Consolidated financial statements and report of independent certified public accountants Tall Oak Midstream Operating, LLC and Subsidiaries December 31, 2022 Exhibit 99.2

Contents Page REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS 3 CONSOLIDATED FINANCIAL STATEMENTS CONSOLIDATED BALANCE SHEET 5 CONSOLIDATED STATEMENT OF OPERATIONS 6 CONSOLIDATED STATEMENT OF MEMBER’S EQUITY 7 CONSOLIDATED STATEMENT OF CASH FLOWS 8 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 9

GT.COM Grant Thornton LLP is the U.S. member firm of Grant Thornton International Ltd (GTIL). GTIL and each of its member firms are separate legal entities and are not a worldwide partnership. Board of Managers Tall Oak Midstream Operating, LLC Opinion We have audited the consolidated financial statements of Tall Oak Midstream Operating, LLC (a Delaware limited liability company) and subsidiaries (the “Company”), which comprise the consolidated balance sheet as of December 31, 2022 and the related consolidated statements of operations, member’s equity, and cash flows for the year then ended, and the related notes to the financial statements. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Basis for opinion We conducted our audits of the consolidated financial statements in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Emphasis of matter As discussed in Note 10 to the consolidated financial statements, the Company has adopted new accounting guidance in 2022 related to the accounting for leases. Our opinion is not modified with respect to this matter. Responsibilities of management for the financial statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date the financial statements are available to be issued. REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS GRANT THORNTON LLP 211 N Robinson Ave, Suite 1200 Oklahoma City, OK 73102-7148 D +1 405 218 2800 F +1 405 218 2801

Auditor’s responsibilities for the audit of the financial statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements. In performing an audit in accordance with US GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. Oklahoma City, Oklahoma April 14, 2023

Tall Oak Midstream Operating, LLC and Subsidiaries The accompanying notes are an integral part of this consolidated financial statement. 5 CONSOLIDATED BALANCE SHEET December 31, 2022 ASSETS CURRENT ASSETS Cash & cash equivalents $ 4,626,026 Accounts receivable 8,078,165 Accounts receivable – related party 2,312 Revenue receivable 15,578,150 Prepaid costs 976,383 Deposits 3,490 Inventory 432,617 Total current assets 29,697,143 PROPERTY, PLANT AND EQUIPMENT, net Property, plant and equipment 387,540,119 Accumulated depreciation (65,515,629) 322,024,490 Contract costs, net 25,979,869 Other assets, net 12,717,580 TOTAL ASSETS $ 390,419,082 LIABILITIES & MEMBER’S EQUITY CURRENT LIABILITIES Accounts payable & accrued liabilities $ 5,868,408 Revenue payable 14,097,327 Capital payable 6,900,000 Lease liabilities 10,929,764 Debt payable 6,250,000 Interest payable 472,147 Total current liabilities 44,517,646 Debt payable 65,627,480 Lease liabilities COMMITMENTS AND CONTINGENCIES (NOTE 9) 1,494,857 MEMBER’S EQUITY 278,779,099 TOTAL LIABILITIES & MEMBER’S EQUITY $ 390,419,082

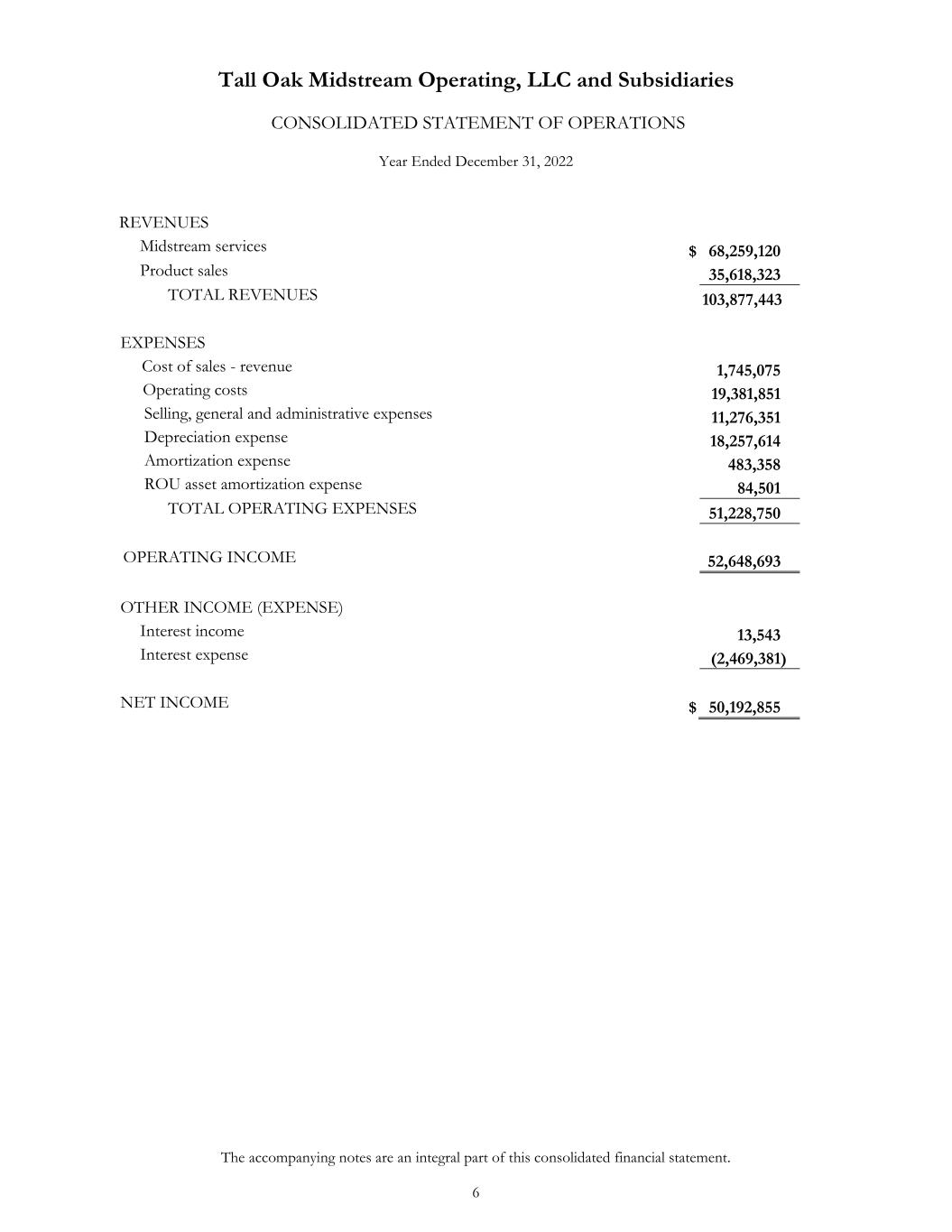

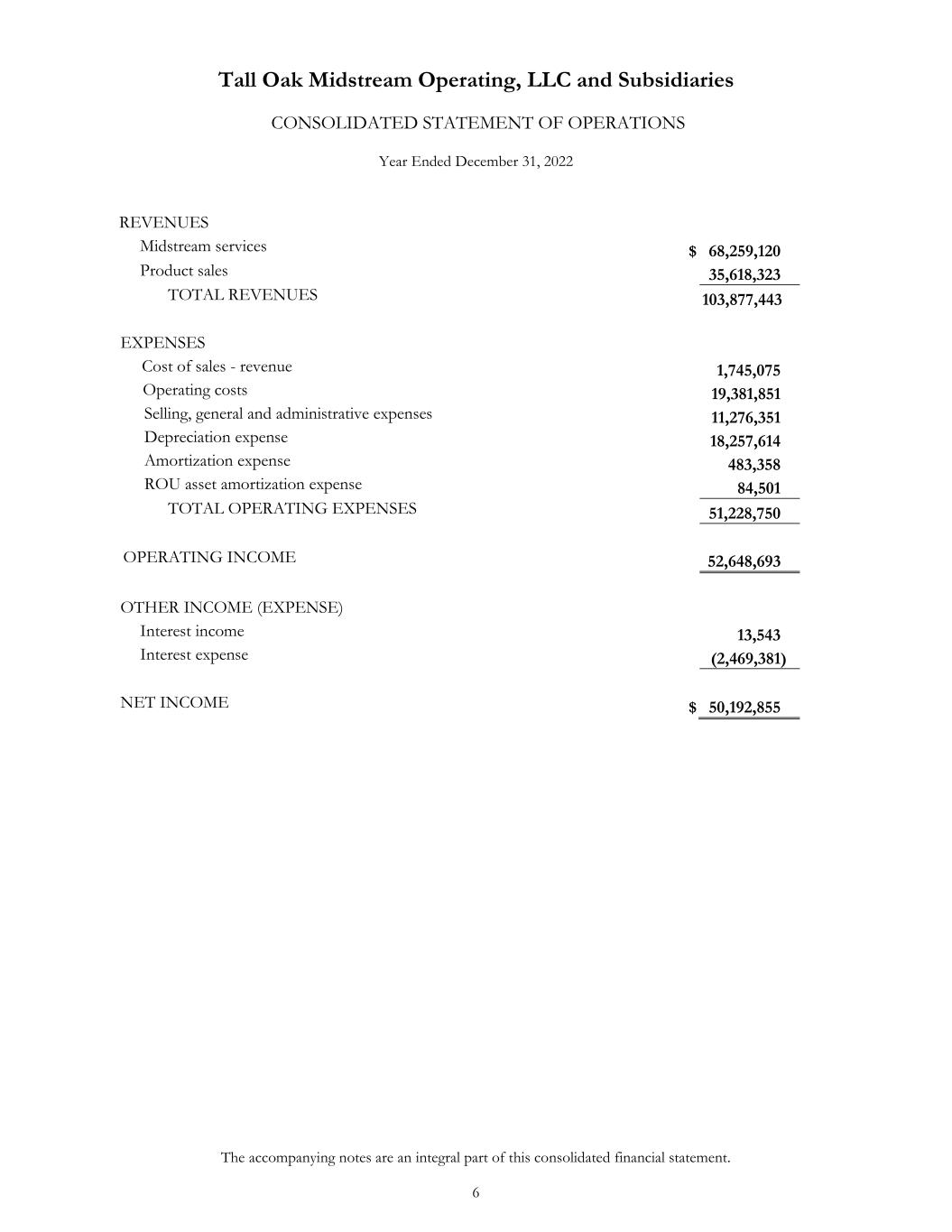

Tall Oak Midstream Operating, LLC and Subsidiaries The accompanying notes are an integral part of this consolidated financial statement. 6 CONSOLIDATED STATEMENT OF OPERATIONS Year Ended December 31, 2022 REVENUES Midstream services $ 68,259,120 Product sales 35,618,323 TOTAL REVENUES 103,877,443 EXPENSES Cost of sales - revenue 1,745,075 Operating costs 19,381,851 Selling, general and administrative expenses 11,276,351 Depreciation expense 18,257,614 Amortization expense 483,358 ROU asset amortization expense 84,501 TOTAL OPERATING EXPENSES 51,228,750 OPERATING INCOME 52,648,693 OTHER INCOME (EXPENSE) Interest income 13,543 Interest expense (2,469,381) NET INCOME $ 50,192,855

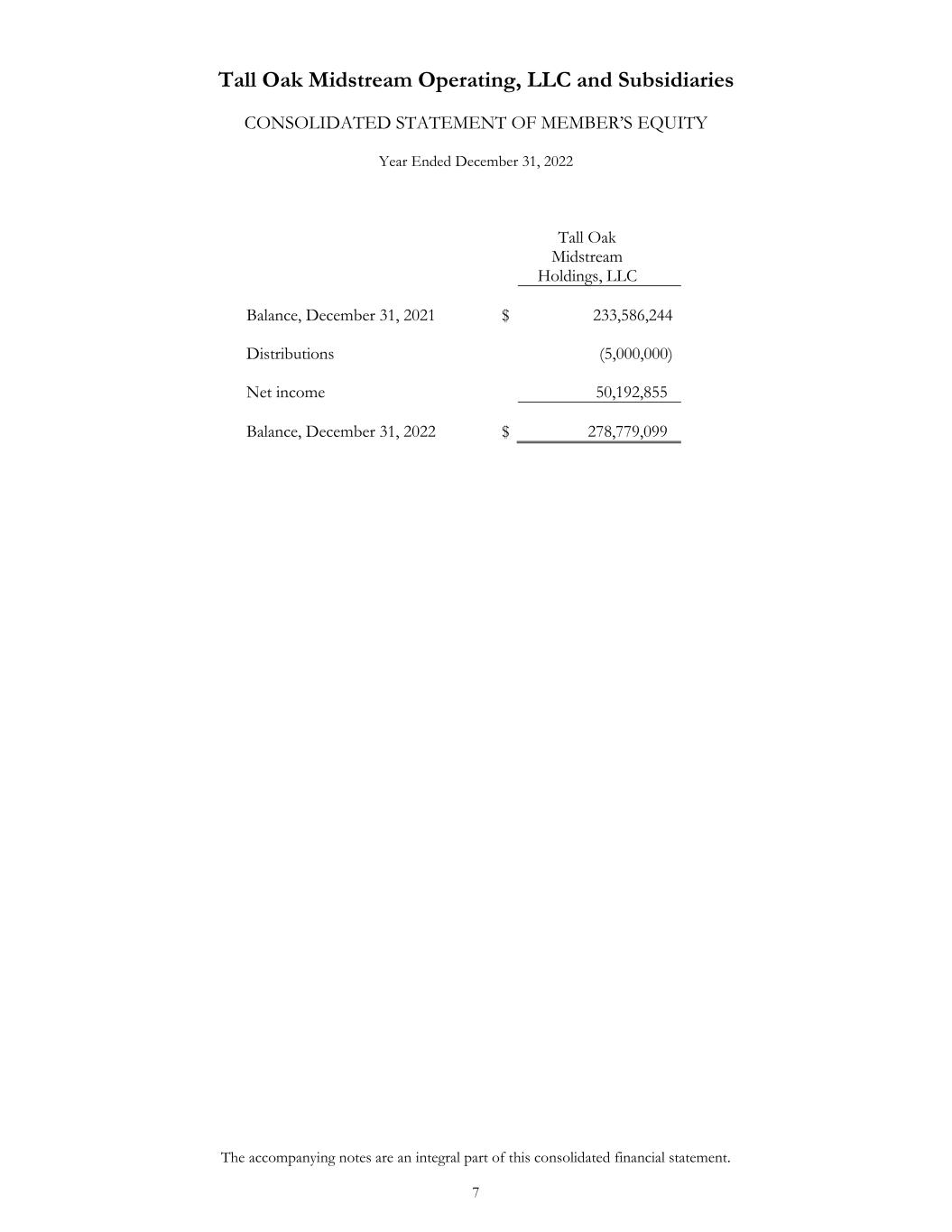

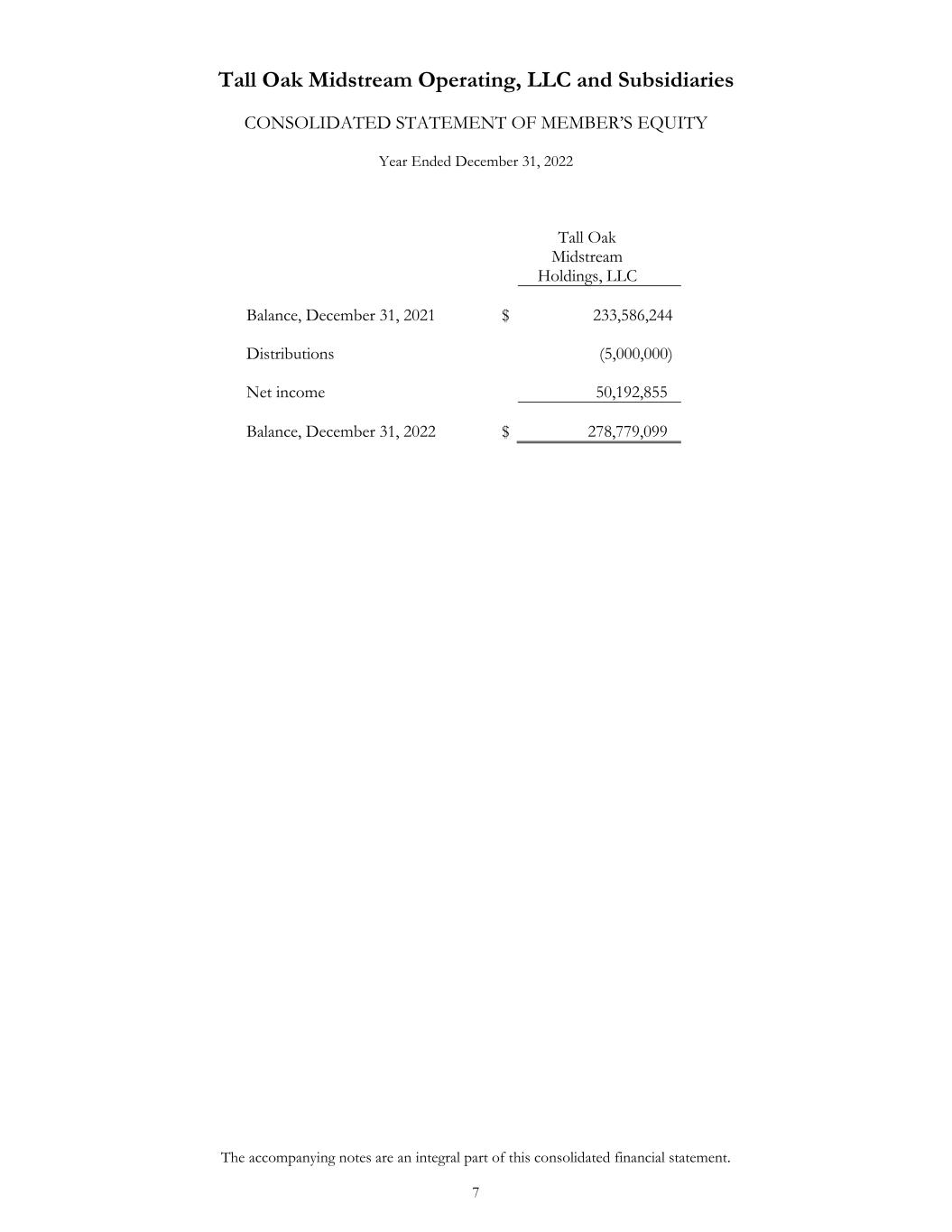

Tall Oak Midstream Operating, LLC and Subsidiaries The accompanying notes are an integral part of this consolidated financial statement. 7 CONSOLIDATED STATEMENT OF MEMBER’S EQUITY Year Ended December 31, 2022 Tall Oak Midstream Holdings, LLC Balance, December 31, 2021 $ 233,586,244 Distributions (5,000,000) Net income 50,192,855 Balance, December 31, 2022 $ 278,779,099

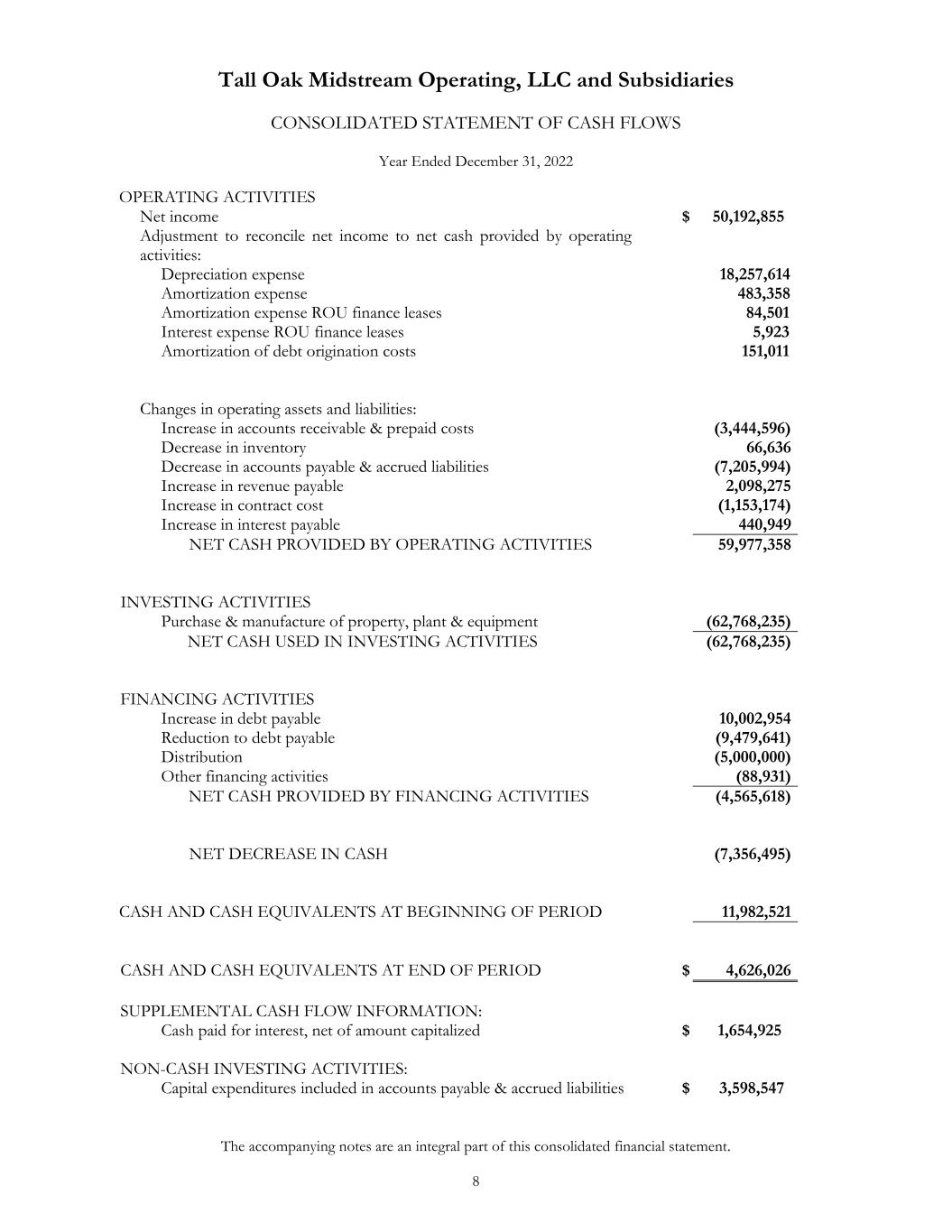

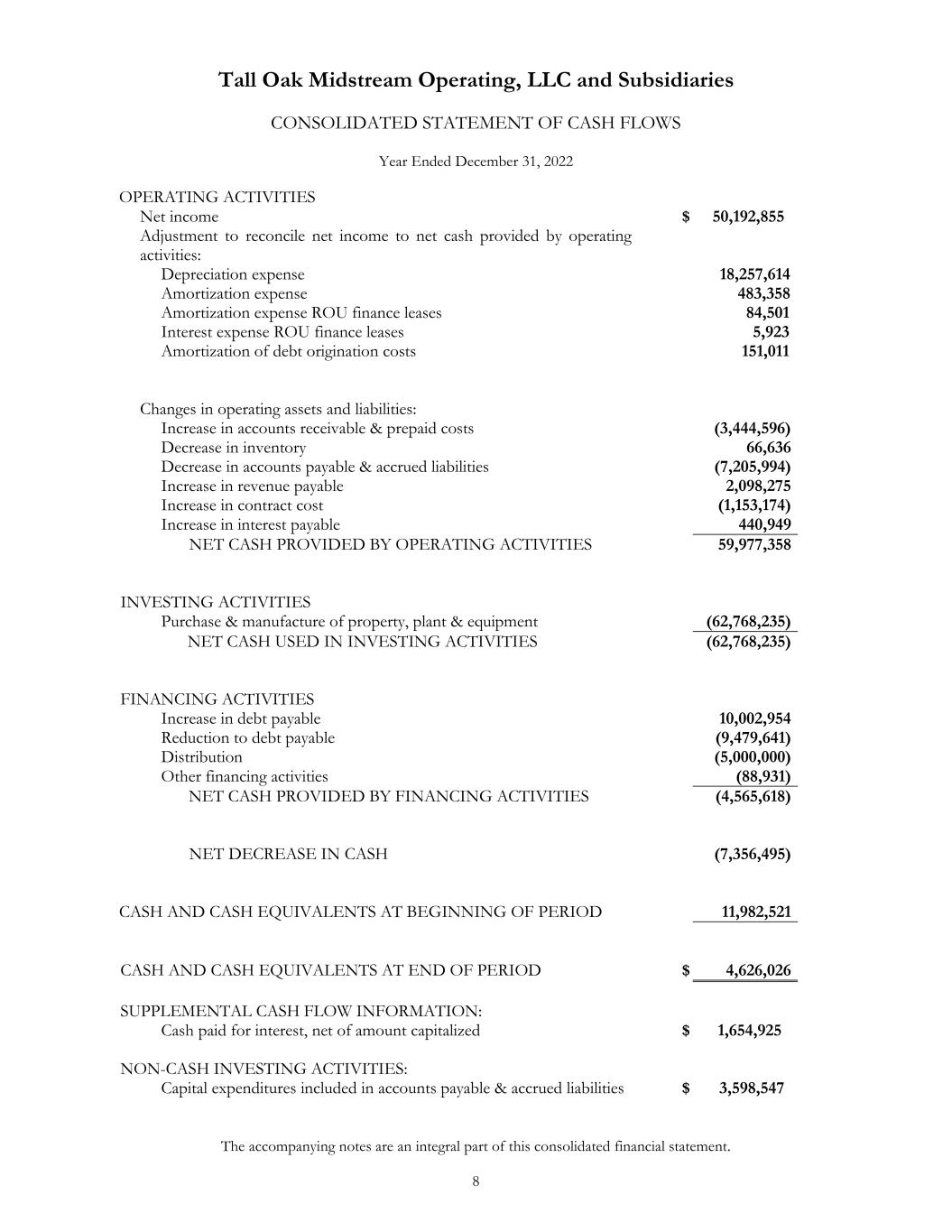

Tall Oak Midstream Operating, LLC and Subsidiaries The accompanying notes are an integral part of this consolidated financial statement. 8 CONSOLIDATED STATEMENT OF CASH FLOWS Year Ended December 31, 2022 OPERATING ACTIVITIES Net income $ 50,192,855 Adjustment to reconcile net income to net cash provided by operating activities: Depreciation expense 18,257,614 Amortization expense 483,358 Amortization expense ROU finance leases 84,501 Interest expense ROU finance leases 5,923 Amortization of debt origination costs 151,011 Changes in operating assets and liabilities: Increase in accounts receivable & prepaid costs (3,444,596) Decrease in inventory 66,636 Decrease in accounts payable & accrued liabilities (7,205,994) Increase in revenue payable 2,098,275 Increase in contract cost (1,153,174) Increase in interest payable 440,949 NET CASH PROVIDED BY OPERATING ACTIVITIES 59,977,358 INVESTING ACTIVITIES Purchase & manufacture of property, plant & equipment (62,768,235) NET CASH USED IN INVESTING ACTIVITIES (62,768,235) FINANCING ACTIVITIES Increase in debt payable Reduction to debt payable 10,002,954 (9,479,641) Distribution (5,000,000) Other financing activities (88,931) NET CASH PROVIDED BY FINANCING ACTIVITIES (4,565,618) NET DECREASE IN CASH (7,356,495) CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 11,982,521 CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 4,626,026 SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest, net of amount capitalized $ 1,654,925 NON-CASH INVESTING ACTIVITIES: Capital expenditures included in accounts payable & accrued liabilities $ 3,598,547

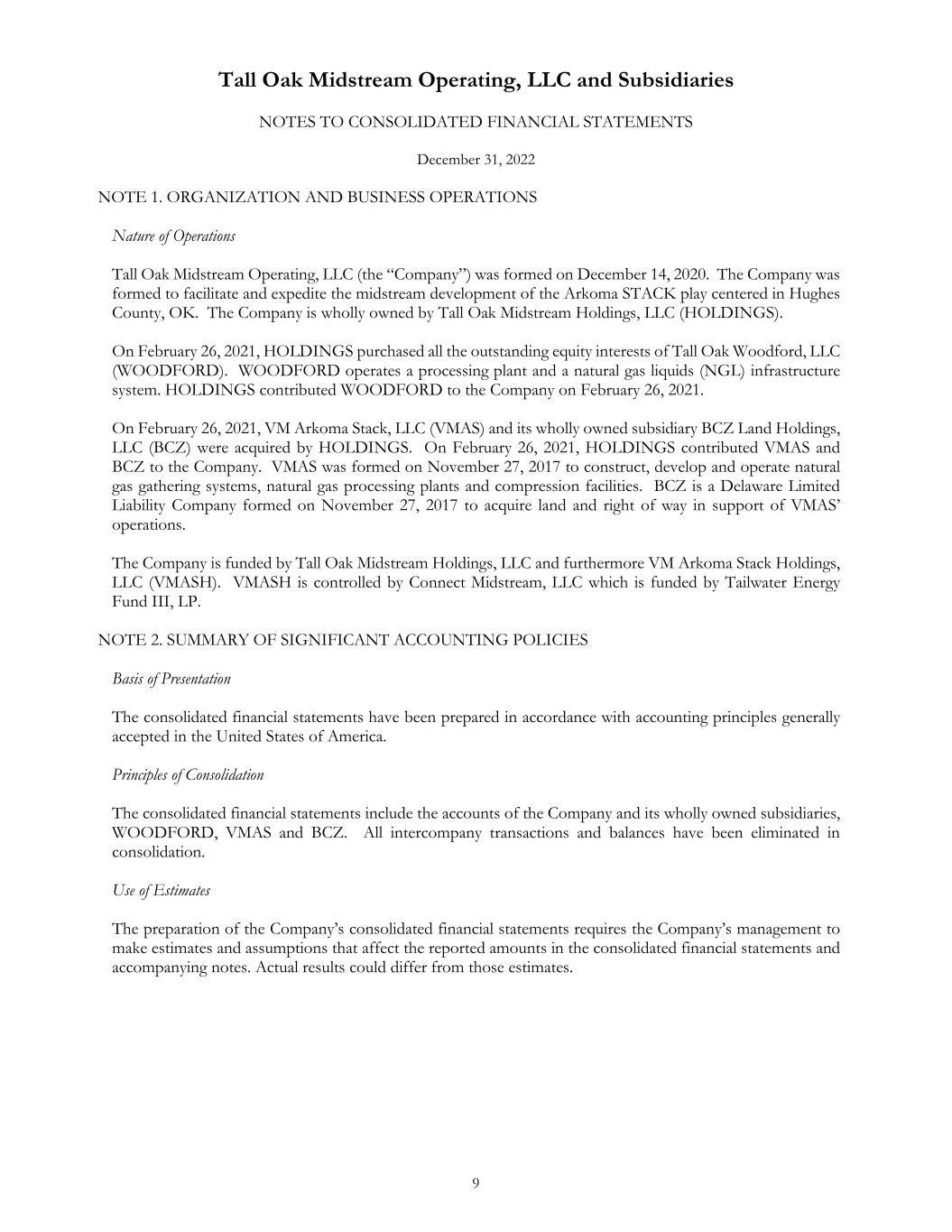

Tall Oak Midstream Operating, LLC and Subsidiaries 9 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2022 NOTE 1. ORGANIZATION AND BUSINESS OPERATIONS Nature of Operations Tall Oak Midstream Operating, LLC (the “Company”) was formed on December 14, 2020. The Company was formed to facilitate and expedite the midstream development of the Arkoma STACK play centered in Hughes County, OK. The Company is wholly owned by Tall Oak Midstream Holdings, LLC (HOLDINGS). On February 26, 2021, HOLDINGS purchased all the outstanding equity interests of Tall Oak Woodford, LLC (WOODFORD). WOODFORD operates a processing plant and a natural gas liquids (NGL) infrastructure system. HOLDINGS contributed WOODFORD to the Company on February 26, 2021. On February 26, 2021, VM Arkoma Stack, LLC (VMAS) and its wholly owned subsidiary BCZ Land Holdings, LLC (BCZ) were acquired by HOLDINGS. On February 26, 2021, HOLDINGS contributed VMAS and BCZ to the Company. VMAS was formed on November 27, 2017 to construct, develop and operate natural gas gathering systems, natural gas processing plants and compression facilities. BCZ is a Delaware Limited Liability Company formed on November 27, 2017 to acquire land and right of way in support of VMAS’ operations. The Company is funded by Tall Oak Midstream Holdings, LLC and furthermore VM Arkoma Stack Holdings, LLC (VMASH). VMASH is controlled by Connect Midstream, LLC which is funded by Tailwater Energy Fund III, LP. NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Basis of Presentation The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. Principles of Consolidation The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, WOODFORD, VMAS and BCZ. All intercompany transactions and balances have been eliminated in consolidation. Use of Estimates The preparation of the Company’s consolidated financial statements requires the Company’s management to make estimates and assumptions that affect the reported amounts in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Tall Oak Midstream Operating, LLC and Subsidiaries 10 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2022 NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED Cash and Cash Equivalents The Company considers all highly liquid instruments with an original maturity of three months or less at the time of issuance to be cash equivalents. The Company places its cash and cash equivalents with reputable financial institutions. At times, balances deposited may exceed FDIC insured limits. The Company has not incurred any losses related to these deposits. Revenue Recognition The Company generates the majority of its revenues from midstream energy services, including gathering, compressing, processing and marketing, through various contractual arrangements, which include fee-based contract arrangements. While its transactions vary in form, the essential element of each transaction is the use of its assets to transport a product or provide a processed product to an end-user at the tailgate of the plant. Revenues from both “Product sales” and “Midstream services” represent revenues from contracts with customers and are reflected on the consolidated statement of operations as follows: • Product sales —Product sales represent the sale of natural gas, NGLs and condensate where the product is sold in connection with providing our midstream services as outlined above. • Midstream services —Midstream services represent all other revenue generated as a result of performing our midstream services as outlined above. Evaluation of Its Contractual Performance Obligations The Company evaluates its contracts with customers that are within the scope of ASC 606. In accordance with the new revenue recognition framework introduced by ASC 606, the Company identifies its performance obligations under its contracts with customers. These performance obligations include promises to perform midstream services for its customers over a specified contractual term. The identification of performance obligations under its contracts requires a contract-by-contract evaluation of when control, including the economic benefit, of commodities transfers to and from us (if at all). For contracts where control of commodities never transfers to us and the Company simply earns a fee for its services, the Company recognizes these fees as midstream services revenues over time as the Company satisfies its performance obligations. The Company acts as an agent and its consolidated statements of operations reflect midstream services revenues that the Company earns based on the terms contained in the applicable contract.

Tall Oak Midstream Operating, LLC and Subsidiaries 11 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2022 NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED Accounting Methodology for Certain Contracts The Company’s midstream service contracts related to NGL or natural gas gathering and processing do not contain a commodity purchase and the Company does not control the commodity. The Company earns a fee for its services and considers these contracts to contain performance obligations for its services. Accordingly, the Company considers the satisfaction of these performance obligations as revenue-generating, and the Company recognizes the fees received for satisfying these performance obligations as midstream service revenues over time as the Company satisfies its performance obligations. The Company also evaluates its contractual arrangements that contain a purchase and sale of commodities under the principal/agent provisions in ASC 606. For contracts where the Company possesses control of the commodity and acts as principal in the purchase and sale, the Company records product sales revenue at the price at which the commodities are sold, with a corresponding cost of sales equal to the cost of the commodities when purchased. For contracts in which the Company does not possess control of the commodities and is acting as an agent, its consolidated statements of operations reflect midstream services revenues that the Company earns based on the terms contained in the applicable contract. Satisfaction of Performance Obligations and Recognition of Revenue For its commodity sales contracts, the Company satisfies its performance obligations at the point in time at which the commodity transfers from us to the customer. This transfer pattern aligns with its billing methodology. Therefore, the Company recognizes product sales revenue at the time the commodity is delivered and in the amount to which the Company has the right to invoice the customer. For its midstream service contracts that contain revenue-generating performance obligations, the Company satisfies its performance obligations over time as the Company performs the midstream services and as the customer receives the benefit of these services over the term of the contract. As permitted by ASC 606, the Company is utilizing the practical expedient that allows an entity to recognize revenue in the amount to which the entity has a right to invoice, since the Company has a right to consideration from its customer in an amount that corresponds directly with the value to the customer of its performance completed to date. Accordingly, the Company recognizes revenue over time as its midstream services are performed. The Company generally accrues one month of sales and the related natural gas, NGL, and condensate purchases and reverses these accruals when the sales and purchases are invoiced and recorded in the subsequent month. Actual results could differ from the accrual estimates. The Company typically receives payment for invoiced amounts within one month, depending on the terms of the contract. The Company accounts for taxes collected from customers attributable to revenue transactions and remitted to government authorities on a net basis (excluded from revenues). Revenue Receivable Balances receivable from product sales are presented as revenue receivable on the consolidated balance sheet.

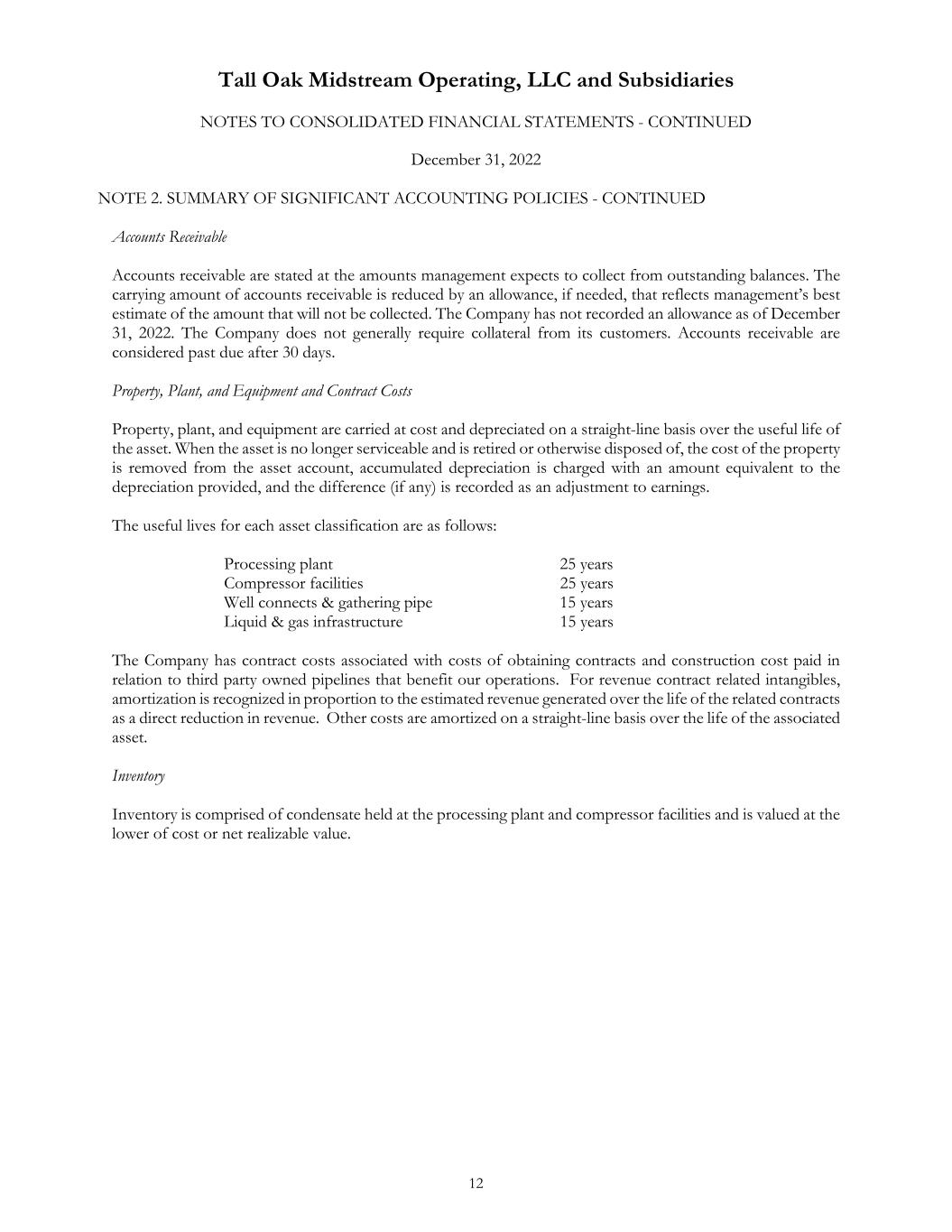

Tall Oak Midstream Operating, LLC and Subsidiaries 12 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2022 NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED Accounts Receivable Accounts receivable are stated at the amounts management expects to collect from outstanding balances. The carrying amount of accounts receivable is reduced by an allowance, if needed, that reflects management’s best estimate of the amount that will not be collected. The Company has not recorded an allowance as of December 31, 2022. The Company does not generally require collateral from its customers. Accounts receivable are considered past due after 30 days. Property, Plant, and Equipment and Contract Costs Property, plant, and equipment are carried at cost and depreciated on a straight-line basis over the useful life of the asset. When the asset is no longer serviceable and is retired or otherwise disposed of, the cost of the property is removed from the asset account, accumulated depreciation is charged with an amount equivalent to the depreciation provided, and the difference (if any) is recorded as an adjustment to earnings. The useful lives for each asset classification are as follows: Processing plant 25 years Compressor facilities 25 years Well connects & gathering pipe 15 years Liquid & gas infrastructure 15 years The Company has contract costs associated with costs of obtaining contracts and construction cost paid in relation to third party owned pipelines that benefit our operations. For revenue contract related intangibles, amortization is recognized in proportion to the estimated revenue generated over the life of the related contracts as a direct reduction in revenue. Other costs are amortized on a straight-line basis over the life of the associated asset. Inventory Inventory is comprised of condensate held at the processing plant and compressor facilities and is valued at the lower of cost or net realizable value.

Tall Oak Midstream Operating, LLC and Subsidiaries 13 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2022 NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED Impairments of Long-Lived Assets and Contract Costs The Company reviews long-lived assets and contract costs for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The recoverability of an asset to be held and used is measured by a comparison of the carrying amount of the asset to future net undiscounted cash flows expected to be generated by the asset. Individual assets are grouped at the lowest level for which the related identifiable cash flows are largely independent of the cash flows of other assets and liabilities. These cash flow estimates require management to make judgments and assumptions related to operating and cash flow results, economic obsolescence, the business climate, contractual, legal and other factors. If the carrying amount exceeds the expected future undiscounted cash flows, the Company recognizes a non-cash impairment loss equal to the excess of net book value over fair value as determined by present value techniques. The estimated cash flows used to assess recoverability of our long-lived assets and measure fair value of our asset group are derived from current business plans, which are developed using near-term and long-term price assumptions, other key assumptions include volume projections, operating costs, timing of incurring such costs, and the use of appropriate values and discount rates. Any changes management makes to these projections and assumptions can result in significant revisions to management’s evaluation of recoverability of its long-lived assets and the recognition of additional impairments. The Company believes its estimates and models used to determine fair values are similar to what a market participant would use. Financial Instruments The carrying value of cash and cash equivalents, accounts payable and accrued liabilities are representative of fair value due to the short-term nature of the instruments. Income Taxes The Company is organized as a Delaware Limited Liability Company. The taxable income of the Company will be included in the federal income tax returns filed by its Members. Accordingly, no tax provision has been made in the consolidated financial statements of the Company. ASC Topic 740, Income Taxes, related to accounting for uncertainty in income taxes, requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Company’s tax returns and disallows the recognition of tax positions not deemed to meet a “more-likely-than-not” threshold of being sustained by the applicable tax authority. The Company’s management does not believe it has any tax positions taken that would not meet this threshold and that would require recognition in these consolidated financial statements. The Company’s policy is to reflect interest and penalties related to uncertain tax positions as part of its selling, general, and administrative expenses when and if they become applicable.

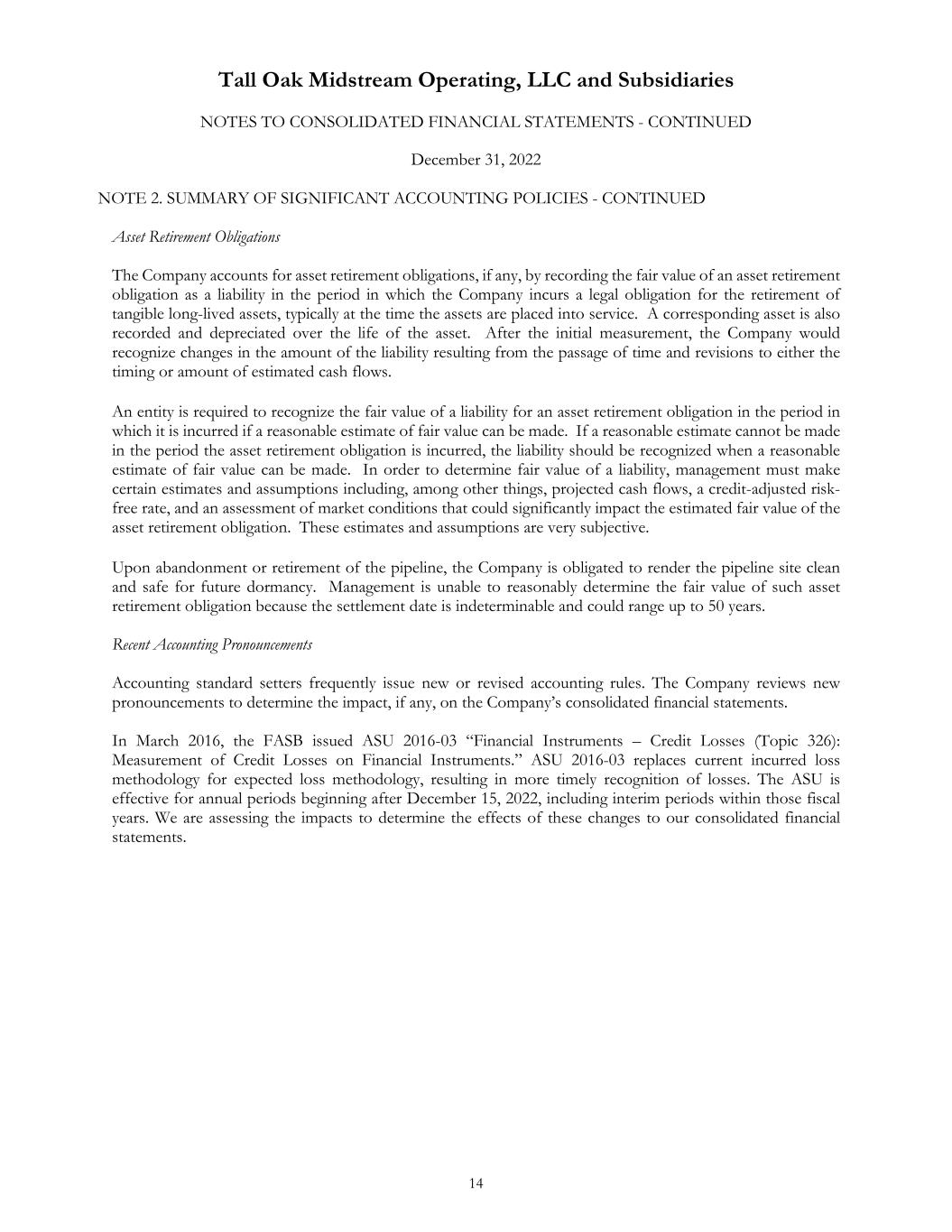

Tall Oak Midstream Operating, LLC and Subsidiaries 14 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2022 NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED Asset Retirement Obligations The Company accounts for asset retirement obligations, if any, by recording the fair value of an asset retirement obligation as a liability in the period in which the Company incurs a legal obligation for the retirement of tangible long-lived assets, typically at the time the assets are placed into service. A corresponding asset is also recorded and depreciated over the life of the asset. After the initial measurement, the Company would recognize changes in the amount of the liability resulting from the passage of time and revisions to either the timing or amount of estimated cash flows. An entity is required to recognize the fair value of a liability for an asset retirement obligation in the period in which it is incurred if a reasonable estimate of fair value can be made. If a reasonable estimate cannot be made in the period the asset retirement obligation is incurred, the liability should be recognized when a reasonable estimate of fair value can be made. In order to determine fair value of a liability, management must make certain estimates and assumptions including, among other things, projected cash flows, a credit-adjusted risk- free rate, and an assessment of market conditions that could significantly impact the estimated fair value of the asset retirement obligation. These estimates and assumptions are very subjective. Upon abandonment or retirement of the pipeline, the Company is obligated to render the pipeline site clean and safe for future dormancy. Management is unable to reasonably determine the fair value of such asset retirement obligation because the settlement date is indeterminable and could range up to 50 years. Recent Accounting Pronouncements Accounting standard setters frequently issue new or revised accounting rules. The Company reviews new pronouncements to determine the impact, if any, on the Company’s consolidated financial statements. In March 2016, the FASB issued ASU 2016-03 “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments.” ASU 2016-03 replaces current incurred loss methodology for expected loss methodology, resulting in more timely recognition of losses. The ASU is effective for annual periods beginning after December 15, 2022, including interim periods within those fiscal years. We are assessing the impacts to determine the effects of these changes to our consolidated financial statements.

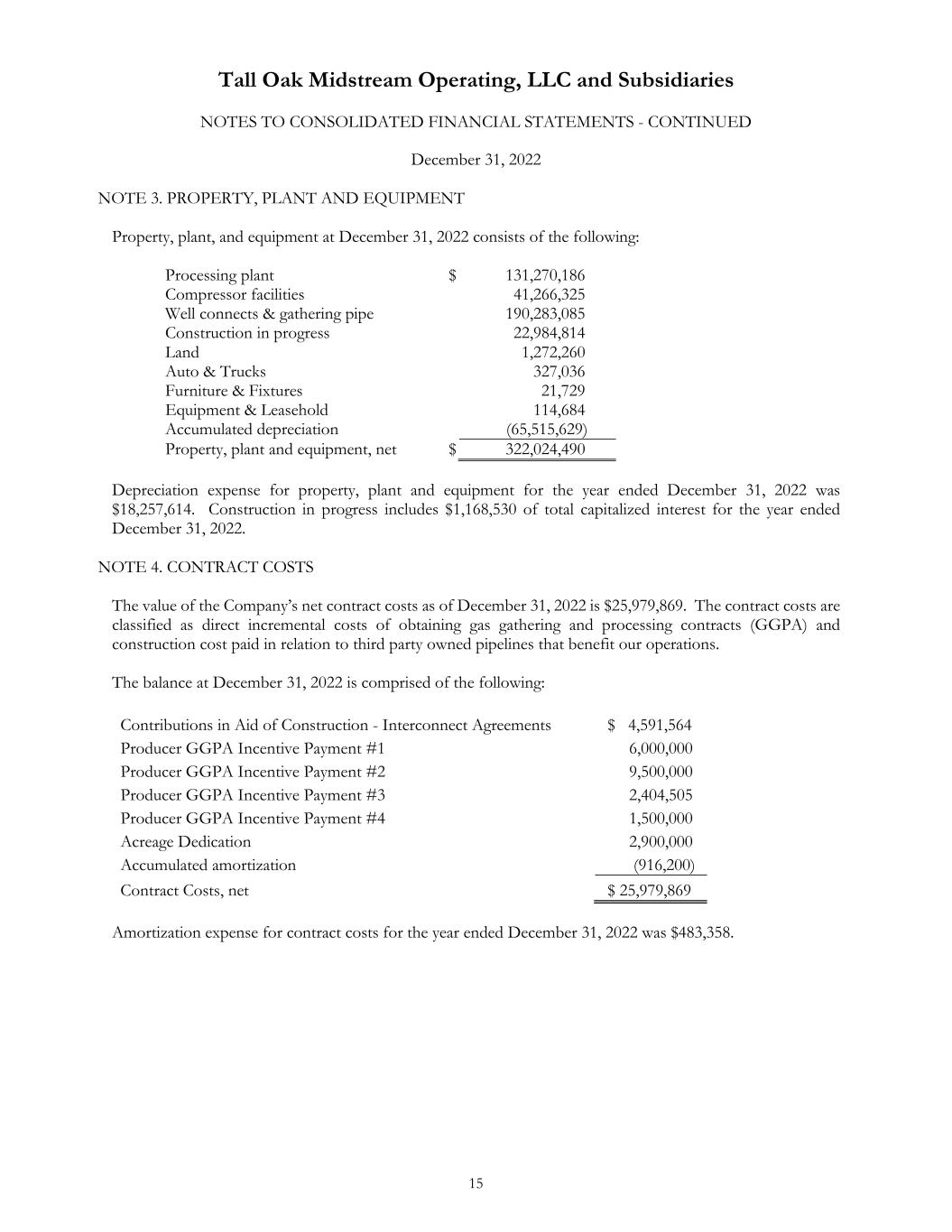

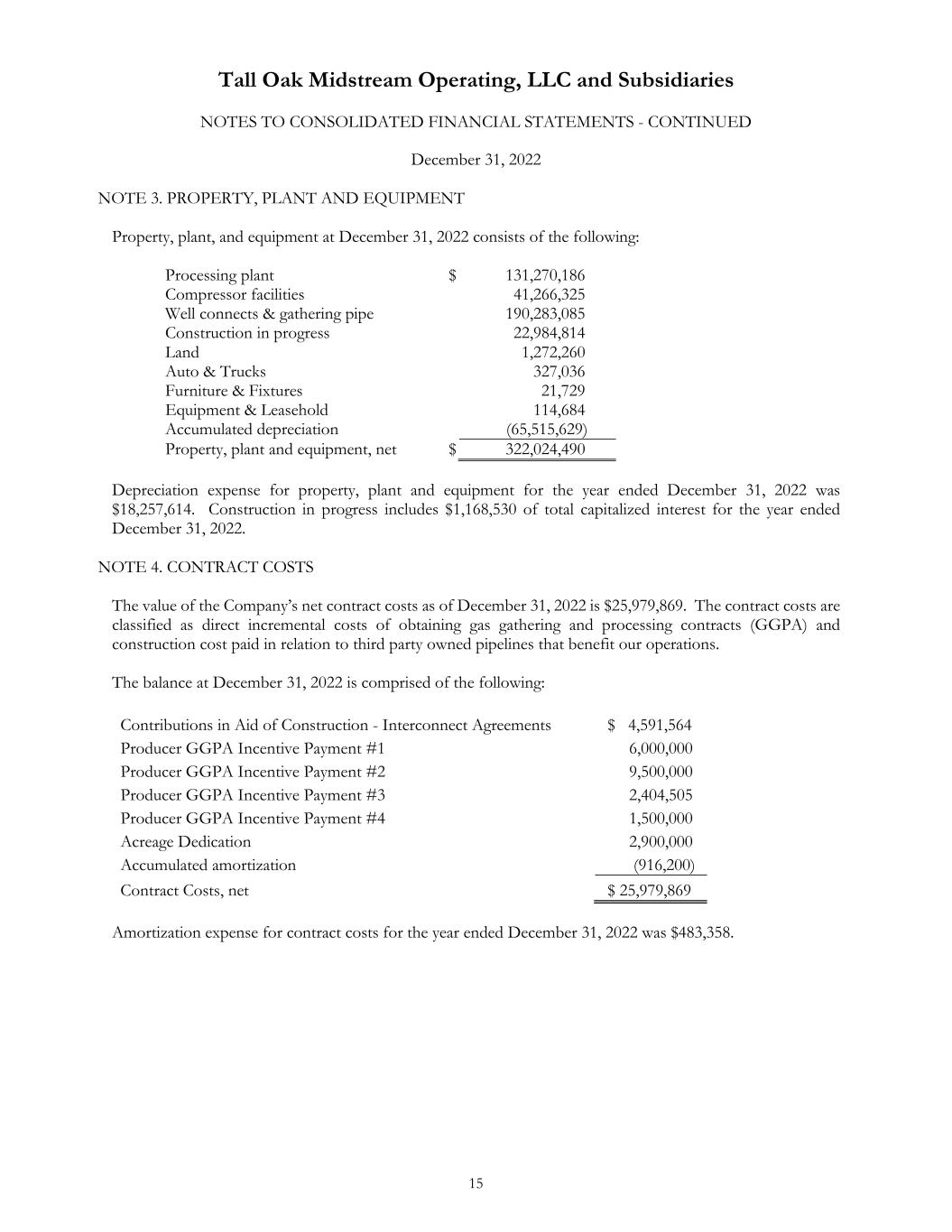

Tall Oak Midstream Operating, LLC and Subsidiaries 15 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2022 NOTE 3. PROPERTY, PLANT AND EQUIPMENT Property, plant, and equipment at December 31, 2022 consists of the following: Processing plant $ 131,270,186 Compressor facilities 41,266,325 Well connects & gathering pipe 190,283,085 Construction in progress 22,984,814 Land 1,272,260 Auto & Trucks 327,036 Furniture & Fixtures 21,729 Equipment & Leasehold 114,684 Accumulated depreciation (65,515,629) Property, plant and equipment, net $ 322,024,490 Depreciation expense for property, plant and equipment for the year ended December 31, 2022 was $18,257,614. Construction in progress includes $1,168,530 of total capitalized interest for the year ended December 31, 2022. NOTE 4. CONTRACT COSTS The value of the Company’s net contract costs as of December 31, 2022 is $25,979,869. The contract costs are classified as direct incremental costs of obtaining gas gathering and processing contracts (GGPA) and construction cost paid in relation to third party owned pipelines that benefit our operations. The balance at December 31, 2022 is comprised of the following: Contributions in Aid of Construction - Interconnect Agreements $ 4,591,564 Producer GGPA Incentive Payment #1 6,000,000 Producer GGPA Incentive Payment #2 9,500,000 Producer GGPA Incentive Payment #3 2,404,505 Producer GGPA Incentive Payment #4 1,500,000 Acreage Dedication 2,900,000 Accumulated amortization (916,200) Contract Costs, net $ 25,979,869 Amortization expense for contract costs for the year ended December 31, 2022 was $483,358.

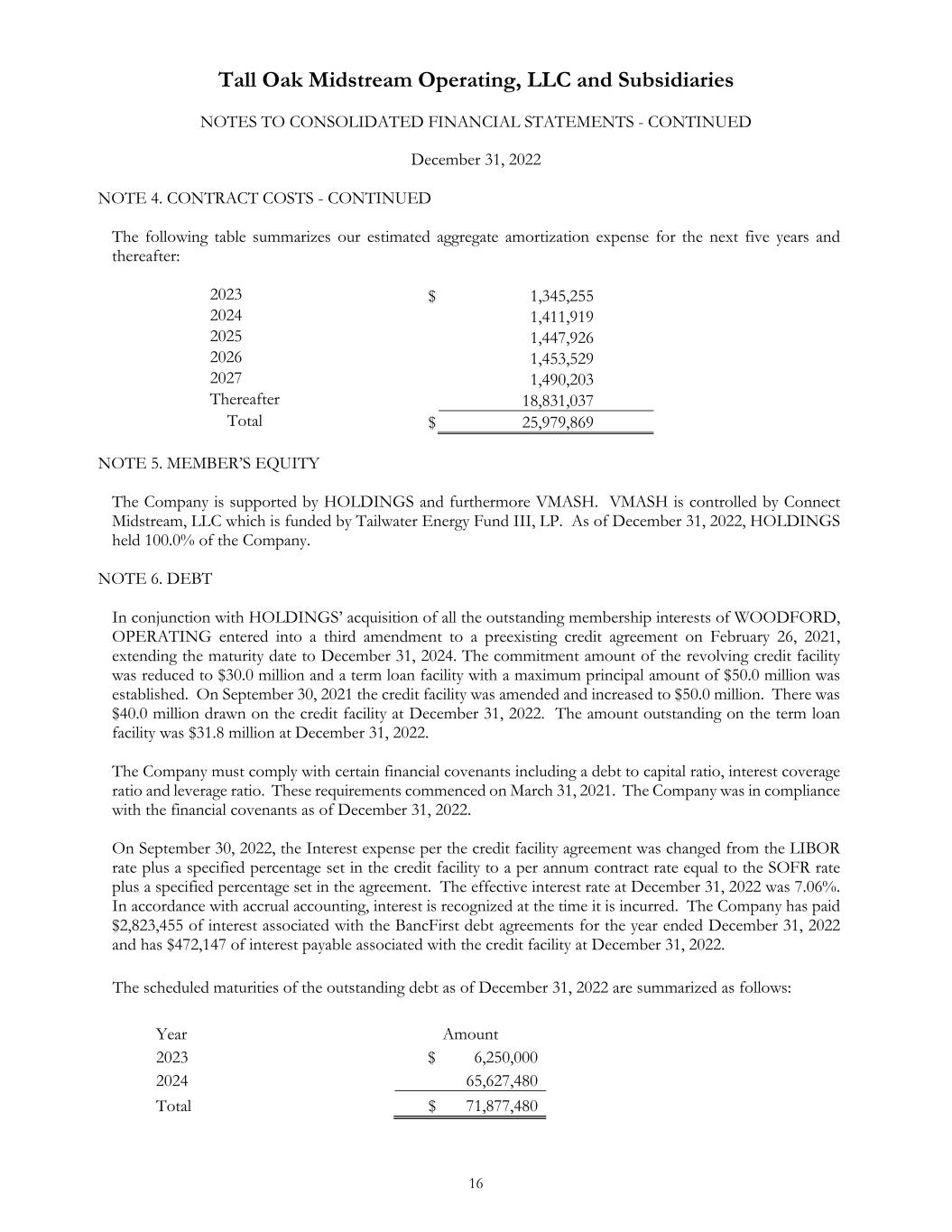

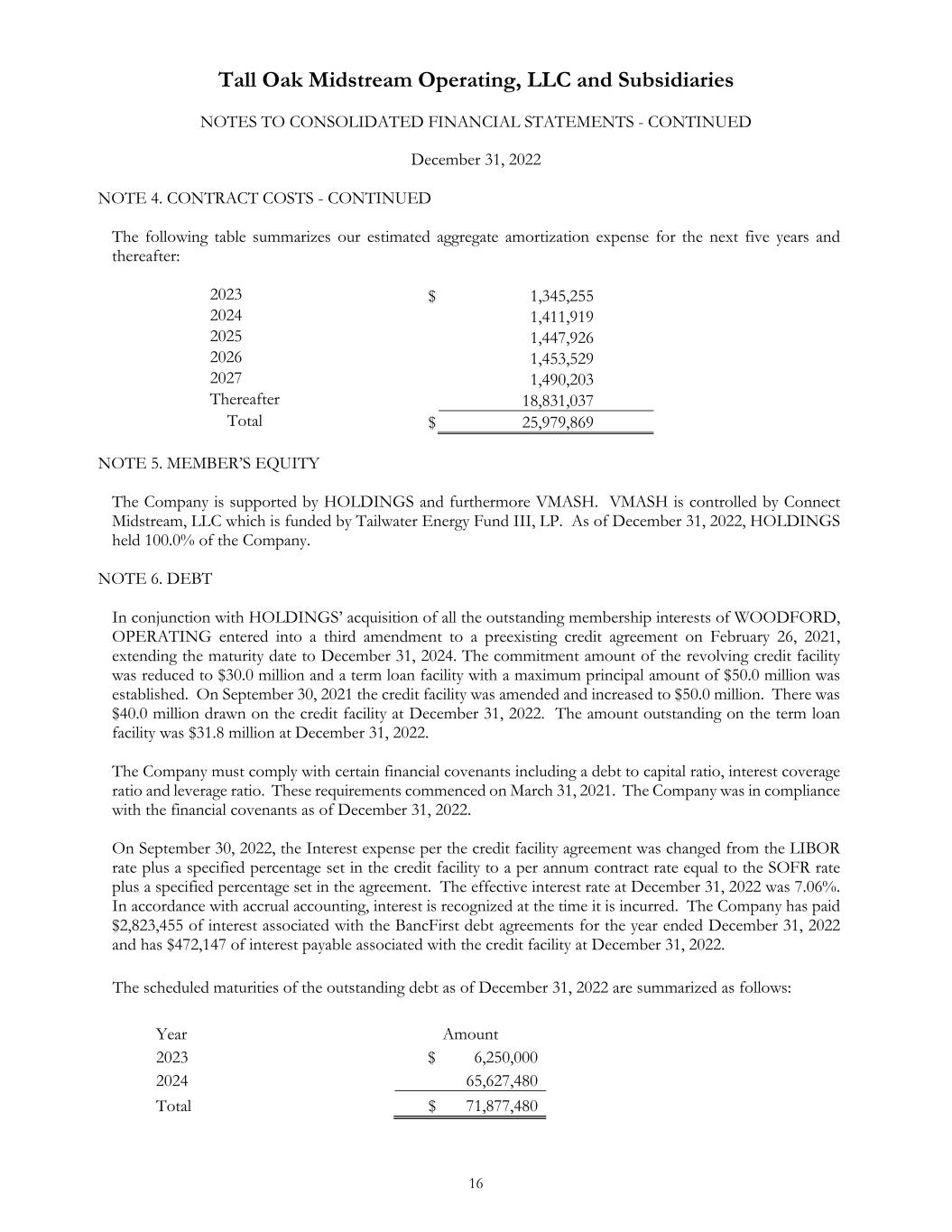

Tall Oak Midstream Operating, LLC and Subsidiaries 16 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2022 NOTE 4. CONTRACT COSTS - CONTINUED The following table summarizes our estimated aggregate amortization expense for the next five years and thereafter: 2023 $ 1,345,255 2024 1,411,919 2025 1,447,926 2026 1,453,529 2027 1,490,203 Thereafter 18,831,037 Total $ 25,979,869 NOTE 5. MEMBER’S EQUITY The Company is supported by HOLDINGS and furthermore VMASH. VMASH is controlled by Connect Midstream, LLC which is funded by Tailwater Energy Fund III, LP. As of December 31, 2022, HOLDINGS held 100.0% of the Company. NOTE 6. DEBT In conjunction with HOLDINGS’ acquisition of all the outstanding membership interests of WOODFORD, OPERATING entered into a third amendment to a preexisting credit agreement on February 26, 2021, extending the maturity date to December 31, 2024. The commitment amount of the revolving credit facility was reduced to $30.0 million and a term loan facility with a maximum principal amount of $50.0 million was established. On September 30, 2021 the credit facility was amended and increased to $50.0 million. There was $40.0 million drawn on the credit facility at December 31, 2022. The amount outstanding on the term loan facility was $31.8 million at December 31, 2022. The Company must comply with certain financial covenants including a debt to capital ratio, interest coverage ratio and leverage ratio. These requirements commenced on March 31, 2021. The Company was in compliance with the financial covenants as of December 31, 2022. On September 30, 2022, the Interest expense per the credit facility agreement was changed from the LIBOR rate plus a specified percentage set in the credit facility to a per annum contract rate equal to the SOFR rate plus a specified percentage set in the agreement. The effective interest rate at December 31, 2022 was 7.06%. In accordance with accrual accounting, interest is recognized at the time it is incurred. The Company has paid $2,823,455 of interest associated with the BancFirst debt agreements for the year ended December 31, 2022 and has $472,147 of interest payable associated with the credit facility at December 31, 2022. The scheduled maturities of the outstanding debt as of December 31, 2022 are summarized as follows: Year Amount 2023 $ 6,250,000 2024 65,627,480 Total $ 71,877,480

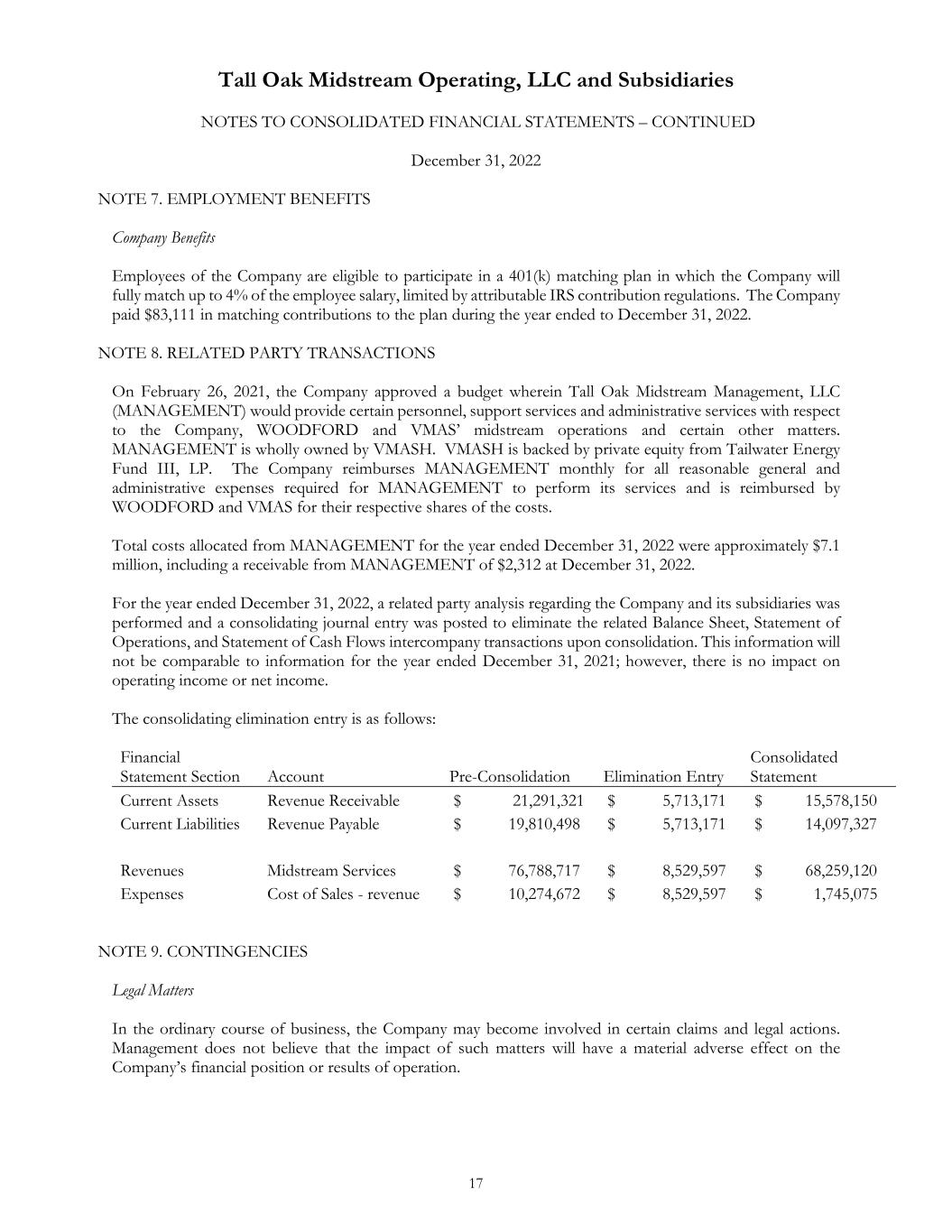

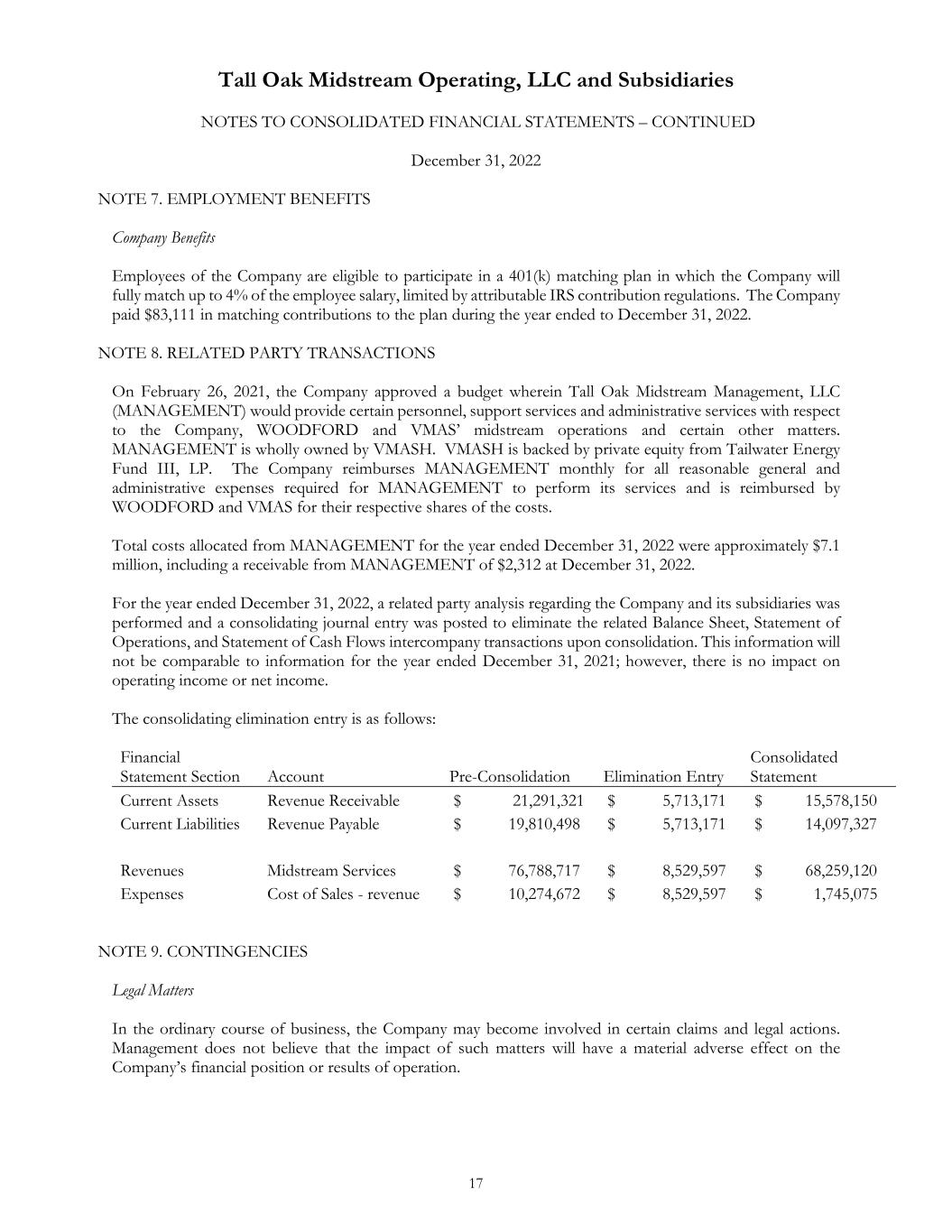

Tall Oak Midstream Operating, LLC and Subsidiaries 17 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED December 31, 2022 NOTE 7. EMPLOYMENT BENEFITS Company Benefits Employees of the Company are eligible to participate in a 401(k) matching plan in which the Company will fully match up to 4% of the employee salary, limited by attributable IRS contribution regulations. The Company paid $83,111 in matching contributions to the plan during the year ended to December 31, 2022. NOTE 8. RELATED PARTY TRANSACTIONS On February 26, 2021, the Company approved a budget wherein Tall Oak Midstream Management, LLC (MANAGEMENT) would provide certain personnel, support services and administrative services with respect to the Company, WOODFORD and VMAS’ midstream operations and certain other matters. MANAGEMENT is wholly owned by VMASH. VMASH is backed by private equity from Tailwater Energy Fund III, LP. The Company reimburses MANAGEMENT monthly for all reasonable general and administrative expenses required for MANAGEMENT to perform its services and is reimbursed by WOODFORD and VMAS for their respective shares of the costs. Total costs allocated from MANAGEMENT for the year ended December 31, 2022 were approximately $7.1 million, including a receivable from MANAGEMENT of $2,312 at December 31, 2022. For the year ended December 31, 2022, a related party analysis regarding the Company and its subsidiaries was performed and a consolidating journal entry was posted to eliminate the related Balance Sheet, Statement of Operations, and Statement of Cash Flows intercompany transactions upon consolidation. This information will not be comparable to information for the year ended December 31, 2021; however, there is no impact on operating income or net income. The consolidating elimination entry is as follows: Financial Statement Section Account Pre-Consolidation Elimination Entry Consolidated Statement Current Assets Revenue Receivable $ 21,291,321 $ 5,713,171 $ 15,578,150 Current Liabilities Revenue Payable $ 19,810,498 $ 5,713,171 $ 14,097,327 Revenues Midstream Services $ 76,788,717 $ 8,529,597 $ 68,259,120 Expenses Cost of Sales - revenue $ 10,274,672 $ 8,529,597 $ 1,745,075 NOTE 9. CONTINGENCIES Legal Matters In the ordinary course of business, the Company may become involved in certain claims and legal actions. Management does not believe that the impact of such matters will have a material adverse effect on the Company’s financial position or results of operation.

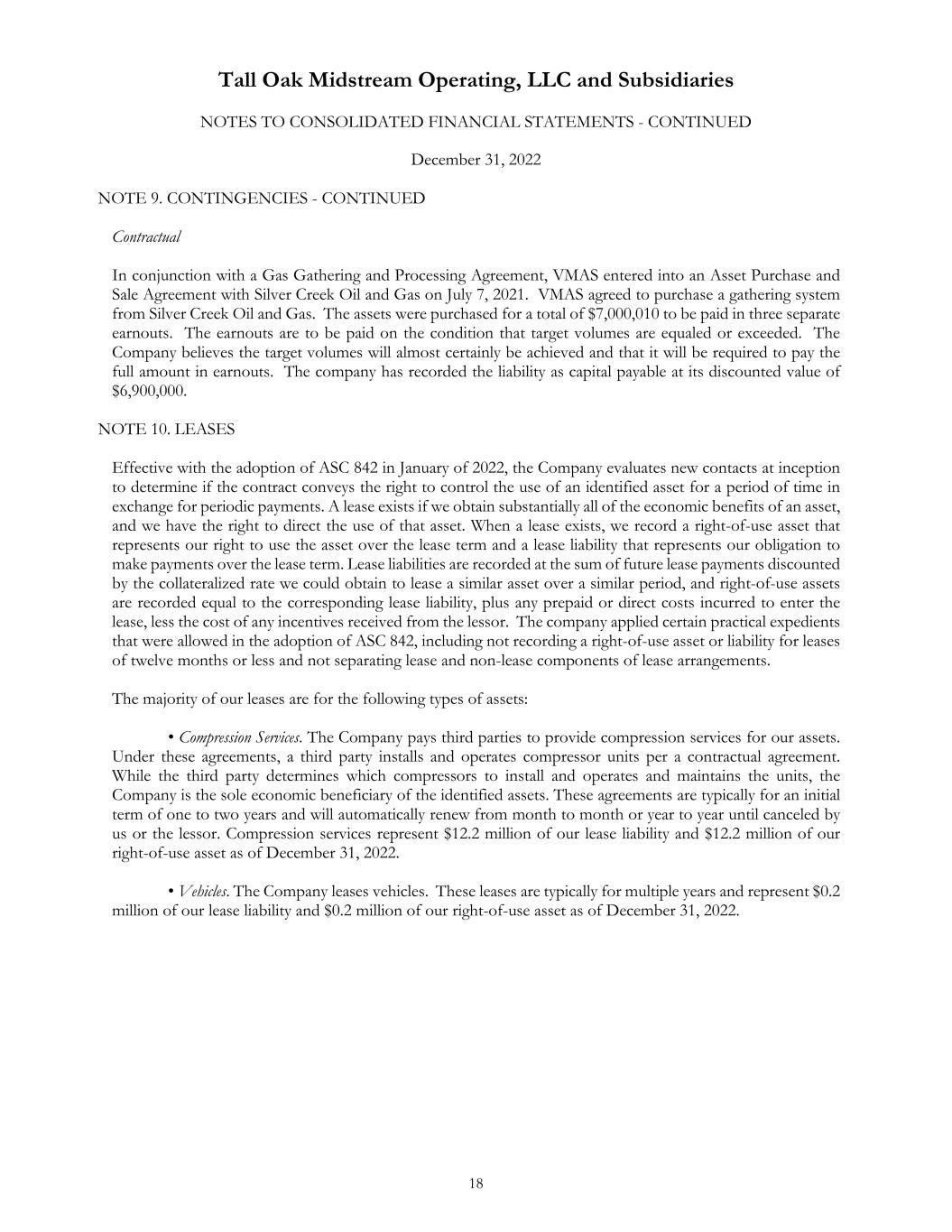

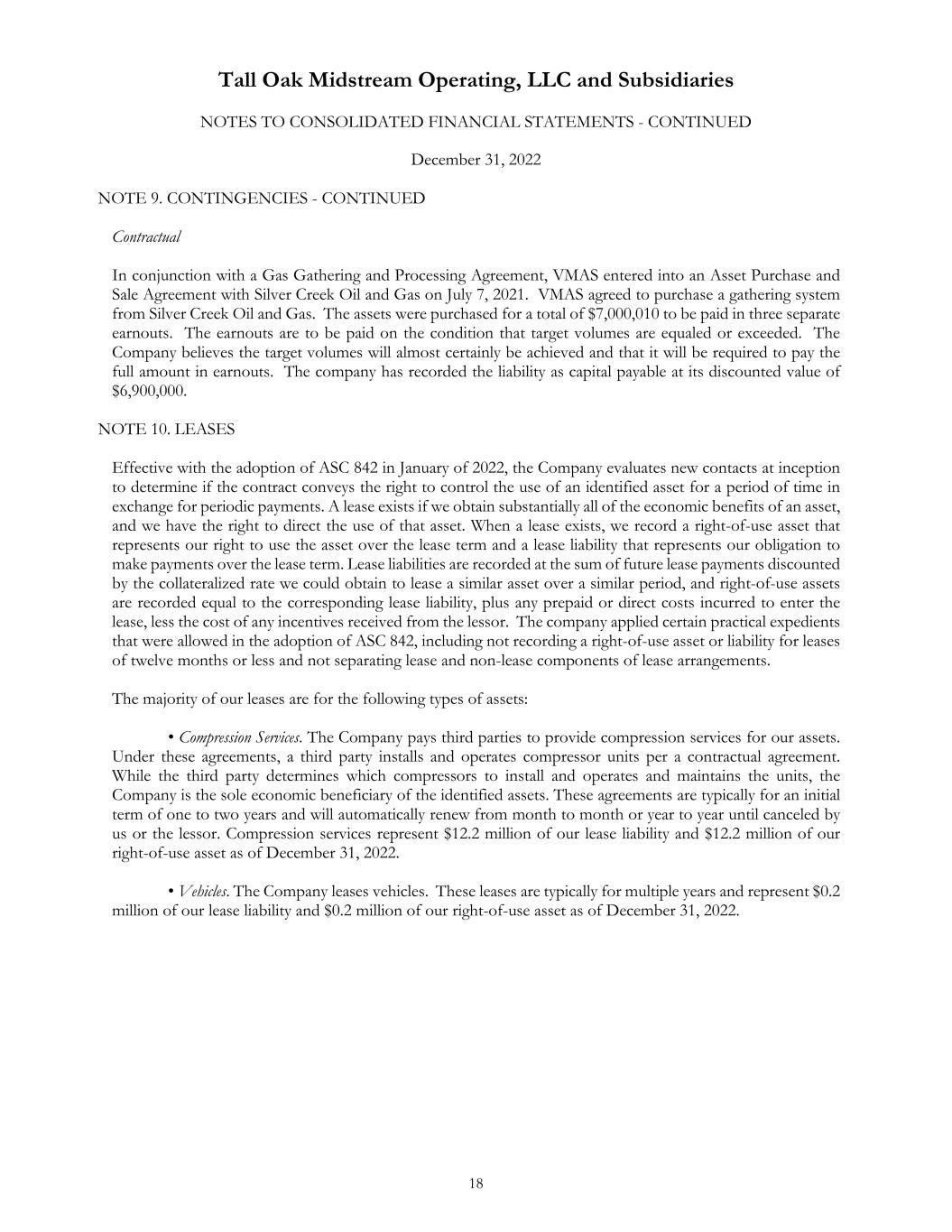

Tall Oak Midstream Operating, LLC and Subsidiaries 18 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2022 NOTE 9. CONTINGENCIES - CONTINUED Contractual In conjunction with a Gas Gathering and Processing Agreement, VMAS entered into an Asset Purchase and Sale Agreement with Silver Creek Oil and Gas on July 7, 2021. VMAS agreed to purchase a gathering system from Silver Creek Oil and Gas. The assets were purchased for a total of $7,000,010 to be paid in three separate earnouts. The earnouts are to be paid on the condition that target volumes are equaled or exceeded. The Company believes the target volumes will almost certainly be achieved and that it will be required to pay the full amount in earnouts. The company has recorded the liability as capital payable at its discounted value of $6,900,000. NOTE 10. LEASES Effective with the adoption of ASC 842 in January of 2022, the Company evaluates new contacts at inception to determine if the contract conveys the right to control the use of an identified asset for a period of time in exchange for periodic payments. A lease exists if we obtain substantially all of the economic benefits of an asset, and we have the right to direct the use of that asset. When a lease exists, we record a right-of-use asset that represents our right to use the asset over the lease term and a lease liability that represents our obligation to make payments over the lease term. Lease liabilities are recorded at the sum of future lease payments discounted by the collateralized rate we could obtain to lease a similar asset over a similar period, and right-of-use assets are recorded equal to the corresponding lease liability, plus any prepaid or direct costs incurred to enter the lease, less the cost of any incentives received from the lessor. The company applied certain practical expedients that were allowed in the adoption of ASC 842, including not recording a right-of-use asset or liability for leases of twelve months or less and not separating lease and non-lease components of lease arrangements. The majority of our leases are for the following types of assets: • Compression Services. The Company pays third parties to provide compression services for our assets. Under these agreements, a third party installs and operates compressor units per a contractual agreement. While the third party determines which compressors to install and operates and maintains the units, the Company is the sole economic beneficiary of the identified assets. These agreements are typically for an initial term of one to two years and will automatically renew from month to month or year to year until canceled by us or the lessor. Compression services represent $12.2 million of our lease liability and $12.2 million of our right-of-use asset as of December 31, 2022. • Vehicles. The Company leases vehicles. These leases are typically for multiple years and represent $0.2 million of our lease liability and $0.2 million of our right-of-use asset as of December 31, 2022.

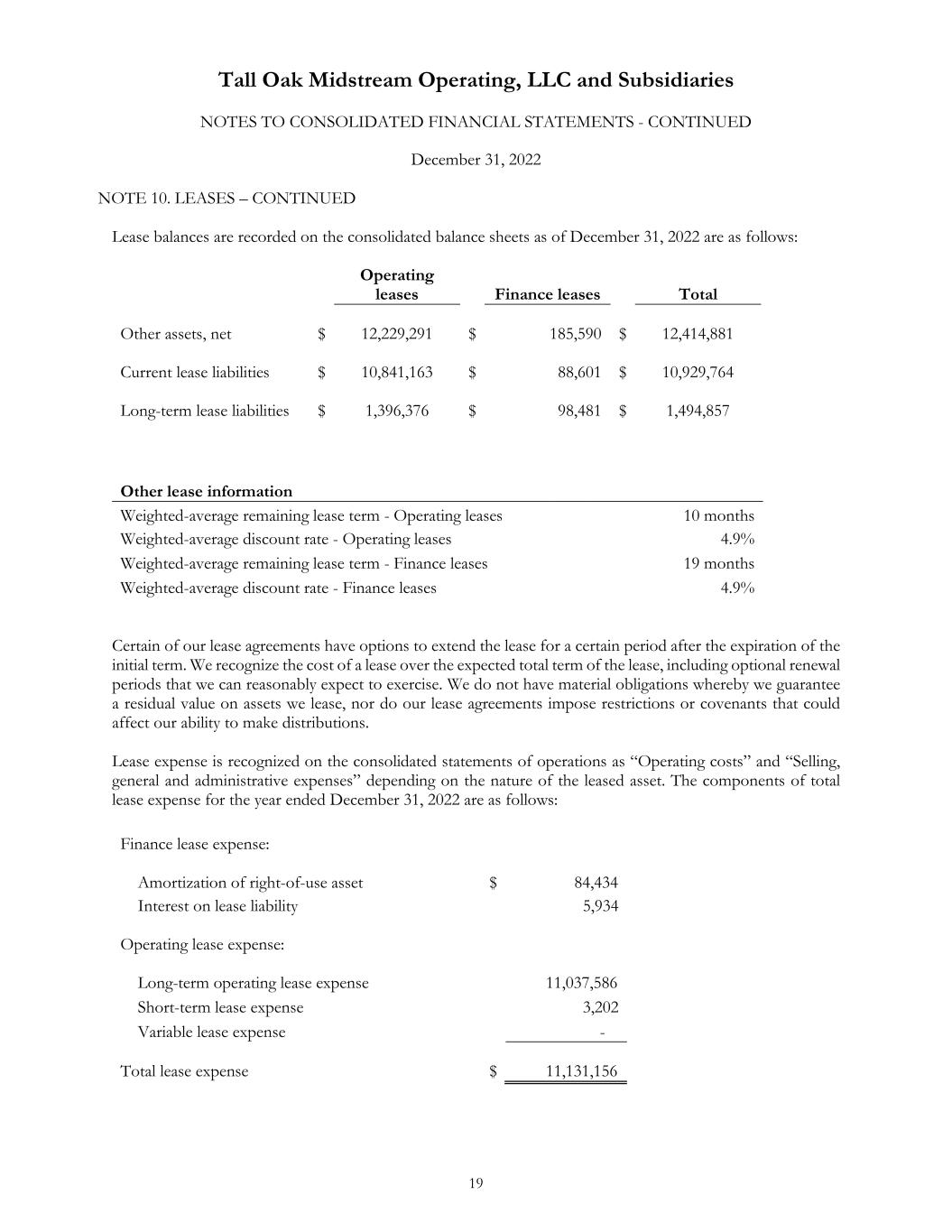

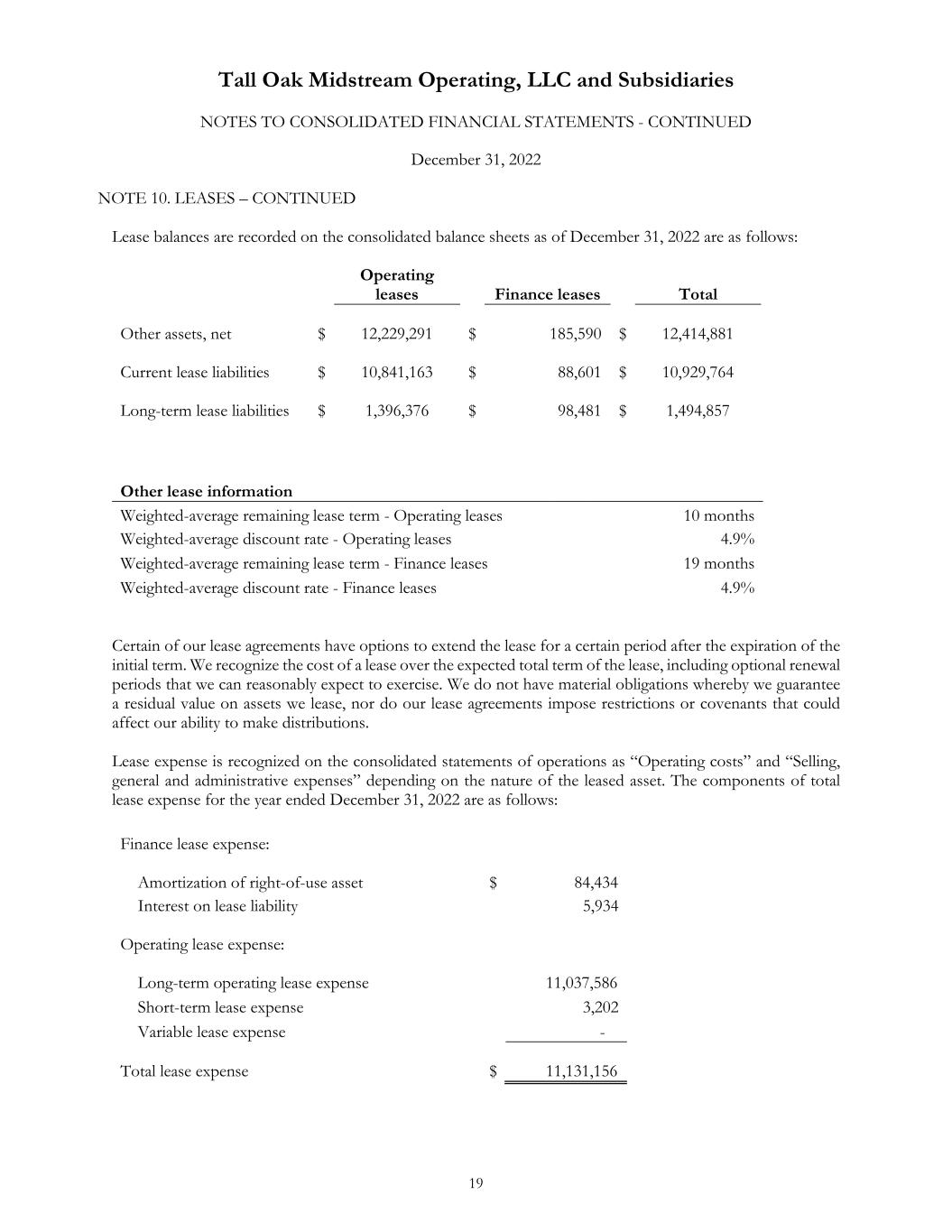

Tall Oak Midstream Operating, LLC and Subsidiaries 19 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2022 NOTE 10. LEASES – CONTINUED Lease balances are recorded on the consolidated balance sheets as of December 31, 2022 are as follows: Operating leases Finance leases Total Other assets, net $ 12,229,291 $ 185,590 $ 12,414,881 Current lease liabilities $ 10,841,163 $ 88,601 $ 10,929,764 Long-term lease liabilities $ 1,396,376 $ 98,481 $ 1,494,857 Other lease information Weighted-average remaining lease term - Operating leases 10 months Weighted-average discount rate - Operating leases 4.9% Weighted-average remaining lease term - Finance leases 19 months Weighted-average discount rate - Finance leases 4.9% Certain of our lease agreements have options to extend the lease for a certain period after the expiration of the initial term. We recognize the cost of a lease over the expected total term of the lease, including optional renewal periods that we can reasonably expect to exercise. We do not have material obligations whereby we guarantee a residual value on assets we lease, nor do our lease agreements impose restrictions or covenants that could affect our ability to make distributions. Lease expense is recognized on the consolidated statements of operations as “Operating costs” and “Selling, general and administrative expenses” depending on the nature of the leased asset. The components of total lease expense for the year ended December 31, 2022 are as follows: Finance lease expense: Amortization of right-of-use asset $ 84,434 Interest on lease liability 5,934 Operating lease expense: Long-term operating lease expense 11,037,586 Short-term lease expense 3,202 Variable lease expense - Total lease expense $ 11,131,156

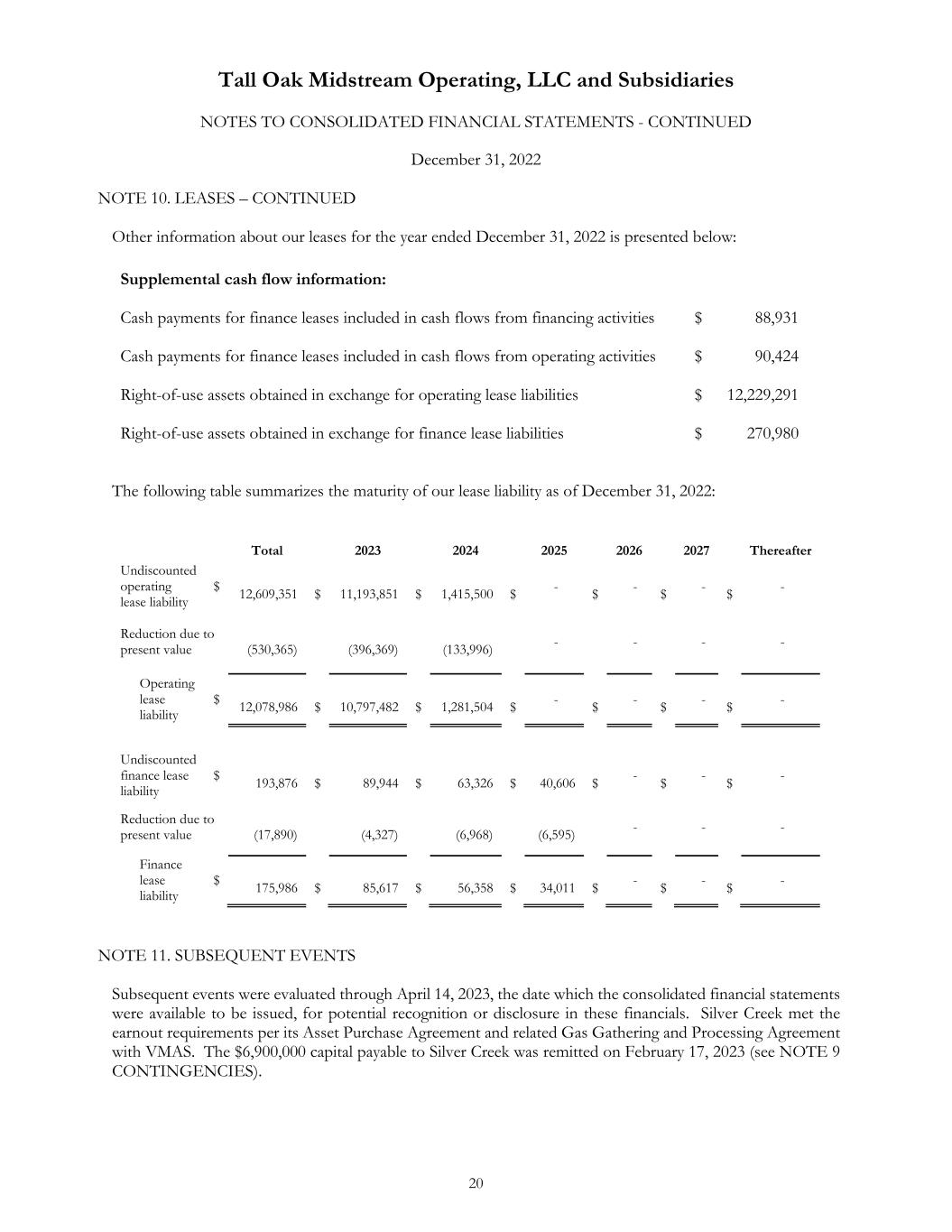

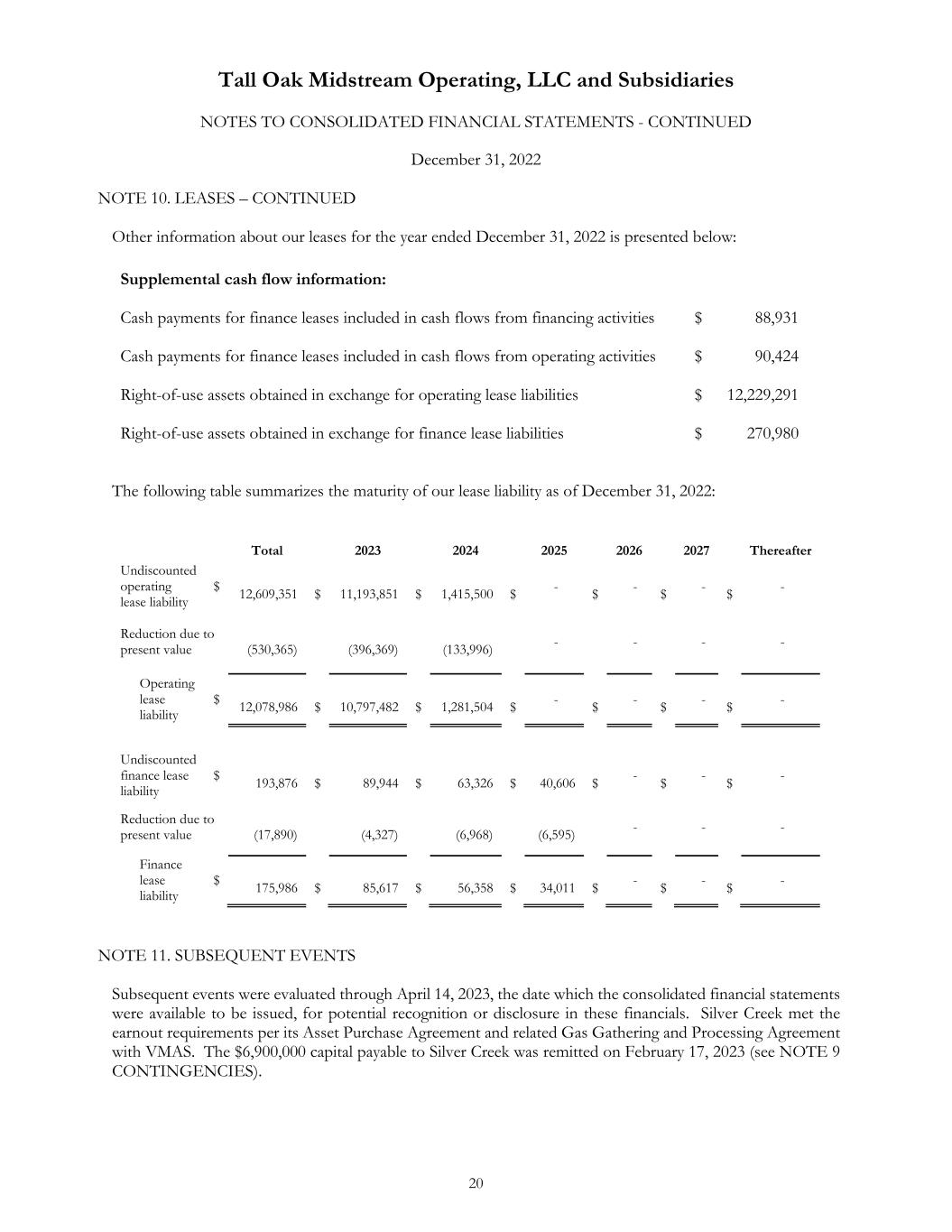

Tall Oak Midstream Operating, LLC and Subsidiaries 20 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2022 NOTE 10. LEASES – CONTINUED Other information about our leases for the year ended December 31, 2022 is presented below: Supplemental cash flow information: Cash payments for finance leases included in cash flows from financing activities $ 88,931 Cash payments for finance leases included in cash flows from operating activities $ 90,424 Right-of-use assets obtained in exchange for operating lease liabilities $ 12,229,291 Right-of-use assets obtained in exchange for finance lease liabilities $ 270,980 The following table summarizes the maturity of our lease liability as of December 31, 2022: Total 2023 2024 2025 2026 2027 Thereafter Undiscounted operating lease liability $ 12,609,351 $ 11,193,851 $ 1,415,500 $ - $ - $ - $ - Reduction due to present value (530,365) (396,369) (133,996) - - - - Operating lease liability $ 12,078,986 $ 10,797,482 $ 1,281,504 $ - $ - $ - $ - Undiscounted finance lease liability $ 193,876 $ 89,944 $ 63,326 $ 40,606 $ - $ - $ - Reduction due to present value (17,890) (4,327) (6,968) (6,595) - - - Finance lease liability $ 175,986 $ 85,617 $ 56,358 $ 34,011 $ - $ - $ - NOTE 11. SUBSEQUENT EVENTS Subsequent events were evaluated through April 14, 2023, the date which the consolidated financial statements were available to be issued, for potential recognition or disclosure in these financials. Silver Creek met the earnout requirements per its Asset Purchase Agreement and related Gas Gathering and Processing Agreement with VMAS. The $6,900,000 capital payable to Silver Creek was remitted on February 17, 2023 (see NOTE 9 CONTINGENCIES).