Various constitutional issues have been under discussion in Canada for a number of years. On August 20, 1998, in response to a reference from the Federal government, the Supreme Court of Canada ruled that under the Constitution of Canada and international law, Quebec may not secede unilaterally from Canada, but that if the people of Quebec voted to secede by a clear majority vote on a clear question, the other provinces and the Federal Government would be obliged to enter negotiations with Quebec with respect to secession, such negotiations to be guided by constitutional principles, including federalism, democracy, constitutionalism and the rule of law, and the protection of minorities.

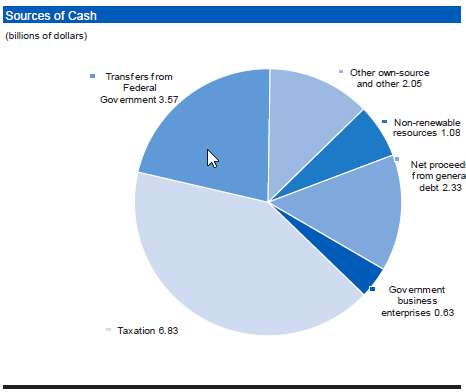

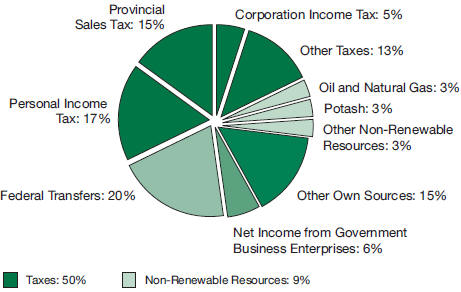

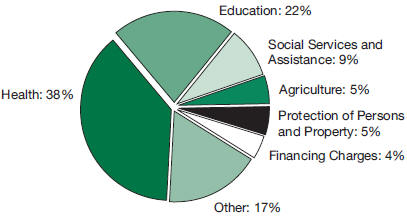

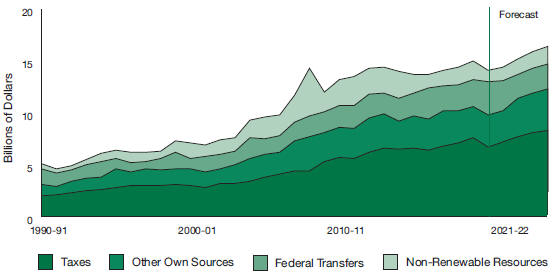

Under the Constitution, each provincial Legislature has exclusive authority to borrow money on the sole credit of that province and the authority to raise revenue for provincial purposes through direct taxation within its territorial limits. Legislatures can also raise revenue through taxation in respect of non-renewable natural resources, forestry resources and sites and facilities for electricity production and generation. Each province owns minerals and other resources on its provincial Crown lands and may own sub-surface resources on its other lands. Each province has the right to levy royalties on all lands and minerals which it owns. Each province has the legislative authority to regulate the exploration for and development, conservation and management of non-renewable natural resources, forestry resources and electricity generation. Each province also has legislative authority in the areas of education, health, social services, property and civil rights, natural resources, municipal institutions and generally all matters of a purely local or private nature.

The Parliament of Canada is empowered to borrow money and to raise revenue by any mode or system of taxation. Parliament has legislative authority over, among other things, the federal public debt and federal property, the regulation of trade and commerce, currency and coinage, banks and banking, bankruptcy and insolvency, navigation and shipping, foreign affairs, defence, postal service and unemployment insurance. It also has authority over matters not assigned to the provincial legislatures.

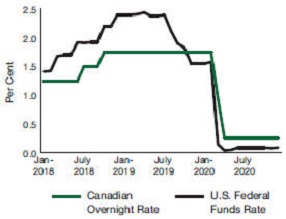

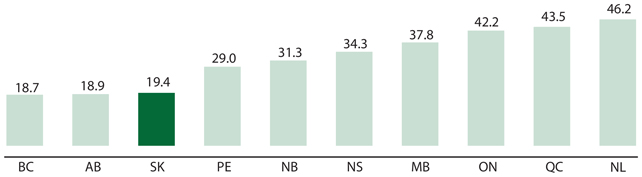

Saskatchewan residents are required to pay both a provincial and federal income tax. While a change in federal income tax rates does not necessitate the adjustment of provincial tax rates, changes in overall effective tax rates for Saskatchewan residents may affect taxes collected by the province. Provincial taxes are also calculated based on federally calculated taxable income. Therefore, a change in the method of calculating this income would directly affect Saskatchewan’s income tax base.

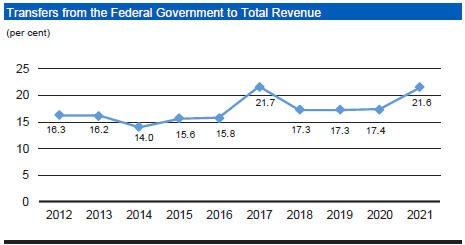

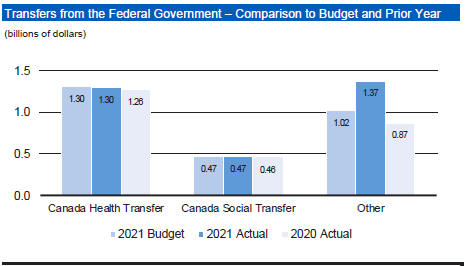

Transfers from the Federal Government

The Canada Health Transfer (CHT) and the Canada Social Transfer (CST) are the Federal Government’s contribution to Saskatchewan in respect of its health care, post-secondary education, childcare, early childhood development and social service programs. The amount of federal assistance does not bear a direct relationship to actual program costs.

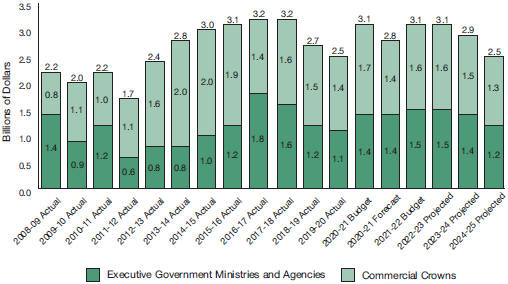

The CHT and CST programs were renewed by the Federal Government in 2014-2015 for a 10-year period. For the first three years, a 6.0% annual escalator mechanism was in place for the CHT. Commencing in 2017-18, the CHT was legislated to grow by the three-year average growth rate of national nominal Gross Domestic Product with a floor of 3.0%. In 2020-21 the three-year average growth rate of national nominal Gross Domestic Product is 3.71%, which will be the growth rate for CHT in that year The provincial entitlement is based on an equal per capita cash provincial allocation of a fixed national entitlement, which stands at $1,330.4 million for CHT and $477.4 million for CST for 2021-22.

Equalization: Equalization is a federal expenditure program that provides unconditional payments to provinces with below average revenue-raising capacities (fiscal capacities), according to a federal formula. The Constitution states that “Parliament and the Government of Canada are committed to the principle of making Equalization payments to ensure that provincial governments have sufficient revenues to provide reasonably comparable levels of public services at reasonably comparable levels of taxation”.

Saskatchewan had historically been a province that received an Equalization payment, receiving a payment in all but seven years from the first year of the program in 1957-58 through to 2007-08. Due primarily to a strong economy relative to other Canadian jurisdictions combined with reforms to the Equalization program introduced in the 2007 federal budget, Saskatchewan has not qualified for an Equalization payment since 2007-08.

Stabilization. The Federal Government provides to provinces a realization formula under the Federal-Provincial Fiscal Arrangements Act. This legislation provides for Federal grants and interest-free loans to a province if revenue from the province’s own sources plus equalization falls below 95 per cent of the previous year’s level, excluding variations of natural resource revenue. The Federal-Provincial Fiscal Arrangements Act also provides a limited guarantee arrangement to compensate provinces for certain losses incurred during the calendar year in which a national personal income tax change results in provincial income tax reductions.

There are two ways in which a province can qualify for a stabilization payment from the federal Government: (1) a 50% year-over-year decline in resource revenues, net of any offsetting year-over-year increase in non-resource revenues; or, (2) a 5% year-over-year decline in non-resource revenues, net of any offsetting year-over-year increase in resource revenues.

Qualifying revenues are calculated in detail according to the provisions of the Federal-Provincial Fiscal Arrangements Regulations, 2007. The payment limit under the Federal Stabilization Program has recently been increased to $170 per capita (for 2019-20 and 2020-21 claims) and will be indexed to GDP growth thereafter.

It is expected that several provinces (including Saskatchewan) may qualify for the program in respect of their large revenue declines in 2020-21. Pending qualification, program payments for 2020-21 claims would be made in 2023-24 and would be recognized for financial statement purposes at such time as the transfer is authorized by the Federal government.

Provincial Government

The executive power in the Province of Saskatchewan is vested in the Lieutenant Governor acting upon the advice of the Executive Council, which is responsible to the Legislative Assembly. The Lieutenant Governor is appointed by the Governor General of Canada in Council and the Governor General, in turn, is appointed by a commission under the Great Seal of Canada. The Executive Council, which includes the Premier and Cabinet Ministers of the Provincial Government, is appointed by the Lieutenant Governor on the nomination of the leader of the political party which forms the Government. Members of the Executive Council hold seats in the Legislative Assembly.

Saskatchewan’s Legislative Assembly has 61 seats and is elected for a term of four years, subject to earlier dissolution by the Lieutenant Governor acting in accordance with constitutional principles. The Legislative Assembly is usually dissolved by the Lieutenant Governor on the recommendation of the Premier. The most recent Provincial election was held on October 26, 2020, and resulted in a majority for the Saskatchewan Party as the Government of Saskatchewan. The representation in the Legislative Assembly as of October 31, 2020, was as follows: Saskatchewan Party, 48 seats; and, New Democratic Party, 13 seats.

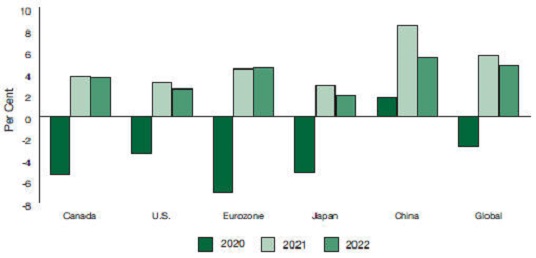

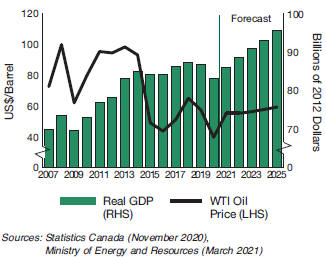

Description of the Economy and Gross Domestic Product

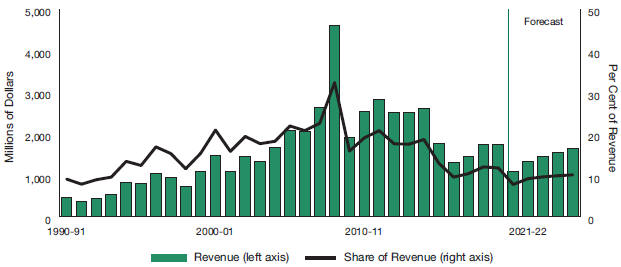

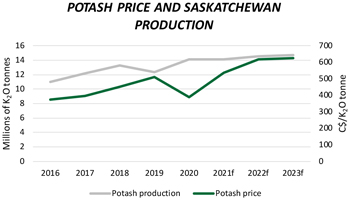

Saskatchewan has a modern, open and diversified economy. Approximately two-thirds of the total value of all goods and services produced in the Province are exported. Major exports include grains, oilseeds, crude oil, potash, natural gas, uranium and manufactured goods. While many of the goods and service producing industries are directly or indirectly related to agriculture and natural resources, the provincial economy continues to diversify into information age activities such as high technology, bio-technology and financial and other services. Saskatchewan’s abundance of renewable and non-renewable resources has made it the largest producer of wheat, second largest producer of crude oil and third largest natural gas producer in Canada. Saskatchewan is also one of the world’s leading suppliers of potash and uranium. The provincial government also operates crown-owned businesses, operating in electricity generation, transmission, and distribution, natural gas transmission and distribution, auto insurance and telecommunications.

4