8

COMPLIANCE WITH ANTI-MONEY LAUNDERING REGULATIONS

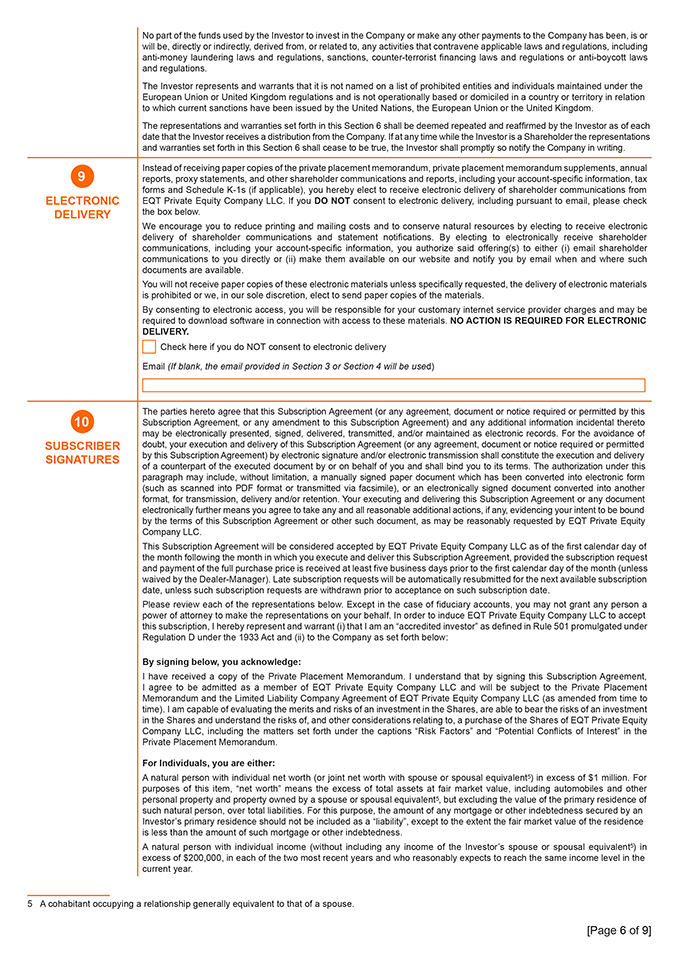

To comply with applicable U.S. and other anti-money laundering laws and regulations, all payments and contributions by the Investor to the Company and all payments and distributions to the Investor from the Company will only be made in the Investor’s name and to and from a bank account of a bank based or incorporated in or formed under the laws of the United States or that is regulated in and either based or incorporated in or formed under the laws of the United States and that is not a “foreign shell bank” within the meaning of the U.S. Bank Secrecy Act (31 U.S.C. § 5311 et seq.), as amended by Title III of the USA PATRIOT Act, as further amended from time to time, and the regulations promulgated thereunder by the U.S. Department of the Treasury, as such regulations may be amended from time to time (the “Bank Secrecy Act”).

The Investor acknowledges that, pursuant to anti-money laundering laws and regulations or requests from regulatory authorities within their respective jurisdictions, the Company, the Manager and/or any administrator acting on behalf of the Company may be required to collect further documentation verifying the Investor’s identity, including, where the Investor is a legal entity, the Investor’s beneficial owner(s)3 and key controllers4 as defined by FinCEN’s U.S. Customer Due Diligence Rule, if applicable, and the source of funds used to purchase Shares before, and from time to time after, acceptance by the Company of this Agreement. The Investor agrees to provide the Company at any time with such information as the Company determines to be necessary or appropriate to comply with the anti-money laundering, countering of terrorist and proliferation financing laws and regulations of any applicable jurisdiction, or to respond to requests for information concerning the identity of Investors from any governmental authority, self-regulatory organization or financial institution in connection with its anti-money laundering compliance procedures, or to update such information. The Investor is advised that the Company may provide information to FinCEN, a bureau of the U.S. Department of Treasury, and other U.S. government and state regulators, where appropriate, in connection with a request for information on behalf of a law enforcement agency investigating terrorist activity or money laundering.

The Company will use reasonable best efforts to not knowingly sell the Shares to any natural person or entity acting, directly or indirectly, in contravention of any applicable money laundering regulations or conventions of the United States or other international jurisdictions, or on behalf of terrorists, terrorist organizations or narcotics traffickers, including those persons or entities that are included on any relevant lists maintained by the United Nations, European Union, North Atlantic Treaty Organization, Financial Action Task Force on Money Laundering, Organization for Economic Cooperation and Development, Office of Foreign Assets Control of U.S. Department of the Treasury (“OFAC”), SEC, U.S. Federal Bureau of Investigation, U.S. Central Intelligence Agency and U.S. Internal Revenue Service, or other similar or successor entities, in each case as may be amended from time to time; or on behalf of a foreign shell bank or a U.S. financial institution that has established, maintains, administers or manages an account in the United States for, or on behalf of, a foreign shell bank (“Prohibited Investments”). The Investor represents and warrants that the proposed subscription for Shares, whether made on its own behalf or, if applicable, as an agent, trustee, representative, intermediary, nominee, or in a similar capacity on behalf of any other person or entity, nominee account or beneficial owner, whether a natural person or entity (each, an “Underlying Beneficial Owner”), is not a Prohibited Investment, and further represents and warrants that it will promptly notify the Company of any change in the Investor’s status or the status of any Underlying Beneficial Owner with respect to its representations and warranties regarding Prohibited Investments. The Investor will provide the Company with additional anti-money laundering information and materials if requested, which may include a copy of the Investor’s policies and procedures relating to compliance with anti-money laundering laws, anti-corruption laws and sanctions laws.

If the Investor is introducing the Underlying Beneficial Owner, the Investor has carried out thorough due diligence as to and established the identities of all Underlying Beneficial Owners (and, if an Underlying Beneficial Owner is not a natural person, the identities of any direct or indirect owner, or other investor, director, senior officer, trustee, beneficiary or grantor of such Underlying Beneficial Owner, or other person who controls such Underlying Beneficial Owner (to the extent applicable)) and their source of funds, in accordance with the anti-money laundering requirements of the Investor’s jurisdiction, holds the evidence of such identities, and will make such information available to the Company or the relevant regulatory authority upon their reasonable request. The Investor has taken all reasonable steps to ensure that its beneficial holders or underlying investors, as applicable, are able to certify to the representations hereunder.

“Sanctions” means any sanctions administered or enforced by the United States Government (including the U.S. Department of Treasury’s Office of Foreign Assets Control and the U.S. Department of State), the United Nations Security Council, the European Union or any European Union member state, His Majesty’s Treasury or any other relevant sanctions authority. The Investor represents and warrants that neither the Investor nor any Underlying Beneficial Owner, nor any person directly or indirectly controlling, controlled by or under common control with the Investor; nor any person having a beneficial interest in the Investor; nor any person for whom the Investor acts as agent or nominee in connection with the Shares; nor any officer, director, authorized person, controller, employee, agent or representative of the Investor (“Related Persons”): (a) is an individual or entity that is: i. the subject or target of any Sanctions (including via ownership or control); ii. resident, located or organized in a country, territory or region that is the subject of comprehensive territorial Sanctions (including, without limitation, the Crimea, Zaporizhzhia and Kherson regions of Ukraine, the so-called Donetsk People’s Republic, the so-called Luhansk People’s Republic, Cuba, Iran, North Korea, and Syria); or (b) is a person otherwise identified as a terrorist organization on any relevant lists maintained by governmental authorities in any jurisdiction; or (c) is a resident in, or organized or chartered under the laws of (i) a jurisdiction that is designated by the U.S. Secretary of the Treasury under the USA PATRIOT Act as warranting special measures because of money laundering concerns or (ii) a jurisdiction that is designated as non-cooperative with international anti-money laundering efforts by a multi-national or inter-governmental group such as the Financial Action Task Force; or (d) is a “Politically Exposed Person,” “immediate family” member or “close associate” of a Politically Exposed Person, except as otherwise disclosed to the Company in writing.

3 Beneficial owner(s) (for purposes of this Agreement) in respect of a legal person means each individual, who directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, owns 10% or more of the equity interests of a legal entity Investor. In respect of a legal arrangement, such as a trust, the term “beneficial owner” will include the grantor/settlor, trustee, protector, enforcer, beneficiaries (with a fixed and vested interest) or any other natural Person exercising ultimate effective control over the Company.

4 Key Controller (for purposes of this Agreement and as defined under FinCEN’s Customer Due Diligence Rule) means a single individual with significant responsibility to control, manage, or direct a legal entity Investor, including an executive officer or senior manager or any other individual who regularly performs similar functions.

[Page 5 of 9]