ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2004

March 14, 2005

TABLE OF CONTENTS

| FORWARD-LOOKING STATEMENTS | 1 | |

| NOTE REGARDING RESERVES DATA AND OTHER OIL AND GAS | | |

| INFORMATION | 2 | |

| | | |

| EXCHANGE RATE INFORMATION | 3 | |

| | | |

| DEFINITIONS | 3 | |

| | | |

| CORPORATE STRUCTURE | 4 | |

| | | |

| GENERAL DEVELOPMENT OF THE BUSINESS | 4 | |

| North America | 4 | |

| International and Frontier | 5 | |

| | | |

| DESCRIPTION OF THE BUSINESS | 5 | |

| North America | 5 | |

| Canada | 7 | |

| United States | 9 | |

| Landholdings, Production and Productive Wells | 9 | |

| International and Frontier | 11 | |

| North Sea | 11 | |

| Southeast Asia | 15 | |

| Algeria | 18 | |

| Trinidad | 19 | |

| Colombia | 20 | |

| Peru | 20 | |

| Qatar | 20 | |

| Alaska | 20 | |

| Other | 20 | |

| Productive Wells and Acreage | 21 | |

| Drilling Activity | 22 | |

| Reserves Estimates | 25 | |

| Other Oil and Gas information | 27 | |

| Continuity of Net Proved Reserves | 27 | |

| Standardized Measure of Discounted Future Net Cash | | |

| Flows From Proved Reserves | 28 | |

| Results of Operations from Oil and Gas Producing | | |

| Activities | 30 | |

| Capitalized Costs Relating to Oil and Gas Activities | 30 | |

| Costs Incurred in Oil and Gas Activities | 31 | |

| Product Netbacks (Net) | 32 | |

| Supplemental Oil and Gas Information | 33 | |

| Continuity of Gross Proved Reserves | 33 | |

| Product Netbacks (Gross) | 34 | |

| Additional Information | 35 | |

| Competitive Conditions | 35 | |

| Social Responsibility and Environmental Protection | 35 | |

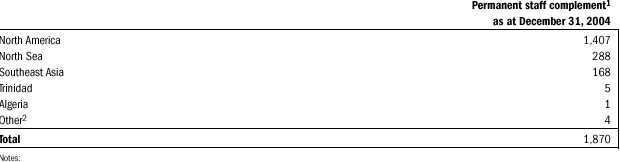

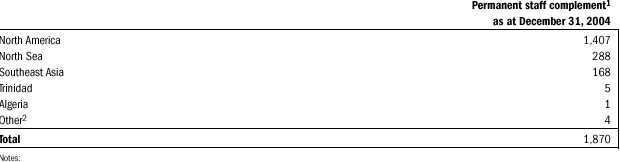

| Employees | 36 | |

| DESCRIPTION OF CAPITAL STRUCTURE | 36 | |

| Share Capital | 36 | |

| Ratings | 37 | |

| | | |

| MARKET FOR THE SECURITIES OF THE COMPANY | 37 | |

| Trading Price and Volume | 38 | |

| | | |

| DIVIDENDS | 38 | |

| | | |

| DIRECTORS AND OFFICERS | 39 | |

| Directors | 39 | |

| Officers | 41 | |

| Shareholdings of Directors and Executive Officers | 41 | |

| Conflicts of Interest | 42 | |

| | | |

| AUDIT COMMITTEE INFORMATION | 42 | |

| | | |

| LEGAL PROCEEDINGS | 42 | |

| | | |

| RISK FACTORS | 42 | |

| | | |

| TRANSFER AGENTS AND REGISTRARS | 45 | |

| | | |

| INTERESTS OF EXPERTS | 45 | |

| | | |

| ADDITIONAL INFORMATION | 45 | |

| | | |

| SCHEDULE A — REPORT ON RESERVES DATA BY TALISMAN’S | | |

| INTERNAL QUALIFIED RESERVES EVALUATOR | 46 | |

| | | |

| SCHEDULE B — REPORT OF MANAGEMENT AND DIRECTORS | | |

| ON OIL AND GAS DISCLOSURE | 47 | |

| | | |

| SCHEDULE C — AUDIT COMMITTEE INFORMATION | 49 | |

FORWARD-LOOKING STATEMENTS

This Annual Information Form contains or incorporates by reference statements that constitute “forward-looking statements” within the meaning of applicable securities legislation.

Unless the context indicates otherwise, a reference in this Annual Information Form to “Talisman” or the “Company” includes direct or indirect subsidiaries of Talisman Energy Inc. and partnership interests held by Talisman Energy Inc. and its subsidiaries.

Identifying forward-looking statements

Forward-looking statements are included throughout this Annual Information Form including, among other places, under the headings “General Development of the Business”, “Description of the Business” and “Legal Proceedings”. These statements include, among others, statements regarding:

- business strategy and plans or budgets;

- business plans for drilling, exploration and development;

- the estimated amounts and timing of capital expenditures;

- royalty rates and exchange rates;

- the merits and timing or anticipated outcome of pending litigation; and

- other expectations, beliefs, plans, goals, objectives, assumptions, information and statements about possible future events, conditions, results of operations or performance.

Statements concerning oil and gas reserves contained in this Annual Information Form under the headings “Description of the Business —Reserves Estimates” and elsewhere may be deemed to be forward-looking statements as they involve the implied assessment that the resources described can be profitably produced in the future, based on certain estimates and assumptions.

Often, but not always, forward-looking statements use words or phrases such as: “expects”, “does not expect” or “is expected”, “anticipates” or “does not anticipate”, “plans” or “planned”, “estimates” or “estimated”, “projects” or “projected”, “forecasts” or “forecasted”, “believes”, “intends”, “likely”, “possible”, “probable”, “scheduled”, “positioned”, “goals” or “objectives”, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Material factors that could cause actual results to differ materially from those in forward-looking statements

Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks and uncertainties, which could cause actual results to differ materially from those anticipated by Talisman and described in the forward-looking statements. These risks and uncertainties include:

- the risks of the oil and gas industry, such as operational risks in exploring for, developing and producing crude oil and natural gas and market demand;

- risks and uncertainties involving geology of oil and gas deposits;

- the uncertainty of reserves estimates and reserves life;

- the uncertainty of estimates and projections relating to production, costs and expenses;

- potential delays or changes in plans with respect to exploration or development projects or capital expenditures;

- fluctuations in oil and gas prices, foreign currency exchange rates and interest rates;

- health, safety and environmental risks;

- uncertainties as to the availability and cost of financing;

- uncertainties related to the litigation process, such as possible discovery of new evidence or acceptance of novel legal theories and the difficulties in predicting the decisions of judges and juries;

- risks in conducting foreign operations (for example, political and fiscal instability or the possibility of civil unrest or military action);

- general economic conditions;

- the effect of acts of, or actions against international terrorism; and

- the possibility that government policies or laws may change or governmental approvals may be delayed or withheld.

A N N U A L I N F O R M A T I O N F O R M 1

We caution that the foregoing list of risks and uncertainties is not exhaustive. Additional information on these and other factors which could affect the Company’s operations or financial results are included under the heading “Risk Factors”, in the Report on Reserves Data by Talisman’s Internal Qualified Reserves Evaluator and the Report of Management and Directors on Oil and Gas Disclosure, attached as schedules to this Annual Information Form, and elsewhere in this Annual Information Form. Additional information may also be found in the Company’s other reports on file with Canadian securities regulatory authorities and the United States Securities and Exchange Commission (the “SEC”).

No obligation to update forward-looking statements

Forward-looking statements are based on the estimates and opinions of the Company’s management at the time the statements are made. The Company assumes no obligation to update forward-looking statements should circumstances or management’s estimates or opinions change.

NOTE REGARDING RESERVES DATA AND OTHER OIL AND GAS INFORMATION

National Instrument 51-101 (“NI 51-101”) of the Canadian Securities Administrators imposes oil and gas disclosure standards for Canadian public companies engaged in oil and gas activities. NI 51-101 and its companion policy specifically contemplate the granting of exemptions from some of the disclosure standards prescribed by NI 51-101 to companies that are active in the United States capital markets to permit the substitution of the disclosures required by the SEC rules in order to provide for comparability of oil and gas disclosure with that provided by U.S. and other international issuers. Talisman has obtained an exemption from Canadian securities regulatory authorities to permit it to provide disclosure in accordance with the relevant U.S. requirements. Accordingly, most of the reserves data and other oil and gas information included in this Annual Information Form is disclosed in accordance with U.S. disclosure requirements. Such information, as well as the info rmation that Talisman discloses in the future in reliance on the exemption, may differ from the corresponding information prepared in accordance with NI 51-101 standards.

The primary differences between the U.S. requirements and the NI 51-101 requirements are that (i) SEC require (and normally permit) disclosure only of proved reserves, whereas NI 51-101 requires disclosure of proved and probable reserves, and (ii) SEC rules require that the reserves and future net revenue be estimated under existing economic and operating conditions, whereas NI 51-101 requires disclosure of proved reserves and the associated future net revenue on a constant basis, and of proved, probable and proved plus probable reserves and the associated future net revenue on a forecast basis. The definitions of proved reserves differ, but Talisman does not believe that the differences in the definitions would result in any material difference in its reserves estimates for that category. The Canadian Oil and Gas Evaluation Handbook (“COGEH”, the reference source for the definition of proved reserves under NI 51-101) states that the differences in the estimated prove d reserves quantities based on constant prices should not be material.

Talisman has disclosed proved reserves (including continuity of reserves) using the standards contained in U.S. Regulation S-X and the standardized measure of discounted future net cash flows from proved reserves determined in accordance with Statement No. 69 of the U.S. Financial Accounting Standards Board (“FAS 69”). U.S. practice is to disclose net proved reserves, after deduction of estimated royalty burdens and including net profit interests. In addition, notwithstanding that Talisman is not required to disclose probable reserves, it has done so using the definition for probable reserves set out by the Society of Petroleum Engineers/World Petroleum Congress (“SPE/WPC”). Talisman does not believe that the differences in the SPE/WPC and NI 51-101 definitions of probable reserves would result in any material difference in its estimates of probable reserves disclosed in this Annual Information Form.

2 A N N U A L I N F O R M A T I O N F O R M

EXCHANGE RATE INFORMATION

Except where otherwise indicated, in this Annual Information Form all dollar amounts are stated in Canadian dollars.The following table sets forth the Canada/U.S. exchange rates on the last day of the years indicated as well as the high, low and average rates for such years. The high, low and average exchange rates for each year were identified or calculated from spot rates in effect on each trading day during the relevant year. The exchange rates shown are expressed as the number of U.S. dollars required to purchase one Canadian dollar. These exchange rates are based on those published on the Bank of Canada’s website as being in effect at approximately noon on each trading day (the “Bank of Canada noon rate”)

| Year ended December 31 | | | | 2002 | 2003 | 2004 |

| Year end | | | | | | 0.6331 | 0.7738 | 0.8308 |

| High | | | | | | | 0.6618 | 0.7738 | 0.8493 |

| Low | - | - | - | - | - | | 0.6199 | 0.6350 | 0.7159 |

| Average | - | - | - | - | | 0.6369 | 0.7156 | 0.7697 |

| | | | | | | | | | |

| | | | | | | | | | |

DEFINITIONS

The abbreviations set forth below have the following meanings:

| bbls | barrels |

| bcf | billion cubic feet |

| boe | barrels of oil equivalent |

| bbls/d | barrels per day |

| mbbls/d | thousand barrels per day |

| mmbbls | million barrels |

| mcf | thousand cubic feet |

| mmcf/d | million cubic feet per day |

liquids or NGLs natural gas liquids

Natural gas is converted to oil equivalent at the ratio of 6 mcf to 1 boe. Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 6:1 is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

Gross acres means the total number of acres in which Talisman has a working interest. Net acres means the sum of the fractional working interests owned in gross acres expressed as whole numbers and fractions thereof.

Gross production means Talisman’s interest in production volumes (through working interests, royalty interests and net profits interests) before the deduction of royalties. Net production means Talisman’s interest in production volumes after deduction of royalties payable by Talisman.

Gross wells means the total number of wells in which the Company owns a working interest. Net wells means the sum of the fractional working interests owned in gross wells expressed as whole numbers and fractions thereof.

A N N U A L I N F O R M A T I O N F O R M 3

CORPORATE STRUCTURE

Talisman Energy Inc. is amalgamated under theCanada Business Corporations Act. The Company’s registered and principal office is located at Suite 3400, 888 Third Street S.W., Calgary, Alberta T2P 5C5.

In 2004, Talisman amended its Articles of Amalgamation to effect a three for one share subdivision.

The following table sets forth the material operating subsidiaries owned directly or indirectly by Talisman, their jurisdictions of incorporation and the percentage of voting securities beneficially owned, controlled or directed by Talisman as at December 31, 2004.

| | Jurisdiction of | Percentage of Voting | |

| Name of Subsidiary | Incorporation | Securities Owned1 | |

| Talisman Energy (UK) Limited | England | 100% | |

| Talisman North Sea Limited | England | 100% | |

| Talisman (Corridor) Ltd. | Barbados | 100% | |

| Petromet Resources Limited | Ontario, Canada | 100% | |

| Fortuna Energy Inc. | Delaware, U.S. | 100% | |

| Talisman Malaysia Limited | Barbados | 100% | |

Note:

1

| With the exception of Talisman Energy (UK) Limited and Talisman (Corridor) Ltd., none of the above subsidiaries has any non-voting securities outstanding. All of the non-voting securities of Talisman Energy (UK) Limited and Talisman (Corridor) Ltd. are directly or indirectly held by Talisman.

|

The above table does not include all of the subsidiaries of Talisman. The assets, sales and operating revenues of unnamed operating subsidiaries individually did not exceed 10%, and in the aggregate did not exceed 20%, of the total consolidated assets or total consolidated sales and operating revenues, respectively, of Talisman as at, and for the year ended, December 31, 2004.

Talisman Energy Inc. and Petromet Resources Limited (“Petromet”), an indirect subsidiary of Talisman, are partners in an Alberta general partnership named Talisman Energy Canada (the “Partnership”). Talisman is the managing partner of the Partnership. Talisman and Petromet contributed to the Partnership substantially all of their oil and gas assets located in Canada, including their interests in the facilities for processing, treating, storing and transporting the production from such assets. Since June 1, 2001, substantially all of Talisman’s and Petromet’s Canadian oil and gas operations have been carried on through the Partnership.

GENERAL DEVELOPMENT OF THE BUSINESS

Talisman is an independent, Canadian based, international upstream oil and gas company whose main business activities include exploration, development, production and marketing of crude oil, natural gas and natural gas liquids. The Company’s reporting segments are North America, the North Sea, Southeast Asia, Trinidad and Algeria, where there are ongoing production, development and exploration activities. The Company is active in a number of other international and frontier areas, including Alaska, Colombia, Peru and Qatar.

During the past three years, Talisman has developed its business and diversified its interests through a combination of exploration, development, acquisitions and dispositions as described below. Internationally, the Company’s exploration strategy is to pursue significant high impact opportunities to enhance production and value.

NORTH AMERICA

In October 2002, an indirect subsidiary of the Company acquired certain producing Trenton-Black River natural gas assets and additional undeveloped lands located in New York State. The same subsidiary subsequently acquired: (1) additional natural gas properties, working interests, production and facilities relating to the Trenton-Black River play in New York State in January 2003; and (2) all of Belden & Blake Corporation’s Trenton-Black River assets in New York, Pennsylvania, Ohio and West Virginia in June 2004 resulting in ownership of approximately 433,000 gross acres. The June 2004 acquisition effectively doubled the subsidiary’s existing net acreage held in the area.

In July 2003, a subsidiary of Talisman acquired various midstream assets in the Deep Basin area of northwestern Alberta through the purchase of Vista Midstream Solutions Ltd.

4 A N N U A L I N F O R M A T I O N F O R M

INTERNATIONAL AND FRONTIER

In 2002, Talisman expanded its exploration interests both offshore and onshore Trinidad. In 2003, the Company began the Angostura development project on offshore Block 2(c). Development continued through 2004 with production beginning in January 2005. Exploration is continuing in the onshore Eastern Block and in offshore Block 2(c) and Block 3(a).

In May 2002, a consortium in which Talisman is a member was awarded Block 46/02, a three million acre exploration block offshore Vietnam. In 2003, the Company completed the PM-3 Commercial Arrangement Area (“PM-3 CAA”) Phase 2/3 Development Project offshore Malaysia/Vietnam. Oil production from this project began in September 2003 and gas production and sales commenced in November 2003. Talisman Malaysia Limited signed a production sharing contract in March 2004 for Block PM-314 offshore Malaysia.

In December 2002, production commenced at the Ourhoud field (Talisman 2%) in Algeria with first oil sales in 2003. In June 2003, production commenced from the Greater MLN field (Talisman 35%).

Talisman completed the sale of its indirect interest in the Greater Nile Oil Project in Sudan to ONGC Videsh Limited, a subsidiary of India’s national oil company, in March 2003. An indirect subsidiary of Talisman had held a 25% interest in the Greater Nile Oil Project, which had been acquired in 1998.

In August 2003, a Talisman subsidiary was awarded four new exploration blocks in the United Kingdom North Sea (“UK North Sea”) and in December 2003, Talisman acquired interests in the Ross, Renee and Rubie fields in the UK North Sea. In early 2004, a Talisman subsidiary acquired an operated interest in the Galley field in the UK North Sea, and in May 2004, Talisman’s wholly owned subsidiaries acquired additional interests in the Flotta Catchment Area.

In September 2003, one of Talisman’s indirect wholly owned subsidiaries acquired the operated interests and associated assets of BP Norge AS in the Gyda field in the Norwegian sector of the North Sea. Two additional licenses were awarded later in 2003. In February 2004, Talisman’s subsidiary acquired an interest from ConocoPhillips Skandinavia AS in two more licences, including the Blane discovery. In December 2004, the subsidiary was awarded interests in five more licences in the Norwegian sector of the North Sea.

In the fourth quarter of 2004,Talisman Energy (UK) Limited acquired all of the outstanding shares of Intrepid Energy Beta Limited, which included an interest in a number of exploration licenses in the UK, Netherlands and German sectors of the North Sea.

In February 2005, Talisman Energy (UK) Limited acquired all of the outstanding shares in Pertra A.S., resulting in the addition of producing and undeveloped fields, as well as several blocks of operated and non-operated exploration acreage in the Norwegian sector of the North Sea.

Talisman announced in August 2004 an agreement for the sale of 2.3 trillion cubic feet of natural gas from the Corridor production sharing contract in Indonesia. A wholly owned subsidiary of Talisman has a 36% interest in the production sharing contract.

Since 2002, Talisman, through various wholly owned subsidiaries, has acquired non-operated interests in several blocks of exploration acreage in the Andean thrust and fold belt of Colombia and Peru. In 2004, the Company continued its ongoing exploration program on this acreage.

Through three separate transactions occurring in 2004, another indirect subsidiary of Talisman acquired an interest in over 400,000 gross acres of land in the North Slope of Alaska.

Talisman continually investigates strategic acquisitions, dispositions and other business opportunities, some of which may be material. In connection with any such transaction, the Company may incur debt or issue equity securities.

DESCRIPTION OF THE BUSINESS

Talisman is one of the largest independent oil and gas producers in Canada. The Company’s main business activities include exploration, development, production and marketing of crude oil, natural gas and natural gas liquids. Each of Talisman’s current areas of operations has exploration and development potential, which Talisman expects will provide for future growth.

All information in this section relating to assets owned or held by Talisman is as of December 31, 2004, unless indicated otherwise.

NORTH AMERICA

Talisman anticipates that it will spend approximately $1.4 billion on exploration and development in Canada and the U.S. in 2005. Of this, over 90% is directed towards natural gas. The Company plans to participate in drilling approximately 525 gross wells in 2005. In the past two years, the Company’s production growth has mainly been achieved through drilling activities.

A N N U A L I N F O R M A T I O N F O R M 5

6 A N N U A L I N F O R M A T I O N F O R M

CANADA

In Canada, the Company’s strategy is to continue oil and natural gas exploration and development with production emphasis on natural gas exploration focused on deeper portions of the Western Canada Sedimentary Basin. Utilization of existing infrastructure and a high level of operatorship enable Talisman to maintain control over costs, production and capital spending.

Exploration and development activities focus on gas opportunities to take advantage of Talisman’s expertise in medium to deep areas of the Western Canada Sedimentary Basin. The majority of this activity will be in the Alberta Foothills, Deep Basin, Edson area, Greater Arch, Monkman/BC Foothills and Southern Alberta Foothills regions.

Talisman’s Canadian exploration and development operations are organized around 13 core producing areas in Alberta, British Columbia, Ontario and Saskatchewan, which accounted for 92% of the Company’s Canadian production in 2004. The balance comprises production from joint venture properties and synthetic oil production from Talisman’s indirect interest in the Syncrude joint venture. Of the 13 core areas the following seven are the principal gas production areas, namely: Greater Arch, Deep Basin, Alberta Foothills, Edson area (in turn comprised of Bigstone/Wild River, Edson and West Whitecourt), Monkman/BC Foothills, Lac La Biche, and Ontario offshore. The following six core areas are the principal oil production areas, namely: Southern Alberta Foothills, Ontario onshore, Chauvin, Carlyle, Central Alberta and Shaunavon. Within its core areas, Talisman operates approximately 80% of its production with high working interests in a large number of facilities.

Seven of the more active core properties accounted for approximately 76% of the Company’s total Canadian production in 2004: Greater Arch, Deep Basin, Alberta Foothills, Edson area, Monkman/BC Foothills, Ontario (onshore and offshore) and Chauvin. Each of these areas is described in greater detail below.

Greater Arch

The Greater Arch remains Talisman’s largest natural gas producing area. Talisman holds operated interests ranging from 42% to 100% in gas plants at Teepee Creek, Belloy, Boundary Lake, George, Josephine and Shane, as well as interests in a number of other non-operated gas plants in the area. The Company has a large inventory of opportunities to explore which are adjacent to existing infrastructure. The Company’s average operated interest in oil and gas properties in the Greater Arch area is 68%. The Company expects that capital spending in 2005 in the Greater Arch area will be approximately $108 million, and plans to participate in drilling approximately 66 wells.

Deep Basin

Talisman owns a 100% working interest in the Cutbank complex, consisting of the Cutbank and Musreau gas plants, five major field compression stations and an extensive gas gathering system, all of which ran close to capacity throughout 2004. Talisman also holds 3% to 8% non-operated interests in the South Wapiti, Wapiti Deep Cut and Narraway gas plants. The Company expects that capital spending in 2005 in the Deep Basin area will be approximately $150 million, and plans to participate in drilling approximately 43 wells.

Alberta Foothills

Major operated facilities in the Alberta Foothills include an 80% interest in the Cordel dehydration facility and associated pipelines, interests ranging from 60% to 100% in the Erith pipeline and related facilities, a 38% interest in the Chungo/Bighorn gas gathering system, and a 45% interest in the Lovett River/Redcap pipeline system. Talisman has non-operated interests in Basing, Voyager, Stolberg and Brown Creek pipelines and associated facilities. The Company expects that capital spending in 2005 in the Alberta Foothills will be approximately $203 million, and plans to participate in drilling 29 wells (approximately half of which are in the Northern Alberta Foothills). Production from the Northern Alberta Foothills area will involve a significant pipeline connection with volumes expected to come on-stream in 2006.

Edson Area

The Company expects that capital spending in 2005 in the Edson area will be approximately $411 million, and plans to spend approximately $84 million on infrastructure and participate in drilling 147 wells. The properties comprising the larger Edson area (Bigstone/Wild River, Edson and West Whitecourt) are detailed below.

Bigstone/Wild River

Talisman holds operated interests ranging from 64% to 100% in the Bigstone West and Wild River gas plants. The Company is currently focusing on infill drilling in the Wild River area of its Bigstone/Wild River acreage. The Company expects that capital spending in 2005 in the Bigstone/Wild River area will be approximately $225 million (including $22 million for expansion of the Wild River gas plant), and plans to participate in drilling 76 wells, 70% of which will be drilled in the Wild River area.

A N N U A L I N F O R M A T I O N F O R M 7

Edson

Talisman holds operated interests ranging from 59% to 100% in the Edson and Medicine Lodge gas plants. Talisman is currently focusing on exploring and exploiting opportunities in the Edson core area. In 2004, Talisman completed the construction of a 10 megawatt co-generation power plant at its Edson gas processing facility, which is expected to reduce direct carbon dioxide emissions by 22,000 tonnes a year. The Company expects that capital spending in 2005 in the Edson area will be approximately $140 million, and plans to participate in drilling 46 wells.

West Whitecourt

Talisman holds a 51% operated interest in McLeod River gas plant as well as non-operated interests ranging from 10% to 12% in the Kaybob South Amalgamated and the West Whitecourt gas plants. Talisman is currently focusing on development drilling in the West Whitecourt area with expected capital spending in 2005 of approximately $46 million to drill 25 wells.

Monkman/BC Foothills

In the Monkman/BC Foothills area, Talisman holds 58% to 100% operated interests in the Bullmoose, Sukunka and West Sukunka dehydration plants, 29% to 32% non-operated interests in the Murray River and Brazion dehydration plants and a 50% interest in the Mink Highhat Gathering System. In 2004, Talisman drilled the b-60-E/93-P-5 well (“b-60-E”) in the Brazion area,which has produced up to 66 mmcf/d gross sales gas in early 2005. b-60-E production is expected to increase Monkman/BC Foothills production by approximately 25% to 35% above the 2004 production levels. Talisman continued to drill in the more mature Triassic play with two out of two wells testing at rates ranging from 16 to 19 mmcf/d. The Company expects that capital spending in 2005 in the Monkman/BC Foothills area will be approximately $88 million, including an expansion of the Bullmoose compressor station, and plans to participate in drilling approximately eight wells.

Ontario

Talisman currently has natural gas production in the offshore area of Lake Erie and oil production onshore. Talisman has a 100% interest in the Renwick, North Wheatley (East),Rochester and Hillman central facilities. In addition, Talisman has interests ranging from 65% to 100% in the Morpeth, Port Stanley, Port Alma, Port Maitland, Rochester and Nanticoke gas plants. Talisman’s drilling program will continue in 2005 with plans to participate in drilling five onshore oil wells and 20 offshore gas wells. The Company expects that capital spending in 2005 in Ontario will be approximately $15 million.

Chauvin

Chauvin is Talisman’s largest domestic oil producing core property. Talisman holds a 100% interest in the Chauvin pipeline, which transports approximately 38 mbbls/d of condensate blended crude. It also holds a 100% interest in the Chauvin Custom Treating Facility. The Company expects that capital spending in 2005 in the Chauvin area will be approximately $37 million, and plans to participate in drilling approximately 45 wells.

Other

In 2004, Talisman drilled a successful gas well in Central Alberta, which tested at 18 mmcf/d. Production from this well is planned to commence at approximately 15 mmcf/d in the first quarter of 2005. Mineral rights have been secured on five sections of land surrounding this well. The Company expects that capital spending in 2005 in the Central Alberta area will be approximately $20 million.

The Company is also exploring the potential for producing coal bed methane on lands in Alberta and British Columbia. Appraisal drilling and prospect evaluation commenced in 2002. The main focus in 2005 will continue to be the development of coal bed methane horizontal drilling and production technology to determine large-scale commercial viability. The Company expects that capital spending in 2005 in this area will be approximately $23 million, and plans to participate in drilling seven wells.

Talisman’s gas production in Turner Valley (a portion of the Southern Alberta Foothills core area), doubled in 2004 with the commissioning of the Little Chicago gas plant in January 2004. Talisman holds a 100% working interest in this gas plant. Successful multi-leg horizontal oil well drilling in Turner Valley in conjunction with a new oil battery is expected to increase liquids production in 2005. The nitrogen injection pilot project that has been underway for approximately two years is demonstrating increased oil production but requires further evaluation prior to planning of commercial expansion. The Company expects that capital spending in 2005 in the Southern Alberta Foothills area will be approximately $82 million, and plans to participate in drilling approximately 21 wells.

Talisman Midstream Operations

The Company’s Midstream Operations department operates over 640 kilometres of gathering pipelines, interconnected with multiple processing plants and downstream pipelines with an average throughput of approximately 390 mmcf/d in 2004. The Company’s 100% owned Central Foothills Gas Gathering System (“CFGGS”), the Columbia Minehead Gas Gathering System, and other midstream pipeline and processing

8 A N N U A L I N F O R M A T I O N F O R M

assets ranging from 75% to 100% ownership, support the exploration and development program in both the Alberta Foothills and Edson areas and also provide transportation processing revenues. The Company spent approximately $20.7 million to expand and optimize midstream assets in 2004. In 2005, the Company plans to spend $32 million to extend the CFGGS and Cutbank/Musreau pipeline systems and $22 million to add 75 mmcf/d of new processing capacity along the CFGGS and 30 mmcf/d at the Cutbank/Musreau pipeline.

Synthetic Oil

Talisman holds a 1.25% indirect interest in the Syncrude oil sands project (the “Syncrude Project”) through the Canadian Oil Sands Limited Partnership. The Syncrude Project is a joint venture established to recover shallow deposits of tar sands using open pit mining methods to extract the crude bitumen and employing delayed coking technology to upgrade it to a high-quality, light (32 degree, API) sweet, synthetic crude oil. The Syncrude Project, located near Fort McMurray, Alberta, exploits portions of the Athabasca oil sands deposit to produce Syncrude Sweet Blend® (“SSB”). Syncrude is in the final phases of the third stage of a large expansion program. Stage three is expected to cost $7.8 billion to increase capacity from the current level of 90 mmbbls per year to approximately 129 mmbbls per year. The expansion is expected to start-up in the fourth quarter of 2005 with production ramping up to full capacity by 2008. Since its start-up in 1978, Syncrud e has produced almost 1.6 billion barrels of synthetic crude oil. In 2004, Syncrude shipped 87 mmbbls of SSB, and approximately 13% of Canada’s crude oil needs are supplied by this joint venture. Talisman expects that its capital spending in 2005 related to the Syncrude Project, including expansion and sustaining capital, will be approximately $25 million.

UNITED STATES

Fortuna Energy Inc. (“Fortuna”), an indirect wholly owned subsidiary of Talisman, increased production primarily from deep horizontal Trenton-Black River formation gas wells in the Appalachia area from 60 mmcf/d in 2003 to 89 mmcf/d in 2004, with a record peak of 126 mmcf/d on January 12, 2005. In the second quarter of 2004, Fortuna expanded its Appalachia interests through the acquisition of an average 73% working interest in Belden & Blake Corporation’s Trenton-Black River interests. This acquisition effectively doubled Fortuna’s land holdings in the area. Fortuna expects that capital spending in 2005 in the Appalachia area will be approximately $102 million, and plans to participate in drilling 23 wells.

Talisman’s indirect wholly owned subsidiary, Fortuna (US) L.P., continues to explore for oil and gas in the western U.S. Fortuna (US) L.P. expects capital spending in 2005 in the U.S. will be approximately $14 million, and plans to participate in drilling two wells.

LANDHOLDINGS, PRODUCTION AND PRODUCTIVE WELLS

The following tables set forth Talisman’s North American landholdings, production and productive wells as at December 31, 2004.

| | Undeveloped Acreage | | Developed Acreage | | Total Acreage | |

| Property | (thousand acres) | | (thousand acres) | | (thousand acres) | |

| - | Gross | | Net | | Gross | | Net | | Gross | | Net | |

| North America | | | | | | | | | | | | |

| Canada | | | | | | | | | | | | |

| Greater Arch | 1,499.8 | | 1,061.7 | | 710.4 | | 340.4 | | 2,210.2 | | 1,402.1 | |

| Deep Basin | 479.7 | | 285.9 | | 234.2 | | 56.6 | | 713.9 | | 342.5 | |

| Alberta Foothills | 442.3 | | 236.7 | | 183.3 | | 72.1 | | 625.6 | | 308.8 | |

| Edson Area | 831.0 | | 579.0 | | 906.8 | | 466.5 | | 1,737.8 | | 1,045.5 | |

| Monkman/BC Foothills | 700.3 | | 396.3 | | 79.6 | | 40.8 | | 779.9 | | 437.1 | |

| Ontario | 752.5 | | 521.0 | | 365.3 | | 236.8 | | 1,117.8 | | 757.8 | |

| Chauvin | 75.0 | | 47.7 | | 80.4 | | 70.8 | | 155.4 | | 118.5 | |

| Other1 | 4,894.8 | | 1,162.1 | | 731.9 | | 497.2 | | 5,626.7 | | 1,659.3 | |

| United States2 | 1,506.3 | | 1,217.5 | | 27.5 | | 25.8 | | 1,533.8 | | 1,243.3 | |

| Total3 | 11,181.7 | | 5,507.9 | | 3,319.4 | | 1,807.0 | | 14,501.1 | | 7,314.9 | |

| Synthetic Oil | 477.3 | | 84.8 | | 11.0 | | 1.5 | | 488.3 | | 86.3 | |

| | | | | | | | | | | | | |

| Notes: | | | | | | | | | | | | |

| 1 | “Other” includes minor properties in Canada, but excludes Scotian Slope, synthetic oil in Alberta and coal leases in British Columbia. |

| 2 | “United States” excludes Alaska. |

| 3 | Fee acreage comprises 5% of the total gross number of acres and 6% of the net number of acres. Fee acreage for Gross Undeveloped totals 622.1; Gross Developed totals 63.0; Net Undeveloped totals 449.1; and Net Developed totals 22.0.

|

A N N U A L I N F O R M A T I O N F O R M 9

| | Oil & Liquids Production | | Natural Gas Production | | Productive Wells2,3,4as at | |

| (bbls/d) | | (mmcf/d) | | December 31, 2004 | |

| Property | Gross5 | | Net5 | | Gross6 | | Net6 | | Gross | | Net | |

| North America | | | | | | | | | | | | |

| Canada | | | | | | | | | | | | |

| Greater Arch | 7,387 | | 5,850 | | 158.5 | | 122.4 | | 1,341 | | 744.1 | |

| Deep Basin | 2,080 | | 1,830 | | 60.8 | | 44.6 | | 468 | | 90.8 | |

| Alberta Foothills | 227 | | 170 | | 151.0 | | 116.9 | | 195 | | 84.8 | |

| Edson Area | 4,393 | | 3,325 | | 208.5 | | 171.2 | | 985 | | 696.9 | |

| Monkman/BC Foothills | — | | — | | 70.5 | | 56.9 | | 62 | | 35.7 | |

| Ontario | 1,749 | | 1,473 | | 16.4 | | 13.8 | | 803 | | 566.4 | |

| Chauvin | 15,665 | | 13,121 | | 16.0 | | 13.0 | | 1,302 | | 1,195.3 | |

| Other1 | 22,892 | | 17,534 | | 114.3 | | 99.2 | | 4,802 | | 1,834.8 | |

| United States7 | — | | — | | 89.1 | | 76.7 | | 50 | | 46.5 | |

| Total | 54,393 | | 43,303 | | 885.1 | | 714.7 | | 10,008 | | 5,295.3 | |

| Synthetic Oil | 2,999 | | 2,868 | | — | | — | | — | | — | |

| | | | | | | | | | | | | |

| Notes: | | | | | | | | | | | | |

| 1 | “Other” includes minor producing properties in Canada. |

| 2 | “Productive Wells” means producing wells and wells capable of production. |

| 3 | Includes wells containing multiple completions as follows: |

| | Oil Wells | | Gas Wells | |

| Gross | 542.0 | | 970.0 | |

| Net | 273.0 | | 516.6 | |

4

| One or more completions in the same bore hole is counted as one well. A well is classified as an oil well if one of the multiple completions in a given well is an oil completion. |

| 5 | Includes approximately 692 bbls/d of liquids attributable to royalty interests and net profits interests. |

| 6 | Includes approximately 10.6 mmcf/d of gas attributable to royalty interests and net profits interests. |

| 7 | “United States” excludes Alaska. |

10 A N N U A L I N F O R M A T I O N F O R M

INTERNATIONAL AND FRONTIER

Talisman’s international and frontier strategy concentrates on opportunities in sedimentary basins that have a proved hydrocarbon system and significant reserves and production potential. Talisman has developed its international business through exploration, development drilling and corporate and property acquisitions in all reporting segments.

Talisman produces substantial oil and gas volumes from the North Sea, with ongoing exploration and development activities in the area. Talisman is also active in Southeast Asia, where development projects in Indonesia, Malaysia and Vietnam are expected to produce significant oil and gas production growth. Talisman also has producing interests in Algeria and Trinidad and exploration interests in other areas including Alaska, Colombia, Peru, Qatar, Falkland Islands and Papua New Guinea.

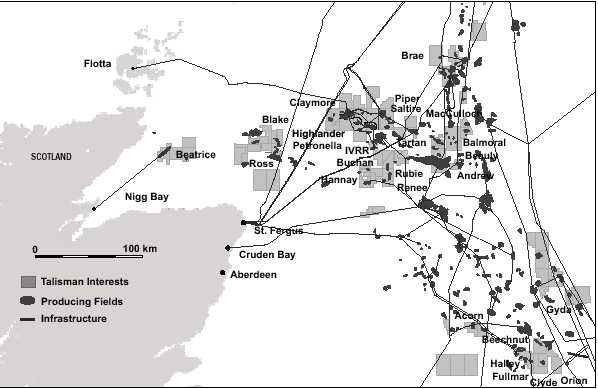

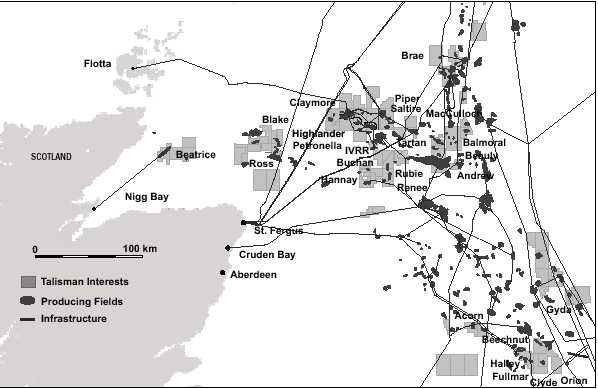

NORTH SEA

Talisman’s North Sea strategy is to develop commercial hubs around core operated properties and infrastructure, and to deliver growth by extending the life of these assets through low risk development opportunities, sub-sea tie-back developments, exploration, secondary recovery, cost reduction and increased third-party tariff revenue. The Company also has a portfolio of non-operated assets.

Talisman’s North Sea assets, which are held principally by Talisman Energy (UK) Limited,Talisman North Sea Limited and Talisman Energy Norge AS, include producing fields and exploration acreage in several areas of the North Sea. Talisman has three core North Sea operating areas: the Mid-North Sea Area (“MNS Area”), the Flotta Catchment Area (“FCA”) and Norway. Talisman also has a number of non-operated interest properties. At the end of 2004, Talisman operated approximately 65% of its North Sea production.

In 2005, Talisman’s capital program in the North Sea is expected to be approximately $1,025 million, with $153 million directed to exploration spending and $872 million directed to development. The Company’s 2005 North Sea drilling program includes participation in up to 10 exploration and 30 development wells (including service wells).

A N N U A L I N F O R M A T I O N F O R M 11

MNS Area Properties

Talisman holds interests ranging from 12% to 100% in a number of production facilities and pipelines in the MNS Area.

Clyde Area

The Company owns various operated interests in the Clyde area, including a 95% operated interest in the Clyde production platform, a 94% operated interest in the Orion field and a 13% non-operated interest in the Fulmar production platform. The Orion tie-back to Clyde was completed in 1999. In 2004, Talisman drilled two development wells on the Clyde field. In January 2004, operations finished on the Eta-2 30/17b exploration well with the wellbore being plugged and abandoned. Talisman made an oil discovery by drilling the Delta well at Block 30/17b. An unsuccessful well was drilled on the Flyndre prospect at Block 30/14-2. In December 2004, the Company spud the Jenny exploration well at Block 30/13c, which was drilling at year end 2004. In 2005, Talisman will drill the Medwin Terrace exploration prospect at Block 30/17b. The 2005 development program includes the drilling of two development wells, one at Clyde and one at Orion, and water injection facility upgrades on the Clyde platform. The Company expects that capital spending in 2005 in the Clyde area will be approximately $108 million.

Buchan Area

The Company has an average 99% operated working interest in the Buchan field, the Buchan floating production platform and the tie-in to the Forties pipeline. Talisman produced its first oil from the Hannay field in March 2002, where it operates with a 99% interest. In October 2002, Talisman drilled the J1 exploration well and in November 2003, the J5 exploration well, both resulting in significant new oil discoveries adjacent to the Buchan field. The discoveries were appraised by drilling the Tweedsmuir appraisal well in July 2004. Talisman holds a 94% interest in the field. In 2004, the Tweedsmuir development was approved and is the main focus of development activity in 2005, including the drilling of three Tweedsmuir development wells. The Company intends to start water injection into the Buchan field in 2005. In addition, the Company intends to drill the North Buchan J2 exploration prospect. The Company expects that capital spending in 2005 in the Buchan area will be approxi mately $474 million.

Ross/Blake Area

In the Ross/Blake area, Talisman has a 69% operated working interest in the Ross field and a 54% non-operated interest in the Blake field, both fields being sub-sea tie-backs to Bleo Holm, the leased Floating, Production, Storage and Offloading vessel. Production from the Blake Flank project commenced in September 2003. Also in 2003 a consortium, including Talisman (37.5%), was awarded Blocks 19/3 and 19/4 in the Twenty-first Licensing Round and a separate Talisman consortium was awarded Block 13/26b as an out-of-round award. Two unsuccessful exploration wells were drilled in the Ross/Blake area in 2004. The Company expects that capital spending in 2005 in the Ross/Blake area will be approximately $40 million, and plans to participate in drilling one exploration well and one development well.

Beatrice Area

Talisman holds a 100% operated interest in the Beatrice Alpha, Bravo and Charlie platforms, as well as the Beatrice/Nigg pipeline and the Nigg terminal. In 2004, Talisman received approval to construct an offshore wind farm demonstrator project adjacent to the Beatrice field.

Other MNS Area Properties

Talisman holds a 60% operated interest in the Beauly field located in Block 16/21c of the MNS. Beauly is a sub-sea tie-back to the Balmoral field. No capital spending is planned for Beauly in 2005.

FCA Properties

Talisman holds interests ranging from 13% to 100% in a number of production facilities and pipelines in the FCA, including an 80% interest in the Flotta terminal.

Piper Area

Talisman holds an 80% operated working interest in the Piper, Saltire, Chanter and Iona fields. In addition, Talisman has a 13% non-operated interest in the MacCulloch field. The Company expects that capital spending in 2005 in the Piper area will be approximately $70 million, including participation in one exploration and two development wells.

12 A N N U A L I N F O R M A T I O N F O R M

Claymore Area

In the Claymore area, Talisman holds a 72% and an 80% operated working interest in the Claymore and Scapa fields, respectively. In 2004, Talisman drilled three development wells on the Claymore field. The Company expects that capital spending in 2005 in the Claymore area will be approximately $89 million, which includes funding for three development wells.

THP Area

Talisman’s subsidiary holds a 100% operated working interest in the Tartan field and the Highlander and Petronella sub-sea tie-back satellite fields; Talisman also holds a 67% operated interest in the Galley field (collectively, “THP Area”). In 2003, Talisman made the North Tartan discovery and in August 2004 production commenced from the field. Also in 2004, Talisman drilled one development well on the Galley field and one unsuccessful exploration well in the THP Area. The Company expects that capital spending in 2005 in the THP Area will be approximately $86 million, and plans to participate in drilling one exploration and two development wells.

Other FCA Properties

Talisman’s subsidiary holds a 78% and 41% operated working interest in the Renee and Rubie fields, respectively. Both fields are sub-sea tie-backs to the Ivanhoe/Rob Roy field in which Talisman has a 23% non-operated interest. Capital spending by the Company in 2005 is expected to be minimal.

Norway

In September 2003, one of Talisman’s indirect wholly owned subsidiaries acquired the 61% operated interest in the Gyda field and associated assets. Two additional licences were awarded later in 2003. In February 2004, Talisman’s subsidiary acquired an interest in two more licences, including the Blane discovery. In December 2004, the subsidiary was awarded interests in five more licences in the Norwegian sector of the North Sea. Three of these licenses give Talisman an operated interest in lands in close proximity to its earlier acquired lands. The remaining two licences are for non-operated interests in lands further north, in the Viking Graben province. In February 2005, Talisman Energy (UK) Limited acquired all of the outstanding shares in Pertra A.S., resulting in the addition of the producing Varg field and undeveloped Varg South field as well as several blocks of operated and non-operated exploration acreage in the Norwegian sector of the North Sea. Production f rom the Varg oilfield is expected to be approximately 10,000 bbls/d net to Talisman. The Company expects that capital spending in 2005 in the Norwegian sector of the North Sea will be approximately $121 million, and plans to participate in drilling two exploration and two development wells.

Non-Operated Interest Properties

Brae Area

Talisman’s non-operated producing interests in the Brae area range from 13% to 18%. Talisman also holds an 8% non-operated interest in the Brae-St. Fergus gas pipeline and terminal. Production from the Brae field commenced in 2003 and in 2004 Talisman participated in one development well in the Brae area. The Company expects that capital spending in 2005 at Brae will be approximately $7 million, and plans to participate in drilling two development wells.

Other Non-Operated Interest Properties

A subsidiary of Talisman holds various non-operated producing interests including: Balmoral (15%), Stirling (15%), Glamis (15%), Andrew (3%), Wytch Farm (5%), Wareham (5%), Alba (2%) and Caledonia (3%) fields. In 2004, Talisman participated in drilling one exploration well and 15 development wells. The Company expects that capital spending in 2005 at its other non-operated interest properties will be approximately $28 million, and plans to participate in drilling two exploration and 13 development wells.

Talisman’s subsidiary holds non-operated producing interests in the Netherlands sector of the North Sea ranging from 2% to 20%. The Company’s interests are in the E, F, G and K sectors.

In the German sector, Talisman’s subsidiary holds a 50% non-operated working interest in one offshore licence, covering portions of blocks C, D, G and H.

A N N U A L I N F O R M A T I O N F O R M 13

Landholdings, Production and Productive Wells

The following tables set forth Talisman’s North Sea landholdings, production and productive wells as at December 31, 2004.

| Undeveloped Acreage | | Developed Acreage | | Total Acreage | |

| Property | (thousand acres) | | (thousand acres) | | (thousand acres) | |

| - | Gross | | Net | | Gross | | Net | | Gross | | Net | |

| Mid-North Sea Area | | | | | | | | | | | | |

| Clyde Area | 343.6 | | 151.2 | | 26.4 | | 21.5 | | 370.0 | | 172.7 | |

| Buchan Area | 326.8 | | 130.1 | | 19.9 | | 19.4 | | 346.7 | | 149.5 | |

| Ross/Blake Area | 315.9 | | 156.8 | | 17.8 | | 12.3 | | 333.7 | | 169.1 | |

| Beatrice Area | 47.6 | | 47.6 | | 11.0 | | 11.0 | | 58.6 | | 58.6 | |

| Other MNS | 66.5 | | 28.3 | | — | | — | | 66.5 | | 28.3 | |

| Flotta Catchment Area | | | | | | | | | | | | |

| Piper Area | 122.7 | | 63.0 | | 37.9 | | 24.6 | | 160.6 | | 87.6 | |

| Claymore Area | 88.2 | | 78.1 | | 23.6 | | 18.6 | | 111.8 | | 96.7 | |

| THP Area | 113.1 | | 64.0 | | 14.5 | | 14.5 | | 127.6 | | 78.5 | |

| Other FCA | 13.5 | | 3.8 | | 15.6 | | 7.7 | | 29.1 | | 11.5 | |

| Norway | 982.2 | | 524.9 | | 33.9 | | 20.7 | | 1,016.1 | | 545.6 | |

| Non-Operated Interests | | | | | | | | | | | | |

| Brae Area | 95.7 | | 15.5 | | 22.7 | | 4.1 | | 118.4 | | 19.6 | |

| Other Non-Operated Interests1 | 1,936.1 | | 857.2 | | 384.5 | | 92.9 | | 2,320.6 | | 950.1 | |

| Total | 4,451.9 | | 2,120.5 | | 607.8 | | 247.3 | | 5,059.7 | | 2,367.8 | |

Note:

1 “Other Non-Operated Interests” includes the Netherlands and Germany.

| Oil & Liquids Production | | Natural Gas Production | | Productive Wells1,2,3as at | |

| Property | (bbls/d) | | (mmcf/d) | | December 31,2004 | |

| - | Gross | | Net | | Gross | | Net | | Gross | | Net | |

| | | | | | | | | | | | |

| Mid-North Sea Area | | | | | | | | | | | | |

| Clyde Area | 14,215 | | 14,215 | | 1.8 | | 1.8 | | 24 | | 22.4 | |

| Buchan Area | 8,814 | | 8,620 | | 0.4 | | 0.4 | | 11 | | 10.9 | |

| Ross/Blake Area | 20,674 | | 20,674 | | 6.5 | | 6.5 | | 19 | | 11.3 | |

| Beatrice Area | 4,270 | | 4,270 | | — | | — | | 28 | | 28.0 | |

| Other MNS | 1,093 | | 1,093 | | 0.1 | | 0.1 | | 1 | | 0.6 | |

| Flotta Catchment Area | | | | | | | | | | | | |

| Piper Area | 16,885 | | 16,883 | | 0.8 | | 0.8 | | 34 | | 21.9 | |

| Claymore Area | 21,499 | | 21,572 | | — | | — | | 36 | | 27.0 | |

| THP Area | 13,896 | | 13,880 | | — | | — | | 27 | | 24.7 | |

| Other FCA | 3,063 | | 3,063 | | — | | — | | 14 | | 4.0 | |

| Norway | 5,862 | | 5,862 | | 3.4 | | 3.4 | | 19 | | 11.4 | |

| Non-Operated Interests | | | | | | | | | | | | |

| Brae Area | 7,111 | | 6,228 | | 83.4 | | 75.1 | | 75 | | 10.3 | |

| Other Non-Operated Interests | 4,479 | | 4,408 | | 17.3 | | 17.3 | | 160 | | 9.2 | |

| Total | 121,861 | | 120,768 | | 113.7 | | 105.4 | | 448 | | 181.7 | |

Notes:

| 1 | “Productive Wells” means producing wells and wells capable of production. |

| 2 | Includes wells containing multiple completions as follows: |

| | Oil Wells | | Gas Wells | |

| Gross | 19.0 | | — | |

| Net | 1.5 | | — | |

| 3 | One or more completions in the same bore hole is counted as one well. A well is classified as an oil well if one of the multiple completions in a given well is an oil completion. |

14 A N N U A L I N F O R M A T I O N F O R M

SOUTHEAST ASIA

The Company’s interests in Southeast Asia include operations in Indonesia, Malaysia and Vietnam and exploration acreage in Papua New Guinea.

In Indonesia, Talisman and its subsidiaries are pursuing a strategy of continued exploitation of existing oil properties and the development of the major natural gas discoveries at Corridor to deliver future production growth.

Talisman plans to spend approximately $75 million in Indonesia in 2005, primarily to participate in drilling two exploration wells and undertake expansion of the Corridor gas facilities.

Corridor PSC

Talisman (Corridor) Ltd. (“TCL”), an indirect wholly owned subsidiary of Talisman, has a 36% non-operated interest in the Corridor production sharing contract (“Corridor PSC Block”) and field production facilities.

In the Corridor PSC Block, TCL’s gas sales to PT Caltex Pacific Indonesia (“Caltex”) commenced in 1998 to the Duri steam flood project and were augmented by a further gas sales agreement with Caltex in 2000. In September 2003, TCL commenced gas sales to Gas Supply Pte. Ltd., located in Singapore, under the terms of a 20-year gas sales agreement. Talisman Transgasindo Ltd. has an indirect 6% interest in the Grissik to Duri pipeline and in the Grissik to Singapore pipeline completed in 2003.

In August 2004, ConocoPhillips (Grissik) Ltd.,as representative of the Corridor PSC contractors, entered into an agreement for the sale of gas to PT Perusahaan Gas Negara (Persero), Tbk, the Indonesian national gas transmission and distribution company. This agreement enables the sale of 2.3 trillion cubic feet (gross) of natural gas from the Corridor PSC Block to the West Java market over a 17-year period commencing in the first quarter of 2007. The Suban Phase 2 gas expansion project was approved in 2004 and includes the installation of two new 200 mmcf/d capacity gas trains, additional pipelines and infrastructure in the Corridor PSC Block.

In 2004, two unsuccessful non-operated exploration wells were drilled in the Corridor PSC Block. No further exploration activity is planned for the Corridor PSC Block in 2005.

The Company expects that capital spending in 2005 in the area will be approximately $63 million, primarily for Suban Phase 2 gas expansion.

A N N U A L I N F O R M A T I O N F O R M 15

Other Properties

Talisman and its subsidiaries hold a 40% non-operated interest in the Corridor technical assistance contract (the “Corridor TAC Block”), a 50% operated interest in the Ogan Komering production sharing contract (the “OK Block”) and a 25% non-operated interest in the offshore Nila production sharing contract (the “Nila Block”).

The enhanced oil recovery contract at Tanjung, in which Talisman held a 50% interest, expired in November 2004 and the enhanced oil recovery contract at Jambi, in which Talisman held a 40% interest, expired in January 2005.

In December 2004, Talisman sold Talisman (Madura) Ltd.,which holds a 25% non-operated interest in the Madura Offshore production sharing contract. Also in December 2004, Talisman participated in an unsuccessful exploration well on the Nila Block.

The 2005 program includes drilling up to two exploration wells on the OK Block. The Company expects that capital spending in 2005 in the area will be approximately $12 million.

Malaysia and Vietnam

In Malaysia and Vietnam, the Company’s strategy is to develop oil and natural gas fields and to deliver production growth through exploration and development. The Company operates three of its four working interest properties in Malaysia and Vietnam, being Block PM-3 CAA/Block 46-Cai Nuoc, Block PM-305 and Block PM-314. Block 46/02 is operated by a joint operating company. Total Malaysia and Vietnam capital spending in 2005 is expected to be $235 million. In addition, the Vietnam Oil and Gas Corporation advised Talisman Vietnam Limited (“TVL”) in December 2004 that TVL’s tender for Block 15-2/01, offshore Vietnam had been successful. The award is subject to agreement of a Petroleum Contract for Block 15-2/01.

Block PM-3 CAA and 46-Cai Nuoc

Two of Talisman’s indirect wholly owned subsidiaries hold interests in Block PM-3 CAA and associated production facilities in Malaysia and Vietnam: Talisman Malaysia Limited (26.4%) and Talisman Malaysia (PM3) Limited (15%). Talisman Vietnam Limited, another indirect wholly owned subsidiary, holds a 33.2% operated interest in the adjacent Block 46-Cai Nuoc area in Vietnam. Part of that area and part of the PM-3 CAA were unitized in 1998 to become the East Bunga Kekwa-Cai Nuoc unit.

In 2003, the Company completed Phase 2/3 of the PM-3 CAA Project, developing a number of fields located in the southeast portion of the block. The project involved the installation of four new wellhead platforms, a central processing platform, a compression annex platform, a floating storage and offloading vessel and interfield pipelines. Phase 2/3 oil production started in September 2003. Natural gas is sold under a long-term contract to Petroliam Nasional Berhad and Vietnam Oil and Gas Corporation, the national oil and gas companies of Malaysia and Vietnam, respectively.

In 2004, Phase 2/3 development drilling continued and the Company had a successful exploration program in the PM-3 CAA and Block 46-Cai Nuoc areas. At year end 2004 the Company was drilling a sidetrack to appraise a new West Bunga Orkid oil discovery. Development studies for these areas are underway.

The Company expects that capital spending in 2005 in the area will be approximately $137 million, and plans to participate in drilling two exploration and appraisal wells and five development wells (including service wells).

Block PM-305

Talisman Malaysia Limited holds a 60% operated working interest in Block PM-305 production sharing contract offshore Malaysia, approximately 250 kilometres southeast of Block PM-3 CAA. In 2003, the Company made an oil discovery 10 kilometres south of the Angsi field. Facilities construction is currently underway and South Angsi development drilling has begun. First oil is planned for mid 2005. Talisman drilled one unsuccessful exploration well on the block in 2004.

The Company expects that capital spending in 2005 in the area will be approximately $81 million, and plans to participate in drilling up to six exploration and nine development wells (including service wells).

Block PM-314

In March 2004, Talisman Malaysia Limited signed a production sharing contract for offshore Block PM-314 in Malaysia. Talisman Malaysia Limited holds a 60% operated working interest in that production sharing contract. The block covers 2.3 million acres immediately west of Block PM-305. In 2004, Talisman acquired a 3D seismic survey over part of the block and interpretation of that data is underway. The Company expects that capital spending in 2005 in the area will be approximately $6 million, and plans to participate in drilling one exploration well.

16 A N N U A L I N F O R M A T I O N F O R M

Block 46/02

In December 2002, Talisman (Vietnam 46/02) Ltd. signed a Petroleum Contract for a 30% interest in Block 46/02 in Vietnam. Talisman (Vietnam 46/02) Ltd. holds a 30% interest in the Truong Son Joint Operating Company (“JOC”),with the remainder held by PetroVietnam Exploration and Production Company (40%) and Petronas Carigali Overseas SDN BHD (30%),the wholly owned exploration and production subsidiaries of the national petroleum companies of Vietnam and Malaysia, respectively. In 2004, the Company drilled two more exploration wells. One was unsuccessful and the other discovered oil, which is being evaluated for potential development. The Company expects that capital spending in 2005 in Block 46/02 will be approximately $11 million, and plans to participate in drilling up to two exploration wells.

Papua New Guinea

The Company holds an operated interest in offshore Papua New Guinea Block PRL-1 (48%),which contains a natural gas discovery, and in Block PPL-244 (35%),which is exploration acreage.

Landholdings, Production and Productive Wells

The following tables set forth Talisman’s Southeast Asia landholdings, production and productive wells as at December 31, 2004.

| | Undeveloped Acreage | | Developed Acreage | | Total Acreage | |

| Property | (thousand acres) | | (thousand acres) | | (thousand acres) | |

| - | Gross | | Net | | Gross | | Net | | Gross | | Net | |

| Indonesia | | | | | | | | | | | | |

| Corridor PSC | 407.6 | | 146.8 | | 150.5 | | 54.2 | | 558.1 | | 201.0 | |

| Other1 | 1,603.5 | | 473.8 | | 117.2 | | 48.0 | | 1,720.7 | | 521.8 | |

| Malaysia and Vietnam | | | | | | | | | | | | |

| Block PM-3 CAA and 46-Cai Nuoc | 129.7 | | 52.6 | | 224.4 | | 92.5 | | 354.1 | | 145.1 | |

| Block PM-305 | 543.6 | | 326.2 | | — | | — | | 543.6 | | 326.2 | |

| Block PM-314 | 2,309.8 | | 1,385.9 | | — | | — | | 2,309.8 | | 1,385.9 | |

| Block 46/02 | 3,023.6 | | 907.1 | | — | | — | | 3,023.6 | | 907.1 | |

| Papua New Guinea | 858.2 | | 325.1 | | — | | — | | 858.2 | | 325.1 | |

| Total | 8,876.0 | | 3,617.5 | | 492.1 | | 194.7 | | 9,368.1 | | 3,812.2 | |

| | | | | | | | | | | | | |

| Note: | | | | | | | | | | | | |

| 1 | “Other” includes Corridor TAC Block, Tanjung Block, Jambi Block, Ogan Komering Block and Nila PSC Block. The enhanced oil recovery contract at Jambi expired in January 2005, but is included in this table as the Company’s interest was still in effect at year end 2004. |

| | Oil & Liquids Production | | Natural Gas Production | | Productive Wells2,3,4as at | |

| Property | (bbls/d) | | (mmcf/d) | | December 31, 2004 | |

| - | Gross | | Net1 | | Gross | | Net1 | | Gross | | Net | |

| Indonesia | | | | | | | | | | | | |

| Corridor PSC | 2,637 | | 948 | | 133 | | 99.3 | | 120 | | 42.9 | |

| Other5 | 10,618 | | 5,351 | | 8 | | 4.8 | | 590 | | 234.4 | |

| Malaysia and Vietnam | | | | | | | | | | | | |

| Block PM-3 CAA and 46-Cai Nuoc | 22,389 | | 14,585 | | 119 | | 89.9 | | 40 | | 16.3 | |

| Block PM-305 | — | | — | | — | | — | | — | | — | |

| Block PM 314 | — | | — | | — | | — | | — | | — | |

| Block 46/02 | — | | — | | — | | — | | — | | — | |

| Papua New Guinea | — | | — | | — | | — | | — | | — | |

| Total | 35,644 | | 20,884 | | 260 | | 194.0 | | 750 | | 293.6 | |

| Notes: | | | | | | | | | | | | |

| 1 | Interests of the Indonesian, Malaysian and Vietnam governments, other than working interests or income taxes, are accounted for as royalties. |

| 2 | “Productive Wells” means producing wells and wells capable of production. |

| 3 | Includes wells containing multiple completions4as follows: |

| | Oil Wells | | Gas Wells | |

| Gross | 99.0 | | — | |

| Net | 39.8 | | — | |

| 4 | One or more completions in the same bore hole is counted as one well. A well is classified as an oil well if one of the multiple completions in a given well is an oil completion. |

| 5 | “Other” includes the Corridor TAC Block, Tanjung Block, Jambi Block and OK Block. The enhanced oil recovery contract at Jambi expired in January 2005, but is included in this table as the Company’s interest was still in effect at year end 2004. |

A N N U A L I N F O R M A T I O N F O R M 17

ALGERIA

Talisman (Algeria) B.V., an indirect wholly owned subsidiary of Talisman, holds a 35% non-operated working interest in Block 405a and Block 215 under a production sharing contract with Algeria’s National Oil Company, Sonatrach. Block 405a contains the Greater Menzel Lejmat North (“Greater MLN”) field as well as a portion of the Ourhoud field.

In 2003, Phase 1 of the Greater MLN development project was completed with production commencing in June 2003. Greater MLN facilities include a central processing facility (“CPF”) and compression for gas injection. Crude oil is pipelined to the Mediterranean coast for export. Phase 2 expansion of the CPF for full pressure maintenance is currently under review, as is the development of the Menzel Lejmat South East field located to the south of Block 405a. The Company expects to relinquish a portion of Block 405a and all of Block 215 in 2005.

Ourhoud

Production at the Ourhoud field (Talisman 2%) commenced in December 2002 with first oil sales in 2003. Production from Ourhoud is anticipated to remain at plateau levels throughout 2005.

The Company expects that capital spending in 2005 in Algeria will be approximately $55 million, which includes funding for two exploration wells and 14 development wells (including service wells).

18 A N N U A L I N F O R M A T I O N F O R M

Landholdings, Production and Productive Wells

The following tables set forth Talisman’s Algerian landholdings, production and productive wells as at December 31, 2004.

| | Undeveloped Acreage | | Developed Acreage | | Total Acreage | |

| Property | (thousand acres) | | (thousand acres) | | (thousand acres) | |

| -- | Gross | | Net | | Gross | | Net | | Gross | | Net | |

| Greater MLN1 | 330.5 | | 115.7 | | 11.2 | | 3.9 | | 341.7 | | 119.6 | |

| Ourhoud | — | | — | | 65.6 | | 1.3 | | 65.6 | | 1.3 | |

| Other2 | 420.0 | | 147.0 | | — | | — | | 420.0 | | 147.0 | |

| Total | 750.5 | | 262.7 | | 76.8 | | 5.2 | | 827.3 | | 267.9 | |

| | | | | | | | | | | | | |

| Notes: | | | | | | | | | | | | |

| 1 “Greater MLN” includes MLSE acreage. | | | | | | | | | | | | |

| 2 “Other” includes Block 215 acreage. | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Oil & Liquids Production | | Natural Gas Production | | Productive Wells2as at | |

| Property | (bbls/d) | | (mmcf/d) | | December 31, 2004 | |

| - | Gross | | Net1 | | Gross | | Net1 | | Gross | | Net | |

| Greater MLN | 9,053 | | 5,544 | | — | | — | | 14 | | 4.9 | |

| Ourhoud | 4,484 | | 2,794 | | — | | — | | 28 | | 0.6 | |

| Total | 13,537 | | 8,338 | | — | | — | | 42 | | 5.5 | |

| | | | | | | | | | | | | |

| Notes: | | | | | | | | | | | | |

| 1 | Interests of the Algerian government, other than working interests or income taxes, are accounted for as royalties. |

| 2 | “Productive Wells” means producing wells and wells capable of production. |

TRINIDAD

Talisman holds a 25% non-operated interest in the Angostura development portion of Block 2(c) and a 36% interest in the balance of Block 2(c) located to the south and retained for further exploration. The 36% interest is comprised of a 25% original interest plus an 11% share of the interest of a non-participating co-venturer, subject to a reinstatement right.

The Greater Angostura Project located in Block 2(c) was sanctioned in 2003 and in 2004 the installation of all field facilities was completed, including a central processing platform and three wellhead platforms. Oil production commenced in January 2005 with oil exported to a new onshore oil terminal located west of Galeota Point in the southeast of Trinidad. In 2004, the Company also drilled one successful exploration well on the block.

Talisman’s wholly owned subsidiary, Talisman (Trinidad Block 3a) Ltd., holds a 30% interest in the production sharing contract on Block 3(a), immediately to the east of Block 2(c). In February 2004, the Company finished drilling the Puncheon-1 exploration well, which tested oil at a rate of 4,443 bbls/d. The well has not been tied in.

In 2002, Talisman (Trinidad) Petroleum Ltd., a wholly owned subsidiary, acquired the right to earn an operated 65% interest in the onshore Eastern Block. This block is comprised of approximately 108 thousand gross acres (44 thousand hectares),of which the Government of Trinidad holds the mineral rights to approximately 95 thousand acres (38.5 thousand hectares) and the balance is freehold title. In 2004,the Company completed its 3D seismic acquisition covering much of the Eastern Block. Seismic data is being interpreted to define a drilling program which will commence in 2005.

The Company expects that capital spending in 2005 in Trinidad will be approximately $100 million, and plans to participate in drilling up to eight exploration and eight development wells (including service wells).

A N N U A L I N F O R M A T I O N F O R M 19

COLOMBIA

In Colombia, Talisman (Colombia) Oil & Gas Ltd.,a wholly owned subsidiary of Talisman, is focusing on an exploration program in a known hydrocarbon basin.

The subsidiary holds non-operated interests in three blocks in the Upper Magdalena Valley region, including Acevedo (70%),Altamizal (30%) and Huila Norte (30%). In 2004,50% of the Huila Norte Block was relinquished. The balance of that block, and the Acevedo and Altamizal blocks, commenced relinquishment in 2004 and are expected to be fully relinquished in 2005.

In the Llanos Foothills region of north-central Colombia, the subsidiary holds a 30% non-operated interest in the Tangara and Mundo Nuevo blocks. In July 2004, the Tangara-1 exploration well was spudded on the Tangara Block and the well was drilling at year end.

The Company expects that capital spending in 2005 in Colombia will be approximately $8 million in order to finish operations at Tangara-1 and to fund ongoing geologic and geophysical work.

PERU

In 2004, Talisman (Peru) Ltd., a wholly owned subsidiary of Talisman, acquired a 25% non-operated interest in Peru’s Block 64 in the Marañon Basin. An exploration well drilled in 2004, encountered drilling problems and was unable to reach the target formation.

The Company expects that capital spending in 2005 in Peru will be approximately $13 million, and plans to participate in drilling one exploration well, which was spud in late January 2005.

QATAR

Talisman Energy (Qatar) Inc.,a wholly owned subsidiary of Talisman, holds a 100% interest in an Exploration and Production Sharing Agreement for offshore Block 10 in Qatar. During 2004, the Company’s subsidiary completed a 3D seismic acquisition on the block. Interpretation of that data is expected to continue into 2005.

The Company expects that capital spending in 2005 in Qatar will be approximately $15 million. The Company plans to drill its first exploration well in late 2005.

ALASKA

In June 2003, the Company’s indirect wholly owned subsidiary, FEX L.P. (“FEX”) (formerly Fortuna Exploration LLP), entered into an agreement with Total E&P USA, Inc. (“Total”), through which the Company earned a 30% interest in certain lands in the Caribou Region of the National Petroleum Reserve — Alaska (“NPRA”). This represented the Company’s initial entry into Alaska. In October 2004, the Company entered into a further agreement with Total whereby FEX acquired a 100% working interest in the Caribou lands. In June 2004, FEX participated in a lease sale covering the Northwest Planning Area of the NPRA, acquiring a 100% interest in over 250,000 acres of land. In October 2004, FEX was successful at another lease sale, acquiring approximately 101,000 acres of State lands in the offshore Harrison Bay area. FEX expects capital spending in 2005 in the Alaska area will be approximately $22 million in 2005, primarily to conduct geologi c and geophysical work to further evaluate these newly acquired lands.

OTHER

Talisman’s strategy is to expand activity in core producing areas and to add new ventures where appropriate. The Company actively investigates new ventures outside core producing areas.

20 A N N U A L I N F O R M A T I O N F O R M

PRODUCTIVE WELLS AND ACREAGE

The following table shows the number of productive wells1in which the Company had a working interest, as well as developed and undeveloped acres assignable to such wells, as of December 31, 2004. Undeveloped acreage is considered to be those lease acres on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and gas regardless of whether or not such acreage contains proved reserves.

| | Productive Wells | | Developed | | Undeveloped | |

| - | Oil Wells2 | | Gas Wells2 | | Acres | | Acres | |

| North America3 | | | | | | | | |

| Gross | 5,351.0 | | 4,657.0 | | 3,330.4 | | 11,659.0 | |

| Net | 2,807.7 | | 2,487.5 | | 1,808.5 | | 5,592.7 | |

| North Sea | | | | | | | | |

| Gross | 424.0 | | 24.0 | | 607.8 | | 4,451.9 | |

| Net | 178.9 | | 2.8 | | 247.3 | | 2,120.5 | |

| Southeast Asia | | | | | | | | |

| Gross | 710.0 | | 40.0 | | 492.1 | | 8,876.0 | |

| Net | 279.0 | | 14.6 | | 194.7 | | 3,617.5 | |

| Algeria | | | | | | | | |

| Gross | 42.0 | | — | | 76.8 | | 750.5 | |

| Net | 5.5 | | — | | 5.2 | | 262.7 | |

| Trinidad | | | | | | | | |

| Gross | 11.0 | | — | | 23.5 | | 299.8 | |

| Net | 2.8 | | — | | 5.9 | | 130.1 | |

| Other4 | | | | | | | | |

| Gross | — | | — | | — | | 5,441.0 | |

| Net | — | | — | | — | | 2,675.6 | |

| Total | | | | | | | | |

| Gross | 6,538.0 | | 4,721.0 | | 4,530.6 | | 31,478.2 | |

| Net | 3,273.9 | | 2,504.9 | | 2,261.6 | | 14,399.1 | |

| | | | | | | | | |

| Notes: | | | | | | | | |

| 1 | “Productive Wells” means producing wells and wells capable of production. |

| 2 | Includes wells containing multiple completions as follows: |

| | Oil Wells | | Gas Wells | |

| 2003 | Gross | 490.0 | | 814.0 | |

| | Net | 263.1 | | 425.4 | |

| 2004 | Gross | 542.0 | | 970.0 | |

| - | Net | 273.0 | | 516.6 | |

One or more completions in the same bore hole is counted as one well. A well is classified as an oil well if one of the multiple completions in a given well is an oil completion.

| 3 | "North America" includes synthetic oil. |

| 4 | “Other” includes Alaska, Colombia, Peru, Qatar, Falkland Islands and Scotian Slope. |

A N N U A L I N F O R M A T I O N F O R M 21

DRILLING ACTIVITY

The following table sets forth the number of wells1Talisman has drilled and tested or participated in drilling and testing, and the net2interest of the Company in such wells for each of the last three fiscal years. The number of wells drilled refers to the number of wells completed at any time during the fiscal years, regardless of when drilling was initiated. The term “completion” refers to the installation of permanent equipment for the production of oil and gas, or, in the case of a dry hole, to reporting of abandonment to the appropriate agency.

| Year Ended | | | | Exploration | | Development | | Total | |

| December 31,2004 | | Oil3 | | Gas3 | | Dry4 | | Total | | Oil3 | | Gas3 | | Dry4 | | Total | | Oil3 | | Gas3 | | Dry4 | | Total | |

| North America | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Canada | | Gross | | 16.0 | | 123.0 | | 15.0 | | 154.0 | | 121.0 | | 301.0 | | 23.0 | | 445.0 | | 137.0 | | 424.0 | | 38.0 | | 599.0 | |

| | | | Net | | 13.4 | | 64.0 | | 11.5 | | 88.9 | | 66.9 | | 183.0 | | 18.6 | | 268.5 | | 80.3 | | 247.0 | | 30.1 | | 357.4 | |

| | United States5 | Gross | | — | | 20.0 | | 1.0 | | 21.0 | | — | | — | | — | | — | | — | | 20.0 | | 1.0 | | 21.0 | |

| | | | Net | | — | | 15.9 | | 1.0 | | 16.9 | | — | | — | | — | | — | | — | | 15.9 | | 1.0 | | 16.9 | |

| North Sea6 | | Gross | | 3.0 | | — | | 6.0 | | 9.0 | | 17.0 | | — | | 1.0 | | 18.0 | | 20.0 | | — | | 7.0 | | 27.0 | |

| | | | Net | | 1.9 | | — | | 4.3 | | 6.2 | | 6.0 | | — | | 0.8 | | 6.8 | | 7.9 | | — | | 5.1 | | 13.0 | |

| Southeast Asia | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Indonesia | | Gross | | — | | — | | 2.0 | | 2.0 | | 9.0 | | — | | — | | 9.0 | | 9.0 | | — | | 2.0 | | 11.0 | |

| | | | Net | | — | | — | | 0.7 | | 0.7 | | 3.8 | | — | | — | | 3.8 | | 3.8 | | — | | 0.7 | | 4.5 | |

| | Malaysia/ | | Gross | | 1.0 | | — | | 3.0 | | 4.0 | | 12.0 | | 2.0 | | 1.0 | | 15.0 | | 13.0 | | 2.0 | | 4.0 | | 19.0 | |

| | Vietnam | | Net | | 0.4 | | — | | 1.6 | | 2.0 | | 5.0 | | 0.8 | | 0.4 | | 6.2 | | 5.4 | | 0.8 | | 2.0 | | 8.2 | |

| Algeria | | Gross | | — | | — | | — | | — | | 3.0 | | — | | — | | 3.0 | | 3.0 | | — | | — | | 3.0 | |

| | | | Net | | — | | — | | — | | — | | 0.1 | | — | | — | | 0.1 | | 0.1 | | — | | — | | 0.1 | |

| Trinidad | | Gross | | 1.0 | | 1.0 | | — | | 2.0 | | 11.0 | | — | | 1.0 | | 12.0 | | 12.0 | | 1.0 | | 1.0 | | 14.0 | |

| | | | Net | | 0.3 | | 0.3 | | — | | 0.6 | | 2.8 | | — | | 0.3 | | 3.1 | | 3.1 | | 0.3 | | 0.3 | | 3.7 | |

| Other7 | | Gross | | — | | — | | 4.0 | | 4.0 | | — | | — | | — | | — | | — | | — | | 4.0 | | 4.0 | |

| | | | Net | | — | | — | | 1.6 | | 1.6 | | — | | — | | — | | — | | — | | — | | 1.6 | | 1.6 | |