UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-41828

t

Atlas Energy Solutions Inc.

(Exact name of Registrant as specified in its Charter)

| |

Delaware | 93-2154509 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification No.) |

5918 W. Courtyard Drive, Suite 500 Austin, Texas | 78730 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(512) 220-1200

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common stock, par value $0.01 per share | | AESI | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer |

| ☒ |

| Accelerated filer |

| ☐ |

Non-accelerated filer |

| ☐ |

| Smaller reporting company |

| ☐ |

Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

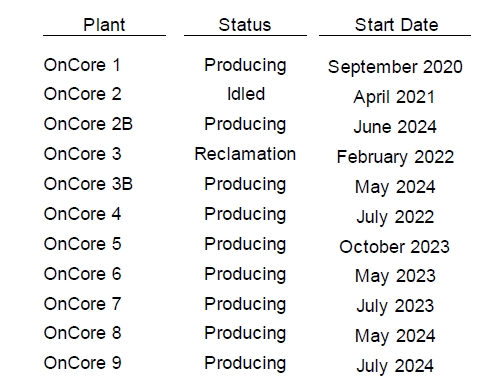

The aggregate market value of the outstanding common stock held by non-affiliates of the registrant as of June 28, 2024, the last business day of the registrant's most recently completed second fiscal quarter, was approximately $1.5 billion based on the closing sale price of $19.93 per share, as reported on the New York Stock Exchange on such date.

As of February 21, 2025, the registrant had 121,740,086 shares of common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2025 Annual Meeting of Stockholders (the “Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K and will be filed within 120 days of the registrant’s fiscal year end.

Table of Contents

GLOSSARY OF COMMONLY USED TERMS

Unless the context otherwise requires, all references in this Annual Report on Form 10‑K (this “Annual Report”) to:

•“2021 Term Loan Credit Facility” refer to the credit facility extended pursuant to the Credit Agreement, dated October 20, 2021, between Atlas Sand Company, LLC, as borrower, and Stonebriar Commercial Finance, LLC, as lender, as amended;

•“2023 ABL Credit Agreement” refer to the Loan, Security and Guaranty Agreement, dated as of February 22, 2023, among Atlas Sand Company, LLC, as borrower, certain of its subsidiaries, as guarantors, the lenders party thereto from time to time and Bank of America, N.A., as agent, sole lead arranger and sole bookrunner;

•“2023 ABL Credit Facility” refer to the credit facility extended pursuant to the 2023 ABL Credit Agreement;

•“2023 Term Loan Credit Agreement” refer to the Credit Agreement, dated July 31, 2023, among Atlas Sand Company, LLC, as borrower, the lender party thereto from time to time and Stonebriar Commercial Finance LLC, as administrative agent, as amended;

•“2023 Term Loan Credit Facility” refer to the credit facility extended pursuant to the 2023 Term Loan Credit Agreement;

•“ABL Amendment” refer to the First Amendment to Loan, Security and Guaranty Agreement, dated February 26, 2024, among Atlas LLC, the subsidiary guarantors party thereto, the lenders party thereto and the ABL Agent, which amends the 2023 ABL Credit Agreement;

•“ABL Agent” refer to Bank of America, N.A. the administrative agent in the 2023 ABL Credit Agreement;

•“A&R Registration Rights Agreement” refer to that certain Amended and Restated Registration Rights Agreement, dated as of October 2, 2023, among the Company, Old Atlas and certain of the Legacy Owners in connection with the consummation of the Up-C Simplification;

•“A&R Stockholders’ Agreement” refer to that certain Amended and Restated Stockholders’ Agreement, dated as of October 2, 2023, among the Company, Old Atlas and the Principal Stockholders in connection with the consummation of the Up-C Simplification;

•“ASC Incentive Plan” refer to the Atlas Sand Company, LLC Long-Term Incentive Plan;

•“ASMC” refer to Atlas Sand Management Company, LLC, a Texas limited liability company;

•“ASMC II” refer to Atlas Sand Management Company II, LLC, a Delaware limited liability company;

•“Atlas LLC” refer to Atlas Sand Company, LLC, a Delaware limited liability company and the predecessor of Old Atlas;

•“Atlas Operating” refer to Atlas Sand Operating, LLC, a Delaware limited liability company and the operating subsidiary of Old Atlas;

•“BLM” refer to the Bureau of Land Management, a federal agency within the U.S. Department of the Interior;

•“Board” refer to the Board of Directors of the Company;

•“Bylaws” refer to the Amended and Restated Bylaws of the Company;

•“CCAA” refer to the Candidate Conservation Agreement with Assurances relating to the DSL;

•“Charter” refer to the Amended and Restated Certificate of Incorporation of the Company;

•“Code” refer to the Internal Revenue Code of 1986, as amended;

•“Common Stock” refer to the common stock of the Company, par value $0.01;

•“Company,” “we,” “us,” “our” and like expressions refer to Atlas Energy Solutions Inc., a Delaware corporation and the public company successor of Old Atlas (f/k/a New Atlas HoldCo Inc.), together with its subsidiaries;

•“DDT Loan” refer to the commitments to provide up to $100.0 million of delayed draw term loan through the 2023 Term Loan Credit Facility;

•“Deferred Cash Consideration Note” refer to a secured PIK toggle seller note in an aggregate principle amount of $111.3 million as of December 31, 2024. This amount is subject to purchase price adjustments as defined in the Hi-Crush Merger Agreement, with a final maturity date of January 31, 2026;

•“DGCL” refer to the General Corporation Law of the State of Delaware;

•“DOL” refer to the U.S. Department of Labor;

•“DSL” refer to the dunes sagebrush lizard;

•“Dune Express” refer to the overland conveyor infrastructure solution;

•“E&P” refer to exploration and production;

•“EPA” refer to the Environmental Protection Agency;

•“ESA” refer to the Endangered Species Act of 1973, as amended;

•“ESG” refer to environmental, social and governance;

•“Exchange Act” refer to the Securities Exchange Act of 1934, as amended;

•“GAAP” refer to the generally accepted accounting principles in the United States of America;

•“Hi-Crush” refer to Hi-Crush Inc., a Delaware corporation;

•“Hi-Crush Merger Agreement” refer to the Agreement and Plan of Merger, dated February 26, 2024 by and among the Company, Atlas LLC, Wyatt Merger Sub 1 Inc., a Delaware corporation and direct, wholly-owned subsidiary of Atlas LLC, Wyatt Merger Sub 2, LLC, a Delaware limited liability company and direct, wholly-owned subsidiary of Atlas LLC, Hi-Crush, Clearlake Capital Partners V Finance, L.P., and HC Minerals Inc., a Delaware corporation;

•“Hi-Crush Stockholder” refer to each stockholder that had executed the Hi-Crush Merger Agreement;

•“Hi-Crush Transaction” refer to the acquisition of the Permian Basin proppant production and logistics businesses and operations of Hi-Crush, in exchange for mixed consideration totaling $456.1 million, subject to customary post-closing adjustments;

•“HoldCos” refer to Holdings, Holdings II, ASMC and ASMC II, collectively;

•“Holdings” refer to Atlas Sand Holdings, LLC, a Delaware limited liability company;

•“Holdings II” refer to Atlas Sand Holdings II, LLC, a Delaware limited liability company;

•“HSR Act” refer to the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended;

•“Initial Term Loan” refer to the $180.0 million single advance term loan that was made on July 31, 2023 through the 2023 Term Loan Credit Facility;

•“IPO” refer to the initial public offering of Old Atlas Class A Common Stock by Old Atlas completed on March 13, 2023;

•“IPO Reorganization Agreement” refer to that certain Master Reorganization Agreement, dated March 8, 2023, among Old Atlas, Atlas Operating, Atlas LLC, ASMC, Holdings, Holdings II, ASMC II and Atlas Sand Merger Sub, LLC, a Delaware limited liability company;

•“IRS” refer to the U.S. Internal Revenue Service;

•“JOBS Act” refer to the Jumpstart Our Business Startups Act of 2012;

•“Legacy Owners” refer to holders of membership interests in Holdings, Holdings II, ASMC and ASMC II, who, prior to the IPO, directly or indirectly held membership interests in Atlas LLC;

•“Lock-Up Period” refer to the period beginning on the date of completion of the IPO, March 13, 2023, and ending 180 days from such date;

•“LTIP” refer to the Atlas Energy Solutions Inc. Long Term Incentive Plan, adopted by the Board in March 2023;

•“Master Reorganization Agreement” refer to that certain Master Reorganization Agreement, dated July 31, 2023, among the Company, Old Atlas, PubCo Merger Sub, Atlas Operating, Opco Merger Sub and Holdings;

•“Mergers” refer to the PubCo Merger and Opco Merger, collectively;

•“Moser” refer to Moser Engine Service, Inc. (d/b/a Moser Energy Systems), a Wyoming corporation and a wholly-owned subsidiary of Moser Acquisition, Inc., a Delaware corporation;

•“Moser Purchase Agreement” refer to the Stock Purchase Agreement, dated January 27, 2025 by and among the Company and among Wyatt Holdings, LLC, a Delaware limited liability company and wholly-owned subsidiary of the Company, and Moser Holdings, LLC, a Delaware limited liability company;

•“Moser Registration Rights Agreements” refer to the registration rights agreement pursuant to the terms of the Moser Purchase Agreement;

•“NYSE” refer to The New York Stock Exchange;

•“Old Atlas” refer to AESI Holdings Inc., a Delaware corporation and the Company’s public company predecessor (f/k/a Atlas Energy Solutions Inc.);

•“Old Atlas Class A Common Stock” refer to shares of Class A common stock, par value $0.01 per share, of Old Atlas;

•“Old Atlas Class B Common Stock” refer to shares of Class B common stock, par value $0.01 per share, of Old Atlas;

•“Old Atlas Common Stock” refer to the Old Atlas Class A Common Stock and Old Atlas Class B Common Stock, collectively;

•“Opco Merger” refer to the merger of Opco Merger Sub with and into Atlas Operating, with Atlas Operating continuing as the surviving company, pursuant to the Master Reorganization Agreement;

•“Opco Merger Sub” refer to Atlas Operating Merger Sub, LLC, a Delaware limited liability company;

•“OPEC+” refer to the Organization of Petroleum Exporting Countries and other oil producing nations;

•“Operating Units” refer to membership interests in Atlas Operating.;

•“Original Registration Rights Agreement” refer to that certain Registration Rights Agreement, dated March 8, 2023, by and among Old Atlas and certain Legacy Owners;

•“Original Stockholders’ Agreement” refer to that certain Stockholders’ Agreement, dated March 8, 2023, by and among Old Atlas and the Principal Stockholders;

•“Previous Atlas Operating LLC Agreement” refer to the Amended and Restated Limited Liability Company Agreement of Atlas Operating, dated March 8, 2023;

•“Principal Stockholders” refer to certain stockholders party to the A&R Stockholders’ Agreement or the Original Stockholders’ Agreement, as applicable;

•“PubCo Merger Sub” refer to AESI Merger Sub Inc., a Delaware corporation;

•“PubCo Merger” refer to the merger of PubCo Merger Sub with and into Old Atlas, with Old Atlas continuing as the surviving corporation and a wholly-owned subsidiary of the Company, pursuant to the Master Reorganization Agreement;

•“Sarbanes-Oxley Act” refer to the Sarbanes-Oxley Act of 2002, as amended;

•“Sealy Smith” refer to The Sealy & Smith Foundation;

•“SEC” refer to the U.S. Securities and Exchange Commission;

•“Second A&R Atlas Operating LLC Agreement” refer to the Second Amended and Restated Limited Liability Company Agreement of Atlas Operating, dated October 2, 2023;

•“Securities Act” refer to the Securities Act of 1933, as amended;

•“Stonebriar” refer to Stonebriar Commercial Finance LLC;

•“Term Loan Amendment” refer to the First Amendment, dated as of February 26, 2024, to Credit Agreement, among Atlas LLC, the lenders party thereto and Stonebriar Commercial Finance LLC, as administrative agent, which amends the 2023 Term Loan Credit Agreement;

•“TCEQ” refer to the Texas Commission on Environmental Quality;

•“Up-C Simplification” refer to the transactions contemplated by the Master Reorganization Agreement, including the Mergers; and

•“USFWS” refer to the U.S. Fish and Wildlife Service.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements that are subject to risks and uncertainties. All statements, other than statements of historical fact included in this Annual Report, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. Additionally the information in this Annual Report includes forward-looking statements related to the recently-announced Moser Acquisition (as defined in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.—Recent Developments”). When used in this Report, the words “may,” “forecast,” “continue,” “could,” “would,” “will,” “plan,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described in Item 1A. “Risk Factors” included in this Annual Report. By their nature, forward-looking statements involve known and unknown risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Although we believe that the forward-looking statements contained in this Annual Report are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those in such forward-looking statements, including but not limited to:

•uncertainties as to whether the Moser Acquisition will achieve its anticipated benefits and projected synergies within the expected time period or at all;

•our ability to successfully integrate the business of Moser in a successful manner and in the expected time period;

•unforeseen or unknown liabilities, future capital expenditures and potential litigation relating to the Moser Acquisition;

•the effect of the announcement or completion of the Moser Acquisition on each of Moser’s or our business relationships and business generally;

•business disruptions or loss of key employees in connection with the Moser Acquisition;

•limitations on our financial flexibility due to existing and future debt following the consummation of the Moser Acquisition;

•our ability to successfully execute our Common Stock repurchase program or implement future Common Stock repurchase programs;

•the ultimate cost and time needed to execute the desired process improvements at our production facilities following the fire that occurred at our Kermit facility on April 14, 2024;

•the ultimate impact of the Kermit facility incident on the Company’s future performance;

•higher than expected costs to operate our proppant production and processing facilities or the Dune Express;

•the amount of proppant we are able to produce, which could be adversely affected by, among other things, operating difficulties and unusual or unfavorable geologic conditions;

•the volume of proppant we are able to sell and our ability to enter into supply contracts for our proppant on acceptable terms;

•the prices we are able to charge, and the margins we are able to realize, from our sales of proppant, logistics services, or mobile power generation;

•the demand for and price of proppant and power generation, particularly in the Permian Basin;

•the success of our electric dredging transition efforts;

•fluctuations in the demand for certain grades of proppant;

•the domestic and foreign supply of and demand for oil and natural gas;

•the effects of actions by, or disputes among or between, members of OPEC with respect to production levels or other matters related to the prices of oil and natural gas;

•changes in the price and availability of natural gas, diesel fuel or electricity that we use as fuel sources for our proppant production facilities and related equipment;

•changes in the availability of grid power that would reduce the need for mobile power supply, particularly in the Permian Basin;

•the availability of capital and our liquidity;

•the level of competition from other companies;

•pending legal or environmental matters;

•changes in laws and regulations (or the interpretation thereof) or increased public scrutiny related to the proppant production and oil and natural gas industries, silica dust exposure or the environment;

•facility shutdowns in response to environmental regulatory actions;

•technical difficulties or failures;

•liability or operational disruptions due to pit-wall or pond failure, environmental hazards, fires, explosions, chemical mishandling or other industrial accidents;

•unanticipated ground, grade or water conditions;

•inability to obtain government approvals or acquire or maintain necessary permits or mining, access or water rights;

•changes in the price and availability of transportation services;

•inability of our customers to take delivery;

•difficulty collecting on accounts receivable;

•the level of completion activity in the oil and natural gas industry;

•inability to obtain necessary proppant production or power generation equipment or replacement parts;

•the amount of water available for processing proppant;

•any planned or future expansion projects or capital expenditures;

•our ability to finance equipment, working capital and capital expenditures;

•inability to successfully grow organically, including through future land acquisitions;

•inaccuracies in estimates of volumes and qualities of our frac sand reserves;

•failure to meet our minimum delivery requirements under our supply agreements;

•material nonpayment or nonperformance by any of our significant customers;

•development of either effective alternative proppants or new processes that replace hydraulic fracturing;

•our ability to borrow funds and access the capital markets;

•our ability to comply with covenants contained in our debt instruments;

•the potential deterioration of our customers’ financial condition, including defaults resulting from actual or potential insolvencies;

•unexpected changes in tariffs, trade barriers, price and exchange controls and other regulatory requirements;

•volatility in political, legal and regulatory environments in connection with the U.S. presidential transition;

•changes in global political or economic conditions, including sustained inflation as well as financial market instability or disruptions to the banking system due to bank failures, both generally and in the markets we serve;

•the impact of geopolitical developments and tensions, war and uncertainty in oil-producing countries (including the invasion of Ukraine by Russia, the Israel-Hamas war, continued instability in the Middle East, including from the Houthi rebels in Yemen, and any related political or economic responses and counter-responses or otherwise by various global actors or the general effect on the global economy);

•health epidemics, such as the COVID-19 pandemic, natural disasters or inclement or hazardous weather conditions, including but not limited to cold weather, droughts, flooding, tornadoes and the physical impacts of climate change;

•physical, electronic and cybersecurity breaches;

•the effects of litigation;

•plans, objectives, expectations and intentions described in this Annual Report that are not historical; and

•other factors discussed elsewhere in this Annual Report, including in Item 1A. “Risk Factors.”

We caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, the risks described in Item 1A. “Risk Factors” in this Annual Report.

You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this Annual Report. Should one or more of the risks or uncertainties described in this Annual Report occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, included in this Annual Report are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements to reflect events or circumstances after the date of this Annual Report.

SUMMARY OF RISK FACTORS

This summary briefly lists the principal risks and uncertainties facing our business, which are only a select portion of those risks. A more complete discussion of those risks and uncertainties is set forth in Item 1A. “Risk Factors.” Additional risks not presently known to us or that we currently deem immaterial may also affect us. If any of these risks occur, our business, financial condition or results of operations could be materially and adversely affected. Our business is subject to, among others, the following principal risks and uncertainties:

Risks Related to Our Business and Operations

•the level of activity in the oil and natural gas industries;

•the cyclical nature of our customers’ businesses and the oil and natural gas industry;

•decreased demand for proppant, the development of technically- and cost-effective alternative proppants or new processes to replace hydraulic fracturing;

•our ability to succeed in competitive markets and on our ability to appropriately react to market fluctuations including price volatility;

•increasing costs, lack of dependability or availability, or an oversupply of transportation services or infrastructure;

•operational hazards and inherent risks;

•potential inability to acquire adequate supplies of water for our dredging operations;

•failure to maintain effective quality control systems at our mining and production facilities;

•environmental and industrial accidents and operational breakdowns;

•the complex and challenging nature of the Dune Express;

•increased attention to ESG and conservation matters;

•loss of or inability to attract and retain members of our workforce;

•a shortage of skilled labor or rising labor costs in the excavation industry;

•inaccuracies in our estimates of sand reserves and resource deposits, or deficiencies in our title to those deposits;

•adverse developments at any of our three production facilities;

•an increase in the price or a significant interruption in the supply of natural gas and electricity or any other energy sources necessary to our continued operations;

•the loss of or a significant reduction in purchases by our largest customers;

•our and our customers’ ability to obtain and maintain necessary permits;

•our inability to take advantage of increasing prices for proppant due to the terms of our supply agreements;

•our inability to meet our minimum proppant delivery requirements under our supply agreements;

•our operational concentration in the Permian Basin;

•complexities involved in the software and technology systems that need to be developed in connection with our autonomous trucking initiative;

•undetected defects, errors or bugs in the hardware or software related to our autonomous driving technology, when deployed;

•unauthorized control or manipulation of the systems in our autonomous proppant-delivery vehicles;

•natural disasters and unusual weather conditions;

•failure of any acquisitions, dispositions and investments to result in the anticipated benefits;

•the material weakness in our internal control over financial reporting that could, if not remediated, result in material misstatements in our financial statements and cause us to fail to meet our reporting obligations;

Risks Related to Our Financial Condition

•the impact of our indebtedness on our financial flexibility and our competitive position;

•the inability to obtain needed capital or financing, on satisfactory terms, or at all;

Risks Related to Our Organizational Structure and Ownership of Our Common Stock

•our potential future reduction or suspension of our dividend;

•impact of future sales or the perception of future sales of our Common Stock;

•the Principal Stockholders’ ability to direct the voting of a significant proportion of the Common Stock;

•the loss of anticipated net cash tax savings as a result of the Up-C Simplification;

•our potential inability to offer equity consideration in acquisitive transactions on a tax-deferred basis;

•public and investor sentiment towards climate change, fossil fuels and other ESG matters;

Risks Related to Environmental, Mining and Other Regulations

•silica-related health issues and related regulation, litigation and legislation;

•legislative and regulatory initiatives relating to hydraulic fracturing and the potential for related litigation;

•environmental and natural resources regulations that impose risks of significant costs and liabilities;

•risks related to climate change, including regulatory, political, litigation and financial risks;

•operational restrictions intended to protect certain species of wildlife;

•restrictions on oil and natural gas development on federal lands;

•regulations that impose stringent occupational health and safety standards on our operations;

•risks related to obtaining, maintaining, and complying with permits necessary for the operation of our business.

Risks Related to the Moser Acquisition

•our inability to integrate the business of Moser successfully;

•potential lawsuits in connection with the Moser Acquisition;

•risks related to anticipated benefits and expectations from the Moser Acquisition;

•our ability to succeed in a new line of business;

•risks related to the market price for our Common Stock following the closing of the Moser Acquisition;

•dependency on relationships with key suppliers;

•our ability to succeed in long sales cycles;

•risks related to our customers power system needs;

•dependency on few customers for a significant portion of our power solutions revenues; and

•changes in the availability of grid power.

PART I

Item 1. Business.

Overview

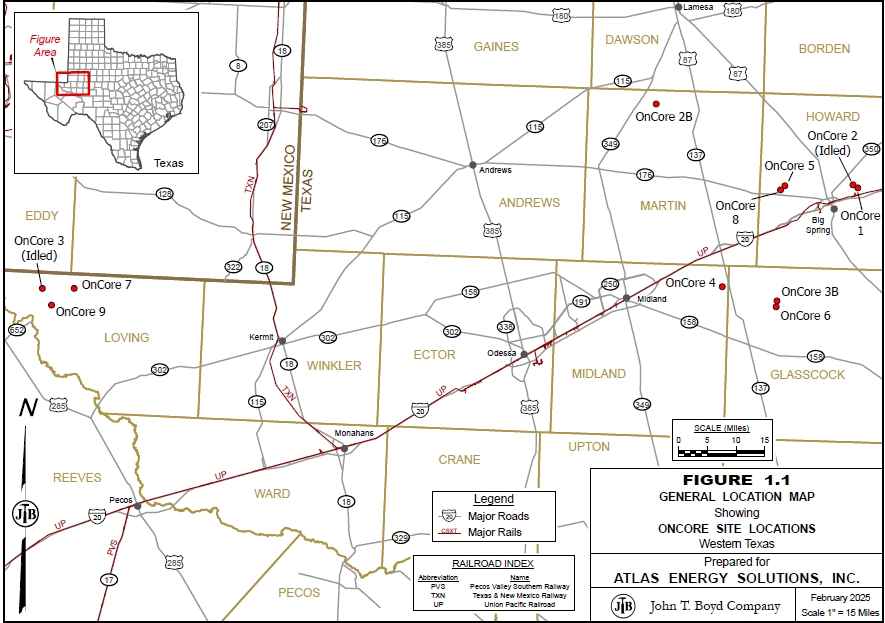

Atlas Energy Solutions Inc. is a leading proppant producer, logistics, and distributed power solutions provider, primarily serving the Permian Basin of West Texas and New Mexico. We operate 14 proppant production facilities across the Permian Basin including both large-scale in-basin facilities and smaller distributed mining units. We manage a portfolio of leading-edge logistics assets, which includes our 42-mile Dune Express conveyor system (the only proppant conveyor system in the world, and the longest conveyor in the United States). In addition, we manage a fleet of over 120 trucks, including early autonomous delivery systems, which are capable of delivering expanded payloads due to our custom-manufactured trailers and patented drop-depot process. Our approach to managing proppant production, logistics, and distributed power solutions operations is intently focused on leveraging technology, automation, and remote operations to drive efficiencies.

We are a low-cost producer of various high-quality, locally sourced proppants used during the well completion process. We offer both dry and damp sand and carry various mesh sizes including 100 mesh and 40/70 mesh. Proppant is a key component necessary to facilitate the recovery of hydrocarbons from oil and natural gas wells.

Our logistics platform is designed to increase the efficiency, safety, and sustainability of the oil and natural gas industry within the Permian Basin, which is increasingly a differentiating factor affecting customer choice among proppant suppliers. The cost of delivering sand, even short distances, can be a significant component of customer spending on well completions given the substantial volumes that are utilized in modern well designs. In addition to our plant automation and our Dune Express proppant delivery system, we are also integrating autonomous driving technologies in certain of our fit-for-purpose trucks, creating the first semi-autonomous oilfield logistics network to increase the automation of the oil and gas proppant supply chain. Our investments in these leading-edge technologies, including autonomous trucking, digital infrastructure, and artificial intelligence, not only drive efficiencies in our operations to the benefit of our customers, but they also deliver beneficial environmental and community impacts. We believe the Company is uniquely positioned to automate and modernize the Permian Basin’s proppant and logistics infrastructure, making the basin a more efficient energy factory, and a better and cleaner place to live and work.

We also provide distributed power solutions through a fleet of more than 900 natural gas-powered reciprocating generators, with approximately 212 megawatts of existing power generation primarily supporting production and artificial lift operations across all major United States resource basins. Our generators are designed for heavy-duty, harsh environments for mission critical power needs. Our in-house manufacturing and remanufacturing capabilities, coupled with critical in-field service, provide quality control and standardization across the fleet with the goal of providing market-leading uptime.

Our mission is to improve human beings’ access to the hydrocarbons that power our lives, and, by doing so, we maximize the value creation for our stockholders. Value creation for our shareholders is our fundamental goal. In order to fulfill our mission and create value for our shareholders, we strive to optimize the outcomes for our broader stakeholders, including our employees and the communities in which we operate. We are proud of the fact that our approach to innovation in the hydrocarbon industry drives efficiencies creating value for our shareholders, while also delivering differentiated social and environmental progress. The Company has driven innovation designed to provide industry-leading environmental benefits by reducing energy consumption, emissions, and our aerial footprint. We call this Sustainable Environmental and Social Progress, and it is driven by shareholder value creation.

We were founded in 2017 by Ben M. "Bud" Brigham, our Executive Chairman, and are led by an entrepreneurial team with a history of constructive disruption bringing significant and complementary experience to this enterprise, including the perspective of longtime E&P operators, which provides for an elevated understanding of the end users of our products and services. Our executive management team has a proven track record with a history of generating positive returns and value creation. Our experience as E&P operators was instrumental to our understanding of the opportunity created by in-basin sand production and supply in the Permian Basin, which we view as North America's premier shale resource and which we believe will remain its most active through economic cycles.

Assets and Operations

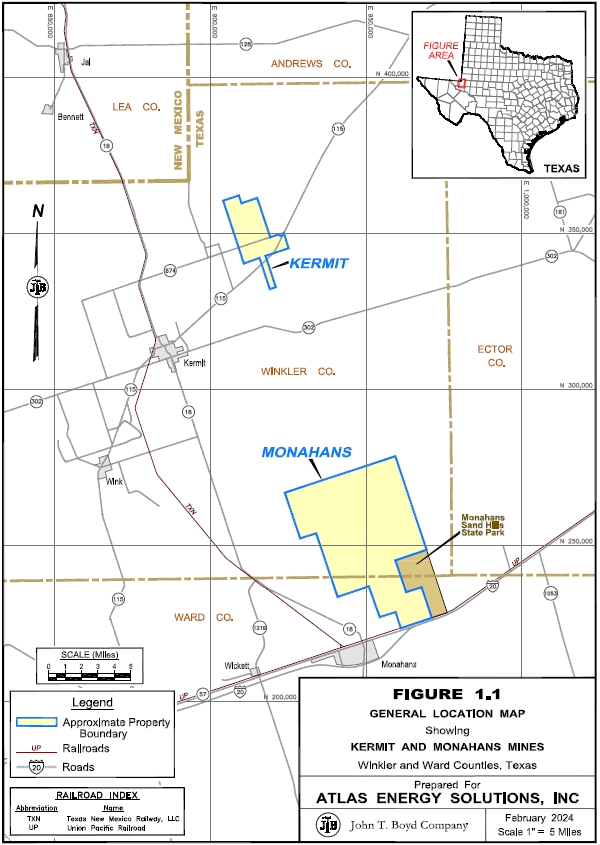

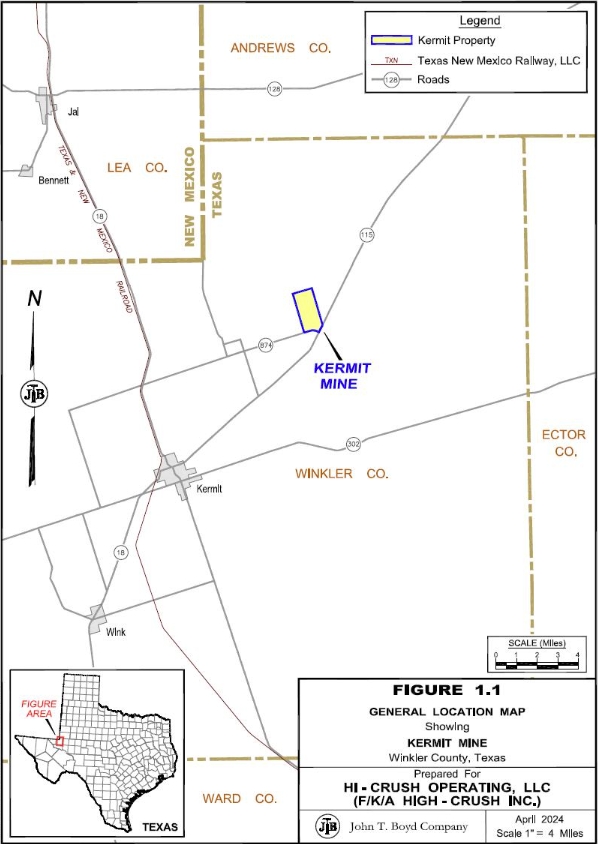

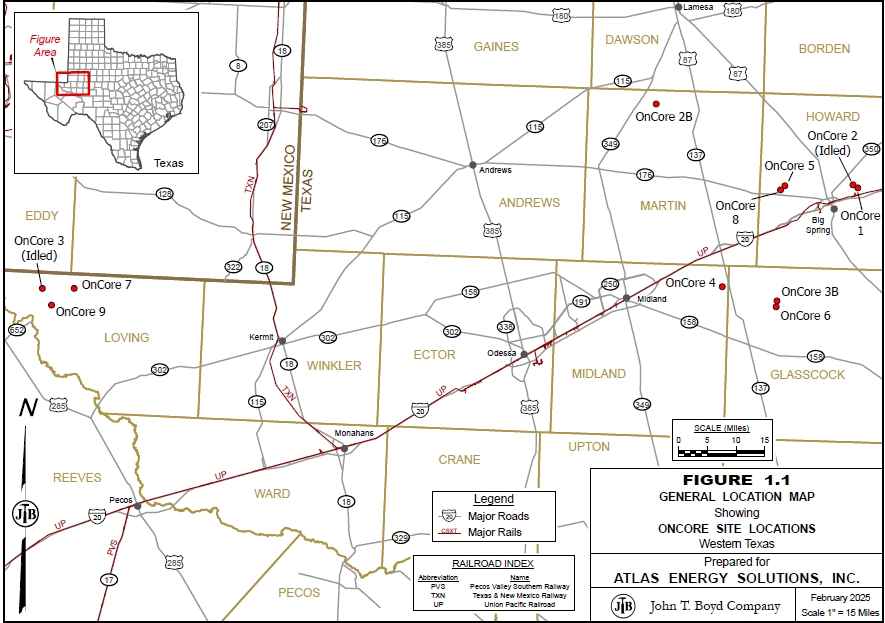

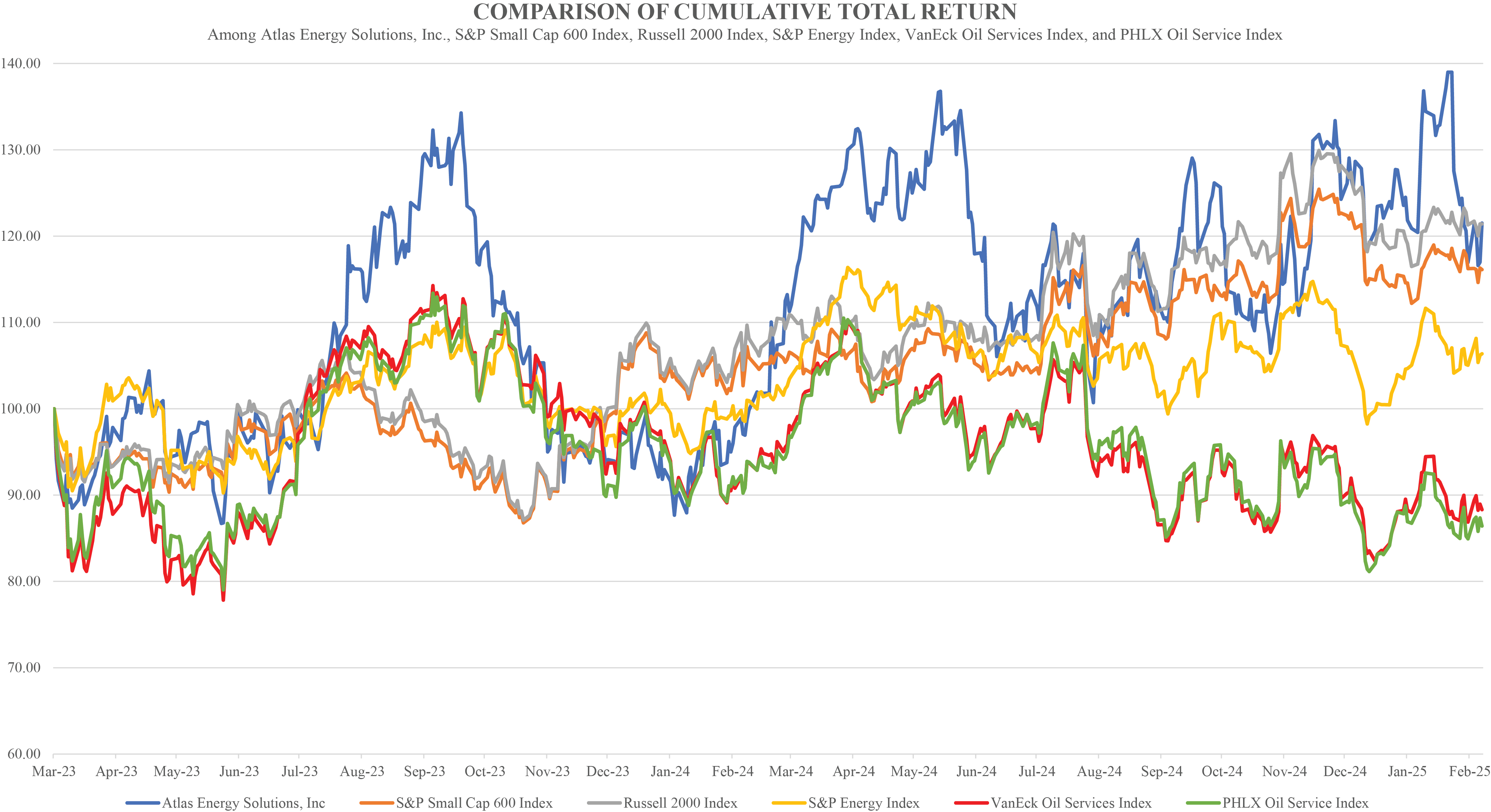

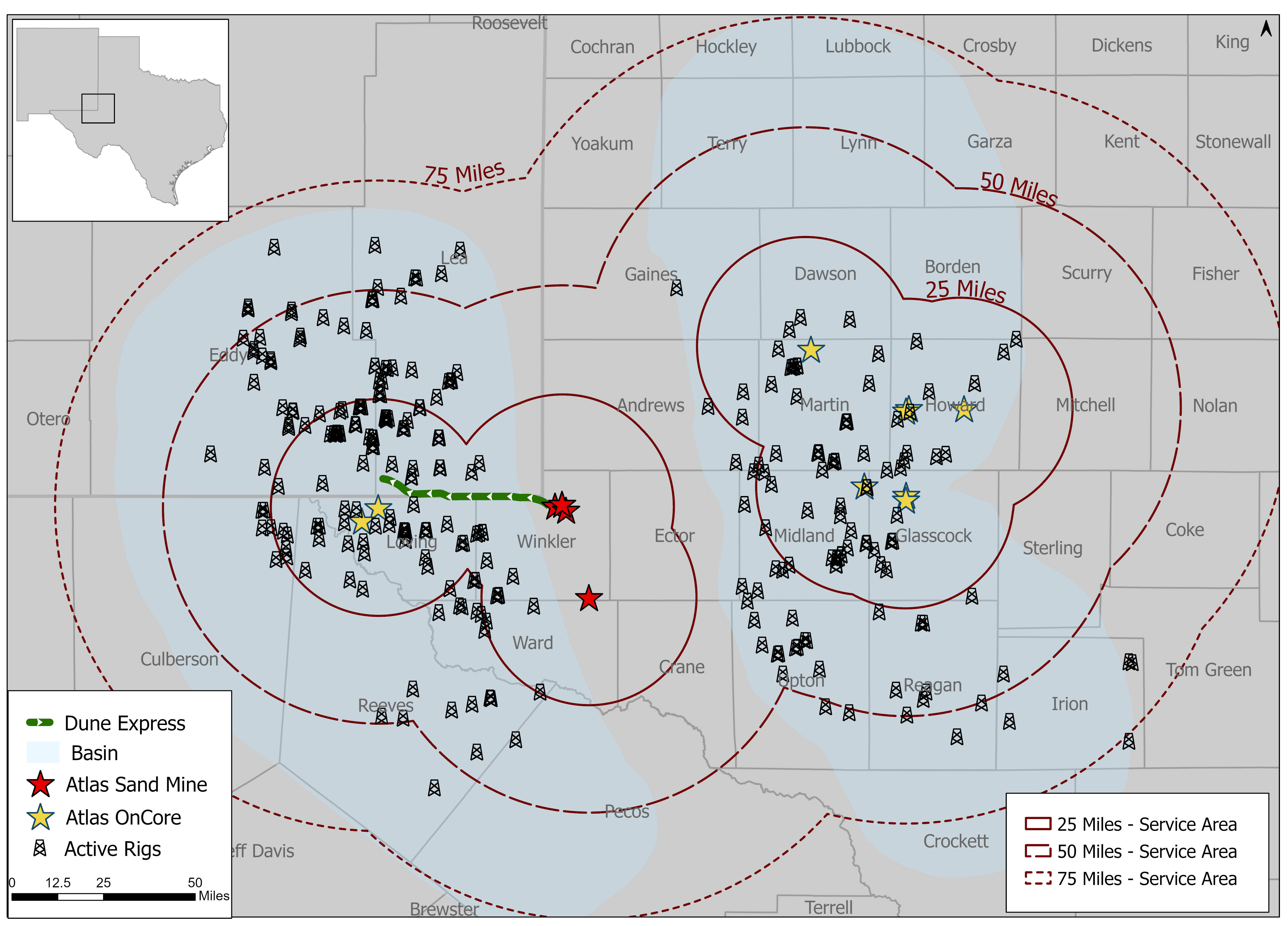

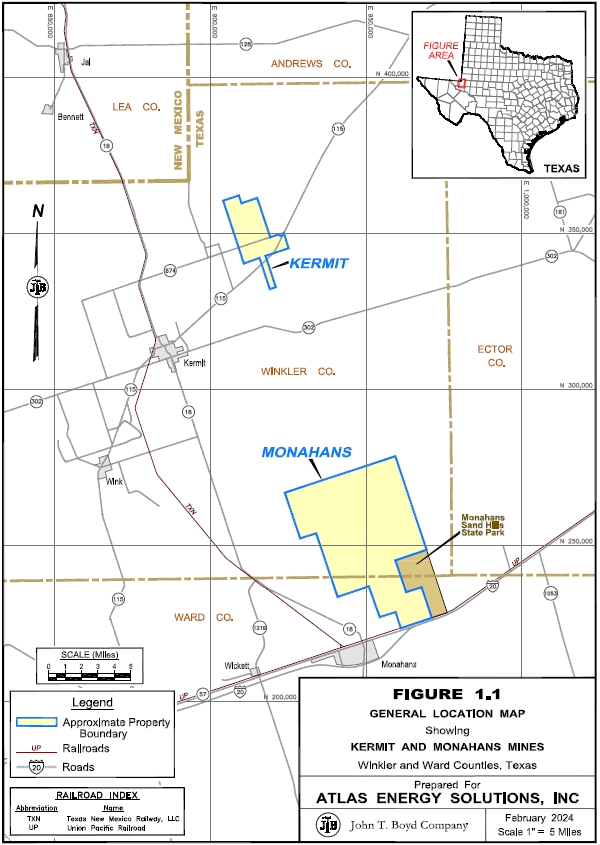

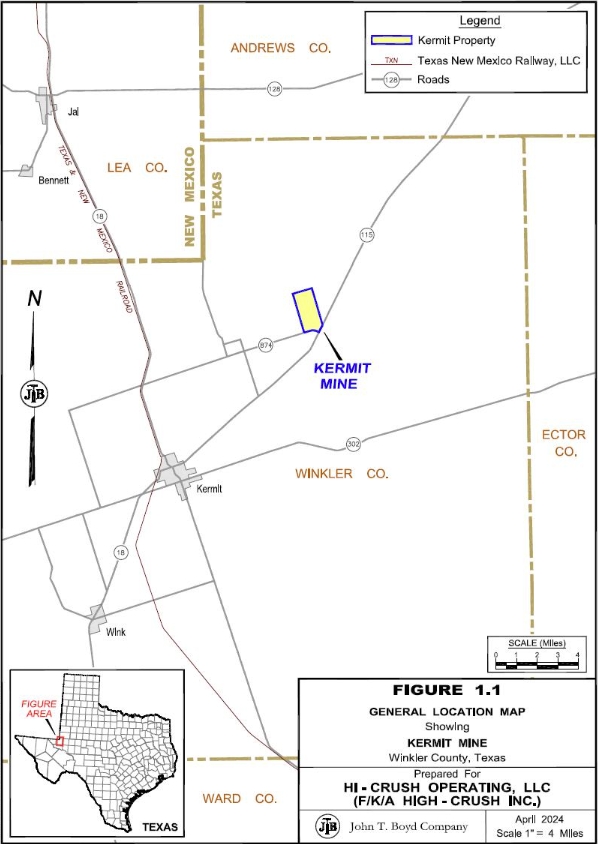

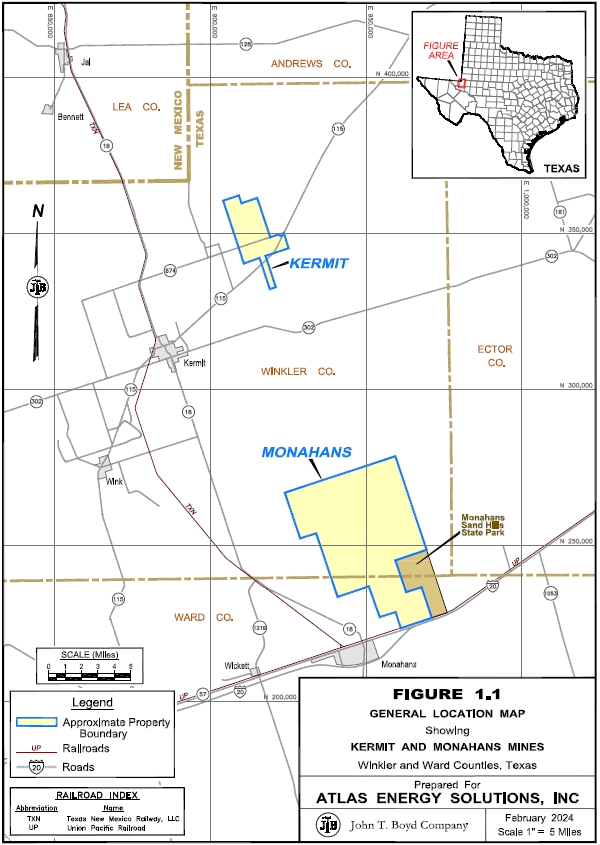

Our Kermit facilities, Monahans facility, and OnCore distributed mining network are located in West Texas. The Kermit facilities consist of the two internally developed Kermit facilities (“K1/K2”) and the two facilities acquired in the Hi-Crush Transaction (“K115/874”). The facilities and OnCore distributed mining network encompass 45,855 gross acres in the aggregate that we own or lease. We have substantial off-dune acreage at Monahans that is not included in our estimated reserves or resources but that could be mined following our removal of material, such as soil and unusable sand, that lies above the useable sand and must be removed to excavate the useable sand, which we refer to as “overburden.”

The Dune Express was completed in December 2024. The Dune Express, which originates at our Kermit facilities and stretches into the middle of the Northern Delaware Basin, is the first long-haul proppant conveyor system in the world. The Dune Express is 42 miles in length, capable of transporting 13 million tons of proppant annually, and is strategically located to deliver proppant to the Northern Delaware Basin. We expect the Dune Express to lower legacy transportation requirements and increase safety by removing trucks from public roadways, thus reducing traffic, accidents and fatalities on public roadways in the region.

We installed two permanent loadout facilities, one located on the Texas side of the Texas-New Mexico state line approximately at the midpoint of the conveyor and one located at the end of the Dune Express right-of-way on BLM land near the Lea-Eddy County line in New Mexico. The conveyor system also utilizes one or more mobile offload systems, which can be mobilized and relocated from time to time, to maximize delivery efficiencies for customers that are proximate to the conveyor system but not proximate to one of the two permanent loadouts connected to the system.

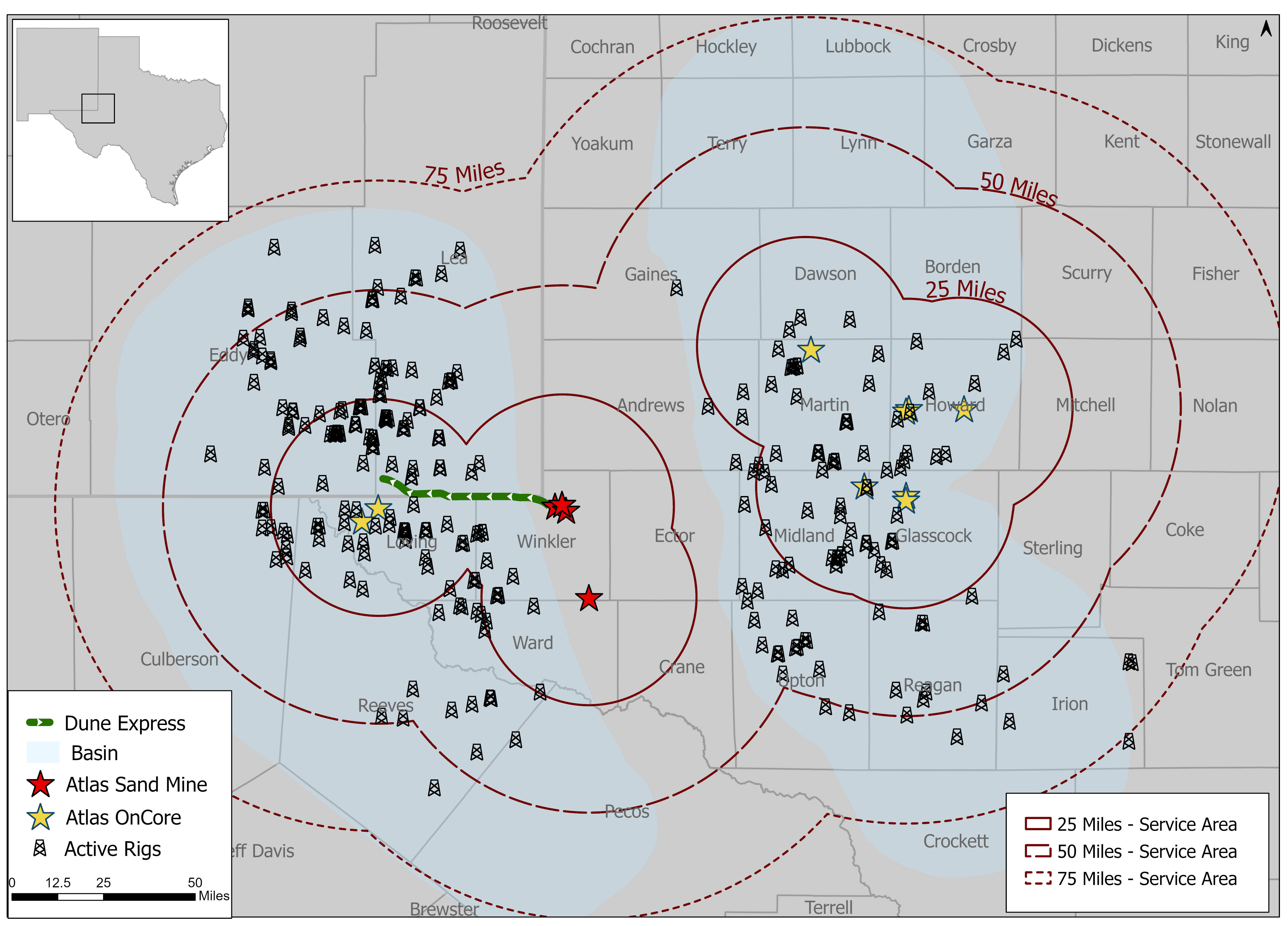

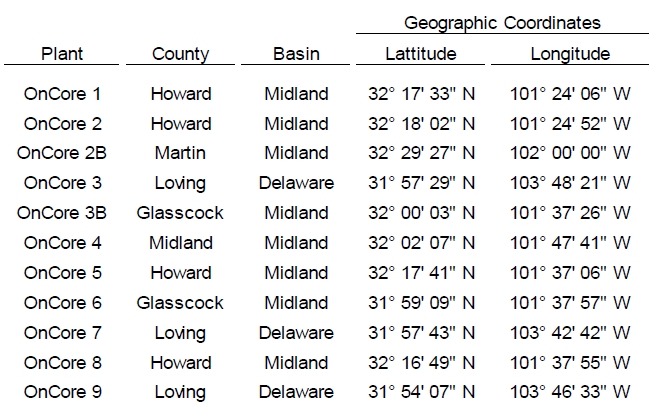

Map of Operations

The following map shows the locations of our Kermit facilities, Monahans facility, and the OnCore distributed mining network in West Texas, as well as the Dune Express route, alongside a recent snapshot of the rig count in the Permian Basin as of December 31, 2024:

Source: Enverus.

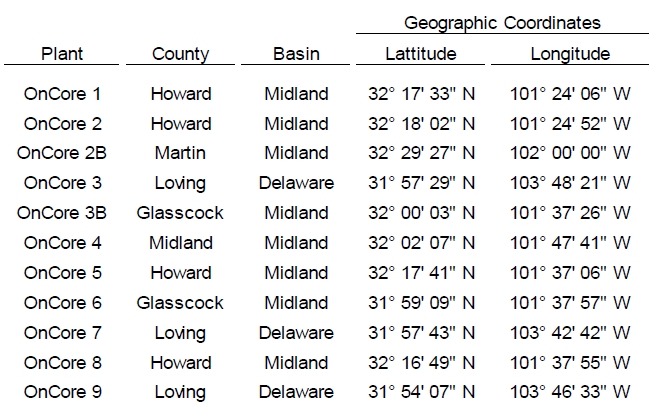

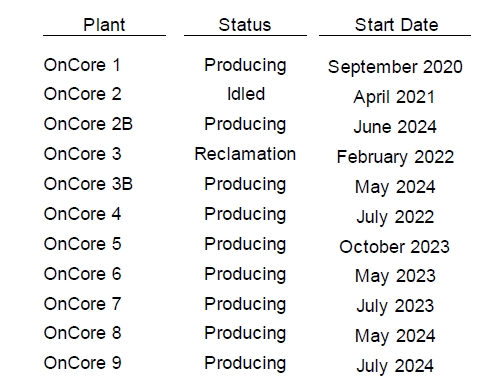

The Kermit facilities and the Monahans facility were built to produce high quality 40/70-mesh and 100-mesh sands, each of which is used extensively in upstream operations in the Permian Basin. Innovative plant design and large-scale operations facilitate low-cost operations and continuity on site. Redundancies were designed into our facilities to remove singular points of failure that could disrupt the production process, ensuring maximum reliability of proppant production and delivery. The facilities are capable of operating year-round and feature advanced safety designs, onsite water supply, power infrastructure and access to low-cost natural gas through connections to interstate natural gas lines. Our OnCore distributed mining network is comprised of 9, built-for-purpose mobile processing plants which produce wet (i.e., undried or damp) 100-mesh sand from leased or customer-owned properties. At each OnCore site, we are responsible for mining and processing the raw sand, selling the finished frac sand products, and reclaiming the disturbed land. The mobility of the OnCore plants provides a great deal of flexibility not afforded to large-scale fixed-plant mining operations.

Further, we benefit from the strategic locations of our facilities, proximal to major highways at the south and north ends of the Winkler Sand Trend. Our Kermit facilities are bisected by two state highways, while our Monahans facility its adjacent to two highways, one of which is Interstate 20, facilitating efficient transportation of our proppant to customers located at various points within the Permian Basin. Accessibility to the western sites for the OnCore mines is via Texas state highway TX-302 or U.S. Route 285; while primary access to the eastern sites is via Interstate 20, state highways TX-137, TX-176, or TX-349.

The operations of our sand facilities are managed and monitored in a highly automated manner from our command center in Austin, Texas. The remote ecosystem allows our employees to simultaneously manage processes at all facilities, resulting in personnel productivity gains.

Our Products and Services

Product

We serve the oil and gas end markets, and our sand reserves contain deposits of fine grade 40/70-mesh and 100-mesh sizes that API specifies for use in wellsite fracturing operations. We believe that this mix of finer grade sand reserves is in higher demand and meets current industry preferences. Based on the reserve report prepared by John T. Boyd Company (“JT Boyd”), our independent mining engineers and geologists, as of December 31, 2024, we had 592.9 million tons of proven and probable sand reserves at our Kermit facilities, Monahans facility, and OnCore distributed mining network. Our reserves were composed of approximately 44% 40/70-mesh, 37% 70/140-mesh, and 19% of 40/140-mesh substrate sand. As of December 31, 2024, we estimate our reserve life to be approximately 30 years for our K1/K2 facilities, 12 years for our K115/874 facilities, 28 years for our Monahans facility, and 21 years for our OnCore distributed mining network, as may be extended or adjusted for future conversions of measured, indicated or inferred resources to proven or probable reserves or any change to our production capacity. For more information regarding our mineral reserves, see Item 2. “Property.—Our Reserves.”

Proppant is stored onsite before transport and delivery by truck to customers’ well sites located primarily in the Delaware and Midland Basins. Our proppant is offered to our customers at the mine or as an integrated mine-to-wellhead solution.

Services

We provide transportation, storage solutions and contract labor services to companies in the oil and gas industry, and with the acquisition of Moser, we will add distributed power services. Transportation services typically consist of transporting product from the plant facilities to the wellsite. The locations of our facilities are within close proximity to well activity and enable us to deliver proppant directly to our customers’ wellheads using a variety of methods, reducing handling costs and delivery lead times.

Our Permits

We have obtained numerous federal, state and local permits required for operations at our Kermit facilities, Monahans facility, and OnCore distributed mining network. Operations are predominantly regulated by the TCEQ with respect to environmental compliance. The predominant permitting requirement is an active New Source Review (“NSR”) permit for air pollution control. Our operations have a current NSR permit which is renewable next in 2028. Other permits held by our operations include Stormwater, Above Ground Storage Tank, Aggregate Production Operation, and a septic permit. A Spill Prevention, Control, and Countermeasure plan is also active at locations.

While resources invested in securing permits are significant, this cost has not had a material adverse effect on our results of operations or financial condition. We cannot be certain that existing environmental laws and regulations will not be reinterpreted or revised or that new environmental laws and regulations will not be adopted or become applicable to us. Revised or additional environmental requirements that result in increased compliance costs or additional operating restrictions could have a material adverse effect on our business.

Environmental and Occupational Health and Safety Regulations

We are subject to stringent and complex federal, state and local laws and regulations governing the discharge of materials into the environment or otherwise relating to protection of worker health, safety and the environment and natural resources (including threatened and endangered species). Compliance with these laws and regulations may expose us to significant costs and liabilities and cause us to incur significant capital expenditures in our operations. Any failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, imposition of remedial obligations and the issuance of injunctions delaying or prohibiting operations. Certain environmental laws may impose strict, joint and several liability for remediation costs. Private parties may also have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for personal injury or property damage. In addition, the trend in environmental regulation has been to place more restrictions on activities that may affect the environment, and thus, any changes in, or more stringent enforcement of, these laws and regulations that result in more stringent and costly pollution control equipment, the occurrence of delays in the permitting or performance of projects, or waste handling, storage, transport, disposal or remediation requirements could have an adverse effect on our operations and financial position.

We do not believe that compliance by us and our customers with federal, state or local environmental laws and regulations will have an adverse effect on our business, financial position or results of operations or cash flows. We cannot assure you, however, that future events, such as changes in existing laws or enforcement policies, the enactment or promulgation of new laws or regulations or the development or discovery of new facts or conditions adverse to our operations will not cause us to incur significant costs. The following is a discussion of material environmental and worker health and safety laws, as amended from time to time, that relate to our operations or those of our customers that could have an adverse effect on our business.

Worker & Community Health and Safety

We are subject to the requirements of the federal Occupational Safety and Health Administration (“OSHA”), the federal Mine Safety and Health Administration, and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and the public. Similar obligations related to community safety are codified in the Emergency Planning & Community Right to Know Act, as authorized by the Superfund Amendments and Reauthorization Act. These laws and regulations are subject to frequent changes and any failure to comply with these laws could lead to the assertion of third-party claims against us, civil or criminal fines and changes in the way we operate our facilities, which one or more events could have an adverse effect on our financial position. We have an internal program of inspection designed to monitor and enforce compliance with worker safety requirements. Historically, our worker and community health and safety compliance costs have not had an adverse effect on our results of operations.

Air Emissions

Our operations and the operations of our customers are subject to the federal Clean Air Act (“CAA”) and related state and local laws, which restrict the emission of air pollutants and impose permitting, monitoring and reporting requirements on various sources. These regulatory programs may require preconstruction permitting, best available control technology analysis, the installation of emissions abatement equipment, modification of operational practices and obtaining permits or similar authorizations for our operations. Obtaining air emissions permits has the potential to delay the development or continued performance of our operations. Over the next several years, we may be required to incur certain capital expenditures for air pollution control equipment or to address air emissions-related issues as we expand our facilities or develop new ones. Changing and increasingly stricter requirements, future non-compliance or failure to maintain necessary permits or other authorizations could require us to incur substantial costs or suspend or terminate our operations. We could be subject to administrative, civil and criminal penalties as well as injunctive relief for noncompliance with air permits or other requirements of the CAA and comparable state laws and regulations.

Climate Change

In the United States, no comprehensive climate change legislation has been implemented at the federal level. However, following the U.S. Supreme Court finding that emissions of greenhouse gases (“GHGs”) constitute a pollutant under the CAA, the EPA has adopted regulations that, among other things, establish construction and operating permit reviews for emissions from certain large stationary sources, require the monitoring and annual reporting of GHG emissions from certain petroleum and natural gas system sources in the United States, and together with the Department of Transportation (the “DOT”), implement GHG emissions limits on vehicles manufactured for operation in the United States. However, on January 20, 2025, President Trump signed an Executive Order directing the EPA to reconsider the legality of its GHG “endangerment finding,” which provides the basis for EPA’s authority to regulate GHG emissions. We cannot predict when or whether the EPA will take action regarding this finding, or the ultimate impacts on our business. Further, while the Inflation Reduction Act of 2022 (“IRA”) appropriated significant federal funding for renewable energy initiatives and, for the first time ever, imposed a fee on GHG emissions from certain facilities, and the EPA has issued a final rule in November 2024 implementing the fee, although the future of this rule is uncertain at this time. The Trump administration may also seek to challenge, repeal, or revise the emissions fee or seek to have Congress modify or repeal the IRA or certain provisions thereof; however, we cannot predict when or whether the new administration may take these actions, if at all, or the resulting impact on our business operations. Additionally, several U.S. states including California and New York, either individually or in regional collaboration, have adopted or are considering adopting legislation, policies, or regulatory initiatives focused on GHG emissions reductions, including cap and trade programs, carbon taxes, performance standards, and reporting and monitoring programs. Internationally, the United Nations-sponsored Paris Agreement (“Paris Agreement”) requires member states to individually determine and submit non-binding emissions reduction targets every five years after 2020. On January 20, 2025, President Trump signed an Executive Order once again withdrawing the United States from the Paris Agreement. While the international community continues to gather annually to develop and negotiate international climate initiatives, pledges, and frameworks, the United States’ participation in future United Nations climate-related conferences and initiatives and the impacts of these orders, pledges, agreements and any legislation or regulation promulgated to fulfill the United States’ commitments under the Paris Agreement or other international agreements cannot be predicted at this time.

Emerging climate-change focused legislation and regulation, policy directives, and related initiatives have the potential to increase our and our customers’ operating costs and reduce demand for our customers’ products and thereby our services. Further, any limitations or restrictions on the development of fossil fuel-specific infrastructure and our customers’ ability to access capital, develop their assets, and market their products may adversely affect our business and results of operations. For more information on applicable climate change-related regulatory matters, developments and risks affecting our business, please see our “Risk Factors—Risks Related to Environmental, Mining and Other Regulations—Our and our customers’ operations are subject to a number of risks arising out of the threat of climate change, including regulatory, political, litigation and financial risks, which could result in increased operating and capital costs for our customers and reduced demand for our products and services” and “Risk Factors—Risks Related to Our Business and Operations— Increased stakeholder and market attention to ESG and conservation matters may adversely impact our business and access to capital.”

Water Discharges

The federal Clean Water Act (“CWA”) and analogous state laws impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and other substances, into waters of the United States. The discharge of pollutants into regulated waters, including jurisdictional wetlands, is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. The CWA also prohibits the discharge of dredge and fill material in regulated waters, including wetlands, unless authorized by a permit issued by the U.S. Army Corps of Engineers (the “Corps”). Federal and state regulatory agencies can impose administrative, civil and criminal penalties, as well as require remedial or mitigation measures, for non-compliance with discharge permits or other requirements of the CWA and analogous state laws and regulations. In the event of an unauthorized discharge of wastes, we may be liable for penalties and costs.

The scope of waters subject to federal jurisdiction has been subject to substantial controversy, with the Corps and EPA pursuing several rulemakings since 2015 to attempt to define the scope of Waters of the United States (“WOTUS”). Most recently, EPA issued a WOTUS rule in September 2023 that is currently only implemented in 24 states due to ongoing litigation. Thus, the operative definition of WOTUS varies by state. At this time, we cannot predict what action, if any, the Trump administration may take to clarify the definition of WOTUS and the scope of the CWA. To the extent the implementation of the final rule, results of the litigation or any action further expands the scope of the CWA’s jurisdiction in areas where we operate, we could face increased costs and delays with respect to obtaining permits for dredge and fill activities in wetland areas.

Additionally, the process for obtaining permits has the potential to delay our operations. Spill prevention, control and countermeasure requirements of federal laws require appropriate containment berms and similar structures to help prevent the contamination of navigable waters by a petroleum hydrocarbon tank spill, rupture or leak. In addition, the CWA and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. Federal and state regulatory agencies can impose administrative, civil and criminal penalties as well as other enforcement mechanisms for non-compliance with discharge permits or other requirements of the CWA and analogous state laws and regulations. The CWA and analogous state laws provide for administrative, civil and criminal penalties for unauthorized discharges and, impose rigorous requirements for spill prevention and response planning, as well as substantial potential liability for the costs of removal, remediation, and damages in connection with any unauthorized discharges.

Hydraulic Fracturing

We supply proppant to the oil and natural gas industry. Hydraulic fracturing is an important common practice that is used to stimulate production of oil and natural gas from low permeability hydrocarbon bearing subsurface rock formations. The hydraulic fracturing process involves the injection of water, proppant and chemicals under pressure into the formation to fracture the surrounding rock, increase permeability and stimulate production. Although we do not directly engage in hydraulic fracturing activities, our customers purchase our proppant for use in their hydraulic fracturing activities. Hydraulic fracturing is typically regulated by state oil and natural gas commissions and similar agencies; however, the EPA has asserted jurisdiction over hydraulic fracturing activities in some circumstances under the Safe Drinking Water Act. Some states have adopted, and other states are considering adopting, regulations that could impose new or more stringent permitting, disclosure or well construction requirements on hydraulic fracturing operations. State and federal regulatory agencies have also recently focused on a possible connection between the operation of injection wells used for oil and natural gas waste disposal and seismic activity. Similar concerns have been raised that hydraulic fracturing may also contribute to seismic activity. Aside from state laws, local land use restrictions may restrict drilling in general or hydraulic fracturing in particular. Municipalities may adopt local ordinances attempting to prohibit hydraulic fracturing altogether or, at a minimum, allow such fracturing processes within their jurisdictions to proceed but regulating the time, place and manner of those processes. At the same time, certain environmental groups have suggested that additional laws may be needed to more closely and uniformly limit or otherwise regulate the hydraulic fracturing process, and legislation has been proposed by some members of Congress to provide for such regulation.

The adoption of new laws or regulations at the federal or state levels imposing reporting obligations on, or otherwise limiting or delaying, the hydraulic fracturing process could make it more difficult to complete natural gas wells, increase our customers’ costs of compliance and doing business and otherwise adversely affect the hydraulic fracturing services they perform, which could negatively impact demand for our proppant. In addition, heightened political, regulatory and public scrutiny of hydraulic fracturing practices could expose us or our customers to increased legal and regulatory proceedings, which could be time-consuming, costly or result in substantial legal liability or significant reputational harm. We could be directly affected by adverse litigation involving us, or indirectly affected if the cost of compliance limits the ability of our customers to operate. Such costs and scrutiny could directly or indirectly, through reduced demand for our proppant, have an adverse effect on our business, financial condition and results of operations.

Non-Hazardous and Hazardous Wastes

The Resource Conservation and Recovery Act (“RCRA”) and comparable state laws control the management and disposal of hazardous and non-hazardous waste. These laws and regulations govern the generation, storage, treatment, transfer and disposal of wastes that we generate. In the course of our operations, we generate waste that are regulated as non-hazardous wastes and hazardous wastes, obligating us to comply with applicable standards relating to the management and disposal of such wastes. In addition, drilling fluids, produced waters and most of the other wastes associated with the exploration, development and production of oil or natural gas, if properly handled, are currently exempt from regulation as hazardous waste under RCRA and, instead, are regulated under RCRA’s less stringent non-hazardous waste provisions, state laws or other federal laws. However, it is possible that certain oil and natural gas drilling and production wastes now classified as non-hazardous could be classified as hazardous wastes in the future. A loss of the RCRA exclusion for drilling fluids, produced waters and related wastes could result in an increase in our customers’ costs to manage and dispose of generated wastes and a corresponding decrease in their drilling operations, which developments could have an adverse effect on our business.

Site Remediation

The Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) and comparable state laws impose strict, joint and several liability on certain classes of persons that contributed to the release of a hazardous substance into the environment without regard to fault or the legality of the original conduct. These persons include the owner and operator of a disposal site where a hazardous substance release occurred and any company that transported, disposed of or arranged for the transport or disposal of hazardous substances released at the site. Under CERCLA, such persons may be liable for the costs of remediating the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. In addition, where contamination may be present, it is not uncommon for the neighboring landowners and other third parties to file claims for personal injury, property damage and recovery of response costs. We have not received notification that we may be potentially responsible for cleanup costs under CERCLA at any site.

Endangered Species

The ESA restricts activities that may affect endangered or threatened species or their habitats. Similar protections are offered to migratory birds under the Migratory Bird Treaty Act (“MBTA”) and analogous state laws. Compliance with these laws may require the implementation of avoidance or mitigation measures or time and place restrictions on certain operations during migration or breeding seasons. The listing of new species as endangered or threatened and the designation of such species’ habitat as critical under the ESA or related laws in areas where we or our customers operate, we or our customers may incur increased costs arising from required species protection measures or experience operational delays or limitations, either of which could adversely affect our and our customers operations or reduce demand for our services. For more information regarding risks associated with compliance with endangered species laws and regulations, including discussion of certain risks related to the DSL and lesser prairie chicken, please see our “Risk Factors—Risks Related to Environmental, Mining and Other Regulations—Restrictions on our operations and those of our customers intended to protect certain species of wildlife could have an adverse impact on our ability to expand some of our existing operations or limit our customers’ ability to develop new oil and natural gas wells.”

Mining and Workplace Safety

Our proppant production operations are subject to mining safety regulation. Mine Safety and Health Administration (“MSHA”) is the primary regulatory organization governing proppant mining and processing. Accordingly, MSHA regulates quarries, surface mines, underground mines and the industrial mineral processing facilities associated with and located at quarries and mines. The mission of MSHA is to administer the provisions of the Federal Mine Safety and Health Act of 1977 and to enforce compliance with mandatory miner safety and health standards. As part of MSHA’s oversight, representatives perform at least two unannounced inspections annually for each above-ground facility. Failure to comply with MSHA’s regulations could result in the imposition of civil or criminal penalties and fines.

In addition, our operations are subject to a number of federal and state laws and regulations, including the OSHA and comparable state statutes, whose purpose is to protect the health and safety of workers. Also, the OSHA hazard communication standard, the EPA community right-to-know regulations under Title III of the federal Superfund Amendment and Reauthorization Act and comparable state statutes require that information be maintained concerning hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and citizens. Violations of OSHA can result in OSHA civil and criminal enforcement. Moreover, the inhalation of respirable crystalline silica is associated with the lung disease silicosis. There is recent evidence of an association between crystalline silica exposure or silicosis and lung cancer and a possible association with other diseases, including immune system disorders such as scleroderma. These health risks have been, and may continue to be, a significant issue confronting the silica industry. In response to these potential concerns, OSHA promulgated a new rule seeking to lower work exposure to crystalline silica. The rule became effective for general industry in 2018. In June 2022, MSHA launched a new enforcement initiative to better protect U.S. miners from health hazards resulting from repeated overexposure to respirable crystalline silica, and in April 2024, MSHA issued a final rule designed to reduce miner exposures to respirable crystalline silica, including by lowering the permissible exposure limit and establishing an action level for all miners. For more information, please see our “Risk Factors—Risks Related to Environmental, Mining and Other Regulations— Silica-related health issues and legislation, including compliance with existing or future regulations relating to respirable crystalline silica, or litigation could have an adverse effect on our business, reputation or results of operations.”

In addition, concerns over silicosis and other potential adverse health effects, as well as concerns regarding potential liability from the use of silica, may have the effect of discouraging our customers’ use of our silica products and discouraging our insurers from risk. The actual or perceived health risks of mining, processing and handling silica could adversely affect silica producers, including us, through reduced use of silica products, the threat of product liability or employee lawsuits, increased scrutiny by federal, state and local regulatory authorities of us and our customers or reduced financing sources available to the silica industry.

Environmental Reviews

If permits or other authorizations from the federal government are required, our future operations may be subject to broad environmental review under the National Environmental Policy Act, as amended (“NEPA”). NEPA requires federal agencies to evaluate the environmental impact of all “major federal actions” significantly affecting the quality of the human environment. The granting of a federal permit for a major development project, such as a proppant production operations, may be considered a “major federal action” that requires review under NEPA. As part of this evaluation, the federal agency considers a broad array of environmental impacts, including, among other things, impacts on air quality, water quality, wildlife (including threatened and endangered species), historic and archeological resources, geology, socioeconomics and aesthetics. NEPA also requires the consideration of alternatives to the project. The NEPA review process, especially the preparation of a full environmental impact statement, can be time consuming and expensive. The purpose of the NEPA review process is to inform federal agencies’ decision-making on whether federal approval should be granted for a project and to provide the public with an opportunity to comment on the environmental impacts of a proposed project. Though NEPA requires only that an environmental evaluation be conducted and does not mandate a particular result, a federal agency could decide to deny a permit or impose certain conditions on its approval, based on its environmental review under NEPA, or a third party could challenge the adequacy of a NEPA review and thereby delay the issuance of a federal permit or approval, which could have an adverse effect on our business. For more information, please see “Risk Factors—Risks Related to Environmental, Mining and Other Regulations—Any restrictions on oil and natural gas development on federal lands have the potential to adversely impact our operations and the operations of our customers.”

Motor Carrier Operations

Among the services we provide, we operate as a motor carrier and therefore are subject to regulation by the DOT and various state agencies. These regulatory authorities exercise broad powers, governing activities such as the authorization to engage in motor carrier operations; regulatory safety; hazardous materials labeling, placarding and marking; financial reporting; and certain mergers, consolidations and acquisitions. There are additional regulations specifically relating to the trucking industry, including testing and specification of equipment and product handling requirements. The trucking industry is subject to possible regulatory and legislative changes that may affect the economics of the industry by requiring changes in operating practices or by changing the demand for common or contract carrier services or the cost of providing truckload services. Some of these possible changes include increasingly stringent environmental regulations, changes in the hours of service regulations which govern the amount of time a driver may drive in any specific period and requiring onboard black box recorder devices or limits on vehicle weight and size.

Interstate motor carrier operations are subject to safety requirements prescribed by the DOT. Intrastate motor carrier operations are subject to safety regulations that often mirror federal regulations. Such matters as weight and dimension of equipment are also subject to federal and state regulations. The DOT regulations also mandate drug testing of drivers. From time to time, various legislative proposals are introduced, including proposals to increase federal, state or local taxes, including taxes on motor fuels, which may increase our costs or adversely impact the recruitment of drivers. We cannot predict whether, or in what form, any increase in such taxes applicable to us will be enacted.

State and Local Regulation

We are subject to a variety of state and local environmental review and permitting requirements. In some cases, the state environmental review may be more stringent than the federal review. Our operations may require state-law based permits in addition to federal permits, requiring state agencies to consider a range of issues, many the same as federal agencies, including, among other things, a project’s impact on wildlife and their habitats, historic and archaeological sites, aesthetics, agricultural operations and scenic areas. The development of new sites and our existing operations also are subject to a variety of local environmental and regulatory requirements, including land use, zoning, building and transportation requirements.

Demand for proppant in the oil and natural gas industry drove a significant increase in the production of proppant. As a result, some local communities expressed concern regarding silica sand mining operations. These concerns have generally included exposure to ambient silica sand dust, truck traffic, water usage and blasting. In response, certain state and local communities have developed or are in the process of developing regulations or zoning restrictions intended to minimize dust from becoming airborne, control the flow of truck traffic, significantly curtail the amount of practicable area for proppant production activities, provide compensation to local residents for potential impacts of proppant production activities and, in some cases, ban issuance of new permits for proppant production activities. To date, we have not experienced any material impact to the development of our proppant production facilities and do not anticipate an impact on future operations as a result of these types of concerns. We would expect this trend to continue as oil and natural gas production increases.

Competition

The market in which we operate is highly competitive. We compete with both public and private large, national producers and small, regional or local in-basin proppant providers, such as Iron Oak Energy Solutions, High Roller Sand, Freedom Proppants, U.S. Silica Inc., Alpine Silica, Badger Mining Corporation, Vista Proppants and Logistics and Capital Sand Company, among others. Competition in the proppant production industry is based on a number of factors, including product and service quality, reliability of the service provider, the geographic location of facilities and the associated logistics costs of transporting proppant from the supplier to the customer, innovation, etc. Following the acquisition of Moser, we will enter the distributed power industry, which is a highly fragmented market with both small and large public and private companies.

Human Capital and Employees

Our employees are a critical asset to our innovative culture and overall success. We are focused on sustaining a high-performance culture through attracting, engaging, developing, retaining and rewarding top talent. We strive to enhance the economic and social wellbeing of our employees and the communities in which we operate. We seek to provide a welcoming environment for our workforce, with best-in-class training and career development opportunities to enable employees to thrive and achieve their career goals.

As of December 31, 2024, we had a total of 1,143 employees, of which 173 service our corporate headquarter offices and 970 work in field locations. None of our employees are represented by labor unions or subject to collective bargaining agreements. We consider our employee relations to be good.

Health and Safety

The health, safety, and wellbeing of our employees is of the utmost importance. We believe that we are an industry leader with a proven track record in safety.

We provide full-time regular employees the option to participate in health and welfare plans, including medical, dental, vision, life and accidental death and dismemberment, accident, critical illness, and short-term and long-term disability insurance plans. We also offer an Employee Assistance Program which provides employees and their family members access to professional providers to help navigate challenging life events.

Available Information

Our headquarters office is located at 5918 W. Courtyard Dr., Suite 500, Austin, TX 78730, and our telephone number at that address is (512) 220‑1200. Our website address is https://atlas.energy. Our periodic reports and other information filed with or furnished to the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as any amendments to such filings, are available free of charge through our website under the “Investors” link as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. The SEC also maintains an internet website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers, including us, that file electronically with the SEC. In addition to its reports filed or furnished with the SEC, the Company publicly discloses material information from time to time in its press releases, at annual meetings of shareholders, in publicly accessible conferences and Investor presentations, and through its website (principally in its Press Room and Investor Relations pages). Information on our website or any other website is not incorporated by reference into this Annual Report and does not constitute a part of this Annual Report.

Item 1A. Risk Factors.

There are numerous factors that affect our business and operating results, many of which are beyond our control. The following is a summary of significant factors that might cause our future results to differ materially from those currently expected. The risks described below are not the only risks facing our Company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations. If any of these risks actually occur, our business, financial position, operating results, cash flows, reserves or our ability to pay our debts and other liabilities could suffer, the trading price and liquidity of our securities could decline and you may lose all or part of your investment in our securities.

Risks Related to Our Business and Operations

Our business operations depend on the level of activity in the oil and natural gas industries, which experience substantial volatility.

Our operations that produce and transport proppant are materially dependent on the levels of activity in oil and natural gas exploration, development and production. More specifically, the demand for the proppant we produce is closely related to the number of oil and natural gas wells completed in geological formations where sand-based proppant is used in fracture treatments. These activity levels are affected by both short- and long-term trends in oil and natural gas prices. Additionally, our distributed power operations are also tied to activity levels in the oil and gas industry, most specifically through levels of spending tied to production, gathering, and treatment activities. In recent years, oil and natural gas prices and, therefore, the level of exploration, development and production activity, have experienced significant volatility.

When oil and natural gas prices decrease, exploration and production companies may reduce their exploration, development, production and well completion activities. During such periods, demand for our products and services, which supply oil and natural gas wells, including our transportation and logistics solutions, may decline, and may lead to a decline in the market price of proppant, if the supply of proppant is not similarly reduced. When demand for proppant increases, there may not be a corresponding increase in the prices for our products or our customers may not increase use of our products, which could have an adverse effect on our business, financial condition and results of operations.