TECHNICAL REPORT SUMMARY

FRAC SAND RESOURCES AND RESERVES

ONCORE PLANTS

West Texas

Prepared For

ATLAS ENERGY SOLUTIONS INC.

By

John T. Boyd Company

Mining and Geological Consultants

Pittsburgh, Pennsylvania, USA

Report No. 3871.010

FEBRUARY 2025

| | |

|

| John T. Boyd Company Mining and Geological Consultants |

| | | |

Chairman | | February 20, 2025 |

James W. Boyd | | File: 3871.010 |

| | | |

President and CEO | | | |

John T. Boyd II | | | |

| | | |

Managing Director and COO | | Atlas Energy Solutions Inc. 5918 West Courtyard Drive, Suite 500 Austin, TX 78730 |

Ronald L. Lewis | |

| |

Vice Presidents | |

Robert J. Farmer | | | |

Jisheng (Jason) Han | | Attention: | Mr. Blake McCarthy |

John L. Weiss | | | Chief Financial Officer |

Michael F. Wick | | | |

William P. Wolf | | | |

| | | |

Managing Director - Australia | | Subject: | Technical Report Summary |

Jacques G. Steenkamp | | | Frac Sand Resources and Reserves |

| | | OnCore Plants |

Managing Director - China | | | West Texas |

Rongjie (Jeff) Li | | | |

| | | |

Managing Director – South America | | Ladies and Gentlemen: |

Carlos F. Barrera | | | |

| | The John T. Boyd Company (BOYD) was retained by Atlas Energy Solutions Inc. (Atlas) to independently prepare estimates of mineral resources and mineral reserves—hereafter referred to as frac sand resources and frac sand reserves, respectively—for the OnCore Plants (or “OnCore”) as of December 31, 2024. |

| |

Pittsburgh | |

4000 Town Center Boulevard, Suite 300 | |

Canonsburg, PA 15317 | |

(724) 873-4400 | |

(724) 873-4401 Fax | |

jtboydp@jtboyd.com | |

| | | |

Denver | | This Technical Report Summary (TRS) has been prepared to support Atlas’ disclosure of the subject frac sand resources and frac sand reserves in accordance with Subpart 1300 and Item 601(b)(96) of Regulation S-K (collectively, “S‑K 1300”) as adopted by the U.S. Securities and Exchange Commission’s (SEC) on October 31, 2018. |

(303) 293-8988 | |

jtboydd@jtboyd.com | |

| |

Brisbane | |

61 7 3232-5000 | |

jtboydau@jtboyd.com | |

| | | |

Beijing | | | |

86 10 6500-5854 | | | |

jtboydcn@jtboyd.com | | Respectfully submitted, |

| | | |

Bogota | | JOHN T. BOYD COMPANY |

+57-3115382113 | | By: |

|

jtboydcol@jtboyd.com | | |

| | |

www.jtboyd.com | | |

| | John T. Boyd II |

| | President and CEO |

TABLE OF CONTENTS

| | | | |

| Page |

| |

LETTER OF TRANSMITTAL | |

| | |

| | |

TABLE OF CONTENTS | |

| | |

GLOSSARY AND ABBREVIATIONS | |

| | |

1.0 | EXECUTIVE SUMMARY | 1-1 |

| 1.1 | Introduction | 1-1 |

| 1.2 | Property Description and Location | 1-1 |

| 1.3 | Geology | 1-3 |

| 1.4 | Exploration | 1-4 |

| 1.5 | Frac Sand Reserves | 1-4 |

| 1.6 | Operations | 1-5 |

| | 1.6.1 | Mining | 1-5 |

| | 1.6.2 | Processing | 1-6 |

| | 1.6.3 | Other Infrastructure | 1-7 |

| 1.7 | Financial Analysis | 1-7 |

| | 1.7.1 | Market Analysis | 1-7 |

| | 1.7.2 | Capital and Operating Cost Estimates | 1-8 |

| | 1.7.3 | Economic Analysis | 1-9 |

| 1.8 | Permitting and Compliance | 1-11 |

| 1.9 | Conclusions | 1-11 |

| | | | |

| | | | |

2.0 | INTRODUCTION | 2-1 |

| 2.1 | Registrant | 2-1 |

| 2.2 | Purpose and Terms of Reference | 2-1 |

| 2.3 | Expert Qualifications | 2-2 |

| 2.4 | Principal Sources of Information | 2-3 |

| | 2.4.1 | Personal Inspections | 2-4 |

| | 2.4.2 | Reliance on Information Provided by the Registrant | 2-4 |

| | 2.4.3 | Verification of Information | 2-5 |

| | 2.4.4 | Other Relevant Data and Information | 2-5 |

| 2.5 | Report Version | 2-5 |

| 2.6 | Units of Measure | 2-5 |

| | | | |

| | | | |

3.0 | PROPERTY OVERVIEW | 3-1 |

| 3.1 | Description and Location | 3-1 |

| 3.2 | History | 3-2 |

| 3.3 | Property Control | 3-10 |

| 3.4 | Adjacent Properties | 3-11 |

| 3.5 | Regulation and Liabilities | 3-11 |

| 3.6 | Accessibility, Local Resources, and Infrastructure | 3-11 |

TABLE OF CONTENTS - Continued

| | | | |

| Page |

| |

| 3.7 | Physiography | 3-12 |

| 3.8 | Climate | 3-13 |

| | | | |

| | | | |

4.0 | GEOLOGY | 4-1 |

| 4.1 | Regional Geology | 4-1 |

| 4.2 | Property Geology | 4-1 |

| | 4.2.1 | General Stratigraphy | 4-1 |

| | 4.2.2 | Structural Geology | 4-3 |

| | 4.2.3 | Frac Sand Geology | 4-3 |

| | | | |

| | | | |

5.0 | EXPLORATION DATA | 5-1 |

| 5.1 | Background | 5-1 |

| 5.2 | Exploration Procedures | 5-3 |

| | 5.2.1 | Drilling and Sampling Methodologies | 5-3 |

| | 5.2.2 | Proppant Sand Testing | 5-4 |

| | 5.2.3 | Other Exploration Methods | 5-5 |

| 5.3 | Laboratory Testing Results | 5-5 |

| | 5.3.1 | Grain Size Distribution | 5-6 |

| | 5.3.2 | Quality Summary | 5-6 |

| 5.4 | Data Verification | 5-7 |

| 5.5 | Adequacy of Exploration and Sampling Data | 5-8 |

| | | | |

| | | | |

6.0 | FRAC SAND RESOURCES AND RESERVES | 6-1 |

| 6.1 | Applicable Standards and Definitions | 6-1 |

| 6.2 | Frac Sand Resources | 6-2 |

| | 6.2.1 | Methodology | 6-2 |

| | 6.2.2 | Classification | 6-3 |

| | 6.2.3 | Estimation Criteria | 6-4 |

| | 6.2.4 | Frac Sand Resource Estimate | 6-5 |

| | 6.2.5 | Validation | 6-5 |

| 6.3 | Frac Sand Reserves | 6-6 |

| | 6.3.1 | Methodology | 6-6 |

| | 6.3.2 | Classification | 6-7 |

| | 6.3.3 | Frac Sand Reserve Estimate | 6-7 |

| | 6.3.4 | Significant Risks and Uncertainties | 6-8 |

| | 6.3.5 | Reconciliation with Previous Estimates | 6-9 |

| | | | |

| | | | |

7.0 | MINING OPERATIONS | 7-1 |

| 7.1 | Mining Method | 7-1 |

| 7.2 | Mine Schedule, Equipment, and Staffing | 7-1 |

| 7.3 | Engineering and Planning | 7-2 |

| 7.4 | Mining Sequence and Production | 7-2 |

| 7.5 | Mining Risks | 7-4 |

| | | | |

| | | | |

TABLE OF CONTENTS - Continued

| | | | |

| Page |

| |

8.0 | PROCESSING OPERATIONS | 8-1 |

| 8.1 | Overview | 8-1 |

| 8.2 | Processing Method | 8-2 |

| | 8.2.1 | Wet Plant | 8-2 |

| 8.3 | Production | 8-3 |

| 8.4 | Processing Risks | 8-3 |

| | | | |

9.0 | MINE INFRASTRUCTURE | 9-1 |

| 9.1 | Overview | 9-1 |

| 9.2 | Transportation | 9-1 |

| 9.3 | Utilities | 9-1 |

| 9.4 | Tailings Disposal | 9-2 |

| | | | |

| | | | |

10.0 | MARKET ANALYSIS | 10-1 |

| 10.1 | Market Overview and Outlook | 10-1 |

| 10.2 | Historical Sales | 10-5 |

| 10.3 | Market Entry Strategies | 10-6 |

| 10.4 | Future Sales | 10-6 |

| | | | |

| | | | |

11.0 | CAPITAL AND OPERATING COSTS | 11-1 |

| 11.1 | Historical Financial Performance | 11-1 |

| 11.2 | Estimated Costs | 11-1 |

| | 11.2.1 | Projected Capital Expenditures | 11-2 |

| | 11.2.2 | Projected Operating Costs | 11-3 |

| | | | |

| | | | |

12.0 | ECONOMIC ANALYSIS | 12-1 |

| 12.1 | Approach | 12-1 |

| 12.2 | Assumptions and Limitations | 12-2 |

| 12.3 | Financial Model Results | 12-3 |

| 12.4 | Sensitivity Analysis | 12-5 |

| | | | |

| | | | |

13.0 | PERMITTING AND COMPLIANCE | 13-1 |

| 13.1 | Permitting Requirements and Status | 13-1 |

| 13.2 | Environmental Studies | 13-1 |

| 13.3 | Waste Disposal and Water Management | 13-2 |

| 13.4 | Compliance | 13-3 |

| 13.5 | Plans, Negotiations, or Agreements | 13-3 |

| 13.6 | Post-Mining Land Use and Reclamation | 13-3 |

| 13.7 | Local Procurement and Hiring | 13-4 |

| | | | |

| | | | |

14.0 | INTERPRETATION AND CONCLUSIONS | 14-1 |

| 14.1 | Findings | 14-1 |

| 14.2 | Significant Risks and Uncertainties | 14-1 |

| 14.3 | Recommendations | 14-2 |

TABLE OF CONTENTS - Continued

| | |

| Page |

List of Tables | |

1.1 | Property Control | 1-3 |

1.2 | Frac Sand Reserves (as of December 31, 2024) | 1-5 |

1.3 | Financial Results | 1-10 |

1.4 | DCF-NPV Analysis | 1-10 |

3.1 | OnCore Plant Locations | 3-1 |

3.2 | Property Status | 3-2 |

3.3 | Property Control | 3-11 |

4.1 | Surficial Geologic Units of the OnCore Properties | 4-2 |

5.1 | OnCore Drilling Summary | 5-2 |

5.2 | Weighted Average Particle Size Distribution, by Site | 5-6 |

5.3 | Proppant Performance Test Results | 5-7 |

6.1 | Frac Sand Resource Classification Criteria | 6-4 |

6.2 | Mining and Processing Recoveries | 6-6 |

6.3 | Frac Sand Reserves (as of December 31, 2024) | 6-7 |

7.1 | Annual Production Requirements and Expected Mine Life | 7-3 |

8.1 | OnCore Plant Commisioning Dates | 8-1 |

10.1 | Historical Sales Data | 10-5 |

10.2 | Frac Sand Sales Forecast | 10-6 |

11.1 | Historical Financials | 11-1 |

11.2 | Capital Expenditures Budget for 2025 | 11-2 |

12.1 | Financial Results | 12-3 |

12.2 | Annual Production and Cash Flow Forecast OnCore Plants | 12-4 |

12.3 | DCF-NPV Analysis | 12-5 |

12.4 | After-Tax NPV10 Sensitivity Analysis ($ millions) | 12-5 |

13.1 | Permit/Registration Summary | 13-2 |

TABLE OF CONTENTS - Continued

| | |

| Page |

List of Figures | |

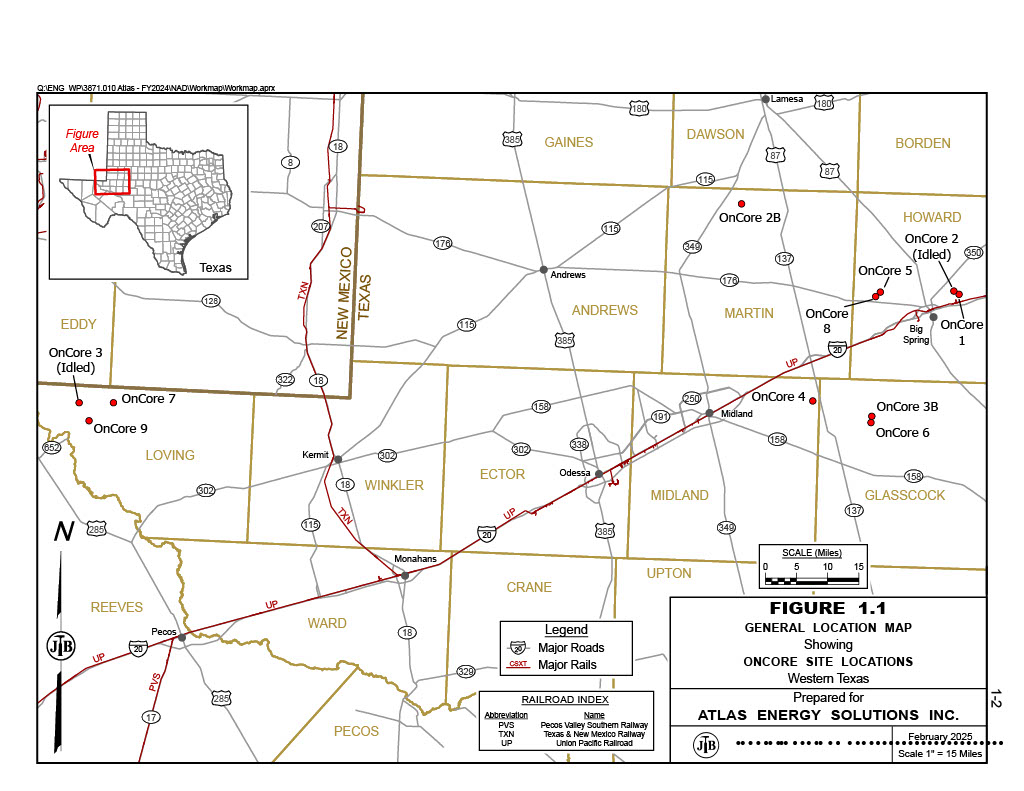

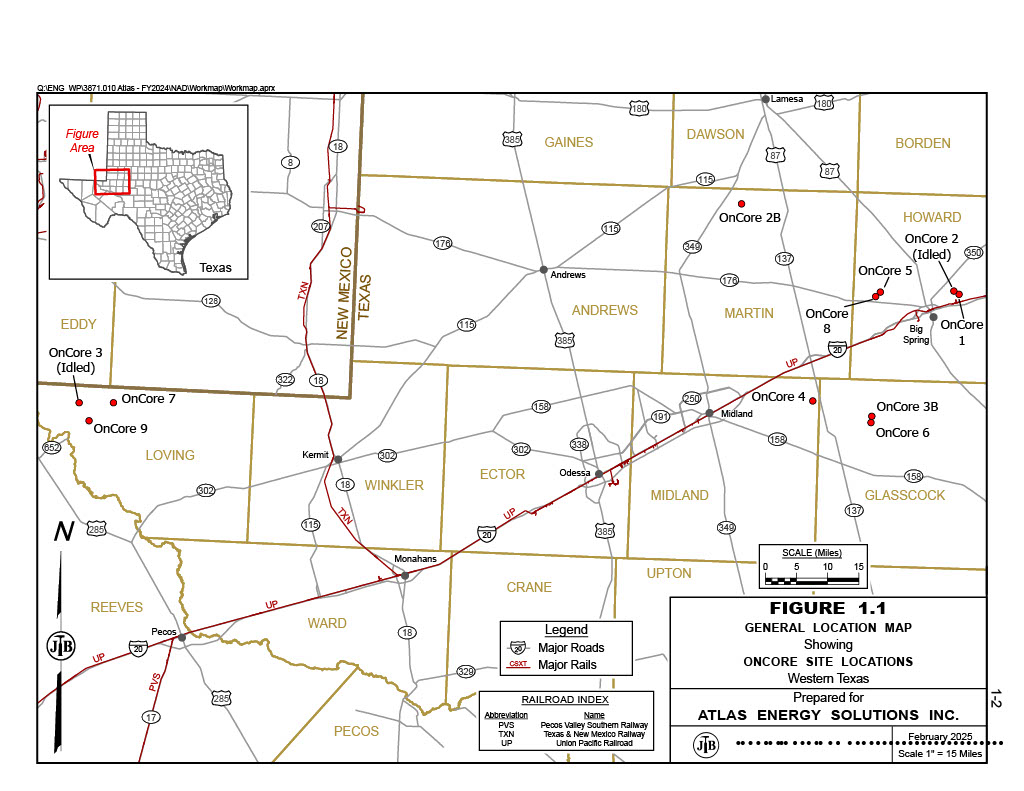

1.1 | General Location Map | 1-2 |

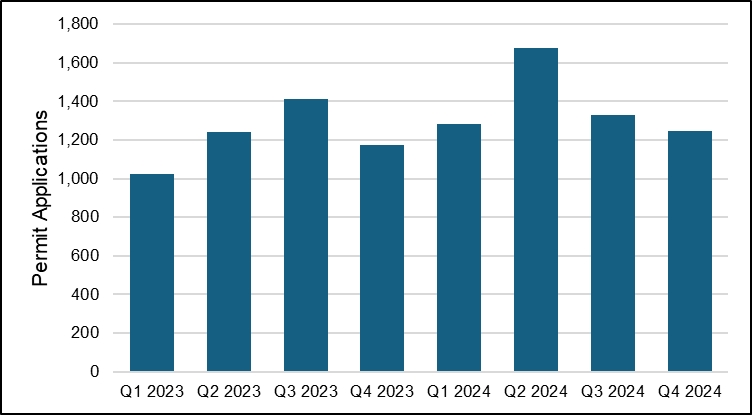

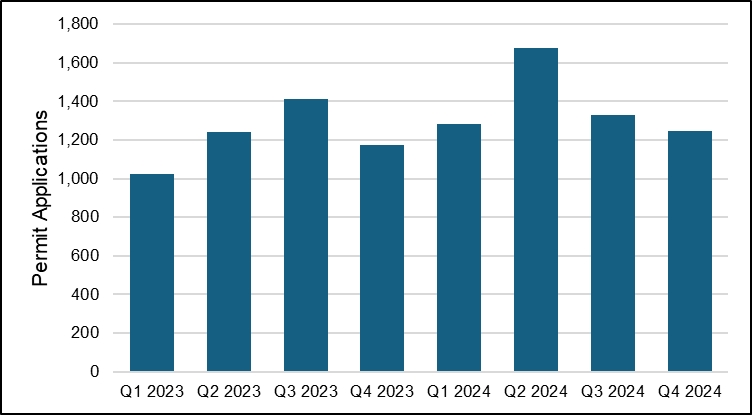

1.2 | Permian Basin Horizontal Oil and Gas Well Permit Submissions | 1-7 |

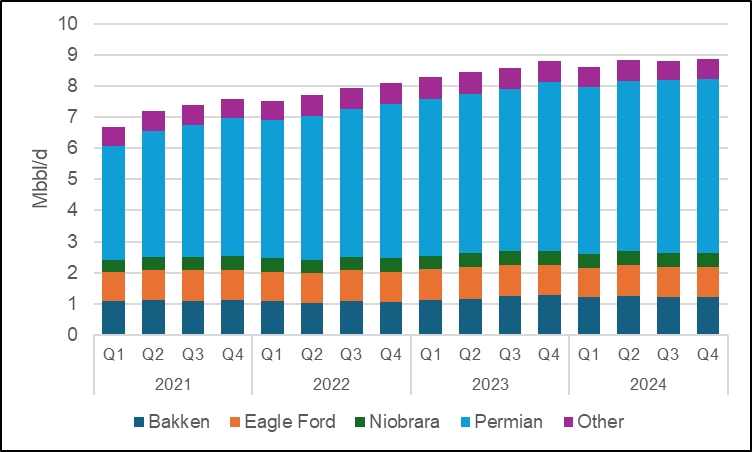

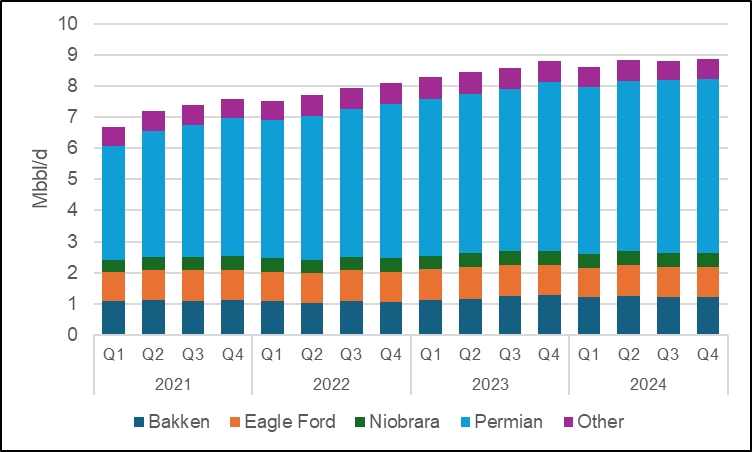

1.3 | Oil Production from Shale and Tight Formations | 1-8 |

3.1 | Site Layout OnCore 1 and 2 Plants | 3-3 |

3.2 | Site Layout OnCore 2B Plant | 3-4 |

3.3 | Site Layout OnCore 3B and 6 Plants | 3-5 |

3.4 | Site Layout OnCore 4 Plant | 3-6 |

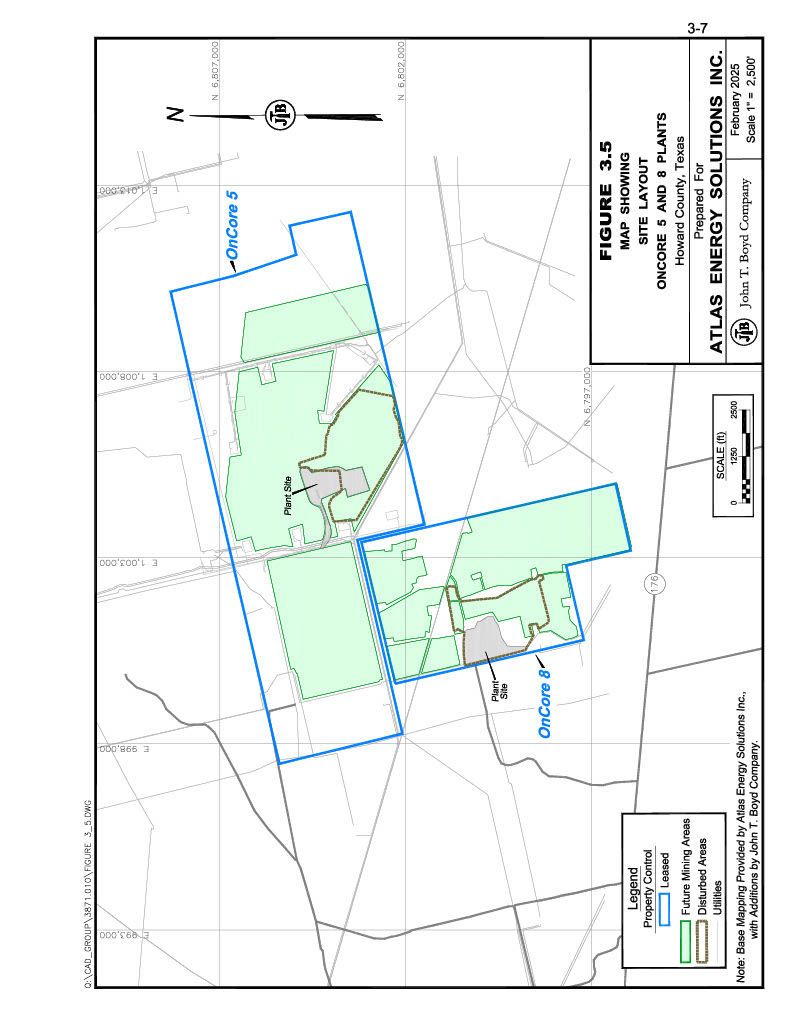

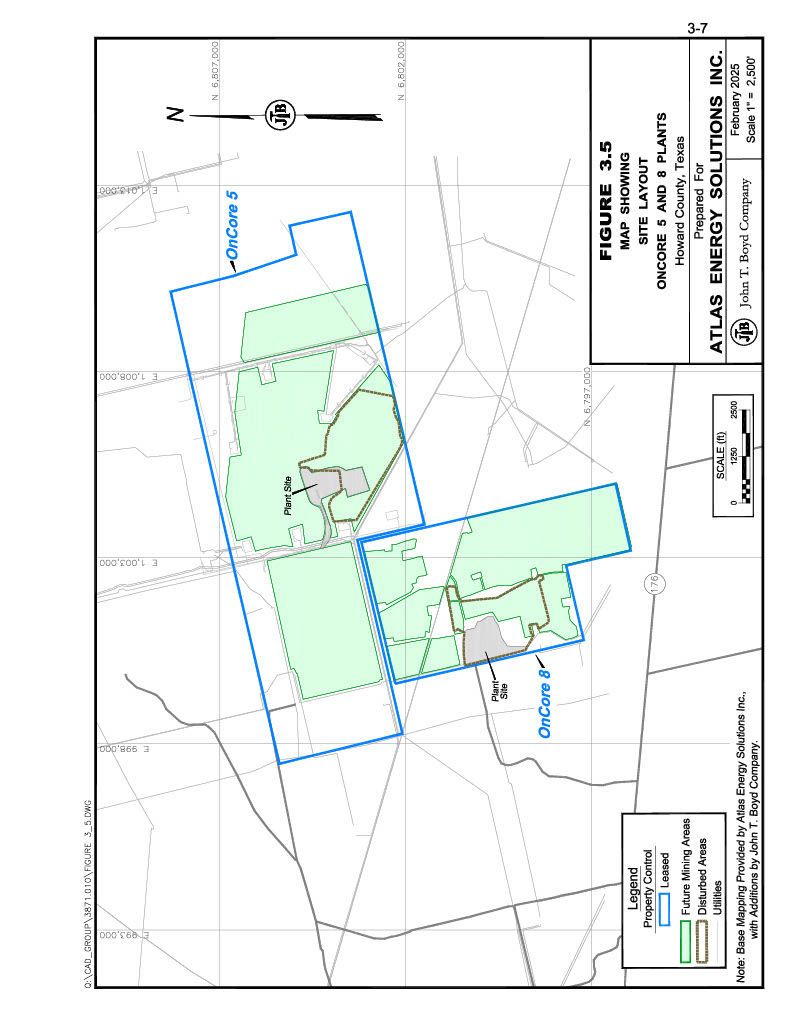

3.5 | Site Layout OnCore 5 and 8 Plants | 3-7 |

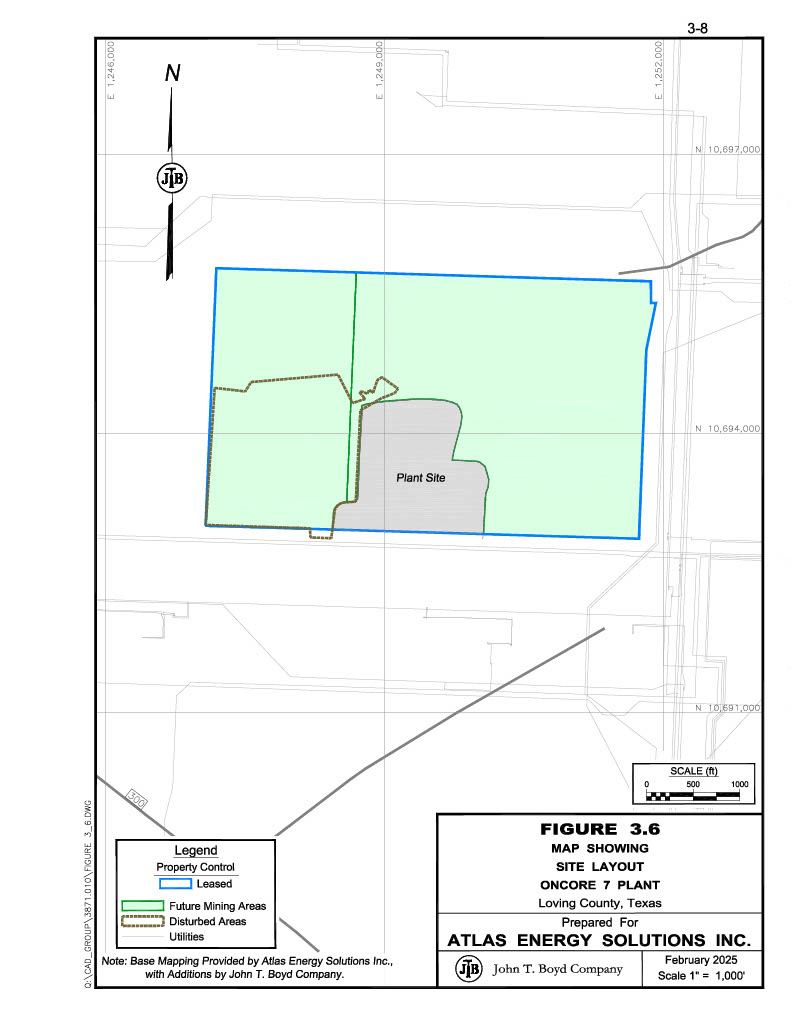

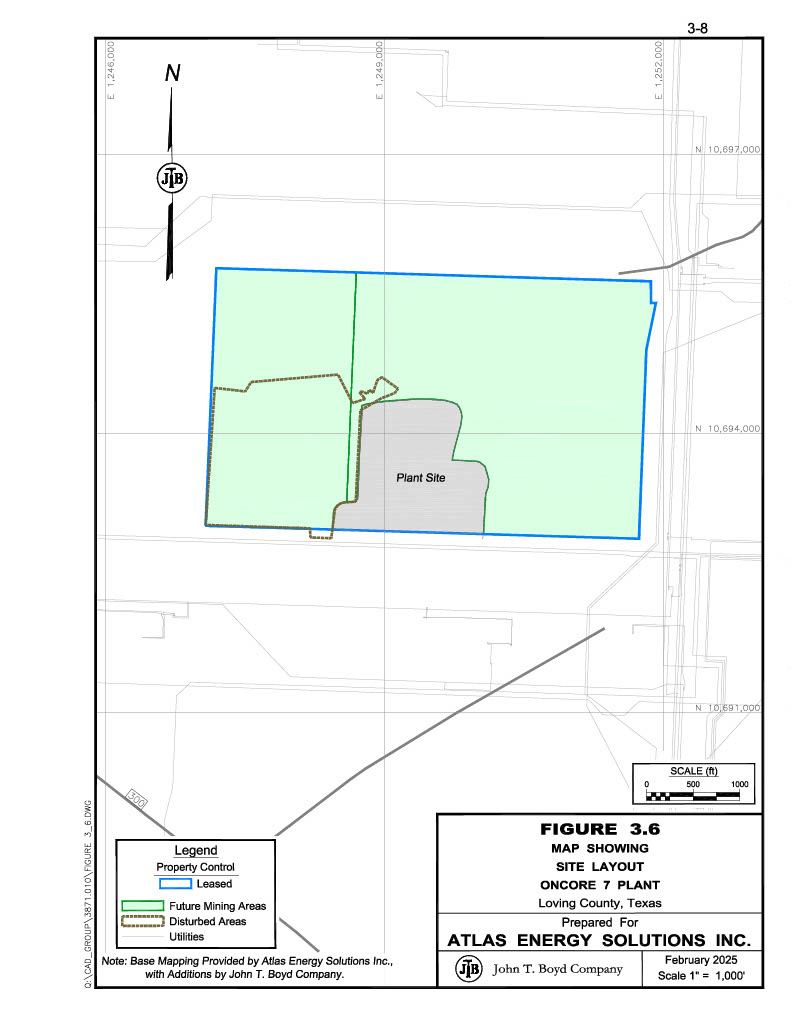

3.6 | Site Layout OnCore 7 Plant | 3-8 |

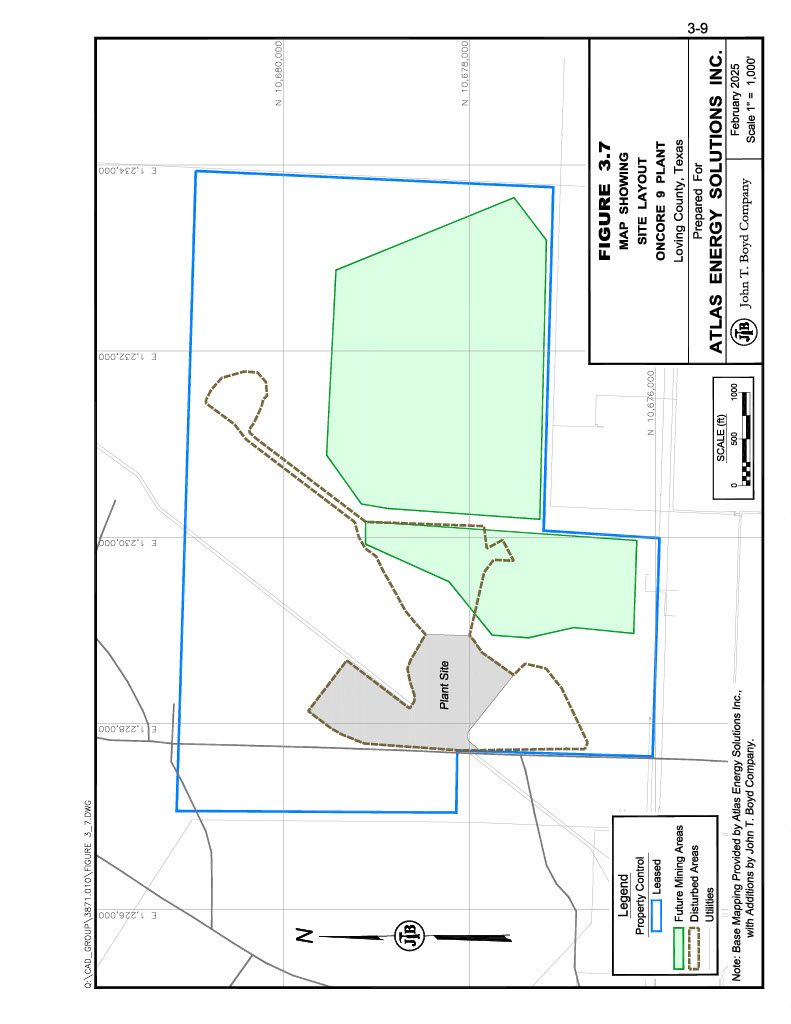

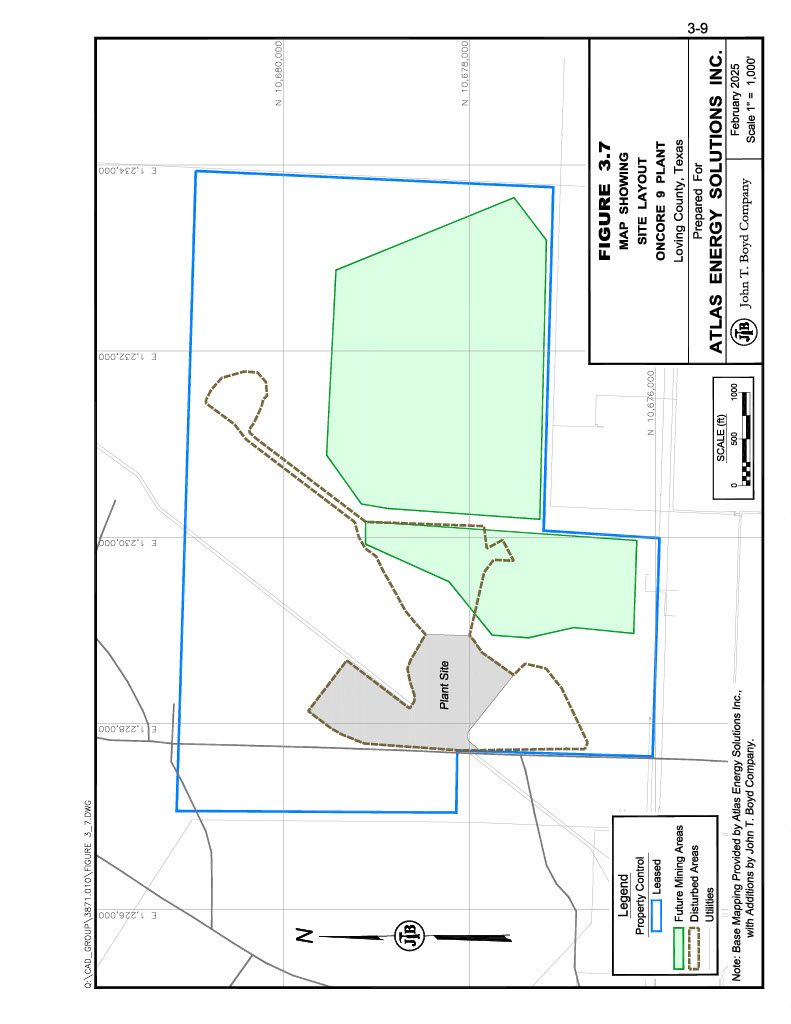

3.7 | Site Layout OnCore 9 Plant | 3-9 |

4.1 | Generalized Stratigraphic Chart, Surficial Deposits of the OnCore Properties | 4-2 |

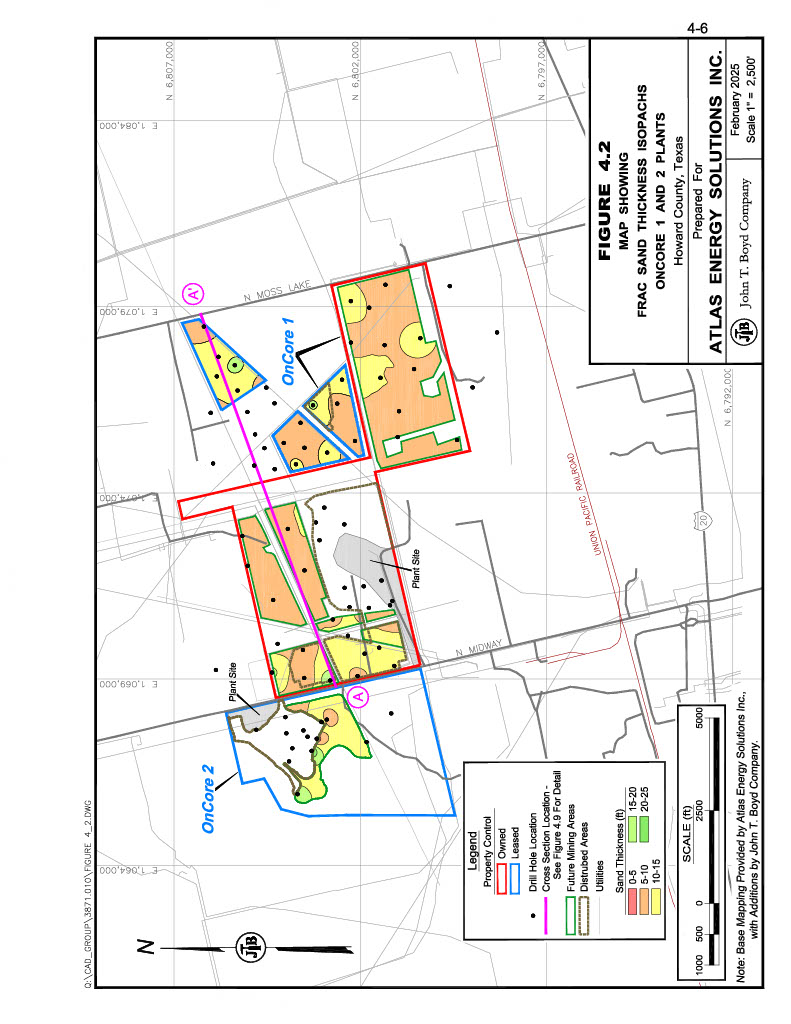

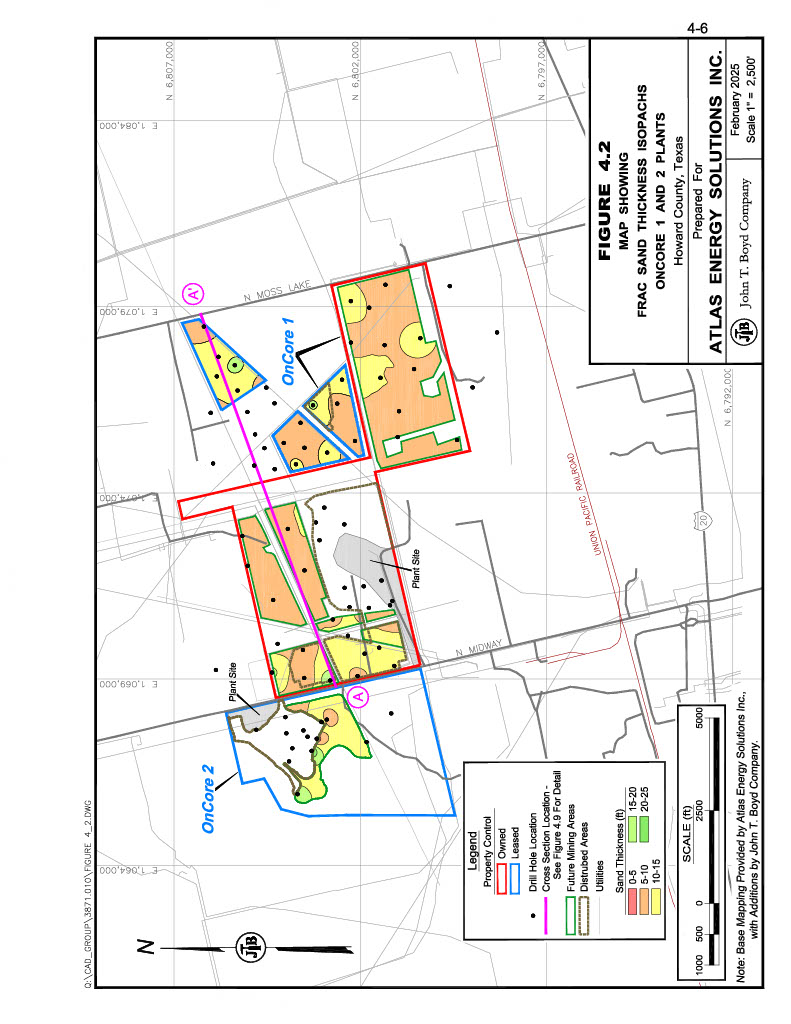

4.2 | Frac Sand Thickness Isopachs OnCore 1 and 2 Plants | 4-6 |

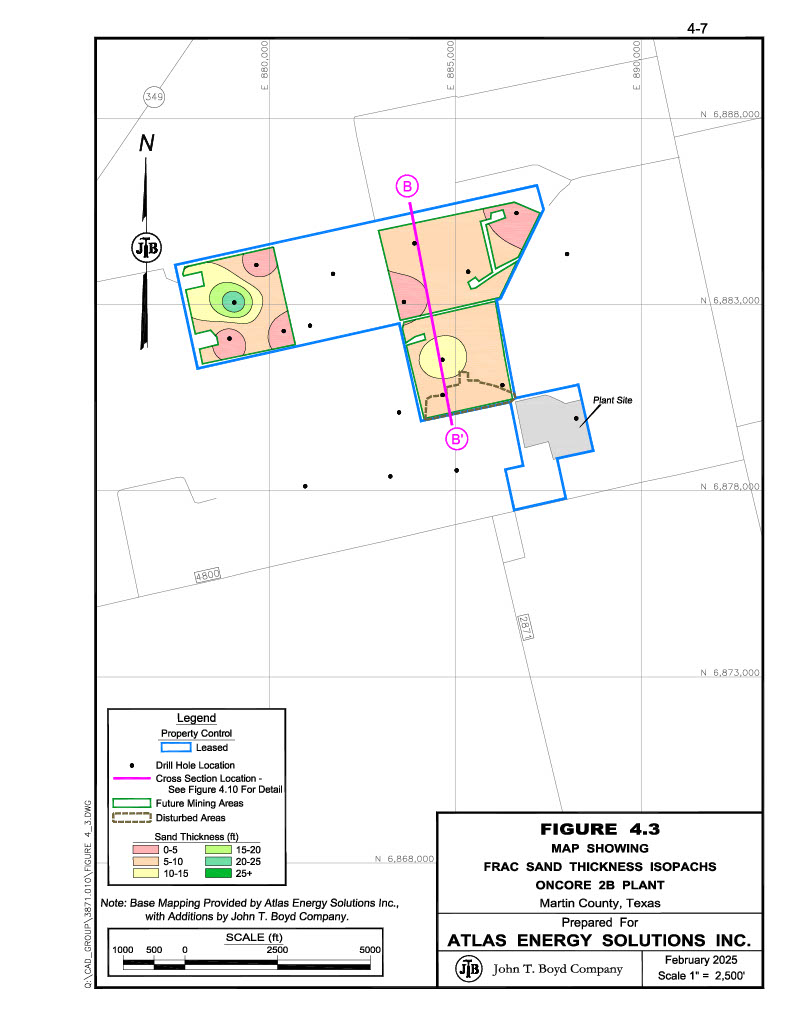

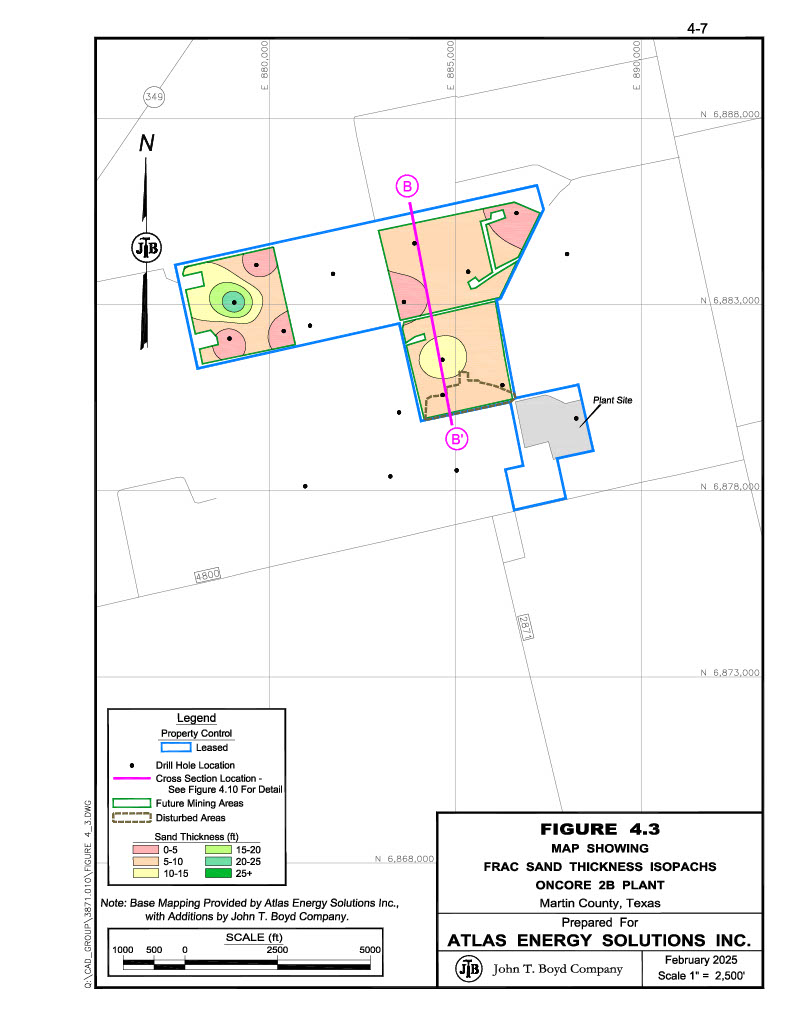

4.3 | Frac Sand Thickness Isopachs OnCore 2B Plant | 4-7 |

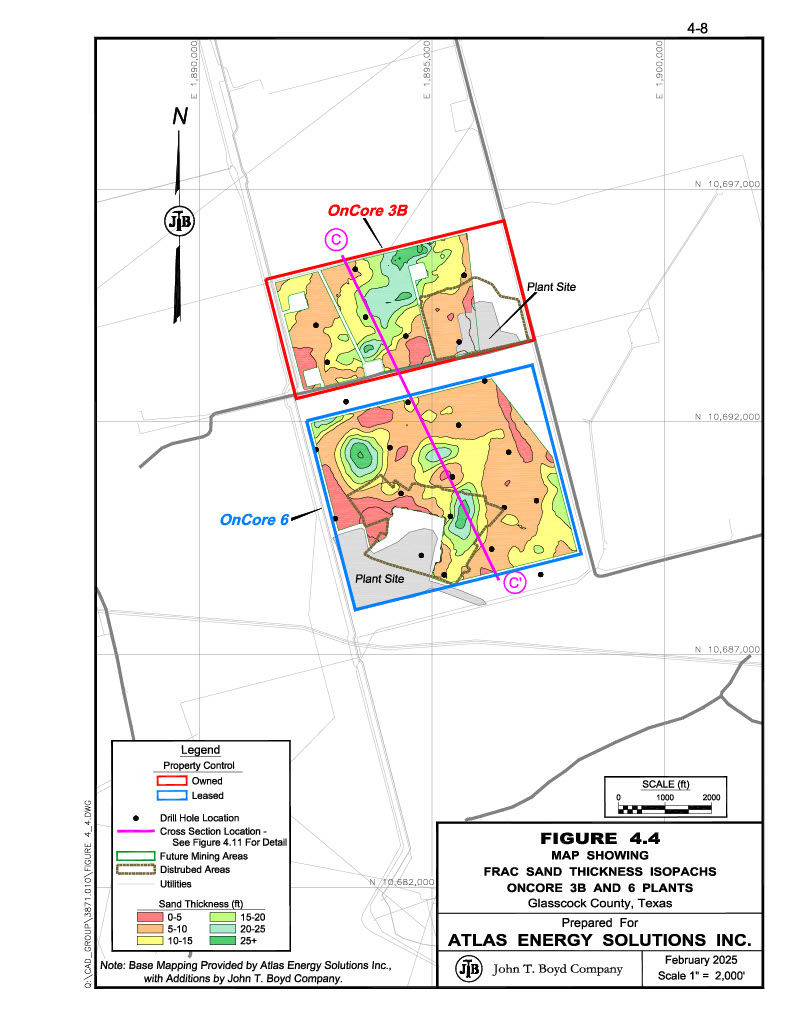

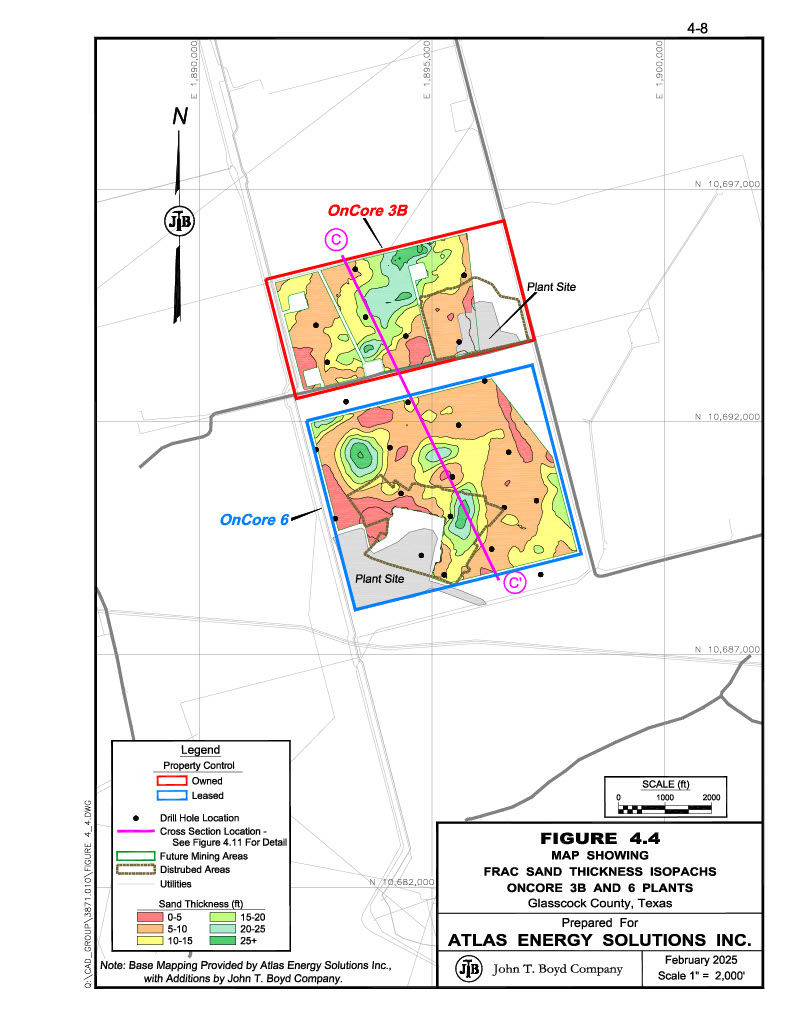

4.4 | Frac Sand Thickness Isopachs OnCore 3B and 6 Plants | 4-8 |

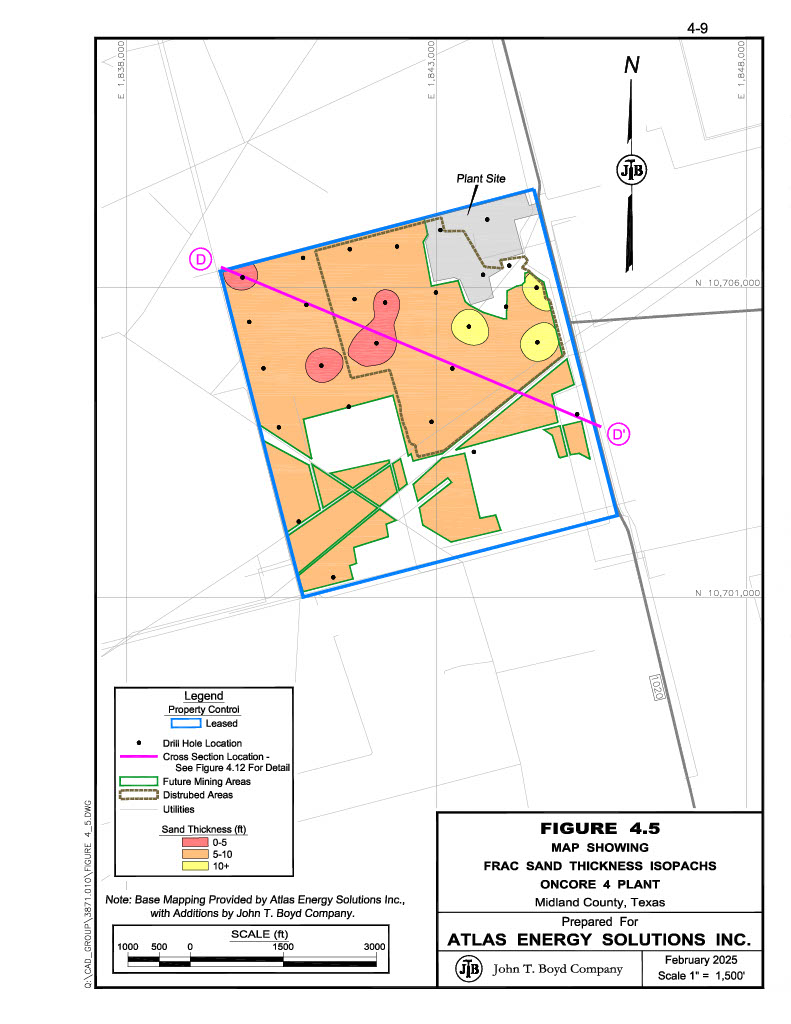

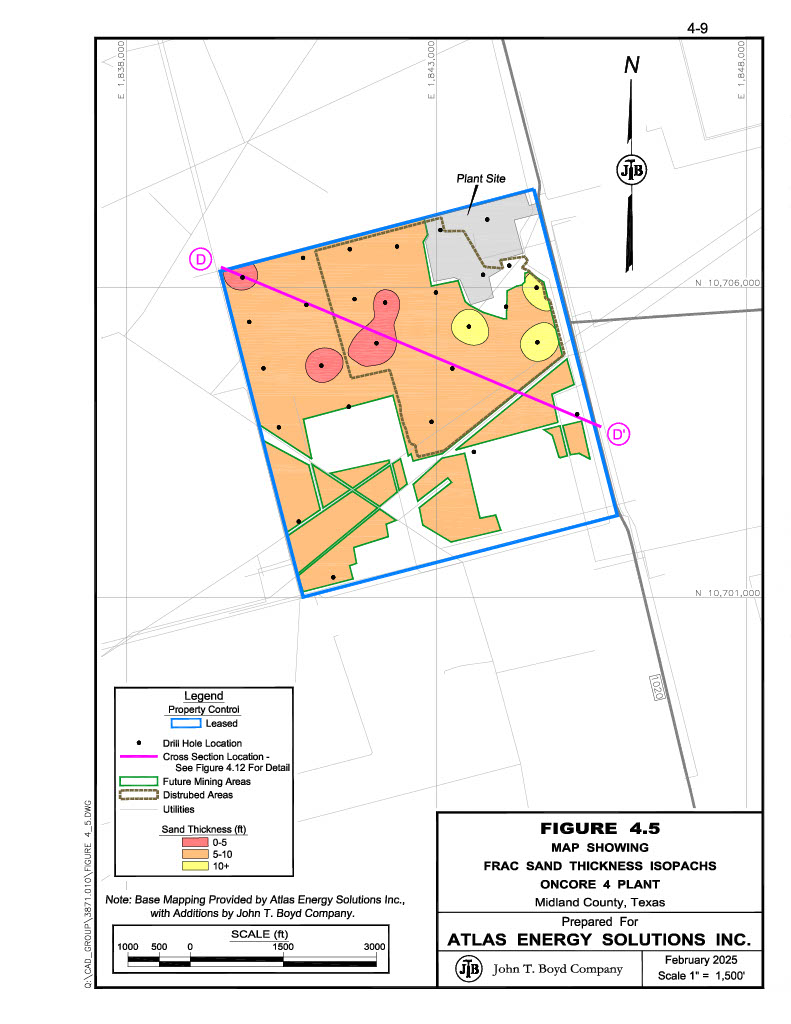

4.5 | Frac Sand Thickness Isopachs OnCore 4 Plant | 4-9 |

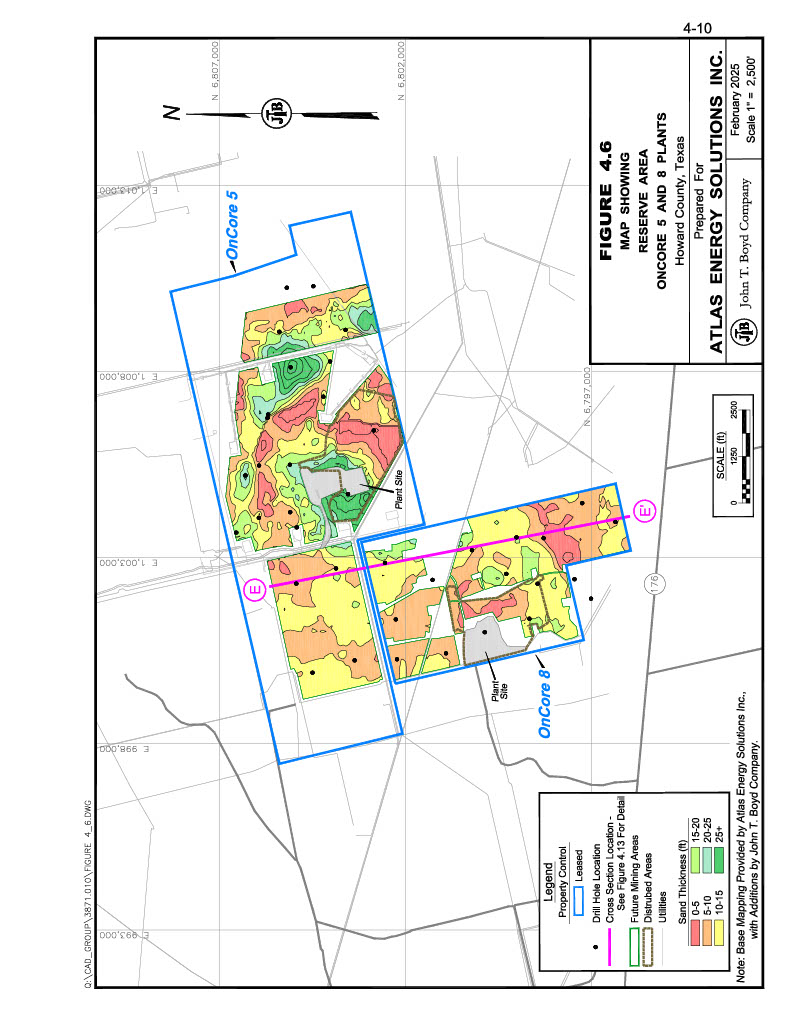

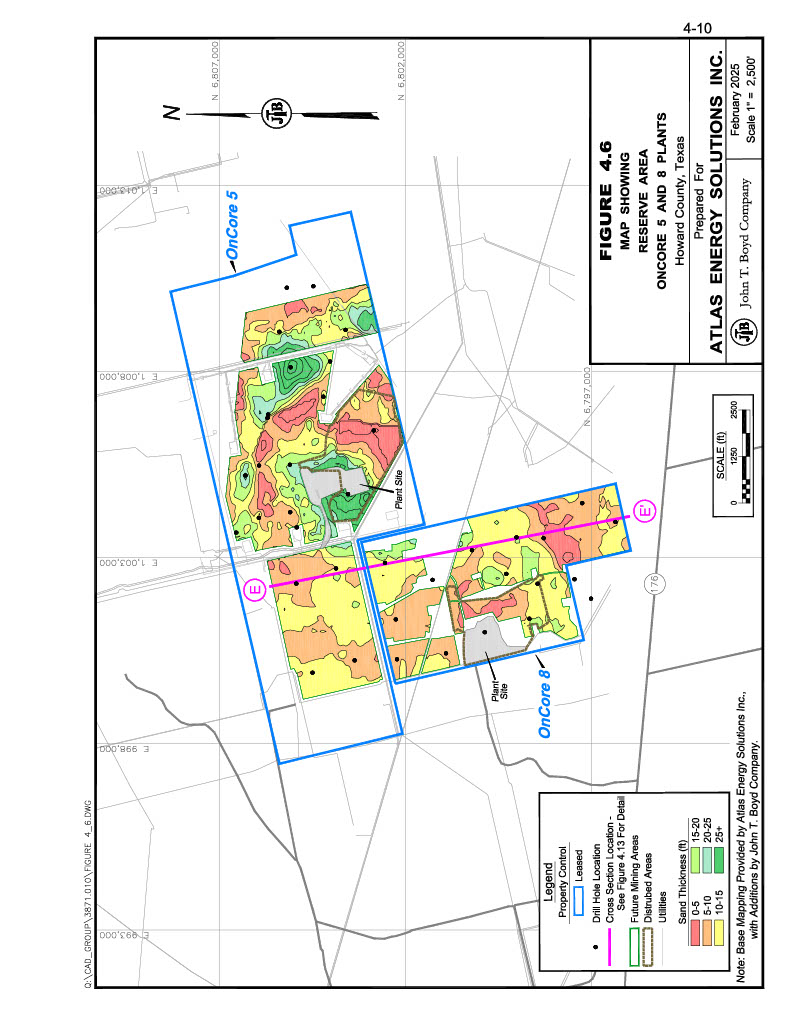

4.6 | Frac Sand Thickness Isopachs OnCore 5 and 8 Plants | 4-10 |

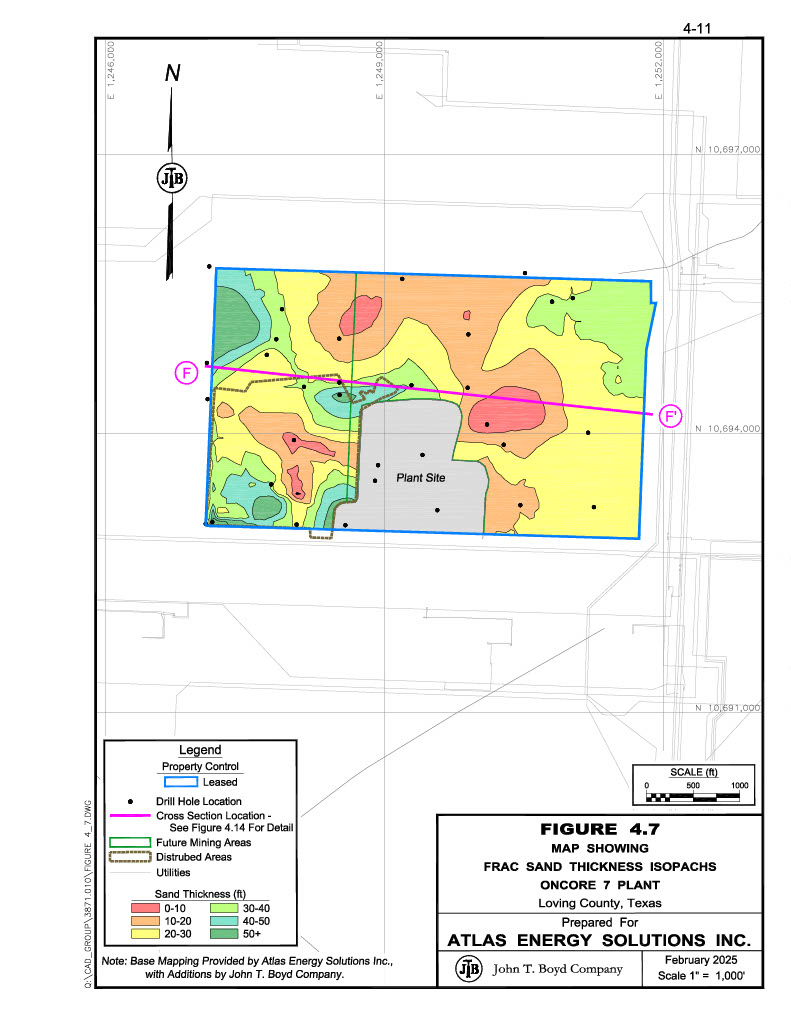

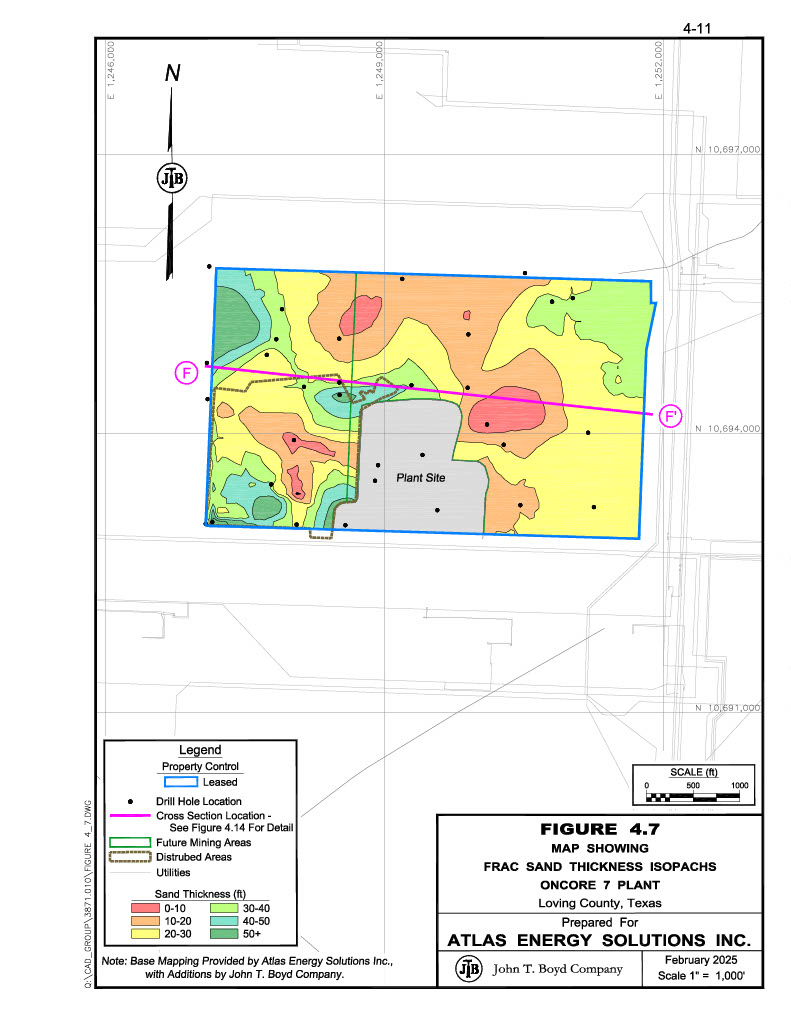

4.7 | Frac Sand Thickness Isopachs OnCore 7 Plant | 4-11 |

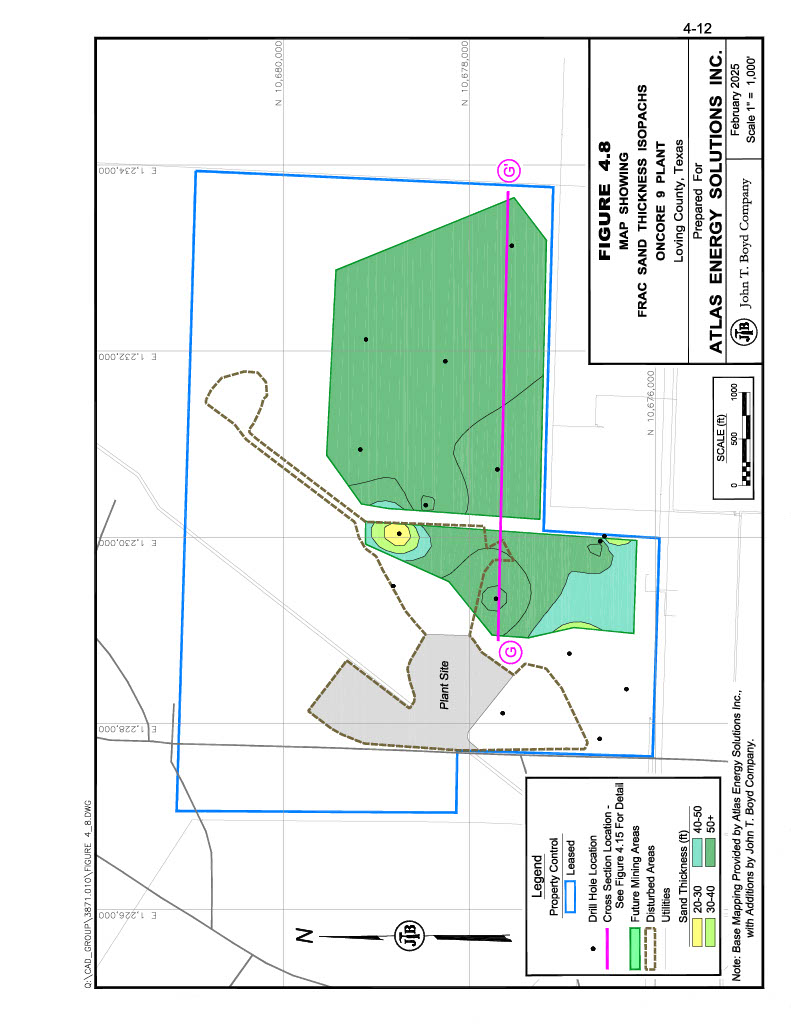

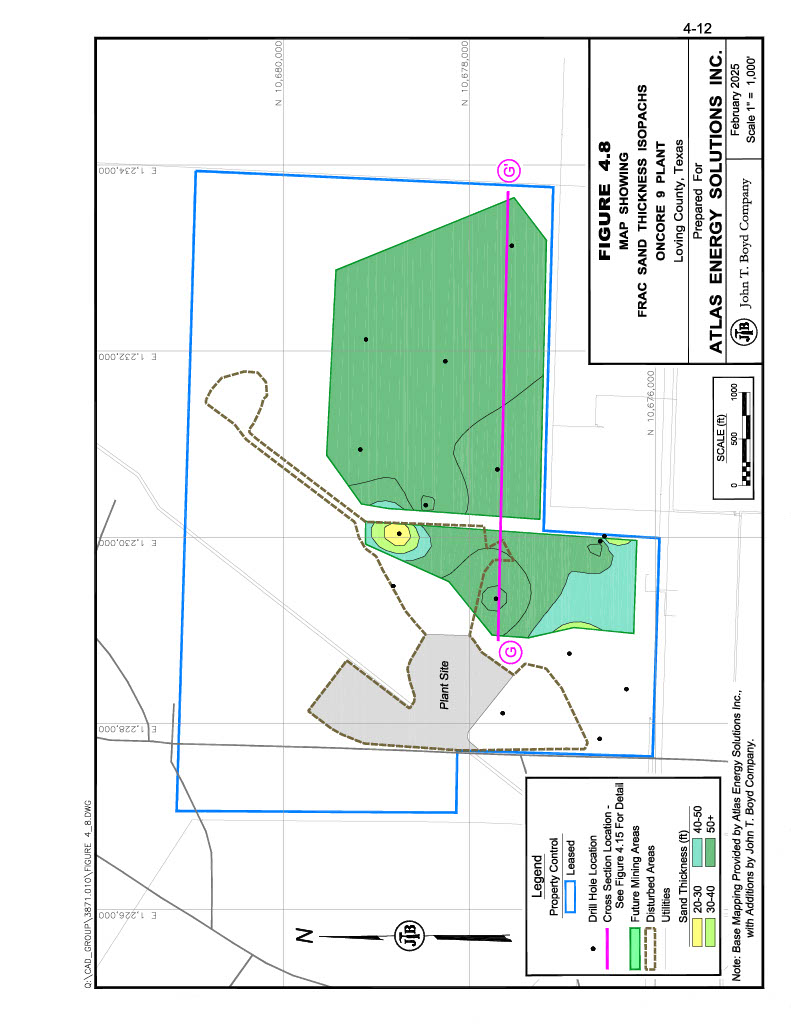

4.8 | Frac Sand Thickness Isopachs OnCore 9 Plant | 4-12 |

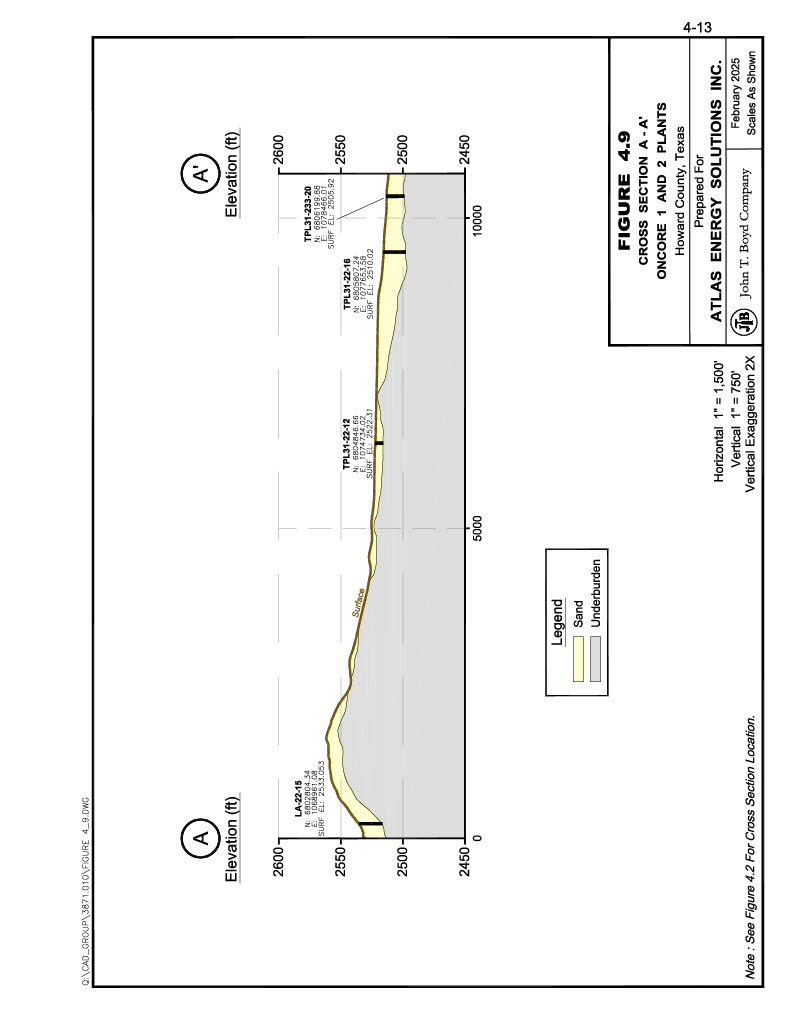

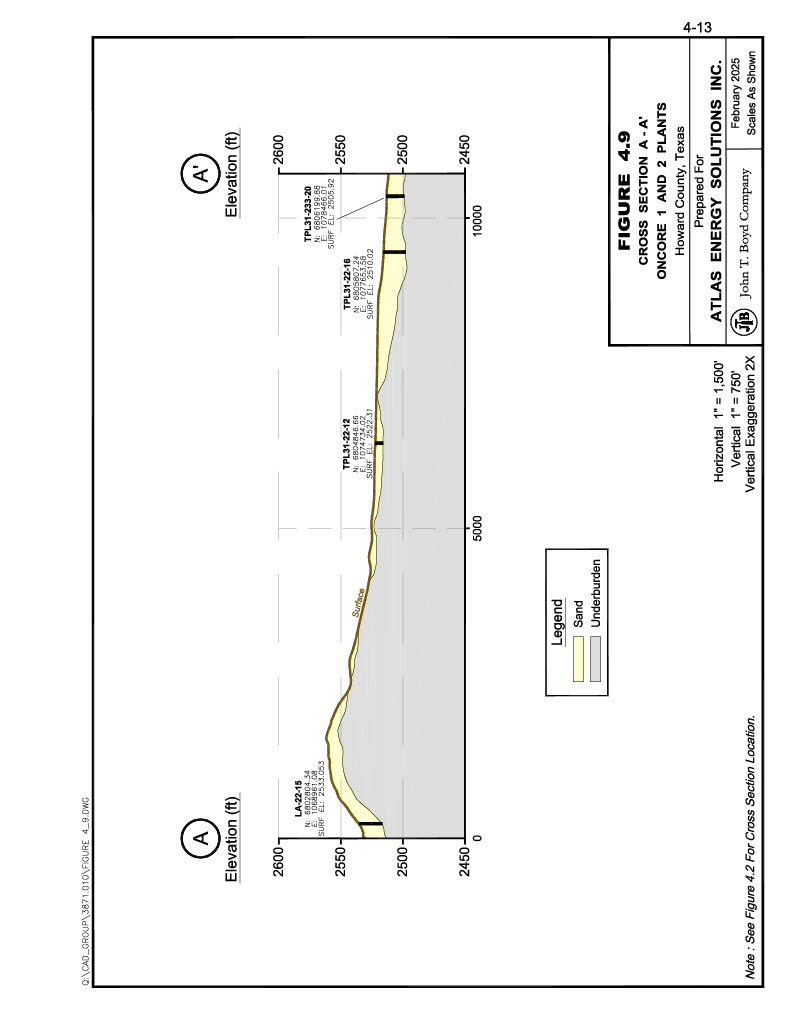

4.9 | Cross Section A-A’ OnCore 1 and 2 Plants | 4-13 |

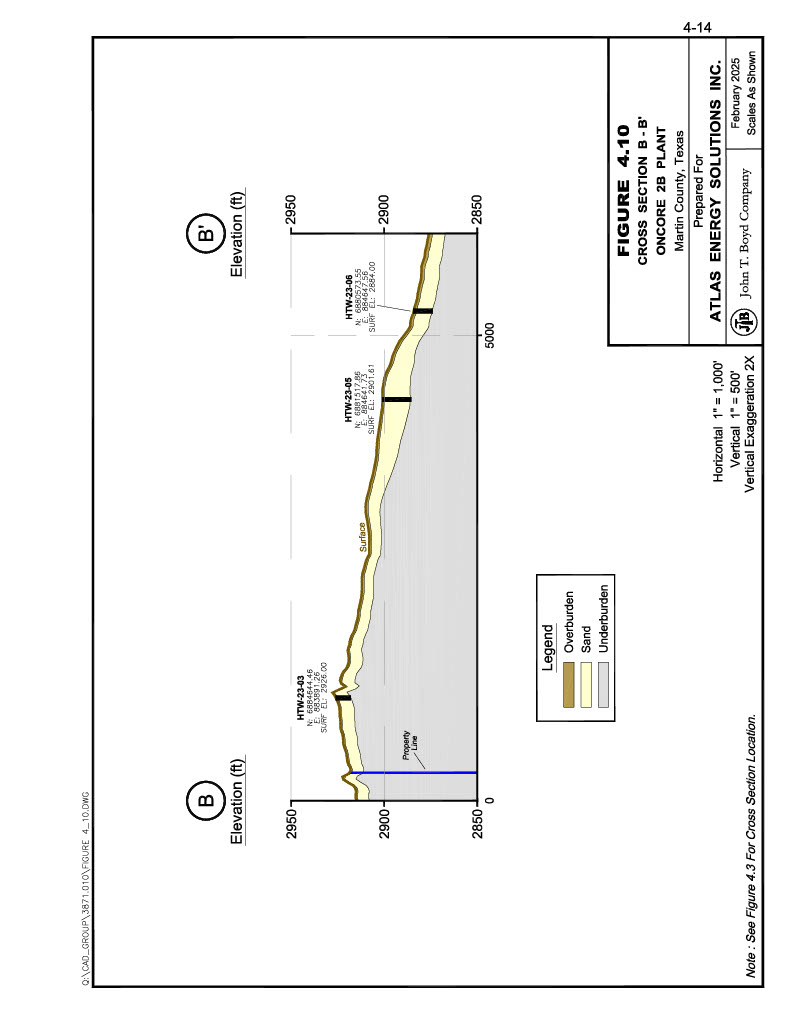

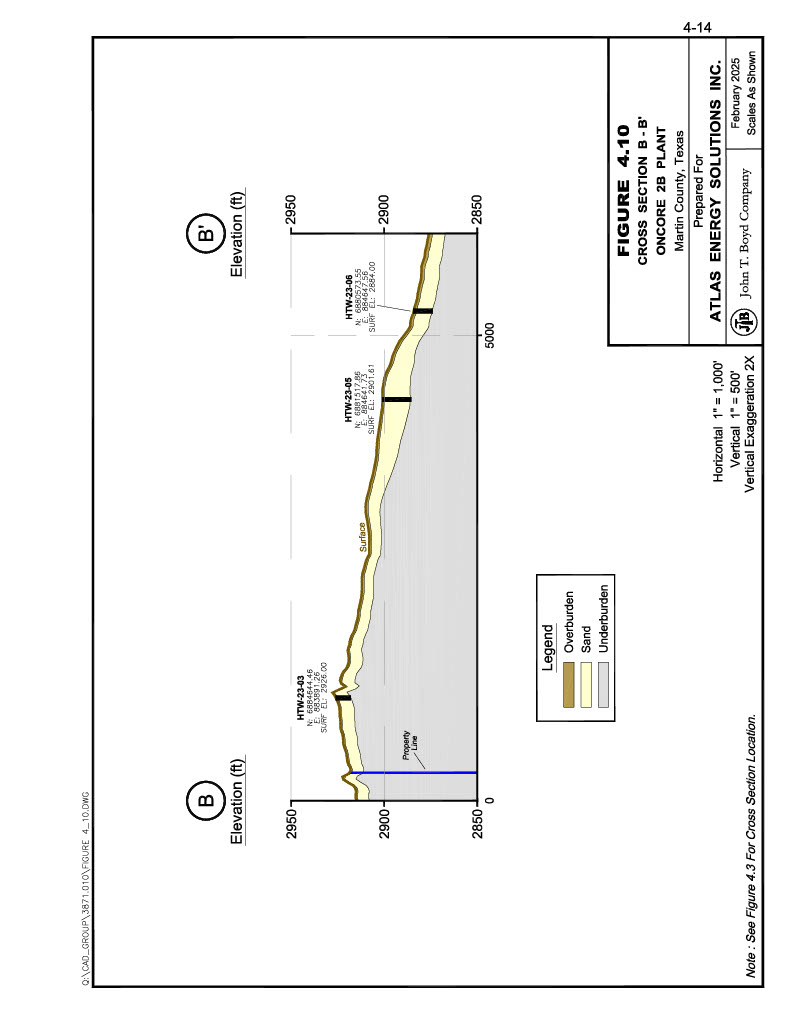

4.10 | Cross Section B-B’ OnCore 2B Plant | 4-14 |

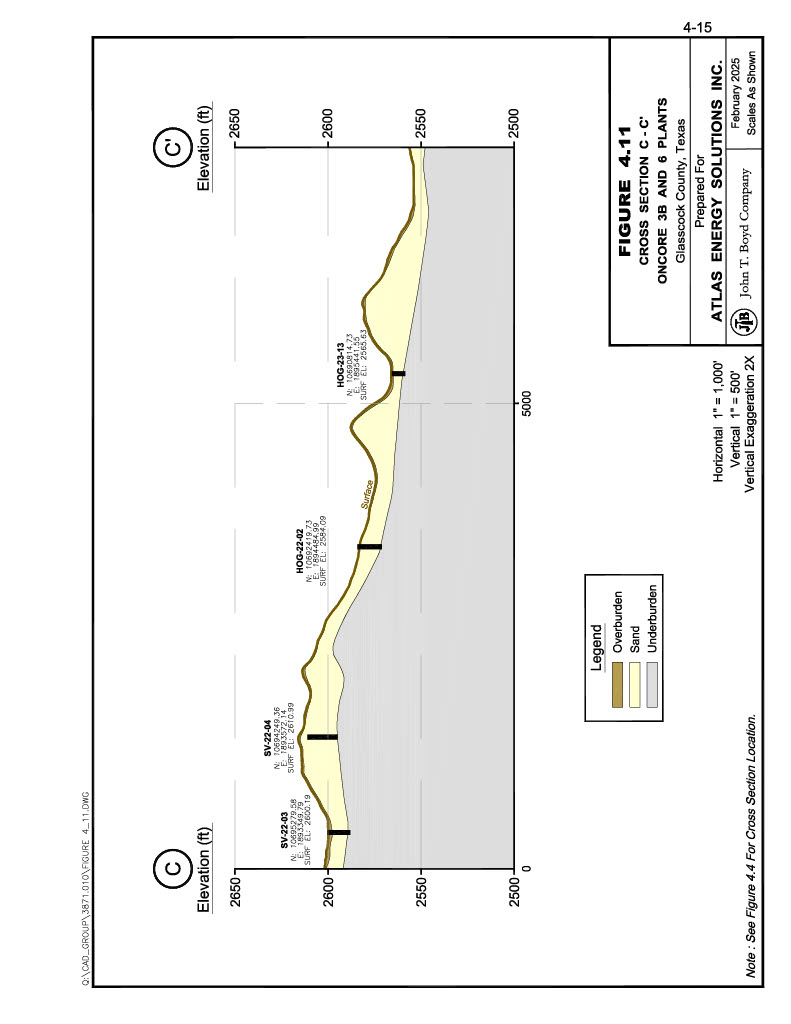

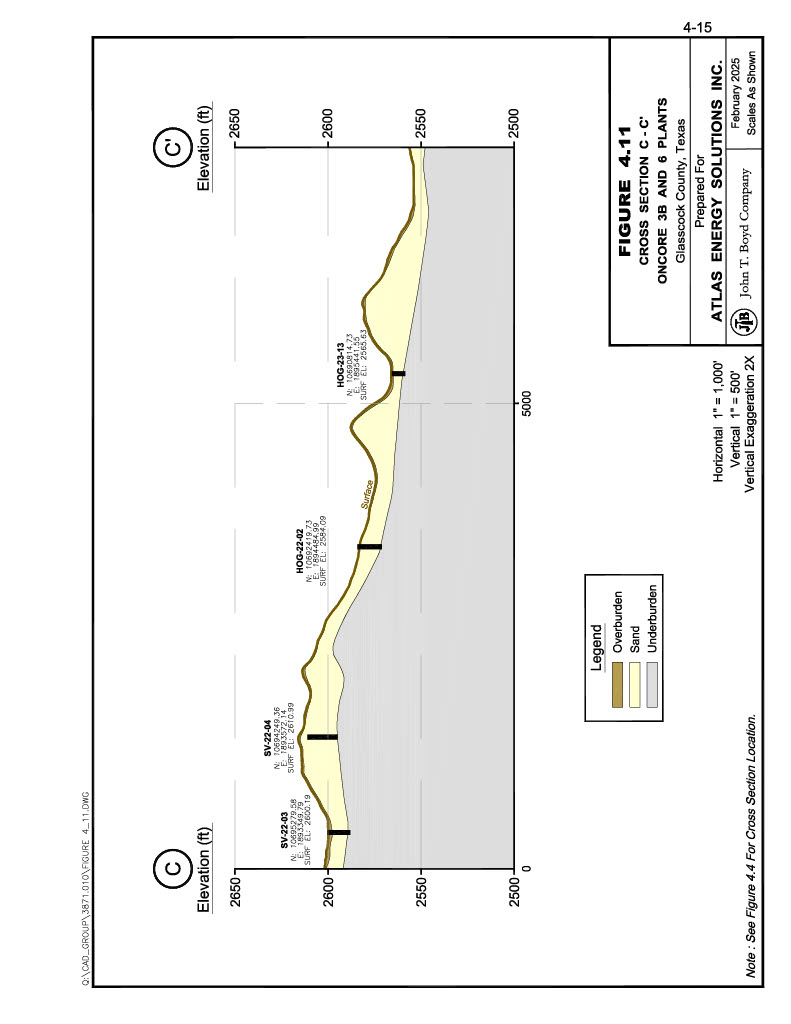

4.11 | Cross Section C-C’ OnCore 3B and 6 Plants | 4-15 |

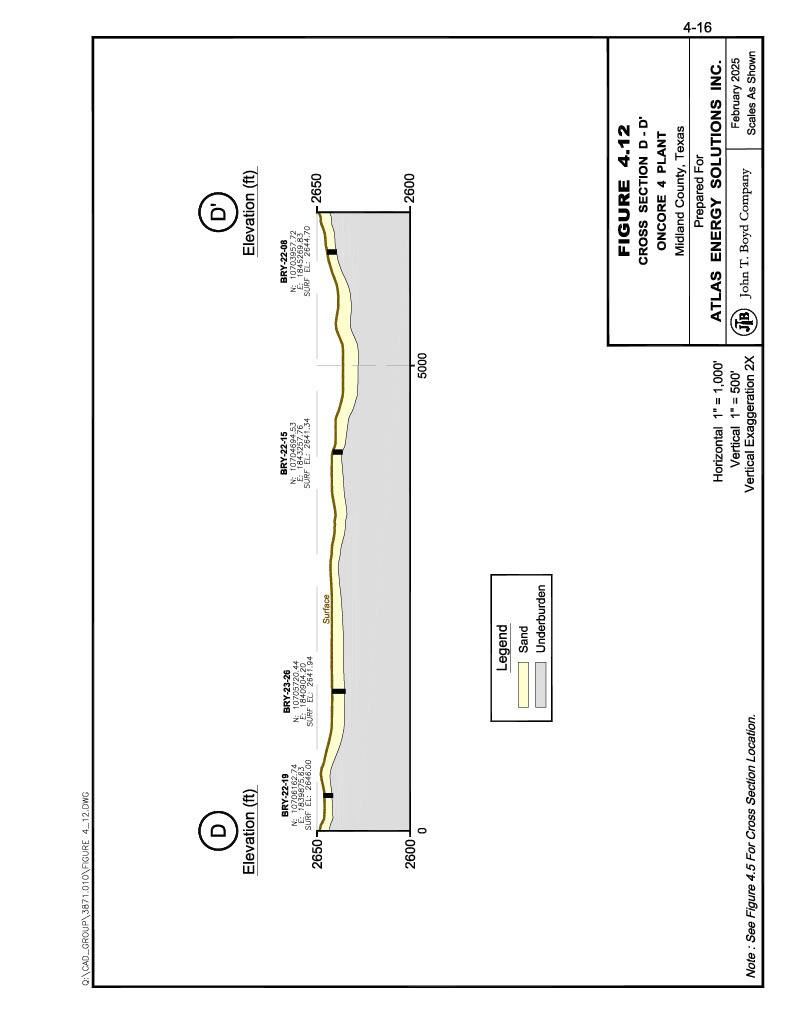

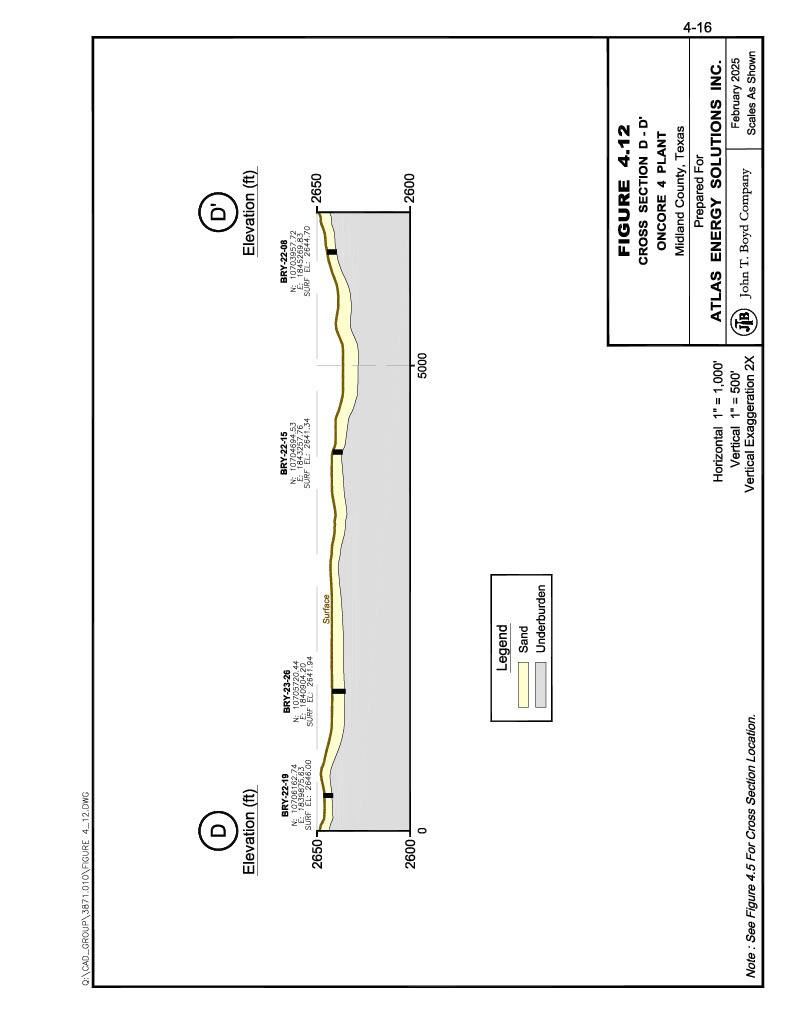

4.12 | Cross Section D-D’ OnCore 4 Plant | 4-16 |

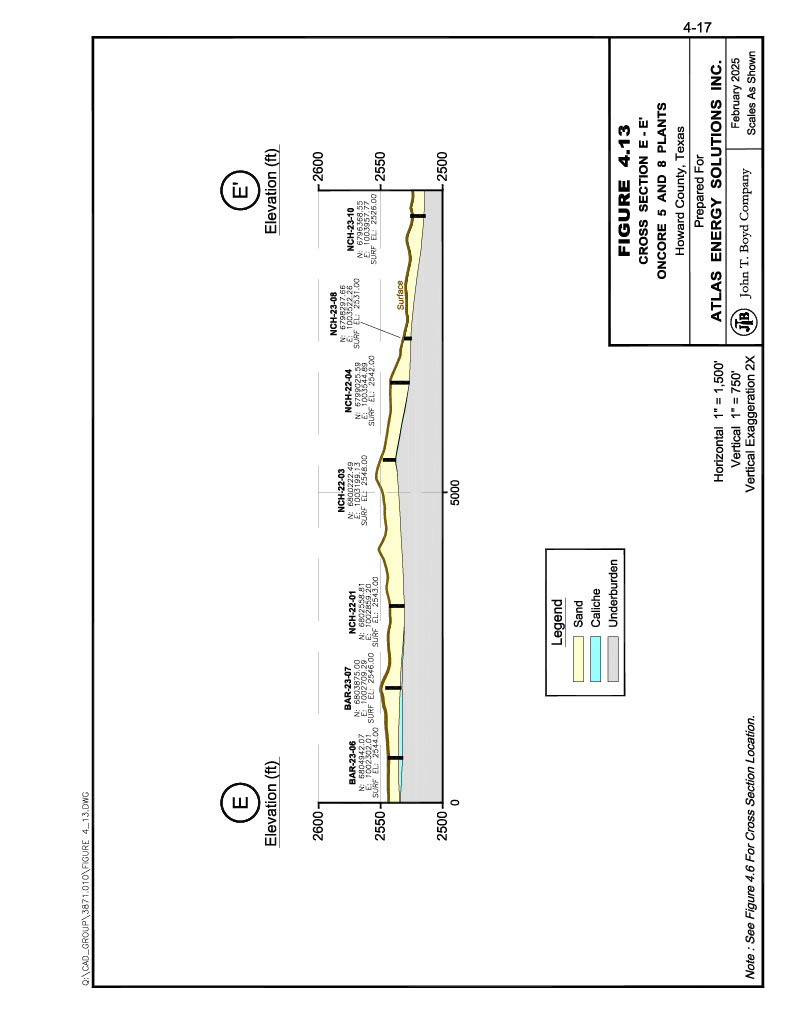

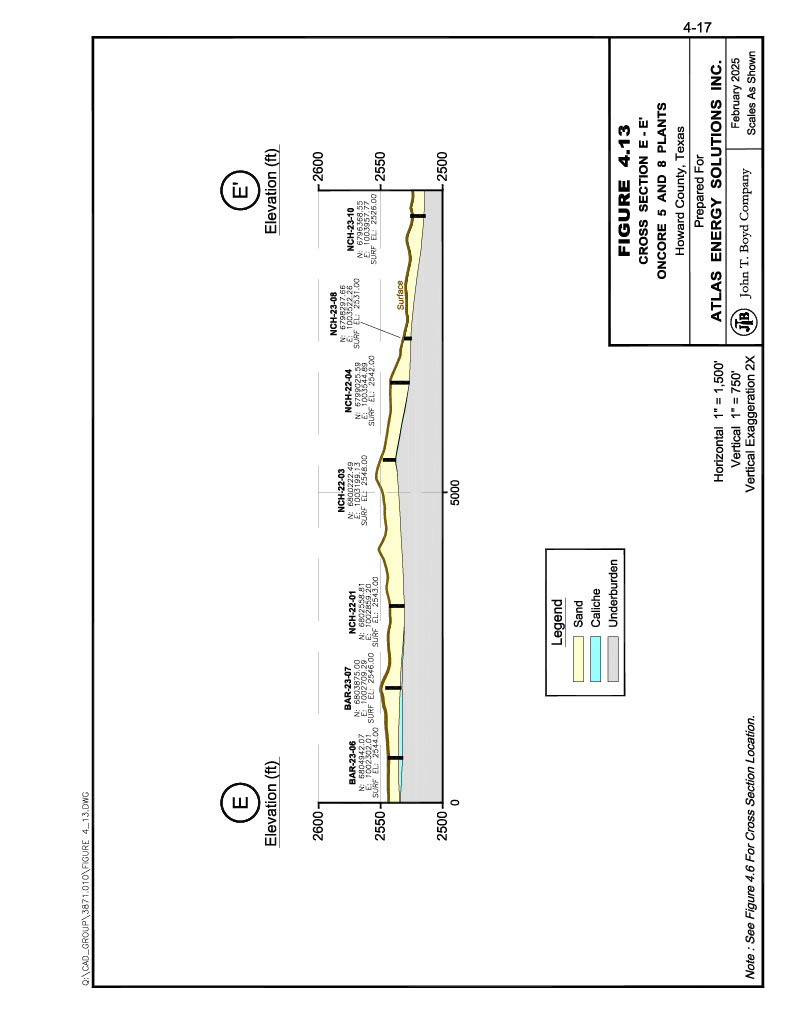

4.13 | Cross Section E-E’ OnCore 5 and 8 Plants | 4-17 |

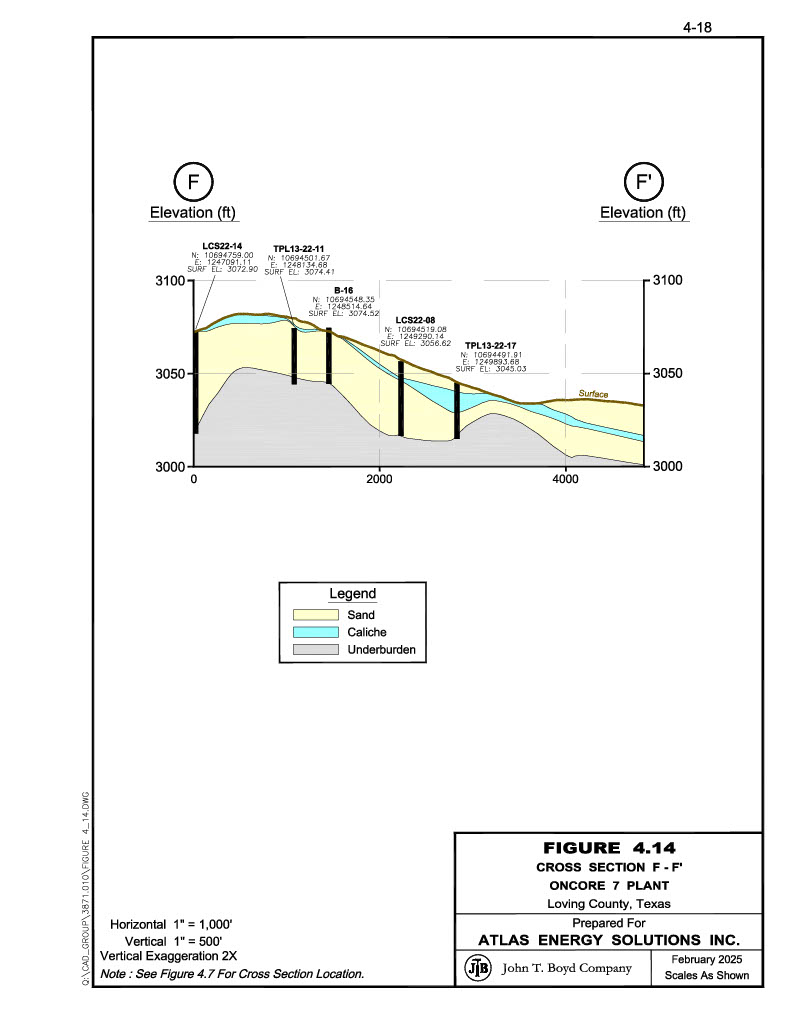

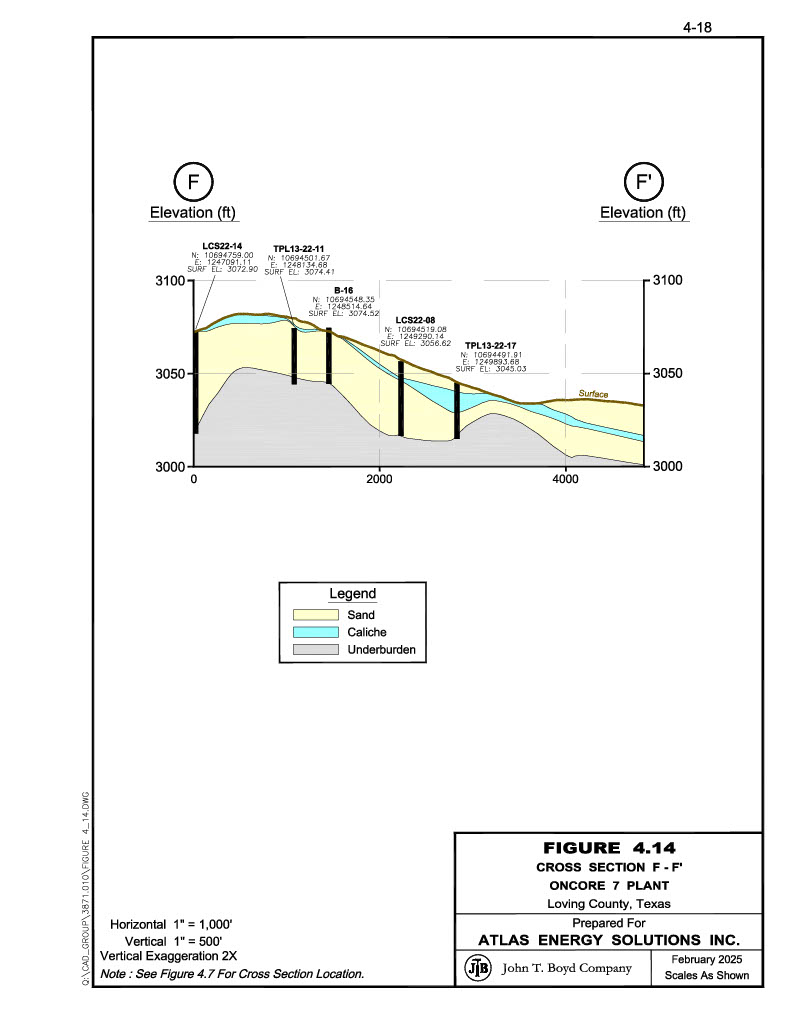

4.14 | Cross Section F-F’ OnCore 7 Plant | 4-18 |

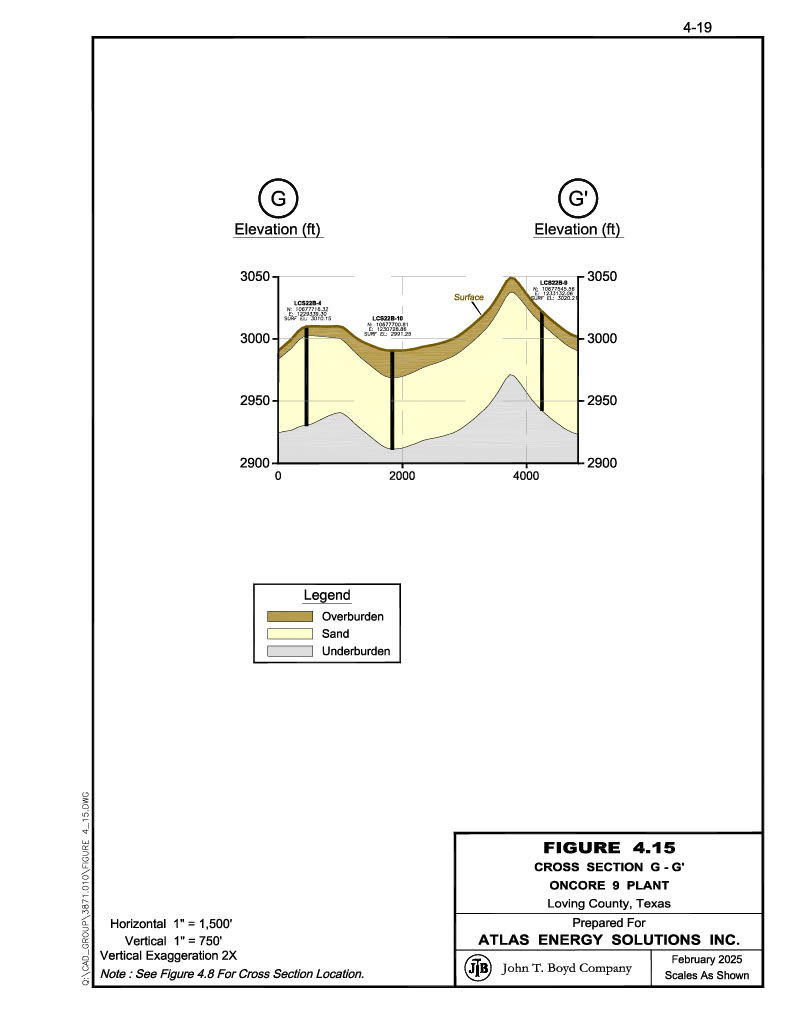

4.15 | Cross Section G-G’ OnCore 9 Plant | 4-19 |

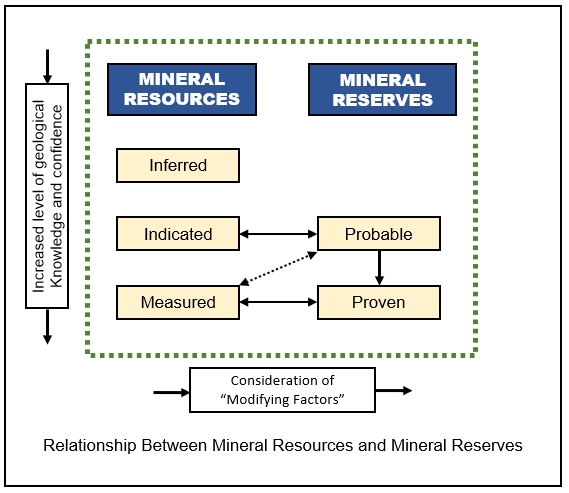

6.1 | Relationship Between Frac Sand Resources and Frac Sand Reserves | 6-2 |

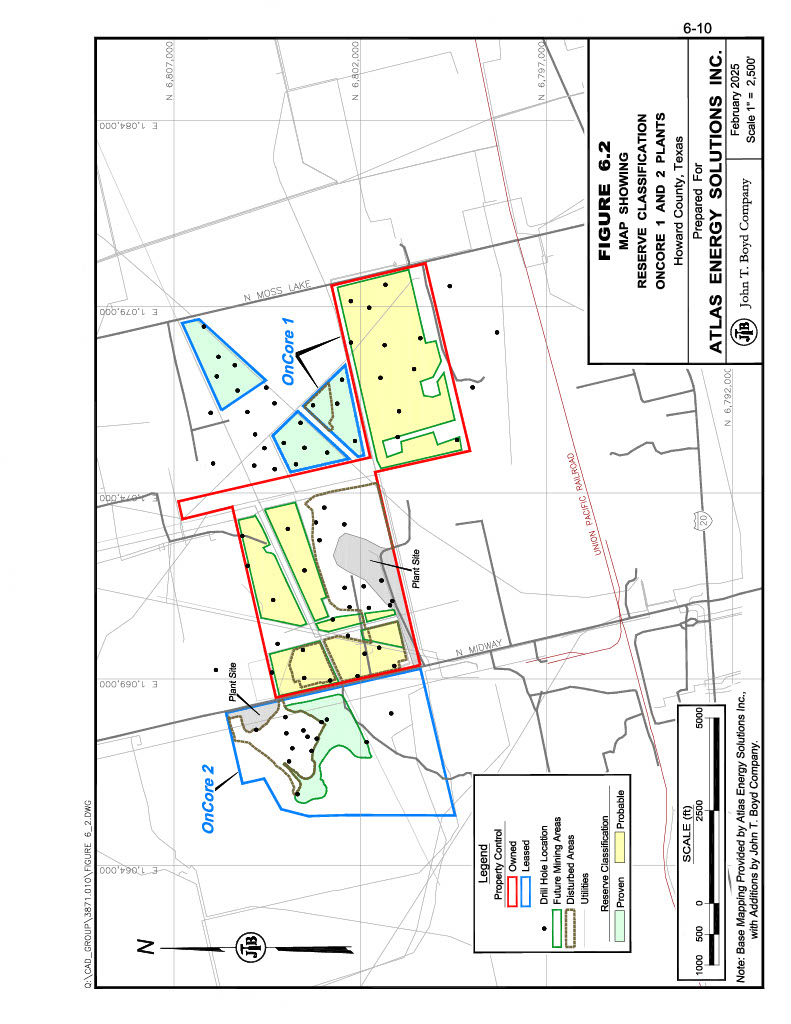

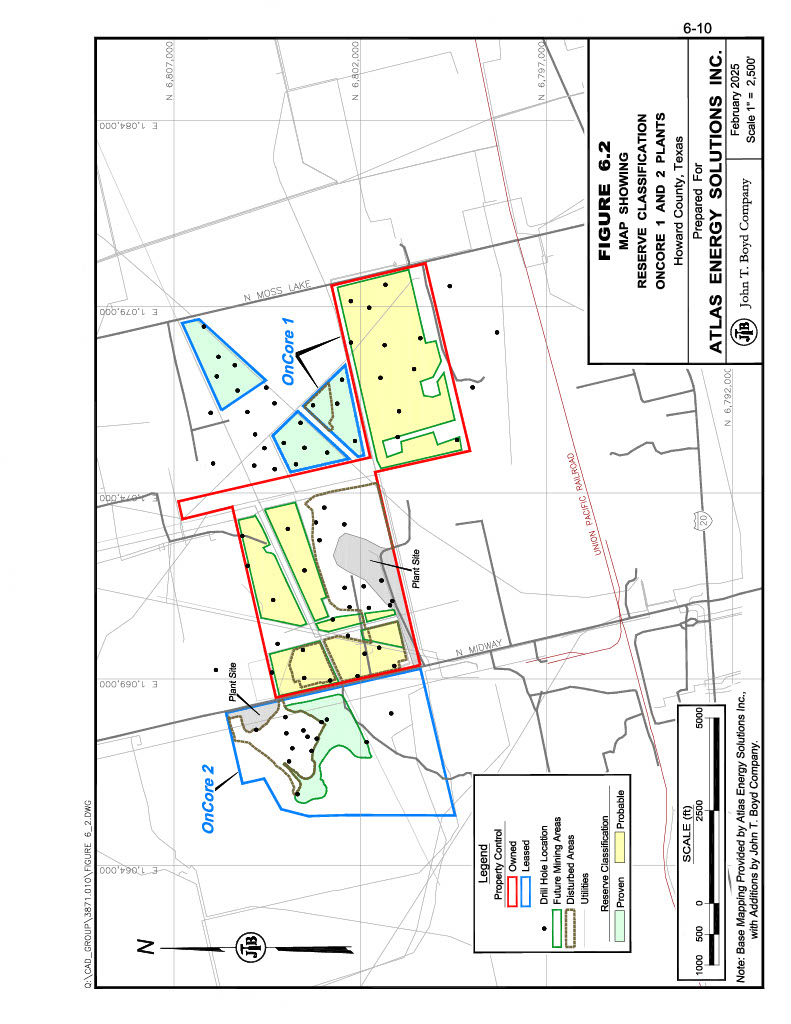

6.2 | Reserve Classification OnCore 1 and 2 Plants | 6-10 |

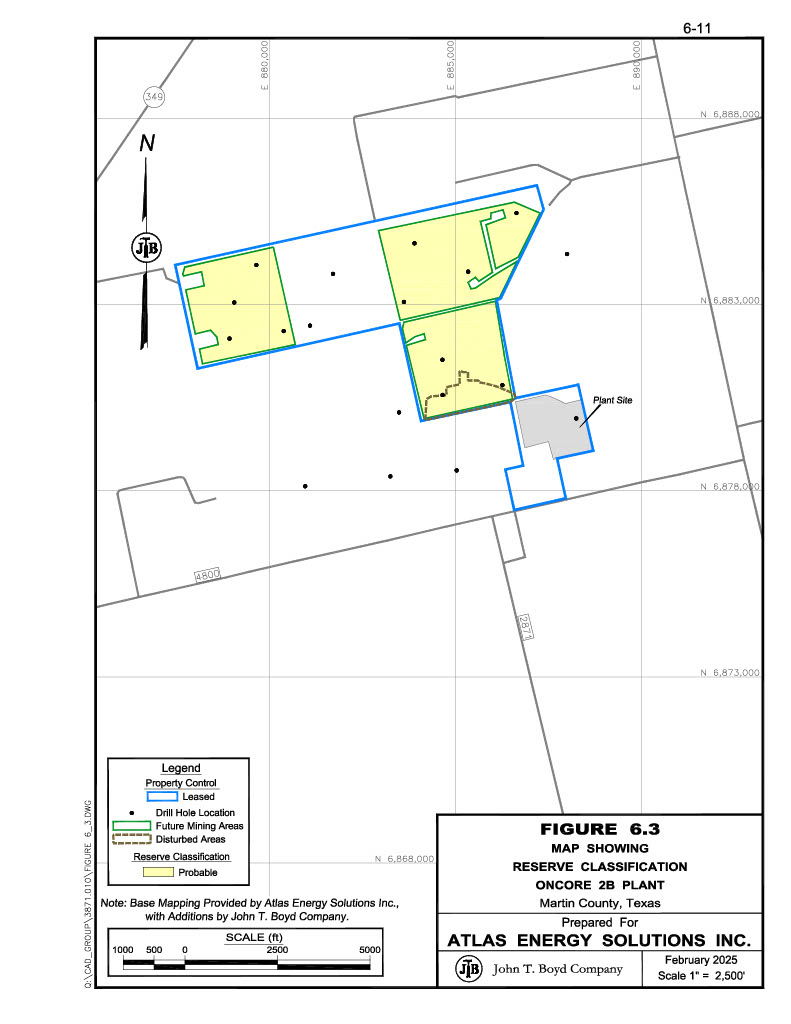

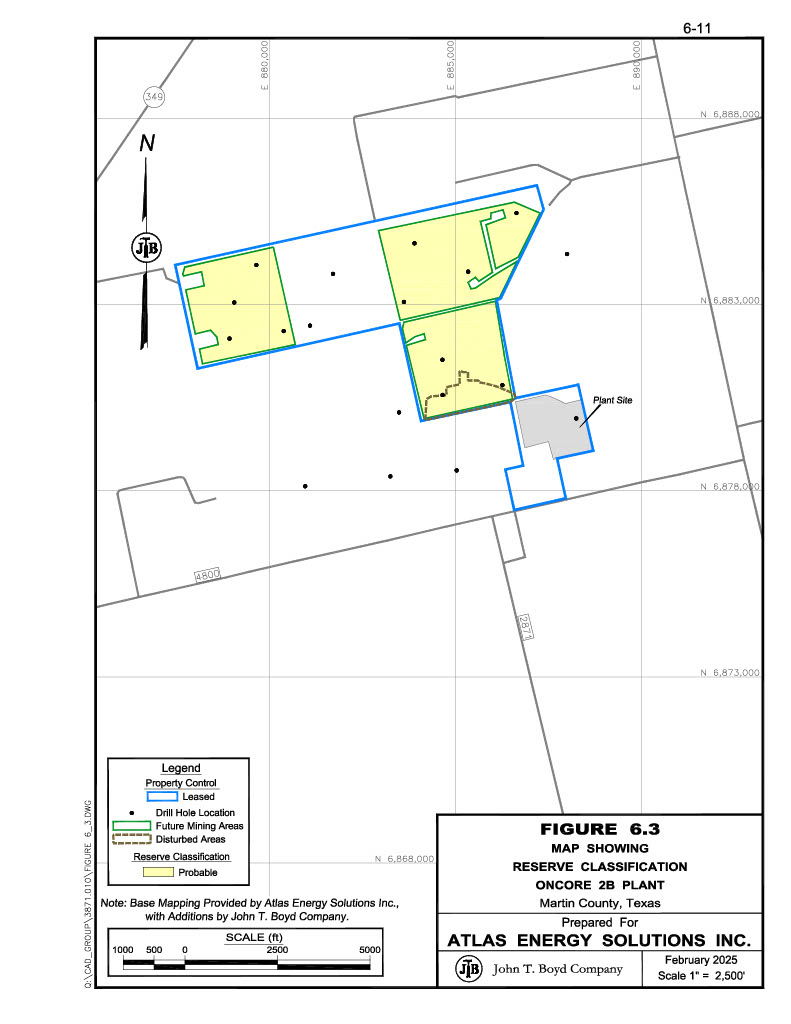

6.3 | Reserve Classification OnCore 2B Plant | 6-11 |

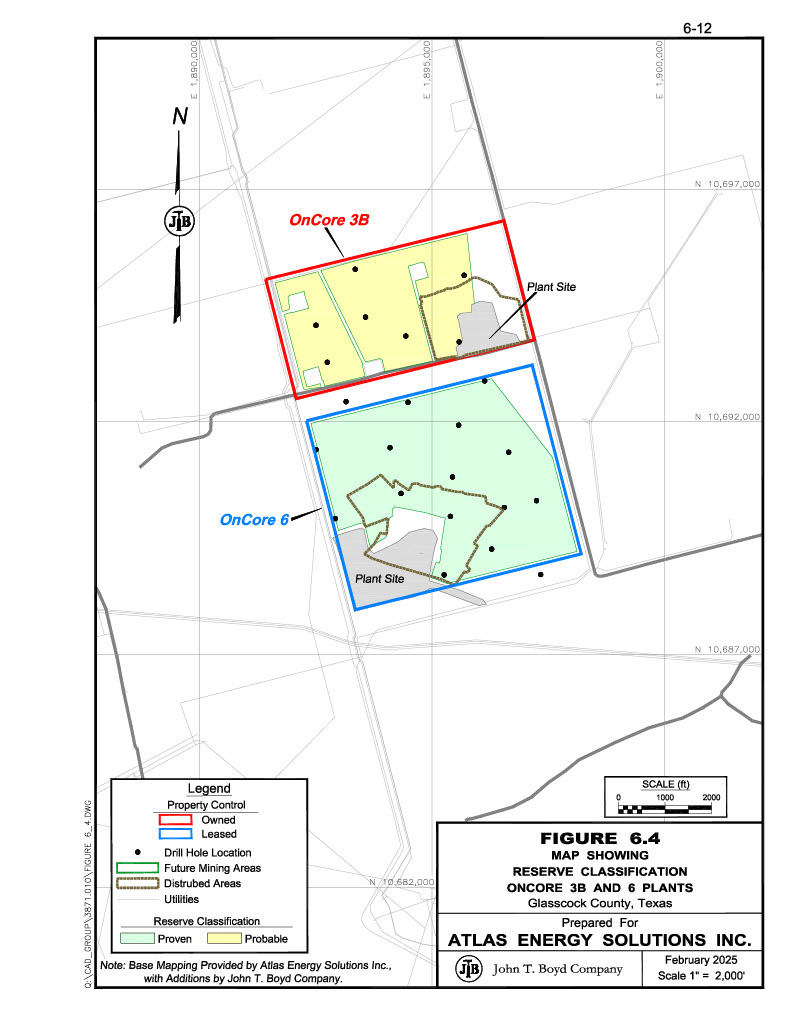

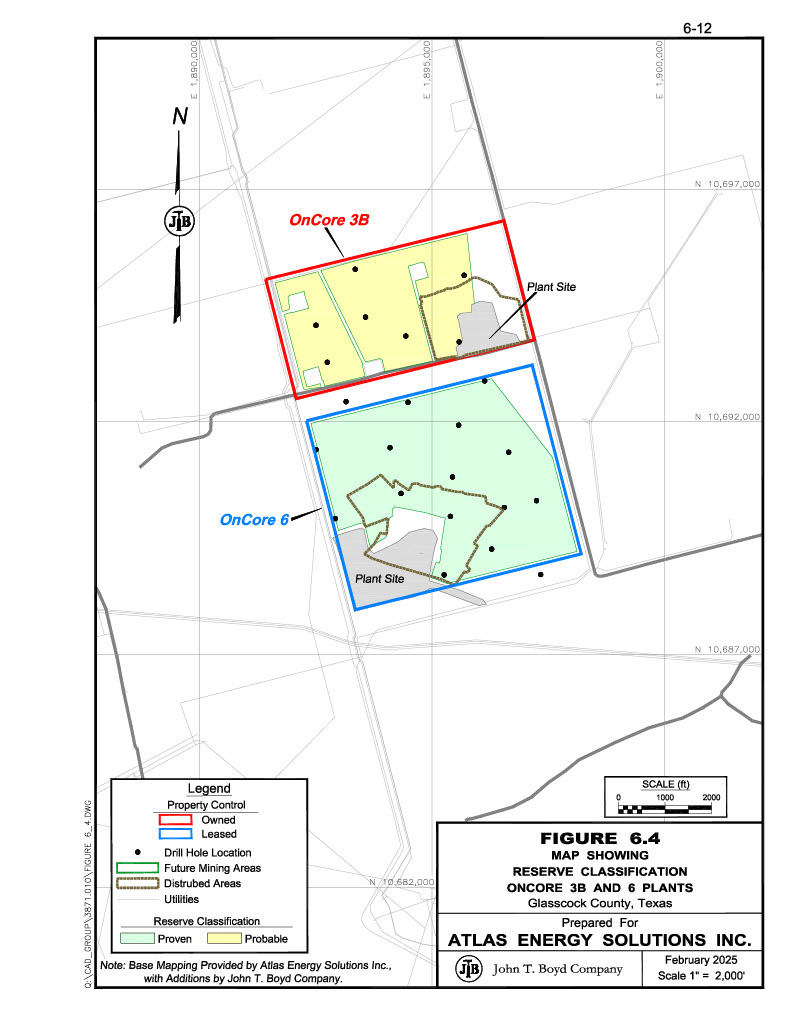

6.4 | Reserve Classification OnCore 3B and 6 Plants | 6-12 |

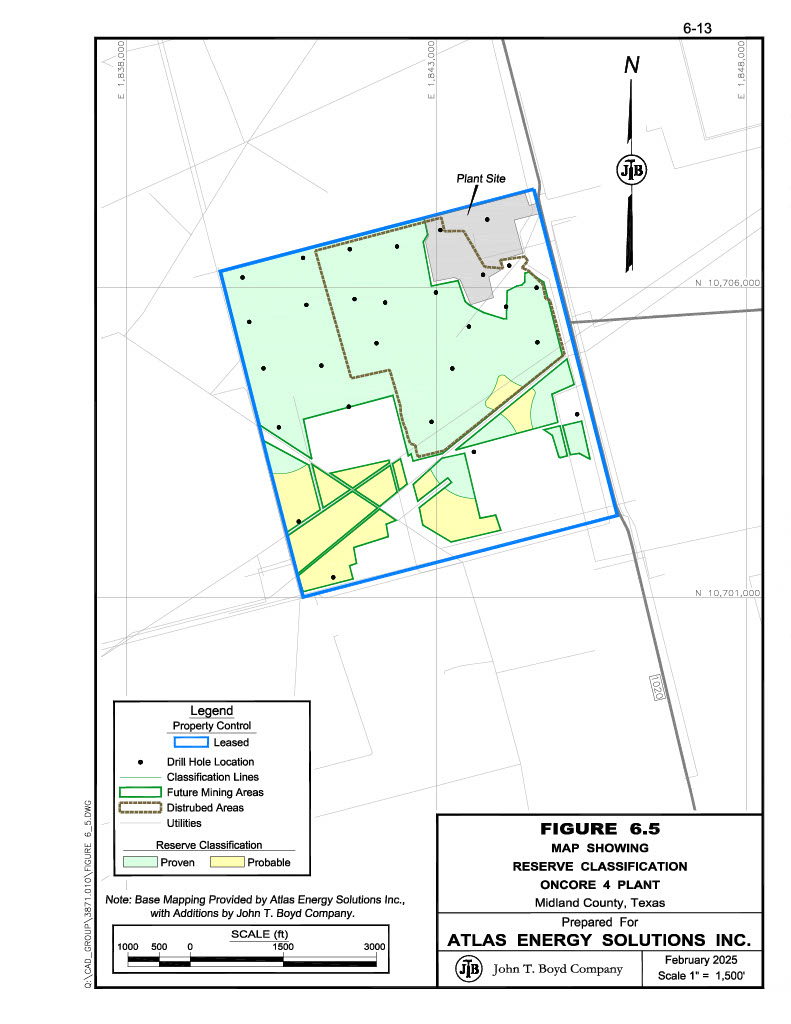

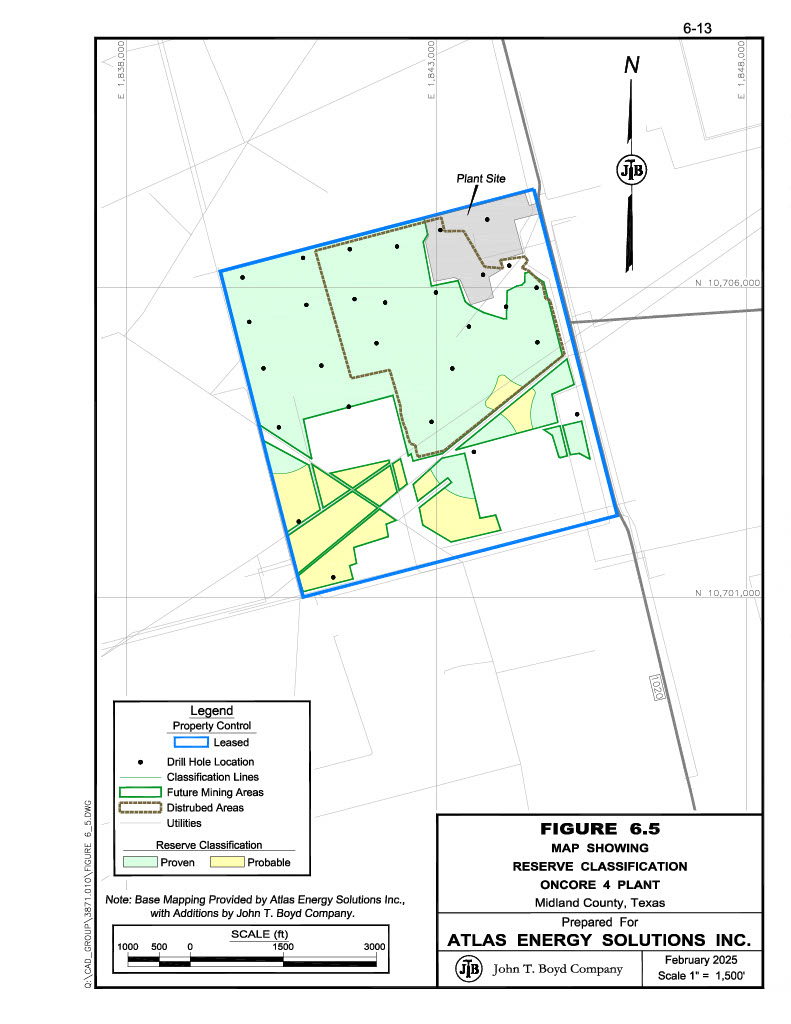

6.5 | Reserve Classification OnCore 4 Plant | 6-13 |

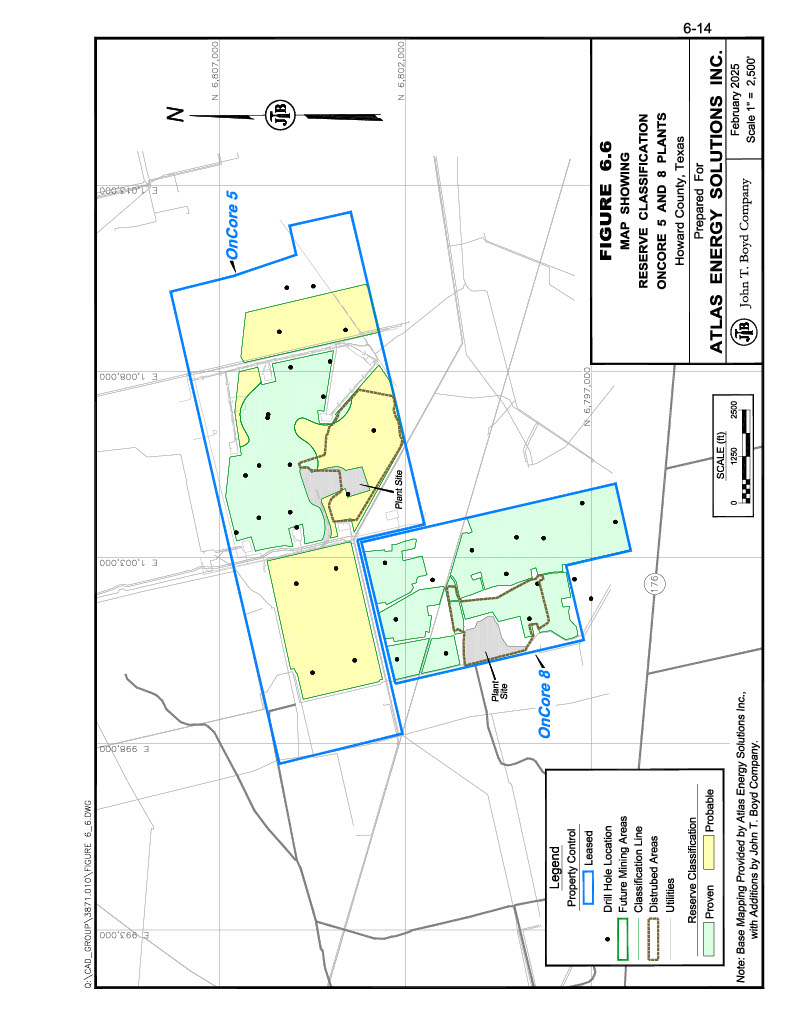

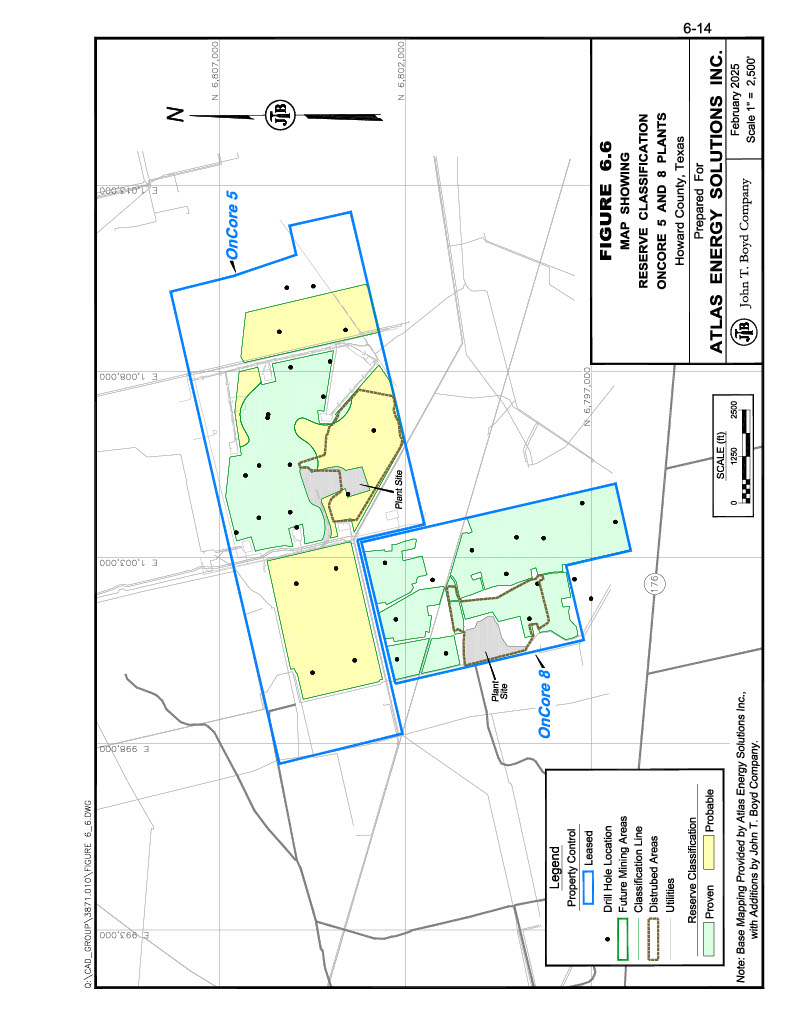

6.6 | Reserve Classification OnCore 5 and 8 Plants | 6-14 |

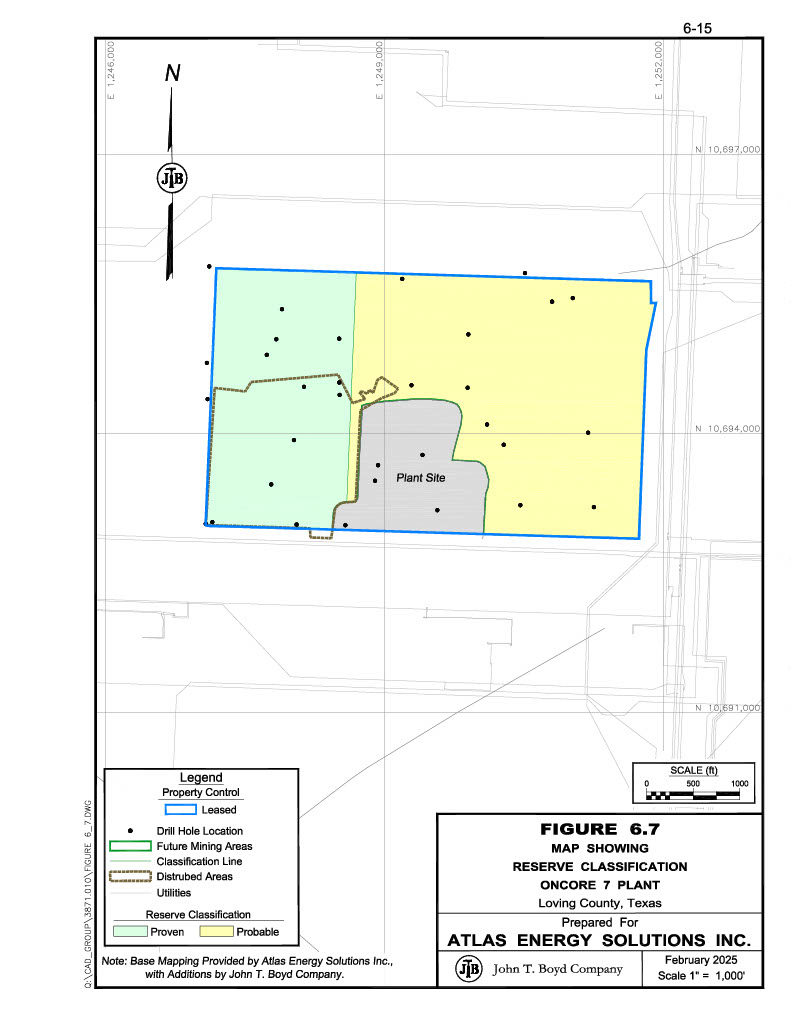

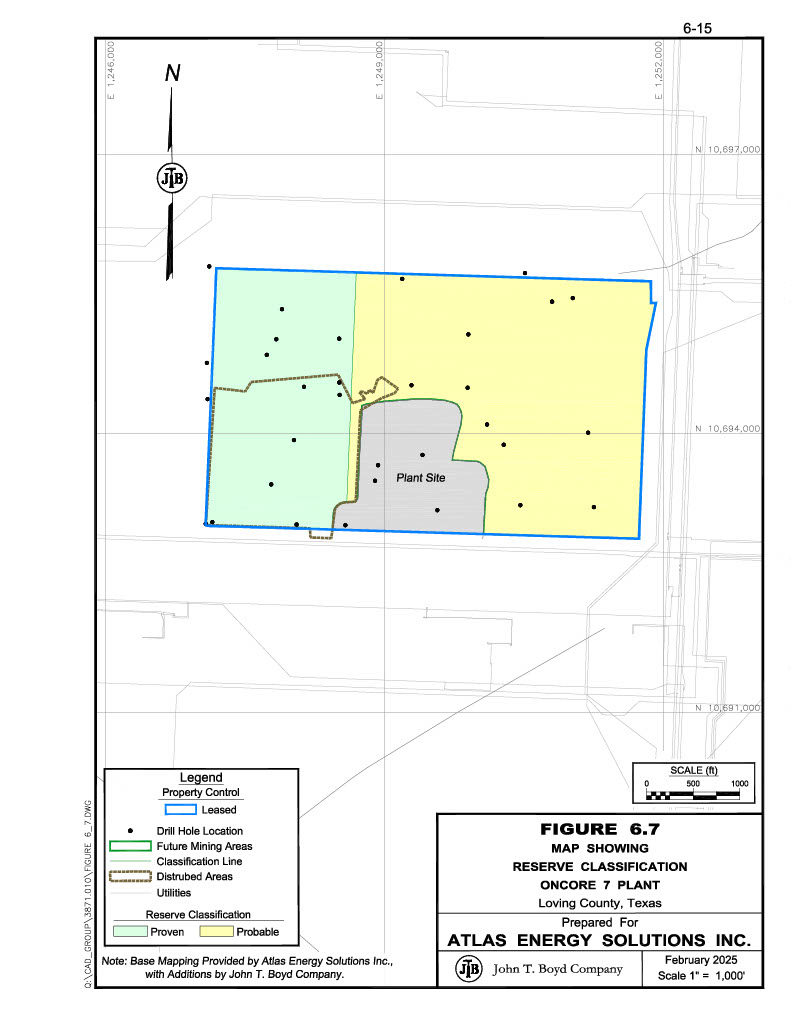

6.7 | Reserve Classification OnCore 7 Plant | 6-15 |

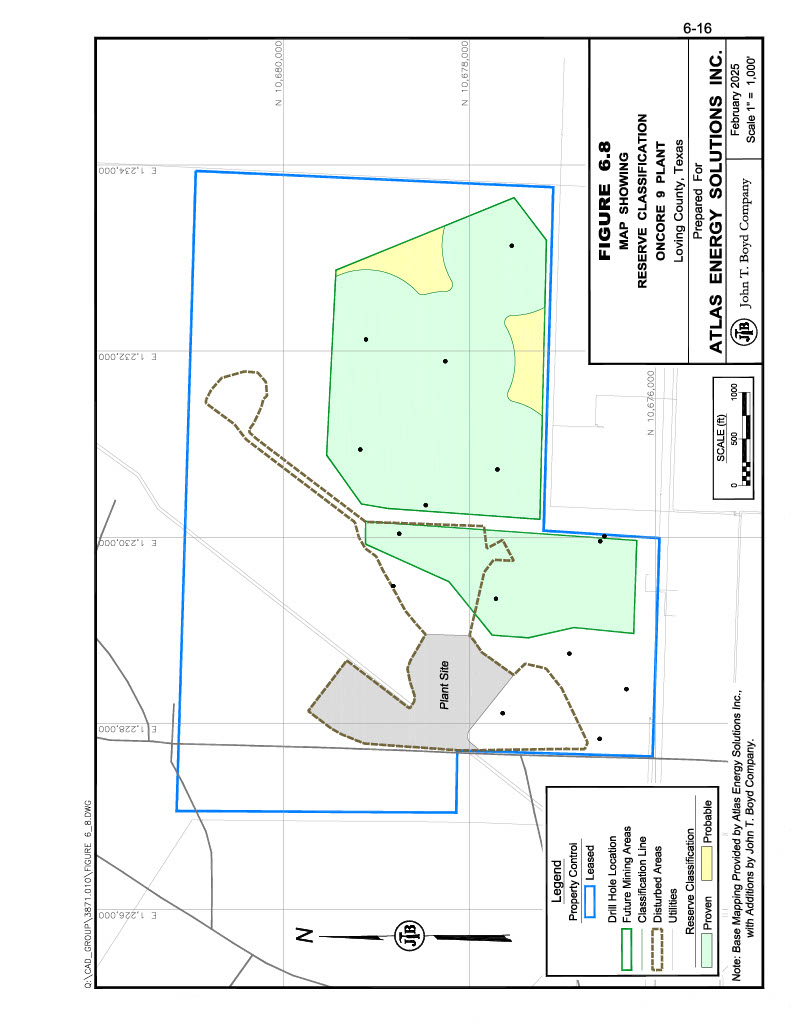

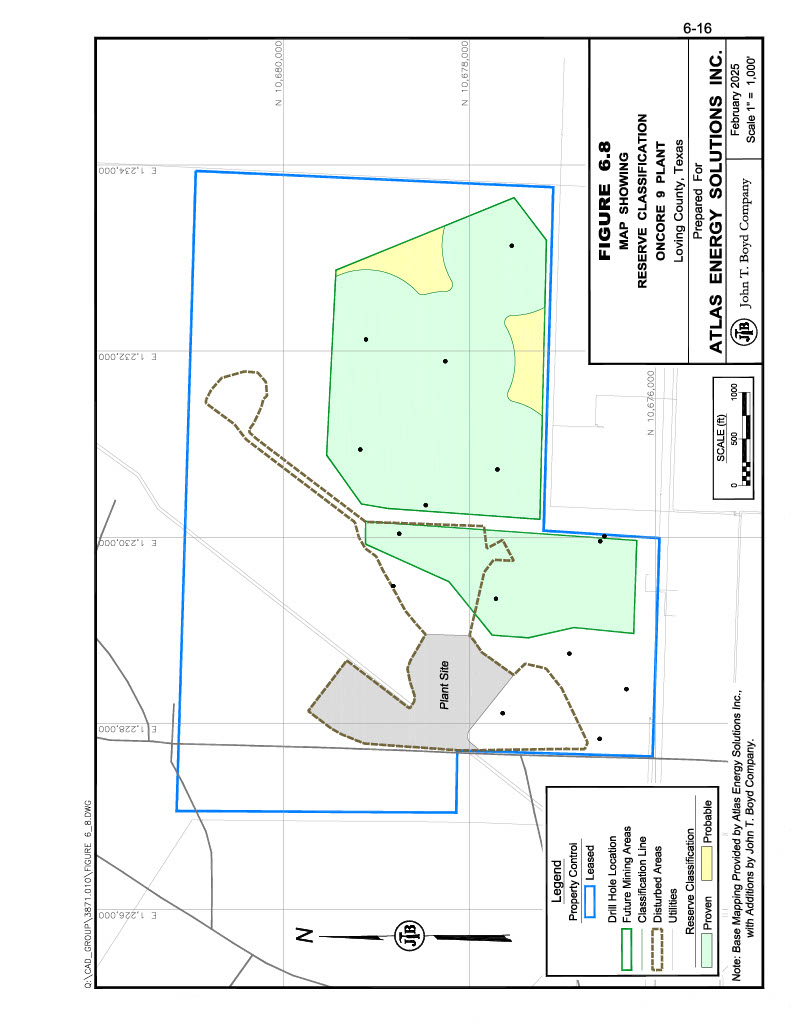

6.8 | Reserve Classification OnCore 9 Plant | 6-16 |

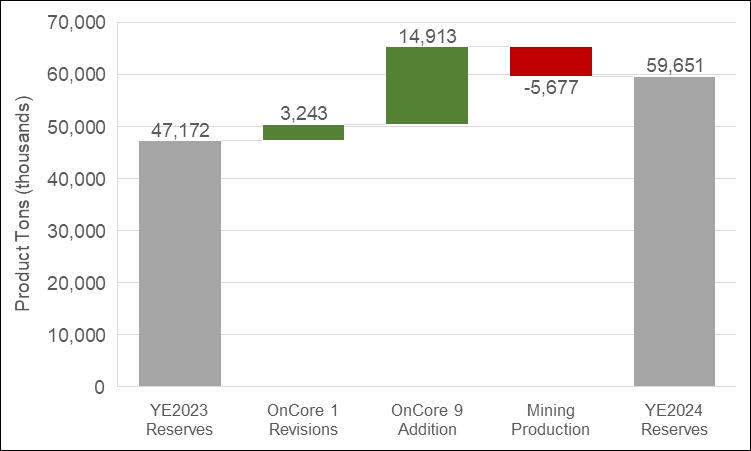

6.9 | Reconciliation with Previous Frac Sand Reserves Estimate | 6-9 |

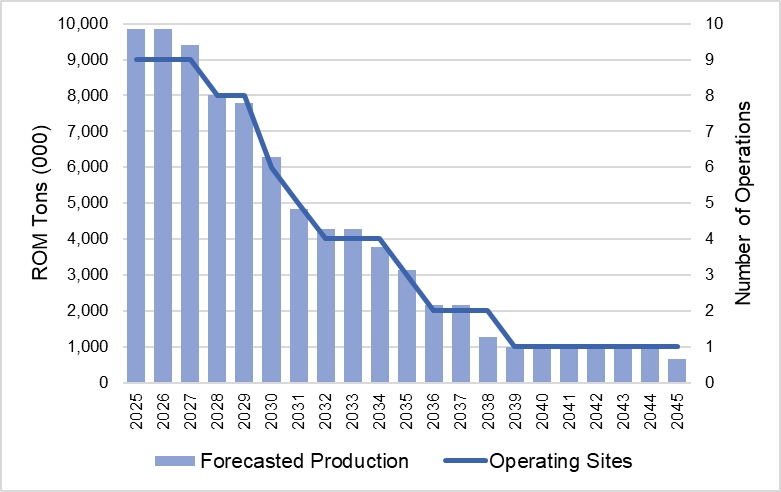

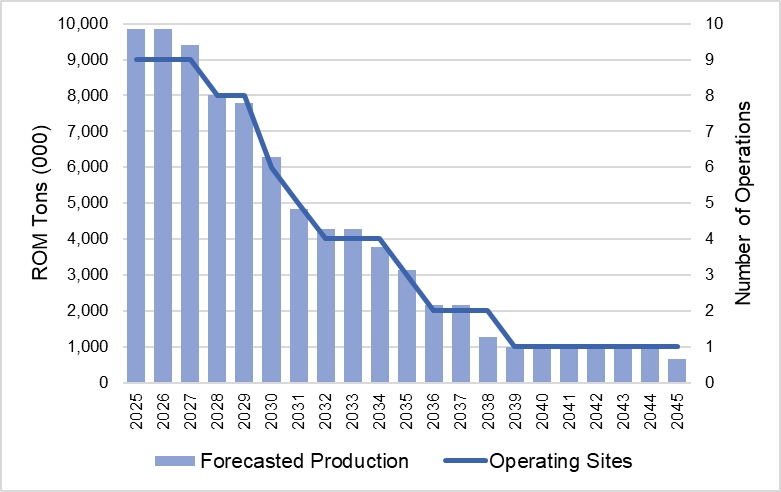

7.1 | LOM Forecasted Mining Production | 7-3 |

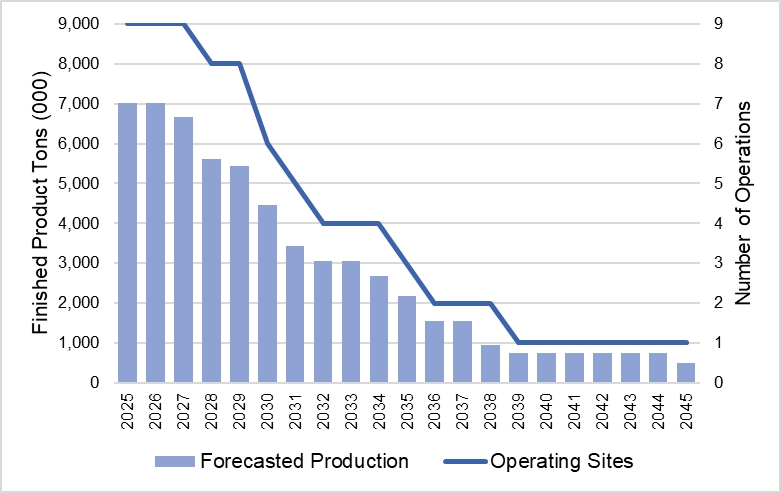

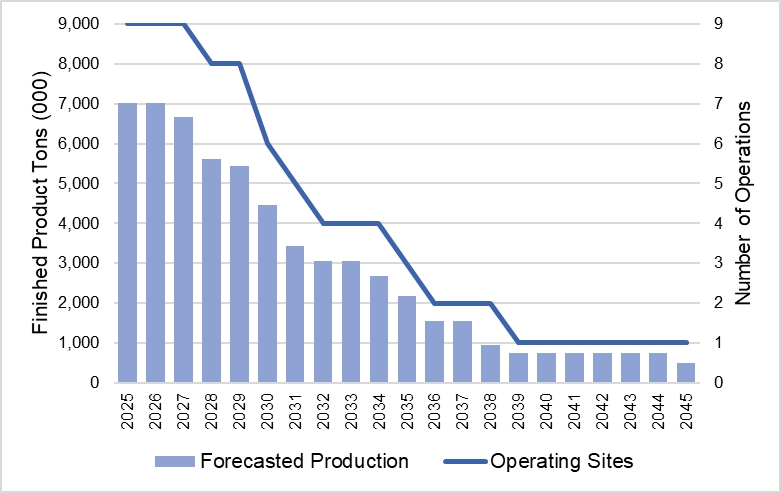

8.1 | LOM Forecasted Processing Plant Production | 8-3 |

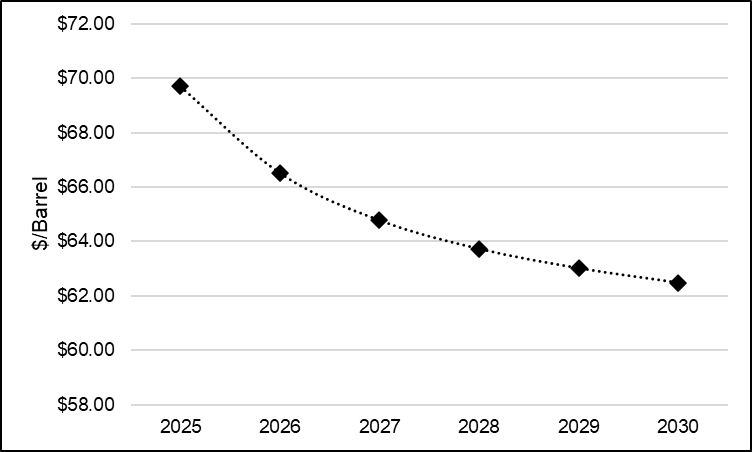

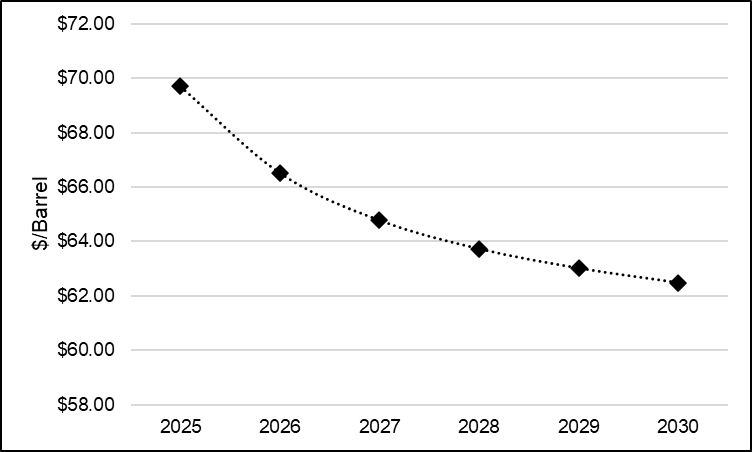

10.1 | WTI Crude Oil Futures Price | 10-1 |

10.2 | U.S. Horizontal Drilling Permits by Region | 10-2 |

10.3 | U.S. Oil Production from Shale and Tight Formations | 10-2 |

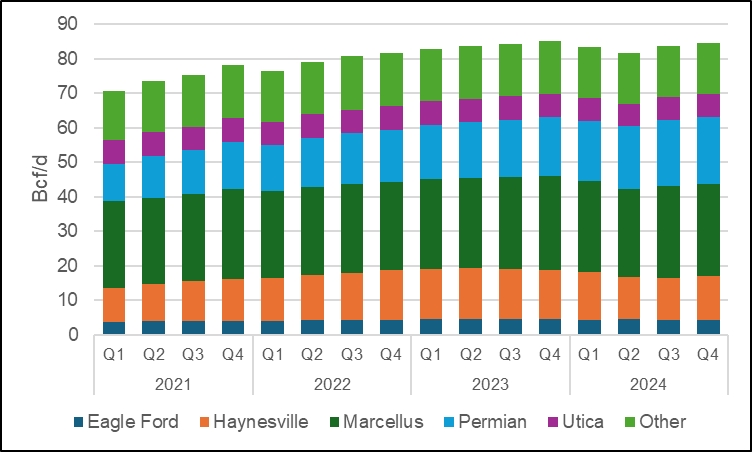

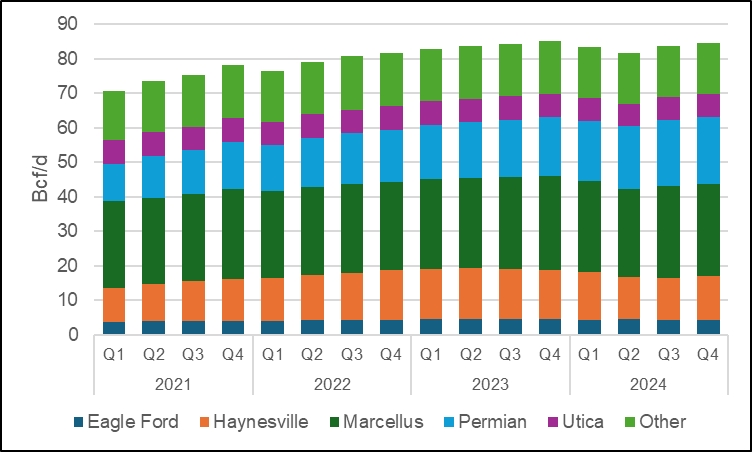

10.4 | U.S. Natural Gas Production from Shale and Tight Formations | 10-3 |

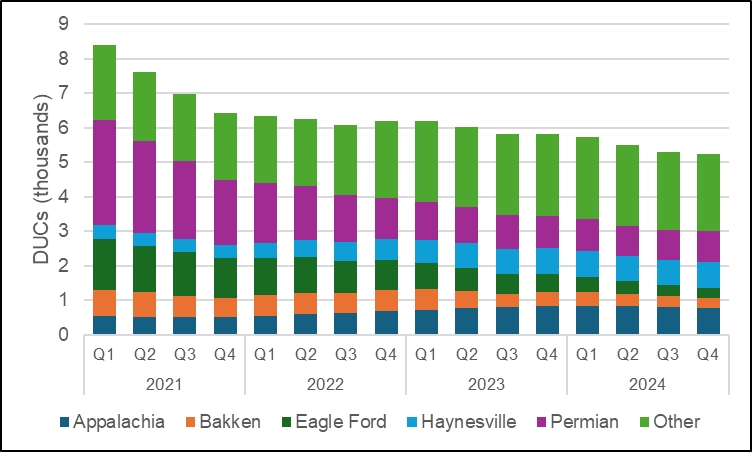

10.5 | U.S. Drilled but Uncompleted Wells | 10-3 |

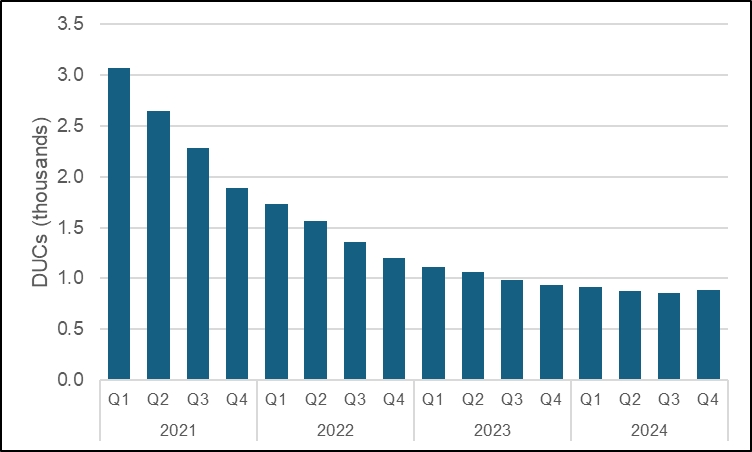

10.6 | Permian Drilled but Uncompleted Wells | 10-4 |

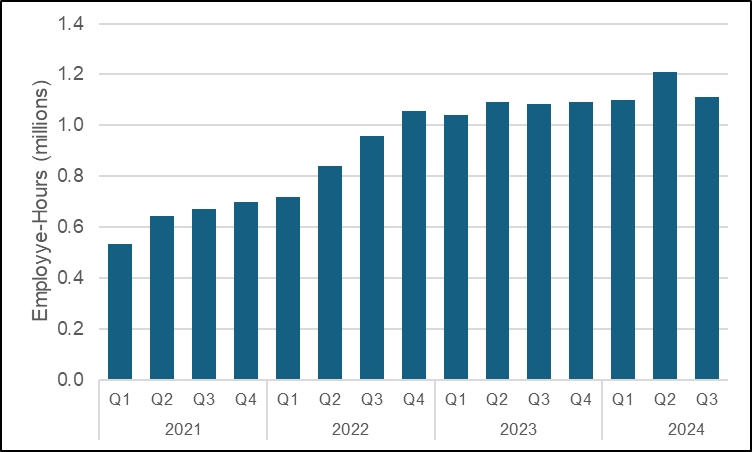

10.7 | Permian In-Basin Mine Employee-Hours (Quarterly) | 10-4 |

| |

| 1 |

| |

GLOSSARY OF ABBREVIATIONS AND DEFINITIONS | |

| | |

000 | : | Thousand(s) |

$ | : | U.S. dollar(s) |

ACS | : | Average cost of goods sold |

AMSL | : | Above mean sea level |

API | : | American Petroleum Institute |

API/ISO | : | API RP 19C/ISO 13503-2, Measurement of Properties of Proppants Used in Hydraulic Fracturing and Gravel-packing Operations |

ASP | : | Average selling price |

Atlas | : | Atlas Energy Solutions Inc. and affiliated companies |

BOYD | : | John T. Boyd Company |

DCF | : | Discounted cash flow |

DDA | : | Depreciation, depletion, and amortization expenses |

EBIT | : | Earnings before interest and taxes |

EBIAT | : | Earnings before interest after taxes |

EBITDA | : | Earnings before interest, taxes, depreciation, and amortization |

E&P | : | Exploration and production |

Frac Sand | : | Frac sand is a naturally occurring, high silica content quartz sand, with grains that are generally well rounded and exhibit high compressive strength characteristics relative to other silica sand. It is utilized as a prop or “proppant” in unconventional shale frac well completions. |

Frac Sand Resource | : | A Frac Sand Resource is a concentration or occurrence of sand material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A Frac Sand Resource is a reasonable estimate of mineralization, taking into account relevant factors such as quality specifications, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. |

| |

| 2 |

| |

GLOSSARY OF ABBREVIATIONS AND DEFINITIONS - Continued | |

| | |

Frac Sand Reserve | : | A Frac Sand Reserve is an estimate of tonnage and grade or quality of Frac Sand Resource that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a Frac Sand Resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

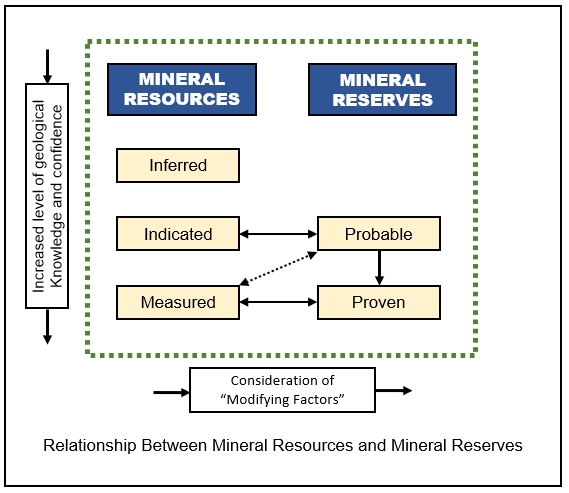

Indicated Frac Sand Resource | : | An Indicated Frac Sand Resource is that part of a Frac Sand Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing, and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Frac Sand Resource has a lower level of confidence than that applying to a Measured Frac Sand Resource and may only be converted to a Probable Frac Sand Reserve. |

Inferred Frac Sand Resource | : | That part of a Frac Sand Resource for which quantity and quality are estimated based on limited geological evidence and sampling. The level of geological uncertainty associated with an Inferred Frac Sand Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an Inferred Frac Sand Resource has the lowest level of geological confidence of all Frac Sand Resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an Inferred Frac Sand Resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a Frac Sand Reserve. |

IRR | : | Internal rate-of-return |

ISO | : | International Organization for Standardization |

LOM | : | Life-of-mine |

Measured Frac Sand Resource | : | A Measured Frac Sand Resource is that part of a Frac Sand Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling, and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Frac Sand |

| |

| 3 |

| |

GLOSSARY OF ABBREVIATIONS AND DEFINITIONS - Continued | |

| | |

| | Resource has a higher level of confidence than that applying to either an Indicated Frac Sand Resource or an Inferred Frac Sand Resource. It may be converted to a Proven Frac Sand Reserve or to a Probable Frac Sand Reserve. |

Mesh | : | A measurement of particle size often used in determining the size distribution of granular material. In the U.S., standard mesh (or sieve) size is defined as the number of openings in one square inch of a screen. For example, a 36-mesh screen will have 36 openings while a 150-mesh screen will have 150 openings. Since the size of the screen (one square inch) is constant, the higher the mesh number the smaller the screen opening and the smaller the particle that will pass through. The following table provides mesh dimensions which are commonly referenced in frac sand specifications: |

| | | | | | |

| | Opening Size |

Mesh | | inches | | mm | | microns |

| | | | | | |

20 | | 0.0331 | | 0.850 | | 850 |

30 | | 0.0232 | | 0.600 | | 600 |

35 | | 0.0197 | | 0.500 | | 500 |

40 | | 0.0165 | | 0.425 | | 425 |

50 | | 0.0117 | | 0.300 | | 300 |

70 | | 0.0083 | | 0.212 | | 212 |

100 | | 0.0059 | | 0.180 | | 180 |

140 | | 0.0041 | | 0.105 | | 105 |

200 | | 0.0029 | | 0.075 | | 75 |

| | |

Mineral Reserve | : | See “Frac Sand Reserve” |

Mineral Resource | : | See “Frac Sand Resource” |

Modifying Factors | : | The factors that a qualified person must apply to Indicated and Measured Frac Sand Resources and then evaluate to establish the economic viability of Frac Sand Reserves. A qualified person must apply and evaluate modifying factors to convert Measured and Indicated Frac Sand Resources to Proven and Probable Frac Sand Reserves. These factors include, but are not restricted to: mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the modifying factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project. |

MSHA | : | Mine Safety and Health Administration. A division of the U.S. Department of Labor. |

| |

| 4 |

| |

GLOSSARY OF ABBREVIATIONS AND DEFINITIONS - Continued | |

| | |

NTU | : | Nephelometric turbidity units |

NPV | : | Net present value |

OnCore | : | OnCore Plants and related faciltities |

Permian Basin | : | A large sedimentary shale basin in the southwestern part of the United States in mainly Texas and New Mexico. The basin produces approximately 4 million barrels per day of oil and holds some of the largest oil and gas reserves in the world. |

PropTester | : | PropTester, Inc. |

Probable Frac Sand Reserve | : | A Probable Frac Sand Reserve is the economically mineable part of an Indicated and, in some circumstances, a Measured Frac Sand Resource. The confidence in the Modifying Factors applying to a Probable Frac Sand Reserve is lower than that applying to a Proven Frac Sand Reserve. |

Proppant Sand | : | See “Frac Sand” |

Proven Frac Sand Reserve | : | A Proven Frac Sand Reserve is the economically mineable part of a Measured Frac Sand Resource. A Proven Frac Sand Reserve implies a high degree of confidence in the Modifying Factors. |

PSI | : | Pounds per square inch |

QP | : | Qualified Person |

Qualified Person | : | An individual who is: 1.A mineral industry professional with at least five years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant; and 2.An eligible member or licensee in good standing of a recognized professional organization at the time the technical report is prepared. For an organization to be a recognized professional organization, it must: i.An organization recognized within the mining industry as a reputable professional association; or ii.A board authorized by U.S. federal, state, or foreign statute to regulate professionals in the mining, geoscience, or related field; b.Admit eligible members primarily based on their academic qualifications and experience; c.Establish and require compliance with professional |

| |

| 5 |

| |

GLOSSARY OF ABBREVIATIONS AND DEFINITIONS - Continued | |

| | |

| | standards of competence and ethics; d.Require or encourage continuing professional development; e.Have and apply disciplinary powers, including the power to suspend or expel a member regardless of where the member practices or resides; and f.Provide a public list of members in good standing. |

ROM | : | Run-of-mine. The as-mined including in-seam clay partings mined with the sand, and out-of-seam dilution. |

SEC | : | U.S. Securities and Exchange Commission |

S-K 1300 | : | Subpart 1300 and Item 601(b)(96) of the U.S. Securities and Exchange Commission’s Regulation S-K |

Surficial | : | Relating to the earth’s surface or the geology that is on the surface. |

TCEQ | : | Texas Commission on Environmental Quality |

Ton | : | Short ton. A unit of weight equal to 2,000 pounds-mass. |

tph | : | Tons per hour |

WIP | : | Work-in-progress |

1.0 EXECUTIVE SUMMARY

Atlas’s OnCore Plants comprise eight small, built-for-purpose mobile processing plants and one larger modular processing plant (currently under construction) which produce wet (i.e., undried or damp) “100 mesh” frac sand—generally in the 40/140 to 40/200 mesh range—from leased or customer-owned properties. At each OnCore site, Atlas is responsible for mining and processing the raw sand, selling the finished frac sand products, and reclaiming the disturbed land. The mobility of the OnCore Plants provides a great deal of flexibility not afforded to large-scale fixed-plant mining operations.

Atlas retained BOYD to independently prepare estimates of frac sand resources and frac sand reserves for the OnCore Plants. The purpose of this TRS is threefold: (1) to summarize technical and scientific information for the subject mining properties, (2) to provide the conclusions of our review of the information for the properties, and (3) to provide statements of frac sand resources and frac sand reserves for the OnCore Plants in accordance with the disclosure requirements set forth in S-K 1300.

Information used in our assessment was obtained from: (1) data, reports, and other information provided by Atlas, (2) discussions with Atlas personnel, (3) records on file with regulatory agencies, (4) data, reports, and other information from public sources, and (5) nonconfidential information in BOYD’s possession.

Unless otherwise noted, the effective date of the information provided herein, including estimates of frac sand resources and frac sand reserves, is December 31, 2024.

1.2.Property Description and Location

The OnCore Plants are located in West Texas. Most are clustered around the City of Big Spring, Texas, about 40 miles east of the Midland-Odessa metropolitan area. The OnCore 7 and 9 sites are located in the opposite direction, approximately 90 miles west of Midland-Odessa. The general locations of the OnCore Plants are provided in Figure 1.1, following this page.<Figure 1.1>

The OnCore sites comprise approximately 6,579 acres of surface and sand mining rights—including 1,172.4 acres owned in fee and 5,406.6 leased acres. Table 1.1, below, provides a brief overview of the property control status of each OnCore site.

| | | | |

Table 1.1 Property Control |

Plant | | Control | | Acreage |

OnCore 1 | | Owned | | 852.8 |

| | Leased | | 132.2 |

OnCore 2 | | Leased | | 391.6 |

OnCore 2B | | Leased | | 877.0 |

OnCore 3B | | Owned | | 319.6 |

OnCore 4 | | Leased | | 640.0 |

OnCore 5 | | Leased | | 1,378.8 |

OnCore 6 | | Leased | | 481.0 |

OnCore 7 | | Leased | | 297.0 |

OnCore 8 | | Leased | | 552.8 |

OnCore 9 | | Leased | | 656.2 |

Total | | | | 6,579.0 |

The OnCore Plants are all located within an active sand dune belt, in an area of West Texas where the High Plains and Trans-Pecos desert regions converge. The region’s surface is characterized by windblown Quaternary-aged sand formations, including sand dunes, undivided sand and silt deposits, and sheet sand deposits.

Most of the OnCore sites are covered by Quaternary sheet and dune sands generally consisting of fine- to medium-grained quartz sand grains mixed with varying degrees of silts, calcareous sands, and caliche nodules. Surficial sand deposition in the study areas may range in thickness from less than 5 ft to over 40 ft. Overburden (i.e., overlying waste) material is generally minimal and easily removed during mining and processing operations. Interbedded alluvial deposits consisting of pebble- to cobble-sized limestone and chert nodules, or caliche are not uncommon, but are easily segregated during mining.

The sand mined at each of the OnCore operations is processed on-site to produce frac sand. Frac sand is a naturally occurring, high silica content quartz sand with grains that are generally well-rounded. The main difference between frac sand and other sands is that frac sand grains are relatively pure in composition, consisting almost entirely of quartz; other sands have numerous impurities that may be cemented to the quartz grains. The pure quartz composition of frac sand grains, along with their homogenous size and well‑rounded and spherical shape, gives these sands the characteristics (e.g., crush strength, low acid solubility, low turbidity) that are needed by oil and gas producers for use in developing wells.

In developing the OnCore sites, Atlas has completed numerous geologic exploration campaigns. A total of 247 drill holes have been completed across the subject OnCore sites. The results of these exploration programs comprise geologic logs and subsurface sand samples, grain size analyses of the samples, and proppant sand testing of composited samples. Exploration summaries were provided to BOYD for our review, along with the collected and analyzed exploration data, which together comprise the primary geologic data used in the evaluation of the frac sand resources and frac sand reserves reported herein.

BOYD’s review indicates that the exploration data: (1) were carefully and professionally collected, prepared, and documented, (2) conform with general industry standards, and (3) are appropriate for use in evaluating and estimating frac sand resources and reserves.

This report provides estimates of frac sand reserves for Atlas’s OnCore Plants in accordance with the requirements set forth in S-K 1300. These estimates were independently prepared by BOYD for the purpose of this report. The reserve estimates are the result of a thorough geologic investigation of the properties, appropriate modeling of the deposits, development of life‑of‑mine (LOM) plans, and consideration of the relevant processing, economic, marketing, legal, environmental, socio-economic, and regulatory factors.

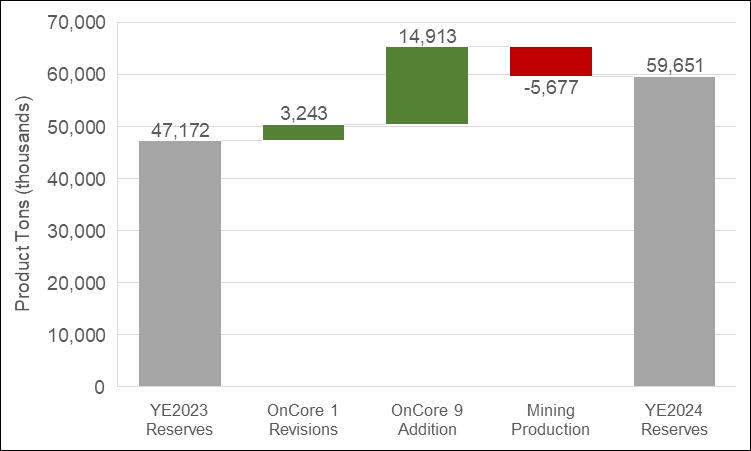

It is BOYD’s independent opinion that the estimated frac sand reserves for the OnCore Plants as of December 31, 2024, total approximately 59.7 million saleable product (i.e., 40/140 to 40/200 mesh frac sand) tons, which are presently controlled by Atlas.

Table 1.2, below, presents the estimated frac sand reserves by classification and mesh size, for the OnCore Plants.

| | | | | | | | | | |

Table 1.2: Frac Sand Reserves (as of December 31, 2024) |

|

Plant | | Mesh Size | | Control | | Product Tons (000) by Classification |

| | | Proven | | Probable | | Total |

| | | | | | | | | | |

OnCore 1 | | 40/140 | | Owned | | - | | 5,004 | | 5,004 |

| | | | Leased | | 2,028 | | - | | 2,028 |

| | | | Subtotal | | 2,028 | | 5,004 | | 7,032 |

OnCore 2 | | 40/140 | | Leased | | 375 | | - | | 375 |

OnCore 2B | | 40/140 | | Leased | | - | | 4,787 | | 4,787 |

OnCore 3B | | 40/140 | | Owned | | - | | 2,891 | | 2,891 |

OnCore 4 | | 40/140 | | Leased | | 1,681 | | 668 | | 2,349 |

OnCore 5 | | 40/140 | | Leased | | 3,442 | | 7,282 | | 10,724 |

OnCore 6 | | 40/140 | | Leased | | 4,322 | | - | | 4,322 |

OnCore 7 | | 40/140 | | Leased | | 3,120 | | 4,692 | | 7,812 |

OnCore 8 | | 40/140 | | Leased | | 4,660 | | - | | 4,660 |

OnCore 9 | | 40/140 | | Leased | | 13,679 | | 1,020 | | 14,699 |

Total | | | | | | 33,307 | | 26,344 | | 59,651 |

Atlas has a well-established history of mining, processing, and selling frac sand products from their regional operations. BOYD has concluded that sufficient studies have been undertaken to enable the frac sand resources to be converted to frac sand reserves based on established operating methods and forecasted costs and revenues. The forecasted sales prices used in the estimation of frac sand reserves for the OnCore Plants varies by location and year, ranging from $23.18 to $31.26 and averaging $24.83 per ton of finished frac sand over the expected life of the reserves (refer to Section 10.5 and Table 12.1 for further details).

There are no reportable additional frac sand resources, excluding those converted to reserves, for the OnCore Plants. Quantities of frac sand controlled by Atlas within the defined boundaries of the OnCore properties, which are not reported as frac sand reserves, are not considered to be technically, economically, and/or legally extractable at the time of determination; as such, they are not reportable as frac sand resources in addition to reserves.

Contractors are employed to excavate sand and overburden (i.e., overlying waste material) at each of the OnCore Plants. The target sand deposits are excavated using conventional truck and excavator surface mining techniques. Generally, the negligibly thin layer of overburden is mined with the underlying sand. The sand is unconsolidated and does not typically require drilling or blasting. Excavators and/or front-end loaders are used to load the excavated sand into articulated haul trucks. The haul trucks deliver raw sand material to run-of-mine (ROM) stockpiles located near the processing facilities.

The OnCore Plants comprise eight smaller mobile wet processing plants and one larger modular wet processing plant. The OnCore operations predominantly produce wet “100 mesh” (i.e., 40/140 to 40/200 mesh) frac sand—that is, the sand is not dried and particles larger than 40 mesh and smaller than 140-to-200 mesh are not considered finished product and are discarded as waste.

The small, built-for-purpose mobile OnCore Plants allow Atlas to move sand mining and processing operations from site to site as deposits are depleted. Indeed, Atlas moved two plants in 2024—one from the nearly exhausted OnCore 2 site to the previously unmined OnCore 2B site, and one from the recently exhausted OnCore 3 site to the previously unmined OnCore 3B site. One newly-constructed mobile plant was deployed in 2024 to the previously unmined OnCore 9 site.

The eight mobile plants were constructed by Superior Industries, Inc. (Superior). While the plants share nearly identical designs, the latter plants incorporate changes made to the early models to improve production. Each of the mobile processing plants has a nominal (or “nameplate”) capacity of 130 feed tons per hour (tph), which equates to approximately 700,000 to 900,000 tons of finished frac sand per year, depending on the expected processing yields of the sand deposits.

Atlas’s modular OnCore 8 processing plant was commissioned in May 2024. Designed by Superior, the OnCore 8 modular processing plant’s design consists of two 250-tph circuits providing a nameplate capacity of 500 tph of feed sand or approximately 3 million tons of finished frac sand per year. The parallel circuit arrangement offers a degree of flexibility as one plant circuit can be idled for maintenance, while the other is operating.

Each of the OnCore Plants’ processing operations comprise two major components which are typical in the production of wet frac sand. These components include:

•Wet Plant – ROM material from the pit is delivered to the wet plant where the coarse material (e.g., gravel) and fine material (e.g., fine sand and silt) is removed from the sand.

•Storage and Loadout – Finished damp sand products are stored in stockpiles resting on a water decant system, where the sand is allowed to dry somewhat. The frac sand is then loaded into feed hoppers, conveyed to a discharge hopper, and loaded into trucks resting on weighing scales.

1.6.3.Other Infrastructure

All of the basic infrastructure required for the ongoing operations is in place or under construction at each of the OnCore Plants. The mining and processing operations are supported by the various utilities and transportation networks needed to allow the production and transportation of finished frac sands.

BOYD is unaware of any reported interruptions, outages, shortages, or failures related to infrastructure requirements which have materially affected operations at any of the OnCore sites. Given the operation is well-established, we opine that there is low risk of such events materially affecting the estimates of frac sand reserves presented herein.

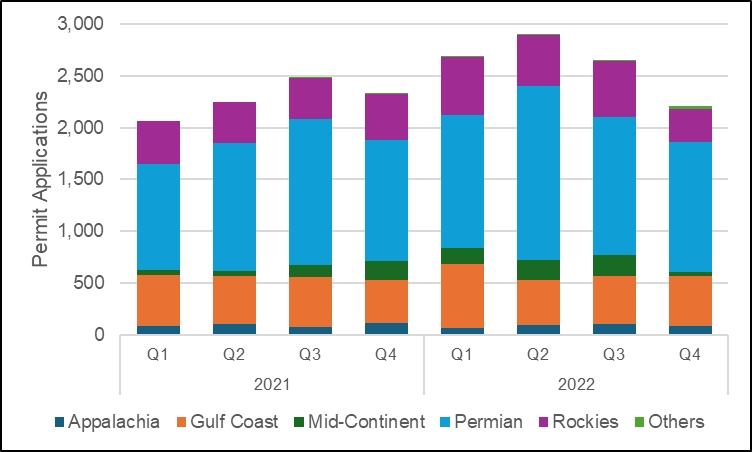

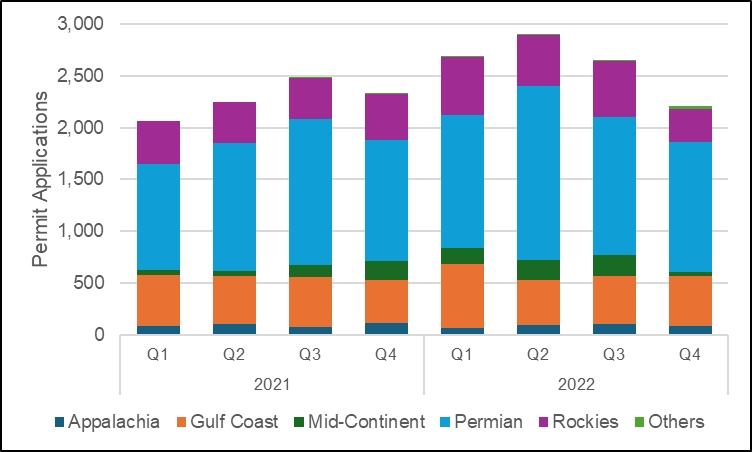

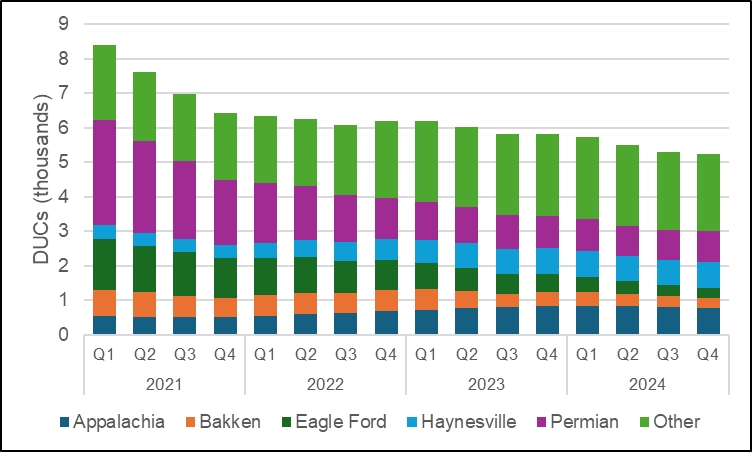

Permit submissions for horizontal oil and gas wells in the Permian Basin indicate a continuation of strong drilling ahead. Utilizing data from the Railroad Commission of

Texas (RRC), the total number of permits filed ranges between 1,200 and 1,700 per quarter in 2024, as shown in Figure 1.2, below.

Source: Enverus (provided by Atlas)

Figure 1.2: Permian Basin Horizontal Oil and Gas Well Permit Submissions

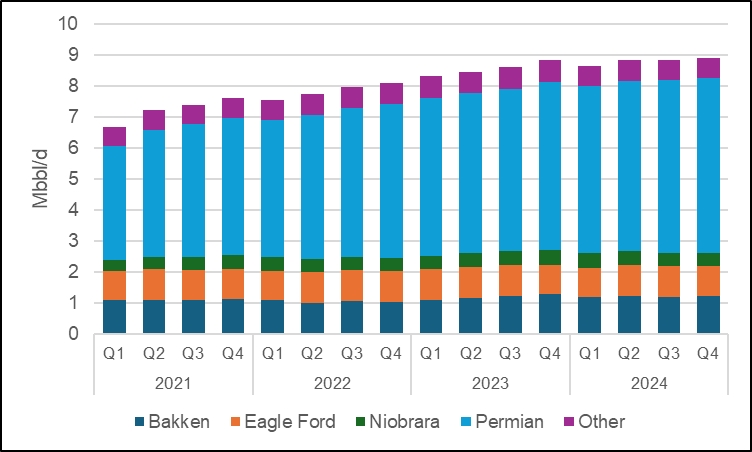

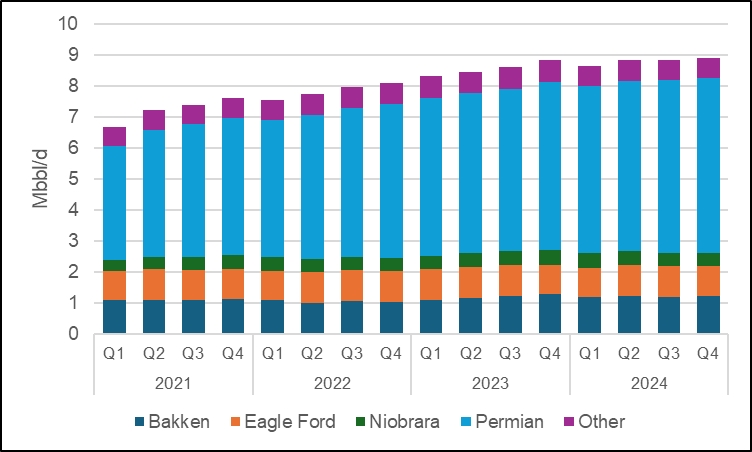

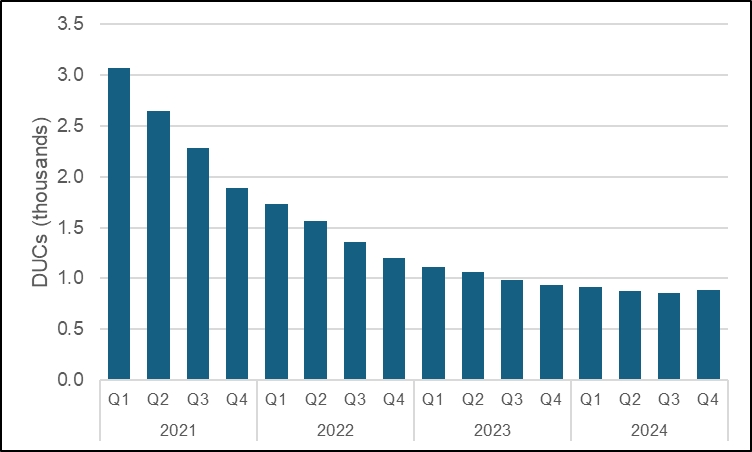

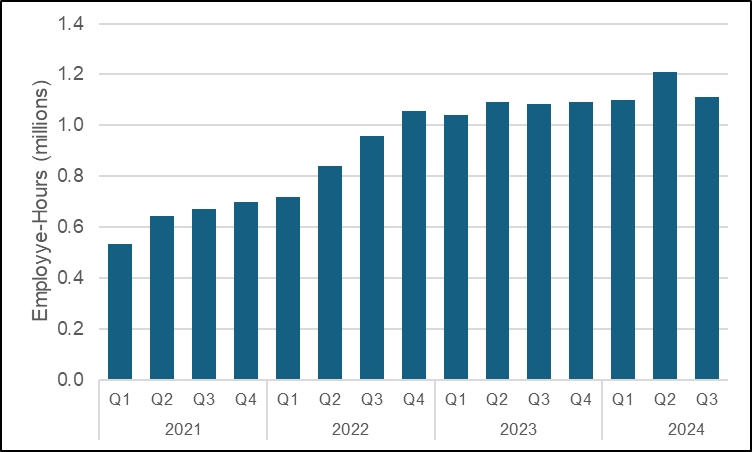

Domestic oil production continues to increase with the Permian leading the way, averaging close to 6 million barrels per day (Mbbl/d) since late 2023, as shown below in Figure 1.3.

Source: EIA (U.S. Energy Information Administration)

Figure 1.3: Oil Production from Shale and Tight Formations

Current frac sand production in the Permian Basin is estimated at 65 million to 70 million tons per year with fairly balanced demand and stable pricing. BOYD anticipates stable frac sand pricing substantially above those used to estimate frac sand reserves for the OnCore Plants. Additionally, we anticipate continued upward sand consumption in the basin due to economic and geopolitical influences on energy demand.

1.7.2.Capital and Operating Cost Estimates

The OnCore Plants’ recent financial performance is summarized as follows:

•The OnCore Plants sold approximately 6.0 million tons of finished frac sand in 2024—a year-over-year increase from 2023 of 28.7%. This was primarily due to the commissioning of two additional mobile plants.

•Atlas’s average selling price (ASP) for frac sand sold from the OnCore Plants was $22.84 per ton in 2024, increasing 8.5% from 2023. The five-year historical ASP was $20.49 per ton.

•Average cost of goods sold (ACS) was $12.87 per ton sold in 2024, increasing 27.5% year-over-year.

•Gross margin (i.e., gross profit as a percentage of gross revenue) has remained positive over the past five years and was 43.6% in 2024.

•Capital expenditures totaled approximately $120.5 million (or $8.60 per ton sold) over the last five years and include all costs related to property acquisition, site preparation, and equipment purchases.

Forward-looking production and unit cost estimates are based on actual past performance and are subject to Atlas’s customary internal budget review and approvals process. In BOYD’s opinion, operating volumes are well-defined and understood, as are mining and processing productivities.

The OnCore Plants and related facilities are fully developed or nearly constructed and should not require any near-term major capital investment beyond 2025’s budgeted $4.7 million to maintain full commercial production. Historically, the timing and amount of capital expenditures have been largely discretionary and within Atlas’s control. BOYD projected sustaining capital expenditures is estimated to average $1.00 per ton sold, which includes: (1) maintenance of production equipment as well as other items needed for the ongoing operations, and (2) site reclamation costs. This unit cost is based on our judgment and experience with similar operations.

Operating cost estimates were developed based on recent actual costs and considering site specific operational activity levels and cost drivers. OnCore’s operating costs are expected to remain relatively consistent (on an uninflated basis) with 2024 results. As such, the projected total cash cost of goods sold averages $14.98 per ton sold over the life of the mine. BOYD considers the future operating cost estimates to be reasonable and appropriate.

A consolidated economic analysis of the OnCore Plants was prepared by BOYD for the purpose of confirming the commercial viability of the reported frac sand reserves. Our financial model forecasts future free cash flow from frac sand production and sales over the life cycle of the operation using annual forecasts of production, sales revenues, and operating and capital costs.

Table 1.3, on the following page, provides a summary of the estimated financial results (on an aggregate basis) for the remaining life of the OnCore Plants.

| | | | |

Table 1.3: Financial Results |

|

| | Units | | Remaining Life of Reserves Total |

|

Expected Remaining Life | | years | | 21 |

| | | | |

Production: | | | | |

ROM Production | | 000 tons | | 83,742 |

Product Sales | | 000 tons | | 59,651 |

Total Revenues | | $ milllions | | 1,481.0 |

Average Selling Price | | $/t sold | | 24.83 |

Total Cost of Goods Sold | | $ milllions | | 893.8 |

Average Cost of Goods Sold | | $/t sold | | 14.98 |

Capital Expenditures | | $ milllions | | 57.4 |

Average Capital Expenditures | | $/t sold | | 0.96 |

Pre-Tax: | | | | |

Cash Flow | | $ milllions | | 529.8 |

NPV10 | | $ milllions | | 342.5 |

After-tax: | | | | |

Cash Flow | | $ milllions | | 436.8 |

NPV10 | | $ milllions | | 280.4 |

Table 1.4 summarizes the results of the pre-tax and after-tax discounted cash flows (DCF) and net present value (NPV) analyses for the OnCore Plants.

| | | | | |

Table 1.4: DCF-NPV Analysis |

| NPV ($ millions) |

| 8% | | 10% | | 12% |

Pre-Tax | 368.8 | | 342.5 | | 319.8 |

After-Tax | 302.2 | | 280.4 | | 261.6 |

The NPV estimate was made for the purpose of confirming the economic viability of the reported proppant sand reserves and not for purposes of valuing Atlas, any of the OnCore operations, or their assets. Internal rate-of-return (IRR) and project payback were not calculated, as there was no initial investment considered in the financial analysis presented herein.

It is BOYD’s opinion that the financial model provides a reasonable and accurate reflection of the OnCore Plants’ expected economic performance based on the assumptions and information available at the time of our review.

1.8.Permitting and Compliance

Several permits are required by federal and state law for mining, processing, and related activities at each of the OnCore operations. BOYD reviewed the permits necessary to support continued operations at each of the OnCore sites. Such required permits appear to be valid and in good standing. The approved permits and certifications are adequate for the continued operation of the mine and processing facilities. New permits, permit revisions, and/or renewals may be necessary from time to time to facilitate future operations. Given sufficient time and planning, Atlas should be able to secure new permits, as required, to maintain its planned operations within the context of current regulations.

Mine safety is regulated by the U.S. Department of Labor’s Mine Safety and Health Administration (MSHA). MSHA inspects the facilities a minimum of twice yearly.

Atlas’s safety record compares favorably with its regional peers.

BOYD is not aware of any regulatory violation or compliance issue which would materially impact the reported frac sand reserves.

It is BOYD’s overall conclusion that the estimates of frac sand reserves, as reported herein: (1) are reasonably supported by sufficient and reliable exploration data, and (2) are reasonably and appropriately supported by technical evaluations, which consider all relevant modifying factors. We are not aware of any other relevant data or information material to the OnCore Plants that would render this report misleading. Our conclusions represent only informed professional judgment.

Given the operating history and status of evolution, residual uncertainty (future risk) for this operation is considered minor under the current and foreseeable operating environment. It is BOYD’s opinion that extraction of the frac sand reserves reported herein is technically, legally, and economically achievable after the consideration of potentially material modifying factors. The ability of Atlas, or any mine operator, to recover all the reported frac sand reserves is dependent on numerous factors that are beyond the control of, and cannot be anticipated by, BOYD. These factors include mining and geologic conditions, the capabilities of management and employees, the securing of required approvals and permits in a timely manner, future frac sand prices, etc. Unforeseen changes in regulations could also impact performance. None of the opinions presented herein are intended to represent that BOYD intends or is qualified to render opinions that are legal or accounting in nature.

2.0 INTRODUCTION

Atlas provides high quality proppant (frac) sand products, as well as proppant supply chain logistics services to the Permian Basin oil and gas industry. The company was founded in 2017 by long-time exploration and production (E&P) operators and is headquartered in Austin, Texas. Mining and processing operations commenced on their Kermit, Texas property in June 2018, and at their Monahans, Texas property in July 2018. In 2023, Atlas added a second mining and processing facility at their Kermit property. In 2024, Atlas acquired the Kermit Mines and OnCore mining facilities of Hi-Crush, Inc.

The company’s common stock is listed on the New York Stock Exchange under the symbol AESI. Additional information regarding Atlas can be found on their website at www.atlas.energy.

2.2.Purpose and Terms of Reference

Atlas retained BOYD to independently prepare and present estimates of frac sand resources and frac sand reserves for the OnCore Plants in accordance with the disclosure requirements set forth in S-K 1300. As such, the purpose of this TRS is threefold: (1) to summarize technical and scientific information for the subject mining properties, (2) to provide the conclusions of our review of the information for the properties, and (3) to provide statements of frac sand resources and frac sand reserves for the OnCore Plants.

BOYD’s opinions and conclusions are based on our detailed review of the supporting geologic, technical, and economic information provided by Atlas, which were used in formulating the estimates of frac sand resources and frac sand reserves disclosed in this report. We independently estimated the frac sand resources and frac sand reserves from first principles using exploration information provided by Atlas or by third-party experts engaged by Atlas. We employed standard engineering and geoscience methods, or a combination of methods, that we considered to be appropriate and necessary to establish the conclusions set forth herein. As in all aspects of mining property evaluation, there are uncertainties inherent in the interpretation of engineering and geoscience data; therefore, our conclusions necessarily represent only informed professional judgment.

The ability of Atlas, or any mine operator, to recover all the estimated frac sand reserves presented in this report is dependent on numerous factors that are beyond the control of, and cannot be anticipated by, BOYD. These factors include mining and geologic

conditions, the capabilities of management and employees, the securing of required approvals and permits in a timely manner, future sand prices, etc. Unforeseen changes in regulations could also impact performance. Opinions presented in this report apply to the site conditions and features as they existed at the time of BOYD’s investigations and those reasonably foreseeable.

This report is intended for use by Atlas, subject to the terms and conditions of its professional services agreement with BOYD. We also consent to Atlas filing this TRS with the SEC pursuant to S-K 1300. Except for the purposes legislated under U.S. securities law, any other uses of or reliance on this report by any third party is at that party’s sole risk.

2.3.Expert Qualifications

BOYD is an independent consulting firm specializing in mining-related engineering and financial consulting services. Since 1943, BOYD has completed over 4,000 projects in the United States and more than 90 other countries. Our full-time staff comprises experts in: civil, environmental, geotechnical, and mining engineering; geology; mineral economics; and market analysis. Our extensive experience in frac sand resource and reserve estimation and our knowledge of the subject properties, provides BOYD an informed basis to opine on the frac sand resources and frac sand reserves available at the OnCore Plants. An overview of BOYD can be found on our website at www.jtboyd.com.

The individuals primarily responsible for the preparation of this report and the estimates of frac sand reserves presented herein are by virtue of their education, experience, and professional association considered qualified persons (QPs) as defined in S-K 1300.

Neither BOYD nor its staff employed in the preparation of this report have any beneficial interest in Atlas, and are not insiders, associates, or affiliates of Atlas. The results of our assignment were not dependent upon any prior agreements concerning the conclusions to be reached, nor were there any undisclosed understandings concerning any future business dealings between Atlas and BOYD. This report was prepared in return for fees based on agreed-upon commercial rates, and the payment for our services was not contingent upon our opinions regarding the project or approval of our work by Atlas and its representatives.

2.4.Principal Sources of Information

The information, estimates, opinions, and conclusions presented herein are informed by: (1) data, reports, and other information provided by Atlas, (2) discussions with Atlas personnel, (3) records on file with regulatory agencies, (4) data, reports, and other information from public sources, and (5) nonconfidential information in BOYD’s possession.

The following information was provided by Atlas:

•Exploration records (e.g., drill hole location maps, drilling logs, and lab testing summaries)

•Mapping data, including:

-Property control boundaries

-Infrastructure locations

-Easement and right-of-way boundaries

-Topograhpic site surveys

•Overview of processing operations and detailed flow diagrams

•Preliminary business plans

•Historical information, including:

-Production reports and reconciliation statements

-Product sales and pricing

•Files related to mining and operating permits

Work files prepared for, and information contained, in the following BOYD reports was utilized to prepare the estimates of frac sand resources and frac sand reserves disclosed herein:

Technical Report Summary: Frac Sand Resources and Reserves, OnCore Plants, West Texas; Prepared for Hi-Crush Operating, LLC (f/k/a Hi-Crush Inc.); April 2024 (BOYD Report No. 3554.018).

Any other information from sources external to BOYD and/or Atlas is referenced accordingly.

The data and workpapers used in the preparation of this report are on file in our offices.

2.4.1.Personal Inspections

Due to time constraints, BOYD did not conduct personal inspections of the OnCore properties or facilities for this assignment. However, BOYD professionals—including the QPs and co-authors of this report—reviewed the OnCore operations with senior Atlas operations and planning personnel via teleconference. During our meetings, we reviewed recent high-resolution aerial photography of the OnCore sites and discussed site geology, mining conditions and operations, and current and proposed processing operations. Additionally, the co-authors have visited many of the neighboring frac sand mining operations in the recent past.

2.4.2.Reliance on Information Provided by the Registrant

In the preparation of this report, BOYD has relied, exclusively and without independent verification, upon information furnished by Atlas with respect to:

•Property title and status

•Encumbrances, easements, and rights-of-way

•Permits, bonds, and reclamation liability

•Sustainability initiatives

•Surface tailings management

•Mine closure requirements and plans

•Monitoring/compliance requirements for protected areas/species

•Market overview and strategy

•Marketing and sales contracts

•Inflation and discount rates

Our opinions and conclusions regarding this information are provided in the relevant sections of this report.

2.4.3.Verification of Information

BOYD exercised due care in reviewing the information provided by Atlas within the scope of our expertise and experience (which is in technical and financial mining issues) and concluded the data are reasonable and reliable considering the status of the subject properties and the purpose for which this report was prepared.

We have no reason to believe that any material facts have been withheld or misstated, or that further analysis may reveal additional material information. However, the accuracy of the results and conclusions of this report are reliant on the accuracy of the information provided by Atlas. While we are not responsible for any material omissions in the information provided for use in this report, we accept responsibility for the disclosure of information contained herein which is within the scope of our expertise.

2.4.4.Other Relevant Data and Information

BOYD is not aware of any additional information that would materially impact the frac sand resource and frac sand reserve estimates reported herein.

The effective (i.e., “as of”) date of this TRS is December 31, 2024. The estimates of frac sand resources and frac sand reserves and supporting information presented in this report are effective as of December 31, 2024.

This is the second TRS for the OnCore Plants filed by Atlas. This report supersedes the previously filed TRS and any predated estimates of frac sand resources or frac reserves for the OnCore Plants. The user of this document should ensure that this is the most recent disclosure of frac sand resources and frac sand reserves for the OnCore Plants as they are no longer valid if more recent estimates are available.

The U.S. customary measurement system has been used throughout this report. Tons are short tons of 2,000 pounds-mass. Unless otherwise stated, currency is expressed in U.S. Dollars ($). Historic prices and costs are presented in nominal (unadjusted) dollars. Future dollar values are expressed on a constant (unescalated) basis as of the effective date of this report.

3.0 PROPERTY OVERVIEW

3.1.Description and Location

Atlas’s OnCore operations are associated with eleven locations spread across five counties—Glasscock, Howard, Loving, Martin, and Midland—in western Texas. Nine mobile OnCore Plants—OnCore 1, 2B, 3B, 4, 5, 6, 7, 8, and 9—are currently operating at nine individual locations. The OnCore 3 site was idled in late-2023 and the mobile plant was moved to the OnCore 3B site in May 2024. The OnCore 2 site was idled in March 2024 and the mobile plant moved to the OnCore 2B site in June 2024.

Each OnCore plant is located within the Permian Basin and operates in a relatively similar manner, mining and processing local sands to produce a damp “100 mesh” frac sand product, which is used in the hydraulic fracturing process (known as “fracking”) to produce petroleum fluids, such as oil, natural gas, and natural gas liquids.

The Midland-Odessa metropolitan area is somewhat central to all of the OnCore Plants. The western-most site—OnCore 9—is located approximately 100 miles west of Midland International Air & Space Port. The northern-most site—OnCore 2B—is located approximately 40 miles to the north-northeast; and the remaining sites located approximately 25 to 55 miles to the northeast of Midland International Air & Space Port.

The locations of currently and formerly operating OnCore plants are shown in Table 3.1, below.

| | | | | | | | |

Table 3.1: OnCore PIant Locations |

| | Geographic Coordinates |

Plant | | County | | Basin | | Lattitude | | Longitude |

|

OnCore 1 | | Howard | | Midland | | 32° 17' 33" N | | 101° 24' 06" W |

OnCore 2 | | Howard | | Midland | | 32° 18' 02" N | | 101° 24' 52" W |

OnCore 2B | | Martin | | Midland | | 32° 29' 27" N | | 102° 00' 00" W |

OnCore 3 | | Loving | | Delaware | | 31° 57' 29" N | | 103° 48' 21" W |

OnCore 3B | | Glasscock | | Midland | | 32° 00' 03" N | | 101° 37' 26" W |

OnCore 4 | | Midland | | Midland | | 32° 02' 07" N | | 101° 47' 41" W |

OnCore 5 | | Howard | | Midland | | 32° 17' 41" N | | 101° 37' 06" W |

OnCore 6 | | Glasscock | | Midland | | 31° 59' 09" N | | 101° 37' 57" W |

OnCore 7 | | Loving | | Delaware | | 31° 57' 43" N | | 103° 42' 42" W |

OnCore 8 | | Howard | | Midland | | 32° 16' 49" N | | 101° 37' 55" W |

OnCore 9 | | Loving | | Delaware | | 31° 54' 07" N | | 103° 46' 33" W |

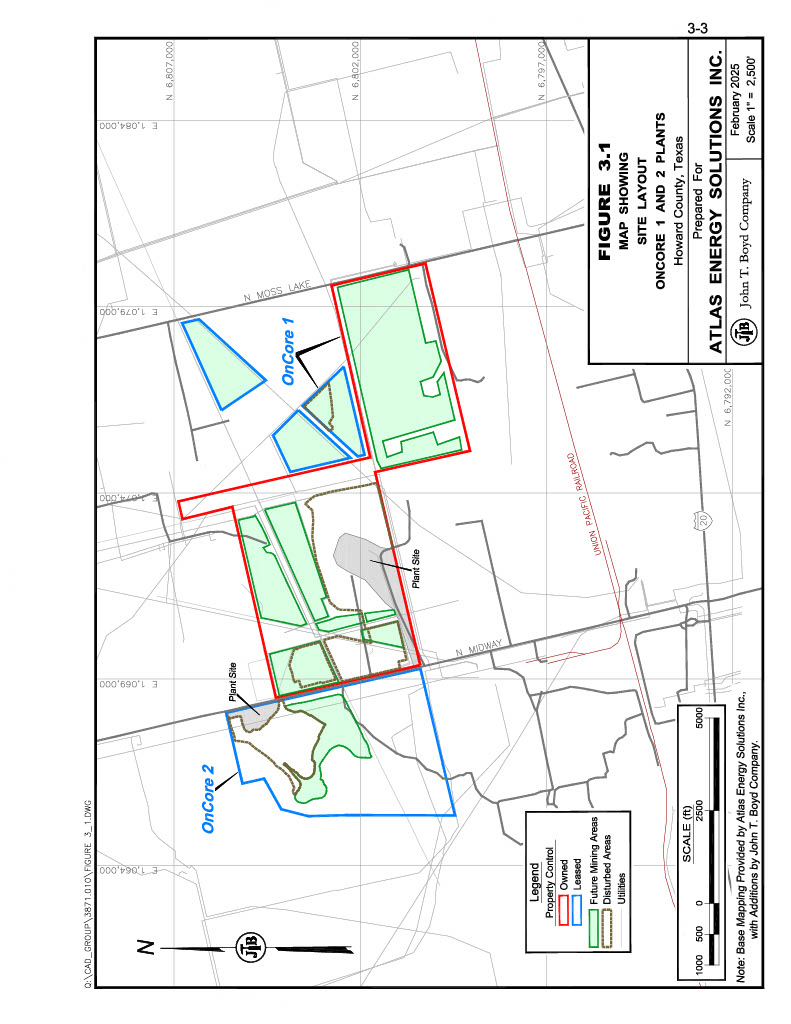

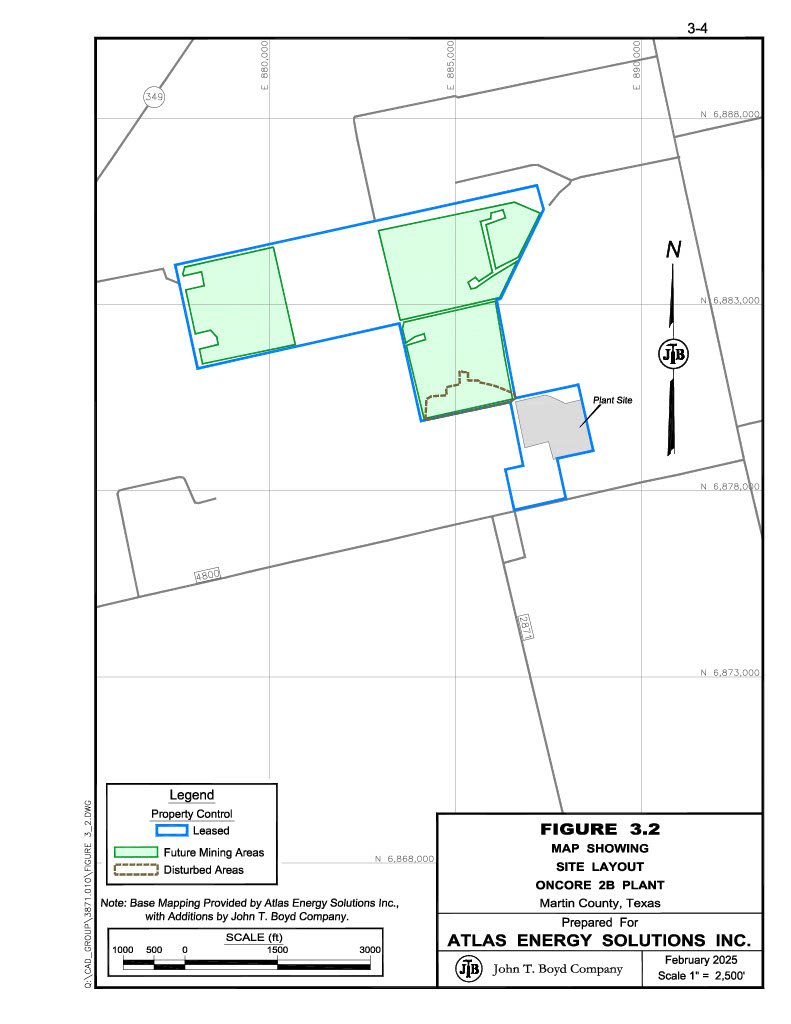

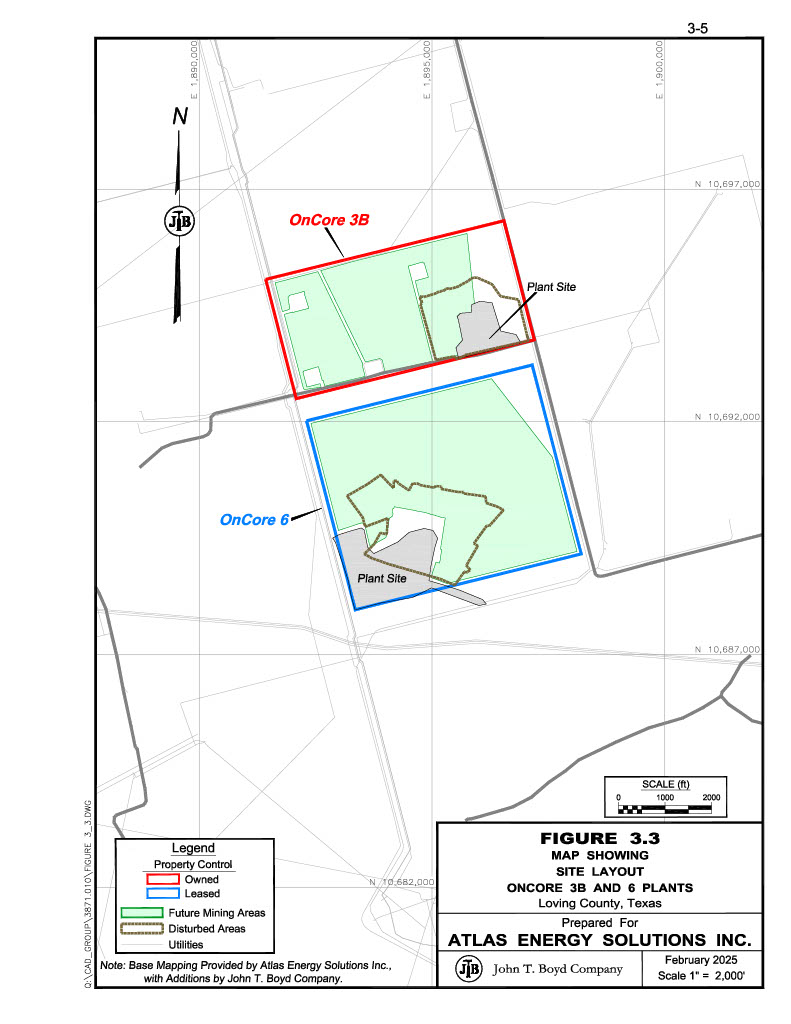

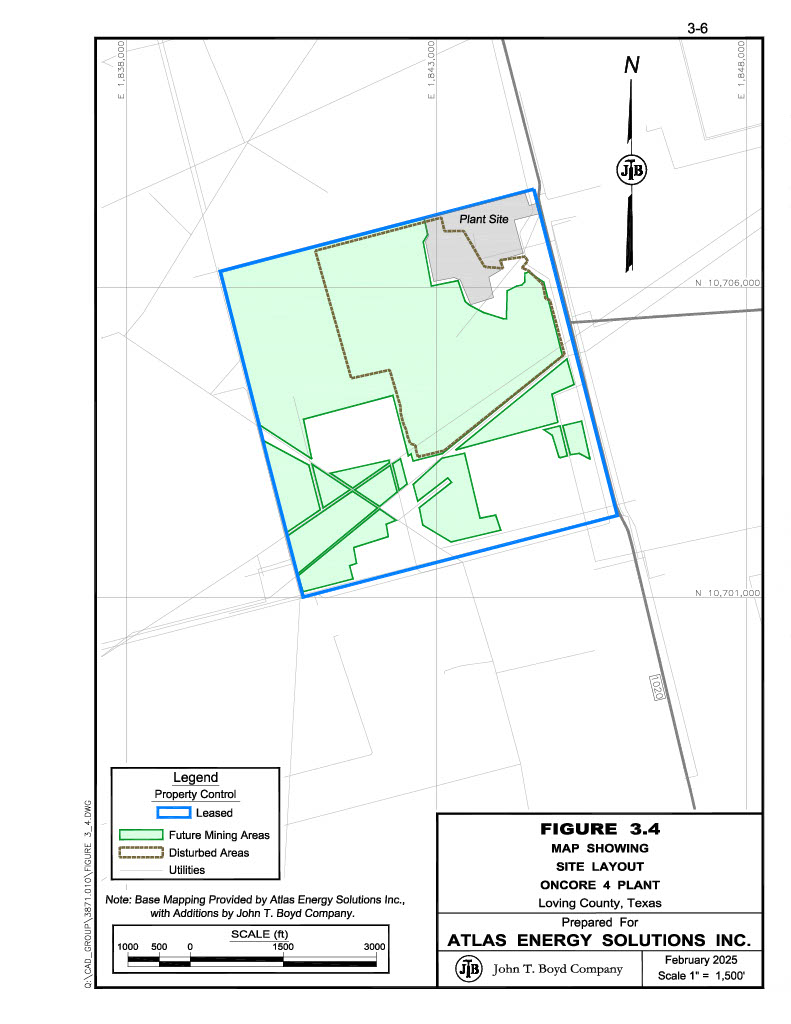

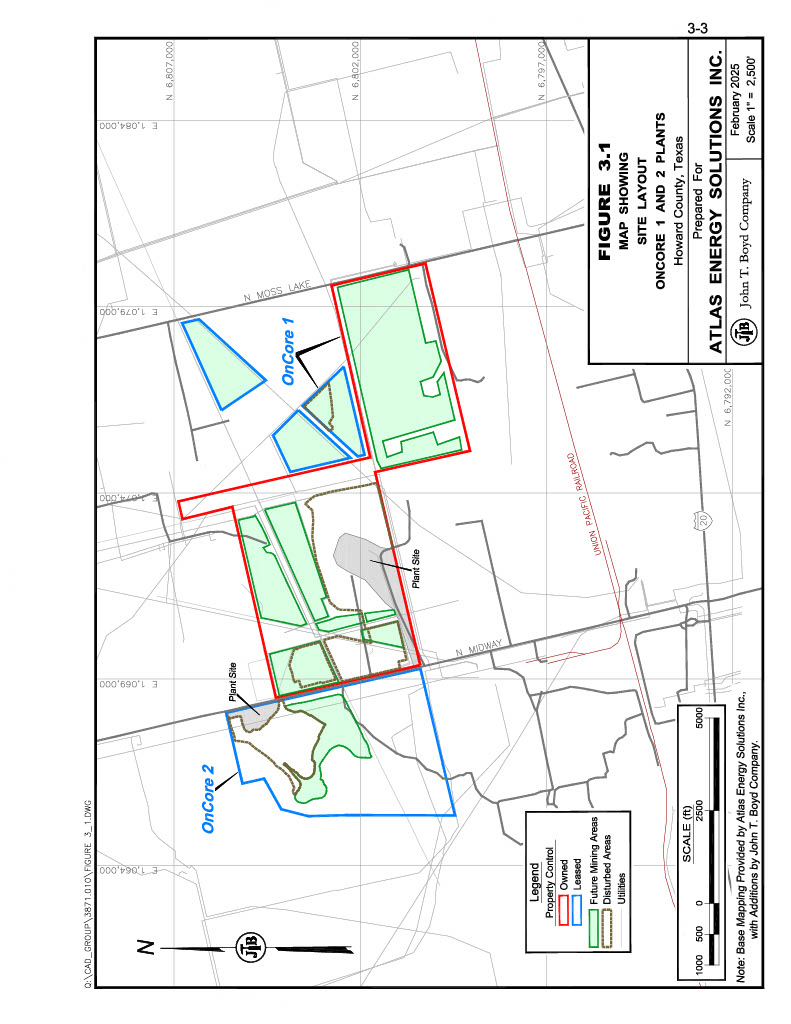

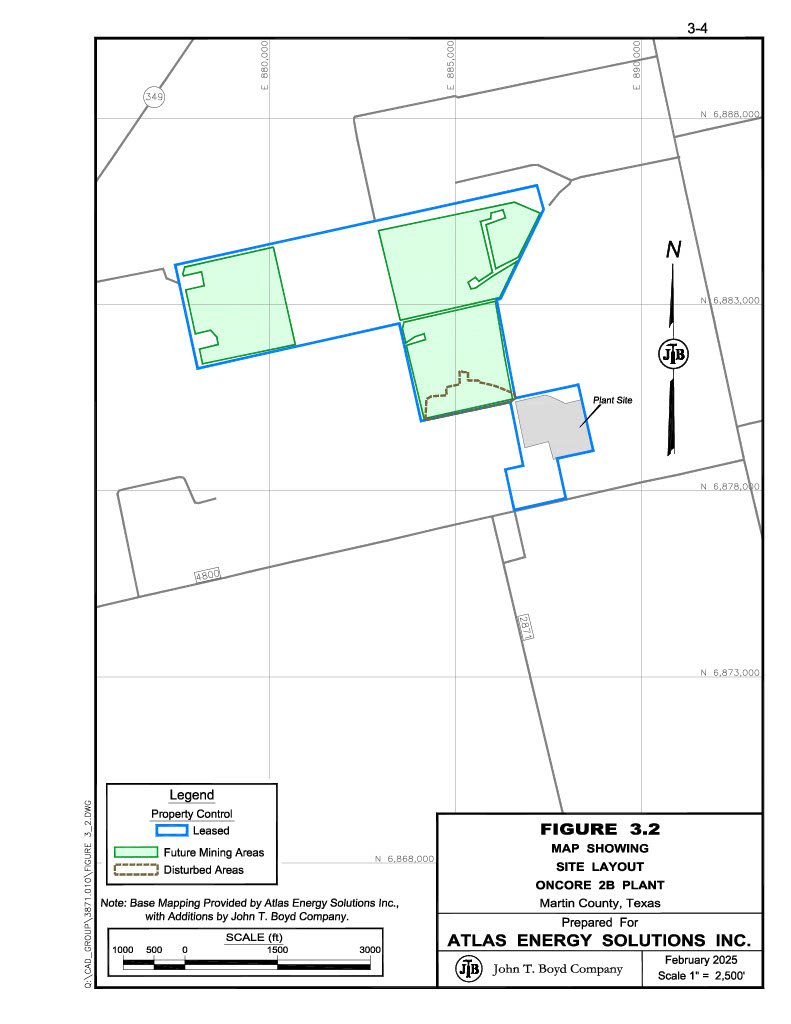

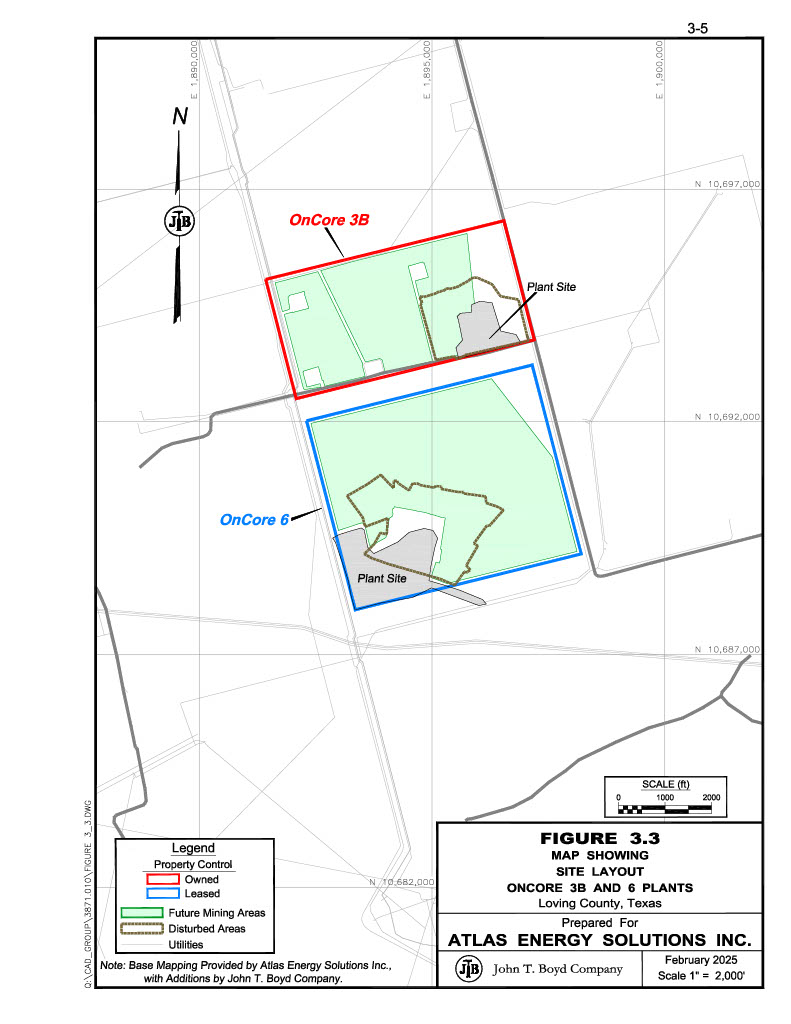

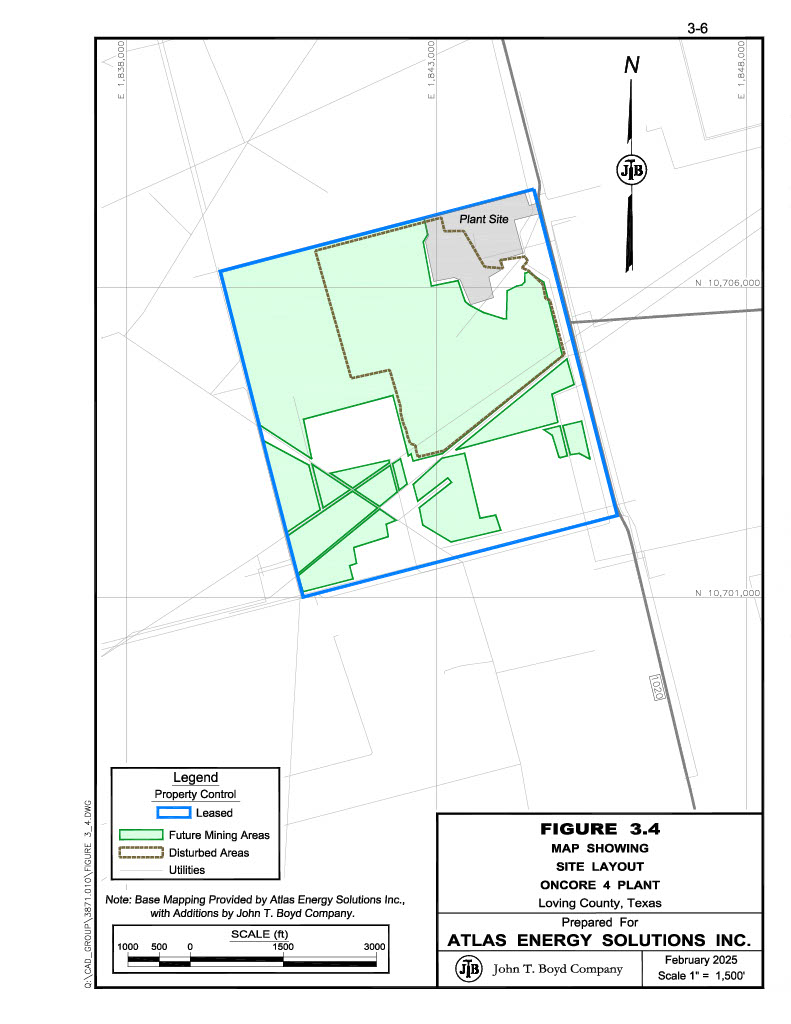

Figures 3.1 through 3.7, on the following pages, show the general layout of each OnCore site, including the locations of processing plants, loadout facilities, and current and former mining pits. Figure 1.1 (page 1-2) illustrates the general locations of the Atlas OnCore Plants.

Extensive surface mining of frac sand has been conducted in the West Texas region since the first “in-basin” frac sand mine—one of Atlas’s Kermit facilities—commenced production in August 2017, and began supplying locally sourced frac sand into the Permian Basin oil and gas industry. Since then, numerous in-basin frac sand mines have been opened across the region.

Atlas developed the OnCore mobile mining and processing concept after completing a series of regional geologic exploration efforts across areas located outside of the historic Permian Basin frac sand mining activity centers. The first OnCore site (OnCore 1) opened in late-2020, and after seeing continued demand for locally sourced damp frac sand, Atlas has now operated a total of eleven different OnCore sites since commencing production at OnCore 1. Two former operations—OnCore 2 and 3—were idled in 2023 and 2024, respectively, and four new sites—OnCore 2B, 3B, 8, and 9—began production between May and July 2024. The status of each OnCore site is provided in Table 3.2, below.

| | | | |

Table 3.2: Property Status |

|

Plant | | Status | | Start Date |

|

OnCore 1 | | Producing | | September 2020 |

OnCore 2 | | ldled | | April 2021 |

OnCore 2B | | Producing | | June 2024 |

OnCore 3 | | Reclamation | | February 2022 |

OnCore 3B | | Producing | | May 2024 |

OnCore 4 | | Producing | | July 2022 |

OnCore 5 | | Producing | | October 2023 |

OnCore 6 | | Producing | | May 2023 |

OnCore 7 | | Producing | | July 2023 |

OnCore 8 | | Producing | | May 2024 |

OnCore 9 | | Producing | | July 2024 |

The OnCore sites comprise approximately 6,579 acres of surface and sand mining rights—including 1,172.4 acres owned in fee and 5,406.6 leased acres. Table 3.3, below, provides a brief overview of the property control status of each OnCore site.

| | | | | | | | |

Table 3.3 Property Control |

|

| | Lease Terms |

Plant | | Control | | Acreage | | Start | | Length |

|

OnCore 1 | | Owned | | 852.8 | | - | | - |

| | Leased | | 132.2 | | 7/18/2022 | | 3 Years |

OnCore 2 | | Leased | | 391.6 | | 3/30/2020 | | Indef. |

OnCore 2B | | Leased | | 877.0 | | 8/28/2023 | | Indef. |

OnCore 3B | | Owned | | 319.6 | | - | | - |

OnCore 4 | | Leased | | 640.0 | | 4/11/2022 | | Indef. |

OnCore 5 | | Leased | | 1,378.8 | | 10/8/2021 | | Indef. |

OnCore 6 | | Leased | | 481.0 | | 12/15/2022 | | 4 years |

OnCore 7 | | Leased | | 297.0 | | 7/18/2022 | | 4 years |

OnCore 8 | | Leased | | 552.8 | | 2/3/2023 | | Indef. |

OnCore 9 | | Leased | | 656.2 | | 6/2/2023 | | 4 years |

Total | | | | 6,579.0 | | | | |

The OnCore sites are primarily operated under lease agreements held between Atlas and various private landowners. Some of the leases have definitive term lengths while others are subject to minimum periodic production requirements. It is generally reasonable to assume that expired leases can be renewed in the ordinary course of business; as such, we do not believe there is any undue risk associated with surface and mineral control to the estimated reserves reported herein.

Non-leased properties were formerly controlled by various Atlas customers and operated under contracts, or “work orders”, that required Atlas to supply minimum quantities of finished frac sand to the landowner at agreed upon prices. These work order-operated properties were purchased by Atlas in late-2024.

All third-party sales of frac sand produced from leased OnCore properties are subject to a royalty payable to the landowners. The blended royalty for the frac sand reserves reported herein is $1.75 per ton sold. It is BOYD’s understanding that there are no additional royalties, overriding or limited royalties, working interests, production payments, net profit interests, or other mineral interests in the OnCore properties.

Several existing frac sand mining operations are located throughout the West Texas region, however much of the current frac sand mining activity is located near Kermit, Texas. Atlas’s OnCore sites have been located away from the current frac sand mining activity center in an attempt to gain an advantage of shorter haul distances to their end use customers. The closest competitor operations to OnCore’s Delaware Basin sites are Independence Texas, LLC. Tree Dog and Z&T Ranch mines in Loving County, near the idled OnCore 3 site, the OnCore 7 site, and the newly deployed OnCore 9 site which is located approximately 4.0 miles to the southwest. OnCore’s Midland Basin operations are more widely distributed. OnCore 1 and the idled OnCore 2 have three nearby competitors—Nomad Proppant Services, LLC, and West Point Silica, LLC both operate on properties adjacent to OnCore 1 to the east and south, respectively, and Big Spring Sands, LLC operates a mine 1 mile southwest of the OnCore 1 site. Oncore 2B has two nearby competitors—Energy In Motion and Vista Minerals—located 2.5 miles to the northwest and 5 miles to the southwest, respectively. At present OnCore 3B, 4, 5, 6, and 8 have no nearby competitors.

There is no information used in this report that has been sourced from adjacent properties.

3.5.Regulation and Liabilities

The OnCore sites operate under several permits and must comply with other federal, state, and municipal law regulations that do not require a specific permit. Atlas reports that necessary permits are in place or applied for to support immediate operations. New permits or permit revisions may be necessary from time to time to facilitate future operations. Given sufficient time and planning, Atlas should be able to secure new permits, as required, to maintain its planned operations within the context of the current regulations.

To the extent known to BOYD, there are no current violations, fines, liens, or other significant factors and risks that may affect access, title, or the right or ability to perform work on the OnCore properties.

3.6.Accessibility, Local Resources, and Infrastructure

The OnCore sites all lie within rural regions of western Texas. The surrounding region has a well-established history of heavy oil and gas industry and agricultural development. The nearby Midland-Odessa metropolitan area has a population of 340,391 according to the 2020 U.S. Census. The surrounding counties have a combined population of over 200,000 people, according to 2020 population estimates by the U.S. Census.

Finished frac sand products from the OnCore Plants are sold at each site’s mine gate, where finished product is weighed and loaded into bulk trucks. General access to each site is via a well‑developed network of primary and secondary roads serviced by local municipality, county, and state governments. These roads offer direct access to each site, and processing facilities and are generally open year-round. Primary vehicular access to the western sites is via Texas state highway TX-302 or U.S. Route 285; while primary access to the eastern sites is via Interstate 20, state highways TX-137, TX-176, TX-137, or TX-349. Each of these roadways provides primary access to various portions of the region’s oil and gas fields.

Several regional airports are located throughout the area, and the Midland International Airport is just over two-hours drive from the farthest OnCore location by road.

Reliable sources of electrical power, water, supplies, and materials are readily available. Electrical power is provided to the operation by regional utility companies. Water is supplied by the public water system, surface impoundments, and water wells. Additionally, each of the OnCore sites retain recycled processing water as much as possible.

The western OnCore sites are located within Chihuahuan Basins ecoregion, while the eastern OnCore sites are located within the Arid Llano Estacado ecoregion. In general, the OnCore sites are located in an area of Texas where the southern High Plains and Trans-Pecos regions converge. The area is relatively flat lying with windblown sand hills and dunes in various locations. The surrounding areas generally consist of desert valleys covered with windblown sheet and dune sands, high plains covered with thick alluvium (the Llano Estacado or Staked Plains), or plateaus consisting of thin carbonate‑based soils (the Caprock Escarpment). The plateau areas, typically covered by a weathering-resistant caliche (a hardened natural cement of calcium carbonate that binds other materials—such as gravel, sand, clay, and silt), may abruptly stand up to 1,000 ft above the plains.

Each of the OnCore sites themselves are relatively flat, with little topographic relief other than the peaks and troughs of sand dunes. Surface elevations between the OnCore sites range from approximately 2,500 ft above mean sea-level (AMSL) on the eastern sites, to approximately 3,100 ft AMSL on the western sites, however the Caprock Escarpment abruptly rises to an elevation of approximately 3,400 ft AMSL between the eastern and western OnCore site locations.

There are not any natural surface waters present on any of the properties.

Land cover in the immediate area consists predominantly of mixed shrubbery, grasses, and other various scrub vegetation.

In and around the OnCore sites, summers are long, humid, and hot; the winters are short, cold, and dry; and the skies are mostly clear year-round. Over the course of the year, the temperature typically varies from 32°F to 97°F and is rarely below 22°F or above 105°F.

The hot season lasts from mid-May to mid-September, with an average daily high temperature above 89°F. The hottest month of the year is July, with an average high of 97°F and low of 72°F. The cool season lasts from late-November to mid‑February, with an average daily high temperature below 67°F. The coldest month of the year is January, with an average low of 33°F and a high of 61°F.

Annual precipitation in the area varies widely from year to year, but generally totals 5 to 12 inches of rain with little-to-no snow.

In general, the operating season for the OnCore mines is year-round. Adverse weather conditions seldom restrict or interfere with the mining, processing, and loading operations; however, extreme weather conditions may temporarily impact operations. Periodic flooding is possible during heavy rainfall.

4.0 GEOLOGY

Atlas’s nine operating OnCore Plants are located across five counties in West Texas, covering an area that spans approximately 140 miles between the western-most and eastern-most plant sites. The OnCore Plants are all located in relatively similar geologic settings where the High Plains and Trans-Pecos desert regions converge. Surficial geologic units are characterized by windblown Quaternary-aged sand formations, which include varying amounts of sand dunes, undivided sand and silt deposits, and sheet sand deposits. The region is bordered by the Caprock Escarpment of the Llano Estacado to the east and the basins and playas of the Chihuahuan Desert to the west and south.

The frac sand resources and frac sand reserves for each of the OnCore sites are hosted in the surficial sand deposits found across the region. The origins of these deposits are believed to be a combination of eroded bedrock material from the southern Rocky Mountains, and locally eroded sandstones. As portions of the southern Rockies were eroded via weathering, particles were carried to the Pecos River. Ancient flooding events of the Pecos River resulted in the suspended particles being deposited into flood plains. Once flood waters receded, winds took over, drying and further transporting these particles over the western Texas region.

The Caprock Escarpment of the Llano Estacado marks the eastern-most extent of the surficial sand deposits. Winds transporting particles into the area are thought to have collided with the escarpment, slowing and dropping particles out to where they have accumulated over time. Winnowing processes caused some degree of particle sorting throughout the region to occur. Due to the mechanisms and long distances of particle transport, sand grains were abraded and rounded as they reached their current locations.

4.2.1.General Stratigraphy

The surficial geologic units at each of the OnCore sites are comprised of undifferentiated Quaternary Age unconsolidated deposits that range in composition from aeolian (windblown) sheet sands and dunes to alluvial sands with silts, clays, and caliche to varying degrees. Geologic mapping in and around the subject properties indicates slight variations in surface geology; however, each OnCore site is in an area where Quaternary-age surficial sand deposits have accumulated. Table 4.1, below, shows the surficial geologic units found on each OnCore property.

| | |

Table 4.1: Surficial Geologic Units of the OnCore Properties |

|

Site | | Surfical Geologic Unit(s) |

|

OnCore 1 | | Windblown Sand Sheets, Dunes, and Dune Ridges Undivided |

OnCore 2B | | Windblown Sand and Silt; Caliche |

OnCore 3B | | Windblown Sand and Silt; Blackwater Draw Formation |

OnCore 4 | | Blackwater Draw Formation |

OnCore 5 | | Windblown Sand Sheets, Dunes, and Dune Ridges Undivided; Blackwater Draw Formation |

OnCore 6 | | Windblown Sand and Silt; Blackwater Draw Formation |

OnCore 7 | | Windblown Sand and Silt; Caliche |

OnCore 8 | | Windblown Sand Sheets, Dunes, and Dune Ridges Undivided; Blackwater Draw Formation |

OnCore 9 | | Windblown Sand and Silt; Caliche |

As shown, stratigraphic units across the OnCore sites range from generally undifferentiated, windblown sheet sands in the western sites, to Blackwater Draw Formation sand deposits in the eastern sites. A generalized stratigraphic chart of the geologic units found at the OnCore sites is presented in Figure 4.1.

| | | |

System | Series | Geologic Units |

West | East |

Quaternary | Pleistocene / Holocene | Sheet and Dune Sand | Sheet and Dune Sand |

Pleistocene | Unconsolidated Alluvium | Unconsolidated Alluvium |

Blackwater Draw Formation |

Neogene | Pliocene | Ogallala Formation | Ogallala Formation |

Figure 4.1: Generalized Stratigraphic Chart,

Surficial Deposits of the OnCore Properties

The following text discusses the strata encountered throughout the areas of the current OnCore sites, in depositional order:

Ogallala Formation

The Ogallala Formation is predominantly comprised of weakly cemented to unconsolidated fine- to medium-grained sands, which may be silty and calcareous in places. A caliche caprock is frequently exhibited, which resists weathering and forms ledges. The thickness of this formation has been recorded up to 550 ft. The Ogallala Formation is rarely encountered at any of the OnCore sites.

Blackwater Draw Formation

The Blackwater Draw Formation is a predominantly fine to medium-grained quartz sand containing silt, caliche, and calcareous nodules. Thickness is typically 25 ft or less and tends to feather out locally.

Quaternary Sheet and Dune Sands

Most of the OnCore sites are covered by Quaternary sheet and dune sands generally consisting of fine- to medium-grained quartz sand grains mixed with varying degrees of silts, calcareous sands, and caliche nodules. Surficial sand deposition in the study areas may range in thickness from less than 5 ft to over 40 ft. Overburden (i.e., overlying waste) material is generally minimal and easily removed during mining and processing operations. Interbedded alluvial deposits consisting of pebble- to cobble-sized limestone and chert nodules, or caliche are not uncommon, but are easily segregated during mining.

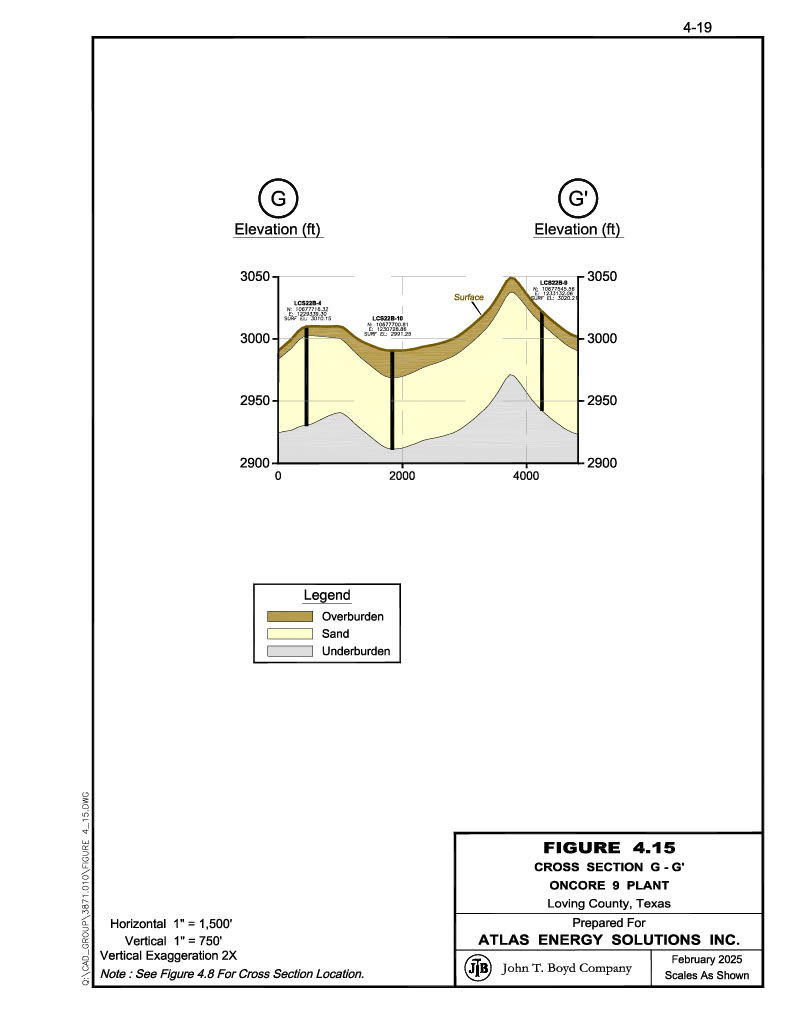

Figures 4.2 through 4.8 (pages 4-6 to 4-12) provide maps of the mineable sand thickness at each of the OnCore sites. Cross-sections through the subject sand deposits are provided in Figures 4.9 through 4.15 (pages 4-13 to 4-19).

The structural features of the Quaternary sands in and around the OnCore properties are relatively non-descript. While the subject sand deposits exhibit variable thickness and extents, they are generally unaffected by folding or faulting. Due to the lack of structural features encountered, there are no known geological features that are believed to materially affect frac sand mining operations on the properties; as such, the deposits are considered to be of low geologic complexity.

The sand mined at the OnCore sites is processed into frac sand products. Frac sand is a naturally occurring silica sand—also known as quartz sand or white sand—which generally exhibit the following characteristics required by oil and gas producers for use in developing wells:

•High-purity – frac sand grains are relatively pure (typically, >95% silicon dioxide) in composition and almost entirely free from contaminants. Typical sand deposits have numerous impurities fused to the silica grains, such as iron, carbonate, potassium, and other trace elements/minerals, which can make them more susceptible to mechanical and chemical alteration. Mineralogical purity of silica content is a characteristic of mature sand, which has been highly reworked and well sorted, so that the mechanically and chemically less-resistant minerals and fine particles have been dissolved or winnowed away.

•Homogeneous grain size – hydraulic fracturing procedures require sand in a relatively narrow range of grain sizes which are dependent on the specific geological conditions of the well and the fracking procedures used. Larger sand grains generally provide better permeability, but smaller sand grains are typically stronger. When describing frac sand, the product is frequently referred to as simply the sieve cut, e.g., 20/40 mesh sand—meaning that 90 percent of the sand is fine enough to pass through a 20-mesh sieve and is coarse enough to be retained on a 40-mesh sieve. Common frac sand sizes include 20/40 mesh, 30/50 mesh, 40/70 mesh, “100 mesh”, “200 mesh”, and finer. The size ranges for “100 mesh” and “200 mesh” vary significantly between manufacturers. As of the date of this report, finer sands such as 40/70 mesh and “100 mesh” have become more widely utilized in shale gas well fracturing.

•High sphericity and roundness – Sphericity and roundness describe the overall shape of the sand grains. Sphericity measures how close the grains approach the shape of a sphere while roundness measures the relative sharpness of corners and curvatures of the grains. Greater sphericity and roundness provide better grain strength and porosity/permeability between grains, allowing better flow of oil and gas from the fractures to the wellhead. A more spherical shape also enables the grains to be carried in the fracking fluid with minimal turbulence.

•High crush resistance – Crush resistance of frac sand is dependent upon the hardness and shape of the sand grain. Generally, a high percentage of silica in the sand increases its crush resistance. Additionally, monocrystalline grains are stronger than composite grains. Crush resistance is expressed as a K-value that indicates the highest pressure (rounded to the nearest 1,000 psi) that generates less than 10 weight percent fines (i.e., crushed sand grains). For example, a K-value of 7 means that, at 7,000 psi pressure, no more than 10 weight percent fines were generated, but more than 10 weight percent fines were generated at the next highest pressure. The higher the K-value, the more crush-resistant the sand is.

•Low acid solubility – Acid solubility is an indication of the amount of soluble cement or soluble mineral grains (i.e., non-silica contaminants) in the frac sand; low solubility requires a high silica content, as pure quartz tends to be insoluble under normal conditions.

•Low turbidity – Turbidity is a measure of the clay, silt, or other fine grains and impurities in the sand. Low turbidity is a result of mineralogical maturity and grain‑size sorting in the natural depositional environment. Generally, fine suspended matter in the mined sand is washed out during processing, so this property can be somewhat controlled for the final product.

Aeolian sand deposits, such as those found on the OnCore sites, which are predominantly comprised of silica sand grains meeting the abovementioned characteristics are well-suited to the commercial production frac sands.

5.0 EXPLORATION DATA

In developing the OnCore sites, Atlas has completed numerous geologic exploration campaigns. A total of 247 drill holes have been completed across the subject OnCore sites. The results of these exploration programs comprise geologic logs and subsurface sand samples, grain size analyses of the samples, and proppant sand testing of composited samples. Exploration summaries were provided to BOYD for our review, along with the collected and analyzed exploration data, which together comprise the primary geologic data used in the evaluation of the frac sand resources and frac sand reserves reported herein.

Maps illustrating the extents of the sand deposits, along with electronic copies of drilling and sampling logs, as well as sampling procedures and laboratory testing summaries were provided for our review. The equipment utilized, and the sampling, logging, and field work performed, are noted as being appropriate for delineating the frac sand deposits. BOYD opines that the work done by Atlas is thorough and complete for the purposes of evaluating and estimating frac sand resources and reserves on the subject sites.

Atlas notes that the OnCore sites have been developed and operated by OnCore personnel from initial greenfield prospecting stages, through current operational status. Generally, each OnCore site was the subject of at least two separate exploration campaigns—the exception being new OnCore sites located adjacent to an operating OnCore site—including a widely-spaced “reconnaissance” exploration campaign to gauge the deposits potential followed by an infill exploration campaign if the initial campaign results are favorable.

Table 5.1, below, summarizes the drilling campaigns completed on each of the OnCore sites:

| | | | | | | | | | | | |

Table 5.1: OnCore Drilling Summary |

| | Drilling | | | | Start / End | | Drillhole | | Driling |

Site | | Campaign | | Property | | Date(s) | | Drillholes | | Count | | Method(s) |

| | | | | | | | | | | | |

OnCore 1 | | 1 | | Atlas | | March 2021 | | LA-21-01 - LA-21-10 | | 10 | | Rotosonic |

| | 2 | | Atlas | | January 2022 | | LA-22-01 - LA-22-09 | | 9 | | Direct Push |

| | 3 | | Atlas | | April 2022 | | LA-22-10 - LA-22-17 | | 8 | | Direct Push |

| | 4 | | Atlas | | March 2022 | | LS-22-01 - LS-22-08 | | 8 | | Direct Push |

| | 5 | | Atlas | | June 2022 | | LS-22-09 - LS-22-14 | | 6 | | Direct Push |

| | 6 | | TPL 31 | | August 2022 | | TPL31-22-01 - TPL31-22-16 | | 16 | | Direct Push |

| | 7 | | TPL 31 | | June 2023 | | TPL31-23-17 - TPL31-23-23 | | 7 | | Direct Push |

| | | | | | | | | | 64 | | |

| | | | | | | | | | | | |

OnCore 2 | | 1 | | Ron White | | 2020 | | RW-20-01 - RW-20-03 | | 3 | | Manual Probe |