Exhibit 96.2

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | i |

DATE AND SIGNATURE PAGE

This Report titled “S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa” was prepared for Blyvoor Gold Operations (Pty) Ltd. The Report is compiled in accordance with the United States Securities and Exchange Commission Part 229 Standard Instructions for Filing Forms Regulation S-K subpart 1300. The effective date of this Report is 29 February 2024.

The Qualified Persons (“QPs”) responsible for this Report are Mr. Uwe Engelmann (Geology and Mineral Resources) and Mr. Daniel (Daan) van Heerden (Mineral Processing, Mineral Extraction, Economic Analysis and Mineral Reserves).

| /s/ U. ENGELMANN | |

| U. ENGELMANN | |

| BSc (Zoo. & Bot.), BSc Hons (Geol.) | |

| Pr.Sci.Nat., FGSSA | |

| DIRECTOR, MINXCON (PTY) LTD | |

| /s/ D. VAN HEERDEN | |

| D. VAN HEERDEN | |

| B Eng (Min.), MCom (Bus. Admin.), MMC | |

| Pr.Eng., FSAIMM, AMMSA | |

| DIRECTOR, MINXCON (PTY) LTD | |

Signed at Little Falls, Gauteng, South Africa, on 31 May 2024.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | ii |

INFORMATION RISK

This Report was prepared by Uwe Engelmann and Daniel van Heerden (the QPs) of Minxcon (Pty) Ltd (“Minxcon”). In the preparation of the Report, the QPs utilised information relating to operational methods and expectations provided to them by various sources. Where possible, the QPs have verified this information from independent sources after making due enquiry of all material issues that are required in order to comply with the requirements of the United States Securities and Exchange Commission Part 229 Standard Instructions for Filing Forms Regulation S-K subpart 1300. The authors of this report are not qualified to provide extensive commentary on legal issues associated with rights to the mineral properties and relied on the information provided to them by the issuer. No warranty or guarantee, be it express or implied, is made by the authors with respect to the completeness or accuracy of the legal aspects of this document.

OPERATIONAL RISKS

The business of mining and mineral exploration, development and production by their nature contain significant operational risks. The business depends upon, amongst other things, successful prospecting programmes and competent management. Profitability and asset values can be affected by unforeseen changes in operating circumstances and technical issues.

POLITICAL AND ECONOMIC RISK

Factors such as political and industrial disruption, currency fluctuation and interest rates could have an impact on future operations, and potential revenue streams can also be affected by these factors. The majority of these factors are, and will be, beyond the control of any operating entity.

FORWARD LOOKING STATEMENTS

Certain statements contained in this document other than statements of historical fact, contain forward-looking statements regarding the operations, economic performance or financial condition, including, without limitation, those concerning the economic outlook for the mining industry, expectations regarding commodity prices, exchange rates, production, cash costs and other operating results, growth prospects and the outlook of operations, including the completion and commencement of commercial operations of specific production projects, its liquidity and capital resources and expenditure, and the outcome and consequences of any pending litigation or enforcement proceedings.

Although the QPs believe that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to be correct. Accordingly, results may differ materially from those set out in the forward-looking statements as a result of, among other factors, changes in economic and market conditions, changes in the regulatory environment and other State actions, success of business and operating initiatives, fluctuations in commodity prices and exchange rates, and business and potential risk management.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | iii |

TABLE OF CONTENTS

| Item 1 - Executive Summary | 1 |

| | I. | Permitting Requirements | | 1 |

| | II. | Geology and Mineral Deposit | | 1 |

| | III. | Status of Exploration | | 1 |

| | IV. | Mineral Resource and Mineral Reserve Estimates | | 2 |

| | V. | Development and Operations | | 2 |

| | VI. | Economic Analysis | | 3 |

| | VII. | Conclusions | | 6 |

| | VIII. | Recommendations | | 7 |

| Item 2 - Introduction | | 9 |

| | Item 2 (a) | - Issuer Receiving the Report; Authors | | 9 |

| | Item 2 (b) | - Terms of Reference and Purpose of the Report | | 9 |

| | Item 2 (c) | - Sources of Information and Data Contained in the Report | | 9 |

| | Item 2 (d) | - Qualified Persons’ Personal Inspection of the Property | | 9 |

| Item 3 - Property Description and Location | | 11 |

| | Item 3 (a) | - Location of the Property | | 11 |

| | Item 3 (b) | - Area of the Property | | 11 |

| | Item 3 (c) | - Mineral Deposit Tenure | | 12 |

| | Item 3 (d) | - Royalties and Payments | | 14 |

| | Item 3 (e) | - Environmental Liabilities | | 15 |

| | Item 3 (f) | - Permits to Conduct Work | | 15 |

| | I. | Water Use Licence | | 15 |

| | II. | Additional Environmental Permits | | 15 |

| | III. | Other | | 16 |

| | Item 3 (g) | - Other Significant Factors and Risks | | 16 |

| Item 4 - Accessibility, Climate, Local Resources, Infrastructure and Physiography | | 17 |

| | Item 4 (a) | - Topography, Elevation and Vegetation | | 17 |

| | Item 4 (b) | - Access to the Property | | 17 |

| | Item 4 (c) | - Climate and Length of Operating Season | | 17 |

| | Item 4 (d) | - Infrastructure | | 18 |

| Item 5 - History | | 19 |

| | Item 5 (a) | - Prior Ownership and Ownership Changes | | 19 |

| | Item 5 (b) | - Historical Exploration and Development | | 19 |

| Item 6 - Geological Setting, Mineralisation and Deposit | | 20 |

| | Item 6 (a) | - Regional Geology | | 20 |

| | Item 6 (b) | - Local and Property Geology | | 20 |

| | Item 6 (c) | - Mineralisation and Deposit Type | | 22 |

| Item 7 - Exploration | | 23 |

| | Item 7 (a) | - Non-drilling Work | | 23 |

| | Item 7 (b) | - Drilling | | 23 |

| | I. | Type and Extent of Drilling | | 23 |

| | II. | Sampling | | 24 |

| | III. | Logging | | 28 |

| | Item 7 (c) | - Hydrogeology | | 28 |

| | Item 7 (d) | - Geotechnical | | 28 |

| Item 8 - Sample Preparation, Analyses and Security | | 29 |

| | Item 8 (a) | - Sample Handling Prior to Dispatch | | 29 |

| | | | | | |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | iv |

| | Item 8 (b) | - Sample Preparation and Analysis Procedures | | 29 |

| | Item 8 (c) | - Quality Assurance and Quality Control | | 30 |

| | Item 8 (d) | - Adequacy of Sample Preparation, Security and Analytical Procedures | | 31 |

| Item 9 - Data Verification | | 33 |

| | Item 9 (a) | - Data Verification Procedures | | 33 |

| | Item 9 (b) | - Limitations on/Failure to Conduct Data Verification | | 33 |

| | Item 9 (c) | - Adequacy of Data | | 33 |

| Item 10 - Mineral Processing and Metallurgical Testing | | 34 |

| | Item 10 (a) | - Nature and Extent of Testing and Analytical Procedures | | 34 |

| | Item 10 (b) | - Basis of Assumptions Regarding Recovery Estimates | | 34 |

| | Item 10 (c) | - Representativeness of Samples and Adequacy of Data | | 34 |

| | Item 10 (d) | - Deleterious Elements for Extraction | | 35 |

| Item 11 - Mineral Resource Estimates | | 36 |

| | Item 11 (a) | - Assumptions, Parameters and Methods Used for Resource Estimates | | 36 |

| | I. | Mineral Resource Estimation Procedures | | 36 |

| | II. | Initial Assessment | | 45 |

| | III. | Mineral Resource Classification | | 45 |

| | IV. | Mineral Resource Statement | | 45 |

| | Item 11 (b) | - Individual Grade of Metals | | 47 |

| | Item 11 (c) | - Factors Affecting Mineral Resource Estimates | | 47 |

| Item 12 - Mineral Reserve Estimates | | 48 |

| | Item 12 (a) | - Key Assumptions, Parameters and Methods | | 48 |

| | I. | Estimation and Modelling Techniques | | 48 |

| | II. | Quality Parameters Applied | | 48 |

| | III. | Modifying Factors | | 49 |

| | IV. | Mineral Reserve Statement | | 49 |

| | Item 12 (b) | - Multiple Commodity Reserve | | 50 |

| | Item 12 (c) | - Factors Affecting Mineral Reserve Estimation | | 50 |

| Item 13 - Mining Methods | | 51 |

| | I. | Mining Layout | | 51 |

| | II. | Mining Strategy | | 51 |

| | Item 13 (a) | - Parameters Relevant to Mine Design | | 52 |

| | Item 13 (b) | - Production Rates, Expected Mine Life, Mining Unit Dimensions, and Mining Dilution | | 53 |

| | I. | Life of Project Production Schedule (Measured and Indicated Mineral Resources) | | 53 |

| | Item 13 (c) | - Requirements for Stripping, Underground Development and Backfilling | | 54 |

| | Item 13 (d) | - Required Mining Fleet, Machinery and Personnel | | 55 |

| | I. | Mining Fleet and Machinery | | 55 |

| | II. | Personnel | | 55 |

| Item 14 - Recovery Methods | | 56 |

| | Item 14 (a) | - Flow Sheets and Process Recovery Methods | | 56 |

| | Item 14 (b) | - Plant Design, Equipment Characteristics and Specifications | | 57 |

| | Item 14 (c) | - Energy, Water and Process Materials Requirements | | 58 |

| | I. | Labour Requirements | | 58 |

| | II. | Reagents and Consumables | | 58 |

| Item 15 - Project Infrastructure | | 59 |

| | Item 15 (a) | - Available Infrastructure | | 59 |

| | Item 15 (b) | - Required Infrastructure | | 59 |

| Item 16 - Market Studies | | 64 |

| | Item 16 (a) | - Commodity Market Assessment | | 64 |

| | | | | | |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | v |

| | I. | World Gold Deposits and Reserves | | 64 |

| | II. | Gold Supply and Demand Fundamentals | | 64 |

| | III. | Gold Pricing | | 65 |

| | IV. | Gold Outlook | | 66 |

| | Item 16 (b) | - Contracts | | 66 |

| Item 17 - Environmental Studies, Permitting and Plans, Negotiations, or Agreements with Local Individuals or Groups | | 67 |

| | Item 17 (a) | - Relevant Environmental Issues and Results of Studies Done | | 67 |

| | Item 17 (b) | - Waste Disposal, Site Monitoring and Water Management | | 68 |

| | I. | Waste Disposal | | 68 |

| | II. | Site Monitoring | | 69 |

| | III. | Water Management | | 69 |

| | Item 17 (c) | - Permit Requirements | | 69 |

| | Item 17 (d) | - Social and Community-Related Requirements | | 69 |

| | Item 17 (e) | - Mine Closure Plans and Costs | | 70 |

| | Item 17 (f) | - Adequacy of Current Plans | | 70 |

| | Item 17 (g) | - Local Procurement and Hiring | | 70 |

| Item 18 - Capital and Operating Costs | | 71 |

| | Item 18 (a) | - Capital Costs | | 71 |

| | Item 18 (b) | - Operating Cost | | 74 |

| | I. | Financial Costs Indicators | | 78 |

| | Item 18 (c) | - Accuracy of Estimates | | 81 |

| Item 19 - Economic Analysis | | 82 |

| | Item 19 (a) | - Principal Assumptions | | 82 |

| | I. | Basis of Evaluation of the Mining Assets | | 82 |

| | II. | Macro-Economic Forecasts | | 82 |

| | III. | Working Capital | | 83 |

| | IV. | Recoveries | | 83 |

| | V. | Discount Rate | | 83 |

| | VI. | Cash Flow Forecast | | 84 |

| | Item 19 (b) | - Net Present Value | | 88 |

| | Item 19 (c) | - Regulatory Items | | 88 |

| | I. | Government Royalties | | 88 |

| | II. | Corporate Taxes | | 89 |

| | Item 19 (d) | - Sensitivity Analysis | | 89 |

| | Item 19 (e) | - Economic Analysis Conclusions | | 92 |

| Item 20 - Adjacent Properties | | 93 |

| Item 21 - Other Relevant Data and Information | | 94 |

| | Item 21 (a) | - Risk Assessment | | 94 |

| Item 22 - Interpretation and Conclusions | | 95 |

| Item 23 - Recommendations | | 97 |

| Item 24 - References | | 98 |

| Item 25 - Reliance on Information Provided by the Registrant | | 99 |

| | | | | | |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | vi |

FIGURES

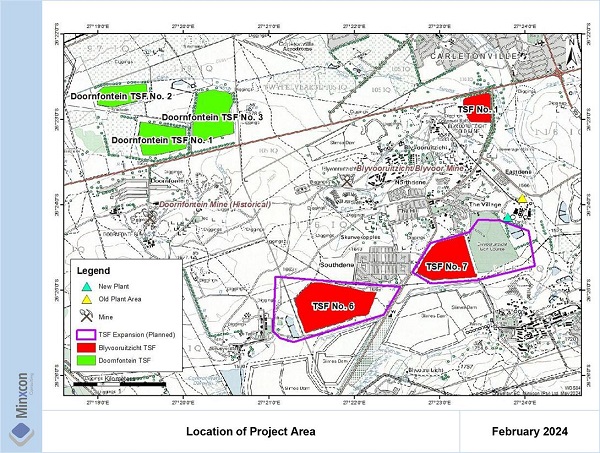

| Figure 1: Location of Project Area | | 12 |

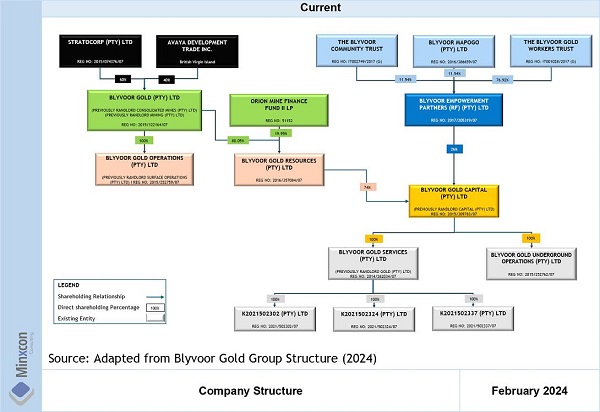

| Figure 2: Company Structure | | 13 |

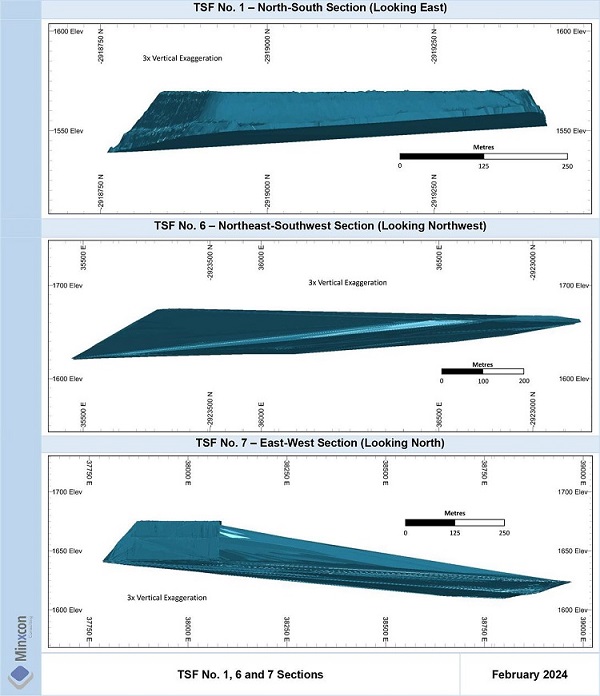

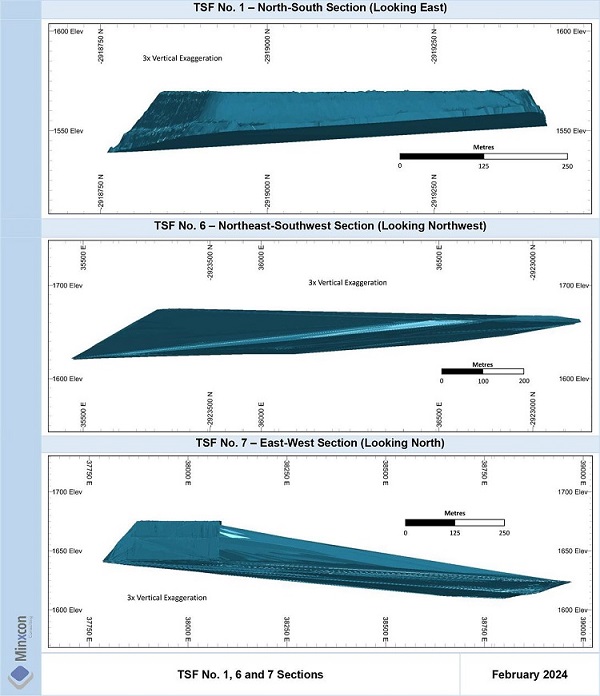

| Figure 3: TSF No. 1, 6 and 7 Sections | | 21 |

| Figure 4: Doornfontein TSF Sections | | 22 |

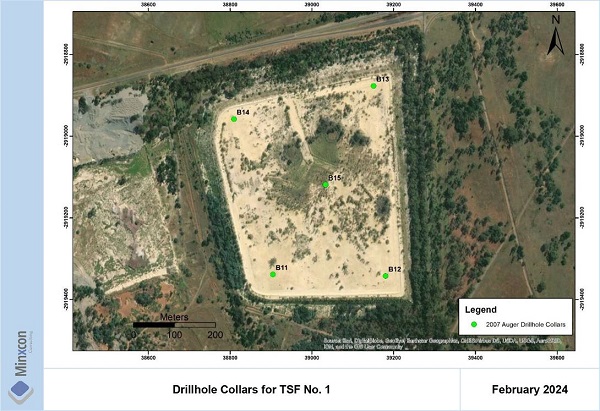

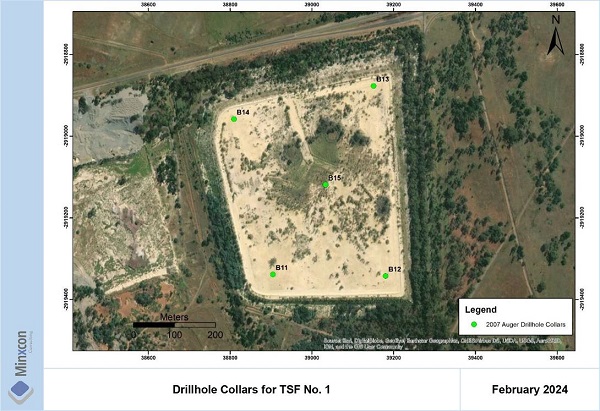

| Figure 5: Drillhole Collars for TSF No. 1 | | 25 |

| Figure 6: Drillhole Collars for TSF No. 6 | | 25 |

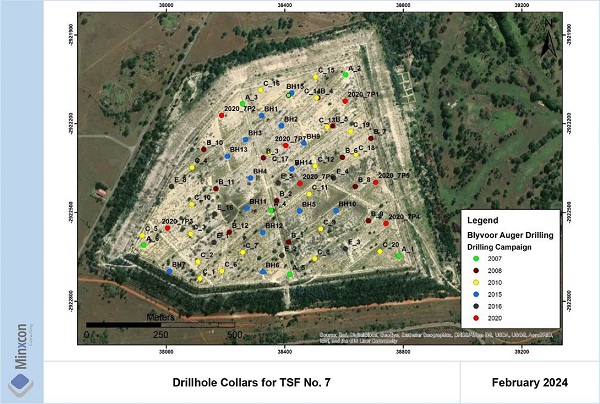

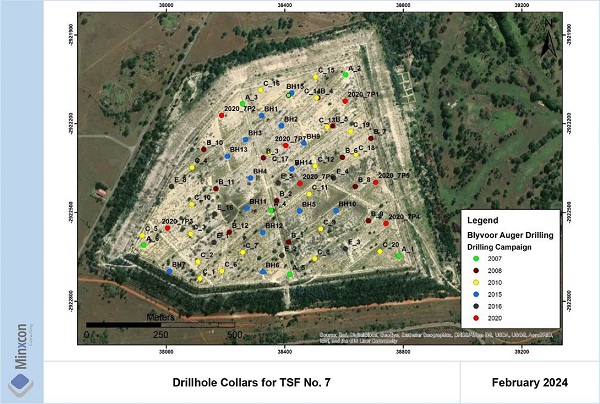

| Figure 7: Drillhole Collars for TSF No. 7 | | 26 |

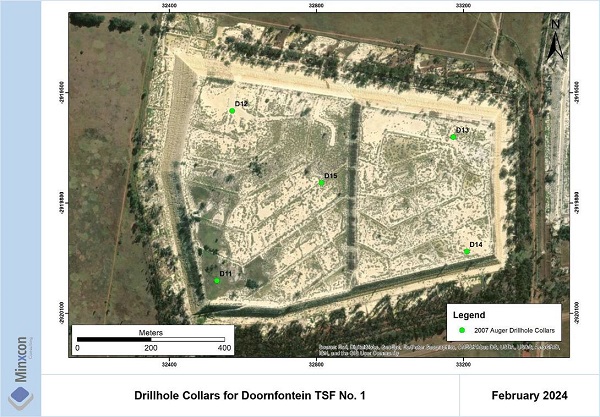

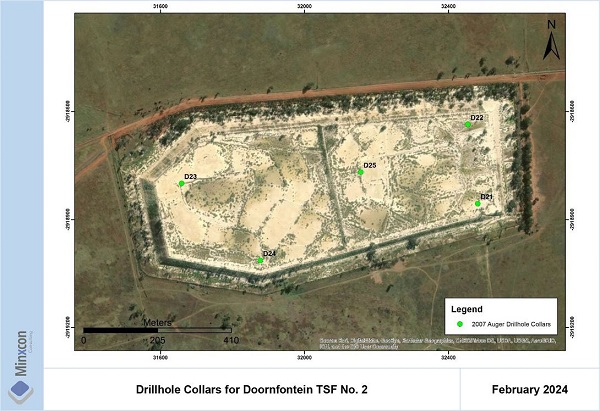

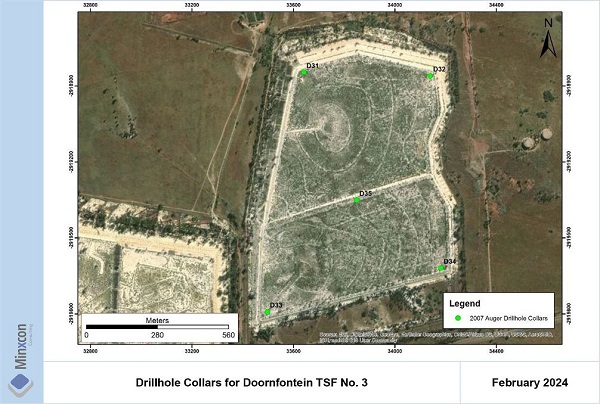

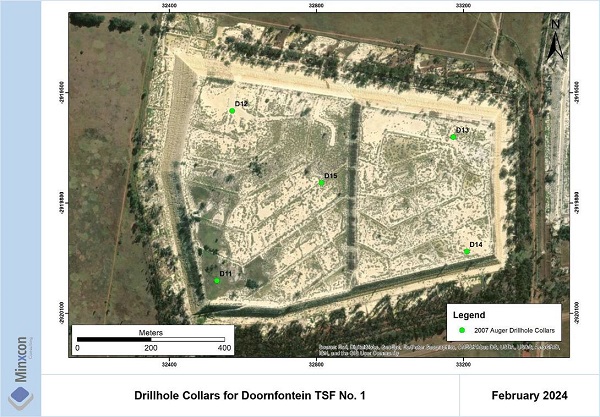

| Figure 8: Drillhole Collars for Doornfontein TSF No. 1 | | 26 |

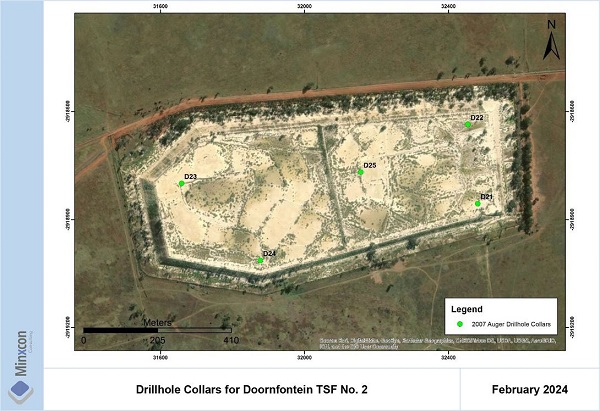

| Figure 9: Drillhole Collars for Doornfontein TSF No. 2 | | 27 |

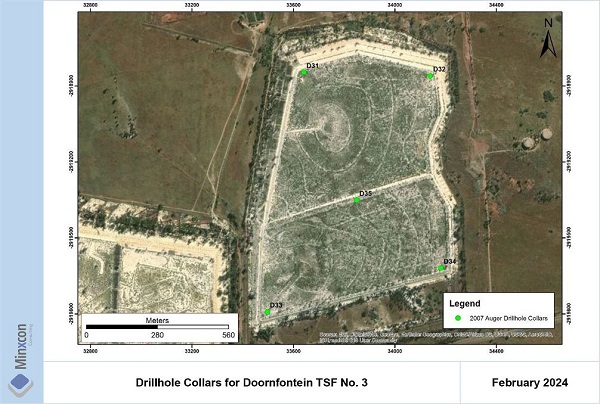

| Figure 10: Drillhole Collars for Doornfontein TSF No. 3 | | 27 |

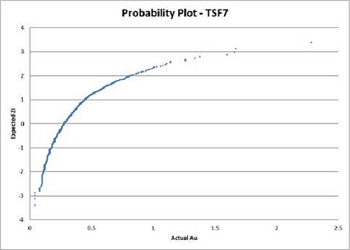

| Figure 11: Outlier Analysis for TSF No. 6 | | 37 |

| Figure 12: Outlier Analysis for TSF No. 7 | | 37 |

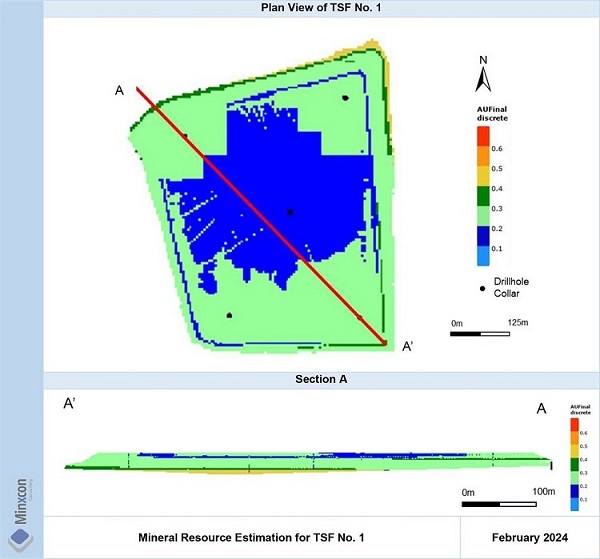

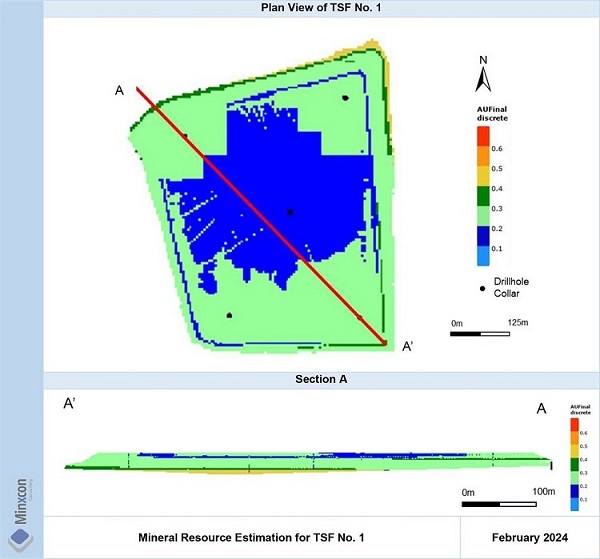

| Figure 13: Mineral Resource Estimation for TSF No. 1 | | 39 |

| Figure 14: Mineral Resource Estimation for TSF No. 6 | | 40 |

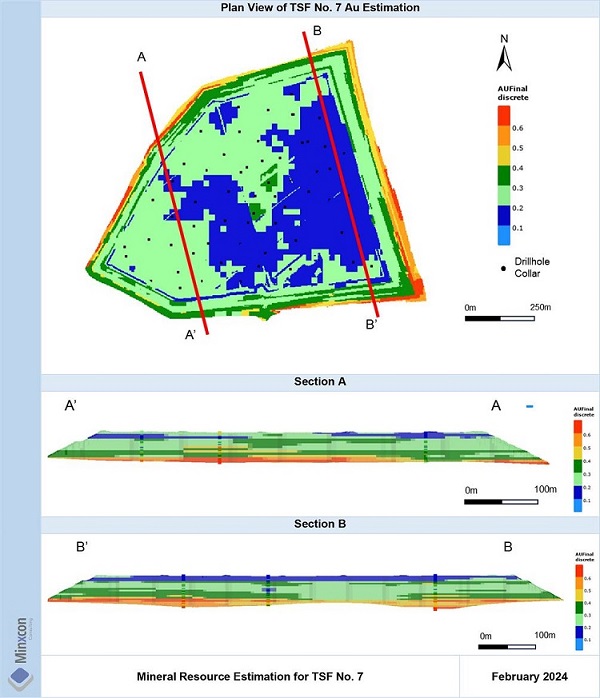

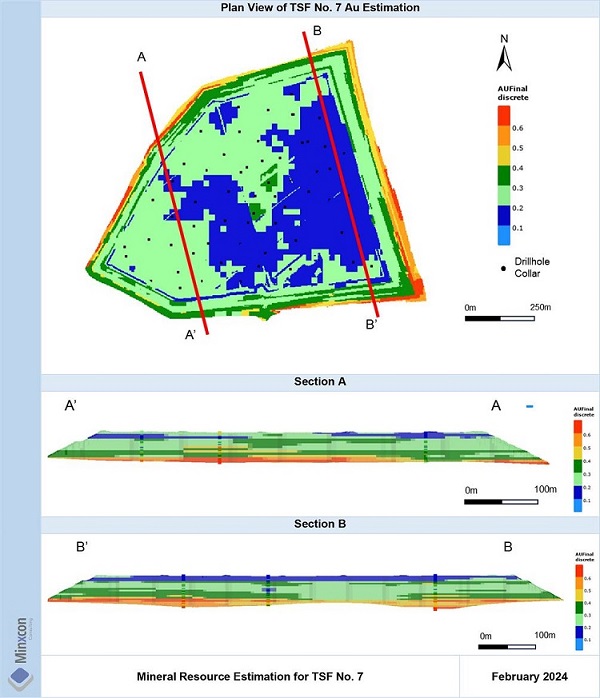

| Figure 15: Mineral Resource Estimation for TSF No. 7 | | 41 |

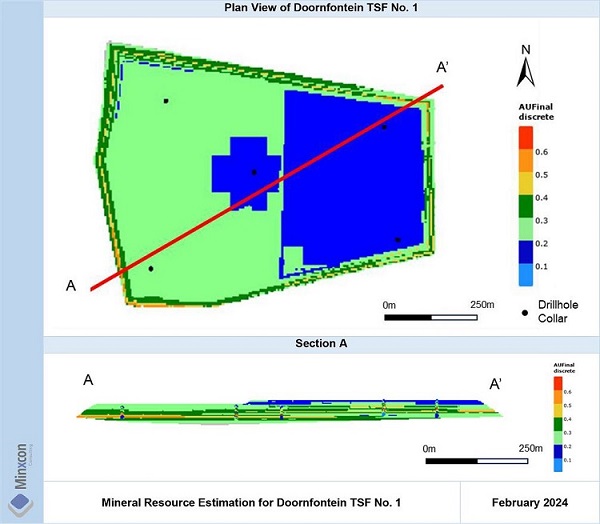

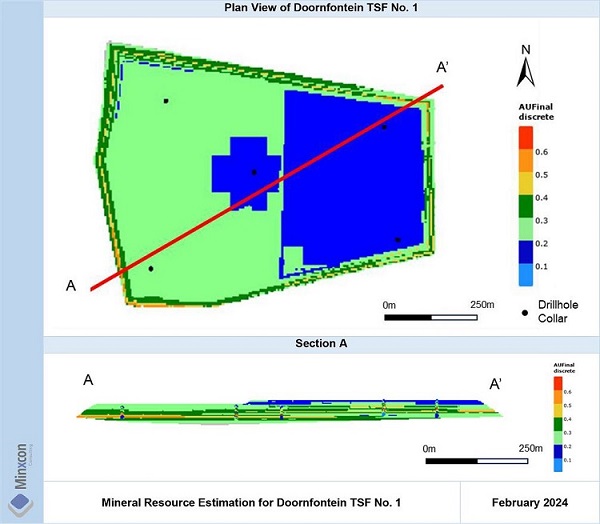

| Figure 16: Mineral Resource Estimation for Doornfontein TSF No. 1 | | 42 |

| Figure 17: Mineral Resource Estimation for Doornfontein TSF No. 2 | | 43 |

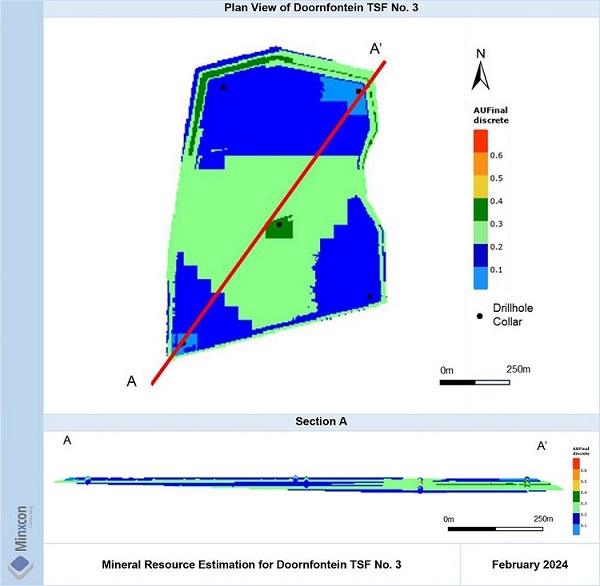

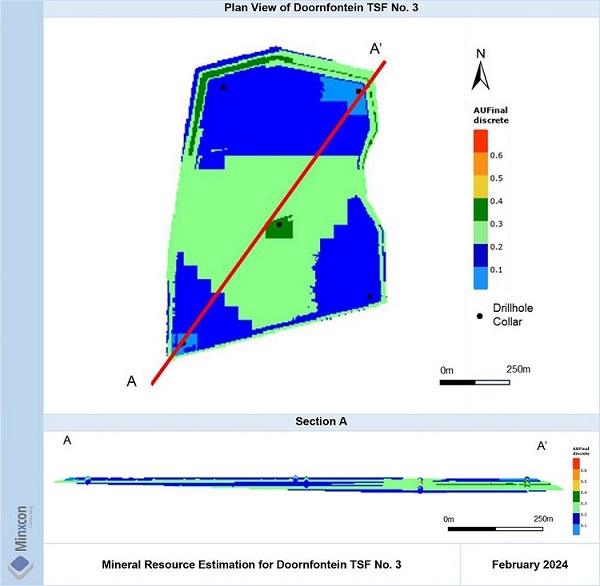

| Figure 18: Mineral Resource Estimation for Doornfontein TSF No. 3 | | 44 |

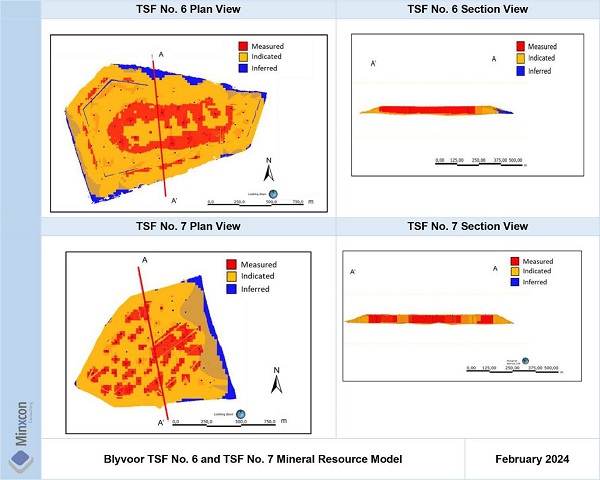

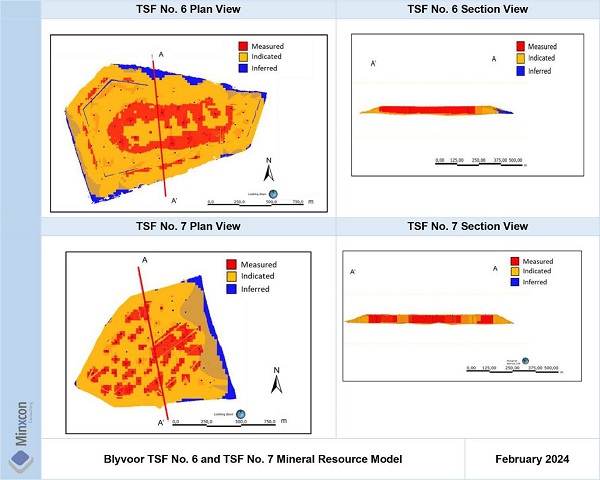

| Figure 19: Blyvoor TSF No. 6 and TSF No. 7 Mineral Resource Model | | 46 |

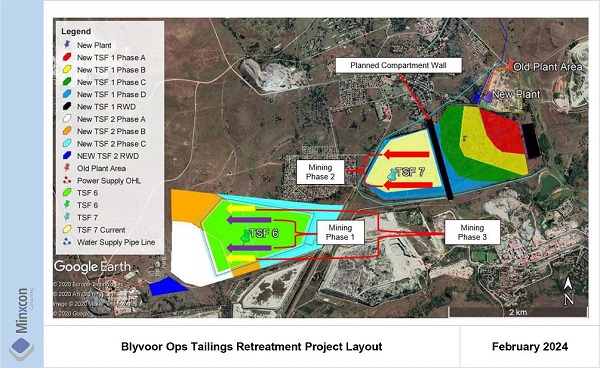

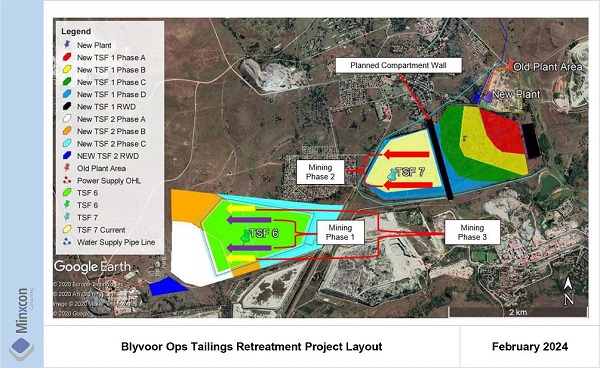

| Figure 20: Blyvoor Ops Tailings Retreatment Project Layout | | 51 |

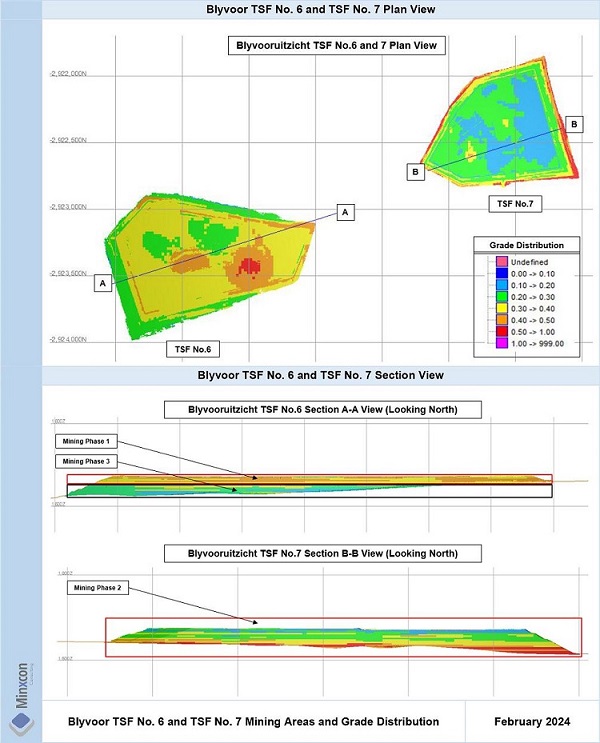

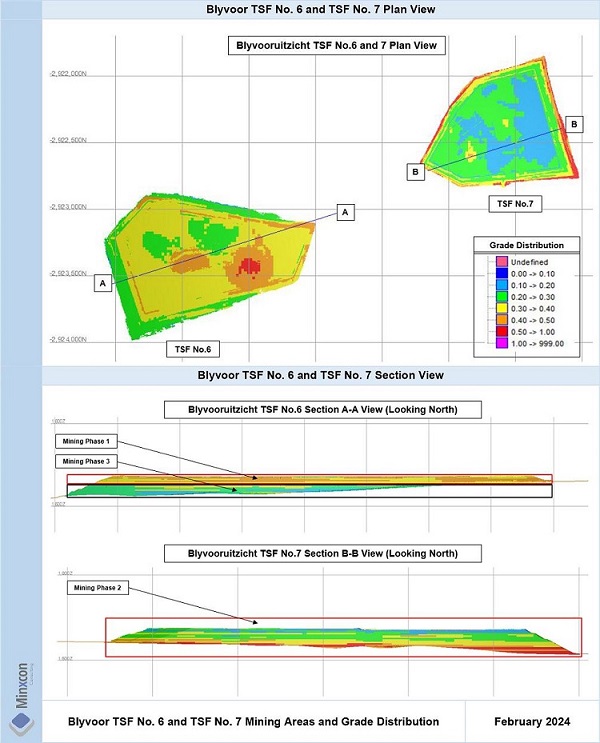

| Figure 21: Blyvoor TSF No. 6 and TSF No. 7 Mining Areas and Grade Distribution | | 52 |

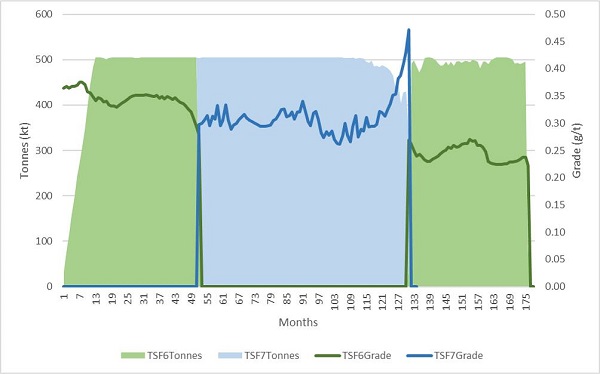

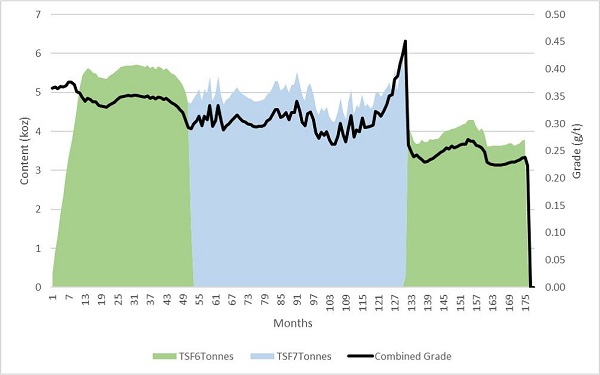

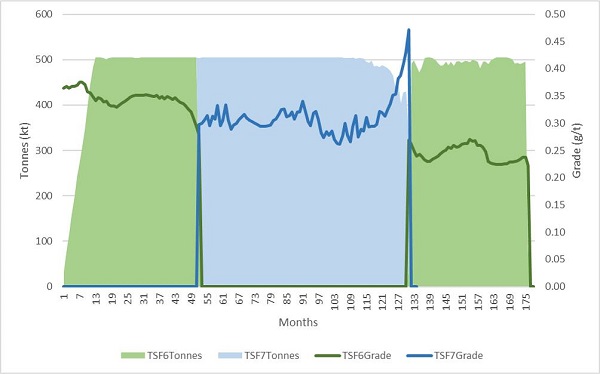

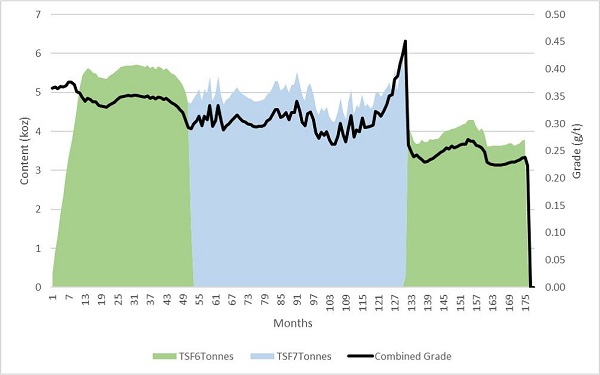

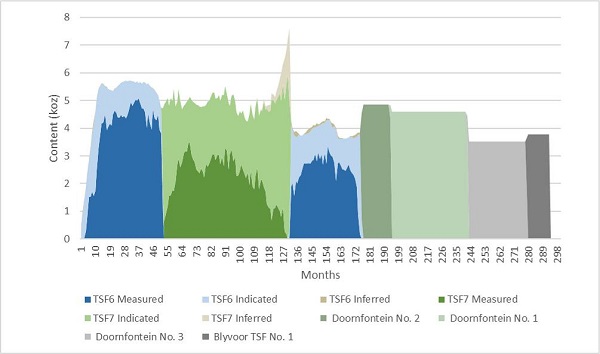

| Figure 22: Diluted Tonnes Delivered to Plant | | 53 |

| Figure 23: Diluted Content Delivered to Plant | | 54 |

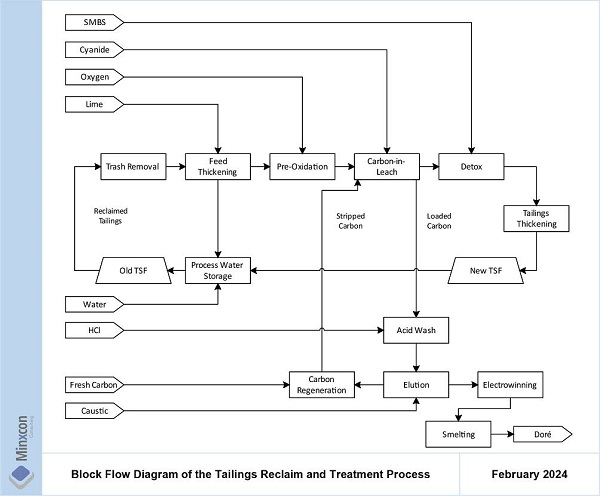

| Figure 24: Block Flow Diagram of the Tailings Reclaim and Treatment Process | | 56 |

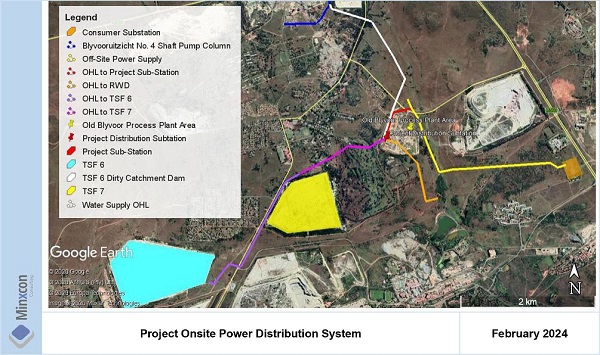

| Figure 25: Project Onsite Power Distribution System | | 60 |

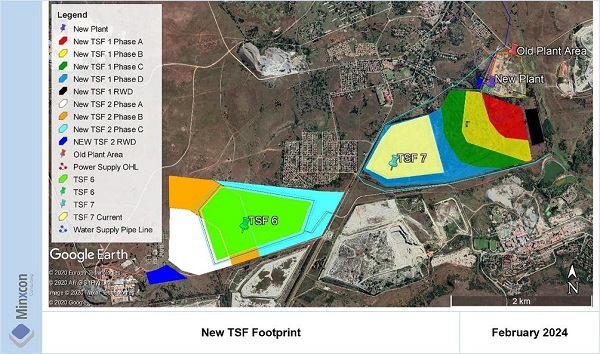

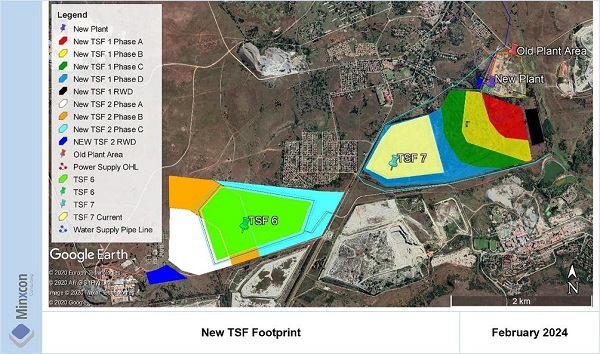

| Figure 26: New TSF Footprints | | 62 |

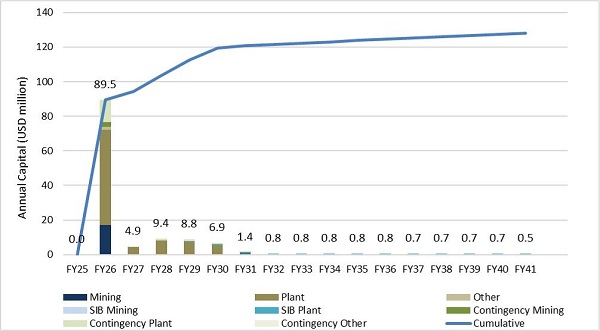

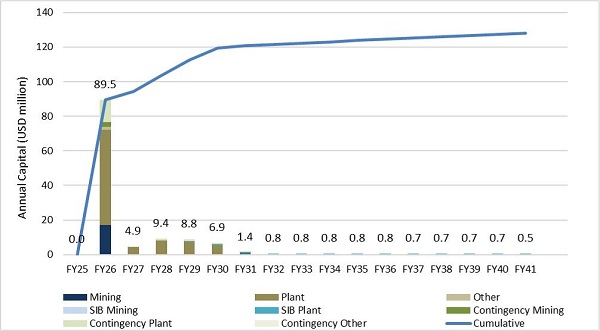

| Figure 27: Capital Schedule | | 74 |

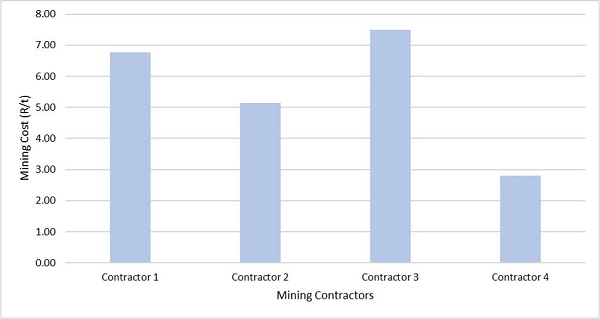

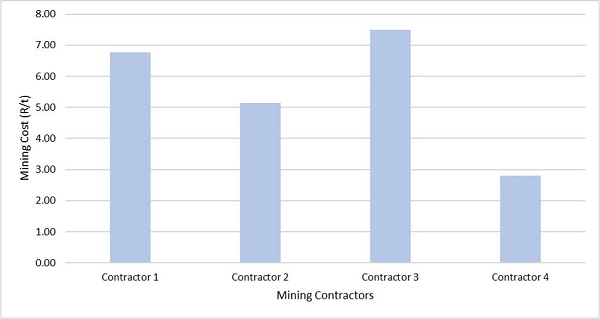

| Figure 28: Contractor Mining Operating Cost Comparison | | 75 |

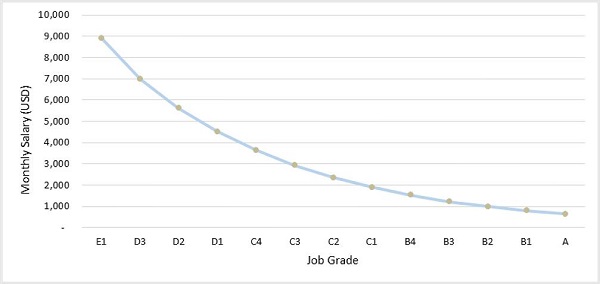

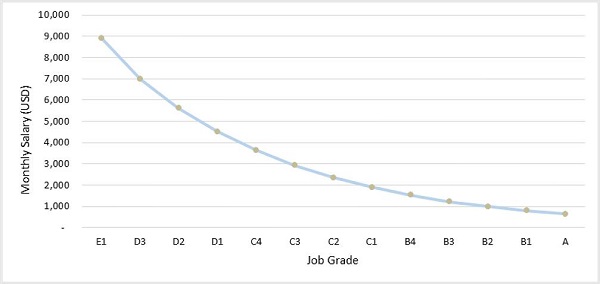

| Figure 29: Monthly Salary per Job Grade | | 77 |

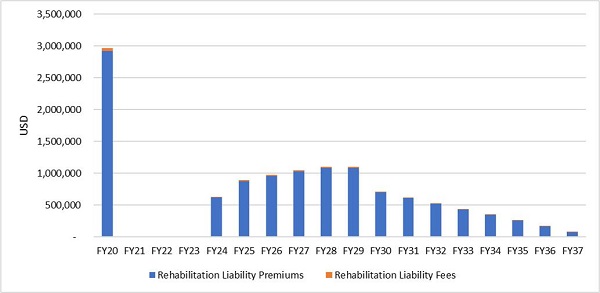

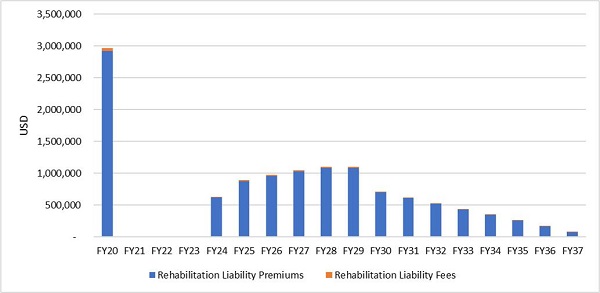

| Figure 30: Rehabilitation Payment Schedule | | 78 |

| Figure 31: Adjusted Operating Cost vs. Feed Tonnes | | 80 |

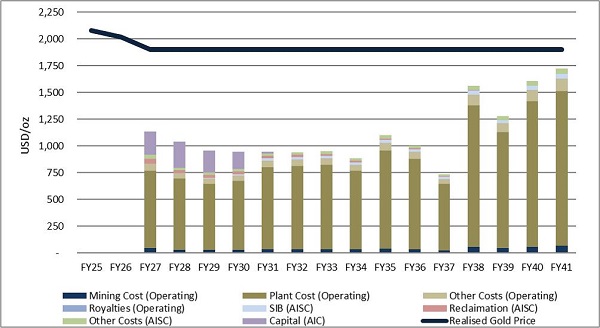

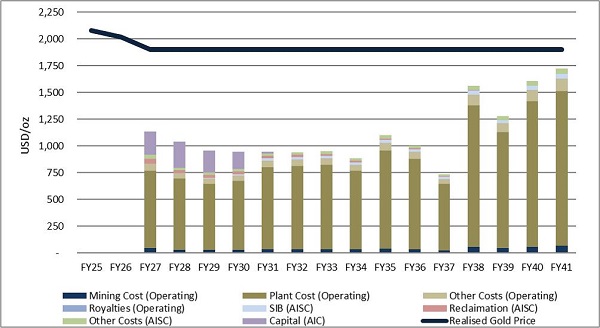

| Figure 32: AISC vs. Gold Price | | 80 |

| Figure 33: AIC vs. Gold Price | | 81 |

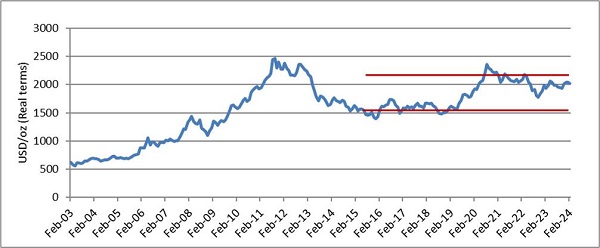

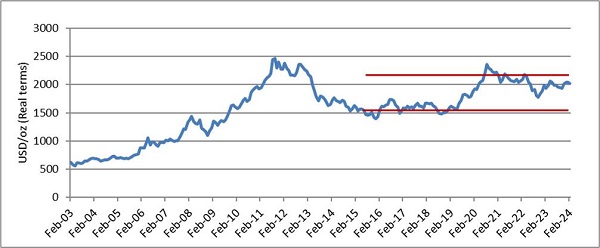

| Figure 34: Real-term Historic Gold Price | | 83 |

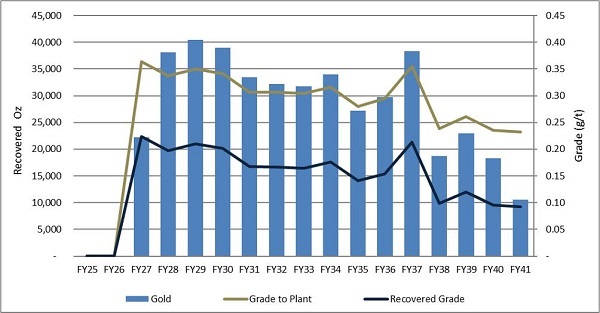

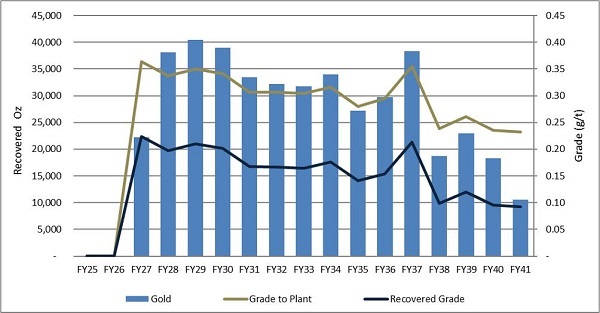

| Figure 35: Saleable Gold Ounces | | 85 |

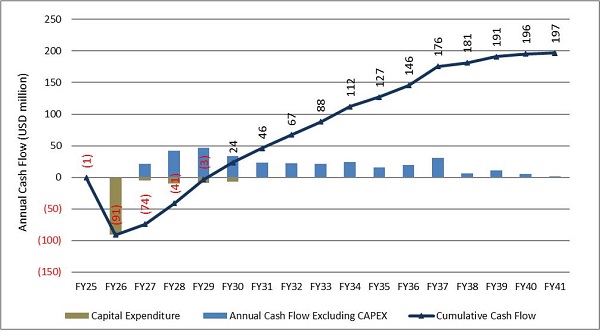

| Figure 36: Undiscounted Cash Flow | | 86 |

| Figure 37: Project Sensitivity (NPV11.4%) | | 90 |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | vii |

TABLES

| Table 1: Co-ordinate Locations and Surface Areas Covered by Each TSF | | 11 |

| Table 2: Registered Usufructs to Blyvoor Ops | | 14 |

| Table 3: Historical Exploration | | 19 |

| Table 4: Drillhole and Sample Summary | | 24 |

| Table 5: Bulk Density Measurements Conducted in 2007 | | 30 |

| Table 6: Classical Statistics for the TSFs | | 36 |

| Table 7: Variogram Parameters for TSF No. 6 and TSF No. 7 | | 37 |

| Table 8: Estimation Parameters for the 2020 Mineral Resource Estimation | | 38 |

| Table 9: Classification Criteria Applied | | 45 |

| Table 10: Mineral Resources for Blyvoor Gold Mine TSFs as at 29 February 2024 | | 46 |

| Table 11: Pay-Limit Calculation | | 48 |

| Table 12: Mineral Reserve Conversion Factors Applied | | 49 |

| Table 13: Mineral Reserves for Blyvoor TSF No. 6 and TSF No. 7 as at 29 February 2024 | | 49 |

| Table 14: Summary of Reagent Consumption | | 58 |

| Table 15: Gold Price Forecast (Nominal Terms) | | 65 |

| Table 16: Mining and Shared Infrastructure Capital Cost Estimation Summary | | 71 |

| Table 17: Plant Capital Summary | | 72 |

| Table 18: Other Capital | | 72 |

| Table 19: Capital Summary | | 73 |

| Table 20: Blyvoor TSF No. 6 and TSF No. 7 Contractor Mining Operating Cost | | 75 |

| Table 21: Summary of Operating Cost | | 76 |

| Table 22: Summary of Reagent Cost | | 76 |

| Table 23: Overhead and Selling Operating Costs Summary | | 77 |

| Table 24: Corporate Costs Summary | | 77 |

| Table 25: Project Cost Indicators | | 79 |

| Table 26: Cost Benchmarks to TSF Retreatment Operations | | 79 |

| Table 27: Macro-Economic Forecasts and Commodity Prices over the Life of Mine | | 83 |

| Table 28: Project Cost of Equity | | 84 |

| Table 29 Southern African Gold Mining Companies’ Beta Values | | 84 |

| Table 30: Production Breakdown in Life of Mine | | 85 |

| Table 31: Annual Cash Flow - Techno-economic Inputs (LoM) | | 87 |

| Table 32: Annual Real Cash Flow (LoM) | | 87 |

| Table 33: Project NPV Summary - Real Terms | | 88 |

| Table 34: Project Profitability Ratios | | 88 |

| Table 35: Grade Sensitivity - MI | | 90 |

| Table 36: Sensitivity Analysis of Commodity Prices and Exchange Rate to NPV11.4% (USDm) | | 91 |

| Table 37: Sensitivity Analysis of Cash Operating Costs and Non-Sustaining Capital Expenditure to NPV11.4% (USDm) | | 91 |

| Table 38: Blyvoor Mine Economic Analysis Summary - Real Terms | | 92 |

EQUATIONS

| Equation 1: Mining Tax Formula | | 89 |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | viii |

LIST OF UNITS AND ABBREVIATIONS

Units: The following units were used in this Report, and are in metric terms:-

| Unit | Definition |

| % | per cent |

| ° | degrees |

| °C | degrees Celsius |

| Ga | billion years |

| km | kilometre |

| kt | kilo-tonne |

| ktpm | Kilo-tonnes per month |

| M | meter |

| m3 | cubic meters |

| Ma | million years |

| mbs | metres below sea level |

| mm | millimetre |

| Mm3 | million cubic meters |

| Mt | million tonnes |

| t | tonne |

| t/m3 | tonnes per cubic meters |

| tpd | tonnes per day |

| kVA | Kilovolt-ampere |

| MVA | Megavolt-ampere |

| V | Volt |

| kV | Kilovolt |

| m³/day | Cubic meters per day |

| m³/month | Cubic meters per month |

| Ml/day | Megalitre per day |

Computation: It is noted that throughout the Report, tables may not compute due to rounding.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | ix |

Abbreviations: The following abbreviations were used in this Report:-

| Item | Description |

| AGA | AngloGold Ashanti Limited |

| AIC | All-in Costs |

| AISC | All-in Sustainable Costs |

| BEE | Black Economic Empowerment |

| BGMC | Blyvooruitzicht Gold Mining Company Limited (in provisional liquidation) |

| Blyvoor Capital | Blyvoor Gold Capital (Pty) Ltd |

| Blyvoor Ops or the Company | Blyvoor Gold Operations (Pty) Ltd |

| CAPEX | Capital Expenditure |

| CAPM | Capital Asset Pricing Model |

| CIL | Carbon-in-Leach |

| CN | Cyanide |

| CPR | Competent Persons’ Report |

| Cwb | Köppen and Geiger classification acronym for subtropical highland climate or temperate oceanic climate with dry winters |

| CWC | Covalent Water Company (Pty) Ltd |

| DCF | Discounted Cash Flow |

| DMRE | Department of Mineral Resources and Energy |

| DRD | DRDGold Ltd |

| EA | Environmental Authorisation |

| EBIT | Earnings before Interest and Taxes |

| EBITDA | Earnings before Interest, Tax, Depreciation and Amortization |

| EW | Electrowinning |

| FCFF | Free Cash Flow to the Firm |

| FY | Financial Year |

| Harmony | Harmony Gold Mining Company Limited |

| HCl | Hydrochloric Acid |

| HNO3 | Nitric Acid |

| IRR | Internal Rate of Return |

| LoM | Life of Mine |

| MCC | Motor Control Centre |

| Minxcon | Minxcon (Pty) Ltd |

| MPRDA | Minerals and Petroleum Resources Development Act, 2002 (Act No 28 of 2002) |

| MR143GP | Converted Mining Right GP 30/5/1/2/2/143 MR |

| NEMA | National Environmental Management Act, No. 107 of 1998 |

| No. | Number |

| NPV | Net Present Value |

| OHL | Overhead Line |

| OPEX | Operating Expenditure |

| PFS | Pre-feasibility Study |

| Project | Blyvoor Gold Tailings Retreatment Project |

| QAQC | Quality Assurance and Quality Control |

| SAMREC Code | South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves (2016 Edition) |

| SIB | Stay in Business |

| S-K 1300 | United States Securities and Exchange Commission Part 229 Standard Instructions for Filing Forms Regulation S-K subpart 1300 |

| SLD | Single Line Diagram |

| SLP | Social and Labour Plan |

| SMBS | Sodium Metabisulphite |

| STC | Secondary Tax on Dividends |

| TRS | Technical Report Summary |

| TSF | Tailings Storage Facility |

| U/F | Underflow |

| USD | United States Dollar |

| VAT | Value Added Tax |

| Village Main Reef | Village Main Reef Limited |

| ZAR | South African Rand |

| ZAR/USD | South African Rand: United States Dollar |

| ZARm | Million South African Rand |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 1 |

ITEM 1 - EXECUTIVE SUMMARY

The Blyvoor Gold Tailings Retreatment Project (“Project”) targets the re-treatment of the tailings storage facilities (“TSFs”) from the historical Blyvooruitzicht and Doornfontein mines that contain gold, with minor uranium and sulphide. The Project it situated 14 km southwest of the town of Carletonville and 80 km southwest of Johannesburg, Gauteng Province, South Africa.

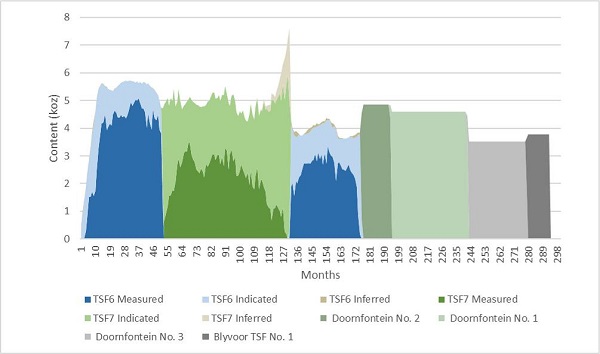

The tailings material occurs on Blyvooruitzicht TSF No. 1 (or TSF No. 1), Blyvooruitzicht TSF No. 6 (or TSF No. 6), Blyvooruitzicht TSF No. 7 (“TSF No. 7”), Doornfontein TSF No. 1, Doornfontein TSF No. 2 and Doornfontein TSF No. 3. The Project specifically aims to remine TSF No. 6 and TSF No. 7 at a newly established plant, with the newly reprocessed tailings being deposited onto an extended TSF No. 7 footprint. At a later stage, the Doornfontein TSFs will be remined with reprocessed tailings deposited onto the then vacant TSF No. 6 footprint.

The Project Area represents a disturbed site that has hosted mining-related activities for decades. Dolomitic lithologies underlie the TSFs, thus triggering the requirement for barriers in the form of appropriate linings. No further sensitive areas are identified within, or related to, the site.

| I. | Permitting Requirements |

The TSFs are currently all under ownership of Blyvoor Gold Operations (Pty) Ltd (or Blyvoor Ops), which is a wholly owned subsidiary of Blyvoor Gold (Pty) Ltd. In the case of the TSFs, Blyvoor Ops is the legal title holder to the immovable property (usufruct, servitudes and old plant structures) as well as movable property (TSFs). An Environmental Authorisation was granted on 19 February 2020 for tailings reclamation for TSF No. 6 and TSF No. 7, deposition onto TSF No. 6 (thereafter onto the available footprint of the reclaimed TSF No. 7), and TSF care and maintenance activities for a 15-year life of mine (TSF No. 1, Doornfontein TSF 1, Doornfontein TSF No. 2 and Doornfontein TSF No. 3). In accordance with the granted Environmental Authorisation, TSF No. 6 and TSF No. 7 are sanctioned for remining activities (under listing notice GNR 921) and deposition onto these footprints. Whilst these TSFs are being mined first in the mining sequence, application can be made to include the remainder of the TSFs in the current Environmental Authorisation. A water use licence inclusive of TSF reclamation activities was granted 14 May 2024.

| II. | Geology and Mineral Deposit |

The Project Area lies within Witwatersrand Basin which is synonymous to numerous current and historical gold mining operations. The TSFs represent layered man-made deposits of treated tailings material derived from ore extracted at the historic Blyvooruitzicht and Doornfontein gold mines, at which the Carbon Leader and Middelvlei Reefs economic placer horizons were exploited. The gold content represents the residue gold which was not extracted in the initial processing of the primary ores.

| III. | Status of Exploration |

The surface operations have undergone various states of exploration and drilling on the Blyvoor TSFs No. 1, 6, 7 and Doornfontein TSFs No. 1, 2, 3 (2007, 2008, 2010, 2015, 2016). The most recent exploration programme concluding in November 2020 served to infill the existing drilling in TSFs No. 6 and 7 and enable the definition of Measured and Indicated Mineral Resources in both. No additional drilling was performed on the other TSFs.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 2 |

| IV. | Mineral Resource and Mineral Reserve Estimates |

Mineral Resources were estimated for Blyvoor TSF No. 1, Doornfontein TSFs No. 1, 2 and 3 on existing data. An inverse distance to the power of 2 was utilised, and due to the limited data, lack of confidence in the QAQC and sampling procedures, an Inferred Mineral Resource was defined for all four of these facilities. Blyvoor TSFs No. 6 and 7 were re-estimated with updated information that included the infill drilling data. For TSF No. 6 previously only 13 drillholes were available and thus new drilling enables complete coverage of the TSF. TSF No. 7 had undergone detailed drilling in previous drilling programmes and the 2020 programme served to infill the drilling grid and increase the confidence in the existing database. Both TSFs were estimated with Ordinary Kriging.

The mine plan mines the total TSF No. 6 and TSF No. 7, including Inferred Mineral Resources attributed to TSF No. 6 and TSF No. 7 (totalling 16 koz). These are not reflected in the Mineral Reserves as they are considered to fall within the Inferred Mineral Resource category. These ounces are however, not reflected in the Mineral Resource table as they will be entirely mined out.

The in situ Mineral Resources declared for the TSFs are shown in the following table. TSF No.6 and TSF No. 7 have been shown as zero as there is no residual Mineral Resource excluding Mineral Reserves for these two TSFs.

Mineral Resources for Blyvoor Gold Mine TSFs as at 29 February 2024

| TSF | Mineral Resource

Classification | Tonnes | Grade | Au Content |

| Mt | g/t | kg | koz |

| TSF No. 6 and No. 7 | Measured and Indicated | 0.0 | 0.0 | 0.0 | 0.0 |

| TSF No. 1 | Inferred | 7.2 | 0.25 | 1,816 | 58 |

| Doornfontein TSF No. 1 | Inferred | 23.7 | 0.31 | 7,278 | 234 |

| Doornfontein TSF No. 2 | Inferred | 9.3 | 0.32 | 2,994 | 96 |

| Doornfontein TSF No. 3 | Inferred | 18.1 | 0.24 | 4,268 | 137 |

| Total Inferred | | 58.32 | 0.28 | 16,357 | 526 |

Notes:

| | 1. | No cut-off applied. |

| | 2. | No geological loss applied. |

| | 3. | Mineral Resources are 100% attributable to Blyvoor Ops. |

| | 4. | Mineral Resources are exclusive of Mineral Reserves. |

The Blyvoor TSF No. 6 and TSF No. 7 Mineral Reserves, as delivered to the plant, are detailed in the table below. The Mineral Reserve contains 816 koz of gold in the Probable Mineral Reserve classification, from the Measured and Indicated Mineral Resources, after having applied modifying factors for conversion from Mineral Resources to Mineral Reserves.

Mineral Reserves for Blyvoor TSF No. 6 and TSF No. 7 as at 29 February 2024

| TSF | Mineral Reserve

Classification | Tonnes | Grade | Au Content |

| kt | g/t | kg | koz |

| TSF No. 6 | Probable | 44,868 | 0.29 | 13,199 | 424 |

| TSF No. 7 | Probable | 39,408 | 0.31 | 12,187 | 392 |

| Total | Probable | 84,276 | 0.30 | 25,385 | 816 |

Notes:

| | 1. | Mineral Reserve cut-off of 0.14g/t was applied, but the entire TSF’s average will be more than the cut-off, therefore everything is mined. |

| | 2. | Mineral Reserves are 100% attributable to Blyvoor Ops. |

| V. | Development and Operations |

The mining method planned to be used for the reclamation of the TSF No. 6 and TSF No. 7 is hydraulic mining. The mining strategy involves a 12-month ramp up to 500 ktpm steady state-production. Mining will commence with targeting the high-grade areas located at upper portion of TSF No. 6 (Phase 1). Upon

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 3 |

completion of the first mining cut on TSF No. 6, mining will move to TSF No. 7 (Phase 2). The entire TSF No. 7 will be mined to create capacity for the new planned TSF. Lastly, the remainder of TSF No. 6 will be mined (Phase 3). A life of Project of 15 years is anticipated.

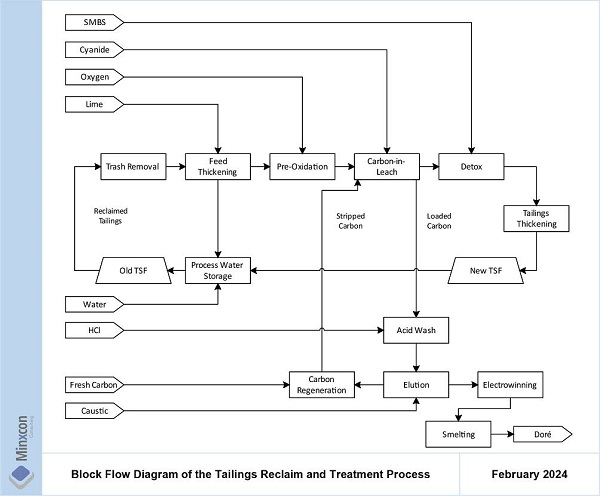

The process plant will accept reclaimed tailings from the hydro-mining operation and recover gold with a conventional carbon-in-leach cyanidation process. Leached gold will be adsorbed on activated carbon and stripped in an elution stage. The eluted gold will be plated and smelted into doré bars, sent to Rand Refinery for final smelting and then sold. Newly generated tailings will be deposited on a newly constructed TSF adjacent to the old plant and TSF No. 7. The new TSF footprint includes dolomite rock which was encountered at 3 m in one borehole and 60 m with another. This necessitated the development of a dolomite risk mitigation plan and further geotechnical studies to ensure a stable foundation for the new TSF.

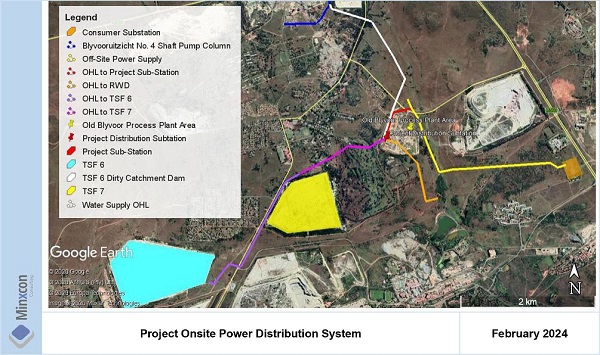

Access to the Project Area is well established on an extensive paved road network surrounding the Project Area. The location of most of the Project’s infrastructure will be located on the old Blyvoor process plant site. This site has mostly been demolished with only derelict civil structures remaining and all infrastructure to support the Project will have to be re-established.

Grid power is available to the Project Area via a 22 kV overhead line running past the Project site and feeds from an Eskom consumer substation located 2.7 km east of the Project. Indications are that the power supply capacity on this line is 20 MVA. Power supply to the Project Area will have to be re-established by tying into the available line and feeding the Project intake and distribution substations. Power will be distributed to the various areas of consumption across the operation. A load estimate has been conducted based on the engineering design and equipment required for the Project. The Project notified maximum demand was estimated to be 8.4 MVA. Sufficient allocation is thus available for the Project.

It is intended that water supply to the Project will be sourced from the Blyvooruitzicht No. 4 Shaft. The Covalent Water Company (a subsidiary of Harmony) conducts dewatering of the old Blyvooruitzicht underground workings. This water is pumped to surface at a rate of 14,000 m³/day and released into a channel that flows into the Mooi River through the Wonderfonteinspruit. The Project will purchase water from the Covalent Water Company which will serve as make-up water for the Project and will augment the return water from the re-deposition of the re-treated tailings. A Project static water balance was conducted and it was estimated that during the dry season (April to September) a total of 14,000 m³/day of make-up water will be required for the Project and will be sufficient to service the hydraulic mining and processing facilities. Further sources of water include dirty surface run-off water collected. Capital provision has been made for the re-establishment of all supporting infrastructure to efficiently manage and operate the tailings retreatment Project.

The evaluator performed an independent mineral asset economic analysis on the Project and the diluted Indicated and Measured Mineral Resources in the LoM plan, for conversion to Mineral Reserves. The Discounted Cash Flow, or DCF, is based on the production schedule and all costs and capital associated to develop, mine and process the orebody. Relevant taxation and other operating factors, such as recoveries and stay-in-business costs were incorporated into the economic analysis to produce a cash flow over the life cycle of the Mine. The effective date of the economic analysis is 29 February 2024.

Both the ZAR/USD exchange rate and USD commodity prices are in real money terms. The table below illustrates the forecasts for the first three years as well as the long-term forecast used in the financial model. Both the price forecast and the short-term exchange rate forecast are taken as the median of various analyst and bank forecasts, with the long-term prices calculated in-house. The medium and long-term exchange rate forecast was calculated in-house using the inflation adjusted purchasing price parity of the

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 4 |

ZAR to USD. The long-term gold price was estimated as the real term average between the two gold price support levels over the past 10 years, i.e. USD1,900/oz. The inflation rate forecasts were sourced from the International Monetary Fund (“IMF”).

Macro-Economic Forecasts and Commodity Prices over the Life of Mine

| Basis | Item | Unit | 2024 | 2025 | 2026 | 2027 | 2028 | LT |

| Calendar Years (Real) | Gold Price | USD/oz | 2,086 | 2,040 | 1,900 | 1,900 | 1,900 | 1,900 |

| Financial Years (Real) | Gold Price | USD/oz | N/A | 2,078 | 2,016 | 1,900 | 1,900 | 1,900 |

| Calendar Years (Real) | Exchange Rate | ZAR/USD | 18.80 | 18.10 | 18.45 | 18.80 | 19.15 | 19.15 |

| Financial Years (Real) | Exchange Rate | ZAR/USD | N/A | 18.68 | 18.16 | 18.51 | 18.86 | 19.15 |

| Calendar Years | US Inflation | % | 2.8% | 2.4% | 2.2% | 2.1% | 2.1% | 2.1% |

| Financial Years | US Inflation | % | N/A | 2.8% | 2.4% | 2.2% | 2.1% | 2.1% |

| Calendar Years | SA Inflation | % | 4.8% | 4.5% | 4.5% | 4.5% | 4.5% | 4.5% |

| Financial Years | SA Inflation | % | N/A | 4.8% | 4.5% | 4.5% | 4.5% | 4.5% |

Source: Median of various Banks and Broker forecasts (Consensus, March 2024); Minxcon; IMF

Costs reported for the Project, which consists of hydro mining, plant and other operating costs are displayed in the following table. Other costs in the Adjusted Operating Costs category include the central and technical services, general and administration, human resources, and other services costs. Other costs for the AISC category include the corporate management costs. The costs are displayed per feed tonne as well as per recovered gold ounce. Costs are primarily based on the December 2020 PFS which have been escalated to current terms as at effective date of 29 February 2024 using appropriate escalation indices from the Steel and Engineering Industries Federation of Southern Africa (“SEIFSA”) Price and Index Pages (“PIPS”).

Project Cost Indicators

| Item | Unit | Blyvoor Tailings |

| Net Turnover | USD/Feed tonne | 9.80 |

| Mine Cost | USD/Feed tonne | 0.18 |

| Plant Costs | USD/Feed tonne | 4.23 |

| Other Costs | USD/Feed tonne | 0.33 |

| Royalties | USD/Feed tonne | 0.00 |

| Operating Costs | USD/Feed tonne | 4.74 |

| SIB | USD/Feed tonne | 0.11 |

| Reclamation | USD/Feed tonne | 0.09 |

| Other Costs | USD/Feed tonne | 0.14 |

| All-in Sustaining Costs (AISC) | USD/Feed tonne | 5.07 |

| Expansion Capital | USD/Feed tonne | 0.35 |

| Other Cash Costs | USD/Feed tonne | 0.00 |

| All-in Costs (AIC) | USD/Feed tonne | 5.42 |

| All-in Cost Margin | % | 34% |

| EBITDA* | USD/Feed tonne | 4.82 |

| EBITDA Margin | % | 49% |

| Gold Recovered | oz | 436,825 |

| Net Turnover | USD/Gold oz | 1,891 |

| Mine Cost | USD/Gold oz | 35 |

| Plant Costs | USD/Gold oz | 816 |

| Other Costs | USD/Gold oz | 64 |

| Royalties | USD/Gold oz | 0 |

| Operating Costs | USD/Gold oz | 915 |

| SIB Capex | USD/Gold oz | 20 |

| Reclamation | USD/Gold oz | 20 |

| Other Costs | USD/Gold oz | 26 |

| All-in Sustaining Costs (AISC) | USD/Gold oz | 982 |

| Expansion Capital | USD/Gold oz | 262 |

| Other Cash Costs | USD/Gold oz | 0 |

| All-in Costs (AIC) | USD/Gold oz | 1,244 |

| EBITDA* | USD/Gold oz | 926 |

Notes:

| | 1. | * EBITDA excludes capital expenditure. |

| | 2. | Costs Include Contingencies |

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 5 |

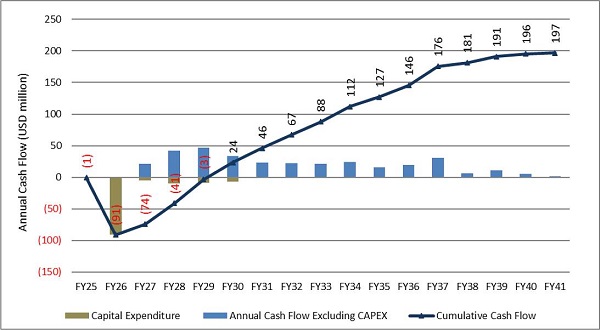

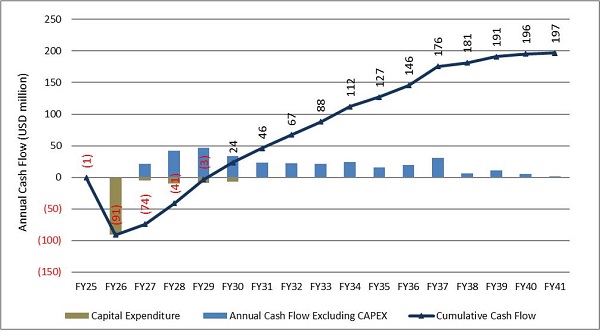

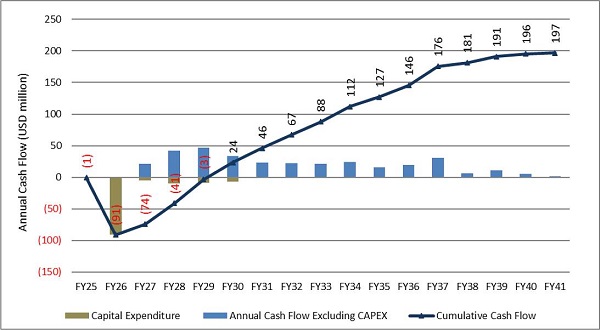

The Project cash flow is illustrated in the figure below. The total capital including the sustaining capital amounts to USD124 million over the mine life. The Mine has a peak funding requirement of USD91 million on a cumulative annual cash flow basis. The payback period of the Project is 3.0 years from start of production.

Undiscounted Cash Flow

The value derived for the income approach only reflects the diluted Indicated and Measured Mineral Resources in the LoM plan, for conversion to Mineral Reserves. The Mineral Reserve is economically viable with a best estimated NPV of USD56 million (USD56 million attributable to Blyvoor Ops) at a real discount rate of 11.4%. The IRR of the Project was calculated 27.0%. The Project has an all-in cost margin of 34% with a break-even gold price of USD1,244/oz. The following table shows a summary of the economic analysis.

Project Economic Analysis Summary - Real Terms

Item | Unit | Blyvoor Ops | Blyvoor Ops

Attributable |

| NPV @ 0% | USD million | 196 | 196 |

| NPV @ 2% | USD million | 159 | 159 |

| NPV @ 4% | USD million | 128 | 128 |

| NPV @ 5% | USD million | 115 | 115 |

| NPV @ 6% | USD million | 103 | 103 |

| NPV @ 8% | USD million | 83 | 83 |

| NPV @ 10% | USD million | 66 | 66 |

| NPV @ 11.4% | USD million | 56 | 56 |

| NPV @ 12% | USD million | 52 | 52 |

| NPV @ 14% | USD million | 196 | 196 |

| IRR | % | | 27% |

| All-in Cost Margin | % | | 34% |

| Peak Funding Requirement (Annualised) | USD million | | 91 |

| Payback | Years | | 3.0 |

| Break-even Gold Price | USD/oz. | | 1,244 |

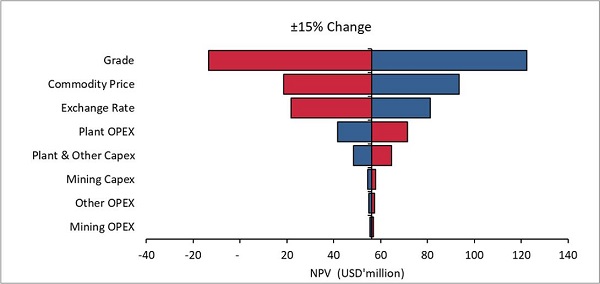

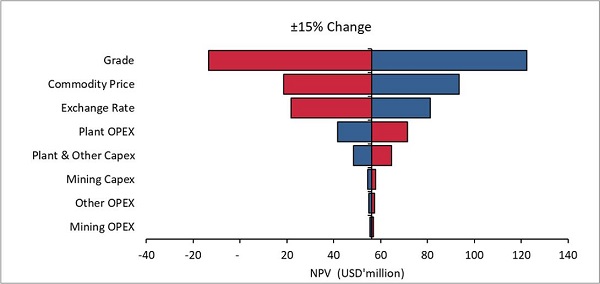

For the DCF, the grade, gold price and exchange rate have the most significant impact on the sensitivity of the Project followed by the mining operating costs as illustrated in the figure below. The Project is least sensitive to capital and plant and other operating costs.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 6 |

Project Sensitivity (NPV11.4%)

Legal Aspects and Tenure

The reclamation of TSF No. 6 and TSF No. 7 is authorised through a granted EA, EMPr and WUL including TSF reclamation activities. The underlying geology across the area comprises amongst others dolomitic units, and appropriate linings are required over the footprint of newly established TSF sites.

Geology and Mineral Resources

TSFs No. 6 and 7 are sufficiently drilled to enable the classification of Measured and Indicated Mineral Resources. It is believed that the variability of the gold distribution is adequately represented by the information obtained from the drillholes. The greatest variability exists vertically, for this reason the block model was estimated at a very high resolution vertically to adequately capture the variability that is expected in a layered deposit such as a TSF. Some grade variability is evident in TSFs No. 6 and 7. Some of the older drilling has limited surface coverage and QAQC information, however the more recent infill drilling on TSF No. 6 and 7 with detailed QAQC and sampling detail serves to increase the confidence and confirm the grades achieved in these areas.

Blyvoor TSF No. 1 and Doornfontein TSFs No. 1, 2 and 3 are all stated as Inferred Mineral Resources, due to a limited number of drillholes in each of these TSFs. Upgrading these to Indicated Mineral Resources would require additional drilling to increase the confidence in the data.

The densities utilised in the estimation process are the historical density figures. These figures are in line with the average densities for Witwatersrand gold mine TSFs. Check density tests were conducted during the 2020 drilling campaign, but the results were inconclusive with TSF No. 6 and TSF No. 7 returning lower than expected densities with average dry densities of 1.34 t/m3 and 1.43 t/m3 respectively. It was therefore deemed prudent to use the historical densities of 1.53 t/m3 and 1.51 t/m3 respectively, which were deemed more in line with average TSF material densities.

Mining

The mining sequence is strategical, ensuring that the ramp up to steady state production, is in line with the planned processing plant capacity. A 12-month ramp up to steady state production of 500 ktpm is considered

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 7 |

practical and achievable. The mining sequence allows for the creation of sufficient capacity on the new planned TSF footprint.

The mine plan targets only Measured and Indicated Mineral Resources, with an anticipated LoM of 15 years. The Project has upside potential in the upgrading and inclusion of Inferred Mineral Resources in the LoM plan. An additional 510 koz of gold could potentially be included in the LoM plan by upgrading the Inferred Mineral Resources to Indicated and Measured Mineral Resources. The inclusion would add an additional ten years to the LoM.

Engineering and Infrastructure

Although the Project is located on historic operations most of the infrastructure required to support the Project has been decommissioned or reclaimed. Sufficient provision has been made with regards to mining and shared infrastructure to re-establish the Project Area and to enable the Project to be managed and operated efficiently.

Processing

Metallurgical testwork indicates recovery is a function of feed grade, and a residue grade of 0.14 g/t can be expected with a CIL process. Tailings can be treated at a rate of 500 ktpm, and the new TSF design can accommodate this rate of deposition. The new TSF will have enough capacity to store the entire volume of TSF No. 6 and TSF No. 7 during the initial 15-year life.

Economic Analysis

The Project plan including only the diluted Indicated and Measured Mineral Resources in the LoM plan, for conversion to Mineral Reserves is financially feasible. The updated Mineral Reserve can therefore be declared. The DCF value of USD56 million for the Project (USD56 million attributable to Blyvoor Ops) was calculated at a real discount rate of 11.4%. The Project has an IRR of 27.0% calculated based on a funding requirement of USD91 million.

The Project financials are most sensitive to grade, commodity prices, and exchange rate. The Project financials are least sensitive to mining capital expenditure and mining and other operating costs.

The all-in sustaining costs for the Project amounts to USD5.07/feed tonne over the LoM, which equates to USD982/oz. The all-in cost for the Project was calculated as USD5.42/feed tonne over the LoM, which equates to USD1,244/oz. The Project therefore has a break-even gold price of USD1,244/oz including capital with an all-in cost margin of 34% over the LoM, which is comparable to similar gold tailings retreatment operations in the Witwatersrand Basin.

Legal Aspects and Tenure

In light of no material risks for the current operations, it is recommended that consideration be given to their environmental audit report outcomes and ensure action plans are in place to deal with non-conformances that may affect the TSF project execution. The Project owners and operators must adhere to environmental and sustainability principles as set out in the MPRDA and NEMA.

Geology and Mineral Resources

Blyvoor TSF No. 1 and Doornfontein TSFs No. 1, 2 and 3 are all stated as Inferred Mineral Resources due to a limited number of drillholes in each of these TSFs. In addition, this older drilling information have limited

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 8 |

QAQC and sampling information and thus have a lower level of confidence. Additional infill drilling is recommended, to add additional Measured and Indicated tonnes that could be considered for extraction along with TSFs No. 6 and 7. This conversion to Measured and Indicated Mineral Resources, if the drilling is successful, would allow for additional conversion into Mineral Reserves for a further possible 8 years of Project life.

It is recommended that with further study work additional density testwork be done to confirm the historical density figures.

Mining

It is recommended that additional drilling is conducted to upgrade Inferred Mineral Resources to Indicated and Measured Mineral Resources for potential inclusion in the Mineral Reserve estimate. Drilling on the remaining TSFs may be conducted while producing from TSF No. 6 and TSF No. 7.

Engineering and Infrastructure

Although sufficient provision has been made for the required infrastructure to support the Project at the planned production rate it will be required to refine the detailed designs for the construction phase and to refine the associated capital and operating cost estimations. Communications should commence with CWC to negotiate the purchase of water, and the associated costs of doing so, from their dewatering at Blyvooruitzicht No. 4 Shaft.

Processing

Complete detailed design of the new TSF that incorporates a Dolomite Risk Mitigation Plan.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 9 |

ITEM 2 - INTRODUCTION

Item 2 (a) - Issuer Receiving the Report; Authors

Minxcon (Pty) Ltd (“Minxcon”) was commissioned by Blyvoor Gold Operations (Pty) Ltd (“Blyvoor Ops” or “the Company”) to compile a Technical Report Summary (“TRS”) on the Blyvoor Gold Tailings Retreatment Project (“Project”), situated in Gauteng Province, South Africa.

The authors of this TRS are Uwe Engelmann and Daniel van Heerden, both of whom are Qualified Persons (“QP”). Mr. Engelmann was responsible for Sections 1-11 and jointly for Sections 20-25 of this TRS, while Mr. van Heerden was responsible for Sections 12-19 and jointly for Sections 20-25 of this TRS.

Item 2 (b) - Terms of Reference and Purpose of the Report

Minxcon was commissioned to prepare the TRS on the Mine in accordance with the United States Securities and Exchange Commission Part 229 Standard Instructions for Filing Forms Regulation S-K subpart 1300 (“S-K 1300”). This TRS follows the guidelines as prescribed by S-K 1300, and only such terms as defined in §229.1300-1305 have been utilised. The TRS is structured in accordance with the format prescribed in §229.601(b)(96).

The Project targets the retreatment of tailings storage facilities (“TSFs”) that contain gold, with minor uranium and sulphide. The purpose of this TRS is to present the Mineral Resources and Mineral Reserves of the Project as at the Company financial year end 29 February 2024. The Mineral Resources and Mineral Reserves are stated at the effective date of 29 February 2024.

The basis for the Mineral Reserves stated in this TRS is a pre-feasibility study (“PFS”). The PFS was completed in 2020, with monetary values escalated to current terms as at 29 February 2024. The PFS is still deemed valid.

No TRS has previously been filed by Blyvoor Ops for the Project in terms of S-K 1300.

All monetary figures in this TRS are expressed in United States Dollars (“USD”).

Item 2 (c) - Sources of Information and Data Contained in the Report

Minxcon has relied on the following reports/opinions:-

| ● | Leyden (2020) for the legal and tenure standing and requirements relating to the Project; and |

| ● | Geotheta Geotechnical Consultants report titled: “Geotechnical Study for Proposed New TSF” for geotechnical detail and design work. |

Minxcon has verified the information as far as possible. Additional information was sourced from those references listed in 0 and are duly referenced in the text where appropriate.

Item 2 (d) - Qualified Persons’ Personal Inspection of the Property

The Qualified Persons (“QP”, as such term is defined in S-K 1300) for this TRS are Mr. U. Engelmann and Mr. D. van Heerden.

Mr. Engelmann conducted a site visit on 1 July 2020 accompanied by representative of Blyvoor Ops team. The site visit was aimed at conducting a physical assessment and inspection of the Project Area, assisting with setting up an exploration drilling programme, and providing guidance on the sampling for the purposes of conducting assay testwork and metallurgical testwork. During the site visit TSF No. 6, TSF No. 7, the old Blyvoor processing facility and the proposed new TSF location were inspected. On 21 September 2020 a team from Minxcon reinvestigated the site and assessed infrastructure provision. Mr van Heerden conducted

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 10 |

a site visit on 15 January 2021 and was accompanied by the Blyvoor Op’s Mineral Resources Manager. TSF No. 6 and TSF No. 7 and the proposed process plant location were visited. No more recent site visits have taken place.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 11 |

ITEM 3 - PROPERTY DESCRIPTION AND LOCATION

The Project comprises the following TSFs that were created during the operation of the underground Blyvooruitzicht and Doornfontein gold mines that targeted the Middelvlei Reef and Carbon Leader Reef in the Far West Rand Goldfield. The TSFs contain gold, with minor uranium and sulphide:-

| ● | Blyvooruitzicht TSF No. 1 (“TSF No. 1”); |

| ● | Blyvooruitzicht TSF No. 6 (“TSF No. 6”); |

| ● | Blyvooruitzicht TSF No. 7 (“TSF No. 7”); |

| ● | Doornfontein TSF No. 2; and |

The Project aims to remine TSF No. 6 and TSF No. 7 at a newly established plant, with newly reprocessed tailings being deposited onto an extended TSF No. 7 footprint. At a later stage, the Doornfontein TSFs will be remined with reprocessed tailings deposited onto the vacant TSF No. 6 footprint. The adjacent Blyvoor underground gold mine are depositing tailings onto TSF No. 6 since late 2019. This was not considered in the evaluation of the Mineral Resources and Mineral Reserves of the TSF.

The Project will require the construction of a new TSF (as an eastern extension to the current TSF no. 7 area) that will be utilised for the deposition of tailings material subsequent to the processing of the reclaimed tailings.

Item 3 (a) - Location of the Property

The town of Carletonville lies immediately north of TSF No. 1, in the southwestern extremity of the Gauteng Province, South Africa. The town of Fochville lies 14 km due southeast. To the northeast, Johannesburg can be accessed over a road network of 80 km.

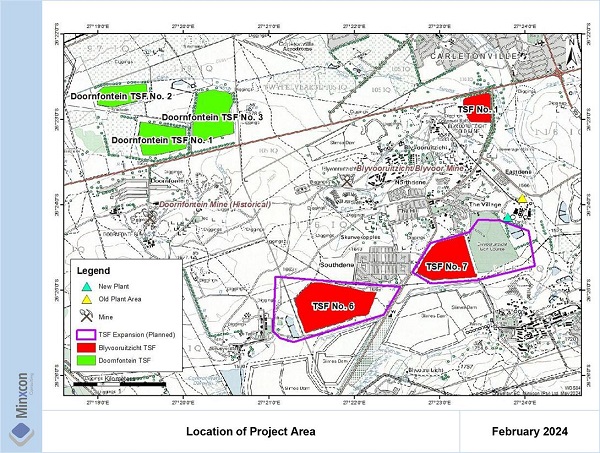

The TSFs, illustrated in Figure 1, are centred on the co-ordinates (WGS84 system) displayed in Table 1.

Table 1: Co-ordinate Locations and Surface Areas Covered by Each TSF

| TSF | Centre Co-ordinates (WGS84) | Footprint | Property |

| Latitude | Longitude | km2 |

| TSF No. 1 | 26°22’53.96”S | 27°23’28.28”E | 0.29 | RE of Portion 15 and Portion 26, Blyvooruitzicht 116 IQ |

| TSF No. 6 | 26°25’12.83”S | 27°21’38.97”E | 1.14 | RE of Portion 1, Blyvooruitzicht 116 IQ |

| TSF No. 7 | 26°24’41.22”S | 27°23’04.26”E | 0.75 | RE of Portion 70 and Portion 66, Blyvooruitzicht 116 IQ |

| Doornfontein TSF No. 1 | 26°23’15.58”S | 27°19’39.80”E | 0.53 | Portion 26, Varkenslaagte 119 IQ |

| Doornfontein TSF No. 2 | 26°22’43.43”S | 27°19’12.91”E | 0.38 | Portion 27, Varkenslaagte 119 IQ |

| Doornfontein TSF No. 3 | 26°22’58.76”S | 27°20’19.39”E | 0.74 | Portion 28, Varkenslaagte 119 IQ |

Item 3 (b) - Area of the Property

The TSFs are located on the farms Blyvooruitzicht 116 IQ and Varkenslaagte 119 IQ. The TSF surface areas and the farms on which they are located are depicted in Table 1.

The extension of TSF No. 7 will cover an additional area of some 2.2 km2 and the new plant area is planned over a footprint area of some 0.3 km2, situated immediately northeast of the extension. These areas are further described in Item 15.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 12 |

Figure 1: Location of Project Area

Item 3 (c) - Mineral Deposit Tenure

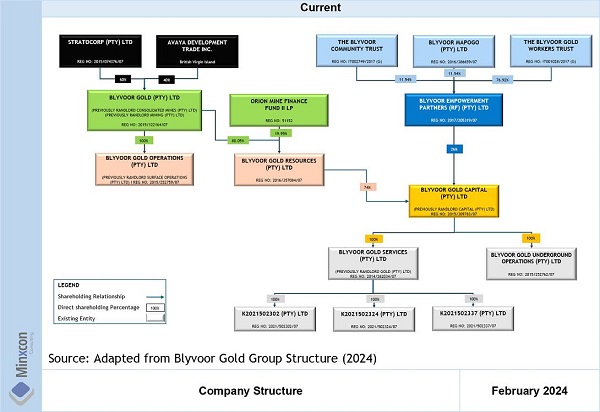

The TSFs are currently all under ownership of Blyvoor Ops, which is currently a wholly owned subsidiary of Blyvoor Gold (Pty) Ltd. Blyvoor Ops is the legal title holder to the immovable property. The current and post-transaction company structure is illustrated in Figure 2.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 13 |

Figure 2: Company Structure

Mining rights in South Africa are issued by the Department of Mineral Resources and Energy (“DMRE”) in accordance with the Mineral and Petroleum Resources Development Act, No 28 of 2002 (“MPRDA”). However, as described by Leyden (2020), “Historic Dumps are not regulated under the MPRDA and, as a consequence, mining rights under the MPRDA cannot be granted over such dumps. The Blyvoor Mining Right therefore does not give Blyvoor Gold Capital the right to mine the TSFs save for that portion of TSF No. 6 which constitutes a New Dump [which constitutes a residue stockpile]. The right to mine Historic Dumps is derived from the common law ownership of such dumps.”

The regulatory framework regarding TSF reclamation is governed by the dates on which the TSF was created, and the final tailings deposited thereon. All the Project TSFs were initially established in the period 1948-1969 and prior to the enactment of the MPRDA, i.e. prior to 2004. Deposition onto all TSFs, with the exception of TSF No. 6, ceased in the 1980s to 1990s.

Rights to reclaim the TSF material requires an Environmental Authorisation (“EA”) in terms of the National Environmental Management Act, No. 107 of 1998 (“NEMA”). An application for an EA relating to mining right number MR143GP was submitted on 13 February 2019 by Blyvoor Gold Capital (Pty) Ltd (“Blyvoor Capital”), a subsidiary of Blyvoor Gold (Pty) Ltd. Mining Right MR143GP covers the underground Blyvoor Mine (the historical Blyvooruitzicht Mine) upon which lease area the Blyvoor TSFs are located. Application was included in this application for the tailings mining operations, which includes the TSFs and associated infrastructure, under Blyvoor Ops. The EA was granted on 19 February 2020 under reference number GP 30/5/1/2/3/2/1 (143) EM with an approved environmental management programme (“EMP”), dated February 2019 compiled by Digby Wells that serves as an update and realignment from the previously approved EMP, dated 2000, with subsequent unapproved 2007 and 2012 amendments to refocus on current activities. Under the EA, the following TSF-related activities have been approved:-

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 14 |

| ● | TSF reclamation (TSF No. 6 and TSF No. 7); |

| ● | Deposition onto TSF No. 6 (thereafter onto the available footprint of the reclaimed TSF No. 7); and |

| ● | TSF care and maintenance activities for a 15-year life of mine (“LoM”; TSF No. 1, Doornfontein TSF 1, Doornfontein TSF No. 2 and Doornfontein TSF No. 3 will be held in care and maintenance for the 15-year LoM). |

In accordance with the granted EA, TSF No. 6 and TSF No. 7 are sanctioned for remining activities (under listing notice GNR 921) and deposition onto these footprints. Whilst these TSFs are being mined first in the mining sequence, application can be made to include the remainder of the TSFs in the current EA. Application is also required to alter or extend the footprint of TSF No. 7.

The approved EA allows for care and maintenance of TSF No. 1, Doornfontein TSF 1, Doornfontein TSF No. 2 and Doornfontein TSF No. 3. Application for amendment to include reclamation (mining) of these TSFs is required to be submitted and approved prior to remining of these TSFs. Blyvoor Ops will make such application whilst mining at TSF No. 6 and TSF No. 7 is taking place. These applications are considered an administrative procedure in the normal course of business.

Leyden (2020), describes that the properties on which the TSFs are situated are owned by a third party, Blyvooruitzicht Gold Mining Company Limited (in provisional liquidation) (“BGMC”). Blyvoor Ops has registered usufructs as listed in Table 2. The usufructs have a validity period of 99 years. Blyvoor Ops has further servitudes registered, including services and roads to the former BGMC treatment plant, and services from TSF No. 1 to main road at the Doornfontein TSFs.

Table 2: Registered Usufructs to Blyvoor Ops

| Usufruct over | Farm | Portion | Comment |

| Doornfontein TSF No. 1 | Varkenslaagte 119 IQ | 26 | Registered to Blyvoor Ops |

| Doornfontein TSF No. 2 | Varkenslaagte 119 IQ | 27 |

| Doornfontein TSF No. 3 | Varkenslaagte 119 IQ | 28 |

| Blyvoor TSF No. 1 | Blyvooruitzicht 116 IQ | Re Portion 15, 26 |

| Blyvoor TSF No. 7 | Blyvooruitzicht 116 IQ | Re Portion 70 and 66 |

| Blyvoor TSF No. 7 Golf Course | Blyvooruitzicht 116 IQ | Portion 66 |

Blyvoor TSF No. 6 | Blyvooruitzicht 116 IQ | | Registered to Blyvoor Capital |

The QPs have not identified any threat to the current EA with continued annual obligations to tenement security and conformance to government notices and directives. Blyvoor Ops will initially rely on the existing Blyvoor Capital rights and permits with respect to the Mining Right, the EA and water use licence under a duly signed agreement for this purpose.

Item 3 (d) - Royalties and Payments

The current Mineral and Petroleum Resources Royalty Act came into effect on 1 March 2010. The law requires all companies extracting minerals in South Africa to pay royalties at a rate of between 0.5% and 7% based on gross sales. Companies are taxed on either the refined or unrefined formula:-

| ● | Refined mineral formula = 0.5 + [EBIT/Gross sales x 12.5] x 100 |

| ● | Unrefined mineral formula = 0.5 + [EBIT/Gross sales x 9] x 100 |

Historic TSFs are not regulated by the MPRDA, which means that royalty payments are not applicable. With the exception of a portion of TSF No. 6, all the remaining TSFs are historic TSFs. No practical split could be made for TSF No. 6 between historic deposition and recent deposition. The QPs therefore treated all TSFs as historic.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 15 |

Item 3 (e) - Environmental Liabilities

In terms of Regulation 54(2) of the MPRDA, financial provision is required for the interim and final rehabilitation activities on the site. The provision is required to be reviewed annually for adequacy and amended to compensate for new activities and/or inflation.

Blyvoor Capital has made provision for the rehabilitation liability estimated in January 2019 which include both surface and underground mining assets, the TSFs as well as historic defunct assets totalling ZAR366 million. Digby Wells updated this estimation to ZAR464 million in 2023, which has been escalated by one year to ZAR492 million by Minxcon for financial modelling purposes. Blyvoor Ops will need to reimburse Blyvoor Capital for their share of guarantees funded as they relate to the TSFs, as well as fund their share of liabilities. The QPs apportioned a payment schedule provided by Blyvoor Capital to Blyvoor Ops for the economic analysis. Blyvoor Ops’ share of the liabilities is estimated to be ZAR319 million which will be funded through guarantees.

There are currently no mechanisms in place regarding unplanned closure, however provision for unplanned closure is factored into the rehabilitation liability.

Item 3 (f) - Permits to Conduct Work

Further permits or plans relating to the planned operations are described in the sections to follow that are required to be in place by the EA ((DMR Ref No. GP30/5/1/2/3/2/1 (143) EM) noted in condition 1, 2, 11, and 19.

A water use licence (“WUL”) no. 10/C23E/GJACEFGI/14399 in terms of the National Water Act, No. 36 of 1998 (“NWA”) was issued to Blyvoor Capital for the Mine on 14 May 2024 and is valid until 14 May 2044. This supersedes the previously issued WUL no. 08/C23E/AEFGJ/1000 issued 19 July 2011 and valid until 19 July 2021. The objective of the new WUL was to be as close as possible to the previous licence with regards to operations, extraction, and deposition. Although some of the infrastructure may not be applicable to the TRS project, wastewater treatment plants for the Blyvoor Village was removed from the new application as they are not owned by Blyvoor Gold. Also removed from the application were Blyvoor TSF No. 1, emergency return water dam and PS Shaft Rock Dump.

| II. | Additional Environmental Permits |

Blvoor Capital has a valid provisional Atmospheric Emissions Licence (“PAEL”), reference number (PAEL/GP/WR-BGC/04/09/2023-6545-VAR) issued 10 November 2023 in terms of the National Environmental Management: Air Quality Act, No. 39 of 2004 (“NEMAQA”) issued by Department of Environment, Forestry and Fisheries for the entire mining right area. This PAEL will allow for 12 months of monitoring from the date of commissioning of the listed activities, during which time emission measurements are required to be made and submitted to the authorities. Subject to these measurements being within legal limits and meeting all PAEL conditions for six consecutive months, an Atmospheric Emissions Licence (“AEL”) valid for five years will be issued. The TSF project need not apply for a separate AEL but should engage with DFFE to establish if the re-treatment of tailings will trigger an additional listed activity other than Subcategory 4:17 noted and if so, a subsequent variation of the PAEL undertaken.

A valid Certificate of Registration (“COR”) issued 15 January 2024 to Blyvoor Capital National Nuclear Regulator (“NNR”) in terms of the National Nuclear Regulatory Act, 1999, relating to the tailings project is in place and applicant should ensure adherence to the conditions of authorisation of Part 1 and specified NNR requirements in Part 2.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 16 |

As noted by Leyden (2020), “Under the Tailings Operational Agreement Blyvoor Capital has agreed to support Blyvoor Operations to ceed or obtain its own permits, approvals and licenses”. This includes permits, approvals and licenses such as a WUL, an AEL and a NNR COR.

The QPs are not aware of any further permits in addition to those described above, which are required for the operations.

Blvoor Capital to develop an auditable maintenance plan to ensure that all critical environmental equipment is maintained as required and a discussion on the implementation and compliance with the maintenance plan be included in the annual audit reports.

Additionally, an alien management programme to control alien invasive plant species and must entail the identification of areas where such infestation occurs and the extent.

Item 3 (g) - Other Significant Factors and Risks

From the evidence available, it is the opinion of the QPs that mining at TSF No. 6 and TSF No. 7 can commence as a valid EA and WUL is in place. It is noted that as the Project currently stands, Blyvoor Ops will not hold all the authorisations it requires to independently conduct the Project. Notwithstanding, Blyvoor Ops can still be held liable for arising environmental impacts. Condition No. 4.8 of the EA (DMR Ref No. GP30/5/1/2/3/2/1 (143) EM) states, “Non-compliance with any condition of this EA or EMPr may result in the issuing of a directive in terms of section 28 and or a compliance notice in terms of section 31L of the NEMA.” Regulation 34 of the Environmental Impact Assessment (“EIA”) Regulations (GNR 982 of 4 December 2014 as amended) provides as follows “Auditing of compliance with environmental authorisation, environmental management programme and closure plan.” The Blyvoor Capital Environmental Audit Report (unpublished draft report, dated 17 May 2024) by Shangoni Management Services (Pty) Ltd) noted that Blyvoor Capital demonstrated a low level of compliance against the management commitments and should ensure adequate implementation of mitigation measures in compliance with EMP and the EA granted for its activities.

As noted previously, Blyvoor Ops will initially rely on the existing Blyvoor Capital rights and permits with respect to the Mining Right, the EA and water use licence under a duly signed agreement for this purpose.

The QPs are not aware of any past material violations or fines. There is reasonable basis to believe that all governmental requirements for the Project have been obtained or can be obtained. The Project owners and operators must adhere to environmental and sustainability principles as set out in the MPRDA.

The QPs are not aware of any further factors or risks that may affect access, title or right or the ability to perform work on the property.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 17 |

ITEM 4 - ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY

Item 4 (a) - Topography, Elevation and Vegetation

The surface topography of the mining lease area is characterised by undulating hills and forms part of the northern slopes of the Gatsrand Ridge. Elevations vary from some 1,400 m to 1,680 m above mean sea level. One distinct watercourse carries seasonal rainwater from the higher catchment areas across the eastern side of the property to the Wonderfonteinspruit.

The mine area is located in the Gauteng Shale Mountain Bushveld and Carletonville Dolomite Grassland vegetation types (Mucina & Rutherford (2006) as noted in the EMP Update for Tailings Reclamation & Underground Mining at Blyvooruitzicht Gold, dated February 2017 by Golder Associates. The vegetation is characterised by short (3–6 m), semi-open thicket, dominated by a variety of woody species. The understory is dominated by a variety of grasses. Some of the ridges form plateaus that support scrubby grassland. Carletonville Dolomite Grassland occurs on undulating plains dissected by rocky chert ridges. The grassland is sour in nature due to severely frosty winters, combined with regular burning. Trees and shrubs typically occur on rocky outcrops and protected areas. Typical grassland is restricted to the exposed sites in the irregular, undulating landscape. This veld type is not suited for crop production due to the shallow and rocky nature of the soils. Grazing of livestock is limited due to the dominance of sour grass species, which results in a low nutrient status of the fodder during winter.

This area is typical of the transitional-type grassland between the high inland plateau and the bushveld of the lower inland plateau, with the resultant low incidence of tree species. The vegetation type in question is considered vulnerable and has a conservation target of 24%. However, only a small portion of it is protected, and 23% is being transformed, primarily through cultivation (17%), urbanization (4%), forestry (1%), and mining (1%). The 2000 EMP in 2000 identified 16 types of trees, shrubs, and grass at the Blyvooruitzicht section, 22 types of grass at the Doornfontein section, and 33 tree, shrub, and flowering plant species at the Doornfontein section inclusive of exotic and invasive species on mine property.

Item 4 (b) - Access to the Property

The Project Area is directly accessible via the R501 main tarred road that connects Carletonville and Potchefstroom. The R501 regional road leading from the N12 national road past the town of Carletonville and in a western direction on to Potchefstroom. From the R501, the Mine is accessed via a direct tarred road onto the lease area that branches off the R501. This road is in a relatively good state of repair and no work or design will be required on this road. Numerous all-weather gravel roads provide access to the various TSFs and Project sites.

Oberholzer is the closest railway station, located approximately 12 km northeast of the Project Area and just north of Carletonville, and is situated on the Johannesburg-Klerksdorp railway line. The O.R. Tambo and Lanseria International Airports in the Johannesburg area support high volumes of daily domestic and international flights. The Carletonville Aerodrome is located some 5 km north of the Project Area.

Item 4 (c) - Climate and Length of Operating Season

The climate in Carletonville is warm and temperate and classified as Cwb by Köppen and Geiger (climate-data.org). Cwb is characterised by a subtropical highland climate or temperate oceanic climate with dry winters, where the ‘C’ refers to mild temperature, the ‘w’ refers to dry winter and the ‘b’ refers to warm summers. Temperatures are warm to mild with an average annual temperature of 15.9°C in Carletonville (climate-data.org). The dominant wind direction in the vicinity of the Project Area is northwest to

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 18 |

northeast. There are no major climatic conditions that will hinder mining activities. Operations can continue year-round.

The Project Area is located in the Highveld climatic zone, which receives average annual precipitation of about 900 mm on its eastern border to about 650 mm in the west. Rainfall occurs mainly in the summer months from October to March in the form of showers and thundershowers. Maximum rainfall occurs in January, and winters are typically dry. The average annual rainfall at Carletonville is 660 mm (climate-data.org). Several distinct watercourses carry seasonal rainwater from the higher catchment areas across the property to the Wonderfonteinspruit (Golder Associates, 2016).

Item 4 (d) - Infrastructure

The local Carletonville region is a well-established mining area. Skilled and semi-skilled labour are readily available, along with all service requirements. The nearby towns of Carletonville and Fochville provide a full range of urban amenities, including medical and educational facilities, financial, retail, and commercial services. Telephone and mobile phone services are reliable, as are the high-speed internet facilities.

Power supply in the general area is well-established. Historically the Blyvoor process plant was supplied by a single 22 kV overhead line (“OHL”) that is fed from an Eskom consumer substation located 2.7 km east of the project area. 3 x 22 kV OHL’s fed from this line and supplied power to the Blyvoor process plant intake substation The line feeding from the Eskom consumer substation is still in place and only a short new OHL needs to be established from this line to the new project intake substation. The historical Blyvoor process facility was significantly larger than the new tailings retreatment plant with a much larger power supply requirement. Supply to the tailings retreatment project will thus be more than sufficient. The reliability of the power supply from Eskom throughout the country is however questionable with rolling blackouts (load shedding) occurring regularly due to the utility’s constraints in generating capacity.

Potable water can be sourced from the Rand Water Board Utility through the Merafong Municipality supply infrastructure which is available on the property. Potable water will be supplied from the project main service water supply. The water will be treated through a potable water treatment plant.

Water in underground workings in the West Rand, and particularly the Carletonville area, is well reported. The Covalent Water Company (Pty) Ltd (“CWC”), pump water to surface from the existing Blyvooruitzicht No. 4 Shaft and Blyvooruitzicht No. 6 Shaft. CWC have been granted servitudes at Blyvooruitzicht No. 4 Shaft and Blyvooruitzicht No. 6 Shaft for access to the existing pumping infrastructure. CWC currently has no use for the water pumped from the underground workings and releases the water into a channel that in turn flows into the Mooi River. The water quality is such that it does not require to be treated prior to releasing it into the river. The water capacity available as well as the quality of the water is ideal for the Project and it is thus planned that the tailings retreatment operation will purchase water from CWC that has been dewatered from Blyvooruitzicht No. 4 shaft (in closest proximity to the project – 2.4 km northwest).

In the unlikely event of a shortfall of water, make-up water can be purchased from Rand Water.

| |

| RESOURCE | RESERVE | VALUE |

Blyvoor Gold Operations (Pty) Ltd

S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa | 19 |

ITEM 5 - HISTORY

Item 5 (a) - Prior Ownership and Ownership Changes

The farm Blyvooruitzicht was initially farmed by one Pieter Daniel Roux. Following successful exploration over the property in the early 1930s, Rand Mines showed interest in the new potential goldfield and acquired ground on the farm Blyvooruitzicht No. 640. This ground belonged to a deceased estate administered by Standard Bank. BGMC was registered on 10 June 1937. At that time, what is currently the MR143GP lease area was divided into Blyvooruitzicht Gold Mine in the east owned by Rand Mines and Doornfontein Gold Mine in the west, owned by Goldfields South Africa.

In June of 1971, Barlow Rand Ltd purchased Rand Mines. In 1995, Blyvooruitzicht Gold Mine and Doornfontein Gold Mine merged to form the greater Blyvooruitzicht Gold Mine under Rand Mines. In 1997, DRDGold Ltd (“DRD”) purchased the greater Blyvooruitzicht Gold Mine from Rand Mines. In November 2011, DRD sold its shareholding in BGMC to Village Main Reef.

Village Main Reef was placed into business rescue in 2013 and most of their assets were placed into liquidation. BGMC was placed under provisional liquidation in August 2013. In 2014-2016, Blyvoor Capital and Blyvoor Ops purchased assets from the liquidators of BGMC. Resulting from the liquidation, AngloGold Ashanti Limited (“AGA”) (now under Harmony) purchased Blyvooruitzicht No. 4 Shaft and Blyvooruitzicht No. 6 Shaft and took over water pumping activities through these shafts through their subsidiary CWC. This action was necessary to protect their down dip mines, being Savuka, Tau Tona and Mponeng.

In 2015, Blyvoor Ops purchased all TSFs excluding TSF No. 4 and No. 5 footprints – (these TSF’s tailings were previously reprocessed).

Item 5 (b) - Historical Exploration and Development

Mining commenced at Blyvoor Mine in the 1930s and continued until the mine went into liquidation in 2013. Table 3 presents the historical/previous (pre-2020) exploration across the TSFs. Also, in 2015 Blyvoor Capital purchased the Blyvooruitzicht processing plant. This facility was later transferred to Blyvoor Ops.

Table 3: Historical Exploration

| Year | TSF | Total Number of Drillholes | Total Meterage | Company |

| m |

| 2007 | TSF No. 1 | 5 | 99.00 | DRD Gold |

| TSF No. 6 | 13 | 402.00 | DRD Gold |

| TSF No. 7 | 6 | 265.00 | DRD Gold |

| Doornfontein TSF No. 1 | 5 | 168.00 | DRD Gold |

| Doornfontein TSF No. 2 | 5 | 88.50 | DRD Gold |

| Doornfontein TSF No. 3 | 5 | 93.00 | DRD Gold |

| 2008 | TSF No. 7 | 12 | 432.00 | DRD Gold |

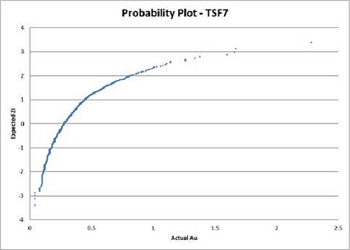

| 2010 | TSF No. 7 | 20 | 793.00 | DRD Gold |