The information in this preliminary prospectus is not complete and may be changed. We and the selling shareholders may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 6, 2024

PRELIMINARY PROSPECTUS

28,050,491 Class A common shares

BBB Foods Inc.

(incorporated in the British Virgin Islands)

This is an initial public offering of the Class A common shares, no par value, of BBB Foods Inc. We are offering 28,050,491 of the Class A common shares being sold in this offering.

Prior to this offering, there has been no public market for our Class A common shares. The estimated initial public offering price for the Class A common shares in this offering is expected to be between US$14.50 and US$16.50 per Class A common share. We intend to apply to list our Class A common shares on the New York Stock Exchange under the symbol “TBBB.” This offering is contingent upon receiving authorization to list our Class A common shares on the New York Stock Exchange.

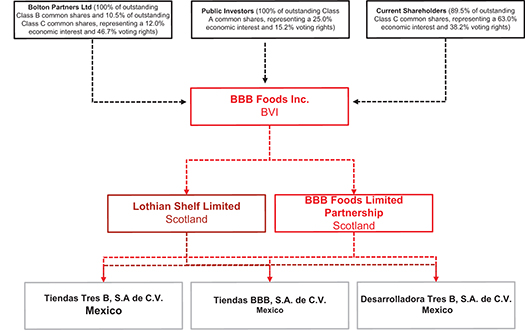

Upon consummation of this offering, we will have three classes of common shares: Class A common shares, Class B common shares and Class C common shares. The rights of the holders of each class of our common shares will be identical, except with respect to voting, conversion, preemptive rights and transfer restrictions applicable to the Class B common shares and conversion and transfer restrictions applicable to our Class C common shares. Each Class A common share will be entitled to one vote. Each Class B common share will be entitled to 15 votes and will be convertible into one Class A common share automatically upon transfer, subject to certain exceptions. Each Class C common share will be entitled to one vote and will be convertible into one Class A common share in certain circumstances, including automatically upon certain transfers and the expiry of the transfer restrictions that will apply to the Class C common shares. Class B common shares and Class C common shares will not be listed on any stock exchange and will not be publicly traded. Holders of Class A common shares, Class B common shares and Class C common shares will vote together as a single class on all matters unless otherwise required by law and subject to certain exceptions set forth in our memorandum and articles of association.

Following this offering, our issued and outstanding Class B common shares, will represent 42.2% of the combined voting power of our outstanding common shares and 4.6% of our total equity ownership, assuming no exercise of the underwriters’ option to purchase additional Class A common shares from the selling shareholders. For further information, see “Description of Share Capital.” Bolton Partners Ltd., a vehicle affiliated with our founder, Chairman and Chief Executive Officer, will, directly or indirectly, own all of our Class B common shares and a portion of our Class C common shares. As a result, Bolton Partners Ltd. will beneficially own approximately 46.7% of the combined voting power of our outstanding common shares following this offering, assuming no exercise of the underwriters’ option to purchase additional Class A common shares from the selling shareholders, and will therefore have significant influence over matters requiring shareholder approval.

We are a “foreign private issuer” under the U.S. federal securities laws and, as a result, have elected to comply with certain reduced public company disclosure and reporting requirements. See “Risk Factors—Risks Relating to this Offering and Our Class A Common Shares—Our status as a foreign private issuer exempts us from certain of the corporate governance standards of the New York Stock Exchange, limiting the protections afforded to investors” and “Risk Factors—Risks Relating to this Offering and Our Class A Common Shares—As a foreign private issuer, we will have different disclosure and other requirements from U.S. domestic registrants. We may take advantage of exemptions from certain corporate governance regulations of the New York Stock Exchange, and this may result in less protection for the holders of our Class A common shares.”

Investing in our Class A common shares involves a high degree of risk. See “Risk Factors” beginning on page 28 of this prospectus.

| | | | | | | | |

| | | Per Class A

Common Share | | | Total | |

Initial public offering price | | US$ | | | | US$ | | |

Underwriting discount and commissions(1) | | US$ | | | | US$ | | |

Proceeds to us (before expenses)(2) | | US$ | | | | US$ | | |

| (1) | See “Underwriting” for a description of all compensation payable to the underwriters. |

| (2) | See “Expenses of the Offering” for a description of all expenses (other than underwriting discounts and commissions) payable in connection with this offering. |

The selling shareholders have granted the underwriters the right to purchase up to an aggregate of 4,207,573 additional Class A common shares from us and the selling shareholders within 30 days from the date of this prospectus, at the initial public offering price, less underwriting discounts and commissions. We will not receive any proceeds from the sale of Class A common shares by the selling shareholders if the underwriters exercise their option to purchase additional Class A common shares from the selling shareholders in connection with this offering.

One or more funds and/or accounts managed by Capital International Investors (collectively, the “Cornerstone Investors”) have, severally and not jointly, indicated an interest in purchasing up to an aggregate of US$88 million in Class A common shares in this offering at the initial public offering price. The Class A common shares to be purchased by the Cornerstone Investors will not be subject to a lock-up agreement with the underwriters. Because these indications of interest are not binding agreements or commitments to purchase, the Cornerstone Investors may determine to purchase more, less or no shares in this offering or the underwriters may determine to sell more, less or no shares to the Cornerstone Investors. The underwriters will receive the same discount on any of our Class A common shares purchased by the Cornerstone Investors as they will from any other Class A common shares sold to the public in this offering.

Neither the U.S. Securities and Exchange Commission (the “SEC”), nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We expect to deliver the Class A common shares to purchasers against payment in New York, New York, on or about , 2024, through the book-entry facilities of The Depository Trust Company.

Global Coordinators

| | |

| J.P. Morgan | | Morgan Stanley |

Joint Bookrunners

| | | | |

| BofA Securities | | Scotiabank | | UBS Investment Bank |

The date of this prospectus is , 2024.