Exhibit 6

| Management’s Discussion and Analysis | | | | | | |

| | | | | | | |

| | | | | | | |

| Highlights | | | | | | |

| (millions of Canadian dollars, unless otherwise stated) | 2004 | | 2003 | | 2002 | |

| | | | (Restated1) | | (Restated1) | |

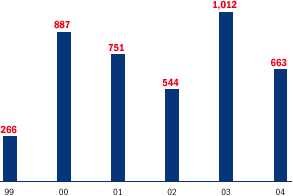

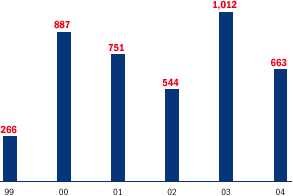

| Net income | 663 | | 1,012 | | 544 | |

| Dividends | 114 | | 90 | | 80 | |

| Per share2(Canadian dollars) | | | | | | |

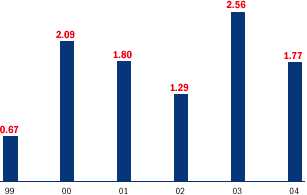

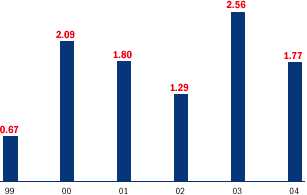

| Net income | 1.77 | | 2.56 | | 1.29 | |

| Dividends | 0.30 | | 0.23 | | 0.20 | |

| Production (mboe/d) | 438 | | 398 | | 445 | |

| Production per share2(boe/share) | 0.42 | | 0.38 | | 0.40 | |

| Average sales price3($/boe) | 42.75 | | 38.51 | | 32.89 | |

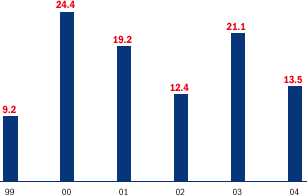

| Gross sales3 | 6,874 | | 5,610 | | 5,351 | |

| Operating costs3($/boe) | 7.04 | | 6.74 | | 6.44 | |

| DD&A, exploration and dry hole expense | 2,199 | | 1,899 | | 1,821 | |

| Cash provided by operating activities | 3,134 | | 2,592 | | 2,415 | |

| Exploration and development spending | 2,538 | | 2,180 | | 1,848 | |

| Total assets | 12,408 | | 11,780 | | 12,017 | |

| Total long-term debt and preferred securities | 2,457 | | 2,634 | | 3,428 | |

| Proved reserves additions (before acquisitions and divestitures) (mmboe) | 265 | | 143 | | 157 | |

| Proved reserves (mmboe) | 1,488 | | 1,362 | | 1,485 | |

| Reserves replacement ratio4 | 166% | | 99% | | 121% | |

1

| Restatement of prior years to effect retroactive adoption of the new accounting policy on asset retirement obligations as at January 1, 2004. See note 2 to the Consolidated Financial Statements.

|

2

| All per share amounts have been retroactively restated to reflect the impact of the Company’s three for one stock split. See note 9 to the Consolidated Financial Statements.

|

3

| During 2004, the Company reclassified transportation costs on a retroactive basis. Previously, these costs had been netted off against revenues or included as operating expenses. See note 2 to the Consolidated Financial Statements.

|

4

| See the MD&A section entitled Reserves Replacement for method of calculation.

|

This Management’s Discussion and Analysis (MD&A) dated March 14, 2005, should be read in conjunction with the Consolidated Financial Statements of the Company. In particular, note 20 provides segmented financial information that forms the basis for much of the following discussion and analysis. The Company’s Consolidated Financial Statements and the financial data included in the MD&A have been prepared in accordance with accounting principles generally accepted in Canada. A summary of the differences between accounting principles generally accepted in Canada (Canadian GAAP) and those generally accepted in the United States (US GAAP) is contained in note 21 to the Consolidated Financial Statements.

Unless otherwise stated, references to production and reserves represent Talisman’s working interest share (including royalty interests and net profits interests) before deduction of royalties. Throughout this MD&A the calculation of barrels of oil equivalent (boe) is calculated at a conversion rate of six thousand cubic feet (mcf) of natural gas for one barrel of oil and is based on an energy equivalence conversion method. BOEs may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf:1 bbl is based on an energy equivalence conversion method primarily applicable at the burner tip and does not represent a value equivalence at the wellhead.

Dollar amounts included in the MD&A are expressed in Canadian dollars unless otherwise indicated. All comparative percentages are between the years ended December 31, 2004 and December 31, 2003, unless stated otherwise.

Talisman Energy Inc. has a number of subsidiaries which conduct business in various parts of the world. Talisman Energy Inc.’s financial statements are prepared on a consolidated basis. For ease of reference, throughout this MD&A the terms “Talisman” and the “Company” are used to refer collectively to Talisman Energy Inc., its direct and indirect subsidiaries and partnership interests held by Talisman Energy Inc. and its subsidiaries, unless the context indicates otherwise.

Additional information relating to the Company, including the Company’s Annual Information Form, can be found on the Canadian System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com. The Company’s annual report on Form 40-F may be found in the EDGAR database at www.sec.gov.

2 T A L I S M A N E N E R G Y I N C .

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

Talisman’s Performance Highlights in 2004

In 2004, total production averaged 438 mboe/d and the Company exited the year producing 452 mboe/d in December. Net income was $663 million ($1.77/share) as higher world commodity prices and increased production were partially offset by the impact of the stronger Canadian dollar in relation to its US counterpart and increased hedging losses, royalties, operating expenses, DD&A and taxes. Net income of $1,012 million in 2003 included the gain on the Sudan sale of $296 million and a $160 million gain from Canadian federal and provincial tax rate reductions.

During 2004, nine million shares were repurchased at an average price of $31.81/share, debt plus preferred securities decreased by $177 million and the Company’s semi-annual dividend rate increased 12.5% to $0.15/share.

Operational highlights for the year included the completion of the Angostura oil and gas field development located on Block 2(c) offshore Trinidad with first oil in January 2005 and the Monkman b-60-E deep gas well discovery in Canada. In the North Sea, first production from the Tartan North field was two months ahead of schedule and approval for the development of the Tweedsmuir fields was received. In Indonesia, an agreement was signed to sell an additional 2.3 tcf of natural gas from the Corridor PSC, in which Talisman has a 36% interest.

In 2004, production averaged 438 mboe/d, 10% above last year’s average. Production per share increased 11%. Talisman spent $2.5 billion on exploration and development activities and participated in drilling 641 successful wells in 2004. During 2003 and 2002, production averaged 398 mboe/d and 445 mboe/d, respectively. These figures include the results of the Sudan operations which were sold during the first quarter of 2003. Excluding Sudan operations, production averaged 385 mboe/d in both 2003 and 2002.

In 2004, Talisman added 265 mmboe of proved reserves, before acquisitions and dispositions, replacing 166% of production. Including acquisition and disposition activity, the Company added 286 mmboe of proved reserves, replacing 179% of production.

| Net Income | | Net Income Per Share |

| ( m i l l i o n s o f d o l l a r s ) | | ( d o l l a r s ) |

| |  |

| | |

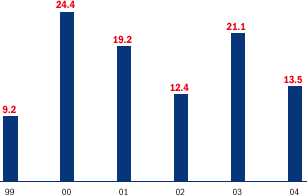

| Gross Sales | | Return on Equity |

| ( m i l l i o n o f d o l l a r s ) | | ( % ) |

| |  |

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

2 0 0 4 A N N U A L R E P O R T 3

2004 Variances

The significant variances from 2003 as summarized in the net income variance table are:

- Higher commodity prices and increased production more than offset the impact of the strengthening of the Canadian dollar and higher royalties.

- Higher commodity prices increased hedging losses.

- Operating expense increased due to current year acquisitions in the North Sea.

- Current taxes rose as a result of increased commodity prices and higher production.

- Cash stock-based compensation payments increased by $35 million.

- The gain on the sale of the Sudan operations in 2003 was $296 million.

- Depreciation, depletion and amortization expense increased $215 million as a result of higher production and increased costs in North America.

- The non-cash portion of the stock-based compensation expense decreased by $49 million (before tax).

- Future taxes are lower in 2004 due to higher cash taxes.

2005 Outlook Summary

Talisman anticipates 2005 production per share to grow to approximately 0.44-0.47 boe/share. Additional discussion of management’s estimates and assumptions for 2005 can be found in the MD&A section entitled Outlook for 2005.

- Production is expected to average 445,000-475,000 boe/d, without acquisitions or dispositions.

- Production increases are expected in most of the Company’s geographic segments with the majority coming from international projects.

- Exploration and development spending is expected to be $3.1 billion ($1.4 billion in North America and $1.0 billion in the North Sea).

- The development of the Tweedsmuir and Tweedsmuir South fields in the North Sea will continue with anticipated production start-up in late 2006 (adding approximately 45,000 boe/d in 2007).

- The Trinidad development project started production in January 2005 and is expected to average 12,000-16,000 bbls/d, net to Talisman, in 2005.

- Long-term debt is expected to remain relatively unchanged at $2.5 billion.

| Net Income(millions of dollars) | | |

| 2003 Net income1 | 1,012 | |

| Favorable (unfavorable) | | |

| Cash items variance | | |

| Oil and liquids volumes | 164 | |

| Natural gas volumes | 342 | |

| Natural gas prices | 216 | |

| Natural gas foreign exchange price impact | (174) | |

| Oil and liquids prices | 1,020 | |

| Oil and liquids foreign exchange price impact | (304) | |

| Hedging — Commodities | (286) | |

| Royalties | (230) | |

| Other revenue | 9 | |

| Operating expense | (159) | |

| Transportation expense | (11) | |

| Interest expense | (21) | |

| Current taxes (including Petroleum Revenue Tax) | (301) | |

| General and administrative | (31) | |

| Stock-based compensation payments | (35) | |

| Other | 3 | |

| Total cash items variance | 202 | |

| Non-cash items | | |

| Gain on sale of Sudan | (296) | |

| Depreciation, depletion and amortization expense | (215) | |

| Dry hole expense | (60) | |

| Exploration expense | (25) | |

| Future taxes (including Petroleum Revenue Tax) | 72 | |

| Stock-based compensation (non-cash) | 49 | |

| Other | (76) | |

| Total non-cash items variance | (551) | |

| 2004 Net income | 663 | |

1

| Restatement of prior year to effect retroactive adoption of the new accounting policy on asset retirement obligations as at January 1, 2004. See note 6 to the Consolidated Financial Statements.

|

Sale of Sudan Operations

On March 12, 2003, Talisman completed the sale of an indirectly held subsidiary, which owned an interest in the Greater Nile Oil Project in Sudan, to ONGC Videsh Limited, a subsidiary of India’s national oil company. The aggregate amount realized by Talisman from the transaction (including interest and cash received by Talisman between September 1, 2002 and closing) was $1.13 billion (US$771 million). (See note 19 to the Consolidated Financial Statements.)

Segmented Results Review

Talisman is an independent international upstream oil and gas company whose main business activities include exploration, development, production, transporting and marketing of crude oil, natural gas and natural gas liquids. The Company’s operations in 2004 were conducted principally in four geographic segments: North America, the North Sea, Southeast Asia and Algeria. The Trinidad Angostura project began production in January 2005. Exploration is being advanced in other areas outside the principal geographic segments including Alaska, Colombia, Qatar and Peru. The Company’s indirectly held interest in the Greater Nile Oil Project in Sudan

4 T A L I S M A N E N E R G Y I N C .

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

was sold on March 12, 2003. The following is a brief summary of the financial results of each geographic segment. Additional geographic financial results disclosure may be found in note 20 of the Consolidated Financial Statements. The Company’s pre-tax segmented income as discussed below is before corporate general and administration, interest, stock-based compensation, taxes and non-segmented foreign exchange gains and losses. Effective January 1, 2004, with the adoption of the new hedge accounting rules (see notes 1(k) and 11 to the Consolidated Financial Statements) the Company allocates hedging gains and losses on the basis of the percentage of relative hedged production. More detailed analysis of the Company’s results can be found after this Segmented Results Review.

North America (excludes Alaska)

During 2004, the North America operations contributed $877 million or 51% of the Company’s pre-tax segmented income of $1.7 billion, down from $892 million (61% of $1.5 billion) in 2003. Gross sales in North America increased 9% to $3.1 billion due principally to higher commodity prices and natural gas production. North American production averaged 205,000 boe/d, up 1% over 2003, and represented 47% of the Company’s total production in 2004. North American operating expense increased 7% to $421 million due to increased natural gas volumes, higher processing fees and well workover and maintenance costs. DD&A increased to $785 million, up from $688 million due to higher production and 2003 acquisitions. Exploration expense increased to $123 million due to the expanded exploration budget. Total exploration and development spending for North America in 2004 was $1.5 billion, up 31% over 2003.

North Sea

The North Sea pre-tax segmented income increased to $486 million and accounted for 28% of the Company’s pre-tax segmented income during 2004, down from 30% in 2003. North Sea gross sales increased 30% to $2.4 billion due primarily to higher prices and increased liquids production, resulting from current year acquisitions. Production averaged 140,800 boe/d or 32% of the Company’s total production. This 7% increase in production also contributed to increases in operating expenses of $134 million and DD&A expense of $45 million. Royalty expense increased due to prior period adjustments in 2003. Dry hole expense increased to $109 million with the inclusion of costs associated with eight wells. Exploration and development spending for the North Sea was $507 million, up 2% from 2003.

Production

( m b o e / d )

Southeast Asia

Southeast Asia contributed 22% ($379 million) to the Company’s pre-tax segmented income in 2004. Gross sales increased 83% to $1.1 billion with a full year of production from PM-3 CAA in Malaysia/Vietnam and increases from Corridor in Indonesia. Southeast Asia production averaged 79,000 boe/d, an increase of 80% over 2003 and contributed 18% to the Company’s total production. Total operating expenses increased 14% from 2003 to $98 million, but unit costs were down 37% to $3.39 per boe as a result of the increase in production mainly related to the low unit cost PM-3 CAA volumes. DD&A expense increased with the growth in production. Capital spending for Southeast Asia was $255 million, down 19% from 2003.

Algeria

Algeria contributed 6% ($97 million) to the Company’s pre-tax segmented income in 2004. Gross sales increased 170% to $254 million with continuing production increases after startup in 2003. Production for 2004 averaged 13,500 bbls/d. Unit operating costs in 2004 decreased 31% to $3.51/bbl as a result of the production increases. Capital spending for Algeria was $8 million, down 76% from 2003 due to the completion of the initial development phase of the Greater MLN project.

Other Exploration and Development

Development continued on the Angostura oil and gas field located on Block 2(c) offshore Trinidad. Including exploratory drilling on the adjacent Block 3(a) and 3D seismic on the onshore Eastern Block, the Company spent $191 million in Trinidad during 2004. Production from the Angostura field started in January 2005. Elsewhere, during 2004 the Company spent $125 million, the majority of which was in Alaska, Colombia, Qatar and Peru.

Corporate Results Review

Revenue

Revenues from oil, liquids and natural gas sales in 2004 were $6.9 billion, up 23% over last year due to higher oil and liquids prices ($716 million), gas volumes ($342 million), oil and liquids volumes ($164 million) and natural gas prices ($42 million). As a result of higher prices, hedging losses in 2004 were $286 million greater than 2003.

| Daily Production Volumes | | | | | | |

| | 2004 | | 2003 | | 2002 | |

| Oil and liquids (mbbls/d) | | | | | | |

| North America | 57.4 | | 59.6 | | 62.7 | |

| North Sea | 121.9 | | 113.1 | | 127.5 | |

| Southeast Asia | 35.6 | | 24.4 | | 22.5 | |

| Algeria | 13.5 | | 6.6 | | — | |

| Sudan | — | | 13.0 | | 60.0 | |

| | 228.4 | | 216.7 | | 272.7 | |

| Natural gas (mmcf/d) | | | | | | |

| North America | 885 | | 864 | | 820 | |

| North Sea1 | 114 | | 109 | | 122 | |

| Southeast Asia | 260 | | 117 | | 94 | |

| | 1,259 | | 1,090 | | 1,036 | |

| Total (mboe/d @ 6:1) | 438 | | 398 | | 445 | |

| Production per share (boe/share) | 0.42 | | 0.38 | | 0.40 | |

1 Includes gas acquired for injection and subsequent resale of 5 mmcf/d in 2004.

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

2 0 0 4 A N N U A L R E P O R T 5

In 2004, production averaged 438 mboe/d for the year, 10% above last year’s average. Production per share increased 11%. The 2003 and 2002 production averages of 398 mboe/d and 445 mboe/d, respectively, include the results of the Sudan operations which were sold during the first quarter of 2003. Excluding the Sudan operations, production averaged 385 mboe/d in both 2003 and 2002. Production in 2004 was 14% higher than the previous year, excluding the Sudan production.

During 2004, North America natural gas production increased by 21 mmcf/d to 885 mmcf/d. This 2% growth in production is due to Talisman’s drilling program. During 2004, Talisman drilled 620 wells in North America with a 94% success rate. Significant production increases were achieved in Appalachia which averaged 89 mmcf/d, up 29 mmcf/d, and in Alberta Foothills, up 21 mmcf/d to 151 mmcf/d, as new wells were brought onstream, which more than offset decreases resulting from natural declines. North America oil and liquids production averaged 57,392 bbls/d during the year, down 4% from 2003 due to natural declines and the Company’s continued focus on natural gas.

North Sea oil and liquids production averaged 121,861 bbls/d, an increase of 8% over 2003, due to the impact of drilling results and asset acquisitions. During 2004, the Company completed a number of acquisitions, one of which increased the Company’s interest in a number of fields in the Flotta Catchment Area. The Company also acquired a 67% interest in the Galley field, as well as additional minor working interests in other North Sea fields and exploration blocks. During the fourth quarter, production averaged 127,943 bbls/d, up 15% over the third quarter, and exited 2004 with production of 132,000 bbls/d in December. North Sea production highlights for 2004 included the startup of the Tartan North development ahead of schedule in August. North Sea natural gas production increased 5% to 114 mmcf/d.

Southeast Asia oil and liquids production averaged 35,644 bbls/d in 2004, an increase of 46% over 2003. Total production for the year in Malaysia/Vietnam increased to 22,388 bbls/d from 8,672 the previous year, reflecting a full year of production from the PM-3 CAA Phase 2 development project, which came on stream in September 2003. Indonesia oil and liquids production averaged 13,255 bbls/d, down 16% from 2003 due to natural decline and the expiry of the Tanjung contract during the fourth quarter of 2004.

Southeast Asia natural gas production increased 122% to 260 mmcf/d in 2004. Natural gas production from PM-3 CAA Phase 2 increased to 119 mmcf/d in 2004, due to a full year of Phase 2 production. Natural gas sales in Indonesia averaged 141 mmcf/d with higher Corridor sales to Caltex and a full year of sales to Singapore, which commenced in September of 2003, under a 20 year contract with Gas Supply Pte Ltd.

Algeria oil production for 2004 averaged 13,537 bbls/d, up from 6,594 bbls/d in 2003 which reflected a partial year of production.

| Commodity Prices1 | | | | | | |

| | 2004 | | 20032 | | 20022 | |

| Oil and liquids ($/bbl) | | | | | | |

| North America | 42.11 | | 35.78 | | 32.81 | |

| North Sea | 48.29 | | 39.72 | | 38.76 | |

| Southeast Asia | 51.29 | | 41.35 | | 40.12 | |

| Algeria | 51.17 | | 39.01 | | — | |

| Sudan | — | | 43.89 | | 37.79 | |

| | 47.45 | | 39.09 | | 37.34 | |

| Natural gas ($/mcf) | | | | | | |

| North America | 6.83 | | 6.58 | | 4.20 | |

| North Sea | 5.55 | | 4.77 | | 4.16 | |

| Southeast Asia | 4.74 | | 5.72 | | 5.65 | |

| | 6.28 | | 6.30 | | 4.33 | |

| Company $/boe (6 mcf=1 boe) | 42.75 | | 38.51 | | 32.89 | |

| Hedging loss/(income) excluded from the above prices | | | | | | |

| Oil and liquids ($/bbl) | 5.42 | | 2.05 | | 0.09 | |

| Natural gas ($/mcf) | 0.07 | | 0.08 | | (0.22) | |

| Total $/boe (6mcf=1boe) | 3.02 | | 1.34 | | (0.46) | |

| Benchmark prices | | | | | | |

| WTI (US$/bbl) | 41.40 | | 30.99 | | 26.15 | |

| Dated Brent (US$/bbl) | 38.22 | | 28.83 | | 25.03 | |

| NYMEX (US$/mmbtu) | 6.09 | | 5.44 | | 3.25 | |

| AECO (C$/gj) | 6.44 | | 6.35 | | 3.86 | |

| US$/Canadian$ exchange rate | 0.768 | | 0.714 | | 0.637 | |

| Canadian$/Pound sterling exchange rate | 2.384 | | 2.288 | | 2.358 | |

1

| Prices exclude gains or losses related to hedging activities and do not include synthetic oil.

|

2

| During 2004, the Company reclassified transportation costs on a retroactive basis. Previously, these costs had been partially netted off against realized prices. See note 2 to the Consolidated Financial Statements.

|

World oil prices reached record levels during 2004, with WTI averaging US$41.40/bbl, a 34% increase over the 2003 WTI average of US$30.99/bbl. North American natural gas prices increased 12% over 2003 with NYMEX averaging US$6.09/mmbtu.

More than 90% of the Company’s revenues are either received in US dollars or are closely referenced to US dollars. The Company converts these revenues to Canadian dollars for reporting purposes. The strengthening of the Canadian dollar reduced Talisman’s reported oil and liquids price by $3.62/bbl to $47.45/bbl, a 21% increase over 2003. During the same time period, WTI increased 34% to average US$41.40 during 2004. Talisman’s North America oil and liquids price averaged $42.11/bbl, up 18% from last year. The Company’s North Sea oil and liquids price averaged $48.29/bbl, up 22% over 2003. The Company’s Southeast Asia oil and liquids price averaged $51.29/bbl, up 24% over 2003. The Company’s Algeria oil price averaged $51.17/bbl, up 31% over 2003, as the price was impacted by the timing of production liftings.

Talisman’s average natural gas price in North America increased 4% to $6.83/mcf. The strengthening of the Canadian dollar during 2004 reduced Talisman’s reported North America natural gas price by

6 T A L I S M A N E N E R G Y I N C .

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

$0.47/mcf. The Company’s North Sea natural gas price increased 16% as a result of an increase in the spot price due to tightening supply/demand fundamentals.

The Company’s natural gas price in Southeast Asia averaged $4.74/mcf, down 17% from 2003, due to the increase in sales from Malaysia/Vietnam, where prices are referenced to the Singapore fuel oil spot market and averaged $3.09/mcf in 2004. Gas production from Malaysia/Vietnam accounted for 46% of Southeast Asia gas production during the current year, up from 4% of total 2003 production for the area. A large portion of Corridor gas production which constituted approximately 51% of the Company’s 2004 gas sales in Southeast Asia, is exchanged for Duri crude oil on an energy equivalence relationship and is sold offshore with payment in US dollars, and averaged $6.38/mcf.

The Company’s average sales prices are before a net hedging loss of $480 million, comprised of a $0.07/mcf loss on gas hedges (2003 — $0.08/mcf loss) and a $5.42/bbl loss on oil hedges (2003 —$2.05/bbl loss). The physical and financial commodity price contracts for 2005 outstanding at year end are disclosed in notes 11 and 12 to the Consolidated Financial Statements with additional discussion in the MD&A section entitled Derivative Financial Instruments and Commodity Sales Contracts. Additional discussion of the expected impact of commodity price contracts on the Company’s 2005 results can be found in the Outlook for 2005 section of this MD&A. The Company’s accounting policy with respect to derivative financial instruments and commodity contracts is disclosed in note 1(k) to the Consolidated Financial Statements.

| Royalties1 | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | 2004 | | 20032 | | 20022 | |

| | Rates (%) | | $millions | | Rates (%) | | $millions | | Rates (%) | | $millions | |

| Oil and liquids | | | | | | | | | | | | |

| North America | 20 | | 174 | | 21 | | 155 | | 21 | | 149 | |

| North Sea | 1 | | 19 | | — | | (3)4 | | 74 | | | |

| Southeast Asia | 41 | | 277 | | 39 | | 143 | | 37 | | 122 | |

| Algeria | 38 | | 97 | | 49 | | 46 | | — | | — | |

| Sudan | — | | — | | 46 | | 97 | | 40 | | 328 | |

| | 14 | | 567 | | 14 | | 438 | | 18 | | 673 | |

| Natural gas | | | | | | | | | | | | |

| North America | 19 | | 425 | | 21 | | 432 | | 18 | | 224 | |

| North Sea | 8 | | 18 | | 6 | | 11 | | 12 | | 21 | |

| Southeast Asia | 25 | | 114 | | 5 | | 13 | | 4 | | 9 | |

| | 19 | | 557 | | 18 | | 456 | | 15 | | 254 | |

| | 16 | | 1,124 | | 16 | | 894 | | 17 | | 927 | |

1

| Royalty rates do not include synthetic oil.

|

2

| During 2004, the Company reclassified transportation costs as an expense on a retroactive basis. Previously, these costs had been partially netted off against revenues. This change has no impact on net income, but increased revenues, resulting in reduced royalty rates, which are percentages of reported prices. See note 2 to the Consolidated Financial Statements.

|

The consolidated royalty expense increased 26% to $1,124 million in 2004, due to higher commodity prices, increased volumes and rate increases in Southeast Asia.

In North America, natural gas royalties decreased slightly to $425 million, averaging 19%, down from 21% in 2003. This reflects higher gas cost allowance, operating costs and royalty holidays, in addition to the increase to 89 mmcf/d in the Company’s Appalachia production, which had a lower royalty rate.

In Southeast Asia, the natural gas royalty rate increased as a result of the impact of the payout of cost recovery pools at Corridor during the first quarter of 2004. Under the terms of the Corridor production sharing contract (PSC),after the Company has recovered its historical capital costs, the Government of Indonesia increases its share of production, which results in a higher royalty rate. Corridor’s natural gas royalty rate averaged 29% during 2004, compared to 5% in the prior year. The Southeast Asia royalty rate was also impacted by a higher proportion of Malaysia/Vietnam volumes at a royalty rate of 24%. Under the terms of the production sharing contract in Malaysia, 60% of gas production is available for cost recovery. The government receives 10% of production as royalty and the remaining 30% profit gas is split 50% to the government and 50% to the working interest owners. This results in a total royalty of 25%, which is combined with a 13% royalty rate in Vietna m for a blended rate of 24%. This royalty rate is expected to continue until the Malaysia gas cost pools are recovered in 2013, based on current forecasts of production and prices.

The Company’s oil and liquids royalty rate remained constant at 14%, while the amount of royalties paid increased 29% to $567 million. This increase is due primarily to a combination of higher prices and production increases in Southeast Asia and Algeria, partially offset by the sale of the Sudan operations. Southeast Asia oil and liquids royalties averaged 41% in 2004, up from 39% in 2003. The total expense almost doubled to $277 million due to production increases in Malaysia/Vietnam where rates, which are tied to production levels, reached a current maximum of 35%, up from 31% last year. Under the terms of the production sharing contract in Malaysia, 50% of oil production is available for cost recovery. The government receives 10% of production as royalty and the remaining 40% profit oil is split 70% to the government and 30% to the working interest owners. This results in a total royalty of 38%, which is combined with an 18% royalty rate in Vietnam for a blended rate o f 35%. This royalty rate is expected to continue until the Malaysia oil cost pools are recovered in the second half of 2006 based on current forecasts of production and prices. In 2007, the rate is expected to increase to approximately 41%.

In Algeria, the royalty expense more than doubled to $97 million as production increased 105% from last year, while the rate decreased to 38% from 49%.

Under the terms of the Algeria production sharing contractual arrangement, Talisman is subject to a 51% total government take, part of which is income tax, during the first five years of production. During the first four years of production, Talisman receives accelerated production entitlement. During the fifth year of the agreement, any accelerated production entitlement received by Talisman during the first four years in excess of 49% on a cumulative basis reverts to the government.

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

2 0 0 4 A N N U A L R E P O R T 7

Accordingly, during the first four years of production, Talisman will record a deferred royalty expense and liability for any production entitlement received in excess of 49%. During 2004, Talisman recorded deferred Algerian royalties of $18 million, for a total of $32 million to date. In both 2004 and 2003, total taxes and royalties combined to average a rate of 51%.

Operating Expenses and Unit Operating Costs

| | 2004 | | 20031 | | 20021 | |

| Oil and liquids | $/bbl | | $millions | | $/bbl | | $millions | | $/bbl | | $millions | |

| North America | 6.75 | | 135 | | 6.28 | | 131 | | 5.55 | | 121 | |

| North Sea | 13.27 | | 592 | | 11.51 | | 475 | | 9.87 | | 459 | |

| Southeast Asia | 5.57 | | 73 | | 7.22 | | 64 | | 7.77 | | 64 | |

| Algeria | 3.51 | | 17 | | 5.07 | | 12 | | — | | — | |

| Sudan | — | | — | | 3.73 | | 18 | | 3.82 | | 84 | |

| | 9.89 | | 817 | | 8.96 | | 700 | | 7.39 | | 728 | |

| Natural gas | $/mcf | | $millions | | $/mcf | | $millions | | $/mcf | | $millions | |

| North America | 0.79 | | 257 | | 0.75 | | 237 | | 0.71 | | 212 | |

| North Sea | 0.55 | | 23 | | 0.37 | | 14 | | 0.43 | | 19 | |

| Southeast Asia | 0.27 | | 25 | | 0.50 | | 22 | | 0.59 | | 21 | |

| | 0.66 | | 305 | | 0.69 | | 273 | | 0.67 | | 252 | |

| Company (boe) | 7.04 | | 1,122 | | 6.74 | | 973 | | 6.44 | | 980 | |

| Synthetic oil | 20.67 | | 23 | | 22.63 | | 22 | | 18.00 | | 19 | |

| Pipeline | — | | 53 | | — | | 44 | | — | | 49 | |

| | — | | 1,198 | | — | | 1,039 | | — | | 1,048 | |

1

| During 2004, the Company reclassified transportation costs on a retroactive basis. Previously, these costs had been partially included in operating expenses. See note 2 to the Consolidated Financial Statements.

|

Total operating expenses for the Company during 2004 were $1.2 billion, 15% higher than last year, with the North Sea comprising $134 million or almost 84% of the $159 million year-over-year increase. On a per unit basis, oil and liquids costs increased 10% to $9.89/bbl and natural gas costs averaged $0.66/mcf, a 4% decrease from 2003.

North America oil and liquids operating costs during 2004 were $135 million, an increase of 3% from 2003, due to increases in maintenance and well workovers, partially offset by reduced power costs. On a per unit basis, the increase in total costs coupled with a 4% decrease in volumes resulting in a 7% increase to $6.75/bbl. Unit operating costs for natural gas increased 5% to $0.79/mcf with higher processing and maintenance and well workover costs partially offset by reduced power costs and the lower unit operating costs ($0.25/mcf) in Appalachia.

In 2004, North Sea operating expenses of $615 million were up $126 million or 26% over last year due to the impact of increased production resulting from recent acquisitions and a 4% strengthening in the pound sterling against the Canadian dollar. The acquisitions resulted in an increase of $97 million of the $126 million increase over 2003. Unit operating costs averaged $11.93/boe which reflects increased maintenance and well workover costs as well as pipeline repair costs at Beatrice.

Southeast Asia unit operating costs decreased 37% to $3.39/boe, due to higher PM-3 CAA and Corridor sales volumes. Oil and liquids unit costs averaged $5.57/bbl, down 23% from the prior year.

In Malaysia/Vietnam, PM-3 CAA unit costs averaged $2.10/bbl, a 66% decrease from 2003, due to increased production volumes. Indonesia unit costs increased 46%, averaging $11.44/bbl, primarily reflecting increased costs and decreased volumes associated with the expiry of the Tanjung contract during the fourth quarter of 2004. Southeast Asia natural gas unit costs averaged $0.27/mcf, 46% less than 2003. At Corridor, total gas expenses decreased by $1 million and production increased by 26% for an average of $0.38/mcf, 25% less than last year. Malaysia/Vietnam averaged $0.12/mcf as production increased to 119 mmcf/d, up from 5 mmcf/d in 2003.

Algeria unit operating costs averaged $3.51/bbl, a decrease of 31% from $5.07/bbl, due to the production increase in 2004.

Transportation Expenses

Effective 2004, the Company began accounting for transportation costs as expenses, on a retroactive basis. Previously, these costs had been either netted off against the realized price or included as a component of operating costs, depending on the circumstances in the various geographic segments. Prior year comparatives were restated to reflect this change in accounting policy. See note 2 to the Consolidated Financial Statements for further details. The result of this reclassification, which had no impact on net income, is set forth in the table below:

| | 2004 | | 2003 | | 2002 | |

| Oil and liquids($/bbl) | | | $millions | | | | $millions | | | | $millions | |

| North America | 0.49 | | 10 | | 0.48 | | 10 | | 0.38 | | 9 | |

| North Sea | 1.14 | | 51 | | 1.16 | | 48 | | 1.24 | | 56 | |

| Southeast Asia | 0.23 | | 3 | | 0.41 | | 4 | | 0.82 | | 7 | |

| Algeria | 1.76 | | 9 | | 1.77 | | 4 | | — | | — | |

| Natural gas($/mcf) | | | | | | | | | | | | |

| North America | 0.20 | | 66 | | 0.21 | | 67 | | 0.24 | | 71 | |

| North Sea | 0.35 | | 14 | | 0.37 | | 15 | | 0.45 | | 20 | |

| Southeast Asia | 0.41 | | 39 | | 0.77 | | 33 | | 0.93 | | 31 | |

| | | | 192 | | | | 181 | | | | 194 | |

Depreciation, Depletion and Amortization Expense (includes accretion of ARO)

| | 2004 | | 20031 | | 20021 | |

| | $/boe | | $millions | | $/boe | | $millions | | $/boe | | $millions | |

| North America | 10.47 | | 785 | | 9.26 | | 688 | | 8.32 | | 606 | |

| North Sea | 12.83 | | 661 | | 12.85 | | 616 | | 12.54 | | 676 | |

| Southeast Asia | 6.02 | | 174 | | 5.92 | | 95 | | 6.24 | | 87 | |

| Algeria | 5.99 | | 30 | | 6.99 | | 17 | | — | | — | |

| Sudan | — | | — | | 3.98 | | 19 | | 4.24 | | 93 | |

| | 10.29 | | 1,650 | | 9.87 | | 1,435 | | 8.99 | | 1,462 | |

1

| Restatement of prior year to effect retroactive adoption of the new accounting policy on asset retirement obligations (ARO) as at January 1, 2004. See note 6 to the Consolidated Financial Statements.

|

The Company’s 2004 depreciation, depletion and amortization (DD&A) expense increased $215 million or 15% to $1.7 billion, with a per unit rate of $10.29/boe. During the fourth quarter of 2004, the Company

8 T A L I S M A N E N E R G Y I N C .

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

recorded an adjustment to DD&A related to prior quarters of the year and changed the estimated lives of certain assets. The DD&A rates in North America increased primarily due to higher drilling costs, increased capital expenditures on infrastructure projects and the inclusion of costs associated with US property and midstream acquisitions in 2003. In the North Sea, total expense increased 7% to $661 million due to the impact of increased production, while the unit rate remained constant. Total DD&A expense for Southeast Asia increased primarily as a result of increased production from Malaysia/Vietnam, which has a higher DD&A rate.

For additional information relating to DD&A refer to the MD&A section entitled Application of Critical Accounting Policies and to note 5 to the Consolidated Financial Statements.

| Dry Hole Expense | | | | | | |

| | | | | | | |

| (millions of dollars) | 2004 | | 2003 | | 2002 | |

| North America | 128 | | 135 | | 128 | |

| North Sea | 109 | | 69 | | 9 | |

| Southeast Asia | 25 | | 9 | | 4 | |

| Algeria | 4 | | 1 | | — | |

| Sudan | — | | — | | 13 | |

| Other | 45 | | 37 | | 20 | |

| | 311 | | 251 | | 174 | |

During 2004, the Company incurred dry hole expenses of $311 million, $60 million higher than last year. In the North Sea, a total of seven wells were expensed and accounted for the majority of the overall increase. The Company also wrote off two wells in Indonesia, four wells in Malaysia/Vietnam and four wells in the rest of the world.

Under the successful efforts method of accounting for oil and gas activities, the costs of unsuccessful and non-commercial exploration wells are written off to dry hole expense in the year such determination is made. Until such determination is made, the costs are included in non-depleted capital. At year end, $284 million of costs relating to exploration wells were included in non-depleted capital and not subject to DD&A pending final determination, the majority of which were drilled in 2004 (2003 — $283 million; 2002 — $353 million).

| Exploration Expense | | | | | | |

| | | | | | | |

| (millions of dollars) | 2004 | | 2003 | | 2002 | |

| North America | 123 | | 87 | | 66 | |

| North Sea | 28 | | 21 | | 20 | |

| Southeast Asia | 20 | | 17 | | 19 | |

| Algeria | — | | — | | 5 | |

| Sudan | — | | 5 | | 6 | |

| Other1 | 67 | | 83 | | 69 | |

| | 238 | | 213 | | 185 | |

1 Other includes Trinidad, Qatar and Alaska.

Exploration expense consists of geological and geophysical costs, seismic, land lease rentals and indirect exploration expenses. These costs are expensed as incurred under the successful efforts method of accounting.

Exploration expense is closely tied to the total amount of exploration activity in a year.

| Corporate and Other | | | | | | |

| | | | | | | |

| (millions of dollars) | 2004 | | 2003 | | 2002 | |

| G&A expense | 183 | | 152 | | 138 | |

| Interest expense | 158 | | 137 | | 164 | |

| Capitalized interest | 13 | | 24 | | 25 | |

| Stock-based compensation | 171 | | 185 | | — | |

| Preferred securities charges | 15 | | 38 | | 42 | |

| Other revenue | 85 | | 76 | | 80 | |

| Other expense | 89 | | 16 | | 113 | |

General and administrative (G&A) expense increased due to salary increases and additional personnel due to expanding investment and operations, additional documentation requirements associated with corporate governance initiatives, and higher legal and pension costs. On a unit basis, G&A was $1.14/boe (2003 — $1.05/boe; 2002 — $0.85/boe).

As a result of the reduction in the total balance of long-term debt and preferred securities, partially offset by higher effective interest rates during the year, the sum of interest on long-term debt, capitalized interest and preferred securities charges decreased by $13 million to $186 million. Interest capitalized over the last year is primarily associated with the Angostura development in Trinidad, which came on production in January 2005, and the Tweedsmuir development project in the North Sea.

During 2004, the Company redeemed its outstanding preferred securities, realizing a $23 million gain (net of tax), being the difference between the carrying value and the redemption cost. The redemptions were funded from current cash flow and bank borrowings, and gains were credited directly to retained earnings. Preferred securities charges, net of taxes, of $9 million have been charged directly to retained earnings. Preferred securities charges, before tax, totaled $15 million. Net income per share includes both the after tax gain on the redemption of, and after tax charges for, preferred securities.

Other revenue includes pipeline and custom treating revenues and miscellaneous income. Other expense for 2004 included foreign exchange losses of $30 million, property impairments in the North Sea at Iona and Claymore of $31 million, a net loss on property dispositions of $30 million, and a $20 million insurance expense adjustment partially offset by a gain on the unwinding of cross currency and interest rate swap contracts of $15 million. The loss on property dispositions was comprised of a loss of $49 million on a sale of North American assets partially offset by gains on other dispositions, principally the sale of the Madura property in Indonesia.

Stock-Based Compensation

Stock-based compensation expense relates to the appreciated value of the Company’s outstanding stock options and cash units at December 31, 2004, which was first expensed during 2003. The Company’s stock-based compensation expense is based on the difference between the Company’s share price and its stock options, or cash units exercise price. The $171 million expensed in 2004 was comprised of $89 million

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

2 0 0 4 A N N U A L R E P O R T 9

non-cash and $82 million cash. The number of options exercised in 2004 was high relative to historical trends. Over the course of the year, the average exercise price of all outstanding options increased from $17.55 per share to $19.58 per share.

The Company’s stock option plans were amended during 2003 to provide employees and directors who hold stock options with the choice upon exercise to purchase a share of the Company at the stated exercise price or to receive a cash payment in exchange for surrendering the option. The cash payment is equal to the appreciated value of the stock option as determined based on the difference between the option’s exercise price and the Company’s share price approximately at the time of surrender. The cash payment alternative is expected to result in reduced shareholder dilution in the future as it is anticipated that most holders of the stock options (now and in the future) will elect to take a cash payment. Such cash payments made by the Company to stock option holders are deductible by the Company for income tax purposes, making these plans more cost effective.

Since the introduction of the cash feature, approximately 98% of options that have been exercised, have been exercised for cash, resulting in reduced dilution of shares.

Additional stock-based compensation expense or recoveries in future periods is dependent on the movement of the Company’s share price and the number of outstanding options and cash units.

Income Taxes

The Company’s effective tax rate for 2004, after deducting Petroleum Revenue Tax (PRT), was 36% compared to 15% in 2003 and 44% in 2002. A number of events in the past two years have significantly impacted the Company’s effective tax rates including tax rate reductions in Canada, sale of the Company’s indirectly held interest in the Greater Nile Oil Project in Sudan in 2003 and a supplemental oil and gas tax enacted in the UK in 2002.

| Effective Income Tax Rate | | | | | | |

| (millions of dollars) | 2004 | | 20031 | | 20021 | |

| Income before tax | 1,165 | | 1,285 | | 1,101 | |

| Less PRT | | | | | | |

| Current | 124 | | 72 | | 91 | |

| Future | 5 | | 20 | | 33 | |

| | 129 | | 92 | | 124 | |

| | 1,036 | | 1,193 | | 977 | |

| Income tax expense/(recovery) | | | | | | |

| Current | 478 | | 229 | | 258 | |

| Future | (105) | | (48) | | 175 | |

| | 373 | | 181 | | 433 | |

| Effective income tax rate (%) | 36 | | 15 | | 44 | |

1

| Restatement of prior year to effect retroactive adoption of the new accounting policy on asset retirement obligations as at January 1, 2004. See note 6 to the Consolidated Financial Statements.

|

In 2004, the Company recorded a future tax recovery of $50 million due to a reduction in Canadian federal and provincial tax rates, compared to a $160 million recovery of future taxes in 2003 for both Canadian rates. A similar reduction in the Alberta corporate tax rate in 2002 resulted in a future tax recovery of $12 million. Effective April 17, 2002, the UK increased its corporate income tax rate applicable to North Sea oil and gas profits by enacting a 10% supplementary charge. This increased the Company’s future tax expense for 2002 by $128 million. Partially offsetting this tax increase was the acceleration of tax allowances for capital expenditures incurred after April 17, 2002.

A normalized effective tax rate after removing the impact of the Canadian and UK tax rate changes, the tax on unrealized foreign exchange gains on foreign denominated debt and the impact of the gain on disposal of the Sudan operations would have been 37% in 2004, 34% in 2003 and 35% in 2002. Foreign exchange rate fluctuations over the past two years have resulted in taxes on gains related to inter-company loans and non-Canadian dollar denominated debt, for which there is no corresponding component of the unrealized gain reflected in income before taxes. See note 15 to the Consolidated Financial Statements for additional information on the Company’s income taxes.

Current income tax expense increased to $478 million in 2004, due primarily to higher commodity prices and volumes, which resulted in increases in current taxes of $175 million in the North Sea, $50 million in Southeast Asia, $33 million in Algeria and $22 million in North America.

The UK Government levies PRT on North Sea fields which received development approval before April 1993, based on gross profit after allowable deductions, including capital and operating expenditures. PRT, which is deductible for purposes of calculating corporate income tax, increased as a result of both higher prices and volumes on fields in the UK subject to PRT.

| Capital Spending1,3 | | | | | | |

| | | | | | | |

| (millions of dollars) | 2004 | | 2003 | | 2002 | |

| North America | 1,500 | | 1,580 | | 939 | |

| North Sea | 721 | | 693 | | 518 | |

| Southeast Asia | 235 | | 316 | | 269 | |

| Algeria | 8 | | 34 | | 107 | |

| Trinidad | 191 | | 130 | | 78 | |

| Sudan | — | | 2 | | 98 | |

| Other2 | 125 | | 93 | | 43 | |

| Corporate, IS and Administrative | 26 | | 38 | | 26 | |

| | 2,806 | | 2,886 | | 2,078 | |

1

| Includes expenditures for exploration, development and asset acquisitions net of dispositions, but excludes the Sudan disposition in 2003.

|

2

| Other includes Colombia, Peru, Qatar and frontier North America.

|

3

| Includes interest costs which are capitalized on major development projects until facilities are completed and ready for use.

|

Natural gas continues to be the focus of the Company’s capital investment activities in North America, supplemented by low risk oil projects and strategic acquisitions. Of the $1.5 billion of capital spending in North America, $590 million related to exploration activities while development accounted for $862 million. The Company participated in 444 gas wells and 137 oil wells in North America and had a success rate of 94%. Development spending was concentrated in

10 T A L I S M A N E N E R G Y I N C .

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

the predominantly gas producing core areas in the Alberta Foothills, Greater Arch, Deep Basin, Monkman/BC Foothills, Edson and Appalachia regions. In addition, the Company spent $48 million on acquisitions ($110 million, net of dispositions of $62 million), including US properties ($93 million).

Total capital spending in the North Sea was $721 million including $150 million for exploration and $357 million for development with the remaining $214 million for net property acquisitions. Development activity included the Tweedsmuir project and drilling and recompletion activity within the Clyde, Buchan, Tartan, Piper and Claymore fields. In addition, development expenditures were incurred in Norway on the Gyda field. A total of 17 successful development wells were drilled during 2004 in the North Sea. Exploration drilling included the successful 21/1a North Buchan J5 well which added significant reserves to Tweedsmuir. During 2004, the Company completed a number of acquisitions, the most significant of which was the $176 million acquisition from Intrepid which resulted in an increase in the Company’s interests in a number of fields in the Flotta Catchment Area. The Company also acquired a 67% interest in the Galley field, as well as additional minor working interests in other North Sea fields and exploration blocks.

Malaysia/Vietnam accounted for a majority of the $235 million of total capital spending in Southeast Asia, due to the PM-3 CAA development and the South Angsi field development in PM305. Talisman participated in drilling 14 successful development wells in Malaysia/Vietnam during 2004. In addition, one successful exploration well was drilled in PM-3 CAA. A total of $3 million, net of proceeds on disposition, was spent in Indonesia. Talisman participated in drilling two unsuccessful wells in Indonesia during 2004.

Capital spending in Algeria totaled $8 million in 2004, as the Company participated in three successful wells during the year.

In Trinidad, a total of $191 million was spent on the Angostura development and exploration activity.

During 2004 the Company spent $63 million in Alaska on seismic, exploratory drilling and land acquisitions. Talisman spent $17 million in Colombia on exploration drilling during 2004, as well as $11 million on seismic acquisition in Qatar and $13 million on exploration in Peru.

Information related to details and funding of the 2005 capital expenditures program is included in the Outlook for 2005 section of this Management’s Discussions and Analysis.

Reserves Replacement

Talisman drilled 641 successful wells in 2004 and increased its total proved reserves by 9% to 1,488 mmboe at the end of 2004. The Company replaced 179% of conventional production from all sources and 166% through the drill bit. Talisman’s net proved reserves increased by 11% to 1,207 mmboe. Drilling related reserve additions totalled 265 mmboe. Talisman also acquired 21 mmboe of proved reserves.

Proved oil and liquids reserves increased 7% to 618 mmbbls. Talisman added a total of 121 mmbbls, including 85 mmbbls in the North Sea, 18 mmbbls in Southeast Asia, 13 mmbbls in Algeria and 13 mmbbls in North America, partially offset by an 8 mmbbls reduction in Trinidad. The majority (75%) of these reserve additions were through discoveries, additions, extensions and revisions. North America (30%) and the North Sea (48%) account for the majority of Talisman’s oil reserves. These are predominantly high quality crude oil and natural gas liquids. Talisman has virtually no heavy oil or bitumen reserves.

Talisman’s proved natural gas reserves increased by 11% in 2004, totaling 5.2 tcf at year end. Talisman’s North American natural gas reserves were 2.6 tcf at year end, unchanged from the previous year. In North America, the Company added a record 479 bcf through the drill bit (147% of production), offset by record natural gas production (325 bcf), minor net asset sales (50 bcf) and downward revisions to existing reserves (113 bcf). These numbers include Fortuna’s natural gas reserves in the northeastern US, which totalled 153 bcf (an increase of 40%) at year end, with the addition of 59 bcf through drilling activities.

Talisman’s proved international natural gas reserves increased 26% to 2.6 tcf at year end. The majority of this increase came from the addition of 695 bcf of proved undeveloped reserves in Indonesia as a result of an agreement to sell gas to PT Perusahaan Gas Negara (Persero), Tbk. (“PGN”), the Indonesian national gas transmission and distribution company. These reserves will be developed over the next two years, in anticipation of sales commencing in the first quarter of 2007.

Over the past three years, Talisman has added 565 mmboe of proved reserves through discoveries, additions and extensions (including revisions) and acquired 58 million boe of proved reserves net of dispositions (not including the impact of the sale of Talisman’s indirect interest in the Greater Nile Oil Project in Sudan). Approximately 90% of Talisman’s proved reserves have been independently evaluated over the past three years.

The reserves replacement ratio of 166% was calculated by dividing the sum of changes (revisions of estimates, improved recovery and discoveries) to estimated proved oil and gas reserves during 2004 by the Company’s 2004 conventional production. The reserves replacement ratio of 179% was calculated by dividing the sum of changes (revisions of estimates, improved recovery, discoveries, acquisitions and dispositions) to estimated proved oil and gas reserves during 2004 by the Company’s 2004 conventional production.

The Company’s management uses reserve replacement ratios, as described above, as an indicator of the Company’s ability to replenish annual production volumes and grow its reserves. It should be noted that a reserve replacement ratio is a statistical indicator that has limitations. As an annual measure, the ratio is limited because it typically varies widely based on the extent and timing of new discoveries, project sanctioning and property acquisitions. Its predictive and comparative value is also limited for the same reasons. In addition, since the ratio does not imbed the cost, value or timing of future production of new reserves, it cannot be used as a measure of value creation.

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

2 0 0 4 A N N U A L R E P O R T 11

Liquidity and Capital Resources

Talisman’s long-term debt at year end was $2.5 billion, down from a total of $2.6 billion of long-term debt ($2.2 billion) and preferred securities ($431 million) at the end of last year. During 2004, the Company generated $3.1 billion of cash provided by operating activities and spent $2.5 billion on exploration and development and a net $242 million on acquisitions. In addition, the Company financed the redemption of the preferred securities, repurchased nine million common shares and paid dividends of $114 million. At year end, the Company had drawn $328 million of its available $1,335 million bank lines of credit. The Company maintains a debt shelf prospectus in the US under the Multi-Jurisdictional Disclosure System under which it may issue up to US$1 billion of debt securities in the US public debt market until January 2006, at which time the current registration statement could no longer be used and a new registration statement would have to be filed.

In 2005, $241 million (US$200 million) of long-term debt matures. None of this debt has been classified as a current liability as the Company currently has the ability and intention to refinance amounts due within one year with existing bank facilities.

At December 31, 2004, the Company had an excess of current liabilities over current assets of $673 million. In 2005, cash provided by operating activities is expected to range between $3.6 and $3.8 billion, with capital expenditures of $3.1 billion, dividends of $110 million and share repurchases in the amount of approximately $300 million. The Company does not expect working capital to change significantly, but to the extent that funds are required to meet obligations, the Company can draw down on its existing bank credit facilities ($1.0 billion available for drawdown at December 31, 2004).

During 2004, the Company redeemed its outstanding preferred securities, realizing a $23 million gain (net of tax), being the difference between the carrying value and the redemption cost. The redemptions were funded from current cash flow and bank borrowings and gains were credited directly to retained earnings. See note 8 to the Consolidated Financial Statements.

During 2004, the Company implemented a three-for-one share split of its issued and outstanding common shares. All per share statistics included in this MD&A have been restated to reflect this share split. See note 9 to the Consolidated Financial Statements.

The Company repurchased 8,987,400 common shares under its normal course issuer bid (NCIB) during 2004 for a total of $286 million ($31.81/share). Subsequent to year end, the Company repurchased an additional 3,811,300 common shares as at March 2, 2005 under the NCIB for a total of $128 million ($33.57/share). The NCIB expires in March 2005 and the Company has received Board of Directors’ approval to renew the NCIB for another year. This will allow the Company to repurchase up to 5% of the Company’s common shares outstanding at the time of renewal.

Two common share dividends were paid in 2004 for a total of $114 million ($0.30/share). The Company’s dividend is determined semi-annually by the Board of Directors. At year end, there were 375 million common shares outstanding, down from 384 million at December 31, 2003. As at March 2, 2005, there were 371 million common shares outstanding, as well as 19,779,240 stock options outstanding.

At the end of 2004, Talisman’s ratio of debt to cash provided by operating activities was 0.78:1 and of debt to debt plus equity was 34%.

For additional information regarding the Company’s liquidity and capital resources, refer to note 7 to the Consolidated Financial Statements. In addition, refer to the Sensitivities table included in the Outlook Section of this MD&A for possible 2005 impacts of various factors on the Company’s estimated 2005 net income and cash provided by operating activities.

Talisman’s investment grade senior unsecured long-term debt credit ratings remain unchanged with Dominion Bond Rating Service (“DBRS”), Moody’s Investor Service, Inc. (“Moody’s”) and Standard & Poor’s (“S&P”) at BBB (high), Baa1 and BBB+, respectively.

Commitments and Off Balance Sheet Arrangements

As part of its normal business, the Company has entered into arrangements and incurred obligations that will impact the Company’s future operations and liquidity, some of which are reflected as liabilities in the Consolidated Financial Statements at year end. The principal commitments of the Company are in the form of debt repayments; abandonment obligations; settlements of derivative financial instruments; lease commitments relating to corporate offices and ocean-going vessels; firm commitments for gathering, processing and transmission services; minimum work commitments under various international agreements; other service contracts and fixed price commodity sales contracts.

Additional disclosure of the Company’s debt repayment obligations and significant commitments can be found in notes 7 and 12 to the Consolidated Financial Statements. A discussion of the Company’s derivative financial instruments and commodity sales contracts can be found in the next section of this MD&A.

12 T A L I S M A N E N E R G Y I N C .

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

The following table includes the Company’s expected future payment commitments and estimated timing of such payments.

| | | | | | Payments due by period1,2 (millions of dollars) | |

Commitments | | Recognized in financial statements | | Total | | Less than 1 year | | 1-3 years | | 4-5 years | | 6-10 years | | 11-15 years | | After 15 years | |

Long-term debt | | Yes — Liability | | 2,457 | | 241 | | 948 | | 318 | | 12 | | 577 | | 361 | |

Abandonment obligations3 | | Yes — Partially accrued as liability | | 2,639 | | 23 | | 96 | | 79 | | 181 | | 604 | | 1,656 | |

Office leases | | No | | 195 | | 23 | | 40 | | 34 | | 91 | | 7 | | — | |

Ocean-going vessel leases | | No | | 159 | | 85 | | 74 | | — | | — | | — | | — | |

Transportation and processing commitments | | No | | 1,012 | | 150 | | 206 | | 152 | | 281 | | 158 | | 65 | |

Minimum work commitments4 | | No | | 327 | | 269 | | 58 | | — | | — | | — | | — | |

Other service contracts | | No | | 143 | | 86 | | 21 | | 8 | | 19 | | 9 | | — | |

Stock options and cash units5 | | Yes — Partially accruedas liability | | 282 | | 160 | | 122 | | — | | — | | — | | — | |

Total | | | | 7,214 | | 1,037 | | 1,565 | | 591 | | 584 | | 1,355 | | 2,082 | |

1

| Payments exclude ongoing operating costs related to certain leases, interest on long-term debt, and payments made to settle derivative contracts.

|

2

| Payments denominated in foreign currencies have been translated at the December 31, 2004 exchange rate.

|

3

| The abandonment obligation represents management’s probability weighted, undiscounted best estimate of the cost and timing of future dismantlement, site restoration and abandonment obligations based on engineering estimates and in accordance with existing legislation and industry practice.

|

4

| Minimum work commitments include contracts awarded for capital projects and those commitments related to exploration or drilling obligations.

|

5

| The liability for stock options and cash units recognized on the balance sheet is based on the Company’s year end stock price and the number of options and cash units outstanding, adjusted for vesting terms. The amount included in this table includes the full value of unvested options and cash units. Timing of payments is based on vesting and expiry. Actual payments are dependent on the Company’s stock price at the time of exercise.

|

Derivative Financial Instruments and Commodity Sales Contracts

The Company manages its exposure to fluctuations in foreign exchange rates, interest rates, electricity costs and commodity prices in part through the use of derivative financial instruments and commodity sales contracts. The accounting policy with respect to derivative financial instruments and commodity sales contracts is set out in note 1(k) to the Consolidated Financial Statements. Derivative financial instruments and commodity sales contracts outstanding at December 31, 2004, including their respective fair values, are detailed in notes 11 and 12 to the Consolidated Financial Statements.

During 2004, the Company had commodity price derivative financial instruments covering 79,000 bbls/d or 35% of the Company’s 2004 worldwide oil and liquids production and 55 mmcf/d or 6% of the Company’s 2004 North American natural gas production. This resulted in a net decrease to recorded sales of $480 million (2003 — $194 million decrease; 2002 — $75 million increase). At December 31, 2004, the Company had outstanding commodity price derivative contracts that cover approximately 6,000 bbls/d (2%) of the Company’s anticipated 2005 worldwide oil and liquids production. An additional 15 mmcf/d (2%) of anticipated 2005 North American natural gas production has been committed under fixed price commodity sales contracts. The Company’s outstanding commodity price derivative contracts have been designated as hedges of the Company’s anticipated future commodity sales. See notes 11 and 12 to the Consolidated Financial Statements for additional detail s regarding the contracts outstanding at year end.

In order to support the Company’s investments in natural gas projects outside North America and the North Sea, Talisman has entered into a number of long-term sales contracts. In conjunction with the PM-3 CAA development project the Company has entered into a long-term firm supply contract for approximately 100 mmcf/d at prices referenced to the Singapore fuel oil spot market. The majority of Talisman’s Corridor natural gas production in Indonesia is currently sold to Caltex under long-term sales agreements, with the majority of the natural gas sales exchanged for crude oil on an energy equivalent relationship. The crude oil received from Caltex is then sold offshore. Sales to Singapore from Corridor are also under long-term sales agreements referenced to the spot price of fuel oil in Singapore. During 2004, the Company signed a long term contract to sell 2.3 tcf of Corridor natural gas to West Java, over a 17 year period with gas sales commencing in 2007, at a price of US$1.91/mcf, with no associated transportation costs. The Company’s share of sales will be approximately 810 bcf based on its 36% interest. The Company anticipates having sufficient production to meet all future delivery commitments.

Effective January 1, 2004, the Company’s US dollar cross currency and interest rate swap contracts were no longer designated as hedges of the £250 million Eurobond, which resulted in a revaluation of this debt and a deferred gain of $17 million which is being amortized over the period to 2009. The swap contracts were terminated in 2004 for net cash proceeds of $138 million and resulted in an additional gain of $15 million. The termination of these contracts did not accelerate recognition of the deferred gain into income.

The Company has established a system of internal controls to minimize risks associated with its derivatives program and credit risk associated with derivatives counterparties. The Board of Directors has authorized the Company to enter into commodity derivative agreements, which in aggregate do not exceed 40% of total estimated production. With the current high commodity prices and the Company’s strong balance sheet, management does not believe the capital expenditure program is under significant risk and has not actively renewed the derivatives program.

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

2 0 0 4 A N N U A L R E P O R T 13

Summary of Quarterly Results

The following is a summary of quarterly results of the Company for the eight most recently completed quarters:

| (millions of Canadian dollars, unless otherwise stated) | | | Three months ended | |

| 2004 | Total Year | | Dec. 31 | | Sept. 30 | | June 30 | | March 31 | |

| Gross Sales | 6,874 | | 1,828 | | 1,788 | | 1,705 | | 1,553 | |

| Total revenue | 5,355 | | 1,402 | | 1,355 | | 1,337 | | 1,261 | |

| Net income1 | 663 | | 121 | | 122 | | 197 | | 223 | |

| Net income available to common shareholders2 | 677 | | 121 | | 122 | | 200 | | 234 | |

| Total assets | 12,408 | | 12,408 | | 12,407 | | 13,007 | | 12,290 | |

| Total long-term liabilities | 5,934 | | 5,934 | | 5,883 | | 6,100 | | 5,860 | |

| Capital expenditures | | | | | | | | | | |

| Exploration | 952 | | 250 | | 280 | | 200 | | 222 | |

| Development | 1,586 | | 478 | | 407 | | 309 | | 392 | |

| Per common share (dollars) | | | | | | | | | | |

| Net income1,2 | 1.77 | | 0.32 | | 0.32 | | 0.52 | | 0.61 | |

| Diluted net income2,4 | 1.74 | | 0.31 | | 0.31 | | 0.51 | | 0.60 | |

| Daily average production | | | | | | | | | | |

| Oil and liquids (bbls/d) | 228,434 | | 235,612 | | 218,441 | | 229,579 | | 230,136 | |

| Natural gas (mmcf/d)3 | 1,259 | | 1,292 | | 1,263 | | 1,244 | | 1,236 | |

| Total (mboe/d) | 438 | | 451 | | 429 | | 437 | | 436 | |

| 2003 (Restated) | | | | | | | | | | |

| Gross Sales | 5,610 | | 1,351 | | 1,272 | | 1,220 | | 1,767 | |

| Total revenue | 4,598 | | 1,128 | | 1,077 | | 1,023 | | 1,370 | |

| Net income1 | 1,012 | | 108 | | 128 | | 202 | | 574 | |

| Net income available to common shareholders2 | 990 | | 103 | | 122 | | 197 | | 568 | |

| Total assets | 11,780 | | 11,780 | | 11,634 | | 11,481 | | 11,849 | |

| Total long-term liabilities | 5,544 | | 5,544 | | 5,594 | | 5,473 | | 5,981 | |

| Capital expenditures | | | | | | | | | | |

| Exploration | 784 | | 221 | | 215 | | 165 | | 183 | |

| Development | 1,396 | | 437 | | 360 | | 327 | | 272 | |

| Per common share (dollars) | | | | | | | | | | |

| Net income1,2 | 2.56 | | 0.27 | | 0.32 | | 0.51 | | 1.46 | |

| Diluted net income2,4 | 2.53 | | 0.24 | | 0.31 | | 0.50 | | 1.44 | |

| Daily average production | | | | | | | | | | |

| Oil and liquids (bbls/d) | 216,716 | | 229,166 | | 202,008 | | 188,682 | | 247,369 | |

| Natural gas (mmcf/d) | 1,090 | | 1,138 | | 1,064 | | 1,061 | | 1,096 | |

| Total (mboe/d) | 398 | | 419 | | 379 | | 365 | | 430 | |

1

| Net income and net income before discontinued operations and extraordinary items are the same.

|

2

| Net income available to common shareholders, net income per share and diluted net income per share are after preferred security charges and have been restated to include the gain on redemption of preferred securities in 2004. See note 17 to the Consolidated Financial Statements.

|

3

| Includes gas acquired for injection and subsequent resale of 5 mmcf/d in Total Year, 8 mmcf/d in June and March, and 3 mmcf/d in, Dec. and Sept.

|

4

| Diluted net income per common share is calculated using the treasury stock method, which gives effect to the potential dilution that could occur if convertible instruments, such as stock options, were exercised in exchange for common shares. However, since inception of the Company’s Stock Appreciation Rights Plan, only approximately 2% of stock options have been exercised for common shares, therefore the dilution was insignificant.

|

The following discussion highlights some of the more significant factors that impacted net income in the eight most recently completed quarters.

During the fourth quarter of 2004, revenue increased over the previous quarter as increases in total volumes combined with higher gas prices to more than offset the impact of a stronger Canadian dollar and increased hedging losses. Net income remained relatively constant in the quarter as reductions in stock-based compensation, operating expenses and dry hole costs were offset by increases in DD&A, impairments and G&A expenses as well as a loss on disposal of fixed assets.

In the third quarter, revenue rose over the second quarter as the increase in oil prices more than offset the reduction in production, resulting from maintenance shutdowns. Net income in the third quarter declined from the previous quarter, as the increase in revenue was more than offset by increases in hedging losses, dry hole costs, exploration expenses and current income taxes. In the first two quarters of 2004, revenue continued to rise due to increases in both commodity prices and production partially offset by increased hedging losses. These factors combined with the benefit of tax rate reductions to increase net income in the first quarter of 2004 over the last quarter of 2003.

14 T A L I S M A N E N E R G Y I N C .

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s

A higher charge for stock-based compensation and reduced tax rate reductions resulted in a drop in net income during the second quarter of 2004 from the previous quarter.

In the first quarter of 2003, the gain on the sale of the Sudan operations increased net income by $296 million. The sale of these operations contributed to the drop in revenues and royalties during the following three quarters of 2003, which was partially offset by production increases in other areas and continued high commodity prices. Net income during the second quarter of 2003 was increased by $160 million due to a reduction in the Canadian federal and provincial tax rates. The Company began recording stock-based compensation in the second quarter of 2003. The second quarter’s net income was reduced by a $105 million ($70 million after tax) catch-up expense relating to outstanding stock options. The third and fourth quarters of 2003 included an additional $80 million ($50 million after tax) of stock-based compensation expense.

Application of Critical Accounting Policies and the Use of Estimates

The preparation of financial statements requires management to make estimates and assumptions that affect reported assets and liabilities, disclosures of contingencies and revenues and expenses. Management is also required to adopt accounting policies that require the use of significant estimates. Actual results could differ materially from those estimates. A summary of significant accounting policies adopted by Talisman can be found in note 1 to the Consolidated Financial Statements. In assisting the Company’s Audit Committee to fulfill its financial statement oversight role, management regularly meets with the Committee to review the Company’s significant accounting policies, estimates and any significant changes thereto including those discussed below.

Management believes the most critical accounting policies, including judgments in their application, that may have an impact on the Company’s financial results relate to the accounting for property, plant and equipment, asset retirement obligation and goodwill. The rate at which the Company’s assets are depreciated or otherwise written off and the asset retirement liability provided for, with the associated accretion expensed to the income statement, are subject to a number of judgments about future events, many of which are beyond management’s control. Reserves recognition is central to much of the accounting for an oil and gas company as described below.

Reserves Recognition

Underpinning Talisman’s oil and gas assets and goodwill are its oil and gas reserves. Detailed rules and industry practice, to which Talisman adheres, have been developed to provide uniform reserves recognition criteria. However, the process of estimating oil and gas reserves is inherently judgmental. There are two principal sources of uncertainty, technical and commercial. Technical reserves estimates are made using available geological and reservoir data as well as production performance data. As new data becomes available, including actual reservoir performance, reserves estimates may change. Reserves can be classified as proved or probable with decreasing levels of certainty as to the likelihood that the reserves will be ultimately produced.

Reserves recognition is also impacted by economic considerations. In order for reserves to be recognized they must be reasonably certain of being produced under existing economic and operating conditions, which is viewed as being at year end commodity prices with a cost profile based on current operations. In particular, in international operations consideration includes the status of field development planning and gas sales contracts. As economic conditions change, primarily as a result of changes in commodity prices and, to a lesser extent, operating and capital costs, marginally profitable production, typically experienced in the later years of a field’s life cycle, may be added to reserves or conversely may no longer qualify for reserves recognition.

The Company’s reserves and revisions to those reserves, though not separately reported on the Company’s balance sheet or income statement, impact the Company’s reported net income through the amortization of the Company’s property, plant and equipment (PP&E), asset and goodwill impairments and the provision for future asset retirement obligations.

The Reserves Committee of Talisman’s Board of Directors reviews the Company’s reserves booking process and related public disclosures and the report of the internal qualified reserves evaluator (IQRE). The primary responsibilities of the Reserves Committee of the Board of Directors include, amongst other things, reviewing the Company’s reserves booking process and recommending to the Board of Directors of Talisman the Company’s annual statement of reserves data and other oil and gas information. The IQRE reports the Company’s annual reserves data to the Reserves Committee and delivers a regulatory certificate regarding proved reserves and their related cash flows.

Depreciation, Depletion and Amortization Expense (DD&A)

A significant portion of the Company’s PP&E is amortized based on the unit of production method with the remaining assets being amortized equally over their expected useful lives. The unit of production method attempts to amortize the asset’s cost over its proved oil and gas reserves base. Accordingly, revisions to reserves or changes to management’s view as to the operational life span of an asset will impact the Company’s future DD&A expense.