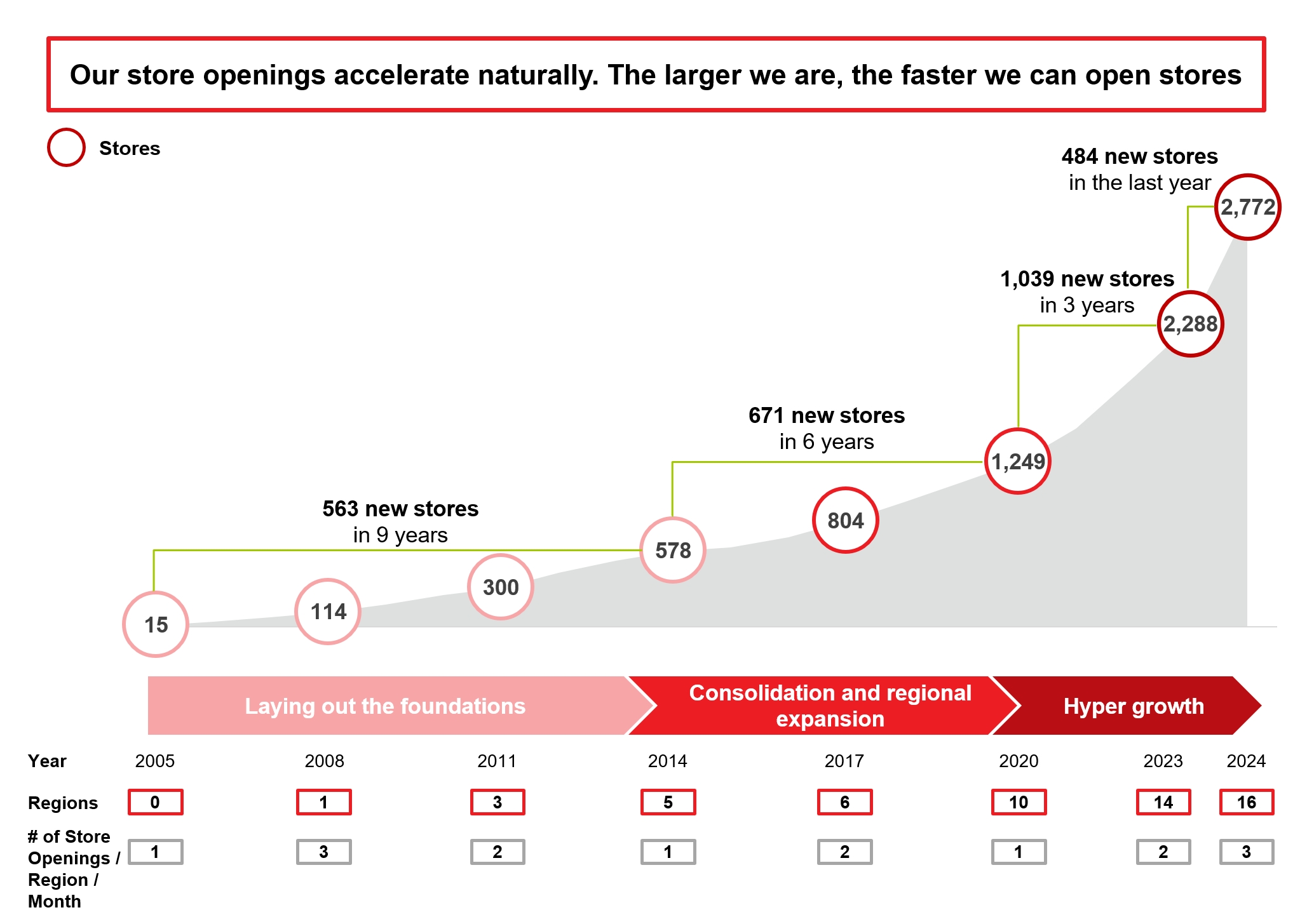

Rapid store expansion capacity

We opened our first store in February 2005, and as of December 31, 2024, we had 2,772 stores and 16 distribution centers. As our sales have grown, the pace of our store openings has accelerated naturally, as illustrated in the chart below. We had 392 net new store openings during 2022, 396 net new store openings during 2023 and 484 net new store openings during 2024, which translates into an average of one new store opening every 18 hours.

6

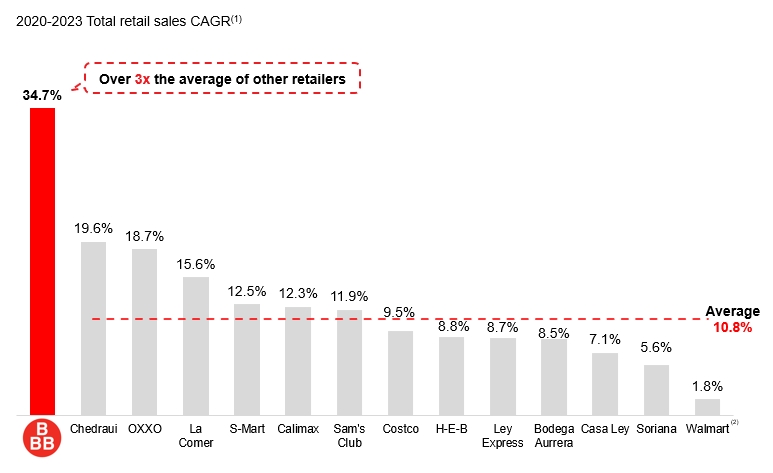

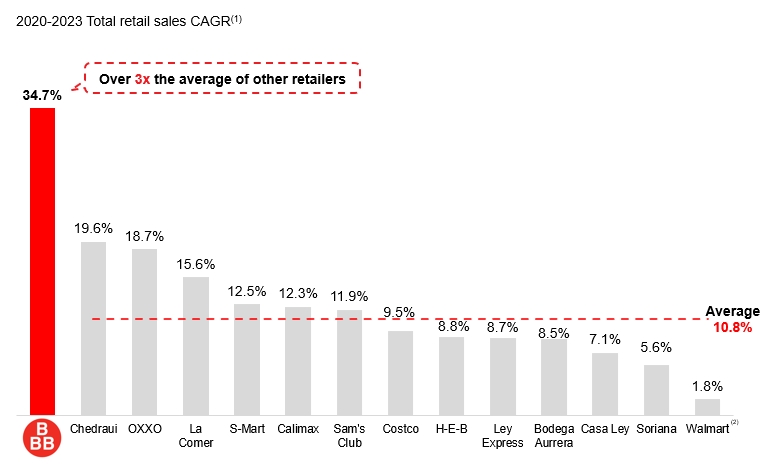

We are the fastest growing retailer in Mexico in terms of sales, based on a comparison of our sales figures with Euromonitor’s analysis of sales growth for the fastest growing retail players in Mexico. As shown below, Tiendas 3B has significantly outpaced incumbent retailers, with a total revenue CAGR of 34.7% from 2020 to 2023.

Source: Based on a comparison of Tiendas 3B's sales figures with Euromonitor's analysis of sales growth for competitors

Notes:

7

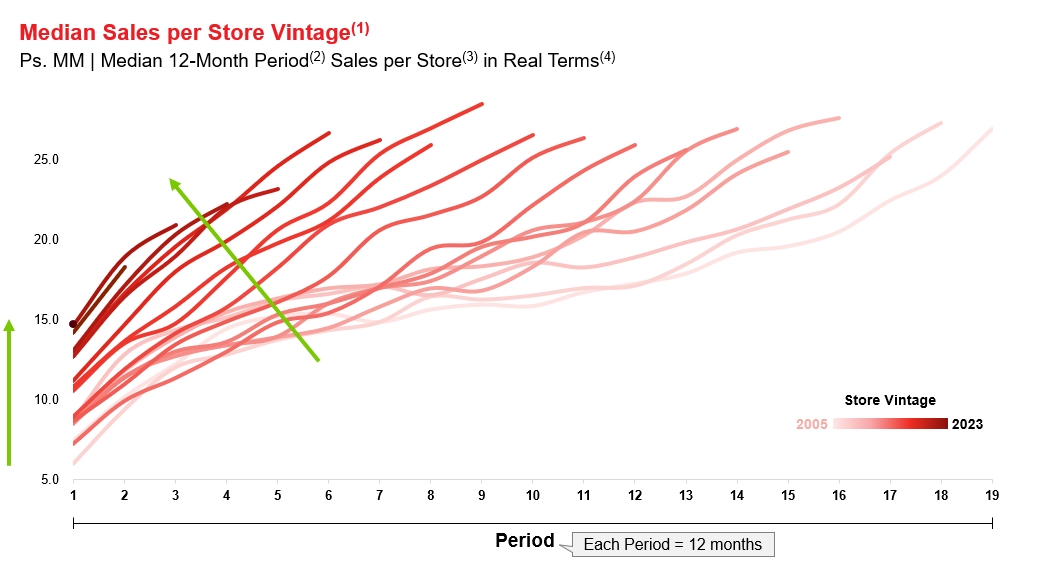

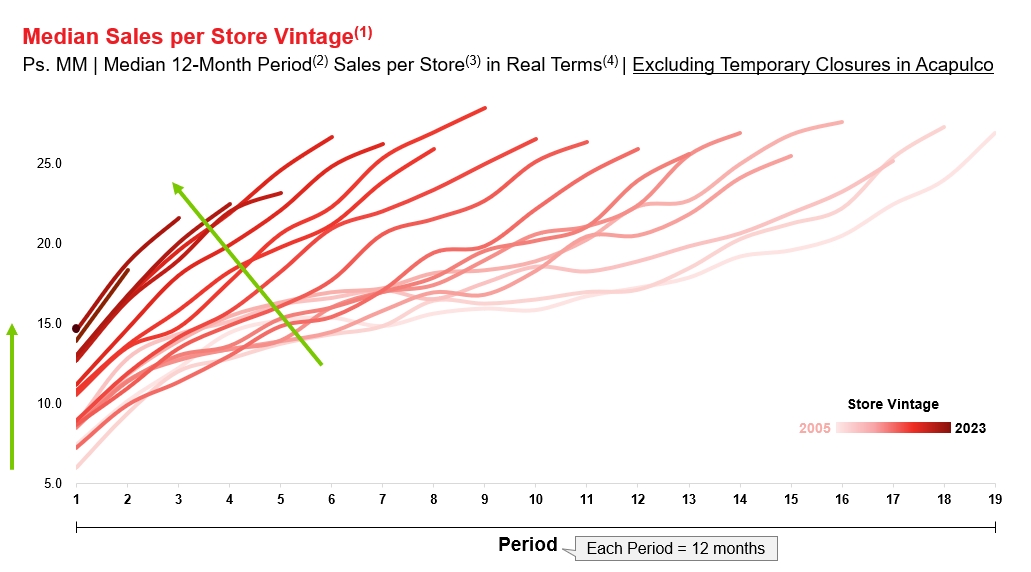

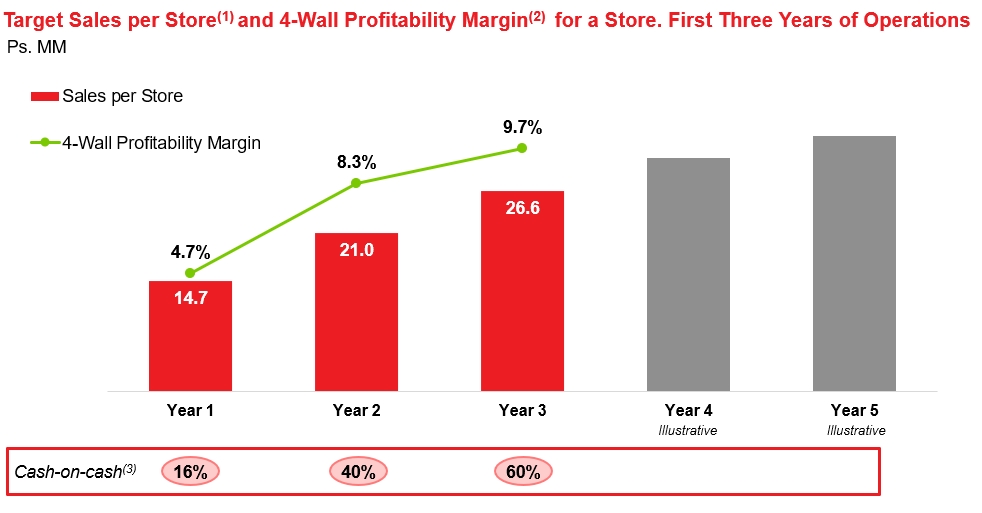

Sales growth underpinned by strong fundamentals

Our Same Store Sales growth and expansion are underpinned by strong store level fundamentals. Although growth through geographic expansion and store openings is a strong component of our expansion strategy, we believe our model is sustainable and scalable given the combined effect of growing average ticket size and a growing volume of transactions per store at our existing stores.

|

|

Notes: |

Notes: |

1. | We calculate average ticket size by dividing revenue from sales of merchandise by total number of transactions | 1. | Average transactions per store per month, only considering stores from vintages with five or more years of operations |

2. | Based on the mid-point of the approximated Total Revenue range for 2024 based on the preliminary information available as of the date of this prospectus | 2. | Based on the mid-point of the approximated Total Revenue range for 2024 based on the preliminary information available as of the date of this prospectus |

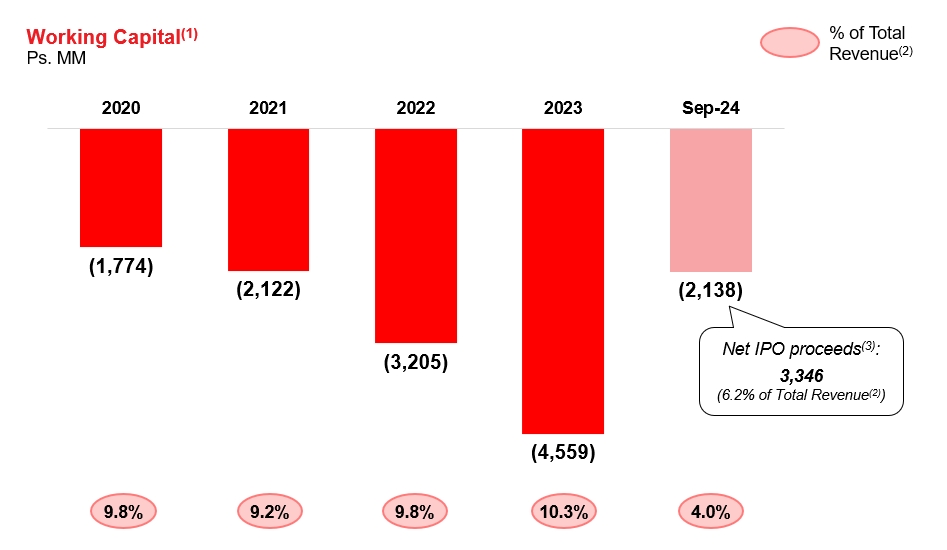

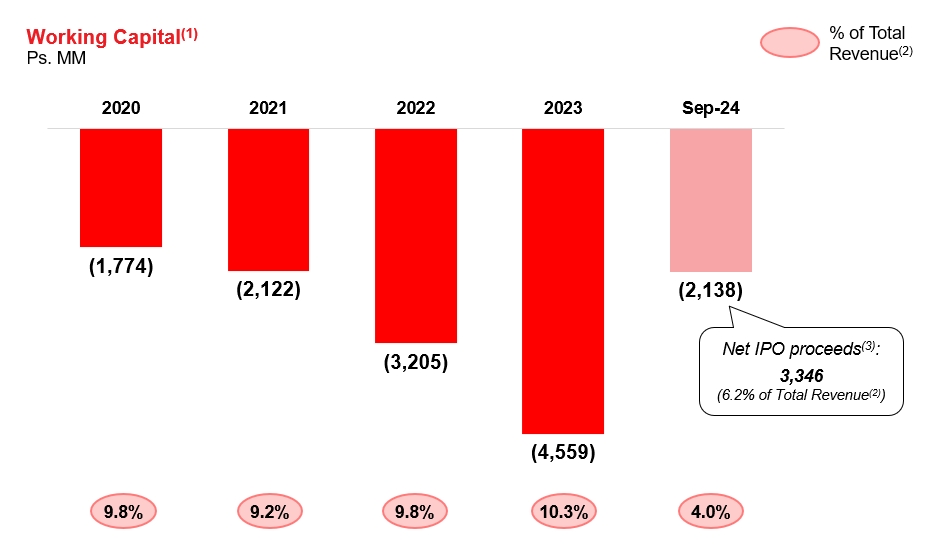

High rotation of our inventory to generate significant negative working capital

By focusing on high rotation items and limiting them to one-brand one-size, curated to satisfy most grocery needs of the average Mexican family, we are able to keep low Inventory Days. In 2023, we had 21 Inventory Days.

Our supplier payment terms (65 Payable Days for 2023) and low Inventory Days (21 Inventory Days for 2023), create a favorable negative working capital cycle that has enabled us to self-fund our rapid expansion. Our negative working capital for 2022, 2023 and the nine months ended September 30, 2024 was Ps.3,205,200 thousand, Ps.4,558,781 thousand and Ps.2,138,451, respectively. Net cash flows provided by our operating activities were Ps.1,366,308 thousand, Ps.2,116,335 thousand, Ps.3,140,349 thousand and Ps.2,378,208 thousand for 2021, 2022, 2023 and the nine months ended September 30, 2024, respectively, compared to our capital expenditures of Ps.532,173 thousand, Ps.1,122,877 thousand, Ps.1,798,019 thousand and Ps.1,642,397 thousand for 2021, 2022, 2023 and the nine months ended September 30, 2024, respectively.

8

Notes:

1. We calculate working capital as total current assets minus total current liabilities.

2. We calculate the percentage of working capital to total revenue for a period by dividing the working capital as of the end of the period by the total revenue for the last twelve months ending on the corresponding period.

3. Net IPO proceeds translated into Mexican pesos for convenience only at the rate of Ps.19.629 per US$1.00, the exchange rate to pay foreign currency denominated obligations due on September 30, 2024 published by the Mexican Central Bank in the Official Gazette.

Lean operational model designed to maximize efficiency and minimize costs

Our limited assortment of products allows us to simplify and optimize operations leading to low sales expense as a percentage of total revenue, which was 10.9% for 2023 and 10.2% for the nine months ended September 30, 2024.

Every aspect of our operations has been carefully optimized for efficiency. We reduce working hours and operating costs by designing our products and packaging with efficiency in mind, choosing the right truck sizes and equipment, making judicious use of technology and efficiently distributing refrigerated goods, store orders, and managing our proprietary logistics infrastructure. For example, we reduce time and costs from stocking shelves by selling directly from the box (usually lidless) that arrives from our distribution centers. Our trucks and stores are designed to allow one driver to unload a store delivery single-handedly in 30 minutes or less and our distribution centers are strategically located to allow optimal re-stocking efficiency and route planning.

Standard supermarkets, with a larger number of SKUs are more complex and costly to run. They need higher gross margins to sustain their operations. By being able to operate at lower costs, we can achieve positive operating profit even with low gross margins, and can offer sustainable lower prices, which we believe is very hard to replicate for traditional grocery retailers.

Significant purchasing power

As our sales have grown, so has our purchasing power. We believe we can buy at very competitive prices since our sales are concentrated in a relatively lower number of SKUs. This allows us to continually lower our purchase costs, improve our payment terms and develop strong supplier relationships, which in turn enables us to transfer generated savings on to our customers. Further, we cooperate closely with our private label suppliers to

9

help them negotiate better terms on their own supplies and raw materials, which also translates into savings for our customers.

Building and constantly reinforcing customer trust and loyalty

We have built enduring customer relationships based on trust in our pricing and quality. We believe that this trust is a cornerstone of our business, allowing us to accelerate our sales growth and eventually expand into higher ticket items and additional product categories (so long as they also deliver our characteristic value-for-money). We offer a no-questions-asked no-receipt-needed money-back return policy on all products we sell. This guarantee helps build trust and encourages our customers to try our private label products.

Decentralized and nimble organization that is close to the action

We have a decentralized and lean organizational structure built around autonomous regions each led by a regional director. As of December 31, 2024, we had 16 operating regions. Each region consists of approximately 150 stores supported by a single distribution center with functional support areas, such as human resources, real estate, logistics, IT and regional purchasing and accounting. For example, the regional directors decide which new stores to open (within company guidelines) without requiring headquarters’ approval. All regions are similarly sized and configured in terms of operations and the model is readily replicable. As each region increases the number of stores it operates beyond 150 and up to 200, a new region is formed in adjacent geographies and stores are shifted accordingly to optimize logistics.

We believe this approach has many benefits. Decisions are closer to the action and therefore nimble. There is less bureaucracy. Opening new regions is rapid, efficient, and cost effective. Benchmarking among similar regions makes managing the entire business efficient and allows us to maintain a small central office even at scale.

We invest significantly in human resource development and our culture. We believe this is essential to maintaining sustainable profitable growth and managing a decentralized structure. We achieve these goals by long-term planning, a belief in the concept of talent density, and investing in in-person training, which is supplemented by more than 100 training modules found in our online “Universidad 3B,” which is designed to foster a strong cultural affinity and operational excellence across the organization.

Founder-led management team with leading industry expertise

We are a founder-led company with a solid management team, the majority of which has been working together for more than 16 years, most since inception. Our management team has 130+ years of combined experience in the retail and hard discount industry, has extensive knowledge of the Mexican grocery market, and has held relevant positions within local and international players. The trajectory and continuity of our management team contributes to a strong and stable corporate culture that is both customer and employee-centric. Our management team has developed highly specialized know-how that we believe is hard to replicate and a key differentiating factor that has propelled our success.

Our Strategy

Unrelenting focus on lean operating model to support profitable growth

Our business model has proven to be sustainable and resilient through different economic cycles, which we expect to continue. We believe we still have room to continue to improve our operating margins through the scalability of our platform. We have sustainably low operating costs as a percentage of sales, driven by scale, rigorous cost discipline, the judicious use of technology, making our processes even more efficient, and better integrating with our private label suppliers. We believe our current operational structure will allow us to continue supporting our expansion efforts at marginal incremental costs.

10

Rapidly expanding number of stores in contiguous regions, while maintaining low investment requirements per new store

We aim to open stores in places that are convenient for our customers, most of which access our stores on foot. We follow a disciplined approach to our geographic expansion without compromising our supply and distribution capabilities. Our standardized format and requirements assure that our capital requirements for new stores remain low, an important component as we fund our rapid expansion.

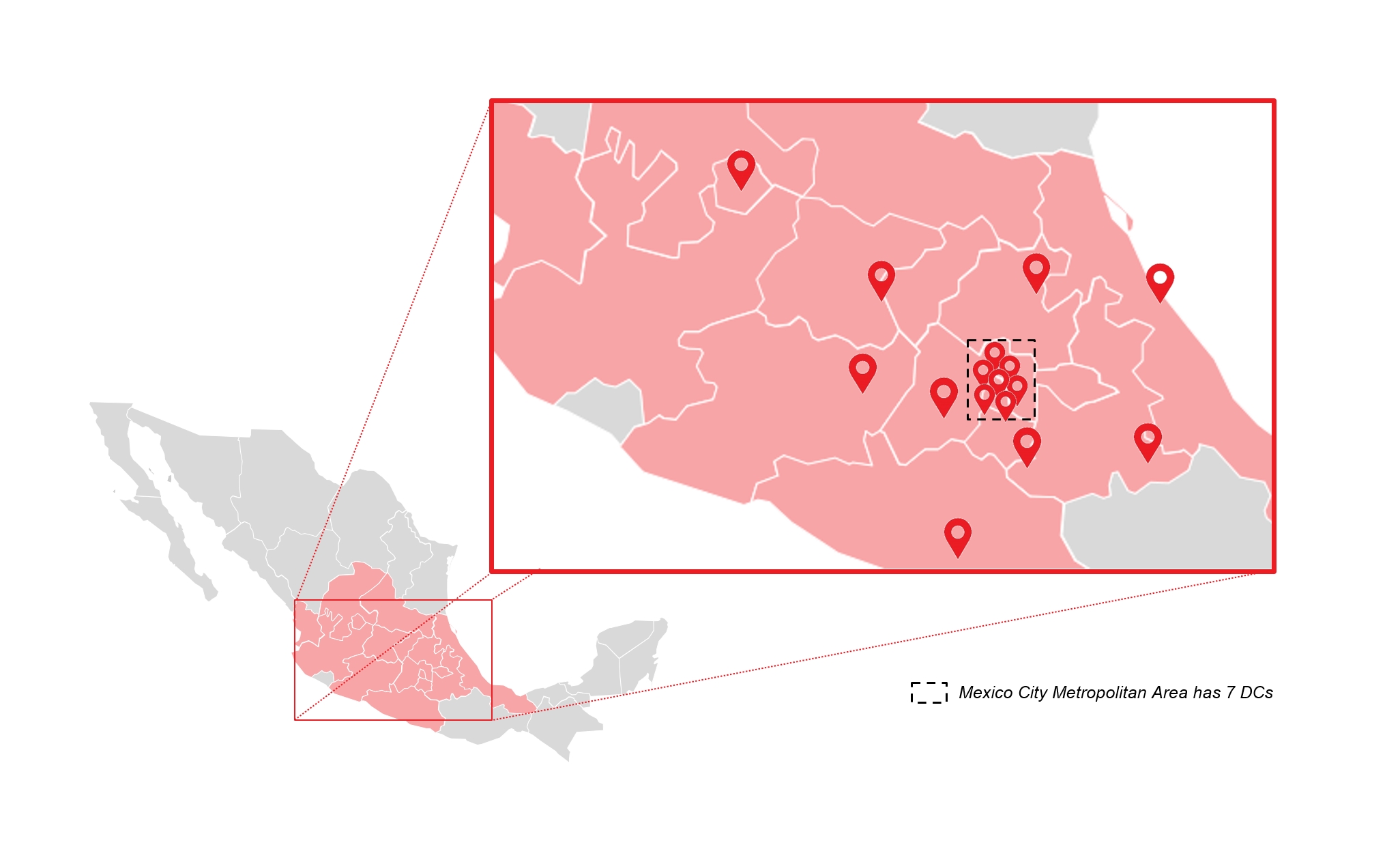

As of December 31, 2024, our stores were concentrated in 16 states in the central region of Mexico, including: Mexico City, State of Mexico, Hidalgo, Puebla, Tlaxcala, Morelos, Queretaro, Guanajuato, Michoacán, Guerrero, Veracruz, Aguascalientes, Nayarit, Jalisco, Zacatecas and San Luis Potosí. This geographic footprint has resulted from progressive expansion as we add new distribution centers to support stores in new areas, in each case targeting critical density to support the efficiencies of our structure. Our store location map reflects our disciplined expansion approach.

Developing new private label product lines

We intend to consolidate our private label leadership by continuing to develop new private label product lines that offer higher value for money than branded alternatives to our customers. We work closely with over 130 suppliers of our private label products to develop new and innovative product lines. Our close relationship and integration allow us to adapt our offering to changing customer needs and preferences. As we increase our private label sales penetration going forward, we will drive greater value to our customers, which we expect will translate into sales growth, while also increasing control of our margins and improving our profitability.

Our frequent client interactions, extensive market studies, and ongoing testing of products, allow us to understand and anticipate customer preferences, and to meet their evolving needs. Our team of 39 purchasers as of December 31, 2024 work hand in hand with our suppliers to continuously innovate and improve our portfolio of products.

We help our suppliers grow alongside us by providing transparency of our growth plans, paying them on time and facilitating access to our wide network of other supplier relationships. We see suppliers as strategic partners because we often find opportunities to develop brands and product presentations, aiming to increase the quality and improve the price of our products. We also help suppliers by sharing best practices we see from suppliers of other of our products (for example access to better packaging and labeling alternatives), which creates efficiencies across our business. Our annual private label supplier fair assists this exchange of ideas and solidifies our supplier ecosystem.

Increasing our sales of “Los Irrepetibles”

We intend to increase the sales contribution of “Los Irrepetibles,” our spot product offering that includes grocery and non-grocery products such as, electronics, apparel, home goods, and others. We offer a changing selection of approximately 50 spot products every two weeks on average. These products offer notably high value for money and add a treasure hunt factor to the shopping experience. We call them “Los Irrepetibles” because they are offered at prices so low that they will not be “repeated” (replenished) once we sell out.

Part of our strategy is to selectively offer higher ticket spot items that still offer tremendous value for money. We are currently conducting tests on a limited scale to assess our customers’ acceptance of these price points and product price elasticity. Going forward, we plan to expand our spot product purchasing division to improve purchasing capacity and product sourcing.

Introducing new categories of products and services

We plan to selectively introduce new product categories to meet our customers’ needs. At any moment we are actively testing several new product categories. As a result of these efforts, we recently introduced the beauty category in our stores. Additionally, we plan to expand our assortment in certain categories, including ice creams

11

and fresh and frozen meats. Based on our internal analysis, we believe there is sufficient demand to introduce SKUs to our offering and drive additional sales and wallet penetration.

Additionally, we believe that our increasingly ubiquitous store footprint can be leveraged to increase the services we offer to our customers at our locations. Currently we offer utility and service payments, top-ups, amongst others. We see opportunities to expand our service offering given our customers’ frequent store visits each week.

Recent Developments

Full Year 2024 Update

Our results for the year ended December 31, 2024 are not yet available as of the date of this prospectus. We expect to finalize our consolidated financial results as of and for the year ended December 31, 2024 after this offering is completed.

Based upon the preliminary information available to us as of the date hereof, we expect to have total revenue between Ps.57.4 billion and Ps.57.5 billion (US$2.92 billion and US$2.93 billion) for full year 2024, which represents an approximate increase of between 30.2% and 30.4% compared to full year 2023, and an estimated CAGR of approximately 33.6% from 2020 to 2024.

We expect our operating income for full year 2024 to increase compared to full year 2023. We note that during 2024, we incurred expenses of between Ps.140 million and Ps.165 million for the year which we believe were largely non-recurring and related to our initial public offering in 2024 (our “IPO”) and our transition to a public company and associated reporting, compliance and other obligations. Approximately fifty to sixty percent of these expenses were incurred during the fourth quarter of 2024 which will affect our margins for that quarter.

During 2024, we had 484 net new store openings to reach 2,772 total stores as of December 31, 2024, which represents a 21.1% increase in our store count compared to year-end 2023. We estimate our Same Store Sales growth for 2024 to be approximately 13.4%, which was underpinned by an estimated increase in average ticket size from Ps.82.4 in 2023 to approximately Ps.85.4 in 2024 and an estimated increase in transactions per store per month (considering stores from vintages with five or more years of operations) from 25.6 thousand in 2023 to approximately 26.8 thousand in 2024. Our private label penetration also increased, with sales from private labels representing an estimated 54% of our sales in 2024 compared to 46.5% in 2023.

We caution you that these results are subject to risks and uncertainties, including those described in this prospectus, and actual results may differ materially. These preliminary results should not be viewed as a substitute for full annual financial statements prepared in accordance with IFRS. For additional information on factors that could impact our results, please refer to the sections “Risk Factors” and “Forward-Looking Statements.” We do not undertake any obligation to update publicly or revise forward-looking statements, whether as a result of new information, future events, or otherwise. You should read this preliminary information in conjunction with our consolidated financial statements and the related operating and financial data contained or incorporated by reference herein.

Management is responsible for the preparation and presentation of the preliminary financial information and estimates included herein. The statements regarding our financial and operating results as of and for the year ended December 31, 2024 are based on our reasonable estimates and preliminary unaudited information available as of the date of this prospectus. Internal reviews and procedures necessary to complete our consolidated financial results as of and for the year ended December 31, 2024 are ongoing as of the date of this prospectus. Accordingly, we cannot provide any assurances that our consolidated financial results as of and for the year ended December 31, 2024 will be consistent with the trends and financial and operating performance shown in our financial information that has been included in this prospectus, or that such results (or the market perception of such results) will not adversely affect the trading price of our Class A common shares.

12

In addition, the preliminary financial information and estimates referred to above have not been audited, reviewed, examined, compiled or subject to agreed-upon procedures by PricewaterhouseCoopers, S.C. Accordingly, PricewaterhouseCoopers, S.C. expresses no opinion or any other form of assurance with respect to such preliminary financial information or statements included herein.

Option and RSU Grants

As of the date of this prospectus, our board of directors has approved the following awards under the new Equity Incentive Plan that was adopted in connection with our IPO:

Merger of Mexican Subsidiaries

In connection with a simplification of our operations, our Mexican subsidiaries, Tiendas BBB, S.A. de C.V. and Desarrolladora Tres B, S.A. de C.V. merged with and into Tiendas Tres B, S.A. de C.V., our main operating subsidiary, with Tiendas Tres B, S.A. de C.V. surviving the merger. The merger was approved by the shareholders of the merged entities on December 31, 2024. We do not expect this transaction to have any effects on our financial position or results of operations.

Summary of Risk Factors

An investment in our Class A common shares is subject to a number of risks, including risks relating to our business and industry, risks related to Mexico and risks related to this offering and our Class A common shares. Please read the information under “Risk Factors” for a more thorough description of these and other risks. Below is a summary of the principal risks we face:

13

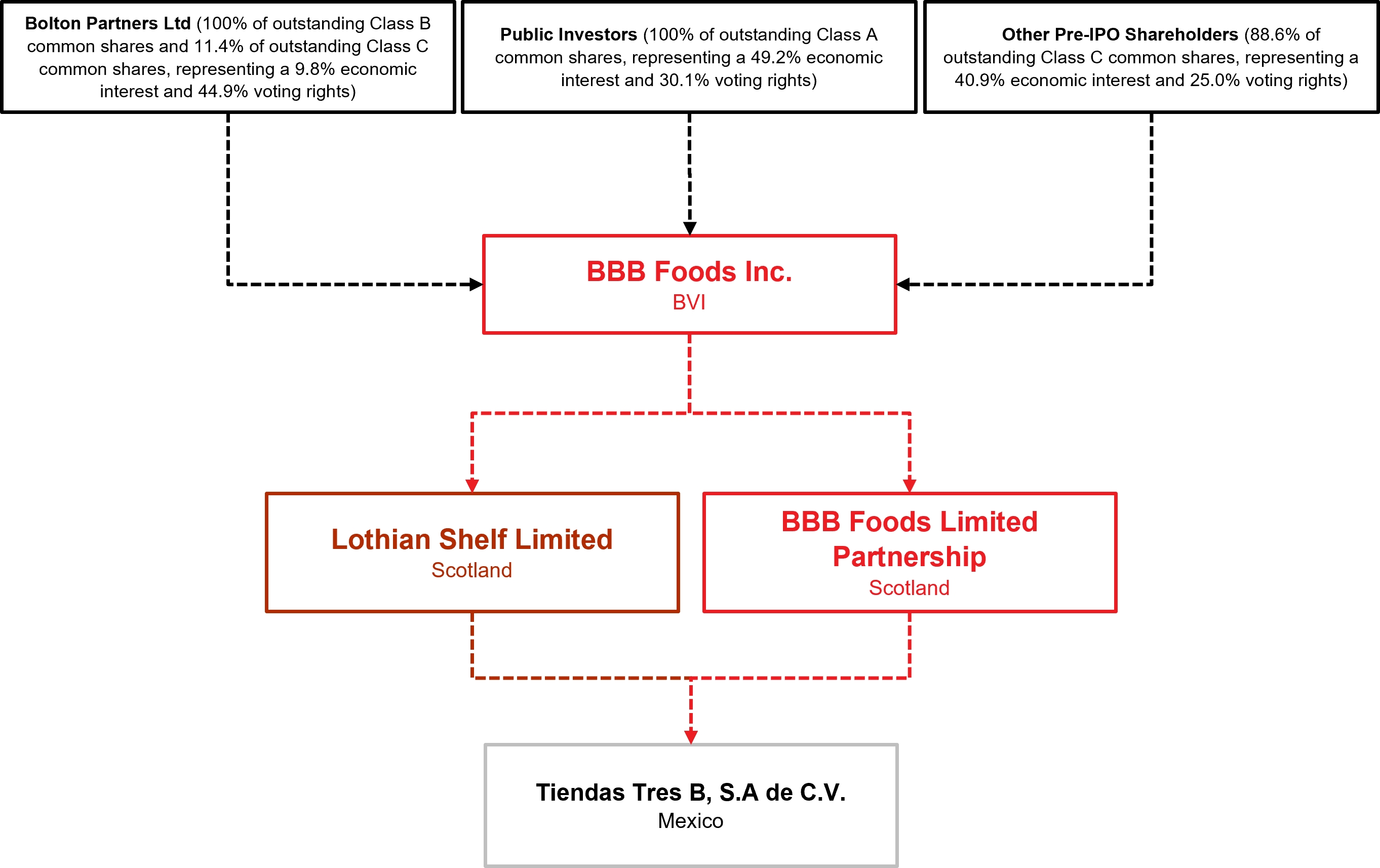

Our Corporate Structure

The Issuer is a holding company incorporated in the British Virgin Islands. The Issuer has no material operations of its own and substantially all of its operations are conducted through the Issuer’s Mexican subsidiary. Investors in the Class A common shares are purchasing equity interests in the British Virgin Islands holding company, and not in such Mexican subsidiary. We indirectly hold 100% equity interests in our Mexican subsidiary.

14

The following chart and the information set forth in the following paragraph presents our corporate structure, including our principal shareholder and principal subsidiaries immediately after the completion of this offering, assuming no exercise of the underwriters’ option to purchase additional Class A common shares.

Bolton Partners Ltd., our principal shareholder, beneficially owned approximately 46.4% of the combined voting power of our outstanding common shares prior to this offering, and will beneficially own approximately 44.9% of the combined voting power of our outstanding common shares following this offering, and therefore has, and will continue to have, significant influence over matters requiring shareholder approval.

However, the foregoing does not include Class C common shares that will be held by our principal shareholder and our directors and officers in respect of both unvested and vested (but currently unexercisable) stock options (other than the Class C common shares corresponding to the Exercised Stock Options) or delayed-delivery awards under the Liquidity Event Share Plan and the Bolton Partners Share Allocation, as applicable. Taking into account such Class C common shares which our principal shareholder, directors and officers will be entitled to receive at later dates, and assuming net settlement at their respective strike prices, our principal shareholder would beneficially own approximately 43.6% of the combined voting power of our outstanding common shares following this offering. See “Selling Shareholders.”

Corporate Information

We were incorporated on July 9, 2004 under the laws of the British Virgin Islands with company number 605635. Our principal executive offices are located at Av. Presidente Masaryk 8, Polanco V Sección, Miguel Hidalgo, Mexico City, Mexico 11560. Our registered office is located at Commerce House, Wickhams Cay 1, P.O. Box 3140, Road Town, Tortola VG1110, British Virgin Islands. Our website is www.tiendas3b.com and our investor relations website is https://www.investortiendas3b.com/. The information contained in, or accessible through, our website is not incorporated into this prospectus or the registration statement of which it forms a part and does not form part of, this prospectus, and you should not consider such information in deciding whether to invest in our Class A common shares.

Conventions that Apply to this Prospectus

Except as otherwise indicated or the context requires, all information in this prospectus assumes:

15

In addition, except for the Exercised Stock Options, or as otherwise indicated or the context requires, the share numbers in this prospectus do not reflect the issuance of (i) any common shares issuable upon the exercise of stock options granted under our 2004 Option Plan, (ii) any common shares issuable upon the exercise of stock options or RSUs granted under our Equity Incentive Plan, or (iii) common shares awarded under the Liquidity Event Share Plan or allocated under the Bolton Partners Share Allocation, nor do they reflect the common shares reserved for issuance under our Equity Incentive Plan.

As of the date of this prospectus, and prior to the exercise of the Exercise Stock Options:

All of such Class C common shares (including those referred to above) are subject to the restrictions on transfer of Class C common shares described under “Description of Our Share Capital—Class C Common Shares.” For additional information regarding the restricted exercise of vested options and delayed delivery of Class C common shares under the Bolton Partners Share Allocation or the Liquidity Event Share Plan, see “Management—2004 Option Plan,” “Management—Liquidity Event Shares” and “Management—Bolton Partners Share Allocation.”

The Class C common shares held by the selling shareholders to be sold in this offering will automatically convert into Class A common shares on a share-for-share basis immediately prior to the settlement of this offering. As a result, purchasers of our common shares in this offering will only receive Class A common shares, and only Class A common shares are being offered by this prospectus. Class B common shares that are not sold by the selling shareholders, will remain Class B common shares unless otherwise converted into Class A common shares. Class C common shares that are not sold by the selling shareholders, including if the underwriters do not exercise their option to purchase additional Class A common shares from the selling shareholders in connection with this offering, will remain Class C common shares unless otherwise converted into Class A common shares. See “Description of Share Capital.”

16

The Offering

This summary highlights information presented in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all the information you should consider before investing in our Class A common shares. You should carefully read this entire prospectus before investing in our Class A common shares including “Risk Factors,” our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021, together with the notes thereto, incorporated by reference in this prospectus, and our unaudited interim condensed consolidated financial statements as of September 30, 2024 and for the three and nine months ended September 30, 2024 and 2023, together with the notes thereto, included elsewhere in this prospectus.

Issuer |

| BBB Foods Inc. |

Class A common shares offered by the |

| 17,500,000 Class A common shares, if the underwriters do not exercise their option to purchase additional Class A common shares from the selling shareholders, or 20,125,000 Class A common shares if the underwriters exercise in full their option to purchase additional Class A common shares from the selling shareholders. The Class A common shares offered hereby consist of (i) Class A common shares issuable upon conversion of Class C common shares held by existing holders of our Class C common shares and (ii) Class A common shares issuable upon conversion of Class C common shares acquired upon the net exercise of the Exercised Stock Options. We will not receive any proceeds from the sale of any Class A common shares by the selling shareholders. |

Class A common shares, Class B |

| Immediately prior to this offering, we had 38,709,677 Class A common shares, 5,200,000 Class B common shares and 68,291,075 Class C common shares outstanding (not including the 2,000,000Class C common shares corresponding to the Exercised Stock Options). |

Class A common shares outstanding |

| 56,209,677 Class A common shares, if the underwriters do not exercise their option to purchase additional Class A common shares from the selling shareholders, or 58,834,677 Class A common shares if the underwriters exercise in full their option to purchase additional Class A common shares from the selling shareholders. |

Class B common shares outstanding |

| 5,200,000 Class B common shares. |

Class C common shares outstanding |

| 52,791,075 Class C common shares, if the underwriters do not exercise their option to purchase additional Class A common shares from the selling shareholders, or 50,466,075 Class C common shares if the underwriters exercise in full their option to purchase additional Class A common shares from the selling shareholders. |

Class C common shares subject to stock |

| 40,943,724 Class C common shares (including the 2,000,000 Class C common shares corresponding to the Exercised Stock Options). |

Class C common shares subject to stock |

| 38,859,033 Class C common shares, if the underwriters do not exercise their option to purchase additional Class A common shares from the selling shareholders, or 38,542,914 Class C common shares if the |

17

|

| underwriters exercise in full their option to purchase additional Class A common shares from the selling shareholders. |

Voting rights |

| The Class A common shares are entitled to one vote per share, whereas the Class B common shares (which are not being sold in this offering) are entitled to 15 votes per share. The Class C common shares (which are not being sold in this offering) are entitled to one vote per share. Each Class B common share may be converted into one Class A common share at the option of the holder. If, at any time, the number of outstanding Class B common shares represents less than 1.0% of the aggregate common shares of the Issuer then outstanding, then each Class B common share will convert automatically into one Class A common share. In addition, each Class B common share will convert automatically into one Class A common share upon any transfer, except for transfers to affiliates and others as described under “Description of Share Capital—Conversion.” Each Class C common share will be converted into one Class A common share upon any transfer, except for transfers to affiliates and others as described under “Description of Share Capital— Conversion” and shall be converted automatically upon the expiry of certain transfer restrictions applicable to the Class C common shares. Holders of Class A common shares, Class B common shares and Class C common shares will vote together as a single class on all matters unless otherwise required by law and subject to certain exceptions set forth in our memorandum and articles of association as described under “Description of Share Capital—Voting Rights.” Upon consummation of this offering, assuming no exercise of the underwriters’ option to purchase additional Class A common shares from the selling shareholders, (1) holders of Class A common shares will hold approximately 30.1% of the combined voting power of our outstanding common shares and approximately 49.2% of our total equity ownership; (2) holders of Class B common shares will hold approximately 41.7% of the combined voting power of our outstanding common shares and approximately 4.6% of our total equity ownership; and (3) holders of Class C common shares will hold approximately 28.2% of the combined voting power of our outstanding common shares and approximately 46.2% of our total equity ownership. If the underwriters exercise their option to purchase additional Class A common shares from the selling shareholders in full, (1) holders of Class A common shares will hold approximately 31.4% of the combined voting power of our outstanding common shares and approximately 51.4% of our total equity ownership; (2) holders of Class B common shares will hold approximately 41.6% of the combined voting power of our outstanding common shares and approximately 4.5% of our total equity ownership; and (3) holders of Class C common shares will hold |

18

|

| approximately 26.9% of the combined voting power of our outstanding common shares and approximately 44.1% of our total equity ownership. The rights of the holders of Class A common shares, Class B common shares and Class C common shares are identical, except with respect to voting, conversion, preemptive rights (as detailed below) and transfer restrictions applicable to the Class B common shares and conversion rights and transfer restrictions applicable to the Class C common shares. Holders of Class B common shares are entitled to preemptive rights to purchase additional Class B common shares in the event that additional Class A common shares are issued, upon the same economic terms and at the same price, in order to maintain such holder’s proportional ownership interest in the Issuer. See “Description of Share Capital” for a description of the material terms of our common shares and the difference between our Class A common shares, Class B common shares and Class C common shares. |

Option to purchase additional Class A |

| The selling shareholders have granted the underwriters the option to purchase up to an additional 2,625,000 Class A common shares from the selling shareholders within 30 days of the date of this prospectus, at the public offering price, less underwriting discounts and commissions, on the same terms as set forth in this prospectus. |

Listing |

| Our Class A common shares are listed on the New York Stock Exchange under the symbol “TBBB.” |

Use of proceeds |

| We will not receive any of the proceeds from Class A common shares sold by the selling shareholders. See “Use of Proceeds.” |

Share capital before and after offering |

| As of the date of this prospectus, we are authorized to issue an unlimited number of Class A common shares, an unlimited number of Class B common shares and an unlimited number of Class C common shares. Immediately after this offering, the Issuer will have outstanding 56,209,677 Class A common shares, 5,200,000 Class B common shares and 52,791,075 Class C common shares, assuming no exercise of the underwriters’ option to purchase additional Class A common shares from the selling shareholders. |

Dividend policy |

| The amount of any distributions will depend on many factors, such as our results of operations, financial condition, cash requirements, prospects and other factors deemed relevant by our board of directors and shareholders. We currently intend to retain all available funds and future earnings, if any, to fund the development and expansion of our business and we do not anticipate paying any cash dividends in the foreseeable future. See “Dividends and Dividend Policy.” |

Lock-ups |

| Holders of our Class B common shares and Class C common shares are subject to restrictions on the transfer of such shares for 24 months from the expiry of the initial 180-day lock-up period on August 6, 2024 (the “Liquidity Lock-Up Period”) relating to our IPO. See “Description of Share Capital.” |

19

Risk factors |

| See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should consider before deciding to invest in our Class A common shares. |

Unless otherwise indicated, all information contained in this prospectus assumes no exercise of the option granted to the underwriters to purchase up to additional 2,625,000 Class A common shares from the selling shareholders in connection with this offering.

20

Summary Financial and Other Information

The following tables set forth, for the periods and as of the dates indicated, our summary financial and operating data. The financial information presented herein has been derived from our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021, together with the notes thereto, incorporated by reference in this prospectus, and our unaudited interim condensed consolidated financial statements as of September 30, 2024 and for the three and nine months ended September 30, 2024 and 2023, together with the notes thereto, each prepared in accordance with IFRS as issued by the IASB, and included elsewhere in this prospectus.

The summary consolidated historical financial data should be read in conjunction with “Presentation of Financial and Other Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021, together with the notes thereto, and our unaudited interim condensed consolidated financial statements as of September 30, 2024 and for the three and nine months ended September 30, 2024 and 2023, together with the notes thereto, included elsewhere in this prospectus.

Our consolidated financial statements are stated in Mexican pesos.

Summary Consolidated Statements of Comprehensive Income Data

For the nine months ended |

|

| For the years ended |

| ||||||||||||||||||||||||

2024 |

| 2024 |

| 2023 |

| 2023 |

| 2023 |

| 2022 |

| 2021 |

| |||||||||||||||

(thousands of US$, |

| (thousands of Ps., except outstanding shares and per share amounts) |

| (thousands of US$, |

|

| (thousands of Ps., except outstanding shares and per share amounts) |

| ||||||||||||||||||||

Revenue from sales of | US$ |

| 2,089,510 |

| Ps. |

| 41,014,985 |

| Ps. |

| 31,694,573 |

| US$ |

| 2,240,960 |

| Ps. |

| 43,987,803 |

| Ps. |

| 32,472,577 |

| Ps. |

| 23,032,275 |

|

Sales of recyclables |

|

| 3,944 |

|

|

| 77,416 |

|

|

| 68,282 |

|

|

| 4,618 |

|

|

| 90,656 |

|

|

| 107,820 |

|

|

| 58,906 |

|

Total revenue |

|

| 2,093,454 |

|

|

| 41,092,401 |

|

|

| 31,762,855 |

|

|

| 2,245,578 |

|

|

| 44,078,459 |

|

|

| 32,580,397 |

|

|

| 23,091,181 |

|

Cost of sales |

|

| (1,753,233 | ) |

|

| (34,414,213 | ) |

|

| (26,733,603 | ) |

|

| (1,886,930 | ) |

|

| (37,038,542 | ) |

|

| (27,655,643 | ) |

|

| (19,655,090 | ) |

Gross profit |

|

| 340,220 |

|

|

| 6,678,188 |

|

|

| 5,029,252 |

|

|

| 358,649 |

|

|

| 7,039,917 |

|

|

| 4,924,754 |

|

|

| 3,436,091 |

|

Sales expenses |

|

| (214,400 | ) |

|

| (4,208,458 | ) |

|

| (3,431,030 | ) |

|

| (245,703 | ) |

|

| (4,822,912 | ) |

|

| (3,460,840 | ) |

|

| (2,422,688 | ) |

Administrative expenses |

|

| (72,676 | ) |

|

| (1,426,551 | ) |

|

| (1,033,144 | ) |

|

| (70,657 | ) |

|

| (1,386,929 | ) |

|

| (952,090 | ) |

|

| (623,874 | ) |

Other income (expense) – |

|

| 360 |

|

|

| 7,066 |

|

|

| 692 |

|

|

| (1,845 | ) |

|

| (36,213 | ) |

|

| 8,445 |

|

|

| 4,524 |

|

Operating profit |

|

| 53,505 |

|

|

| 1,050,245 |

|

|

| 565,770 |