Tall Oak Midstream Operating, LLC and Subsidiaries Consolidated Interim Financial Statements (Unaudited) As of and for the Nine Month Periods Ended September 30, 2024 and 2023 Exhibit 99.3

Contents Page INDEPENDENT AUDITOR’S REVIEW REPORT 3 CONSOLIDATED INTERIM FINANCIAL STATEMENTS CONSOLIDATED INTERIM BALANCE SHEETS 4 CONSOLIDATED INTERIM STATEMENTS OF OPERATIONS 5 CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN MEMBER’S EQUITY 6 CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS 7 NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS 8

Weaver and Tidwell, L.L.P. 499 West Sheridan Avenue, Suite 2450 | Oklahoma City, OK 73102 Main: 405.594.9200 CPAs AND ADVISORS | WEAVER.COM Independent Auditor’s Review Report To the Member of Tall Oak Midstream Operating, LLC Results of Review of Interim Financial Information We have reviewed the accompanying consolidated interim balance sheet as of September 30, 2024, and the related consolidated interim statements of operations, changes in member’s equity, and cash flows for the nine-month periods ended September 30, 2024, and 2023, and the related notes (collectively referred to as the interim financial information) of Tall Oak Midstream Operating, LLC and subsidiaries (the “Company”). Based on our review, we are not aware of any material modifications that should be made to the accompanying interim financial information for it to be in accordance with accounting principles generally accepted in the United States of America. Basis for Review Results We conducted our review in accordance with auditing standards generally accepted in the United States of America (GAAS) applicable to reviews of interim financial information. A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. A review of interim financial information is substantially less in scope than an audit conducted in accordance with GAAS, the objective of which is an expression of an opinion regarding the financial information as a whole, and accordingly, we do not express such an opinion. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our review. We believe that the results of the review procedures provide a reasonable basis for our conclusion. Responsibilities of Management for the Interim Financial Information Management is responsible for the preparation and fair presentation of the interim financial information in accordance with accounting principles generally accepted in the United States of America; and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of interim financial information that is free from material misstatement, whether due to fraud or error. Report on Balance Sheet as of December 31, 2023 We have previously audited, in accordance with auditing standards generally accepted in the United States of America, the consolidated balance sheet as of December 31, 2023, and the related consolidated statements of operations, changes in member’s equity, and cash flows for the year then ended (not presented herein); and we expressed an unmodified audit opinion on those audited consolidated financial statements in our report dated April 8, 2024. In our opinion, the accompanying consolidated balance sheet of the Company as of December 31, 2023, is consistent, in all material respects, with the audited consolidated financial statements from which it has been derived. WEAVER AND TIDWELL, L.L.P. Okalahoma City, Oklahoma December 2, 2024

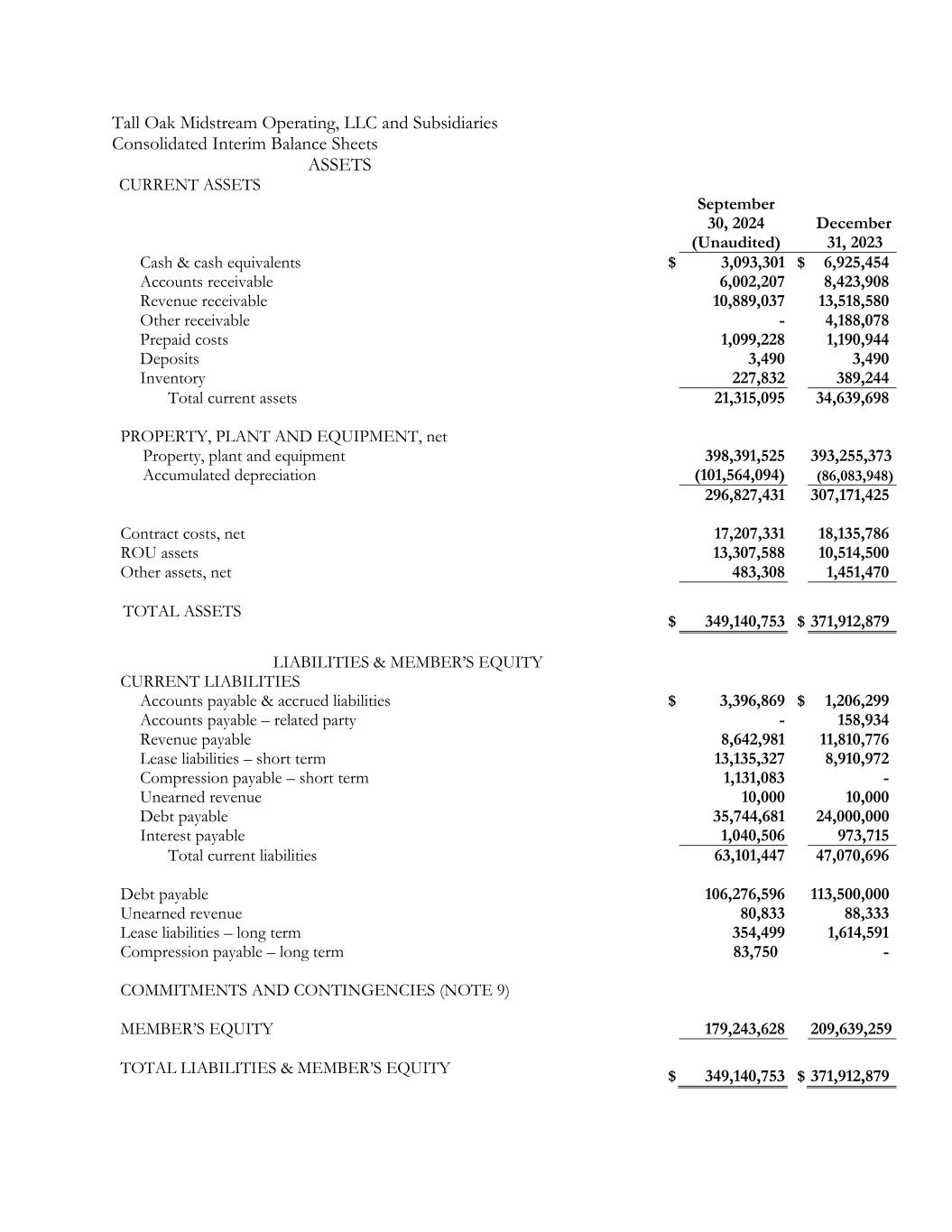

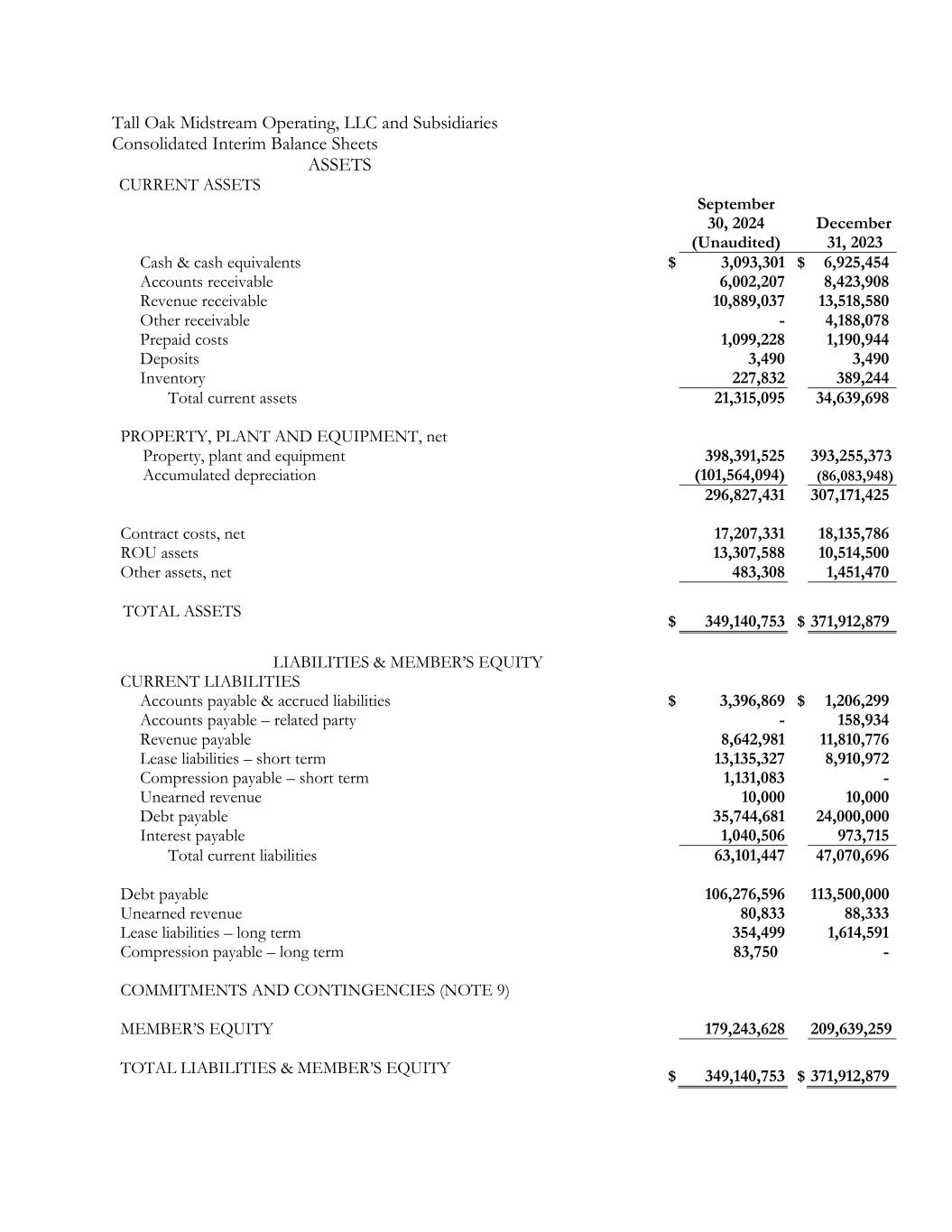

Tall Oak Midstream Operating, LLC and Subsidiaries Consolidated Interim Balance Sheets ASSETS CURRENT ASSETS September 30, 2024 (Unaudited) December 31, 2023 Cash & cash equivalents $ 3,093,301 $ 6,925,454 Accounts receivable 6,002,207 8,423,908 Revenue receivable 10,889,037 13,518,580 Other receivable - 4,188,078 Prepaid costs 1,099,228 1,190,944 Deposits 3,490 3,490 Inventory 227,832 389,244 Total current assets 21,315,095 34,639,698 PROPERTY, PLANT AND EQUIPMENT, net Property, plant and equipment 398,391,525 393,255,373 Accumulated depreciation (101,564,094) (86,083,948) 296,827,431 307,171,425 Contract costs, net 17,207,331 18,135,786 ROU assets 13,307,588 10,514,500 Other assets, net 483,308 1,451,470 TOTAL ASSETS $ 349,140,753 $ 371,912,879 LIABILITIES & MEMBER’S EQUITY CURRENT LIABILITIES Accounts payable & accrued liabilities $ 3,396,869 $ 1,206,299 Accounts payable – related party - 158,934 Revenue payable 8,642,981 11,810,776 Lease liabilities – short term 13,135,327 8,910,972 Compression payable – short term 1,131,083 - Unearned revenue 10,000 10,000 Debt payable 35,744,681 24,000,000 Interest payable 1,040,506 973,715 Total current liabilities 63,101,447 47,070,696 Debt payable 106,276,596 113,500,000 Unearned revenue 80,833 88,333 Lease liabilities – long term 354,499 1,614,591 Compression payable – long term COMMITMENTS AND CONTINGENCIES (NOTE 9) 83,750 - MEMBER’S EQUITY 179,243,628 209,639,259 TOTAL LIABILITIES & MEMBER’S EQUITY $ 349,140,753 $ 371,912,879

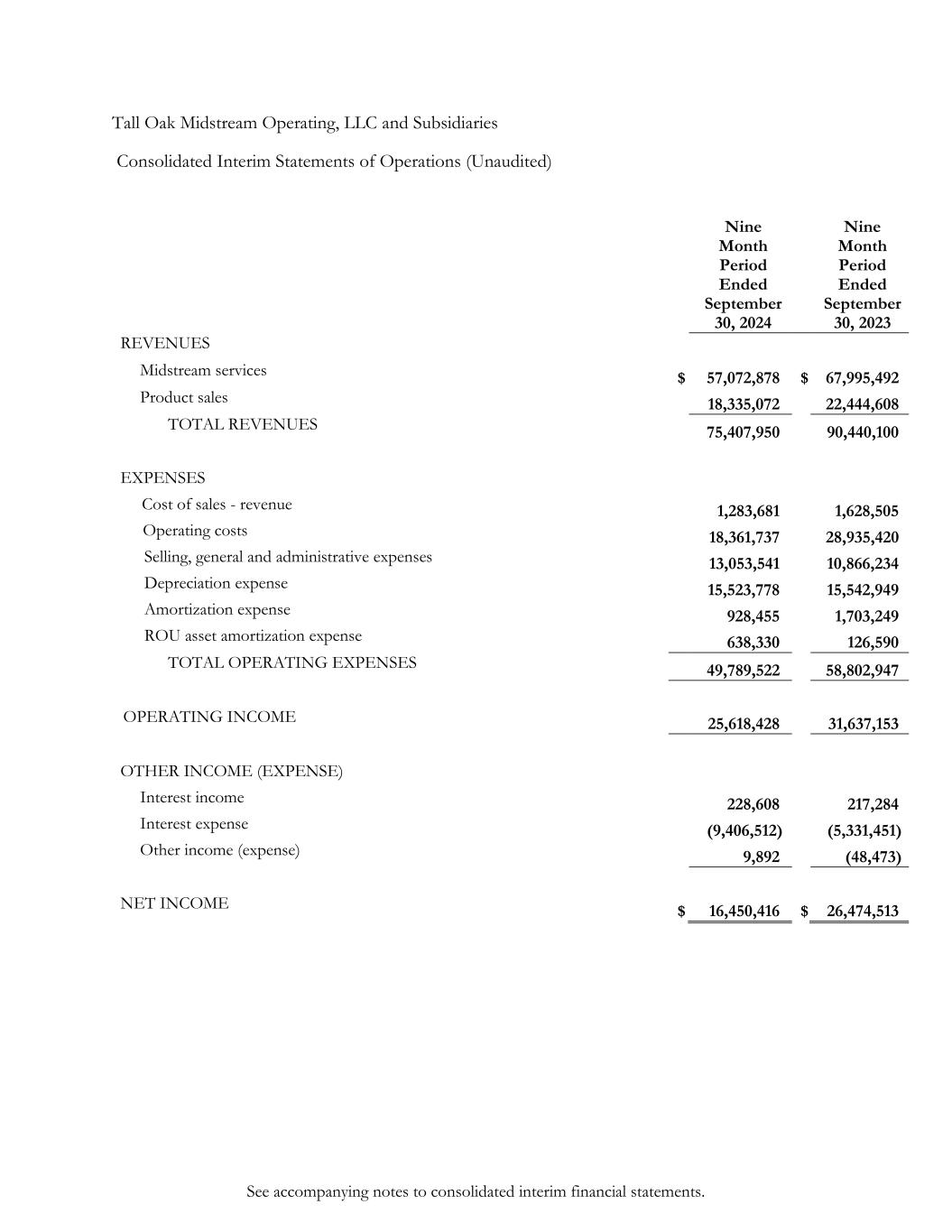

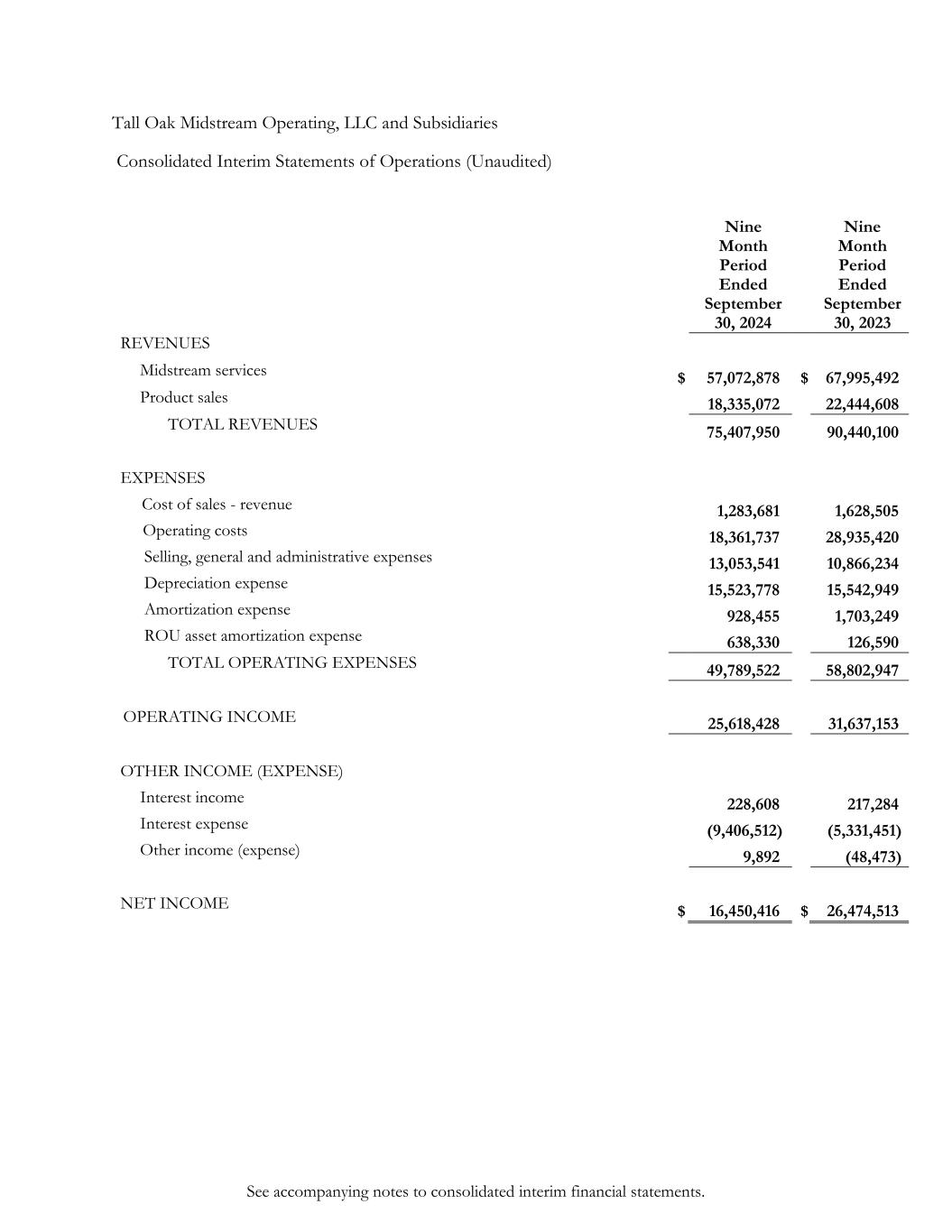

See accompanying notes to consolidated interim financial statements. Tall Oak Midstream Operating, LLC and Subsidiaries Consolidated Interim Statements of Operations (Unaudited) Nine Month Period Ended September 30, 2024 Nine Month Period Ended September 30, 2023 REVENUES Midstream services $ 57,072,878 $ 67,995,492 Product sales 18,335,072 22,444,608 TOTAL REVENUES 75,407,950 90,440,100 EXPENSES Cost of sales - revenue 1,283,681 1,628,505 Operating costs 18,361,737 28,935,420 Selling, general and administrative expenses 13,053,541 10,866,234 Depreciation expense 15,523,778 15,542,949 Amortization expense 928,455 1,703,249 ROU asset amortization expense 638,330 126,590 TOTAL OPERATING EXPENSES 49,789,522 58,802,947 OPERATING INCOME 25,618,428 31,637,153 OTHER INCOME (EXPENSE) Interest income 228,608 217,284 Interest expense (9,406,512) (5,331,451) Other income (expense) 9,892 (48,473) NET INCOME $ 16,450,416 $ 26,474,513

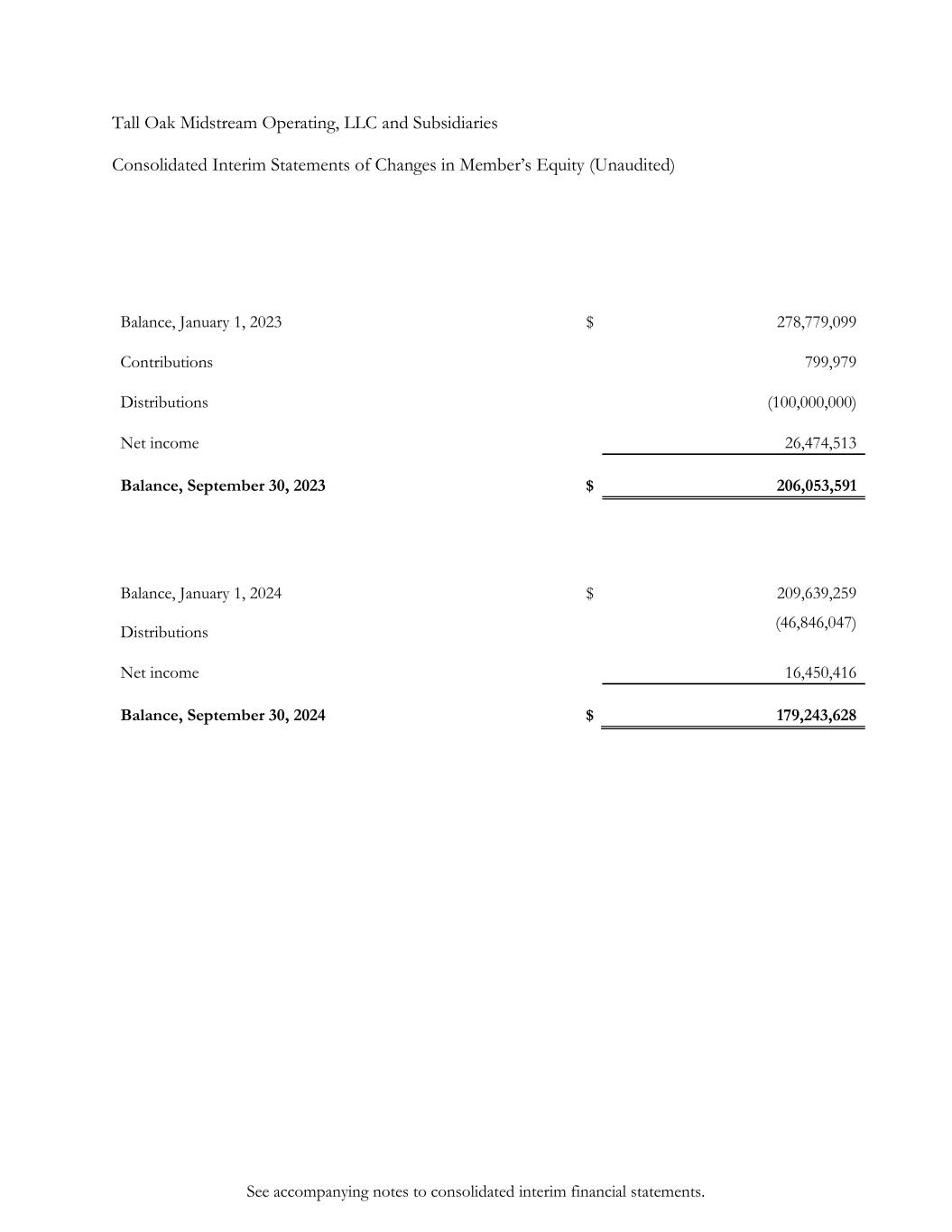

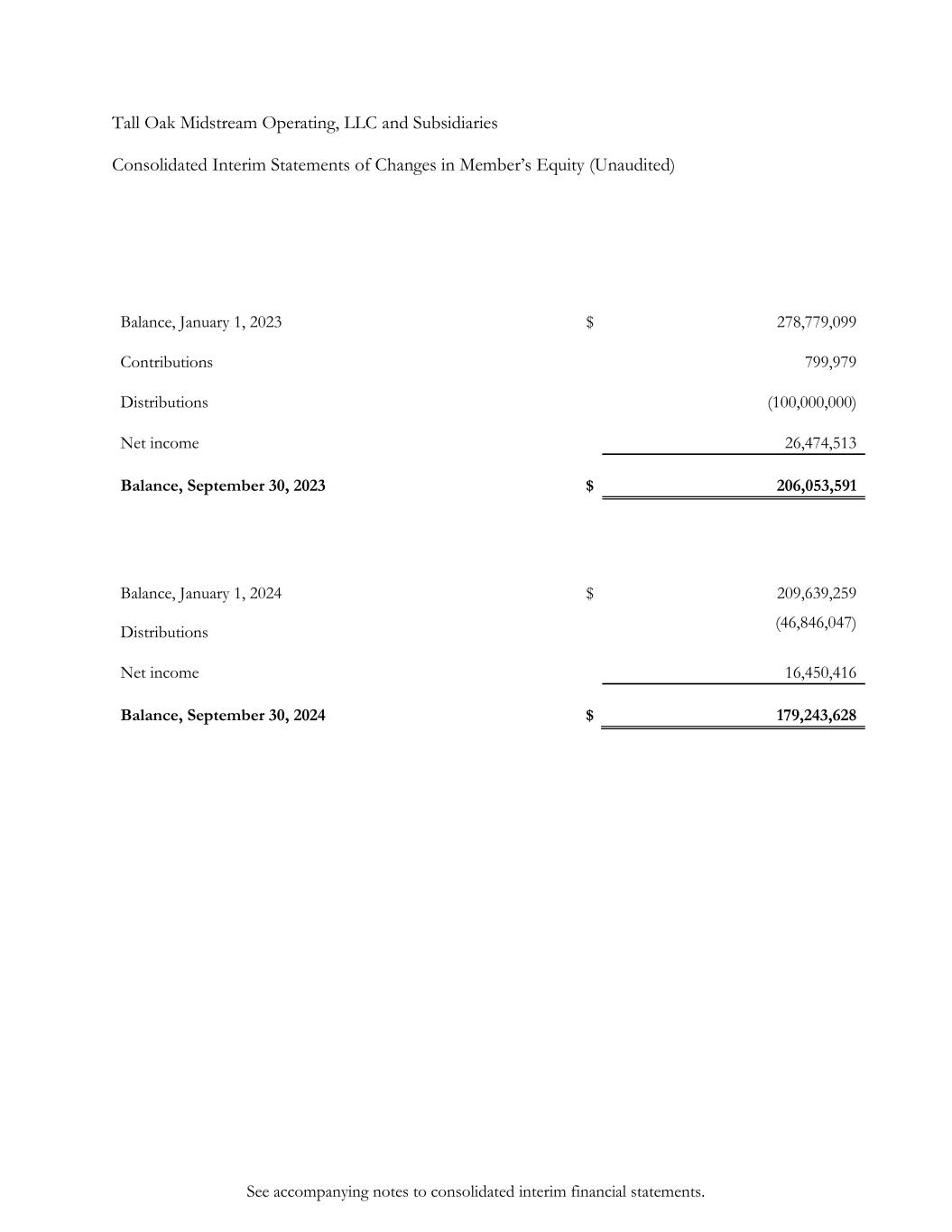

See accompanying notes to consolidated interim financial statements. Tall Oak Midstream Operating, LLC and Subsidiaries Consolidated Interim Statements of Changes in Member’s Equity (Unaudited) Balance, January 1, 2023 $ 278,779,099 Contributions 799,979 Distributions (100,000,000) Net income 26,474,513 Balance, September 30, 2023 $ 206,053,591 Balance, January 1, 2024 $ 209,639,259 Distributions (46,846,047) Net income 16,450,416 Balance, September 30, 2024 $ 179,243,628

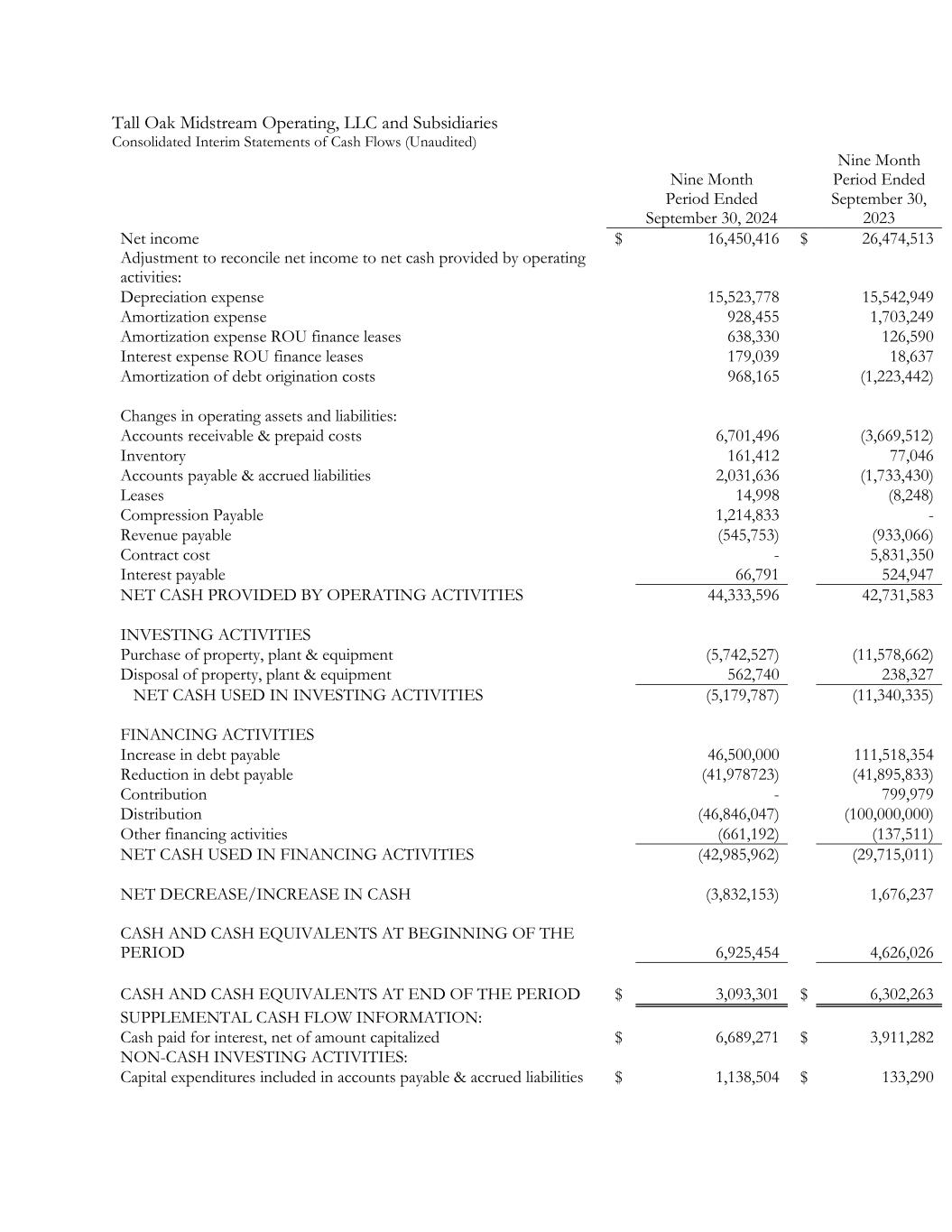

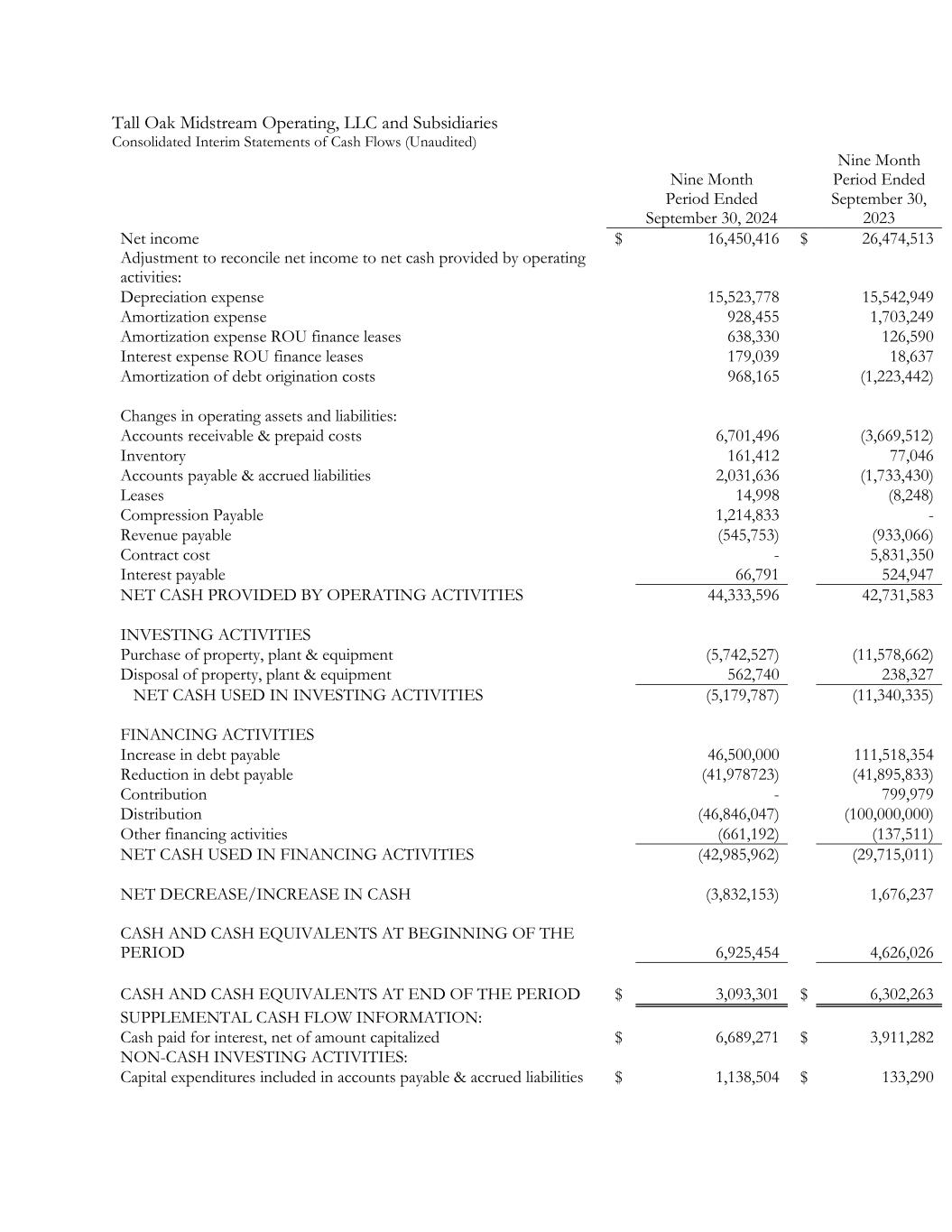

Tall Oak Midstream Operating, LLC and Subsidiaries Consolidated Interim Statements of Cash Flows (Unaudited) Nine Month Period Ended September 30, 2024 Nine Month Period Ended September 30, 2023 Net income $ 16,450,416 $ 26,474,513 Adjustment to reconcile net income to net cash provided by operating activities: Depreciation expense 15,523,778 15,542,949 Amortization expense 928,455 1,703,249 Amortization expense ROU finance leases 638,330 126,590 Interest expense ROU finance leases 179,039 18,637 Amortization of debt origination costs 968,165 (1,223,442) Changes in operating assets and liabilities: Accounts receivable & prepaid costs 6,701,496 (3,669,512) Inventory 161,412 77,046 Accounts payable & accrued liabilities 2,031,636 (1,733,430) Leases 14,998 (8,248) Compression Payable 1,214,833 - Revenue payable (545,753) (933,066) Contract cost - 5,831,350 Interest payable 66,791 524,947 NET CASH PROVIDED BY OPERATING ACTIVITIES 44,333,596 42,731,583 INVESTING ACTIVITIES Purchase of property, plant & equipment (5,742,527) (11,578,662) Disposal of property, plant & equipment 562,740 238,327 NET CASH USED IN INVESTING ACTIVITIES (5,179,787) (11,340,335) FINANCING ACTIVITIES Increase in debt payable 46,500,000 111,518,354 Reduction in debt payable (41,978723) (41,895,833) Contribution - 799,979 Distribution (46,846,047) (100,000,000) Other financing activities (661,192) (137,511) NET CASH USED IN FINANCING ACTIVITIES (42,985,962) (29,715,011) NET DECREASE/INCREASE IN CASH (3,832,153) 1,676,237 CASH AND CASH EQUIVALENTS AT BEGINNING OF THE PERIOD 6,925,454 4,626,026 CASH AND CASH EQUIVALENTS AT END OF THE PERIOD $ 3,093,301 $ 6,302,263 SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest, net of amount capitalized $ 6,689,271 $ 3,911,282 NON-CASH INVESTING ACTIVITIES: Capital expenditures included in accounts payable & accrued liabilities $ 1,138,504 $ 133,290

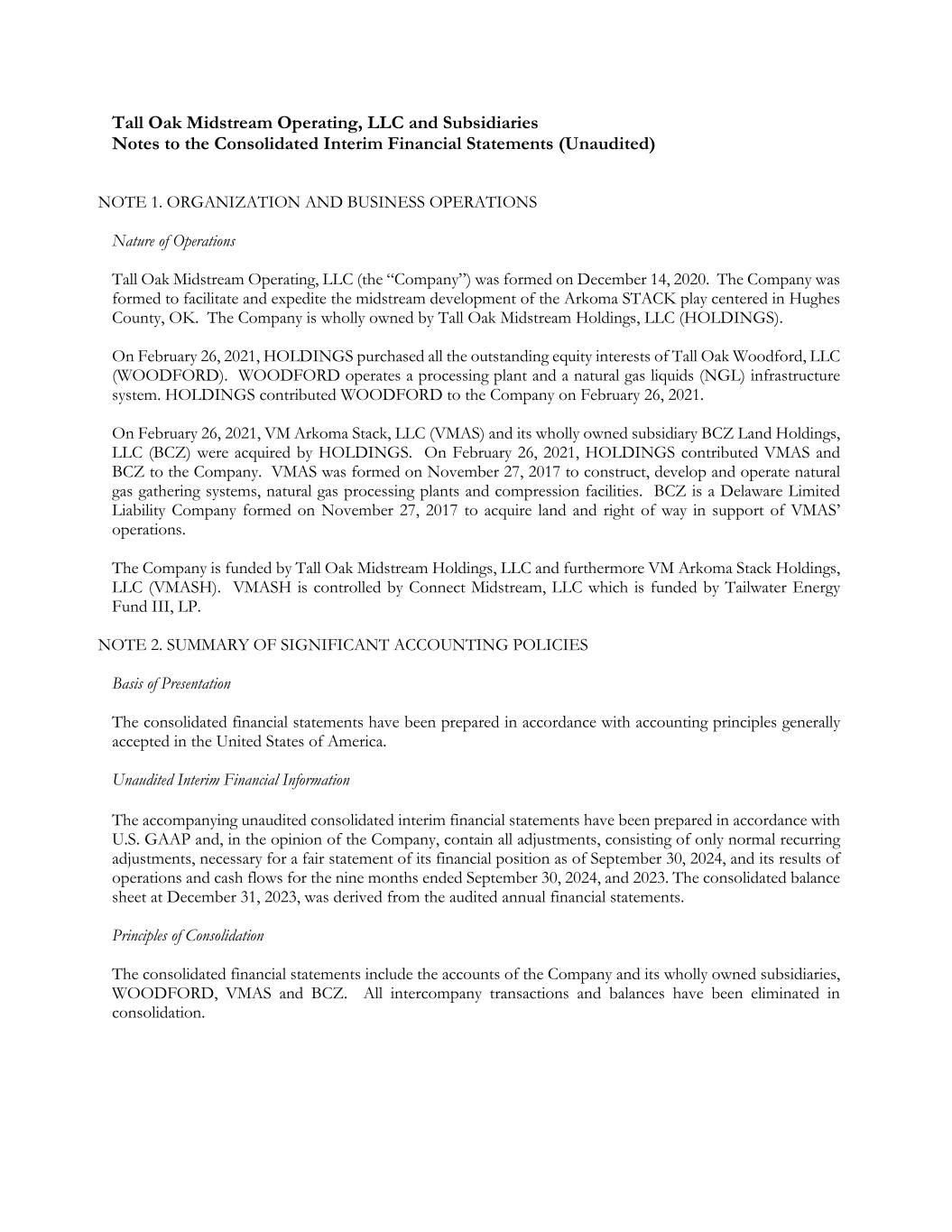

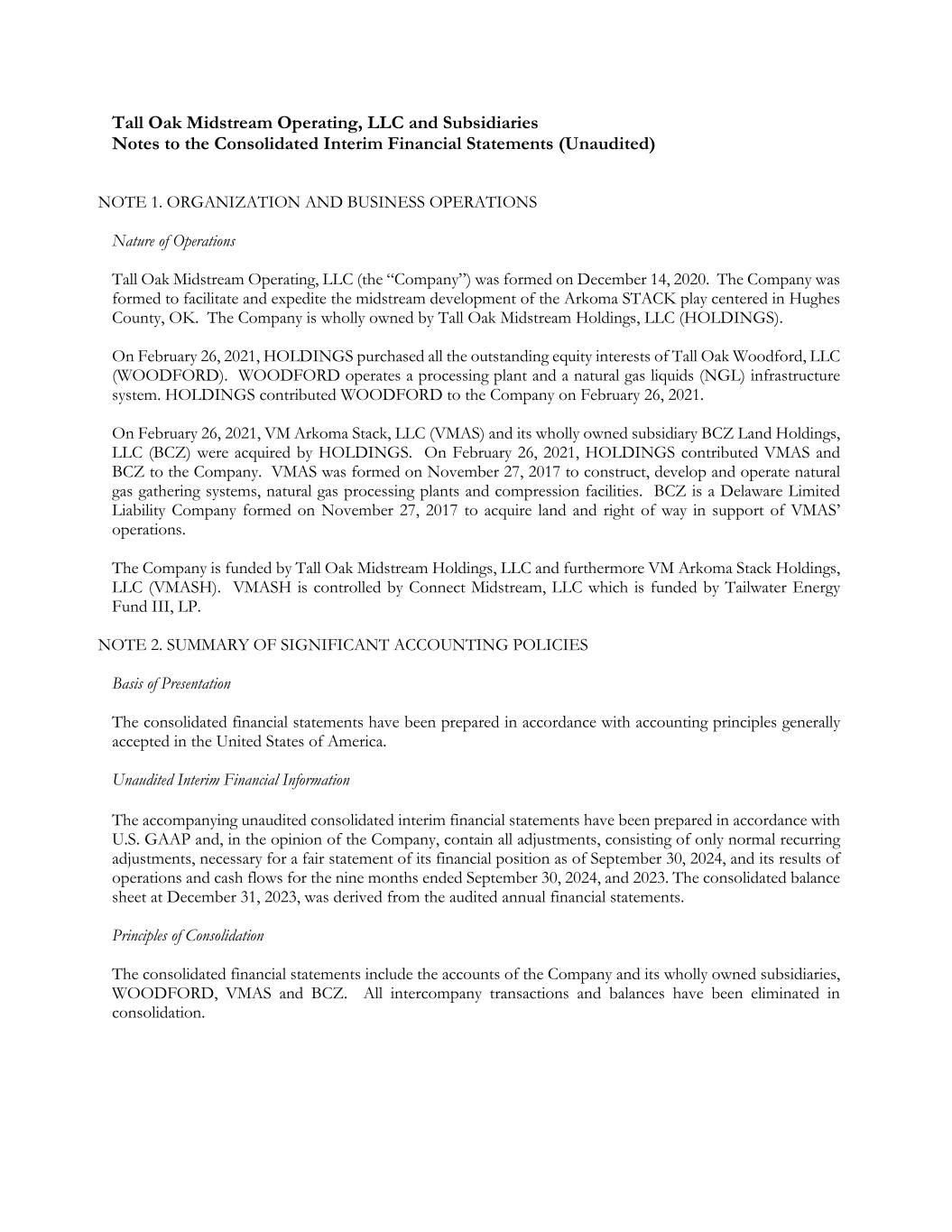

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 1. ORGANIZATION AND BUSINESS OPERATIONS Nature of Operations Tall Oak Midstream Operating, LLC (the “Company”) was formed on December 14, 2020. The Company was formed to facilitate and expedite the midstream development of the Arkoma STACK play centered in Hughes County, OK. The Company is wholly owned by Tall Oak Midstream Holdings, LLC (HOLDINGS). On February 26, 2021, HOLDINGS purchased all the outstanding equity interests of Tall Oak Woodford, LLC (WOODFORD). WOODFORD operates a processing plant and a natural gas liquids (NGL) infrastructure system. HOLDINGS contributed WOODFORD to the Company on February 26, 2021. On February 26, 2021, VM Arkoma Stack, LLC (VMAS) and its wholly owned subsidiary BCZ Land Holdings, LLC (BCZ) were acquired by HOLDINGS. On February 26, 2021, HOLDINGS contributed VMAS and BCZ to the Company. VMAS was formed on November 27, 2017 to construct, develop and operate natural gas gathering systems, natural gas processing plants and compression facilities. BCZ is a Delaware Limited Liability Company formed on November 27, 2017 to acquire land and right of way in support of VMAS’ operations. The Company is funded by Tall Oak Midstream Holdings, LLC and furthermore VM Arkoma Stack Holdings, LLC (VMASH). VMASH is controlled by Connect Midstream, LLC which is funded by Tailwater Energy Fund III, LP. NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Basis of Presentation The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. Unaudited Interim Financial Information The accompanying unaudited consolidated interim financial statements have been prepared in accordance with U.S. GAAP and, in the opinion of the Company, contain all adjustments, consisting of only normal recurring adjustments, necessary for a fair statement of its financial position as of September 30, 2024, and its results of operations and cash flows for the nine months ended September 30, 2024, and 2023. The consolidated balance sheet at December 31, 2023, was derived from the audited annual financial statements. Principles of Consolidation The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, WOODFORD, VMAS and BCZ. All intercompany transactions and balances have been eliminated in consolidation.

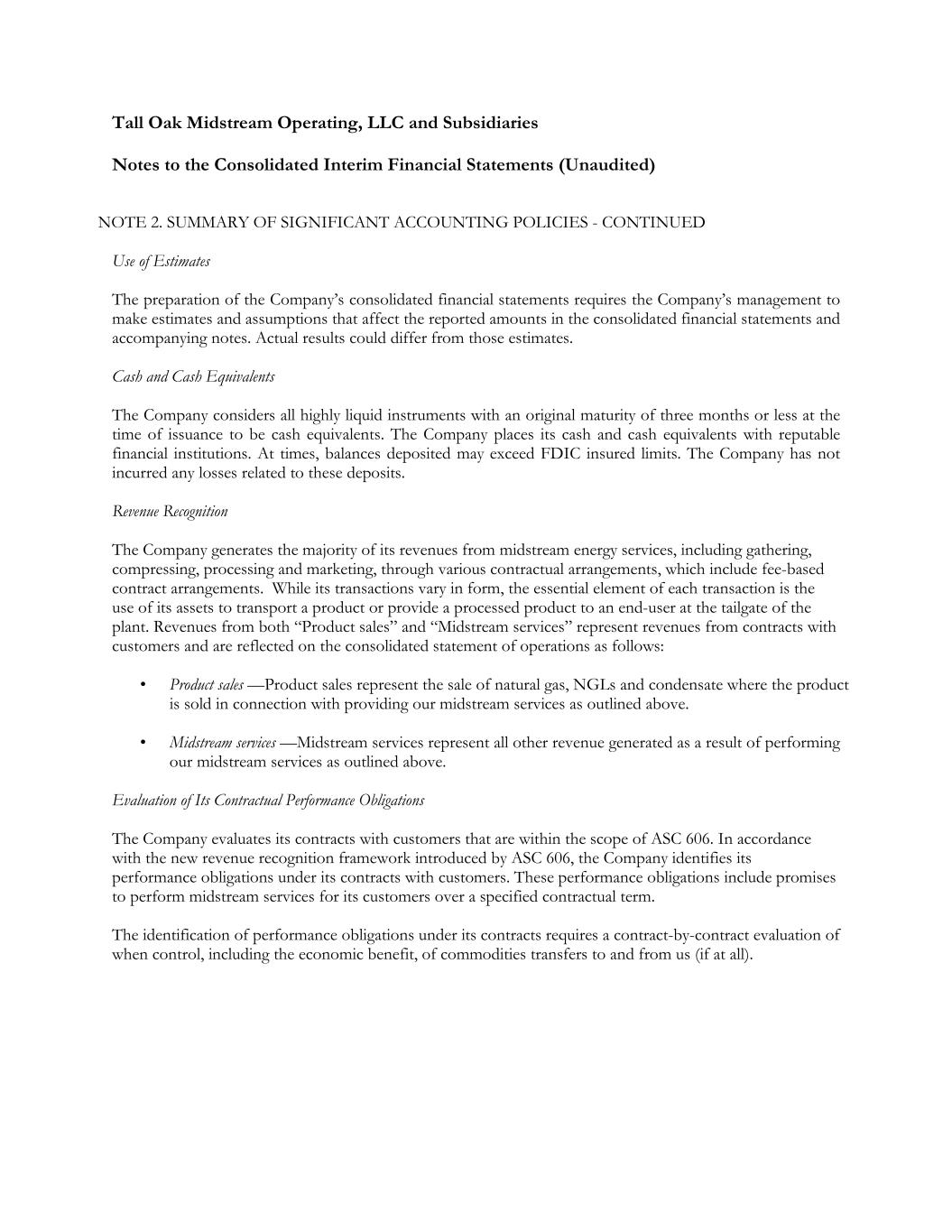

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED Use of Estimates The preparation of the Company’s consolidated financial statements requires the Company’s management to make estimates and assumptions that affect the reported amounts in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates. Cash and Cash Equivalents The Company considers all highly liquid instruments with an original maturity of three months or less at the time of issuance to be cash equivalents. The Company places its cash and cash equivalents with reputable financial institutions. At times, balances deposited may exceed FDIC insured limits. The Company has not incurred any losses related to these deposits. Revenue Recognition The Company generates the majority of its revenues from midstream energy services, including gathering, compressing, processing and marketing, through various contractual arrangements, which include fee-based contract arrangements. While its transactions vary in form, the essential element of each transaction is the use of its assets to transport a product or provide a processed product to an end-user at the tailgate of the plant. Revenues from both “Product sales” and “Midstream services” represent revenues from contracts with customers and are reflected on the consolidated statement of operations as follows: • Product sales —Product sales represent the sale of natural gas, NGLs and condensate where the product is sold in connection with providing our midstream services as outlined above. • Midstream services —Midstream services represent all other revenue generated as a result of performing our midstream services as outlined above. Evaluation of Its Contractual Performance Obligations The Company evaluates its contracts with customers that are within the scope of ASC 606. In accordance with the new revenue recognition framework introduced by ASC 606, the Company identifies its performance obligations under its contracts with customers. These performance obligations include promises to perform midstream services for its customers over a specified contractual term. The identification of performance obligations under its contracts requires a contract-by-contract evaluation of when control, including the economic benefit, of commodities transfers to and from us (if at all).

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED Accounting Methodology for Certain Contracts The Company’s midstream service contracts related to NGL or natural gas gathering and processing do not contain a commodity purchase and the Company does not control the commodity. The Company earns a fee for its services and considers these contracts to contain performance obligations for its services. Accordingly, the Company considers the satisfaction of these performance obligations as revenue-generating, and the Company recognizes the fees received for satisfying these performance obligations as midstream service revenues over time as the Company satisfies its performance obligations. For contracts in which the Company does not possess control of the commodities and is acting as an agent, its consolidated statements of operations reflect midstream services revenues that the Company earns based on the terms contained in the applicable contract. The Company also evaluates its contractual arrangements that contain a purchase and sale of commodities under the principal/agent provisions in ASC 606. For contracts where the Company possesses control of the commodity and acts as principal in the purchase and sale, the Company records product sales revenue at the price at which the commodities are sold, with a corresponding cost of sales equal to the cost of the commodities when purchased. Satisfaction of Performance Obligations and Recognition of Revenue For its commodity sales contracts, the Company satisfies its performance obligations at the point in time at which the commodity transfers from us to the customer. This transfer pattern aligns with its billing methodology. Therefore, the Company recognizes product sales revenue at the time the commodity is delivered and in the amount to which the Company has the right to invoice the customer. For its midstream service contracts that contain revenue-generating performance obligations, the Company satisfies its performance obligations over time as the Company performs the midstream services and as the customer receives the benefit of these services over the term of the contract. As permitted by ASC 606, the Company is utilizing the practical expedient that allows an entity to recognize revenue in the amount to which the entity has a right to invoice, since the Company has a right to consideration from its customer in an amount that corresponds directly with the value to the customer of its performance completed to date. Accordingly, the Company recognizes revenue over time as its midstream services are performed. The Company generally accrues one month of sales and the related natural gas, NGL, and condensate purchases and reverses these accruals when the sales and purchases are invoiced and recorded in the subsequent month. Actual results could differ from the accrual estimates. The Company typically receives payment for invoiced amounts within one month, depending on the terms of the contract. The Company accounts for taxes collected from customers attributable to revenue transactions and remitted to government authorities on a net basis (excluded from revenues). Revenue Receivable/Payable Balances receivable from product sales are presented as revenue receivable on the consolidated balance sheet. Balances payable from product sales are presented as revenue payable on the consolidated balance sheet. The balances for revenue receivable were $10,889,037 and $13,518,580 for September 30, 2024 and December 31, 2023, respectively.

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – CONTINUED Other Receivable During the year ended December 31, 2023, WOODFORD amended a contract with an existing producer to incentivize the producer to drill wells. As a result of the amendment, a receivable was recorded. The receivable balance was $4,188,078 at December 31, 2023. The Company’s Other Receivable was paid in full by the party to the contract during February of 2024. As of September 30, 2024 there is no Other Receivable balance. Accounts Receivable Accounts and revenues receivable include amounts due from customers for midstream services and product sales under normal trade terms, generally requiring payment within 30 days. Accounts receivable are presented net of an allowance for expected credit losses. The balances for accounts receivable were $6,002,207 and $8,423,908 for September 30, 2024 and December 31, 2023, respectively. The Company adopted ASU 2016-13, Financial Instruments – Credit Losses and the subsequent applicable modifications to the rule on January 1, 2023. The Company may record a specific reserve for individual accounts when the Company becomes aware of specific customer circumstances. The Company recorded no allowance for any receivables as of December 31, 2023 or September 30, 2024. The Company determines its allowance for expected credit losses for all other accounts by considering a number of factors including the length of time accounts receivable are past due, the Company’s previous loss history, the debtor’s current ability to pay its obligations to the Company, and the condition of the general economy and industry as a whole. The Company does not generally require collateral from its customers. The Company did not determine the need to record any additional expected credit losses as of December 31, 2023 or September 30, 2024. The adoption of the ASU 2016-13 was adopted under the modified retrospective approach and did not result in an adjustment to opening retaining earnings as of January 1, 2023. Property, Plant, and Equipment and Contract Costs Property, plant, and equipment are carried at cost and depreciated on a straight-line basis over the useful life of the asset. When the asset is no longer serviceable and is retired or otherwise disposed of, the cost of the property is removed from the asset account, accumulated depreciation is charged with an amount equivalent to the depreciation provided, and the difference (if any) is recorded as an adjustment to earnings. The useful lives for each asset classification are as follows: Processing plant 25 years Compressor facilities 25 years Well connects & gathering pipe 15 years Liquid & gas infrastructure 15 years The Company has contract costs associated with costs of obtaining contracts and construction cost paid in relation to third party owned pipelines that benefit our operations. During 2023 the Company made a change in amortization method for certain contract related intangibles from a unit of production based method to straight line. The Company accounted for the change prospectively in accordance with GAAP. All other cost is amortized on a straight-line basis over the life of the associated asset.

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED Inventory Inventory is comprised of condensate held at the processing plant and compressor facilities. Inventory is valued at net realizable value. Impairments of Long-Lived Assets and Contract Costs The Company reviews long-lived assets and contract costs for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The recoverability of an asset to be held and used is measured by a comparison of the carrying amount of the asset to future net undiscounted cash flows expected to be generated by the asset. Individual assets are grouped at the lowest level for which the related identifiable cash flows are largely independent of the cash flows of other assets and liabilities. These cash flow estimates require management to make judgments and assumptions related to operating and cash flow results, economic obsolescence, the business climate, contractual, legal and other factors. If the carrying amount exceeds the expected future undiscounted cash flows, the Company recognizes a non-cash impairment loss equal to the excess of net book value over fair value as determined by present value techniques. The estimated cash flows used to assess recoverability of our long-lived assets and measure fair value of our asset group are derived from current business plans, which are developed using near-term and long-term price assumptions, other key assumptions include volume projections, operating costs, timing of incurring such costs, and the use of appropriate values and discount rates. Any changes management makes to these projections and assumptions can result in significant revisions to management’s evaluation of recoverability of its long-lived assets and the recognition of additional impairments. The Company believes its estimates and models used to determine fair values are similar to what a market participant would use. Financial Instruments The carrying value of cash and cash equivalents, accounts payable and accrued liabilities are representative of fair value due to the highly liquid and short-term nature of the instruments. Income Taxes The Company is organized as a Delaware Limited Liability Company. The taxable income of the Company will be included in the federal income tax returns filed by its Members. Accordingly, no tax provision has been made in the consolidated financial statements of the Company. ASC Topic 740, Income Taxes, related to accounting for uncertainty in income taxes, requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Company’s tax returns and disallows the recognition of tax positions not deemed to meet a “more-likely-than-not” threshold of being sustained by the applicable tax authority. The Company’s management does not believe it has any tax positions taken that would not meet this threshold and that would require recognition in these consolidated financial statements. The Company’s policy is to reflect interest and penalties related to uncertain tax positions as part of its selling, general, and administrative expenses when and if they become applicable.

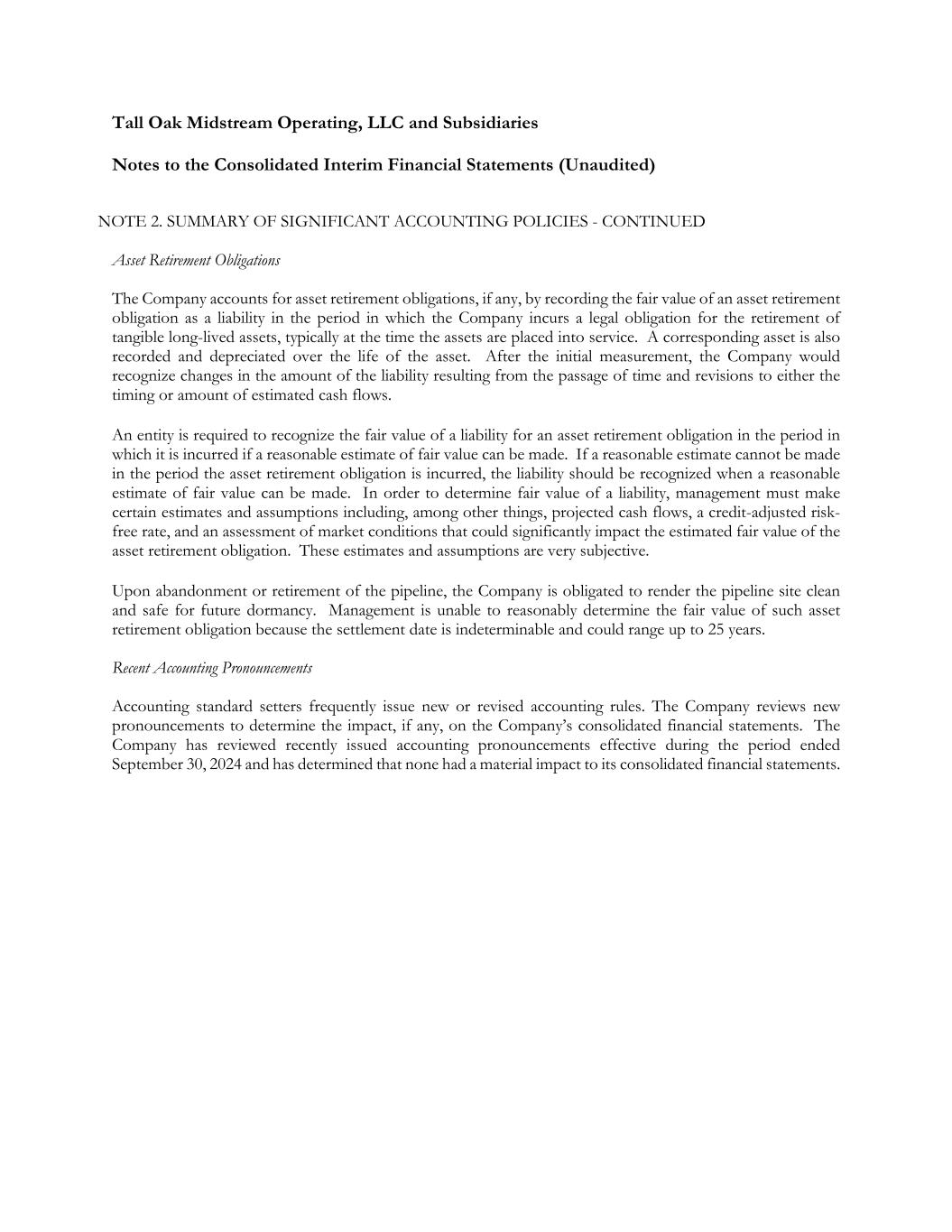

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED Asset Retirement Obligations The Company accounts for asset retirement obligations, if any, by recording the fair value of an asset retirement obligation as a liability in the period in which the Company incurs a legal obligation for the retirement of tangible long-lived assets, typically at the time the assets are placed into service. A corresponding asset is also recorded and depreciated over the life of the asset. After the initial measurement, the Company would recognize changes in the amount of the liability resulting from the passage of time and revisions to either the timing or amount of estimated cash flows. An entity is required to recognize the fair value of a liability for an asset retirement obligation in the period in which it is incurred if a reasonable estimate of fair value can be made. If a reasonable estimate cannot be made in the period the asset retirement obligation is incurred, the liability should be recognized when a reasonable estimate of fair value can be made. In order to determine fair value of a liability, management must make certain estimates and assumptions including, among other things, projected cash flows, a credit-adjusted risk- free rate, and an assessment of market conditions that could significantly impact the estimated fair value of the asset retirement obligation. These estimates and assumptions are very subjective. Upon abandonment or retirement of the pipeline, the Company is obligated to render the pipeline site clean and safe for future dormancy. Management is unable to reasonably determine the fair value of such asset retirement obligation because the settlement date is indeterminable and could range up to 25 years. Recent Accounting Pronouncements Accounting standard setters frequently issue new or revised accounting rules. The Company reviews new pronouncements to determine the impact, if any, on the Company’s consolidated financial statements. The Company has reviewed recently issued accounting pronouncements effective during the period ended September 30, 2024 and has determined that none had a material impact to its consolidated financial statements.

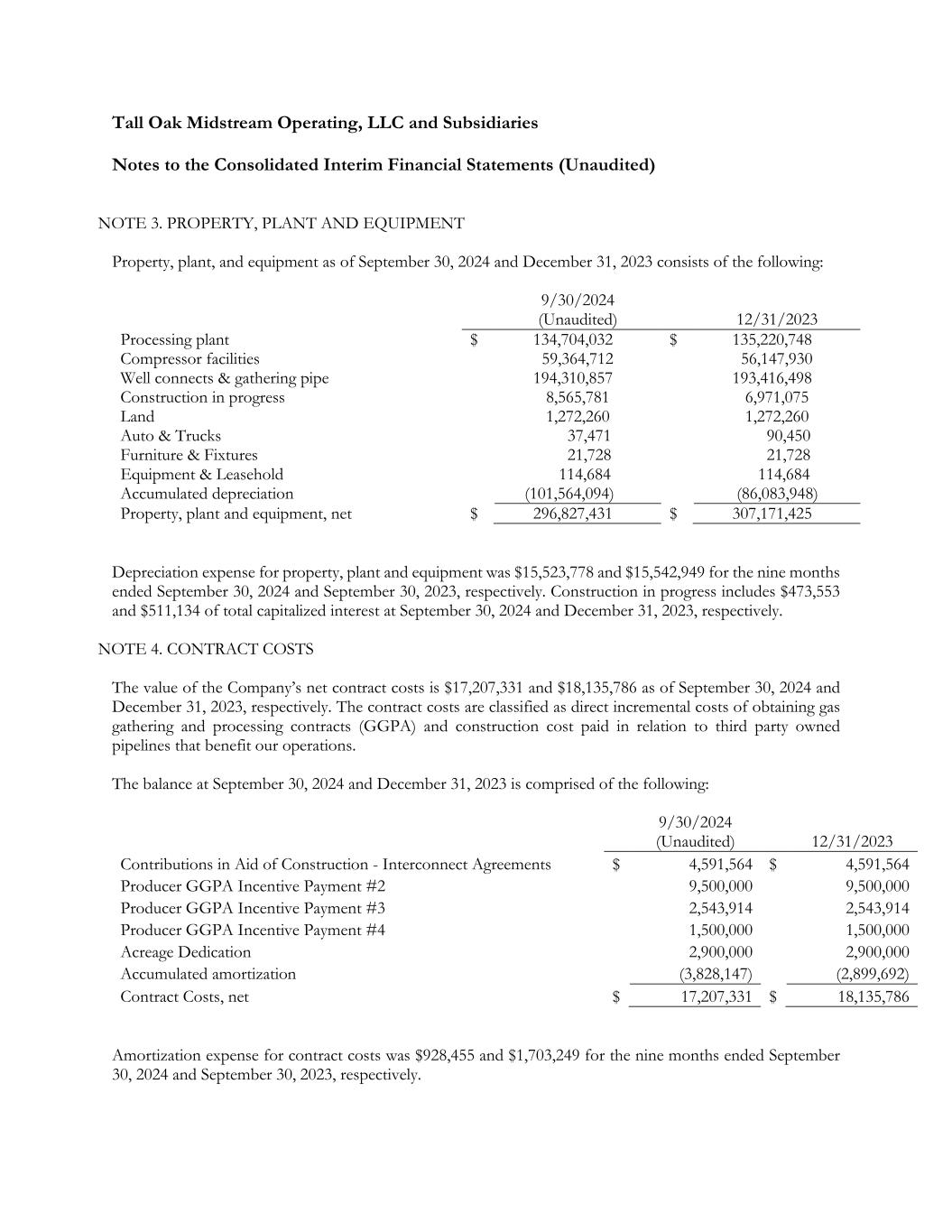

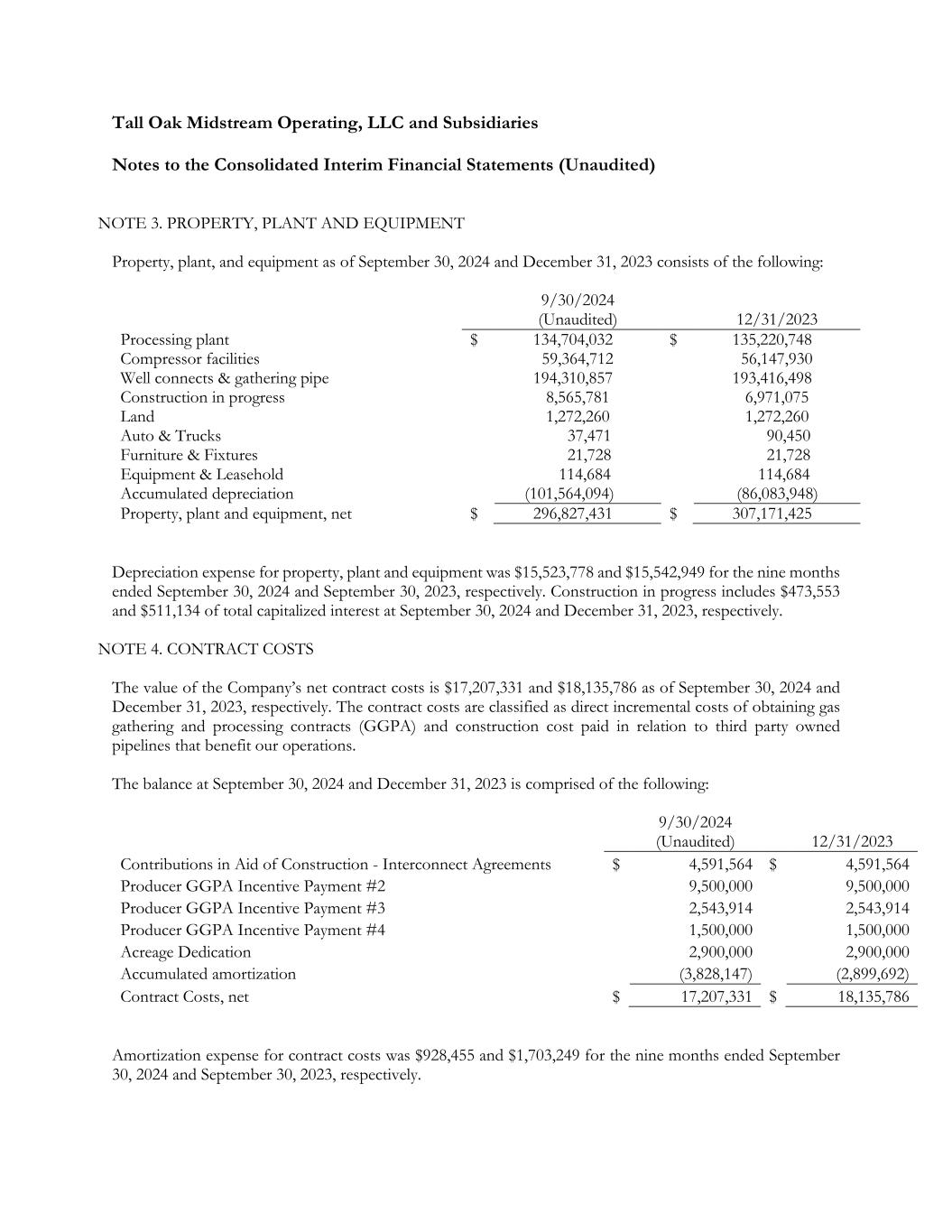

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 3. PROPERTY, PLANT AND EQUIPMENT Property, plant, and equipment as of September 30, 2024 and December 31, 2023 consists of the following: 9/30/2024 (Unaudited) 12/31/2023 Processing plant $ 134,704,032 $ 135,220,748 Compressor facilities 59,364,712 56,147,930 Well connects & gathering pipe 194,310,857 193,416,498 Construction in progress 8,565,781 6,971,075 Land 1,272,260 1,272,260 Auto & Trucks 37,471 90,450 Furniture & Fixtures 21,728 21,728 Equipment & Leasehold 114,684 114,684 Accumulated depreciation (101,564,094) (86,083,948) Property, plant and equipment, net $ 296,827,431 $ 307,171,425 Depreciation expense for property, plant and equipment was $15,523,778 and $15,542,949 for the nine months ended September 30, 2024 and September 30, 2023, respectively. Construction in progress includes $473,553 and $511,134 of total capitalized interest at September 30, 2024 and December 31, 2023, respectively. NOTE 4. CONTRACT COSTS The value of the Company’s net contract costs is $17,207,331 and $18,135,786 as of September 30, 2024 and December 31, 2023, respectively. The contract costs are classified as direct incremental costs of obtaining gas gathering and processing contracts (GGPA) and construction cost paid in relation to third party owned pipelines that benefit our operations. The balance at September 30, 2024 and December 31, 2023 is comprised of the following: 9/30/2024 (Unaudited) 12/31/2023 Contributions in Aid of Construction - Interconnect Agreements $ 4,591,564 $ 4,591,564 Producer GGPA Incentive Payment #2 9,500,000 9,500,000 Producer GGPA Incentive Payment #3 2,543,914 2,543,914 Producer GGPA Incentive Payment #4 1,500,000 1,500,000 Acreage Dedication 2,900,000 2,900,000 Accumulated amortization (3,828,147) (2,899,692) Contract Costs, net $ 17,207,331 $ 18,135,786 Amortization expense for contract costs was $928,455 and $1,703,249 for the nine months ended September 30, 2024 and September 30, 2023, respectively.

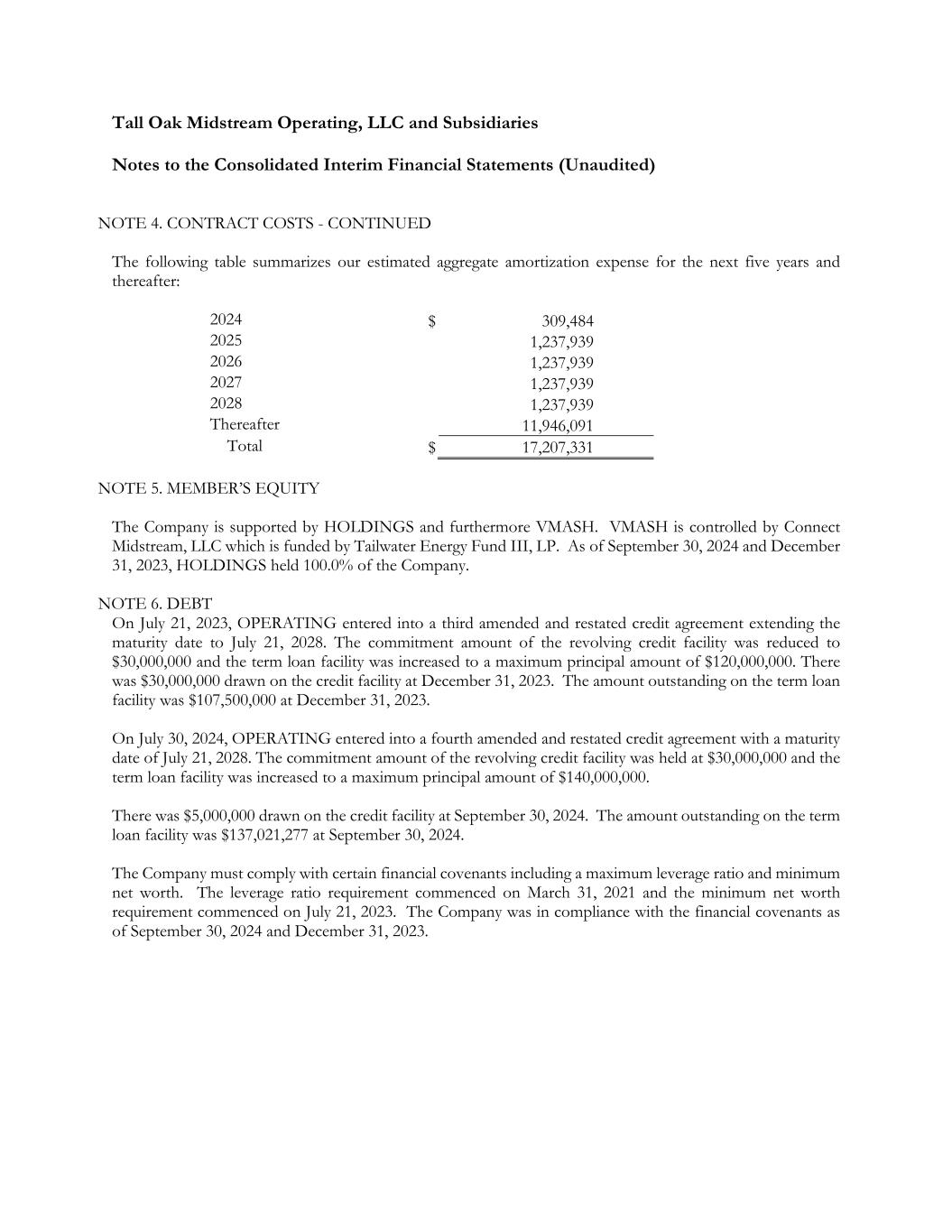

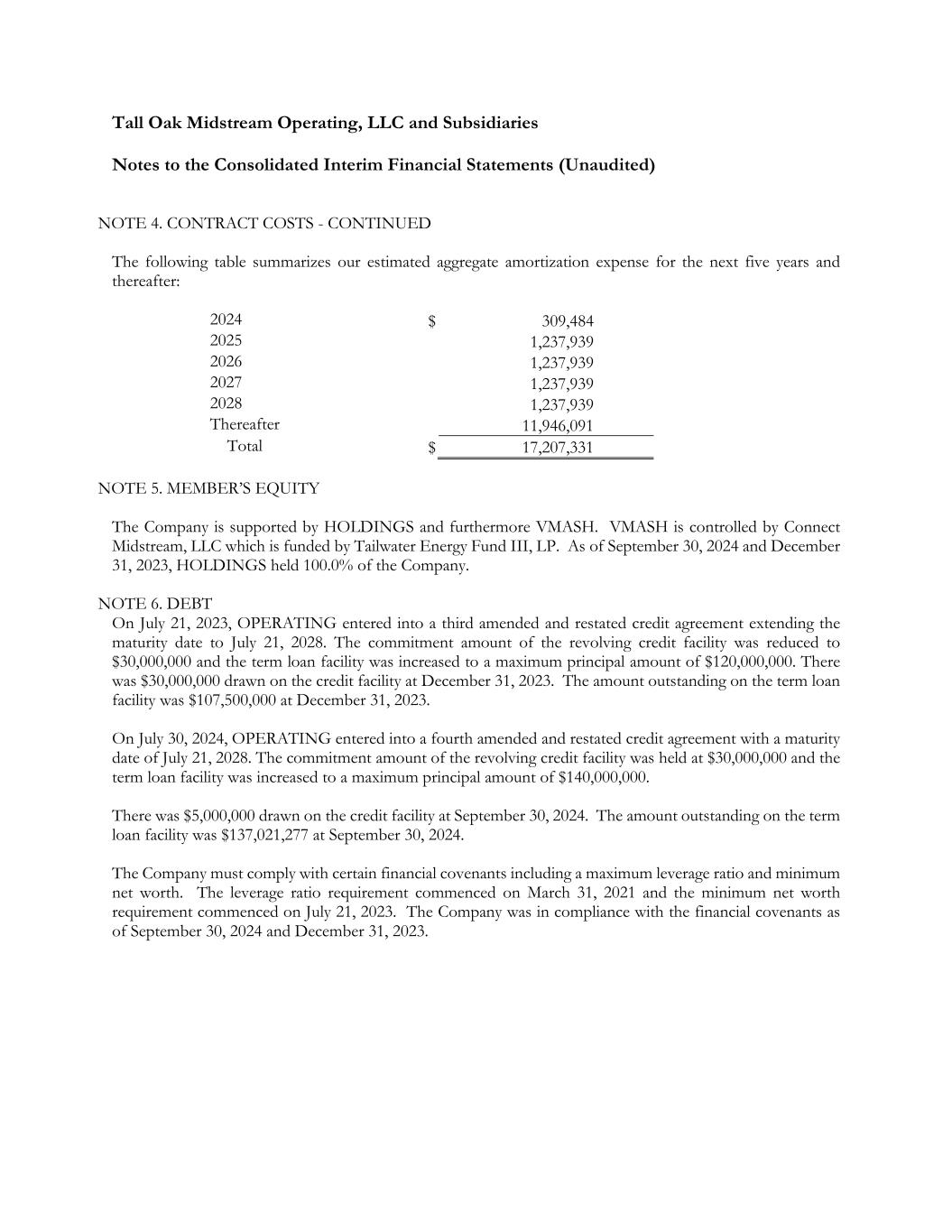

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 4. CONTRACT COSTS - CONTINUED The following table summarizes our estimated aggregate amortization expense for the next five years and thereafter: 2024 $ 309,484 2025 1,237,939 2026 1,237,939 2027 1,237,939 2028 1,237,939 Thereafter 11,946,091 Total $ 17,207,331 NOTE 5. MEMBER’S EQUITY The Company is supported by HOLDINGS and furthermore VMASH. VMASH is controlled by Connect Midstream, LLC which is funded by Tailwater Energy Fund III, LP. As of September 30, 2024 and December 31, 2023, HOLDINGS held 100.0% of the Company. NOTE 6. DEBT On July 21, 2023, OPERATING entered into a third amended and restated credit agreement extending the maturity date to July 21, 2028. The commitment amount of the revolving credit facility was reduced to $30,000,000 and the term loan facility was increased to a maximum principal amount of $120,000,000. There was $30,000,000 drawn on the credit facility at December 31, 2023. The amount outstanding on the term loan facility was $107,500,000 at December 31, 2023. On July 30, 2024, OPERATING entered into a fourth amended and restated credit agreement with a maturity date of July 21, 2028. The commitment amount of the revolving credit facility was held at $30,000,000 and the term loan facility was increased to a maximum principal amount of $140,000,000. There was $5,000,000 drawn on the credit facility at September 30, 2024. The amount outstanding on the term loan facility was $137,021,277 at September 30, 2024. The Company must comply with certain financial covenants including a maximum leverage ratio and minimum net worth. The leverage ratio requirement commenced on March 31, 2021 and the minimum net worth requirement commenced on July 21, 2023. The Company was in compliance with the financial covenants as of September 30, 2024 and December 31, 2023.

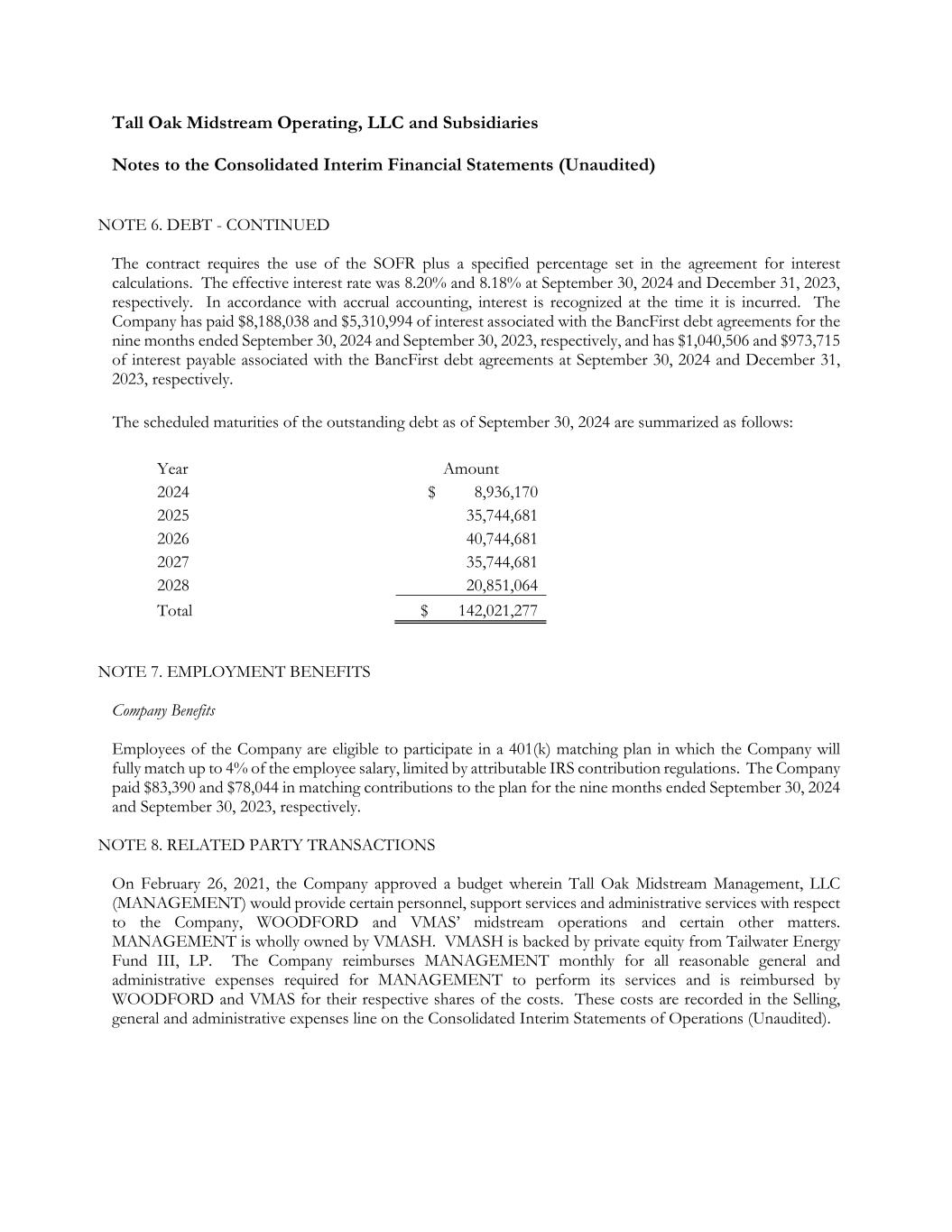

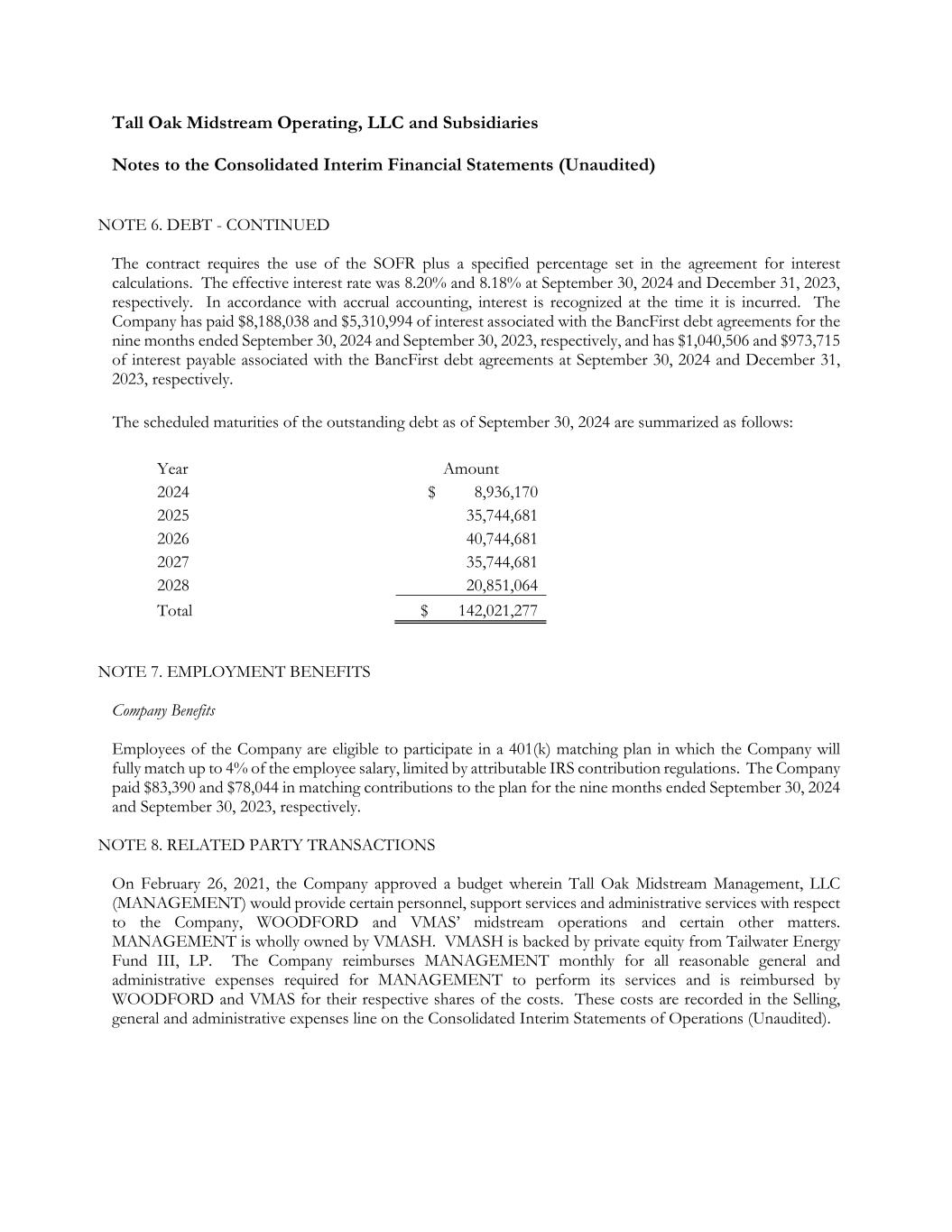

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 6. DEBT - CONTINUED The contract requires the use of the SOFR plus a specified percentage set in the agreement for interest calculations. The effective interest rate was 8.20% and 8.18% at September 30, 2024 and December 31, 2023, respectively. In accordance with accrual accounting, interest is recognized at the time it is incurred. The Company has paid $8,188,038 and $5,310,994 of interest associated with the BancFirst debt agreements for the nine months ended September 30, 2024 and September 30, 2023, respectively, and has $1,040,506 and $973,715 of interest payable associated with the BancFirst debt agreements at September 30, 2024 and December 31, 2023, respectively. The scheduled maturities of the outstanding debt as of September 30, 2024 are summarized as follows: Year Amount 2024 $ 8,936,170 2025 35,744,681 2026 40,744,681 2027 35,744,681 2028 20,851,064 Total $ 142,021,277 NOTE 7. EMPLOYMENT BENEFITS Company Benefits Employees of the Company are eligible to participate in a 401(k) matching plan in which the Company will fully match up to 4% of the employee salary, limited by attributable IRS contribution regulations. The Company paid $83,390 and $78,044 in matching contributions to the plan for the nine months ended September 30, 2024 and September 30, 2023, respectively. NOTE 8. RELATED PARTY TRANSACTIONS On February 26, 2021, the Company approved a budget wherein Tall Oak Midstream Management, LLC (MANAGEMENT) would provide certain personnel, support services and administrative services with respect to the Company, WOODFORD and VMAS’ midstream operations and certain other matters. MANAGEMENT is wholly owned by VMASH. VMASH is backed by private equity from Tailwater Energy Fund III, LP. The Company reimburses MANAGEMENT monthly for all reasonable general and administrative expenses required for MANAGEMENT to perform its services and is reimbursed by WOODFORD and VMAS for their respective shares of the costs. These costs are recorded in the Selling, general and administrative expenses line on the Consolidated Interim Statements of Operations (Unaudited).

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 8. RELATED PARTY TRANSACTIONS – CONTINUED Total costs allocated from MANAGEMENT were $9,081,676 and $7,022,442 for the nine months ended September 30, 2024 and September 30, 2023, respectively. Included in these cost is a payable to MANAGEMENT in the amount of $158,934 at December 31, 2023. No intercompany receivable or payable to MANAGEMENT at September 30, 2024. Consolidating journal entries eliminate the related Balance Sheet, Statement of Operations, and Statement of Cash Flows intercompany transactions upon consolidation. NOTE 9. COMMITMENTS AND CONTINGENCIES Legal Matters In the ordinary course of business, the Company may become involved in certain claims and legal actions. Management does not believe that the impact of such matters will have a material adverse effect on the Company’s financial position or results of operation. NOTE 10. LEASES Effective with the adoption of ASC 842 in January of 2022, the Company evaluates new contracts at inception to determine if the contract conveys the right to control the use of an identified asset for a period of time in exchange for periodic payments. A lease exists if we obtain substantially all of the economic benefits of an asset, and we have the right to direct the use of that asset. When a lease exists, we record a right-of-use asset that represents our right to use the asset over the lease term and a lease liability that represents our obligation to make payments over the lease term. Lease liabilities are recorded at the sum of future lease payments discounted by the collateralized rate we could obtain to lease a similar asset over a similar period, and right-of-use assets are recorded equal to the corresponding lease liability, plus any prepaid or direct costs incurred to enter the lease, less the cost of any incentives received from the lessor. The company applied certain practical expedients that were allowed in the adoption of ASC 842, including not recording a right-of-use asset or liability for leases of twelve months or less and not separating lease and non-lease components of lease arrangements. The majority of our leases are for the following types of assets: • Compression Services. The Company pays third parties to provide compression services for our assets. Under these agreements, a third party installs and operates compressor units per a contractual agreement. While the third party determines which compressors to install and operates and maintains the units, the Company is the sole economic beneficiary of the identified assets. These agreements are typically for an initial term of one to two years and will automatically renew from month to month or year to year until canceled by us or the lessor. During the period ended September 30, 2024, the company exercised purchase options on six compressor units resulting in the units being remeasured as finance leases. Compression services represent $12,976,211 of our lease liability and $12,804,645 of our right-of-use asset as of September 30, 2024 and $10,208,595 of our lease liability and $10,208,595 of our right-of-use asset as of December 31, 2023.

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 10. LEASES – CONTINUED • Vehicles. The Company leases vehicles. These leases are typically for multiple years and represent $513,615 of our lease liability and $502,943 of our right-of-use asset as of September 30, 2024 and $316,970 of our lease liability and $305,905 of our right-of-use asset as of December 31, 2023. Lease balances recorded on the consolidated balance sheets as of September 30, 2024 are as follows: Operating leases Finance leases Total ROU assets $ 5,461,213 $ 7,846,375 $ 13,307,588 Current lease liabilities $ 5,372,887 $ 7,762,440 $ 13,135,327 Long-term lease liabilities $ 103,324 $ 251,175 $ 354,499 Other lease information Weighted-average remaining lease term - Operating leases 9 months Weighted-average discount rate - Operating leases 8.00% Weighted-average remaining lease term - Finance leases 3 months Weighted-average discount rate - Finance leases 8.13% Lease balances recorded on the consolidated balance sheets as of December 31, 2023 are as follows: Operating leases Finance leases Total ROU assets $ 10,208,595 $ 305,905 $ 10,514,500 Current lease liabilities $ 8,756,650 $ 154,322 $ 8,910,972 Long-term lease liabilities $ 1,451,943 $ 162,648 $ 1,614,591 Other lease information Weighted-average remaining lease term - Operating leases 13 months Weighted-average discount rate - Operating leases 7.63% Weighted-average remaining lease term - Finance leases 24 months Weighted-average discount rate - Finance leases 7.37%

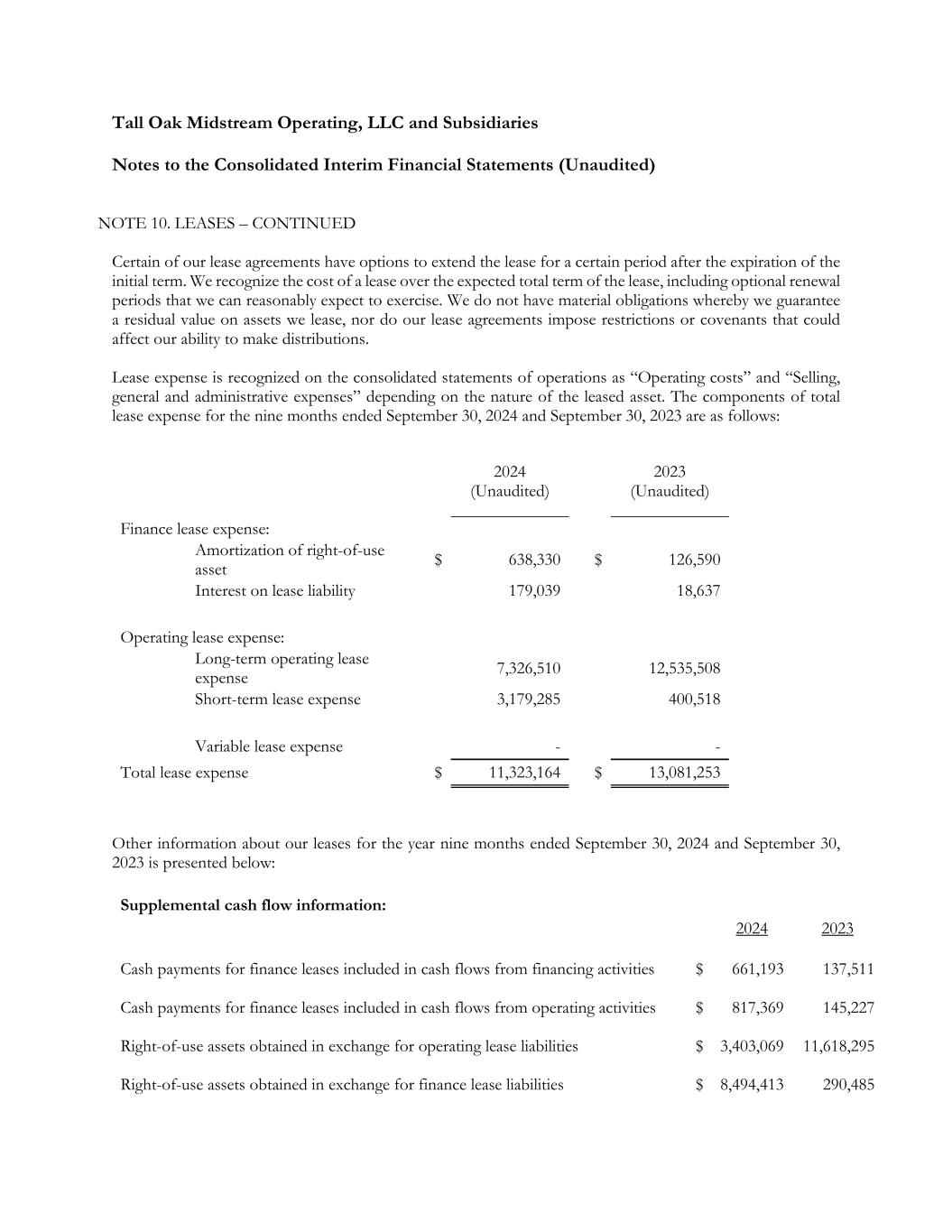

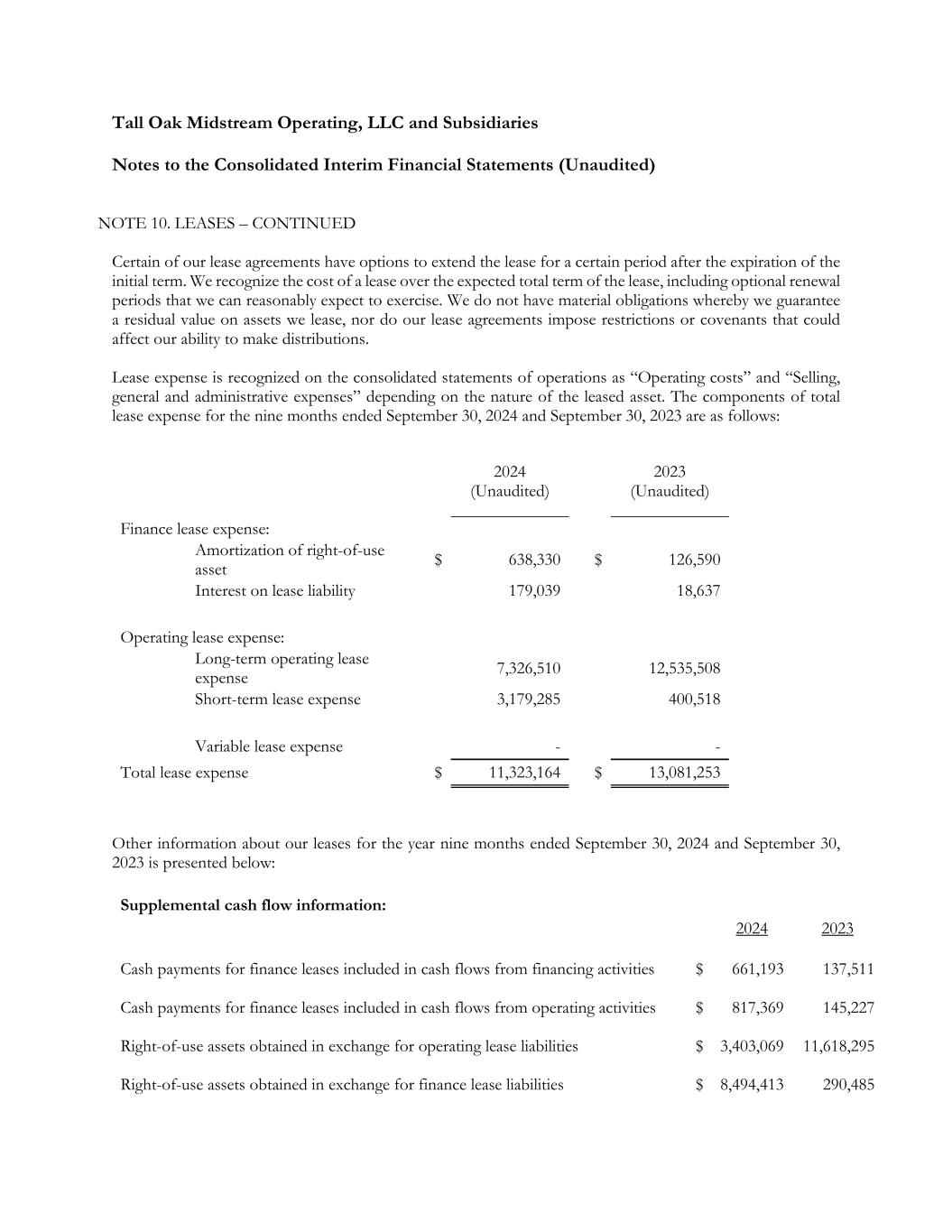

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 10. LEASES – CONTINUED Certain of our lease agreements have options to extend the lease for a certain period after the expiration of the initial term. We recognize the cost of a lease over the expected total term of the lease, including optional renewal periods that we can reasonably expect to exercise. We do not have material obligations whereby we guarantee a residual value on assets we lease, nor do our lease agreements impose restrictions or covenants that could affect our ability to make distributions. Lease expense is recognized on the consolidated statements of operations as “Operating costs” and “Selling, general and administrative expenses” depending on the nature of the leased asset. The components of total lease expense for the nine months ended September 30, 2024 and September 30, 2023 are as follows: 2024 (Unaudited) 2023 (Unaudited) Finance lease expense: Amortization of right-of-use asset $ 638,330 $ 126,590 Interest on lease liability 179,039 18,637 Operating lease expense: Long-term operating lease expense 7,326,510 12,535,508 Short-term lease expense 3,179,285 400,518 Variable lease expense - - Total lease expense $ 11,323,164 $ 13,081,253 Other information about our leases for the year nine months ended September 30, 2024 and September 30, 2023 is presented below: Supplemental cash flow information: 2024 2023 Cash payments for finance leases included in cash flows from financing activities $ 661,193 137,511 Cash payments for finance leases included in cash flows from operating activities $ 817,369 145,227 Right-of-use assets obtained in exchange for operating lease liabilities $ 3,403,069 11,618,295 Right-of-use assets obtained in exchange for finance lease liabilities $ 8,494,413 290,485

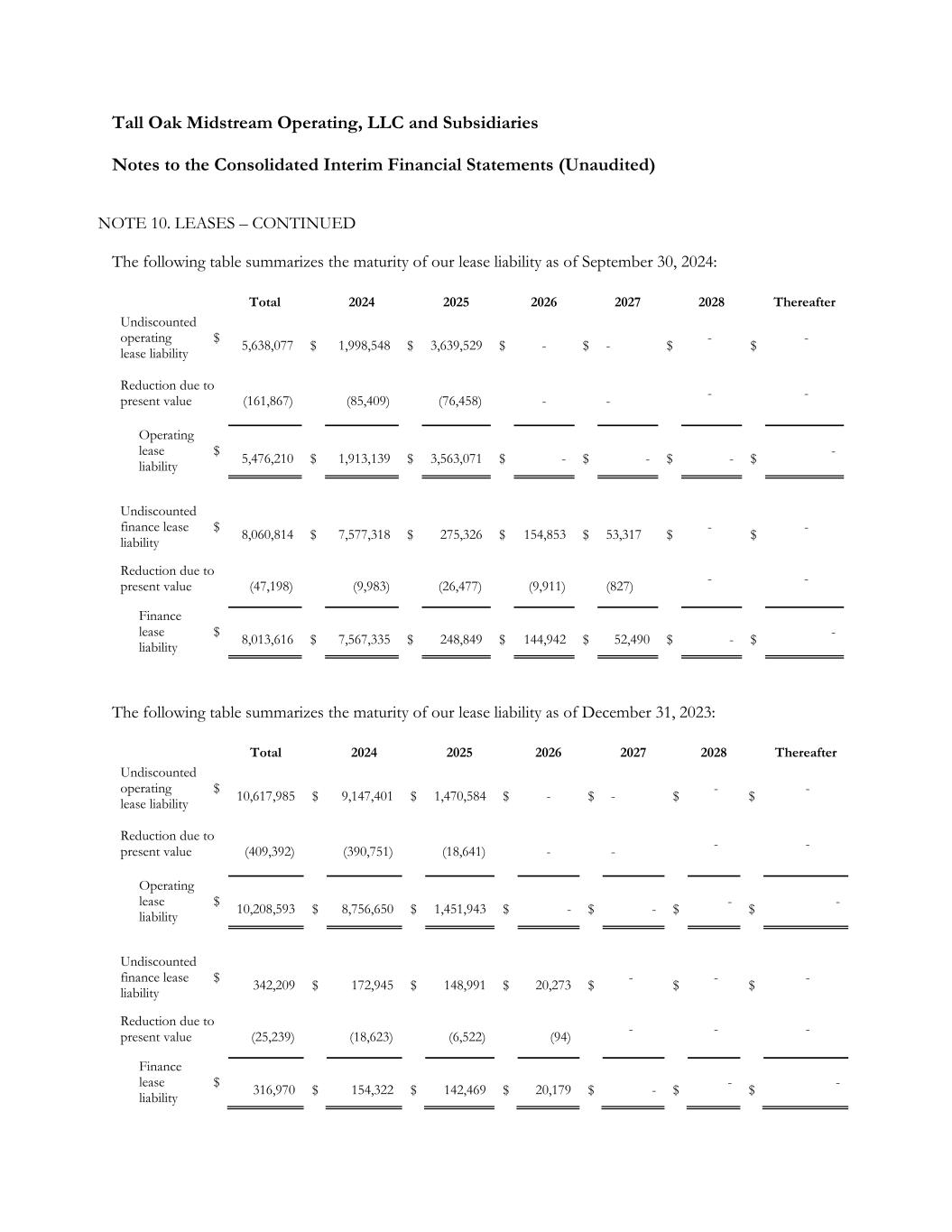

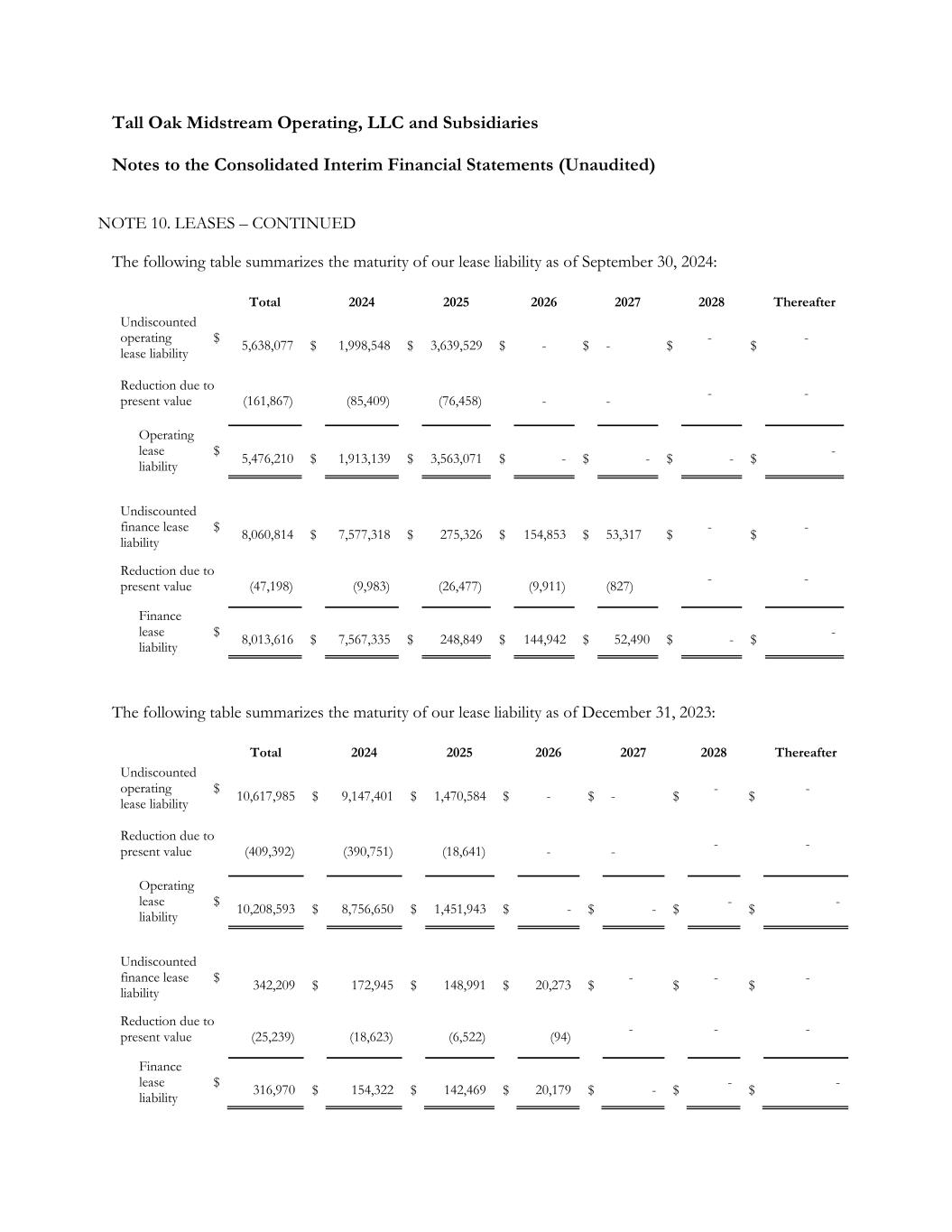

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 10. LEASES – CONTINUED The following table summarizes the maturity of our lease liability as of September 30, 2024: Total 2024 2025 2026 2027 2028 Thereafter Undiscounted operating lease liability $ 5,638,077 $ 1,998,548 $ 3,639,529 $ - $ - $ - $ - Reduction due to present value (161,867) (85,409) (76,458) - - - - Operating lease liability $ 5,476,210 $ 1,913,139 $ 3,563,071 $ - $ - $ - $ - Undiscounted finance lease liability $ 8,060,814 $ 7,577,318 $ 275,326 $ 154,853 $ 53,317 $ - $ - Reduction due to present value (47,198) (9,983) (26,477) (9,911) (827) - - Finance lease liability $ 8,013,616 $ 7,567,335 $ 248,849 $ 144,942 $ 52,490 $ - $ - The following table summarizes the maturity of our lease liability as of December 31, 2023: Total 2024 2025 2026 2027 2028 Thereafter Undiscounted operating lease liability $ 10,617,985 $ 9,147,401 $ 1,470,584 $ - $ - $ - $ - Reduction due to present value (409,392) (390,751) (18,641) - - - - Operating lease liability $ 10,208,593 $ 8,756,650 $ 1,451,943 $ - $ - $ - $ - Undiscounted finance lease liability $ 342,209 $ 172,945 $ 148,991 $ 20,273 $ - $ - $ - Reduction due to present value (25,239) (18,623) (6,522) (94) - - - Finance lease liability $ 316,970 $ 154,322 $ 142,469 $ 20,179 $ - $ - $ -

Tall Oak Midstream Operating, LLC and Subsidiaries Notes to the Consolidated Interim Financial Statements (Unaudited) NOTE 11. COMPRESSION PAYABLE On January 22, 2024, VMAS and WOODFORD entered into separate purchase agreements and bills of sale to purchase multiple compressor units from an outside third party. On February 15, 2024, WOODFORD assigned all its rights, obligations and interests in its purchase agreement and bill of sale to VMAS. These units have monthly installment payments that began in February 2024 and run through December 2025. The liability has been recorded as Compression Payable and has an outstanding balance of $1,214,833 at September 30, 2024. NOTE 12. SUBSEQUENT EVENTS Subsequent events were evaluated through December 2, 2024, the date which the consolidated financial statements were available to be issued, for potential recognition or disclosure in these financials. On October 1, 2024, Summit Midstream Corporation, a Delaware corporation (“SUMMIT”), entered into a Business Contribution Agreement (the “Business Contribution Agreement”), by and among SUMMIT, Summit Midstream Partners, LP, a Delaware limited partnership (the “PARTNERSHIP”), and HOLDINGS, pursuant to which, among other things, upon the satisfaction of the terms and conditions set forth therein, HOLDINGS will contribute all of its equity interests in the Company to the PARTNERSHIP, in exchange for an aggregate amount equal to (i) $425,000,000, consisting of (x) $155,000,000 in cash consideration, subject to certain adjustments contemplated by the Business Contribution Agreement and (y) 7,471,008 shares of Class B common stock of SUMMIT, par value $0.01 per share (the “Class B Common Stock”) and 7,471,008 common units representing limited partner interests of the PARTNERSHIP (the “Partnership Units” and together with the Class B Common Stock, the “Securities”), plus (ii) potential cumulative earnout payments continuing through March 31, 2026 not to exceed $25,000,000 in the aggregate that HOLDINGS may become entitled to receive pursuant to the Business Contribution Agreement subject to the Company and its customers meeting certain development requirements. The transaction closed on December 2, 2024.