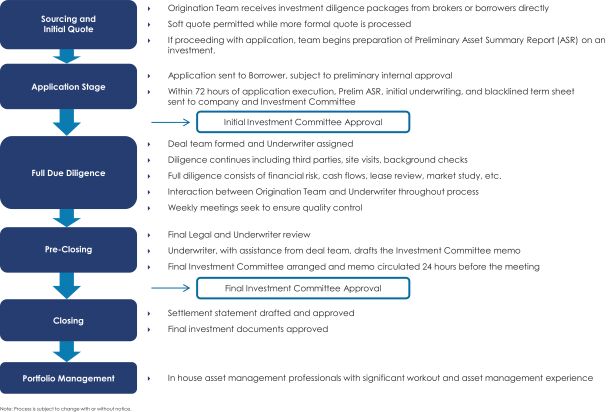

synergies with Benefit Street Partner’s commercial real estate team’s existing debt sourcing capabilities by leveraging its significant scale and existing relationships to source high quality lending opportunities.

We may co-invest, subject to the conditions included in the exemptive order received by our Advisor from the SEC, with certain of our affiliates. See “—Allocation of Co-Investment Opportunities” and “Item 7. Certain Relationships and Related Transactions, and Trustee Independence” below. We believe that such co-investments afford us additional investment opportunities and an ability to build a diverse portfolio.

As a BDC, we are generally required to invest at least 70% of our total assets in securities of private and certain U.S. public companies (other than certain financial institutions), cash, cash equivalents and U.S. government securities and other limited float high quality debt investments that mature in one year or less.

We are permitted to borrow money from time to time within the levels permitted by the 1940 Act that are applicable to us. Subject to the receipt of certain approvals and compliance with certain disclosure requirements, we are permitted to reduce our asset coverage, as defined in the 1940 Act from 200% to 150% so long as we meet certain disclosure requirements. On April 8, 2024, our sole shareholder approved the reduced asset coverage requirements and declined the Company’s offer to repurchase all of its outstanding Common Shares. As a result, we are subject to the reduced asset coverage requirements in Section 61(a)(2) of the 1940 Act, which permit a BDC to double the maximum amount of leverage that it is permitted to incur by reducing the asset coverage requirements applicable to such BDC from 200% to 150%.

Our Advisor, BSP and Franklin Templeton

Our Advisor is served by Benefit Street Partners’ commercial real estate origination, investment and portfolio management team. BSP consists of over 100 investment professionals and over 250 total employees as of March 31, 2024.

BSP is a leading credit-focused alternative asset management firm with approximately $42 billion in assets under management as of December 31, 2023. Established in 2008, the BSP platform manages funds for institutions and high-net-worth investors across various credit funds and complementary strategies, including private/opportunistic debt, structured credit, high yield, special situations, and commercial real estate debt. These strategies complement each other as they all leverage the sourcing, analytical, compliance, and operational capabilities that encompass BSP’s robust platform.

Our Advisor’s core commercial real estate investment committee consists of Michael Comparato, Head of Real Estate, Senior Portfolio Manager of BSP Real Estate (“BSP RE”), Jerome Baglien, Chief Financial Officer and Chief Operating Officer of BSP RE, Tanya Mollova, Managing Director of BSP RE, and Matthew Jacobs, Managing Director and Chief Credit Officer of BSP RE, each with substantial experience in originating, underwriting and structuring real estate credit investments.

Franklin Resources, Inc. (“Franklin Templeton”) (NYSE: BEN), an affiliate of the Advisor, is a global investment management organization with subsidiaries and serving clients in over 150 countries. Franklin Templeton’s mission is to help clients achieve better outcomes through investment management expertise, wealth management and technology solutions. Through its specialist investment managers, the company offers specialization on a global scale, bringing extensive capabilities in fixed income, equity, alternatives, and multi-asset solutions. With more than 1,300 investment professionals, and offices in major financial markets around the world, the California-based company has more than 75 years of investment experience and approximately $1.6 trillion in assets under management as of January 31, 2024.

Investment Strategy

The Company’s investment strategy is to originate, acquire, finance and manage a portfolio of primarily CRE debt investments, focused on senior secured, CRE loans diversified across geography. More specifically, for at least 80% of our portfolio, we will target debt instruments issued by companies primarily engaged in the business of

6