Summary Financial Statements

Notes to the Financial Statements

1. Significant Accounting Policies (continued)

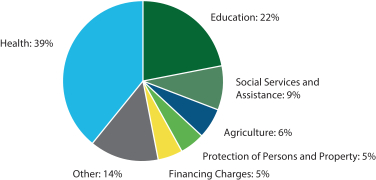

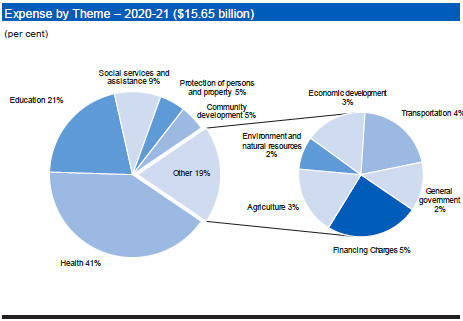

The general government theme includes expenses for centralized government services including: government contributions to, and management of, employee benefit plans; property, vehicle and information technology management; the collection of government revenues; the formation of budgetary policy; the preparation and audit of the Government’s public accounts; and the constitutional, political and law enactment aspect of the Government.

The health theme includes expenses to support, maintain and restore the physical and mental health of Saskatchewan residents. Health expense primarily includes: the delivery of health services through acute, emergency, rehabilitative, long-term, community-based, and home-based care; cancer prevention, diagnosis and treatment programs; the prevention and control of infectious diseases; the subsidization of prescription drugs; and the education and promotion of healthy lifestyles.

The protection of persons and property theme includes expenses to promote and ensure the security, safety and protection of residents and property which is mainly achieved through a fair justice system, policing programs and supervision and rehabilitation services for offenders. Protection of persons and property also includes: services that promote, support and enforce safe work practices and employment standards; provincial emergency management through 911 services, public safety, disaster assistance and wildfire management; and victims’ services.

The social services and assistance theme includes expenses to provide financial assistance and services to individuals and families in need because of poverty, abuse, neglect and disability. This includes income support programs, accessible and safe housing, child protection services, adoption services and providing life’s needs to persons with intellectual disabilities.

The transportation theme includes expenses for the development, construction and maintenance of an integrated provincial transportation system using highways, rural roads, bridges, ferry crossings, airstrips and communication networks.

Schedule 18 identifies the entities included in each theme.

New accounting standards

A number of new and amended Canadian public sector accounting standards have been issued but not applied in preparing these financial statements. These standards will come into effect as follows:

PS 3450 Financial Instruments (effective April 1, 2022), a new standard establishing guidance on the recognition, measurement, presentation and disclosure of financial instruments, including derivatives.

PS 2601 Foreign Currency Translation (effective April 1, 2022), replaces PS 2600 with revised guidance on the recognition, presentation and disclosure of transactions that are denominated in a foreign currency.

PS 1201 Financial Statement Presentation (effective in the period PS 3450 and PS 2601 are adopted), replaces PS 1200 with revised general reporting principles and standards of presentation and disclosure in government financial statements.

PS 3041 Portfolio Investments (effective in the period PS 3450, PS 2601 and PS 1201 are adopted), replaces PS 3040 with revised guidance on accounting for, and presentation and disclosure of, portfolio investments.

PS 3280 Asset Retirement Obligations (effective April 1, 2022), a new standard establishing guidance on the recognition, measurement, presentation and disclosure of a liability for retirement of a tangible capital asset.

PS 3400 Revenue (effective April 1, 2023), a new standard establishing guidance on the recognition, measurement, presentation and disclosure of revenue.

PS 3160 Public Private Partnerships (effective April 1, 2023), a new standard establishing guidance on the recognition, measurement and disclosure of public private partnerships arrangements.

The Government plans to adopt these new and amended standards on the effective date and is currently analyzing the impact this will have on these financial statements.

52 Government of Saskatchewan Public Accounts 2020-21