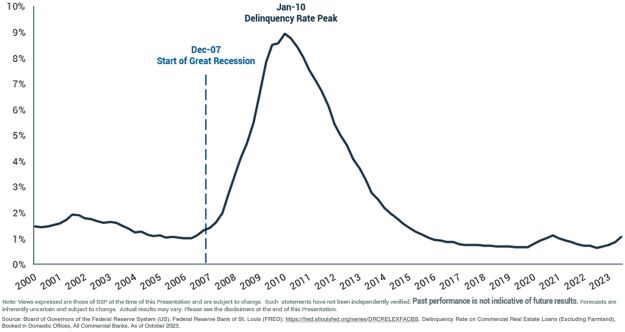

attractive risk-adjusted returns. Changes in general economic conditions will affect the creditworthiness of borrower entities and/or the value of underlying real estate collateral relating to our investments and may include economic and/or market fluctuations, changes in environmental, zoning and other laws, casualty or condemnation losses, regulatory limitations on rents, decreases in property values, changes in the appeal of properties to tenants, changes in supply and demand of real estate products, fluctuations in real estate fundamentals, the financial resources of borrower entities, energy supply shortages, various uninsured or uninsurable risks, natural disasters, pandemics or outbreaks of contagious disease, political events, terrorism and acts of war, outbreak of wars and military conflicts, changes in government regulations, changes in monetary policy, changes in real property tax rates and/or tax credits, changes in operating expenses, changes in interest rates, changes in inflation rates, changes in the availability of debt financing and/or mortgage funds which may render the sale or refinancing of properties difficult or impracticable, increased mortgage defaults, increases in borrowing rates, changes in consumer spending, negative developments in the economy and/or adverse changes in real estate values generally and other factors that are beyond our control. This risk may be magnified in the case of the more recent conflicts between Israel and Hamas, and the ongoing conflict between Russia and Ukraine, due to the significant sanctions and other restrictive actions taken against Russia by the U.S. and other countries, as well as the cessation of all business in Russia by many global companies. In addition, recent concerns about the real estate market, rising interest rates, inflation, energy costs and geopolitical issues have contributed to increased volatility and diminished expectations for the economy and markets going forward.

We cannot predict the degree to which economic conditions generally, and the conditions for real estate debt investing in particular, will improve or decline. Any declines in the performance of the U.S. and global economies or in the real estate debt markets could have a material adverse effect on our business, financial condition, and results of operations.

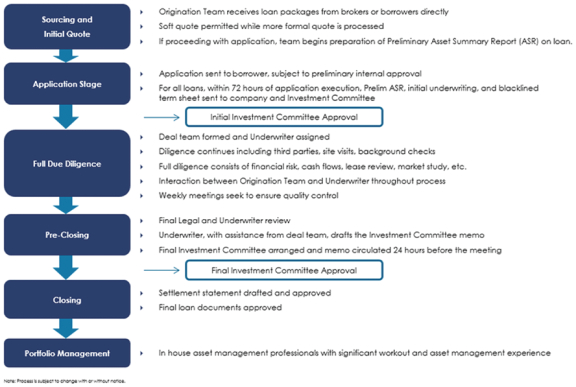

To the extent that the Company originates commercial mortgage loans, it will be subject to the laws, rules, and regulations of various Federal, state and local government agencies regarding the origination, processing, underwriting, sale and servicing of mortgage loans.

Applicable laws, rules, and regulations may limit the interest rates, finance charges and other fees that the Company and/or the Advisor may charge in connection with a loan origination, may require the Company and/or the Advisor to make extensive disclosure, and may impose on the Company and/or the Advisor qualification and licensing obligations and reporting and net worth requirements. As an originator of mortgage loans, the Company and/or the Advisor may be subject to inspection by government agencies. The Company’s and/or the Advisor’s failure to comply with applicable requirements could lead to, among other things, the loss of the ability to originate further loans, the rescission or voiding of existing mortgage loans (or parts thereof), civil damages, class action lawsuits, and Federal, state and/or local enforcement actions. In addition, Federal, state, and local governments have proposed and may enact additional laws, rules, and regulations governing the origination of mortgage loans. These additional laws, rules and regulations may impose obligations and restrictions on the Company and/or the Advisor that may have an adverse effect on the Company’s ability to achieve its investment objective.

Investments in single tenant net lease properties would expose us to risks related to the tenant’s financial stability.

To the extent the Company invests in single tenant net leased properties. If so, the performance of these investments will depend heavily on the financial stability of the tenant. A default by any such tenant, or the bankruptcy or insolvency of the tenant, could lead to the loss of lease revenues and significantly increase the carrying cost of the property. Under U.S. bankruptcy law, a tenant that is the subject of bankruptcy proceedings has the option of assuming or rejecting any unexpired lease. If the tenant rejects the lease, any resulting claim we have for breach of the lease (excluding collateral securing the claim) will be treated as a general unsecured claim and the maximum claim will be capped.

72