UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02699

AIM Growth Series (Invesco Growth Series)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 12/31

Date of reporting period: 12/31/21

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

(b) Not Applicable

| | |

| Annual Report to Shareholders | | December 31, 2021 |

Invesco Active Allocation Fund

Nasdaq:

A: OAAAX ⬛ C: OAACX ⬛ R: OAANX ⬛ Y: OAAYX ⬛ R5: PAAJX ⬛ R6: PAAQX

Management’s Discussion of Fund Performance

| | | | |

| |

Performance summary | |

For the year ended December 31, 2021, Class A shares of Invesco Active Allocation Fund (the Fund), at net asset value (NAV), underperformed the Custom Invesco Active Allocation Index. Your Fund’s long-term performance appears later in this report. | |

Fund vs. Indexes | | | | |

Total returns, 12/31/20 to 12/31/21, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. | |

Class A Shares | | | 13.92 | % |

Class C Shares | | | 13.01 | |

Class R Shares | | | 13.64 | |

Class Y Shares | | | 14.24 | |

Class R5 Shares | | | 14.19 | |

Class R6 Shares | | | 14.29 | |

Bloomberg Global Aggregate Index, Hedged▼ | | | -1.39 | |

Custom Invesco Active Allocation Index⬛ | | | 14.37 | |

MSCI All Country World Index▼ | | | 18.54 | |

Source(s): ▼RIMES Technologies Corp.; ∎Invesco, RIMES Technologies Corp. | | | | |

| | | | | |

Market conditions and your Fund

Global equity markets ended the first quarter of 2021 in positive territory amid concerns about rising bond yields and inflation, with value stocks outperforming growth stocks. The successful rollout of coronavirus (COVID-19) vaccinations in the US and UK benefited equity markets. However, even regions facing slower rollouts, including the Eurozone and Japan, performed well, driven by a rebound in global demand for goods.

During the second quarter of 2021, global equity markets were again bolstered by the continued acceleration of vaccination rollouts and easing of COVID-19-related restrictions in most developed markets. In a reversal from the first quarter, growth stocks outperformed value stocks in most regions. Emerging market equities were led by Brazil which benefited from global tailwinds, while regulatory concerns weighed on Chinese equities.

Developed global equity markets were flat in the third quarter of 2021 amid concerns about rising inflation, supply disruptions and the economic growth rate. Emerging market equities declined during the quarter, primarily due to weak performance from Chinese equities, which were affected by significant regulatory changes in the private tutoring industry, increased regulation in the technology sector and the potential default of a large Chinese property developer.

Most developed global equity markets ended the fourth quarter of 2021 in positive territory despite rising inflation and the emergence of Omicron, a new COVID-19 variant. Pandemic-related supply chain disruptions and labor shortages intensified during the quarter, resulting in higher costs for companies and consumers. Emerging market equities continued to decline due to COVID-19 concerns and China’s ongoing regulatory tightening and slowing economic growth.

Overall, developed market equities outperformed emerging market equities for the fiscal year.

Strategic asset class exposures in the Fund are obtained through investments in underlying representative mutual funds and exchange-traded funds targeting a pre-defined level of risk. From an absolute performance perspective, strategic allocations to the US and international equities produced positive performance which led to positive Fund returns. Exposures to large-, mid- and small-cap US equities were the leading contributors to positive absolute performance for the fiscal year. Exposure to internationally developed market equities was also a notable contributor to positive absolute performance for the fiscal year. In contrast, strategic allocations to emerging markets equity investments produced negative returns and were the leading detractors from absolute performance.

Relative to the Fund’s custom index, an underweight allocation to US equity and manager selection within International and Emerging Markets Equity, was the leading detractor from relative performance results for the fiscal year. Within the allocation to equity, Invesco International Select Equity Fund, Invesco Developing Markets Fund and Invesco S&P Emerging Markets Low Volatility Fund were the leading detractors from relative performance. These Funds delivered negative returns in 2021 and substantially underperformed broader equities as uncertainty around inflation and concerns surrounding the regulatory environment in the Chinese market muted investor risk appetite during the fiscal year. Invesco Macro Allocation Fund within the alternatives allocation also slightly detracted from relative performance.

Conversely, style selection in US equity and an underweight allocation to fixed income contributed to Fund performance results

relative to its custom index. Within US equity, the Invesco S&P SmallCap Low Volatility ETF and Invesco Russell 1000 Dynamic Multifactor ETF were the leading contributors to relative performance. US equities performed well as many companies continually beat earning estimates throughout the fiscal year. An underweight allocation in fixed income was also accretive to relative performance as broadly core bonds underperformed non-core fixed income such as high-yield and convertible bonds for the fiscal year.

Please note that some of the Fund’s underlying funds use derivatives, including futures and total return swaps, which may create economic leverage in the underlying funds. Therefore, some of the performance of the strategy, both positive and negative, can be attributed to these instruments. Derivatives can be a cost-effective way to gain exposure to asset classes.

It has been our privilege to oversee Invesco Active Allocation Fund and we thank you for your continued investment.

Portfolio manager(s):

Jeffrey Bennett

Jacob Borbidge

Alessio de Longis

Duy Nguyen

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. and its affiliates. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

2 Invesco Active Allocation Fund

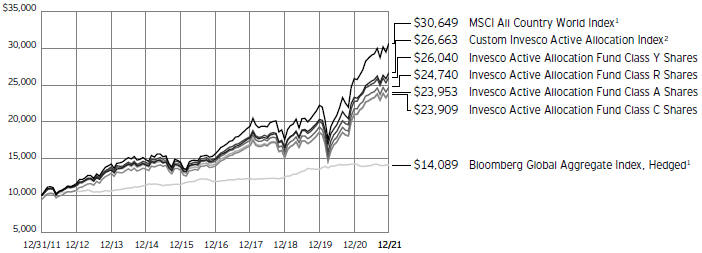

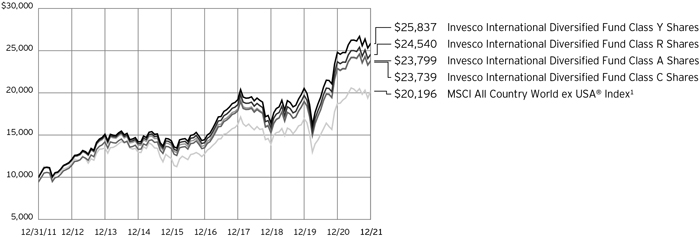

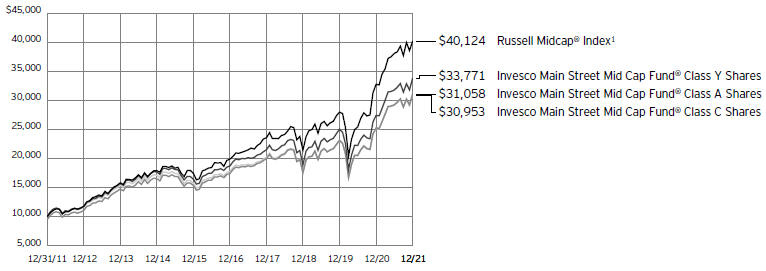

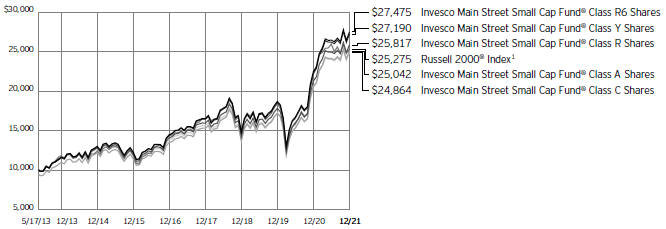

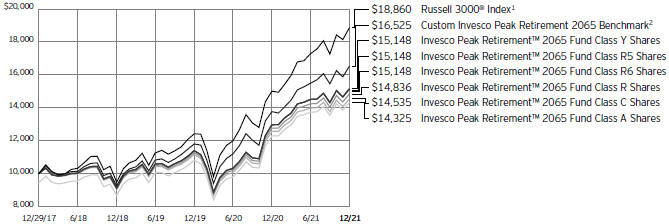

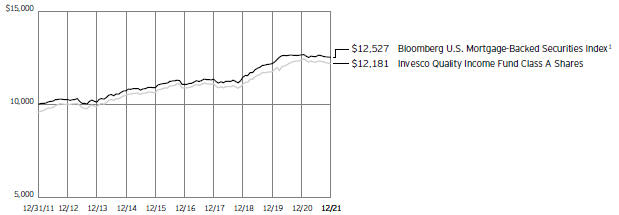

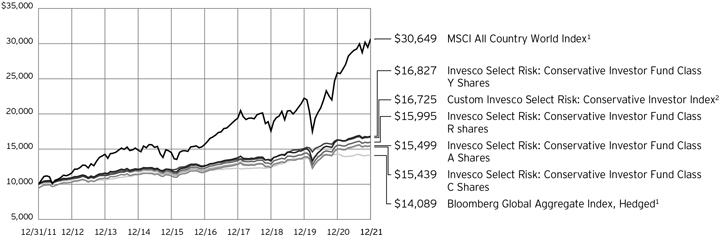

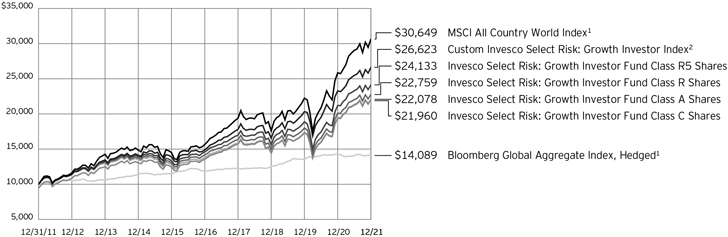

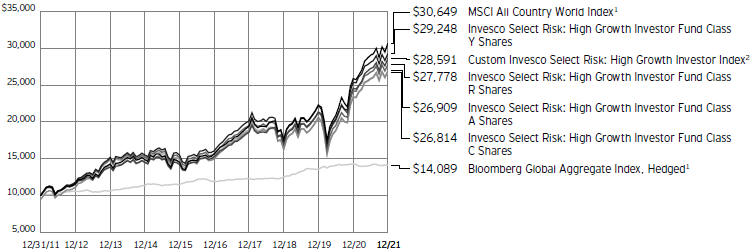

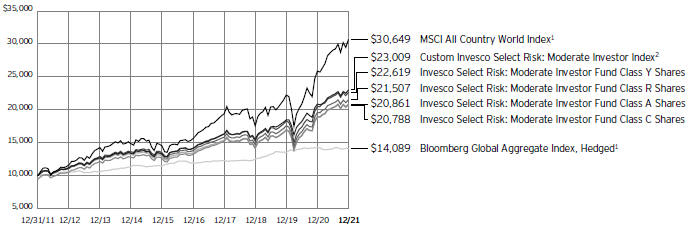

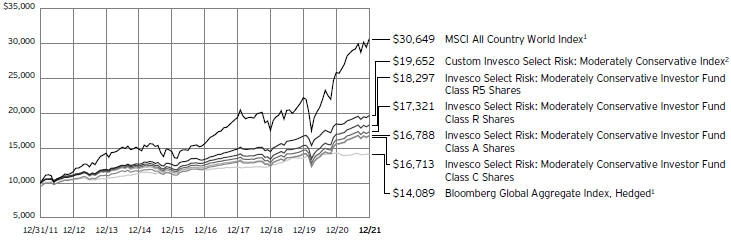

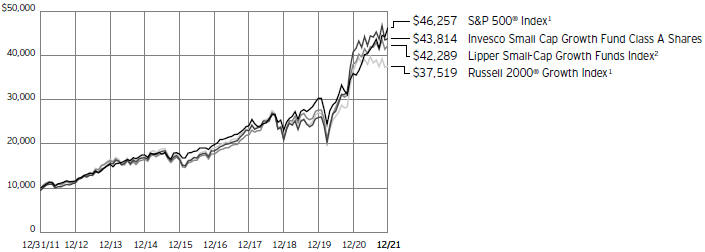

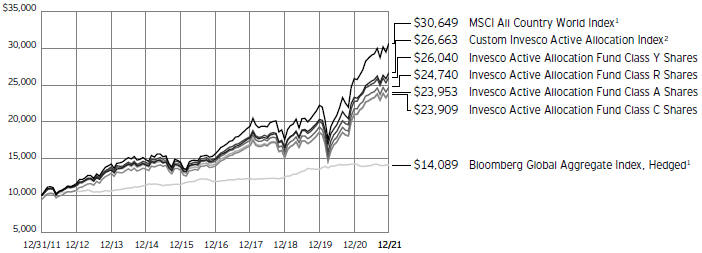

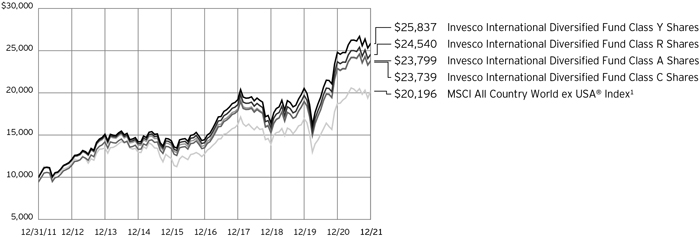

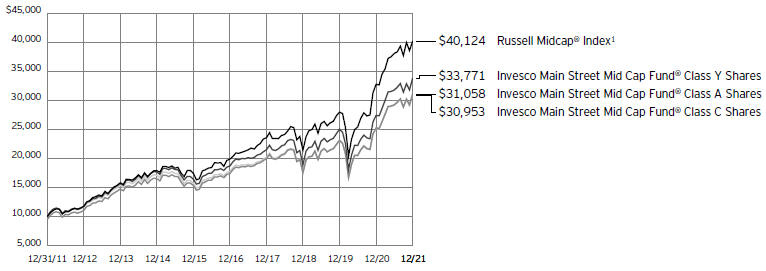

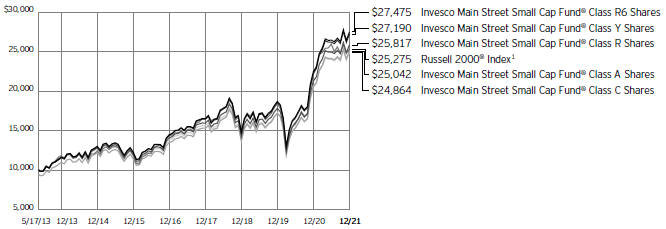

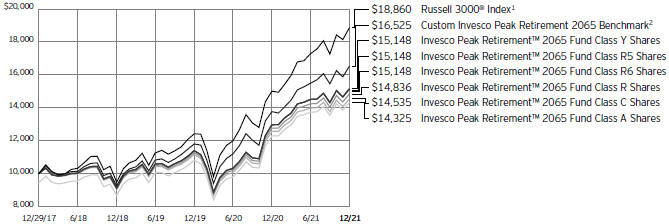

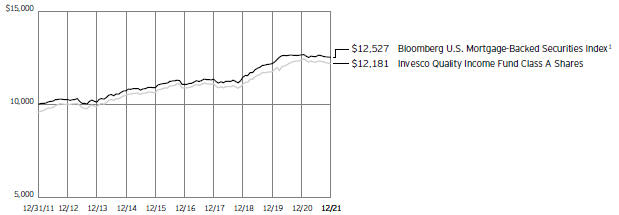

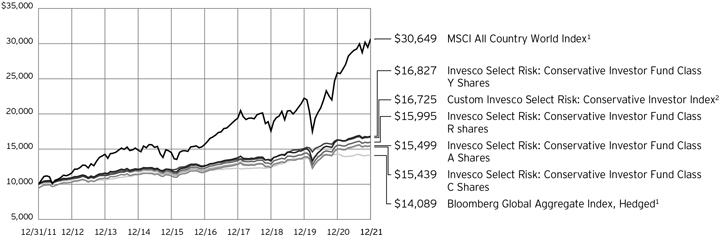

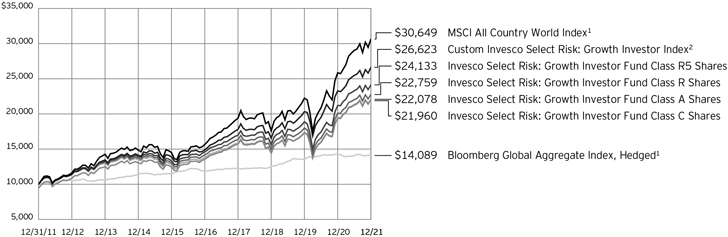

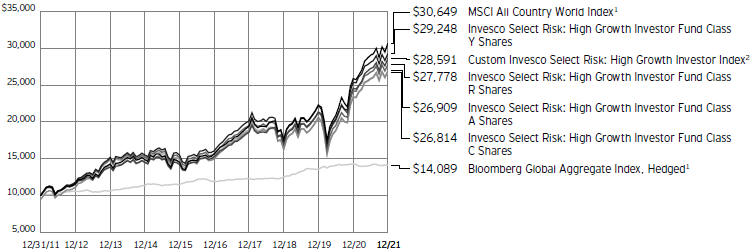

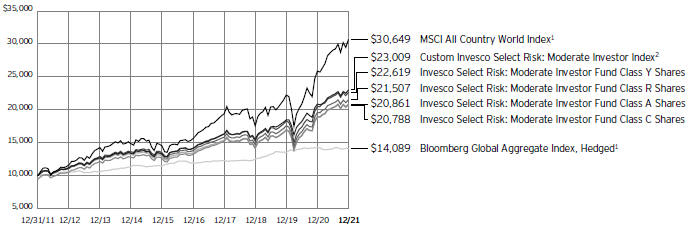

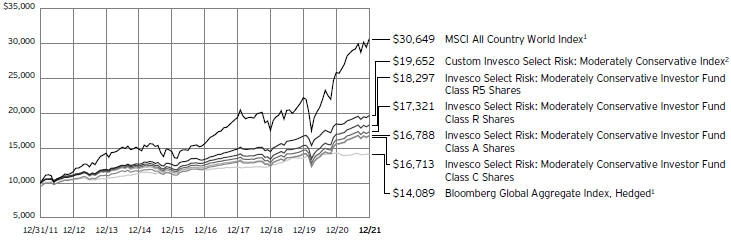

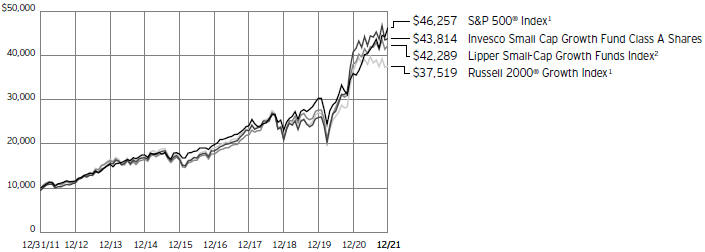

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 12/31/11

| 1 | Source: RIMES Technologies Corp. |

| 2 | Source: Invesco, RIMES Technologies Corp. |

Past performance cannot guarantee future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including management

fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees;

performance of a market index does not. Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

3 Invesco Active Allocation Fund

| | | | |

Average Annual Total Returns | |

As of 12/31/21, including maximum applicable sales charges | |

| |

Class A Shares | | | | |

Inception (4/5/05) | | | 5.80 | % |

10 Years | | | 9.13 | |

5 Years | | | 10.10 | |

1 Year | | | 7.62 | |

| |

Class C Shares | | | | |

Inception (4/5/05) | | | 5.78 | % |

10 Years | | | 9.11 | |

5 Years | | | 10.52 | |

1 Year | | | 12.01 | |

| |

Class R Shares | | | | |

Inception (4/5/05) | | | 5.92 | % |

10 Years | | | 9.48 | |

5 Years | | | 11.06 | |

1 Year | | | 13.64 | |

| |

Class Y Shares | | | | |

Inception (4/5/05) | | | 6.49 | % |

10 Years | | | 10.04 | |

5 Years | | | 11.62 | |

1 Year | | | 14.24 | |

| |

Class R5 Shares | | | | |

10 Years | | | 9.82 | % |

5 Years | | | 11.50 | |

1 Year | | | 14.19 | |

| |

Class R6 Shares | | | | |

10 Years | | | 9.84 | % |

5 Years | | | 11.53 | |

1 Year | | | 14.29 | |

Effective May 24, 2019, Class A, Class C, Class R, and Class Y shares of the Oppenheimer Portfolio Series: Active Allocation Fund, (the predecessor fund), were reorganized into Class A, Class C, Class R and Class Y shares, respectively, of the Invesco Active Allocation Fund. Returns shown above, for periods ending on or prior to May 24, 2019, for Class A, Class C, Class R and Class Y shares are those for Class A, Class C, Class R and Class Y shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

Class R5 shares incepted on May 24, 2019. Performance shown on or prior to that date is that of the predecessor fund’s Class A shares at net asset value and includes the 12b-1 fees applicable to Class A shares.

Class R6 shares incepted on May 24, 2019. Performance shown on or prior to that date is that of the predecessor fund’s Class A shares at net asset value and includes the 12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ performance for the most recent month-endperformance. Performance figures reflect reinvested distributions, changes in

net asset value and the effect of the maximum sales charge unless otherwise stated. Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

Class A share performance reflects the maximum 5.50% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class R, Class Y, Class R5 and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

4 Invesco Active Allocation Fund

Supplemental Information

Invesco Active Allocation Fund’s investment objective is to seek total return.

| ∎ | Unless otherwise stated, information presented in this report is as of December 31, 2021, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data is provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About indexes used in this report

| ∎ | The Bloomberg Global Aggregate Index, Hedged tracks fixed-income performance of regions around the world while hedging the currency back to the US dollar. |

| ∎ | The Custom Invesco Active Allocation Index is composed of 80% MSCI All Country World Index and 20% Bloomberg Global Aggregate Bond Index, Hedged. |

| ∎ | The MSCI All Country World Index is an unmanaged index considered representative of large- and mid-cap stocks across developed and emerging markets. The index is computed using the net return, which withholds applicable taxes for non-resident investors. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

|

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. |

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

5 Invesco Active Allocation Fund

Fund Information

Portfolio Composition*

| | |

| By fund type | | % of total investments |

| Equity Funds | | 78.05% |

| Fixed Income Funds | | 16.00 |

| Alternative Funds | | 5.45 |

| Money Market Funds | | 0.50 |

| * | Based on the Schedule of Investments, which classifies each underlying fund and other investments into broad asset classes based on their predominant investments. |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security. Data presented here are as of December 31, 2021.

6 Invesco Active Allocation Fund

Schedule of Investments

December 31, 2021

Invesco Active Allocation Fund

Schedule of Investments in Affiliated Issuers–99.21%(a)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | % of | | | | | | | | | | | | Change in | | | | | | | | | | | | | |

| | | Net | | | | | | | | | | | | Unrealized | | | | | | | | | | | | | |

| | | Assets | | | Value | | | Purchases | | | Proceeds | | | Appreciation | | | Realized | | | Dividend | | | Shares | | | Value | |

| | | 12/31/21 | | | 12/31/20 | | | at Cost | | | from Sales | | | (Depreciation) | | | Gain (Loss) | | | Income | | | 12/31/21 | | | 12/31/21 | |

| |

Alternative Funds-5.41% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco Fundamental Alternatives Fund, Class R6 | | | – | | | $ | 55,481,334 | | | $ | – | | | $ | (56,146,122 | ) | | $ | (86,227 | ) | | $ | 751,015 | | | $ | – | | | | – | | | $ | – | |

| |

Invesco Global Real Estate Income Fund, Class R6 | | | 2.19% | | | | 41,137,391 | | | | 9,022,174 | | | | (5,101,265 | ) | | | 7,668,025 | | | | 273,113 | | | | 1,179,437 | | | | 5,294,649 | | | | 52,999,438 | |

| |

Invesco Macro Allocation Strategy Fund, Class R6 | | | 3.22% | | | | 58,974,029 | | | | 27,518,143 | | | | (3,703,646 | ) | | | (4,923,943 | ) | | | 2,720,946 | | | | 4,308,906 | | | | 9,135,760 | | | | 77,928,029 | |

| |

Invesco Master Event-Linked Bond Fund, Class R6 | | | – | | | | 15,761,053 | | | | 404,733 | | | | (13,938,262 | ) | | | 9,923,768 | | | | (12,151,292 | ) | | | 387,141 | | | | – | | | | – | |

| |

Total Alternative Funds | | | | | | | 171,353,807 | | | | 36,945,050 | | | | (78,889,295 | ) | | | 12,581,623 | | | | (8,406,218 | ) | | | 5,875,484 | | | | | | | | 130,927,467 | |

| |

Domestic Equity Funds-44.07% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco Discovery Mid Cap Growth Fund, Class R6 | | | 8.66% | | | | 170,699,286 | | | | 66,975,040 | | | | (36,009,706 | ) | | | 5,400,876 | | | | 30,801,813 | | | | – | | | | 5,731,046 | | | | 209,641,660 | |

| |

Invesco Main Street Small Cap Fund, Class R6 | | | 8.38% | | | | 258,197,346 | | | | 14,825,382 | | | | (104,507,371 | ) | | | 5,096,871 | | | | 43,823,377 | | | | 159,502 | | | | 9,492,964 | | | | 202,769,725 | |

| |

Invesco Russell 1000 Dynamic Multifactor ETF | | | 7.39% | | | | 199,191,004 | | | | – | | | | (67,579,257 | ) | | | 20,735,703 | | | | 26,525,091 | | | | 1,923,897 | | | | 3,528,058 | | | | 178,872,541 | |

| |

Invesco S&P 500® Low Volatility ETF | | | 7.06% | | | | 148,248,427 | | | | 3,768,269 | | | | (12,779,692 | ) | | | 30,529,571 | | | | 1,239,688 | | | | 2,648,383 | | | | 2,491,713 | | | | 171,006,263 | |

| |

Invesco S&P 500® Pure Growth ETF | | | 5.05% | | | | 144,945,461 | | | | – | | | | (54,672,651 | ) | | | 20,709,034 | | | | 11,196,568 | | | | 5,456 | | | | 579,539 | | | | 122,178,412 | |

| |

Invesco S&P SmallCap Low Volatility ETF | | | 7.53% | | | | 237,391,613 | | | | – | | | | (108,970,151 | ) | | | 27,613,742 | | | | 26,202,234 | | | | 2,323,384 | | | | 3,498,511 | | | | 182,237,438 | |

| |

Total Domestic Equity Funds | | | | | | | 1,158,673,137 | | | | 85,568,691 | | | | (384,518,828 | ) | | | 110,085,797 | | | | 139,788,771 | | | | 7,060,622 | | | | | | | | 1,066,706,039 | |

| |

Fixed Income Funds-15.88% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco 1-30 Laddered Treasury ETF | | | 2.01% | | | | – | | | | 49,265,911 | | | | (2,247,398 | ) | | | 1,501,146 | | | | 48,400 | | | | 452,485 | | | | 1,328,448 | | | | 48,568,059 | |

| |

Invesco Core Plus Bond Fund, Class R6 | | | 7.43% | | | | 181,242,686 | | | | 12,257,540 | | | | (7,350,219 | ) | | | (6,056,484 | ) | | | 1,513,598 | | | | 4,000,970 | | | | 16,289,099 | | | | 179,831,649 | |

| |

Invesco Income Fund, Class R6(b) | | | 1.74% | | | | 40,138,257 | | | | 3,151,611 | | | | (1,460,303 | ) | | | 317,594 | | | | 3,784 | | | | 1,385,187 | | | | 5,352,602 | | | | 42,124,979 | |

| |

Invesco Taxable Municipal Bond ETF | | | 3.71% | | | | 59,381,798 | | | | 35,073,343 | | | | (4,367,734 | ) | | | (163,879 | ) | | | (64,779 | ) | | | 2,182,443 | | | | 2,726,297 | | | | 89,858,749 | |

| |

Invesco Variable Rate Investment Grade ETF(b) | | | 0.99% | | | | 21,014,766 | | | | 3,441,026 | | | | (627,297 | ) | | | 60,777 | | | | 247 | | | | 176,326 | | | | 953,127 | | | | 23,885,363 | |

| |

Total Fixed Income Funds | | | | | | | 301,777,507 | | | | 103,189,431 | | | | (16,052,951 | ) | | | (4,340,846 | ) | | | 1,501,250 | | | | 8,197,411 | | | | | | | | 384,268,799 | |

| |

Foreign Equity Funds-33.35% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco Emerging Markets All Cap Fund, Class R6 | | | 2.86% | | | | 54,636,628 | | | | 27,785,837 | | | | (4,600,928 | ) | | | (8,615,710 | ) | | | 2,699,635 | | | | 657,605 | | | | 1,821,462 | | | | 69,306,630 | |

| |

Invesco Developing Markets Fund, Class R6 | | | 4.49% | | | | 55,872,773 | | | | 81,827,908 | | | | (13,168,076 | ) | | | (16,026,017 | ) | | | 5,400,566 | | | | 588,097 | | | | 2,314,159 | | | | 108,765,465 | |

| |

Invesco Global Fund, Class R6 | | | 10.70% | | | | 261,395,966 | | | | 17,131,774 | | | | (42,961,671 | ) | | | 12,548,564 | | | | 28,034,906 | | | | – | | | | 2,058,147 | | | | 259,017,765 | |

| |

Invesco Global Infrastructure Fund, Class R6 | | | 0.68% | | | | 15,580,513 | | | | 313,279 | | | | (2,067,194 | ) | | | 2,274,747 | | | | 266,126 | | | | 313,279 | | | | 1,265,852 | | | | 16,367,471 | |

| |

Invesco International Select Equity Fund, Class R6 | | | 2.79% | | | | 84,867,565 | | | | 1,755,526 | | | | (4,009,552 | ) | | | (15,824,371 | ) | | | 2,341,426 | | | | 271,242 | | | | 5,347,534 | | | | 67,646,310 | |

| |

Invesco International Small-Mid Company Fund, Class R6 | | | 3.64% | | | | 86,485,210 | | | | 14,956,634 | | | | (17,948,117 | ) | | | 897,828 | | | | 11,687,866 | | | | 334,146 | | | | 1,548,232 | | | | 88,140,852 | |

| |

Invesco RAFI™ Strategic Developed ex-US ETF | | | 2.88% | | | | 76,742,374 | | | | – | | | | (15,817,133 | ) | | | 4,955,344 | | | | 4,152,497 | | | | 2,561,753 | | | | 2,296,931 | | | | 69,642,948 | |

| |

Invesco S&P Emerging Markets Low Volatility ETF | | | 2.27% | | | | 53,996,335 | | | | – | | | | (4,923,257 | ) | | | 5,126,402 | | | | 714,113 | | | | 2,442,967 | | | | 2,215,151 | | | | 54,913,593 | |

| |

Invesco S&P International Developed Low Volatility ETF | | | 3.04% | | | | 68,430,012 | | | | 3,388,815 | | | | (2,805,639 | ) | | | 4,429,821 | | | | 39,704 | | | | 2,214,516 | | | | 2,302,090 | | | | 73,482,713 | |

| |

Total Foreign Equity Funds | | | | | | | 758,007,376 | | | | 147,159,773 | | | | (108,301,567 | ) | | | (10,233,392 | ) | | | 55,336,839 | | | | 9,383,605 | | | | | | | | 807,283,747 | |

| |

Money Market Funds-0.50% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco Government & Agency Portfolio, Institutional Class,

0.03%(c) | | | 0.17% | | | | 2,269,211 | | | | 95,501,462 | | | | (93,548,971 | ) | | | – | | | | – | | | | 679 | | | | 4,221,702 | | | | 4,221,702 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

7 Invesco Active Allocation Fund

Invesco Active Allocation Fund (continued)

Schedule of Investments in Affiliated Issuers–99.21%(a)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | % of Net

Assets

12/31/21 | | | Value 12/31/20 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Realized

Gain (Loss) | | | Dividend

Income | | | Shares

12/31/21 | | | Value 12/31/21 | |

| |

Money Market Funds-(continued) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco Liquid Assets Portfolio, Institutional Class, 0.02%(c) | | | 0.13% | | | $ | 1,620,880 | | | $ | 68,215,330 | | | $ | (66,820,595 | ) | | | $ – | | | $ | (116 | ) | | $ | 292 | | | | 3,014,897 | | | $ | 3,015,499 | |

| |

Invesco Treasury Portfolio, Institutional Class, 0.01%(c) | | | 0.20% | | | | 2,593,385 | | | | 109,144,528 | | | | (106,913,111 | ) | | | – | | | | – | | | | 281 | | | | 4,824,802 | | | | 4,824,802 | |

| |

Total Money Market Funds | | | | | | | 6,483,476 | | | | 272,861,320 | | | | (267,282,677 | ) | | | – | | | | (116 | ) | | | 1,252 | | | | | | | | 12,062,003 | |

| |

TOTAL INVESTMENTS IN AFFILIATED ISSUERS

(excluding investments purchased with cash collateral from securities on loan)

(Cost $1,853,385,919) | | | 99.21% | | | | 2,396,295,303 | | | | 645,724,265 | | | | (855,045,318 | ) | | | 108,093,182 | | | | 188,220,526 | | | | 30,518,374 | | | | | | | | 2,401,248,055 | |

| |

Investments Purchased with Cash Collateral from Securities on Loan | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Money Market Funds-0.00% | | | | | | | | | | | | | | | | | | | | | |

Invesco Private Government Fund, 0.02%(c) | | | – | | | | – | | | | 41,694,167 | | | | (41,694,167 | ) | | | – | | | | – | | | | 197 | (d) | | | – | | | | – | |

| |

Invesco Private Prime Fund, 0.11%(c) | | | – | | | | – | | | | 96,054,338 | | | | (96,053,644 | ) | | | – | | | | (694 | ) | | | 1,946 | (d) | | | – | | | | – | |

| |

Total Investments Purchased with Cash Collateral from Securities on Loan

(Cost $0) | | | 0.00% | | | | – | | | | 137,748,505 | | | | (137,747,811 | ) | | | – | | | | (694 | ) | | | 2,143 | | | | | | | | – | |

| |

TOTAL INVESTMENTS IN AFFILIATED ISSUERS

(Cost $1,853,385,919) | | | 99.21% | | | $ | 2,396,295,303 | | | $ | 783,472,770 | | | $ | (992,793,129 | ) | | | $108,093,182 | | | $ | 188,219,832 | (e)(f) | | $ | 30,520,517 | (e) | | | | | | $ | 2,401,248,055 | |

| |

OTHER ASSETS LESS LIABILITIES | | | 0.79% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 19,219,197 | |

| |

NET ASSETS | | | 100.00% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 2,420,467,252 | |

| |

Investment Abbreviations:

ETF - Exchange-Traded Fund

Notes to Schedule of Investments:

| (a) | Each underlying fund and the Fund are affiliated by either having the same investment adviser or an investment adviser under common control with the Fund’s investment adviser. |

| (b) | Amounts include a return of capital distribution reclassification which reduces dividend income and increases realized gain (loss) and/or change in unrealized appreciation (depreciation). |

| (c) | The rate shown is the 7-day SEC standardized yield as of December 31, 2021. |

| (d) | Represents the income earned on the investment of cash collateral, which is included in securities lending income on the Statement of Operations. Does not include rebates and fees paid to lending agent or premiums received from borrowers, if any. |

| (e) | Amounts exclude return of capital received from previously held underlying funds due to the timing of the determination of the character of dividends received. |

| (f) | Includes capital gains distributions from affiliated underlying funds as follows: |

| | | | |

| Fund Name | | Capital Gain | |

| |

Invesco Core Plus Bond Fund | | $ | 1,775,472 | |

Invesco Emerging Markets All Cap Fund | | | 2,598,832 | |

Invesco Developing Markets Fund | | | 5,141,689 | |

Invesco Discovery Mid Cap Growth Fund | | | 28,225,649 | |

Invesco Global Fund | | | 17,131,774 | |

Invesco International Select Equity Fund | | | 1,484,284 | |

Invesco International Small-Mid Company Fund | | | 7,938,569 | |

Invesco Macro Allocation Strategy Fund | | | 2,657,500 | |

Invesco Main Street Small Cap Fund | | | 14,665,880 | |

Invesco RAFI™ Strategic Developed ex-US ETF | | | 390,134 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

8 Invesco Active Allocation Fund

| | | | | | | | | | | | | | | | | | |

| Open Futures Contracts(a) | |

| |

| Long Futures Contracts | | Number of

Contracts | | | Expiration

Month | | Notional

Value | | | Value | | | Unrealized

Appreciation

(Depreciation) | |

| |

Equity Risk | | | | | | | | | | | | | | | | | | |

| |

E-Mini S&P 500 Index | | | 159 | | | March-2022 | | $ | 37,830,075 | | | $ | 789,112 | | | | $ 789,112 | |

| |

Nikkei 225 Index | | | 7 | | | March-2022 | | | 1,751,369 | | | | 12,603 | | | | 12,603 | |

| |

STOXX Europe 600 Index | | | 187 | | | March-2022 | | | 5,178,779 | | | | 190,025 | | | | 190,025 | |

| |

Subtotal | | | | | | | | | | | | | 991,740 | | | | 991,740 | |

| |

Interest Rate Risk | | | | | | | | | | | | | | | | | | |

| |

U.S. Treasury 10 Year Notes | | | 566 | | | March-2022 | | | 73,845,313 | | | | 682,473 | | | | 682,473 | |

| |

Subtotal–Long Futures Contracts | | | | | | | | | | | | | 1,674,213 | | | | 1,674,213 | |

| |

| | | | | |

Short Futures Contracts | | | | | | | | | | | | | | | | | | |

| |

Equity Risk | | | | | | | | | | | | | | | | | | |

| |

MSCI Emerging Markets Index | | | 291 | | | March-2022 | | | (17,842,665 | ) | | | (159,186 | ) | | | (159,186 | ) |

| |

Total Futures Contracts | | | | | | | | | | | | $ | 1,515,027 | | | | $1,515,027 | |

| |

| (a) | Futures contracts collateralized by $4,551,204 cash held with Merrill Lynch, the futures commission merchant. |

| | | | | | | | | | | | | | | | | | | | | | |

| Open Forward Foreign Currency Contracts | |

| |

Settlement Date | | | | Contract to | | | Unrealized Appreciation

(Depreciation) | |

| | Counterparty | | | | | Deliver | | | | | | Receive | |

Currency Risk | | | | | | | | | | | | | | | | | | | | | | |

| |

03/16/2022 | | Bank of America, N.A. | | | KRW | | | | 2,783,600,000 | | | | USD | | | | 2,359,783 | | | $ | 22,945 | |

| |

03/16/2022 | | Bank of America, N.A. | | | PHP | | | | 319,070,000 | | | | USD | | | | 6,294,535 | | | | 122,044 | |

| |

03/16/2022 | | Bank of America, N.A. | | | USD | | | | 6,679,656 | | | | IDR | | | | 97,022,000,000 | | | | 89,311 | |

| |

03/16/2022 | | Bank of America, N.A. | | | USD | | | | 6,779,353 | | | | SEK | | | | 61,420,000 | | | | 21,758 | |

| |

03/16/2022 | | Barclays Bank PLC | | | PHP | | | | 21,530,000 | | | | USD | | | | 424,446 | | | | 7,942 | |

| |

03/16/2022 | | Barclays Bank PLC | | | USD | | | | 4,900,539 | | | | EUR | | | | 4,327,000 | | | | 32,985 | |

| |

03/02/2022 | | Goldman Sachs International | | | USD | | | | 7,339,858 | | | | BRL | | | | 41,840,000 | | | | 70,089 | |

| |

03/16/2022 | | Goldman Sachs International | | | USD | | | | 476,994 | | | | MXN | | | | 10,145,000 | | | | 12,266 | |

| |

03/16/2022 | | J.P. Morgan Chase Bank, N.A. | | | USD | | | | 2,388,411 | | | | INR | | | | 182,680,000 | | | | 42,753 | |

| |

03/16/2022 | | J.P. Morgan Chase Bank, N.A. | | | USD | | | | 6,313,289 | | | | NOK | | | | 56,660,000 | | | | 112,023 | |

| |

03/16/2022 | | Morgan Stanley and Co. International PLC | | | USD | | | | 1,892,548 | | | | EUR | | | | 1,673,000 | | | | 14,960 | |

| |

03/16/2022 | | Morgan Stanley and Co. International PLC | | | USD | | | | 19,156 | | | | IDR | | | | 278,000,000 | | | | 240 | |

| |

03/16/2022 | | Morgan Stanley and Co. International PLC | | | USD | | | | 479,139 | | | | NOK | | | | 4,300,000 | | | | 8,486 | |

| |

03/16/2022 | | Morgan Stanley and Co. International PLC | | | USD | | | | 477,775 | | | | ZAR | | | | 7,715,000 | | | | 1,504 | |

| |

03/16/2022 | | UBS AG | | | KRW | | | | 2,046,400,000 | | | | USD | | | | 1,735,473 | | | | 17,516 | |

| |

03/16/2022 | | UBS AG | | | USD | | | | 6,776,095 | | | | SGD | | | | 9,250,000 | | | | 85,386 | |

| |

Subtotal–Appreciation | | | | | | | | | | | | | | | | 662,208 | |

| |

| | | | | | |

Currency Risk | | | | | | | | | | | | | | | | | | | | | | |

| |

03/16/2022 | | Bank of America, N.A. | | | NZD | | | | 9,970,000 | | | | USD | | | | 6,763,191 | | | | (57,831 | ) |

| |

03/16/2022 | | Bank of America, N.A. | | | USD | | | | 3,741,029 | | | | JPY | | | | 423,260,000 | | | | (59,368 | ) |

| |

03/16/2022 | | BNP Paribas S.A. | | | CAD | | | | 8,610,000 | | | | USD | | | | 6,767,686 | | | | (37,907 | ) |

| |

03/16/2022 | | BNP Paribas S.A. | | | THB | | | | 219,250,000 | | | | USD | | | | 6,515,875 | | | | (45,663 | ) |

| |

03/16/2022 | | Goldman Sachs International | | | CZK | | | | 146,450,000 | | | | USD | | | | 6,476,363 | | | | (180,567 | ) |

| |

03/16/2022 | | J.P. Morgan Chase Bank, N.A. | | | GBP | | | | 20,000 | | | | USD | | | | 26,474 | | | | (589 | ) |

| |

03/16/2022 | | Morgan Stanley and Co. International PLC | | | AUD | | | | 9,480,000 | | | | USD | | | | 6,804,055 | | | | (94,314 | ) |

| |

03/16/2022 | | Morgan Stanley and Co. International PLC | | | CHF | | | | 6,255,000 | | | | USD | | | | 6,797,944 | | | | (79,410 | ) |

| |

03/16/2022 | | Morgan Stanley and Co. International PLC | | | GBP | | | | 5,100,000 | | | | USD | | | | 6,750,076 | | | | (150,932 | ) |

| |

03/16/2022 | | Morgan Stanley and Co. International PLC | | | USD | | | | 6,739,682 | | | | COP | | | | 26,430,000,000 | | | | (291,135 | ) |

| |

03/16/2022 | | Morgan Stanley and Co. International PLC | | | USD | | | | 3,060,401 | | | | JPY | | | | 346,740,000 | | | | (44,337 | ) |

| |

03/16/2022 | | Morgan Stanley and Co. International PLC | | | USD | | | | 7,365,473 | | | | RUB | | | | 552,300,000 | | | | (83,668 | ) |

| |

03/16/2022 | | Morgan Stanley and Co. International PLC | | | USD | | | | 3,161,495 | | | | TWD | | | | 87,115,000 | | | | (2,277 | ) |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

9 Invesco Active Allocation Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Open Forward Foreign Currency Contracts–(continued) | |

| |

Settlement Date | | | | Contract to | | | | | | Unrealized Appreciation

(Depreciation) | |

| | Counterparty | | | | | Deliver | | | | | | | | | Receive | | | | |

03/16/2022 | | UBS AG | | | CZK | | | | 5,990,000 | | | | | | | | USD | | | | 264,885 | | | | | | | $ | (7,392) | |

| |

Subtotal–Depreciation | | | | | | | | | | | | | | | | | | | | | | | | (1,135,390) | |

| |

Total Forward Foreign Currency Contracts | | | | | | | | | | | | | | | | | | | | | | | $ | (473,182) | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Open Centrally Cleared Credit Default Swap Agreements(a) | |

| |

| Reference Entity | | Buy/Sell

Protection | | | (Pay)/

Receive

Fixed

Rate | | | Payment

Frequency | | | Maturity Date | | | Implied

Credit

Spread(b) | | | Notional Value | | | Upfront

Payments Paid

(Received) | | | Value | | | Unrealized

Appreciation | |

| |

| | | | | | | | | | |

Credit Risk | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Markit CDX Emerging Markets Index, Series 36, Version 1 | | | Sell | | | | 1.00 | % | | | Quarterly | | | | 12/20/2026 | | | | 1.873% | | | | USD | | | | 31,800,000 | | | $ | (1,584,312 | ) | | $ | (1,278,424 | ) | | | $305,888 | |

| |

Markit CDX North America High Yield Index, Series 37, Version 1 | | | Sell | | | | 5.00 | | | | Quarterly | | | | 12/20/2026 | | | | 2.930 | | | | USD | | | | 13,000,000 | | | | 1,045,924 | | | | 1,188,239 | | | | 142,315 | |

| |

Total Centrally Cleared Credit Default Swap Agreements | | | | | | | | | | | | | | | $ | (538,388 | ) | | $ | (90,185 | ) | | | $448,203 | |

| |

| (a) | Centrally cleared swap agreements collateralized by $4,980,556 cash held with J.P. Morgan Chase Bank, N.A. |

| (b) | Implied credit spreads represent the current level, as of December 31, 2021, at which protection could be bought or sold given the terms of the existing credit default swap agreement and serve as an indicator of the current status of the payment/performance risk of the credit default swap agreement. An implied credit spread that has widened or increased since entry into the initial agreement may indicate a deteriorating credit profile and increased risk of default for the reference entity. A declining or narrowing spread may indicate an improving credit profile or decreased risk of default for the reference entity. Alternatively, credit spreads may increase or decrease reflecting the general tolerance for risk in the credit markets generally. |

Abbreviations:

| | | | |

| AUD | | – | | Australian Dollar |

| BRL | | – | | Brazilian Real |

| CAD | | – | | Canadian Dollar |

| CHF | | – | | Swiss Franc |

| COP | | – | | Colombia Peso |

| CZK | | – | | Czech Koruna |

| EUR | | – | | Euro |

| GBP | | – | | British Pound Sterling |

| IDR | | – | | Indonesian Rupiah |

| INR | | – | | Indian Rupee |

| JPY | | – | | Japanese Yen |

| KRW | | – | | South Korean Won |

| MXN | | – | | Mexican Peso |

| NOK | | – | | Norwegian Krone |

| NZD | | – | | New Zealand Dollar |

| PHP | | – | | Philippines Peso |

| RUB | | – | | Russian Ruble |

| SEK | | – | | Swedish Krona |

| SGD | | – | | Singapore Dollar |

| THB | | – | | Thai Baht |

| TWD | | – | | New Taiwan Dollar |

| USD | | – | | U.S. Dollar |

| ZAR | | – | | South African Rand |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 Invesco Active Allocation Fund

Statement of Assets and Liabilities

December 31, 2021

| | | | |

Assets: | | | | |

Investments in affiliated underlying funds, at value

(Cost $1,853,385,919) | | $ | 2,401,248,055 | |

| |

Other investments: | | | | |

Variation margin receivable – futures contracts | | | 10,089,039 | |

| |

Variation margin receivable – centrally cleared swap agreements | | | 22,966 | |

| |

Unrealized appreciation on forward foreign currency contracts outstanding | | | 662,208 | |

| |

Deposits with brokers: | | | | |

Cash collateral – exchange-traded futures contracts | | | 4,551,204 | |

| |

Cash collateral – centrally cleared swap agreements | | | 4,980,556 | |

| |

Cash collateral – OTC Derivatives | | | 400,000 | |

| |

| Cash | | | 6,654 | |

| |

Receivable for: | | | | |

Dividends – affiliated underlying funds | | | 14,481 | |

| |

Fund shares sold | | | 1,526,926 | |

| |

Investment for trustee deferred compensation and retirement plans | | | 143,669 | |

| |

Other assets | | | 56,422 | |

| |

Total assets | | | 2,423,702,180 | |

| |

| |

Liabilities: | | | | |

Other investments: | | | | |

Unrealized depreciation on forward foreign currency contracts outstanding | | | 1,135,390 | |

| |

Payable for: | | | | |

Fund shares reacquired | | | 820,815 | |

| |

Accrued fees to affiliates | | | 1,093,073 | |

| |

Accrued trustees’ and officers’ fees and benefits | | | 44,870 | |

| |

Accrued other operating expenses | | | (2,889 | ) |

| |

Trustee deferred compensation and retirement plans | | | 143,669 | |

| |

Total liabilities | | | 3,234,928 | |

| |

Net assets applicable to shares outstanding | | $ | 2,420,467,252 | |

| |

| | | | |

Net assets consist of: | | | | |

Shares of beneficial interest | | $ | 1,807,914,156 | |

| |

Distributable earnings | | | 612,553,096 | |

| |

| | $ | 2,420,467,252 | |

| |

| |

Net Assets: | | | | |

Class A | | $ | 1,973,744,815 | |

| |

Class C | | $ | 247,856,780 | |

| |

Class R | | $ | 166,899,832 | |

| |

Class Y | | $ | 31,941,295 | |

| |

Class R5 | | $ | 10,775 | |

| |

Class R6 | | $ | 13,755 | |

| |

|

Shares outstanding, no par value, with an unlimited number of shares authorized: | |

Class A | | | 127,993,640 | |

| |

Class C | | | 16,509,398 | |

| |

Class R | | | 10,899,224 | |

| |

Class Y | | | 2,034,670 | |

| |

Class R5 | | | 700 | |

| |

Class R6 | | | 894 | |

| |

Class A: | | | | |

Net asset value per share | | $ | 15.42 | |

| |

Maximum offering price per share

(Net asset value of $15.42 ÷ 94.50%) | | $ | 16.32 | |

| |

Class C: | | | | |

Net asset value and offering price per share | | $ | 15.01 | |

| |

Class R: | | | | |

Net asset value and offering price per share | | $ | 15.31 | |

| |

Class Y: | | | | |

Net asset value and offering price per share | | $ | 15.70 | |

| |

Class R5: | | | | |

Net asset value and offering price per share | | $ | 15.39 | |

| |

Class R6: | | | | |

Net asset value and offering price per share | | $ | 15.39 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 Invesco Active Allocation Fund

Statement of Operations

For the year ended December 31, 2021

| | | | |

Investment income: | | | | |

Dividends from affiliated underlying funds (includes securities lending income of $ 51,006) | | $ | 26,818,778 | |

| |

Interest | | | 449 | |

| |

Total investment income | | | 26,819,227 | |

| |

| |

Expenses: | | | | |

Advisory fees | | | 2,110,052 | |

| |

Administrative services fees | | | 344,099 | |

| |

Custodian fees | | | 71,271 | |

| |

Distribution fees: | | | | |

Class A | | | 4,848,973 | |

| |

Class C | | | 2,600,800 | |

| |

Class R | | | 797,177 | |

| |

Transfer agent fees – A, C, R and Y | | | 2,969,435 | |

| |

Transfer agent fees – R5 | | | 11 | |

| |

Transfer agent fees – R6 | | | 11 | |

| |

Trustees’ and officers’ fees and benefits | | | 51,503 | |

| |

Registration and filing fees | | | 120,257 | |

| |

Professional services fees | | | 67,697 | |

| |

Other | | | 1,341 | |

| |

Total expenses | | | 13,982,627 | |

| |

Less: Fees waived and/or expense offset arrangement(s) | | | (417,581 | ) |

| |

Net expenses | | | 13,565,046 | |

| |

Net investment income | | | 13,254,181 | |

| |

| |

Realized and unrealized gain (loss) from: | | | | |

Net realized gain (loss) from: | | | | |

Affiliated underlying fund shares | | | 110,116,969 | |

| |

Foreign currencies | | | (12,030 | ) |

| |

Forward foreign currency contracts | | | 84,140 | |

| |

Futures contracts | | | 4,735,794 | |

| |

Swap agreements | | | 3,116,832 | |

| |

Capital gain distributions from affiliated underlying fund shares | | | 82,009,783 | |

| |

| | | 200,051,488 | |

| |

Change in net unrealized appreciation (depreciation) of: | | | | |

Affiliated underlying fund shares | | | 108,093,182 | |

| |

Foreign currencies | | | 891,551 | |

| |

Forward foreign currency contracts | | | (731,427 | ) |

| |

Futures contracts | | | 224,534 | |

| |

Swap agreements | | | (2,075,214 | ) |

| |

| | | 106,402,626 | |

| |

Net realized and unrealized gain | | | 306,454,114 | |

| |

Net increase in net assets resulting from operations | | $ | 319,708,295 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 Invesco Active Allocation Fund

Statement of Changes in Net Assets

For the years ended December 31, 2021 and 2020

| | | | | | | | |

| | | 2021 | | | 2020 | |

| |

Operations: | | | | | | | | |

Net investment income | | | $ 13,254,181 | | | | $ 17,754,099 | |

| |

Net realized gain | | | 200,051,488 | | | | 253,041,378 | |

| |

Change in net unrealized appreciation (depreciation) | | | 106,402,626 | | | | (5,515,139 | ) |

| |

Net increase in net assets resulting from operations | | | 319,708,295 | | | | 265,280,338 | |

| |

| |

Distributions to shareholders from distributable earnings: | | | | | |

Class A | | | (153,175,119 | ) | | | (214,320,063 | ) |

| |

Class C | | | (18,154,278 | ) | | | (34,582,803 | ) |

| |

Class R | | | (12,616,970 | ) | | | (16,220,779 | ) |

| |

Class Y | | | (2,531,897 | ) | | | (3,252,106 | ) |

| |

Class R5 | | | (943 | ) | | | (1,324 | ) |

| |

Class R6 | | | (1,184 | ) | | | (1,328 | ) |

| |

Total distributions from distributable earnings | | | (186,480,391 | ) | | | (268,378,403 | ) |

| |

| | |

Share transactions–net: | | | | | | | | |

Class A | | | (109,520,434 | ) | | | 105,562,430 | |

| |

Class C | | | (29,604,925 | ) | | | (76,527,526 | ) |

| |

Class R | | | 11,774,429 | | | | 7,552,383 | |

| |

Class Y | | | 2,145,797 | | | | 2,361,651 | |

| |

Class R6 | | | 3,174 | | | | – | |

| |

Net increase (decrease) in net assets resulting from share transactions | | | (125,201,959 | ) | | | 38,948,938 | |

| |

Net increase in net assets | | | 8,025,945 | | | | 35,850,873 | |

| |

| | |

Net assets: | | | | | | | | |

Beginning of year | | | 2,412,441,307 | | | | 2,376,590,434 | |

| |

End of year | | | $2,420,467,252 | | | | $2,412,441,307 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

13 Invesco Active Allocation Fund

Financial Highlights

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset

value,

beginning

of period | | Net

investment

income

(loss)(a) | | Net gains

(losses)

on securities

(both

realized and

unrealized) | | Total from

investment

operations | | Dividends

from net

investment

income | | Distributions

from net

realized

gains | | Total

distributions | | Net asset

value, end

of period | | Total

return(b) | | Net assets,

end of period

(000’s omitted) | | Ratio of

expenses

to average

net assets

with fee waivers

and/or

expenses

absorbed(c) | | Ratio of

expenses

to average net

assets without

fee waivers

and/or

expenses

absorbed(d) | | Ratio of net

investment

income

(loss)

to average

net assets | | Portfolio

turnover (e) |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/21 | | | | $14.70 | | | | | $ 0.10 | | | | | $ 1.92 | | | | | $ 2.02 | | | | | $(0.32 | ) | | | | $(0.98 | ) | | | | $(1.30 | ) | | | | $15.42 | | | | | 13.92 | %(f) | | | | $1,973,745 | | | | | 0.45 | %(f) | | | | 0.47 | %(f) | | | | 0.64 | %(f) | | | | 16 | % |

Year ended 12/31/20 | | | | 14.66 | | | | | 0.13 | | | | | 1.76 | | | | | 1.89 | | | | | (0.14 | ) | | | | (1.71 | ) | | | | (1.85 | ) | | | | 14.70 | | | | | 13.04 | (f) | | | | 1,973,119 | | | | | 0.44 | (f) | | | | 0.48 | (f) | | | | 0.94 | (f) | | | | 70 | |

Eleven months ended 12/31/19 | | | | 13.89 | | | | | 0.21 | | | | | 1.85 | | | | | 2.06 | | | | | (0.44 | ) | | | | (0.85 | ) | | | | (1.29 | ) | | | | 14.66 | | | | | 14.84 | | | | | 1,867,751 | | | | | 0.52 | (g) | | | | 0.56 | (g) | | | | 1.52 | (g) | | | | 24 | |

Year ended 01/31/19 | | | | 15.25 | | | | | 0.15 | | | | | (1.27 | ) | | | | (1.12 | ) | | | | (0.24 | ) | | | | – | | | | | (0.24 | ) | | | | 13.89 | | | | | (7.22 | ) | | | | 1,636,759 | | | | | 0.53 | | | | | 0.57 | | | | | 1.04 | | | | | 38 | |

Year ended 01/31/18 | | | | 12.68 | | | | | 0.10 | | | | | 2.63 | | | | | 2.73 | | | | | (0.16 | ) | | | | – | | | | | (0.16 | ) | | | | 15.25 | | | | | 21.62 | | | | | 1,888,596 | | | | | 0.53 | | | | | 0.59 | | | | | 0.75 | | | | | 9 | |

Year ended 01/31/17 | | | | 11.38 | | | | | 0.15 | | | | | 1.27 | | | | | 1.42 | | | | | (0.12 | ) | | | | – | | | | | (0.12 | ) | | | | 12.68 | | | | | 12.50 | | | | | 1,645,373 | | | | | 0.56 | | | | | 0.60 | | | | | 1.20 | | | | | 5 | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/21 | | | | 14.34 | | | | | (0.02 | ) | | | | 1.86 | | | | | 1.84 | | | | | (0.19 | ) | | | | (0.98 | ) | | | | (1.17 | ) | | | | 15.01 | | | | | 13.01 | | | | | 247,857 | | | | | 1.21 | | | | | 1.23 | | | | | (0.12 | ) | | | | 16 | |

Year ended 12/31/20 | | | | 14.35 | | | | | 0.02 | | | | | 1.70 | | | | | 1.72 | | | | | (0.02 | ) | | | | (1.71 | ) | | | | (1.73 | ) | | | | 14.34 | | | | | 12.18 | | | | | 263,343 | | | | | 1.20 | | | | | 1.24 | | | | | 0.18 | | | | | 70 | |

Eleven months ended 12/31/19 | | | | 13.60 | | | | | 0.10 | | | | | 1.81 | | | | | 1.91 | | | | | (0.31 | ) | | | | (0.85 | ) | | | | (1.16 | ) | | | | 14.35 | | | | | 14.09 | | | | | 342,957 | | | | | 1.28 | (g) | | | | 1.32 | (g) | | | | 0.76 | (g) | | | | 24 | |

Year ended 01/31/19 | | | | 14.92 | | | | | 0.04 | | | | | (1.23 | ) | | | | (1.19 | ) | | | | (0.13 | ) | | | | – | | | | | (0.13 | ) | | | | 13.60 | | | | | (7.92 | ) | | | | 489,474 | | | | | 1.28 | | | | | 1.32 | | | | | 0.28 | | | | | 38 | |

Year ended 01/31/18 | | | | 12.41 | | | | | (0.00 | ) | | | | 2.57 | | | | | 2.57 | | | | | (0.06 | ) | | | | – | | | | | (0.06 | ) | | | | 14.92 | | | | | 20.72 | | | | | 579,999 | | | | | 1.28 | | | | | 1.34 | | | | | (0.03 | ) | | | | 9 | |

Year ended 01/31/17 | | | | 11.14 | | | | | 0.05 | | | | | 1.25 | | | | | 1.30 | | | | | (0.03 | ) | | | | – | | | | | (0.03 | ) | | | | 12.41 | | | | | 11.66 | | | | | 535,568 | | | | | 1.31 | | | | | 1.35 | | | | | 0.44 | | | | | 5 | |

Class R | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/21 | | | | 14.60 | | | | | 0.06 | | | | | 1.91 | | | | | 1.97 | | | | | (0.28 | ) | | | | (0.98 | ) | | | | (1.26 | ) | | | | 15.31 | | | | | 13.64 | | | | | 166,900 | | | | | 0.71 | | | | | 0.73 | | | | | 0.38 | | | | | 16 | |

Year ended 12/31/20 | | | | 14.58 | | | | | 0.09 | | | | | 1.74 | | | | | 1.83 | | | | | (0.10 | ) | | | | (1.71 | ) | | | | (1.81 | ) | | | | 14.60 | | | | | 12.70 | | | | | 147,675 | | | | | 0.70 | | | | | 0.74 | | | | | 0.68 | | | | | 70 | |

Eleven months ended 12/31/19 | | | | 13.82 | | | | | 0.17 | | | | | 1.83 | | | | | 2.00 | | | | | (0.39 | ) | | | | (0.85 | ) | | | | (1.24 | ) | | | | 14.58 | | | | | 14.54 | | | | | 139,693 | | | | | 0.77 | (g) | | | | 0.81 | (g) | | | | 1.27 | (g) | | | | 24 | |

Year ended 01/31/19 | | | | 15.17 | | | | | 0.11 | | | | | (1.26 | ) | | | | (1.15 | ) | | | | (0.20 | ) | | | | – | | | | | (0.20 | ) | | | | 13.82 | | | | | (7.44 | ) | | | | 125,162 | | | | | 0.78 | | | | | 0.82 | | | | | 0.78 | | | | | 38 | |

Year ended 01/31/18 | | | | 12.62 | | | | | 0.07 | | | | | 2.61 | | | | | 2.68 | | | | | (0.13 | ) | | | | – | | | | | (0.13 | ) | | | | 15.17 | | | | | 21.28 | | | | | 134,457 | | | | | 0.78 | | | | | 0.84 | | | | | 0.49 | | | | | 9 | |

Year ended 01/31/17 | | | | 11.32 | | | | | 0.11 | | | | | 1.28 | | | | | 1.39 | | | | | (0.09 | ) | | | | – | | | | | (0.09 | ) | | | | 12.62 | | | | | 12.29 | | | | | 117,356 | | | | | 0.81 | | | | | 0.85 | | | | | 0.94 | | | | | 5 | |

Class Y | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/21 | | | | 14.94 | | | | | 0.14 | | | | | 1.96 | | | | | 2.10 | | | | | (0.36 | ) | | | | (0.98 | ) | | | | (1.34 | ) | | | | 15.70 | | | | | 14.24 | | | | | 31,941 | | | | | 0.21 | | | | | 0.23 | | | | | 0.88 | | | | | 16 | |

Year ended 12/31/20 | | | | 14.88 | | | | | 0.17 | | | | | 1.77 | | | | | 1.94 | | | | | (0.17 | ) | | | | (1.71 | ) | | | | (1.88 | ) | | | | 14.94 | | | | | 13.22 | | | | | 28,284 | | | | | 0.20 | | | | | 0.24 | | | | | 1.18 | | | | | 70 | |

Eleven months ended 12/31/19 | | | | 14.08 | | | | | 0.24 | | | | | 1.88 | | | | | 2.12 | | | | | (0.47 | ) | | | | (0.85 | ) | | | | (1.32 | ) | | | | 14.88 | | | | | 15.11 | | | | | 26,168 | | | | | 0.28 | (g) | | | | 0.32 | (g) | | | | 1.76 | (g) | | | | 24 | |

Year ended 01/31/19 | | | | 15.42 | | | | | 0.19 | | | | | (1.29 | ) | | | | (1.10 | ) | | | | (0.24 | ) | | | | – | | | | | (0.24 | ) | | | | 14.08 | | | | | (7.00 | ) | | | | 24,190 | | | | | 0.29 | | | | | 0.33 | | | | | 1.28 | | | | | 38 | |

Year ended 01/31/18 | | | | 12.81 | | | | | 0.13 | | | | | 2.68 | | | | | 2.81 | | | | | (0.20 | ) | | | | – | | | | | (0.20 | ) | | | | 15.42 | | | | | 21.98 | | | | | 63,523 | | | | | 0.28 | | | | | 0.34 | | | | | 0.90 | | | | | 9 | |

Year ended 01/31/17 | | | | 11.51 | | | | | 0.20 | | | | | 1.26 | | | | | 1.46 | | | | | (0.16 | ) | | | | – | | | | | (0.16 | ) | | | | 12.81 | | | | | 12.69 | | | | | 56,496 | | | | | 0.31 | | | | | 0.35 | | | | | 1.65 | | | | | 5 | |

Class R5 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/21 | | | | 14.68 | | | | | 0.14 | | | | | 1.92 | | | | | 2.06 | | | | | (0.37 | ) | | | | (0.98 | ) | | | | (1.35 | ) | | | | 15.39 | | | | | 14.19 | | | | | 11 | | | | | 0.19 | | | | | 0.21 | | | | | 0.90 | | | | | 16 | |

Year ended 12/31/20 | | | | 14.65 | | | | | 0.17 | | | | | 1.75 | | | | | 1.92 | | | | | (0.18 | ) | | | | (1.71 | ) | | | | (1.89 | ) | | | | 14.68 | | | | | 13.29 | | | | | 10 | | | | | 0.18 | | | | | 0.22 | | | | | 1.20 | | | | | 70 | |

Period ended 12/31/19(h) | | | | 14.28 | | | | | 0.16 | | | | | 1.54 | | | | | 1.70 | | | | | (0.48 | ) | | | | (0.85 | ) | | | | (1.33 | ) | | | | 14.65 | | | | | 11.94 | | | | | 10 | | | | | 0.22 | (g) | | | | 0.26 | (g) | | | | 1.82 | (g) | | | | 24 | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 12/31/21 | | | | 14.67 | | | | | 0.14 | | | | | 1.93 | | | | | 2.07 | | | | | (0.37 | ) | | | | (0.98 | ) | | | | (1.35 | ) | | | | 15.39 | | | | | 14.29 | | | | | 14 | | | | | 0.19 | | | | | 0.21 | | | | | 0.90 | | | | | 16 | |

Year ended 12/31/20 | | | | 14.65 | | | | | 0.17 | | | | | 1.75 | | | | | 1.92 | | | | | (0.19 | ) | | | | (1.71 | ) | | | | (1.90 | ) | | | | 14.67 | | | | | 13.25 | | | | | 10 | | | | | 0.17 | | | | | 0.22 | | | | | 1.21 | | | | | 70 | |

Period ended 12/31/19(h) | | | | 14.28 | | | | | 0.17 | | | | | 1.54 | | | | | 1.71 | | | | | (0.49 | ) | | | | (0.85 | ) | | | | (1.34 | ) | | | | 14.65 | | | | | 12.02 | | | | | 10 | | | | | 0.14 | (g) | | | | 0.18 | (g) | | | | 1.90 | (g) | | | | 24 | |

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Does not include sales charges and is not annualized for periods less than one year, if applicable. |

| (c) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the Fund invests. Because the underlying funds have varied expenses and fee levels and the Fund may own different proportions at different times, the amount of fees and expenses incurred indirectly by the Fund will vary. Estimated underlying fund expenses are not expenses that are incurred directly by the Fund. They are expenses that are incurred directly by the underlying funds and are deducted from the value of the funds the Fund invests in. The effect of the estimated underlying fund expenses that the Fund bears indirectly is included in the Fund’s total return. Estimated acquired fund fees from underlying funds was 0.53% and 0.63% for the years ended December 31, 2021 and 2020, respectively. |

| (d) | Does not include indirect expenses from affiliated fund fees and expenses of 0.62%, 0.63%, 0.63% and 0.63% for the eleven months ended December 31, 2019, and for the years ended January 31, 2019, 2018 and 2017, respectively. |

| (e) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. |

| (f) | The total return, ratio of expenses to average net assets and ratio of net investment income to average net assets reflect actual 12b-1 fees of 0.24% for the years ended December 31, 2021 and 2020, respectively. |

| (h) | Commencement date after the close of business on May 24, 2019. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

14 Invesco Active Allocation Fund

Notes to Financial Statements

December 31, 2021

NOTE 1–Significant Accounting Policies

Invesco Active Allocation Fund (the “Fund”) is a series portfolio of AIM Growth Series (Invesco Growth Series) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company authorized to issue an unlimited number of shares of beneficial interest. Information presented in these financial statements pertains only to the Fund. Matters affecting the Fund or each class will be voted on exclusively by the shareholders of the Fund or each class.

The Fund’s investment objective is to seek total return.

The Fund currently consists of six different classes of shares: Class A, Class C, Class R, Class Y, Class R5 and Class R6. Class Y shares are available only to certain investors. Class A shares are sold with a front-end sales charge unless certain waiver criteria are met. Under certain circumstances, load waived shares may be subject to contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class R, Class Y, Class R5 and Class R6 shares are sold at net asset value. Class C shares held for eight years after purchase are eligible for automatic conversion into Class A shares of the same Fund (the “Conversion Feature”). The automatic conversion pursuant to the Conversion Feature will generally occur at the end of the month following the eighth anniversary after a purchase of Class C shares.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations – Securities of investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded. Investments in shares of funds that are not traded on an exchange are valued at the end-of-day net asset value per share of such fund. Securities in the underlying funds, including restricted securities, are valued in accordance with the valuation policy of such fund. The policies of the underlying funds affiliated with the Funds, as a result of having the same investment adviser, are set forth below. |

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining net asset value (“NAV”) per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Variable rate senior loan interests are fair valued using quotes provided by an independent pricing service. Quotes provided by the pricing service may reflect appropriate factors such as ratings, tranche type, industry, company performance, spread, individual trading characteristics, institution-size trading in similar groups of securities and other market data.

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end-of-day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Pricing services generally value debt obligations assuming orderly transactions of institutional round lot size, but a fund may hold or transact in the same securities in smaller, odd lot sizes. Odd lots often trade at lower prices than institutional round lots. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Swap agreements are fair valued using an evaluated quote, if available, provided by an independent pricing service. Evaluated quotes provided by the pricing service are valued based on a model which may include end-of-day net present values, spreads, ratings, industry, company performance and returns of referenced assets. Centrally cleared swap agreements are valued at the daily settlement price determined by the relevant exchange or clearinghouse.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the investment adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Funds may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain of each Fund’s investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general market conditions which are not specifically related to the particular issuer, such as real or perceived adverse economic conditions, changes in the general outlook for revenues or corporate earnings, changes in interest or currency rates, regional or global instability, natural or environmental disasters, widespread disease or

15 Invesco Active Allocation Fund

other public health issues, war, acts of terrorism or adverse investor sentiment generally and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| B. | Securities Transactions and Investment Income – Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Distributions from ordinary income from underlying funds, if any, are recorded as dividend income on ex-dividend date. Distributions from gains from underlying funds, if any, are recorded as realized gains on the ex-dividend date. The following policies are followed by the underlying funds: Interest income (net of withholding tax, if any) is recorded on an accrual basis from settlement date and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Pay-in-kind interest income and non-cash dividend income received in the form of securities in-lieu of cash are recorded at the fair value of the securities received. Paydown gains and losses on mortgage and asset-backed securities are recorded as adjustments to interest income. |

The Fund may periodically participate in litigation related to the Fund’s investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

| C. | Country Determination – For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

| D. | Distributions – Distributions from net investment income and net realized capital gain, if any, are generally declared and paid annually and recorded on the ex-dividend date. The Fund may elect to treat a portion of the proceeds from redemptions as distributions for federal income tax purposes. |

| E. | Federal Income Taxes – The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| F. | Expenses – Expenses included in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses of the underlying funds. The effects of the underlying funds expenses are included in the realized and unrealized gain/loss on the investments in the underlying funds. Estimated expenses of the underlying funds are discussed further within the Financial Highlights. |

Fees provided for under the Rule 12b-1 plan of a particular class of the Fund and which are directly attributable to that class are charged to the operations of such class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses attributable to Class R5 and Class R6 are allocated based on relative net assets of Class R5 and Class R6. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses relating to all other classes are allocated among those classes based on relative net assets. All other expenses are allocated among the classes based on relative net assets.

| G. | Accounting Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

| H. | Indemnifications – Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

| I. | Securities Lending – The Fund may lend portfolio securities having a market value up to one-third of the Fund’s total assets. Such loans are secured by collateral equal to no less than the market value of the loaned securities determined daily by the securities lending provider. Such collateral will be cash or debt securities issued or guaranteed by the U.S. Government or any of its sponsored agencies. Cash collateral received in connection with these loans is invested in short-term money market instruments or affiliated, unregistered investment companies that comply with Rule 2a-7 under the Investment Company Act and money market funds (collectively, “affiliated money market funds”) and is shown as such on the Schedule of Investments. The Fund bears the risk of loss with respect to the investment of collateral. It is the Fund’s policy to obtain additional collateral from or return excess collateral to the borrower by the end of the next business day, following the valuation date of the securities loaned. Therefore, the value of the collateral held may be temporarily less than the value of the securities on loan. When loaning securities, the Fund retains certain benefits of owning the securities, including the economic equivalent of dividends or interest generated by the security. Lending securities entails a risk of loss to the Fund if, and to the extent that, the market value of the securities loaned were to increase and the borrower did not increase the collateral accordingly, and the borrower failed to return the securities. The securities loaned are subject to termination at the option of the borrower or the Fund. Upon termination, the borrower will return to the Fund the securities loaned and the Fund will return the collateral. Upon the failure of the borrower to return the securities, collateral may be liquidated and the securities may be purchased on the open market to replace the loaned securities. The Fund could experience delays and costs in gaining access to the collateral and the securities may lose value during the delay which could result in potential losses to the Fund. Some of these losses may be indemnified by the lending agent. The Fund bears the risk of any deficiency in the amount of the collateral available for return to the borrower due to any loss on the collateral invested. Dividends received on cash collateral investments for securities lending transactions, which are net of compensation to counterparties, are included in Dividends from affiliated underlying funds on the Statement of Operations. The aggregate value of securities out on loan, if any, is shown as a footnote on the Statement of Assets and Liabilities. |

On September 29, 2021, the Board of Trustees appointed Invesco Advisers, Inc. (the “Adviser” or “Invesco”) to serve as an affiliated securities lending agent for the Fund. Prior to September 29, 2021, the Bank of New York Mellon (“BNYM”) served as the sole securities lending agent for the Fund under the securities lending program. BNYM also continues to serve as a lending agent. To the extent the Fund utilizes the Adviser as an affiliated securities lending agent, the Fund conducts its securities lending in accordance with, and in reliance upon, no-action letters issued by the SEC staff that provide guidance on how an affiliate may act as a direct agent lender and receive compensation for those services in a manner consistent with the federal securities laws. For the year ended December 31, 2021, the Fund paid the Adviser $1,137 in fees for securities lending agent services.

| J. | Foreign Currency Translations – Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. |

16 Invesco Active Allocation Fund