UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2031

MFS SERIES TRUST V

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: September 30

Date of reporting period: March 31, 2008

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

MFS® International New Discovery Fund

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ

NO BANK OR CREDIT UNION GUARANTEE Ÿ NOT A DEPOSIT Ÿ

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR

NCUA/NCUSIF

3/31/08

MIO-SEM

LETTER FROM THE CEO

Dear Shareholders:

Many of our MFS® fund shareholders have been justifiably concerned, as have most investors around the world, about the state of the global economy. As we enter 2008 we see the market volatility that began in the third quarter of 2007 has intensified.

We here at MFS, and those before us who guided the firm with the same disciplined investment process, have weathered many major economic disruptions over our eight-plus decades of managing clients’ investments. We have managed money through the Great Depression, 14 recessions, as well as numerous market crises caused by wars, political upheavals, and terrorist attacks. MFS remains in business because our investors believe in the integrity of our long-term investment strategy and its proven results.

Worries over market volatility are valid, and investors cannot always expect to see the kind of returns stocks have delivered in the bull markets of past years. Yet we believe our strategy of ADR — allocating across the major asset classes, diversifying within each class, and regularly rebalancing your portfolio to maintain your desired allocation — can help you pursue the highest investment returns while minimizing the effects of market fluctuations.

MFS is a world leader in domestic and global investing. Our team approach is research driven, globally integrated, and balanced. We have 176 investment management professionals located in the Americas, Europe, and Asia who focus on the fundamentals of each security and then integrate our sophisticated quantitative approach.* This collaborative process allows us to find opportunities in any market environment.

I personally would like to thank you for your continued business. We want you to be confident that we are constantly managing our fund offerings with you in mind, while adding new products that can help you to choose what fits your unique financial goals.

Respectfully,

Robert J. Manning

Chief Executive Officer and Chief Investment Officer

MFS Investment Management®

May 15, 2008

* as of 12/31/07

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

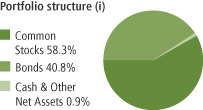

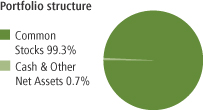

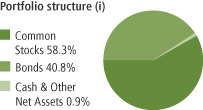

PORTFOLIO COMPOSITION

| | |

| Top ten holdings | | |

| Linde AG | | 1.5% |

| Christian Dior S.A. | | 1.5% |

| Symrise AG | | 1.3% |

| Synthes, Inc. | | 1.2% |

| TNT N.V. | | 1.1% |

| Konica Minolta Holdings, Inc. | | 1.1% |

| Catlin Group Ltd. | | 1.0% |

| Royal KPN N.V. | | 1.0% |

| Geberit AG | | 1.0% |

| Uni-Charm Corp. | | 0.9% |

| | |

| Equity sectors | | |

| Financial Services | | 20.0% |

| Industrial Goods & Services | | 10.3% |

| Technology | | 10.0% |

| Health Care | | 9.5% |

| Utilities & Communications | | 8.2% |

| Basic Materials | | 7.9% |

| Consumer Staples | | 7.0% |

| Special Products & Services | | 5.9% |

| Energy | | 5.7% |

| Autos & Housing | | 4.6% |

| Leisure | | 4.2% |

| Transportation | | 3.4% |

| Retailing | | 2.1% |

| |

| Country weightings | | |

| Japan | | 17.4% |

| United Kingdom | | 12.2% |

| Germany | | 10.5% |

| France | | 6.8% |

| United States | | 5.8% |

| Netherlands | | 4.8% |

| Switzerland | | 4.2% |

| Mexico | | 3.2% |

| Canada | | 3.1% |

| Other Countries | | 32.0% |

Percentages are based on net assets as of 3/31/08.

The portfolio is actively managed and current holdings may be different.

2

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, October 1, 2007 through March 31, 2008

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period October 1, 2007 through March 31, 2008.

The expenses include the payment of a portion of the transfer-agent-related expenses of MFS funds that invest in the fund. For further information, please see the Notes to the Financial Statements.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

3

Expense Table – continued

| | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | Beginning

Account Value

10/01/07 | | Ending

Account Value

3/31/08 | | Expenses

Paid During

Period (p)

10/01/07-3/31/08 |

| A | | Actual | | 1.44% | | $1,000.00 | | $896.06 | | $6.83 |

| | Hypothetical (h) | | 1.44% | | $1,000.00 | | $1,017.80 | | $7.26 |

| B | | Actual | | 2.14% | | $1,000.00 | | $892.94 | | $10.13 |

| | Hypothetical (h) | | 2.14% | | $1,000.00 | | $1,014.30 | | $10.78 |

| C | | Actual | | 2.14% | | $1,000.00 | | $893.00 | | $10.13 |

| | Hypothetical (h) | | 2.14% | | $1,000.00 | | $1,014.30 | | $10.78 |

| I | | Actual | | 1.14% | | $1,000.00 | | $897.40 | | $5.41 |

| | Hypothetical (h) | | 1.14% | | $1,000.00 | | $1,019.30 | | $5.76 |

| R | | Actual | | 1.64% | | $1,000.00 | | $895.17 | | $7.77 |

| | Hypothetical (h) | | 1.64% | | $1,000.00 | | $1,016.80 | | $8.27 |

| R1 | | Actual | | 2.23% | | $1,000.00 | | $892.39 | | $10.55 |

| | Hypothetical (h) | | 2.23% | | $1,000.00 | | $1,013.85 | | $11.23 |

| R2 | | Actual | | 1.77% | | $1,000.00 | | $894.88 | | $8.38 |

| | Hypothetical (h) | | 1.77% | | $1,000.00 | | $1,016.15 | | $8.92 |

| R3 | | Actual | | 1.72% | | $1,000.00 | | $894.61 | | $8.15 |

| | Hypothetical (h) | | 1.72% | | $1,000.00 | | $1,016.40 | | $8.67 |

| R4 | | Actual | | 1.47% | | $1,000.00 | | $895.71 | | $6.97 |

| | Hypothetical (h) | | 1.47% | | $1,000.00 | | $1,017.65 | | $7.41 |

| R5 | | Actual | | 1.19% | | $1,000.00 | | $897.20 | | $5.64 |

| | Hypothetical (h) | | 1.19% | | $1,000.00 | | $1,019.05 | | $6.01 |

| 529A | | Actual | | 1.74% | | $1,000.00 | | $894.72 | | $8.24 |

| | Hypothetical (h) | | 1.74% | | $1,000.00 | | $1,016.30 | | $8.77 |

| 529B | | Actual | | 2.39% | | $1,000.00 | | $891.56 | | $11.30 |

| | Hypothetical (h) | | 2.39% | | $1,000.00 | | $1,013.05 | | $12.03 |

| 529C | | Actual | | 2.39% | | $1,000.00 | | $891.50 | | $11.30 |

| | Hypothetical (h) | | 2.39% | | $1,000.00 | | $1,013.05 | | $12.03 |

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid is equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Effective January 1, 2008 the fund’s Class R2, Class R3, Class R4, and Class R5 retirement plan administration and service fee was terminated (as described in Note 3 of the Notes to the Financial Statements). Had this fee not been in effect throughout the entire six month period, the annualized expense ratios would have been 1.64%, 1.64%, 1.39% and 1.13% for Class R2, Class R3, Class R4 and Class R5 shares respectively. The

4

Expense Table – continued

actual expenses paid during the period would have been approximately $7.80, $7.79, $6.61, and $5.38 and the hypothetical expenses paid during the period would have been approximately $8.29, $8.29, $7.03 and $5.72 for Class R2, Class R3, Class R4 and Class R5 shares, respectively.

Effective March 1, 2008 the fund’s Class R1 retirement plan administration and service fee were terminated and the Class R1 distribution fee was increased (as described in Note 3 of the Notes to the Financial Statements). Had these fee changes been in effect throughout the entire six month period, the annualized expense ratio would have been 2.14%. The actual expenses paid during the period would have been approximately $10.16 and the hypothetical expenses paid during the period would have been approximately $10.81.

Effective April 1, 2008 the fund’s Class 529A, 529B, and 529C shares program manager fee was reduced (as described in Note 3 of the Notes to Financial Statements). Had this fee change been in effect throughout the entire six month period, the annualized expense ratio would have been 1.59%, 2.24% and 2.24% for Class 529A, 529B and 529C shares, respectively. The actual expenses paid during the period would have been approximately $7.56, $10.63 and $10.63 and the hypothetical expenses paid during the period would have been approximately $8.04, $11.31 and $11.31 for Class 529A, Class 529B and Class 529C shares, respectively.

Note to Shareholders: On April 18, 2008, Class R shares and Class R2 shares were converted into Class R3 shares. After the conversion, Class R3, Class R4, and Class R5 were renamed Class R2, Class R3, and Class R4, respectively.

5

PORTFOLIO OF INVESTMENTS

3/31/08 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | |

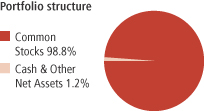

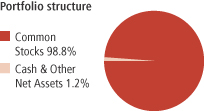

| Common Stocks - 98.8% | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Aerospace - 0.7% | | | | | |

| Cobham PLC | | 3,293,176 | | $ | 13,060,406 |

| Finmeccanica S.p.A. | | 227,400 | | | 7,731,067 |

| Meggitt PLC | | 960,566 | | | 5,252,359 |

| | | | | |

| | | | | $ | 26,043,832 |

| Airlines - 1.1% | | | | | |

| Arriva PLC | | 769,750 | | $ | 10,470,937 |

| Copa Holdings S.A. | | 696,300 | | | 26,535,992 |

| Tam S.A., ADR (l) | | 305,400 | | | 5,860,625 |

| | | | | |

| | | | | $ | 42,867,554 |

| Alcoholic Beverages - 0.7% | | | | | |

| Grupo Modelo S.A. de C.V., “C” | | 4,238,400 | | $ | 18,553,326 |

| Pernod Ricard S.A. | | 60,720 | | | 6,244,766 |

| | | | | |

| | | | | $ | 24,798,092 |

| Apparel Manufacturers - 0.8% | | | | | |

| Adidas AG | | 142,396 | | $ | 9,464,253 |

| Burberry Group PLC | | 279,600 | | | 2,497,720 |

| Li & Fung Ltd. | | 4,473,000 | | | 16,736,887 |

| | | | | |

| | | | | $ | 28,698,860 |

| Automotive - 1.4% | | | | | |

| Bridgestone Corp. | | 1,284,800 | | $ | 21,940,737 |

| Continental AG | | 171,657 | | | 17,499,680 |

| Kongsberg Automotive A.S.A (l) | | 261,000 | | | 1,465,242 |

| Yamaha Motor Co. Ltd. (l) | | 758,500 | | | 14,016,392 |

| | | | | |

| | | | | $ | 54,922,051 |

| Biotechnology - 1.1% | | | | | |

| Actelion Ltd. (a)(l) | | 313,229 | | $ | 17,073,180 |

| CSL Ltd. | | 688,155 | | | 23,205,258 |

| | | | | |

| | | | | $ | 40,278,438 |

| Broadcasting - 2.3% | | | | | |

| Fuji Television Network, Inc. | | 14,127 | | $ | 20,998,333 |

| Grupo Televisa S.A., ADR | | 1,279,280 | | | 31,009,747 |

| Societe Television Francaise 1 | | 258,956 | | | 5,693,514 |

6

Portfolio of Investments (unaudited) – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | |

| Broadcasting - continued | | | | | |

| WPP Group PLC | | 2,423,460 | | $ | 28,881,656 |

| | | | | |

| | | | | $ | 86,583,250 |

| Brokerage & Asset Managers - 3.2% | | | | | |

| Aberdeen Asset Management PLC | | 876,300 | | $ | 2,406,658 |

| Bolsa de Mercadorias & Futuros | | 1,357,500 | | | 12,398,322 |

| Daiwa Securities Group, Inc. (l) | | 2,741,000 | | | 23,848,432 |

| Deutsche Boerse AG | | 104,950 | | | 16,901,048 |

| IG Group Holdings PLC | | 3,252,386 | | | 21,105,396 |

| Julius Baer Holding Ltd. | | 118,501 | | | 8,731,464 |

KBC Ancora NPV | | 40,253 | | | 4,139,831 |

| Rathbone Brothers PLC | | 1,368,718 | | | 28,769,453 |

| Van Lanschot N.V. (l) | | 34,657 | | | 3,623,933 |

| | | | | |

| | | | | $ | 121,924,537 |

| Business Services - 4.6% | | | | | |

| Amadeus Fire AG | | 243,158 | | $ | 5,541,905 |

| Bunzl PLC | | 2,151,947 | | | 30,275,807 |

| Electrocomponents PLC | | 1,154,800 | | | 4,161,913 |

| Experian Group Ltd. | | 2,011,964 | | | 14,641,920 |

| Intelligence NPV | | 1,394 | | | 1,313,842 |

| Intertek Group PLC | | 1,180,948 | | | 24,166,972 |

| JFE Shoji Holdings, Inc. (l) | | 3,712,000 | | | 26,477,990 |

| Kloeckner & Co. AG | | 373,607 | | | 19,111,613 |

| LPS Brasil - Consultoria de Imoveis S.A. | | 247,761 | | | 4,412,560 |

| Satyam Computer Services Ltd., ADR | | 1,445,700 | | | 32,658,363 |

| TAKKT AG | | 314,000 | | | 5,644,906 |

| USS Co. Ltd. (l) | | 124,810 | | | 8,687,177 |

| | | | | |

| | | | | $ | 177,094,968 |

| Cable TV - 0.1% | | | | | |

| NDS Group PLC, ADR (a) | | 61,500 | | $ | 3,005,505 |

| | |

| Chemicals - 0.8% | | | | | |

| Hoganas AB (l) | | 165,700 | | $ | 3,938,698 |

| Makhteshim-Agan Industries Ltd. | | 1,399,900 | | | 10,256,436 |

| Syngenta AG | | 36,200 | | | 10,603,654 |

| Victrex PLC | | 304,105 | | | 4,528,718 |

| | | | | |

| | | | | $ | 29,327,506 |

| Computer Software - 0.4% | | | | | |

| Trend Micro, Inc. (l) | | 354,500 | | $ | 14,095,531 |

7

Portfolio of Investments (unaudited) – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | |

| Computer Software - Systems - 2.1% | | | | | |

| Cap Gemini S.A. | | 132,719 | | $ | 7,555,837 |

| Detica Group PLC | | 174,500 | | | 863,332 |

| Fujitsu Ltd. | | 3,838,000 | | | 25,188,553 |

| HCL Technologies Ltd. | | 2,303,880 | | | 14,542,812 |

| Indra Sistemas S.A. (l) | | 99,200 | | | 2,855,879 |

| Obic NPV | | 55,240 | | | 9,820,770 |

| Wincor Nixdorf AG | | 264,081 | | | 21,132,381 |

| | | | | |

| | | | | $ | 81,959,564 |

| Conglomerates - 1.0% | | | | | |

| DCC PLC | | 151,000 | | $ | 3,563,046 |

| First Pacific Co. Ltd. | | 21,034,000 | | | 13,943,331 |

| Smiths Group PLC | | 177,066 | | | 3,300,462 |

| ThyssenKrupp AG | | 300,420 | | | 17,183,845 |

| | | | | |

| | | | | $ | 37,990,684 |

| Construction - 3.2% | | | | | |

| Corporacion Moctezuma S.A. de C.V. | | 1,005,500 | | $ | 2,403,830 |

| CRH PLC | | 452,000 | | | 17,179,014 |

| Geberit AG | | 252,842 | | | 37,667,337 |

| Kaufman & Broad S.A. (l) | | 60,200 | | | 2,465,683 |

| Nexity International | | 319,572 | | | 13,729,672 |

| SARE Holding S.A. de C.V., “B” | | 15,835,567 | | | 21,881,658 |

| Schindler Holding AG (l) | | 79,090 | | | 5,923,092 |

| Wienerberger AG | | 413,746 | | | 22,000,783 |

| | | | | |

| | | | | $ | 123,251,069 |

| Consumer Goods & Services - 4.8% | | | | | |

| Beiersdorf AG (l) | | 87,000 | | $ | 7,317,594 |

| Christian Dior S.A. | | 502,000 | | | 55,550,375 |

| Hengan International Group Co. Ltd. | | 3,358,000 | | | 11,520,688 |

| Henkel KGaA, IPS (l) | | 199,200 | | | 9,205,846 |

| Kao Corp. | | 784,000 | | | 22,206,848 |

| Kimberly-Clark de Mexico S.A. de C.V., “A” | | 6,092,690 | | | 27,019,482 |

| Kose Corp. | | 82,700 | | | 1,786,920 |

| Natura Cosmeticos S.A. NPV | | 752,300 | | | 7,686,828 |

| Societe BIC S.A. | | 60,379 | | | 3,722,387 |

| Uni-Charm Corp. | | 491,800 | | | 36,147,600 |

| | | | | |

| | | | | $ | 182,164,568 |

| Containers - 0.4% | | | | | |

| DS Smith PLC | | 1,043,200 | | $ | 3,237,380 |

| Mayr-Melnhof Karton AG NPV | | 50,301 | | | 5,074,774 |

8

Portfolio of Investments (unaudited) – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | |

| Containers - continued | | | | | |

| Smurfit Kappa PLC | | 153,000 | | $ | 1,840,135 |

| Viscofan SA | | 164,453 | | | 3,766,279 |

| | | | | |

| | | | | $ | 13,918,568 |

| Electrical Equipment - 2.5% | | | | | |

| Halma PLC | | 1,068,936 | | $ | 4,106,815 |

| Hitachi Cable (l) | | 614,000 | | | 2,293,019 |

| Legrand S.A. | | 830,673 | | | 26,051,412 |

| LS Industrial Systems Co. Ltd. | | 323,681 | | | 20,161,602 |

| OMRON Corp. | | 541,100 | | | 11,222,477 |

| Prysmian S.p.A. | | 793,188 | | | 16,924,818 |

| Saft Groupe S.A. (l) | | 70,500 | | | 2,780,729 |

| Spectris PLC | | 738,080 | | | 10,896,321 |

| | | | | |

| | | | | $ | 94,437,193 |

| Electronics - 7.2% | | | | | |

| Advantest Corp. NPV (l) | | 90,200 | | $ | 2,384,828 |

| ARM Holdings PLC | | 5,804,290 | | | 10,128,463 |

| ASM Pacific Technology Ltd. | | 3,112,000 | | | 22,593,563 |

| Cenit AG Systemhaus | | 54,200 | | | 611,658 |

| Delta Electronics, Inc. | | 3,595,000 | | | 10,656,786 |

| Flextronics International Ltd. (a) | | 1,883,240 | | | 17,683,624 |

| Funai Electric Co. Ltd. (l) | | 279,400 | | | 9,608,884 |

| Hirose Electric Co. Ltd. (l) | | 198,600 | | | 22,362,716 |

| Hoya Corp. | | 85,400 | | | 2,023,155 |

| Konica Minolta Holdings, Inc. (l) | | 2,998,500 | | | 41,322,860 |

| Melexis N.V. (l) | | 184,500 | | | 3,054,746 |

| Nippon Electric Glass Co. Ltd. | | 2,209,000 | | | 34,608,598 |

| Realtek Semiconductor Corp. | | 2,201,725 | | | 6,566,148 |

| Richtek Technology Corp. | | 918,000 | | | 7,399,401 |

| Ricoh Co. Ltd. | | 1,766,000 | | | 29,505,245 |

| SAES Getters S.p.A. (l) | | 113,180 | | | 3,253,528 |

| SUMCO Corp. (l) | | 632,500 | | | 13,793,428 |

| Vacon Oyj (l) | | 88,900 | | | 3,928,829 |

| Venture Corp. Ltd. | | 3,031,000 | | | 23,352,389 |

| Wolfson Microelectronics PLC | | 3,590,450 | | | 8,080,840 |

| | | | | |

| | | | | $ | 272,919,689 |

| Energy - Independent - 2.9% | | | | | |

| Arch Coal, Inc. | | 400,000 | | $ | 17,400,000 |

| Galp Energia SGPS, S.A. | | 317,300 | | | 7,567,246 |

| Niko Resources Ltd. | | 133,400 | | | 10,799,387 |

| OMV AG | | 299,378 | | | 19,779,824 |

9

Portfolio of Investments (unaudited) – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | |

| Energy - Independent - continued | | | | | |

| Peabody Energy Corp. | | 400,000 | | $ | 20,400,000 |

| Talisman Energy, Inc. | | 1,956,350 | | | 34,643,004 |

| | | | | |

| | | | | $ | 110,589,461 |

| Engineering - Construction - 1.5% | | | | | |

| Acciona S.A. | | 30,000 | | $ | 8,033,012 |

| Aker Kvaerner A.S.A | | 330,630 | | | 7,528,404 |

| Koninklijke BAM Groep N.V. | | 368,886 | | | 8,692,712 |

| North American Energy Partners, Inc. (a) | | 1,738,320 | | | 26,665,829 |

| Orascom Construction Industries Co. | | 72,489 | | | 5,466,628 |

| | | | | |

| | | | | $ | 56,386,585 |

| Food & Beverages - 0.8% | | | | | |

| Associated British Foods PLC | | 214,772 | | $ | 3,726,469 |

| Grupo Continental S.A. | | 2,245,300 | | | 5,393,107 |

| Ito EN Ltd. (l) | | 64,000 | | | 1,141,571 |

| Kerry Group PLC | | 657,309 | | | 20,593,654 |

| | | | | |

| | | | | $ | 30,854,801 |

| Food & Drug Stores - 0.6% | | | | | |

| Aeon Co. Ltd. | | 700,000 | | $ | 8,459,665 |

| Axfood AB (l) | | 97,500 | | | 3,470,218 |

| Lawson, Inc. (l) | | 282,200 | | | 12,478,087 |

| | | | | |

| | | | | $ | 24,407,970 |

| Furniture & Appliances - 0.0% | | | | | |

| Ekornes A.S.A. | | 104,600 | | $ | 1,899,224 |

| | |

| Gaming & Lodging - 0.6% | | | | | |

| Ladbrokes PLC | | 1,971,680 | | $ | 12,169,075 |

| William Hill PLC | | 1,435,200 | | | 10,693,581 |

| | | | | |

| | | | | $ | 22,862,656 |

| Health Maintenance Organizations - 0.2% | | | | | |

| Odontoprev S.A. | | 359,200 | | $ | 8,181,111 |

| | |

| Insurance - 4.8% | | | | | |

| Admiral Group PLC | | 1,005,550 | | $ | 16,011,462 |

| Aflac, Inc. | | 64,107 | | | 4,163,750 |

| Amlin PLC | | 3,166,846 | | | 17,065,077 |

| Aspen Insurance Holdings Ltd. | | 769,565 | | | 20,301,125 |

| Cathay Financial Holding Co. Ltd. | | 1,926,000 | | | 4,958,593 |

| Catlin Group Ltd. | | 4,475,880 | | | 39,251,661 |

10

Portfolio of Investments (unaudited) – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | |

| Insurance - continued | | | | | |

| CNP Assurances S.A. | | 233,712 | | $ | 28,802,098 |

| Euler Hermes | | 8,096 | | | 867,904 |

| Hiscox Ltd. | | 4,183,716 | | | 19,848,418 |

| Old Mutual PLC | | 7,853,500 | | | 17,208,273 |

| QBE Insurance Group Ltd. | | 706,151 | | | 14,328,549 |

| | | | | |

| | | | | $ | 182,806,910 |

| Internet - 0.3% | | | | | |

| Iliad S.A. | | 75,000 | | $ | 7,461,255 |

| Universo Online S.A., IPS | | 1,021,300 | | | 4,407,357 |

| | | | | |

| | | | | $ | 11,868,612 |

| Leisure & Toys - 0.7% | | | | | |

| Sankyo Co. Ltd. (l) | | 278,800 | | $ | 16,646,767 |

| Ubisoft Entertainment S.A. | | 96,706 | | | 8,329,342 |

| | | | | |

| | | | | $ | 24,976,109 |

| Machinery & Tools - 5.6% | | | | | |

| Assa Abloy AB, “B” | | 398,000 | | $ | 7,216,758 |

| Bucyrus International, Inc., “A” | | 223,190 | | | 22,687,264 |

| Burckhardt Compression Holding AG | | 69,909 | | | 22,307,266 |

| Demag Cranes AG | | 133,560 | | | 6,096,464 |

| Fenner PLC | | 435,300 | | | 2,028,469 |

| GEA Group AG | | 720,650 | | | 24,227,428 |

| Harsco Corp. | | 464,880 | | | 25,745,054 |

| KCI Konecranes PLC (l) | | 576,992 | | | 22,220,966 |

| Mitsui Mining & Smelting Co. Ltd. | | 4,653,000 | | | 14,743,792 |

| Neopost S.A. (l) | | 205,448 | | | 23,052,272 |

| Rotork PLC | | 136,600 | | | 2,922,698 |

| Sandvik AB | | 259,800 | | | 4,514,098 |

| SKF AB (l) | | 258,200 | | | 5,192,373 |

| Timken Co. | | 1,023,910 | | | 30,430,605 |

| | | | | |

| | | | | $ | 213,385,507 |

| Major Banks - 3.3% | | | | | |

| Banco Santander Chile, ADR | | 363,170 | | $ | 18,979,264 |

| Deutsche Postbank AG | | 206,950 | | | 19,751,892 |

| Erste Bank der oesterreichischen Sparkassen AG (l) | | 311,280 | | | 20,168,226 |

| Natixis S.A. | | 1,216,140 | | | 19,559,650 |

| Raiffeisen International Bank Holding AG | | 143,786 | | | 19,596,669 |

| Sumitomo Trust & Banking Co. Ltd. | | 1,500,000 | | | 10,348,623 |

| Unibanco - Uniao de Bancos Brasileiros S.A., ADR | | 152,540 | | | 17,792,266 |

| | | | | |

| | | | | $ | 126,196,590 |

11

Portfolio of Investments (unaudited) – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | |

| Medical & Health Technology & Services - 0.9% | | | | | |

| Diagnosticos da America S.A. | | 442,300 | | $ | 8,811,411 |

| Kobayashi Pharmaceutical Co. Ltd. | | 152,200 | | | 5,897,789 |

| OPG Groep NV | | 732,689 | | | 20,711,835 |

| | | | | |

| | | | | $ | 35,421,035 |

| Medical Equipment - 3.9% | | | | | |

| Cremer S.A. | | 479,300 | | $ | 3,611,474 |

| Fresenius AG, IPS | | 262,400 | | | 21,846,889 |

| Miraca Holdings, Inc. | | 589,000 | | | 15,477,585 |

| QIAGEN N.V. (l) | | 304,200 | | | 6,289,756 |

| Synthes, Inc. | | 333,020 | | | 46,561,456 |

| William Demant Holdings A/S (l) | | 312,625 | | | 24,979,297 |

| Zimmer Holdings, Inc. (a) | | 397,764 | | | 30,969,905 |

| | | | | |

| | | | | $ | 149,736,362 |

| Metals & Mining - 2.5% | | | | | |

| Cameco Corp. NPV | | 683,270 | | $ | 22,484,423 |

| First Uranium Corp. NPV | | 926,700 | | | 6,866,781 |

| Grupo Mexico S.A.B. de C.V. | | 1,625,000 | | | 10,786,013 |

| Inmet Mining Corp. | | 257,423 | | | 18,774,469 |

| Salzgitter AG | | 109,281 | | | 19,005,975 |

| SSAB Svenskt Stal AB, “A” (l) | | 126,700 | | | 3,560,696 |

| Steel Authority of India Ltd. | | 3,365,124 | | | 15,633,792 |

| | | | | |

| | | | | $ | 97,112,149 |

| Natural Gas - Distribution - 1.3% | | | | | |

| Gaz de France (l) | | 422,120 | | $ | 25,477,518 |

| Tokyo Gas Co. Ltd. (l) | | 5,579,000 | | | 22,593,809 |

| | | | | |

| | | | | $ | 48,071,327 |

| Natural Gas - Pipeline - 0.2% | | | | | |

| Enagas S.A. | | 281,900 | | $ | 8,422,655 |

| | |

| Oil Services - 2.8% | | | | | |

| Acergy S.A. (l) | | 1,227,710 | | $ | 26,448,620 |

| Expro International Group PLC | | 400,000 | | | 9,280,206 |

| Fugro N.V. (l) | | 386,584 | | | 30,014,009 |

| Petrofac Ltd. | | 177,316 | | | 1,972,525 |

| Saipem S.p.A. | | 724,772 | | | 29,296,403 |

| Schoeller-Bleckmann Oilfield Equipment | | 57,250 | | | 5,099,949 |

| Vallourec S.A. (l) | | 18,480 | | | 4,485,149 |

| | | | | |

| | | | | $ | 106,596,861 |

| Other Banks & Diversified Financials - 7.6% | | | | | |

| Aeon Credit Service Co. Ltd. | | 1,962,900 | | $ | 26,359,955 |

| Anglo Irish Bank Corp. PLC | | 2,443,182 | | | 32,584,859 |

12

Portfolio of Investments (unaudited) – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | |

| Other Banks & Diversified Financials - continued | | | | | |

| Babcock & Brown Ltd. | | 379,846 | | $ | 5,153,016 |

| Banco de Oro Universal Bank | | 1,625,700 | | | 2,029,552 |

| Banco Macro S.A., ADR | | 308,200 | | | 7,812,870 |

| Banco Panamericano S.A., IPS | | 1,200,000 | | | 5,308,674 |

| Bancolombia S.A., ADR | | 168,300 | | | 5,967,918 |

| Bank of Cyprus Public Co. Ltd. | | 500,000 | | | 5,918,812 |

| Chiba Bank Ltd. (l) | | 3,238,000 | | | 22,054,434 |

| Close Brothers Group PLC | | 268,400 | | | 3,283,821 |

| Credicorp Ltd. | | 61,900 | | | 4,440,706 |

| Credito Emiliano S.p.A. (l) | | 324,000 | | | 4,293,592 |

| CSU Cardsystem S.A. | | 1,555,990 | | | 4,254,469 |

| Grupo Financiero Banorte S.A. de C.V. | | 1,592,500 | | | 6,902,254 |

| Hachijuni Bank Ltd. (l) | | 1,136,000 | | | 7,293,694 |

| Hana Financial Group, Inc. | | 642,651 | | | 26,424,813 |

| Housing Development Finance Corp. Ltd. | | 324,943 | | | 19,372,554 |

| Komercni Banka A.S. | | 99,919 | | | 23,866,177 |

| OTP Bank Ltd., GDR | | 16,101 | | | 1,315,999 |

| Redecard S.A. NPV | | 456,300 | | | 7,603,046 |

| Sapporo Hokuyo Holdings, Inc. (l) | | 228 | | | 1,593,996 |

| Shizuoka Bank Ltd. (l) | | 2,240,000 | | | 26,740,624 |

| SNS REAAL Groep N.V. | | 975,550 | | | 19,785,907 |

| Unione di Banche Italiane Scpa | | 722,106 | | | 18,495,636 |

| | | | | |

| | | | | $ | 288,857,378 |

| Pharmaceuticals - 3.4% | | | | | |

| Hisamitsu Pharmaceutical Co., Inc. | | 814,100 | | $ | 29,630,350 |

| Ipsen S.A. | | 276,663 | | | 15,702,691 |

| Merck KGaA (l) | | 150,949 | | | 18,600,205 |

| Novo Nordisk A/S, “B” (l) | | 358,515 | | | 24,510,344 |

| STADA Arzneimittel AG (l) | | 278,890 | | | 20,252,959 |

| Tanabe Seiyaku Co. Ltd. (l) | | 1,766,000 | | | 20,557,738 |

| | | | | |

| | | | | $ | 129,254,287 |

| Pollution Control - 0.0% | | | | | |

| Biffa PLC | | 147,078 | | $ | 1,017,124 |

| | |

| Precious Metals & Minerals - 0.3% | | | | | |

| Paladin Resources Ltd. NPV (l) | | 2,607,881 | | $ | 12,206,301 |

| | |

| Printing & Publishing - 0.5% | | | | | |

| Bloomsbury Publishing PLC | | 281,300 | | $ | 920,376 |

| Fimalac S.A. (l) | | 40,800 | | | 2,441,278 |

| Reed Elsevier PLC, ADR | | 712,534 | | | 9,056,813 |

| Schibsted A.S.A. (l) | | 277,950 | | | 8,293,025 |

| | | | | |

| | | | | $ | 20,711,492 |

13

Portfolio of Investments (unaudited) – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | |

| Railroad & Shipping - 0.5% | | | | | |

| Jinhui Shipping & Transportation Ltd. | | 1,173,500 | | $ | 11,425,296 |

| SMRT Corp. Ltd. | | 6,830,000 | | | 9,049,855 |

| | | | | |

| | | | | $ | 20,475,151 |

| Real Estate - 1.1% | | | | | |

| Deutsche Wohnen AG (l) | | 752,450 | | $ | 21,567,351 |

| Great Eagle Holdings Ltd. | | 886,000 | | | 2,419,952 |

| Hypo Real Estate Holding AG (l) | | 420,652 | | | 10,928,388 |

| Yanlord Land Group Ltd. | | 3,723,000 | | | 5,797,878 |

| | | | | |

| | | | | $ | 40,713,569 |

| Special Products & Services - 0.3% | | | | | |

| Filtrona PLC | | 2,763,200 | | $ | 9,424,374 |

| MFS Ltd. | | 244,515 | | | 165,866 |

| | | | | |

| | | | | $ | 9,590,240 |

| Specialty Chemicals - 3.9% | | | | | |

| Akzo Nobel N.V. | | 245,000 | | $ | 19,651,878 |

| Croda International PLC | | 631,200 | | | 8,298,360 |

| Linde AG | | 396,435 | | | 55,995,072 |

| Lonza Group AG (l) | | 73,335 | | | 9,721,898 |

| Methanex Corp. NPV | | 244,430 | | | 6,417,669 |

| Symrise AG (l) | | 1,875,174 | | | 48,420,379 |

| | | | | |

| | | | | $ | 148,505,256 |

| Specialty Stores - 0.7% | | | | | |

| Bulgari S.p.A. (l) | | 792,160 | | $ | 9,152,238 |

| Inchcape PLC | | 226,500 | | | 1,805,535 |

| NEXT PLC | | 643,309 | | | 14,529,649 |

| Pendragon PLC | | 3,398,278 | | | 2,274,283 |

| | | | | |

| | | | | $ | 27,761,705 |

| Telecommunications - Wireless - 1.6% | | | | | |

| Cellcom Israel Ltd. | | 200,000 | | $ | 6,286,000 |

| MTN Group Ltd. | | 838,080 | | | 12,709,532 |

| NII Holdings, Inc. “B” (a) | | 199,100 | | | 6,327,398 |

| Philippine Long Distance Telephone Co. | | 372,010 | | | 24,859,147 |

| Tim Participacoes S.A., ADR | | 150,000 | | | 4,843,500 |

| Turkcell Iletisim Hizmetleri A.S., ADR | | 300,000 | | | 6,267,000 |

| | | | | |

| | | | | $ | 61,292,577 |

14

Portfolio of Investments (unaudited) – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| Common Stocks - continued | | | | |

| Telephone Services - 3.4% | | | | | | |

| China Netcom Group Corp. Ltd. | | | 10,227,000 | | $ | 29,436,266 |

| Elisa Oyj, “A” | | | 143,600 | | | 3,585,620 |

| Royal KPN N.V. | | | 2,294,340 | | | 38,747,605 |

| Telecom Argentina S.A., ADR (a) | | | 801,491 | | | 16,975,579 |

| Telekom Austria AG | | | 360,841 | | | 7,455,192 |

| Telenor A.S.A. | | | 1,690,940 | | | 32,362,012 |

| | | | | | |

| | | | | | $ | 128,562,274 |

| Tobacco - 0.7% | | | | | | |

| Swedish Match AB (l) | | | 1,178,380 | | $ | 25,680,111 |

| | |

| Trucking - 1.8% | | | | | | |

| Seino Holdings Co. NPV (l) | | | 966,000 | | $ | 6,293,961 |

| TNT N.V. | | | 1,115,880 | | | 41,442,193 |

| Yamato Holdings Co. Ltd. | | | 1,438,000 | | | 21,217,684 |

| | | | | | |

| | | | | | $ | 68,953,838 |

| Utilities - Electric Power - 1.7% | | | | | | |

| AES Tiete S.A., IPS | | | 230,608,000 | | $ | 7,687,592 |

| British Energy Group PLC | | | 2,203,980 | | | 28,516,743 |

| Eletropaulo Metropolitana S.A., IPS | | | 65,750,000 | | | 5,179,382 |

| Enersis S.A., ADR (l) | | | 572,800 | | | 10,127,104 |

| Equatorial Energia S.A., IEU | | | 586,600 | | | 5,601,974 |

| Hong Kong Electric Holdings | | | 1,499,000 | | | 9,551,448 |

| | | | | | |

| | | | | | $ | 66,664,243 |

| Total Common Stocks (Identified Cost, $3,498,263,940) | | | | | $ | 3,766,302,930 |

| | |

| Collateral for Securities Loaned - 6.7% | | | | | | |

| Morgan Stanley, 2.25%, dated 3/31/08, due 4/01/08, total to be received $253,811,584 (secured by various U.S. Treasury and Federal Agency obligations and Mortgage Backed securities in an individually traded account), at Cost and Net Asset Value | | | 253,795,722 | | $ | 253,795,722 |

| | |

| Money Market Funds (v) - 0.8% | | | | | | |

MFS Institutional Money Market Portfolio, 2.877%,

at Cost and Net Asset Value | | $ | 31,537,501 | | $ | 31,537,501 |

| Total Investments (Identified Cost, $3,783,597,163) (k) | | | | | $ | 4,051,636,153 |

| | |

| Other Assets, Less Liabilities - (6.3)% | | | | | | (239,282,066) |

| Net Assets - 100.0% | | | | | $ | 3,812,354,087 |

| (a) | Non-income producing security. |

| (k) | As of March 31, 2008, the fund had 23 securities that were fair valued, aggregating $470,695,087 and 11.62% of market value, in accordance with the policies adopted by the Board of Trustees. |

| (l) | All or a portion of this security is on loan. |

| (v) | Underlying fund that is available only to investment companies managed by MFS. The rate quoted is the annualized seven-day yield of the fund at period end. |

15

Portfolio of Investments (unaudited) – continued

The following abbreviations are used in this report and are defined:

| ADR | | American Depository Receipt |

| GDR | | Global Depository Receipt |

| IEU | | International Equity Unit |

| IPS | | International Preference Stock |

See Notes to Financial Statements

16

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 3/31/08 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | |

| Assets | | | | |

| Investments, at value | | | | |

Non-affiliated issuers, at value

(identified cost, $3,752,059,662) | | $4,020,098,652 | | |

| Underlying funds, at cost and value | | 31,537,501 | | |

| Total Investments, at value including $304,199,427 of securities on loan (identified cost, $3,783,597,163) | | $4,051,636,153 | | |

| Foreign currency, at value (identified cost, $32,608,311) | | 32,703,355 | | |

| Receivable for investments sold | | 240,345,763 | | |

| Receivable for fund shares sold | | 1,211,694 | | |

| Interest and dividends receivable | | 12,710,521 | | |

| Other assets | | 53,060 | | |

| Total assets | | | | $4,338,660,546 |

| Liabilities | | | | |

| Payable to custodian | | $1,635,611 | | |

| Payable for investments purchased | | 257,900,036 | | |

| Payable for fund shares reacquired | | 10,119,725 | | |

| Collateral for securities loaned, at value (c) | | 253,795,722 | | |

| Payable to affiliates | | | | |

Management fee | | 388,169 | | |

Shareholder servicing costs | | 1,493,236 | | |

Distribution and service fees | | 140,713 | | |

Administrative services fee | | 5,168 | | |

Program manager fees | | 133 | | |

| Payable for independent trustees’ compensation | | 12,342 | | |

| Accrued expenses and other liabilities | | 815,604 | | |

| Total liabilities | | | | $526,306,459 |

| Net assets | | | | $3,812,354,087 |

| Net assets consist of: | | | | |

| Paid-in capital | | $3,384,721,521 | | |

| Unrealized appreciation (depreciation) on investments and translation of assets and liabilities in foreign currencies (net of $104,959 deferred country tax) | | 268,001,226 | | |

| Accumulated net realized gain (loss) on investments and foreign currency transactions | | 158,700,928 | | |

| Undistributed net investment income | | 930,412 | | |

| Net assets | | | | $3,812,354,087 |

| Shares of beneficial interest outstanding | | | | 168,803,295 |

17

Statement of Assets and Liabilities (unaudited) – continued

| | | | |

| Class A shares | | | | |

Net assets | | $2,231,610,260 | | |

Shares outstanding | | 98,713,282 | | |

Net asset value per share | | | | $22.61 |

Offering price per share (100 / 94.25 × net asset value per share) | | | | $23.99 |

| Class B shares | | | | |

Net assets | | $224,185,569 | | |

Shares outstanding | | 10,314,061 | | |

Net asset value and offering price per share | | | | $21.74 |

| Class C shares | | | | |

Net assets | | $347,755,076 | | |

Shares outstanding | | 16,049,894 | | |

Net asset value and offering price per share | | | | $21.67 |

| Class I shares | | | | |

Net assets | | $893,280,795 | | |

Shares outstanding | | 38,556,918 | | |

Net asset value, offering price, and redemption price per share | | | | $23.17 |

| Class R shares | | | | |

Net assets | | $29,215,999 | | |

Shares outstanding | | 1,298,678 | | |

Net asset value, offering price, and redemption price per share | | | | $22.50 |

| Class R1 shares | | | | |

Net assets | | $3,100,448 | | |

Shares outstanding | | 145,266 | | |

Net asset value, offering price, and redemption price per share | | | | $21.34 |

| Class R2 shares | | | | |

Net assets | | $2,113,139 | | |

Shares outstanding | | 98,388 | | |

Net asset value, offering price, and redemption price per share | | | | $21.48 |

| Class R3 shares | | | | |

Net assets | | $36,512,808 | | |

Shares outstanding | | 1,646,769 | | |

Net asset value, offering price, and redemption price per share | | | | $22.17 |

| Class R4 shares | | | | |

Net assets | | $22,300,430 | | |

Shares outstanding | | 988,997 | | |

Net asset value, offering price, and redemption price per share | | | | $22.55 |

18

Statement of Assets and Liabilities (unaudited) – continued

| | | | |

| Class R5 shares | | | | |

Net assets | | $17,396,527 | | |

Shares outstanding | | 768,888 | | |

Net asset value, offering price, and redemption price per share | | | | $22.63 |

| Class 529A shares | | | | |

Net assets | | $3,204,612 | | |

Shares outstanding | | 143,401 | | |

Net asset value per share | | | | $22.35 |

Offering price per share (100 / 94.25 × net asset value per share) | | | | $23.71 |

| Class 529B shares | | | | |

Net assets | | $860,781 | | |

Shares outstanding | | 40,406 | | |

Net asset value and offering price per share | | | | $21.30 |

| Class 529C shares | | | | |

Net assets | | $817,643 | | |

Shares outstanding | | 38,347 | | |

Net asset value and offering price per share | | | | $21.32 |

| (c) | Non-cash collateral is not included. |

On sales of $50,000 or more, the offering prices of Class A and Class 529A shares are reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, Class C, Class 529B, and Class 529C shares.

See Notes to Financial Statements

19

Financial Statements

STATEMENT OF OPERATIONS

Six months ended 3/31/08 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | | | |

| Net investment income | | | | | | |

| Income | | | | | | |

Dividends | | $35,065,766 | | | | |

Dividends from underlying funds | | 67,035 | | | | |

Interest | | 922,633 | | | | |

Foreign taxes withheld | | (1,912,828 | ) | | | |

| Total investment income | | | | | $34,142,606 | |

| Expenses | | | | | | |

Management fee | | $20,059,010 | | | | |

Distribution and service fees | | 8,083,119 | | | | |

Program manager fees | | 6,437 | | | | |

Shareholder servicing costs | | 2,986,072 | | | | |

Administrative services fee | | 254,610 | | | | |

Retirement plan administration and services fees | | 36,650 | | | | |

Independent trustees’ compensation | | 23,796 | | | | |

Custodian fee | | 705,506 | | | | |

Shareholder communications | | 210,000 | | | | |

Auditing fees | | 28,285 | | | | |

Legal fees | | 29,377 | | | | |

Miscellaneous | | 224,865 | | | | |

| Total expenses | | | | | $32,647,727 | |

Fees paid indirectly | | (6,654 | ) | | | |

Reduction of expenses by investment adviser and distributor | | (650,388 | ) | | | |

| Net expenses | | | | | $31,990,685 | |

| Net investment income | | | | | $2,151,921 | |

| Realized and unrealized gain (loss) on investments | | | | | | |

| Realized gain (loss) (identified cost basis) | | | | | | |

Investment transactions | | $274,904,037 | | | | |

Foreign currency transactions | | (934,772 | ) | | | |

Net realized gain (loss) on investments

and foreign currency transactions | | | | | $273,969,265 | |

| Change in unrealized appreciation (depreciation) | | | | | | |

Investments (net of $1,034,489 decrease in deferred

country tax) | | $(765,757,607 | ) | | | |

Translation of assets and liabilities in foreign currencies | | (119,666 | ) | | | |

Net unrealized gain (loss) on investments

and foreign currency translation | | | | | $(765,877,273 | ) |

Net realized and unrealized gain (loss) on investments

and foreign currency | | | | | $(491,908,008 | ) |

| Change in net assets from operations | | | | | $(489,756,087 | ) |

See Notes to Financial Statements

20

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | |

| | | Six months ended

3/31/08 | | | Year ended

9/30/07 | |

| Change in net assets | | (unaudited) | | | | |

| From operations | | | | | | |

| Net investment income | | $2,151,921 | | | $38,638,575 | |

Net realized gain (loss) on investments and foreign

currency transactions | | 273,969,265 | | | 891,368,819 | |

Net unrealized gain (loss) on investments and foreign

currency translation | | (765,877,273 | ) | | 215,946,398 | |

| Change in net assets from operations | | $(489,756,087 | ) | | $1,145,953,792 | |

| Distributions declared to shareholders | | | | | | |

| From net investment income | | | | | | |

Class A | | $(24,163,466 | ) | | $(22,091,946 | ) |

Class B | | (376,544 | ) | | (460,593 | ) |

Class C | | (772,620 | ) | | (918,618 | ) |

Class I | | (11,893,368 | ) | | (9,199,175 | ) |

Class R | | (214,881 | ) | | (294,678 | ) |

Class R1 | | (16,669 | ) | | (4,147 | ) |

Class R2 | | (15,660 | ) | | (9,919 | ) |

Class R3 | | (275,619 | ) | | (172,957 | ) |

Class R4 | | (214,335 | ) | | (86,964 | ) |

Class R5 | | (220,734 | ) | | (186,371 | ) |

Class 529A | | (21,867 | ) | | (16,567 | ) |

Class 529B | | (837 | ) | | (1,500 | ) |

Class 529C | | (611 | ) | | (247 | ) |

| From net realized gain on investments | | | | | | |

Class A | | (475,752,013 | ) | | (255,439,302 | ) |

Class B | | (50,310,374 | ) | | (30,402,266 | ) |

Class C | | (79,656,967 | ) | | (43,456,896 | ) |

Class I | | (172,293,681 | ) | | (76,340,811 | ) |

Class R | | (6,170,021 | ) | | (4,162,288 | ) |

Class R1 | | (668,584 | ) | | (129,106 | ) |

Class R2 | | (426,867 | ) | | (121,013 | ) |

Class R3 | | (7,439,660 | ) | | (2,570,447 | ) |

Class R4 | | (4,163,726 | ) | | (911,460 | ) |

Class R5 | | (3,542,386 | ) | | (1,620,424 | ) |

Class 529A | | (610,379 | ) | | (267,877 | ) |

Class 529B | | (181,931 | ) | | (75,974 | ) |

Class 529C | | (164,118 | ) | | (71,625 | ) |

| Total distributions declared to shareholders | | $(839,567,918 | ) | | $(449,013,171 | ) |

21

Statements of Changes in Net Assets – continued

| | | | | | |

| | | Six months ended

3/31/08 | | | Year ended

9/30/07 | |

| | | (unaudited) | | | | |

| Change in net assets from fund share transactions | | $299,873,000 | | | $(125,213,814 | ) |

| Redemption fees | | $— | | | $21,900 | |

| Total change in net assets | | $(1,029,451,005 | ) | | $571,748,707 | |

| Net assets | | | | | | |

| At beginning of period | | 4,841,805,092 | | | 4,270,056,385 | |

| At end of period (including undistributed net investment income of $930,412 and $36,965,702, respectively) | | $3,812,354,087 | | | $4,841,805,092 | |

See Notes to Financial Statements

22

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | | |

| | | Six months

ended

3/31/08 (unaudited) | | | Years ended 9/30 |

| Class A | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 |

| | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | $30.87 | | | $26.64 | | | $24.15 | | | $19.62 | | | $15.48 | | | $11.82 |

Income (loss) from

investment operations | | | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.02 | | | $0.25 | | | $0.20 | | | $0.11 | | | $0.07 | | | $0.07 |

Net realized and unrealized gain (loss) on investments and foreign currency | | (2.78 | ) | | 6.84 | | | 4.07 | | | 5.54 | | | 4.18 | | | 3.59 |

| Total from investment operations | | $(2.76 | ) | | $7.09 | | | $4.27 | | | $5.65 | | | $4.25 | | | $3.66 |

Less distributions declared

to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | $(0.27 | ) | | $(0.23 | ) | | $(0.13 | ) | | $— | | | $(0.01 | ) | | $— |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | (1.12 | ) | | (0.10 | ) | | — |

Total distributions declared

to shareholders | | $(5.50 | ) | | $(2.86 | ) | | $(1.78 | ) | | $(1.12 | ) | | $(0.11 | ) | | $— |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $— |

| Net asset value, end of period | | $22.61 | | | $30.87 | | | $26.64 | | | $24.15 | | | $19.62 | | | $15.48 |

| Total return (%) (r)(s)(t) | | (10.39 | )(n) | | 28.17 | | | 18.69 | | | 29.77 | | | 27.55 | | | 31.08 |

| Ratios (%) (to average net assets) and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 1.49 | (a) | | 1.51 | | | 1.55 | | | 1.61 | | | 1.63 | | | 1.81 |

Expenses after

expense reductions (f) | | 1.44 | (a) | | 1.46 | | | 1.55 | | | 1.61 | | | 1.63 | | | 1.62 |

| Net investment income | | 0.14 | (a) | | 0.88 | | | 0.77 | | | 0.49 | | | 0.38 | | | 0.51 |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | | | 61 | | | 88 |

Net assets at end of period

(000 Omitted) | | $2,231,610 | | | $2,891,693 | | | $2,635,185 | | | $1,984,799 | | | $1,033,312 | | | $371,042 |

See Notes to Financial Statements

23

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | |

| | | Six months

ended

3/31/08 (unaudited) | | | Years ended 9/30 | |

| Class B | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | $29.76 | | | $25.77 | | | $23.44 | | | $19.19 | | | $15.23 | | | $11.70 | |

Income (loss) from

investment operations | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.07 | ) | | $0.05 | | | $0.03 | | | $(0.04 | ) | | $(0.05 | ) | | $(0.02 | ) |

Net realized and unrealized

gain (loss) on investments and

foreign currency | | (2.68 | ) | | 6.61 | | | 3.95 | | | 5.41 | | | 4.11 | | | 3.55 | |

| Total from investment operations | | $(2.75 | ) | | $6.66 | | | $3.98 | | | $5.37 | | | $4.06 | | | $3.53 | |

Less distributions declared

to shareholders | | | | | | | | | | | | | | | | | | |

From net investment income | | $(0.04 | ) | | $(0.04 | ) | | $— | | | $— | | | $— | | | $— | |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | (1.12 | ) | | (0.10 | ) | | — | |

Total distributions declared

to shareholders | | $(5.27 | ) | | $(2.67 | ) | | $(1.65 | ) | | $(1.12 | ) | | $(0.10 | ) | | $— | |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $— | |

| Net asset value, end of period | | $21.74 | | | $29.76 | | | $25.77 | | | $23.44 | | | $19.19 | | | $15.23 | |

| Total return (%) (r)(s)(t) | | (10.71 | )(n) | | 27.30 | | | 17.92 | | | 28.94 | | | 26.73 | | | 30.17 | |

Ratios (%) (to average net

assets) and Supplemental data: | | | | | | | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 2.14 | (a) | | 2.16 | | | 2.20 | | | 2.26 | | | 2.28 | | | 2.46 | |

Expenses after

expense reductions (f) | | 2.14 | (a) | | 2.16 | | | 2.20 | | | 2.26 | | | 2.28 | | | 2.27 | |

| Net investment income (loss) | | (0.57 | )(a) | | 0.16 | | | 0.10 | | | (0.21 | ) | | (0.28 | ) | | (0.17 | ) |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | | | 61 | | | 88 | |

Net assets at end of period

(000 Omitted) | | $224,186 | | | $301,724 | | | $311,077 | | | $277,244 | | | $186,920 | | | $84,767 | |

See Notes to Financial Statements

24

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | |

| | | Six months

ended

3/31/08 (unaudited) | | | Years ended 9/30 | |

| Class C | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | $29.69 | | | $25.74 | | | $23.41 | | | $19.17 | | | $15.22 | | | $11.69 | |

Income (loss) from

investment operations | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.07 | ) | | $0.05 | | | $0.03 | | | $(0.04 | ) | | $(0.05 | ) | | $(0.02 | ) |

Net realized and unrealized

gain (loss) on investments and

foreign currency | | (2.67 | ) | | 6.59 | | | 3.95 | | | 5.40 | | | 4.10 | | | 3.55 | |

| Total from investment operations | | $(2.74 | ) | | $6.64 | | | $3.98 | | | $5.36 | | | $4.05 | | | $3.53 | |

Less distributions declared

to shareholders | | | | | | | | | | | | | | | | | | |

From net investment income | | $(0.05 | ) | | $(0.06 | ) | | $(0.00 | ) | | $— | | | $— | | | $— | |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | (1.12 | ) | | (0.10 | ) | | — | |

Total distributions declared

to shareholders | | $(5.28 | ) | | $(2.69 | ) | | $(1.65 | ) | | $(1.12 | ) | | $(0.10 | ) | | $— | |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $— | |

| Net asset value, end of period | | $21.67 | | | $29.69 | | | $25.74 | | | $23.41 | | | $19.17 | | | $15.22 | |

| Total return (%) (r)(s)(t) | | (10.70 | )(n) | | 27.24 | | | 17.96 | | | 28.92 | | | 26.69 | | | 30.20 | |

| Ratios (%) (to average net assets) and Supplemental data: | | | | | | | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 2.14 | (a) | | 2.16 | | | 2.20 | | | 2.26 | | | 2.28 | | | 2.46 | |

Expenses after

expense reductions (f) | | 2.14 | (a) | | 2.16 | | | 2.20 | | | 2.26 | | | 2.28 | | | 2.27 | |

| Net investment income (loss) | | (0.58 | )(a) | | 0.18 | | | 0.11 | | | (0.17 | ) | | (0.26 | ) | | (0.17 | ) |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | | | 61 | | | 88 | |

Net assets at end of period

(000 Omitted) | | $347,755 | | | $472,596 | | | $435,798 | | | $339,331 | | | $189,941 | | | $69,101 | |

See Notes to Financial Statements

25

Financial Highlights – continued

| | | | | | | | | | | | | | | | | |

| | | Six months

ended

3/31/08 (unaudited) | | | Years ended 9/30 |

| Class I | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 |

| | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | $31.55 | | | $27.18 | | | $24.59 | | | $19.89 | | | $15.65 | | | $11.91 |

Income (loss) from

investment operations | | | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.06 | | | $0.35 | | | $0.29 | | | $0.19 | | | $0.14 | | | $0.12 |

Net realized and unrealized gain (loss) on investments and foreign currency | | (2.85 | ) | | 6.97 | | | 4.14 | | | 5.63 | | | 4.23 | | | 3.62 |

| Total from investment operations | | $(2.79 | ) | | $7.32 | | | $4.43 | | | $5.82 | | | $4.37 | | | $3.74 |

Less distributions declared

to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | $(0.36 | ) | | $(0.32 | ) | | $(0.19 | ) | | $— | | | $(0.03 | ) | | $— |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | (1.12 | ) | | (0.10 | ) | | — |

Total distributions declared

to shareholders | | $(5.59 | ) | | $(2.95 | ) | | $(1.84 | ) | | $(1.12 | ) | | $(0.13 | ) | | $— |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $— |

| Net asset value, end of period | | $23.17 | | | $31.55 | | | $27.18 | | | $24.59 | | | $19.89 | | | $15.65 |

| Total return (%) (r)(s) | | (10.26 | )(n) | | 28.54 | | | 19.09 | | | 30.24 | | | 28.05 | | | 31.40 |

| Ratios (%) (to average net assets) and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 1.14 | (a) | | 1.16 | | | 1.20 | | | 1.26 | | | 1.29 | | | 1.46 |

Expenses after

expense reductions (f) | | 1.14 | (a) | | 1.16 | | | 1.20 | | | 1.26 | | | 1.29 | | | 1.27 |

| Net investment income | | 0.48 | (a) | | 1.19 | | | 1.11 | | | 0.87 | | | 0.75 | | | 0.89 |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | | | 61 | | | 88 |

Net assets at end of period

(000 Omitted) | | $893,281 | | | $1,040,477 | | | $791,709 | | | $515,202 | | | $232,247 | | | $69,214 |

See Notes to Financial Statements

26

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | |

| | | Six months

ended

3/31/08 (unaudited) | | | Years ended 9/30 | |

| Class R | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 (i) | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | $30.69 | | | $26.51 | | | $24.05 | | | $19.57 | | | $15.47 | | | $12.22 | |

Income (loss) from

investment operations | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.01 | ) | | $0.19 | | | $0.15 | | | $0.08 | | | $0.06 | | | $0.04 | |

Net realized and unrealized

gain (loss) on investments and

foreign currency | | (2.77 | ) | | 6.81 | | | 4.07 | | | 5.52 | | | 4.16 | | | 3.21 | |

| Total from investment operations | | $(2.78 | ) | | $7.00 | | | $4.22 | | | $5.60 | | | $4.22 | | | $3.25 | |

Less distributions declared

to shareholders | | | | | | | | | | | | | | | | | | |

From net investment income | | $(0.18 | ) | | $(0.19 | ) | | $(0.11 | ) | | $— | | | $(0.02 | ) | | $— | |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | (1.12 | ) | | (0.10 | ) | | — | |

Total distributions declared

to shareholders | | $(5.41 | ) | | $(2.82 | ) | | $(1.76 | ) | | $(1.12 | ) | | $(0.12 | ) | | $— | |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $— | |

| Net asset value, end of period | | $22.50 | | | $30.69 | | | $26.51 | | | $24.05 | | | $19.57 | | | $15.47 | |

| Total return (%) (r)(s) | | (10.48 | )(n) | | 27.92 | | | 18.54 | | | 29.58 | | | 27.40 | | | 26.60 | (n) |

Ratios (%) (to average net

assets) and Supplemental data: | | | | | | | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 1.64 | (a) | | 1.66 | | | 1.70 | | | 1.76 | | | 1.79 | | | 1.96 | (a) |

Expenses after

expense reductions (f) | | 1.64 | (a) | | 1.66 | | | 1.70 | | | 1.76 | | | 1.79 | | | 1.77 | (a) |

| Net investment income (loss) | | (0.05 | )(a) | | 0.67 | | | 0.61 | | | 0.37 | | | 0.34 | | | 0.44 | (a) |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | | | 61 | | | 88 | |

Net assets at end of period

(000 Omitted) | | $29,216 | | | $39,655 | | | $42,498 | | | $29,525 | | | $12,683 | | | $1,596 | |

See Notes to Financial Statements

27

Financial Highlights – continued

| | | | | | | | | | | | |

| | | Six months

ended

3/31/08 (unaudited) | | | Years ended 9/30 | |

| Class R1 | | | 2007 | | | 2006 | | | 2005 (i) | |

| | | | | | | | | | | |

Net asset value, beginning

of period | | $29.42 | | | $25.58 | | | $23.43 | | | $21.18 | |

Income (loss) from

investment operations | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.08 | ) | | $0.05 | | | $0.01 | | | $0.00 | (w) |

Net realized and unrealized

gain (loss) on investments and

foreign currency | | (2.64 | ) | | 6.50 | | | 3.93 | | | 2.25 | (g) |

| Total from investment operations | | $(2.72 | ) | | $6.55 | | | $3.94 | | | $2.25 | |

Less distributions declared

to shareholders | | | | | | | | | | | | |

From net investment income | | $(0.13 | ) | | $(0.08 | ) | | $(0.14 | ) | | $— | |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | — | |

Total distributions declared

to shareholders | | $(5.36 | ) | | $(2.71 | ) | | $(1.79 | ) | | $— | |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) |

| Net asset value, end of period | | $21.34 | | | $29.42 | | | $25.58 | | | $23.43 | |

| Total return (%) (r)(s) | | (10.76 | )(n) | | 27.10 | | | 17.83 | | | 10.62 | (n) |

Ratios (%) (to average net

assets) and Supplemental data: | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 2.23 | (a) | | 2.30 | | | 2.40 | | | 2.47 | (a) |

Expenses after

expense reductions (f) | | 2.23 | (a) | | 2.26 | | | 2.30 | | | 2.47 | (a) |

| Net investment income (loss) | | (0.63 | )(a) | | 0.17 | | | 0.05 | | | 0.01 | (a) |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | |

Net assets at end of period

(000 Omitted) | | $3,100 | | | $3,413 | | | $1,287 | | | $192 | |

See Notes to Financial Statements

28

Financial Highlights – continued

| | | | | | | | | | | | |

| | | Six months

ended

3/31/08 (unaudited) | | | Years ended 9/30 | |

| Class R2 | | | 2007 | | | 2006 | | | 2005 (i) | |

| | | | | | | | | | | |

Net asset value, beginning

of period | | $29.57 | | | $25.73 | | | $23.46 | | | $21.18 | |

Income (loss) from

investment operations | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.02 | ) | | $0.12 | | | $0.06 | | | $0.03 | |

Net realized and unrealized

gain (loss) on investments and

foreign currency | | (2.65 | ) | | 6.57 | | | 3.98 | | | 2.25 | (g) |

| Total from investment operations | | $(2.67 | ) | | $6.69 | | | $4.04 | | | $2.28 | |

Less distributions declared

to shareholders | | | | | | | | | | | | |

From net investment income | | $(0.19 | ) | | $(0.22 | ) | | $(0.12 | ) | | $— | |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | — | |

Total distributions declared

to shareholders | | $(5.42 | ) | | $(2.85 | ) | | $(1.77 | ) | | $— | |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) |

| Net asset value, end of period | | $21.48 | | | $29.57 | | | $25.73 | | | $23.46 | |

| Total return (%) (r)(s) | | (10.51 | )(n) | | 27.56 | | | 18.25 | | | 10.76 | (n) |

Ratios (%) (to average net

assets) and Supplemental data: | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 1.77 | (a) | | 1.97 | | | 2.10 | | | 2.17 | (a) |

Expenses after

expense reductions (f) | | 1.77 | (a) | | 1.91 | | | 1.95 | | | 2.17 | (a) |

| Net investment income (loss) | | (0.13 | )(a) | | 0.43 | | | 0.26 | | | 0.33 | (a) |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | |

Net assets at end of period

(000 Omitted) | | $2,113 | | | $2,185 | | | $878 | | | $170 | |

See Notes to Financial Statements

29

Financial Highlights – continued

| | | | | | | | | | | | | | | |

| | | Six months

ended

3/31/08 (unaudited) | | | Years ended 9/30 | |

| Class R3 | | | 2007 | | | 2006 | | | 2005 | | | 2004 (i) | |

| | | | | | | | | | | | | | |

Net asset value, beginning

of period | | $30.35 | | | $26.27 | | | $23.91 | | | $19.51 | | | $16.95 | |

Income (loss) from

investment operations | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.01 | ) | | $0.16 | | | $0.14 | | | $0.10 | | | $(0.11 | ) |

Net realized and unrealized

gain (loss) on investments and

foreign currency | | (2.75 | ) | | 6.73 | | | 4.01 | | | 5.42 | | | 2.80 | |

| Total from investment operations | | $(2.76 | ) | | $6.89 | | | $4.15 | | | $5.52 | | | $2.69 | |

Less distributions declared

to shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.19 | ) | | $(0.18 | ) | | $(0.14 | ) | | $— | | | $(0.03 | ) |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | (1.12 | ) | | (0.10 | ) |

Total distributions declared

to shareholders | | $(5.42 | ) | | $(2.81 | ) | | $(1.79 | ) | | $(1.12 | ) | | $(0.13 | ) |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) |

| Net asset value, end of period | | $22.17 | | | $30.35 | | | $26.27 | | | $23.91 | | | $19.51 | |

| Total return (%) (r)(s) | | (10.54 | )(n) | | 27.75 | | | 18.36 | | | 29.25 | | | 15.99 | (n) |

Ratios (%) (to average net

assets) and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 1.72 | (a) | | 1.85 | | | 1.95 | | | 2.01 | | | 2.05 | (a) |

Expenses after

expense reductions (f) | | 1.72 | (a) | | 1.81 | | | 1.85 | | | 2.01 | | | 2.05 | (a) |

| Net investment income (loss) | | (0.10 | )(a) | | 0.57 | | | 0.54 | | | 0.44 | | | (0.70 | )(a) |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | | | 61 | |

Net assets at end of period

(000 Omitted) | | $36,513 | | | $40,709 | | | $23,313 | | | $4,468 | | | $259 | |

See Notes to Financial Statements

30

Financial Highlights – continued

| | | | | | | | | | | | |

| | | Six months

ended

3/31/08 (unaudited) | | | Years ended 9/30 | |

| Class R4 | | | 2007 | | | 2006 | | | 2005 (i) | |

| | | | | | | | | | | |

Net asset value, beginning

of period | | $30.82 | | | $26.64 | | | $24.15 | | | $21.75 | |

Income (loss) from

investment operations | | | | | | | | | | | | |

Net investment income (d) | | $0.02 | | | $0.24 | | | $0.21 | | | $0.12 | |

Net realized and unrealized

gain (loss) on investments and

foreign currency | | (2.79 | ) | | 6.82 | | | 4.06 | | | 2.28 | (g) |

| Total from investment operations | | $(2.77 | ) | | $7.06 | | | $4.27 | | | $2.40 | |

Less distributions declared

to shareholders | | | | | | | | | | | | |

From net investment income | | $(0.27 | ) | | $(0.25 | ) | | $(0.13 | ) | | $— | |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | — | |

Total distributions declared

to shareholders | | $(5.50 | ) | | $(2.88 | ) | | $(1.78 | ) | | $— | |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00(w | ) | | $0.00 | (w) | | $0.00 | (w) |

| Net asset value, end of period | | $22.55 | | | $30.82 | | | $26.64 | | | $24.15 | |

| Total return (%) (r)(s) | | (10.43 | )(n) | | 28.08 | | | 18.71 | | | 11.03 | (n) |

Ratios (%) (to average net

assets) and Supplemental data: | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 1.47 | (a) | | 1.56 | | | 1.59 | | | 1.68 | (a) |

Expenses after

expense reductions (f) | | 1.47 | (a) | | 1.56 | | | 1.59 | | | 1.68 | (a) |

| Net investment income | | 0.19 | (a) | | 0.84 | | | 0.80 | | | 1.11 | (a) |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | |

Net assets at end of period

(000 Omitted) | | $22,300 | | | $21,806 | | | $8,192 | | | $56 | |

See Notes to Financial Statements

31

Financial Highlights – continued

| | | | | | | | | | | | |

| | | Six months

ended

3/31/08 (unaudited) | | | Years ended 9/30 | |

| Class R5 | | | 2007 | | | 2006 | | | 2005 (i) | |

| | | | | | | | | | | |

Net asset value, beginning

of period | | $30.92 | | | $26.70 | | | $24.19 | | | $21.75 | |

Income (loss) from

investment operations | | | | | | | | | | | | |

Net investment income (d) | | $0.05 | | | $0.34 | | | $0.14 | | | $0.16 | |

Net realized and unrealized

gain (loss) on investments and

foreign currency | | (2.78 | ) | | 6.81 | | | 4.20 | | | 2.28 | (g) |

| Total from investment operations | | $(2.73 | ) | | $7.15 | | | $4.34 | | | $2.44 | |

Less distributions declared

to shareholders | | | | | | | | | | | | |

From net investment income | | $(0.33 | ) | | $(0.30 | ) | | $(0.18 | ) | | $— | |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | — | |

Total distributions declared

to shareholders | | $(5.56 | ) | | $(2.93 | ) | | $(1.83 | ) | | $— | |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) |

| Net asset value, end of period | | $22.63 | | | $30.92 | | | $26.70 | | | $24.19 | |

| Total return (%) (r)(s) | | (10.28 | )(n) | | 28.42 | | | 19.00 | | | 11.22 | (n) |

Ratios (%) (to average net

assets) and Supplemental data: | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 1.19 | (a) | | 1.26 | | | 1.30 | | | 1.37 | (a) |

Expenses after

expense reductions (f) | | 1.19 | (a) | | 1.26 | | | 1.30 | | | 1.37 | (a) |

| Net investment income | | 0.40 | (a) | | 1.13 | | | 0.52 | | | 1.41 | (a) |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | |

Net assets at end of period

(000 Omitted) | | $17,397 | | | $22,080 | | | $16,063 | | | $56 | |

See Notes to Financial Statements

32

Financial Highlights – continued

| | | | | | | | | | | | | | | | | |

| | | Six months

ended

3/31/08 (unaudited) | | | Years ended 9/30 |

| Class 529A | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 |

| | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | $30.54 | | | $26.40 | | | $23.97 | | | $19.52 | | | $15.43 | | | $11.81 |

Income (loss) from

investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.01 | ) | | $0.17 | | | $0.13 | | | $0.05 | | | $0.03 | | | $0.07 |

Net realized and unrealized

gain (loss) on investments and

foreign currency | | (2.76 | ) | | 6.76 | | | 4.04 | | | 5.52 | | | 4.16 | | | 3.55 |

| Total from investment operations | | $(2.77 | ) | | $6.93 | | | $4.17 | | | $5.57 | | | $4.19 | | | $3.62 |

Less distributions declared

to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | $(0.19 | ) | | $(0.16 | ) | | $(0.09 | ) | | $— | | | $— | | | $— |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | (1.12 | ) | | (0.10 | ) | | — |

Total distributions declared

to shareholders | | $(5.42 | ) | | $(2.79 | ) | | $(1.74 | ) | | $(1.12 | ) | | $(0.10 | ) | | $— |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $— |

| Net asset value, end of period | | $22.35 | | | $30.54 | | | $26.40 | | | $23.97 | | | $19.52 | | | $15.43 |

| Total return (%) (r)(s)(t) | | (10.53 | )(n) | | 27.78 | | | 18.38 | | | 29.50 | | | 27.23 | | | 30.76 |

Ratios (%) (to average net

assets) and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 1.74 | (a) | | 1.76 | | | 1.80 | | | 1.86 | | | 1.88 | | | 2.06 |

Expenses after

expense reductions (f) | | 1.74 | (a) | | 1.76 | | | 1.80 | | | 1.86 | | | 1.88 | | | 1.87 |

| Net investment income (loss) | | (0.10 | )(a) | | 0.58 | | | 0.52 | | | 0.25 | | | 0.16 | | | 0.50 |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | | | 61 | | | 88 |

Net assets at end of period

(000 Omitted) | | $3,205 | | | $3,566 | | | $2,642 | | | $1,731 | | | $806 | | | $297 |

See Notes to Financial Statements

33

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | |

| | | Six months

ended

3/31/08 | | | Years ended 9/30 | |

| Class 529B | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | $29.29 | | | $25.48 | | | $23.25 | | | $19.09 | | | $15.19 | | | $11.70 | |

Income (loss) from

investment operations | | | | | | | | | | | | | | | | | | |

Net investment loss (d) | | $(0.10 | ) | | $(0.01 | ) | | $(0.03 | ) | | $(0.09 | ) | | $(0.09 | ) | | $(0.05 | ) |

Net realized and unrealized

gain (loss) on investments and

foreign currency | | (2.64 | ) | | 6.50 | | | 3.91 | | | 5.37 | | | 4.09 | | | 3.54 | |

| Total from investment operations | | $(2.74 | ) | | $6.49 | | | $3.88 | | | $5.28 | | | $4.00 | | | $3.49 | |

Less distributions declared

to shareholders | | | | | | | | | | | | | | | | | | |

From net investment income | | $(0.02 | ) | | $(0.05 | ) | | $— | | | $— | | | $— | | | $— | |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | (1.12 | ) | | (0.10 | ) | | — | |

Total distributions declared

to shareholders | | $(5.25 | ) | | $(2.68 | ) | | $(1.65 | ) | | $(1.12 | ) | | $(0.10 | ) | | $— | |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $— | |

| Net asset value, end of period | | $21.30 | | | $29.29 | | | $25.48 | | | $23.25 | | | $19.09 | | | $15.19 | |

| Total return (%) (r)(s)(t) | | (10.84 | )(n) | | 26.93 | | | 17.62 | | | 28.61 | | | 26.41 | | | 29.83 | |

Ratios (%) (to average net

assets) and Supplemental data: | | | | | | | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 2.39 | (a) | | 2.41 | | | 2.45 | | | 2.50 | | | 2.53 | | | 2.71 | |

Expenses after

expense reductions (f) | | 2.39 | (a) | | 2.41 | | | 2.45 | | | 2.50 | | | 2.53 | | | 2.52 | |

| Net investment loss | | (0.78 | )(a) | | (0.04 | ) | | (0.10 | ) | | (0.44 | ) | | (0.52 | ) | | (0.39 | ) |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | | | 61 | | | 88 | |

Net assets at end of period

(000 Omitted) | | $861 | | | $1,007 | | | $727 | | | $297 | | | $172 | | | $70 | |

See Notes to Financial Statements

34

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | |

| | | Six months

ended

3/31/08 | | | Years ended 9/30 | |

| Class 529C | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | $29.31 | | | $25.45 | | | $23.22 | | | $19.07 | | | $15.17 | | | $11.69 | |

Income (loss) from

investment operations | | | | | | | | | | | | | | | | | | |

Net investment loss (d) | | $(0.09 | ) | | $(0.02 | ) | | $(0.04 | ) | | $(0.08 | ) | | $(0.09 | ) | | $(0.01 | ) |

Net realized and unrealized

gain (loss) on investments and

foreign currency | | (2.65 | ) | | 6.52 | | | 3.92 | | | 5.35 | | | 4.09 | | | 3.49 | |

| Total from investment operations | | $(2.74 | ) | | $6.50 | | | $3.88 | | | $5.27 | | | $4.00 | | | $3.48 | |

Less distributions declared

to shareholders | | | | | | | | | | | | | | | | | | |

From net investment income | | $(0.02 | ) | | $(0.01 | ) | | $— | | | $— | | | $— | | | $— | |

From net realized gain

on investments | | (5.23 | ) | | (2.63 | ) | | (1.65 | ) | | (1.12 | ) | | (0.10 | ) | | — | |

Total distributions declared

to shareholders | | $(5.25 | ) | | $(2.64 | ) | | $(1.65 | ) | | $(1.12 | ) | | $(0.10 | ) | | $— | |

Redemption fees added to

paid-in capital (d) | | $— | | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $0.00 | (w) | | $— | |

| Net asset value, end of period | | $21.32 | | | $29.31 | | | $25.45 | | | $23.22 | | | $19.07 | | | $15.17 | |

| Total return (%) (r)(s)(t) | | (10.85 | )(n) | | 26.97 | | | 17.64 | | | 28.58 | | | 26.44 | | | 29.88 | |

Ratios (%) (to average net

assets) and Supplemental data: | | | | | | | | | | | | | | | | | | |

Expenses before

expense reductions (f) | | 2.39 | (a) | | 2.41 | | | 2.45 | | | 2.50 | | | 2.53 | | | 2.71 | |

Expenses after

expense reductions (f) | | 2.39 | (a) | | 2.41 | | | 2.45 | | | 2.50 | | | 2.53 | | | 2.52 | |

| Net investment loss | | (0.76 | )(a) | | (0.06 | ) | | (0.14 | ) | | (0.39 | ) | | (0.50 | ) | | (0.09 | ) |

| Portfolio turnover | | 35 | | | 67 | | | 68 | | | 55 | | | 61 | | | 88 | |