UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-02699 |

AIM Growth Series (Invesco Growth Series) |

(Exact name of registrant as specified in charter) |

11 Greenway Plaza, Suite 1000 Houston, Texas 77046 |

(Address of principal executive offices) (Zip code) |

|

Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 |

(Name and address of agent for service) |

Registrant’s telephone number, including area code: (713)626-1919

Date of fiscal year end: October 31

Date of reporting period: 10/31/19

| Item 1. | Reports to Stockholders. |

| | | | |

| | Annual Report | | 10/31/2019 |

| | |

| | Invesco |

| | Oppenheimer |

| | Mid Cap Value |

| | Fund* |

| | Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. |

| | If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at invesco. com/edelivery. |

| | You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 800 959 4246 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with your financial intermediary or all funds held with the fund complex if you invest directly with the Fund. |

| |

| | *Prior to the close of business on May 24, 2019, the Fund’s name was Oppenheimer Mid Cap Value Fund. See Important Update on the following page for more information. |

Important Update

On October 18, 2018, Massachusetts Mutual Life Insurance Company, an indirect corporate parent of OppenheimerFunds, Inc. and its subsidiaries OFI Global Asset Management, Inc., OFI SteelPath, Inc. and OFI Advisors, LLC, announced that it had entered into an agreement whereby Invesco Ltd., a global investment management company would acquire OppenheimerFunds and its subsidiaries (together, “OppenheimerFunds”). After the close of business on May 24, 2019 Invesco Ltd. completed the acquisition of OppenheimerFunds. This Fund was included in that acquisition and as of that date, became part of the Invesco family of funds. Please visit invesco.com for more information or call Invesco’s Client Services team at800-959-4246.

Table of Contents

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT10/31/19

| | | | | | | | | | | | |

| | | Class A Shares of the Fund | | |

| | | |

| | | Without Sales Charge | | With Sales Charge | | Russell MidCap Value Index |

| 1-Year | | | 5.72 | % | | | -0.09 | % | | | 10.08 | % |

| 5-Year | | | 5.15 | | | | 3.97 | | | | 6.95 | |

| 10-Year | | | 9.59 | | | | 8.97 | | | | 12.90 | |

Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit invesco.com for the most recentmonth-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Investment return and principal value will vary so that you may have a gain or a loss when you sell shares. Fund returns include changes in share price, reinvested distributions and a 5.50% maximum applicable sales charge except where “without sales charge” is indicated. Returns for periods of less than one year are cumulative and not annualized. As the result of a reorganization after the close of business on May 24, 2019, the returns of the Fund for periods on or prior to May 24, 2019 reflect performance of the Oppenheimer predecessor fund. Share class returns will differ from those of the predecessor fund because they have different expenses. Returns do not consider capital gains or income taxes on an individual’s investment. See Fund

3 INVESCO OPPENHEIMER MID CAP VALUE FUND

prospectus and summary prospectus for more information on share classes, sales charges and new fee agreements, if any. Fund literature is available at invesco.com.

4 INVESCO OPPENHEIMER MID CAP VALUE FUND

Fund Performance Discussion

Performance Summary

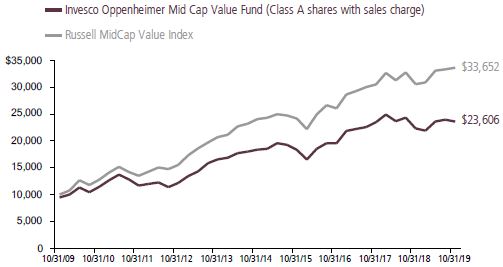

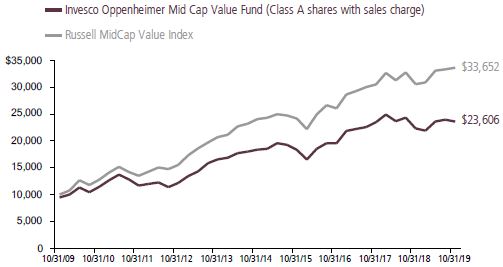

For the fiscal year ended October 31, 2019, Class A shares (at NAV) of Invesco Oppenheimer Mid Cap Value Fund (the Fund) underperformed the Russell Midcap Value Index, the Fund’s style-specific benchmark.

Your Fund’s long-term performance appears later in this report.

Market Conditions and Your Fund

The fiscal year began with noticeable market volatility in the final months of 2018, which continued throughyear-end, as US equity markets suffered a sharpsell-off due to ongoing trade concerns between the US and China, fears of a global economic slowdown and lower oil prices from a supply glut. Oil prices plummeted from near $64 per barrel in early November 2018 to around $45

per barrel in late December 2018.1 In this environment, there was a flight to safety, as investors fled to more defensive areas of the markets, such as health care, utilities and US Treasuries. The US Federal Reserve (the Fed) raised interest rates two times during the fiscal year: in September and December 2018.2

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

Note: Effective June 21, 2019, Jeffrey Vancavage took over management responsibilities of the Fund.

5 INVESCO OPPENHEIMER MID CAP VALUE FUND

Following a sharpsell-off during the fourth quarter of 2018, equity markets rebounded in the first quarter of 2019, fueled by optimism about a potentialUS-China trade deal and the Fed’s indication that there would be no interest rate hikes in 2019, a surprising shift in monetary policy. The Fed’s more accommodative stance provided a supportive environment for equities and fixed income, even as US economic data were mixed and overseas growth appeared to be slowing. Against this backdrop, the S&P 500 Index posted its best first quarter returns since 1998.

Although the S&P 500 Index posted modest gains for the second quarter of 2019, the US stock market experienced increased volatility. After four consecutive months of rising stock markets, the market sold off in May 2019, along with bond yields and oil prices, as investors weighed the impact of the lingering trade war between the US and China, as well as potential tariffs imposed on Mexico. In addition, economic data showed a slowing domestic and global economy.

Key issues that concerned investors in the second quarter of 2019 carried over into the third quarter. TheUS-China trade conflict worried investors and stifled business investment, even as the Fed cut interest rates by 0.25% in July and again in September 2019. This environment, combined with evidence of slowing global economic growth, fueled market volatility in August 2019. The US Treasury yield curve inverted several times, increasing fears of a possible US

recession. As a result, August saw increased risk aversion, with investors crowding into asset classes perceived as safe havens, such as US Treasuries and gold. However, the Fed’s accommodative tone provided some support for risk assets.

In October 2019, optimism that phase one of aUS-China trade deal would be completed, a delayed Brexit agreement until January 2020 and better-than-expected third-quarter corporate earnings results, helped send risk assets higher. During its October meeting, the Fed cut interest rates again by 0.25% based on business investment and exports remaining weak. Despite increased market volatility, mostUS-based equity indexes produced modest to strong returns for the fiscal year.

For the fiscal year, the Russell Mid Cap Value Index posted a gain of 10.08%. Within the Russell Midcap Value Index, nine out of eleven sectors had positive returns for the year, with real estate and industrials leading the way. Energy was the worst performing sector in the index with a decline of approximately-29%, while communication services had a more modest decline of approximately-3%.

Security selection and an overweight in the industrials sector was the largest detractor from relative returns, and key detractors within the sector included XPO Logistics, one of the largest transportation and logistics service providers in the world and Textron, an industrial conglomerate primarily focused on aerospace and defense related business lines.

6 INVESCO OPPENHEIMER MID CAP VALUE FUND

Shares of Textron suffered after the company reported revenue declines across a number of its business units. Despite weakness in the stock, we believe continued recovery in business jet demand should drive significant margin expansion within the company’s largest segment. We maintained our position in the company at the end of the period.

Security selection and an overweight in the consumer discretionary sector also detracted from the fund’s relative return. Within the discretionary sector, key detractors included department store chain Nordstrom and Brunswick Corporation, a leading manufacturer of marine engines and boats, as well as fitness and billiards equipment. Corporation shares of Brunswick underperformed due to concerns that tariffs on Chinese manufactured marine engines would hamper future results.

Stock selection in financials, particularly within the banking and insurance industries, detracted from relative performance. Key individual detractors within these areas included Wintrust Financial, Zions Bancorporation and Willis Towers Watson. Bank shares faced headwinds due to the flattening yield curve and lower interest rate environment during the period.

The Fund’s underweights in defensive areas such as utilities and real estate also detracted from relative returns as these were among the best performing sectors within the index for the period.

Stock selection in the information technology sector was the largest contributor to the fund’s relative return. Within the sector, KLA Corporation, which manufactures yield-management and process-monitoring and control systems for the semiconductor industry, and Synopsys, a market leader in electronic design automation software, were top contributors. During the period, KLA reported stronger than expected revenue, and earnings estimates moved higher through the year.

Stock selection in consumer staples and health care also contributed to the fund’s relative return. In health care, Myriad Genetics was a strong contributor, while Coca-Cola European Partners was a key contributor in the staples sector.

During the period, the fund management team changed, and a number of holdings that did not fit the team’s investment process were eliminated from the portfolio. At year end, the fund’s largest overweights relative to the index were in financials, consumer discretionary and information technology, while the largest underweights were in utilities and real estate.

Looking ahead, we believe market volatility may continue given the potential for a slowing global economy, geopolitical tensions and uncertainty about US trade policy. We believe market volatility creates opportunities to invest in companies with attractive valuations and strong fundamentals. We believe that ultimately those valuations

7 INVESCO OPPENHEIMER MID CAP VALUE FUND

and fundamentals will be reflected in those companies’ stock prices.

As always, we are committed to working to achieve positive returns for the Fund’s shareholders through an entire market cycle. Thank you for your continued investment in the Invesco Oppenheimer Mid Cap Value Fund.

1 Source: Bloomberg

2 Source: US Federal Reserve.

Jeffrey Vancavage, Portfolio Manager

8 INVESCO OPPENHEIMER MID CAP VALUE FUND

Top Holdings and Allocations

TOP TEN COMMON STOCK HOLDINGS

| | | | |

| Liberty Property Trust | | | 3.2 | % |

| Arthur J. Gallagher & Co. | | | 3.2 | |

| Willis Towers Watson plc | | | 3.0 | |

| Encompass Health Corp. | | | 3.0 | |

| Centene Corp. | | | 2.9 | |

| Keysight Technologies, Inc. | | | 2.8 | |

| KLA Corp. | | | 2.8 | |

| Knight-Swift Transportation Holdings, Inc., Cl. A | | | 2.7 | |

| Johnson Controls International plc | | | 2.7 | |

| Hudson Pacific Properties, Inc. | | | 2.6 | |

Holdings and allocations are subject to change and are not buy/sell recommendations. Percentages are as of October 31, 2019 and are based on net assets.

TOP TEN COMMON STOCK INDUSTRIES

| | | | |

| Commercial Banks | | | 9.4 | % |

| Real Estate Investment Trusts (REITs) | | | 8.1 | |

| Insurance | | | 8.0 | |

| Health Care Providers & Services | | | 7.8 | |

| Hotels, Restaurants & Leisure | | | 6.7 | |

| Electric Utilities | | | 5.8 | |

| Chemicals | | | 4.3 | |

| Communications Equipment | | | 3.6 | |

| Food & Staples Retailing | | | 3.5 | |

| Oil, Gas & Consumable Fuels | | | 3.3 | |

Holdings and allocations are subject to change and are not buy/sell recommendations. Percentages are as of October 31, 2019 and are based on net assets.

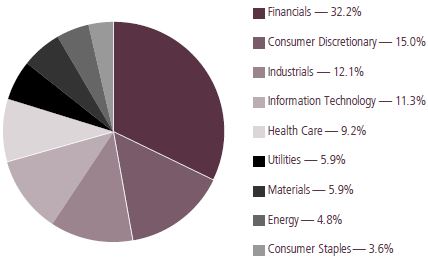

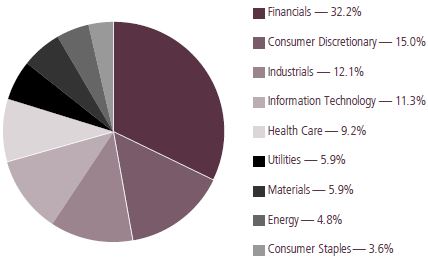

SECTOR ALLOCATION

Holdings and allocations are subject to change and are not buy/sell recommendations. Percentages are as of October 31, 2019, and are based on the total market value of common stocks.

For more current Fund holdings, please visit invesco.com.

9 INVESCO OPPENHEIMER MID CAP VALUE FUND

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 10/31/19

| | | | | | | | | | | | | | | | | | |

| | | Inception

Date | | | 1-Year | | | 5-Year | | | 10-Year | | | |

| Class A (QVSCX) | | | 1/3/89 | | | | 5.72 | % | | | 5.15 | % | | | 9.59 | % | | |

| Class C (QSCCX) | | | 9/1/93 | | | | 4.95 | | | | 4.37 | | | | 8.75 | | | |

| Class R (QSCNX) | | | 3/1/01 | | | | 5.48 | | | | 4.89 | | | | 9.30 | | | |

| Class Y (QSCYX) | | | 10/24/05 | | | | 5.99 | | | | 5.41 | | | | 9.90 | | | |

| Class R5 (MCVDX)1 | | | 5/24/19 | | | | 5.91 | | | | 5.19 | | | | 9.61 | | | |

| Class R6 (QSCIX) | | | 2/28/12 | | | | 6.16 | | | | 5.60 | | | | 9.02 | 2 | | |

| |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 10/31/19 | | | |

| | | Inception Date | | | 1-Year | | | 5-Year | | | 10-Year | | | |

| Class A (QVSCX) | | | 1/3/89 | | | | -0.09 | % | | | 3.97 | % | | | 8.97 | % | | |

| Class C (QSCCX) | | | 9/1/93 | | | | 4.02 | | | | 4.37 | | | | 8.75 | | | |

| Class R (QSCNX) | | | 3/1/01 | | | | 5.48 | | | | 4.89 | | | | 9.30 | | | |

| Class Y (QSCYX) | | | 10/24/05 | | | | 5.99 | | | | 5.41 | | | | 9.90 | | | |

| Class R5 (MCVDX)1 | | | 5/24/19 | | | | 5.91 | | | | 5.19 | | | | 9.61 | | | |

| Class R6 (QSCIX) | | | 2/28/12 | | | | 6.16 | | | | 5.60 | | | | 9.02 | 2 | | |

1. Pursuant to the closing of the transaction described in the Notes to Financial Statements, after the close of business on May 24, 2019, Class I shares were reorganized as Class R6 shares.

2. Shows performance since inception.

Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit invesco.com for the most recentmonth-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Investment return and principal value will vary so that you may have a gain or a loss when you sell shares. Performance shown at NAV does not include the applicablefront-end sales charge, which would have reduced the performance. The current maximum initial sales charge for Class A shares is 5.50%, and the contingent deferred sales charge for Class C shares is 1% for the1-year period. Class R, Class Y, Class R5 and Class R6 shares have no sales charge; therefore, performance is at NAV. Effective after the close of business on May 24, 2019, Class A, Class C, Class R, Class Y, and Class I shares of the predecessor fund were reorganized into Class A, Class C, Class R, Class Y, and Class R6 shares, respectively, of the Fund. Class R5 shares’ performance shown prior to the inception date is that of the predecessor fund’s Class A shares at NAV and includes the12b-1 fees applicable to Class A shares. Class A shares’ performance reflects any applicable fee waivers and/or expense reimbursements. Returns shown for Class A, Class C, Class R, Class Y, Class R5, and Class R6 shares are blended returns of the predecessor fund and the Fund. Share class returns will differ from those of the predecessor fund because of different expenses. See Fund prospectuses and summary prospectuses for more information on share classes, sales charges and new fee agreements, if any. Fund literature is available at invesco.com.

The Fund’s performance is compared to that of the Russell MidCap Value Index. The Russell MidCap Value Index measures the performance of themid-cap value segment of the U.S.

10 INVESCO OPPENHEIMER MID CAP VALUE FUND

equity universe. It includes those Russell MidCap Index companies with lowerprice-to-book ratios and lower forecasted growth values. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Before investing, investors should carefully read the prospectus and/or summary prospectus and carefully consider the investment objectives, risks, charges and expenses. For this and more complete information about the fund(s), investors should ask their advisors for a prospectus/summary prospectus or visit invesco. com/fundprospectus.

Shares of Invesco funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

11 INVESCO OPPENHEIMER MID CAP VALUE FUND

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire6-month period ended October 31, 2019.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended October 31, 2019” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes.The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such asfront-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

12 INVESCO OPPENHEIMER MID CAP VALUE FUND

| | | | | | | | | | | | |

| Actual | | Beginning

Account

Value

May 1, 2019 | | | Ending Account Value

October 31, 2019 | | Expenses Paid During 6 Months Ended

October 31, 20191,2 |

| Class A | | $ | 1,000.00 | | | $ | 999.30 | | | $ | 5.86 | |

| Class C | | | 1,000.00 | | | | 995.40 | | | | 9.70 | |

| Class R | | | 1,000.00 | | | | 998.00 | | | | 7.13 | |

| Class Y | | | 1,000.00 | | | | 1,000.50 | | | | 4.65 | |

| Class R5 | | | 1,000.00 | | | | 1,001.10 | | | | 3.51 | |

| Class R6 | | | 1,000.00 | | | | 1,001.40 | | | | 3.79 | |

| | | |

| Hypothetical | | | | | | | | | | | | |

| (5% return before expenses) | | | | | | | | | | | | |

| Class A | | | 1,000.00 | | | | 1,019.36 | | | | 5.92 | |

| Class C | | | 1,000.00 | | | | 1,015.53 | | | | 9.80 | |

| Class R | | | 1,000.00 | | | | 1,018.10 | | | | 7.20 | |

| Class Y | | | 1,000.00 | | | | 1,020.57 | | | | 4.70 | |

| Class R5 | | | 1,000.00 | | | | 1,021.17 | | | | 4.08 | |

| Class R6 | | | 1,000.00 | | | | 1,021.42 | | | | 3.83 | |

1. Actual expenses paid for Class A, C, R, Y, and R6are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 184/365(to reflect theone-half year period). Actual expenses paid for Class R5 are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 160/365to reflect the period from after the close of business on May 24, 2019 (inception of offering) to October 31, 2019.

2.Hypothetical expenses paid for all classes are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period).

Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the6-month period ended October 31, 2019 for Classes A, C, R, Y and R6 and for the period from after the close of business on May 24, 2019 (inception of offering) to October 31, 2019 for Class R5 are as follows:

| | | | |

| Class | | Expense Ratios |

| Class A | | | 1.16 | % |

| Class C | | | 1.92 | |

| Class R | | | 1.41 | |

| Class Y | | | 0.92 | |

| Class R5 | | | 0.80 | |

| Class R6 | | | 0.75 | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the

13 INVESCO OPPENHEIMER MID CAP VALUE FUND

Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

14 INVESCO OPPENHEIMER MID CAP VALUE FUND

SCHEDULE OF INVESTMENTSOctober 31, 2019

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks—97.3% | | | | | |

| Consumer Discretionary—14.6% | | | | | |

| Distributors—2.3% | | | | | | | | |

| LKQ Corp.1 | | | 710,301 | | | $ | 24,143,131 | |

| Entertainment—1.5% | | | | | | | | |

| Take-Two Interactive Software, Inc.1 | | | 133,532 | | | | 16,070,576 | |

| Hotels, Restaurants & Leisure—6.7% | | | | | |

| Norwegian Cruise Line Holdings Ltd.1 | | | 483,597 | | | | 24,547,384 | |

| Royal Caribbean Cruises Ltd. | | | 213,013 | | | | 23,182,205 | |

| Wyndham Hotels & Resorts, Inc. | | | 409,395 | | | | 22,095,048 | |

| | | | | | | 69,824,637 | |

| Specialty Retail—2.1% | | | | | |

| Advance Auto Parts, Inc. | | | 134,485 | | | | 21,851,123 | |

| Textiles, Apparel & Luxury Goods—2.0% | |

| Tapestry, Inc. | | | 807,455 | | | | 20,880,786 | |

| Consumer Staples—3.5% | | | | | |

| Food & Staples Retailing—3.5% | | | | | |

| Kroger Co. (The) | | | 1,051,123 | | | | 25,899,671 | |

| Performance Food Group Co.1 | | | 241,645 | | | | 10,296,493 | |

| | | | | | | 36,196,164 | |

| Energy—4.6% | | | | | | | | |

| Energy Equipment & Services—1.3% | | | | | |

| TechnipFMC plc | | | 707,461 | | | | 13,958,206 | |

| Oil, Gas & Consumable Fuels—3.3% | | | | | |

| Marathon Oil Corp. | | | 1,483,670 | | | | 17,106,715 | |

| Noble Energy, Inc. | | | 895,074 | | | | 17,239,125 | |

| | | | | | | 34,345,840 | |

| Financials—31.3% | | | | | | | | |

| Capital Markets—1.8% | | | | | |

| Stifel Financial Corp. | | | 340,816 | | | | 19,078,880 | |

| Commercial Banks—9.4% | | | | | |

| Comerica, Inc. | | | 250,281 | | | | 16,373,383 | |

| KeyCorp | | | 1,303,854 | | | | 23,430,256 | |

| TCF Financial Corp. | | | 505,263 | | | | 20,003,362 | |

| Wintrust Financial Corp. | | | 297,234 | | | | 18,969,474 | |

| Zions Bancorp NA | | | 397,912 | | | | 19,286,795 | |

| | | | | | | 98,063,270 | |

| | | | | | | | |

| | | Shares | | | Value | |

| Consumer Finance—1.9% | | | | | |

| Santander Consumer USA Holdings, Inc. | | | 780,057 | | | $ | 19,563,830 | |

| Diversified Financial Services—2.1% | | | | | |

| Voya Financial, Inc. | | | 409,792 | | | | 22,112,376 | |

| Insurance—8.0% | | | | | | | | |

| Arthur J. Gallagher & Co. | | | 361,900 | | | | 33,012,518 | |

| Athene Holding Ltd., Cl. A1 | | | 444,279 | | | | 19,259,495 | |

| Willis Towers Watson plc | | | 167,366 | | | | 31,280,705 | |

| | | | | | | | 83,552,718 | |

| Real Estate Investment Trusts (REITs)—8.1% | |

| Hudson Pacific Properties, Inc. | | | 750,369 | | | | 26,953,254 | |

| Liberty Property Trust | | | 558,899 | | | | 33,014,164 | |

| Life Storage, Inc. | | | 222,328 | | | | 24,215,966 | |

| | | | | | | 84,183,384 | |

| Health Care—8.9% | | | | | | | | |

| Biotechnology—1.1% | | | | | | | | |

| Myriad Genetics, Inc.1 | | | 338,291 | | | | 11,390,258 | |

| Health Care Providers & Services—7.8% | |

| Centene Corp.1 | | | 580,590 | | | | 30,817,717 | |

| DaVita, Inc.1 | | | 342,551 | | | | 20,073,489 | |

| Encompass Health Corp. | | | 485,111 | | | | 31,056,806 | |

| | | | | | | 81,948,012 | |

| Industrials—11.8% | | | | | | | | |

| Aerospace & Defense—2.5% | | | | | |

| Textron, Inc. | | | 560,000 | | | | 25,810,400 | |

| Building Products—2.7% | | | | | |

| Johnson Controls International plc | | | 640,997 | | | | 27,774,400 | |

| Machinery—1.7% | | | | | | | | |

| Kennametal, Inc. | | | 586,634 | | | | 18,156,322 | |

| Marine—2.2% | | | | | | | | |

| Kirby Corp.1 | | | 292,227 | | | | 23,132,690 | |

| Road & Rail—2.7% | | | | | | | | |

| Knight-Swift Transportation Holdings, Inc., Cl. A | | | 776,252 | | | | 28,302,148 | |

15 INVESCO OPPENHEIMER MID CAP VALUE FUND

SCHEDULE OF INVESTMENTS Continued

| | | | | | | | |

| | | Shares | | | Value |

| Information Technology—11.0% | | | | | |

| Communications Equipment—3.6% | | | | | |

| Ciena Corp.1 | | | 694,556 | | | $ | 25,781,919 | |

| Plantronics, Inc. | | | 294,028 | | | | 11,590,584 | |

| | | | | | | | 37,372,503 | |

| Electronic Equipment, Instruments, & Components—2.8% | |

| Keysight | | | | | | | | |

Technologies, Inc.1 | | | 291,154 | | | | 29,380,350 | |

| IT Services—0.8% | | | | | | | | |

DXC Technology Co. | | | 296,500 | | | | 8,204,155 | |

| Semiconductors & Semiconductor Equipment—2.8% | |

| KLA Corp. | | | 173,548 | | | | 29,336,554 | |

| Software—1.0% | | | | | | | | |

| Teradata Corp.1 | | | 344,798 | | | | 10,319,804 | |

| Materials—5.8% | | | | | | | | |

| Chemicals—4.3% | | | | | | | | |

| Eastman Chemical Co. | | | 248,269 | | | | 18,878,375 | |

| W.R. Grace & Co. | | | 380,837 | | | | 25,306,618 | |

| | | | | | | 44,184,993 | |

| | | | | | | | |

| | | Shares | | | Value |

| Metals & Mining—1.5% | | | | | |

| Freeport-McMoRan, Inc. | | | 1,617,350 | | | $ | 15,882,377 | |

| Utilities—5.8% | | | | | | | | |

| Electric Utilities—5.8% | | | | | |

| Edison International | | | 287,391 | | | | 18,076,894 | |

| Evergy, Inc. | | | 329,280 | | | | 21,044,285 | |

| FirstEnergy Corp. | | | 435,449 | | | | 21,040,895 | |

| | | | | | | 60,162,074 | |

Total Common Stocks

(Cost $988,223,163) | | | | | | | 1,015,181,961 | |

| Investment Company—2.7% | | | | | |

Invesco Government & Agency Portfolio, Institutional Class, 1.71%2(Cost $28,140,196) | | | 28,140,196 | | | | 28,140,196 | |

Total Investments, at Value

(Cost $1,016,363,359) | | | 100.0% | | | | 1,043,322,157 | |

| Net Other Assets (Liabilities) | | | 0.0 | | | | 308,619 | |

| Net Assets | | | 100.0% | | | $ | 1,043,630,776 | |

| | | | | | | | |

Footnotes to Schedule of Investments

1.Non-income producing security.

2. The money market fund and the Fund are affiliated by having the same investment adviser. The rate shown is the7-day SEC standardized yield as of October 31, 2019.

See accompanying Notes to Financial Statements.

16 INVESCO OPPENHEIMER MID CAP VALUE FUND

STATEMENT OF ASSETS AND LIABILITIESOctober 31, 2019

| | | | |

| Assets | | | | |

| Investments, at value—see accompanying schedule of investments: | | | | |

| Unaffiliated companies (cost $988,223,163) | | $ | 1,015,181,961 | |

| Affiliated companies (cost $28,140,196) | | | 28,140,196 | |

| | | | 1,043,322,157 | |

| Cash | | | 1,000,000 | |

| Receivables and other assets: | | | | |

| Investments sold | | | 3,073,680 | |

| Shares of beneficial interest sold | | | 125,732 | |

| Dividends | | | 112,994 | |

| Other | | | 179,128 | |

| Total assets | | | 1,047,813,691 | |

| Liabilities | | | | |

| Payables and other liabilities: | | | | |

| Investments purchased | | | 1,832,623 | |

| Shares of beneficial interest redeemed | | | 1,110,883 | |

| Transfer and shareholder servicing agent fees | | | 496,293 | |

| Trustees’ compensation | | | 283,245 | |

| Distribution and service plan fees | | | 259,538 | |

| Shareholder communications | | | 133,102 | |

| Advisory fees | | | 20,947 | |

| Administration fees | | | 174 | |

| Dividends | | | 2 | |

| Other | | | 46,108 | |

| Total liabilities | | | 4,182,915 | |

| Net Assets | | $ | 1,043,630,776 | |

| | | | |

| | | | |

| Composition of Net Assets | | | | |

| |

| Shares of beneficial interest | | $ | 887,044,900 | |

| Total distributable earnings | | | 156,585,876 | |

| Net Assets | | $ | 1,043,630,776 | |

| | | | |

17 INVESCO OPPENHEIMER MID CAP VALUE FUND

STATEMENT OF ASSETS AND LIABILITIESContinued

| | | | |

| Net Asset Value Per Share | | | | |

| Class A Shares: | | | | |

| |

| Net asset value and redemption price per share (based on net assets of $812,552,158 and 16,098,367 shares of beneficial interest outstanding) | | $ | 50.47 | |

| |

| Maximum offering price per share (net asset value plus sales charge of 5.50% of offering price) | | $ | 53.41 | |

| |

| Class C Shares: | | | | |

| |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $77,108,204 and 1,907,078 shares of beneficial interest outstanding) | | $ | 40.43 | |

| |

| Class R Shares: | | | | |

| |

| Net asset value, redemption price and offering price per share (based on net assets of $56,571,780 and 1,177,389 shares of beneficial interest outstanding) | | $ | 48.05 | |

| |

| Class Y Shares: | | | | |

| |

| Net asset value, redemption price and offering price per share (based on net assets of $92,267,804 and 1,775,351 shares of beneficial interest outstanding) | | $ | 51.97 | |

| |

| Class R5 Shares: | | | | |

| |

| Net asset value, redemption price and offering price per share (based on net assets of $10,457 and 207.27 shares of beneficial interest outstanding) | | $ | 50.45 | |

| |

| Class R6 Shares: | | | | |

| |

| Net asset value, redemption price and offering price per share (based on net assets of $5,120,373 and 99,487 shares of beneficial interest outstanding) | | $ | 51.47 | |

See accompanying Notes to Financial Statements.

18 INVESCO OPPENHEIMER MID CAP VALUE FUND

STATEMENT

OF OPERATIONSFor the Year Ended October 31, 2019

| | | | |

| | |

| Investment Income | | | | |

| Dividends: | | | | |

| Unaffiliated companies | | $ | 17,807,141 | |

| Affiliated companies | | | 769,211 | |

| Interest | | | 25,945 | |

| Total investment income | | | 18,602,297 | |

| Expenses | | | | |

| Advisory fees | | | 7,819,691 | |

| Administration fees | | | 64,853 | |

| Distribution and service plan fees: | | | | |

| Class A | | | 1,933,527 | |

| Class C | | | 1,346,255 | |

| Class R | | | 291,559 | |

| Transfer and shareholder servicing agent fees: | | | | |

| Class A | | | 1,620,005 | |

| Class C | | | 273,212 | |

| Class R | | | 120,061 | |

| Class Y | | | 194,285 | |

| Class R5 | | | 4 | |

| Class R6 | | | 1,570 | |

| Shareholder communications: | | | | |

| Class A | | | 118,147 | |

| Class C | | | 14,802 | |

| Class R | | | 8,416 | |

| Class Y | | | 14,157 | |

| Class R5 | | | 1 | |

| Class R6 | | | 759 | |

| Trustees’ compensation | | | 22,228 | |

| Borrowing fees | | | 19,120 | |

| Custodian fees and expenses | | | 8,554 | |

| Other | | | 161,370 | |

| Total expenses | | | 14,032,576 | |

| Less waivers and reimbursement of expenses | | | (448,790 | ) |

| Net expenses | | | 13,583,786 | |

| | |

| Net Investment Income | | | 5,018,511 | |

| | |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain on unaffiliated companies (includes net gain (loss) from securities sold to affiliates of $4,694,838) | | | 137,951,211 | |

| Net change in unrealized appreciation/(depreciation) on investment transactions | | | (84,869,163 | ) |

| Net Increase in Net Assets Resulting from Operations | | $ | 58,100,559 | |

| | | | |

See accompanying Notes to Financial Statements.

19 INVESCO OPPENHEIMER MID CAP VALUE FUND

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended October 31, 2019 | | Year Ended October 31, 2018 |

| Operations | | | | | | | | |

| Net investment income | | $ | 5,018,511 | | | $ | 5,112,617 | |

| Net realized gain | | | 137,951,211 | | | | 104,306,995 | |

| Net change in unrealized appreciation/(depreciation) | | | (84,869,163 | ) | | | (166,166,373 | ) |

| | | | |

| Net increase (decrease) in net assets resulting from operations | | | 58,100,559 | | | | (56,746,761 | ) |

| Dividends and/or Distributions to Shareholders | | | | | | | | |

| Distributions to shareholders from distributable earnings: | | | | | | | | |

| Class A | | | (72,637,509 | ) | | | (59,400,111 | ) |

| Class B | | | — | | | | (238,230 | ) |

| Class C | | | (17,869,697 | ) | | | (15,307,725 | ) |

| Class R | | | (5,702,053 | ) | | | (5,055,286 | ) |

| Class Y | | | (9,291,097 | ) | | | (6,842,010 | ) |

| Class R5 | | | (55 | ) | | | — | |

| Class R6 | | | (398,380 | ) | | | (175,383 | ) |

| | | | |

| Total distributions from distributable earnings | | | (105,898,791 | ) | | | (87,018,745 | ) |

| Beneficial Interest Transactions | | | | | | | | |

| Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | | | | | |

| Class A | | | 40,991,680 | | | | (65,922,651 | ) |

| Class B | | | — | | | | (4,321,439 | ) |

| Class C | | | (84,064,574 | ) | | | (23,337,632 | ) |

| Class R | | | (2,961,995 | ) | | | (11,121,462 | ) |

| Class Y | | | (7,102,847 | ) | | | 6,199,881 | |

| Class R5 | | | 10,000 | | | | — | |

| Class R6 | | | 878,714 | | | | 2,298,581 | |

| | | | |

| Total beneficial interest transactions | | | (52,249,022 | ) | | | (96,204,722 | ) |

| Net Assets | | | | | | | | |

| Total decrease | | | (100,047,254 | ) | | | (239,970,228 | ) |

| Beginning of period | | | 1,143,678,030 | | | | 1,383,648,258 | |

| | | | |

| End of period | | $ | 1,043,630,776 | | | $ | 1,143,678,030 | |

| | | | |

See accompanying Notes to Financial Statements.

20 INVESCO OPPENHEIMER MID CAP VALUE FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Class A | | Year Ended October 31, 2019 | | | Year Ended October 31, 2018 | | | Year Ended October 31, 2017 | | | Year Ended October 31, 2016 | | | Year Ended October 30, 20151 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $52.59 | | | | $58.99 | | | | $49.28 | | | | $46.44 | | | | $46.72 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.27 | | | | 0.29 | | | | 0.17 | | | | 0.24 | | | | 0.24 | |

| Net realized and unrealized gain (loss) | | | 2.39 | | | | (3.02) | | | | 9.76 | | | | 2.83 | | | | (0.29) | |

| Total from investment operations | | | 2.66 | | | | (2.73) | | | | 9.93 | | | | 3.07 | | | | (0.05) | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.26) | | | | (0.21) | | | | (0.22) | | | | (0.23) | | | | (0.23) | |

| Distributions from net realized gain | | | (4.52) | | | | (3.46) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (4.78) | | | | (3.67) | | | | (0.22) | | | | (0.23) | | | | (0.23) | |

| Net asset value, end of period | | | $50.47 | | | | $52.59 | | | | $58.99 | | | | $49.28 | | | | $46.44 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value3 | | | 5.74% | | | | (5.00)% | | | | 20.20% | | | | 6.62% | | | | (0.13)% | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $812,552 | | | | $801,597 | | | | $965,887 | | | | $920,277 | | | | $966,842 | |

| Average net assets (in thousands) | | | $788,440 | | | | $927,026 | | | | $986,140 | | | | $916,503 | | | | $1,085,463 | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.55% | | | | 0.50% | | | | 0.31% | | | | 0.53% | | | | 0.49% | |

| Expenses excluding specific expenses listed below | | | 1.21% | | | | 1.17% | | | | 1.18% | | | | 1.19% | | | | 1.17% | |

| Interest and fees from borrowings5 | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | |

| Total expenses6 | | | 1.21% | | | | 1.17% | | | | 1.18% | | | | 1.19% | | | | 1.17% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.17% | | | | 1.17%7 | | | | 1.17% | | | | 1.19%7 | | | | 1.17%7 | |

| Portfolio turnover rate8 | | | 129% | | | | 71% | | | | 63% | | | | 34% | | | | 47% | |

1. Represents the last business day of the Fund’s reporting period

2. Per share amounts calculated based on the average shares outstanding during the period.

3.Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| Year Ended October 31, 2019 | | | 1.21 | % | | |

| Year Ended October 31, 2018 | | | 1.17 | % | | |

| Year Ended October 31, 2017 | | | 1.18 | % | | |

| Year Ended October 31, 2016 | | | 1.19 | % | | |

| Year Ended October 30, 2015 | | | 1.17 | % | | |

7. Waiver was less than 0.005%.

8.Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable.

See accompanying Notes to Financial Statements.

21 INVESCO OPPENHEIMER MID CAP VALUE FUND

FINANCIAL HIGHLIGHTSContinued

| | | | | | | | | | | | | | | | | | | | |

| Class C | | Year Ended

October 31,

2019 | | | Year Ended

October 31,

2018 | | | Year Ended

October 31,

2017 | | | Year Ended

October 31,

2016 | | | Year Ended

October 30,

20151 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $43.15 | | | | $49.20 | | | | $41.26 | | | | $39.00 | | | | $39.35 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss2 | | | (0.08) | | | | (0.12) | | | | (0.20) | | | | (0.09) | | | | (0.11) | |

| Net realized and unrealized gain (loss) | | | 1.89 | | | | (2.46) | | | | 8.15 | | | | 2.37 | | | | (0.24) | |

| Total from investment operations | | | 1.81 | | | | (2.58) | | | | 7.95 | | | | 2.28 | | | | (0.35) | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.01) | | | | (0.01) | | | | (0.01) | | | | (0.02) | | | | 0.00 | |

| Distributions from net realized gain | | | (4.52) | | | | (3.46) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (4.53) | | | | (3.47) | | | | (0.01) | | | | (0.02) | | | | 0.00 | |

| Net asset value, end of period | | | $40.43 | | | | $43.15 | | | | $49.20 | | | | $41.26 | | | | $39.00 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value3 | | | 4.95% | | | | (5.72)% | | | | 19.30% | | | | 5.84% | | | | (0.87)% | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $77,108 | | | | $172,168 | | | | $220,394 | | | | $226,455 | | | | $253,446 | |

| Average net assets (in thousands) | | | $134,731 | | | | $204,959 | | | | $233,758 | | | | $233,067 | | | | $278,916 | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.21)% | | | | (0.26)% | | | | (0.44)% | | | | (0.23)% | | | | (0.26)% | |

| Expenses excluding specific expenses listed below | | | 1.96% | | | | 1.93% | | | | 1.93% | | | | 1.95% | | | | 1.92% | |

| Interest and fees from borrowings5 | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | |

| Total expenses6 | | | 1.96% | | | | 1.93% | | | | 1.93% | | | | 1.95% | | | | 1.92% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.93% | | | | 1.93%7 | | | | 1.92% | | | | 1.95%7 | | | | 1.92%7 | |

| Portfolio turnover rate8 | | | 129% | | | | 71% | | | | 63% | | | | 34% | | | | 47% | |

1. Represents the last business day of the Fund’s reporting period

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| Year Ended October 31, 2019 | | | 1.96 | % | | |

| Year Ended October 31, 2018 | | | 1.93 | % | | |

| Year Ended October 31, 2017 | | | 1.93 | % | | |

| Year Ended October 31, 2016 | | | 1.95 | % | | |

| Year Ended October 30, 2015 | | | 1.92 | % | | |

7. Waiver was less than 0.005%.

8. Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable.

See accompanying Notes to Financial Statements.

22 INVESCO OPPENHEIMER MID CAP VALUE FUND

| | | | | | | | | | | | | | | | | | | | |

| Class R | | Year Ended

October 31,

2019 | | | Year Ended

October 31,

2018 | | | Year Ended

October 31,

2017 | | | Year Ended

October 31,

2016 | | | Year Ended

October 30,

20151 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $50.30 | | | | $56.61 | | | | $47.31 | | | | $44.59 | | | | $44.88 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.14 | | | | 0.13 | | | | 0.04 | | | | 0.13 | | | | 0.12 | |

| Net realized and unrealized gain (loss) | | | 2.27 | | | | (2.87) | | | | 9.36 | | | | 2.71 | | | | (0.30) | |

| Total from investment operations | | | 2.41 | | | | (2.74) | | | | 9.40 | | | | 2.84 | | | | (0.18) | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.14) | | | | (0.11) | | | | (0.10) | | | | (0.12) | | | | (0.11) | |

| Distributions from net realized gain | | | (4.52) | | | | (3.46) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (4.66) | | | | (3.57) | | | | (0.10) | | | | (0.12) | | | | (0.11) | |

| Net asset value, end of period | | | $48.05 | | | | $50.30 | | | | $56.61 | | | | $47.31 | | | | $44.59 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value3 | | | 5.48% | | | | (5.26)% | | | | 19.90% | | | | 6.38% | | | | (0.38)% | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $56,572 | | | | $62,089 | | | | $81,351 | | | | $82,661 | | | | $97,983 | |

| Average net assets (in thousands) | | | $58,562 | | | | $74,653 | | | | $84,193 | | | | $85,721 | | | | $114,811 | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.30% | | | | 0.25% | | | | 0.07% | | | | 0.28% | | | | 0.25% | |

| Expenses excluding specific expenses listed below | | | 1.47% | | | | 1.42% | | | | 1.43% | | | | 1.45% | | | | 1.42% | |

| Interest and fees from borrowings5 | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | |

| Total expenses6 | | | 1.47% | | | | 1.42% | | | | 1.43% | | | | 1.45% | | | | 1.42% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.42% | | | | 1.42%7 | | | | 1.42% | | |

| 1.45%7

|

| | | 1.42%7 | |

| Portfolio turnover rate8 | | | 129% | | | | 71% | | | | 63% | | | | 34% | | | | 47% | |

1. Represents the last business day of the Fund’s reporting period

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | Year Ended October 31, 2019 | | 1.47% | | |

| | Year Ended October 31, 2018 | | 1.42% | | |

| | Year Ended October 31, 2017 | | 1.43% | | |

| | Year Ended October 31, 2016 | | 1.45% | | |

| | Year Ended October 30, 2015 | | 1.42% | | |

7. Waiver was less than 0.005%.

8. Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable.

See accompanying Notes to Financial Statements.

23 INVESCO OPPENHEIMER MID CAP VALUE FUND

FINANCIAL HIGHLIGHTSContinued

| | | | | | | | | | | | | | | | | | | | |

| Class Y | | Year Ended

October 31,

2019 | | | Year Ended

October 31,

2018 | | | Year Ended

October 31,

2017 | | | Year Ended

October 31,

2016 | | | Year Ended

October 30,

20151 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $54.01 | | | | $60.47 | | | | $50.52 | | | | $47.59 | | | | $47.88 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.40 | | | | 0.44 | | | | 0.30 | | | | 0.36 | | | | 0.36 | |

| Net realized and unrealized gain (loss) | | | 2.47 | | | | (3.09) | | | | 10.01 | | | | 2.91 | | | | (0.30) | |

| Total from investment operations | | | 2.87 | | | | (2.65) | | | | 10.31 | | | | 3.27 | | | | 0.06 | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.39) | | | | (0.35) | | | | (0.36) | | | | (0.34) | | | | (0.35) | |

| Distributions from net realized gain | | | (4.52) | | | | (3.46) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (4.91) | | | | (3.81) | | | | (0.36) | | | | (0.34) | | | | (0.35) | |

| Net asset value, end of period | | | $51.97 | | | | $54.01 | | | | $60.47 | | | | $50.52 | | | | $47.59 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value3 | | | 6.00% | | | | (4.77)% | | | | 20.47% | | | | 6.92% | | | | 0.12% | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $92,268 | | | | $103,522 | | | | $108,996 | | | | $61,964 | | | | $49,241 | |

| Average net assets (in thousands) | | | $94,725 | | | | $106,563 | | | | $91,745 | | | | $49,957 | | | | $51,876 | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.79% | | | | 0.74% | | | | 0.53% | | | | 0.74% | | | | 0.73% | |

| Expenses excluding specific expenses listed below | | | 0.97% | | | | 0.93% | | | | 0.94% | | | | 0.95% | | | | 0.92% | |

| Interest and fees from borrowings5 | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | |

| Total expenses6 | | | 0.97% | | | | 0.93% | | | | 0.94% | | | | 0.95% | | | | 0.92% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.93% | | | | 0.93%7 | | | | 0.93% | | |

| 0.95%7

|

| |

| 0.92%7

|

|

| Portfolio turnover rate8 | | | 129% | | | | 71% | | | | 63% | | | | 34% | | | | 47% | |

1. Represents the last business day of the Fund’s reporting period

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | Year Ended October 31, 2019 | | 0.97% | | |

| | Year Ended October 31, 2018 | | 0.93% | | |

| | Year Ended October 31, 2017 | | 0.94% | | |

| | Year Ended October 31, 2016 | | 0.95% | | |

| | Year Ended October 30, 2015 | | 0.92% | | |

7. Waiver was less than 0.005%.

8. Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable.

See accompanying Notes to Financial Statements.

24 INVESCO OPPENHEIMER MID CAP VALUE FUND

| | | | |

| Class R5 | | Period Ended October 31, 20191 |

| Per Share Operating Data | | | | |

| Net asset value, beginning of period | | | $48.25 | |

| Income (loss) from investment operations: | | | | |

| Net investment income2 | | | 0.20 | |

| Net realized and unrealized gain | | | 2.27 | |

| Total from investment operations | | | 2.47 | |

| Dividends and/or distributions to shareholders: | | | | |

| Dividends from net investment income | | | (0.27) | |

| Distributions from net realized gain | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (0.27) | |

| Net asset value, end of period | | | $50.45 | |

| | | | |

| | | | |

| Total Return, at Net Asset Value3 | | | 5.10% | |

| | | | |

Ratios/Supplemental Data | | | | |

| Net assets, end of period (in thousands) | | | $10 | |

| Average net assets (in thousands) | | | $10 | |

| Ratios to average net assets:4 | | | | |

| Net investment income | | | 0.91% | |

| Expenses excluding specific expenses listed below | | | 0.83% | |

| Interest and fees from borrowings | | | 0.00% | |

| Total expenses5 | | | 0.83% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.80% | |

| Portfolio turnover rate6 | | | 129% | |

1. For the period from after the close of business on May 24, 2019 (inception of offering) to October 31, 2019.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| Period Ended October 31, 2019 | | | 0.86 | % | | |

6. Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable.

See accompanying Notes to Financial Statements.

25 INVESCO OPPENHEIMER MID CAP VALUE FUND

FINANCIAL HIGHLIGHTSContinued

| | | | | | | | | | | | | | | | | | | | |

| Class R6 | | Year Ended

October 31,

2019 | | | Year Ended

October 31,

2018 | | | Year Ended

October 31,

2017 | | | Year Ended

October 31,

2016 | | | Year Ended

October 30,

20151 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $53.53 | | | | $59.97 | | | | $50.10 | | | | $47.20 | | | | $47.49 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.48 | | | | 0.53 | | | | 0.39 | | | | 0.44 | | | | 0.43 | |

| Net realized and unrealized gain (loss) | | | 2.45 | | | | (3.06) | | | | 9.94 | | | | 2.89 | | | | (0.27) | |

| Total from investment operations | | | 2.93 | | | | (2.53) | | | | 10.33 | | | | 3.33 | | | | 0.16 | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.47) | | | | (0.45) | | | | (0.46) | | | | (0.43) | | | | (0.45) | |

| Distributions from net realized gain | | | (4.52) | | | | (3.46) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (4.99) | | | | (3.91) | | | | (0.46) | | | | (0.43) | | | | (0.45) | |

| Net asset value, end of period | | | $51.47 | | | | $53.53 | | | | $59.97 | | | | $50.10 | | | | $47.20 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value3 | | | 6.18% | | | | (4.61)% | | | | 20.69% | | | | 7.10% | | | | 0.31% | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $5,120 | | | | $4,302 | | | | $2,522 | | | | $950 | | | | $788 | |

| Average net assets (in thousands) | | | $4,740 | | | | $4,067 | | | | $1,375 | | | | $803 | | | | $621 | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.96% | | | | 0.91% | | | | 0.69% | | | | 0.93% | | | | 0.88% | |

| Expenses excluding specific expenses listed below | | | 0.80% | | | | 0.76% | | | | 0.75% | | | | 0.76% | | | | 0.73% | |

| Interest and fees from borrowings5 | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | |

| Total expenses6 | | | 0.80% | | | | 0.76% | | | | 0.75% | | | | 0.76% | | | | 0.73% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.76% | | | | 0.76%7 | | | | 0.75%7 | | | | 0.76%7 | | | | 0.73%7 | |

| Portfolio turnover rate8 | | | 129% | | | | 71% | | | | 63% | | | | 34% | | | | 47% | |

1. Represents the last business day of the Fund’s reporting period

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| Year Ended October 31, 2019 | | | 0.80 | % | | |

| Year Ended October 31, 2018 | | | 0.76 | % | | |

| Year Ended October 31, 2017 | | | 0.75 | % | | |

| Year Ended October 31, 2016 | | | 0.76 | % | | |

| Year Ended October 30, 2015 | | | 0.73 | % | | |

7. Waiver was less than 0.005%.

8. Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable.

See accompanying Notes to Financial Statements.

26 INVESCO OPPENHEIMER MID CAP VALUE FUND

NOTES TO FINANCIAL STATEMENTSOctober 31, 2019

Note 1 – Significant Accounting Policies

Invesco Oppenheimer Mid Cap Value Fund (the “Fund”) is a series portfolio of AIM Growth Series (Invesco Growth Series) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as anopen-end series management investment company authorized to issue an unlimited number of shares of beneficial interest. Information presented in these financial statements pertains only to the Fund. Matters affecting the Fund or each class will be voted on exclusively by the shareholders of such Fund or each class.

Prior to the close of business on May 24, 2019, the Fund operated as Oppenheimer Mid Cap Value Fund(the “Acquired Fund” or “Predecessor Fund”). The Acquired Fund was reorganized after the close of business on May 24, 2019 (the “Reorganization Date”) through the transfer of all of its assets and liabilities to the Fund (the “Reorganization”).

Upon closing of the Reorganization, holders of the Acquired Fund’s Class A, Class C, Class R, and Class Y shares received the corresponding class of shares of the Fund and holders of the Acquired Fund’s Class I shares received Class R6 shares of the Fund. Information for the Acquired Fund’s Class I shares prior to the Reorganization is included with Class R6 shares throughout this report. Class R5 shares commenced operations on the Reorganization Date.

The Fund’s investment objective is to seek capital appreciation.

The Fund currently consists of six different classes of shares: Class A, Class C, Class R, Class Y, Class R5 and Class R6. Class Y shares are available only to certain investors. Class A shares are sold with afront-end sales charge unless certain waiver criteria are met and under certain circumstances load waived shares may be subject to contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class R, Class Y, Class R5 and Class R6 shares are sold at net asset value. Class C shares held for ten years after purchase are eligible for automatic conversion into Class A shares of the same Fund (the “Conversion Feature”). The automatic conversion pursuant to the Conversion Feature will generally occur at the end of the month following the tenth anniversary after a purchase of Class C shares.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

A. Security Valuations– Securities, including restricted securities, are valued according to the following policy.

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in theover-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed

27 INVESCO OPPENHEIMER MID CAP VALUE FUND

NOTES TO FINANCIAL STATEMENTSContinued

options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining net asset value (“NAV”) per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments inopen-end andclosed-end registered investment companies that do not trade on an exchange are valued at theend-of-day net asset value per share. Investments inopen-end andclosed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such asinstitution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Pricing services generally value debt obligations assuming orderly transactions of institutional round lot size, but a fund may hold or transact in the same securities in smaller, odd lot sizes. Odd lots often trade at lower prices than institutional round lots. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the investment adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies

28 INVESCO OPPENHEIMER MID CAP VALUE FUND

and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| B. | Securities Transactions and Investment Income - Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on the accrual basis from settlement date. Dividend income (net of withholding tax, if any) is recorded on theex-dividend date. |

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment transactions reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and the Statement of Changes in Net Assets, or the net investment income per share and the

29 INVESCO OPPENHEIMER MID CAP VALUE FUND

NOTES TO FINANCIAL STATEMENTSContinued

ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser.

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

The Fund recharacterizes distributions received from REIT investments based on information provided by the REIT into the following categories: ordinary income, long-term and short-term capital gains, and return of capital. If information is not available on a timely basis from the REIT, the recharacterization will be based on available information which may include the previous year’s allocation. If new or additional information becomes available from the REIT at a later date, a recharacterization will be made in the following year. The Fund records as dividend income the amount recharacterized as ordinary income and as realized gain the amount recharacterized as capital gain in the Statement of Operations, and the amount recharacterized as return of capital as a reduction of the cost of the related investment. These recharacterizations are reflected in the accompanying financial statements.

| C. | Country Determination- For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. |

| D. | Distributions -Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from accounting principles generally accepted in the United States of America (“GAAP”), are recorded on theex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as determined necessary by the Adviser. |

| E. | Federal Income Taxes -The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income, including any net realized gain on investments not offset by capital loss carryforwards, if any, to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remains open for the three preceding fiscal reporting period ends. The Fund has analyzed its tax positions for the fiscal year ended October 31, 2019, including open tax years, and does not believe there are any uncertain tax positions requiring recognition in the Fund’s financial statements. |

The tax components of capital shown in the following table represent distribution

30 INVESCO OPPENHEIMER MID CAP VALUE FUND

requirements the Fund must satisfy under the income tax regulations, losses the Fund may be able to offset against income and gains realized in future years and unrealized appreciation or depreciation of securities and other investments for federal income tax purposes.

| | | | | | | | | | | | | | |

Undistributed Net Investment Income | | Undistributed

Long-Term