- JNJ Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Johnson & Johnson (JNJ) DEF 14ADefinitive proxy

Filed: 11 Mar 20, 8:05am

| o | Preliminary Proxy Statement | |

| o | Confidential, for the Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material under § 240.14a-12 | |

| ý | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1 | ) | Title of each class of securities to which transaction applies: |

| (2 | ) | Aggregate number of securities to which transaction applies: |

| (3 | ) | Per unit price or other underlying value of transaction compute pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4 | ) | Proposed maximum aggregate value of transaction: |

| (5 | ) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1 | ) | Amount Previously Paid: |

| (2 | ) | Form, Schedule or Registration Statement No.: |

| (3 | ) | Filing Party: |

| (4 | ) | Date Filed: |

|

2020 Proxy Statement - 2 | ||

| March 11, 2020 | |||

| Notice of Annual Meeting and Proxy Statement | |||

You are invited to attend the Annual Meeting of Shareholders of Johnson & Johnson (the Company). For entry to the Annual Meeting, please bring your admission ticket and a valid photo ID (see "Admission Ticket Procedures" on page 109 of this Proxy Statement). | |||

When: Thursday, April 23, 2020 10:00 a.m., Eastern Time Doors to Meeting Open at 9:15 a.m. | Where: Hyatt Regency New Brunswick Two Albany Street New Brunswick, New Jersey | ||

We will broadcast the Annual Meeting as a live webcast at www.investor.jnj.com, under “Webcasts & Presentations.” | |||

| Items of Business: | |||

| 1. Elect the 13 nominees named in this Proxy Statement to serve as Directors for the coming year; | |||

| 2. Vote, on an advisory basis, to approve named executive officer compensation; | |||

| 3. Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020; | |||

| 4. Approve an amendment to our Restated Certificate of Incorporation; | |||

| 5. Vote on the two (2) shareholder proposals contained in this Proxy Statement, if properly presented at the Annual Meeting; and | |||

| 6. Transact such other matters as may properly come before the Annual Meeting, and at any adjournment or postponement of the Annual Meeting. | |||

| Voting: | |||

You are eligible to vote if you were a shareholder of record at the close of business on February 25, 2020. Ensure that your shares are represented at the meeting by voting in one of several ways: | |||

To vote VIA THE INTERNET, go to the website listed on your proxy card or Notice. | |||

To vote BY PHONE, call the telephone number specified on your proxy card or on the website listed on your Notice. | |||

If you received paper copies of your proxy materials, mark, sign, date and return your proxy card in the postage-paid envelope provided to vote BY MAIL. | |||

Attend the Annual Meeting to vote IN PERSON (see “Annual Meeting Attendance” and “Admission Ticket Procedures” on page 109 of this Proxy Statement). | |||

| By order of the Board of Directors, | |||

| |||

MATTHEW ORLANDO Worldwide Vice President, Corporate Governance Corporate Secretary | |||

| Dear Fellow Shareholders, | ||||

In September of 2019, Johnson & Johnson celebrated its 75th anniversary as a publicly traded company, reminding us how the Company’s broad-based expertise, businesses and resources have produced health-enhancing innovations and strong financial performance through decade after decade of economic, social and market transformations. The Company demonstrated its resilience again in this year’s complex external environment, and we are looking forward to its future in this time of ever-increasing opportunity, challenge and change. Your Board is focused on issues that are important to the Company and its shareholders, and it is my privilege as your Lead Director to share some of our priorities with you. | |||||

2020 Proxy Statement - 4 | ||

| A MESSAGE FROM OUR LEAD DIRECTOR | |||||

| 2020 PROXY STATEMENT – SUMMARY | |||||

| Voting Overview and Vote Recommendations of Board - Items of Business | |||||

| BOARD OF DIRECTORS | INDEX OF FREQUENTLY | ||||

| Item 1: Election of Directors | REQUESTED INFORMATION | ||||

| Nominees | Admission Ticket Procedures | ||||

| Director Nomination Process, Board Refreshment and Board Composition | Annual Meeting Attendance | ||||

| Board Leadership Structure | Anti-Pledging, Hedging Policy | ||||

| Board Committees | Auditor Fees | ||||

| Board Meetings and Processes | Auditor Tenure | ||||

| Oversight of Strategy | Board Evaluation | ||||

| Oversight of Risk | Board Leadership Structure | ||||

| Oversight of Human Capital Management | Board Meeting Attendance | ||||

| Shareholder Engagement | CEO Pay Ratio | ||||

| Corporate Governance Highlights | CEO Performance Evaluation | ||||

| Director Independence | Compensation Consultant | ||||

| Related Person Transactions | Compensation Summary | ||||

| Stock Ownership and Section 16 Compliance | Contacting the Board | ||||

| Director Compensation | Corporate Governance Materials | ||||

| COMPENSATION OF EXECUTIVES | Death Benefits | ||||

| Item 2: Advisory Vote to Approve Named Executive Officer Compensation | Director Biographies | ||||

| Compensation Committee Report | Director Independence | ||||

| Compensation Discussion and Analysis | Director Overboarding Policy | ||||

| 2019 Performance and Compensation | Director Qualifications | ||||

| Executive Compensation Philosophy | Exec. Comp. Recoupment Policy | ||||

| Components of Executive Compensation | How to Vote | ||||

| Peer Groups for Pay and Performance | Lead Director Duties | ||||

| Compensation Decision Process | Long-Term Incentives | ||||

| Governance of Executive Compensation | Notice and Access | ||||

| Additional Information Concerning Executive Compensation | Pay For Performance | ||||

| Executive Compensation Tables | Peer Group Comparisons | ||||

| 2019 Summary Compensation Table | Perquisites | ||||

| 2019 Grants of Plan-Based Awards | Political Spending Oversight | ||||

| 2019 Outstanding Equity Awards at Fiscal Year-End | Proxy Access | ||||

| 2019 Option Exercises and Stock Vested | Related Person Transactions | ||||

| 2019 Pension Benefits | Risk Oversight | ||||

| 2019 Non-Qualified Deferred Compensation | Severance Benefits | ||||

| 2019 Potential Payments Upon Termination | Shareholder Outreach | ||||

| Ratio of the Annual Total Compensation of the Median-Paid Employee to CEO | Shareholder Outreach - | ||||

| AUDIT MATTERS | Compensation | ||||

| Audit Committee Report | Shareholder Proposals | ||||

| Item 3: Ratification of Appt. of Independent Registered Public Accounting Firm | Stock Ownership Requirements for: | ||||

| AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION | Directors | ||||

| Item 4: Amendment to the Restated Certificate of Incorporation | Executive Officers | ||||

| SHAREHOLDER PROPOSALS | Stock Ownership | ||||

| Item 5: Independent Board Chair | Websites | ||||

| Item 6: Report on Governance of Opioids-Related Risks | |||||

| GENERAL INFORMATION | |||||

2020 Proxy Statement - 5 | ||

| VOTING OVERVIEW AND VOTE RECOMMENDATIONS OF BOARD - ITEMS OF BUSINESS | |||||

Election of Director Nominees: Please Vote FOR all Nominees | |||||

| 1 | Election of 13 Director Nominees (pages 10-16) | þ | |||

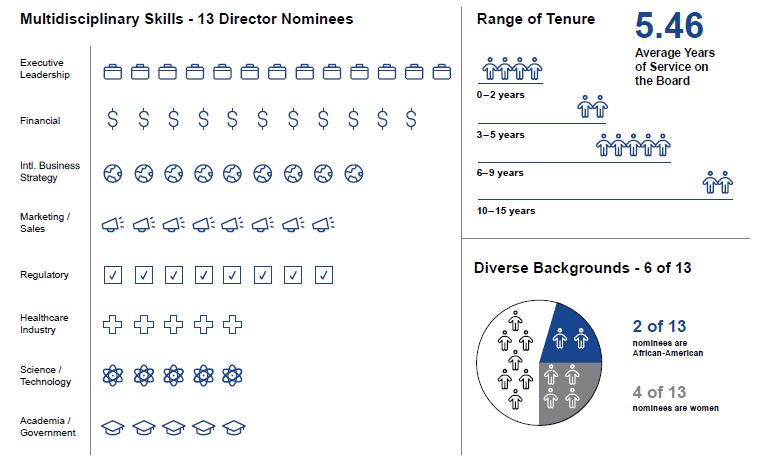

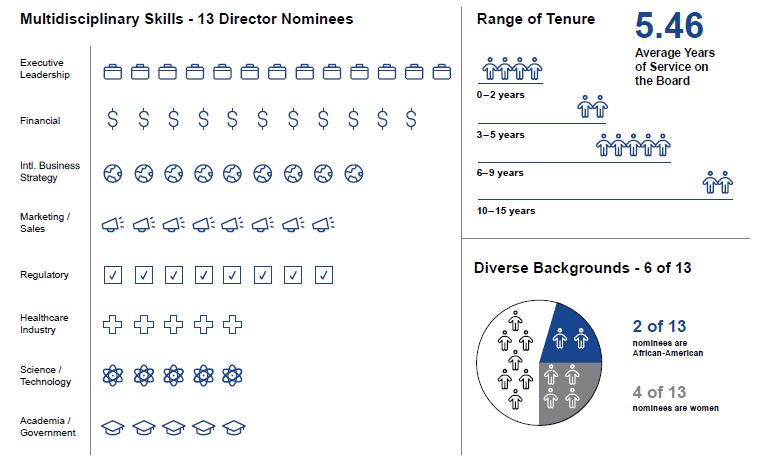

• Diverse slate of Director nominees with broad and relevant leadership and experience. • All nominees are independent, except the Chairman. • Average Director tenure is 5.46 years. | |||||

Management Proposals: Please Vote FOR all Management Proposals | |||||

| 2 | Advisory Vote to Approve Named Executive Officer Compensation (Say on Pay) (page 43) | þ | |||

• Independent oversight by the Compensation & Benefits Committee with the assistance of an independent external advisor. • Executive compensation targets are determined based on annual review of publicly available information and executive compensation surveys among the Executive Peer Group (page 67). | |||||

| 3 | Ratification of Appointment of Independent Registered Public Accounting Firm (page 98) | þ | |||

• PricewaterhouseCoopers LLP is an independent accounting firm with the breadth of expertise and knowledge necessary to effectively audit our business. • Independence supported by periodic mandated rotation of the audit firm's lead engagement partner. | |||||

| 4 | Amendment to the Restated Certificate of Incorporation to Permit Removal of Directors without Cause (page 100) | ||||

• The Company’s current Restated Certificate of Incorporation provides that a Director may be removed only for cause. The proposed amendment would delete this provision. • The Board and the Nominating & Corporate Governance Committee regularly review our corporate governance practices and recognize the emerging practice to permit removal of Directors without cause. | þ | ||||

Shareholder Proposals: Please Vote AGAINST the following Shareholder Proposals | |||||

| 5 | Independent Board Chair (page 101) | ý | |||

• It is crucial that the Board maintain the flexibility to tailor its leadership structure to best fit the Company’s needs as they evolve, as well as to best respond to the challenges facing the Company. • Our current Board structure, with a robust Lead Director and Committees each composed entirely of independent Directors, provides appropriately strong independent leadership and oversight. • Independent Directors hold regularly scheduled Executive Sessions and each Committee holds regularly scheduled private sessions with their respective compliance leaders to ensure transparent and candid feedback. | |||||

| 6 | Report on Governance of Opioids-Related Risks (page 104) | ý | |||

• The Company’s current opioids-related business activities are immaterial. • We have created a resource, www.factsaboutourprescriptionopioids.com, in an effort to be transparent, and to update shareholders about, among other things, our prior opioid business activities and the related litigation. • We already provide meaningful and substantive disclosure concerning the governance measures and other controls implemented to manage significant risks, including risks related to litigation and reputational risks. • The Board believes that the preparation of the report contemplated by this proposal is unnecessary and duplicative of existing disclosures. | |||||

2020 Proxy Statement - 6 | ||

| DIRECTOR NOMINEES (pages 10 to 16) | ||||||||||||

| Name | Age | Director Since | Primary Occupation | Board Committees | ||||||||

| AUD | CB | NCG | RC | STS | FIN | |||||||

| M. C. Beckerle | I | 65 | 2015 | Chief Executive Officer, Huntsman Cancer Institute; Distinguished Professor of Biology, College of Science, University of Utah | ü | C | ||||||

| D. S. Davis | I | 68 | 2014 | Former Chairman and Chief Executive Officer, United Parcel Service, Inc. | C | ü | ||||||

| I. E. L. Davis | I | 69 | 2010 | Chairman, Rolls-Royce Holdings plc; Former Chairman and Worldwide Managing Director, McKinsey & Company | ü | ü | ||||||

| J. A. Doudna | I | 56 | 2018 | Professor of Chemistry; Professor of Biochemistry & Molecular Biology; Li Ka Shing Chancellor's Professor in Biomedical and Health, University of California, Berkeley | ü | |||||||

| A. Gorsky | CH | 59 | 2012 | Chairman and Chief Executive Officer, Johnson & Johnson | C | |||||||

| M. A. Hewson | I | 66 | 2019 | Chairman, President and Chief Executive Officer, Lockheed Martin Corporation | ü | |||||||

| H. Joly | I | 60 | 2019 | Executive Chairman and former Chief Executive Officer, Best Buy Co., Inc. | ü | |||||||

| M. B. McClellan | I | 56 | 2013 | Director, Duke-Robert J. Margolis, MD, Center for Health Policy | ü | ü | ||||||

| A. M. Mulcahy | LD | I | 67 | 2009 | Former Chairman and Chief Executive Officer, Xerox Corporation | ü | ü* | ü | ||||

| C. Prince | I | 70 | 2006 | Retired Chairman and Chief Executive Officer, Citigroup Inc. | ü | C | ||||||

| A. E. Washington | I | 69 | 2012 | Duke University’s Chancellor for Health Affairs; President and Chief Executive Officer, Duke University Health System | ü | ü | ||||||

| M. A. Weinberger | I | 58 | 2019 | Former Chairman and Chief Executive Officer, EY (Ernst & Young) | ü | ü | ||||||

| R. A. Williams | I | 70 | 2011 | Former Chairman and Chief Executive Officer, Aetna Inc. | C | ü | ||||||

| * Ms. Mulcahy will be appointed as the Chairman of the Nominating & Corporate Governance Committee at our April Board Meeting. | ||||||||||||

| CH | Chairman of the Board | |||||||||||

| C | Committee Chair | |||||||||||

| LD | Lead Director | |||||||||||

| I | Independent Director | |||||||||||

| AUD | Audit Committee | |||||||||||

| CB | Compensation & Benefits Committee | |||||||||||

| NCG | Nominating & Corporate Governance Committee | |||||||||||

| RC | Regulatory Compliance Committee | |||||||||||

| STS | Science, Technology & Sustainability Committee | |||||||||||

| FIN | Finance Committee | |||||||||||

2020 Proxy Statement - 7 | ||

| BOARD REFRESHMENT AND BOARD NOMINEE COMPOSITION (page 18) | ||||||||||||||

| ||||||||||||||

| CORPORATE GOVERNANCE HIGHLIGHTS (page 32) | ||||||||||||||

| Effective Board Structure and Composition | Responsive and Accountable to Shareholders | |||||||||||||

| ü | Strong independent Board leadership | ü | Annual election of Directors | |||||||||||

| ü | Independent Lead Director | ü | Majority voting standard for Director elections | |||||||||||

| ü | Annual review of Board leadership | ü | One class of stock | |||||||||||

| ü | Executive Sessions of independent Directors | ü | Proxy access | |||||||||||

| ü | Private Committee sessions with key compliance leaders | ü | Director overboarding policy | |||||||||||

| ü | Rigorous Board and Committee evaluations | ü | No shareholder rights plan | |||||||||||

| ü | Regular Board refreshment | ü | No supermajority requirements in Certificate of Incorporation / By-Laws | |||||||||||

| ü | Diverse and skilled Board | ü | Shareholder right to call special meetings | |||||||||||

| ü | Active shareholder engagement | |||||||||||||

| Additional Governance Features | ü | Annual Say on Pay advisory vote | ||||||||||||

| ü | Code of Business Conduct | ü | Policy Against Pledging, Hedging and Short Selling of Company Stock | |||||||||||

| ü | Cybersecurity oversight | ü | Disclosure on drug pricing in Janssen U.S. Transparency Report | |||||||||||

| ü | Enhanced litigation disclosure | ü | ESG disclosure in annual Health for Humanity Report | |||||||||||

| ü | Robust compensation recoupment policy framework | |||||||||||||

| OUR ANNUAL SHAREHOLDER ENGAGEMENT CYCLE (page 30) | ||||||||||||||

| ||||||||||||||

2020 Proxy Statement - 8 | ||

| EXECUTIVE COMPENSATION SUMMARY | |||||

| Shareholder Outreach and Our Compensation Program Changes | |||||

At our 2019 Annual Meeting, approximately 66% of our shareholders voted in support of our executive compensation program. During 2019, we enhanced our shareholder outreach and engagement efforts to solicit feedback on our programs and practices. In total, we met with approximately 115 shareholders representing approximately 35% of our total shares outstanding and approximately 50% of our institutional ownership. We believe that our 2019 vote, commonly known as "Say on Pay," was largely the result of mixed views of a one-time supplemental severance payment made in 2018 to a former named executive officer. We discussed this issue as well as other items related to our executive compensation program with our shareholders. On pages 48 and 49 we provide more detail on our shareholder outreach, what we heard, and our compensation program changes in response to shareholder feedback. | |||||

| What We Heard | What We Did | ||||

| Avoid paying supplemental severance, but do not make a commitment to never do so in the future. | We will provide severance benefits within the parameters of our existing plans, and, based on shareholder feedback, we will retain flexibility if additional actions are required by the circumstances. | ||||

| Add more structure to our annual incentives. | We redesigned our executives' 2020 annual incentives with clear weightings on financial and strategic goals and identified threshold, target, and maximum levels of financial performance and payout. | ||||

| Use only 3-year measures in the 3-year PSUs. Discontinue using three 1-year sales measures. | We redesigned our PSUs to be based on 3-year earnings per share (EPS) and 3-year relative total shareholder return (TSR) - each weighted 50% - beginning with our 2020 awards. | ||||

| Shareholders did not express concern over personal use of the company car and driver, but we changed our program based on competitive market data. | Beginning in 2020, we capped the value of our car and driver perquisite. | ||||

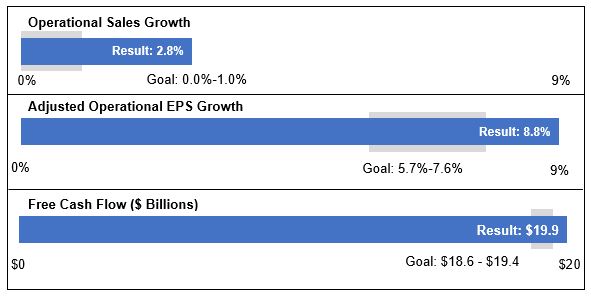

| Company Performance | |||||

| We delivered strong performance in 2019. We exceeded our financial goals and met our strategic goals. This was driven by strong performance in our Pharmaceuticals business and positive momentum in our Medical Devices and Consumer businesses. We summarize our performance against our financial and strategic goals on pages 50 to 53. | |||||

| Financial Goal | Goal | Results | |||

Exceeded our operational sales growth goal | 0.0% - 1.0% | 2.8% | |||

Exceeded our adjusted operational EPS growth goal | 5.7% - 7.6% | 8.8% | |||

Exceeded our free cash flow goal ($ Billions) | $18.6 - $19.4 | $19.9 | |||

| Note: Operational sales growth, adjusted operational EPS growth, and free cash flow are non-GAAP measures. See page 53 for details. | |||||

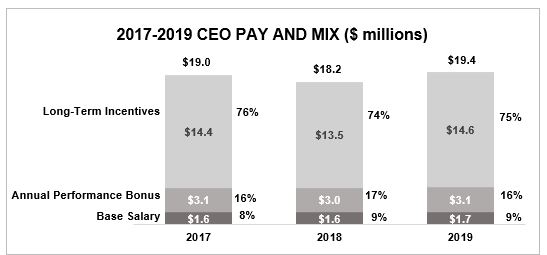

| Compensation Decisions for 2019 Performance | |||||

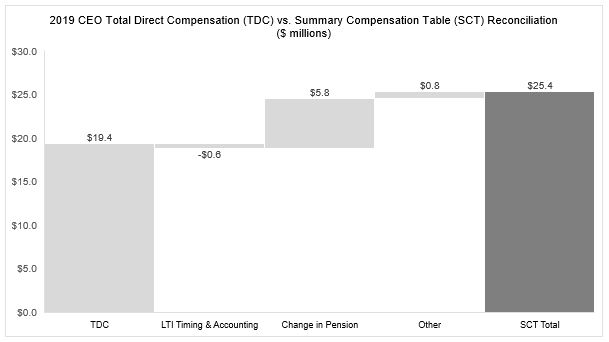

| The Company exceeded its financial goals and met its strategic goals. The Board recognized Mr. Gorsky’s 2019 performance by awarding him an annual performance bonus at 108% of target and long-term incentives at 108% of target. After reviewing market data and other factors, the Board kept Mr. Gorsky's salary rate unchanged at $1,650,000 per year. His salary rate has remained the same since 2018. | |||||

| Compensation Item | 2019 Amount ($) | Percent of Target (%) | |||

| Salary Earned | $1,650,000 | ||||

| Annual Performance Bonus | 3,120,000 | 108 | % | ||

| Long-Term Incentive Awards | 14,610,000 | 108 | % | ||

| Total Direct Compensation | $19,380,000 | ||||

We describe the performance and compensation of our Chairman/CEO on page 54 and our named executive officers on pages 55 to 57. | |||||

2020 Proxy Statement - 9 | ||

| þ | The Board of Directors recommends a vote FOR election of each of the below-named Director nominees. |

| MARY C. BECKERLE, Ph.D. | |||||

| Independent Director since 2015 | Biography: | ||||

| Dr. Beckerle, age 65, has served as Chief Executive Officer of the Huntsman Cancer Institute at the University of Utah since 2006. She is the Associate Vice President for Cancer Affairs and a Distinguished Professor of Biology and Oncological Sciences at the University of Utah. Dr. Beckerle joined the faculty of the University of Utah in 1986 and currently holds the Jon M. Huntsman Presidential Endowed Chair. Dr. Beckerle has served on the National Institute of Health (NIH) Advisory Committee to the Director, on the Board of Directors of the American Association for Cancer Research, as President of the American Society for Cell Biology and as the Chair of the American Cancer Society Council for Extramural Grants. She currently serves on a number of scientific advisory boards, including the Medical Advisory Board of the Howard Hughes Medical Institute, the Board of Scientific Advisors of the National Cancer Institute (USA) and the External Advisory Board of the Dana Farber/Harvard Cancer Center. | ||||

| Current Committees: | |||||

| • | Chair, Science, Technology & Sustainability | ||||

| • | Member, Regulatory Compliance | ||||

| Skills and Qualifications: | |||||

| Other Public Board Service: | • | Expertise in scientific research and organizational management in the | |||

| • | Huntsman Corporation (since 2011) | healthcare arena | |||

| • | Active participant in national and international scientific affairs | ||||

| • | Strong focus on patient experience | ||||

2020 Proxy Statement - 10 | ||

| D. SCOTT DAVIS | ||||

| Independent Director since 2014 | Biography: | |||

| Mr. Davis, age 68, served as Chairman and Chief Executive Officer of United Parcel Service, Inc. (UPS) (shipment and logistics) from 2008 to 2014, and as Chairman from 2014 to 2016. Previously, Mr. Davis held various leadership positions with UPS, primarily in the finance and accounting area, including as Vice Chairman and Chief Financial Officer. Mr. Davis is a Certified Public Accountant. He previously served on the Board of the Federal Reserve Bank of Atlanta from 2003 to 2009, serving as Chairman in 2009. | |||

| Skills and Qualifications: | ||||

| • | Deep understanding of emerging markets and international operations, | |||

| Current Committees: | public policy and global economic indicators | |||

| • | Chair, Audit | • | Expertise in management, strategy, finance and operations | |

| • | Member, Compensation & Benefits | • | Expertise in supply chain logistics at a time of rapid global expansion | |

| in the healthcare industry | ||||

| Other Public Board Service: | ||||

| • | Honeywell International, Inc. (since 2005) | |||

| Recent Past Public Board Service: | ||||

| • | United Parcel Service, Inc. (2008-2016) | |||

| • | EndoChoice, Inc. (2014-2016) | |||

| IAN E. L. DAVIS | ||||

| Independent Director since 2010 | Biography: | |||

| Mr. Davis, age 69, is currently non-executive Chairman, Rolls-Royce Holdings plc. Mr. Davis retired from McKinsey & Company (management consulting) in 2010 as a Senior Partner, having served as Chairman and Worldwide Managing Director from 2003 until 2009. In his more than 30 years at McKinsey, he served as a consultant to a range of global organizations across the public, private and not-for-profit sectors. Prior to becoming Chairman and Worldwide Managing Director, he was Managing Partner of McKinsey's practice in the United Kingdom and Ireland. His experience included oversight for McKinsey clients and services in Asia, Europe, the Middle East and Africa, and expertise in the consumer products and retail industries. Mr. Davis is a Director Majid Al Futtaim Holding LLC, and a Senior Advisor at Apax Partners, a private equity firm. | |||

| Current Committees: | ||||

| • | Member, Audit | Skills and Qualifications: | ||

| • | Member, Regulatory Compliance | • | Expertise in leading a broad global business | |

| • | Deep understanding of global business trends | |||

| Other Public Board Service: | • | Expertise in strategy and business transformation | ||

| • | BP, plc (since 2010) | |||

| • | Rolls-Royce Holdings plc (since 2013) | |||

2020 Proxy Statement - 11 | ||

| JENNIFER A. DOUDNA, Ph.D. | ||||

| Independent Director since 2018 | Biography: | |||

| Dr. Doudna, age 56, joined the faculty at University of California, Berkeley, as a Professor of Biochemistry & Molecular Biology in 2002. She directs the Innovative Genomics Institute, a joint UC Berkeley-UC San Francisco center, holds the Li Ka Shing Chancellor's Professorship in Biomedical and Health, and is the Chair of the Chancellor's Advisory Committee on Biology at UC Berkeley. Dr. Doudna is Principal Investigator at the Doudna Lab at UC Berkeley and has founded and serves on the Scientific Advisory Boards of Caribou Biosciences, Inc. and Intellia Therapeutics, Inc., both leading CRISPR genome engineering companies. She has been an Investigator with the Howard Hughes Medical Institute since 1997. Dr. Doudna is the recipient of numerous scientific awards in biochemistry and genetics. Dr. Doudna is a Director of Driver Inc. and a Trustee for Pomona College. | |||

| Current Committees: | ||||

| • | Member, Science, Technology & Sustainability | Skills and Qualifications: | ||

| • | Pioneer in the field of biochemistry, having co-discovered the simplified | |||

| Other Public Board Service: | genome editing technique CRISPR-Cas9 | |||

| • | None | • | Expertise in scientific research and innovation | |

| • | Leader in integration of scientific research and ethics | |||

| ALEX GORSKY | ||||

| Management - Director since 2012 | Biography: | |||

| Mr. Gorsky, age 59, was appointed as Chairman, Board of Directors in December 2012. He was named Chief Executive Officer, Chairman of the Executive Committee and joined the Board of Directors in April 2012. Mr. Gorsky began his Johnson & Johnson career with Janssen Pharmaceutica Inc. in 1988. Over the next 15 years, he advanced through positions of increasing responsibility in sales, marketing and management. In 2001, Mr. Gorsky was appointed President of Janssen Pharmaceutical Inc., and in 2003 he was named Company Group Chairman of the Johnson & Johnson pharmaceutical business in Europe, the Middle East and Africa. Mr. Gorsky left Johnson & Johnson in 2004 to join Novartis Pharmaceuticals Corporation, where he served as head of the pharmaceutical business in North America. Mr. Gorsky returned to Johnson & Johnson in 2008 as Company Group Chairman for Ethicon. In early 2009, he was appointed Worldwide Chairman of the Surgical Care Group and member of the Executive Committee. In September 2009, he was appointed Worldwide Chairman of the Medical Devices and Diagnostics Group. Mr. Gorsky became Vice Chairman of the Executive Committee in January 2011. Mr. Gorsky serves on the Boards of the Travis Manion Foundation, the National Academy Foundation and the Wharton Board of Overseers. He is a Member of the Board of the Business Roundtable and serves as the Chairman of its Corporate Governance Committee. | |||

| Current Committees: | ||||

| • | Chair, Finance | |||

Other Public Board Service: | ||||

| • | International Business Machines Corporation (since 2014) | |||

| Skills and Qualifications: | ||||

| • | Leadership of global business in healthcare industry | |||

| • | Expertise in strategy and operations of our Company as well as its risks | |||

| and challenges | ||||

| • | Deep commitment to ethical, Credo-based leadership | |||

2020 Proxy Statement - 12 | ||

| MARILLYN A. HEWSON | ||||

| Independent Director since 2019 | Biography: | |||

| Ms. Hewson, age 66, has served since January 2014 as Chairman, President and Chief Executive Officer of Lockheed Martin Corporation (aerospace), a global security and aerospace company principally engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems, products and services. Ms. Hewson was Chief Executive Officer and President of Lockheed Martin from January to December 2013 and has served as a Director since 2012. Ms. Hewson currently serves on the University of Alabama’s Culverhouse College of Commerce Board of Visitors and its President's Cabinet, the Boards of Governors of the United Service Organizations (USO) and Aerospace Industries Association, the Boards of Directors of the Congressional Medal of Honor Foundation, Catalyst, Inc., and the Business Roundtable, and the International Advisory Board of the Atlantic Council. Ms. Hewson also serves on the Board of Trustees for King Abdullah University of Science and Technology in the Kingdom of Saudi Arabia and Khalifa University of Science and Technology in the United Arab Emirates. | |||

| Current Committees: | ||||

| • | Member, Compensation & Benefits | |||

| Other Public Board Service: | ||||

| • | Lockheed Martin Corporation (since 2012) | Skills and Qualifications: | ||

| • | Expertise in executive and operational leadership in a global, regulated | |||

| Recent Past Public Board Service: | industry | |||

| • | DuPont; DowDuPont Inc. (2007-2019) | • | Insight and experience in global business management, strategic planning, | |

| cybersecurity, finance, supply chain, leveraged services and manufacturing | ||||

| • | Expertise in government relations and human capital management | |||

| HUBERT JOLY | ||||

| Independent Director since 2019 | Biography: | |||

| Mr. Joly, age 60, became the Executive Chairman of Best Buy Co., Inc. (consumer electronics) in June 2019, having joined the company in 2012 as President and Chief Executive Officer and becoming Chairman, President, and Chief Executive in 2015. From 2004 to 2008, he was Global President and Chief Executive Officer, Carlson Wagonlit Travel, and then served as President and Chief Executive Officer of Carlson Companies from 2008 to 2012. In 1999, he joined Vivendi as Global Chief Executive Officer, Vivendi Universal Games, and was later appointed Executive Vice President of U.S. Assets and Deputy Chief Financial Officer of Vivendi Universal. Prior roles included, from 1996 to 1999, Vice President, Europe and President of Electronic Data Systems France and, from 1983 to 1996, McKinsey & Company, eventually serving as Partner. Mr. Joly is also a Vice Chairman of The Business Council and serves on the Board of Directors of Sciences Po Foundation, the Board of Trustees of the Minneapolis Institute of Art and the International Advisory Board of his alma mater, HEC Paris. | |||

| Current Committees: | ||||

| • | Member, Nominating & Corporate Governance | |||

| Other Public Board Service: | ||||

| • | Best Buy Co., Inc. (since 2012) | Skills and Qualifications: | ||

| • | Ralph Lauren Corporation (since 2009) | • | Extensive strategic, operational and financial expertise relevant to | |

| international corporations | ||||

| • | Successfully led the digital transformation of consumer businesses, with | |||

| focus on customer experience | ||||

| • | Experience in business transformation and human capital management | |||

2020 Proxy Statement - 13 | ||

| MARK B. McCLELLAN, M.D., Ph.D. | ||||

| Independent Director since 2013 | Biography: | |||

| Dr. McClellan, age 56, became the inaugural Director of the Duke-Robert J. Margolis, MD, Center for Health Policy and the Margolis Professor of Business, Medicine and Policy at Duke University in January 2016. He is also a faculty member at Dell Medical School at The University of Texas in Austin. Previously, he served from 2007 to 2015 as a Senior Fellow in Economic Studies and as Director of the Initiatives on Value and Innovation in Health Care at the Brookings Institution. Dr. McClellan served as Administrator of the Centers for Medicare & Medicaid Services for the U.S. Department of Health and Human Services from 2004 to 2006 and as Commissioner of the U.S. Food and Drug Administration (FDA) from 2002 to 2004. He served as a Member of the President's Council of Economic Advisers and as Senior Director for Healthcare Policy at the White House from 2001 to 2002 and, during the Clinton administration, held the position of Deputy Assistant Secretary for Economic Policy for the Department of the Treasury. Dr. McClellan previously served as an Associate Professor of Economics and Medicine with tenure at Stanford University, where he also directed the Program on Health Outcomes Research. Dr. McClellan is the founding Chair and a current Board member of the Reagan-Udall Foundation, is a Member of the National Academy of Medicine, Chairs the Academy's Leadership Consortium for Value and Science-Driven Health Care, and Co-Chairs the Guiding Committee of the Health Care Payment Learning and Action Network. He sits on the Boards of Directors of ResearchAmerica!, Long Term Quality Alliance, Alignment Healthcare, Seer, Inc., National Alliance for Hispanic Health and the Alliance for Health Policy. | |||

| Current Committees: | ||||

| • | Member, Regulatory Compliance | |||

| • | Member, Science, Technology & Sustainability | |||

| Other Public Board Service: | ||||

| • | Cigna Corporation (since 2018) | |||

| Skills and Qualifications: | ||||

| • | Extensive experience in public health policy, including as Commissioner of | |||

| the U.S. Food and Drug Administration and Administrator for the U.S. Centers | ||||

| for Medicare & Medicaid Services | ||||

| • | Broad knowledge of, and unique insights into, the challenges facing the | |||

| healthcare industry | ||||

| ANNE M. MULCAHY | ||||

Independent Director since 2009 Lead Director since 2012 | Biography: | |||

| Ms. Mulcahy, age 67, was Chairman and Chief Executive Officer of Xerox Corporation (business equipment and services) until July 2009, when she retired as CEO after eight years in the position. Prior to serving as CEO, Ms. Mulcahy was President and Chief Operating Officer of Xerox. She also served as President of Xerox's General Markets Operations, which created and sold products for reseller, dealer and retail channels. Earlier in her career at Xerox, which began in 1976, Ms. Mulcahy served as Vice President for Human Resources with responsibility for compensation, benefits, human resource strategy, labor relations, management development and employee training; and as Vice President and Staff Officer for Customer Operations, covering South America and Central America, Europe, Asia and Africa. Ms. Mulcahy was the U.S. Board Chair of Save the Children from March 2010 to February 2017, and was appointed as a Trustee in February 2018. | |||

| Current Committees: | ||||

• Member, Audit • Member, Finance • Member, Nominating & Corporate Governance | ||||

| Skills and Qualifications: | ||||

| • | Experience leading a large, global manufacturing and services company | |||

| Other Public Board Service: | with one of the world's most recognized brands | |||

| • | Graham Holdings Company (since 2008) | • | Expertise in organizational and operational management issues crucial to a | |

| • | LPL Financial Holdings Inc. (since 2013) | large public company. | ||

| • | Williams-Sonoma, Inc. (since 2018) | • | Deep commitment to business innovation and talent development | |

| Recent Past Public Board Service: | ||||

| • | Target Corporation (1997-2017) | |||

2020 Proxy Statement - 14 | ||

| CHARLES PRINCE | ||||

| Independent Director since 2006 | Biography: | |||

| Mr. Prince, age 70, served as Chief Executive Officer of Citigroup Inc. (financial services) from 2003 to 2007 and as Chairman from 2006 to 2007. Previously, he served as Chairman and Chief Executive Officer of Citigroup's Global Corporate and Investment Bank from 2002 to 2003, Chief Operating Officer from 2001 to 2002 and held positions of increasing responsibility since joining Commercial Credit Company, a predecessor to Citigroup, in 1979. Mr. Prince began his career as an attorney at U.S. Steel Corporation in 1975. Mr. Prince is a Director of Lord Abbett Family of Funds and a member of the Council on Foreign Relations and The Council of Chief Executives. | |||

| Current Committees: | Skills and Qualifications: | |||

| • | Chair, Regulatory Compliance | • | Expertise leading a diverse global company in a regulated environment | |

| • | Member, Nominating & Corporate Governance | • | Deep expertise in compliance and risk oversight | |

| • | Well-developed legal, global business and financial acumen | |||

| Other Public Board Service: | ||||

| • | None | |||

| Recent Past Public Board Service: | ||||

| • | Xerox Corporation (2008-2018) | |||

| A. EUGENE WASHINGTON, M.D., M.Sc. | ||||

| Independent Director since 2012 | Biography: | |||

| Dr. Washington, age 69, is Duke University's Chancellor for Health Affairs and the President and Chief Executive Officer of the Duke University Health System. Previously, he was Vice Chancellor of Health Sciences, Dean of the David Geffen School of Medicine at UCLA; Chief Executive Officer of the UCLA Health System; and Distinguished Professor of Gynecology and Health Policy at UCLA. Prior to UCLA, he served as Executive Vice Chancellor and Provost at the University of California, San Francisco (UCSF) from 2004 to 2010. Dr. Washington co-founded UCSF's Medical Effectiveness Research Center for Diverse Populations in 1993 and served as Director until 2005. He was Chair of the Department of Obstetrics, Gynecology, and Reproductive Sciences at UCSF from 1996 to 2004. Dr. Washington also co-founded the UCSF-Stanford Evidence-based Practice Center and served as its first Director from 1997 to 2002. Prior to UCSF, Dr. Washington worked at the Centers for Disease Control and Prevention. Dr. Washington was elected to the National Academy of Sciences' Institute of Medicine in 1997, where he served on its governing Council. He was founding Chair of the Board of Governors of the Patient-Centered Outcomes Research Institute, served as a member of the Scientific Management Review Board for the NIH, and also served as Chairman of the Board of Directors of both the California HealthCare Foundation and The California Wellness Foundation. Dr. Washington serves on the Boards of Directors of the Kaiser Foundation Hospitals and Kaiser Foundation Health Plan, Inc. | |||

| Current Committees: | ||||

| • | Member, Compensation & Benefits | |||

| • | Member, Science, Technology & Sustainability | |||

| Other Public Board Service: | ||||

| • | None | |||

| Skills and Qualifications: | ||||

| • | Expertise in medicine, clinical research and healthcare innovation | |||

| • | Important customer and patient perspective through leadership of | |||

| complex health systems | ||||

| • | Expertise in health policy | |||

2020 Proxy Statement - 15 | ||

| MARK A. WEINBERGER | ||||

| Independent Director since 2019 | Biography: | |||

| Mr. Weinberger, age 58, served as the Global Chairman and Chief Executive Officer of EY (Ernst & Young) (professional services) from 2013 through June 2019, having served as Global Chairman and CEO-elect in the prior year. He was Assistant Secretary of the U.S. Treasury in the George W. Bush Administration and was appointed by President Bill Clinton to serve on the U.S. Social Security Administration Advisory Board. Mr. Weinberger is on the Board of Directors of the Business Roundtable and he previously chaired its Tax and Fiscal Policy Committee and Audit Committee. He is also a Member of the International Advisory Board of British-American Business Council and is on the Board of Advisors for the American Council for Capital Formation. Mr. Weinberger is a Strategic Advisor to the FCLTGlobal (Focusing Capital on the Long-term), is on the CEO Advisory Council of JUSTCapital, and serves on the Board of Directors of the National Bureau of Economic Research and the Aspen Economic Strategy Group. He is also on the Boards of Trustees for the United States Council for International Business, the Greater Washington Partnership, The Concord Coalition, Emory University and Case Western Reserve University. | |||

| Current Committees: | ||||

| • | Member, Audit | |||

| • | Member, Regulatory Compliance | |||

| Other Public Board Service: | ||||

| • | MetLife Inc. (since 2019) | Skills and Qualifications: | ||

| • | Experience leading a global business and working at the highest levels of | |||

| government | ||||

| • | Track record of driving transformative change in the public and private | |||

| sectors during periods of unprecedented disruption | ||||

| • | Expertise in accounting, compliance and corporate governance, with | |||

| a strong commitment to corporate purpose | ||||

| RONALD A. WILLIAMS | ||||

| Independent Director since 2011 | Biography: | |||

| Mr. Williams, age 70, served as Chairman and Chief Executive Officer of Aetna Inc. (managed care and health insurance) from 2006 to 2010 and as Chairman from 2010 until his retirement in April 2011. He is also an advisor to the private equity firm Clayton, Dubilier & Rice, LLC. In addition, Mr. Williams serves on the Boards of Directors of Peterson Institute for International Economics, the National Academy Foundation and the President's Circle of the National Academics, the Advisory Board of Peterson Center on Healthcare and is Vice Chairman of the Board of Trustees of The Conference Board. Previously, Mr. Williams served on President Barack Obama's Management Advisory Board from 2011 to January 2017, as Chairman of the Council for Affordable Quality Healthcare from 2007 to 2010, as Vice Chairman of The Business Council from 2008 to 2010 and on the Board of MIT Corporation until July 2019. | |||

| Current Committees: | ||||

| • | Chair, Compensation & Benefits | |||

| • | Member, Nominating & Corporate Governance | Skills and Qualifications: | ||

| • | Broad experience leading a complex company in the healthcare industry | |||

| Other Public Board Service: | • | Expertise in corporate governance and leadership during times of | ||

| • | The Boeing Company (since 2010) | business disruption and transformation | ||

| • | American Express Company (since 2007) | • | Expertise in operational management and insight into both public | |

| healthcare policy and the healthcare industry | ||||

| Recent Past Public Board Service: | ||||

| • | Envision Healthcare Holdings, Inc. (2011-2017) | |||

2020 Proxy Statement - 16 | ||

| General Criteria for Nomination to the Board | ||

| Candidates for the Board should meet the following criteria: | ||

| l | possess the highest ethical character and share values with Our Credo | |

| l | strong personal and professional reputation consistent with our image and reputation | |

| l | proven record of accomplishment within candidate’s field, with superior credentials and recognition | |

| l | leadership of a major complex organization, including scientific, government, educational and other non-profit institutions | |

| The Board also seeks Directors who: | ||

| l | are widely recognized leaders in the fields of medicine or biological sciences, including those who have received the most prestigious awards and honors in their fields | |

| l | have expertise and experience relevant to our business, and the ability to offer advice and guidance to the CEO based on that expertise and experience | |

| l | are independent, without the appearance of any conflict in serving as a Director, and independent of any particular constituency, with the ability to represent all shareholders | |

| l | exercise sound business judgment | |

| l | are diverse, reflecting differences in skills, regional and industry experience, background, race, ethnicity, gender and other unique characteristics | |

2020 Proxy Statement - 17 | ||

| BOARD NOMINEE COMPOSITION |

|

2020 Proxy Statement - 18 | ||

| l | Chairman of the Board and Chief Executive Officer: Alex Gorsky | ||

| l | Independent Lead Director: Anne M. Mulcahy | ||

| l | The Chairman and Lead Director positions are evaluated and appointed annually by the independent Directors | ||

| l | The Nominating & Corporate Governance Committee annually reviews in Executive Session the Board leadership structure | ||

| l | All five main Board Committees composed of independent Directors | ||

| l | Independent Directors met in Executive Session at each of the eight regular 2019 Board meetings | ||

| The Board believes there is no single board leadership structure that is optimal in all circumstances. The Board, with its diverse skills and experience, considers the most appropriate leadership structure for our Company in the context of the specific circumstances and challenges facing us. | ||

| l | The Directors come from a variety of organizational backgrounds with direct experience in a wide range of leadership and management structures. | |

| l | The independent Directors appropriately challenge management and demonstrate the independence and free thinking necessary for effective oversight. | |

| l | The Directors prioritize shareholder engagement and discuss the feedback received. | |

| As a result, the Board is in the best position to evaluate the relative benefits and challenges of different Board leadership structures and ultimately decide which one best serves the interests of our stakeholders as defined in Our Credo (on the back cover of this Proxy Statement). | ||

In February 2018, the Board amended our Principles of Corporate Governance to reflect that the Nominating & Corporate Governance Committee review the Board's leadership structure on an annual basis and at other appropriate times, including whether it remains in our Company’s best interests to continue to combine the roles of Chairman of the Board and CEO. The Principles of Corporate Governance can be found at www.investor.jnj.com/gov.cfm. | ||

| In conducting its review, the Committee considers, among other things: | ||

| l | The effectiveness of the policies, practices and people in place at our Company to help ensure strong, independent Board oversight. | |

| l | Our Company’s performance and the effect a specific leadership structure could have on its performance. | |

| l | The Board’s performance and the effect a specific leadership structure could have on performance, including the Board's efficacy at overseeing specific enterprise risks. | |

| l | The Chairman’s performance in the role of Chairman (separate and apart from his performance as CEO). | |

| l | The views of our Company’s shareholders as expressed both during our shareholder engagement and through shareholder proposals. | |

| l | Applicable legislative and regulatory developments. | |

| l | The practices at other similarly situated companies and trends in governance. | |

2020 Proxy Statement - 19 | ||

| Board Agendas, Information and Schedules | • | Approves information sent to the Board and determines timeliness of information flow from management |

| • | Periodically provides feedback on quality and quantity of information flow from management | |

| • | Participates in setting, and ultimately approves, the agenda for each Board meeting | |

| • | Approves meeting schedules to ensure sufficient time for discussion of all agenda items | |

| • | With the Chairman/CEO, determines who attends Board meetings, including management and outside advisors | |

| Committee Agendas and Schedules | • | Reviews in advance the schedule of Committee meetings |

| • | Monitors flow of information from Committee Chairs to the full Board | |

| Board Executive Sessions | • | Has the authority to call meetings and Executive Sessions of the independent Directors |

| • | Presides at all meetings of the Board at which the Chairman/CEO is not present, including Executive Session of the independent Directors | |

| Communicating with Management | • | After each Executive Session of the independent Directors, communicates with the Chairman/CEO to provide feedback and also to act upon the decisions and recommendations of the Independent Directors |

| • | Acts as liaison between the independent Directors and the Chairman/CEO and management on a regular basis and when special circumstances arise | |

| Communicating with Stakeholders | • | Meets with major shareholders or other external parties as necessary |

| • | Is regularly apprised of inquiries from shareholders and involved in responding to these inquiries | |

| • | Under the Board’s guidelines for handling shareholder and employee communications to the Board, is advised promptly of any communications directed to the Board or any member of the Board that allege misconduct on the part of Company management, or raise legal, ethical or compliance concerns about Company policies or practices | |

Chair and CEO Performance Evaluations | • | Leads the annual performance evaluation of the Chairman/CEO, distinguishing as necessary between performance as Chairman and performance as CEO |

Board Performance Evaluation | • | Leads the annual performance evaluation of the Board |

| New Board Member Recruiting | • | Interviews Board candidates, as appropriate |

CEO Succession | • | Leads the CEO succession planning process |

Crisis Management | • | Participates in crisis management oversight, as appropriate |

Limits on Leadership Positions of Other Boards | • | May only serve as chair, lead or presiding director, or similar role, or as CEO of another public company if approved by the full Board upon recommendation from the Nominating & Corporate Governance Committee |

2020 Proxy Statement - 20 | ||

| DIRECTOR NOMINEES | ||||||||||||

| Name | Age | Director Since | Primary Occupation | Board Committees | ||||||||

| AUD | CB | NCG | RC | STS | FIN | |||||||

| M. C. Beckerle | I | 65 | 2015 | Chief Executive Officer, Huntsman Cancer Institute; Distinguished Professor of Biology, College of Science, University of Utah | ü | C | ||||||

D. S. Davis(1) | I | 68 | 2014 | Former Chairman and Chief Executive Officer, United Parcel Service, Inc. | C | ü | ||||||

| I. E. L. Davis | I | 69 | 2010 | Chairman, Rolls-Royce Holdings plc; Former Chairman and Worldwide Managing Director, McKinsey & Company | ü | ü | ||||||

| J. A. Doudna | I | 56 | 2018 | Professor of Chemistry. Professor of Biochemistry & Molecular Biology, Li Ka Shing Chancellor's Professor in Biomedical and Health, University of California, Berkeley | ü | |||||||

| A. Gorsky | CH | 59 | 2012 | Chairman and Chief Executive Officer, Johnson & Johnson | C | |||||||

| M. A. Hewson | I | 66 | 2019 | Chairman, President and Chief Executive Officer, Lockheed Martin Corporation | ü | |||||||

| H. Joly | I | 60 | 2019 | Executive Chairman and former Chief Executive Officer, Best Buy Co., Inc. | ü | |||||||

| M. B. McClellan | I | 56 | 2013 | Director, Duke-Robert J. Margolis, MD, Center for Health Policy | ü | ü | ||||||

| A. M. Mulcahy | LD | I | 67 | 2009 | Former Chairman and Chief Executive Officer, Xerox Corporation | ü | ü* | ü | ||||

| C. Prince | I | 70 | 2006 | Retired Chairman and Chief Executive Officer, Citigroup Inc. | ü | C | ||||||

| A. E. Washington | I | 69 | 2012 | Duke University’s Chancellor for Health Affairs, President and Chief Executive Officer, Duke University Health System | ü | ü | ||||||

| M. A. Weinberger | I | 58 | 2019 | Former Chairman and Chief Executive Officer, EY (Ernst & Young) | ü | ü | ||||||

| R. A. Williams | I | 70 | 2011 | Former Chairman and Chief Executive Officer, Aetna Inc. | C | ü | ||||||

| Number of Meetings in 2019 | 8(2) | 7 | 4 | 4 | 4 | 0 | ||||||

(1) | Designated as an “audit committee financial expert” | |||||||||||

(2) | Does not include teleconferences held prior to each release of quarterly earnings (four in total) | |||||||||||

| * | Ms. Mulcahy will be appointed as Chairman of the Nominating & Corporate Governance Committee at our April Board Meeting. | |||||||||||

| CH | Chairman of the Board | |||||||||||

| C | Committee Chair | |||||||||||

| LD | Lead Director | |||||||||||

| I | Independent Director | |||||||||||

| AUD | Audit Committee | |||||||||||

| CB | Compensation & Benefits Committee | |||||||||||

| NCG | Nominating & Corporate Governance Committee | |||||||||||

| RC | Regulatory Compliance Committee | |||||||||||

| STS | Science, Technology & Sustainability Committee | |||||||||||

| FIN | Finance Committee | |||||||||||

2020 Proxy Statement - 21 | ||

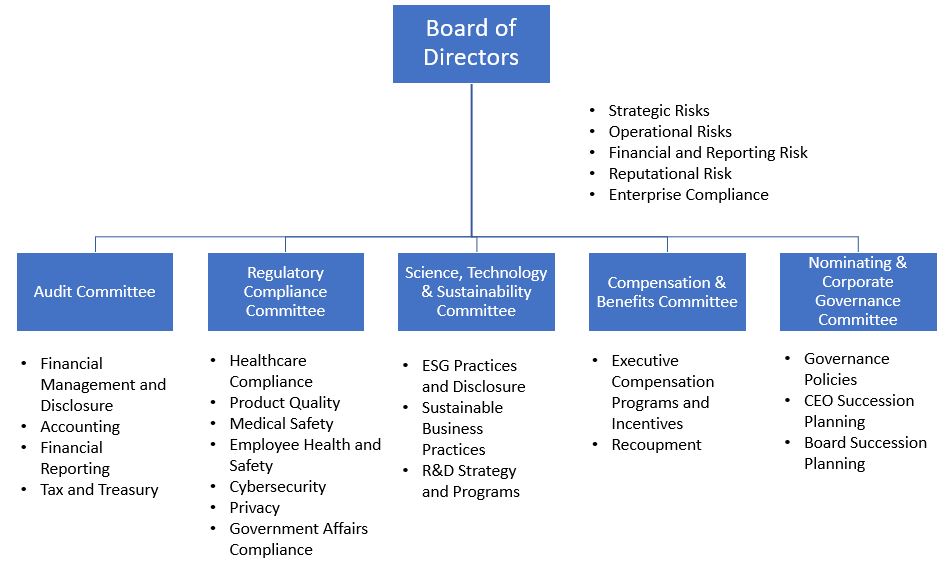

| l | Oversees our financial management, accounting and reporting processes and practices | |

| l | Appoints, retains, compensates and evaluates our independent auditor | |

| l | Oversees our internal audit organization, reviews its annual plan and reviews results of its audits | |

| l | Oversees the quality and adequacy of our Company’s internal accounting controls and procedures | |

| l | Reviews and monitors our financial reporting compliance and practices and our disclosure controls and procedures | |

| l | Discusses with management the processes used to assess and manage our exposure to financial risk and monitors risks related to tax and treasury | |

In performing these functions, the Audit Committee meets periodically with the independent auditor, management and internal auditors (including in private sessions) to review their work and confirm that they are properly discharging their respective responsibilities. For more information on Audit Committee activities in 2019, see the Audit Committee Report on page 97. The Board has designated Mr. D. S. Davis, the Chairman of the Audit Committee and an independent Director, as an “audit committee financial expert” under the rules and regulations of the U.S. Securities and Exchange Commission (SEC) after determining that he meets the requirements for such designation. The determination was based on his being a Certified Public Accountant and his experience as Chief Financial Officer at United Parcel Service, Inc. Any employee or other person who wishes to contact the Audit Committee to report good faith complaints regarding fiscal improprieties, internal accounting controls, accounting or auditing matters can do so by writing to the Audit Committee c/o Johnson & Johnson, Office of the Corporate Secretary, One Johnson & Johnson Plaza, New Brunswick, NJ 08933, or by using the online submission form at www.investor.jnj.com/communication.cfm. Such reports may be made anonymously. | ||

| l | Establishes our executive compensation philosophy and principles | |

| l | Reviews, and recommends for approval by the independent Directors the compensation for our Chief Executive Officer, and approves the compensation for our other executive officers | |

| l | Sets the composition of the group of peer companies used for comparison of executive compensation | |

| l | Oversees the design and management of the various pension, long-term incentive, savings, health and benefit plans that cover our employees | |

| l | Reviews the compensation for our non-employee Directors and recommends compensation for approval by the full Board | |

| l | Provides oversight of the compensation philosophy and policies of the Management Compensation Committee, a non-Board committee composed of Mr. Gorsky (Chairman/CEO), Mr. Joseph J. Wolk (Executive Vice President, Chief Financial Officer) and Dr. Peter M. Fasolo (Executive Vice President, Chief Human Resources Officer), which, under delegation from the Compensation & Benefits Committee, determines management compensation and establishes perquisites and other compensation policies for employees other than our executive officers | |

| The Compensation & Benefits Committee has retained Frederic W. Cook & Co., Inc. as its independent compensation consultant for matters related to executive officer and non-employee Director compensation. For further discussion of the role of the Compensation & Benefits Committee in the executive compensation decision-making process and a description of the nature and scope of the consultant’s assignment, see “Governance of Executive Compensation” on page 70. | ||

2020 Proxy Statement - 22 | ||

| l | Oversees matters of corporate governance, including the evaluation of the policies and practices of the Board and the Board leadership structure | |

| l | Oversees the process for performance evaluations of the Board and its Committees | |

| l | Reviews our executive succession plans | |

| l | Evaluates any questions of possible conflicts of interest for the Board and Executive Committee members | |

| l | Reviews potential candidates for the Board as discussed on page 10 and recommends Director nominees to the Board for approval | |

| l | Reviews and recommends Director orientation and continuing education programs for Board members | |

| l | Oversees compliance with the Code of Business Conduct & Ethics for Members of the Board of Directors and Executive Officers | |

| l | Evaluates our Board leadership structure on an annual basis | |

| l | Oversees regulatory compliance and adherence to high-quality standards in the areas of healthcare compliance, anti-corruption laws, and the manufacture and supply of products | |

| l | Compliance with applicable laws, regulations and Company policies related to medical safety, product quality, environmental regulations, employee health and safety, privacy, cybersecurity and political expenditures | |

| l | Reviews the policies, practices and priorities for our political expenditure and lobbying activities | |

| l | Oversees our compliance with privacy regulations | |

| l | Oversees our risk management programs related to global cybersecurity, information security, product quality, and technology | |

| l | Monitors and reviews the overall strategy, priorities and effectiveness of the research and development organizations supporting our businesses | |

| l | Serves as a resource and provides input as needed regarding the scientific and technological aspects of product- safety matters | |

| l | Assists the Board in identifying and comprehending significant emerging science and technology policy and public health issues and trends that may impact our overall business strategy | |

| l | Assists the Board in its oversight of our major acquisitions and business development activities as they relate to the acquisition or development of new science or technology | |

| l | Oversees our environmental, social and governance (ESG) policies and programs designed to promote sustainable business practices and to mitigate risks related to employee health, safety and sustainability, including our external citizenship and sustainability commitments and our annual Health for Humanity Report | |

| l | Composed of the Chairman and Lead Director of the Board | |

| l | Exercises the authority of the Board during the intervals between Board meetings, as permitted by law and our By‑Laws | |

| l | Acts between Board meetings as needed, generally by unanimous written consent in lieu of a meeting | |

| l | Any action is taken pursuant to specific advance delegation by the Board or is later ratified by the Board | |

2020 Proxy Statement - 23 | ||

| • | Board Evaluations: At the end of 2019, the Chairman and the Lead Director met with each Director individually to collect feedback on the Board’s responsibilities, structure, composition, procedures, priorities, culture and engagement. Directors also have the opportunity to provide anonymous written comments through secure technology to enable additional candid feedback, and most Directors did provide anonymous written comments. In all cases, input from the evaluations was summarized and discussed with the full Board. The results of the evaluations were positive and affirming, with only minor administrative action items to address. |

| • | Committee Evaluations: Committee members complete a written questionnaire to facilitate self-evaluation during an Executive Session of the Committee. Upon completion of the self-evaluation, the Committee Chair shares the results with the full Board, including any follow-up actions. |

2020 Proxy Statement - 24 | ||

| • | The Board conducts an extensive review of our long-term strategic plans on an annual basis. The Board also reviews the long-term strategic plans of each of our business segments. | |

| • | Throughout the year, the Board reviews and discusses matters related to our strategy with senior management to ensure that our operations are aligned with our long-term strategy. | |

| • | Independent Directors hold regularly scheduled Executive Sessions without management present to discuss Company performance and review alignment with long-term strategy. Certain Committees also meet in private session with senior management in our financial, legal, compliance and quality functions, among others. | |

| • | The Board regularly discusses and reviews global economic, geopolitical, socioeconomic, industry and regulatory trends and the competitive environment. The Board also considers feedback on strategy from our shareholders and other stakeholders to ensure that our short- and long-term strategies are appropriately designed to promote long-term growth. | |

| • | The Board consults with external advisors to understand outside perspectives on the risks and opportunities facing our Company. | |

2020 Proxy Statement - 25 | ||

| • | The Board reviews and discusses strategic, operational, financial and reporting, reputational and compliance risks. | |

| • | Throughout the year, the Board and the applicable Committees receive updates from management regarding various enterprise risk management issues and risks related to our business segments, including risks related to drug pricing, litigation, product quality and safety, reputation and sustainability. | |

| • | The Board consults with external advisors, including outside counsel, consultants and industry experts, to ensure that it is well informed about the risks and opportunities facing our Company. | |

| • | Independent Directors hold regularly scheduled Executive Sessions without management present to discuss our risk management practices and risks facing our Company and our businesses. In certain Committees, independent Directors also meet in private session with management and compliance leaders. | |

| • | In addition, the Board has tasked designated Committees of the Board to assist with the oversight of certain categories of risk management, and the Committees report to the full Board on these matters following Committee meetings. Each Committee reviews its charter on an annual basis to ensure oversight is evolving with the business. | |

| ||||

2020 Proxy Statement - 26 | ||

Responsibility for identifying environmental, social and governance (ESG) risks is integrated across the enterprise and managed by the Enterprise Governance Council (the Council). The Council is composed of senior leaders who represent our three business segments, our independent compliance functions and our enterprise functions with the ability to impact ESG issues. The Council and management reference the ERM to identify potential ESG risks relevant to our Company. The Council monitors these risks on a quarterly basis to ensure a clear and comprehensive view of existing and emerging ESG risks, identify controls, and help establish mitigation plans to address those risks. The Council reviews the outcomes of these assessments in its ESG priority topics scorecard review. For more information, please see our Health for Humanity Report at healthforhumanityreport.jnj.com. The Science, Technology & Sustainability (STS) Committee is primarily responsible for overseeing ESG risk. However, because ESG risk assessment is an integral part of our overall approach to risk management, ESG risks are reviewed and evaluated by the Board and its Committees as part of their ongoing risk oversight of our Company. For example, the Regulatory Compliance Committee meets with the Chief Quality Officer to review our product quality program and key metrics on a quarterly basis. Extensive disclosure on our product quality programs is also provided in our annual Health for Humanity Report. Please see “Board Oversight of Risk Management” on page 26. The STS Committee oversees our ESG priorities and disclosures on an annual basis. The STS Committee reviews the ESG disclosures in our annual Health for Humanity Report and evaluates our progress against our Health for Humanity 2020 Goals. The STS Committee oversees certain Council initiatives on an annual basis and our overall citizenship and sustainability efforts, including our results as measured by the Access to Medicines Index. The STS Committee updates the full Board on these matters, including our Access to Medicines and Global Public Health strategy. By integrating ESG risk into the responsibilities of the STS Committee, which also oversees research and development, we ensure that ESG considerations are integrated in our product development process from its earliest stages. | Significant Recognitions: | |

| ||

| ||

| ||

| ||

2020 Proxy Statement - 27 | ||

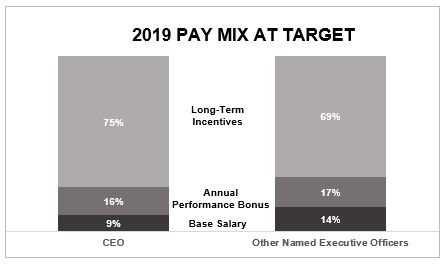

| Key Elements of Our Executive Compensation Programs | ||

| Balanced performance-based awards | Performance-based awards are based on the achievement of strategic and leadership objectives in addition to financial metrics | |

| Multi-year Performance Period and Vesting | The performance period and vesting schedules for long-term incentives overlap and, therefore, reduce the motivation to maximize performance in any one period. Performance share units, restricted share units, and options vest three years from the grant date | |

| Balanced Mix of Pay Components | The target compensation mix is not overly weighted toward annual incentive awards and represents a balance of cash and long-term equity compensation vesting over three years | |

| Capped Incentive Awards | Annual performance bonuses and long-term incentive awards are capped at 200% of target | |

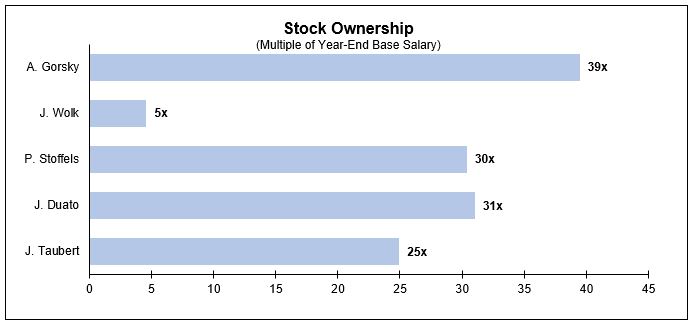

| Stock Ownership Guidelines | Our CEO must directly or indirectly own equity in our Company equal to six times base salary, and the other members of our Executive Committee must own equity equal to three times base salary and retain this level of ownership at all times while serving as an Executive Committee member | |

| No Change in Control Arrangements | None of our executive officers have in place any change-in-control arrangements that would result in guaranteed payouts | |

| Compensation Recoupment Policy | The Board has the authority to recoup executive officers’ past compensation in the event of a material restatement of our financial results and for significant misconduct of Company policy or laws relating to the manufacturing, sales or marketing of our products | |

On a biennial basis, we conduct the Our Credo Survey, which assesses the degree to which senior leadership demonstrates Our Credo values. In the interim years, we conduct the Our Voice Employee Survey, which measures important aspects of our culture such as employee engagement, inclusion, development, health and wellness, collaboration, execution, innovation, and compliance and risk. The results of both surveys are closely reviewed by senior leadership and Human Resources, and managers are provided with detailed anonymized reports highlighting their team results, strengths and areas where an improvement plan is recommended. In 2019, the Company conducted the Our Voice Employee Survey. Our overall participation rate was 87%, 3% higher than in 2017. Our overall results have increased to 81% favorable. We benchmark our performance on the Our Voice Employee Survey with the Mayflower group, which is a consortium of top tier, global companies dedicated to employee surveys. We are in the top quartile of Mayflower companies on recommending the company as a great place to work and wanting to stay with the company, which are critical components of employee engagement. The results of each survey are reviewed with the Board. | A few highlights from the 2019 Our Voice Survey: | |||

| 95% | I am willing to give extra effort to help J&J meet its goals. | |||

| 87% | I would recommend J&J as a great place to work. | |||

| 91% | I would like to be working at J&J one year from now. | |||

2020 Proxy Statement - 28 | ||

A Note about Litigation: Patient safety and product quality have always been and will remain our first priority, and our employees around the globe are committed to ensuring that our products are safe and of high quality. Our Quality and Compliance organization, led by our Chief Quality Officer, implements quality processes and procedures designed to ensure that our products meet our quality standards, which meet or exceed industry requirements. You can learn more about our quality processes at https://healthforhumanityreport.jnj.com/responsible-business-practices/product-quality-safety-reliability. In addition, our Medical Safety organization, which is led by our Chief Medical Safety Officer, monitors our products from research and development through clinical trials, as well as pre- and post- regulatory approvals. This team of doctors and scientists prioritizes our patient experience and ensures that safety remains our first consideration in any decision along the value chain involving the quality or safety of our products. We recognize that there are many factors that contribute to the decision to commence litigation, many of which are not related to product quality or patient safety. Furthermore, jury verdicts are not medical, scientific or regulatory conclusions about our products. When faced with litigation, our approach will depend on the facts and circumstances. Regarding the ongoing talc and opioids litigation: • We are committed to defending the safety of JOHNSON'S® Baby Powder. Please see factsabouttalc.com for information on the safety of talc.• We acted responsibly in selling approved opioid-based pain medicines that met real patient needs and were designed and labeled to reduce abuse and misuse. As previously announced, the Company and its U.S.-based Janssen Pharmaceutical Companies have entered into an agreement in principle to settle opioid litigation. Please see factsaboutourprescriptionopioids.com for information on our position regarding ongoing litigation.We deeply sympathize with those suffering from any medical condition. Our focus remains on delivering life-saving and life-changing treatments and solutions to our patients and customers around the world. |

2020 Proxy Statement - 29 | ||

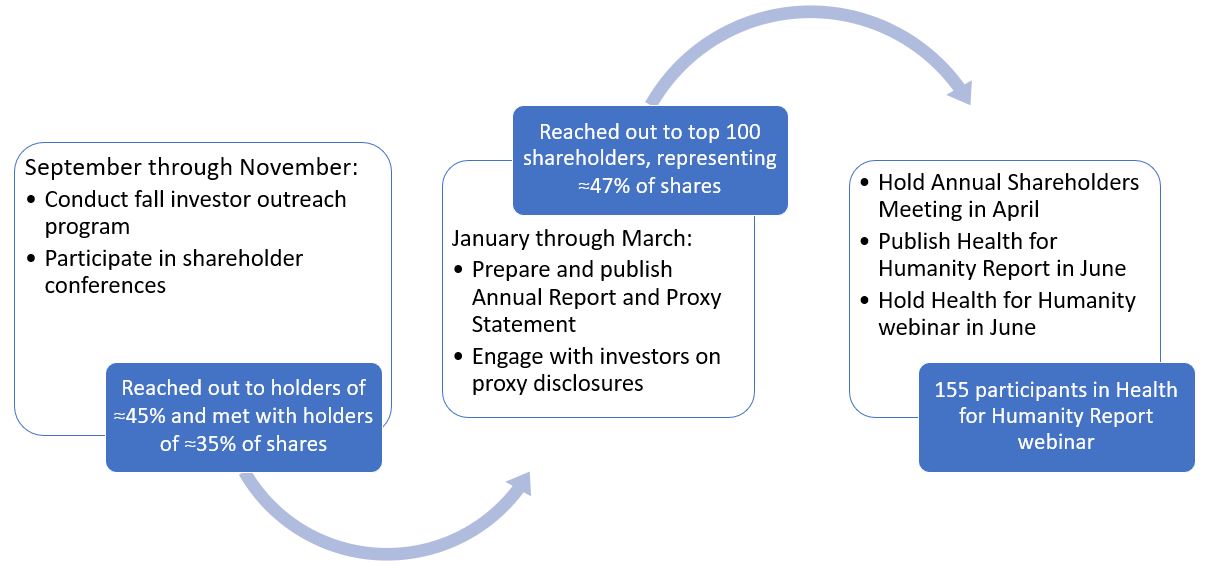

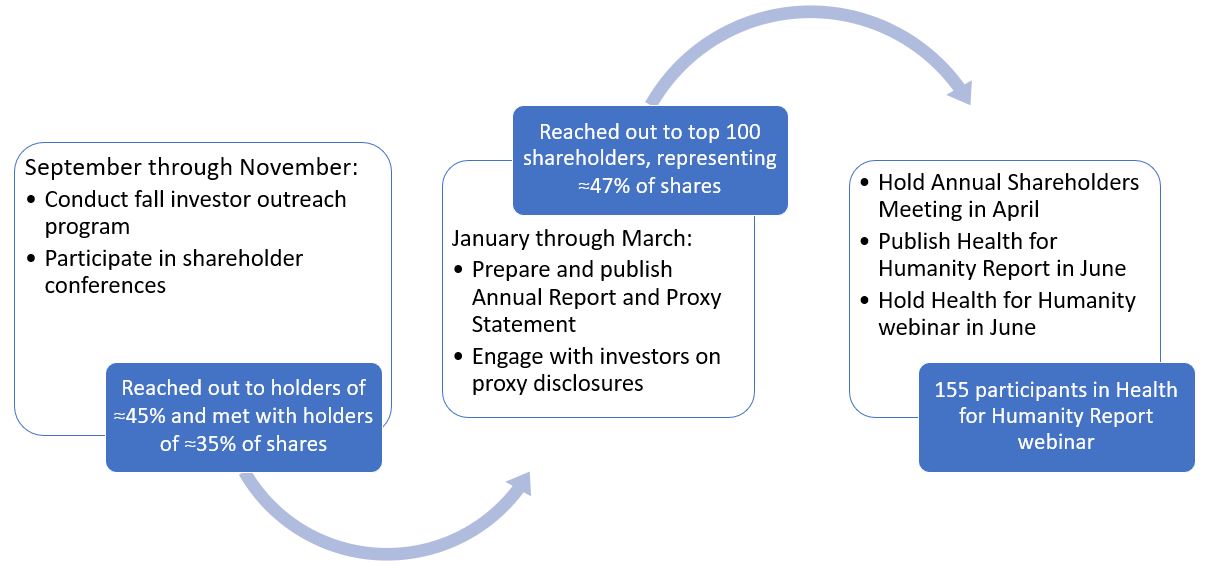

| Our Approach to Shareholder Engagement | |||

| l | Our shareholder engagement program occurs primarily in the fall of each calendar year. In early summer, the governance team reviews the voting results from the prior Annual Shareholders’ Meeting, our current performance and the external environment, as well as trends in corporate governance and executive compensation, to develop a plan for shareholder engagement during the fall. We review the plan with our outside advisors to ensure that our program is appropriately inclusive and focused on topics of greatest interest to our shareholders. During the fall engagement season: | ||

l l | We reached out to shareholders representing approximately 45% of our shares outstanding and approximately 64% of our institutional ownership. We met with approximately 115 U.S. and international institutional shareholders representing approximately 35% of our shares outstanding and approximately 50% of our institutional ownership. | ||

| l | Prior to the 2019 Annual Meeting, we reached out to our top 100 shareholders, who represent approximately 47% of our outstanding shares, and sought a dialogue and feedback on the items of business and disclosure in our 2019 Proxy Statement. | ||

| l | We include a section on our voting card inviting all shareholders to share comments with the Board. Prior to the 2019 Annual Meeting,151 shareholders provided comments. Shareholders may contact any of our Directors, including the Lead Director, using any of the options described on page 111. | ||

| l | We hosted our second annual Health for Humanity Report webinar coinciding with the release of our annual Health for Humanity Report in June 2019, which documents our progress in citizenship and sustainability. The webinar provided shareholders with the opportunity to engage and ask questions of our leaders in areas of Investor Relations, Product Quality, Medical Safety, Legal, Global Public Health and Environmental Health, Safety and Sustainability. | ||

| l | We continually share feedback from our shareholders with the Board for their consideration. | ||

| OUR ANNUAL SHAREHOLDER ENGAGEMENT CYCLE | |||

| |||

2020 Proxy Statement - 30 | ||

| l | Board Composition and Diversity | l | Executive Compensation and Compensation Metrics | ||

| l | Board Evaluation Process | l | Lead Director Responsibilities | ||

| l | Board Oversight of Risk | l | Litigation | ||

| l | Shareholder Engagement and Communication | l | Product Quality and Safety | ||

| l | Board Tenure and Refreshment | l | Pharmaceutical Pricing Transparency and Access | ||

| l | Succession Planning and Talent Development | l | Separation of the Chairman and CEO Roles | ||

| l | Culture and Human Capital Management | l | Shareholder Proposals | ||

| l | Environment, Social and Governance Reporting | l | Tax Policy | ||

| What We Heard | What We Did | |

| Provide more disclosure on your approach to risk oversight and include information on ESG risk. | We have expanded disclosure on Oversight of Strategy, Risk and Human Capital Management to more clearly describe our approach to risk oversight, including oversight of ESG matters (pages 25 to 29). | |

| Commit to disclose if the Board determines that it is appropriate to recoup executive compensation. | We committed to provide disclosure in the subsequent proxy statement if the Board determines to recoup executive compensation in accordance with our recoupment policy (page 73). | |

| Disclosure on talc litigation in your 2019 Proxy Statement was helpful. Please expand it to include opioids. | We have expanded this disclosure to also include the opioid litigation (page 29). | |

| Clearly identify skills in Director biographies that are relevant to your Company. | We have revised the Director biographies to simplify presentation and better emphasize the relevant skills that each Director brings to the Board (pages 10 to 16). | |

| Disclose how risks related to public concern over drug pricing strategies are integrated into your executive compensation programs. | We expanded our disclosure on how the Board oversees risks related to executive compensation, including risks related to drug pricing (pages 27 and 28). | |

| Avoid paying supplemental severance, but do not make a commitment to never do so in the future. | We will provide severance benefits within the parameters of our existing plans, and, based on shareholder feedback, we will retain flexibility if additional actions are required by the circumstances (pages 48 and 49). | |

| Add more structure to your annual incentives. | We redesigned our executives' 2020 annual incentives with clear weightings on financial and strategic goals and identified threshold, target and maximum levels of financial performance and payout (pages 48 and 49). | |

| Use only three-year measures in three-year Performance Share Units (PSUs). Discontinue using three one-year sales measures. | We redesigned our PSUs to be based on three-year adjusted operational EPS and three-year relative TSR (each weighted 50%) beginning with our 2020 awards (pages 48 and 49). | |

2020 Proxy Statement - 31 | ||

| Effective Board Structure and Composition | ||

| Strong Independent Board Leadership | All Directors other than our Chairman/CEO are independent. All Committees other than the Finance Committee are comprised solely of independent Directors. | |

| Independent Lead Director | The independent Directors appoint a Lead Director on an annual basis. | |

| Annual Review of Board Leadership | The Nominating & Corporate Governance Committee conducts an annual review of the Board leadership structure to ensure effective Board leadership. | |

| Executive Sessions of Independent Directors | Independent Directors meet in Executive Session without management present at each Board and Committee meeting. | |

| Private Committee Sessions with Key Compliance Leaders | Independent Directors hold private Committee sessions with key compliance leaders without the Chairman/CEO present. | |

| Rigorous Board and Committee Evaluations | The Board evaluates its performance on an annual basis. Each Committee evaluates its performance on an annual basis based on guidance from the Nominating & Corporate Governance Committee. | |

| Regular Board Refreshment | The Board’s balanced approach to refreshment results in an effective mix of experienced and new Directors. | |

| Diverse and Skilled Board | The Board is committed to diversity, reflecting differences in skills, regional and industry experience, background, race, ethnicity, gender and other unique characteristics. | |

| Responsive and Accountable to Shareholders | ||

| Annual Election of Directors | Each Director is elected annually to ensure accountability to our shareholders. | |

| Majority Voting Standard for Director Elections | In an election where the number of Directors nominated does not exceed the total number of Directors to be elected, Director nominees must receive the affirmative vote of a majority of votes cast to be elected. If a Director nominee receives more votes “against” his or her election than votes “for” his or her election, the Director must promptly offer his or her resignation. | |