Exhibit 96.1

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | i |

DATE AND SIGNATURE PAGE

This Report titled “S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa” was prepared for Blyvoor Gold Resources (Pty) Ltd. The Report is compiled in accordance with the United States Securities and Exchange Commission Part 229 Standard Instructions for Filing Forms Regulation S-K subpart 1300. The effective date of this Report is 29 February 2024.

The Qualified Persons (“QPs”) responsible for this Report are Mr. Uwe Engelmann (Geology and Mineral Resources) and Mr. Daniel (Daan) van Heerden (Mineral Processing, Mineral Extraction, Economic Analysis and Mineral Reserves).

| /s/ U ENGELMANN | |

| U ENGELMANN | |

| BSc (Zoo. & Bot.), BSc Hons (Geol.) | |

| Pr.Sci.Nat., FGSSA | |

| DIRECTOR, MINXCON (PTY) LTD | |

| /s/ D VAN HEERDEN | |

| D VAN HEERDEN | |

| B Eng (Min.), MCom (Bus. Admin.), MMC | |

| Pr.Eng., FSAIMM, AMMSA | |

| DIRECTOR, MINXCON (PTY) LTD | |

Signed at Little Falls, Gauteng, South Africa, on 30 May 2024.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | ii |

INFORMATION RISK

This Report was prepared by Uwe Engelmann and Daniel van Heerden (the QPs) of Minxcon (Pty) Ltd (“Minxcon”). In the preparation of the Report, the QPs utilised information relating to operational methods and expectations provided to them by various sources. Where possible, the QPs have verified this information from independent sources after making due enquiry of all material issues that are required in order to comply with the requirements of the United States Securities and Exchange Commission Part 229 Standard Instructions for Filing Forms Regulation S-K subpart 1300. The authors of this report are not qualified to provide extensive commentary on legal issues associated with rights to the mineral properties and relied on the information provided to them by the issuer. No warranty or guarantee, be it express or implied, is made by the authors with respect to the completeness or accuracy of the legal aspects of this document.

OPERATIONAL RISKS

The business of mining and mineral exploration, development and production by their nature contain significant operational risks. The business depends upon, amongst other things, successful prospecting programmes and competent management. Profitability and asset values can be affected by unforeseen changes in operating circumstances and technical issues.

POLITICAL AND ECONOMIC RISK

Factors such as political and industrial disruption, currency fluctuation and interest rates could have an impact on future operations, and potential revenue streams can also be affected by these factors. The majority of these factors are, and will be, beyond the control of any operating entity.

FORWARD LOOKING STATEMENTS

Certain statements contained in this document other than statements of historical fact, contain forward-looking statements regarding the operations, economic performance or financial condition, including, without limitation, those concerning the economic outlook for the mining industry, expectations regarding commodity prices, exchange rates, production, cash costs and other operating results, growth prospects and the outlook of operations, including the completion and commencement of commercial operations of specific production projects, its liquidity and capital resources and expenditure, and the outcome and consequences of any pending litigation or enforcement proceedings.

Although the QPs believe that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to be correct. Accordingly, results may differ materially from those set out in the forward-looking statements as a result of, among other factors, changes in economic and market conditions, changes in the regulatory environment and other State actions, success of business and operating initiatives, fluctuations in commodity prices and exchange rates, and business and potential risk management.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | iii |

TABLE OF CONTENTS

| Item 1 - Executive Summary | 1 |

| | I. | Permitting Requirements | | 1 |

| | II. | Geology and Mineral Deposit | | 1 |

| | III. | Status of Exploration | | 2 |

| | IV. | Mineral Resource and Mineral Reserve Estimates | | 2 |

| | V. | Development and Operations | | 3 |

| | VI. | Economic Analysis | | 4 |

| | VII. | Conclusions | | 6 |

| | VIII. | Recommendations | | 8 |

| Item 2 - Introduction | | 10 |

| | Item 2 (a) | - Issuer Receiving the Report; Authors | | 10 |

| | Item 2 (b) | - Terms of Reference and Purpose of the Report | | 10 |

| | Item 2 (c) | - Sources of Information and Data Contained in the Report | | 10 |

| | Item 2 (d) | - Qualified Persons’ Personal Inspection of the Property | | 10 |

| Item 3 - Property Description and Location | | 12 |

| | Item 3 (a) | - Location of the Property | | 12 |

| | Item 3 (b) | - Area of the Property | | 13 |

| | Item 3 (c) | - Mineral Deposit Tenure | | 14 |

| | Item 3 (d) | - Royalties and Payments | | 15 |

| | I. | Government Royalties | | 15 |

| | II. | Streaming Arrangement | | 15 |

| | Item 3 (e) | - Environmental Liabilities | | 16 |

| | Item 3 (f) | - Permits to Conduct Work | | 17 |

| | I. | Environmental Authorisation | | 17 |

| | II. | Water Use Licence | | 17 |

| | III. | Additional Environmental Permits | | 17 |

| | IV. | other | | 18 |

| | Item 3 (g) | - Other Significant Factors and Risks | | 18 |

| Item 4 - Accessibility, Climate, Local Resources, Infrastructure and Physiography | | 19 |

| | Item 4 (a) | - Topography, Elevation and Vegetation | | 19 |

| | Item 4 (b) | - Access to the Property | | 19 |

| | Item 4 (c) | - Climate and Length of Operating Season | | 19 |

| | Item 4 (d) | - Infrastructure | | 20 |

| | I. | Regional Infrastructure | | 20 |

| | II. | Mine Infrastructure | | 20 |

| Item 5 - History | | 22 |

| | Item 5 (a) | - Prior Ownership and Ownership Changes | | 22 |

| | Item 5 (b) | - Historical Exploration and Development | | 22 |

| Item 6 - Geological Setting, Mineralisation and Deposit | | 23 |

| | Item 6 (a) | - Regional Geology | | 23 |

| | Item 6 (b) | - Local and Property Geology | | 23 |

| | Item 6 (c) | - Mineralisation and Deposit Type | | 28 |

| Item 7 - Exploration | | 29 |

| | Item 7 (a) | - Non-drilling Work | | 29 |

| | I. | Survey Procedures and Parameters | | 29 |

| | II. | Sampling Methods and Sample Quality | | 31 |

| | III. | Sample Data | | 31 |

| | IV. | Results and Interpretation of Exploration Information | | 31 |

| | | | | | |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | iv |

| | Item 7 (b) | - Drilling | | 32 |

| | I. | Type and Extent of Drilling | | 32 |

| | II. | Factors Influencing the Accuracy of Results | | 32 |

| | III. | Exploration Properties – Drill Hole Details | | 33 |

| | Item 7 (c) | - Hydrogeology | | 33 |

| | Item 7 (d) | - Geotechnical | | 33 |

| Item 8 - Sample Preparation, Analyses and Security | | 34 |

| | Item 8 (a) | - Sample Handling Prior to Dispatch | | 34 |

| | Item 8 (b) | - Sample Preparation and Analysis Procedures | | 34 |

| | Item 8 (c) | - Quality Assurance and Quality Control | | 35 |

| | Item 8 (d) | - Adequacy of Sample Preparation, Security and Analytical Procedures | | 36 |

| Item 9 - Data Verification | | 38 |

| | Item 9 (a) | - Data Verification Procedures | | 38 |

| | Item 9 (b) | - Limitations on/Failure to Conduct Data Verification | | 39 |

| | Item 9 (c) | - Adequacy of Data | | 39 |

| Item 10 - Mineral Processing and Metallurgical Testing | | 40 |

| | Item 10 (a) | - Nature and Extent of Testing and Analytical Procedures | | 40 |

| | Item 10 (b) | - Basis of Assumptions Regarding Recovery Estimates | | 40 |

| | Item 10 (c) | - Representativeness of Samples and Adequacy of Data | | 40 |

| | Item 10 (d) | - Deleterious Elements for Extraction | | 40 |

| Item 11 - Mineral Resource Estimates | | 41 |

| | Item 11 (a) | - Assumptions, Parameters and Methods Used for Resource Estimates | | 41 |

| | I. | Mineral Resource Estimation Procedures | | 41 |

| | II. | Initial Assessment | | 48 |

| | III. | Mineral Resource Classification | | 48 |

| | IV. | Mineral Resource Statement | | 49 |

| | Item 11 (b) | - Individual Grade of Metals | | 53 |

| | Item 11 (c) | - Factors Affecting Mineral Resource Estimates | | 53 |

| Item 12 - Mineral Reserve Estimates | | 54 |

| | Item 12 (a) | - Key Assumptions, Parameters and Methods | | 54 |

| | I. | Design Methodology | | 54 |

| | II. | Cut- Off Grade | | 54 |

| | III. | Modifying Factors | | 55 |

| | IV. | Mineral Resource to Mineral Reserve Conversion | | 55 |

| | V. | Mineral Resource to Mineral Reserve Reconciliation | | 57 |

| | Item 12 (b) | - Multiple Commodity Reserve | | 59 |

| | Item 12 (c) | - Factors Affecting Mineral Reserve Estimation | | 59 |

| Item 13 - Mining Methods | | 60 |

| | I. | Opening Up | | 60 |

| | II. | Development | | 60 |

| | III. | Conventional Stoping | | 61 |

| | IV. | Selective Bench Mining | | 61 |

| | Item 13 (a) | - Parameters Relevant to Mine Design | | 61 |

| | I. | Geotechnical and Hydrological Parameters | | 61 |

| | II. | Seismic Management | | 62 |

| | III. | Underground Access, Ore Flow and Material Handling | | 62 |

| | IV. | Ventilation and Cooling | | 65 |

| | | | | | |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | v |

| | Item 13 (b) | - Production Rates, Expected Mine Life, Mining Unit Dimensions, and Mining Dilution | | 65 |

| | I. | Shift Cycle | | 65 |

| | II. | Production Rates | | 65 |

| | III. | Life of Mine Plan | | 66 |

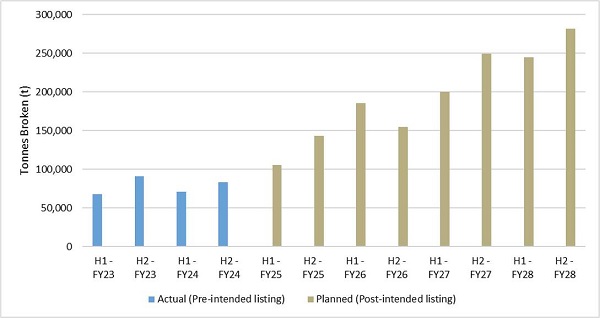

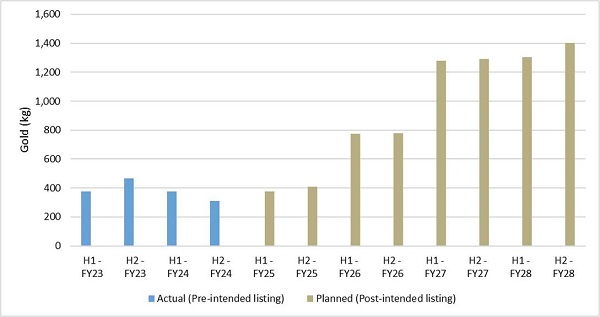

| | IV. | Mining Performance | | 67 |

| | V. | Mining Unit Dimensions | | 69 |

| | VI. | Mine Design | | 70 |

| | VII. | Mineral Reserve Conversion Factors | | 73 |

| | Item 13 (c) | - Requirements for Stripping, Underground Development and Backfilling | | 74 |

| | I. | Underground Development | | 74 |

| | II. | Backfilling | | 75 |

| | Item 13 (d) | - Required Mining Fleet, Machinery and Personnel | | 75 |

| | I. | Mining Fleet and Machinery | | 75 |

| | II. | Personnel | | 76 |

| Item 14 - Recovery Methods | | 77 |

| | Item 14 (a) | - Flow Sheets and Process Recovery Methods | | 77 |

| | Item 14 (b) | - Plant Design, Equipment Characteristics and Specifications | | 78 |

| | Item 14 (c) | - Energy, Water and Process Materials Requirements | | 79 |

| | I. | Labour Requirements | | 79 |

| | II. | Reagents and Consumables | | 80 |

| Item 15 - Project Infrastructure | | 82 |

| | Item 15 (a) | - Infrastructure General Arrangement | | 82 |

| | I. | Surface Infrastructure Layout | | 82 |

| | II. | Shafts and Underground | | 82 |

| | Item 15 (b) | - Mining Operations | | 83 |

| | I. | Surface Operations | | 83 |

| | II. | Underground Operations | | 84 |

| | III. | Completed and Remaining Project Works – Infrastructure | | 85 |

| | Item 15 (c) | - Services | | 88 |

| Item 16 - Market Studies | | 89 |

| | Item 16 (a) | - Commodity Market Assessment | | 89 |

| | I. | World Gold Deposits and Reserves | | 89 |

| | II. | Gold Supply and Demand Fundamentals | | 89 |

| | III. | Gold Pricing | | 90 |

| | IV. | Gold Outlook | | 91 |

| | Item 16 (b) | - Contracts | | 91 |

| Item 17 - Environmental Studies, Permitting and Plans, Negotiations, or Agreements with Local Individuals or Groups | | 92 |

| | Item 17 (a) | - Relevant Environmental Issues and Results of Studies Done | | 92 |

| | I. | Land Use and Site | | 92 |

| | II. | Fauna and Flora | | 92 |

| | III. | Surface Instability | | 92 |

| | IV. | Ionising Radiation | | 93 |

| | V. | Acid Mine Drainage | | 93 |

| | VI. | Groundwater | | 93 |

| | Item 17 (b) | - Waste Disposal, Site Monitoring and Water Management | | 93 |

| | I. | Waste Disposal | | 93 |

| | II. | Site Monitoring – Water | | 93 |

| | III. | Site Monitoring – Sinkholes | | 94 |

| | IV. | Site Monitoring – Dust Fallout | | 94 |

| | V. | Site Monitoring – Radioactivity | | 94 |

| | VI. | Water Management | | 94 |

| | | | | | |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | vi |

| | Item 17 (c) | - Permit Requirements | | 94 |

| | Item 17 (d) | - Social and Community-Related Requirements | | 94 |

| | Item 17 (e) | - Mine Closure Plans and Costs | | 95 |

| | Item 17 (f) | - Adequacy of Current Plans | | 96 |

| | Item 17 (g) | - Local Procurement and Hiring | | 96 |

| Item 18 - Capital and Operating Costs | | 97 |

| | Item 18 (a) | - Capital Costs | | 97 |

| | Item 18 (b) | - Operating Cost | | 100 |

| | I. | Financial Costs Indicators | | 107 |

| | Item 18 (c) | - Accuracy of Estimates | | 110 |

| Item 19 - Economic Analysis | | 111 |

| | Item 19 (a) | - Principal Assumptions | | 111 |

| | I. | Basis of Evaluation of the Mining Assets | | 111 |

| | II. | Macro-Economic Forecasts | | 111 |

| | III. | Working Capital | | 112 |

| | IV. | Recoveries | | 112 |

| | V. | Discount Rate | | 112 |

| | VI. | Cash Flow Forecast | | 113 |

| | Item 19 (b) | - Net Present Value | | 121 |

| | Item 19 (c) | - Regulatory Items | | 122 |

| | I. | Government Royalties | | 122 |

| | II. | Corporate Taxes | | 122 |

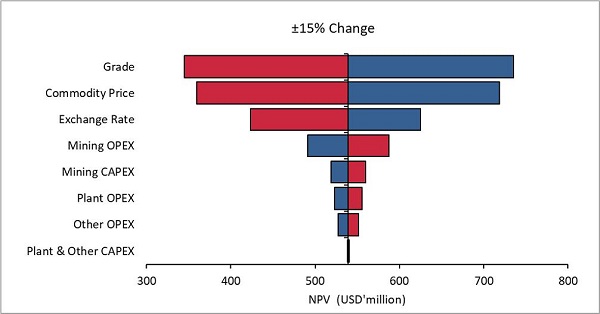

| | Item 19 (d) | - Sensitivity Analysis | | 122 |

| | Item 19 (e) | - Economic Analysis Conclusions | | 125 |

| Item 20 - Adjacent Properties | | 126 |

| Item 21 - Other Relevant Data and Information | | 129 |

| | Item 21 (a) | - Risk Assessment | | 129 |

| Item 22 - Interpretation and Conclusions | | 133 |

| Item 23 - Recommendations | | 135 |

| Item 24 - References | | 137 |

| Item 25 - Reliance on Information Provided by the Registrant | | 138 |

| | | | | | |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | vii |

FIGURES

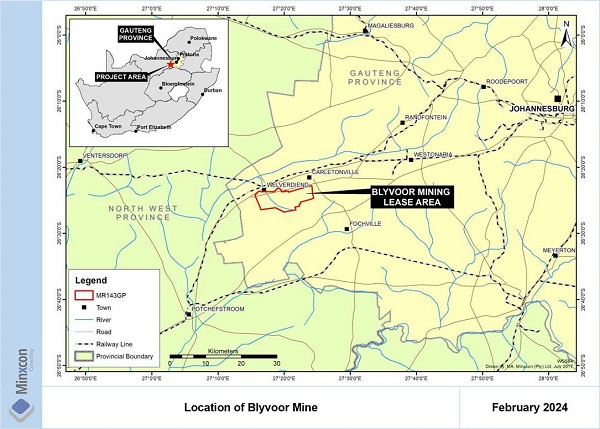

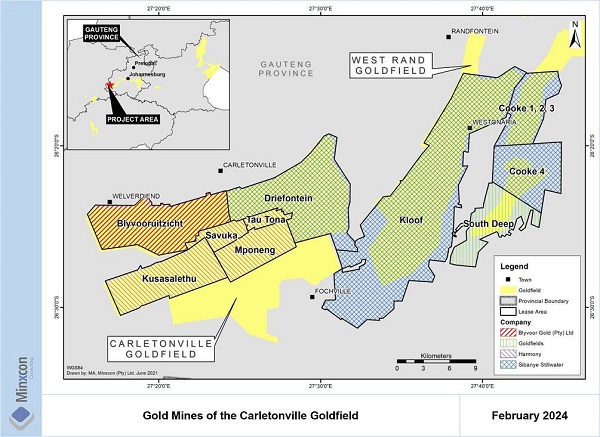

| Figure 1: Location of Blyvoor Mine | | 12 |

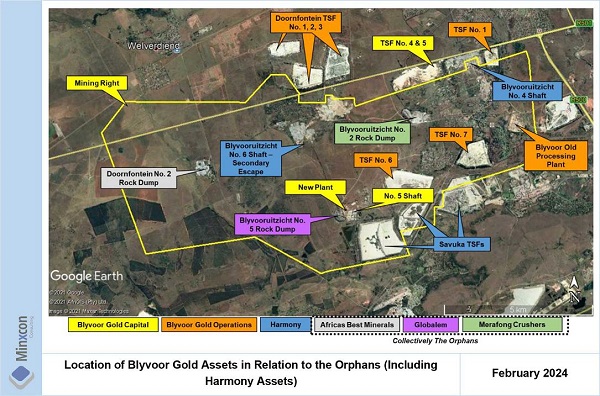

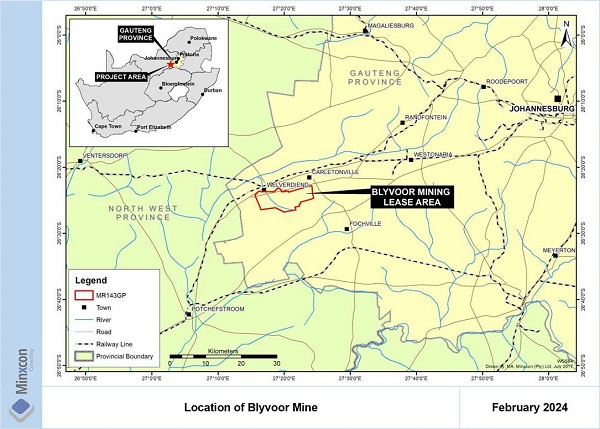

| Figure 2: Location of Blyvoor Gold Assets in Relation to the Orphans (Including Harmony Assets) | | 13 |

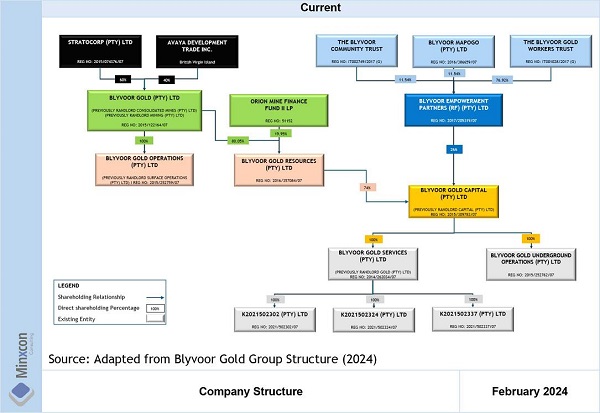

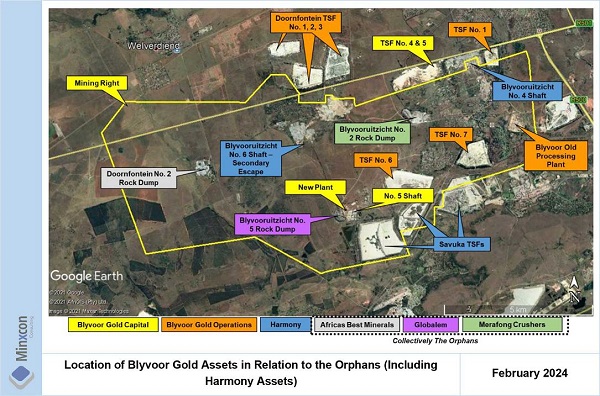

| Figure 3: Company Structure | | 15 |

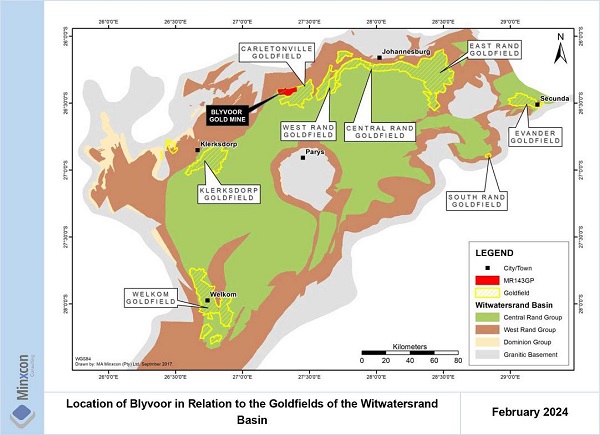

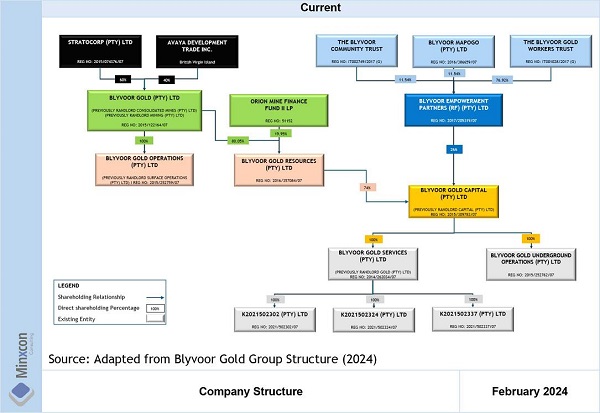

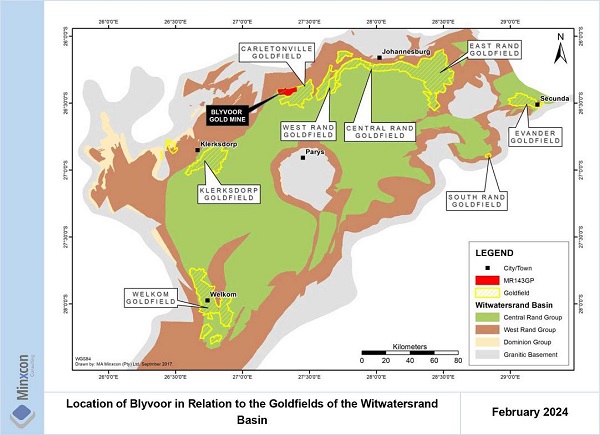

| Figure 4: Location of Blyvoor in Relation to the Goldfields of the Witwatersrand Basin | | 24 |

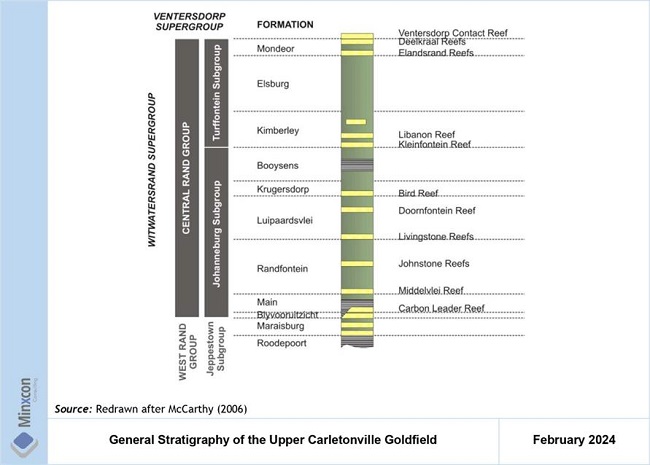

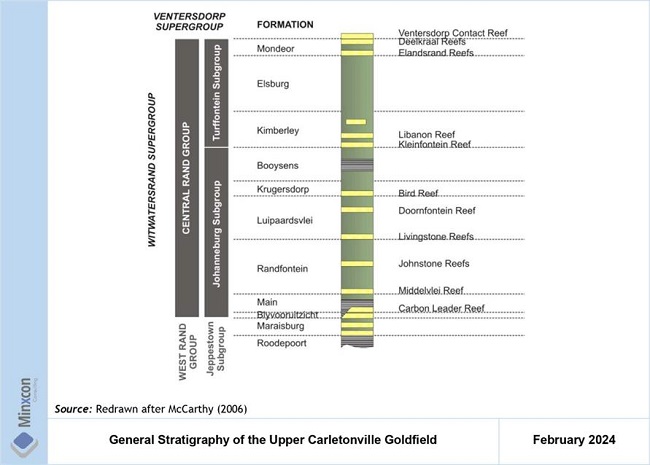

| Figure 5: General Stratigraphy of the Upper Carletonville Goldfield | | 25 |

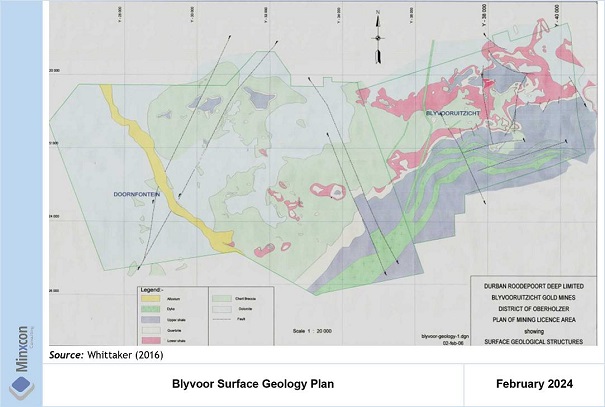

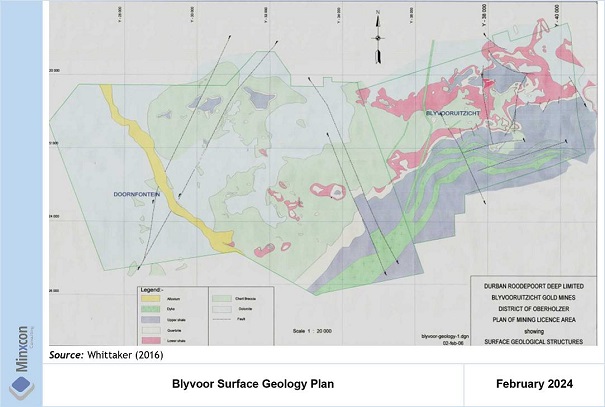

| Figure 6: Blyvoor Surface Geology Plan | | 27 |

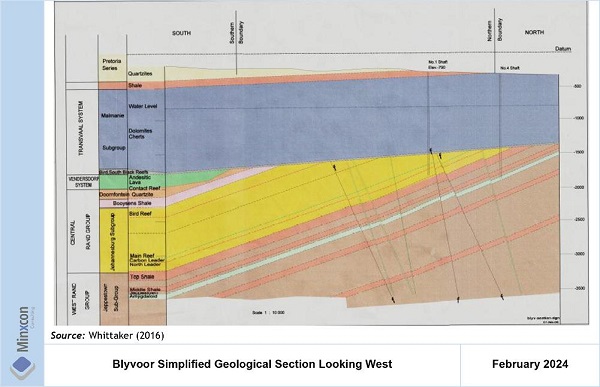

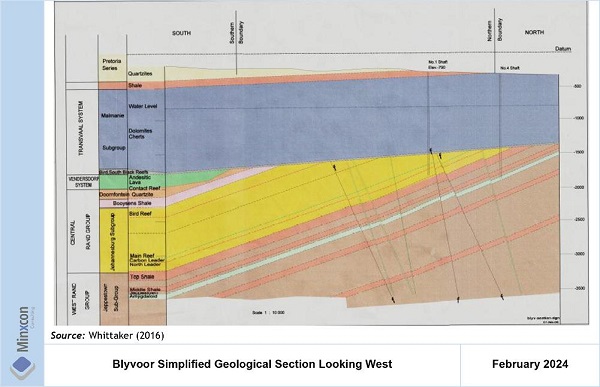

| Figure 7: Blyvoor Simplified Geological Section Looking West | | 27 |

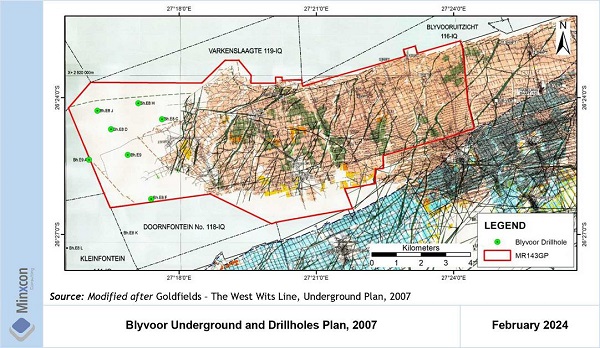

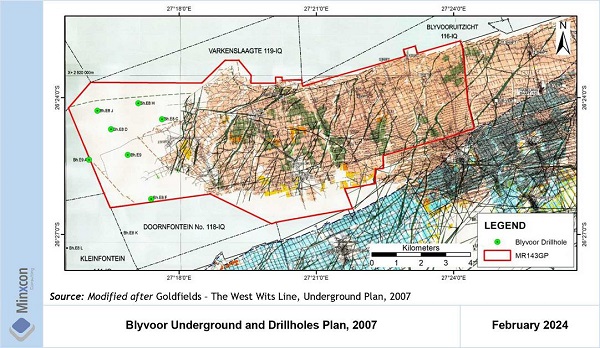

| Figure 8: Blyvoor Underground and Drillholes Plan, 2007 | | 32 |

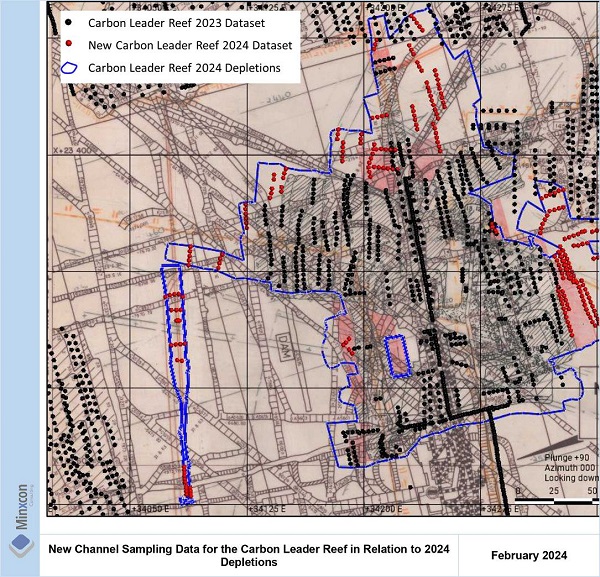

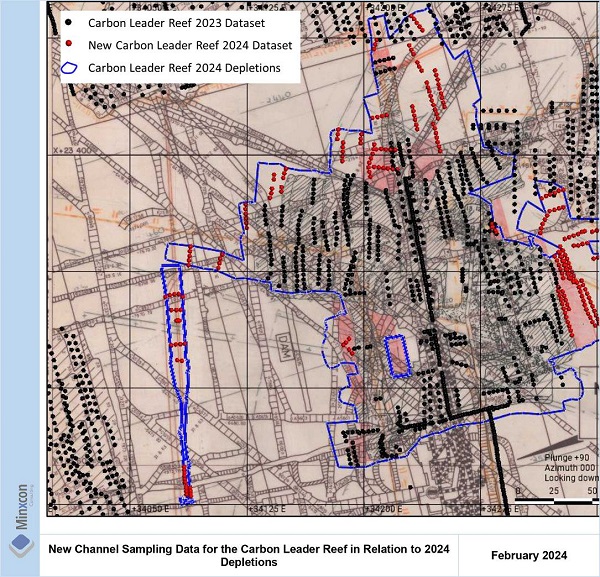

| Figure 9: New Channel Sampling Data for the Carbon Leader Reef in Relation to 2024 Depletions. | | 38 |

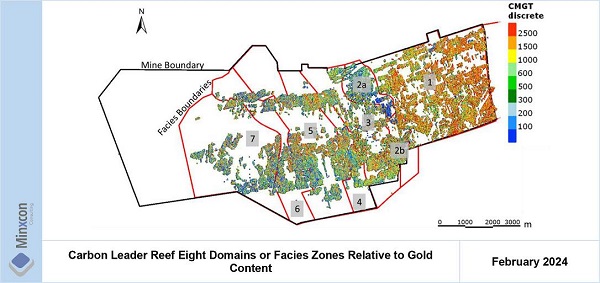

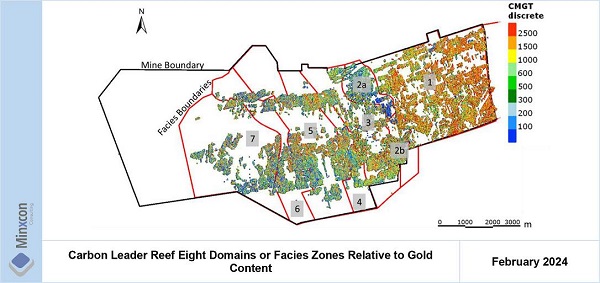

| Figure 10: Carbon Leader Reef Eight Domains or Facies Zones Relative to Gold Content | | 42 |

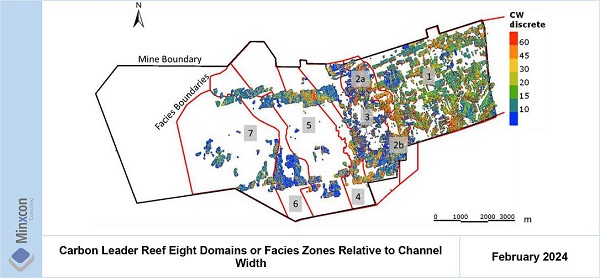

| Figure 11: Carbon Leader Reef Eight Domains or Facies Zones Relative to Channel Width | | 43 |

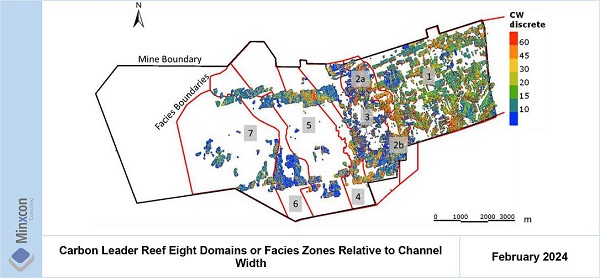

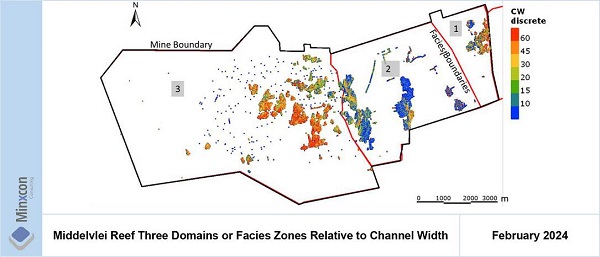

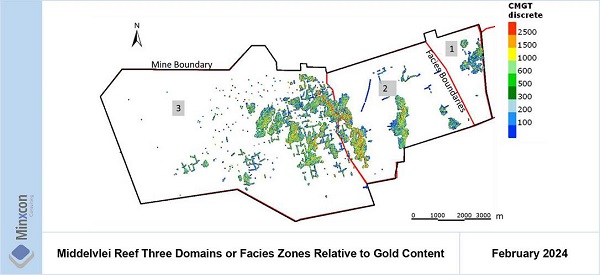

| Figure 12: Middelvlei Reef Three Domains or Facies Zones Relative to Gold Content | | 43 |

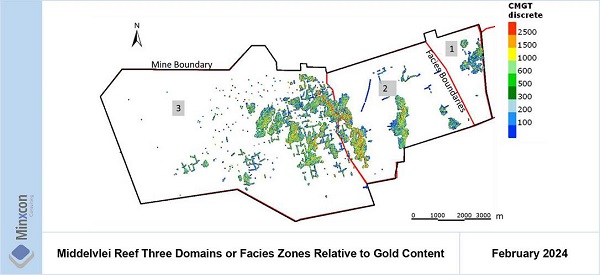

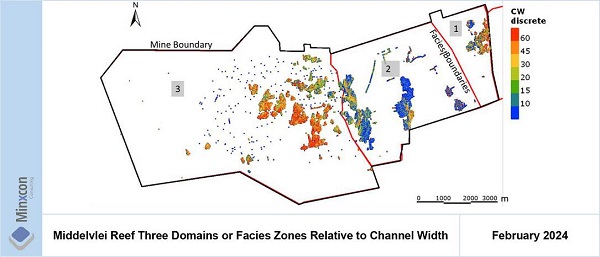

| Figure 13: Middelvlei Reef Three Domains or Facies Zones Relative to Channel Width | | 44 |

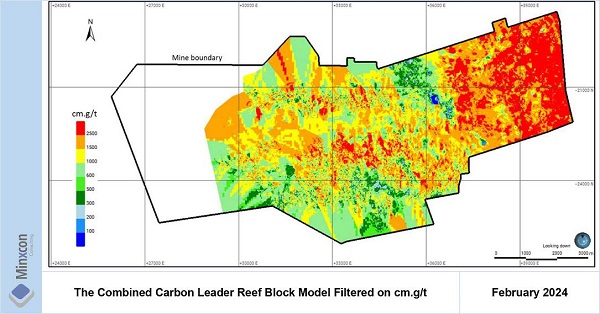

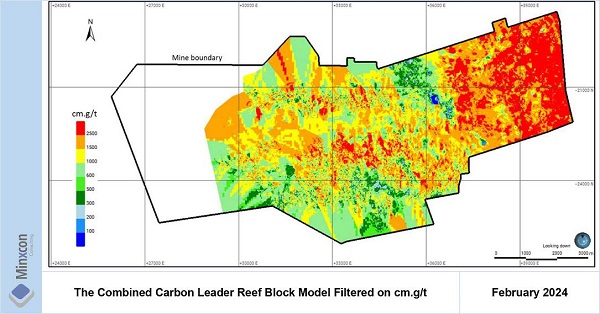

| Figure 14: The Combined Carbon Leader Reef Block Model Filtered on cm.g/t | | 46 |

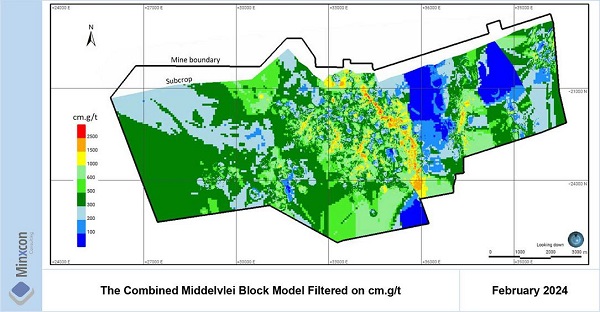

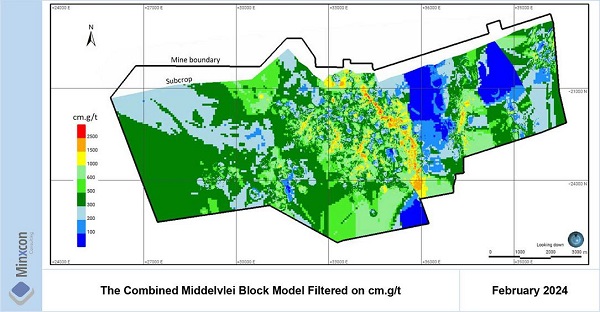

| Figure 15: The Combined Middelvlei Reef Block Model Filtered on cm.g/t | | 46 |

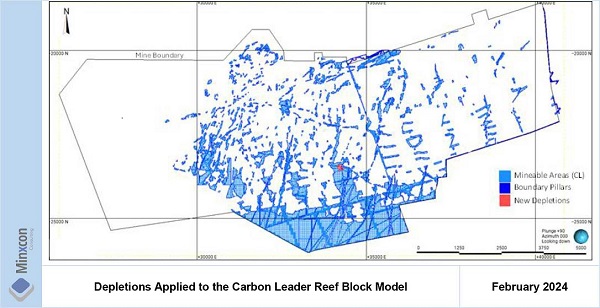

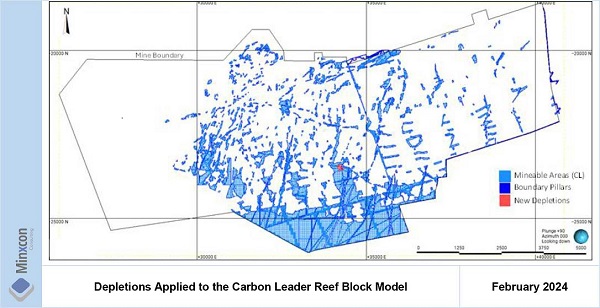

| Figure 16: Depletions Applied to the Carbon Leader Reef Block Model | | 47 |

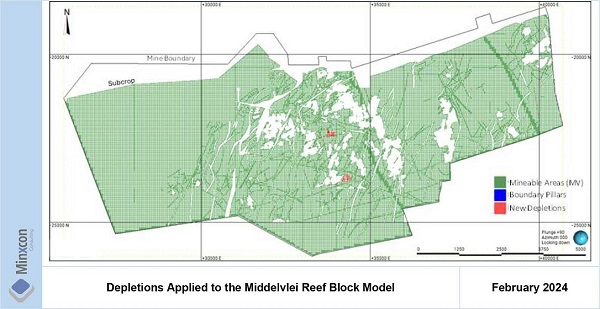

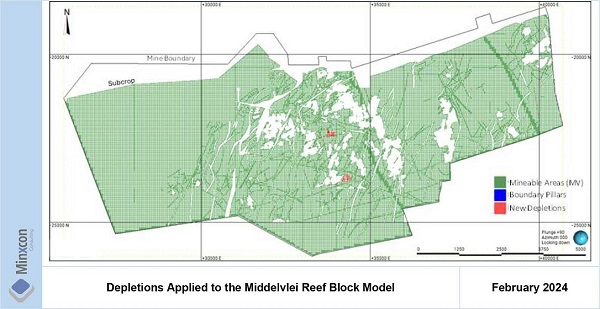

| Figure 17: Depletions Applied to the Middelvlei Reef Block Models | | 47 |

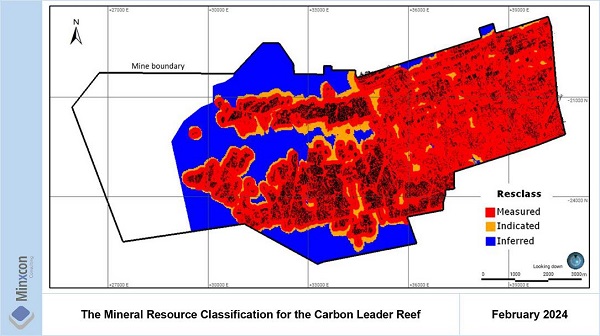

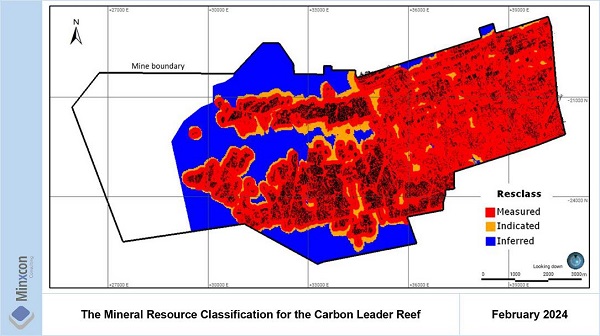

| Figure 18: The Mineral Resource Classification for the Carbon Leader Reef | | 49 |

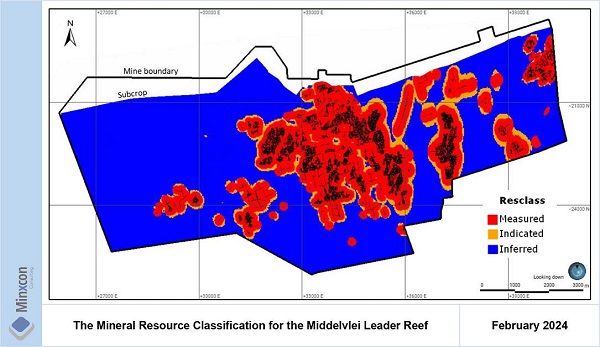

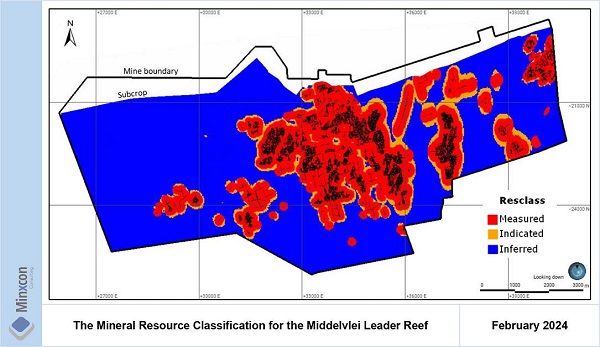

| Figure 19: The Mineral Resource Classification for the Middelvlei Reef | | 49 |

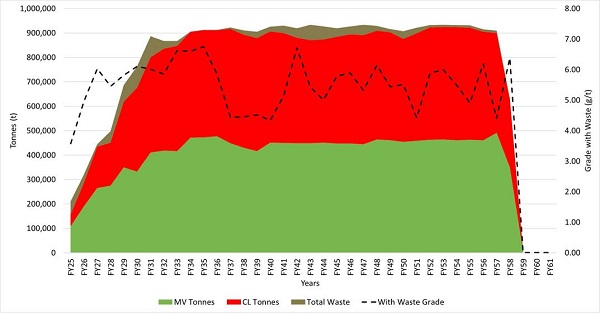

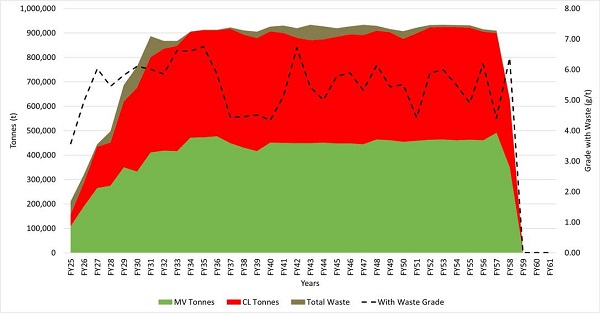

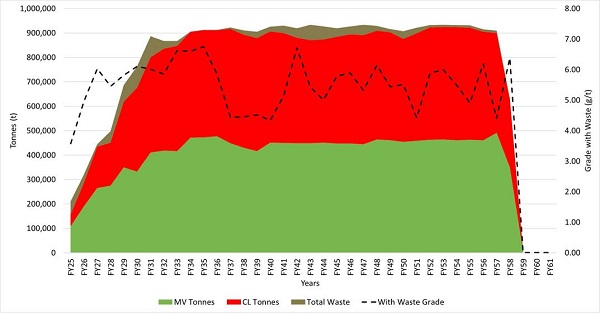

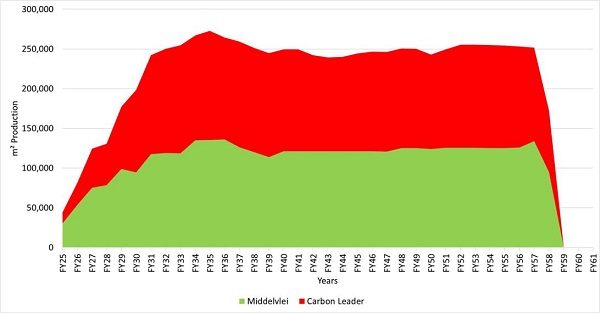

| Figure 20: Diluted Life of Mine Production Schedule by Reef Classification (2024) | | 56 |

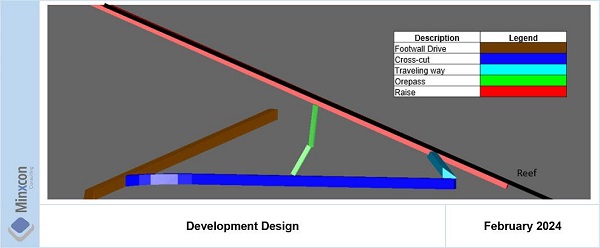

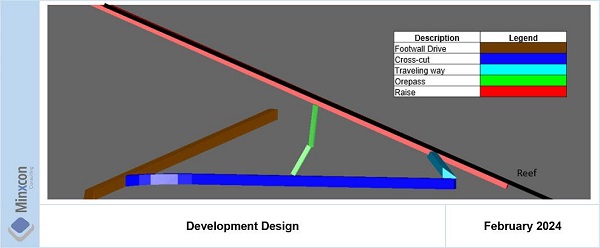

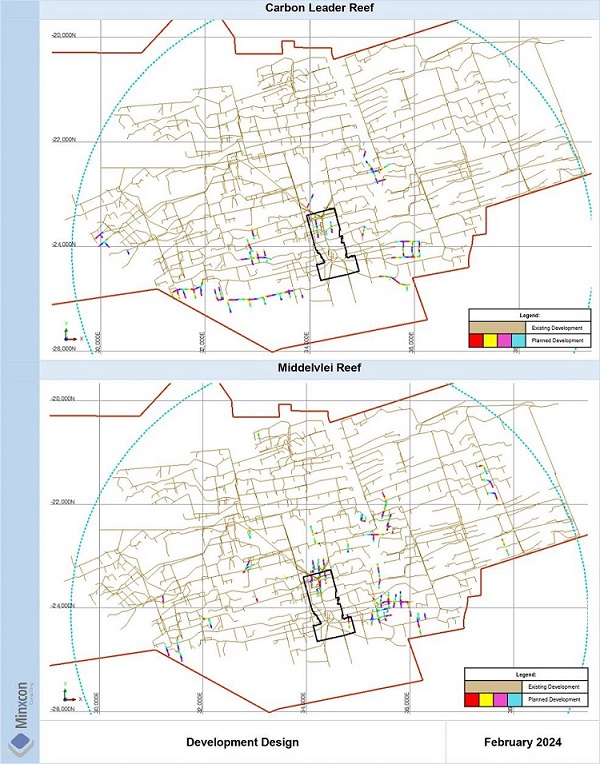

| Figure 21: Development Design | | 60 |

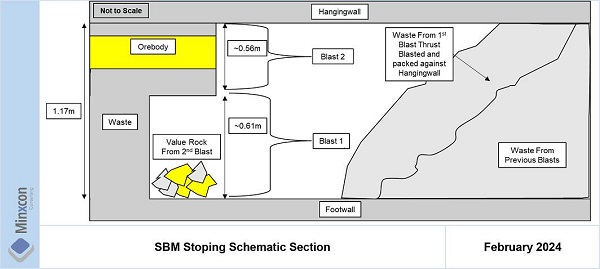

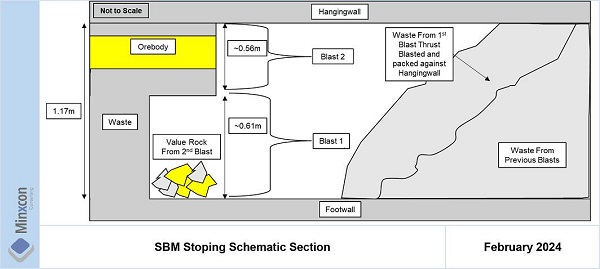

| Figure 22: Schematic Representation of SBM Stoping | | 61 |

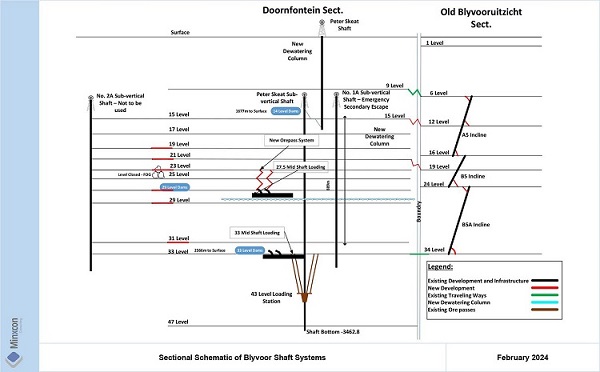

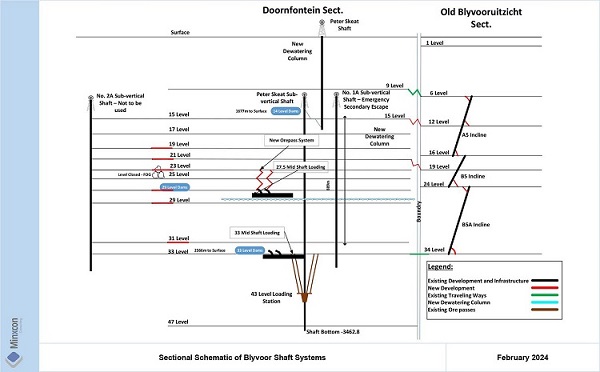

| Figure 23: Sectional Schematic of Blyvoor Shaft Systems | | 64 |

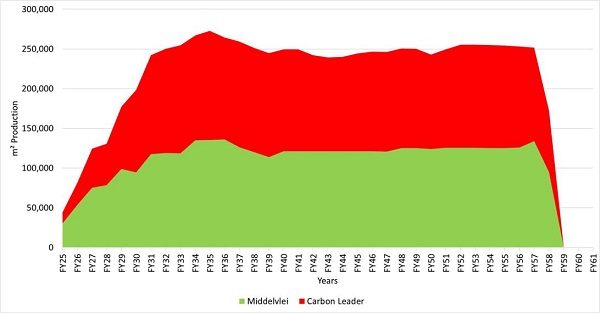

| Figure 24: Square Meter Production Profile by Reef Category | | 66 |

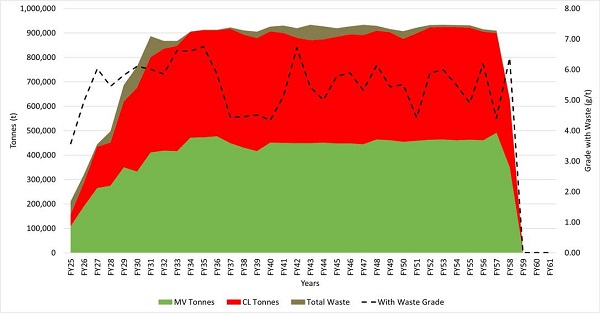

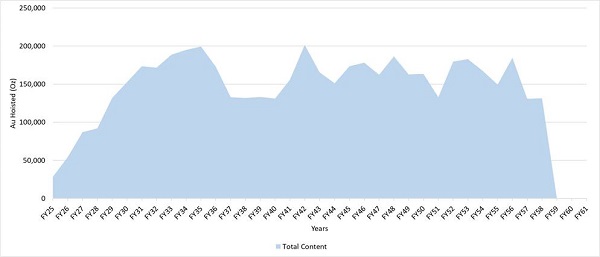

| Figure 25: Diluted Tonnes Delivered to Plant over Life of Mine | | 67 |

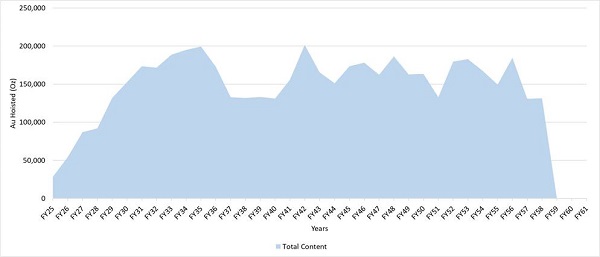

| Figure 26: Diluted Content Delivered to the Plant | | 67 |

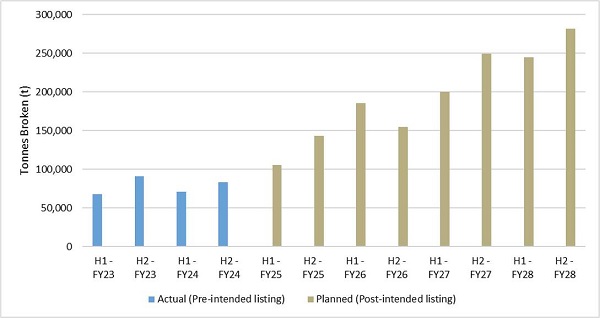

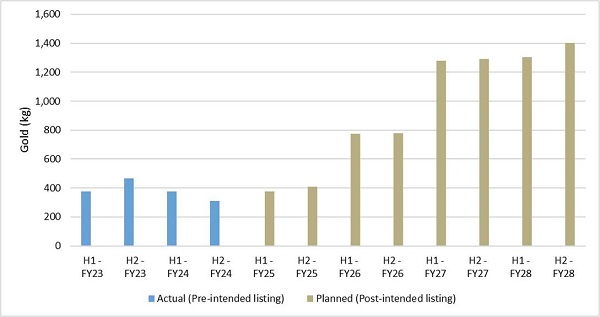

| Figure 27: Pre- and Post- Intended Listing Planned Tonnes over 6 Years | | 68 |

| Figure 28: Pre- and Post- Intended Listing Planned Gold over 6 Years in Kilograms | | 68 |

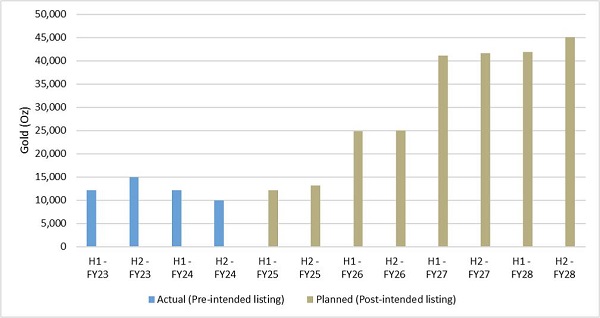

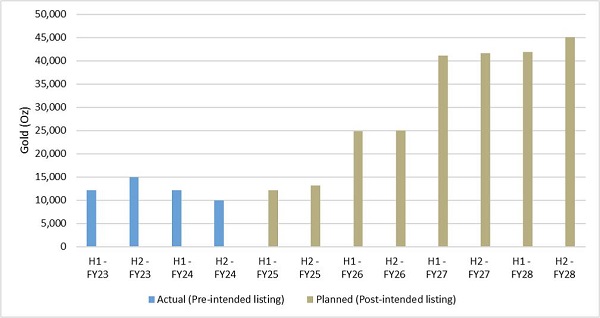

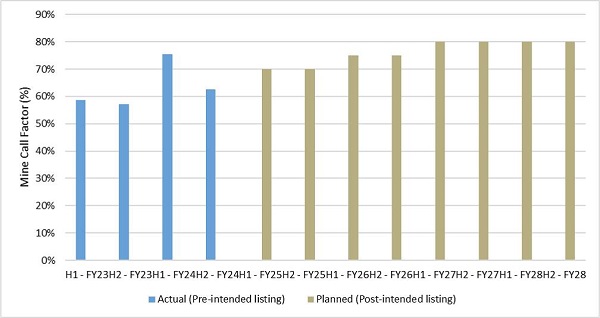

| Figure 29: Actual Gold Produced vs Planned Gold over 6 years in Ounces | | 69 |

| Figure 30: Actual MCF vs Planned MCF over 6 years | | 69 |

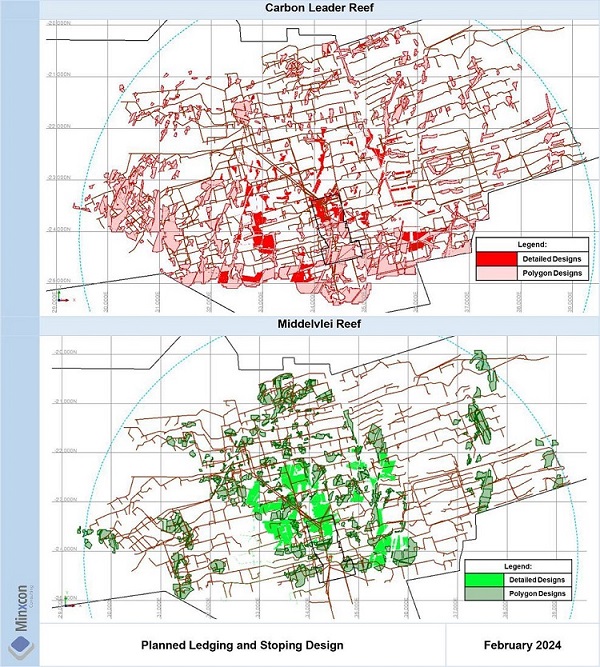

| Figure 31: Planned Ledging and Stoping Design | | 71 |

| Figure 32: Development and Opening Up | | 72 |

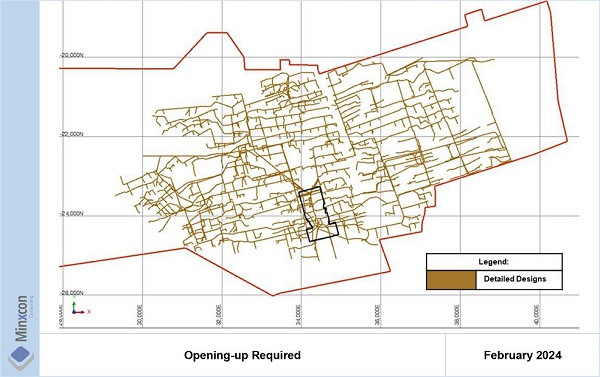

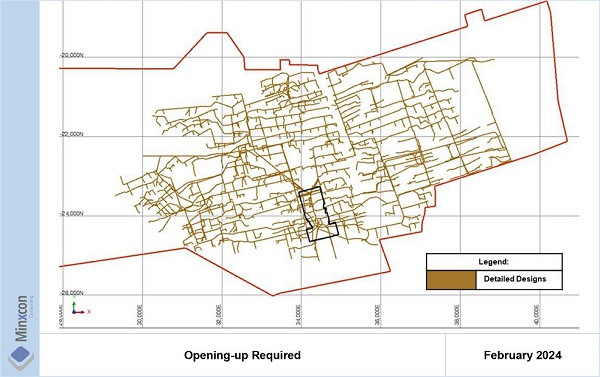

| Figure 33: Opening-up Required | | 73 |

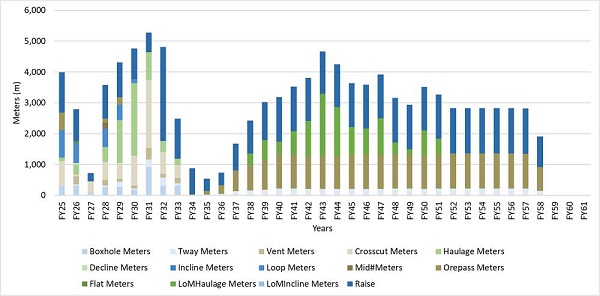

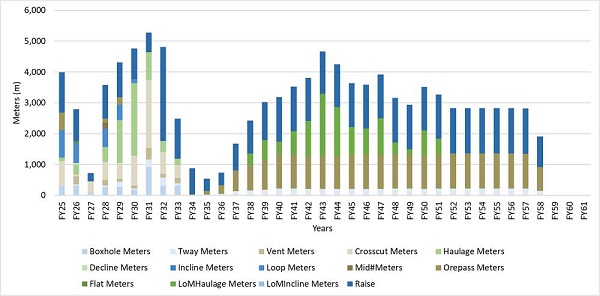

| Figure 34: Development Requirement over Life of Mine | | 74 |

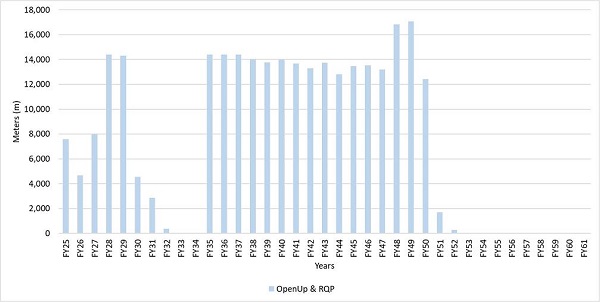

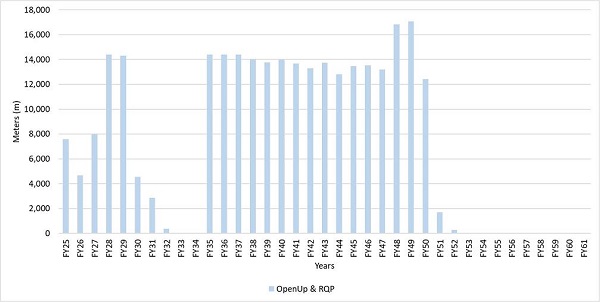

| Figure 35: Opening Up Required Over Life of Mine | | 75 |

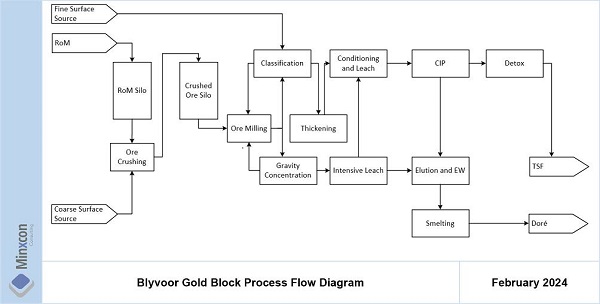

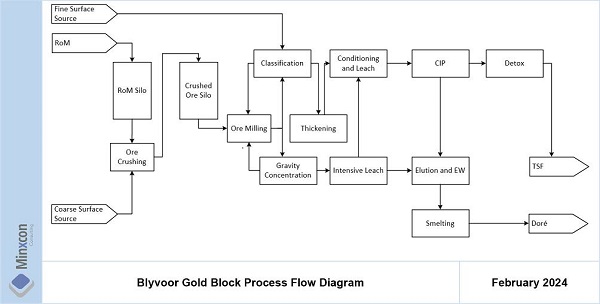

| Figure 36: Blyvoor Gold Block Process Flow Diagram | | 77 |

| Figure 37: PS Shaft Surface Infrastructure General Arrangement and Layout | | 83 |

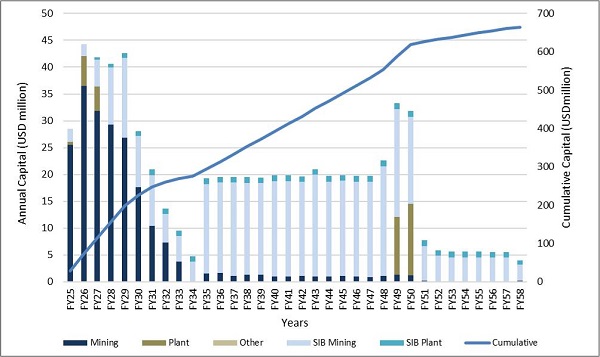

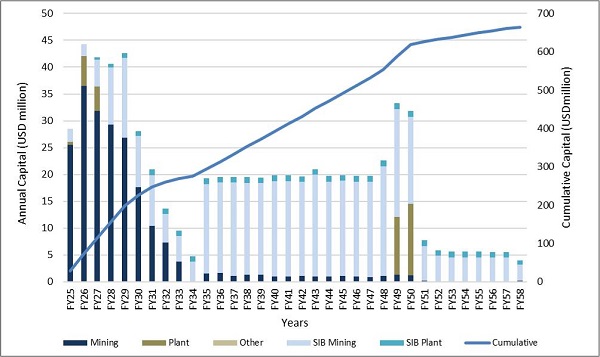

| Figure 38: Capital Schedule | | 100 |

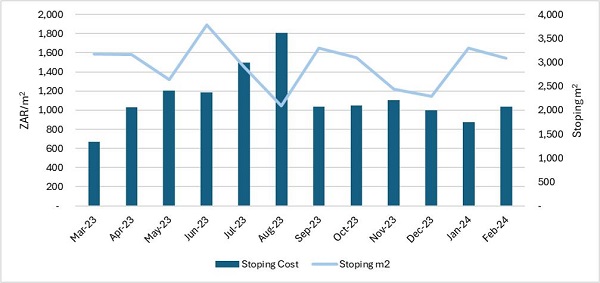

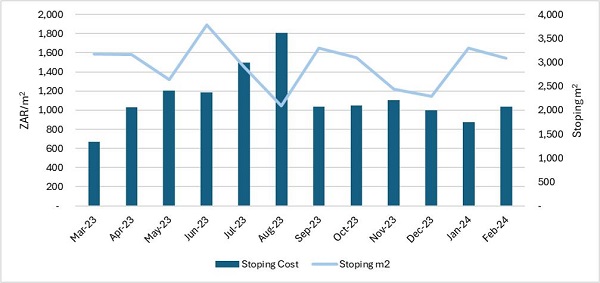

| Figure 39: Actual Stoping Operating Cost (excluding Labour) | | 101 |

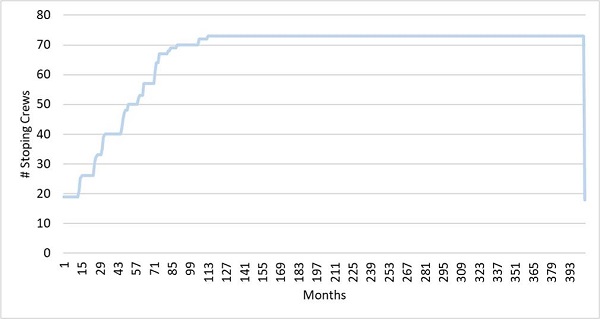

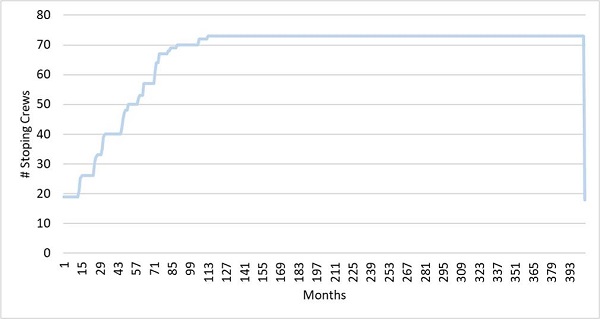

| Figure 40: Stoping Crew Build-up | | 101 |

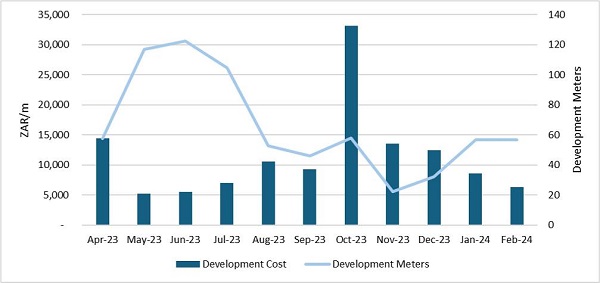

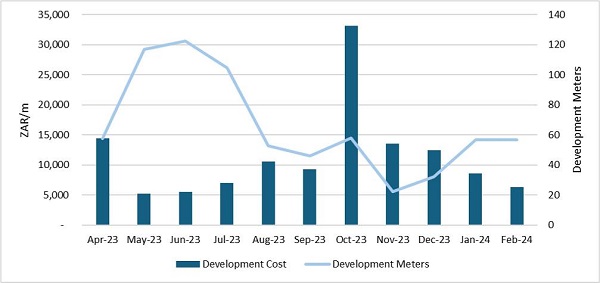

| Figure 41: Actual Development Cost (Excluding Labour) | | 102 |

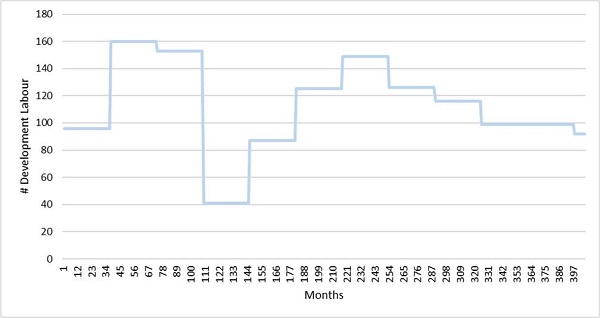

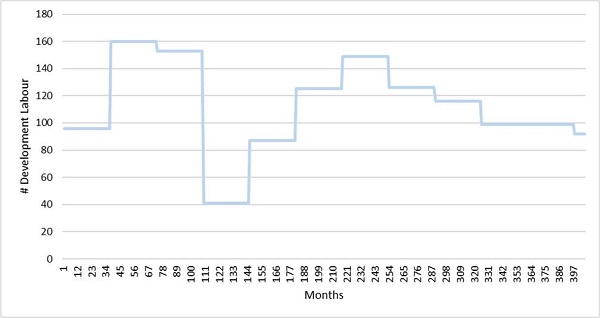

| Figure 42: Development Labour Numbers | | 103 |

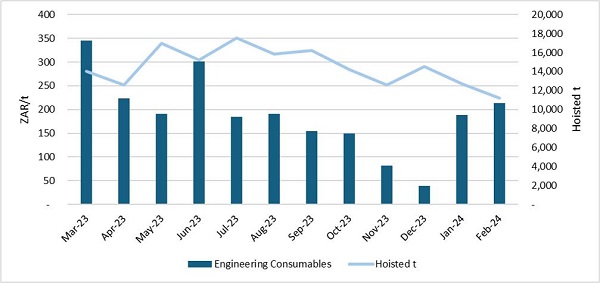

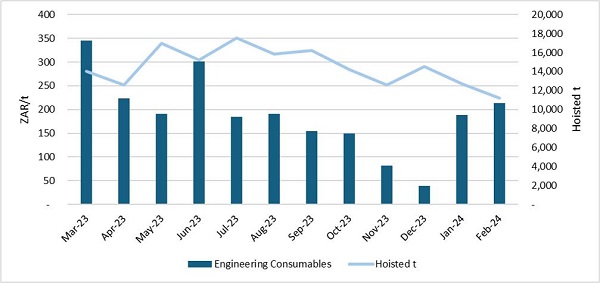

| Figure 43: Actual Engineering Operating Cost (excluding Labour) | | 104 |

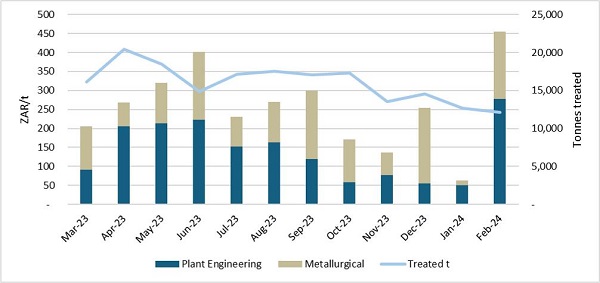

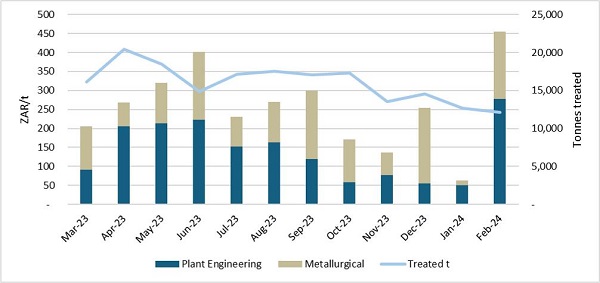

| Figure 44: Actual Plant Operating Costs (excluding Labour and Power) | | 105 |

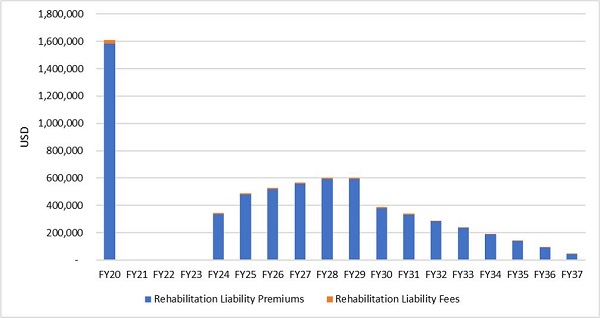

| Figure 45: Rehabilitation Payment Schedule | | 107 |

| Figure 46: Adjusted Operating Cost vs. Milled Tonnes | | 109 |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | viii |

| Figure 47: AISC vs. Gold Price | | 109 |

| Figure 48: AIC vs. Gold Price | | 110 |

| Figure 49: Real-term Historic Gold Price | | 112 |

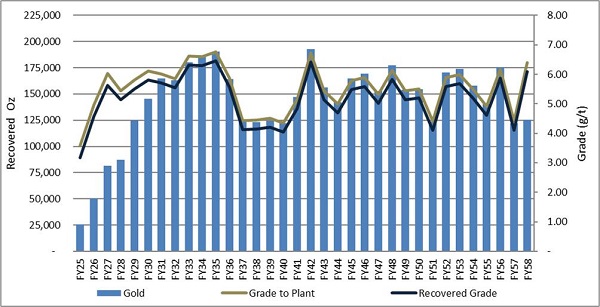

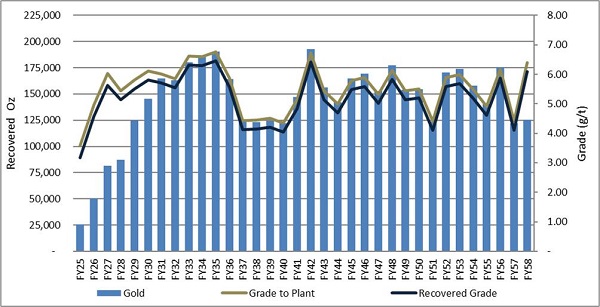

| Figure 50: Saleable Gold Ounces | | 114 |

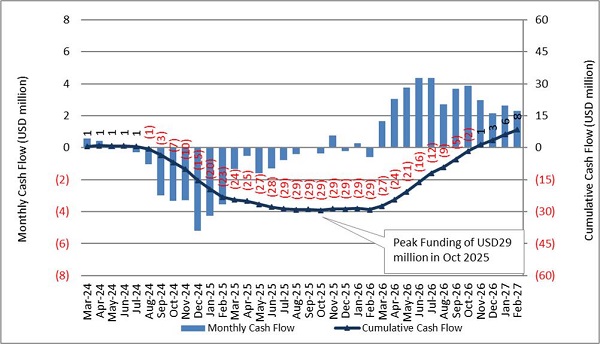

| Figure 51: Undiscounted Monthly Cash Flow – 36 Months | | 115 |

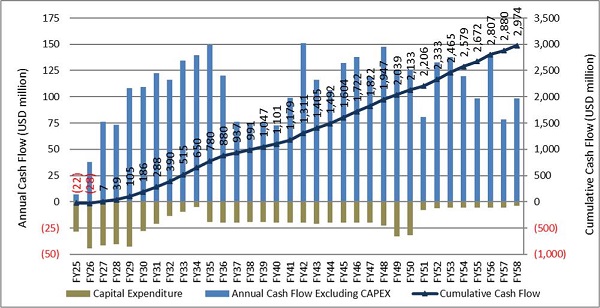

| Figure 52: Undiscounted Cash Flow | | 115 |

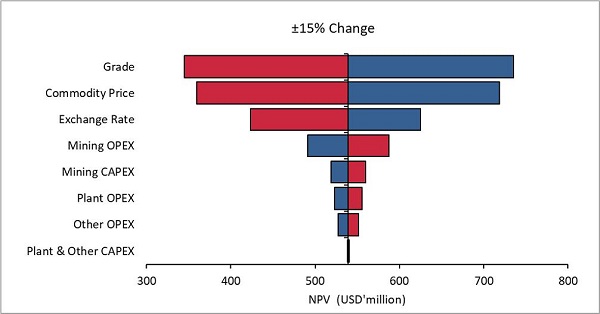

| Figure 53: Project Sensitivity (NPV11.9%) | | 123 |

| Figure 54: Gold Mines of the Carletonville Goldfield | | 127 |

TABLES

| Table 1: Summary of Mining Right for Blyvoor Mine | | 14 |

| Table 2: Assessed Rehabilitation Liabilities attached to MR143GP as of February 2024 with Amended Splits | | 16 |

| Table 3: Historical Development Summary of the Mine | | 22 |

| Table 4: Raw Statistics for Gold Content for the 2023 and 2024 Datasets | | 41 |

| Table 5: Raw Statistics for Channel Width for the 2023 and 2024 Datasets | | 41 |

| Table 6: Carbon Leader Facies | | 42 |

| Table 7: Pay Limit Derivation Factors | | 48 |

| Table 8: Attributable Mineral Resources Inclusive of Mineral Reserves for the Carbon Leader Reef for Blyvoor Mine as at 29 February 2024 | | 50 |

| Table 9: Attributable Mineral Resources Exclusive of Mineral Reserves for the Carbon Leader Reef for Blyvoor Mine as at 29 February 2024 | | 51 |

| Table 10: Attributable Mineral Resources Inclusive of Mineral Reserves for the Middelvlei Reef for Blyvoor Mine as at 29 February 2024 | | 51 |

| Table 11: Attributable Mineral Resources Exclusive of Mineral Reserves for the Middelvlei Reef for Blyvoor Mine as at 29 February 2024 | | 52 |

| Table 12: Combined Total Attributable Mineral Resources Inclusive of Mineral Reserves for Blyvoor Mine as at 29 February 2024 | | 52 |

| Table 13: Combined Total Attributable Mineral Resources Exclusive of Mineral Reserves for Blyvoor Mine as at 29 February 2024 | | 53 |

| Table 14: Cut-off Calculation | | 54 |

| Table 15: Mineral Reserve Conversion Factors Summary | | 55 |

| Table 16: Mineral Reserves for the Carbon Leader Reef for Blyvoor Mine as at 29 February 2024 | | 56 |

| Table 17: Mineral Reserves for the Middelvlei Reef for Blyvoor Mine 29 February 2024 | | 57 |

| Table 18: Combined Total Mineral Reserves for Blyvoor Mine as at 29 February 2024 | | 57 |

| Table 19: Combined Mineral Resources for the Blyvoor Mine as at 29 February 2024 (Inclusive) | | 58 |

| Table 20: Combined Mineral Resources for the Blyvoor Mine as at 29 February 2024 (Exclusive) | | 58 |

| Table 21: Combined Mineral Resources for the Blyvoor Mine as at 29 February 2024 (In Life of Mine Plan) | | 58 |

| Table 22: Combined Mineral Reserves for Blyvoor Mine as at 29 February 2024 | | 58 |

| Table 23: Underground Operation Shift Cycle | | 65 |

| Table 24: Planned Development Advance Rates | | 66 |

| Table 25: Conventional Stoping and SBM Production Parameters | | 66 |

| Table 26: Development Dimensions | | 70 |

| Table 27: Development Parameters | | 70 |

| Table 28: Required Equipment | | 75 |

| Table 29: Equipment Schedule | | 76 |

| Table 30: Blyvoor Mine Mining Personnel for FY2025 | | 76 |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | ix |

| Table 31: Plant Labour Complement | | 80 |

| Table 32: Reagent and Consumable Consumptions | | 81 |

| Table 33: Doornfontein - Blyvooruitzicht Boundary Connection Development | | 85 |

| Table 34: Gold Price Forecast (Nominal Terms) | | 90 |

| Table 35: Mining and Infrastructure Capital Cost Estimate | | 97 |

| Table 36: Plant Capital Summary | | 98 |

| Table 37: Capital Summary | | 99 |

| Table 38: Stoping Consumables Cost | | 100 |

| Table 39: Development Consumables Cost | | 102 |

| Table 40: Mining Operating Costs Summary | | 105 |

| Table 41: Plant Operating Costs Summary | | 106 |

| Table 42: Overhead and Selling Operating Costs Summary | | 106 |

| Table 43: Corporate Costs Summary | | 106 |

| Table 44: Project Cost Indicators | | 108 |

| Table 45: Macro-Economic Forecasts and Commodity Prices over the Life of Mine | | 112 |

| Table 46: Blyvoor Mine Cost of Equity | | 113 |

| Table 47: Southern African Gold Mining Companies’ Beta Values | | 113 |

| Table 48: Production Breakdown in Life of Mine | | 114 |

| Table 49: Annual Cash Flow – Techno-economic Inputs (First 17 Years) | | 117 |

| Table 50: Annual Cash Flow – Techno-economic Inputs (Remaining 17 Years) | | 117 |

| Table 51: Annual Real Cash Flow (First 17 Years) | | 118 |

| Table 52: Annual Real Cash Flow (Remaining 17 Years) | | 118 |

| Table 53: Annual Cash Flow – Techno-economic Inputs (First 5 Years – Half Yearly) | | 119 |

| Table 54: Annual Real Cash Flow (First 5 Years – Half Yearly) | | 120 |

| Table 55: Blyvoor Mine NPV Summary – Real Terms | | 121 |

| Table 56: Project Profitability Ratios | | 121 |

| Table 57: Sensitivity Analysis of Commodity Prices and Exchange Rate to NPV11.9% (USDm) | | 124 |

| Table 58: Sensitivity Analysis of Cash Operating Costs and Grade to NPV11.9% (USDm) | | 124 |

| Table 59: Blyvoor Mine Economic Analysis Summary – Real Terms | | 125 |

| Table 60: Risk Assessment | | 130 |

EQUATIONS

| Equation 1: Mining Tax Formula | | 122 |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | x |

LIST OF UNITS AND ABBREVIATIONS

Units: The following units were used in this Report, and are in metric terms:-

| Unit | Definition |

| % | Per cent |

| %m/m | Percent of mass |

| %v/v | Percent of volume |

| / | Per |

| ± or ~ | Approximately |

| ° | Degrees |

| °C | Degrees Celsius |

| a | Year |

| Boz | Billion ounces |

| cm | Centimetre |

| cm.g/t | Centimetre grammes per tonne |

| d | Day |

| ft | Foot |

| g | Grammes |

| g/t | Grammes per tonne |

| Ga | Billion years (1,000,000,000 years) |

| ha | Hectares |

| hr | Hour |

| kg | Kilogram (1,000 g) |

| km | Kilometre (1,000 m) |

| km2 | Square kilometres |

| koz | Kilo ounces (1,000 oz) |

| kt | Kilotonnes (1,000 t) |

| ktpa | Kilotonnes per annum |

| ktpm | Kilo tonnes per month |

| kV | Kilovolt (1,000 volts) |

| kVA | Kilovolt ampere |

| kW | Kilowatt (1,000 W) |

| l | Litre |

| l/sec | Litres per second |

| m | Metre |

| M | Molarity |

| m/crew/month | Meter per crew per month |

| Unit | Definition |

| m/month | Meter per month |

| m2 | Square metres |

| m²/month | Square meter per month |

| m3 | Cubic metres |

| m3/s | Cubic meters per second |

| Ma | Million years (1,000,000 years) |

| mbs | Metres below sea level |

| min | Minute |

| Ml | Million litres (1,000,000 l) |

| mm | Millimetre |

| Mm3 | Million cubic meters |

| mo | Month |

| Moz | Million ounces (1,000,000 oz) |

| Mt | Million tonnes (1,000,000 t) |

| MVA | Megavolt ampere |

| MW | Megawatt (1,000,000 W) |

| MWh | Megawatt hour |

| oz | Troy Ounces |

| per man/month | Per man month |

| s | Second (time) |

| t | Tonne |

| t/m³ | Tonnes per cubic meter |

| t/man | Tonne per man |

| tpa | Tonnes per annum |

| tpd | Tonnes per day |

| tph | Tonnes per hour |

| tpm | Tonnes per month |

| V | Volts |

| W | Watt |

| x | By/Multiplied by |

| ZAR/ore t | South African Rand per ore tonne |

| μm | Micrometre |

Computation: It is noted that throughout the Report, tables may not compute due to rounding.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | xi |

Abbreviations: The following abbreviations were used in this Report:-

| Abbreviation | Description |

| AGA | AngloGold Ashanti Limited |

| AIC | All-in Costs |

| AISC | All-in Sustainable Costs |

| ASG | Advanced Strike Gully |

| BEE | Black Economic Empowerment |

| BGMC | Blyvooruitzicht Gold Mining Company Limited (in provisional liquidation) |

| Blyvoor, Blyvoor Mine or Mine | Blyvoor Gold Mine |

| Blyvoor Capital | Blyvoor Gold Capital (Pty) Ltd |

| Blyvoor Gold | Blyvoor Gold (Pty) Ltd |

| Blyvoor Resources or Client or Company | Blyvoor Gold Resources (Pty) Ltd |

| BP | Boundary Pillar |

| CAE | CAE Mining (Datamine™) |

| CAPEX | Capital Expenditure |

| CAPM | Capital Asset Pricing Model |

| CCTV | Closed-circuit Television |

| CIL | Carbon-in-Leach |

| CIP | Carbon-in-Pulp |

| CL | Carbon Leader Reef |

| Coffey Mining | Coffey Mining (SA) Pty Ltd |

| CPI | Consumer Price Indices |

| Cwb | Köppen and Geiger classification acronym for subtropical highland climate or temperate oceanic climate with dry winters |

| CWC | Covalent Water Company (Pty) Ltd |

| DCF | Discounted Cash Flow |

| DMRE | Department of Mineral Resources and Energy |

| DRD | DRDGold Ltd |

| EA | Environmental Authorisation |

| EBIT | Earnings before Interest and Taxes |

| EBITDA | Earnings before Interest, Tax, Depreciation and Amortization |

| EIA | Environmental Impact Assessment |

| EMP | Environmental Management Programme |

| FCFE | Free Cash Flow to Equity |

| FCFF | Free Cash Flow to the Firm |

| FEL | Front-End Loader |

| FoG | Fall of Ground |

| FWRDWA | Far West Rand Dolomitic Water Association |

| FY | Financial Year |

| GDP | Gross Domestic Product |

| Guardrisk | Guardrisk Insurance Company Limited |

| H1 | First Half-year |

| H2 | Second Half-year |

| Harmony | Harmony Gold Mining Company Limited |

| HDSAs | Historically Disadvantaged South Africans |

| HRD | Human Resource Development |

| IPC | Intermediate Pump Chamber |

| IRL | In-Line Leach Reactor |

| IRR | Internal Rate of Return |

| JORC Code | 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Mineral Reserves |

| JPLs | Joint Provisional Liquidators |

| KE | Kriging Efficiencies |

| LED | Local Economic Development |

| LoM | Life of Mine |

| M&I | Measured and Indicated (Mineral Resources) |

| MCF | Mine Call Factor |

| Minxcon | Minxcon (Pty) Ltd |

| MPRDA | Mineral and Petroleum Resources Development Act, No 28 of 2002 |

| MR | Middelvlei Reef |

| MR143GP | Converted Mining Right GP 30/5/1/2/2/143 MR |

| NEMA | National Environmental Management Act, No. 107 of 1998 |

| No. | Number |

| NPV | Net Present Value |

| NWA | National Water Act, No. 36 of 1998 |

| OHMS | Open House Management Solutions |

| OPEX | Operating Expenditure |

| Orphans | Third party acquired components of the historical Mining Right 46/99 that were not grouped underpurchased by Blyvoor Gold Capital (Pty) Ltd or Blyvoor Gold Operations (Pty) Ltd |

| P100 or P80 | Per cent of sample or stream larger than or smaller than a specified value |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | xii |

| Abbreviation | Description |

| PDC | Process Design Criteria |

| PEA | Preliminary Economic Assessment |

| PEM | Prospectivity Enhancement Multiplier |

| PFS | Pre-Feasibility Study |

| ProOptima | ProOptima Audit Services |

| PS Shaft | Peter Skeat Shaft, previously known as the No. 5 Shaft |

| PSD | Particle size distribution |

| PSSV Shaft | Peter Skeat Sub-vertical Shaft, previously known as the No. 5A Sub-vertical Shaft |

| QAQC | Quality Assurance and Quality Control |

| RoM | Run of Mine |

| RTO | Reverse Takeover |

| SAMREC Code | South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves |

| SBM | Selective Blast Mining |

| SG | Specific Gravity |

| SIB | Stay in Business |

| S-K 1300 | United States Securities and Exchange Commission Part 229 Standard Instructions for Filing Forms Regulation S-K subpart 1300 |

| SLP | Social and Labour Plan |

| SoR | Slopes of Regression |

| STC | Secondary Tax on Dividends |

| TSF | Tailings Storage Facility |

| USD | United States Dollar |

| VALMIN Code | 2015 Edition of the Code and Guidelines for the Technical Assessment and/or Valuation of Mineral and Petroleum Assets and Securities for Independent Expert Reports |

| Village Main Reef | Village Main Reef Limited |

| ZAR | South African Rand |

| ZAR/USD | South African Rand: United States Dollar |

| ZARm | Million South African Rand |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 1 |

ITEM 1 - EXECUTIVE SUMMARY

The Blyvoor Gold Mine is an operating underground gold mine situated in the Carletonville Goldfield of the Witwatersrand Basin. The Mine occurs 14 km southwest of the town of Carletonville and 80 km southwest of Johannesburg, Gauteng Province, South Africa.

Gold mineralisation is hosted in the Middelvlei and Carbon Leader reefs and accessed through the Peter Skeat Shaft (or PS Shaft, previously known as the No. 5 Shaft), which recommenced operations in quarter 3 2019 after a hiatus from 2013. Mineralisation is extracted mostly through conventional mining methods; however, a Selective Blast Mining method (“SBM”) is applied to those carbon leader stopes that lend themselves to this method. Current mining rates do not exceed 30 ktpm, but it is planned to ramp up production to 80 ktpm. Extracted material is processed at a hard rock gold extraction carbon-in-pulp plant situated adjacent to PS Shaft. The plant has a nameplate processing capacity of 40 ktpm but is currently achieving some 22 ktpm due to mining constraints.

| I. | Permitting Requirements |

The Blyvoor Mine operates under a mining right GP 30/5/1/2/2/143 MR, encompassing 6,708.4273 ha and which is valid for gold mining until 16 February 2047. An Environmental Authorisation was granted on 19 February 2020 for the Mining Right Project Area inclusive of the underground operations. The water use licence for the Project was granted on 14 May 2024. The mining right is issued to Blyvoor Gold Capital (Pty) Ltd in which Blyvoor Gold Resources (Pty) Ltd holds 74% shareholding.

| II. | Geology and Mineral Deposit |

Blyvoor lies within the late Archaean Witwatersrand Basin. This basin comprises up to 7,000 m thick interbedded sequence of argillaceous and arenaceous sedimentary rocks mainly dipping at shallow angles towards the centre of the basin and extend laterally for some 350 km northeast-southwest and 120 km northwest-southeast on the Kaapvaal Craton. The upper portion of the basin-fill (Central Rand Group), which contains the sedimentary reefs or mineralised zones, outcrops at its northern extent near Johannesburg. Further west, south and east, the basin is overlain by a combination of up to 4,000 m of younger Archaean, Proterozoic and Mesozoic volcanic and sedimentary rocks. Locally, Blyvoor falls within the Carletonville Goldfield.

The majority of Blyvoor is structurally relatively undisturbed. In the western section, however, the area is structurally complex due to the presence of the Master Bedding Fault which rejuvenated older faults and formed new ones in close proximity to its plane. The Master Bedding Fault has eliminated a large percentage of the Carbon Leader to the north of Doornfontein No. 2 Shaft, but the Middelvlei is present over the whole lease area. Major structures in close proximity to historical mining activities at 35 Level and below, are the Boulder and Alpha Dykes. The Boulder Dyke has a downthrow of 40 m to 95 m to the north and strikes east-west.

Economic gold mineralisation in the Witwatersrand Basin sediments occurs typically within quartz pebble conglomerate reefs. The reefs are generally less than 2 m in thickness. Stratigraphically, most economic placers were found in the Central Rand Group at various stratigraphic levels and usually represent significant stratigraphic unconformities. At Blyvoor, two economic placer horizons were exploited. These are namely the Carbon Leader and Middelvlei Reefs and occur in quartzites of the Main Reef Conglomerate Formation of the Johannesburg Subgroup of the Central Rand Group. The auriferous conglomerates dip uniformly at 22°S.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 2 |

The Carbon Leader is a high grade, predominantly thin (<40 cm) carbon-rich reef and is the principle economic horizon at the Blyvoor Mine. Grades decrease towards the south and southwest. The origin of the carbon is in debate as to whether it originated hydrothermally or from algae. Within the deeper southern section of the project area (below 35 Level), carbon is scarcer and hence likely responsible for the decline in grade.

The Middelvlei Reef is the second economic horizon at the Blyvoor Mine and lies stratigraphically 50 m to 75 m above the Carbon Leader. Towards the south, the separation increases due to a minor angular unconformity. The Middelvlei Reef is characterised by lower grades than the Carbon Leader. Owing to the historical variable payability and presence of sedimentologically controlled pay shoots, the Middelvlei Reef has been mined in scattered payable areas.

| III. | Status of Exploration |

Exploration at Blyvoor is strictly of a historical nature as the Mine is a mature operation. Blyvoor’s life of mine is concentrated in close proximity to historical mining areas. Minxcon is of the opinion that no further exploration work is deemed necessary due to the fact that the no new ground is being explored. Data from adjacent operations is utilised in conjunction with available project data for interpretations and Mineral Resource estimations.

| IV. | Mineral Resource and Mineral Reserve Estimates |

Measured, Indicated and Inferred Mineral Resources are based on Ordinary Kriging. Estimation was performed in 2D space for the Carbon Leader and Middelvlei Reefs. Geological losses of 5%, 10% and 15% were applied to Measured, Indicated and Inferred Mineral Resources, respectively. The total Mineral Resources Excluding Mineral Reserves are detailed in the following table.

Combined Total Attributable Mineral Resources Exclusive of Mineral Reserves for Blyvoor Mine as at 29 February 2024

Mineral Resource

Classification | Stope Width | Stope Tonnes | Stope Grade | Stope Content | Gold Content |

| cm | Mt | g/t | cm.g/t | kg | Moz |

| Measured | 117 | 11,25 | 4,74 | 555 | 53 356 | 1,72 |

| Indicated | 117 | 2,75 | 3,45 | 403 | 9 478 | 0,30 |

| Total M&I | 117 | 14,00 | 4,50 | 526 | 62 834 | 2,02 |

Mineral Resource

Classification | Stope Width | Stope Tonnes | Stope Grade | Stope Content | Gold Content |

| cm | Mt | g/t | cm.g/t | kg | Moz |

| Inferred | 117 | 58.81 | 4.40 | 515 | 258,752 | 8.32 |

Notes:

| 1. | Mineral Resources are reported at a 300 cm.g/t (2.56 g/t over 117 cm stoping width equivalent) pay limit. |

| 2. | Depletions were applied. |

| 3. | Boundary pillars were excluded from the Mineral Resources, reported inclusive of internal pillars and shaft pillars. |

| 4. | A geological loss of 5% for Measured, 10% for Indicated and 15% for Inferred Mineral Resources has been applied. |

| 5. | Mineral Resources are 74% attributable to Blyvoor Gold Resources (Pty) Ltd and occur within the mining right perimeter. |

| 6. | Mineral Resources are Exclusive of Mineral Reserves. |

Inferred Mineral Resources inclusive and exclusive of Mineral Reserves are the same as there are no inferred Mineral Resources in the Mineral Reserve. Mineral Resources in the Measured and Indicated Mineral Resource classifications were converted into Proven and Probable Mineral Reserves, by applying the applicable modifying factors. The total Mineral Reserves for Blyvoor Mine as at 29 February 2024 are presented in the following table.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 3 |

Combined Total Mineral Reserves for Blyvoor Mine as at 29 February 2024

Mineral Reserve

Classification | Delivered Grade | Delivered Tonnes | Delivered Au Content |

g/t | Mt | kg | Moz |

| Mineral Reserves in LoM plan |

| Proved | 5.69 | 7.94 | 45,164.11 | 1.45 |

| Probable | 5.49 | 20.89 | 114,665.04 | 3.69 |

| Total | 5.54 | 28.83 | 159,829.15 | 5.14 |

| Mineral Reserves as 74% attributable to Blyvoor Resources |

| Proved | 5.69 | 5.88 | 33,421.44 | 1.07 |

| Probable | 5.49 | 15.46 | 84,852.13 | 2.73 |

| Total | 5.54 | 21.33 | 118,273.57 | 3.80 |

Notes:

| 1. | Mineral Reserves stated at a long term gold price of USD1,900/oz and a long term exchange rate of ZAR/USD 19.15. |

| 2. | Mineral Reserves are reported at a 496 cm.g/t cut-off grade applied. |

| 3. | Minimum remnant area of 1,000 m² applied. |

| 4. | Mining extraction of 80% applied to all remnants. |

| 5. | Pillar provision of 15% applied. |

| 6. | Stope width is the average SBM mining cut over a 117 cm mining width. |

Mineral Resources from the Measured and Indicated Mineral Resource Mineral Resources from the Measured and Indicated Mineral Resource Classifications were converted into Proven and Probable Mineral Reserves. The Mineral Reserve estimate consists of 30% Proven and 70% Probable Mineral Reserves on a gold content basis.

| V. | Development and Operations |

The Blyvoor Mine utilises conventional mining and Selective Bench Mining (“SBM”) to extract the Carbon Leader Reef and Middelvlei Reef from the PS Shaft Complex. Re-opening or re-equipping the current workings will continue while mining. The orepass system, footwall drives, crosscuts, and main surface shaft (PS Shaft) will access the workings. All stopes and development ends have been or will be refurbished to ensure safe access for men and material.

Men and material will be transported through PS Shaft and PSSV Shaft. Ore will be hoisted to 15 Level via cage hoisting, where the ore is then cross-trammed to PS Shaft and hoisted to surface. The re-establishment and extension of the 15-19 Level incline shaft to 21 Level will assist in reducing the cage-hoisting requirements within the PSSV shaft. Below 21 Level, ore will be transferred from active mining levels via a new orepass system to the newly established mid-shaft loading station at 27.5 Level in the PSSV. Ore will be hoisted from the mid-shaft loading station to 14 Level and then transferred on 15 level to the PS shaft ore loading system to be hoisted to surface.

The underground workings from 10 m above 29 Level at PSSV are flooded and are currently inaccessible. The Blyvoor PS Shaft project consisted of re-opening the PS Shaft Complex and returning the operation to a targeted steady state production of 80 ktpm. Numerous activities have been initiated and/or completed since cessation of the operation, including transfer of the mining right to Blyvoor Gold, award of an Environmental Authorisation, Mineral Resource update, mine planning, operating cost estimates, capital cost estimates and financial modelling. The mine has subsequently successfully been returned to production.

The process plant has been operating at a consistent recovery of 91.5%, and this can be expected to continue as long as the ore mineralogy does not change. The average processing rate for the past 12 months was 15.5 ktpm, and there are indications that higher processing rates can be achieved with operational improvements.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 4 |

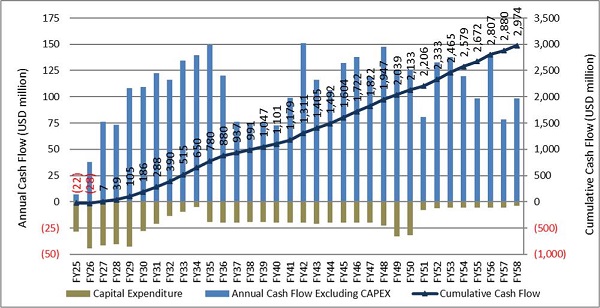

The evaluator performed an independent mineral asset economic analysis on the Blyvoor Mine and the diluted Indicated and Measured Mineral Resources in the LoM plan, for conversion to Mineral Reserves. The Discounted Cash Flow, or DCF, is based on the production schedule and all costs and capital associated to develop, mine and process the orebody. Relevant taxation and other operating factors, such as recoveries and stay-in-business costs were incorporated into the economic analysis to produce a cash flow over the life cycle of the Mine. The effective date of the economic analysis is 29 February 2024.

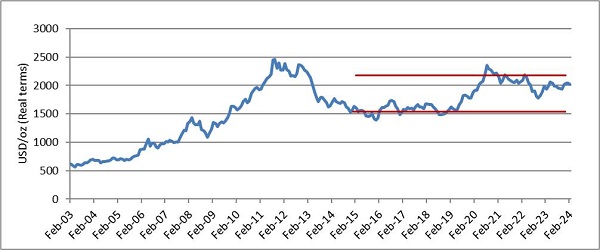

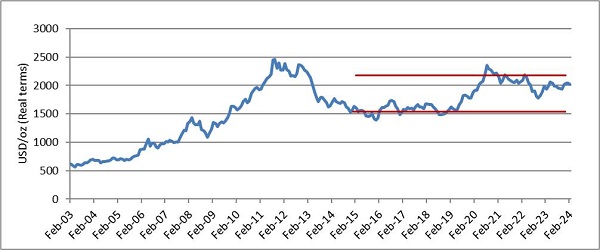

Both the ZAR/USD exchange rate and USD commodity prices are in real money terms. The table below illustrates the forecasts for the first three years as well as the long-term forecast used in the financial model. Both the price forecast and the short-term exchange rate forecast are taken as the median of various analyst and bank forecasts, with the long-term prices calculated in-house. The medium and long-term exchange rate forecast was calculated in-house using the inflation adjusted purchasing price parity of the ZAR to USD. The long-term gold price was estimated as the real term average between the two gold price support levels over the past 10 years, i.e. USD1,900/oz. The inflation rate forecasts were sourced from the International Monetary Fund (“IMF”).

Macro-Economic Forecasts and Commodity Prices over the Life of Mine

| Basis | Item | Unit | 2024 | 2025 | 2026 | 2027 | 2028 | LT |

| Calendar Years (Real) | Gold Price | USD/oz | 2,086 | 2,040 | 1,900 | 1,900 | 1,900 | 1,900 |

| Financial Years (Real) | Gold Price | USD/oz | N/A | 2,078 | 2,016 | 1,900 | 1,900 | 1,900 |

| Calendar Years (Real) | Exchange Rate | ZAR/USD | 18.80 | 18.10 | 18.45 | 18.80 | 19.15 | 19.15 |

| Financial Years (Real) | Exchange Rate | ZAR/USD | N/A | 18.68 | 18.16 | 18.51 | 18.86 | 19.15 |

| Calendar Years | US Inflation | % | 2.8% | 2.4% | 2.2% | 2.1% | 2.1% | 2.1% |

| Financial Years | US Inflation | % | N/A | 2.8% | 2.4% | 2.2% | 2.1% | 2.1% |

| Calendar Years | SA Inflation | % | 4.8% | 4.5% | 4.5% | 4.5% | 4.5% | 4.5% |

| Financial Years | SA Inflation | % | N/A | 4.8% | 4.5% | 4.5% | 4.5% | 4.5% |

Source: Median of various Banks and Broker forecasts (Consensus, March 2024); Minxcon; IMF.

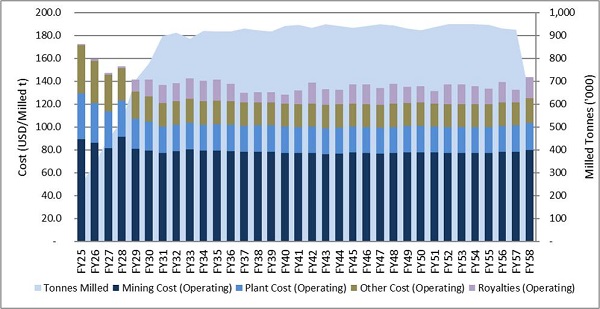

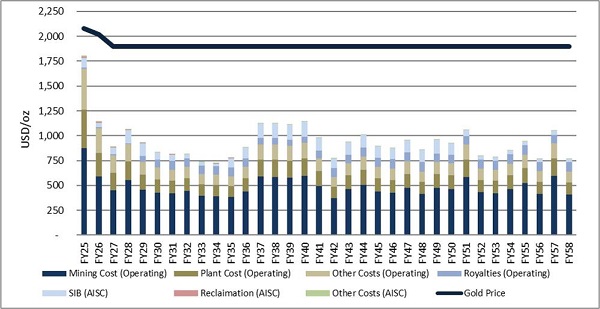

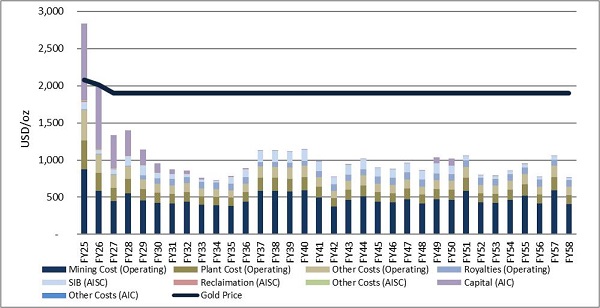

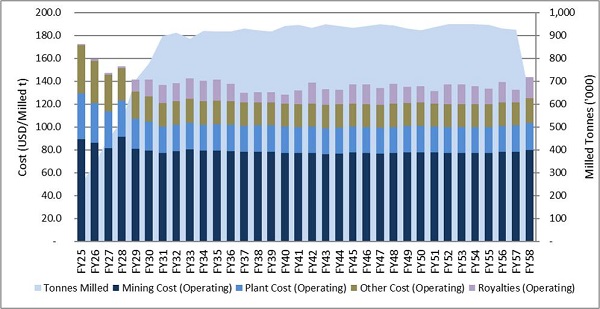

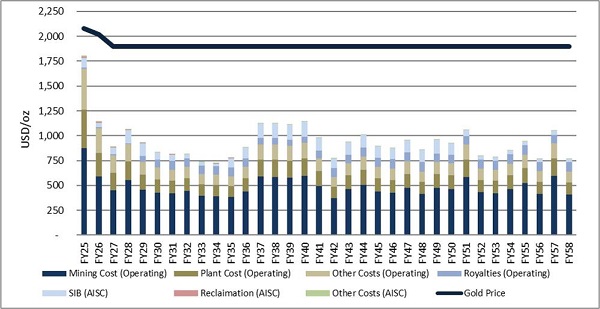

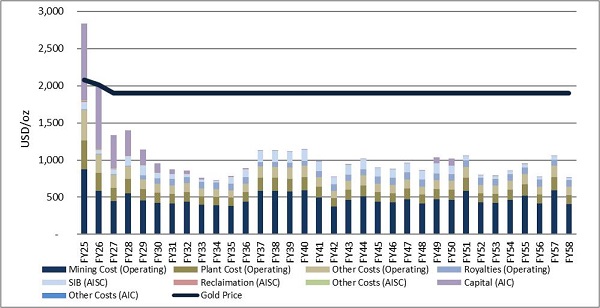

Costs reported for the Blyvoor Mine, which consists of mining, plant and other operating costs, as well as government royalty payments are displayed in the table to follow. Other costs in the Adjusted Operating Costs category include the central and technical services, general and administration, human resources, and other services costs. Other costs for the AISC category include the corporate management costs. The costs are displayed per milled tonne as well as per recovered gold ounce. A combination of budget costs and actual costs were considered for the financial analysis. Operating costs are inclusive of a 5% contingency, while capital costs are inclusive of a 15% contingency.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 5 |

Project Cost Indicators

| Item | Unit | Blyvoor Gold |

| Net Turnover | USD/Milled tonne | 308 |

| Mine Cost | USD/Milled tonne | 78 |

| Plant Costs | USD/Milled tonne | 24 |

| Other Costs | USD/Milled tonne | 21 |

| Royalties | USD/Milled tonne | 14 |

| Operating Costs | USD/Milled tonne | 137 |

| SIB | USD/Milled tonne | 15 |

| Reclamation | USD/Milled tonne | 0 |

| Other Costs | USD/Milled tonne | 0 |

| All-in Sustaining Costs (AISC) | USD/Milled tonne | 152 |

| Expansion Capital | USD/Milled tonne | 8 |

| Other Cash Costs | USD/Milled tonne | 0 |

| All-in Costs (AIC) | USD/Milled tonne | 161 |

| All-in Cost Margin | % | 48% |

| EBITDA* | USD/Milled tonne | 171 |

| EBITDA Margin | % | 55% |

| Gold Recovered | oz | 4,853,618 |

| Net Turnover | USD/Gold oz | 1,833 |

| Mine Cost | USD/Gold oz | 466 |

| Plant Costs | USD/Gold oz | 141 |

| Other Costs | USD/Gold oz | 126 |

| Royalties | USD/Gold oz | 82 |

| Operating Costs | USD/Gold oz | 815 |

| SIB Capex | USD/Gold oz | 87 |

| Reclamation | USD/Gold oz | 1 |

| Other Costs | USD/Gold oz | 2 |

| All-in Sustaining Costs (AISC) | USD/Gold oz | 905 |

| Expansion Capital | USD/Gold oz | 49 |

| Other Cash Costs | USD/Gold oz | 0 |

| All-in Costs (AIC) | USD/Gold oz | 954 |

| EBITDA* | USD/Gold oz | 1,015 |

Notes:

| 1. | * EBITDA excludes capital expenditure. |

| 2. | Costs Includes Contingencies |

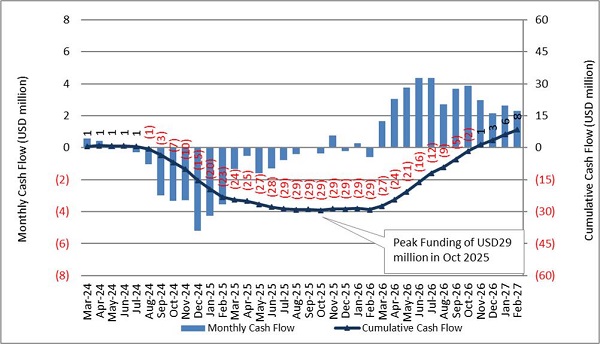

The total capital including the sustaining capital amounts to USD665 million over the mine life. The Mine is in ramp-up phase from 15 ktpm to 40 ktpm in the initial period and 80 ktpm within 7 years. Initial capital has been spent, with additional capital being sustaining and expansion capital.

The capital planned for year 1 (FY25) of USD28.4 million and for year 2 (FY26) of USD44.2 million is not fully offset by free cash flows from the operation in these years and results in a peak funding requirement of USD29 million in month 20 (October 2025).

The production profile and mine development plan shown in this report relies on access to these funds to achieve the stated results. The evaluator has been informed that the funding is intended to be raised during a listing of Blyvoor Gold Capital (Pty) Ltd’s holding company, which is anticipated for August or September 2024.

For the DCF, the grade, gold price and exchange rate have the most significant impact on the sensitivity of the Mine followed by the mining operating costs. The Mine is least sensitive to capital and plant and other operating costs.

The value derived for the income approach only reflects the diluted Indicated and Measured Mineral Resources in the LoM plan, for conversion to Mineral Reserves. The Mineral Reserve is economically viable with a best estimated NPV of USD539 million (USD399 million attributable to Blyvoor Gold Resources (Pty)

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 6 |

Ltd) at a real discount rate of 11.9%. The IRR of the Project is 96%, however the mine is already in operation with initial capital already spent. The following table shows a summary of the economic analysis.

Blyvoor Mine Economic Analysis Summary – Real Terms

| Item |

Unit |

Blyvoor Mine | Blyvoor Gold

Resources (Pty) Ltd

Attributable |

| NPV @ 0% | USD million | 2,974 | 2,201 |

| NPV @ 2% | USD million | 2,064 | 1,527 |

| NPV @ 4% | USD million | 1,485 | 1,099 |

| NPV @ 5% | USD million | 1,275 | 944 |

| NPV @ 6% | USD million | 1,104 | 817 |

| NPV @ 8% | USD million | 845 | 626 |

| NPV @ 10% | USD million | 664 | 491 |

| NPV @ 11.9% | USD million | 539 | 399 |

| NPV @ 12% | USD million | 533 | 395 |

| NPV @ 14% | USD million | 436 | 323 |

| IRR | % | | 96.2% |

| All-in Cost Margin | % | | 48% |

| Peak Funding Requirement | USD million | | 29 |

| Payback | Months | | 33 |

| Break-even Gold Price | USD/oz. | | 954 |

Legal Aspects and Tenure

Blyvoor Capital are in possession of all necessary permit licences and authorisations for the current operations, the most significant of these being an environmental authorisation, environmental management programme and a water use licence.

Geology and Mineral Resources

The geology and structure of the mine is well understood. The operation is a typical mature Witwatersrand Gold Mine with years of historical data. New sampling data as at 29 February 2024 was provided for facies 3 on the Middelvlei Reef and facies 5 for the Carbon Leader Reef. Therefore, new estimates in 2024 were only produced for these two facies using the same estimation approach applied in 2023. New depletions as of 29 February 2024 were applied to the Carbon Leader and Middelvlei reefs.

There has been no significant change in the Mineral Resource Classification and grade between 2023 and 2024 for both the Carbon Leader and Middelvlei reefs.

Mining

With SBM only mining 25% of the Carbon Leader reef, conventional mining is the main mining method. SBM has been validated as a mining technique, but face availability is required if one needs to get the same advance as conventional mining. The mining process makes sense, mining close to the shaft area, in areas that require little opening up and redevelopment. To ensure that all planned mining areas are available, ongoing reconnaissance has been planned. The existing mining infrastructure must be made accessible before the mine plan can go forward. Activities for opening up have been planned and are currently underway. Until the orepass system feeding ore to the mid-shaft hoisting arrangement is finished, cage hoisting in the PS Sub-vertical Shaft above 27 Level to 15 Level (roughly 548 m) is planned. The mine plan only targets measured and indicated Mineral Resources inferred Mineral Resources do not provide any economic benefit.

Engineering and Infrastructure

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 7 |

The PS Shaft operation is well-established and equipped. Repairs have been conducted on equipment and infrastructure that had been damaged and/or vandalised since the operation’s closure and this infrastructure has been restored to service. The established equipment and infrastructure includes offices, change houses, lamp room, Eskom and Blyvoor electrical sub-stations, winding plants, main ventilation fans, shafts, pumping infrastructure, as well as a sewage plant.

Refurbishment and re-equipping of the power supply and electrical distribution infrastructure has been completed and recommissioned.

Potable water is sourced from Rand Water. A supply line has been installed and connected to the existing supply line leading onto the Blyvoor Mine lease area.

Service water will mainly be sourced from underground and the estimated available 25 Ml/day of fissure water ingress is deemed sufficient for the planned production rates.

Owing to PSSV Shaft being flooded from 10 m above 29 Level, ore cannot be hoisted from the installed loading station located on 43 Level. Commissioning of the mid-shaft loading station on 27.5 Level has been completed and the completion of an orepass system will be required to facilitate rock hoisting above 27 Level in PSSV Shaft with the rock winder.

Ventilation of the underground workings is a critical part of the mining operation. A review of the initial mining plan has been conducted by a ventilation specialist and it has been deemed that utilisation of only one ventilation fan and no refrigeration will be required during production above 31 Level. When mining at a production rate of 80 ktpm below 31 Level refrigeration will be required together with the utilisation of the second installed main ventilation fan.

Once mining moves further away from the PS Shaft Complex, establishment of ventilation fans at the historic Doornfontein No. 2 Shaft and the Blyvooruitzicht No. 3 Ventilation Shaft will be required.

Dewatering of the underground workings will commence one year prior to mining proceeding below 2 Level. Initial dewatering will be conducted with submersible pumps through PSSV Shaft and PS Shaft. Once the permanent pump stations and associated infrastructure below 31 Level were replaced and recommissioned, this infrastructure and equipment will be utilised to dewater the underground workings. The selected pumping equipment and infrastructure will have sufficient capacity for the required dewatering and sufficient capital has been allowed for the acquisition thereof.

Re-equipping and recommissioning of Incline shafts in the old Blyvooruitzicht section will be required to sustain the targeted production rates. This will include rails, sleepers, winders, ore tipping arrangements and all services required for mining and re-equipping of the old workings. Sufficient capital has been allowed for this purpose.

Processing

The process plant has been operating at an average recovery of 91.5%, and this can be expected to continue as long as the ore mineralogy does not change. The average processing rate for the 12 months ending March 2024 was 16.0 ktpm, and there are indications that higher processing rates can be achieved with operational improvements.

Economic Analysis

The Blyvoor Mine plan including only the diluted Indicated and Measured Mineral Resources in the LoM plan, for conversion to Mineral Reserves is financially feasible. The updated Mineral Reserve can therefore be declared. The DCF value of USD539 million for the Blyvoor Mine (USD399 million attributable to Blyvoor Gold

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 8 |

Resources (Pty) Ltd) was calculated at a real discount rate of 11.9%. A high IRR of 96% was calculated based on a peak funding requirement of USD29 million, with initial capital already spent.

Blyvoor Mine has an all-in cost margin of 48%, which is high compared to similar mines. All-in sustaining costs for the Blyvoor Mine amount to USD152/milled t, which equates to USD905/oz. All-in costs for the Blyvoor Mine amount to USD161/milled t, which equates to USD954/oz. Funding of USD29 million is required in month 20 (October 2025) as the expansion capital in the first two years is not fully offset by internally generated free cash flow. The payback period was calculated as 33 months.

The Mine is most sensitive to grade, commodity prices and exchange rate. The Mine is least sensitive to capital and other plant and other operating costs.

The Project has a break-even gold price of USD954/oz including capital.

Legal Aspects and Tenure

Blyvoor Capital are in possession of all necessary permit licences and authorisations for the current operations, the most significant of these being a mining right, environmental authorisation, environmental management programme and a water use licence. In light of no material risks for the current operations, an environmental audit undertaken for 2024 noted minor areas for improvement. Submission of the provisional Air Emissions Licence first quarterly report is pending. It is imperative that a contingency or action plan should be put in place to facilitate future compliance and improvement of on-site environmental and sustainability principles as set out in the MPRDA, NEMA and NEMAQA.

Geology and Mineral Resources

As mining progresses, channel width information should be compared to current channel width estimates as the channel width data is spatially not as well spread as the cm.g/t datasets. The channel width data can then be remodelled for more complete channel width modelling. The current model does; however, utilise the cm.g/t data to produce a cm.g/t estimate and report resources at a stope width of 117cm which is typically thicker than the current channel widths estimated. CW data is being collected with the new sampling being conducted in the mining areas and this will be incorporated into the modelling in future.

It is recommended that the facies modelling of the Middelvlei Reef be reviewed with further Mineral Resource updates to refine the estimation for future mine planning.

Reconciliations of mined grades with block model grades should be performed.

Mining

Ongoing reconnaissance should be conducted to assess the availability and condition of planned underground access and workings beyond the fifth year. If the reconnaissance identifies inaccessible areas, it may be necessary to revise the plan accordingly. The reconnaissance must be utilised to revise the capital estimate for shaft refurbishment, dewatering, pump stations, substations, mining equipment, and rail-bound equipment. For the later years of operation, a comprehensive ventilation plan that includes refrigeration should be developed. To determine the ventilation requirements beyond the first five years of mining, simulations of ventilation should be conducted. To optimise extraction and support techniques, ongoing rock engineering investigations and re-modelling are necessary. Considering seismic activities, it is recommended that a risk register and seismic monitoring continue, and plans be implemented.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 9 |

Engineering and Infrastructure

Cage hoisting is a difficult and time-consuming process, although it has been estimated that sufficient cage hoisting capacity (22.5 ktpm) exists. Delays in the commissioning a new orepass system feeding ore to the new commissioned 27.5 Level mid-shaft loading station may constitute a risk and fast tracking the establishment is being considered. Proper controls and management of the cage hoisting process will be required during the cage hoisting phase, as congestion on shaft stations can easily cause delays and production constraints.

Investigations need to be conducted to fully understand the requirements for re-equipping the old Blyvooruitzicht section Incline shafts. A ventilation study and simulation need to be conducted to fully understand the ventilation and cooling requirements once mining in the extremities of the project areas as well as when mining proceeds below 31 Level.

Considering the criticality of dewatering the flooded workings, it is recommended that the commencement of the detailed study work regarding the dewatering system and associated infrastructure be expedited. This is required to ensure timeous establishment of the pump system and infrastructure and prevent any delay of mining below 29 Level.

Processing

The plant expansion design study was completed in May 2023 and planned commissioning must be informed by the mining planning. A new TSF must be planned for in 20 years to allow for deposition at that time.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 10 |

ITEM 2 - INTRODUCTION

Item 2 (a) - Issuer Receiving the Report; Authors

Minxcon (Pty) Ltd (“Minxcon”) was commissioned by Blyvoor Gold Resources (Pty) Ltd (“Blyvoor Resources” or “the Company”) to compile a Technical Report Summary (“TRS”) Blyvoor Gold Mine (“Blyvoor Mine”, “Blyvoor” or the “Mine”), situated in Gauteng Province, South Africa. The Mine is owned and operated by, and was commissioned by, Blyvoor Gold Capital (Pty) Ltd (“Blyvoor Capital”).

The authors of this TRS are Uwe Engelmann and Daniel van Heerden, each of which is a Qualified Person (“QP”). Mr. Engelmann was responsible for Sections 1-11 and jointly for 20-25 of this TRS, while Mr. van Heerden was responsible for Sections 12-19 and jointly for 20-25 of this TRS.

Item 2 (b) - Terms of Reference and Purpose of the Report

Minxcon was commissioned to prepare the TRS on the Mine in accordance with the United States Securities and Exchange Commission Part 229 Standard Instructions for Filing Forms Regulation S-K subpart 1300 (“S-K 1300”). This TRS follows the guidelines as prescribed by S-K 1300, and only such terms as defined in §229.1300-1305 were utilised. The TRS is structured in accordance with the format prescribed in §229.601(b)(96).

Blyvoor is an operating underground mine with ore processed at an on-site plant. The purpose of this TRS is to present the Mineral Resources and Mineral Reserves of the Mine as of the Company financial year end 29 February 2024. The Mineral Resources and Mineral Reserves are stated at the effective date of 29 February 2024.

The basis for the Mineral Reserves stated in this TRS is a life of mine plan, which constitutes a study with detail and accuracy levels better than the requirements for a pre-feasibility study. The QP has reviewed the life of mine plan and is satisfied that it has demonstrated that, at the time of reporting, the extraction of the Mineral Reserve is economically viable under reasonable investment and market assumptions. The life of mine plan is technically achievable and is the basis of determining the Mineral Reserve.

All monetary figures in this TRS are expressed in United States Dollars (“USD”).

Item 2 (c) - Sources of Information and Data Contained in the Report

The following sources of information were supplied to Minxcon by Blyvoor Gold personnel to complete the scope of work and to compile this Report:-

| ● | Minxcon has accepted information supplied by Blyvoor Gold regarding the permits and licences as valid and complete, as provided by Mr Dave Whittaker. |

| ● | Reliance was made on documentation prepared by Digby Wells Environmental for calculations on environmental liabilities. |

| ● | Tax information, i.e. tax losses and unredeemed capital expenditure was provided by Blyvoor Gold and are regarded as valid. |

| ● | The Rand Refinery agreement was provided by Blyvoor Gold. |

| ● | Blyvoor Gold provided the rehabilitation liabilities as approved by the DMRE. |

Additional information was sourced from those references listed in Item 24 and are duly referenced in the text where appropriate.

Item 2 (d) - Qualified Persons’ Personal Inspection of the Property

The Qualified Person (“QP”, as such term is defined S-K 1300) for this TRS are Mr. U. Engelmann and Mr. D. van Heerden.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 11 |

Mr. van Heerden and Mr. Engelmann undertook an underground site visit on 11 March 2021 accompanied by various Blyvoor Gold staff members to inspect the mining start up and geology on 15 Level. On 10 February 2023, Mr. Eben Jansen (Processing Engineer, Minxcon) and Mr. Mardus Jansen van Vuuren (Plant Superintendent, Minxcon) undertook a visit to the site to investigate the plant with the specific task to investigate the milling capacity and make recommendations for improvement. They were accompanied by Blyvoor Plant Manager. Mr van Heerden conducted a later site visit on 19 May 2023 accompanied by various Blyvoor Gold staff members to inspect the recent mining activities on 15 Level and 27 Level.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 12 |

ITEM 3 - PROPERTY DESCRIPTION AND LOCATION

Item 3 (a) - Location of the Property

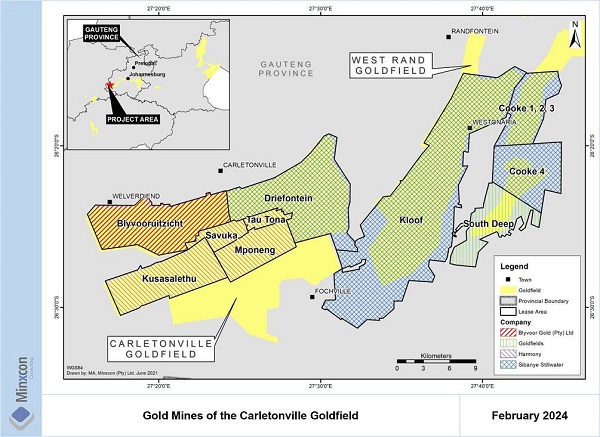

As illustrated in Figure 1, the Mine is located some 14 km by road southwest of the town of Carletonville, in the south-western extremity of the Gauteng Province, South Africa, and within the Oberholzer Magisterial District. The town of Fochville lies 30 km due southeast and Westonaria 42 km due northeast. To the northeast, Johannesburg can be accessed over a well-established road network of 80 km. The Mine is centred on the co-ordinates (WGS84 system) 26°25’31“S, 27°20’42“E.

Figure 1: Location of Blyvoor Mine

Figure 2 illustrates the Blyvoor assets in relation to other assets in the area.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 13 |

Figure 2: Location of Blyvoor Gold Assets in Relation to the Orphans (Including Harmony Assets)

The yellow areas in the Figure 2 indicate the Blyvoor Gold Capital (Pty) Ltd assets, who mines the mining right area (project area). The orange areas indicate Blyvoor Operations (Pty) Ltd assets, who intend to process tailings. The blue areas indicate the Anglo Gold Ashanti Limited (“AGA”) assets that were purchased from the provisional liquidator and which were subsequently sold to Harmony Gold Mining Company Limited (“Harmony”) in 2020. Harmony is currently pumping in order to protect the integrity of the underground pillar between the Blyvoor PSSV Shaft underground workings and their neighbouring Savuka Gold Mine.

Item 3 (b) - Area of the Property

Blyvoor Gold holds the Peter Skeat Shaft (“PS Shaft”, previously known as the No. 5 Shaft) and the mining right covering the underground gold mining operation of the Blyvooruitzicht Gold Mining Company Ltd (in provisional liquidation) (“BGMC”). The mining right covers an area of 6,708.4273 hectares. Gold mineralisation is accessed via the PS Shaft, which recommenced operations in quarter 2 2019 after operation shutdown from 2013.

The Mine is in a prolific gold mining area within the Carletonville Goldfield. The region hosts several well-established gold mines and is well serviced by all amenities. The Mine is operated by an owners team. Gold mineralisation hosted in the Middelvlei and Carbon Leader reefs is extracted via conventional mining methods, however the Selective Blast Mining method (“SBM”) is applied to those carbon leader stopes / panels that lend themselves to this method. Current mining rates do not exceed 30 ktpm, but it is planned to ramp up production to 80 ktpm. Extracted material is processed at a hard rock gold extraction carbon-in-pulp (“CIP”) plant situated adjacent to PS Shaft. The plant has a nameplate processing capacity of 40 ktpm but is currently achieving some 15 ktpm. The underground workings from 10 m above 29 Level at Peter Skeat Sub-vertical Shaft (“PSSV Shaft”, previously known as the No. 5A Sub-vertical Shaft) are flooded and are currently inaccessible.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 14 |

Item 3 (c) - Mineral Deposit Tenure

Mining rights are issued by the South African Department of Mineral Resources and Energy (“DMRE”, previously Department of Mineral Resources) in accordance with the Mineral and Petroleum Resources Development Act, No 28 of 2002 (“MPRDA”).

The Blyvoor Mine is encompassed under a converted mining right GP 30/5/1/2/2/143 MR (“MR143GP”) issued in the name of Blyvoor Gold Capital (Pty) Ltd. Table 1 provides a summary of the details of MR143GP.

Table 1: Summary of Mining Right for Blyvoor Mine

Right Number | Holding Company | Farm | Area | Commodity | Commencement Date | Expiry Date |

| ha |

| MR143GP | Blyvoor Gold

Capital (Pty) Ltd | Various portions of the farms Blyvooruitzicht 116 IQ, Doornfontein 118 IQ, and Varkenslaagte 119 IQ | 6,708.4273 | Gold | 17 Feb 2017 | 16 Feb 2047 |

The QPs have viewed a copy of MR143GP and are satisfied with its validity and authenticity. The QPs have not identified any threat to the mining right with continued annual obligations to tenement security and conformance to government notices and directives.

An amendment application in terms of Section 102 of the MPRDA has been submitted to the DMRE on 30 March 2023 to include additional commodities (silver, nickel, copper, platinum group metals), and to include the mining of tailings material from 2028.

The mineral right MR143GP is held by Blyvoor Capital, a registered subsidiary (74%) of Blyvoor Resources. The remaining 26% ownership of Blyvoor Capital is held by Blyvoor Empowerment Partners (RF) (Pty) Ltd, which represents Black persons as defined in terms of the Black Economic Empowerment (“BEE”) Act and as set out in the Mining Charter. The MR143GP was issued prior to gazetting of the 2018 Mining Charter which requires mines to hold a 30% BEE representation, thus the 26% BEE requirement of the previous Charter remains in force.

The current and post-transaction company structure is illustrated in Figure 3.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 15 |

Figure 3: Company Structure

Several servitudes and usufructs for services are required for the operation. These services include water, electricity, and pumping, amongst others. Servitudes and usufructs were surveyed and registered for all operational areas of the Mine. The usufructs have a validity period of 99 years under ownership to Blyvoor Gold.

Item 3 (d) - Royalties and Payments

The current Mineral and Petroleum Resources Royalty Act came into effect on 1 March 2010. The law requires all companies extracting minerals in South Africa to pay royalties at a rate of between 0.5% and 7% based on gross sales. Companies are taxed on either the refined or unrefined formula:-

| ● | Refined mineral formula = 0.5 + [EBIT/Gross sales x 12.5] x 100 |

| ● | Unrefined mineral formula = 0.5 + [EBIT/Gross sales x 9] x 100 |

The refined mineral formula has been used for Blyvoor Mine as the gold is refined to at least 99.5% purity at Rand Refinery, and the Company sells the refined product at spot prices.

Blyvoor also has a streaming arrangement in place with Nomad Royalty Company Ltd. whereby gold is to be sold to Nomad Royalty Company Ltd. (the purchaser) at a fixed price of USD572/oz for gold volumes amounting to the following:-

| ● | For the first 300,000 oz delivered to the purchaser:- |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 16 |

| ○ | 10% of production to be delivered to the purchaser, capped at 16,000 oz delivered/ 160,000 oz produced per annum. |

| ○ | Thereafter, 5% of the production in excess of 160,000 oz per annum for that year. |

| ● | After the purchaser has received 300,000 oz, with production capped at 10,320,000 oz:- |

| ○ | 0.5% of production to be delivered to the purchaser, capped at 500 oz delivered or 100,000 oz produced per calendar year. |

| ○ | Thereafter, 0% of the remaining production for that year (i.e. no charge). |

Item 3 (e) - Environmental Liabilities

In terms of Regulation 54(2) of the MPRDA, Blyvoor Gold is required to make financial provision for the interim and final rehabilitation activities on the site. The provision is required to be reviewed annually for adequacy and amended to compensate for new activities and/or inflation.

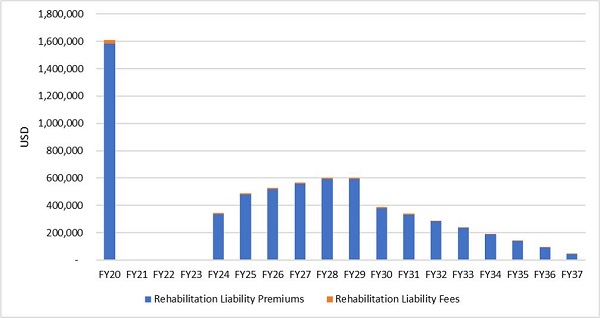

The rehabilitation liability provision was updated by Digby Wells in May 2023. These costs have been reviewed and escalated to 2024 terms by Minxcon. As per discussion with Blyvoor management, the DMRE has accepted the escalated costs, but has not requested an updated payment plan. The apportioned of the escalated liabilities to the three entities/groupings are set out in Table 2.

Table 2: Assessed Rehabilitation Liabilities attached to MR143GP as of February 2024 with Amended Splits

Description | DMRE Financial Provision Assessment | Percentage of Liability |

| ZARm |

| Blyvoor Gold Capital (Pty) Ltd | 125.3 | 25% |

| Blyvoor Gold Operations (Pty) Ltd | 213.5 | 43% |

| Orphans | 153.7 | 32% |

| Total | 492.5 | 100.0% |

In October 2020 Blyvoor Gold Capital (Pty) Ltd applied to the DMRE to amend the closure liability funding by consolidating all existing guarantees and funding arrangements into a single financial guarantee through Guardrisk. The existing guarantees of ZAR39.2 million, guarantees provided in 2020 of ZAR35.2 million and the Trust Fund balance of ZAR55.8 million would all be consolidated into a new guarantee of ZAR130.2 million, with the remaining ZAR236.1 million to be funded through guarantees over a period of eight years. This arrangement was accepted by the DMRE in a letter dated 26 October 2020, and a Guardrisk guarantee in the amount of ZAR130.2 million was provided to the DMRE on 22 October 2020.

A payment schedule was provided to Minxcon detailing a period of 18 years to fully fund the guarantees of ZAR366.3 million. The available funds transferred to Guardrisk are sufficient to fully fund premiums to Guardrisk for four years. The payment schedule was apportioned between Blyvoor Gold Capital (Pty) Ltd and Blyvoor Gold Operations (Pty) Ltd. The payment schedule has been updated for the escalated ZAR492.5 million.

Blyvoor Gold, through the granting of the EA, has commenced the process of formally reverting the accountability of the Orphans liability to the new owners of the assets through Section 102 applications. In addition, the liability associated with Blyvoor Gold Operations (Pty) Ltd is intended to be separated through a Section 102 Amendment of the Mining Right.

Once these developments are concluded, Blyvoor Gold Capital (Pty) Ltd will have a total liability of ZAR125.2 million). In the unlikely event that the Orphans liability cannot be passed on to the new owners of the assets and Blyvoor Gold Capital (Pty) Ltd and Blyvoor Gold Operations (Pty) Ltd carry the entire Orphans liability, then the total liability will remain at ZAR492.5 million. The payment plan already in place, which Blyvoor Gold Capital (Pty) Ltd and Blyvoor Gold Operations (Pty) Ltd are currently funding, already provides for a ZAR366 million liability, with the payment plan updated for the higher ZAR492.5 million. Any success in

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Resources (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa | 17 |

reducing the overall liability through the allocation of liabilities to the owners of the Orphans will result in a reduction of cost.

Item 3 (f) - Permits to Conduct Work

Further permits or plans relating to the planned operations are described in the sections to follow that are required to be in place by the EA ((DMR Ref No. GP30/5/1/2/3/2/1 (143) EM) noted in condition 1, 2, 11, and 19.

| I. | Environmental Authorisation |

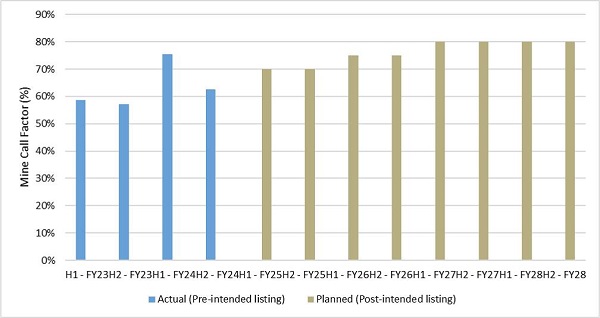

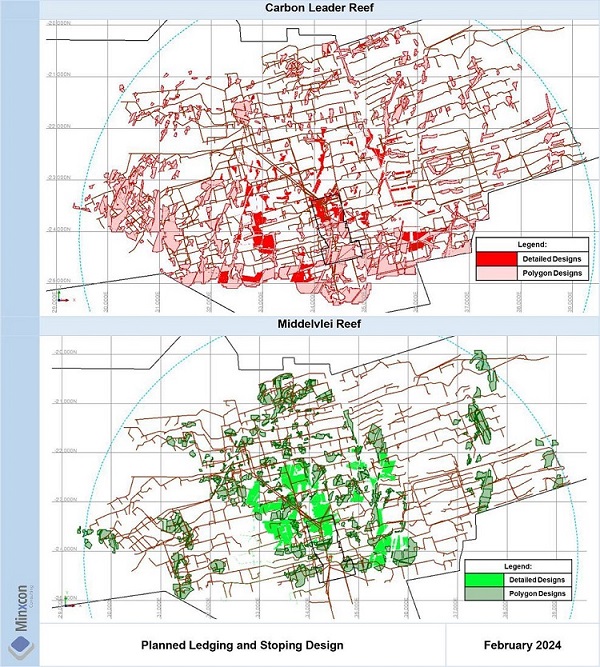

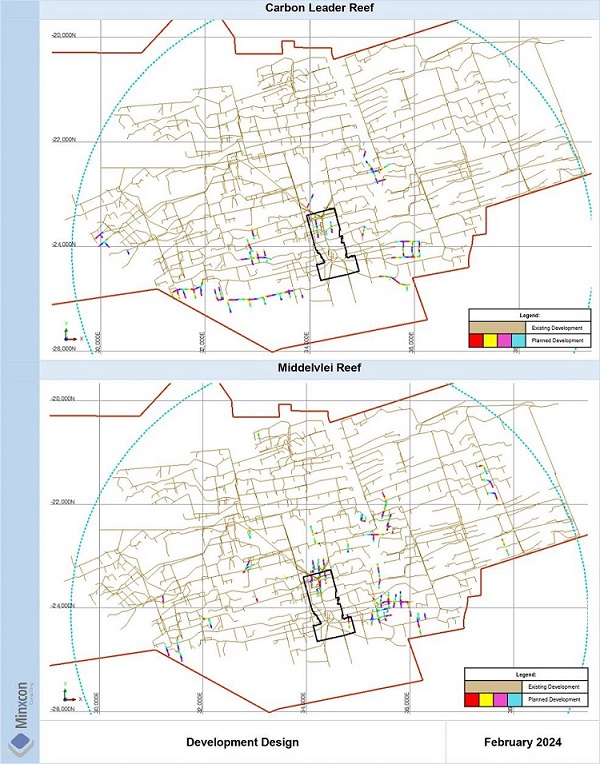

An Environmental Authorisation (“EA”) as part of the MR143GP was granted on 19 February 2020 by the DMRE to Blyvoor Gold for the current operations in terms of the National Environmental Management Act, No. 107 of 1998 (“NEMA”). Environmental Impact Assessment (“EIA”) and Environmental Management Programme (“EMPr”) reports support this authorisation. Annual audits are required to be undertaken annually by external environmental auditors against the approved EA and EMPr and submitted to the DMRE.